The Construction and Evolution of Technological Innovation Ecosystem of Chinese Firms: A Case Study of LCD Technology of CEC Panda

Abstract

:1. Introduction

2. Literature Review

2.1. The Concept of Technological Innovation Ecosystem

2.2. Construction of Technological Innovation Ecosystem Based on Core Enterprises

2.3. Evolution Mechanism of Technological Innovation Ecosystem

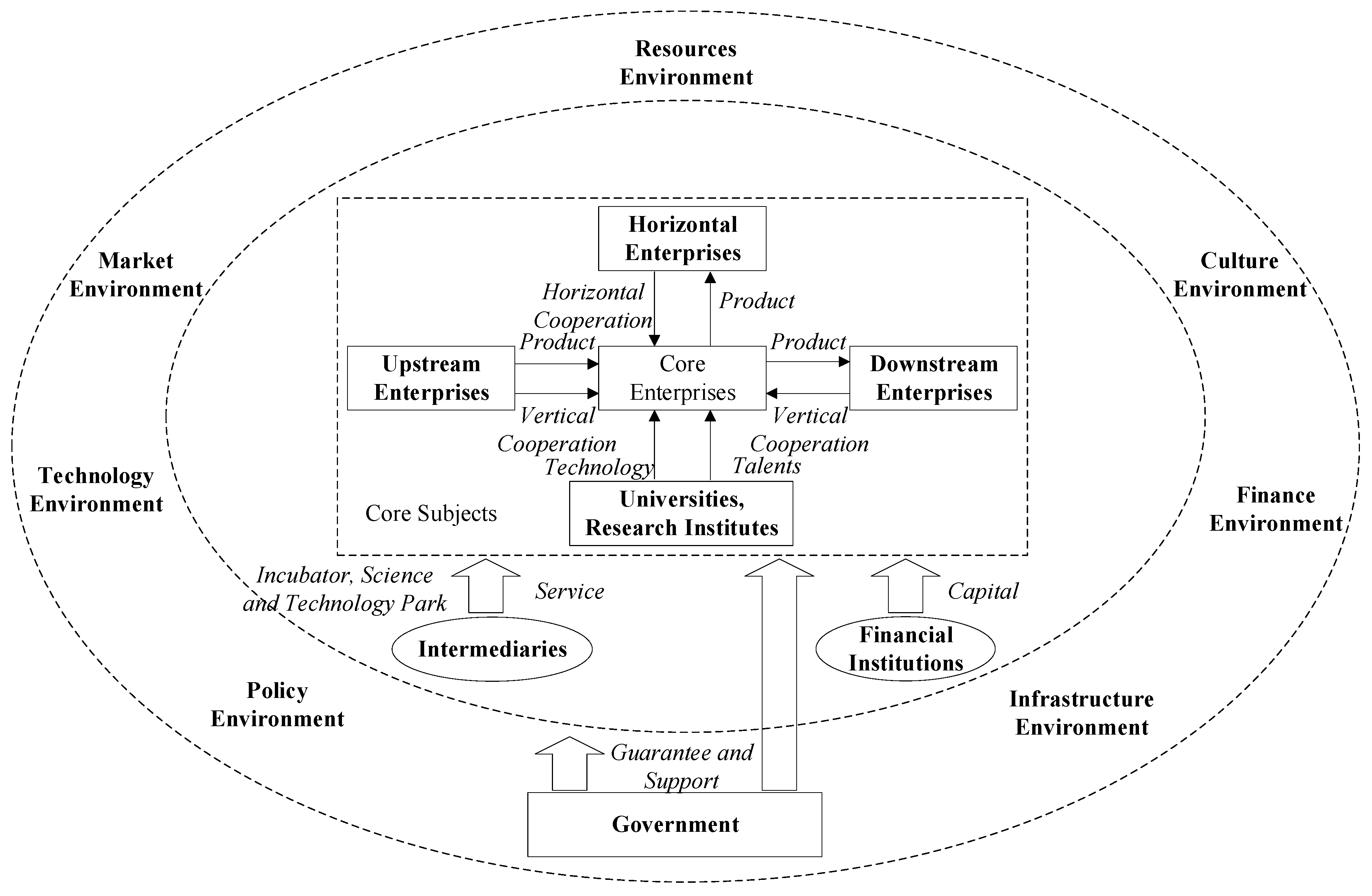

3. Elements Composition and Relations of Technological Innovation Ecosystem

4. Research Design

4.1. Research Methods and Data Sources

4.2. Case Description

5. Case Analysis

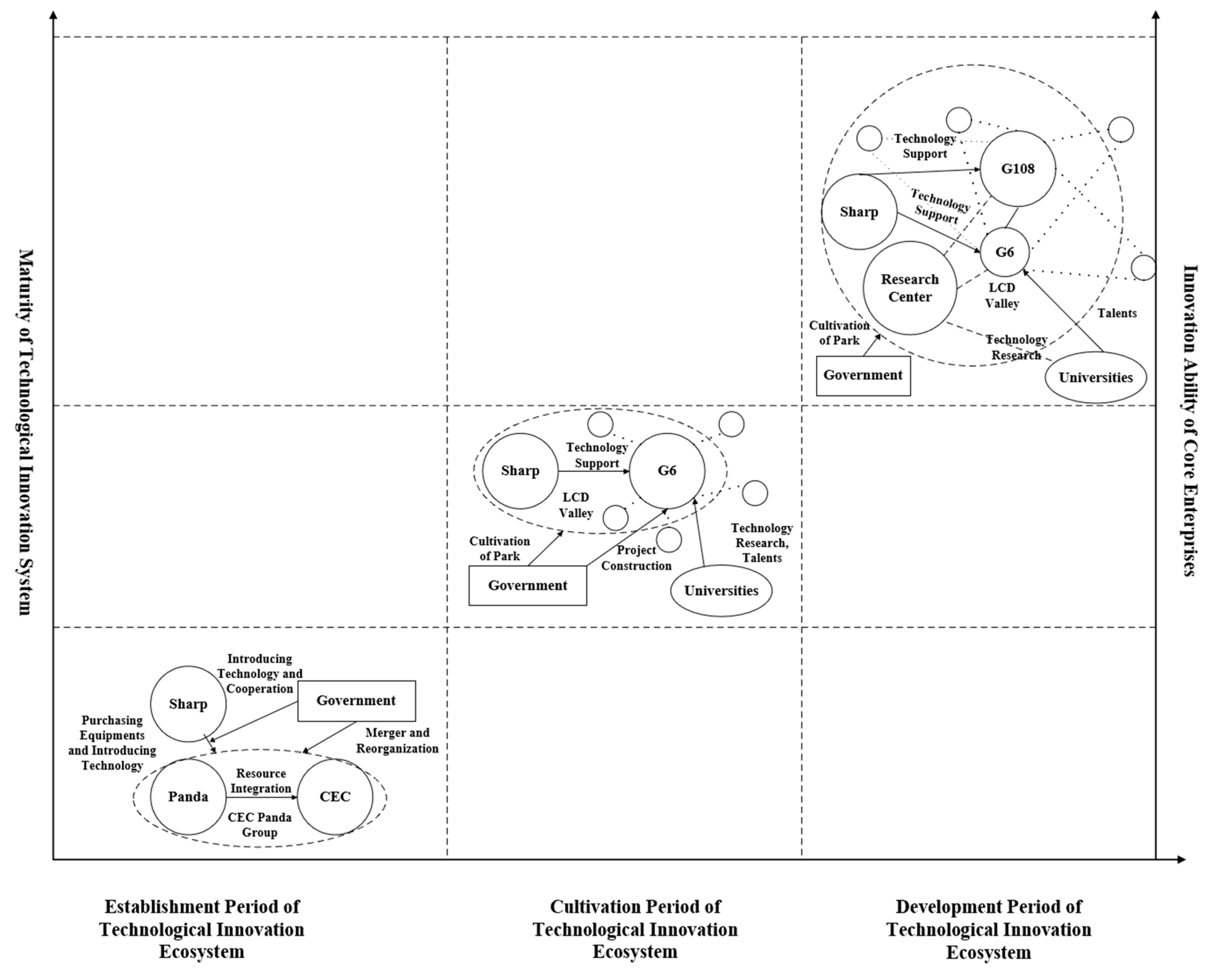

5.1. Formation Period of Technological Innovation Ecosystem (2005–2009)

5.1.1. Innovation Environment

5.1.2. Establishment of Core Enterprises

5.1.3. Construction of Technical Cooperation Network

5.2. Incubation Period of Technological Innovation Ecosystem (2009–2013)

5.2.1. Innovation Environment

5.2.2. Innovation Environment

5.2.3. Expansion of Technical Cooperation Network

5.3. Development Period of Technological Innovation Ecosystem (2013–2017)

5.3.1. Innovation Environment

5.3.2. Technological Development of Core Enterprises

5.3.3. Platform of Technological Cooperation Network

5.4. The Whole Process Evolution of Technological Innovation Ecosystem

5.5. Evolutionary Driving Mechanism of Technological Innovation Ecosystem

6. Conclusions and Discussion

6.1. Research Conclusion

6.2. Discussion

6.3. Theoretical Significance and Research Prospect

- 1)

- We analyzed how Chinese manufacturing enterprises can achieve technological catch-up by means of technological innovation ecosystem. We examined the bottlenecks that need to be addressed and the conditions that they require for leaping-frogging technological growth, which would contribute to enriching the discussions on technology catch-up theory for late-developing enterprises with open innovation. For industries with substantial investment and high technology content, realizing technology investment by solely relying on funds and the will of the company itself would be difficult. Government guidance and support are of particular importance. With government assistance, enterprises can increase their technical investment without considering short-term gains. Although the company’s development at the early stages is highly dependent on foreign technology, as the demand for innovation increases, an ecosystem, with itself as the core, is eventually formed through cooperation with enterprises, universities, and other organizations, will gradually improve its own research and development level, and will finally get rid of technological dependence.

