Independent Directors and Organizational Performance: New Evidence from A Meta-Analytic Regression Analysis

Abstract

1. Introduction

2. Theoretical Foundations

3. Literature Review and Hypotheses Development

3.1. Linking Board Independence and Corporate Financial Performance

3.2. Conceptual Moderators

3.2.1. Effect of Countries’ Legal Systems: Communitarian vs. Shareholder Perspective

3.2.2. The Role of Mechanisms to Protect Minority Investors

4. Method Features

4.1. Sample Selection

4.2. Inclusion Criteria

4.3. Meta-Analytic Procedure

4.4. Variables’ Measures

4.4.1. Countries’ Legal Systems

4.4.2. Minority Investors’ Protection Mechanisms

4.4.3. Incidence of Market Conditions (Methodological Moderator)

4.4.4. Corporate Financial Performance Measurement: Accounting-Based vs. Market-Based Approaches (Methodological Moderator)

4.4.5. Journal Quality Standards (Methodological Moderator)

5. Results

6. Discussion

7. Conclusions, Limitations, and Future Research Agenda

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

| Author | Year | Journal | Sample Size | Observed Size Effects | Author | Year | Journal | Sample Size | Observed Size Effects |

|---|---|---|---|---|---|---|---|---|---|

| Acero & Alcalde | 2012 | Spanish Accounting Review | 171 | 0.106 | Jackling & Johl | 2009 | Corporate Governance: An International Review | 180 | 0.06 |

| Adams & Jiang | 2016 | Journal of Banking & Finance | 1168 | 0.2 to 0.31 | Jackowicz & Kowalewski | 2012 | Emerging Markets Review | 156 | 0.07 |

| Adams & Ferreira | 2009 | Journal of Financial Economics | 8253 | −0.041 to −0.011 | Javaid-Lone, Ali & Khan | 2016 | Corporate Governance: The international Journal of Business in Society | 250 | 0.12 |

| Akpan & Amran | 2014 | Journal of Finance and Accounting | 270 | −0.061 | Jizi | 2017 | Business Strategy and the Environment | 1155 | −0.03 |

| Aman & Nguyen | 2008 | Journal of the Japanese and International Economies | 1550 | 0.026 to 0.136 | Jizi, Salama, Dixon & Stratling | 2014 | Journal of Business Ethics | 291 | 0.13 |

| Arayssi, Dah & Jizi | 2016 | Sustainability Accounting, Management and Policy Journal | 975 | −0.033 to 0.039 | Johnson & Greening | 1999 | Academy of Management Journal | 252 | −0.12 to −0.03 |

| Arena, Bozzolna & Michelon | 2015 | Corporate Social Responsibility and Environmental Management | 288 | −0.112 to 0.168 | Kaczmarek, Kimino & Py | 2012 | Corporate Governance: An International Review | 3106 | 0.04 |

| Barakat, Pérez & Ariza | 2015 | Review of Managerial Science | 101 | 0.04 | Kang, Ding & Charoenwong | 2010 | Journal of Business Research | 45 | 0.31 |

| Barroso Castro, La Concha, Dominguez, Gravel & Periñan | 2009 | Corporate Governance: An International Review | 862 | −0.02 | Rao, Tilt & Lester | 2012 | Corporate Governance: The international journal of business in society | 96 | 0.06 |

| Beiner, Drobetz, Schmid & Zimmermann | 2006 | European Financial Management | 109 | −0.1247 | Kent & Monem | 2008 | Australian Accounting Review | 72 | −0.01 |

| Ben-Amar, Chang & McIlkenny | 2015 | Journal of Business Ethics | 541 | −0.05 to −0.03 | Kiel & Nicholson | 2003 | Corporate Governance: An International Review | 348 | −0.179 to 0.023 |

| Berrone & Gomez-Mejia | 2009 | Academy of Management Journal | 2088 | −0.07 to −0.01 | Kilic | 2015 | International Journal of Business and Management | 130 | −0.089 to 0.017 |

| Bhagat & Bolton | 2013 | Journal of Financial and Quantitative Analysis | 6683 | −0.05 to −0.04 | Kiliç & Kuzey | 2016 | Gender in Management: An International Journal | 745 | −0.018 to 0.058 |

| Bonn | 2004 | Journal of the Australian and New Zealand Academy of Management | 84 | −0.87 to 0.285 | Kim | 2013 | International Management Review | 290 | −0.11 |

| Bonn, Yoshikawa & Phan | 2004 | Asian Business & Management | 169 | −0.052 to 0.254 | Kock, Santaló & Diestre | 2012 | Journal of Management Studies | 657 | 0.01 |

| Bonn, Yoshikawa & Phan | 2004 | Asian Business & Management | 104 | −0.011 to −0.028 | Kouki & Guizani | 2015 | International Business Research | 294 | 0.3 |

| Boulouta | 2013 | Journal of Business Ethics | 820 | 0.0236 | Kyereboah-Coleman & Biekpe | 2006 | Corporate Ownership and Control | 176 | −0.008 |

| Brammer, Millington & Pavelin | 2009 | British Journal of Management | 199 | −0.095 | Lefort & Urzúa | 2008 | Journal of Business Research | 562 | 0.06 |

| Cai, Keasey, & Short | 2006 | European Financial Management | 566 | −0.05 | Li, Zhang & Foo | 2013 | Chinese Management Studies | 613 | 0.01 |

| Chapple, Kent & Routledge | 2012 | Working paper (Social Science Research Network) | 1182 | −0.01 | Liao, Luo & Tang | 2015 | The British Accounting Review | 329 | −0.16 |

| Charles, Redor & Zopounidis | 2015 | Economics Bulletin | 1181 | −0.094 | Lim, Matolcsy & Chow | 2007 | European Accounting Review | 181 | 0.116 |

