Green Supplier Evaluation and Selection with an Extended MABAC Method Under the Heterogeneous Information Environment

Abstract

1. Introduction

2. Literature Review

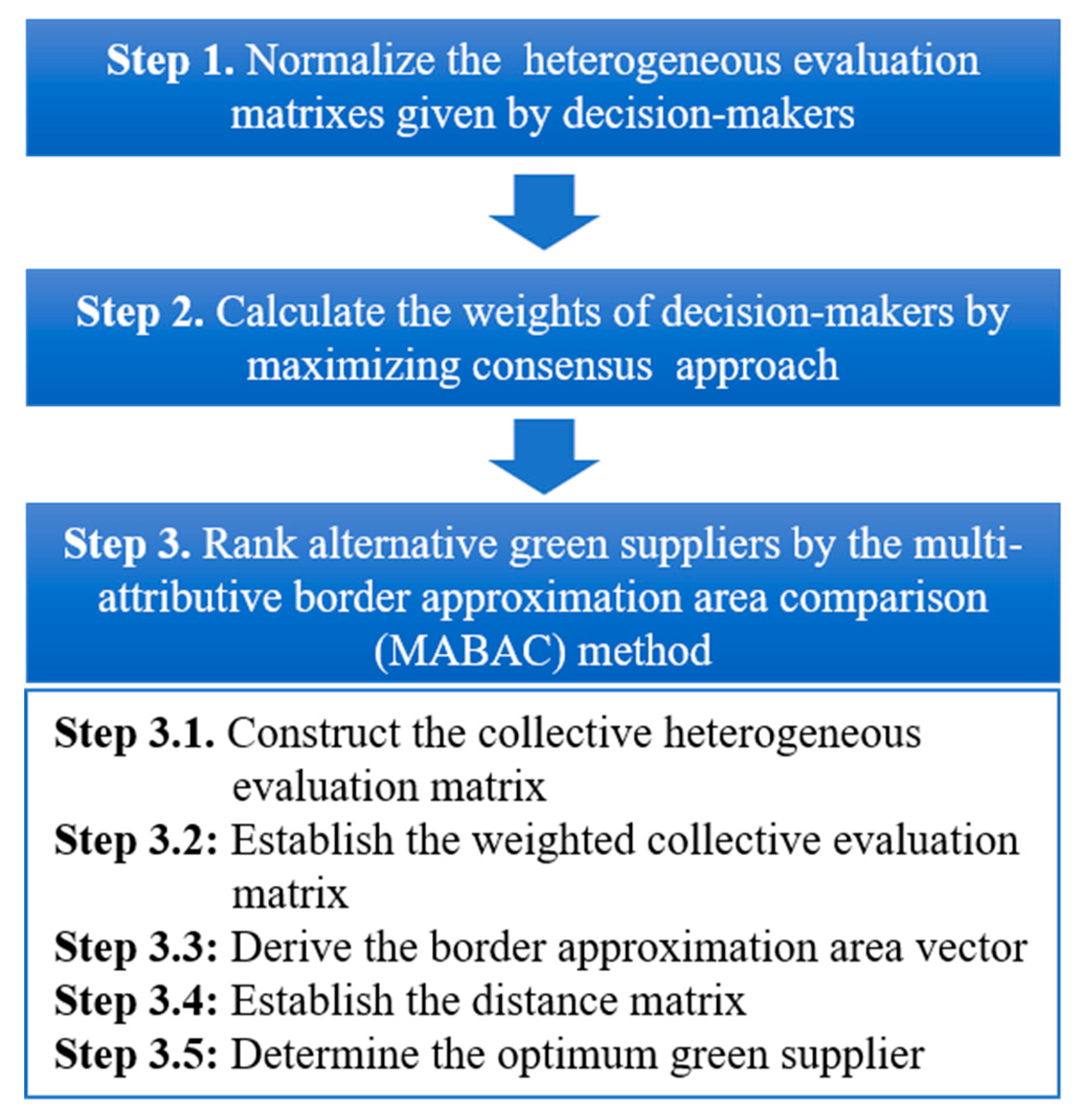

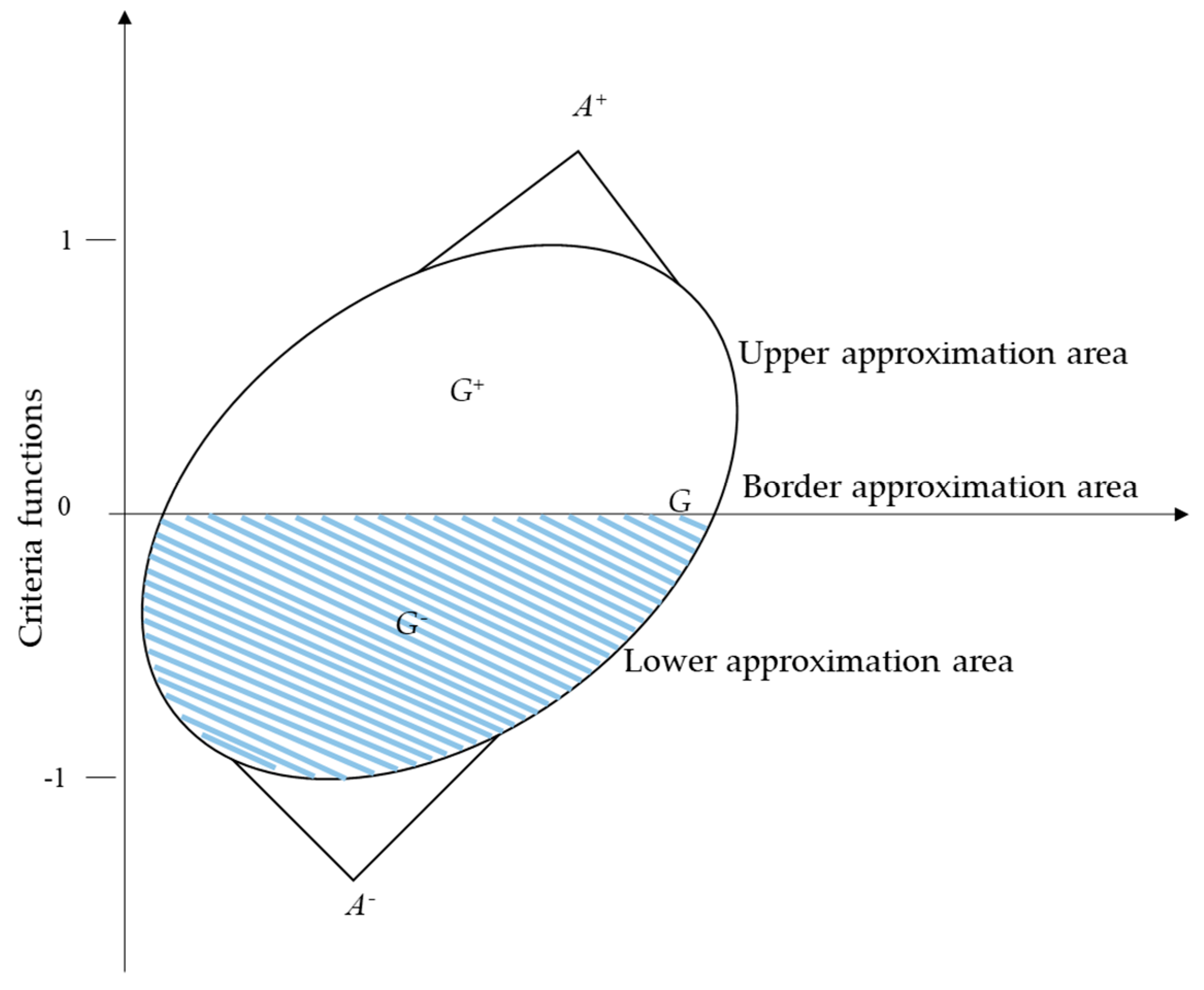

3. The Proposed Green Supplier Selection Model

4. Case Study

4.1. Implementation

4.2. Comparisons and Discussion

5. Managerial Implications

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Mirzaee, H.; Naderi, B.; Pasandideh, S.H.R. A preemptive fuzzy goal programming model for generalized supplier selection and order allocation with incremental discount. Comput. Ind. Eng. 2018, 122, 292–302. [Google Scholar] [CrossRef]