- 2)

- We discussed the evolution mechanism of the technological innovation ecosystem for Chinese manufacturing enterprises and the interactive driving modes of the internal and external environment. This would help to explain the inherent law of technological innovation ecosystem evolution, particularly for technology-intensive enterprises. Different drivers at different stages propel the evolution of the technology innovation ecosystem that is built by core enterprises. The driving forces at the earliest (formation) stage of the technological innovation ecosystem were driven by pressures from the external market environment, technical environment, and resource environment. At the second (incubation) stage, the driving forces are primarily directed by four external factors (i.e., policy environment, cultural environment, financial environment, and infrastructure environment), the internal technological demand, and the innovation willingness of enterprises. At the third (development) stage, technological demand and the innovation willingness of enterprises mainly drives the progress in the technology innovation ecosystem.

- 3)

- Previous studies have mainly focused on the cooperative relationship among enterprises and universities, but less on the role of government departments. Here, we discussed the role of government in technological innovation in detail. In the context of external system and policy support, government support includes the creation of cooperative innovation relationships through policy guidance, and influencing the track of technological growth of enterprises. We found that early government guidance can solve the problem of "innovation inertia". With the development and expansion of enterprises, the direct guidance of government gradually transitions into indirect supervision, leading enterprises to become more independent and paving the way for a more conducive innovation environment.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Innovation Environment | Typical Examples | Keywords | Coding Result | References | |

|---|---|---|---|---|---|

| Market Environment | In the second quarter of 2005, Sharp’s global LCD TV sales reached 750,000 units, and its annual sales are expected to exceed 300 units. The combined sales of LCD TV in all domestic enterprises are less than half of its total. | Sales volume, market share | The market environment is under great pressure. | [46] | |

| Technology Environment | 1. The investment of a 4th generation line of LCD panel is 7.5 billion yuan, the fifth generation line is 10 billion yuan, and the sixth generation line is 20 billion yuan. Excessive capital and technical barriers make it difficult for domestic enterprises to enter this industry. 2. The lack of core manufacturing industry makes Chinese color TV companies lose their voice in the competition of LCD era and become a “marginalized” group. | Technical barriers, technology marginalization | The technical environment is not friendly and the technical level is low. | [47] | |

| Resources Environment | At present, China produces and sells hundreds of millions of color TV sets annually, 80% of which are flat panel TV. But almost all the LCD panels needed for TV production depend on imports, with an annual import of nearly US$40 billion, making it the fourth largest single import commodity after oil, iron ore and chips. | LCD panel depends on import | Resources depend on imports and are subject to constraints | [48] | |

| Policy Environment | National | 1.“Outline of National Medium and Long Term Science and Technology Development Planning (2006–2020)”, 2.“Special Project for Specialization of Flat Panel Display Devices”, 3. “Notice on Continuing to Organize and Implement Special Issues Concerning Industrialization of New Flat Panel Display Devices”, 4.“Notice on Several Policies to Encourage the Development of Digital Television Industry”, 5.“Eleventh Five-Year Plan for Informatization of National Economic and Social Development”, 6.“Planning for the Adjustment and Revitalization of Electronic Information Industry”, 7. “Notice on Preferential Policies for Import Tax to Support the Development of New Display Industry” | Priority development, promotion of union, expansion of scale and cultivation of independent innovation ability | Promoting the development of flat panel industry in policy environment | 1. [49] 2. [50] 3. [51] 4. [52] 5. [53] 6. [54] 7. [55] |

| Local | 1.“Nanjing Ten Industrial Chains Development Action Program”, 2.“Software Industry Revitalization Plan and Electronic Industry Rejuvenation Plan”, 3.“Some Policy Opinions on Accelerating the Development of New Display Industry in Nanjing” | Focus on supporting, promoting technological innovation and creating a good policy environment | Strongly support the development of flat panel industry in policy | 1. [56] 2. [57] 3. [58] | |

| Culture Environment | Make “CEC Panda” a first-class electronic high-tech enterprise with international influence and vigorously revitalize the brand of “Panda” | Create a first-class brand | To become the first-class goal at home and abroad | [59] | |

| Finance Environment | 1.Nanjing SASAC, CEC Group, Jiangsu Guoxin Asset Management Company and other companies restructure and invest resources in China Electric Panda. 2.In the form of loan discount, the central government has allocated 20 billion yuan of special funds for technological renovation, giving priority support to six aspects, such as new display and transformation of color TV industry. | Resource restructuring, capital investment, loan discount | Good financial environment and sufficient funds for restructuring | 1. [60] 2. [61] | |

| Infrastructure Environment | The LCD Valley of the 6th Generation Line Project is located in the economic and technological development zone of Qixia District, Nanjing, adjacent to Xianlin university town, which has a good geographical environment advantage. | Construction location has geographical environment advantage | Good infrastructure environment | [62] | |

| Innovation Environment | Typical Examples | Keywords | Coding Result | References | |

|---|---|---|---|---|---|

| Market Environment | The advanced technology, excellent product performance indicators and complete downstream industry chain of CEC Group, the 6th generation project market is fully guaranteed. | Market guarantee | Low market pressure | [41] | |

| Technology Environment | The introduction of new technology has made this line the most advanced 6th generation line in the world, and its main performance indicators can reach the optimal level among domestic and foreign counterparts. | Close to the world’s leading level | Reduction of technology environment pressure | [39] | |

| Resources Environment | A large number of contacts and cooperation agreements have been signed with the core suppliers of LCD panel raw materials. | Suppliers of LCD panel raw materials, cooperation agreements | Develop cooperation to reduce resource constraints | Retrieve from interview records. | |