| Chen, Crossland, & Huang | 2016 | Strategic Management Journal | 13,248 | −0.07 to 0.04 | Liu, Wei y Xie | 2014 | Journal of Corporate Finance | 16964 | 0.128 |

| Cheung, Connelly, Impaphayom & Zhou | 2007 | Journal of International Financial Management & Accounting | 168 | 0.027 to 0.043 | Mallin & Michelon | 2011 | Accounting and Business Research | 278 | 0.081 |

| Cheung, Jiang, Limpaphayom & Lu | 2010 | European Financial Management | 287 | −0.011 to 0.024 | McGuinness, Vieito & Wang | 2017 | Journal of Corporate Finance | 2412 | 0.02 |

| Choi, Lee & Park | 2013 | Corporate Governance: An International Review | 2042 | −0.07 to 0.03 | Mohammadi, Basir & Löö | 2015 | CESIS Electronic Working Paper Series | 55769 | −0.09 |

| Combs, Ketchen, Perryman & Donahue | 2007 | Journal of Management Studies | 73 | 0.00 | Mori, Golesorkhi, Randøy & Hermes | 2015 | Strategic Change | 228 | −0.025 |

| Cormier, Ledoux & Magnan | 2011 | Management Decision | 137 | −0.1 | Musteen, Datta & Kemmerer | 2010 | British Journal of Management | 324 | −0.00 |

| Cumming, Leung & Rui | 2015 | Academy of Management Journal | 1448 | 0.07 | Nekhili & Gatfaoui | 2013 | Journal of Business Ethics | 450 | −0.106 to −0.213 |

| Daghsni, Zouhayer & Mbarek | 2016 | Arabian Journal of Business and Management Review | 350 | 0.068 | Nguyen, Locke & Reddley | 2015 | International Review of Economics and Finance | 479 | −0.03 |

| Dang & Nguyen | 2016 | Management International | 284 | −0.144 to −0.136 | Nurhayati, Taylor & Tower | 2015 | Proceedings of the Australasian Conference on Business and Social Sciences | 285 | 0.032 |

| Darmadi | 2013 | Corporate Governance: The International Journal of Business in Society | 354 | −0.1 to 0.01 | Oh, Chang & Cheng | 2016 | Journal of Business Ethics | 1332 | −0.01 |

| Darmadi & Gunawan | 2013 | Managerial Finance | 101 | 0.046 | O’Reilly & Main | 2012 | Working paper (Social Science Research Network) | 1796 | 0.04 |

| David, Bloom & Hillman | 2007 | Strategic Management Journal | 730 | −0.2 to −0.16 | Ouyang | 2007 | Published PhD dissertation | 23,209 | −0.039 to 0.122 |

| De Villiers | 2011 | Journal of Management | 5997 | −0.01 to 0.00 | Ozcan & Ince | 2016 | International Business Research | 112 | −0.16 to −0.18 |

| Desender, Aguilera, Crespi & García-cestona | 2013 | Strategic Management Journal | 242 | −0.13 | Pahuja & Bhatia | 2010 | The IUP Journal of Corporate Governance | 50 | −0.036 to 0.031 |

| Dixon-Fowler, Ellstrand & Johnson | 2017 | Journal of Business Ethics | 76 | 0.12 | Pathan & Faff | 2013 | Journal of Banking & Finance | 2640 | −0.21 to −0.16 |

| Dobbin & Jung | 2011 | North Carolina Law Review | 3016 | 0.025 | Pathan, Skully y Wickramanayake | 2007 | Asia Pacific Financial Markets | 64 | 0.075 to 0.1579 |

| Ducassy | 2015 | Research in International Business and Finance | 41 | 0.19 | Peng, Li, Xie & Su | 2010 | Asia Pacific Journal of Management | 300 | −0.017 |

| Dunn & Sainty | 2009 | International Journal of Managerial Finance | 174 | 0.025 | Peng, Zhang & Li | 2007 | Management and Organization Review | 1202 | 0.05 |

| Fernández, Gómez-Ansón & Fernández-Méndez | 1998 | Investigaciones Económicas | 67 | 0.203 | Prado-Lorenzo, Sánchez, & Gallego-Álvarez | 2009 | Revista Española de Financiación y Contabilidad | 288 | 0.04 |

| Fernández-Gago, Cabeza-García & Nieto | 2016 | Review of Managerial Science | 145 | 0.014 | Rodriguez-Fernadez, Fernández-Alonso & Rodríguez-Rodríguez | 2013 | Revista Europea de Dirección y Economía de la Empresa | 121 | 0.02 to 0.112 |

| Fidanoski, Mateska & Simeonovski | 2014 | Advances in Financial Economics | 175 | −0.1 to 0.12 | Rubino, Tenuta & Cambrea | 2016 | Journal of Management & Governance | 1613 | −0.0176 |

| Galbreath | 2011 | Journal of Management and Organization | 161 | 0.04 to 0.22 | Rutledge, Karim & Lu | 2016 | Journal of Applied Business and Economics | 470 | 0.038 |

| Galbreath | 2016 | Business Strategy and the Environment | 300 | 0.02 | Sahin, Basfirinci & Ozsalih | 2011 | Published PhD dissertation | 96 | −0.136 to 0.171 |

| Gallego-Álvarez, García-Sánchez, & Rodríguez-Dominguez | 2010 | Spanish Accounting Review | 288 | 0.062 | Saibaba | 2013 | IUP Journal of Corporate Governance | 195 | −0.217 |

| García Lara, García Osma & Penalva | 2007 | European Accounting Review | 193 | 0.08 | Setia-Atmaja | 2009 | Corporate Governance: An International Review | 0.21 | 0.04 to 0.21 |