- Chen, C.H. A new multi-criteria assessment model combining GRA techniques with intuitionistic fuzzy entropy-based TOPSIS method for sustainable building materials supplier selection. Sustainability 2019, 11, 2265. [Google Scholar] [CrossRef]

- Mishra, A.R.; Rani, P.; Pardasani, K.R.; Mardani, A. A novel hesitant fuzzy WASPAS method for assessment of green supplier problem based on exponential information measures. J. Clean. Prod. 2019, 238, 117901. [Google Scholar] [CrossRef]

- Wang, X.; Cai, J.; Xiao, J. A novel decision-making framework for sustainable supplier selection considering interaction among criteria with heterogeneous information. Sustainability 2019, 11, 2820. [Google Scholar] [CrossRef]

- Liu, A.; Xiao, Y.; Ji, X.; Wang, K.; Tsai, S.B.; Lu, H.; Cheng, J.; Lai, X.; Wang, J. A novel two-stage integrated model for supplier selection of green fresh product. Sustainability 2018, 10, 2371. [Google Scholar] [CrossRef]

- Quan, M.; Wang, Z.; Liu, H.; Shi, H. A hybrid MCDM approach for large group green supplier selection with uncertain linguistic information. IEEE Access 2018, 6, 50372–50383. [Google Scholar] [CrossRef]

- Wu, Q.; Zhou, L.; Chen, Y.; Chen, H. An integrated approach to green supplier selection based on the interval type-2 fuzzy best-worst and extended VIKOR methods. Inf. Sci. 2019, 502, 394–417. [Google Scholar] [CrossRef]

- Van, L.H.; Yu, V.F.; Dat, L.Q.; Dung, C.C.; Chou, S.Y.; Loc, N.V. New integrated quality function deployment approach based on interval neutrosophic set for green supplier evaluation and selection. Sustainability 2018, 10, 838. [Google Scholar] [CrossRef]

- Shi, H.; Quan, M.Y.; Liu, H.C.; Duan, C.Y. A novel integrated approach for green supplier selection with interval-valued intuitionistic uncertain linguistic information: A case study in the agri-food industry. Sustainability 2018, 10, 733. [Google Scholar] [CrossRef]

- Bai, C.; Kusi-Sarpong, S.; Badri Ahmadi, H.; Sarkis, J. Social sustainable supplier evaluation and selection: A group decision-support approach. Int. J. Prod. Res. 2019, 57, 7046–7067. [Google Scholar] [CrossRef]

- Awasthi, A.; Govindan, K.; Gold, S. Multi-tier sustainable global supplier selection using a fuzzy AHP-VIKOR based approach. Int. J. Prod. Econ. 2018, 195, 106–117. [Google Scholar] [CrossRef]

- Dos Santos, B.M.; Godoy, L.P.; Campos, L.M.S. Performance evaluation of green suppliers using entropy-TOPSIS-F. J. Clean. Prod. 2019, 207, 498–509. [Google Scholar] [CrossRef]

- Duan, C.Y.; Liu, H.C.; Zhang, L.J.; Shi, H. An extended alternative queuing method with linguistic Z-numbers and its application for green supplier selection and order allocation. Int. J. Fuzzy Syst. 2019, 21, 2510–2523. [Google Scholar] [CrossRef]

- Li, J.; Fang, H.; Song, W. Sustainable supplier selection based on SSCM practices: A rough cloud TOPSIS approach. J. Clean. Prod. 2019, 222, 606–621. [Google Scholar] [CrossRef]

- Mao, R.J.; You, J.X.; Duan, C.Y.; Shao, L.N. A heterogeneous MCDM framework for sustainable supplier evaluation and selection based on the IVIF-TODIM method. Sustainability 2019, 11, 5057. [Google Scholar] [CrossRef]

- Meng, F.; Chen, X.; Zhang, Q. Multi-attribute decision analysis under a linguistic hesitant fuzzy environment. Inf. Sci. 2014, 267, 287–305. [Google Scholar] [CrossRef]

