Landfill Levy Imposition on Construction and Demolition Waste: Australian Stakeholders’ Perceptions

Abstract

1. Introduction

- To explore C&D waste key stakeholders’ perceptions of the landfill levy.

- To identify the best approach to improve the effectiveness of current landfill levy regimes.

2. Methodology

2.1. Sample and Data Collection

2.2. Survey Design

2.3. Data Analysis and Presentation

3. Results

3.1. Participants Profile

3.2. Approaches to Reduce C&D Waste Landfilling

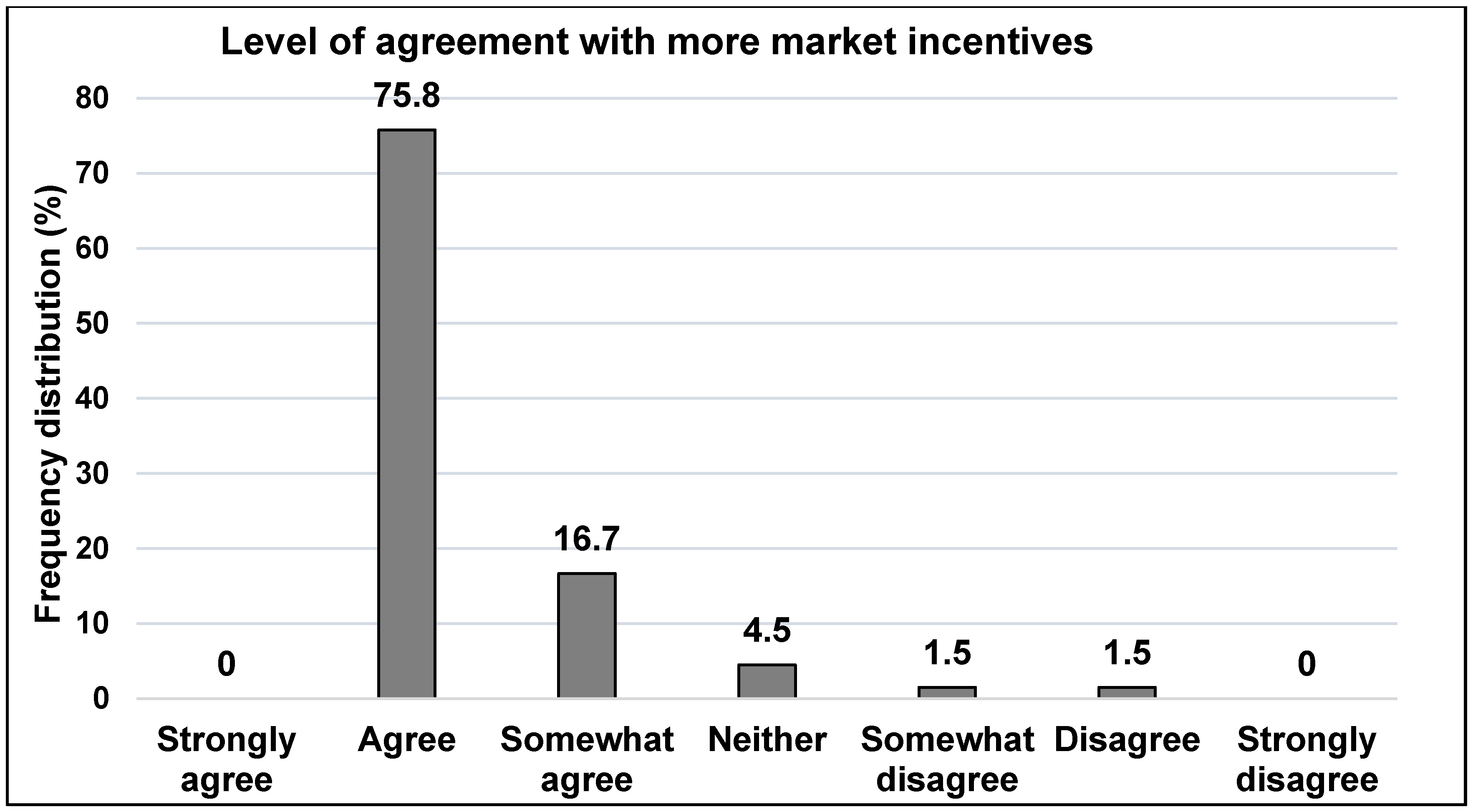

- Express your degree of agreement on the following statements: More market incentives (e.g., remove regulatory barriers; foster minimum recycled content in products; invest in technologies to recycle and facilitate trade such as trading platforms) can better increase C&D waste reduction, re-use and recycling in Australia.

