Blockchain Application for the Paris Agreement Carbon Market Mechanism—A Decision Framework and Architecture

Abstract

:1. The Paris Agreement Carbon Market Mechanism

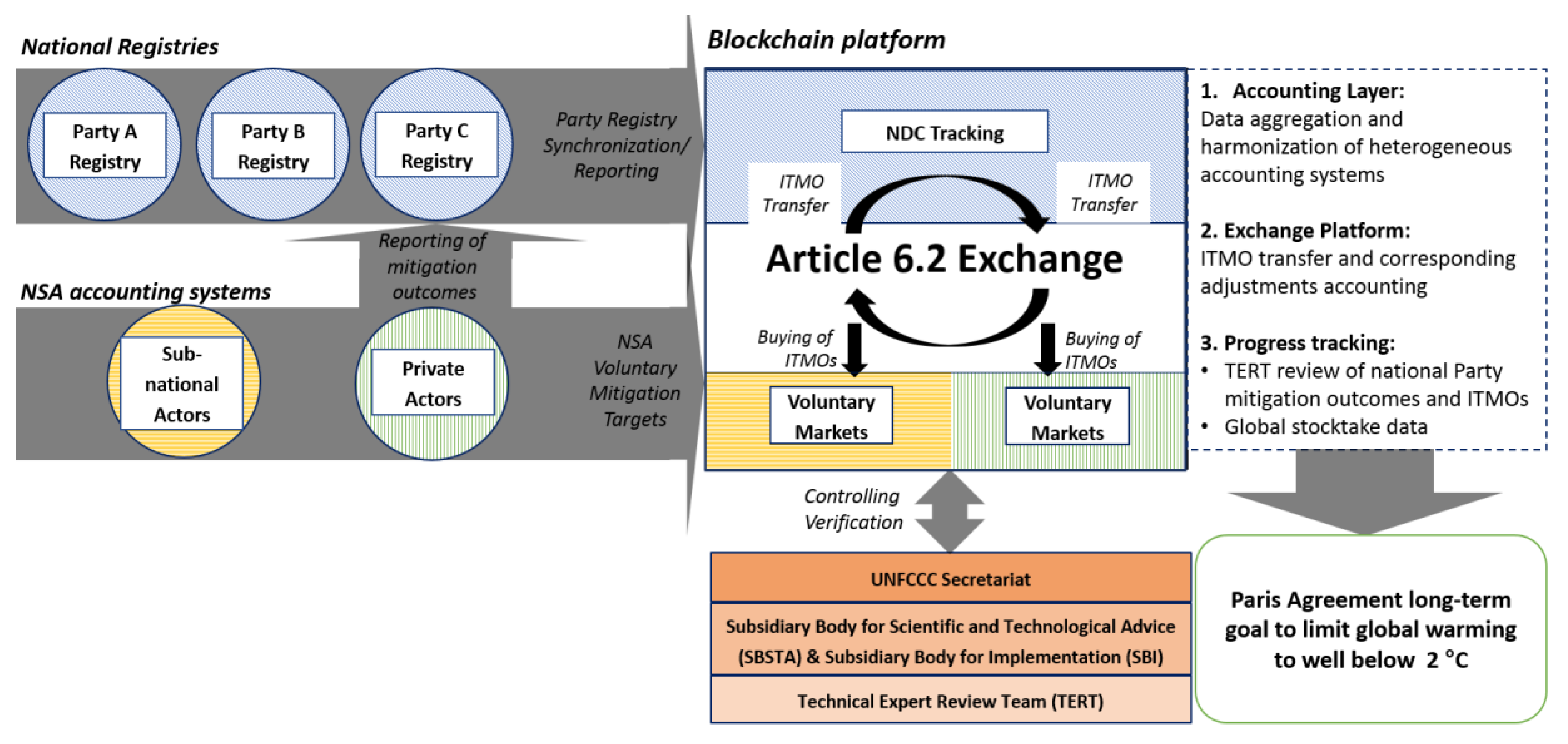

1.1. Safeguarding Environmental Integrity through Robust Accounting

1.2. Blockchain as an Aggregation Platform

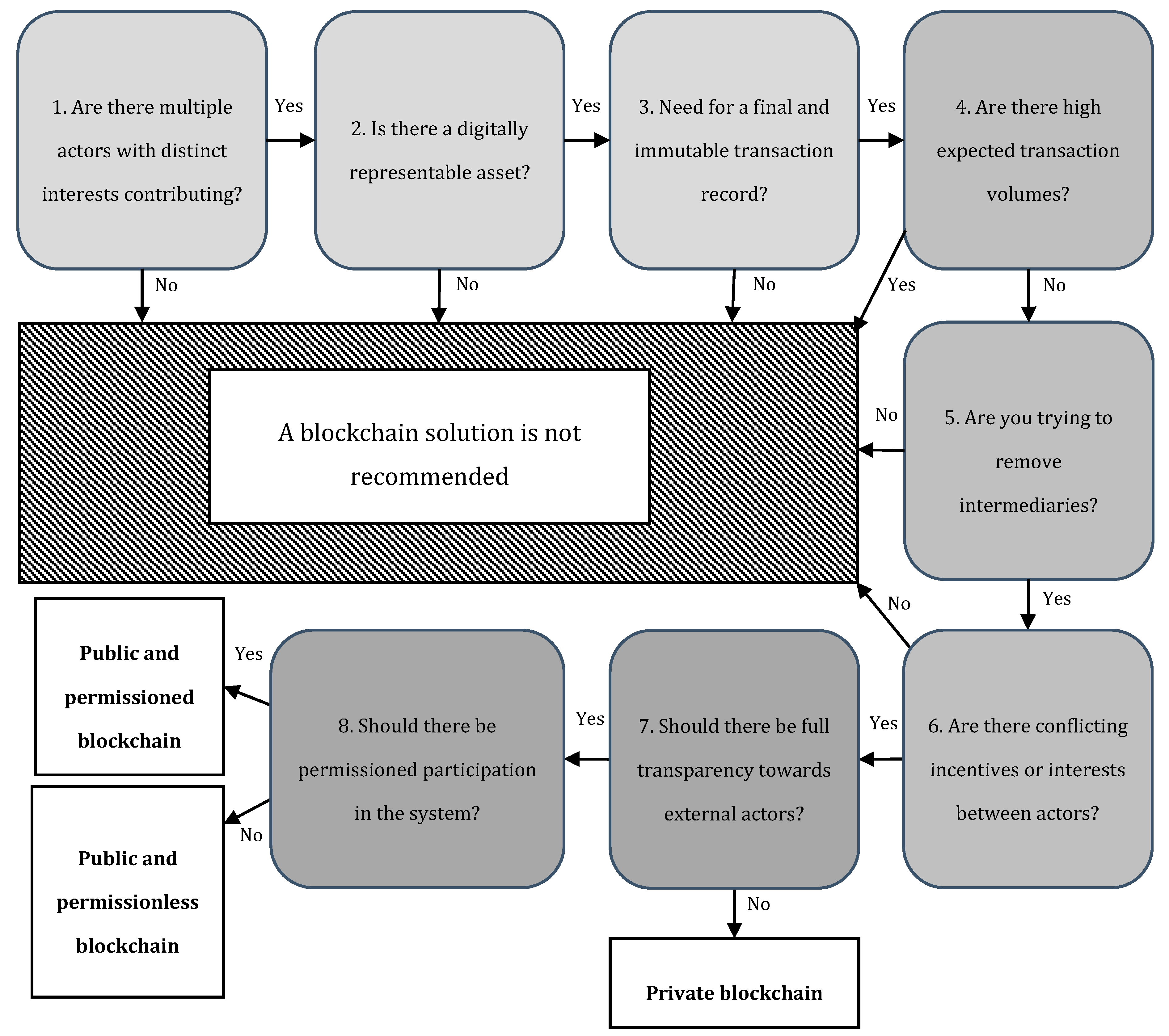

2. Blockchain Decision Framework for the Article 6.2 Market Mechanism

2.1. Multiple Actors Contributing?

2.2. Digitally Representable Asset?

2.3. Final State and Immutable Record?

2.4. High Transaction Volume?

2.5. Removing Intermediaries?

2.6. Conflicting Incentives of Actors?

2.7. Public or Private Transactions?

2.8. System Permissioning?

3. Discussions—Carbon Market Platform Architecture

4. Conclusions and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- UNFCCC. Paris Agreement, United Nations Framework Convention on Climate Change; UNFCCC: Paris, France, 2015. Available online: https://unfccc.int/files/meetings/paris_nov_2015/application/pdf/paris_agreement_english_.pdf (accessed on 25 February 2019).

- World Bank Group. State and Trends of Carbon Pricing 2019; World Bank: Washington, DC, USA, 2019; ISBN 9781464814358. Available online: http://documents.worldbank.org/curated/en/128121575306092470/Summary-Report-Simulation-on-Connecting-Climate-Market-Systems (accessed on 19 May 2020).