- Yuan, J.; Li, C.; Li, W.; Liu, D.; Li, X. Linguistic hesitant fuzzy multi-criterion decision-making for renewable energy: A case study in Jilin. J. Clean. Prod. 2018, 172, 3201–3214. [Google Scholar] [CrossRef]

- Krishankumar, R.; Ravichandran, K.S.; Premaladha, J.; Kar, S.; Zavadskas, E.K.; Antucheviciene, J. A decision framework under a linguistic hesitant fuzzy set for solving multi-criteria group decision making problems. Sustainability 2018, 10, 2608. [Google Scholar] [CrossRef]

- Dong, J.Y.; Yuan, F.F.; Wan, S.P. Extended VIKOR method for multiple criteria decision-making with linguistic hesitant fuzzy information. Comput. Ind. Eng. 2017, 112, 305–319. [Google Scholar] [CrossRef]

- Liu, H.C.; Quan, M.Y.; Li, Z.; Wang, Z.L. A new integrated MCDM model for sustainable supplier selection under interval-valued intuitionistic uncertain linguistic environment. Inf. Sci. 2019, 486, 254–270. [Google Scholar] [CrossRef]

- Phochanikorn, P.; Tan, C. An integrated multi-criteria decision-making model based on prospect theory for green supplier selection under uncertain environment: A case study of the Thailand palm oil products industry. Sustainability 2019, 11, 1872. [Google Scholar] [CrossRef]

- Lu, H.; Jiang, S.; Song, W.; Ming, X. A rough multi-criteria decision-making approach for sustainable supplier selection under vague environment. Sustainability 2018, 10, 2622. [Google Scholar] [CrossRef]

- Pamučar, D.; Ćirović, G. The selection of transport and handling resources in logistics centers using Multi-Attributive Border Approximation area Comparison (MABAC). Expert Syst. Appl. 2015, 42, 3016–3028. [Google Scholar] [CrossRef]

- Liang, R.X.; He, S.S.; Wang, J.Q.; Chen, K.; Li, L. An extended MABAC method for multi-criteria group decision-making problems based on correlative inputs of intuitionistic fuzzy information. Comput. Appl. Math. 2019, 38, 112. [Google Scholar] [CrossRef]

- Xue, Y.X.; You, J.X.; Lai, X.D.; Liu, H.C. An interval-valued intuitionistic fuzzy MABAC approach for material selection with incomplete weight information. Appl. Soft Comput. 2016, 38, 703–713. [Google Scholar] [CrossRef]

- Pamučar, D.; Stević, Ž.; Zavadskas, E.K. Integration of interval rough AHP and interval rough MABAC methods for evaluating university web pages. Appl. Soft Comput. J. 2018, 67, 141–163. [Google Scholar] [CrossRef]

- Pamucar, D.; Chatterjee, K.; Zavadskas, E.K. Assessment of third-party logistics provider using multi-criteria decision-making approach based on interval rough numbers. Comput. Ind. Eng. 2019, 127, 383–407. [Google Scholar] [CrossRef]

- Wang, H.; Jiang, Z.; Zhang, H.; Wang, Y.; Yang, Y.; Li, Y. An integrated MCDM approach considering demands-matching for reverse logistics. J. Clean. Prod. 2019, 208, 199–210. [Google Scholar] [CrossRef]

- Yazdani, M.; Pamucar, D.; Chatterjee, P.; Chakraborty, S. Development of a decision support framework for sustainable freight transport system evaluation using rough numbers. Int. J. Prod. Res. 2019. [Google Scholar] [CrossRef]

- Liu, H.C.; You, J.X.; Duan, C.Y. An integrated approach for failure mode and effect analysis under interval-valued intuitionistic fuzzy environment. Int. J. Prod. Econ. 2019, 207, 163–172. [Google Scholar] [CrossRef]

- Mahmoudi, M.; Amoozad Mahdiraji, H.; Jafarnejad, A.; Safari, H. Dynamic prioritization of equipment and critical failure modes: An interval-valued intuitionistic fuzzy condition-based model. Kybernetes 2019, 48, 1913–1941. [Google Scholar] [CrossRef]

- Adar, T.; Delice, E.K. New integrated approaches based on MC-HFLTS for healthcare waste treatment technology selection. J. Enterp. Inf. Manag. 2019, 32, 688–711. [Google Scholar] [CrossRef]

