Risk-Informed Performance Assessment of Construction Projects

Abstract

1. Introduction

2. Risk and Performance Management Integration Approaches

- The contextual, which mainly propose a framing of risk and performance in the context of broader frameworks such as strategic or enterprise risk management (ERM). For example, in [18], performance management is identified as an autonomous step for strategy monitoring, while risk management is identified as a component in the strategy realization step. In this case, there is rather a co-operation than an integration of the two frameworks. Other efforts have concluded that ERM and performance are positively related, nevertheless they have not investigated the mechanisms or even the existence of a direct relation between the two frameworks [27,28,29,30,31].

- The controlling, which mainly focus on project control, in the light of uncertainty [32,33,34]. In these cases, deviations of performance expressed as time and cost are investigated through Monte Carlo simulations addressing this way the modeling of uncertainties in performance assessment. These attempts aim at detecting the potential of performance deviations through a stochastic analysis and support project control rather than utilize risk management for setting performance goals.

- The performative, which are actually combining risk and performance management to set new performance goals during a project’s development. In this group of attempts, earned value analysis (EVA) plays a central role by constituting the methodological background for performance measurement that is further enhanced with risk management practices. For example, the introduction of control charts [35] validates the idea of stochastically predicting deviations due to potential risks, but also addresses the idea of moving from benchmark values to statistically determined ones for setting performance goals. This idea is further developed in other research efforts where setting performance goals is more and more enriched with risk management tools and techniques. Based on a combination of EVA, statistical analysis, and Monte Carlo simulations, tolerance limits are set for project’s performance control [36], or performance goals are directly estimated with a level of confidence [37]. Even in cases when the required total work is either completely unknown or uncertain, a proper modification of EVA to address fuzzy numbers is proposed for estimating both past and future performance values [14].

3. Proposed Methodological Integration of Risk and Performance Assessment

3.1. Methodological Background for Performance Assessment

3.1.1. The Cost Dimension

3.1.2. The Time Dimension

3.1.3. The Billing Dimension

3.1.4. The Safety Dimension

3.1.5. The Profitability Dimension

3.1.6. The Quality Dimension

3.1.7. The Team Satisfaction Dimension

- Involvement with the project;

- Client/Suppliers response to team’s needs;

- Project Manager response to team’s needs;

- Adequate equipment;

- Adequate training;

- Appropriate financial compensation;

- Clarity of responsibilities;

- Quality of supervision;

- Interest in the nature of work;

- Cooperative environment;

- Conformity with internal procedures during work;

- Access to project baselines and progress reports.

3.1.8. The Client Dimension

- Understanding of the project requirements;

- Understanding of client system and procedures;

- Response to client requests/needs;

- Flexibility and adjustment to change;

- Overall capability of contractor’s project team;

- Effective communication;

- Innovation in problem solving;

- Performance with respect to cost;

- Performance with respect to schedule;

- Performance with respect to service quality;

- Performance with respect to product quality;

- Performance with respect to safety procedures.

