The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms

Abstract

1. Introduction

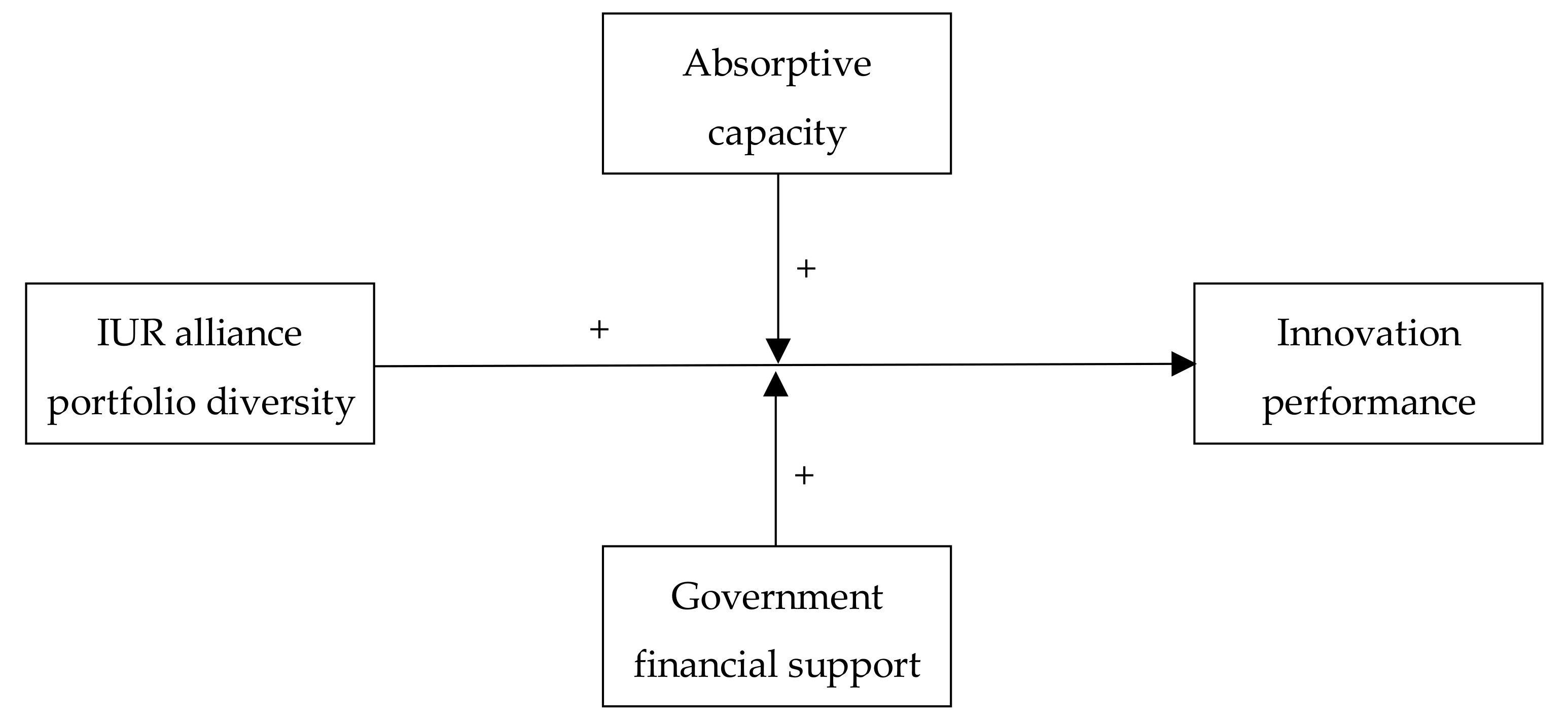

2. Theory and Hypotheses

2.1. I–U–R Alliance Portfolio Diversity and Firm Innovation Performance

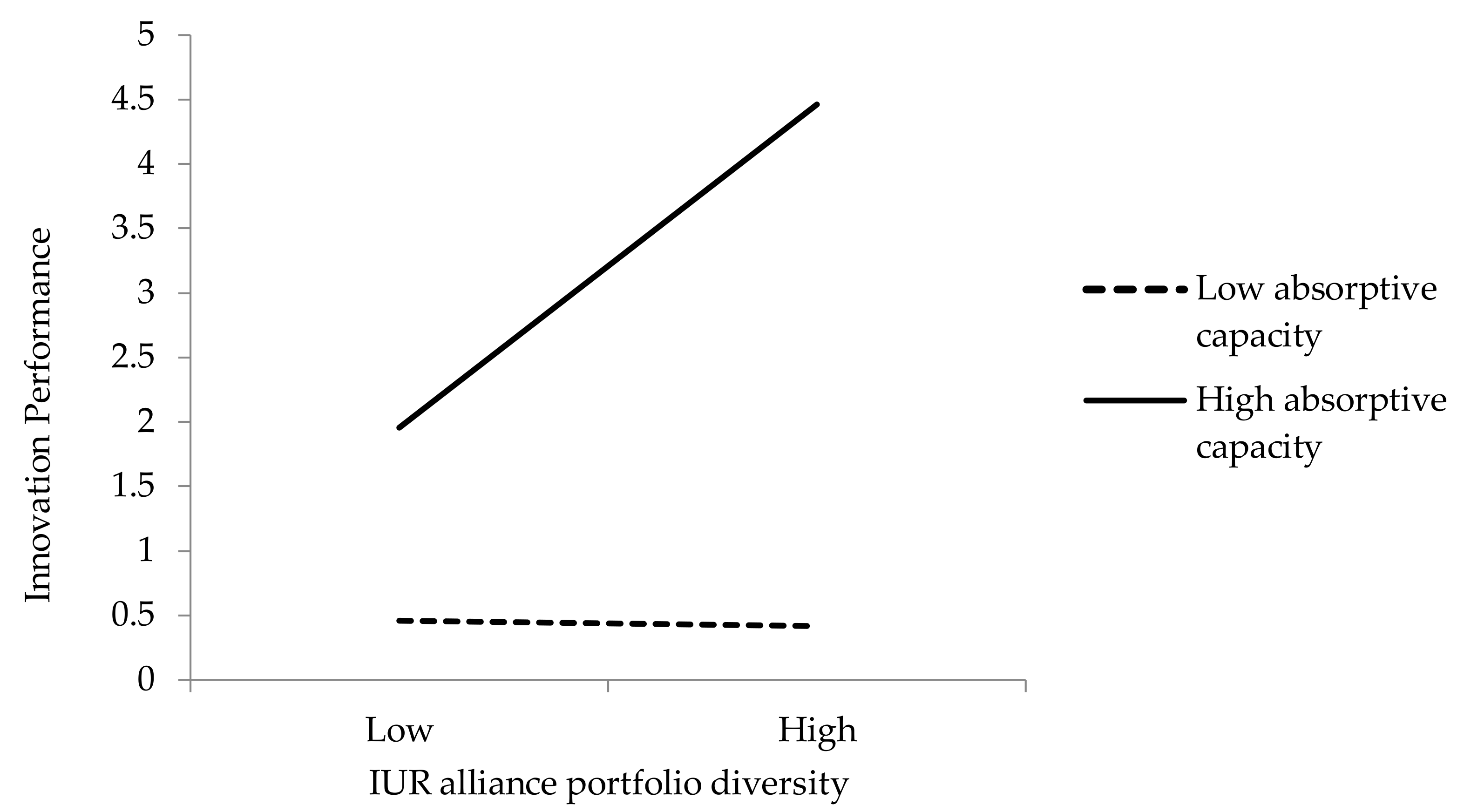

2.2. The Contingent Effect of a Firm’s Absorptive Capacity

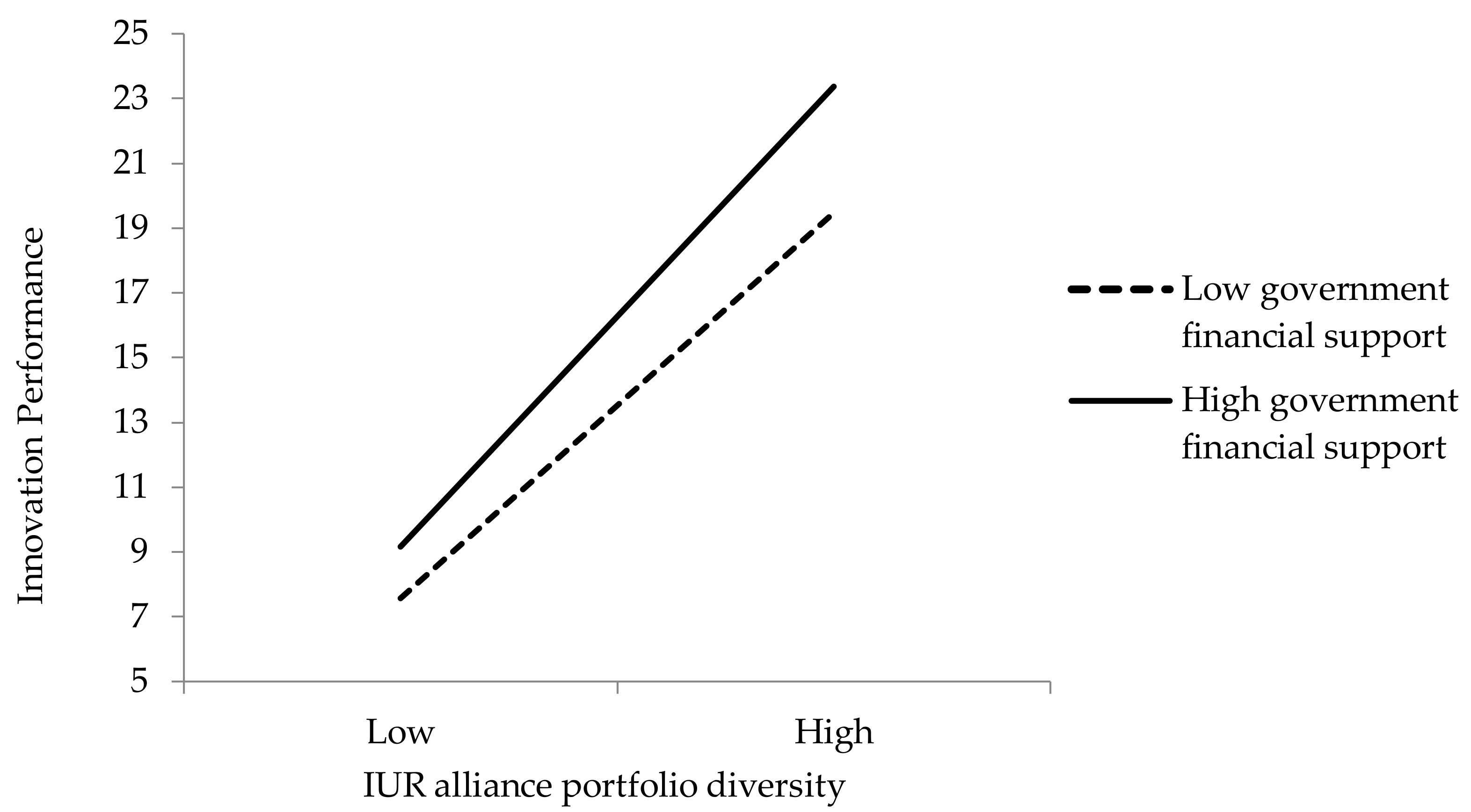

2.3. The Contingent Effect of Government Financial Support

3. Data and Methods

3.1. Sample

3.2. Measures

3.2.1. Dependent Variable

3.2.2. Explanatory Variables

3.2.3. Control Variables

3.3. Methods

4. Results

Robustness Checks

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

5.3. Limitations and Further Research

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Li, R.; Du, Y.; Tang, H.; Boadu, F.; Xue, M. MNEs’ subsidiary HRM practices and firm innovative performance: A tacit knowledge approach. Sustainability 2019, 11, 1388. [Google Scholar] [CrossRef]

- Wei, X.; Chen, W. How does a firm’s previous social network position affect innovation? Evidence from Chinese listed companies. Sustainability 2019, 11, 1191. [Google Scholar] [CrossRef]