| Policy Environment | National | 1.“Decision of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries”, 2.“Investment in Technology Progress and Technology Transformation of Equipment Manufacturing Industry (2010)”, 3.“Currently Prioritized Guidelines for Key Areas of High-Tech Industrialization (2011)”, 4.“Industrial Transformation and Upgrading Plan 2011–2015”, 5. “Guide Catalogue for Major Innovations in Major Technical Equipment”, 6.“Twelfth Five-Year Development Plan for Electronic Information Manufacturing Industry”, 7.“Electronic Special Equipment 12th Five-Year Plan”, 8. “The 12th Five-Year National Strategic Emerging Industry Development Plan”, 9.“The New 12th Five-Year Plan for Display Technology Development” | Overall planning, rational layout, and vital support | Rational construction of the industrial chain | 1. [63] 2. [64] 3. [65] 4. [66] 5. [66] 6. [67] 7. [68] 8. [69] 9. [70] |

| Local | 1.“Nanjing LCD Valley Industry Development Plan (2010–2015)”, 2.“Notice of the Municipal Government on Promulgating the Top 50 Industrial Enterprises (Groups) and the List of 50 Key Investment Projects of Industrial Upgrades in 2012”, 3. “Notice of the Municipal Government Establishes the Leading Group for the Promotion of Nanjing LCD Panel Projects” | Pushing forward and supporting vigorously | Promoting the construction of flat industry chain based on LCD valley | 1. [71] 2. [72] 3. [73] | |

| Culture Environment | For the 6th generation line construction, two mandatory guarantees are required. First, to ensure the construction period. It is necessary to achieve the goal of not returning, the standard is not falling, and the time is unchanged. Second, to ensure the level, we must ensure that the 6th generation line will produce products with the 8th generation line or even 10th generation line level and build the world’s best 6th generation line, reflecting the technical competitiveness of Nanjing 6th generation line. | Speeding up construction, leading quality standards in the world, guaranteeing project progress and introducing high-end technology | Promoting the rapid and sound construction of the 6th generation line | [40] | |

| Finance Environment | Through preferential policies and taxes, Nanjing has provided a suitable environment for the further development of the flat panel display industry. It has attracted many flat-panel display companies and has driven a large number of supporting projects to follow up quickly. Currently, an industrial cluster represented by TFT-LCD has been formed. | Preferential tax policy | Good finance environment | [74] | |

| Infrastructure Environment | In order to create a suitable infrastructure environment for the future development of the 6th generation line, in the case of the fire protection design of the 6th generation line giant factory, there is no ready-made standard in the country, the provincial and municipal fire departments help them to design a reasonable plan; With the help of the gas and other departments, the power supply and gas supply facilities of the 6th generation line were built and used in the fastest time. | Creating a good technology environment | Building a sound infrastructure environment | [39] | |

| Innovation Environment | Typical Examples | Keywords | Coding Result | References | |

|---|---|---|---|---|---|

| Market Environment | The excellent characteristics of the 6th generation line products are far from meeting the market demand. | Excellent characteristics of products, far from meeting the market demand, polycentric processes, creative innovation | Low sales pressure, high market demand | Retrieve from interview records. | |

| Technology Environment | The operation of the G108 project marks that China has broken through a key process technology in the field of new flat panel display, filling the gap in IGZO mass production technology. | Breaking through key technologies, filling gaps in technology | Technology is first-class in thecountry, leading the world | [75] | |

| Resources Environment | Localization of core materials such as glass, target, special gas, chemical liquid crystal, and polarizer materials | Gradually realize localization | Innovative resources to realize localization, reducing resource dependence | Retrieve from interview records. | |

| Policy Environment | National | 1.Encourage Imported Technologies and Product Catalogue (2014), 2. 2014–2016 New Display Industry Innovation and Development Action Plan | Raw materials, increase tariffs | Guiding enterprises to develop to localization and reducing resource dependence | 1. [76] 2. [77] |

| Local | 1.“Opinions of the Provincial Government on Further Strengthening the Promotion and Application of New Technologies and New Products”, 2.“The Outline of the Thirteenth Five-Year Plan for National Economic and Social Development of Nanjing”, 3. “Made in China 2025 Nanjing Implementation Plan (2015—2017)”, 4.“Notice of the Government on the Key Investment Projects for Industrial Upgrading in Nanjing in 2014” | Planning and Guiding, promoting independent innovation, accelerating the training and introduction of talents and creating a suitable industrial development environment | Focus on Creating Innovation Environment | 1. [78] 2. [79] 3. [80] 4. [81] | |

| Culture Environment | Through five years of development, achieving the goal of the first domestic industrial scale and the first independent innovation capability in the flat panel display industry. Through ten years of effort, becoming the strategic goal of the world-class flat panel display integrated manufacturer. | Domestic industry scale first, international first-class level | Pursuing development goals of innovation and leading | “Feasibility study report of CEC Panda Group” | |

| Finance Environment | 1. In January 2014, Huadong Science and Technology, a listed company of China Electronics, announced a non-public issuance plan, intending to raise more than 10 billion yuan to invest in the CEC Panda 8.5 generation line, leveraging the capital market to promote the growth of the panel business. 2. As the lead bank of syndicated loans, CCB (China Construction Bank) will continue to increase its support for CEC Panda, accelerate the development of enterprises by providing better financial services, and achieve mutual benefit and win-win between banks and enterprises. | Financing, mutual benefit and win-win between banks and enterprises | Adequate funds for technology research and development | 1. [82] 2. [83] | |

| Infrastructure Environment | Nanjing LCD Valley takes planning as the guide, takes advanced generation LCD panel project as the core, introduces upstream and downstream supporting projects, and constructs LCD industrial clusters with perfect industrial support, a high degree of industrial cluster, strong innovation ability, proprietary intellectual property rights, domestic and international orientation. | Introducing supporting projects, Improving the industrial chain, LCD industry cluster | Improvement of industrial chain | [84] | |