- Kollmuss, A.; Schneider, L.; Zhezherin, V. Has Joint Implementation Reduced GHG Emissions? Lessons Learned for the Design of Carbon Market Mechanisms; Stockholm Environment Institute: Stockholm, Sweden, 2015; Volume 7, Available online: https://www.sei.org/publications/has-joint-implementation-reduced-ghg-emissions-lessons-learned-for-the-design-of-carbon-market-mechanisms (accessed on 4 March 2019).

- La Hoz Theuer, S.; Schneider, L.; Broekhoff, D.; Kollmuss, A. International Transfers Under Article 6 in the Context of Diverse Ambition of NDCs. Environmental Integrity Risks and Options to Address Them; Stockholm Environment Institute: Stockholm, Sweden, 2017; Volume 10, Available online: https://mediamanager.sei.org/documents/Publications/SEI-2017-WP-international-transfers.pdf (accessed on 4 March 2019).

- Schneider, L.; Füssler, J.; Kohli, A.; Graichen, J.; Healy, S.; Cames, M.; Broekhoff, D.; Lazarus, M.; La Hoz Theuer, S.; Cook, V. Robust Accounting of International Transfers under Article 6 of the Paris Agreement; German Emissions Trading Authority, German Environment Agency: Berlin, Germany, 2017; p. 69. [Google Scholar]

- Kreibich, N.; Hermwille, L. Robust Transfers of Mitigation Outcomes. Understanding Environmental Integrity Challenges; JIKO Policy Paper No 2/2016; Wuppertal Institute: Wuppertal, Germany, 2016; Available online: https://www.carbon-mechanisms.de/en/publications/details/?jiko%5Bpubuid%5D=464&cHash=8376aade6adae596956280f7bdc3bdda (accessed on 22 May 2020).

- Hanle, L.; Gillenwater, M.; Pulles, T.; Radunksy, K. Challenges and Proposed Reforms to the UNFCCC Expert Review Process for the Enhanced Transparency Framework Coalition on Paris Agreement Capacity Building; Coalition on Paris Agreement Capacity Building and Greenhouse Gas Management Institute: Seattle, WA, USA, 2019; Volume 1, Available online: http://capacitybuildingcoalition.org/wp-content/uploads/2019/04/CoPACB_Discussion-Paper_Review-Process-2019.1-FINAL.pdf (accessed on 22 May 2020).

- Zhang, X.; Aranguiz, M.; Xu, D.; Zhang, X.; Xu, X. Utilising Blockchain for Better Enforcement of Green Finance Law and Regulations. In Transforming Climate Finance and Green Investment with Blockchains; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018; p. 368. ISBN 9780128144473. [Google Scholar]

- Mehling, M.A.; Metcalf, G.E.; Stavins, R.N. Linking Heterogeneous Climate Policies (Consistent with the Paris Agreement). Harvard Project Climate Agreement. 2017. [Google Scholar] [CrossRef] [Green Version]

- Schoenefeld, J.J.; Hildén, M.; Jordan, A.J. The challenges of monitoring national climate policy: Learning lessons from the EU. Clim. Policy 2018, 18, 118–128. [Google Scholar] [CrossRef] [Green Version]

- Galenovich, A.; Lonshakov, S.; Shadrin, A. Blockchain Ecosystem for Carbon Markets, Environmental Assets, Rights, and Liabilities. In Transforming Climate Finance and Green Investment with Blockchains; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018; p. 368. ISBN 978-0-12-814447-3. [Google Scholar]

- CLI. Navigating Blockchain and Climate Action 2019 State and Trends; Climate Ledger Initiative: 2019; p. 72. Available online: https://www.climateledger.org/en/News.3.html?nid=33 (accessed on 30 April 2020).

- World Bank Group. Summary Report: Simulation on Connecting Climate Market Systems (English); World Bank Group: Washington, DC, USA, 2019; Available online: http://documents.worldbank.org/curated/en/128121575306092470/Summary-Report-Simulation-on-Connecting-Climate-Market-Systems (accessed on 31 March 2020).

- CLI. Navigating Blockchain and Climate Action. An Overview; Climate Ledger Initiative: 2018; p. 88. Available online: https://www.climateledger.org/resources/CLI_Report_Dec181.pdf (accessed on 3 May 2020).

- Baumann, T. Blockchain for Planetary Stewardship: Using the Disruptive Force of Distributed Ledger to Fight Climate Disruption; Blockchain Research Institute: Toronto, ON, Canada, 2018; pp. 1–34. Available online: https://www.transparency-partnership.net/system/files/document/Baumann_Blockchain%20for%20Planetary%20Stewardship%20Framework_Blockchain%20Research%20Institute.pdf (accessed on 22 June 2019).