- Guan, J.; Zhao, Q. The impact of university-industry collaboration networks on innovation in nanobiopharmaceuticals. Technol. Forecast. Soc. Chang. 2013, 80, 1271–1286. [Google Scholar] [CrossRef]

- Greco, M.; Grimaldi, M.; Cricelli, L. Open innovation actions and innovation performance. Eur. J. Innov. Manag. 2015, 18, 150–171. [Google Scholar] [CrossRef]

- Greco, M.; Grimaldi, M.; Cricelli, L. An analysis of the open innovation effect on firm performance. Eur. Manag. J. 2016, 34, 501–516. [Google Scholar] [CrossRef]

- Freitas, I.M.B.; Marques, R.A.; e Silva, E.M.D.P. University-industry collaboration and innovation in emergent and mature industries in new industrialized countries. Res. Policy 2013, 42, 443–453. [Google Scholar] [CrossRef]

- Maietta, O.W. Determinants of university–firm R&D collaboration and its impact on innovation: A perspective from a low-tech industry. Res. Policy 2015, 44, 1341–1359. [Google Scholar]

- Sherwood, A.L.; Covin, J.G. Knowledge acquisition in university-industry alliances: An empirical investigation from a learning theory perspective. J. Prod. Innov. Manag. 2010, 25, 162–179. [Google Scholar] [CrossRef]

- Archer, N.P.; Ghasemzadeh, F. An integrated framework for project portfolio selection. Int. J. Proj. Manag. 1999, 17, 207–216. [Google Scholar] [CrossRef]

- Wassmer, U. Alliance portfolios: A review and research agenda. J. Manag. 2010, 36, 141–171. [Google Scholar] [CrossRef]

- Kobarg, S.; Stumpf-Wollersheim, J.; Welpe, I.M. University-industry collaborations and product innovation performance: The moderating effects of absorptive capacity and innovation competencies. J. Technol. Transf. 2018, 43, 1696–1724. [Google Scholar] [CrossRef]

- Belderbos, R.; Jacob, J.; Lokshin, B. Corporate venture capital (CVC) investments and technological performance: Geographic diversity and the interplay with technology alliances. J. Bus. Ventur. 2018, 33, 20–34. [Google Scholar] [CrossRef]

- Leeuw, T.D.; Lokshin, B.; Duysters, G. Returns to alliance portfolio diversity: The relative effects of partner diversity on firm’s innovative performance and productivity. J. Bus. Res. 2014, 67, 1839–1849. [Google Scholar] [CrossRef]

- Degener, P.; Maurer, I.; Bort, S. Alliance portfolio diversity and innovation: The interplay of portfolio coordination capability and proactive partner selection capability. J. Manag. Stud. 2018, 55, 1386–1422. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaría, L. The importance of diverse collaborative networks for the novelty of product innovation. Technovation 2017, 27, 367–377. [Google Scholar] [CrossRef]

- Chung, D.; Kim, M.J.; Kang, J. Influence of alliance portfolio diversity on innovation performance: The role of internal capabilities of value creation. Rev. Manag. Sci. 2018. [Google Scholar] [CrossRef]

- Etzkowitz, H.; Leydesdorff, L. The dynamics of innovation: From national systems and “Mode 2” to a Triple Helix of university-industry-government relations. Res. Policy 2000, 29, 109–123. [Google Scholar] [CrossRef]

- Johnson, W.H.A. Roles, resources and benefits of intermediate organizations supporting triple helix collaborative R&D: The case of Precarn. Technovation 2008, 28, 495–505. [Google Scholar]

- Leydesdorff, L.; Fritsch, M. Measuring the knowledge base of regional innovation systems in Germany in terms of a Triple Helix dynamics. Res. Policy 2006, 35, 1538–1553. [Google Scholar] [CrossRef]

- Bos, B.; Faems, D.; Noseleit, F. Alliance concentration in multinational companies: Examining alliance portfolios, firm structure, and firm performance. Strateg. Manag. J. 2017, 38, 2298–2309. [Google Scholar] [CrossRef]

- Xu, D.; Lu, J.W.; Gu, Q. Organizational forms and multi-population dynamics: Economic transition in China. Adm. Sci. Q. 2014, 59, 517–547. [Google Scholar] [CrossRef]

