Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review

Abstract

1. Introduction

2. Background of Mass Appraisal

2.1. Definition of Mass Appraisal

2.2. The Role of Models in Mass Appraisal

3. Materials and Methods

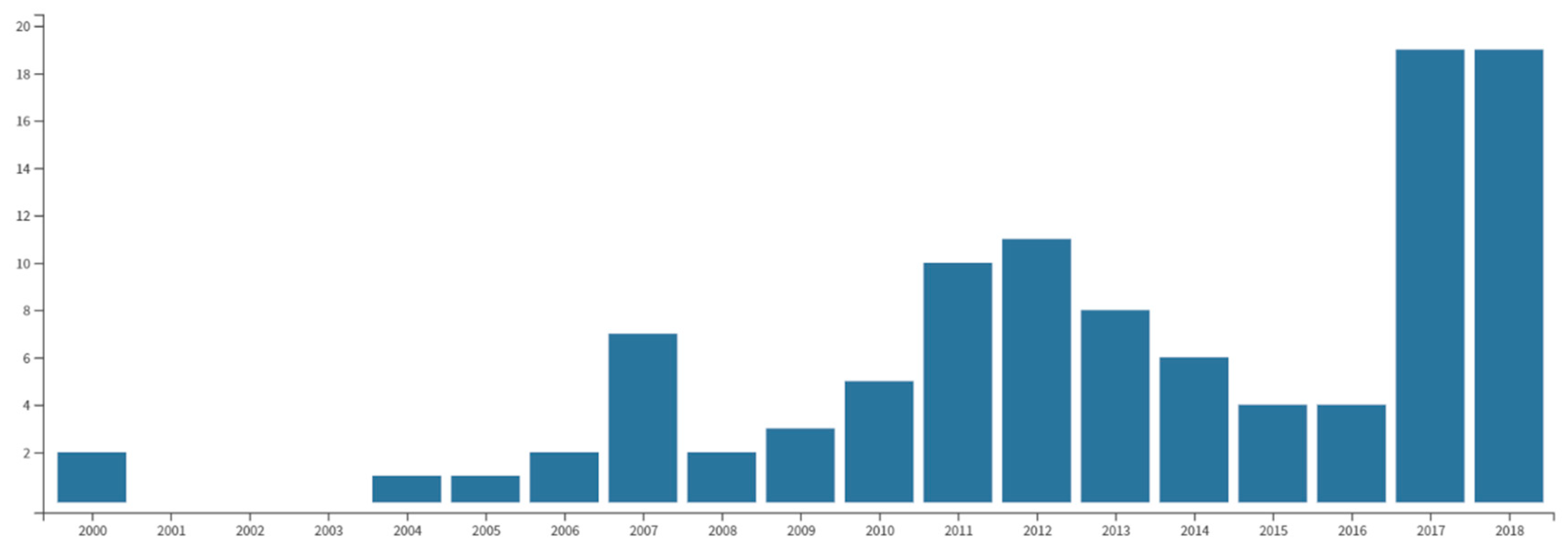

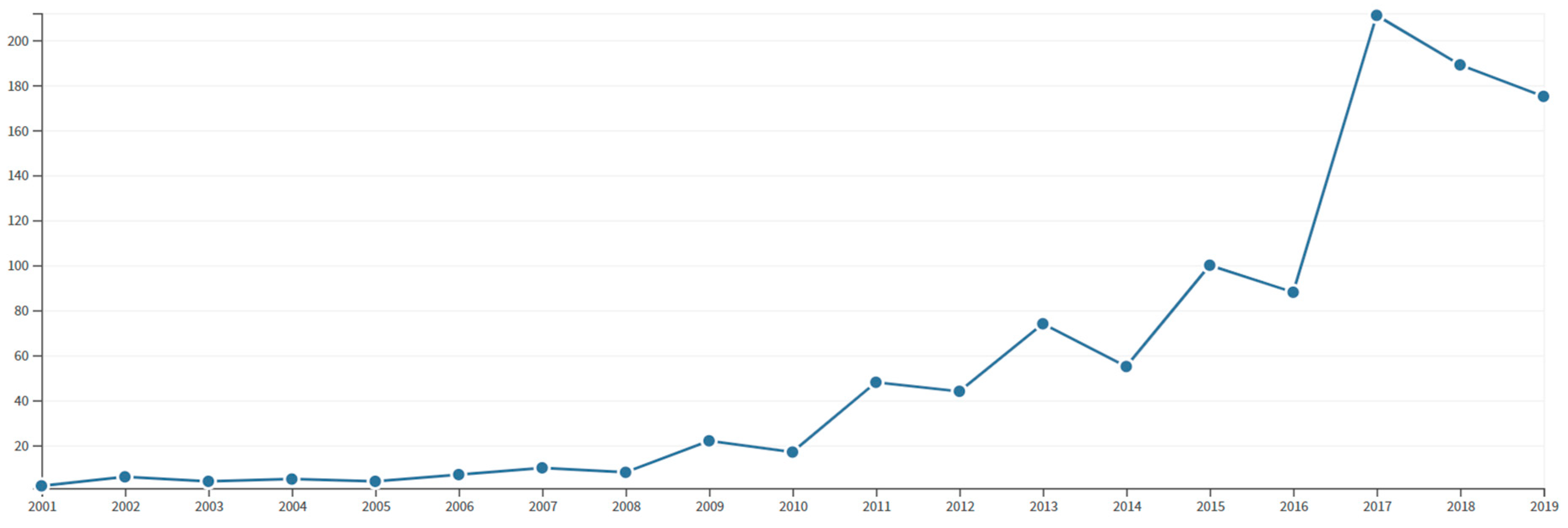

3.1. Paper Retrieval

3.2. Overview of the Selected Papers

4. Discussion of Methods and Models

4.1. AI-Based Model

4.1.1. Multiple Regression Analysis

4.1.2. Expert System and Decision Support System

4.1.3. Artificial Neural Networks (ANN)

4.1.4. Tree-Based Model

4.1.5. Hierarchical Model

4.1.6. Cluster Analysis

4.1.7. Rough Set Theory and Fuzzy Set Theory

4.1.8. Reasoning-Based Model

4.1.9. Other Models

4.2. GIS-Based Model

4.2.1. Geographically Weighted Regression (GWR)

4.2.2. Geographically Weighted Principal Component Analysis

4.2.3. Spatial Error Model and Spatial Lag Model

4.2.4. Location Value Response Surface

4.3. MIX-Based Model

5. Conclusion

Author Contributions

Funding

Conflicts of Interest

References

- IAAO. Standard on Mass Appraisal of Real Prop.; IAAO: Kansas City, MO, USA, 2017. [Google Scholar]

- RICS. RICS Valuation-Global Standards; RICS: London, UK, 2017. [Google Scholar]

- IVSC. International Valuation Standards; IVSC: London, UK, 2017. [Google Scholar]

- The Appraisal Foundation. 2018–2019 Uniform Standards of Professional Appraisal Practice; The Appraisal Foundation: Washington, DC, USA, 2018. [Google Scholar]

- Gloudemans, R.; Almy, R. Fundamentals of Mass Appraisal, 1st ed.; IAAO: Kansas City, MO, USA, 2011. [Google Scholar]