- World Bank Group. State and Trends of Carbon Pricing 2018; World Bank Group: Washington, DC, USA, 2018; Volume 137. Available online: http://www.ncbi.nlm.nih.gov/pubmed/11051013%0Ahttp://www.thieme-connect.de/DOI/DOI?10.1055/s-2008-1037045 (accessed on 29 May 2019).

- CLI. Blockchain Potentials and Limitations for Selected Climate Policy Instruments; Climate Ledger Initiative: 2019. Available online: https://www.giz.de/en/downloads/giz2019-EN-Blockchain-Potentials-Climate-Policy.pdf (accessed on 8 May 2019).

- Dong, X.; Mok, R.C.K.; Tabassum, D.; Guigon, P.; Ferreira, E.; Sinha, C.S.; Prasad, N.; Madden, J.; Baumann, T.; Libersky, J.; et al. Blockchain and Emerging Digital Technologies for Enhancing Post-2020 Climate Markets; World Bank Group: Washington, DC, USA, 2018; Available online: http://documents.worldbank.org/curated/en/942981521464296927/Blockchain-and-emerging-digital-technologies-for-enhancing-post-2020-climate-markets (accessed on 25 September 2018).

- Jackson, A.; Lloyd, A.; Macinante, J.; Hüwener, M. Networked Carbon Markets: Permissionless Innovation With Distributed Ledgers. In Transforming Climate Finance and Green Investment with Blockchains, 1st ed.; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018; pp. 1–15. ISBN 978-0-12-814447-3. [Google Scholar]

- Macinante, J. A Conceptual Model for Networking of Carbon Markets on Distributed Ledger Technology Architecture; University of Edinburgh, School of Law Research Paper 2017/09: Edinburgh, UK,, 2017; Volume 11, pp. 243–260. [Google Scholar] [CrossRef]

- Macinante, J. Networking Carbon Markets—Key Elements of the Process; The World Bank Group:: Washington, DC, USA,, 2016; pp. 1–90. Available online: http://pubdocs.worldbank.org/en/424831476453674939/1700504-Networking-Carbon-Markets-Web.pdf (accessed on 20 November 2018).

- Wainstein, M.E. Open Climate. Leveraging Blockchain for a Global, Transparent and Integrated Climate Accounting System; Yale Open Innovative Lab: New Haven, CT, USA, 2019; pp. 1–23. [Google Scholar]

- UNFCCC. DRAFT TEXT on SBSTA 48-2 Agenda Item 12(a). Matters Relating to Article 6 of the Paris Agreement: Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Version 1 of 9 September 02:00 hrs—Corrected Version*; UNFCCC: Bonn, Germany, 2018. [Google Scholar]

- UNFCCC. DRAFT TEXT on SBSTA 49 Agenda Item 11(a). Matters Relating to Article 6 of the Paris Agreement: Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Version 2 of 8 December 10:00 hrs; UNFCCC: Bonn, Germany, 2018; p. 13.

- UNFCCC. DRAFT TEXT on SBSTA 50 Agenda Item 11(a). Matters Relating to Article 6 of the Paris Agreement: Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Version 2 of 26 June 16:45:00 hrs (edited); UNFCCC: Bonn, Germany, 2019; Volume 11, pp. 1–17.

- UNFCCC. DRAFT TEXT on SBSTA 51 Agenda Item 12(a). Matters Relating to Article 6 of the Paris Agreement: Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Version 3 of 9 December 19:40 hrs; UNFCCC: Madrid, Spain, 2019.

- Cames, M.; Healy, S.; Tänzler, D.; Li, L.; Melnikova, J.; Warnecke, C.; Kurdziel, M. International Market Mechanisms after Paris—Discussion Paper; German Environment Agency: Berlin, Germany, 2016; Available online: https://www.adelphi.de/en/system/files/mediathek/bilder/International_market_mech_after_Paris_discussion_paper.pdf (accessed on 4 March 2019).

- Kreibich, N.; Obergassel, W. Carbon Markets After Paris: How to Account for the Transfer of Mitigation Results? JIKO Policy Paper No. 01/2016; Wuppertal Institute: Wuppertal, Germany, 2016; Available online: http://www.carbon-mechanisms.de/fileadmin/media/dokumente/publikationen/PP_2016_01_Accounting_bf.pdf (accessed on 18 June 2019).

- Obergassel, W.; Asche, F. Shaping the Paris Mechanisms Part III: An Update on Submissions on Article 6 of the Paris Agreement; JIKO policy paper No 05/2017; Wuppertal Institute: Wuppertal, Germany, 2017; Available online: http://www.carbon-mechanisms.de/fileadmin/media/dokumente/Publikationen/Policy_Paper/PP_2016_04_Article_6_Submissions_bf.pdf (accessed on 4 March 2019).