- Aschhoff, B.; Schmidt, T. Empirical evidence on the success of R&D cooperation—Happy together? Rev. Ind. Organ. 2008, 33, 41–62. [Google Scholar]

- Hagedoorn, J.; Lokshin, B.; Zobel, A.K. Partner type diversity in alliance portfolios: Multiple dimensions, boundary conditions and firm innovation performance. J. Manag. Stud. 2018, 55, 809–836. [Google Scholar] [CrossRef]

- Raesfeld, A.V.; Geurts, P.; Jansen, M.; Boshuizen, J.; Luttge, R. Influence of partner diversity on collaborative public R&D project outcomes: A study of application and commercialization of nanotechnologies in the Netherlands. Technovation 2012, 32, 227–233. [Google Scholar]

- Wassmer, U.; Li, S.; Madhok, A. Resource ambidexterity through alliance portfolios and firm performance. Strateg. Manag. J. 2017, 38, 384–394. [Google Scholar] [CrossRef]

- Lahiri, N.; Narayanan, S. Vertical integration, innovation, and alliance portfolio size: Implications for firm performance. Strateg. Manag. J. 2013, 34, 1042–1064. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2010, 22, 197–220. [Google Scholar] [CrossRef]

- Chesbrough, H.; Schwartz, K. Innovating business models with co-development partnerships. Res.-Technol. Manag. 2007, 50, 55–59. [Google Scholar] [CrossRef]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Ozcan, P.; Eisenhardt, K.M. Origin of alliance portfolios: Entrepreneurs, network strategies, and firm performance. Acad. Manag. J. 2009, 52, 246–279. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Hurmelinna-Laukkanen, P.; Olandera, H.; Panfilii, V. Orchestrating R&D networks: Absorptive capacity, network stability, and innovation appropriability. Eur. Manag. J. 2012, 30, 552–563. [Google Scholar]

- Rupietta, C.; Backes-Gellner, U. Combining knowledge stock and knowledge flow to generate superior incremental innovation performance—Evidence from Swiss manufacturing. J. Bus. Res. 2019, 94, 209–222. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Daghfous, A. Absorptive capacity and the implementation of knowledge-intensive best practices. SAM Adv. Manag. J. 2004, 69, 21–27. [Google Scholar]

- Chen, Y.S.; Lin, M.J.J.; Chang, C.H. The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Ind. Mark. Manag. 2009, 38, 152–158. [Google Scholar] [CrossRef]

- Cockburn, I.M.; Henderson, R.M. Absorptive capacity, coauthoring behavior, and the organization of research in drug discovery. J. Ind. Econ. 1998, 46, 157–182. [Google Scholar] [CrossRef]

- Argote, L.; Mcevily, B.; Reagans, R. Managing knowledge in organizations: An integrative framework and review of emerging themes. Manag. Sci. 2003, 49, 571–582. [Google Scholar] [CrossRef]

- Schweisfurth, T.G.; Raasch, C. Absorptive capacity for need knowledge: Antecedents and effects for employee innovativeness. Res. Policy 2018, 47, 687–699. [Google Scholar] [CrossRef]

- Schilling, M.A. Technological lockout: An integrative model of the economic and strategic factors driving technology success and failure. Acad. Manag. Rev. 1998, 23, 267–284. [Google Scholar] [CrossRef]

- Greco, M.; Grimaldi, M.; Cricelli, L. Hitting the nail on the head: Exploring the relationship between public subsidies and open innovation efficiency. Technol. Forecast. Soc. Chang. 2017, 118, 213–225. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2016, 62, 375–404. [Google Scholar] [CrossRef]

- Zhao, S.; Xu, B.; Zhang, W. Government R&D subsidy policy in China: An empirical examination of effect, priority, and specifics. Technol. Forecast. Soc. Chang. 2018, 135, 75–82. [Google Scholar]

- Kang, K.N.; Park, H. Influence of government R&D support and inter-firm collaborations on innovation in Korean biotechnology SMEs. Technovation 2012, 32, 68–78. [Google Scholar]

- Lee, D.; Kirkpatrick-Husk, K.; Madhavan, R. Diversity in alliance portfolios and performance outcomes: A meta-analysis. J. Manag. 2017, 43, 1472–1497. [Google Scholar] [CrossRef]

