4.1. Basic Model and Estimation Method

Carbon emissions, as an externality factor in economic development, can transfer not only through atmosphere diffusions due to a change of natural climate conditions, but also through industrial shifts and element flows in human activities, and generate the phenomenon of spatial transmission. Thus, carbon emissions may have a significant correlation effect in space [

39]. The omission of such spatial correlation will necessarily result in an error in the estimation of models and false parameter tests [

40]. This paper introduces a special weight matrix, and uses the spatial econometric model to control the possible spatial association.

Then, we expand Equation (18) to construct the econometric model as follows:

where

is a spatial weight matrix reflecting the spatial relationship among the units;

is a set of control variables;

represents the individual effect;

is a random disturbance term; both

and

are the spatial lag coefficients reflecting the space-dependent relation between variables; and

is the spatial error coefficient reflecting the spatial relation existing in the random disturbance item. If both

and

are equal to zero, Equation (21) is a Spatial Error Model (SEM), which means that the spatial relations are influenced by unobservable factors in different regions; that is to say, the spatial correlation features are reflected in random perturbation terms. If both

and

are equal to zero, Equation (21) is a Spatial Lagged Model (SLM), which means that spatial relations come from explained variables between different regions. If

is equal to zero, Equation (21) is a Spatial Dubin Model (SDM), which means that spatial relationships are not only derived from explained variables between different regions, but also from explanatory variables between different regions. The specific model settings are required to be further inspected.

Due to the spatial lag term

being included in the model, a mutual causality between the dependent and independent variables exists, which leads to endogeneity problems. So, the OLS, fixed effects, and random effects estimators have a large probability to be biased. However, Arellano and Bond presented a differential generalized method of moments (DIFF-GMM) estimation [

41] that can solve those problems effectively. The authors suggest using the lagging term of endogenous explanatory variable as the instrumental variable of difference term to control the endogeneity. Therefore, this paper chooses the difference GMM to estimate Equation (20). As a consistent estimate, GMM requires instrumental variables to be strictly exogenous and highly correlated with endogenous variables, and there is no autocorrelation in the disturbance term. These require the Hansen or Sargan instrumental variable tests and the Arellano–Bond autocorrelation test [

42].

4.2. Construction of Spatial Weight Matrix

The common spatial weight matrices include the 0–1 adjacent weight matrix, the geographic distance weight matrix, and the economic distance weight matrix. We consider that the 0–1 neighboring weight matrix does not reflect the spatial connections between individuals that are geographically adjacent, but not bordering. Although the geographic distance weight matrix or the economic distance weight matrix respectively reflect the relationship between individuals regarding geospatial and economic behavior, the spatial correlation between actual regions may not only come from one aspect of geography or economy. Therefore, this paper adopts a nested form of geographic distance and economic distance, which not only takes the spatial influence of the geographical distance into account, but also reflects the objective fact of economic factor overflow in the interregions [

43].

This paper sets the spatial weight matrix as:

where

represents the proportion of the economic distance space weight to the geographical distance space weight. This paper chooses

.

is the economic distance weight matrix with the definition as:

In Equation (23),

is the economic distance between two regions, the difference of two regions’ per capita GDP is used as a

proxy in this paper, and

is the geographic distance weight defined as:

where

is the geographical distance between two provinces’ capital cities.

In addition, the global spatial autocorrelation tests are carried out for China’s carbon emissions using Moran’s I, and its scatter diagram describes the overall spatial relationship among all the units within the study’s scope. Moran’s I is a measure of the spatial autocorrelation developed by Pratrick Alfred Pierce Moran [

44], reflecting the correlation between the observed value and the spatial lagging term; that is, the certain property value in one region is related to the same attribute value in a nearby region [

45]. Moran’s I is defined as:

where

is the element of the spatial weight matrix. Moran’s

; if the value of Moran’s I is greater than zero, it means that there is a positive spatial correlation, and vice versa.