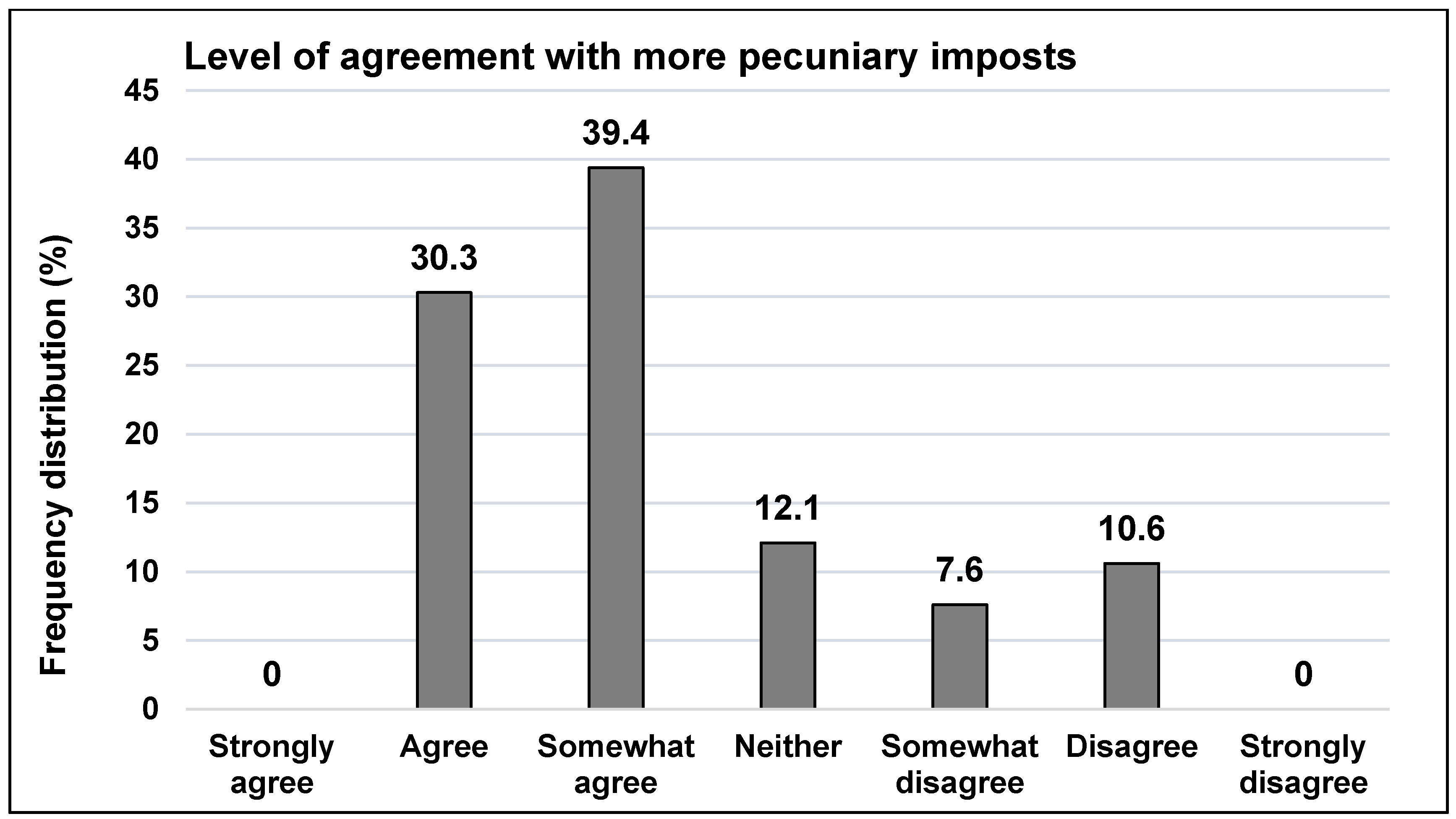

- Express your degree of agreement on the following statements: More pecuniary imposts (e.g., landfill levy increases; taxes on producers; more regulations, monitoring and enforcement) can better increase C&D waste reduction, re-use and recycling in Australia.