3.1.9. Calculation of the Overall Project Performance

3.2. Improvements of the Performance Assessment Methodological Background

3.2.1. The Modified Billing Performance Index

3.2.2. The Modified Quality Performance Index

3.2.3. The Normalization Process

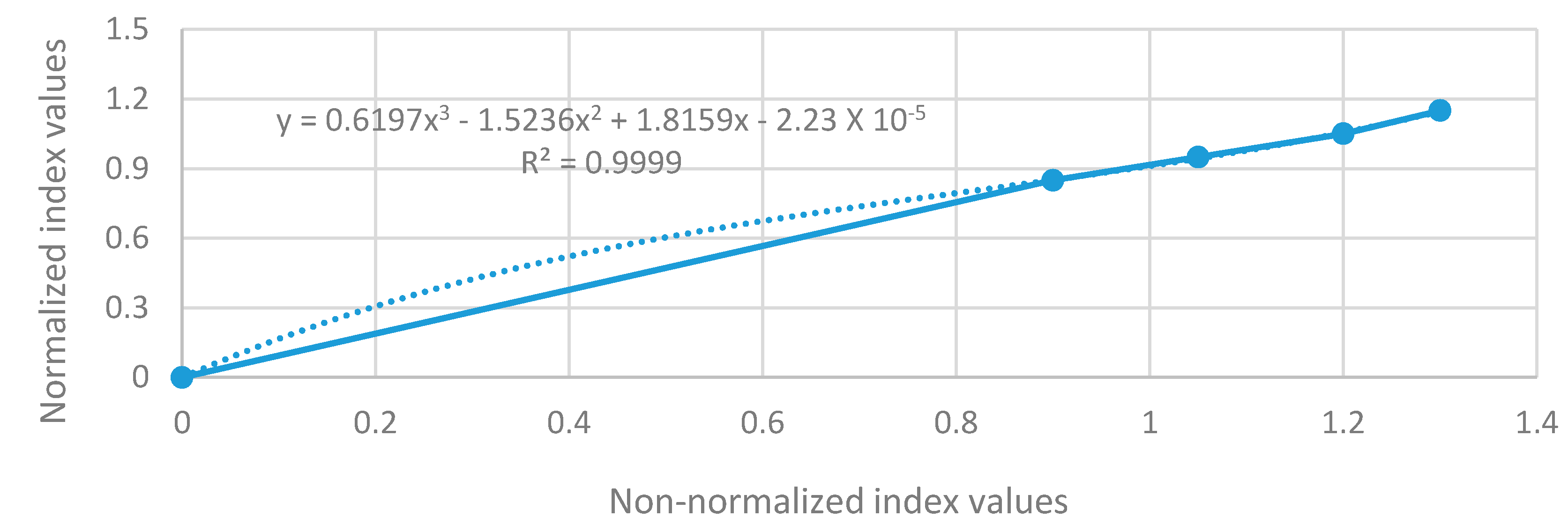

- The marginal values of the respective classes in the two linear grading systems (i.e., the index’s rating system and the normalized system) are forming pairs, which are plotted in the XY plane. Then, a graphical presentation is created by drawing the trend line of the set of paired values.

- The equation of the trend line is derived with a desired R2 approximating the value of “1” as the best fitting equation is required to transpose from an indicator’s rating system to the normalized respective one. For this reason, third degree polynomials are selected, although even linear equations had an R2 > 0.98. It should be mentioned that polynomials of a greater degree could be inappropriate due to overfitting.

- The normalization equation can be used for transposing any value given to the indicator’s rating system to the normalized rating system for the calculation of the project’s performance index.

3.3. Introduction of the Risk Factor in the Performance Assessment Methodology

- Step 1: Calculation of the risk associated with each performance index. Several formulae have been proposed in the literature for calculating the total risk from individual risks [40,42,44,45]. To use an equation that addresses crisp numbers and considers the uneven contribution of individual risks to the overall risk, based on their significance as stated by their value, Equation (15) suggested in [44] is adopted in the context of this research:where N is the number of total risks for a single dimension i.

- Step 2: Calculation of the risk level of each performance index. The risk level (RL) of a performance index is actually the normalized value of the respective dimension’s total risk against the sum of all total risks of all performance dimensions. It is calculated through Equation (16) and it allows the weighting of all performance indices in the range [0, 1]:

- Step 3: Calculation of the risk factor of each performance index. The risk factor (RF) is the risk coefficient in the calculation of risk-informed performance. It is calculated for each performance index through Equation (17):RFi = 1 − RLi

- Step 4: Calculation of risk-informed project’s performance index. The last step for calculating risk-informed performance is the introduction of the risk factor to Equation (9). The new form of the equation that calculates PI is that of Equation (18):RiPI = w1 × RF1 × CPI + w2 × RF2 × SPI + w3 × RF3 × BPI + w4 × RF4 × PPI + w5 × RF5 × SFI + w6 × RF6 × QPI + w7 × RF7 × TSI + w8 × RF8 × CSIAs shown in this equation, the project’s performance index has been replaced by the risk-informed performance index (RiPI), while all performance indices are weighted both in terms of their significance and the risk that is associated to them.