- D’Amato, M.; Amato, M. A Brief Outline of AVM Models and Standards Evolutions. In Advances in Automated Valuation Modeling: Avm After the Non-Agency Mortgage Crisis; D’Amato, M., Kauko, T., Eds.; Springer: Berlin, Germany, 2017; Volume 86, pp. 3–21. [Google Scholar]

- Vandell, K.D. Expanding the academic discipline of real estate valuation A historical perspective with implications for the future. J. Prop. Invest. Finance 2007, 25, 427. [Google Scholar] [CrossRef]

- McCluskey, W.J.; McCord, M.; Davis, P.T.; Haran, M.; McIlhatton, D. Prediction accuracy in mass appraisal: A comparison of modern approaches. J. Prop. Res. 2013, 30, 239–265. [Google Scholar] [CrossRef]

- Jahanshiri, E.; Buyong, T.; Shariff, A.R.M. A Review of Property Mass Valuation Models. Pertanika J. Sci. Technol. 2011, 19, 23–30. [Google Scholar]

- Kontrimas, V.; Verikas, A. The mass appraisal of the real estate by computational intelligence. Appl. Soft Comput. 2011, 11, 443–448. [Google Scholar] [CrossRef]

- Zurada, J.; Levitan, A.S.; Guan, J. A Comparison of Regression and Artificial Intelligence Methods in a Mass Appraisal Context. J. Real Estate Res. 2011, 33, 349–387. [Google Scholar]

- Tretton, D. Where is the world of property valuation for taxation purposes going? J. Prop. Invest. Finance 2007, 25, 482. [Google Scholar] [CrossRef]

- Hefferan, M.J.; Boyd, T. Property taxation and mass appraisal valuations in Australia—Adapting to a new environment. Prop. Manag. 2010, 28, 149. [Google Scholar] [CrossRef]

