How Environmental Beliefs Affect Consumer Willingness to Pay for the Greenness Premium of Low-Carbon Agricultural Products in China: Theoretical Model and Survey-based Evidence

Abstract

1. Introduction

2. The Theoretic Model

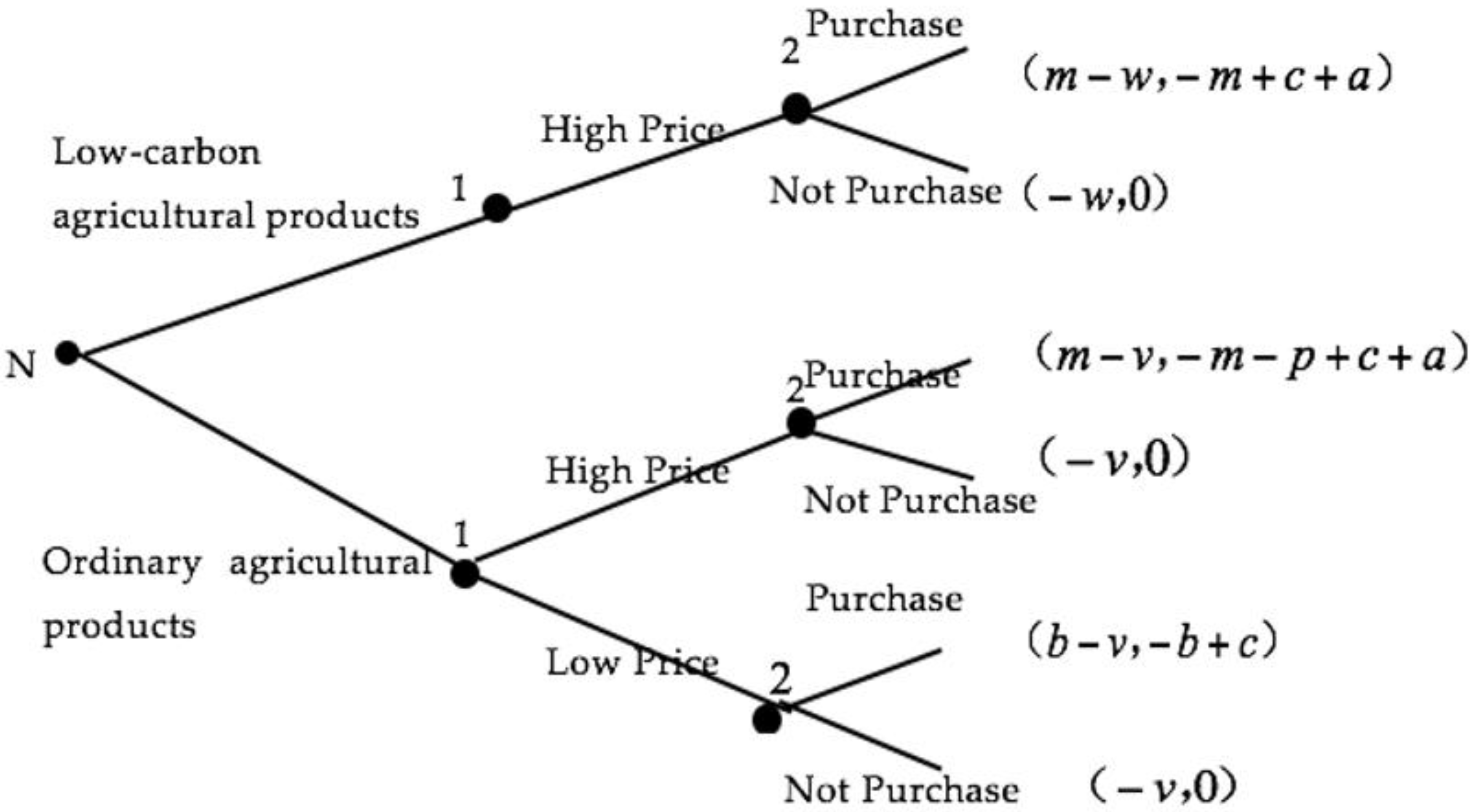

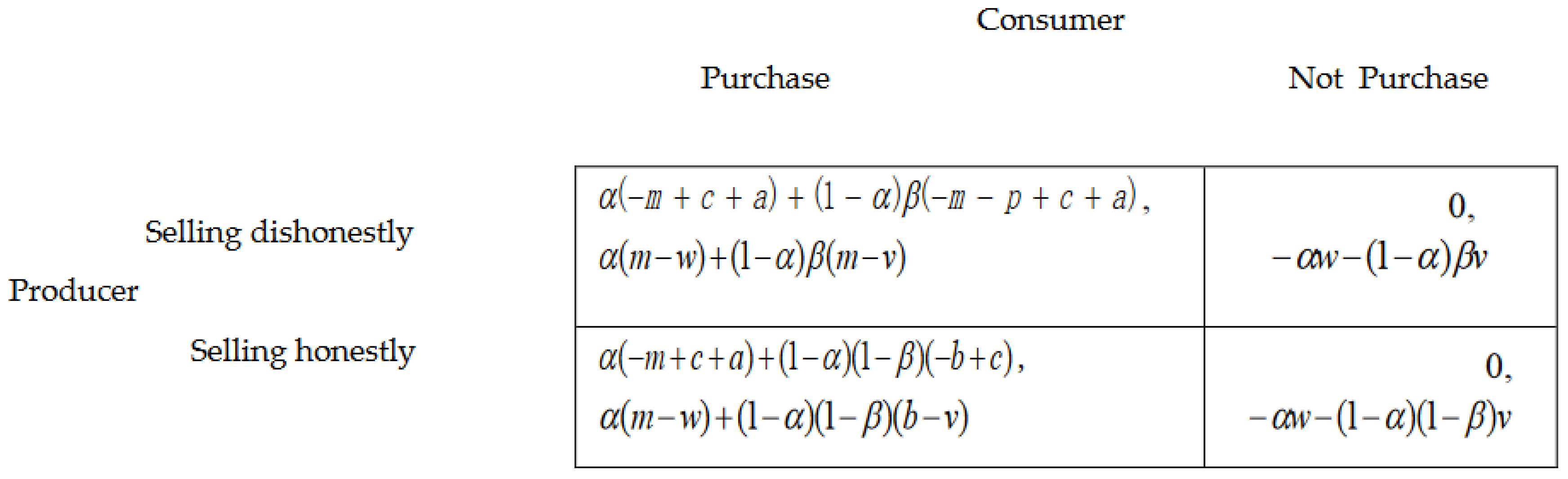

2.1. The Game Model

2.1.1. The Game Set Up

2.1.2. The Game Structure

2.1.3. The Equilibrium Condition

2.2. The Econometrics Model

3. Data Source and Sample Analysis

3.1. The Reliablity and Validity of Questionnaire

3.2. Sample Characteristics

3.3. Variable Selection and Statistics Description

4. Empirical Results and Discussions

4.1. Benchmark Analysis

4.2. The Heterogeneity Analysis

5. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A: The Deduction of Dominating Strategy

- (1).

- if and are always equal to 0, choosing “Purchase” always gives the same outcome as choosing “Not Purchase” no matter what the producers do. (Strategy “Purchase” is equivalent to “Not Purchase”);

- (2).

- if and are always greater than 0, choosing “Purchase” always gives a better outcome than choosing “Not Purchase” no matter what the producers do. (Strategy “Purchase” strictly dominates “Not Purchase”)

- (3).

- if and are always less than 0, choosing “Purchase” always gives a worse outcome than choosing “Not Purchase” no matter what the other player(s) do. (Strategy “Not Purchase” strictly dominates “Purchase”).

- (1).

- if is always equal to and is equal to , choosing “Selling dishonestly” always gives the same outcome as choosing “Selling honestly” no matter what the consumers do. (Strategy “Selling dishonestly” is equivalent to “Selling honestly”)

- (2).

- if is always greater than and is always greater than , choosing “Selling dishonestly” always gives a better outcome than choosing “Selling honestly” no matter what the consumers do. (Strategy “Selling dishonestly” strictly dominates “Selling honestly”)

- (3).

- if is always less than and is always less than , choosing “Selling dishonestly” always gives a worse outcome than choosing “Selling honestly” no matter what the consumers do. (Strategy “Selling honestly” strictly dominates “Selling dishonestly”).