3.4. Extension of the Risk-informed Performance Assessment Methodology

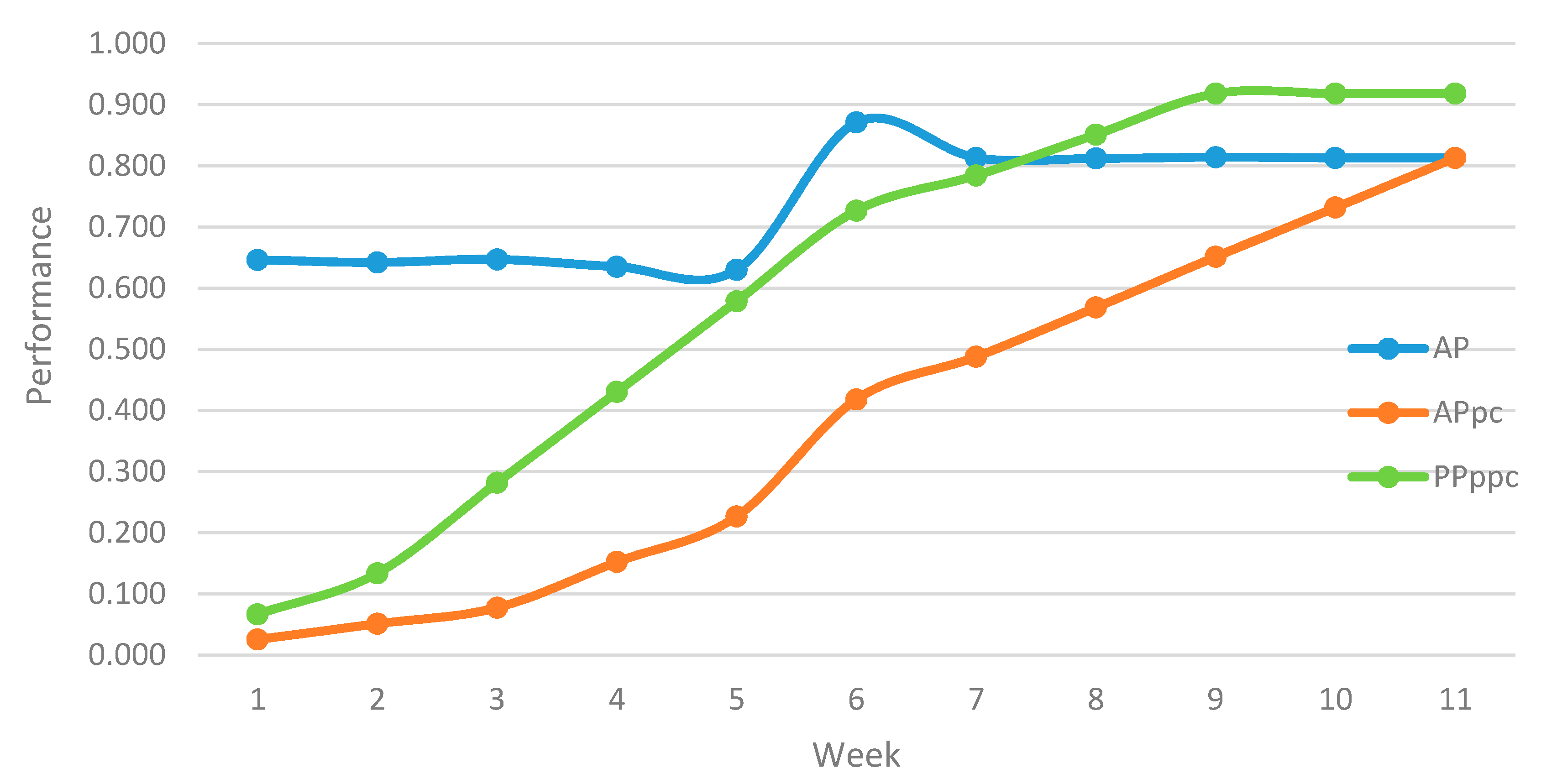

- Planned performance (PP) is the value of performance that must be achieved at the construction project’s completion according to the project’s planning and design. The maximum value of PP is taken through Equation (18) when no deviations from planning occur (i.e., CPI = SPI = BPI = 1) and is dependent on the values that the construction project manager sets for the factors affecting performance (i.e., indicators calculated from Equations (4), (5), (7), (8) and (11)).

- Actual performance (AP) is the value of performance that is actually achieved at the time when the project’s control is taking place. At this point, all variables are taking the values recorded according to the project’s progress and AP is calculated through Equation (18) (i.e., AP = RiPI).

- Step 1: The project performance buffer (PPB) is defined according to Equation (21):where APmean is the project’s estimated mean actual performance and APp is the estimated performance for a given level of confidence p. Both estimations are based on Monte Carlo simulation, where the simulated variables are the performance indicators that determine RiPI (AP), while the risk factors and weights in Equation (18) are constants determined by the analyst.PPB = APmean − APp

- Step 2: PPB is allotted in time according to the project’s control plan, based on Equation (22):where σ2Pp is the total performance variation, i.e., σ2Pp = ΣwPt. The accumulated performance buffer at any given time (APBt) indicates the total use of the buffer until the period of the project’s control and is calculated according to Equation (23):PBt = (wPt × PPB/σ2Pp)APBt = PBt + APBt−1

- Step 3: Project control entails the comparison of the accumulated performance buffer (APBt) added to the actual performance at a given time with the planned performance at the same time. This comparison is mathematically expressed by Equation (24):where PCIt is the performance control index, which can be either: (a) Positive (PCIt > 0), thus indicating an improved performance compared to the planned one or (b) negative (PCIt < 0), thus indicating a reduced performance compared to the originally planned.PCIt = APBt + APPC − PPPPC

- Step 4: Having knowledge of the project’s status regarding performance achievement, the methodology concludes with the estimation of performance at project’s completion. The respective index (EPACt) is calculated according to Equation (25):EPACt = (PP + PCIt)EPACt is the estimated performance at project’s completion and a greater value than PP (EPACt > PP) indicates the existence of a quantified performance surplus that can be managed accordingly, while a lower value than PP (EPACt < PP) indicates the existence of a quantified performance shortage that should be covered through appropriate interventions.

3.5. Verification of Risk-Informed Performance Assessment

- Fees include 10% profit. Payments are expected to be fully consistent with billing at the design phase; however, the actual cash flows are recorded as presented in Table 6.