- Filippakopoulou, M.; Potsiou, C. Research on residential property taxation and its impact on the real estate market in Greece. Surv. Rev. 2014, 46, 333–341. [Google Scholar] [CrossRef]

- Augustyniak, H.; Laszek, J.; Olszewski, K.; Waszczuk, J. Property valuation for mortgage purposes in Poland. Prop. Manag. 2018, 36, 234–247. [Google Scholar] [CrossRef]

- Boshoff, D.; de Kock, L. Investigating the use of Automated Valuation Models (AVMs) in the South African commercial property market. Acta Str. 2013, 20, 1–21. [Google Scholar]

- Ciuna, M.; Salvo, F.; Simonotti, M. The Multilevel Model in the Computer-Generated Appraisal: A Case in Palermo. In Advances in Automated Valuation Modeling: Avm after the Non-Agency Mortgage Crisis; D’amato, M., Kauko, T., Eds.; Springer: Berlin, Germany, 2017; Volume 86, pp. 225–261. [Google Scholar]

- Tajani, F.; Morano, P.; Ntalianis, K. Automated valuation models for real estate portfolios A method for the value updates of the property assets. J. Prop. Invest. Finance 2018, 36, 324–347. [Google Scholar] [CrossRef]

- French, N. UK freehold reversionary properties: Valuation practice revisited. J. Eur. Real Estate Res. 2013, 6, 218–235. [Google Scholar] [CrossRef]

- Ciuna, M.; Milazzo, L.; Salvo, F. A Mass Appraisal Model Based on Market Segment Parameters. Buildings 2017, 7, 34. [Google Scholar] [CrossRef]

- Lin, C.C.; Mohan, S.B. Effectiveness comparison of the residential property mass appraisal methodologies in the USA. Int. J. Hous. Mark. Anal. 2011, 4, 224–243. [Google Scholar] [CrossRef]

- Geltner, D.; Goetzmann, W. Two decades of commercial property returns: A repeated-measures regression-based version of the NCREIF index. J. Real Estate Finance Econ. 2000, 21, 5–21. [Google Scholar] [CrossRef]

- Shimizu, C.; Nishimura, K.G. Biases in appraisal land price information: The case of Japan. J. Prop. Invest. Finance 2006, 24, 150. [Google Scholar] [CrossRef]

- Acciani, C.; Fucilli, V.; Sardaro, R. Data mining in real estate appraisal: A model tree and multivariate adaptive regression spline approach. Aestimum 2011, 58, 27–45. [Google Scholar]

- Florencio, L.; Cribari-Neto, F.; Ospina, R. Real estate appraisal of land lots using GAMLSS models. Chil. J. Stat. 2012, 3, 75–91. [Google Scholar]

- Narula, S.C.; Wellington, J.F.; Lewis, S.A. Valuating residential real estate using parametric programming. Eur. J. Oper. Res. 2012, 217, 120–128. [Google Scholar] [CrossRef]

- Del Giudice, V.; Manganelli, B.; De Paola, P. Hedonic Analysis of Housing Sales Prices with Semiparametric Methods. Int. J. Agric. Environ. Inf. Syst. 2017, 8, 65–77. [Google Scholar] [CrossRef]

- Van der Walt, K.; Boshoff, D. An analysis of the use of mass appraisal methods for agricultural properties. Acta Struct. 2017, 24, 44–76. [Google Scholar] [CrossRef]

- Demetriou, D. Automating the land valuation process carried out in land consolidation schemes. Land Use Policy 2018, 75, 21–32. [Google Scholar] [CrossRef]

- Kilpatrick, J. Expert systems and mass appraisal. J. Prop. Invest. Finance 2011, 29, 529. [Google Scholar] [CrossRef]

- Amidu, A.-R.; Boyd, D. Expert problem solving practice in commercial property valuation: An exploratory study. J. Prop. Invest. Finance 2018, 36, 366–382. [Google Scholar] [CrossRef]

- Raslanas, S.; Zavadskas, E.K.; Kaklauskas, A.; Zabulenas, A.R. Land Value Tax in the Context of Sustainable Urban Development and Assesment. Part II—Analysis of Land Valuation Techniques: The Case of Vilnius. Int. J. Strateg. Prop. Manag. 2010, 14, 173–190. [Google Scholar] [CrossRef]

- Ferreira, F.A.F.; Spahr, R.W.; Sunderman, M.A. Using multiple criteria decision analysis (MCDA) to assist in estimating residential housing values. Int. J. Strateg. Prop. Manag. 2016, 20, 354–370. [Google Scholar] [CrossRef]

