Towards a Valuation and Taxation Information Model for Chinese Rural Collective Construction Land

Abstract

:1. Introduction

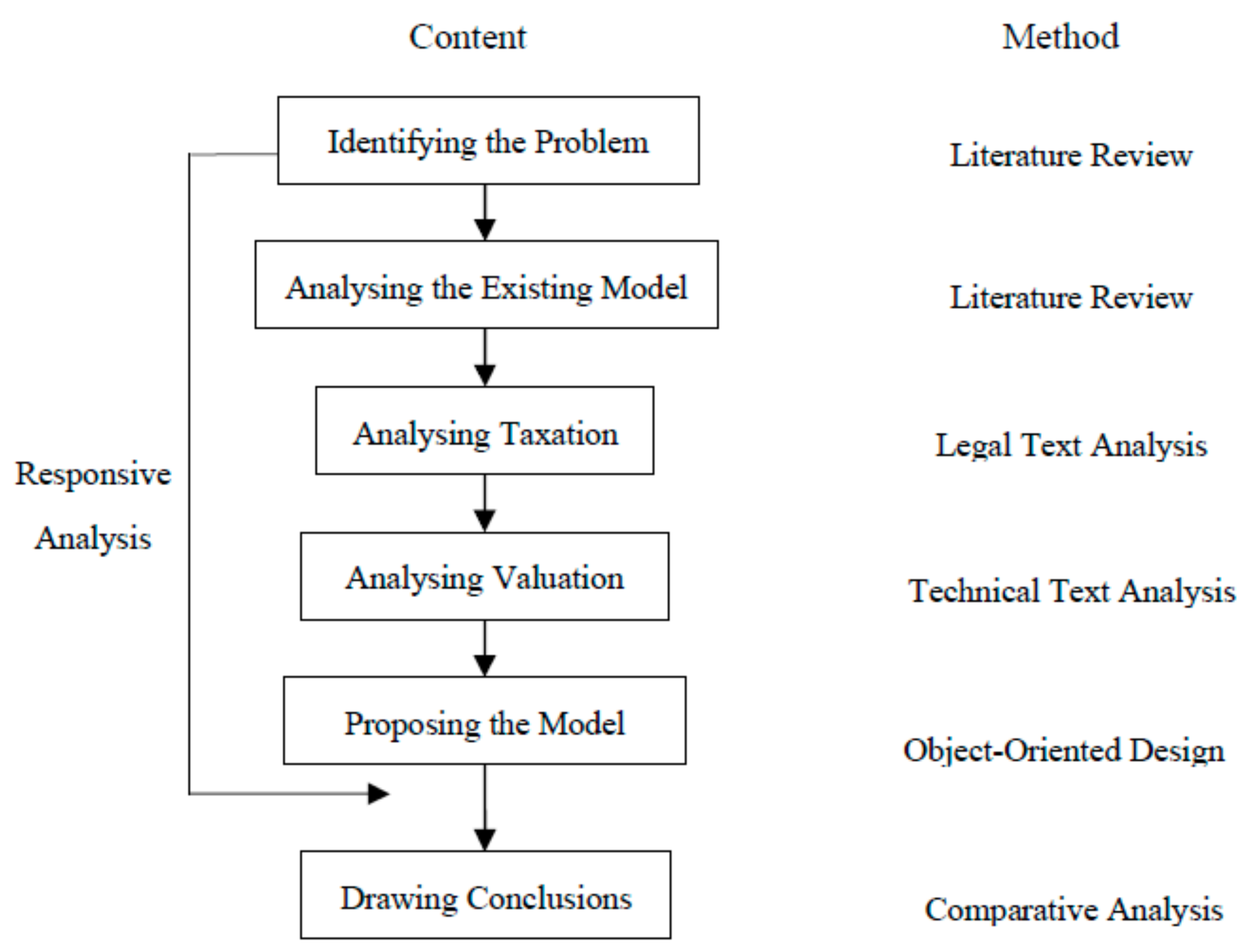

2. Methodology

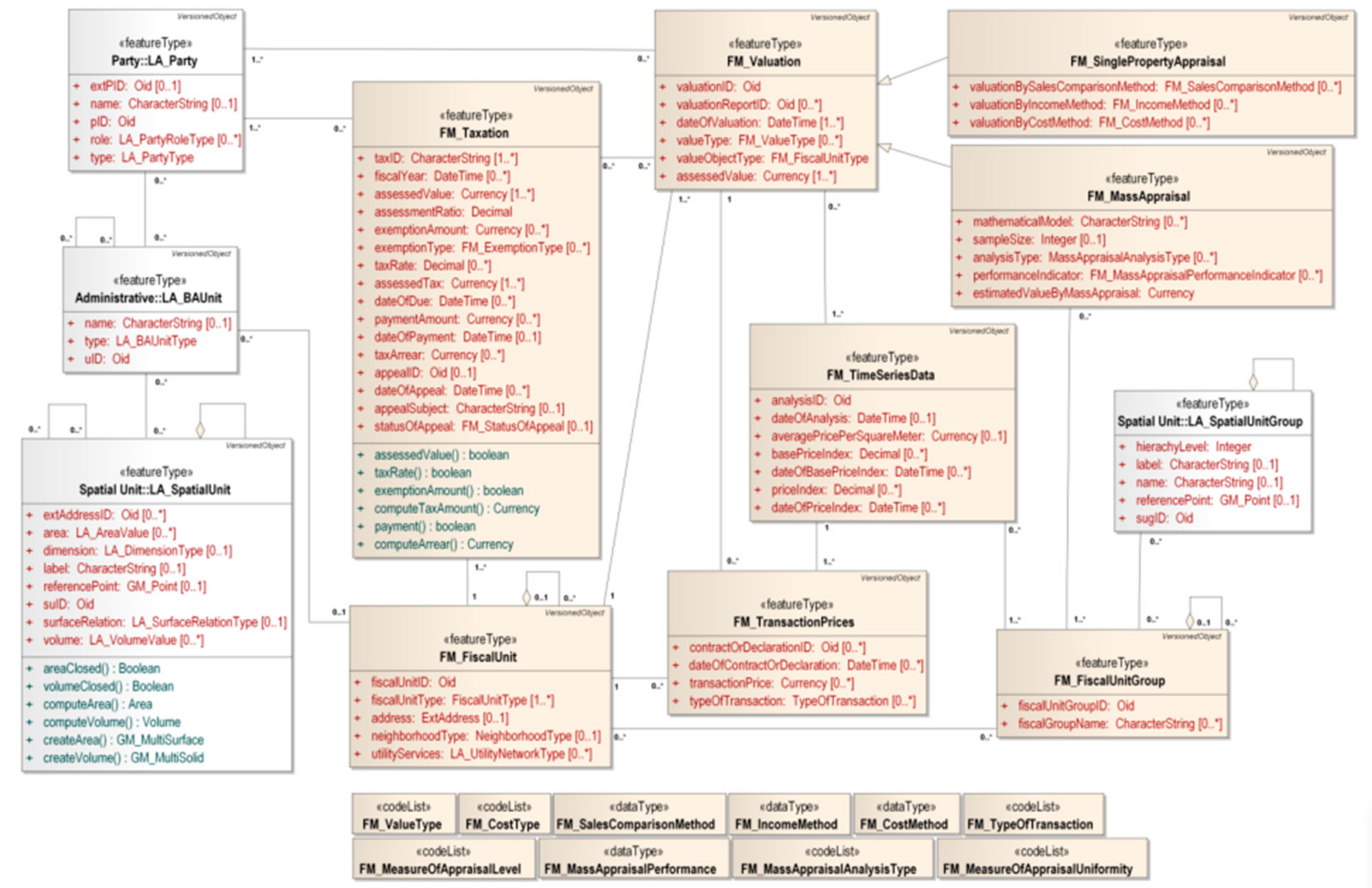

3. Review of Existing Information Models

3.1. Core and Extension LADM Classes