- Each activity is carried out from a team of two persons. The total man-hours for the completion of the project are 380. An initial estimation at the design phase for a loss of 10 manhours is not confirmed as the actual manhours lost are as presented in Table 6.

- At the design phase, the cost of reworks is expected to be at 750 €; however, the actual cost of reworks is the one presented in Table 6.

- Eleven risks have been identified through the risk identification process.

4. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Musawir, A.; Serra, C.E.M.; Zwikael, O.; Ali, I. Project governance, benefit management, and project success: Towards a framework for supporting organizational strategy implementation. Int. J. Proj. Manag. 2017, 35, 1658–1672. [Google Scholar] [CrossRef]

- Lamprou, A.; Vagiona, D. Success criteria and critical success factors in project success: A literature review. Rel. Int. J. 2018, 1, 276–284. [Google Scholar]

- Bryde, D.; Unterhitzenberger, C.; Joby, R. Conditions of success for earned value analysis in projects. Int. J. Proj. Manag. 2017, 36, 474–484. [Google Scholar] [CrossRef]

- Demirkesen, S.; Ozorhon, B. Impact of integration management on construction project management performance. Int. J. Proj. Manag. 2017, 35, 1639–1654. [Google Scholar] [CrossRef]

- Orihuela, P.; Pacheco, S.; Orihuela, J. Proposal of performance indicators for the design of housing projects. Procedia Eng. 2017, 196, 498–505. [Google Scholar] [CrossRef]

- Sanchez, O.P.; Terlizzi, M.A.; de Moraes, H.R.O.C. Cost and time project management success factors for information systems development projects. Int. J. Proj. Manag. 2017, 35, 1608–1626. [Google Scholar] [CrossRef]

- Chen, H.L.; Chen, W.T.; Lin, Y.L. Earned value project management: Improving the predictive power of planned value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- Omar, M.N.; Fayek, A.R. Modeling and evaluating construction project competencies and their relationship to project performance. Autom. Constr. 2016, 69, 115–130. [Google Scholar] [CrossRef]

- Warburton, R.D.H.; Cioffi, D.F. Estimating a project’s earned and final duration. Int. J. Proj. Manag. 2016, 34, 1493–1504. [Google Scholar] [CrossRef]

- Yun, S.; Choi, J.; de Oliveira, D.P.; Mulva, S.P. Development of performance metrics for phase-based capital project benchmarking. Int. J. Proj. Manag. 2016, 34, 389–402. [Google Scholar] [CrossRef]

- Abd El-Karim, M.S.B.A.; Mosa El Nawawy, O.A.; Abdel-Alim, A.M. Identification and assessment of risk factors affecting construction projects. HBRC J. 2015, 13, 202–216. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Vilutienė, T.; Turskis, Z.; Šaparauskas, J. Multi-criteria analysis of projects’ performance in construction. Arch. Civ. Mech. Eng. 2014, 14, 114–121. [Google Scholar] [CrossRef]

- Cheng, E.W.L.; Ryan, N.; Kelly, S. Exploring the perceived influence of safety management practices on project performance in the construction industry. Saf. Sci. 2012, 50, 363–369. [Google Scholar] [CrossRef]

- Naeni, L.M.; Shadrokh, S.; Salehipour, A. A fuzzy approach for the earned value management. Int. J. Proj. Manag. 2011, 29, 764–772. [Google Scholar] [CrossRef]

- Nassar, N.K. An integrated framework for evaluation of performance of construction projects. In PMI® Global Congress 2009—North America, Orlando, FL, USA, 10–13 October 2009; Project Management Institute: Newtown Square, PA, USA, 2009. [Google Scholar]

- Pheng, L.S.; Chuan, Q.T. Environmental factors and work performance of project managers in the construction industry. Int. J. Proj. Manag. 2006, 24, 24–37. [Google Scholar] [CrossRef]

- Thekdi, S.; Aven, T. An enhanced data-analytic framework for integrating risk management and performance management. Reliab. Eng. Syst. Saf. 2016, 156, 277–287. [Google Scholar] [CrossRef]

- Cokins, G. Performance Management: Intergrating Strategy Execution Methodologies, Risk and Analytics, 1st ed.; John Wiley & Sons, Inc: Hoboken, NJ, USA, 2009. [Google Scholar]

- Bassioni, H.A.; Price, A.D.F.; Hassan, T.M. Performance measurement in construction. J. Manag. Eng. 2004, 20, 42–50. [Google Scholar] [CrossRef]

- Aven, T. On the new ISO guide on risk management terminology. Reliab. Eng. Syst. Saf. 2011, 96, 719–726. [Google Scholar] [CrossRef]

- Aven, T. On how to define, understand and describe risk. Reliab. Eng. Syst. Saf. 2010, 95, 623–631. [Google Scholar] [CrossRef]