References

- Dess, G.G.; Picken, J.C. Changing roles: Leadership in the 21st century. Organ. Dyn. 2000, 28, 18–34. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Appleyard, M.M. Open Innovation and Strategy. Calif. Manag. Rev. 2007, 50, 57–76. [Google Scholar] [CrossRef]

- Lee, S.; Park, G.; Yoon, B.; Park, J. Open innovation in SMEs—An intermediated network model. Res. Policy 2010, 39, 290–300. [Google Scholar] [CrossRef]

- Bing, S.; Daming, Z. How to Construct Enterprises’ Technology Innovation Ecosystem: From the Perspective of Core Enterprise. J. Bus. Econ. 2011, 1, 36–43. [Google Scholar]

- Figueiredo, P.N. Beyond technological catch-up: An empirical investigation of further innovative capability accumulation outcomes in latecomer firms with evidence from Brazil. J. Eng. Technol. Manag. 2014, 31, 73–102. [Google Scholar] [CrossRef]

- Choung, J.Y.; Hwang, H.R.; Song, W. Transitions of Innovation Activities in Latecomer Countries: An Exploratory Case Study of South Korea. World Dev. 2014, 54, 156–167. [Google Scholar] [CrossRef]

- Yao, M.; Wu, D.; Wu, X.; Fan, Y. Co-evolution of business model design and technology innovation strategy in the process of technological catch-up—A case study of Alibaba Group. Sci. Res. Manag. 2017, 38, 48–55. [Google Scholar]

- Hu, H.; Zhang, L. Catch-Up of Chinese Pharmaceutical Firms Facing Technological Complexity. Int. J. Innov. Technol. Manag. 2015, 12, 295–313. [Google Scholar] [CrossRef]

- Peng, X.; Zheng, S.; Wu, X.; Wu, D. How to Catch Up to the Frontier for Later-Developing Enterprises? From the Perspective of Dual Learning. Manag. World 2017, 2, 142–158. [Google Scholar]

- Zheng, G.; Guo, Y.; Luo, G.; Zhao, K.; Liu, C. Technological catch-up, dynamic capabilities and innovation capabilities: A case study of CIMC Tank Container. Sci. Res. Manag. 2016, 37, 31–41. [Google Scholar]

- Mei, L.; Chen, J.; Liu, Y. Innovation ecosystem: Origin, knowledge evolution and theoretical framework. Stud. Sci. Sci. 2014, 32, 1771–1780. [Google Scholar]

- Chesbrough, H.; Kim, S.; Agogino, A. Chez panisse: Building an open innovation ecosystem. Calif. Manag. Rev. 2014, 56, 144–171. [Google Scholar] [CrossRef]

- Xia, Q.; Chen, C. Business Ecosystem Reconstruction of Chinese Incumbent Manufacturing Firms. Chin. J. Manag. 2016, 13, 165–172. [Google Scholar]

- Li, Q.; Gu, X.; Zhao, C. Research Summary of Innovation Ecosystem: A Hierarchical Analysis Framework. Sci. Manag. Res. 2016, 34, 14–17. [Google Scholar]

- Adner, R. Match your innovation strategy to your innovation ecosystem. Harv. Bus. Rev. 2006, 84, 98–107. [Google Scholar]

- Jiang, S.; Lu, P.; Chen, J. Literature Review on Enterprise Innovation Ecosystem: From Perspective of Core Enterprise. Technol. Econ. 2015, 34, 18–23. [Google Scholar]

- Ouyang, T.; Hu, J.; Li, Y.; Zhou, N.; Guo, H. Study on Innovation Ecosystem Dynamic Evolution of DFH Minisatellite Aerospace Complex Product: The Alignment Perspective of Strategic Logic and Organizational Cooperation. Chin. J. Manag. 2015, 12, 546–557. [Google Scholar]

- Wang, H.; Wang, Y.; Wu, J.; Liu, J. Evolution Mechanism of Innovation Ecosystem for New Energy Vehicles: Case of BYD New Energy Vehicles. China Soft Sci. 2016, 4, 81–94. [Google Scholar]

- Oh, D.S.; Phillips, F.; Park, S.; Lee, E. Innovation ecosystems: A critical examination. Technovation 2016, 54, 1–6. [Google Scholar] [CrossRef]

- Clarysse, B.; Wright, M.; Bruneel, J.; Mahajan, A. Creating value in ecosystems: Crossing the chasm between knowledge and business ecosystems. Res. Policy 2014, 43, 1164–1176. [Google Scholar] [CrossRef]