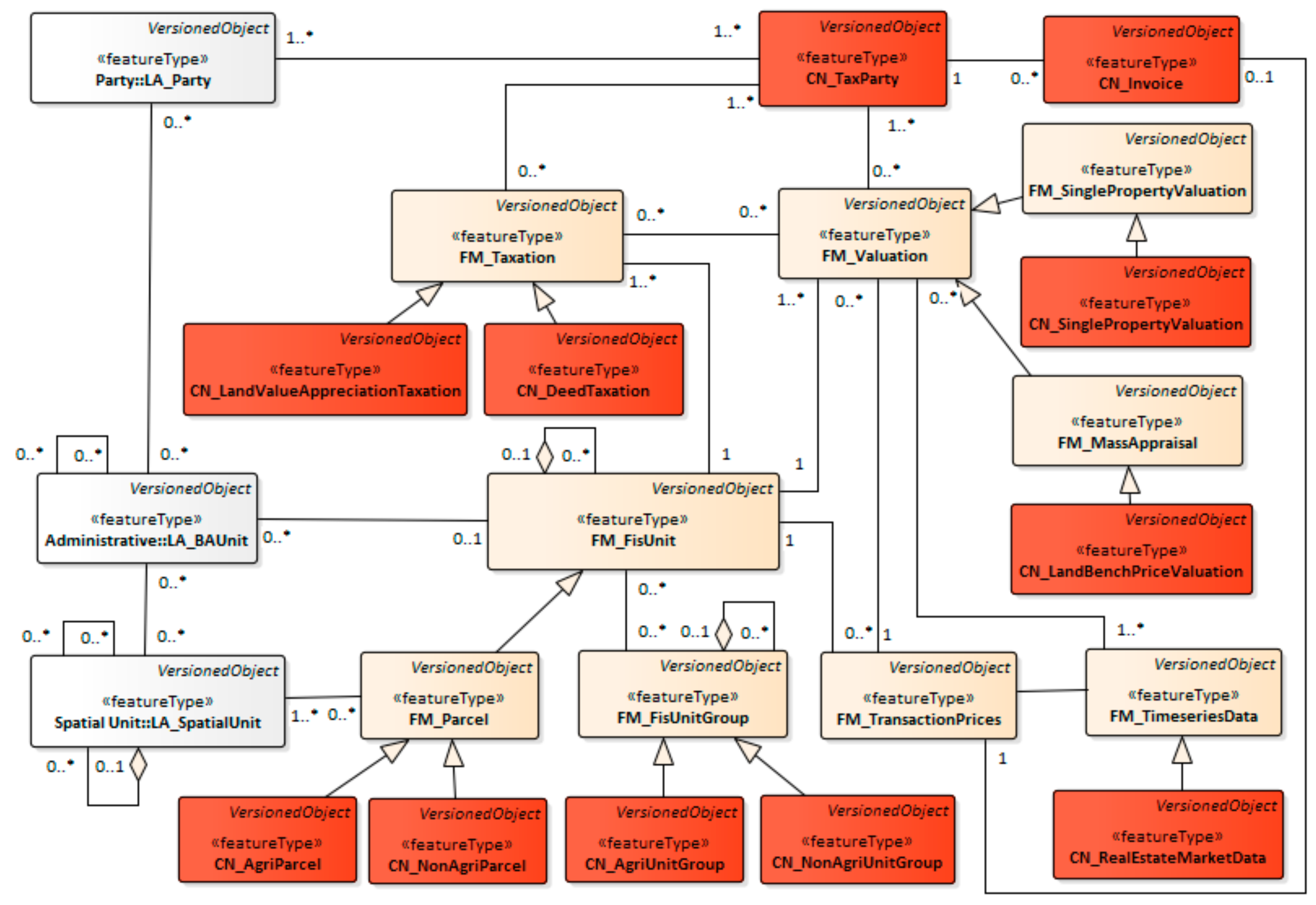

3.2. Core Classes of the Fiscal Extension Module

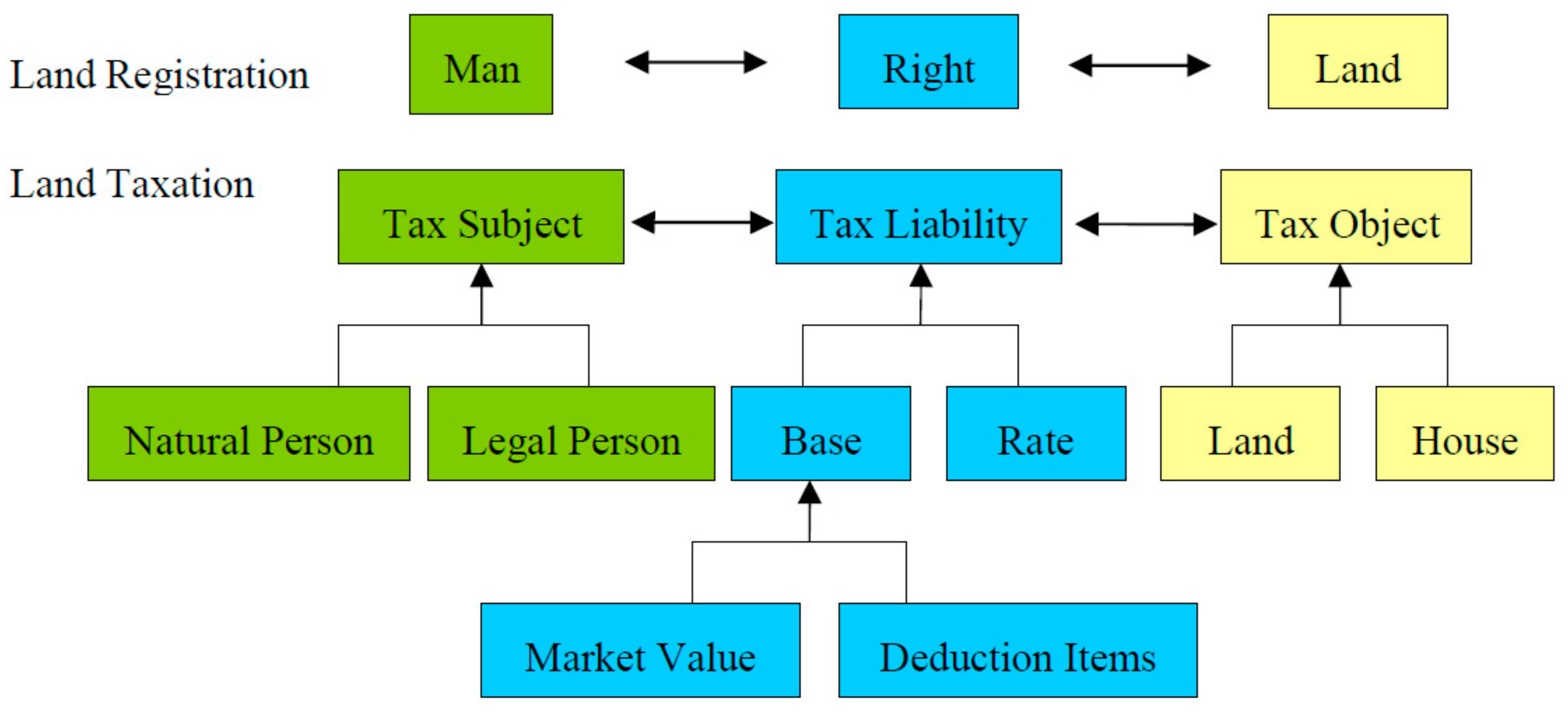

4. Tax-Related Legal Regulations

4.1. Related Tax Conception

4.2. Land Value Appreciation Tax

4.2.1. Administrative Regulations on LVAT