| Garcia-Sanchez, Cuadrado-Ballesteros & Sepulveda | 2014 | Management Decision | 686 | 0.015 | Shaukat, Qiu & Trojanowski | 2016 | Journal of Business Ethics | 2028 | 0.02 |

| Giannarakis | 2014 | Social Responsibility Journal | 100 | −0.033 to 0.108 | Stefanelli & Cotugno | 2012 | Academy of Banking Studies Journal | 76 | −0.104 |

| Gregory-Smith, Main & O’Reilly | 2014 | The Economic Journal | 13,870 | −0.024 | Tang | 2016 | European Management Journal | 364 | −0.01 to 0.03 |

| Gul, Srinidhi & Tsui | 2008 | Working paper (Social Science Research Network) | 2784 | −0.0166 to −0.0031 | Tauringana & Chithambo | 2015 | The British Accounting Review | 860 | 0.07 |

| Gulzar & Wang | 2011 | International Journal of Accounting and Financial Reporting | 1011 | −0.02 | Triana, Miller & Trzebiatowski | 2013 | Organization Science | 462 | −0.02 |

| Gupta, Lam, Sami & Zhou | 2015 | Working paper (Social Science Research Network) | 1153 | 0.02 | Uadiale | 2010 | International Journal of Business and Management | 30 | 0.075 to 0.75 |

| Hafsi & Turgut | 2013 | Journal of Business Ethics | 95 | −0.01 | Alix Valenti, Luce & Mayfield | 2011 | Management Research Review | 87 | −0.28 |

| Hahn & Lasfer | 2007 | Cass Business School Research Paper | 764 | 0.012 to 0.022 | Villanueva-Villar, Rivo-López & Lago-Peñas | 2016 | Business Research Quarterly | 438 | 0.083 |

| Haque | 2017 | The British Accounting Review | 363 | −0.04 to −0.01 | Vo & Nguyen | 2014 | International Journal of Economics and Finance | 752 | −0.06 to 0 |

| Hogan, Olson & Sharma | 2014 | Journal of Leadership, Accountability and Ethics | 540 | 0.11 | Walls & Berrone | 2015 | Journal of Business Ethics | 1320 | 0.08 |

| Hoje & Harjoto | 2011 | Journal of Business Ethics | 13,389 | −0.04 to 0.01 | Walls & Hoffman | 2013 | Journal of Organizational Behavior | 1881 | −0.18 |

| Honeine & Swan | 2011 | Working paper (Social Science Research Network) | 1374 | −0.14 to 0.04 | Walls, Berrone & Phan | 2012 | Strategic Management Journal | 2002 | −0.01 |

| Horner & Valenti | 2012 | Journal of Leadership, Accountability and Ethics | 238 | −0.01 | Wang, Wang, Zhang & Yang | 2012 | African Journal of Business Management | 446 | 0.007 |

| Horvath & Spirollari | 2012 | Prague economic papers | 680 | 0.028 | Zemzem & Kacemb | 2014 | International Journal of Finance & Banking Studies | 170 | 0.18 |

| Hu, Tam & Tan | 2010 | Asia Pacific Journal of Management | 304 | 0.03 to 0.07 | Zhang | 2012 | Corporate Governance: The international journal of business in society | 475 | −0.03 to −0.02 |

| Huang | 2010 | Journal of Management and Organization | 297 | 0.174 | Zhang, Zhu & Ding | 2013 | Journal of Business Ethics | 516 | −0.01 |

| Hussain, Rigoni & Orij | 2016 | Journal of Business Ethics | 152 | 0.037 | Zorn, Shropshire, Martin, Combs & Ketchen | 2017 | Strategic Management Journal | 3124 | 0.03 to 0.04 |

References

- Daily, C.M.; Dalton, D.R.; Cannella, A.A. Corporate governance: Decades of dialogue and data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9, 7–26. [Google Scholar]

- Hermes, N.; Postma, T.J.; Zivkov, O. Corporate governance codes in the European Union: Are they driven by external or domestic forces? Int. J. Manag. Financ. 2006, 2, 280–301. [Google Scholar] [CrossRef]

- Fidanoski, F.; Simeonovski, K.; Mateska, V. The Impact of Board Diversity on Corporate Performance: New Evidence from Southeast Europe. In Corporate Governance in the US and Global Settings; Emerald Group Publishing Limited: Bingley, UK, 2014; pp. 81–123. [Google Scholar]

- Lefort, F.; Urzúa, F. Board independence, firm performance and ownership concentration: Evidence from Chile. J. Bus. Res. 2008, 61, 615–622. [Google Scholar] [CrossRef]

- Choi, J.J.; Park, S.W.; Yoo, S.S. The value of outside directors: Evidence from corporate governance reform in Korea. J. Financ. Quant. Anal. 2007, 42, 941–962. [Google Scholar] [CrossRef]

- Jackling, B.; Johl, S. Board structure and firm performance: Evidence from India′s top companies. Corp. Gov. Int. Rev. 2009, 17, 492–509. [Google Scholar] [CrossRef]

- Pathan, S.; Skully, M.; Wickramanayake, J. Board size, independence and performance: An analysis of Thai banks. Asia-Pac. Financ. Mark. 2007, 14, 211–227. [Google Scholar] [CrossRef]

- Terjesen, S.; Couto, E.B.; Francisco, P.M. Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. J. Manag. Gov. 2016, 20, 447–483. [Google Scholar] [CrossRef]

- Horvath, R.; Spirollari, P. Do the board of directors’ characteristics influence firm’s performance? The US evidence. Prague Econ. Pap. 2012, 4, 470–486. [Google Scholar] [CrossRef]

- Kyereboah-Coleman, A.; Biekpe, N. The relationship between board size, board composition, CEO duality and firm performance: Experience from Ghana. Corp. Ownersh. Control 2006, 4, 114–122. [Google Scholar] [CrossRef]