- Pergelova, A.; Angulo-Ruiz, F. The impact of government financial support on the performance of new firms: The role of competitive advantage as an intermediate outcome. Entrep. Reg. Dev. 2014, 26, 663–705. [Google Scholar] [CrossRef]

- Caner, T.; Bruyaka, O.; Prescott, J.E. Flow Signals: Evidence from patent and alliance portfolios in the US biopharmaceutical Industry. J. Manag. 2018, 55, 232–264. [Google Scholar] [CrossRef]

- Shi, W.; Sun, S.L.; Pinkham, B.C.; Peng, M.W. Domestic alliance network to attract foreign partners: Evidence from international joint ventures in China. J. Int. Bus. Stud. 2014, 45, 338–362. [Google Scholar] [CrossRef]

- Lin, Z.; Peng, M.W.; Yang, H.; Sun, S.L. How do networks and learning drive M&As? An institutional comparison between China and the United States. Strateg. Manag. J. 2009, 30, 1113–1132. [Google Scholar]

- Du, X.; Jian, W.; Du, Y.; Feng, W.; Zeng, Q. Religion, the nature of ultimate owner, and corporate philanthropic giving: Evidence from China. J. Bus. Ethics 2014, 123, 235–256. [Google Scholar] [CrossRef]

- Joshi, A.M.; Nerkar, A. When do strategic alliances inhibit innovation by firms? Evidence from patent pools in the global optical disc industry. Strateg. Manag. J. 2011, 32, 1139–1160. [Google Scholar] [CrossRef]

- Boone, C.; Lokshin, B.; Guenter, H.; Belderbos, M. Top management team nationality diversity, corporate entrepreneurship, and innovation in multinational firms. Strateg. Manag. J. 2019, 40, 277–302. [Google Scholar] [CrossRef]

- Liang, X.; Liu, A.M.M. The evolution of government sponsored collaboration network and its impact on innovation: A bibliometric analysis in the Chinese solar PV sector. Res. Policy 2018, 47, 1295–1380. [Google Scholar] [CrossRef]

- Yanadori, Y.; Cui, V. Creating incentives for innovation? The relationship between pay dispersion in R&D groups and firm innovation performance. Strateg. Manag. J. 2013, 34, 1502–1511. [Google Scholar]

- Vasudeva, G.; Anand, J. Unpacking absorptive capacity: A study of knowledge utilization from alliance portfolios. Acad. Manag. J. 2011, 54, 611–623. [Google Scholar] [CrossRef]

- Wuyts, S.; Dutta, S. Benefiting from alliance portfolio diversity: The role of past internal knowledge creation strategy. J. Manag. 2014, 40, 1653–1674. [Google Scholar] [CrossRef]

- Jong, J.P.J.D.; Freel, M. Absorptive capacity and the reach of collaboration in high technology small firms. Res. Policy 2010, 39, 47–54. [Google Scholar] [CrossRef]

- Nambisan, S. Industry technical committees, technological distance, and innovation performance. Res. Policy 2013, 42, 928–940. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Alexandre, M.T. Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organ. Sci. 2009, 20, 759–780. [Google Scholar] [CrossRef]

- Wu, W.; Yu, K.; Ma, S.; Chu, C.; Li, S.; Ma, C.; Tsai, S. An empirical study on optimal strategies of Industry-University-Institute green innovation with subsidy. Sustainability 2018, 10, 1667. [Google Scholar] [CrossRef]

- Andrevski, G.; Brass, D.J.; Ferrier, W.J. Alliance portfolio configurations and competitive action frequency. J. Manag. 2016, 42, 811–837. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Boeker, W. Old technology meets new technology: Complementarities, similarities, and alliance formation. Strateg. Manag. J. 2008, 29, 47–77. [Google Scholar] [CrossRef]

- Faems, D.; Visser, M.D.; Andries, P.; Looy, B.V. Technology alliance portfolios and financial performance: Value-enhancing and cost-increasing effects of open innovation. J. Prod. Innov. Manag. 2010, 27, 785–796. [Google Scholar] [CrossRef]