4.3. Definitions of Variables

The factors affecting carbon emissions are complicated. In this study, we study the effects at the provincial level, because regional differences between provinces is an important issue that can’t be ignored. To this end, in this paper, the variables with regional difference characteristics are selected as far as possible to describe the regional heterogeneity and to avoid the bias error caused by the model estimation due to missing variables. The specific variables are defined as follows:

1. Explained variables: carbon emissions ()

The carbon emission data from 30 provinces, municipalities directly under the central government, and the autonomous regions are from the China Emission Accounts and Datasets (CEADs) [

46,

47]. It refers to the emissions generated in the process of combustion for 17 kinds of fossil fuels and cement production. CH4, N20, and other greenhouse gases are not included. The latest carbon emission data currently published by the database is only to 2015. This paper uses the quadratic exponential smoothing algorithm and China’s provincial carbon emission data from 2004 to 2015 to estimate the missing data for 2016. The carbon emissions in Chinese provinces show an obvious agglomeration phenomenon (

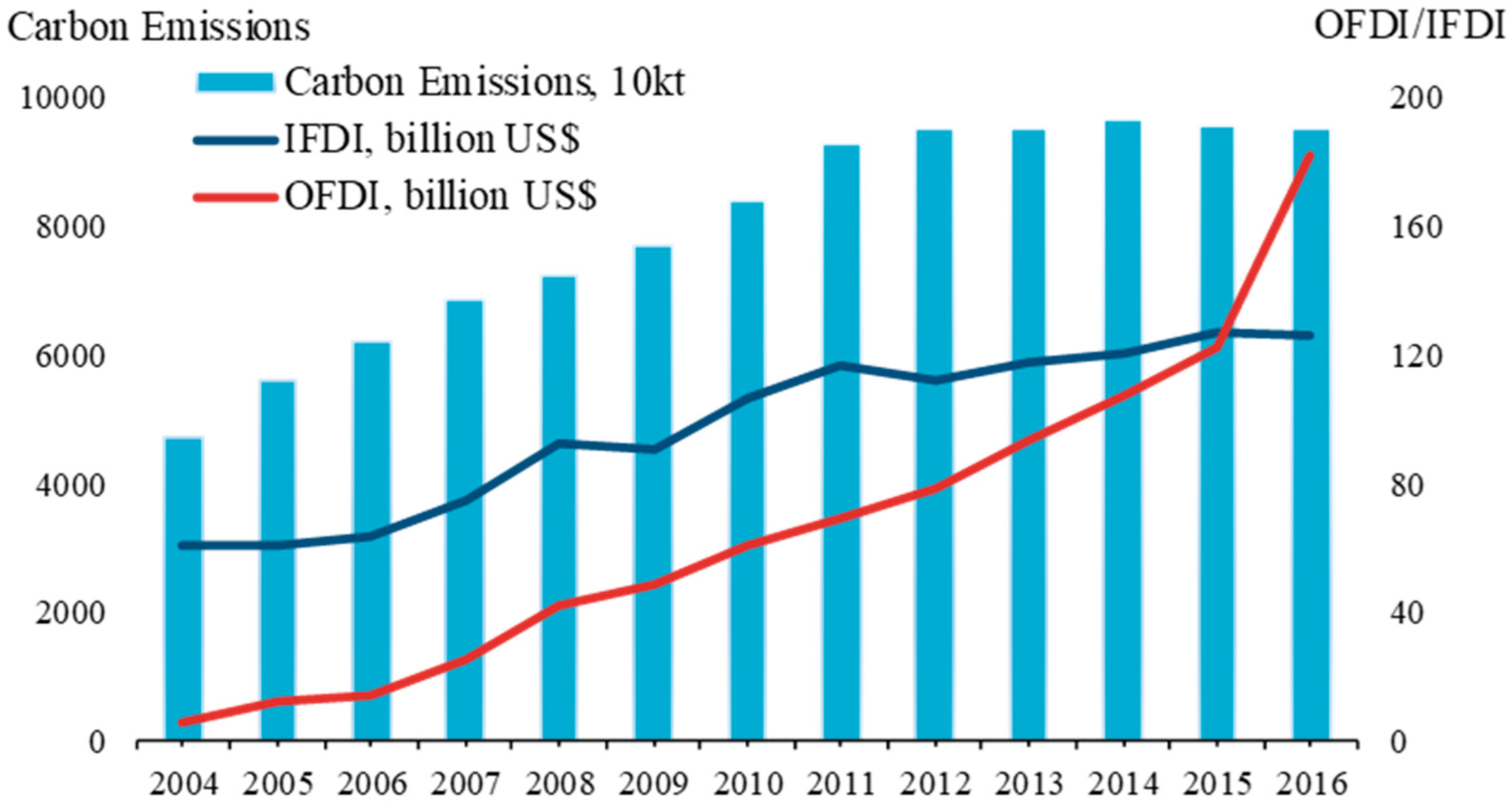

Figure 2). Inner Mongolia, Shanxi, Henan, Hebei, Shandong, Liaoning, and Jiangsu were the highest carbon-emitting provinces in 2004, while Xinjiang, Gansu, Yunnan, and Guangxi were the lowest. Similarly, in 2015, Inner Mongolia, Shanxi, Henan, Hebei, Shandong, Liaoning, and Jiangsu were still the highest carbon-emitting provinces, while Yunnan, Guangxi, Guizhou, Chongqing, Jiangxi, and Fujian were the lowest ones, indicating that the carbon emissions in Chinese provinces show relatively stable gathering characteristics.

2. Core explanatory variable: coordinated development level of two-way FDI (COOR)

This paper selects the actually utilized value of foreign direct investment by each province and the overseas direct investment of each province to measure the flow of inward FDI and OFDI, respectively. The coordinated development levels of IFDI and OFDI are calculated by Equations (13) and (14), with ①

usually being considered as low-degree coupling coordination; ②

being considered moderate coupling coordination; ③

being considered high-degree coupling coordination; ④

being considered extreme coupling coordination. In

