Financing for Water—Water for Financing: A Global Review of Policy and Practice

Abstract

1. Introduction

1.1. Scope and Purpose

1.2. The Water Sector in International Development

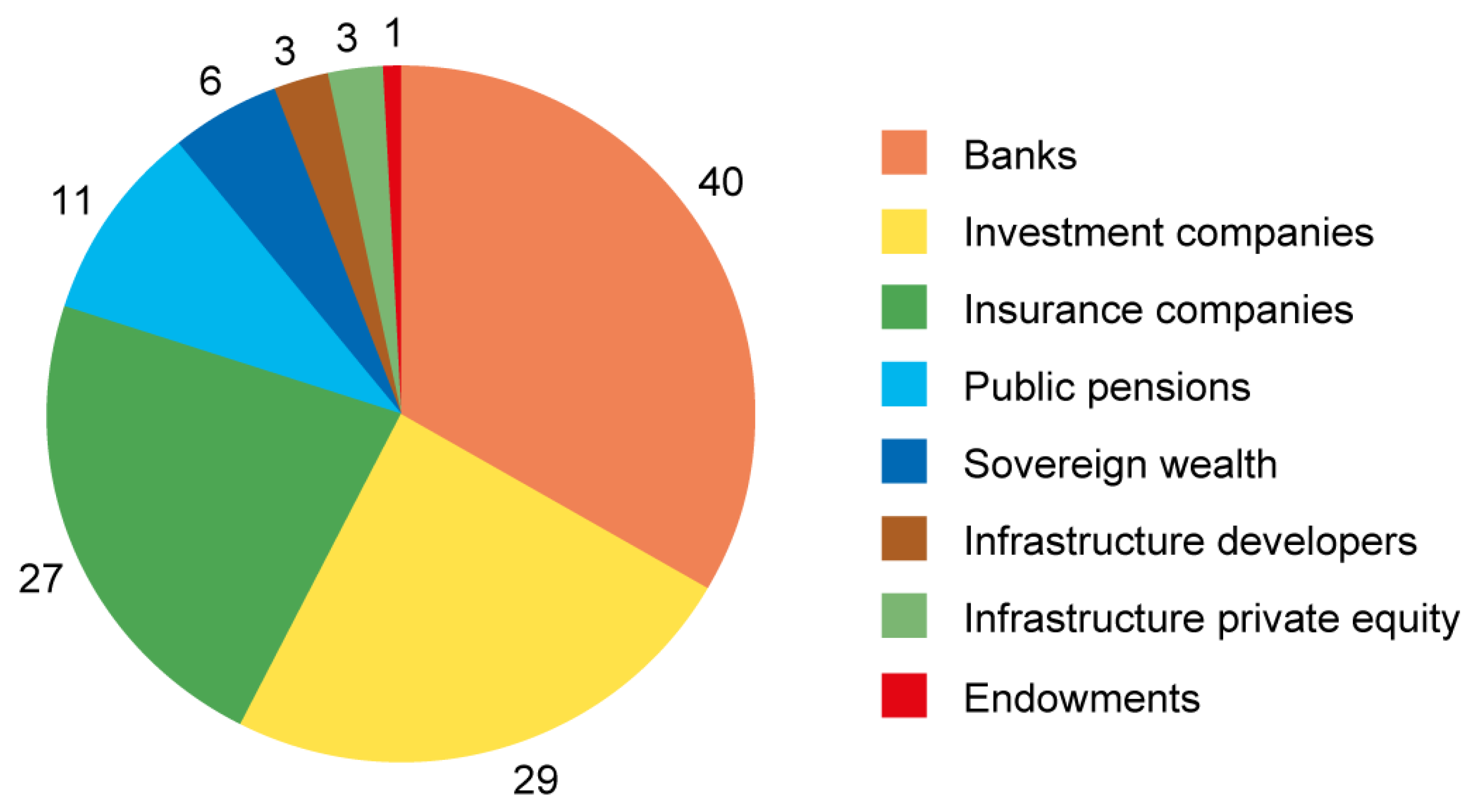

1.3. The Financial Sector

2. Financing to Develop and Manage Water

2.1. The Economic Case for Investment in Water Security

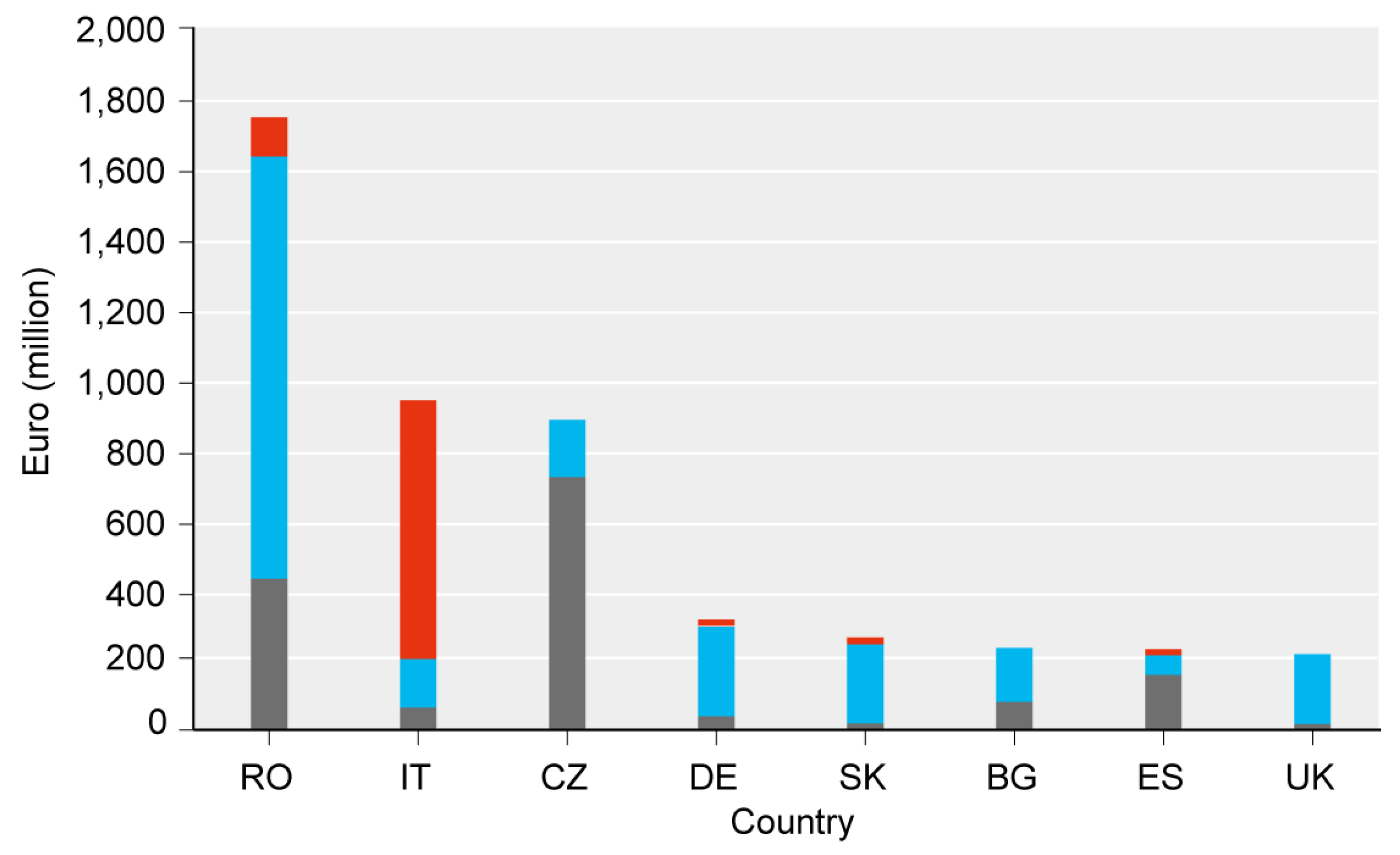