- La Hoz Theuer, S.; Schneider, L.; Broekhoff, D. When less is more: Limits to international transfers under article 6 of the Paris Agreement. Climate Policy 2018, 19, 401–413. [Google Scholar] [CrossRef]

- Schneider, L.; La Hoz Theuer, S. Environmental integrity of international carbon market mechanisms under the Paris Agreement. Clim. Policy 2019, 19, 386–400. [Google Scholar] [CrossRef] [Green Version]

- Müller, B.; Michaelowa, A. How to operationalise accounting under Article 6 market mechanisms of the Paris Agreement. Climate Policy 2019, 19, 812–819. [Google Scholar] [CrossRef]

- Michaelowa, A.; Hermwille, L.; Obergassel, W.; Butzengeiger, S. Additionality revisited: Guarding the integrity of market mechanisms under the Paris Agreement. Clim. Policy 2019, 19, 1211–1224. [Google Scholar] [CrossRef] [Green Version]

- Mehling, M.A.; Metcalf, G.E.; Stavins, R.N. Linking climate policies to advance global mitigation. Science 2018, 359, 997–998. [Google Scholar] [CrossRef] [Green Version]

- Widerberg, O.; Pattberg, P.H. Non-State Actors in a Paris Agreement: Are Cities and Companies Bridging the Ambition Gap? FORES Policy Brief 2015, 1, 1–6. Available online: http://fores.se/wp-content/uploads/2015/05/NSA_Policy_brief_Bonn2.pdf (accessed on 22 May 2020).

- Höhne, N.; Kuramochi, T.; Warnecke, C.; Röser, F.; Fekete, H.; Hagemann, M.; Day, T.; Tewari, R.; Kurdziel, M.; Sterl, S.; et al. The Paris Agreement: Resolving the inconsistency between global goals and national contributions. Clim. Policy 2017, 17, 16–32. [Google Scholar] [CrossRef]

- Greiner, S.; Chagas, T.; Krämer, N.; Michaelowa, A.; Brescia, D.; Hoch, S. Moving Towards Next Generation Carbon Markets—Observations From Article 6 Pilots. Climate Finance Innovators 2019, 1, 1–87. Available online: https://www.climatefinanceinnovators.com/wp-content/uploads/2019/03/Moving-toward-next-generation-carbon-markets.pdf (accessed on 18 June 2019).

- Van Unger, M. Host Country Authorizations under Article 6 Paris Agreement: Developments After COP 24 (Katowice); Atlas Environmental Law Advisory: Berlin, Germany, 2019; Volume 24, Available online: https://www.carbon-mechanisms.de/fileadmin/media/dokumente/Publikationen/Studie/Studie_2019_ATLAS_Host_Country_Authorizations_Art_6_eng.pdf (accessed on 22 May 2020).

- Aldy, J.E.; Pizer, W.A.; Akimoto, K. Comparing emissions mitigation efforts across countries. Clim. Policy 2017, 17, 501–515. [Google Scholar] [CrossRef]

- Karlsson-Vinkhuyzen, S.I.; Groff, M.; Tamás, P.A.; Dahl, A.L.; Harder, M.; Hassall, G. Entry into force and then? The Paris agreement and state accountability. Clim. Policy 2018, 18, 593–599. [Google Scholar] [CrossRef] [Green Version]

- Schneider, L.; La Hoz Theuer, S.; Howard, A.; Kizzier, K.; Cames, M. Outside in? Using international carbon markets for mitigation not covered by nationally determined contributions (NDCs) under the Paris Agreement. Clim. Policy 2020, 20, 18–29. [Google Scholar] [CrossRef]

- Greiner, S.; Krämer, N.; Michaelowa, A.; Espelage, A. Article 6 Corresponding Adjustments: Key Accounting Challenges for Article 6 Transfers of Mitigation Outcomes; Climate Focus B.V.: Amsterdam, The Netherlands; Perspectives Climate Group GmbH: Freiburg, Germany, 2019; Available online: https://www.carbon-mechanisms.de/fileadmin/media/dokumente/Publikationen/Studie/2019_ClimateFocus_Perspectives_Corresponding_Adjustments_Art6.pdf (accessed on 29 April 2020).

- UNFCCC. FAQ’s on the Operationalisation of the Enhanced Transparency Framework. In Moving Towards the Enhanced Transparency Framework; UNFCCC: Bonn, Germany, 2020; Available online: https://unfccc.int/enhanced-transparency-framework#eq-10 (accessed on 22 May 2020).