- Olechowski, A.; Oehmen, J.; Seering, W.; Ben-Daya, M. The professionalization of risk management: What role can the ISO 31000 risk management principles play? Int. J. Proj. Manag. 2016, 34, 1568–1578. [Google Scholar] [CrossRef]

- Aven, T. The risk concept-historical and recent development trends. Reliab. Eng. Syst. Saf. 2012, 99, 33–44. [Google Scholar] [CrossRef]

- Mohammed, H.K.; Knapkova, A. The Impact of total risk management on company’s performance. Procedia Soc. Behav. Sci. 2016, 220, 271–277. [Google Scholar] [CrossRef]

- Jafari, M.; Chadegani, A.; Biglari, V. Effective risk management and company’s performance: Investment in innovations and intellectual capital using behavioural and practical approach. Int. Res. J. Financ. Econ. 2011, 3, 780–786. [Google Scholar]

- Neely, A.; Adams, C.; Kennerley, M. The Performance Prism: The Scorecard for Measuring and Managing Business Success; Prentice Hall: Upper Saddle River, NJ, USA, 2002; pp. 159–160. [Google Scholar]

- Gordon, L.A.; Loeb, M.P.; Tseng, C.Y. Enterprise risk management and firm performance: A contingency perspective. J. Account. Public Policy 2009, 28, 301–327. [Google Scholar] [CrossRef]

- McShane, M.K.; Nair, A.; Rustambekov, E. Does enterprise risk management increase firm value? J. Account. Audit. Financ. 2011, 26, 641–658. [Google Scholar] [CrossRef]

- Lundqvist, S.A. An exploratory study of enterprise risk management: Pillars of ERM. J. Account. Audit. Financ. 2014, 29, 393–429. [Google Scholar] [CrossRef]

- Callahan, C.; Soileau, J. Does enterprise risk management enhance operating performance? Adv. Account. 2017, 37, 122–139. [Google Scholar] [CrossRef]

- Florio, C.; Leoni, G. Enterprise risk management and firm performance: The Italian case. Br. Account. Rev. 2017, 49, 56–74. [Google Scholar] [CrossRef]

- Pajares, J.; López-Paredes, A. An extension of the EVM analysis for project monitoring: The cost control index and the schedule control index. Int. J. Proj. Manag. 2011, 29, 615–621. [Google Scholar] [CrossRef]

- Acebes, F.; Pajares, J.; Galán, J.M.; López-Paredes, A. Beyond earned value management: A graphical framework for integrated cost, schedule and risk monitoring. Procedia Soc. Behav. Sci. 2013, 74, 181–189. [Google Scholar] [CrossRef]

- Acebes, F.; Pajares, J.; Galán, J.M.; López-Paredes, A. A new approach for project control under uncertainty. Going back to the basics. Int. J. Proj. Manag. 2014, 32, 423–434. [Google Scholar] [CrossRef]

- Leu, S.-S.; Lin, Y.-C. Project performance evaluation based on statistical process control techniques. J. Constr. Eng. Manag. 2008, 134, 813–819. [Google Scholar] [CrossRef]

- Colin, J.; Vanhoucke, M. Setting tolerance limits for statistical project control using earned value management. Omega 2014, 49, 107–122. [Google Scholar] [CrossRef]

- Lipke, W.; Zwikael, O.; Henderson, K.; Anbari, F. Prediction of project outcome. The application of statistical methods to earned value management and earned schedule performance indexes. Int. J. Proj. Manag. 2009, 27, 400–407. [Google Scholar] [CrossRef]

- Zidane, Y.J.-T.; Andersen, B.; Johansen, A.; Ahmad, S. “Need for Speed”: Framework for measuring construction project pace—Case of road project. Procedia Soc. Behav. Sci. 2016, 226, 12–19. [Google Scholar] [CrossRef][Green Version]

- Langston, C. Development of generic key performance indicators for PMBOK® using a 3D project integration model. Australas J. Constr. Econ. Build. 2013, 13, 78–91. [Google Scholar] [CrossRef]

- Majumder, D.; Debnath, J.; Biswas, A. Risk analysis in construction sites using fuzzy reasoning and fuzzy Analytic Hierarchy Process. Procedia Technol. 2013, 10, 604–614. [Google Scholar] [CrossRef]

- Yeung, J.F.Y.; Chan, A.P.C.; Chan, D.W.M. Fuzzy set theory approach for measuring the performance of relationship-based construction projects in Australia. J. Manag. Eng. 2012, 28, 181–192. [Google Scholar] [CrossRef]

- Samantra, C.; Datta, S.; Mahapatra, S.S. Fuzzy based risk assessment module for metropolitan construction project: An empirical study. Eng. Appl. Artif. Intell. 2017, 65, 449–464. [Google Scholar] [CrossRef]

- Shankar, N.R.; Rao, P.P.B. Ranking fuzzy numbers with a distance method using circumcenter of centroids and an index of modality. Adv. Fuzzy Syst. 2011, 2011, 1–7. [Google Scholar]