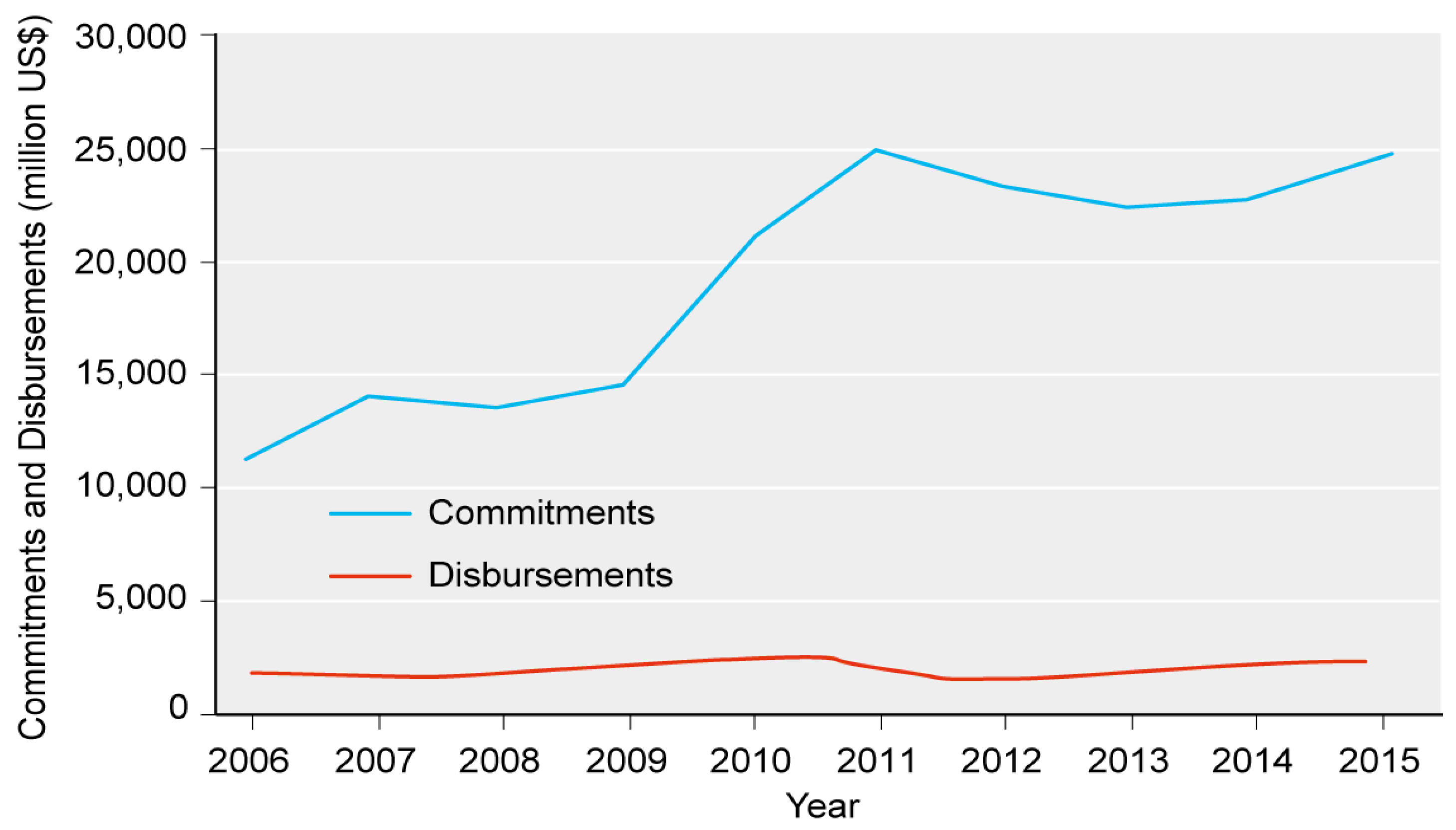

2.2. Capital Flows to Water

2.3. Seeking Increased Finance

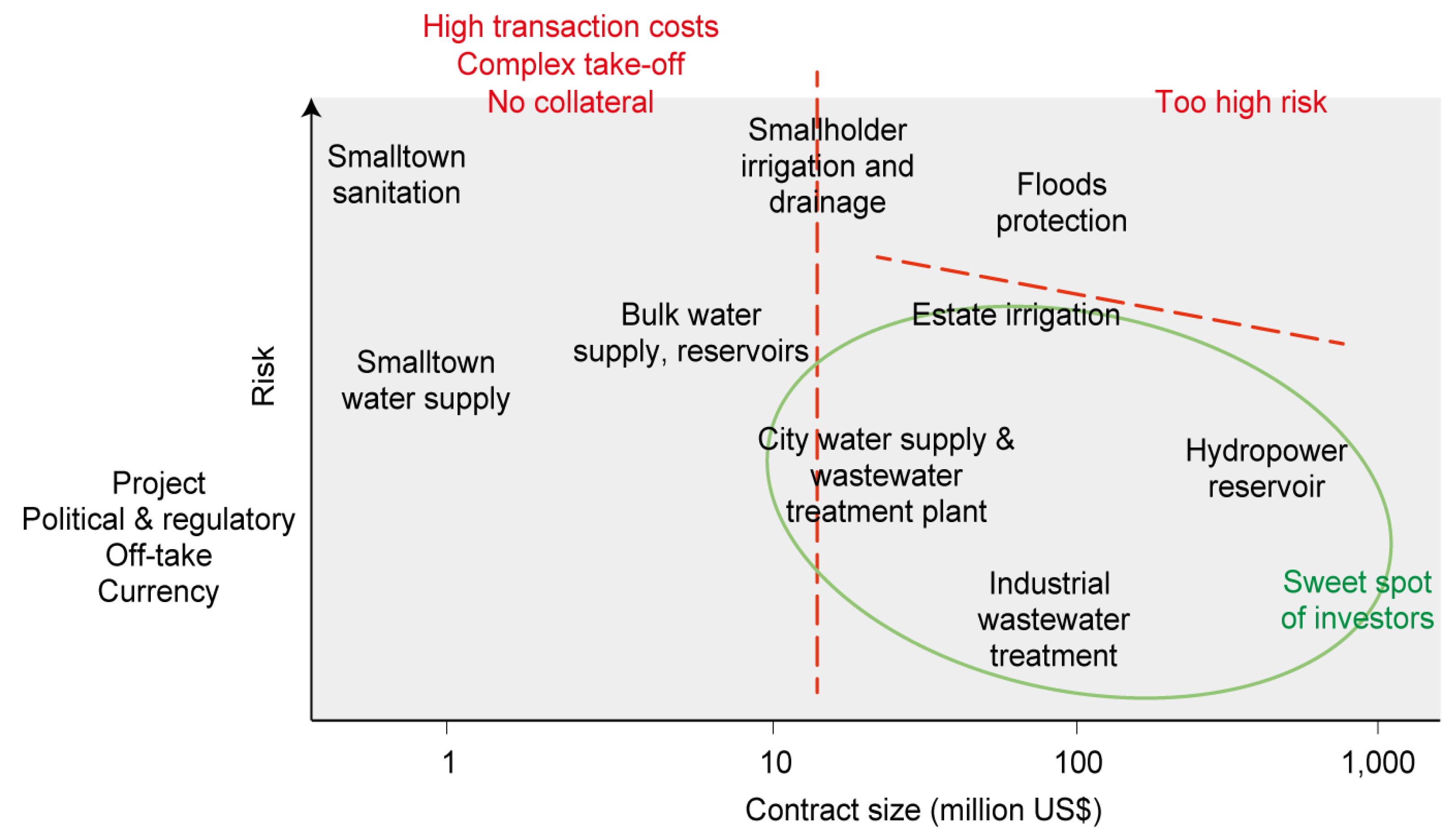

2.4. Incentives and Disincentives for Commercial Financing to Water

2.5. Options for the Road Forward

- Financial risk mitigating measures can be explored to make projects more attractive, such as contingent subordinated guarantees to better share risk; a facility to cover debt service default risk emanating from regulatory changes; a counterparty risk cover facility; and a refinancing facility to allow commercial banks to extend the tenor of their loans—with water projects often demanding tenors of up to 30 years, commonly longer than for loans in the energy sector or in industry [50].