- Lam, K.C.; Yu, C.Y.; Lam, C.K. Support vector machine and entropy based decision support system for property valuation. J. Prop. Res. 2009, 26, 213–233. [Google Scholar] [CrossRef]

- Naderi, I.; Sharbatoghlie, A.; Vafaeimehr, A. Housing valuation model: An investigation of residential properties in Tehran. Int. J. Hous. Mark. Anal. 2012, 5, 20–40. [Google Scholar] [CrossRef]

- Garcia, N.; Gamez, M.; Alfaro, E. ANN plus GIS: An automated system for property valuation. Neurocomputing 2008, 71, 733–742. [Google Scholar] [CrossRef]

- Peterson, S.; Flanagan, A.B. Neural Network Hedonic Pricing Models in Mass Real Estate Appraisal. J. Real Estate Res. 2009, 31, 147–164. [Google Scholar]

- Selim, H. Determinants of house prices in Turkey: Hedonic regression versus artificial neural network. Expert Syst. Appl. 2009, 36, 2843–2852. [Google Scholar] [CrossRef]

- McCluskey, W.; Davis, P.; Haran, M.; McCord, M.; McIlhatton, D. The potential of artificial neural networks in mass appraisal: The case revisited. J. Financ. Manag. Prop. Constr. 2012, 17, 274. [Google Scholar] [CrossRef]

- Mimis, A.; Rovolis, A.; Stamou, M. Property valuation with artificial neural network: The case of Athens. J. Prop. Res. 2013, 30, 128–143. [Google Scholar] [CrossRef]

- Nguyen, V.; Shi, H.; Szajman, J. Sensitivity analysis and optimisation to input variables using winGamma and ANN: A case study in automated residential property valuation. Int. J. Adv. Appl. Sci. 2015, 2, 19–24. [Google Scholar]

- Abidoye, R.B.; Chan, A.P.C. Modelling property values in Nigeria using artificial neural network. J. Prop. Res. 2017, 34, 36–53. [Google Scholar] [CrossRef]

- Abidoye, R.B.; Chan, A.P.C. Artificial neural network in property valuation: Application framework and Res. trend. Prop. Manag. 2017, 35, 554–571. [Google Scholar] [CrossRef]

- Demetriou, D. A spatially based artificial neural network mass valuation model for land consolidation. Environ. Plan. B Urban Anal. City Sci. 2017, 44, 864–883. [Google Scholar] [CrossRef]

- Abidoye, R.B.; Chan, A.P.C. Improving property valuation accuracy: A comparison of hedonic pricing model and artificial neural network. Pac. Rim Prop. Res. J. 2018, 24, 71–83. [Google Scholar] [CrossRef]

- Morillo Balsera, M.C.; Martinez-Cuevas, S.; Molina Sanchez, I.; Garcia-Aranda, C.; Martinez Izquierdo, M.E. Artificial neural networks and geostatistical models for housing valuations in urban residential areas. Geogr. Tidsskr. Dan. Geogr. 2018, 118, 184–193. [Google Scholar] [CrossRef]

- Yacim, J.A.; Boshoff, D.G.B. Impact of Artificial Neural Networks Training Algorithms on Accurate Prediction of Property Values. J. Real Estate Res. 2018, 40, 375–418. [Google Scholar]

- Yacim, J.A.; Boshoff, D.G.B. Combining BP with PSO algorithms in weights optimisation and ANNs training for mass appraisal of properties. Int. J. Hous. Mark. Anal. 2018, 11, 290–314. [Google Scholar] [CrossRef]

- Zhou, G.; Ji, Y.; Chen, X.; Zhang, F. Artificial Neural Networks and the Mass Appraisal of Real Estate. Int. J. Online Eng. 2018, 14, 180–187. [Google Scholar] [CrossRef]

- Reyes-Bueno, F.; Manuel Garcia-Samaniego, J.; Sanchez-Rodriguez, A. Large-scale simultaneous market segment definition and mass appraisal using decision tree learning for fiscal purposes. Land Use Policy 2018, 79, 116–122. [Google Scholar] [CrossRef]

- Antipov, E.A.; Pokryshevskaya, E.B. Mass appraisal of residential apartments: An application of Random forest for valuation and a CART-based approach for model diagnostics. Exp. Syst. Appl. 2012, 39, 1772–1778. [Google Scholar] [CrossRef]