- Mahadeo, J.D.; Soobaroyen, T.; Hanuman, V.O. Board composition and financial performance: Uncovering the effects of diversity in an emerging economy. J. Bus. Ethics 2012, 105, 375–388. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Rhoades, D.L.; Rechner, P.L.; Sundaramurthy, C. Board composition and financial performance: A meta-analysis of the influence of outside directors. J. Manag. Issues 2000, 12, 76–91. [Google Scholar]

- Van Essen, M.; van Oosterhout, J.H.; Carney, M. Corporate boards and the performance of Asian firms: A meta-analysis. Asia Pac. J. Manag. 2012, 29, 873–905. [Google Scholar] [CrossRef]

- Mutlu, C.C.; Van Essen, M.; Peng, M.W.; Saleh, S.F.; Duran, P. Corporate Governance in China: A Meta-Analysis. J. Manag. Stud. 2018, 55, 943–979. [Google Scholar] [CrossRef]

- Borenstein, M.H.; Hedges, L.V.; Higgins, J.P.T.; Rothstein, H.R. Introduction to Meta-Analysis; Wiley: Chichester, UK, 2009. [Google Scholar]

- Lipsey, M.W.; Wilson, D.B. Practical Meta-Analysis; Sage: Newcastle upon Tyne, UK, 2001. [Google Scholar]

- Rediker, K.J.; Seth, A. Boards of directors and substitution effects of alternative governance mechanisms. Strateg. Manag. J. 1995, 16, 85–99. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Filatotchev, I.; Gospel, H.; Jackson, G. An organizational approach to comparative corporate governance: Costs, contingencies, and complementarities. Organ. Sci. 2008, 19, 475–492. [Google Scholar] [CrossRef]

- Yoshikawa, T.; Zhu, H.; Wang, P. National governance system, corporate ownership, and roles of outside directors: A corporate governance bundle perspective. Corp. Gov. Int. Rev. 2014, 22, 252–265. [Google Scholar] [CrossRef]

- Desender, K.A.; Aguilera, R.V.; Crespi, R.; García-cestona, M. When does ownership matter? Board characteristics and behavior. Strateg. Manag. J. 2013, 34, 823–842. [Google Scholar] [CrossRef]

- Gentry, R.J.; Shen, W. The relationship between accounting and market measures of firm financial performance: How strong is it? J. Manag. Issues 2010, 22, 514–530. [Google Scholar]

- Ortas, E.; Álvarez, I.; Zubeltzu, E. Firms’ Board Independence and Corporate Social Performance: A Meta-Analysis. Sustainability 2017, 9, 1006. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate Governance and Sustainability Performance: Analysis of Triple Bottom Line Performance. J. Bus. Ethics 2016, 149, 411–432. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks. The Triple Bottom Line of 21st Century; Capstone Publishing Limited: Oxford, UK, 1997. [Google Scholar]

- Schaltegger, S.; Wagner, M. Managing sustainability performance measurement and reporting in an integrated manner. Sustainability accounting as the link between the sustainability balanced scorecard and sustainability reporting. In Sustainability Accounting and Reporting; Springer: Dordrecht, The Netherlands, 2006; pp. 681–697. [Google Scholar]

- Denis, D.K.; McConnell, J.J. International corporate governance. J. Financ. Quant. Anal. 2003, 38, 1–36. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. A theory of friendly boards. J. Financ. 2007, 62, 217–250. [Google Scholar] [CrossRef]

- Hillman, A.J.; Dalziel, T. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Zheng, C.; Kouwenberg, R. A bibliometric review of global research on corporate governance and board attributes. Sustainability 2019, 11, 3428. [Google Scholar] [CrossRef]

- Ferrarini, G.A.; Filippelli, M. Independent directors and controlling shareholders around the world. In Research Handbook on Shareholder Power; Edward Elgar: Cheltenham, UK, 2014; pp. 269–295. [Google Scholar]

- Hopt, K.J. Comparative Corporate Governance: The State of Art and International Regulation. Am. J. Comp. Law 2011, 59, 1–72. [Google Scholar] [CrossRef]

- Fama, E.F. Agency Problems and the Theory of the Firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Corporate ownership around the world. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Johanson, D.; Østergren, K. The movement toward independent directors on boards: A comparative analysis of Sweden and the UK. Corp. Gov. Int. Rev. 2010, 18, 527–539. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Bertoni, F.; Meoli, M.; Vismara, S. Board independence, ownership structure and the valuation of IPOs in continental Europe. Corp. Gov. Int. Rev. 2014, 22, 116–131. [Google Scholar] [CrossRef]

- Combs, J.G.; Ketchen, D.J.; Perryman, A.A.; Donahue, M.S. The moderating effect of CEO power on the board composition–firm performance relationship. J. Manag. Stud. 2007, 44, 1299–1323. [Google Scholar] [CrossRef]

- Gordon, J.N. The rise of independent directors. Directorship 2008, 34, 58–63. [Google Scholar]

- Baysinger, B.D.; Butler, H.N. Corporate governance and the board of directors: Performance effects of changes in board composition. J. Law Econ. Organ. 1985, 1, 101–124. [Google Scholar]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Stiles, P.; Taylor, B. Boards at Work: How Directors View Their Roles and Responsibilities; Oxford University Press: New York, NY, USA, 2001. [Google Scholar]

- Rosenstein, S.; Wyatt, J.G. Outside directors, board independence, and shareholder wealth. J. Financ. Econ. 1990, 26, 175–191. [Google Scholar] [CrossRef]

- Elloumi, F.; Gueyie, J. Financial distress and corporate governance: An empirical analysis. Corp. Gov. Int. J. Bus. Soc. 2001, 1, 15–23. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Stanford University Press: Stanford, CA, USA, 2003. [Google Scholar]