References

- Horrigan, L.; Lawrence, R.S.; Walker, P. How sustainable agriculture can address the environmental and human health harms of industrial agriculture. Environ. Health Perspect. 2002, 110, 445–456. [Google Scholar] [CrossRef] [PubMed]

- Hopper, W.D. The development of agriculture in developing countries. Sci. Am. 1976, 235, 196–205. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change. Climate Change 2007: Mitigation of Climate Change Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Intergovernmental Panel on Climate Change. Climate Change 2013: Mitigation of Climate Change Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Li, X.H. Overview of Studies on Low-Carbon Agriculture. Agric. Econ. Sci. Technol. 2011, 22, 11–13. (In Chinese) [Google Scholar]

- Jin, M.; Zhao, C. Analysis on the Green Agricultural Product Consumer Intent and Consumer Behaviors. Chin. Rural Econ. 2008, 5, 44–55. (In Chinese) [Google Scholar]

- Caswell, J.A. Valuing the benefits and costs of improved food safety and nutrition. Aust. J. Agric. Res. Econ. 1998, 42, 409–424. [Google Scholar] [CrossRef]

- Kimura, A.; Wada, Y.; Kamada, A.; Masuda, T.; Okamoto, M.; Goto, S.I.; Tsuzuki, D.; Cai, D.; Oka, T.; Dan, I. Interactive effects of carbon footprint information and its accessibility on value and subjective qualities of food products. Appetite 2010, 55, 271–278. [Google Scholar] [CrossRef]

- Newman, T.P.; Fernandes, R. A re-assessment of factors associated with environmental concern and behavior using the 2010 general social survey. Environ. Educ. Res. 2016, 22, 153–175. [Google Scholar] [CrossRef]

- Ting, D.H.; Cheng, C.F.C. Developing pro-environmental behaviour: Ecotourism fieldtrip and experiences. Int. J. Sustain. High. Educ. 2017, 18, 1212–1229. [Google Scholar] [CrossRef]

- Gadenne, D.; Sharma, B.; Kerr, D.; Smith, T. The influence of consumers’ environmental beliefs and attitudes on energy saving behaviours. Energy Policy 2011, 39, 7684–7694. [Google Scholar] [CrossRef]

- Corraliza, J.A.; Berenguer, J. Environmental values, beliefs, and actions: A situational approach. Environ. Behav. 2000, 32, 832–848. [Google Scholar] [CrossRef]

- Whitmarsh, L. Behavioural responses to climate change: Asymmetry of intentions and impacts. J. Environ. Psychol. 2009, 29, 13–23. [Google Scholar] [CrossRef]

- Wu, Y.H.; Wu, L.F. Study on willingness to pay for the low-carbon agricultural products in urban—taking low carbon pork as an example. Rural. Technol. Econ. 2012, 8, 4–12. (In Chinese) [Google Scholar]

- Shuai, C.M.; Ding, L.P.; Zhang, Y.K.; Guo, Q.; Shuai, J. How consumers are willing to pay for low-carbon products—Results from a carbon-labeling scenario experiment in China. J. Clean. Prod. 2014, 83, 366–373. [Google Scholar] [CrossRef]

- Harris, S.M. Does sustainability sell? Market responses to sustainability certification. Manag. Environ. Qual. Int. J. 2007, 18, 50–60. [Google Scholar] [CrossRef]

- Howard, P.H. Central Coast consumers want more food-related information, from safety to ethics. Calif. Agric. 2006, 60, 14–19. [Google Scholar] [CrossRef]

- Vanclay, J.K.; Shortiss, J.; Aulsebrook, S.; Gillespie, A.M.; Howell, B.C.; Johanni, R.; Maher, M.J.; Mitchell, K.M.; Stewart, M.D.; Yates, J. Customer Response to Carbon Labelling of Groceries. J. Consum. Policy 2011, 34, 153–160. [Google Scholar] [CrossRef]

- Upham, P.; Dendler, L.; Bleda, M. Carbon labelling of grocery products: Public perceptions and potential emissions reductions. J. Clean. Prod. 2011, 19, 348–355. [Google Scholar] [CrossRef]

- Hobbs, J.E.; Bailey, D.V.; Dickinson, D.L.; Haghiri, M. Traceability in the Canadian Red Meat Sector: Do Consumers Care? Can. J. Agric. Econ. Rev. Can. Dagroecon. 2005, 53, 47–65. [Google Scholar] [CrossRef]

- Tan, M.; Tan, R.; Khoo, H.H. Prospects of carbon labelling—A life cycle point of view. J. Clean. Prod. 2014, 72, 76–88. [Google Scholar] [CrossRef]