- McCluskey, W.; Daud, D.; Kamarudin, N. Boosted regression trees: An application for the mass appraisal of residential property in Malaysia. J. Financ. Manag. Prop. Constr. 2014, 19, 152. [Google Scholar] [CrossRef]

- Hui, S.K.; Cheung, A.; Pang, J. A Hierarchical Bayesian Approach for Residential Property Valuation: Application to Hong Kong Housing Market. Int. Real Estate Rev. 2010, 13, 1–29. [Google Scholar]

- Cervello-Royo, R.; Guijarro, F.; Pfahler, T.; Preuss, M. An Analytic Hierarchy Process (AHP) framework for property valuation to identify the ideal 2050 portfolio mixes in EU-27 countries with shrinking populations. Qual. Quant. 2016, 50, 2313–2329. [Google Scholar] [CrossRef]

- Arribas, I.; Garcia, F.; Guijaro, F.; Oliver, J.; Tamosiuniene, R. Mass Appraisal of Residential Real Estate Using Multilevel Modelling. Int. J. Strateg. Prop. Manag. 2016, 20, 77–87. [Google Scholar] [CrossRef]

- Francke, M.K.; Vos, G.A. The hierarchical trend model for property valuation and local price indices. J. Real Estate Finance Econ. 2004, 28, 179–208. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Valenti, A. Forms and Functions of the Real Estate Market of Palermo (Italy). Science and Knowledge in the Cluster Analysis Approach. In Appraisal: From Theory to Practice; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Springer: Berlin, Germany, 2017; pp. 191–202. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Gaps and Overlaps of Urban Housing Sub-market: Hard Clustering and Fuzzy Clustering Approaches. In Appraisal: From Theory to Practice; Stanghellini, S., Morano, P., Bottero, M., Oppio, A., Eds.; Springer: Berlin, Germany, 2017; pp. 203–219. [Google Scholar] [CrossRef]

- Calka, B. Estimating Residential Property Values on the Basis of Clustering and Geostatistics. Geosciences 2019, 9, 143. [Google Scholar] [CrossRef]

- Meszek, W. Property Valuation Under Uncertainty. Simulation vs Strategic Model. Int. J. Strateg. Prop. Manag. 2013, 17, 79–92. [Google Scholar] [CrossRef]

- Buttimer, R.; Ott, S.H. Commercial real estate valuation, development and occupancy under leasing uncertainty. Real Estate Econ. 2007, 35, 21–56. [Google Scholar] [CrossRef]

- Del Giudice, V.; De Paola, P.; Cantisani, G.B. Rough Set Theory for Real Estate Appraisals: An Application to Directional District of Naples. Buildings 2017, 7, 12. [Google Scholar] [CrossRef]

- D’Amato, M. Comparing Rough Set Theory with Multiple Regression Analysis as Automated Valuation Methodologies. Int. Real Estate Rev. 2007, 10, 42–65. [Google Scholar]

- Lasota, T.; Smetek, M.; Trawinski, B.; Trawinski, G. An Attempt to Use Self-Adapting Genetic Algorithms to Optimize Fuzzy Systems for Predicting from a Data Stream. In New Research in Multimedia and Internet Systems; Zgrzywa, A., Choros, K., Sieminski, A., Eds.; Springer: Berlin, Germany, 2015; Volume 314, pp. 81–90. [Google Scholar]

- Stumpf Gonzalez, M.A.; Formoso, C.T. Mass appraisal with genetic fuzzy rule-based systems. Prop. Manag. 2006, 24, 20. [Google Scholar] [CrossRef]

- Ma, X.; Zeng, D.; Wang, R.; Gao, J.; Qin, B. An intelligent price-appraisal algorithm based on grey correlation and fuzzy mathematics. J. Intell. Fuzzy Syst. 2018, 35, 2943–2950. [Google Scholar] [CrossRef]

- Lasota, T.; Trawinski, B.; Trawinski, K. An Attempt to Use the KEEL Tool to Evaluate Fuzzy Models for Real Estate Appraisal. In New Trends in Multimedia and Network Information Systems; Zgrzywa, A., Choros, K., Sieminski, A., Eds.; Springer: Berlin, Germany, 2008; Volume 181, pp. 125–139. [Google Scholar]

- Lasota, T.; Telec, Z.; Trawinski, B.; Trawinski, K. Investigation of the eTS Evolving Fuzzy Systems Applied to Real Estate Appraisal. J. Mult. Valued Logic Soft Comput. 2011, 17, 229–253. [Google Scholar]