- Pfeffer, J. Size and composition of corporate boards of directors: The organization and its environment. Adm. Sci. Q. 1972, 17, 218–228. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A.; Paetzold, R.L. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. J. Manag. Stud. 2000, 37, 235–256. [Google Scholar] [CrossRef]

- Gales, L.M.; Kesner, I.F. An analysis of board of director size and composition in bankrupt organizations. J. Bus. Res. 1994, 30, 271–282. [Google Scholar] [CrossRef]

- Kesner, I.F. Directors′ characteristics and committee membership: An investigation of type, occupation, tenure, and gender. Acad. Manag. J. 1988, 31, 66–84. [Google Scholar]

- Dalziel, T.; Gentry, R.J.; Bowerman, M. An integrated agency–resource dependence view of the influence of directors′ human and relational capital on firms′ R&D spending. J. Manag. Stud. 2011, 48, 1217–1242. [Google Scholar]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Ionascu, M.; Ionascu, I.; Sacarin, M.; Minu, M. Women on boards and financial performance: Evidence from a European emerging market. Sustainability 2018, 10, 1644. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 1999, 42, 674–686. [Google Scholar]

- Rhoades, D.L.; Rechner, P.L.; Sundaramurthy, C. A Meta-analysis of Board Leadership Structure and Financial Performance: Are “two heads better than one”? Corp. Gov. Int. Rev. 2001, 9, 311–319. [Google Scholar] [CrossRef]

- Heugens, P.P.; Van Essen, M.; van Oosterhout, J.H. Meta-analyzing ownership concentration and firm performance in Asia: Towards a more fine-grained understanding. Asia Pac. J. Manag. 2009, 26, 481–512. [Google Scholar] [CrossRef]

- Sánchez-Ballesta, J.P.; García-Meca, E. A meta-analytic vision of the effect of ownership structure on firm performance. Corp. Gov. Int. Rev. 2007, 15, 879–892. [Google Scholar] [CrossRef]

- Honeine, S.; Swan, P.L. What Are the Determinants of Board Performance: Skin in the Game, Composition, Diversity, Size? Available online: http://dx.doi.org/10.2139/ssrn.1914769 (accessed on 19 November 2019).

- Ameer, R.; Ramli, F.; Zakaria, H. A new perspective on board composition and firm performance in an emerging market. Corp. Gov. Int. J. Bus. Soc. 2010, 10, 647–661. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo-Institutional framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Kouki, M.; Guizani, M. Outside directors and firm performance: The moderating effects of ownership and board leadership structure. Int. Bus. Res. 2015, 8, 104. [Google Scholar] [CrossRef]

- Liu, Y.; Wei, Z.; Xie, F. Do women directors improve firm performance in China? J. Corp. Financ. 2014, 28, 169–184. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Kaczmarek, S.; Kimino, S.; Pye, A. Board Task-related Faultlines and Firm Performance: A Decade of Evidence. Corp. Gov. Int. Rev. 2012, 20, 337–351. [Google Scholar] [CrossRef]

- Darmadi, S. Do women in top management affect firm performance? Evidence from Indonesia. Corp. Gov. Int. J. Bus. Soc. 2013, 13, 288–304. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Jackson, G. The cross-national diversity of corporate governance: Dimensions and determinants. Acad. Manag. Rev. 2003, 28, 447–465. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Investor protection and corporate governance. J. Financ. Econ. 2000, 58, 3–27. [Google Scholar] [CrossRef]

- Weimer, J.; Pape, J. A taxonomy of systems of corporate governance. Corp. Gov. Int. Rev. 1999, 7, 152–166. [Google Scholar] [CrossRef]

- Haake, S. National business systems and industry-specific competitiveness. Organ. Stud. 2002, 23, 711–736. [Google Scholar] [CrossRef]

- Tengblad, S.; Ohlsson, C. The framing of corporate social responsibility and the globalization of national business systems: A longitudinal case study. J. Bus. Ethics 2010, 93, 653–669. [Google Scholar] [CrossRef]

- Ball, R.; Kothari, S.; Robin, A. The effect of international institutional factors on properties of accounting earnings. J. Account. Econ. 2000, 29, 1–51. [Google Scholar] [CrossRef]

- Owen, G.; Kirchmaier, T.; Grant, J. Corporate Governance in the US and Europe: Where Are We Now? In Corporate Governance in the US and Europe; Palgrave Macmillan: London, UK, 2006. [Google Scholar]

- Kock, C.J.; Min, B.S. Legal Origins, Corporate Governance, and Environmental Outcomes. J. Bus. Ethics 2016, 138, 507–524. [Google Scholar] [CrossRef]

- Marginson, P.; Sisson, K. The structure of transnational capital in Europe: The emerging Euro-company and its implications for industrial relations. Eur. J. Ind. Relat. 2000, 6, 9–34. [Google Scholar] [CrossRef]

- Djankov, S.; La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The law and economics of self-dealing. J. Financ. Econ. 2008, 88, 430–465. [Google Scholar] [CrossRef]

- Bonn, I.; Yoshikawa, T.; Phan, P.H. Effects of board structure on firm performance: A comparison between Japan and Australia. Asian Bus. Manag. 2004, 3, 105–125. [Google Scholar] [CrossRef]

- Lau, C.; Fan, D.K.; Young, M.N.; Wu, S. Corporate governance effectiveness during institutional transition. Int. Bus. Rev. 2007, 16, 425–448. [Google Scholar] [CrossRef]

- Rajagopalan, N.; Zhang, Y. Corporate governance reforms in China and India: Challenges and opportunities. Bus. Horiz. 2008, 51, 55–64. [Google Scholar] [CrossRef]