- Nee, V.; Opper, S. A theory of innovation: Market transition, property rights, and innovative activity. J. Inst. Theor. Econ. 2010, 166, 397–425. [Google Scholar] [CrossRef]

- Wiseman, R.M.; Bromiley, P. Toward a model of risk in declining organizations: An empirical examination of risk, performance and decline. Organ. Sci. 1996, 7, 524–543. [Google Scholar] [CrossRef]

- Lin, J.Y. Effects on diversity of R&D sources and human capital on industrial performance. Technol. Forecast. Soc. Chang. 2010, 85, 168–184. [Google Scholar]

- Tsai, K.H. Collaborative networks and product innovation performance: Toward a contingency perspective. Res. Policy 2009, 38, 765–778. [Google Scholar] [CrossRef]

- Wang, C.; Lin, G. Dynamics of innovation in globalizing China: Regional environment, inter-firm relations and firm attributes. J. Econ. Geogr. 2013, 13, 397–418. [Google Scholar] [CrossRef]

- Cameron, C.; Trivedi, P. Regression Analysis of Count Data; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Boston, MA, USA, 2002. [Google Scholar]

- Heckman, J.J. Sample selection bias as a specification error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Cohen, P.; Cohen, J.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis in Behavioral Sciences; Erlbaum: Mahwah, NJ, USA, 2003. [Google Scholar]

- Mangematin, V.; Nesta, L. What kind of knowledge can a firm absorb? Int. J. Technol. Manag. 1999, 18, 149–172. [Google Scholar] [CrossRef]

- Huang, K.F.; Lin, K.H.; Wu, L.Y.; Yu, P.H. Absorptive capacity and autonomous R&D climate roles in firm innovation. J. Bus. Res. 2015, 68, 87–94. [Google Scholar]

- Martinez, M.G.; Zouaghi, F.; Garcia, M.S. Capturing value from alliance portfolio diversity: The mediating role of R&D human capital in high and low tech industries. Technovation 2017, 59, 55–67. [Google Scholar]

- Cui, A.S.; O’Connor, G. Alliance portfolio resource diversity and firm innovation. J. Mark. 2012, 76, 24–43. [Google Scholar] [CrossRef]

- Mouri, N.; Sarkar, M.B.; Frye, M. Alliance portfolios and shareholder value in post-IPO firms: The moderating roles of portfolio structure and firm-level uncertainty. J. Bus. Ventur. 2012, 27, 355–371. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; Bosch, F.A.J.V.D.; Volberda, H.W. Managing potential and realized absorptive capacity: How do organizational antecedents matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef]

- Sarkar, M.B.; Aulakh, P.S.; Madhok, A. Process capabilities and value generation in alliance portfolios. Organ. Sci. 2009, 20, 583–600. [Google Scholar] [CrossRef]

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Innovation performance | 1 | ||||||||||

| 2 | Firm size | 0.39 | 1 | |||||||||

| 3 | Firm age | 0.02 | −0.05 | 1 | ||||||||

| 4 | SOE | 0.01 | 0.10 | −0.06 | 1 | |||||||

| 5 | IIE (in %) | 0.05 | 0.01 | −0.02 | −0.02 | 1 | ||||||

| 6 | Asset–liability ratio | 0.18 | 0.39 | 0.00 | 0.25 | 0.05 | 1 | |||||

| 7 | Past firm performance | 0.07 | 0.17 | −0.03 | −0.19 | −0.03 | −0.39 | 1 | ||||

| 8 | Year | 0.03 | 0.08 | 0.22 | −0.00 | −0.24 | −0.04 | −0.12 | 1 | |||

| 9 | GFS | 0.44 | 0.69 | 0.01 | 0.09 | 0.10 | 0.35 | 0.05 | 0.08 | 1 | ||

| 10 | Absorptive capacity | 0.45 | 0.76 | −0.10 | 0.03 | 0.10 | 0.25 | 0.23 | 0.07 | 0.64 | 1 | |

| 11 | I–U–R APD | 0.16 | 0.19 | −0.03 | 0.07 | −0.01 | 0.10 | 0.03 | 0.14 | 0.18 | 0.18 | 1 |

| Mean | 311.72 | 23.11 | 18.83 | 0.63 | 14.44 | 0.50 | 0.04 | 0.50 | 17.54 | 0.46 | 0.52 | |