- Blended finance is increasingly recognized as an innovative important tool, where concessional finance is applied (“structured” into a deal) specifically to help lower risk profiles and transaction costs with the aim to facilitate entry of commercial finance for development purposes in EMDEs [51,52,53]. Several financial and development institutions are actively piloting different arrangements to use concessional funds to crowd in commercial funds. The OECD has outlined five principles for blended finance: (i) anchor blended finance to a development rationale, (ii) design blended finance to increase the mobilization of commercial finance, e.g., deploy blended finance to address market failures, while minimising the use of concessionality, (iii) tailor blended finance to local context, (iv) focus on effective partnering for blended finance, e.g., by allocating risks in a targeted, balanced and sustainable manner, and (v) monitor blended finance for transparency and financial and development results. Instruments include insurance and guarantee systems to transfer part of the risks from the investing partners to a guarantor. Examples are SIDA’s Guarantee Portfolio with specialized instruments [54], and the Philippine Water Revolving Fund with guarantees provided by JICA [55]. Pioneering institutions are the MIGA that insures foreign direct investments against losses related to currency inconvertibility and transfer restrictions, expropriation, war, civil disturbance, terrorism and sabotage, breach of contract, and the non-honouring of financial obligations. Nonetheless, MIGA has had few transactions for water thus far. Also, the International Finance Corporation (IFC) offers guarantees, such as one for the bond issued by the Mexican municipality of Tlalnepantla de Baz for a local water conservation project; here, IFC provided a partial credit guarantee that allowed the bond to obtain a better credit rating, higher than that of the municipality itself [56]. Currently, many donor agencies are engaged in developing guarantee-like systems.

- Intermediary institutions can be designed to better connect the interests and capabilities of the water and financing industries. Intermediary agencies are able to pool specialized knowledge on finance supply and investment projects. As transpired from the above, the financial industry and the water sector are rather separate epistemic communities with different language, interests and procedures. Intermediaries have been functioning in richer economies for several decades such as the Netherlands Water Boards Bank (NWB Waterbank), Aquafin (Belgium), the Agences de l’eau (river basin-based Water Agencies, France) and USEPA (US). They possess intricate knowledge of both the water sector and its financing demands, and of the capital markets. The governance system and incorporation of these institutions differs, depending on the administrative structure and needs of the country. However, they help pool the financing requests for different projects of their clients, i.e., water utilities, municipalities and water boards, sometimes packaging small-scale investments into larger vehicles and ensuring quality control; on the supply side, they also pool the financial resources, e.g., combining public funds or income from tariffs with funds attracted from banks and institutional investors. This pooling (syndication) helps mitigate risk profiles of individual investments, scale-up operations, and thus, lower transaction costs.

- Debt in local currency denomination may prove superior to dependence on the international markets using denominations in strong currencies, even taking into account the comparatively high interest rates prevailing in local markets. The World Bank [5] compared the net present value of borrowing in low-interest strong currency versus high-interest local currency and found that local currency often has the advantage due to the likely depreciation of the local against the stronger currency. Also, international markets go through cycles of tightening, and of fluctuating interest rates and exchange rates. Such fluctuations may push vulnerable borrowers into default. In addition, local financiers may be more familiar with local conditions and its regulatory climate. As the financial industry globally has grown fast (Table 1) so have local capital assets expanded and are achieving scale, capability and appetite for water investments. Because the local demand for water finance is also still of modest scale, it may be well suited for the local markets. The Philippine Water Revolving Fund [55], the Water Financing Facility [57] and others are therefore arranging their capital demand in local currency.

- Alaerts and Kaspersma [47] conclude that the development of institutional capacity (the “capacity to act”) is a systemic requirement for development in the water sector as described before, however, also the financing community and its regulators are dependent on reliable data and information and the institutional capacity to utilize this information and translate it into effective decision-making. Institutional capacity development is also known as knowledge management in the corporate sector. It typically implies a knowledge transfer process as well as a (more political) agreement to engage in a change process for the institution, i.e., for the utility, ministry, department, company or sector [58]. The capacity development process is preferably laid out in a realistic implementation strategy based on a gap analysis between the available and the desired capacity. Instruments for individual capacity development include education, training, peer learning, mentoring and experiential learning. At the level of institutions such as organisations and the whole sector, knowledge can be acquired, shared and developed through educating and training the individual staff but also through institutional tools such as twinning arrangements, communities of practice, dedicated formal and informal networks, internal knowledge management procedures and targets to make sure staff share and build on knowledge, and human resource management. This knowledge may aim to impart or develop (i) technical knowledge and knowhow (e.g., on design of dikes and accounting), (ii) skills and operational procedures (e.g., on negotiation, management), (iii) attitudes (e.g., on leadership and values), and (iv) to set in motion an autonomous and endogenic learning process [47]. This applies, e.g., to government agencies, local governments, utilities, regulators, but also local banks and other potential financiers, as well as to local consumer associations, NGOs, politicians and the press. Muhairwe [52], who turned around the Uganda National Water and Sewerage Corporation in 2000–2004 to become one of the best performing water utilities in the EMDEs, recommends to start preparing for and maintaining the institutional change processes by conducting sustained but targeted training for different groups in the organization.