4.2.2. Implementation Measures on LVAF

4.2.3. Law on LVAT (draft)

4.3. Deed Tax

5. Technical Specifications on the Valuation of RCL

5.1. Real Estate Valuation

5.2. Land Classification

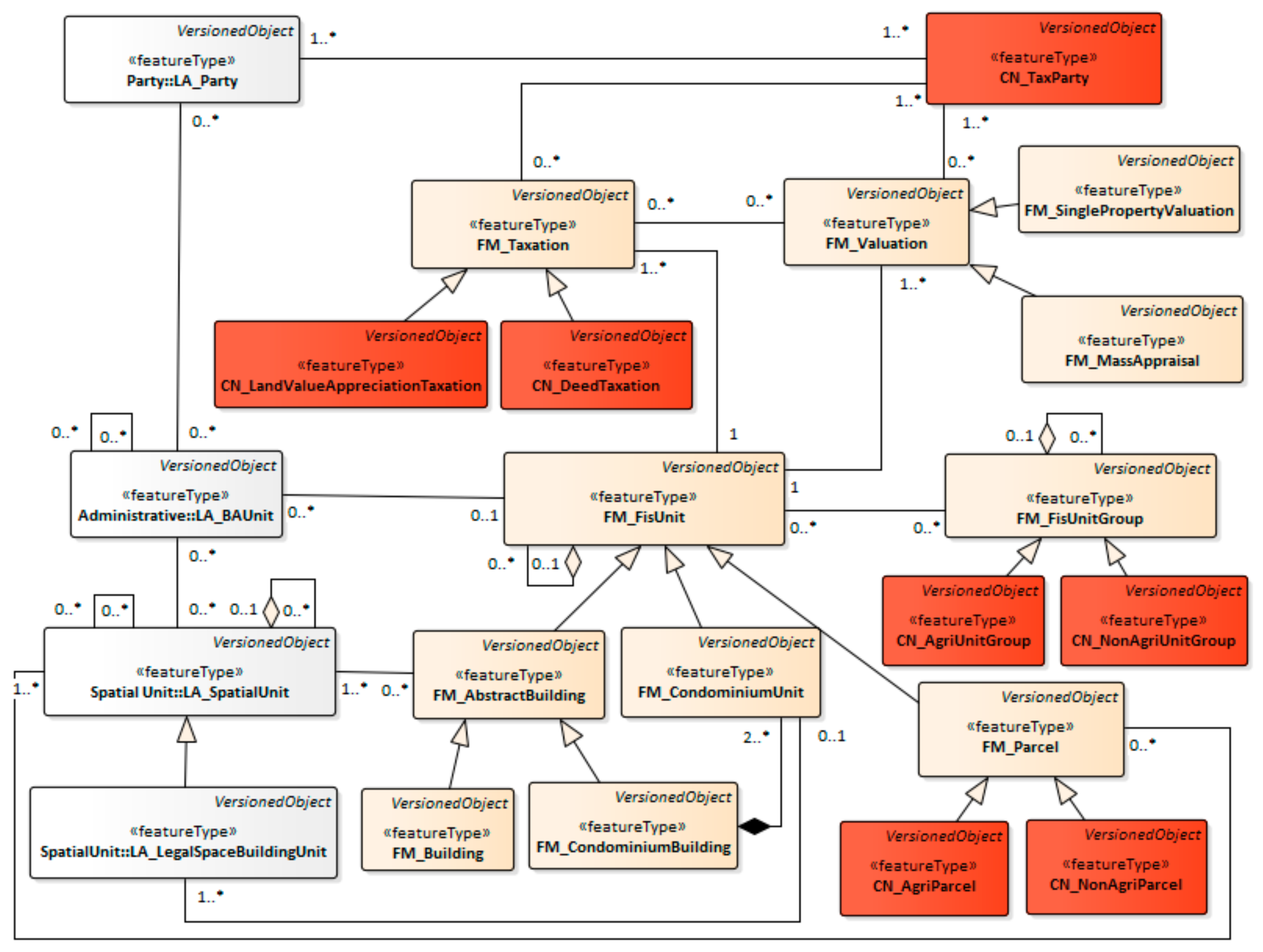

6. Land Valuation and Taxation for Chinese Rural Collective Construction Land