- Shi, H.; Liu, H.C.; Li, P.; Xu, X.G. An integrated decision making approach for assessing healthcare waste treatment technologies from a multiple stakeholder. Waste Manag. 2017, 59, 508–517. [Google Scholar] [CrossRef] [PubMed]

- Luo, S.Z.; Liang, W.Z. Optimization of roadway support schemes with likelihood-based MABAC method. Appl. Soft Comput. 2019, 80, 80–92. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. Operations on fuzzy numbers. Int. J. Syst. Sci. 1978, 9, 613–626. [Google Scholar] [CrossRef]

- Yue, Z. An extended TOPSIS for determining weights of decision makers with interval numbers. Knowl. Based Syst. 2011, 24, 146–153. [Google Scholar] [CrossRef]

- Alikhani, R.; Torabi, S.A.; Altay, N. Strategic supplier selection under sustainability and risk criteria. Int. J. Prod. Econ. 2019, 208, 69–82. [Google Scholar] [CrossRef]

- Haeri, S.A.S.; Rezaei, J. A grey-based green supplier selection model for uncertain environments. J. Clean. Prod. 2019, 221, 768–784. [Google Scholar] [CrossRef]

- Guarnieri, P.; Trojan, F. Decision making on supplier selection based on social, ethical, and environmental criteria: A study in the textile industry. Resour. Conserv. Recycl. 2019, 141, 347–361. [Google Scholar] [CrossRef]

- Lu, Z.; Sun, X.; Wang, Y.; Xu, C. Green supplier selection in straw biomass industry based on cloud model and possibility degree. J. Clean. Prod. 2019, 209, 995–1005. [Google Scholar] [CrossRef]

- Liang, Y.; Liu, J.; Qin, J.; Tu, Y. An improved multi-granularity interval 2-tuple TODIM approach and its application to green supplier selection. Int. J. Fuzzy Syst. 2019, 21, 129–144. [Google Scholar] [CrossRef]

- Meksavang, P.; Shi, H.; Lin, S.M.; Liu, H.C. An extended picture fuzzy VIKOR approach for sustainable supplier management and its application in the beef industry. Symmetry 2019, 11, 468. [Google Scholar] [CrossRef]

- Memari, A.; Dargi, A.; Akbari Jokar, M.R.; Ahmad, R.; Abdul Rahim, A.R. Sustainable supplier selection: A multi-criteria intuitionistic fuzzy TOPSIS method. J. Manuf. Syst. 2019, 50, 9–24. [Google Scholar] [CrossRef]

- Xu, J.; Wu, Z. A maximizing consensus approach for alternative selection based on uncertain linguistic preference relations. Comput. Ind. Eng. 2013, 64, 999–1008. [Google Scholar] [CrossRef]

- Zhang, X.; Xu, Z. Soft computing based on maximizing consensus and fuzzy TOPSIS approach to interval-valued intuitionistic fuzzy group decision making. Appl. Soft Comput. 2015, 26, 42–56. [Google Scholar] [CrossRef]

- Banaeian, N.; Mobli, H.; Fahimnia, B.; Nielsen, I.E.; Omid, M. Green supplier selection using fuzzy group decision making methods: A case study from the agri-food industry. Comput. Oper. Res. 2018, 89, 337–347. [Google Scholar] [CrossRef]