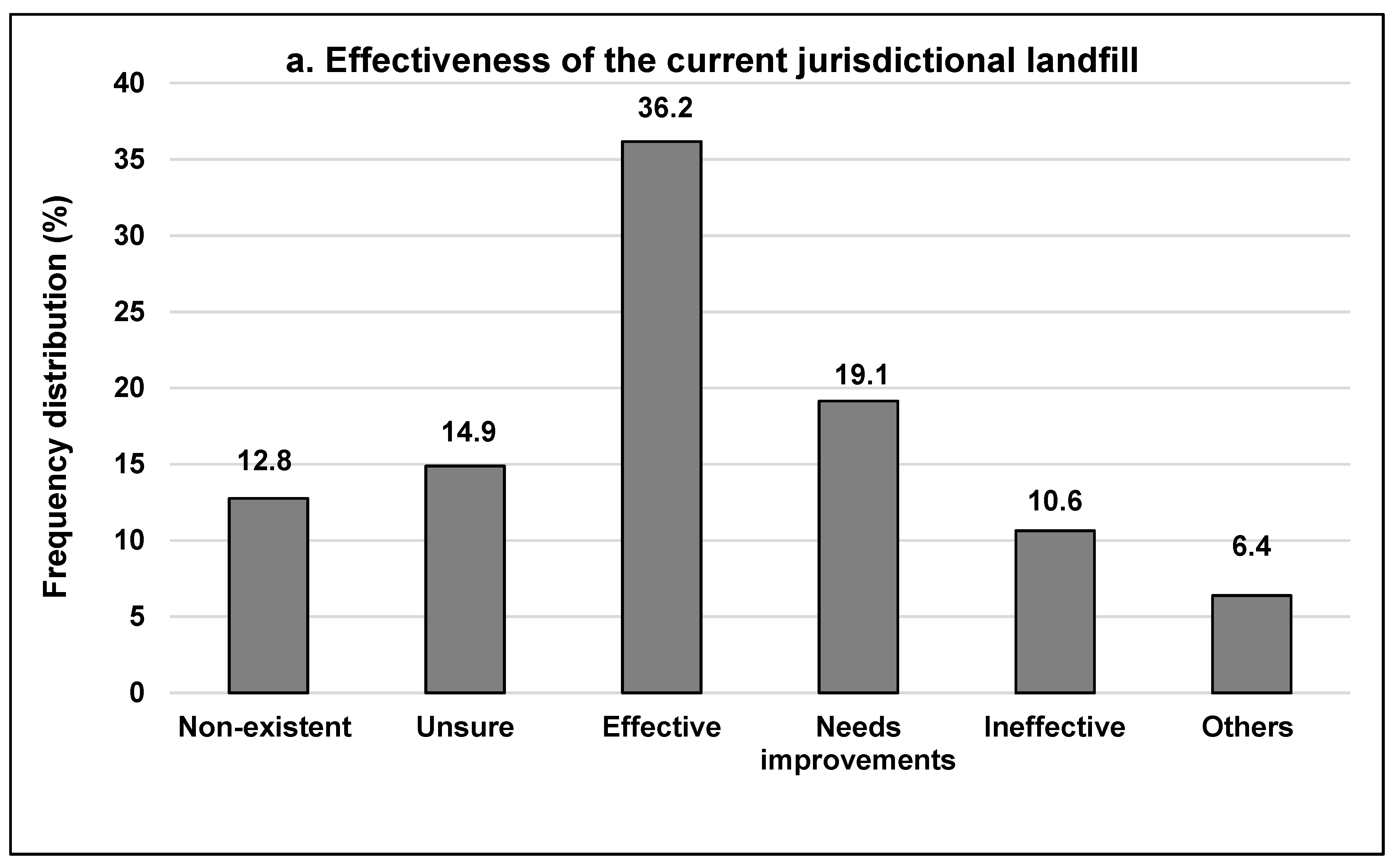

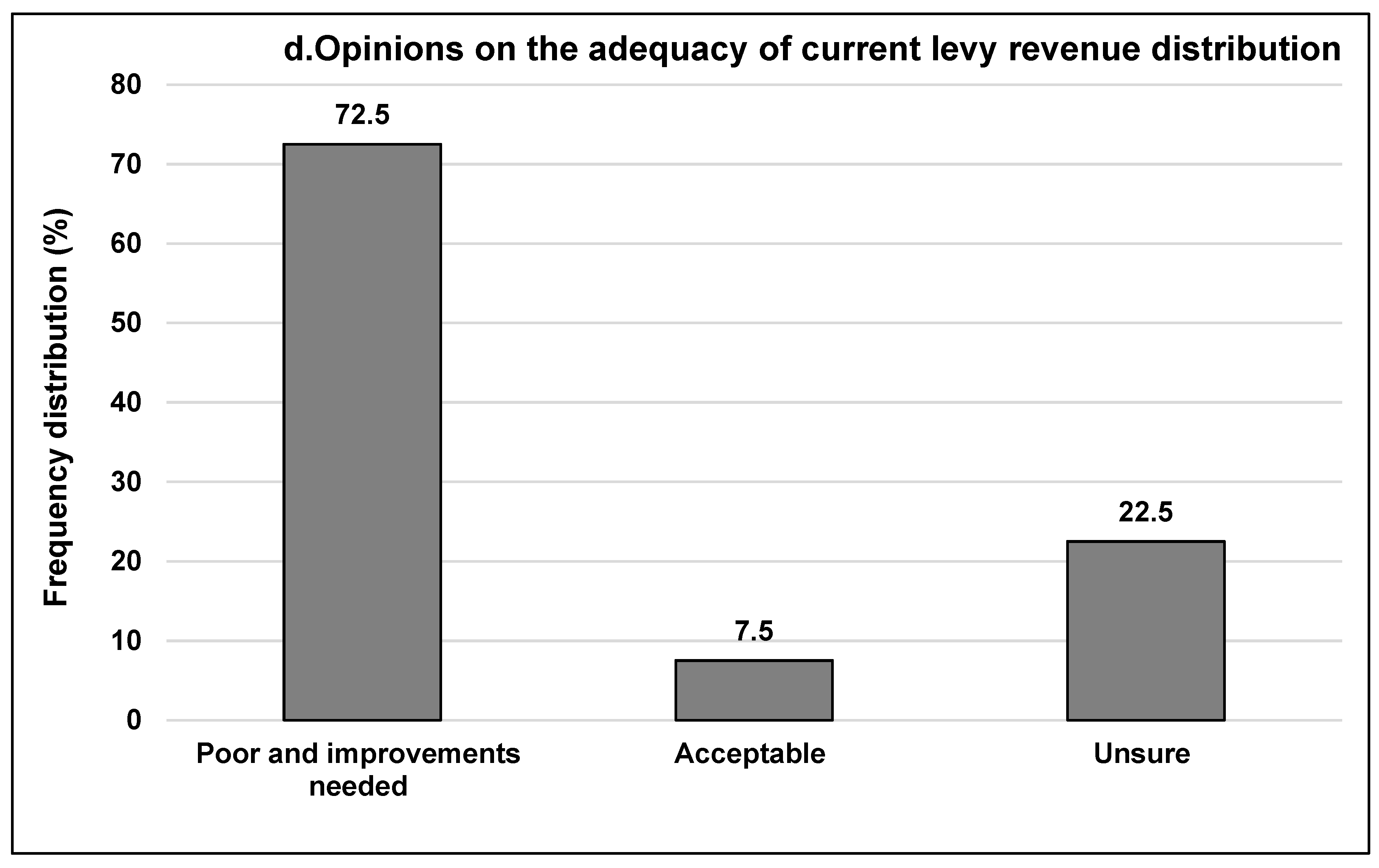

3.3. Effectiveness of Landfill Levies in C&D Waste Management Frameworks

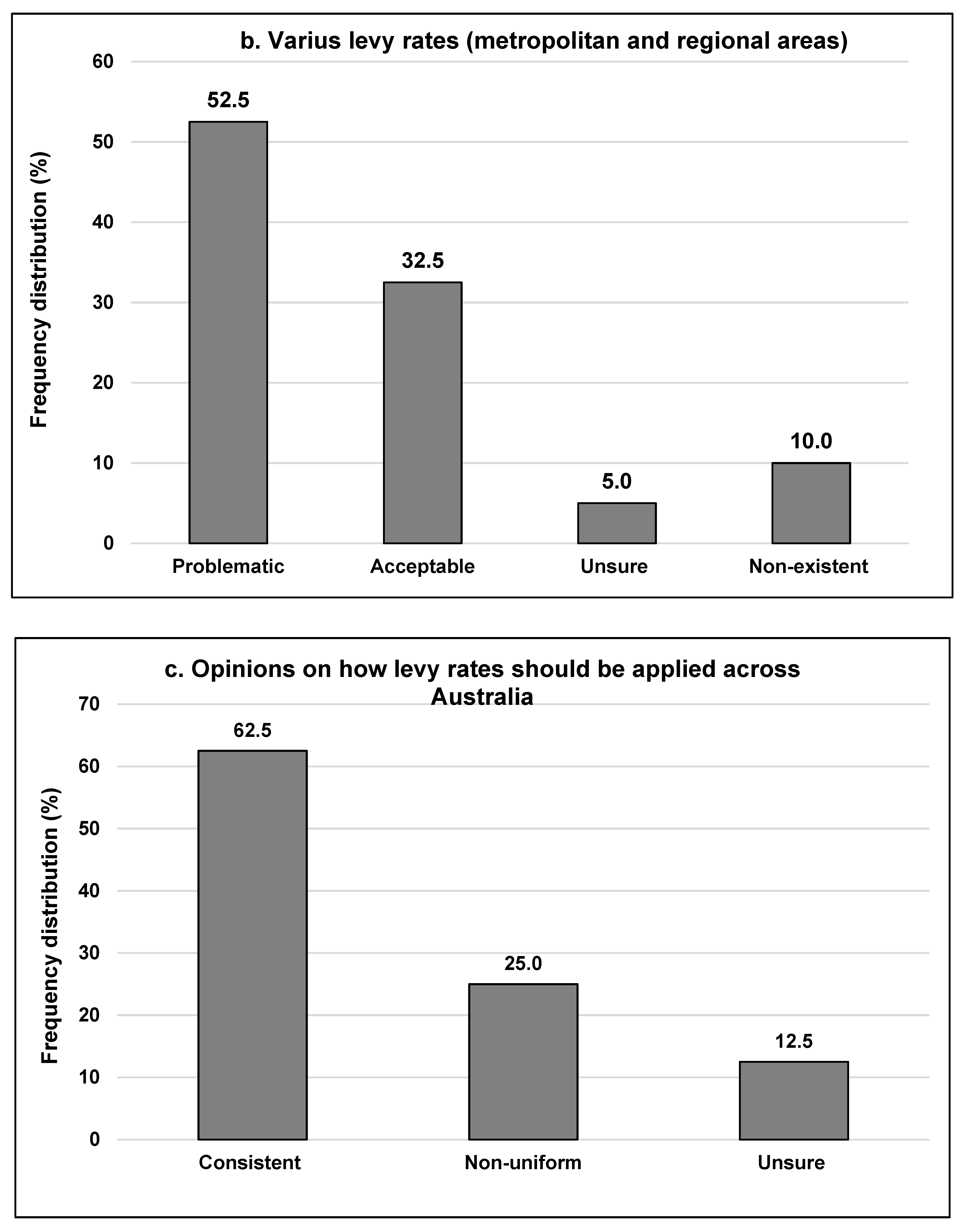

3.4. Characteristics of the Landfill Levy

4. Discussion

4.1. Improvements

- “[Levy rate] needs to be higher in regional areas to promote recycling. Otherwise there is not the market for C&D material in these locations”.

- “Levy rates should be less in regional (Qld) where there is no option to recycle”.

- “Agreed due to the remoteness conditions of the NT, which could help preventing illegal dumping”.

- “A differential levy works in mainland states because of the vast geographic size of mainland states”.

- “Regions are too diverse to be able to manage the same way as metro areas due to lack of resource availability”.

- “It is ineffective in WA due to [Department of Water and Environmental Regulations] DWER being unable to control illegal operations”.