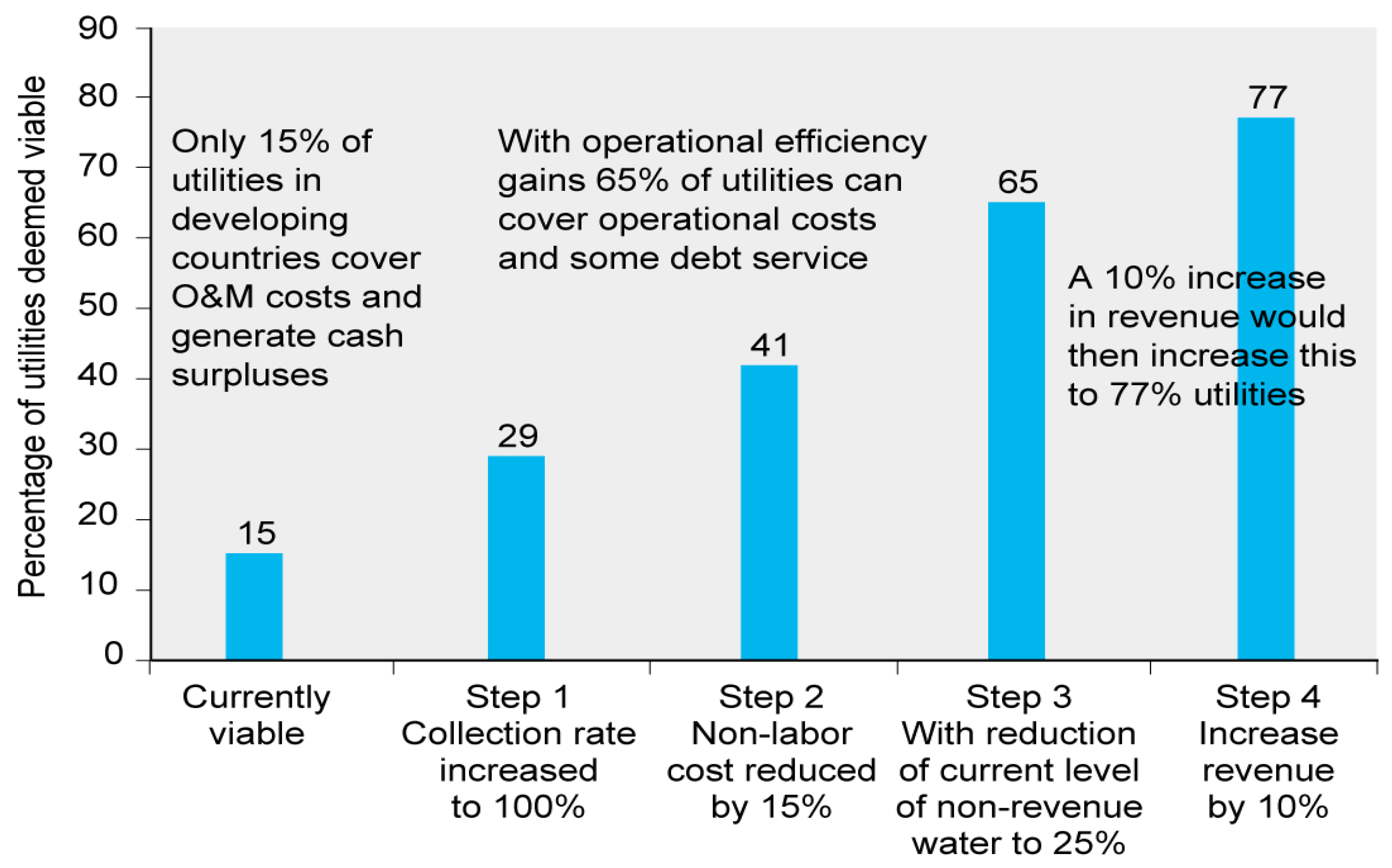

- Finally, the focal area of enhancing the creditworthiness of water supply utilities can be addressed by taking simple straightforward steps. In a large sample of 690 utilities across the globe, only an estimated 15% of service providers were found to cover their O&M costs and create a basic surplus (assumed as having cash revenues exceeding costs by at least 20%), a requirement for access to commercial credit [60]. Figure 5 shows how four measures are able to cut costs and bolster revenue, rendering up to 77% of utilities financially viable—without raising tariffs. Full creditworthiness is more likely to occur when the provider recovers at least 150% of operating costs.

3. Water for the Financing Sector—A Changing Climate

3.1. A Changing Dynamic to Protect Assets from Water Risk

3.2. Assessing Exposure to Climate Risk

4. Conclusions

Funding

Conflicts of Interest

References

- UN (United Nations). Resolution 64/292: The Human Right to Water and Sanitation; United Nations: New York, NY, USA, 2010. [Google Scholar]

- HLPW (High-Level Panel on Water). Making Every Drop Count. An Agenda for Action; HLPW Outcome Document; United Nations: New York, NY, USA, 2018. [Google Scholar]

- ICWE (International Conference on Water and the Environment). The Dublin Statement on Water and Sustainable Development. Available online: http://www.wmo.int/pages/prog/hwrp/documents/english/icwedece.html (accessed on 21 December 2018).

- WWAP (United Nations World Water Assessment Programmer). The United Nations World Water Development Report 2018: Nature-Based Solutions for Water; UNESCO: Paris, France, 2018. [Google Scholar]

- World Bank/UNICEF (United Nations Children’s Fund). Sanitation and Water for All: Priority Actions for Sector Financing; The World Bank: Washington, DC, USA, 2017. [Google Scholar]

- WHO (World Health Organization). UN-Water Global Analysis and Assessment of Sanitation and Drinking-Water (GLAAS) 2017 Report: Financing Universal Water, Sanitation and Hygiene under the Sustainable Development Goals; World Health Organization: Geneva, Switzerland, 2017. [Google Scholar]

- WHO/UNICEF (World Health Organization and United Nations Children’s Fund). Progress on Sanitation and Drinking Water: 2015 Update and MDG Assessment; World Health Organization: Geneva, Switzerland, 2015. [Google Scholar]

- UNDESA. World Population Prospects: Key Findings and Advance Tables—The 2017 Revision; Working Paper No. ESA/P/WP/248; UNDESA, Population Division: New York, NY, USA, 2017; Available online: esa.un.org/unpd/wpp/Publications/Files/WPP2017_KeyFindings.pdf (accessed on 12 August 2018).