- Royer, P.S. Risk management: The undiscovered dimension of project management. Proj Manag. J. 2000, 31, 6–13. [Google Scholar] [CrossRef]

- Zolotukhin, A.; Gudmestad, O. Application of fuzzy sets theory in qualitative and quantitative risk assessment. Int. J. Offshore Polar Eng. 2002, 12, 1–9. [Google Scholar]

| Studies on Key Success Factors | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Factors | [3] | [4] | [5] | [6] | [7] | [8] | [9] | [10] | [11] | [12] | [13] | [14] | [15] |

| Time | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Cost | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Quality | X | X | X | X | X | X | X | X | X | X | X | X | |

| Safety | X | X | X | X | X | X | |||||||

| Client Satisfaction | X | X | X | ||||||||||

| Team Satisfaction | X | ||||||||||||

| Profitability | X | X | X | ||||||||||

| Risk | X | ||||||||||||

| Environmental Impact | X | ||||||||||||

| Effectiveness | X | X | X | ||||||||||

| Billing | X | ||||||||||||

| Society Impact | X | ||||||||||||

| Staffing | X | ||||||||||||

| Procurement | X | ||||||||||||

| Class | Condition | Index Range |

|---|---|---|

| A | Outstanding Performance | I > 1.15 |

| B | Exceeding Target | 1.05 < I ≤ 1.15 |

| C | Within Target | 0.95 < I ≤ 1.05 |

| D | Below Target | 0.85 < I ≤ 0.95 |

| E | Poor Performance | I ≤ 0.85 |

| Indicator | Equation | R2 |

|---|---|---|

| BPI | y = 4.9657x3 − 7.8118x2 + 4.0553x − 1.97 × 10−6 | 0.998 |

| PPI | y = 0.6197x3 − 1.5236x2 + 1.8159x − 2.23 × 10−5 | 0.999 |

| SFI | y = 3.3333x3 − 1x2 − 0.9333x + 1.15 | 1.0 |

| QPI | y = −0.0143x3 + 0.1167x2 − 0.35x + 1.2976 | 1.0 |

| TSI | y = 0.005x3 − 0.0923x2 + 0.6021x − 0.5148 | 0.999 |

| CSI | y = 0.005x3 − 0.0923x2 + 0.6021x − 0.5148 | 0.999 |

| Probability (P) Class | Fuzzy Number | Consequence (C) Class | Fuzzy Number |

|---|---|---|---|

| Absolute certain | (0.8, 0.9, 1.0, 1.0; 1.0) | Very high | (0.7, 0.8, 0.9, 1.0; 1.0) |

| Very frequent | (0.7, 0.8, 0.8, 0.9; 1.0) | High | (0.5, 0.6, 0.7, 0.8; 1.0) |

| Frequent | (0.5, 0.6, 0.7, 0.8; 1.0) | Moderate | (0.3, 0.4, 0.5, 0.6; 1.0) |

| Probable | (0.4, 0.5, 0.5, 0.6; 1.0) | Low | (0.1, 0.2, 0.3, 0.4; 1.0) |

| Occasional | (0.2, 0.3, 0.4, 0.5; 1.0) | Very low | (0, 0.1, 0.2, 0.3; 1.0) |

| Rare | (0.1, 0.2, 0.2, 0.3; 1.0) | ||

| Very rare | (0, 0, 0.1, 0.2; 1.0) |

| Activities | Planned Duration (Weeks) | Planned Cost (€) | Actual Duration (Weeks) | Actual Cost (€) | ||

|---|---|---|---|---|---|---|

| Minimum | Maximum | Mean | ||||

| A1 | 1 | 3 | 2 | 700 | 3 | 720 |

| A2 | 2 | 6 | 4 | 1900 | 4 | 2000 |

| A3 | 3 | 7 | 5 | 1500 | 6 | 1620 |

| A4 | 1 | 3 | 2 | 700 | 2 | 750 |

| Total | 9 | 4800 | 11 | 5090 | ||

| Week | Running Activity | Work Completed (%) | AC (€) | Payments (€) | Lost Man-Hours (hrs) | Cost of Reworks (€) |