- Field, A.P.; Gillett, R. How to do a meta-analysis. Br. J. Math. Stat. Psychol. 2010, 63, 665–694. [Google Scholar] [CrossRef]

- Peterson, R.A.; Brown, S.P. On the use of beta coefficients in meta-analysis. J. Appl. Psychol. 2005, 90, 175. [Google Scholar] [CrossRef] [PubMed]

- Garcia-Meca, E.; Sánchez-Ballesta, J.P. The association of board independence and ownership concentration with voluntary disclosure: A meta-analysis. Eur. Account. Rev. 2010, 19, 603–627. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Wagner, D.; Block, J.H.; Miller, D.; Schwens, C.; Xi, G. A meta-analysis of the financial performance of family firms: Another attempt. J. Fam. Bus. Strategy 2015, 6, 3–13. [Google Scholar] [CrossRef]

- Byron, K.; Post, C. Women on Boards of Directors and Corporate Social Performance: A Meta-Analysis. Corp. Gov. Int. Rev. 2016, 24, 428–442. [Google Scholar] [CrossRef]

- Wood, J. Methodology for dealing with duplicate study effects in a meta-analysis. Organ. Res. Methods 2008, 11, 79–95. [Google Scholar] [CrossRef]

- Aguinis, H.; Gottfredson, R.K.; Wright, T.A. Best-practice recommendations for estimating interaction effects using meta-analysis. J. Organ. Behav. 2011, 32, 1033–1043. [Google Scholar] [CrossRef]

- Higgins, J.; Thompson, S.G. Quantifying heterogeneity in a meta-analysis. Stat. Med. 2002, 21, 1539–1558. [Google Scholar] [CrossRef]

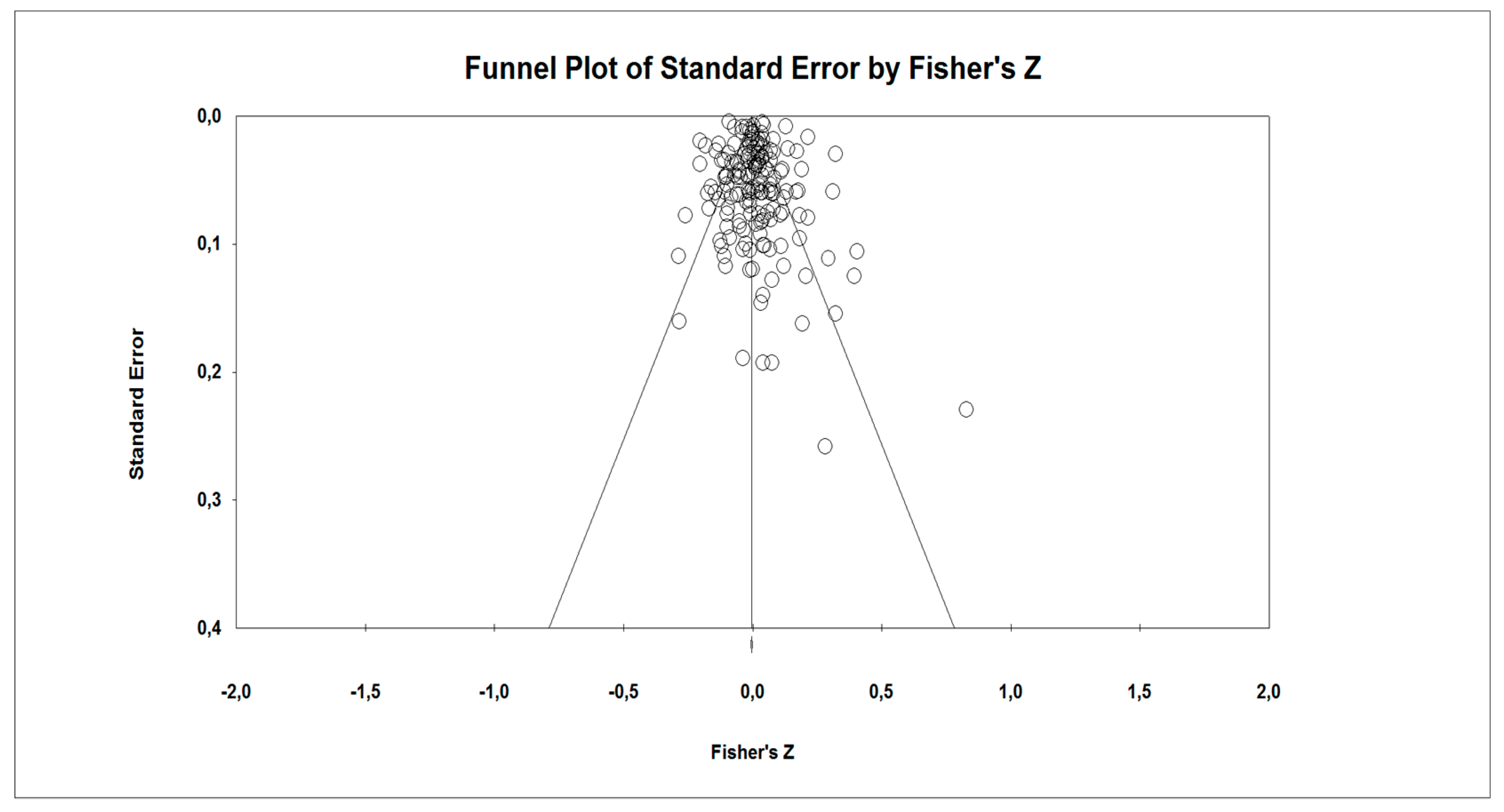

- Rosenthal, R. The file drawer problem and tolerance for null results. Psychol. Bull. 1979, 86, 638. [Google Scholar] [CrossRef]