| Decision-Makers | Criteria | Green Suppliers | ||||

|---|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | ||

| DM1 | C1 | |||||

| C2 | (70,90,91,92) | (30,80,85,90) | (50,60,75,85) | (75,80,85,95) | (80,85,90,95) | |

| C3 | ||||||

| C4 | [65,88] | [87,90] | [45,58] | [70,90] | [92,95] | |

| C5 | 118 | 116 | 120 | 115 | 110 | |

| C6 | [0.81,0.90] | [0.76,0.83] | [0.74,0.85] | [0.74,0.82] | [0.79,0.85] | |

| C7 | (3,4,5,6) | (6,7,8,9) | (5,6,7,8) | (1,2,3,4) | (5,6,7,8) | |

| C8 | ||||||

| DM2 | C1 | |||||

| C2 | (80,85,90,95) | (50,60,75,85) | (30,80,85,90) | (75,80,85,95) | (70,90,91,92) | |

| C3 | ||||||

| C4 | [75,88] | [87,90] | [45,58] | [66,87] | [89,95] | |

| C5 | 118 | 116 | 120 | 115 | 110 | |

| C6 | [0.78,0.86] | [0.74,0.82] | [0.72,0.83] | [0.76,0.81] | [0.78,0.85] | |

| C7 | (5,6,7,8) | (2,3,4,5) | (3,4,5,6) | (2,3,4,5) | (6,7,8,9) | |

| C8 | ||||||

| DM3 | C1 | |||||

| C2 | (72,80,90,95) | (50,60,75,85) | (74,80,82,85) | (65,70,78,81) | (82,84,89,92) | |

| C3 | ||||||

| C4 | [75,89] | [82,90] | [78,86] | [66,78] | [65,90] | |

| C5 | 118 | 116 | 120 | 115 | 110 | |

| C6 | [0.79,0.88] | [0.76,0.85] | [0.73,0.84] | [0.75,0.82] | [0.80,0.86] | |

| C7 | (5,6,7,8) | (3,5,6,7) | (4,5,6,7) | (4,5,6,7) | (6,7,8,9) | |

| C8 | ||||||

| Decision-Makers | Criteria | Green Suppliers | ||||

|---|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | ||

| DM1 | C1 | |||||

| C2 | (0.74,0.95,0.96,0.97) | (0.32,0.84,0.90,0.95) | (0.53,0.63,0.79,0.90) | (0.79,0.84,0.90,1.00) | (0.84,0.90,0.95,1.00) | |

| C3 | ||||||

| C4 | [0.68,0.93] | [0.92,0.95] | [0.47,0.61] | [0.74,0.95] | [0.97,1.00] | |

| C5 | 0.02 | 0.03 | 0.00 | 0.04 | 0.08 | |

| C6 | [0.90,1.00] | [0.84,0.92] | [0.82,0.94] | [0.82,0.91] | [0.88,0.94] | |

| C7 | (0.33,0.44,0.56,0.67) | (0.67,0.78,0.89,1.00) | (0.56,0.67,0.78,0.89) | (0.11,0.33,0.33,0.44) | (0.56,0.67,0.78,0.89) | |

| C8 | ||||||

| DM2 | C1 | |||||

| C2 | (0.84,0.90,0.95,1.00) | (0.53,0.63,0.79,0.90) | (0.32,0.84,0.90,0.95) | (0.79,0.84,0.90,1.00) | (0.84,0.90,0.95,1.00) | |

| C3 | ||||||

| C4 | [0.79,0.93] | [0.92,0.95] | [0.47,0.61] | [0.69,0.92] | [0.94,1.00] | |

| C5 | 0.02 | 0.03 | 0.00 | 0.04 | 0.08 | |

| C6 | [0.91,1.00] | [0.86,0.95] | [0.84,0.97] | [0.88,0.94] | [0.91,0.99] | |

| C7 | (0.56,0.67,0.78,0.89) | (0.22,0.33,0.44,0.56) | (0.33,0.44,0.56,0.67) | (0.22,0.33,0.44,0.56) | (0.67,0.78,0.89,1.00) | |

| C8 | ||||||

| DM3 | C1 | |||||

| C2 | (0.76,0.84,0.95,1.00) | (0.53,0.63,0.79,0.89) | (0.78,0.84,0.86,0.89) | (0.68,0.74,0.82,0.85) | (0.86,0.88,0.94,0.97) | |

| C3 | ||||||

| C4 | [0.83,0.99] | [0.91,1.00] | [0.87,0.96] | [0.73,0.87] | [0.72,1.00] | |

| C5 | 0.02 | 0.03 | 0.00 | 0.04 | 0.08 | |

| C6 | [0.90,1.00] | [0.86,0.97] | [0.83,0.95] | [0.85,0.93] | [0.91,0.98] | |

| C7 | (0.56,0.67,0.78,0.89) | (0.33,0.56,0.67,0.78) | (0.44,0.56,0.67,0.78) | (0.44,0.56,0.67,0.78) | (0.67,0.78,0.89,1.00) | |