| S. D. | 1061.5 | 1.25 | 4.14 | 0.48 | 9.64 | 0.18 | 0.06 | 0.50 | 1.67 | 1.66 | 0.22 | |

| Minimum | 0 | 20.24 | 6 | 0 | 0.45 | 0.09 | −0.28 | 0 | 10.50 | −7.95 | 0 | |

| Maximum | 10881 | 27.10 | 31 | 1 | 60 | 0.98 | 0.29 | 1 | 22.11 | 4.85 | 0.82 |

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Industry dummies | Included | Included | Included | Included | Included |

| Region dummies | Included | Included | Included | Included | Included |

| Intercept | −12.642 *** | −13.190 *** | −4.487 * | −12.761 *** | −4.608 * |

| (2.167) | (2.136) | (2.069) | (1.780) | (1.888) | |

| Firm size | 0.729 *** | 0.729 *** | 0.319 *** | 0.337 *** | 0.016 |

| (0.091) | (0.091) | (0.091) | (0.088) | (0.089) | |

| Firm age | −0.014 | −0.006 | 0.026† | 0.013 | 0.023† |

| (0.020) | (0.019) | (0.015) | (0.015) | (0.014) | |

| SOE | 0.163 | 0.099 | 0.235† | 0.079 | 0.067 |

| (0.177) | (0.184) | (0.137) | (0.146) | (0.129) | |

| IIE | 0.017 † | 0.018 * | 0.017 * | 0.021 ** | 0.016 * |

| (0.009) | (0.008) | (0.006) | (0.008) | (0.006) | |

| Asset-liability ratio | 1.360 * | 1.156 † | 0.266 | 0.078 | −0.103 |

| (0.670) | (0.640) | (0.496) | (0.436) | (0.403) | |

| Past firm performance | 7.844 *** | 7.260 *** | 3.437 * | 5.448 *** | 3.086 * |

| (2.156) | (2.025) | (1.394) | (1.256) | (1.224) | |

| Year | 0.172 | 0.085 | −0.043 | −0.080 | −0.130 |

| (0.168) | (0.159) | (0.124) | (0.124) | (0.113) | |

| Inverse Mills ratio | −1.091 | −0.868 | −0.298 | 0.269 | 0.563 |

| (0.857) | (0.885) | (0.855) | (0.857) | (0.857) | |

| I–U–R APD | 0.947 ** | 1.072 *** | 1.151 *** | 0.985 *** | |

| (0.349) | (0.303) | (0.311) | (0.296) | ||

| Absorptive capacity | 0.451 *** | 0.421 *** | |||

| (0.058) | (0.049) | ||||

| I–U–R APD × Absorptive capacity | 0.936 *** | 0.482 † | |||

| (0.238) | (0.272) | ||||

| GFS | 0.477 *** | 0.421 *** | |||

| (0.057) | (0.053) | ||||

| I–U–R APD × GFS | 0.842 *** | 0.475 * | |||

| (0.166) | (0.224) | ||||

| Observations | 350 | 350 | 350 | 350 | 350 |

| Wald Chi-square | 720.04 | 708.65 | 825.54 | 931.77 | 1171.14 |

| Log likelihood | −1935.884 | −1932.064 | −1885.451 | −1886.401 | −1858.107 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, S.; Yuan, C.; Wang, Y. The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability 2019, 11, 2321. https://doi.org/10.3390/su11082321

Zhang S, Yuan C, Wang Y. The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability. 2019; 11(8):2321. https://doi.org/10.3390/su11082321

Chicago/Turabian StyleZhang, Shuman, Changhong Yuan, and Yuying Wang. 2019. "The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms" Sustainability 11, no. 8: 2321. https://doi.org/10.3390/su11082321

APA StyleZhang, S., Yuan, C., & Wang, Y. (2019). The Impact of Industry–University–Research Alliance Portfolio Diversity on Firm Innovation: Evidence from Chinese Manufacturing Firms. Sustainability, 11(8), 2321. https://doi.org/10.3390/su11082321