- Gay, B.; Dousset, B. Innovation and network structural dynamics: Study of the alliance network of a major sector of the biotechnology industry. Res. Policy 2005, 34, 1457–1475. [Google Scholar] [CrossRef]

- Cassiman, B.; Valentini, G. Open innovation: Are inbound and outbound knowledge flows really complementary? Strateg. Manag. J. 2016, 37, 1034–1046. [Google Scholar] [CrossRef]

- Wu, S.; Gu, X. The Governance Model Selection of Strategic Emerging Industrial Innovation Ecosystem’s Collaborative Innovation. RD Manag. 2014, 26, 13–21. [Google Scholar]

- Neslen, A. EU Calls for Urgency in ‘Seriously Lagging’ Paris Climate Talks. Available online: http://www.theguardian.com/environment/2015/aug/20/paris-climate-talks-seriously-lagging-eucalls-urgency (accessed on 20 August 2015).

- Taminiau, J.; Nyangon, J.; Lewis, A.S.; Byrne, J. Sustainable business model innovation: Using polycentric and creative climate change governance. In Collective Creativity for Responsible and Sustainable Business Practice; IGI Global: Hershey, PA, USA, 2017; pp. 140–159. [Google Scholar]

- Nyangon, J.; Byrne, J. Diversifying electricity customer choice: REVing up the New York energy vision for polycentric innovation. Energy Syst. Environ. 2018, 3–24. [Google Scholar] [CrossRef]

- Liu, Z.; Liu, S. Polycentric Development and the Role of Urban Polycentric Planning in China’s Mega Cities: An Examination of Beijing’s Metropolitan Area. Sustainability 2018, 10, 1588. [Google Scholar] [CrossRef]

- Kaplan, S. Framing Contests: Strategy Making under Uncertainty. Organ. Sci. 2008, 19, 729–752. [Google Scholar] [CrossRef]

- Yan, H. Natural Selection in Financial Markets: Does it Work? Manag. Sci. 2008, 54, 1935–1950. [Google Scholar] [CrossRef]

- Wu, C.; Zhao, J.; Wang, Y. A Review on Industrial Eco-System of Technological Innovation. Sci. Sci. Manag. S T 2013, 34, 115–123. [Google Scholar]

- Robert, K.Y. Case Study Research: Design and Methods; Chongqing University Press: Chongqing, China, 2010. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory Building from Cases: Opportunities And Challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Laamanen, T.; Wallin, J. Cognitive Dynamics of Capability Development Paths. J. Manag. Stud. 2009, 46, 950–981. [Google Scholar] [CrossRef]

- Ying, G. Thirty Years of Development of Flat Panel Display Technology in China. Advances Display. 2009, 2, 6–16. [Google Scholar]

- Gu Jianbing. CEC Nanjing Reorganization Ended: Five Billion Fattening Panda Electronics in Three Years. 21st Century Business Herald. Available online: http://it.sohu.com/20070517/n250070585.shtml (accessed on 17 May 2007).

- Yu, D. CEC Reorganizes Seven Electronic Enterprises in Nanjing – Problem of Panda Electronics to Be Solved. Economic Observer. Available online: http://www.eeo.com.cn/2007/0518/63832.shtml (accessed on 21 May 2007).

- Ma, L.; Liu, M. The Electronic Industry Is Expected to Become A “Leader” Again After Upgrading. Nanjing Daily. Available online: http://xuewen.cnki.net/CCND-NJRB20150401A013.html (accessed on 1 April 2015).

- Liang, Y. Behind the Investment Tide of the High Generation Panel. Household Appliance 2009, 10, 62–68. [Google Scholar]

- Gu, H.; Liu, M. Focus on The Construction of the 6th Generation of The LCD Valley. Nanjing Daily. Available online: http://xuewen.cnki.net/CCND-NJRB20110329A014.html (accessed on 29 March 2011).

- Web of ZOL News Center. Available online: http://www.cecpanda.com/SJTCMS/html/CECPANDA/subcompany_yejingxianshi.shtml (accessed on 24 March 2010).

- China Electronics (CEC) Panda. Introduction to the 6th generation LCD panel project of CEC Panda. Available online: https://wenku.baidu.com/view/505c1ae16294dd88d0d26b9c.html (accessed on 22 June 2010).

- Official website of Nanjing Flat Panel Industry Association. Available online: http://www.fpdchina.com/ (accessed on 18 December 2009).

- Tao, J. Report on the High Generation LCD Panel Project of CEC Panda Group. The Flat Panel Displays, the Upstream and Downstream Industrial Technology Market Docking Exchange Meeting. Available online: http://cpfd.cnki.com.cn/Article/CPFDTOTAL-DZSC201411001001.htm (accessed on 21 November 2014).

- Zheng, X. Analysis of the role of government subsidies in the innovation and development of BOE. Financ. Account. 2019, 10, 70–71. [Google Scholar]

- Ma, L.; Shao, Y. The Influence of Organizational Learning Balance and Alliance Combination Network Matching on Technical Capability in Secondary Innovation - A Case Study of BOE from 1993 to 2018. Chin. J. Manag. 2019, 16, 810–820. [Google Scholar]

- Bai, Y. Without leading enterprises - China will lose the LCD Era. People’s Daily Market News. Available online: http://www.techweb.com.cn/news/2005-09-19/21701.shtml (accessed on 19 September 2005).