- Guan, J.; Shi, D.; Zurada, J.M.; Levitan, A.S. Analyzing Massive Data Sets: An Adaptive Fuzzy Neural Approach for Prediction, with a Real Estate Illustration. J. Organ. Comput. Electron. Commer. 2014, 24, 94–112. [Google Scholar] [CrossRef]

- Alcantud, J.C.R.; Cruz Rambaud, S.; Munoz Torrecillas, M.J. Valuation Fuzzy Soft Sets: A Flexible Fuzzy Soft Set Based Decision Making Procedure for the Valuation of Assets. Symmetry 2017, 9, 253. [Google Scholar] [CrossRef]

- Kettani, O.; Oral, M. Designing and implementing a real estate appraisal system: The case of Quebec Province, Canada. Socio Econ. Plan. Sci. 2015, 49, 1–9. [Google Scholar] [CrossRef]

- Yeh, I.C.; Hsu, T.-K. Building real estate valuation models with comparative approach through case-based reasoning. Appl. Soft Comput. 2018, 65, 260–271. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F.; Locurcio, M. Multicriteria analysis and genetic algorithms for mass appraisals in the Italian property market. Int. J. Hous. Mark. Anal. 2018, 11, 229–262. [Google Scholar] [CrossRef]

- Ahn, J.J.; Byun, H.W.; Oh, K.J.; Kim, T.Y. Using ridge regression with genetic algorithm to enhance real estate appraisal forecasting. Exp. Syst. Appl. 2012, 39, 8369–8379. [Google Scholar] [CrossRef]

- Chen, J.-H.; Ong, C.F.; Zheng, L.; Hsu, S.-C. Forecasting Spatial Dynamics of the Housing Market Using Support Vector Machine. Int. J. Strateg. Prop. Manag. 2017, 21, 273–283. [Google Scholar] [CrossRef]

- Lins, M.P.E.; Novaes, L.F.D.; Legey, L.F.L. Real estate appraisal: A double perspective data envelopment analysis approach. Ann. Oper. Res. 2005, 138, 79–96. [Google Scholar] [CrossRef]

- Bellotti, A. Reliable region predictions for automated valuation models. Ann. Math. Artif. Intell. 2017, 81, 71–84. [Google Scholar] [CrossRef]

- Lake, I.R.; Lovett, A.A.; Bateman, I.J.; Day, B. Using GIS and large-scale digital data to implement hedonic pricing studies. Int. J. Geogr. Inf. Sci. 2000, 14, 521–541. [Google Scholar] [CrossRef]

- Yu, S.-M.; Han, S.-S.; Chai, C.-H. Modeling the value of view in high-rise apartments: A 3D GIS approach. Environ. Plan. B Plan. Des. 2007, 34, 139–153. [Google Scholar] [CrossRef]

- Kuburic, M.; Cirovic, G. The Application of Intelligent Techniques for Massreal Estate Appraisal. Geod. List 2012, 66, 39–58. [Google Scholar]

- Lozano-Gracia, N.; Anselin, L. Is the price right?: Assessing estimates of cadastral values for Bogota, Colombia. Reg. Sci. Policy Pract. 2012, 4, 495. [Google Scholar] [CrossRef]

- Naude, S.D.; Kleynhans, T.E.; van Niekerk, A.; Ellis, F.; Lambrechts, J.J.N. Application of spatial resource data to assist in farmland valuation. Land Use Policy 2012, 29, 614–628. [Google Scholar] [CrossRef]

- Brankovic, S. Real Estate Mass Appraisal in the Real Estate Cadastre and GIS Environment. Geod. List 2013, 67, 119–134. [Google Scholar]

- Carmen Morillo, M.; Garcia-Cepeda, F.; Martinez-Cuevas, S.; Molina, I.; Garcia-Aranda, C. Geostatistical Study of the Rural Property Market Applicable to the Region of Murcia (Spain) by M. Carmen Morillo1 et al. Appl. Spat. Anal. Policy 2017, 10, 585–607. [Google Scholar] [CrossRef]

- Cheung, S.K.C. A Localized Model for Residential Property Valuation: Nearest Neighbor with Attribute Differences. Int. Real Estate Rev. 2017, 20, 221–250. [Google Scholar]

- Cellmer, R.; Belej, M.; Zrobek, S.; Kovac, M.S. Urban Land Value Maps—A Methodological Approach. Geod. Vestn. 2014, 58, 535–551. [Google Scholar] [CrossRef]

- Bourassa, S.C.; Cantoni, E.; Hoesh, M. Spatial dependence, housing submarkets, and house price prediction. J. Real Estate Finance Econ. 2007, 35, 143–160. [Google Scholar] [CrossRef]