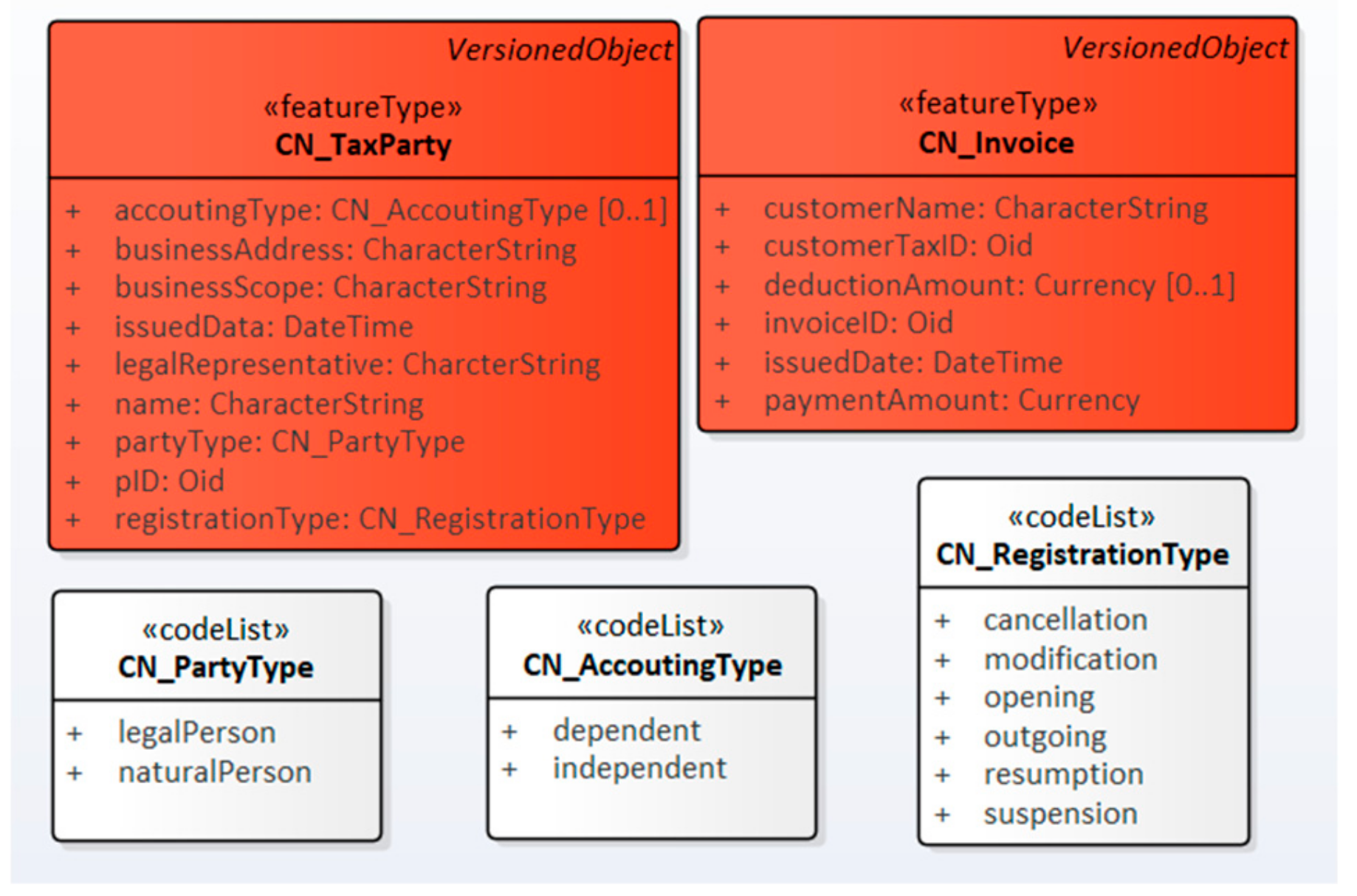

6.1. Tax Subject

6.2. Tax Liability

6.3. Land Valuation

6.4. Tax Object

7. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Dale, P.F.; McLaughlin, J.D. Land Administration; Oxford University Press: Oxford, UK, 1999. [Google Scholar]

- Williamson, I.; Enemark, S.; Wallace, J.; Rajabifard, A. Land Administration for Sustainable Development; ESRI Press: Redlands, CA, USA, 2010. [Google Scholar]

- Zevenbergen, J. System of Land Registration: Aspects and Effects; Delft University of Techlonogy: Delft, The Netherland, 2002. [Google Scholar]