- “It increases building costs without reducing waste”.

- “As per findings by the Waste Authority in 2014 before the levy was increased, the cost of transport is a key factor in providing incentive to recycle rather than landfill. But if you are generating waste next to a landfill, it is cheaper to landfill than recycle in WA”.

4.2. Government Role

- Maintain a separate waste levy trust account from which all levies collected are managed;

- The Trust Account should have clear rules on how the funds are to be allocated and reported on, including objectives that link to the State’s waste avoidance, resource recovery plans;

- Levies raised are only invested in activities consistent with the Trust Account’s rules and objectives;

- Guaranteeing a minimum percentage of levies to be spent annually on activities to implement the jurisdiction’s waste avoidance and resource recovery strategies, resource recovery and remanufacturing industry development plans, market development initiatives and infrastructure plans.

4.3. Market Development

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Shooshtarian, S.; Maqsood, T.; Khalfan, M.; Wong, S.P.P.; Yang, R. Managing Construction and Demolition (C&D) Waste in Australia. In Proceedings of the CIB World Building Congress 2019 ‘Constructing Smart Cities’, Hong Kong, China, 2–4 July 2019; Faculty of Construction and Environment, The Hong Kong Polytechniques University: Hong Kong, China, 2019. [Google Scholar]

- Peng, C.L.; Scorpio, D.E.; Kibert, C.J. Strategies for Successful Construction and Demolition Waste Recycling Operations. Constr. Manag. Econ. 1997, 15, 49–58. [Google Scholar] [CrossRef]

- Wainberg, R. The State of Waste; Waste Management (and Resource Recovery) Association of Australia: Sydney, Australia, 2012. [Google Scholar]

- Carr, A.; Fetherston, É.; Makled, T.; Meyer, L. Towards a Circular Plastics Economy: Policy Solutions for Closing the Loop on Plastic. Ph.D. Thesis, University of Michigan, Ann Arbor, MI, USA, 2019. [Google Scholar]

- Ritchie, M. China’s National Sword Policy: The Impact on Australia’s Recycling; MRA Consulting Group: Sydney, Australia, 2018. [Google Scholar]

- Shooshtarian, S.; Khalfan, M.; Maqsood, T.; Wong, S.P.P.; Yang, J.R. The Australian Construction and Demolition Waste Management in the Face of New Waste Import Policies by Foreign Countries. Sustain. Dev. 2020. under review. [Google Scholar]

- Sahajwalla, V. Big Challenges, Micro Solutions: Closing the Loop in Australia’s Waste Crisis. AQ Aust. Q. 2018, 89, 13–18. [Google Scholar]

- Environment and Communications References Committee. Never Waste a Crisis: The Waste and Recycling Industry in Australia; Parliament of Australia: Canberra, Australia, 2018. [Google Scholar]