- Zhao, R.; Zhong, S. Carbon labelling influences on consumers’ behavior: A system dynamics approach. Ecol. Indic. 2015, 51, 98–106. [Google Scholar] [CrossRef]

- Tait, P.; Saunders, C.; Guenther, M.; Rutherford, P.; Miller, S. Exploring the impacts of food label format on consumer willingness to pay for environmental sustainability: A choice experiment approach in the United Kingdom and Japan. Int. Food Res. J. 2016, 23, 1787–1796. [Google Scholar]

- Beattie, G.; Sale, L.; McGuire, L. Information of Carbon Labelling and Consumer Response; Final Project Report; The University of Manchester Sustainable Consumption Institute: Manchester, UK, 2009. [Google Scholar]

- O’connor, R.E.; Bard, R.J.; Fisher, A. Risk perceptions, general environmental beliefs, and willingness to address climate change. Risk Anal. 1999, 19, 461–471. [Google Scholar] [CrossRef]

- Albarracín, D.; Wyer, J.R. The cognitive impact of past behavior: Influences on beliefs, attitudes, and future behavioral decisions. J. Pers. Soc. Psychol. 2000, 79, 5–22. [Google Scholar] [CrossRef] [PubMed]

- Bodur, H.O.; Brinberg, D.; Coupey, E. Belief, affect, and attitude: Alternative models of the determinants of attitude. J. Consum. Psychol. 2000, 9, 17–28. [Google Scholar] [CrossRef]

- Bang, H.K.; Ellinger, A.E.; Hadjimarcou, J.; Traichal, P.A. Consumer concern, knowledge, belief, and attitude toward renewable energy: An application of the reasoned action theory. Psychol. Mark. 2000, 17, 449–468. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitudes and Predicting Social Behavior. Englewood Cliffs; Prentice Hall: Englewood, NJ, USA, 1980. [Google Scholar]

- Ajzen, I.; Madden, T.J. Prediction of goal-directed behavior: Attitudes, intentions, and perceived behavioral control. J. Exp. Soc. Psychol. 1986, 22, 453–474. [Google Scholar] [CrossRef]

- Emons, W. Credence Goods and Fraudulent Experts. RAND J. Econ. 1997, 28, 107–119. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. Q. J. Ecol. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Gadema, Z.; Oglethorpe, D. The use and usefulness of carbon labelling food: A policy perspective from a survey of UK supermarket shoppers. Food Policy 2011, 36, 815–822. [Google Scholar] [CrossRef]

- Ashby, D.; West, C.R.; Ames, D. The ordered logistic regression model in psychiatry: Rising prevalence of dementia in old people’s homes. Stat. Med. 1989, 8, 1317–1326. [Google Scholar] [CrossRef]

- Xiong, K.; Kong, F.; Zhang, N.; Lei, N.; Sun, C. Analysis of the Factors Influencing Willingness to Pay and Payout Level for Ecological Environment Improvement of the Ganjiang River Basin. Sustainability 2018, 10, 2149. [Google Scholar] [CrossRef]

| Items | KMO test | Bartlett’s test | Factor loading | Cumulative variance contribution rate (%) | Sig. of Bartlett’s test |

|---|---|---|---|---|---|

| Respondent’s cognition towards global climate change | 0.735 | 127.625 | 0.591 | 73.621 | 0.000 |

| Respondent’s cognition of the distinction of agricultural products | 0.761 | 113.517 | 0.612 | 76.252 | 0.000 |

| Respondent’s cognition of the environmental effect of low-carbon agricultural products | 0.811 | 179.272 | 0.585 | 69.837 | 0.000 |

| Respondent’s understanding toward carbon labelling | 0.783 | 146.876 | 0.673 | 76.255 | 0.000 |

| Respondent’s trust in carbon labelling | 0.795 | 161.356 | 0.598 | 71.297 | 0.000 |