- Milkoreit, M.; Haapala, K. The global stocktake: Design lessons for a new review and ambition mechanism in the international climate regime. Int. Environ. Agreem. Polit. Law Econ. 2019, 19, 89–106. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; Mccallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Kewell, B.; Adams, R.; Parry, G. Blockchain for good? Strateg. Chang. 2017, 26, 429–437. [Google Scholar] [CrossRef] [Green Version]

- Dai, J.; Vasarhelyi, M.A. Toward Blockchain-Based Accounting and Assurance. J. Inf. Syst. 2017, 31, 5–21. [Google Scholar] [CrossRef]

- Bano, S.; Sonnino, A.; Al-bassam, M.; Azouvi, S.; Mccorry, P. SoK: Consensus in the Age of Blockchains. arXiv 2017, arXiv:1711.03936. Available online: https://arxiv.org/pdf/1711.03936.pdf (accessed on 5 August 2019).

- Schletz, M.; Nassiry, D.; Lee, M.-K. Blockchain and Tokenized Securities: The Potential for Green Finance; ADBI Working Papers; Asian Development Bank Institute: Tokyo, Japan, 2020; Available online: https://www.adb.org/publications/blockchain-tokenized-securities-potential-green-finance (accessed on 5 February 2020).

- Peters, G.W.; Panayi, E. Understanding modern banking ledgers through blockchain technologies: Future of transaction processing and smart contracts on the internet of money. In Banking beyond Banks and Money; Springer: Cham, Switzerland, 2016; pp. 239–278. [Google Scholar] [CrossRef] [Green Version]

- Duchenne, J. Blockchain and Smart Contracts: Complementing Climate Finance, Legislative Frameworks, and Renewable Energy Projects. In Transforming Climate Finance and Green Investment with Blockchains; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018; p. 368. ISBN 9780128144473. [Google Scholar]

- Xu, X.; Weber, I.; Staples, M.; Zhu, L.; Bosch, J.; Bass, L.; Pautasso, C.; Rimba, P. A Taxonomy of Blockchain-Based Systems for Architecture Design. In Proceedings of the 2017 IEEE International Conference on Software Architecture (ICSA), Gothenburg, Sweden, 3–7 April 2017; Volume 43, pp. 243–252. [Google Scholar]

- UNFCCC. SBSTA 48. Agenda Item 12(a). Revised Informal Note Containing Draft Elements of the Guidance on Cooperative Approaches Referred to in Article 6, Paragraph 2, of the Paris Agreement; Version @ 17:00 of 8 May 2018 (edited); UNFCCC: Bonn, Germany, 2018; Volume 12, pp. 1–24.

- Blockchain for Climate Foundation. Putting the Paris Agreement on the Blockchain. 2018. Available online: https://www.blockchainforclimate.org/ (accessed on 10 October 2018).

- Poseidon Foundation Climate Rescue. Empoerwing People to Save the Planet with Every Purchase; Poseidon Operations Ltd.: Ewropa Business Center, Malta, 2019; Available online: https://poseidon.eco/assets/documents/Poseidon-Climate-Rescue.pdf (accessed on 23 May 2020).

- AirCarbon Exchange. AirCarbon Exchange. 2020. Available online: https://www.aircarbon.co/exchange (accessed on 10 February 2020).

- Pedersen, A.B.; Risius, M.; Beck, R. Blockchain Decision Path: “When To Use Blockchain? ”—“Which Blockchain Do You Mean?”. MIS Q. Exec. 2019, 18, 24. Available online: https://pure.itu.dk/ws/files/83594249/MISQe_BC_in_the_Maritime_Shipping_Industry_Revision.pdf (accessed on 13 August 2019).

- World Economic Forum These 11 Questions Will Help You Decide If Blockchain Is Right for Your Business. Available online: https://www.weforum.org/agenda/2018/04/questions-blockchain-toolkit-right-for-business (accessed on 1 December 2018).

- Wüst, K.; Gervais, A. Do you need a Blockchain? IACR Cryptol. ePrint Arch 2017, 1, 1–17. Available online: https://eprint.iacr.org/2017/375.pdf.

- Zachariadis, M.; Hileman, G.; Scott, S.V. Governance and control in distributed ledgers: Understanding the challenges facing blockchain technology in financial services. Inf. Organ. 2019, 29, 105–117. [Google Scholar] [CrossRef]

- EBRD. Operationalising Article 6 of the Paris Agreement. Perspectives of Developers and Investors on Scaling-up Private Sector Investment.; European Bank for Reconstruction and Development: London, UK, 2017; Available online: https://www.ieta.org/resources/International_WG/Article6/Portal/operationalising-article-6-of-the-paris-agreement.pdf (accessed on 22 November 2018).