- Egger, M.; Davey Smith, G.; Schneider, M.; Minder, C. Bias in meta-analysis detected by a simple, graphical test. BMJ 1997, 315, 629–634. [Google Scholar] [CrossRef]

- Siddiqui, S.S. The association between corporate governance and firm performance–a meta-analysis. Int. J. Account. Inf. Manag. 2015, 23, 218–237. [Google Scholar] [CrossRef]

- World Bank. Doing Business; World Bank Group: Washington, DC, USA, 2015. [Google Scholar]

- Aebi, V.; Sabato, G.; Schmid, M. Risk management, corporate governance, and bank performance in the financial crisis. J. Bank. Financ. 2012, 36, 3213–3226. [Google Scholar] [CrossRef]

- Van Essen, M.; Engelen, P.; Carney, M. Does “Good” Corporate Governance Help in a Crisis? The Impact of Country-and Firm-Level Governance Mechanisms in the European Financial Crisis. Corp. Gov. Int. Rev. 2013, 21, 201–224. [Google Scholar] [CrossRef]

- Francis, B.B.; Hasan, I.; Wu, Q. Do corporate boards matter during the current financial crisis? Rev. Financ. Econ. 2012, 21, 39–52. [Google Scholar] [CrossRef]

- O’Sullivan, J.; Mamun, A.; Hassan, M.K. The relationship between board characteristics and performance of bank holding companies: Before and during the financial crisis. J. Econ. Financ. 2016, 40, 438–471. [Google Scholar] [CrossRef]

- Yeh, Y.; Chung, H.; Liu, C. Committee Independence and Financial Institution Performance during the 2007–08 Credit Crunch: Evidence from a Multi-country Study. Corp. Gov. Int. Rev. 2011, 19, 437–458. [Google Scholar] [CrossRef]

- Walker, D. A Review of Corporate Governance in UK Banks and Other Financial Industry Entities; The Walker Review Secretariat: London, UK, 2009; pp. 1–175.

- International Corporate Governance Network. ICGN Global Stewardship Principles; International Corporate Governance Network: London, UK, 2017. [Google Scholar]

- Jean du, P.; Anil, H.; Jason, H. G20/OECD Principles of Corporate Governance; OECD Publishing: Paris, France, 2015. [Google Scholar]

- Aguilera, R.V.; Cuervo-Cazurra, A. Codes of good governance. Corp. Gov. Int. Rev. 2009, 17, 376–387. [Google Scholar] [CrossRef]

- Cuomo, F.; Mallin, C.; Zattoni, A. Corporate governance codes: A review and research agenda. Corp. Gov. Int. Rev. 2016, 24, 222–241. [Google Scholar] [CrossRef]

- ECGI European Corporate Governance Institute. Available online: https://ecgi.global/content/codes (accessed on 19 November 2019).

- Zattoni, A.; Cuomo, F. Why adopt codes of good governance? A comparison of institutional and efficiency perspectives. Corp. Gov. Int. Rev. 2008, 16, 1–15. [Google Scholar] [CrossRef]

- Ferreira, D.; Kirchmaier, T. Corporate boards in Europe: Size, independence and gender diversity. In Boards and Shareholders in European Listed Companies: Facts, Context and Post-Crisis Reforms; Belcredi, M., Ferrarini, G., Eds.; Cambridge University Press: Cambridge, UK, 2013; pp. 191–224. [Google Scholar]

- Linck, J.S.; Netter, J.M.; Yang, T. The determinants of board structure. J. Financ. Econ. 2008, 87, 308–328. [Google Scholar] [CrossRef]

- Catalyst Quick Take: Women on Corporate Boards Globally. 2017. Available online: https://www.catalyst.org/research/women-on-corporate-boards/ (accessed on 19 November 2019).

- Zahra, S.A. Goverance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Acad. Manag. J. 1996, 39, 1713–1735. [Google Scholar] [CrossRef]

- Adams, R.B. Governance and the financial crisis. Int. Rev. Financ. 2012, 12, 7–38. [Google Scholar] [CrossRef]

- Kirkpatrick, G. The corporate governance lessons from the financial crisis. OECD J. Financ. Mark. Trends 2009, 2009, 61–87. [Google Scholar] [CrossRef]

- Office for Official Publications of the European Communities. European Commission Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Action Plan: European Company Law and Corporate Governance—A Modern Legal Framework for More Engaged Shareholders and Sustainable Companies; Office for Official Publications of the European Communities: Luxembourg, 2012. [Google Scholar]

- Davies, P.L.; Hopt, K.J. Corporate Boards in Europe—Accountability and Convergence. Am. J. Comp. Law 2013, 61, 301–376. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Chakravarthy, B.S. Measuring strategic performance. Strateg. Manag. J. 1986, 7, 437–458. [Google Scholar] [CrossRef]

- Cochran, P.L.; Wood, R.A. Corporate social responsibility and financial performance. Acad. Manag. J. 1984, 27, 42–56. [Google Scholar]

- Barth, M.E. Fair value accounting: Evidence from investment securities and the market valuation of banks. Account. Rev. 1994, 69, 1–25. [Google Scholar]

- Richard, P.J.; Devinney, T.M.; Yip, G.S.; Johnson, G. Measuring organizational performance: Towards methodological best practice. J. Manag. 2009, 35, 718–804. [Google Scholar] [CrossRef]

- Nayyar, P.R. Performance effects of three foci in service firms. Acad. Manag. J. 1992, 35, 985–1009. [Google Scholar]

- De Andres, P.; Azofra, V.; Lopez, F. Corporate boards in OECD countries: Size, composition, functioning and effectiveness. Corp. Gov. Int. Rev. 2005, 13, 197–210. [Google Scholar] [CrossRef]