- Climate Bonds Initiative. Green Bond Highlight; Climate Bonds Initiative: London, UK, January 2018. [Google Scholar]

- UN-Water. Available online: http://www.unwater.org/publications/water-security-infographic/ (accessed on 12 November 2018).

- WWAP (United Nations World Water Assessment Programmer). The United Nations World Water Development Report 4: Managing Water under Uncertainty and Risk; United Nations Educational, Scientific and Cultural Organization: Paris, France, 2012. [Google Scholar]

- OECD (Organization for Economic Co-operation and Development). OECD Environmental Outlook to 2050; OECD: Paris, France, 2012. [Google Scholar]

- Sadoff, C.W.; Hall, J.W.; Grey, D.; Aerts, J.C.; Ait-Kadi, M.; Brown, C.; Cox, A.; Dadson, S.; Garrick, D.; Kelman, J.; et al. Securing Water, Sustaining Growth: Report of the GWP/OECD Task Force on Water Security and Sustainable Growth; University of Oxford: Oxford, UK, 2015. [Google Scholar]

- Ligtvoet, W. The Geography of Future Water Challenges; PBL Netherlands Environmental Assessment Agency: The Hague, The Netherlands, 2018. [Google Scholar]

- NOAA (National Oceanic and Atmospheric Administration). Available online: https://coast.noaa.gov/states/fast-facts/hurricane-costs.html (accessed on 12 October 2018).

- Ciolli, J. Hurricanes Irma and Harvey Cause Goldman Sachs to Slash Its Outlook for the US Economy. Available online: http://www.businessinsider.com/goldman-sachs-hurricane-irma-harvey-gdp-impact-2017-9 (accessed on 11 September 2018).

- World Bank. Water Overview; The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- World Bank. High and Dry: Climate Change, Water and the Economy; The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Inderst, G.; Stewart, F. Institutional Investment in Infrastructure in Developing Countries: Introduction to Potential Models; Policy Research Working Paper 6780; The World Bank: Washington, DC, USA, 2014. [Google Scholar]

- McKinsey. Financing Change: How to Mobilize Private Sector Financing for Sustainable Infrastructure; McKinsey & Partners: New York, NY, USA, 2016. [Google Scholar]

- Hutton, G.; Varughese, M. The Costs of Meeting the Sustainable Development Goal Targets on Drinking Water, Sanitation and Hygiene; Technical Paper 10317; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- WWC (World Water Council). Increasing Financial Flows for Urban Sanitation; World Water Council: Marseilles, France, 2018. [Google Scholar]

- ADB (Asian Development Bank). Meeting Asia’s Infrastructure Needs; Asian Development Bank: Manila, Philippines, 2017. [Google Scholar]

- World Bank. Private Participation in Infrastructure Database. Available online: https://ppi.worldbank.org/ (accessed on 11 September 2018).

- OECD (Organization for Economic Co-operation and Development). Available online: https://data.oecd.org/drf/private-flows.htm#indicator-chart (accessed on 12 October 2018).

- Winpenny, J.; Trémolet, S.; Cardone, R. Aid Flows to the Water Sector: Overview and Recommendations; The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- OECD (Organization for Economic Co-Operation and Development). Financing Water and Sanitation in Developing Countries: Key Trends and Figures; OECD: Paris, France, 2017. [Google Scholar]

- IPCC (Intergovernmental Panel on Climate Change). Climate Change 2014: Impacts, Adaptation, and Vulnerability; Working Group II Contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014; Available online: www.ipcc.ch/report/ar5/wg2/ (accessed on 12 November 2018).

- Buchner, B.; Trabacchi, C.; Mazza, F.; Abramskiehn, D.; Wang, D. Global Landscape of Climate Finance; Climate Policy Initiative. 2015. Available online: https://climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2015/ (accessed on 21 December 2018).

- UNEP (United Nations Environment Programmer). The Adaptation Finance Gap Report 2016; United Nations Environment Programmer: Nairobi, Kenya, 2016. [Google Scholar]

- Russ, D.; Thambiah, Y.; Foscari, N. Can Infrastructure Investing Enhance Portfolio Efficiency? Crédit Suisse Asset Management. Available online: https://www.credit-suisse.com/pwp/am/downloads/marketing/infrastructure_ch_uk_lux_ita_scandinavia.pdf (accessed on 2 October 2018).

- Bain & Co. Capital Super-Abundance; Bain & Co: Boston, MA, USA, 2015; Available online: www.bain.com/publications/articles/a-world-awash-in-money.aspx (accessed on 12 October 2018).

- World Bank. Indicators. 2018. Available online: https://data.worldbank.org/indicator/ny.gdp.mktp.cd (accessed on 12 October 2018).

- McKinsey. Global Capital Markets-Entering a New Era; McKinsey & Partners: New York, NY, USA, 2009. [Google Scholar]

- PwC. Capital Markets 2020; Price Waterhouse Coopers, 2015. Available online: https://www.pwc.se/sv/pdf-reports/capital-markets-2020-will-it-change-for-good.pdf. (accessed on 2 October 2018).