- Forghani, R.; Sher, W.; Kanjanabootra, S.; Totoev, Y. Consequence of Waste Levy Revocation: Case Study Queensland, Australia. In Proceedings of the 23rd Annual Pacific Rim Real Estate Society Conference on The Built Environment and Health, Infrastructure and System Resilience Planning, Sydney, Australia, 15–18 Janary 2016; Sydney University of Technology: Sydney, Australia, 2017. [Google Scholar]

- Park, J.; Tucker, R. Overcoming Barriers to the Reuse of Construction Waste Material in Australia: A Review of the Literature. Int. J. Constr. Manag. 2017, 17, 228–237. [Google Scholar]

- Wu, H.; Zuo, J.; Yuan, H.; Zillante, G.; Wang, J. Cross-Regional Mobility of Construction and Demolition Waste in Australia: An Exploratory Study. Resour. Conserv. Recycl. 2020, 156, 104710. [Google Scholar]

- Rameezdeen, R.; Chileshe, N.; Hosseini, M.; Lehmann, S. A Qualitative Examination of Major Barriers in Implementation of Reverse Logistics within the South Australian Construction Sector. Int. J. Constr. Manag. 2016, 16, 185–196. [Google Scholar] [CrossRef]

- Shooshtarian, S.; Maqsood, T.; Wong, P.S.; Khalfan, M.; Yang, J. Development of a Domestic Market for Construction and Demolition Waste in Australia. In Proceedings of the 43rd AUBEA Conference: Built to Thrive: Creating Buildings and Cities That Support Individual Well-Being and Community Prosperity, Noosa, Australia, 6–8 November 2019; Central Queenslaand University: Noosa, Australia, 2019; pp. 612–628. [Google Scholar]

- Pickin, J.; Randell, P.; Trinh, J.; Grant, B. National Waste Report 2018; Australian Department of the Environment and Energy: Canberra, Australia, 2018. [Google Scholar]

- Hammond, J.D. A Growth Tax for the States?-Rubbish! Monash Univ. Law Rev. 1977, 4, 1977–1978. [Google Scholar]

- Shooshtarian, S.; Maqsood, T.; Wong, P.; Khalfan, M.; Yang, R. Review of Energy Recovery from Construction and Demolition Waste in Australia. J. Constr. Eng. Manag. Innov. 2019, 2, 112–130. [Google Scholar] [CrossRef]

- Serpo, A.; Read, R. White Paper: Review of Waste Levies in Australia; National Waste & Recycling Industry Council: Sydney, Australia, 2019. [Google Scholar]

- Davis, P.; Simon, L.; Sher, W.; Tang, P.; Newaz, M.T. Key Solutions for Construction and Demolition (C&D) Waste Management in NSW, Australia. In Proceedings of the 43rd AUBEA Conference: Built to Thrive: Creating Buildings and Cities That Support Individual Well-Being and Community Prosperity, Noosa, Australia, 6–8 November 2019; Central Queenslaand University: Noosa, Australia, 2019; pp. 612–628. [Google Scholar]

- Ministry for the Environment. Review of the Effectiveness of the Waste Disposal Levy, 2014 in Accordance with Section 39 of the Waste Minimisation Act 2008; Ministry for the Environment: Wellington, New Zealand, 2014. [Google Scholar]

- Queensland Government. Transforming Queensland’s Recycling and Waste Industry; Directions Paper; Queensland Government: Brisbane, Australia, 2018.

- Yu, A.T.W.; Poon, C.; Wong, A.; Yip, R.; Jaillon, L.C. Impact of Construction Waste Disposal Charging Scheme on Work Practices at Construction Sites in Hong Kong. Waste Manag. 2013, 33, 138–146. [Google Scholar] [PubMed]

- Edge Environment. Construction and Demolition Waste Guide—Recycling and Re-Use across the Supply Chain; The Department of Energy and Environment: Canberra, Australia, 2012. [Google Scholar]

- WA’s Department of Water and Environmental Regulation. Review of the Waste Levy: Consultation Paper; Department of Water and Environmental Regulation: Perth, Australia, 2020. [Google Scholar]

- Qualtrics, LLC. Qualtrics [Software]; Qualtrics: Provo, UT, USA, 2014. [Google Scholar]

- Park, S.-Y.; Levy, S.E. Corporate Social Responsibility: Perspectives of Hotel Frontline Employees. Int. J. Contemp. Hosp. Manag. 2014, 26, 332–348. [Google Scholar] [CrossRef]

- NSW Environment Protection Authority. Waste Less, Recycle More; NSW Government: Sydney, Australia, 2016.