- Peng, M.W.; Li, Y.; Xie, E.; Su, Z. CEO duality, organizational slack, and firm performance in China. Asia Pac. J. Manag. 2010, 27, 611–624. [Google Scholar] [CrossRef]

- Beiner, S.; Drobetz, W.; Schmid, M.M.; Zimmermann, H. An integrated framework of corporate governance and firm valuation. Eur. Financ. Manag. 2006, 12, 249–283. [Google Scholar] [CrossRef]

- O′Boyle, E.H.; Pollack, J.M.; Rutherford, M.W. Exploring the relation between family involvement and firms′ financial performance: A meta-analysis of main and moderator effects. J. Bus. Ventur. 2012, 27, 1–18. [Google Scholar] [CrossRef]

- Dess, G.G.; Robinson, R.B. Measuring organizational performance in the absence of objective measures: The case of the privately-held firm and conglomerate business unit. Strateg. Manag. J. 1984, 5, 265–273. [Google Scholar] [CrossRef]

- Shane, S.; Kolvereid, L. National environment, strategy, and new venture performance: A three country study. J. Small Bus. Manag. 1995, 33, 37. [Google Scholar]

- Hedged, V.; Olkin, I. Statistical Methods for Metaanalysis; Academic press Inc.: Orlando, FL, USA, 1990. [Google Scholar]

- Hambrick, D.C.; Finkelstein, S. The effects of ownership structure on conditions at the top: The case of CEO pay raises. Strateg. Manag. J. 1995, 16, 175–193. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Law and finance. J. Political Econ. 1998, 106, 1113–1155. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Legal determinants of external finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R. Investor protection and corporate valuation. J. Financ. 2002, 57, 1147–1170. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Desender, K.A.; Kabbach de Castro, L.R. A Bundle Perspective to Comparative Corporate Governance. In The SAGE Handbook of Corporate Governance; Sage Publications, Inc.: Thousand Oaks, CA, USA, 2012; p. 379. [Google Scholar]

- Williamson, O.E. Corporate boards of directors: In principle and in practice. J. Law Econ. Organ. 2007, 24, 247–272. [Google Scholar] [CrossRef]

- Ward, A.J.; Brown, J.A.; Rodriguez, D. Governance bundles, firm performance, and the substitutability and complementarity of governance mechanisms. Corp. Gov. Int. Rev. 2009, 17, 646–660. [Google Scholar] [CrossRef]

| Number of Effects | Percentage of Positive Effect Sizes | |

|---|---|---|

| All Primary Studies | 126 | 54.76% |

| CFP Measure | ||

| Accounting-Based | 84 | 58.33% |

| Market-Based | 42 | 47.62% |

| Market Conditions | ||

| 2010–2017 | 30 | 63.33% |

| 2007–2009 | 25 | 40.00% |

| 2002–2006 | 45 | 64.44% |

| Before 2002 | 26 | 38.46% |

| Countries’ Legal Systems | ||

| Civil Law | 49 | 57.14% |

| Common Law | 77 | 53.25% |

| Model 1 (Full Sample) | Model 2 (Full Sample) | Model 3 (Sub-Sample 1) | Model 4 (Sub-Sample 2) | |

|---|---|---|---|---|

| Overall Size Effect | ||||

| Intercept | 0.0071 (0.0093) | 0.0220 ** (0.0112) | 0.0498 *** (0.0265) | −0.2234 ** (0.1109) |

| Moderators | ||||

| CFP Measure (Market-Based) | −0.0435 ** (0.0191) | |||

| 2007–2009 | −0.0415 * (0.0332) | −0.0213 (0.0422) | ||

| 2002–2006 | −0.0104 (0.0282) | 0.0604 * (0.0398) | ||

| Before 2002 | −0.0902 *** (0.0375) | 0.0255 (0.0431) | ||

| Common Law Countries | −0.0065 (0.0282) | −0.0631 ** (0.0308) | ||

| Protection of Minority Investors | −0.0020 (0.0125) | 0.0362 ** (0.0183) | ||

| Journal Quality | 0.0001 (0.0001) | −0.0002 (0.0001) | ||

| Model Additional Data | ||||

| K | 126 | 126 | 84 | 42 |

| I² | 93.46% | 93.44% | 90.08% | 81.39% |

| R² | 0.00 | 0.06 | 0.12 | 0.40 |

| Qmodel (p) | 0.00 [1.00] | 5.21 [0.02] | 7.06 [0.21] | 16.76 [0.01] |

| Qresidual (p) | 1912.55 [0.00] | 1889.28 [0.00] | 756.33 [0.00] | 188.05 [0.00] |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zubeltzu-Jaka, E.; Ortas, E.; Álvarez-Etxeberria, I. Independent Directors and Organizational Performance: New Evidence from A Meta-Analytic Regression Analysis. Sustainability 2019, 11, 7121. https://doi.org/10.3390/su11247121

Zubeltzu-Jaka E, Ortas E, Álvarez-Etxeberria I. Independent Directors and Organizational Performance: New Evidence from A Meta-Analytic Regression Analysis. Sustainability. 2019; 11(24):7121. https://doi.org/10.3390/su11247121

Chicago/Turabian StyleZubeltzu-Jaka, Eugenio, Eduardo Ortas, and Igor Álvarez-Etxeberria. 2019. "Independent Directors and Organizational Performance: New Evidence from A Meta-Analytic Regression Analysis" Sustainability 11, no. 24: 7121. https://doi.org/10.3390/su11247121

APA StyleZubeltzu-Jaka, E., Ortas, E., & Álvarez-Etxeberria, I. (2019). Independent Directors and Organizational Performance: New Evidence from A Meta-Analytic Regression Analysis. Sustainability, 11(24), 7121. https://doi.org/10.3390/su11247121