- He, D.; Leckow, R.; Haksar, V.; Mancini-Griffoli, T.; Jenkinson, N.; Kashima, M.; Khiaonarong, T.; Rochon, C.; Tourpe, H.; Adrian, T.; et al. Fintech and Financial Services: Initial Considerations; International Monetary Fund: Washington, DC, USA, 2017; p. 49. [Google Scholar]

- Cong, L.W.; He, Z. Blockchain Disruption and Smart Contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Niya, S.R.; Jha, S.S.; Bocek, T.; Stiller, B. Design and implementation of an automated and decentralised pollution monitoring system with blockchains, smart contracts, and LoRaWAN. In Proceedings of the IEEE/IFIP Network Operations and Management Symposium: Cognitive Management in a Cyber World, NOMS 2018, Taipei, Taiwan, 23–27 April 2018; pp. 1–4. [Google Scholar]

- UN. United Nations Treaty Collection. Available online: https://treaties.un.org/pages/ViewDetails.aspx?src=TREATY&mtdsg_no=XXVII-7-d&chapter=27&clang=_en (accessed on 28 December 2018).

- UNFCCC. Review Process|UNFCCC. Available online: https://unfccc.int/process/transparency-and-reporting/reporting-and-review-under-the-convention/greenhouse-gas-inventories-annex-i-parties/review-process (accessed on 27 December 2018).

- OECD. The Tokenisation of Assets and Potential Implications for Financial Markets; OECD Blockchain Policy Series; Organisation for Economic Co-operation and Development: Paris, France, 2020; Available online: http://www.oecd.org/finance/The-Tokenisation-of-Assets-and-Potential-Implications-for-Financial-Markets.htm (accessed on 18 January 2020).

- Faisal, T.; Courtois, N.; Serguieva, A. The Evolution of Embedding Metadata in Blockchain Transactions. In Proceedings of the 2018 International Joint Conference on Neural Networks (IJCNN), Rio de Janeiro, Brazil, 8–13 July 2018. [Google Scholar] [CrossRef] [Green Version]

- Nofer, M.; Gomber, P.; Hinz, O.; Schiereck, D. Blockchain. Bus. Inf. Syst. Eng. 2017, 59, 183–187. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T.; Rogers, N. Blockchain Adoption: Technological, Organisational and Environmental Considerations. In Business Transformation through Blockchain; Treiblmaier, H., Beck, R., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; pp. 47–76. ISBN 9783319989112. [Google Scholar]

- Glaser, F. Pervasive Decentralisation of Digital Infrastructures: A Framework for Blockchain enabled System and Use Case Analysis. In Proceedings of the HICSS 2017 Proc., Hilton Waikoloa Village, HI, USA, 4–7 January 2017; pp. 1543–1552. [Google Scholar] [CrossRef]

- Born, R.; Distributed Ledger Technology for Climate Action Assessment. EIT Climate-KIC, 1, 2018, pp. 1–129. Available online: https://www.climate-kic.org/wp-content/uploads/2018/11/DLT-for-Climate-Action-Assessment-Nov-2018.pdf (accessed on 7 May 2020).

- Xu, X.; Pautasso, C.; Zhu, L.; Gramoli, V.; Ponomarev, A.; Tran, A.B.; Chen, S. The blockchain as a software connector. In Proceedings of the 13th Working IEEE/IFIP Conference on Software Architecture (WICSA), Venice, Italy, 5–8 April 2016; pp. 182–191. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where is current research on Blockchain technology?—A systematic review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef] [PubMed]

- Macrinici, D.; Cartofeanu, C.; Gao, S. Smart contract applications within blockchain technology: A systematic mapping study. Telemat. Inform. 2018, 35, 2337–2354. [Google Scholar] [CrossRef]

- CMA. The Katowice Texts—Proposal by the President; Conference of Parties: Katowice, Poland, 2018; Available online: https://unfccc.int/sites/default/files/resource/Katowice text%2C 14 Dec2018_1015AM.pdf (accessed on 19 December 2018).

- Franke, L.; Schletz, M.; Salomo, S. Designing a Blockchain Model for the Paris Agreement’s Carbon Market Mechanism. Sustainability 2020, 12, 68. [Google Scholar] [CrossRef] [Green Version]

- Dunkel, S. How a Blockchain Network Can Ensure Compliance With Clean Development Mechanism Methodology and Reduce Uncertainty About Achieving Intended Nationally Determined Contributions. In Transforming Climate Finance and Green Investment with Blockchains; Marke, A., Ed.; Academic Press: Cambridge, MA, USA, 2018; p. 368. ISBN 978-0-12-814447-3. [Google Scholar]

- WEF. The Future of Financial Infrastructure—An Ambitious Look at How Blockchain Can Reshape Financial Services; Future of Financial Services Series; World Economic Forum: Cologny, Switzerland, 2016; p. 130. Available online: http://www3.weforum.org/docs/WEF_The_future_of_financial_infrastructure.pdf (accessed on 20 March 2020).