- IMF (International Monetary Fund). Global Financial Stability Report 2016; International Monetary Fund: Washington, DC, USA, 2016. [Google Scholar]

- ADB (Asian Development Bank). Benchmarking and Data Book of Water Utilities in India; ADB: Manila, Philippines, 2007. [Google Scholar]

- World Bank. Water and Wastewater Services in the Danube Region. A State of the Sector; World Bank: Washington, DC, USA, 2015. [Google Scholar]

- GWL (Global Water Leaders Group). The Global Value of Water; The Global Water Leaders Group: Oxford, UK, 2017. [Google Scholar]

- Ho, T.; Lee, S. The Oxford Guide to Financial Modeling: Applications for Capital Markets, Corporate Finance, Risk Management, and Financial Institutions; Oxford University Press: New York, NY, USA; Oxford, UK, 2004. [Google Scholar]

- OECD. A Framework for Financing Water Resources; OECD Publishing: Paris, France, 2012. [Google Scholar]

- Micale, V.; Tonkonogy, B.; Mazza, F. Understanding and Increasing Climate Financing for Adaptation; Climate Policy Initiative. Available online: https://climatepolicyinitiative.org/publication/understanding-and-increasing-finance-for-climate-adaptation-in-developing-countries/ (accessed on 21 December 2018).

- 2018 OECD. Green Finance Forum. Available online: www.oecd.org/cgfi/2018-forum-documents.htm (accessed on 30 November 2018).

- European Parliament. On Absorption of Structural and Cohesion Funds: Lessons Learnt for the Future Cohesion Policy of the EU; European Parliament 2010/2305(INI): Brussels, Belgium, 2011. [Google Scholar]

- European Court of Auditors. Commission’s and Member States’ Actions in the Last Years of the 2007–2013 Programmes Tackled Low Absorption but Had Insufficient Focus on Results; Report 17; European Court of Auditors: Brussels, Belgium, 2018. [Google Scholar]

- World Bank. Data from Annual Reports and Sectoral Reports 2006–2018; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Alaerts, G.; Kaspersma, J. Progress and Challenges in Knowledge and Capacity Development. In Capacity for Improved Water Management; Blokland, M., Alaerts, G., Kaspersma, J., Hare, M., Eds.; Taylor & Francis: London, UK, 2009. [Google Scholar]

- World Bank. World Development Report 2019: The Changing Nature of Work; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Ministry of Economic Development. Financing the Uganda Water Sector; Proceedings, Ministry of Economic Development, Makerere University: Kampala, Uganda, 24 September 2018. [Google Scholar]

- GIF (Global Infrastructure Facility). Making Infrastructure Rewarding. A Report by the Global Infrastructure Facility; Global Infrastructure Facility: Washington, DC, USA, 2016. [Google Scholar]

- OECD (Organisation for Economic Co-Operation and Development). Blended Finance—Mobilising Resources for Sustainable Development and Climate Action in Developing Countries; OECD: Paris, France, 2017. [Google Scholar]

- GIZ (Gesellschaft für Zusammenarbeit). Closing the Financing Gap for Water in Line with SDG Ambitions: The Role of Blended Finance; Proceedings of a Workshop, GIZ: Eschborn, Germany, 2018. [Google Scholar]

- OECD (Organisation for Economic Co-Operation and Development). Blended Finance for Water Investment; Working Paper; OECD: Paris, France, 2018. [Google Scholar]

- SIDA (Swedish International Development Agency). Sida’s Guarantee Portfolio. 2018. Available online: http://www.oecd.org/water/OECD-GIZ-Conference-Background-Document-Sida-Guarantee-Portfolio-2017.pdf (accessed on 30 October 2018).

- JICA (Japan International Cooperation Agency). The Philippine Water Revolving Fund (PWRF); Proceedings, GIZ Conference on Blended Finance, GIZ: Eschborn, Germany, 2018. [Google Scholar]

- World Bank. Case Studies in Blended Finance for Water and Sanitation. 2016. Available online: https://www.wsp.org/sites/wsp.org/files/publications/WSS-9-Case-Studies-Blended-Finance.pdf. (accessed on 14 July 2018).

- WFF (Water Finance Facility). Available online: https://waterfinancefacility.com/2017/11/20/portfolio/ (accessed on 14 November 2018).

- Sewilam, H.; Alaerts, G. Developing knowledge and capacity. In World Water Development Report; Chapter 26; UNESCO: Paris, France, 2012. [Google Scholar]

- Wehn de Montalvo, U.; Alaerts, G. Leadership in knowledge and capacity development in the water sector: a status review. Water Policy 2013, 15, 1–14. [Google Scholar] [CrossRef]

- World Bank. Easing the Transition to Commercial Finance for Sustainable Water and Sanitation; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- AQUASTAT. Available online: http://www.fao.org/nr/water/aquastat/water_use/index.stm (accessed on 23 December 2018).

- Wada, Y.; Flörke, M.; Hanasaki, N.; Eisner, S.; Fischer, G.; Tramberend, S.; Satoh, Y.; Van Vliet, M.T.H.; Yillia, P.; Ringler, C.; et al. Modelling global water use for the 21st century: The Water Futures and Solutions (WFaS) initiative and its approaches. Geosci. Model Dev. 2016, 9, 175–222. [Google Scholar] [CrossRef]

- Burek, P.; Satoh, Y.; Fischer, G.; Kahil, M.T.; Scherzer, A.; Tramberend, S.; Nava, L.F.; Wada, Y.; Eisner, S.; Flörke, M.; et al. Water Futures and Solution: Fast Track Initiative (Final Report); IIASA Working Paper; International Institute for Applied Systems Analysis (IIASA): Laxenburg, Austria, 2016; Available online: pure.iiasa.ac.at/13008/ (accessed on 14 January 2018).