|---|---|---|---|---|---|---|

| 1 | A1 | 4 | 240 | 0 | 6 | 0 |

| 2 | A1 | 8 | 240 | 0 | 9 | 0 |

| 3 | A1 | 12 | 240 | 0 | 2 | 0 |

| 4 | A2,A3 | 24 | 770 | 0 | 5 | 270 |

| 5 | A2,A3 | 36 | 770 | 0 | 8 | 230 |

| 6 | A2,A3 | 48 | 770 | 3333 | 0 | 0 |

| 7 | A2,A3 | 60 | 770 | 0 | 1 | 500 |

| 8 | A3 | 70 | 270 | 0 | 5 | 0 |

| 9 | A3 | 80 | 270 | 0 | 2 | 0 |

| 10 | A4 | 90 | 375 | 0 | 0 | 0 |

| 11 | A4 | 100 | 375 | 0 | 0 | 0 |

| 12 | - | 0 | 0 | - | - | |

| 13 | - | 0 | 0 | - | - | |

| 14 | - | 0 | 2266 | - | - | |

| Total | 5090 | 5599 | 38 | 1000 |

| Satisfaction Parameter | Weights | Level of Satisfaction | Product |

|---|---|---|---|

| 1 | 0.0795 | 6 | 0.477 |

| 2 | 0.0756 | 7 | 0.530 |

| 3 | 0.0622 | 6 | 0.373 |

| 4 | 0.1009 | 8 | 0.807 |

| 5 | 0.1035 | 8 | 0.828 |

| 6 | 0.1016 | 9 | 0.914 |

| 7 | 0.0795 | 5 | 0.397 |

| 8 | 0.0795 | 5 | 0.397 |

| 9 | 0.0795 | 8 | 0.636 |

| 10 | 0.0795 | 8 | 0.636 |

| 11 | 0.0795 | 6 | 0.477 |

| 12 | 0.0795 | 7 | 0.556 |

| TSI | 7.028 |

| Satisfaction Parameter | Weights | Level of Satisfaction | Product |

|---|---|---|---|

| 1 | 0.0801 | 6 | 0.481 |

| 2 | 0.0769 | 7 | 0.539 |

| 3 | 0.0657 | 6 | 0.394 |

| 4 | 0.0980 | 8 | 0.784 |

| 5 | 0.1002 | 6 | 0.601 |

| 6 | 0.0985 | 6 | 0.591 |

| 7 | 0.0801 | 7 | 0.561 |

| 8 | 0.0801 | 8 | 0.641 |

| 9 | 0.0801 | 8 | 0.641 |

| 10 | 0.0801 | 7 | 0.561 |

| 11 | 0.0801 | 8 | 0.641 |

| 12 | 0.0801 | 9 | 0.721 |

| CSI | 7.154 |

| Performance Index | Non-Normalized Value | Normalized Value | Weights |

|---|---|---|---|

| CPI | 0.943 | 0.943 | 0.15 |

| SPI | 1.000 | 1.000 | 0.10 |

| BPI | 0.595 | 0.693 | 0.10 |

| SFI | 0.100 | 1.050 | 0.15 |

| PPI | 0.655 | 0.710 | 0.15 |

| QPI | 0.244 | 1.218 | 0.15 |

| TSI | 7.028 | 0.893 | 0.10 |

| CSI | 7.154 | 0.899 | 0.10 |

| Risk | Probability | Consequence | Rij |

|---|---|---|---|

| R11 | (0.4, 0.5, 0.5, 0.6; 1.0) | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.20, 0.30, 0.35, 0.48; 1.0) |

| R12 | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.25, 0.36, 0.49, 0.64; 1.0) |

| R21 | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.25, 0.36, 0.49, 0.64; 1.0) |