Figure 3, the vertical coordinate representing the coupling coordination level shows an imbalance phenomenon among regions for the coordinated development of China’s two-way FDI: the eastern regions of the two-way FDI’s coupling coordination level rank the highest, the central regions are in the middle, and the western regions are the lowest.

3. Other control variables

Output scale (S): Carbon emissions, as derivatives from the production process, are directly linked to the scale of an economy’s output. Carbon emissions in the production process will also increase with the expansion of the output scale. The gross domestic product (GDP) of each province in this paper is selected as the proxy variable of the output scale. The real GDP is obtained using the GDP index for converting GDP at the current price into the constant price at the base year of 2004.

Environmental regulation intensity (REGU): In general, the greater the government’s investment in environmental pollution control, the stricter the punishment for pollution discharge against rules; the pollution discharge can be controlled to a certain extent to improve the environmental quality. This paper uses the proportion of investment value for environmental pollution control to provincial GDP as a proxy variable for environmental regulation intensity.

Capital–labor ratio (KL): This paper uses the ratio of fixed capital stock to the annual average employees in each province to measure the input composition of production factors for enterprises, where fixed capital stock is obtained using the perpetual inventory method for the base year 2004 with the depreciation rate of 9.6% taken from Zhang et al. (2004) [

48].

Industrial structure (ISS): The industrialization promotion will generate more emissions. At the early stage of economic development, extensive economic growth has a negative impact on the environment, the mode of economic growth will transfer into the intensive type with the economic development to a certain extent. In this paper, the proportion that the value of the second industry added to the GDP of each province is selected as the proxy variable for the industrial structure.

R&D expenditure (RD): The impact of R&D expenditure on technological progress is directional, and thus, the impact on the environment is also uncertain. R&D expenditure includes investment in the research and development of more advanced environmental technologies and cleaning equipment, and also to increase productivity and production output. The proportion of the R&D expenditure to the GDP of each province in this paper is selected as the proxy variable for R&D investment.