- World Bank Group. Distributed Ledger Technology (DLT) and Blockchain; FinTech Note; The World Bank Group: Washington, DC, USA, 2017; Available online: http://documents.worldbank.org/curated/en/177911513714062215/Distributed-Ledger-Technology-DLT-and-blockchain (accessed on 14 January 2019).

- OECD. Blockchain Technologies as a Digital Enabler for Sustainable Infrastructure; OECD Environment Policy Paper NO. 16; Organisation for Economic Co-operation and Development: Paris, France, 2019; Available online: http://www.oecd.org/finance/The-Tokenisation-of-Assets-and-Potential-Implications-for-Financial-Markets.htm (accessed on 26 October 2019).

- Howson, P. Tackling climate change with blockchain. Nat. Clim. Chang. 2019, 9, 644–645. [Google Scholar] [CrossRef]

- Beck, R.; Stenum Czepluch, J.; Lollike, N.; Malone, S. Blockchain—The gateway to trust-free cryptographic transactions. In Proceedings of the 24th European Conference on Information Systems, ECIS, Istanbul, Turkey, 12–15 June 2016; pp. 1–14. [Google Scholar]

- Notheisen, B.; Cholewa, J.B.; Shanmugam, A.P. Trading Real-World Assets on Blockchain: An Application of Trust-Free Transaction Systems in the Market for Lemons. Bus. Inf. Syst. Eng. 2017, 59, 425–440. [Google Scholar] [CrossRef]

- Seidel, M.D.L. Questioning Centralized Organizations in a Time of Distributed Trust. J. Manag. Inq. 2018, 27, 40–44. [Google Scholar] [CrossRef]

- Leonhard, R. Forget Paris: Building a Carbon Market in the U.S. Using Blockchain-Based Smart Contracts. SSRN 2017, 1–23. [Google Scholar] [CrossRef]

- Reitwiessner, C. zkSNARKs in a Nutshell. Ethereum Blog 2016, 6, 1–15. Available online: https://blog.ethereum.org/2016/12/05/zksnarks-in-a-nutshell/ (accessed on 24 May 2020).

- Kiviat, T.I. Beyond Bitcoin: Issues in regulating blockchain transactions. Duke Law J. 2015, 65, 569–608. Available online: https://scholarship.law.duke.edu/dlj/vol65/iss3/4/ (accessed on 26 August 2018).

- Beck, R.; Müller-Bloch, C. Blockchain as Radical Innovation: A Framework for Engaging with Distributed Ledgers as Incumbent Organization. In Proceedings of the 50th Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, 4–7 January 2017; pp. 5390–5399. [Google Scholar] [CrossRef] [Green Version]

- Ashley, M.J.; Johnson, M. Establishing a Secure, Transparent, and Autonomous Blockchain of Custody for Renewable Energy Credits and Carbon Credits. IEEE Eng. Manag. Rev. 2018, 46, 100–102. [Google Scholar] [CrossRef]

- Zhao, F.; Chan, W.K. (Victor) When Is Blockchain Worth It? A Case Study of Carbon Trading. Energies 2020, 13, 1980. [Google Scholar] [CrossRef] [Green Version]

- Verles, M.; Braden, S.; Taibi, F.-Z.; Olsen, K.H. Sustainable Development Stakeholder Consultation: Ensuring the Consultation of Relevant Stakeholders When Implementing Activities under Article 6 of the Paris Agreement. 2018. Available online: https://backend.orbit.dtu.dk/ws/files/163019150/5._Policy_Brief_Stakeholder_Consultation_180824.pdf (accessed on 28 April 2020).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schletz, M.; Franke, L.A.; Salomo, S. Blockchain Application for the Paris Agreement Carbon Market Mechanism—A Decision Framework and Architecture. Sustainability 2020, 12, 5069. https://doi.org/10.3390/su12125069

Schletz M, Franke LA, Salomo S. Blockchain Application for the Paris Agreement Carbon Market Mechanism—A Decision Framework and Architecture. Sustainability. 2020; 12(12):5069. https://doi.org/10.3390/su12125069

Chicago/Turabian StyleSchletz, Marco, Laura A. Franke, and Søren Salomo. 2020. "Blockchain Application for the Paris Agreement Carbon Market Mechanism—A Decision Framework and Architecture" Sustainability 12, no. 12: 5069. https://doi.org/10.3390/su12125069