- Susnik, J. Economic metrics to estimate current and future resource use, with a focus on water withdrawals. J. Sust. Prod. Consum. 2015, 2, 109–127. [Google Scholar]

- Alexandratos, N.; Bruinsma, J. World Agriculture Towards 2030/2050: The 2012 Revision; ESA Working paper No. 12-03; Food and Agriculture Organization of the United Nations (FAO): Rome, Italy, 2012; Available online: www.fao.org/docrep/016/ap106e/ap106e.pdf (accessed on 12 August 2018).

- Hallegatte, S.; Green, C.; Nicholls, R.J.; Corfee-Morlot, J. Future flood losses in major coastal cities. Nat. Clim. Chang. Lett. 2014, 3, 802. [Google Scholar] [CrossRef]

- Hinkel, J.; Lincke, D.; Vafeidis, A.; Perrette, M.; Nicholls, R.; Tol, R.; Marzeion, B.; Fettweis, X.; Ionescu, C.; Levermann, A. Coastal flood damage and adaptation costs under 21st century sea-level rise. Proc. Natl. Acad. Sci. USA 2014, 111, 3292–3297. [Google Scholar] [CrossRef] [PubMed]

- CNN. Available online: https://edition.cnn.com/2018/03/02/us/weather-bomb-cyclone/index.html (accessed on 12 October 2018).

- World Bank. Thai Flood 2011; The World Bank: Bangkok, Thailand, 2012. [Google Scholar]

- Gassert, F.; Landis, M.; Luck, M.; Reig, P.; Shiao, T. Aqueduct Global Maps 2.1; Working Paper; World Resources Institute: Washington, DC, USA, 2017. [Google Scholar]

- WRI (World Resources Institute). 2018. Available online: https://www.wri.org/blog/2018/01/40-indias-thermal-power-plants-are-water-scarce-areas-threatening-shutdowns. (accessed on 12 November 2018).

- The Bulletin. Available online: https://thebulletin.org/what-cape-town-learned-its-drought11698 (accessed on 6 July 2018).

- USGCRP. Impacts, Risks, and Adaptation in the United States: Fourth National Climate Assessment, Volume II: Report-in-Brief; Reidmiller, D.R., Avery, C.W., Easterling, D.R., Kunkel, K.E., Lewis, K.L.M., Maycock, T.K., Stewart, B.C., Eds.; U.S. Global Change Research Program: Washington, DC, USA, 2018. [Google Scholar]

- Mazzacurati, E.; Vargas Mallard, D.; Turner, J.; Steinberg, N.; Shaw, C. Measuring Physical Climate Risk in Equity Portfolios; Deutsche Asset Management Global Research Group: Frankfurt, Germany; New York, NY, USA, 2017. [Google Scholar]

- TCFD (Task Force on Climate-Related Financial Disclosures). Final Report—Recommendations of the Task Force on Climate-Related Financial Disclosures; Bank for International Settlements, Financial Stability Board: Basel, Switzerland, 2017. [Google Scholar]

- EBRD. Advancing TCFD Guidance on Physical Climate Risks and Opportunities; Conference, European Bank for Reconstruction and Development: London, UK, 2018. [Google Scholar]

- European Union. Report on Climate-Related Disclosures; Technical Expert Group on Sustainable Finance, European Commission: Brussels, Belgium, 2019. [Google Scholar]

| 1990 | 2000 | 2015 | 2020 Forecast | Increment 1990–2020 (compounded) | |

|---|---|---|---|---|---|

| Population 1 (billion) | 5.33 | 6.15 | 7.38 | 7.80 | +46% |

| +1.9% p.a. | +1.3% p.a. | +1.2% p.a. | +1.1% p.a. | +1.5% avg. p.a. | |

| GDP 2 (US$ billion) | 22,574 | 33,571 | 74,843 | 83,824 | +271% |

| +2.9% p.a. | +1.5% p.a. | +2.8% p.a. | +3% p.a. | ||

| Financial capital (US $ tr) | |||||

| Bain 3 | 200 | - | 750 | ||

| McKinsey 4 | 54 | 112 | 220 | 260 | +381% |

| +9% p.a. | - | +12.7% avg. p.a. | |||

| PwC 5 | - | 20–25 | 70–80 | - | - |

| IMF 6 | - | - | 292 | - | - |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alaerts, G.J. Financing for Water—Water for Financing: A Global Review of Policy and Practice. Sustainability 2019, 11, 821. https://doi.org/10.3390/su11030821

Alaerts GJ. Financing for Water—Water for Financing: A Global Review of Policy and Practice. Sustainability. 2019; 11(3):821. https://doi.org/10.3390/su11030821

Chicago/Turabian StyleAlaerts, Guy J. 2019. "Financing for Water—Water for Financing: A Global Review of Policy and Practice" Sustainability 11, no. 3: 821. https://doi.org/10.3390/su11030821

APA StyleAlaerts, G. J. (2019). Financing for Water—Water for Financing: A Global Review of Policy and Practice. Sustainability, 11(3), 821. https://doi.org/10.3390/su11030821