| R22 | (0.4, 0.5, 0.5, 0.6; 1.0) | (0.1, 0.2, 0.3, 0.4; 1.0) | (0.04, 0.10, 0.15, 0.24; 1.0) |

| R31 | (0.2, 0.3, 0.4, 0.5; 1.0) | (0.1, 0.2, 0.3, 0.4; 1.0) | (0.02, 0.06, 0.12, 0.20; 1.0) |

| R41 | (0.7, 0.8, 0.8, 0.9; 1.0) | (0.5, 0.6, 0.7, 0.8; 1.0) | (0.35, 0.48, 0.56, 0.72; 1.0) |

| R42 | (0.2, 0.3, 0.4, 0.5; 1.0) | (0.3, 0.4, 0.5, 0.6; 1.0) | (0.06, 0.12, 0.20, 0.30; 1.0) |

| R51 | (0.4, 0.5, 0.5, 0.6; 1.0) | (0.1, 0.2, 0.3, 0.4; 1.0) | (0.04, 0.10, 0.15, 0.24; 1.0) |

| R61 | (0.7, 0.8, 0.8, 0.9; 1.0) | (0, 0.1, 0.2, 0.3; 1.0) | (0, 0.08, 0.16, 0.27; 1.0) |

| R71 | (0.1, 0.2, 0.2, 0.3; 1.0) | (0.3, 0.4, 0.5, 0.6; 1.0) | (0.03, 0.08, 0.10, 0.18; 1.0) |

| R81 | (0, 0, 0.1, 0.2; 1.0) | (0, 0.1, 0.2, 0.3; 1.0) | (0, 0, 0.02, 0.06; 1.0) |

| Risk | X0 | Y0 | CRRij |

|---|---|---|---|

| R11 | 0.330 | 0.405 | 0.522 |

| R12 | 0.432 | 0.382 | 0.576 |

| R21 | 0.432 | 0.382 | 0.576 |

| R22 | 0.130 | 0.409 | 0.429 |

| R31 | 0.097 | 0.409 | 0.421 |

| R41 | 0.525 | 0.393 | 0.656 |

| R42 | 0.167 | 0.403 | 0.437 |

| R51 | 0.130 | 0.409 | 0.429 |

| R61 | 0.125 | 0.401 | 0.420 |

| R71 | 0.095 | 0.414 | 0.425 |

| R81 | 0.017 | 0.416 | 0.416 |

| Performance Index | CRRi | RL | RF |

|---|---|---|---|

| CPI | 0.550 | 0.148 | 0.852 |

| SPI | 0.508 | 0.136 | 0.864 |

| BPI | 0.421 | 0.113 | 0.887 |

| SFI | 0.557 | 0.150 | 0.850 |

| PPI | 0.429 | 0.115 | 0.885 |

| QPI | 0.420 | 0.113 | 0.887 |

| TSI | 0.425 | 0.114 | 0.886 |

| CSI | 0.416 | 0.112 | 0.888 |

| Week | Work Completion as Scheduled (%) | PPPPC | PRBt | wPt | Actual Work Completion (%) | Actual Performance (AP) | APPC |

|---|---|---|---|---|---|---|---|

| 0 | 0 | 0 | 0.918 | 0 | 0 | 0 | 0 |

| 1 | 7.29 | 0.067 | 0.851 | 0.067 | 4 | 0.646 | 0.026 |

| 2 | 14.58 | 0.134 | 0.784 | 0.067 | 8 | 0.642 | 0.051 |

| 3 | 30.73 | 0.282 | 0.636 | 0.148 | 12 | 0.647 | 0.078 |

| 4 | 46.88 | 0.430 | 0.488 | 0.148 | 24 | 0.635 | 0.152 |

| 5 | 63.02 | 0.579 | 0.339 | 0.148 | 36 | 0.630 | 0.227 |

| 6 | 79.17 | 0.727 | 0.191 | 0.148 | 48 | 0.871 | 0.418 |

| 7 | 85.42 | 0.784 | 0.134 | 0.057 | 60 | 0.813 | 0.488 |

| 8 | 92.71 | 0.851 | 0.067 | 0.067 | 70 | 0.812 | 0.568 |

| 9 | 100 | 0.918 | 0 | 0.067 | 80 | 0.814 | 0.651 |

| 10 | - | - | - | - | 90 | 0.813 | 0.732 |

| 11 | - | - | - | - | 100 | 0.818 | 0.818 |

| Week | Actual Work Completion (%) | AP | APPC | APBt | PPPPC | PCIt | EPACt |

|---|---|---|---|---|---|---|---|

| 1 | 4 | 0.646 | 0.026 | 0.006 | 0.067 | −0.036 | 0.882 |

| 2 | 8 | 0.642 | 0.051 | 0.011 | 0.134 | −0.071 | 0.847 |

| 3 | 12 | 0.647 | 0.078 | 0.023 | 0.282 | −0.181 | 0.737 |

| 4 | 24 | 0.635 | 0.152 | 0.036 | 0.430 | −0.242 | 0.676 |

| 5 | 36 | 0.630 | 0.227 | 0.048 | 0.579 | −0.304 | 0.614 |

| 6 | 48 | 0.871 | 0.418 | 0.060 | 0.727 | −0.249 | 0.669 |

| 7 | 60 | 0.813 | 0.488 | 0.065 | 0.784 | −0.231 | 0.687 |

| 8 | 70 | 0.812 | 0.568 | 0.070 | 0.851 | −0.212 | 0.706 |

| 9 | 80 | 0.814 | 0.651 | 0.076 | 0.918 | −0.191 | 0.727 |

| 10 | 90 | 0.813 | 0.732 | 0.076 | 0.918 | −0.110 | 0.808 |

| 11 | 100 | 0.818 | 0.818 | 0.076 | 0.918 | −0.024 | 0.884 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Papanikolaou, M.; Xenidis, Y. Risk-Informed Performance Assessment of Construction Projects. Sustainability 2020, 12, 5321. https://doi.org/10.3390/su12135321

Papanikolaou M, Xenidis Y. Risk-Informed Performance Assessment of Construction Projects. Sustainability. 2020; 12(13):5321. https://doi.org/10.3390/su12135321

Chicago/Turabian StylePapanikolaou, Merkourios, and Yiannis Xenidis. 2020. "Risk-Informed Performance Assessment of Construction Projects" Sustainability 12, no. 13: 5321. https://doi.org/10.3390/su12135321

APA StylePapanikolaou, M., & Xenidis, Y. (2020). Risk-Informed Performance Assessment of Construction Projects. Sustainability, 12(13), 5321. https://doi.org/10.3390/su12135321