| Characteristics | Classification | Number | Ratio |

|---|---|---|---|

| Gender | Male | 201 | 32.68% |

| Female | 414 | 67.32% | |

| Under 19 | 30 | 4.88% | |

| 20~29 | 189 | 30.73% | |

| Age | 30~39 | 228 | 37.07% |

| 40~49 | 96 | 15.61% | |

| 50 and above | 72 | 11.71% | |

| Middle school or below | 147 | 23.90% | |

| Education | High school | 198 | 32.20% |

| College | 210 | 34.15% | |

| Graduates or above | 60 | 9.75% | |

| 3000 CNY and under | 105 | 17.07% | |

| Family income (month) | 3001~5000 CNY | 216 | 35.12% |

| 5001~7000 CNY | 168 | 27.32% | |

| 7000 CNY and above | 126 | 20.49% | |

| Franchised stores | 63 | 10.24% | |

| Channels to purchase | Supermarkets | 417 | 67.81% |

| Farmers markets | 99 | 16.10% | |

| Others | 36 | 5.85% |

| Cognition towards Global Climate Change | ||||||

| Impact of Climate Change | Big | Moderate | Small | None | ||

| Number of Respondents | 102 | 291 | 156 | 66 | ||

| Percentage | 16.58% | 47.31% | 25.37% | 10.73% | ||

| Cognition of the Distinction between Low-carbon Products and the Ordinary Ones | ||||||

| Pollution | Ordinary Rice is More Polluting | Low-Carbon Rice is More Polluting | ||||

| Number of Respondents | 608 | 7 | ||||

| Percentage | 98.86% | 1.14% | ||||

| Cognition of the Environmental Effect of Low-Carbon Agricultural Products | ||||||

| Environmental Effect | Big | Moderate | Small | None | ||

| Number of Respondents | 186 | 249 | 123 | 57 | ||

| Percentage | 30.24% | 40.49% | 20.00% | 9.27% | ||

| Understanding towards Carbon Labelling | ||||

| Understanding | Very Good | Moderate | Fewer | None |

| Number of Respondents | 48 | 219 | 199 | 149 |

| Percentage | 7.80% | 35.61% | 32.36% | 24.23% |

| Whether to Trust Carbon Labelling | ||||

| Trust | No | Yes | ||

| Number of Respondents | 344 | 271 | ||

| Percentage | 55.93% | 44.07% | ||

| Price (CNY) | Proportion Exceeding the Initial Price (%) | Persons Willing to Purchase | Proportion (%) |

|---|---|---|---|

| 2.2 | 10% | 227 | 40.04% |

| 2.4 | 20% | 192 | 33.86% |

| 2.8 | 40% | 68 | 11.99% |

| 3.6 | 80% | 46 | 8.11% |

| 4.0 | 100% | 34 | 6.00% |

| Variables | Range | Implication and Explanation | Model 1 | Model 2 | ||

|---|---|---|---|---|---|---|

| Mean Std Dev | Mean Std Dev | |||||

| Dependent variables | ||||||

| Willingness to pay | 0–1 | Whether consumers are willing to pay for the premium of the low-carbon rice (0 = No; 1 = Yes) | 0.92 | 0.035 | — | — |

| The premium level willing to pay | 1–5 | The premium level that consumers willing to pay for low-carbon rice (1 = 10%; 2 = 20%; 3 = 40%; 4 = 80%; 5 = 100%) | — | — | 2.06 | 0.037 |

| Control variables | ||||||

| Sex | 0–1 | 0 = Male; 1 = Female | 0.67 | 0.029 | 0.63 | 0.026 |

| Age | 1–5 | 1 = Under 19; 2 = 19~29; 3 = 30~39; 4 = 40~49; 5 = 50 and above | 2.99 | 0.068 | 3.23 | 0.079 |

| Monthly income | 1–4 | 1 = 3000 CNY and below; 2 = 3001~5000 CNY; 3 = 5001~7000 CNY; 4 = 7000 CNY above | 2.51 | 0.047 | 2.78 | 0.059 |

| Education | 1–4 | 1 = middle school and under; 2 = high school; 3 = junior college or university; 4 = graduate or above | 2.30 | 0.042 | 2.52 | 0.057 |

| Purchase ways | 1–4 | 1 = others;2 = farmers market;3 = supermarkets; 4 = franchised stores | 2.82 | 0.064 | 3.13 | 0.074 |

| Understanding towards carbon labelling (understanding) | 1–4 | 1 = none; 2 = fewer; 3 = moderate; 4 = very good | 2.27 | 0.039 | 2.49 | 0.051 |

| Consumer trust in carbon labelling (trust) | 0–1 | 0 = no; 1 = yes | 0.41 | 0.012 | 0.45 | 0.013 |