- Larsson, G. Land Registration and Cadastral Systems: Tools for Land Information and Management; Wiley: New York, NY, USA, 1991. [Google Scholar]

- Lemmen, C.; van Oosterom, P.; Bennett, R. The Land Administration Domain Model. Land Use Policy 2015, 49, 535–545. [Google Scholar] [CrossRef]

- Lemmen, C.; van Oosterom, P.; Kalantari, M. Towards a New Working Item Proposal for Edition II of LADM. In Proceedings of the 7th International FIG Workshop on the Land Administration Domain Model, Zagreb, Croatia, 11–13 April 2018. [Google Scholar]

- Van Oosterom, P.; Kara, A.; Kalogianni, E.; Shnaidman, A.; Indrajit, A.; Alattas, A.; Lemmen, C. Joint ISO/TC211 and OGC Revision of the LADM: Valuation Information, Spatial Planning Information, SDG Land Indicators, Refined Survey Model, Links to BIM, Support of LA Processes, Technical Encodings, and Much More on Their Way! In Proceedings of the FIG Working Week 2019, Geospatial Information for a Smarter Life and Environmental Resilience, Hanoi, Vietnam, 22–26 April 2019. [Google Scholar]

- Çağdas, V.; Kara, A.; van Oosterom, P.; Lemmen, C.; Isikdag, Ü.; Kathmann, R.; Stubkjær, E. An Initial Design of ISO 19152:2012 LADM Based Valuation and Taxation Data Model. In Proceedings of the ISPRS Annals of the Photogrammetry, Remote Sensing and Spatial Information Sciences, Athens, Greece, 20–21 October 2016; pp. 145–154. [Google Scholar] [CrossRef]

- Ho, P. Institutions in Transition: Land Ownership, Property Rights, Social Conflicts in China; Oxford University Press: New York, NY, USA, 2005. [Google Scholar]

- Long, H.; Li, Y.; Liu, Y.; Woods, M.; Zou, J. Accelerated Restructuring in Rural China Fueled by ‘Increasing vs. Decreasing balance’ Land-Use Policy for Dealing With Hollowed Villages. Land Use Policy 2012, 29, 11–22. [Google Scholar] [CrossRef]

- Xu, Z.G.; Zhuo, Y.F.; Wu, C.F.; Li, G. Economic Interpretation and Jurisprudence Deduction of Tripartite Entitlement System of Rural Residential Land. China Land Sci. 2018, 32, 16–22. [Google Scholar] [CrossRef]

- He, X.F. Logic of Land Rights II; Oriental Press: Beijing, China, 2013; pp. 17–19. [Google Scholar]

- McAllister, P.; Shepherd, E.; Wyatt, P. Policy Shifts, Developer Contributions and Land Value Capture in London 2005–2017. Land Use Policy 2018, 78. [Google Scholar] [CrossRef]

- Wang, J.; Samsura, D.A.A.; van der Krabben, E. Institutional Barriers to Financing Transit-Oriented Development in China: Analyzing Informal Land Value Capture Strategies. Transp. Policy 2019, 82. [Google Scholar] [CrossRef]

- Enemark, S.; McLaren, R.; van der Molen, P. Land Governance in Support of the Millennium Development Goals; International Federation of Surveyors (FIG): Copenhagen, Denmark, 2010. [Google Scholar]

- Çağdas, V. An Application Domain Extension to CityGML for immovable property taxation: A Turkish case study. Int. J. Appl. Earth Obs. Geoinf. 2013, 21, 545–555. [Google Scholar] [CrossRef]

- Kara, A.; Çağdas, V.; Isikdag, Ü.; van Oosterom, P.; Lemmen, C.; Stubkjær, E. Towards an International Data Standard for Immovable Property Valuation. In Proceedings of the FIG Working Week 2017, Surveying the world of tomorrow—From digitalisation to augmented reality, Helsinki, Finland, 29 May–2 June 2017. [Google Scholar]

- Kara, A.; Çağdaş, V.; Işıkdağ, Ü.; van Oosterom, P.; Lemmen, C.; Stubkjær, E. Towards Turkish LADM Valuation Information Model Country Profile. In Proceedings of the FIG Working Week 2018, Istanbul, Turkey, 6–11 May 2018. [Google Scholar]

- Kara, A.; Kathmann, R.; van Oosterom, P.; Lemmen, C.; Işıkdağ, Ü. Towards the Netherlands LADM Valuation Information Model Country Profile. In Proceedings of the FIG Working Week 2019 Geospatial information for a smarter life and environmental resilience, Hanoi, Vietnam, 22–26 April 2019. [Google Scholar]

- Kara, A.; Çağdaş, V.; Işıkdağ, Ü.; van Oosterom, P.; Lemmen, C.; Stubkjær, E. The LADM Valuation Module Based on INTERLIS. In Proceedings of the 7th LADM Workshop, Zagreb, Croatia, 11–13 April 2018. [Google Scholar]