- Wu, D. Domestic TV manufacturers strive for the upper reaches. Shenzhen Special Zone Daily. Available online: http://finance.sina.com.cn/roll/20070619/05001482714.shtml (accessed on 19 June 2007).

- Wang, F. Chinese game of high generation line of LCD panel. New Economy Weekly. 2011, 7, 52–55. [Google Scholar]

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/jrzg/2006-02/09/content_183787.htm (accessed on 9 February 2006).

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/gzdt/2007-12/18/content_837613.htm (accessed on 18 December 2007).

- Web of General Office of the National Development and Reform Commission of the People’s Republic of China. Available online: http://bgt.ndrc.gov.cn (accessed on 6 December 2007).

- Web of General Office of the State Council. Available online: http://www.gov.cn/zhengce/index.htm (accessed on 1 January 2008).

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwhd/2008-04/17/content_947090.htm (accessed on 17 April 2008).

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwgk/2009-04/15/content_1282430.htm (accessed on 15 April 2009).

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwgk/2009-06/02/content_1330068.htm (accessed on 2 June 2009).

- Web of Nanjing Municipal Commission of Development & Reform. Available online: http://fgw.nanjing.gov.cn (accessed on 20 July 2007).

- Web of Nanjing Municipal Government. Available online: http://www.nanjing.gov.cn/xxgkn/zcfgk/ (accessed on 23 October 2008).

- Web of Nanjing Municipal Government. Available online: http://www.chinalawedu.com/falvfagui/fg22016/229642.shtml (accessed on 27 February 2006).

- Zhang, L. Revitalizing old brands and making new achievements. Nanjing Daily. Available online: http://xuewen.cnki.net/CCND-NJRB20080607A015.html (accessed on 7 June 2008).

- Wang, T. China Electronics Group enters Nanjing Panda. China Securities Journal. Available online: http://business.sohu.com/20070516/n250043191.shtml (accessed on 16 May 2007).

- Cui, J. Ten years of LCD: dignity and misunderstanding. China Econ. Inf. 2013, 16, 28–39. [Google Scholar]

- Wang, X.; Gu, H. Building LCD Valley and revitalizing electronics industry in Nanjing. Nanjing Daily. Available online: http://xuewen.cnki.net/CCND-NJRB20100503A013.html (accessed on 3 May 2010).

- Web of the central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwgk/2010-10/18/content_1724848.htm (accessed on 18 October 2010).

- Web of National Development and reform Commission. Available online: http://www.ndrc.gov.cn/rdzt/zdtzgg/ (accessed on 6 August 2010).

- Web of National Development and Reform Commission. Available online: http://www.ndrc.gov.cn/zcfb/zcfbgg/201110/t20111020_439315.html (accessed on 20 October 2011).

- Web of the Central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwgk/2012-01/18/content_2047619.htm (accessed on 18 January 2012).

- Web of Ministry of Industry and Information Technology of the People’s Republic of China. Available online: www.miit.gov.cn (accessed on 24 February 2012).

- Web of Electronic information industry. Available online: http://www.cena.com.cn/industrynews/20120228/31419.html (accessed on 28 February 2012).

- Web of the Central People’s Government of the People’s Republic of China. Available online: http://www.gov.cn/zwgk/2012-07/20/content_2187770.htm (accessed on 20 July 2012).

- Web of Ministry of Science and Technology of the People’s Republic of China. Available online: http://www.most.gov.cn/kjzc/zdkjzcjd/201209/t20120917_96796.htm (accessed on 17 September 2012).

- Web of Nanjing Municipal Government. Available online: http://www.nanjing.gov.cn/xxgkn/zcfgk/ (accessed on 29 October 2009).

- Web of Nanjing Municipal Government. Available online: http://www.nanjing.gov.cn/zdgk/201202/t20120229_1055751.html (accessed on 20 February 2012).

- Web of Nanjing Municipal Government. Available online: http://www.nanjing.gov.cn/zdgk/200906/t20090605_1055296.html (accessed on 4 June 2009).

- Hu, M.; Liang, L. Co-constructed a high generation LCD panel production line. China Electronics News. Available online: http://xuewen.cnki.net/CCND-CDZB200909010011.html (accessed on 1 September 2009).

- China Electronics Corporation. The world’s first 8.5-generation IGZO LCD panel production line project is put into operation. ChinaSOE 2015, 4, 11. [Google Scholar]

- National Development and Reform Commission of the People’s Republic of China. Available online: http://www.gov.cn/xinwen/2014-03/20/content_2642228.htm (accessed on 20 March 2014).

- National Development and Reform Commission of the People’s Republic of China. Available online: http://www.miit.gov.cn/n1146295/n1652858/n1652930/n3757021/c3758342/content.html (accessed on 14 December 2015).

- Jiangsu Provincial People’s Government. Available online: http://www.jiangsu.gov.cn/art/2012/12/14/art_65017_345697.html (accessed on 14 December 2012).

- Web of Nanjing Municipal Government. Available online: http://jsnews2.jschina.com.cn/system/2016/05/06/028590321.shtml (accessed on 6 May 2016).