| Cognition towards global climate change (influence) | 1–4 | 1 = none; 2 = small; 3 = moderate; 4 = big | 2.70 | 0.056 | 2.81 | 0.059 |

| Cognition towards the difference of products (difference) | 0–1 | 0= low-carbon rice is more polluting; 1= ordinary rice is more polluting | 0.99 | 0.014 | 1 | 0.012 |

| Cognition towards the environmental effect of the low-carbon rice (function) | 1–4 | 1= none; 2 = small; 3 = moderate; 4 = big | 2.92 | 0.071 | 3.09 | 0.072 |

| Variable | Regression Coefficient | Standard Deviation | Marginal Effect |

|---|---|---|---|

| age | 0.107 | 0.092 | 0.036 |

| sex | -0.054 | 0.047 | -0.012 |

| income | 0.677 *** | 0.112 | 0.198 *** |

| education | 0.357 | 0.304 | 0.107 |

| way | 0.097 | 0.089 | 0.033 |

| understand | 0.369 *** | 0.102 | 0.128 *** |

| trust | 0.501 *** | 0.137 | 0.186 *** |

| influence | 0.235 ** | 0.099 | 0.077 ** |

| difference | 0.342 *** | 0.124 | 0.124 *** |

| function | 0.276 ** | 0.118 | 0.0083 ** |

| constant | 0.583 ** | 0.256 | — |

| Variable | Regression Coefficient | Standard Deviation |

|---|---|---|

| female | 0.217 | 0.196 |

| age (19~29) | 0.153 | 0.132 |

| age (30~39) | 0.306 | 0.257 |

| age (40~49) | 0.398 | 0.363 |

| age (50 and above) | 0.539 | 0.471 |

| income (3001~5000 CNY) | 0.597 ** | 0.246 |

| income (5001~7000 CNY) | 0.723 ** | 0.351 |

| income (7000 CNY above) | 2.577 *** | 0.501 |

| high school | 0.439 * | 0.258 |

| junior college or university | 0.862 | 0.721 |

| graduate or above | 1.327 *** | 0.402 |

| way (farmers market) | 0.196 | 0.153 |

| way (supermarkets) | 0.322 | 0.255 |

| way (franchised stores) | 0.472 | 0.403 |

| understand (fewer) | 0.561 ** | 0.279 |

| understand (moderate) | 0.732 ** | 0.351 |

| understand (very keen) | 1.561 *** | 0.413 |

| trust (yes) | 2.136 *** | 0.328 |

| influence (small) | 0.985 ** | 0.482 |

| influence (moderate) | 1.781 ** | 0.851 |

| influence (big) | 3.425 *** | 0.593 |

| difference (ordinary rice is more polluting) | 2.537 *** | 0.459 |

| function (small) | 0.602 ** | 0.297 |

| function (moderate) | 0.793 ** | 0.395 |

| function (big) | 1.315 *** | 0.313 |

| threshold value (premium is 10%) | 0.196 | 0.139 |

| threshold value (premium is 20%) | 0.412 | 0.276 |

| threshold value (premium is 40%) | 0.685 | 0.503 |

| threshold value (premium is 80%) | 0.723 | 0.529 |

| Variable | Under Junior College | Junior College and above | Family Monthly Income less than 5000 CNY | Family Monthly Income 5000 CNY and above | Aged less than 30 Years | Aged 30 Years and above |

|---|---|---|---|---|---|---|

| Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | |

| influence | 0.117 (0.083) | 0.347 ** (0.139) | 0.089 (0.073) | 0.521 *** (0.176) | 0.198 ** (0.097) | 0.256 ** (0.125) |

| difference | 0.203 * (0.107) | 0.463 *** (0.141) | 0.159 (0.127) | 0.621 *** (0.155) | 0.285 ** (0.059) | 0.379 *** (0.086) |

| function | 0.132 (0.096) | 0.392 ** (0.192) | 0.106 * (0.062) | 0.469 *** (0.128) | 0.201 ** (0.093) | 0.292 ** (0.143) |

| control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| constant | 0.926 *** (0.215) | 0.785 *** (0.163) | 0.821 *** (0.186) | 0.502 *** (0.103) | 0.899 *** (0.197) | 0.626 *** (0.152) |