- Kara, A.; Işıkdağ, Ü.; Çağdaş, V.; van Oosterom, P.; Lemmen, C.; Stubkjær, E. A Database Implementation of LADM Valuation Information Model in Turkish Case Study. In Proceedings of the 7th LADM Workshop, Zagreb, Croatia, 11–13 April 2018. [Google Scholar]

- Polat, Z.A.; Alkan, M. Design and Implementation of A LADM-Based External Archive Data Model for Land Registry and Cadastre Transactions in Turkey: A Case Study of Municipality. Land Use Policy 2018, 77, 249–266. [Google Scholar] [CrossRef]

- Kobasa, M.; Shavrov, S.; Batura, O. ISO19152 Standard: Role of LA_ExtValuation Class for Land Administration. In Proceedings of the FIG Working Week 2018, Istanbul, Turkey, 6–11 May 2018. [Google Scholar]

- Çağdas, V.; Stubkjaer, E. Design Research for Cadastral Systems. Comput. Environ. Urban Syst. 2011, 35, 77–87. [Google Scholar] [CrossRef]

- Hespanha, J.P. Development Methodology for an Integrated Legal Cadastre. Ph.D. Thesis, TU Delft, Delft, The Netherlands, 2012. [Google Scholar]

- Kalantari, M.; Dinsmore, K.; Urban-Karr, J.; Rajabifard, A. A Roadmap to Adopt the Land Administration Domain Model in Cadastral Information Systems. Land Use Policy 2015, 49, 552–564. [Google Scholar] [CrossRef]

- Lemmen, C. A Domain Model for Land Administration; University of Twente, Delft University of Technology: Amsterdam, The Netherlands, 2012. [Google Scholar]

- Kaufmann, J. Cadastre 2014: A Vision for a Future Cadastral System. In Proceedings of the 1st Congress on Cadastre in the European Union, Granada, Spain, 15–17 May 2002; p. 51. [Google Scholar]

- ISO. ISO 19152:2012 Geographic Information—Land Administration Domain Model (LADM); ISO: Geneva, Switzerland, 2012. [Google Scholar]

- Paulsson, J.; Paasch, J.M. The Land Administration Domain Model—A literature survey. Land Use Policy 2015, 49, 546–551. [Google Scholar] [CrossRef]

- Henssen, J.L.G. Basic Principles of the Main Cadastral Systems in the World. In Proceedings of the One Day Seminar Held during the Annual Meeting of Commission 7, Cadastre and Rural Land Management, of International Federation of Surveyors (FIG), Delft, The Netherlands, 16 May 1995. [Google Scholar]

- Standing Commitee of National People’s Congress. Law on Taxation Administration; Order 25 of the President of the People’s Republic of China; Standing Commitee of National People’s Congress: Beijing, China, 2015. [Google Scholar]

- State Council. Administrative Regulations on Land Value Appreciation Tax; Order 138 of State Councile; State Council: Beijing, China, 1993. [Google Scholar]

- State Council. Administrative Regulations on Deed Tax; Order 224 of State Councile; State Council: Beijing, China, 1997. [Google Scholar]

- Ministry of Finance. Implementation Rules for the Administrative Regulations on Land Value Appreciation Tax; Administrative Document 6 of Ministry of Finance; Ministry of Finance: Beijing, China, 1995. [Google Scholar]

- Ministry of Finance and Ministry of Land and Resources. Implementation Measures for the Collection and Use Administration on the Land Appreciation Adjustment Fees of Rural Collective Construction Land; Administrative Document 41 of Ministry of Finance; Ministry of Finance: Beijing, China; Ministry of Land and Resources: Beijing, China, 2016. [Google Scholar]

- Ministry of Finance. Implementation Rules for the Administrative Regulations on Deed Tax; Administrative Document 52 of Ministry of Finance; Ministry of Finance: Beijing, China, 1997. [Google Scholar]

- IVSC. International Valuation Standards; IVSC: London, UK, 2017. [Google Scholar]

- TEGoVA. European Valuation Standards (EVS), 8th ed.; TEGoVA: Brussels, Belgium, 2016. [Google Scholar]

- CIREA. Real Estate Valuation Standard (GB/T 50291-2015); CREVA: Beijing, China, 2015. [Google Scholar]

- CREVA. Urban Land Valuation Standard (GB/T18508-2014); CREVA: Beijing, China, 2014. [Google Scholar]

- CREVA. Agricultural Land Valuation Standard (GB/T28406-2014); CREVA: Beijing, China, 2012. [Google Scholar]

- CREVA. Technical Specifications on Land Valuation of Right to Use Collective Land; Administrative Document 18 of CREVA; CREVA: Beijing, China, 2016. [Google Scholar]

- CREVA. Urban Land Classification and Grading Standard (GB/T 18507-2014); CREVA: Beijing, China, 2014. [Google Scholar]