- Environmental Protection Authority Victoria. Environment Protection (Distribution of Landfill Levy) Regulations 2010; Environmental Protection Authority: Melbourne, Australia, 2010.

- Rundle, P.G.; Bahadori, A.; Doust, K. Effective Front-End Strategies to Reduce Waste on Construction Projects; Springer: New York City, NY, USA, 2019. [Google Scholar]

- Shooshtarian, S.; Maqsood, T.; Wong, S.P.P.; Khalfan, M. Review of Waste Strategy Documents in Australia: Analysis of Strategies for Construction and Demolition Waste. Int. J. Environ. Waste Manag. 2020, 25, 1–18. [Google Scholar]

- Dominish, E.; Florin, N.; Giurco, D.; Corder, G.; Golev, A.; Lane, R.; Rhamdhani, A.; Reck, B.; Graedel, T.; Sharpe, S.; et al. Australian Opportunities in a Circular Economy for Metals: Findings of the Wealth from Waste Cluster: Wealth from Waste; Wealth from Waste Cluster: Sydney, Australia, 2017. [Google Scholar]

- Caldera, S.; Ryley, T.; Zatyko, N. Developing a Marketplace for Construction and Demolition Waste. In Proceedings of the 1st Asia Pacific SDEWES Conference: Engineering a Sustainable Circular Economy: Materials, Energy and Infrastructure Integration for Smart Cities and Industry, Gold Coast, Australia, 6–9 April 2020. [Google Scholar]

| Question | Distribution | (%) |

|---|---|---|

| Field of activity | Construction | 16 |

| Demolition | 8 | |

| Landfill | 15 | |

| Legislation | 6 | |

| Industry association | 6 | |

| Waste recovery | 20 | |

| Waste delivery and transport | 10 | |

| Consultancy | 7 | |

| Manufacturing | 4 | |

| R&D | 3 | |

| Regulations & enforcement | 5 | |

| Experience | <6 years | 43.1 |

| 6–10 years | 13.7 | |

| 11–15 years | 16.7 | |

| >15 years | 26.5 | |

| State/territory | ACT | 1.8 |

| NSW | 24.3 | |

| NT | 6.3 | |

| Qld | 16.2 | |

| Tas | 3.6 | |

| Vic | 30.6 | |

| WA | 17.1 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shooshtarian, S.; Maqsood, T.; Khalfan, M.; Yang, R.J.; Wong, P. Landfill Levy Imposition on Construction and Demolition Waste: Australian Stakeholders’ Perceptions. Sustainability 2020, 12, 4496. https://doi.org/10.3390/su12114496

Shooshtarian S, Maqsood T, Khalfan M, Yang RJ, Wong P. Landfill Levy Imposition on Construction and Demolition Waste: Australian Stakeholders’ Perceptions. Sustainability. 2020; 12(11):4496. https://doi.org/10.3390/su12114496

Chicago/Turabian StyleShooshtarian, Salman, Tayyab Maqsood, Malik Khalfan, Rebecca J. Yang, and Peter Wong. 2020. "Landfill Levy Imposition on Construction and Demolition Waste: Australian Stakeholders’ Perceptions" Sustainability 12, no. 11: 4496. https://doi.org/10.3390/su12114496

APA StyleShooshtarian, S., Maqsood, T., Khalfan, M., Yang, R. J., & Wong, P. (2020). Landfill Levy Imposition on Construction and Demolition Waste: Australian Stakeholders’ Perceptions. Sustainability, 12(11), 4496. https://doi.org/10.3390/su12114496