| LR | 63.821 | 79.525 | 61.732 | 80.639 | 68.617 | 74.012 |

| McFadden R2 | 0.526 | 0.651 | 0.518 | 0.701 | 0.623 | 0.639 |

| Obs. | 345 | 270 | 321 | 294 | 219 | 396 |

| Under Junior College | Junior College and above | Family Monthly Income 5000 CNY and under | Family Monthly Income 5000 CNY above | 29 Years Old and under | 30 Years Old and above | |

|---|---|---|---|---|---|---|

| Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | Regression Coefficient | |

| influence (small) | 0.863 * (0.502) | 2.102 *** (0.583) | 0.679 * (0.358) | 3.103 *** (0.751) | 0.963 ** (0.469) | 1.302 ** (0.628) |

| influence (moderate) | 1.327 ** (0.659) | 3.465 *** (0.892) | 1.103 ** (0.498) | 4.011 *** (0.949) | 1.896 ** (0.956) | 2.172 ** (1.063) |

| influence (big) | 2.016 ** (0.867) | 4.263 *** (1.012) | 1.821 ** (0.765) | 4.568 *** (1.304) | 3.179 *** (0.873) | 3.623 *** (1.087) |

| difference (ordinary rice is more polluting) | 1.522 ** (0.751) | 3.468 *** (0.913) | 1.179 ** (0.585) | 3.823 *** (0.796) | 2.125 *** (0.403) | 2.768 *** (0.521) |

| function (small) | 0.515 * (0.269) | 1.023 *** (0.306) | 0.359 * (0.196) | 1.625 *** (0.401) | 0.627 ** (0.298) | 0.687 ** (0.323) |

| function (moderate) | 0.723 * (0.379) | 1.653 *** (0.407) | 0.576 * (0.309) | 2.023 *** (0.516) | 0.789 ** (0.387) | 0.912 ** (0.451) |

| function (big) | 0.922 ** (0.461) | 1.891 *** (0.623) | 0.858 ** (0.423) | 2.519 *** (0.697) | 1.015 *** (0.301) | 1.558 *** (0.363) |

| Threshold value (premium is 10%) | 0.149 (0.101) | 0.258 (0.177) | 0.139 (0.092) | 0.267 (0.178) | 0.192 (0.131) | 0.211 (0.146) |

| Threshold value (premium is 20%) | 0.303 (0.229) | 0.483 (0.353) | 0.285 (0.221) | 0.487 (0.359) | 0.416 (0.289) | 0.436 (0.318) |

| Threshold value (premium is 40%) | 0.578 (0.392) | 0.713 (0.501) | 0.526 (0.389) | 0.732 (0.591) | 0.656 (0.561) | 0.702 (0.523) |

| Threshold value (premium is 80%) | 0.617 (0.468) | 0.801 (0.596) | 0.598 (0.473) | 0.837 (0.612) | 0.729 (0.528) | 0.763 (0.612) |

| LR | 87.353 | 110.259 | 79.658 | 113.155 | 99.627 | 101.323 |

| McFadden R2 | 0.651 | 0.758 | 0.625 | 0.789 | 0.712 | 0.733 |

| Number | 305 | 262 | 283 | 284 | 192 | 375 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhong, S.; Chen, J. How Environmental Beliefs Affect Consumer Willingness to Pay for the Greenness Premium of Low-Carbon Agricultural Products in China: Theoretical Model and Survey-based Evidence. Sustainability 2019, 11, 592. https://doi.org/10.3390/su11030592

Zhong S, Chen J. How Environmental Beliefs Affect Consumer Willingness to Pay for the Greenness Premium of Low-Carbon Agricultural Products in China: Theoretical Model and Survey-based Evidence. Sustainability. 2019; 11(3):592. https://doi.org/10.3390/su11030592

Chicago/Turabian StyleZhong, Shihu, and Jie Chen. 2019. "How Environmental Beliefs Affect Consumer Willingness to Pay for the Greenness Premium of Low-Carbon Agricultural Products in China: Theoretical Model and Survey-based Evidence" Sustainability 11, no. 3: 592. https://doi.org/10.3390/su11030592

APA StyleZhong, S., & Chen, J. (2019). How Environmental Beliefs Affect Consumer Willingness to Pay for the Greenness Premium of Low-Carbon Agricultural Products in China: Theoretical Model and Survey-based Evidence. Sustainability, 11(3), 592. https://doi.org/10.3390/su11030592