- CREVA. Agriculture Land Classification Standard (GB/T 28405-2012); CREVA: Beijing, China, 2012. [Google Scholar]

- State Bureau of Taxation. Administrative Measures for the Tax Registration. Order 36 of State Bureau of Taxation; State Bureau of Taxation: Beijing, China, 2014. [Google Scholar]

- SAC. Code Rules for the Uniform Social Credit Code for Legal Persons and Other Organizations (GB 32100-2015); SAC: Beijing, China, 2015. [Google Scholar]

- SAC. Code Rules for Citizenship Number (GB 11643-1999); SAC: Beijing, China, 1999. [Google Scholar]

- Wong, V. Land Policy Reform in China: Dealing with Forced Expropriation and the Dual Land Tenure System. In Centre for Comparative and Public Law Occasional Paper No. 25; Faculty of Law, The University of Hong Kong: Hong Kong, 2014. [Google Scholar]

- IAAO. Standard on Mass Appraisal of Real Property; International Association of Assessing Officers: Kansas City, MO, USA, 2013. [Google Scholar]

| Process | Method | Input | Output |

|---|---|---|---|

| Identifying the scientific problem | Literature review | Journal articles, conference articles, scientific and technical books | Scientific problem |

| Analysing the existing models | Literature review | Journal articles, conference articles | Research deficiencies |

| Analysing tax laws | Text analysis of legal documents | Documents of laws and administrative regulations | Legal restraints |

| Analysing the valuation specifications | Text analysis of technical specifications | Technical specifications of real estate valuation | Technical restraints |

| Proposing the information model | Object-oriented design | Legal and technical restraints | Information model |

| Drawing the conclusions | Comparative analysis | Research problem and model | Conclusions and discussions |

| Sales Comparison | Income Capitalisation | Cost | Residual | Bench Price Adjustment | |

|---|---|---|---|---|---|

| IVS | √ | √ | √ | ||

| EVS | √ | √ | √ | ||

| CREVS | √ | √ | √ | √ | √ |

| CULVS | √ | √ | √ | √ | √ |

| CALVS | √ | √ | √ | √ | √ |

| CSVRL | √ | √ | √ | √ | √ |

| First Level | Second Level |

|---|---|

| C1 Prosperity | C11 Business and service prosperity |

| C2 Transportation | C21 Road accessibility, C22 Bus convenience, C23 External traffic convenience, C24 Road network density |

| C3 Infrastructure | C31 Living facilities, C32 Public facilities |

| C4 Environment | C41 Environmental quality, C42 Quality of cultural and sports facilities, C43 Green space coverage, C44 Natural environment |

| C5 Demographic features | C51 Population density |

| First Level | Second Level |

|---|---|

| A1 Local climate | A11 Temperature, A12 Accumulated temperature, A13 Precipitation, A14 Evaporation, A15 Acid rain, A16 Disaster climate, A17 Frost-free period |

| A2 Topography and geomorphology | A21 Geomorphic type, A22 Topographic position, A23 Elevation, A24 Slope, A25 Slope direction, A26 Erosion degree |

| A3 Soil | A31 Soil depth, A32 Obstacle depth, A33 Soil texture, A34 Profile configuration, A35 Soil pH, A36 Soil salinity |

| A4 Water resources | A41 Groundwater depth, A42 Water guarantee rate, A43 Water quality |

| A5 Infrastructure | A51 Forest network rate, A52 Irrigation guarantee rate, A53 Drainage, A54 Field road, A55 Field power supply |

| A6 Convenient features for cultivated land | A61 Plot size, A62 Plot shape, A63 Plot flatness, A64 Plot elevation difference, A65 Farming distance |

| A7 Location | A71 The farmer’s market influence |

| A8 Transportation | A81 Road accessibility, A82 External traffic convenience |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Z.; Zhuo, Y.; Li, G.; Liao, R.; Wu, C. Towards a Valuation and Taxation Information Model for Chinese Rural Collective Construction Land. Sustainability 2019, 11, 6610. https://doi.org/10.3390/su11236610

Xu Z, Zhuo Y, Li G, Liao R, Wu C. Towards a Valuation and Taxation Information Model for Chinese Rural Collective Construction Land. Sustainability. 2019; 11(23):6610. https://doi.org/10.3390/su11236610

Chicago/Turabian StyleXu, Zhongguo, Yuefei Zhuo, Guan Li, Rong Liao, and Cifang Wu. 2019. "Towards a Valuation and Taxation Information Model for Chinese Rural Collective Construction Land" Sustainability 11, no. 23: 6610. https://doi.org/10.3390/su11236610

APA StyleXu, Z., Zhuo, Y., Li, G., Liao, R., & Wu, C. (2019). Towards a Valuation and Taxation Information Model for Chinese Rural Collective Construction Land. Sustainability, 11(23), 6610. https://doi.org/10.3390/su11236610