- McCluskey, W.; Borst, R. Specifying the effect of location in multivariate valuation models for residential properties A critical evaluation from the mass appraisal perspective. Prop. Manag. 2007, 25, 312. [Google Scholar] [CrossRef]

- Lockwood, T.; Rossini, P. Efficacy in Modelling Location within the Mass Appraisal Process. Pac. Rim Prop. Res. J. 2011, 17, 418–442. [Google Scholar] [CrossRef]

- McCluskey, W.J.; Borst, R.A. Detecting and validating residential housing submarkets A geostatistical approach for use in mass appraisal. Int. J. Hous. Mark. Anal. 2011, 4, 290–318. [Google Scholar] [CrossRef]

- Dimopoulos, T.; Moulas, A. A Proposal of a Mass Appraisal System in Greece with CAMA System: Evaluating GWR and MRA techniques in Thessaloniki Municipality. Open Geosci. 2016, 8, 675–693. [Google Scholar] [CrossRef]

- Bidanset, P.E.; Lombard, J.R.; Davis, P.; McCord, M.; McCluskey, W.J. Further Evaluating the Impact of Kernel and Bandwidth Specifications of Geographically Weighted Regression on the Equity and Uniformity of Mass Appraisal Models. In Advances in Automated Valuation Modeling: Avm after the Non-Agency Mortgage Crisis; Damato, M., Kauko, T., Eds.; Springer: Berlin, Germany, 2017; Volume 86, pp. 191–199. [Google Scholar]

- Borst, R.A. A Space-Time Model for Computer Assisted Mass Appraisal. Aestimum, 2012; 535–545. Available online: https://oaj.fupress.net/index.php/ceset/article/view/6637 (accessed on 2 December 2019).

- Wu, C.; Ye, X.; Ren, F.; Du, Q. Modified Data-Driven Framework for Housing Market Segmentation. J. Urban Plan. Dev. 2018, 144. [Google Scholar] [CrossRef]

- Zhang, R.; Du, Q.; Geng, J.; Liu, B.; Huang, Y. An improved spatial error model for the mass appraisal of commercial real estate based on spatial analysis: Shenzhen as a case study. Habitat Int. 2015, 46, 196–205. [Google Scholar] [CrossRef]

- Uberti, M.S.; Homem Antunes, M.A.; Debiasi, P.; Tassinari, W. Mass appraisal of farmland using classical econometrics and spatial modeling. Land Use Policy 2018, 72, 161–170. [Google Scholar] [CrossRef]

- Anselin, L. Under the hood issues in the specification and interpretation of spatial regression models. Agric. Econ. 2002, 27, 247–267. [Google Scholar] [CrossRef]

- Walacik, M.; Cellmer, R.; Zrobek, S. Mass Appraisal—International Background, Polish Solutions and Proposal of new Methods Application. Geod. List 2013, 67, 255–269. [Google Scholar]

- Palma, M.; Cappello, C.; De Iaco, S.; Pellegrino, D. The residential real estate market in Italy: A spatio-temporal analysis. Qual. Quant. 2019, 53, 2451–2472. [Google Scholar] [CrossRef]

- Bidanset, P.E.; Lombard, J.R. Evaluating Spatial Model Accuracy in Mass Real Estate Appraisal: A Comparison of Geographically Weighted Regression and the Spatial Lag Model. Cityscape 2014, 16, 169–182. [Google Scholar]

- Quintos, C. Spatial Weight Matrices and Their Use As Baseline Values and Location-Adjustment Factors in Property Assessment Models. Cityscape 2013, 15, 295–306. [Google Scholar]

- D’Amato, M. A Location Value Response Surface Model for Mass Appraising: An Iterative Location Adjustment Factor in Bari, Italy. Int. J. Strateg. Prop. Manag. 2010, 14, 231–244. [Google Scholar] [CrossRef]

- D’Amato, M.; Siniak, N. Mass Appraisal Modelling in Minsk: Testing different Models Location sensitive. Aestimum. 2012, pp. 735–743. Available online: https://oaj.fupress.net/index.php/ceset/article/view/6651 (accessed on 2 December 2019).