| C8 | ||||||

| Criteria | Green Suppliers | ||||

|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | |

| C1 | |||||

| C2 | (0.77,0.90,0.95,0.99) | (0.44,0.72,0.83,0.92) | (0.54,0.76,0.84,0.91) | (0.76,0.81,0.87,0.96) | (0.82,0.91,0.95,0.98) |

| C3 | |||||

| C4 | [0.76,0.95] | [0.91,0.96] | [0.59,0.71] | [0.72,0.91] | [0.89,1.00] |

| C5 | 0.020 | 0.030 | 0.000 | 0.040 | 0.080 |

| C6 | [0.90,1.00] | [0.86,0.94] | [0.83,0.95] | [0.85,0.93] | [0.90,0.97] |

| C7 | (0.47,0.58,0.69,0.80) | (0.43,0.58,0.69,0.80) | (0.46,0.57,0.68,0.79) | (0.24,0.36,0.47,0.58) | (0.62,0.73,0.84,0.96) |

| C8 | |||||

| Criteria | Green Suppliers | ||||

|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | |

| C1 | |||||

| C2 | (0.155,0.180,0.190,0.197) | (0.088,0.143,0.166,0.183) | (0.108,0.152,0.169,0.182) | (0.152,0.162,0.175,0.191) | (0.163,0.181,0.189,0.196) |

| C3 | |||||

| C4 | [0.076,0.095] | [0.091,0.096] | [0.059,0.071] | [0.072,0.091] | [0.089,0.100] |

| C5 | 0.003 | 0.005 | 0.000 | 0.006 | 0.012 |

| C6 | [0.135,0.150] | [0.128,0.142] | [0.124,0.143] | [0.127,0.139] | [0.134,0.145] |

| C7 | (0.047,0.058,0.069,0.080) | (0.043,0.058,0.069,0.080) | (0.046,0.057,0.068,0.079) | (0.024,0.036,0.047,0.058) | (0.062,0.073,0.084,0.096) |

| C8 | |||||

| Green Suppliers | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | PVi | Ranking |

|---|---|---|---|---|---|---|---|---|---|---|

| A1 | 0.008 | 0.017 | 0.024 | −0.003 | 0.003 | 0.006 | 0.003 | 0.018 | 0.076 | 2 |

| A2 | 0.004 | −0.024 | −0.019 | 0.011 | 0.005 | −0.002 | 0.002 | −0.002 | −0.025 | 5 |

| A3 | 0.035 | −0.014 | −0.017 | −0.018 | 0.000 | −0.004 | 0.002 | −0.002 | −0.016 | 4 |

| A4 | −0.001 | 0.011 | 0.033 | −0.003 | 0.006 | −0.004 | −0.019 | −0.004 | 0.017 | 3 |

| A5 | 0.026 | 0.020 | 0.013 | 0.011 | 0.012 | 0.003 | 0.019 | 0.029 | 0.132 | 1 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.-G.; Shi, H.; Zhang, L.-J.; Liu, H.-C. Green Supplier Evaluation and Selection with an Extended MABAC Method Under the Heterogeneous Information Environment. Sustainability 2019, 11, 6616. https://doi.org/10.3390/su11236616

Xu X-G, Shi H, Zhang L-J, Liu H-C. Green Supplier Evaluation and Selection with an Extended MABAC Method Under the Heterogeneous Information Environment. Sustainability. 2019; 11(23):6616. https://doi.org/10.3390/su11236616

Chicago/Turabian StyleXu, Xue-Guo, Hua Shi, Li-Jun Zhang, and Hu-Chen Liu. 2019. "Green Supplier Evaluation and Selection with an Extended MABAC Method Under the Heterogeneous Information Environment" Sustainability 11, no. 23: 6616. https://doi.org/10.3390/su11236616

APA StyleXu, X.-G., Shi, H., Zhang, L.-J., & Liu, H.-C. (2019). Green Supplier Evaluation and Selection with an Extended MABAC Method Under the Heterogeneous Information Environment. Sustainability, 11(23), 6616. https://doi.org/10.3390/su11236616