- Glennon, D.; Kiefer, H.; Mayock, T. Measurement error in residential property valuation: An application of forecast combination. J. Hous. Econ. 2018, 41, 1–29. [Google Scholar] [CrossRef]

- Guo, J.; Xu, S.; Bi, Z. An integrated cost-based approach for real estate appraisals. Inf. Technol. Manag. 2014, 15, 131–139. [Google Scholar] [CrossRef]

- Calka, B.; Bielecka, E. The Application of Geoinformation Theory in Housing Mass Appraisal. In Proceedings of the 2016 Baltic Geodetic Congress (BGC Geomatics), Gdańsk, Poland, 2–4 June 2016; pp. 239–243. [Google Scholar]

- Chen, Z.; Hu, Y.; Zhang, C.J.; Liu, Y. An Optimal Rubrics-Based Approach to Real Estate Appraisal. Sustainability 2017, 9, 909. [Google Scholar] [CrossRef]

- Giuffrida, S.; Gagliano, F.; Nocera, F.; Trovato, M.R. Landscape Assessment and Economic Accounting in Wind Farm Programming: Two Cases in Sicily. Land 2018, 7, 120. [Google Scholar] [CrossRef]

- Maliene, V.; Deveikis, S.; Kirsten, L.; Malys, N. Commercial Leisure Property Valuation: A Comparison of the Case Studies in UK and Lithuania. Int. J. Strateg. Prop. Manag. 2010, 14, 35–48. [Google Scholar] [CrossRef]

- Metzner, S.; Kindt, A. Determination of the parameters of automated valuation models for the hedonic property valuation of residential properties A literature-based approach. Int. J. Hous. Mark. Anal. 2018, 11, 73–100. [Google Scholar] [CrossRef]

- You, Q.; Pang, R.; Cao, L.; Luo, J. Image-Based Appraisal of Real Estate Properties. IEEE Trans. Multimed. 2017, 19, 2751–2759. [Google Scholar] [CrossRef]

- Mou, C.; Zhou, Q.; Ran, Y.; Ge, L.; Wang, Y. Recommending property with short days-on-market for estate agency A real estate appraisal approach by using transactions data and profile information. J. Ambient Intell. Humaniz. Comput. 2018, 9, 2077–2092. [Google Scholar] [CrossRef]

- Lorenz, D.; Luetzkendorf, T. Sustainability and property valuation Systematisation of existing approaches and recommendations for future action. J. Prop. Invest. Finance 2011, 29, 644. [Google Scholar] [CrossRef]

| Standard 1 | Institution 2 | Year (1st version) | Year (latest version) |

|---|---|---|---|

| SMARP [1] | IAAO | 1976 | 2017 |

| RICS Red Book [2]. | RICS | 1983 | 2017 |

| IVS [3]. | IVSC | 1990’s | 2017 |

| USPAP [4]. | AF | 1987 | 2018 |

| Rank | Source Titles | Records |

|---|---|---|

| 1 | International Journal of Strategic Property Management | 7 |

| =1 | Journal of Property Investment & Finance | 7 |

| 3 | International Journal of Housing Markets and Analysis | 6 |

| 4 | Property Management | 5 |

| 5 | Land Use Policy | 4 |

| =5 | Journal of Property Research | 4 |

| Title | Authors | Source Title | Year | Citations 3 |

|---|---|---|---|---|

| Spatial Dependence, Housing Submarkets, and House Price Prediction | Bourassa, Steven C.; Cantoni, Eva; Hoesh, Martin | Journal of Real Estate Finance and Economics | 2007 | 83 |

| Determinants of House Prices in Turkey: Hedonic Regression Versus Artificial Neural Network | Selim, Hasan | Expert Systems with Applications | 2009 | 75 |

| The Mass Appraisal of the Real Estate by Computational Intelligence | Kontrimas, Vilius; Verikas, Antanas | Applied Soft Computing | 2011 | 66 |

| Neural Network Hedonic Pricing Models in Mass Real Estate Appraisal | Peterson, Steven; Flanagan, Albert B. | Journal of Real Estate Research | 2009 | 57 |

| A Comparison of Regression and Artificial Intelligence Methods in a Mass Appraisal Context | Zurada, Jozef; Levitan, Alan S.; Guan, Jian | Journal of Real Estate Research | 2011 | 46 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; Li, V.J. Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review. Sustainability 2019, 11, 7006. https://doi.org/10.3390/su11247006

Wang D, Li VJ. Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review. Sustainability. 2019; 11(24):7006. https://doi.org/10.3390/su11247006

Chicago/Turabian StyleWang, Daikun, and Victor Jing Li. 2019. "Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review" Sustainability 11, no. 24: 7006. https://doi.org/10.3390/su11247006

APA StyleWang, D., & Li, V. J. (2019). Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review. Sustainability, 11(24), 7006. https://doi.org/10.3390/su11247006