- Web of Zhonggu Law. Available online: http://www.9ask.cn/fagui/201507/253962_1.html (accessed on 16 July 2015).

- Web of Nanjing Municipal Government. Available online: http://www.nanjing.gov.cn/zdgk/201404/t20140415_1056119.html (accessed on 20 March 2014).

- Wang, Y. Huadong Technology plans to raise 10 billion yuan to invest in CEC Panda 8.5 generation line. First Financial Daily. Available online: http://tech.sina.com.cn/e/2014-07-23/09009512255.shtml (accessed on 23 July 2014).

- Web of China Finance. Available online: http://finance.china.com.cn/roll/20131121/1988361.shtml (accessed on 21 November 2013).

- Web of Huaqiang Electronics. Available online: https://tech.hqew.com/news_706849 (accessed on 10 August 2016).

| Year | Event |

|---|---|

| 2007 | The restructured China Electronics (CEC) Panda Group was established in Nanjing |

| 2009 | Signed an import agreement with Sharp for the 6th generation Liquid Crystal Display (LCD) panel production line project |

| 2010 | Establishment of Nanjing Flat Plate Industry Association by joint Sharp Company and relevant research institutions and universities |

| 2011 | The 6th generation LCD panel production line project completed and put into operation |

| 2012 | Jointly with Fudan University to establish “China Electric Panda-Fudan University Flat Panel Display Technology Research Center” |

| 2013 | 1. Complete the localization of most materials needed for LCD panel production 2. Startup the 8.5th generation production line project |

| 2014 | Invested 1.535 billion to build flat panel display engineering technology research center |

| 2015 | The 8.5th generation LCD panel production line project completed and put into operation |

| 2016 | Launched the world’s first 98-inch 8K LCD TV named “Heaven View” with IGZO Technology |

| Year | Employees | Master Degree or Above | College Degree or Above | Administrative Staff | Sales Staff | Production Staff | R & D Staff | Financial Staff |

|---|---|---|---|---|---|---|---|---|

| 2005 | 2025 | 35 | 924 | 288 | 39 | 1122 | 511 | 65 |

| 2006 | 1999 | 36 | 944 | 277 | 42 | 1158 | 457 | 65 |

| 2007 | 1900 | 31 | 802 | 173 | 210 | 864 | 578 | 75 |

| 2008 | 3262 | 50 | 1579 | 264 | 349 | 1523 | 137 | |

| 2009 | 3276 | 83 | 1558 | 265 | 353 | 1534 | 985 | 139 |

| 2010 | 3147 | 63 | 1359 | 265 | 1369 | 1038 | 145 | |

| 2011 | 3305 | 82 | 1349 | 270 | 358 | 1381 | 1099 | 156 |

| 2012 | 3378 | 88 | 1330 | 279 | 302 | 1548 | 1101 | 148 |

| 2013 | 3303 | 109 | 1267 | 273 | 322 | 1437 | 1113 | 158 |

| 2014 | 4138 | 114 | 1857 | 342 | 340 | 1874 | 1394 | 188 |

| 2015 | 4079 | 158 | 1965 | 341 | 335 | 1807 | 1406 | 190 |

| 2016 | 3819 | 176 | 1902 | 321 | 315 | 1590 | 1400 | 193 |

| 2017 | 3831 | 183 | 1942 | 322 | 303 | 1576 | 1429 | 201 |

| Year | List of Major Cooperative Enterprises | Number of Domestic Cooperative Companies | Number of Foreign Cooperative Companies |

|---|---|---|---|

| 2005–2009 | Sharp Corporation | 0 | 1 |

| 2009–2013 | Sharp Corporation, Merck Corporation of Japan, Toppan Printing Co. Ltd., Toyota Motor Corporation, Sumitomo Chemical Co., Ltd., Dai Nippon Printing Co., Ltd., Nitto Group, CE Lighting, Solomon Systech Limited, Admiral Oversea Corporation | 7 | 3 |

| 2013–2017 | Sharp Corporation, Hefei IRICO Epilight Technology CO., Ltd., General Research Institute for Nonferrous Metals, Lida Optical and Electronic Co., Ltd., Kelead Photoelectric Materials Co., Ltd., Runma Chemical Co., Ltd., Beijing Asahi Electronic Materials Co. LTD., Slichem Display Material Co., Ltd., Shenzhen Shengbo Optoelectronics Technology Co., Ltd., Sunnypol Opto-electronice Co., Ltd | 1 | 10 |

| Innovation Subjects | ||||||

|---|---|---|---|---|---|---|

| Core Subjects | Auxiliary Subjects | |||||

| Core Enterprises | Related Cooperative Enterprise | Research Institutions | Government | Intermediaries | Financial Institutions | Science Park |

| CEC Panda Group (G6 Project) | Sharp Company | The National and Local Government | Bank | |||

| Innovation Subjects | ||||||

|---|---|---|---|---|---|---|

| Core Subjects | Auxiliary Subjects | |||||

| Core Enterprise | Related Cooperative Enterprise | Scientific Research Institution | Government | Intermediaries | Financial Institution | Science and Technology Park |

| CEC Panda LCD Company | Sharp, Japan Merck, Japan Toppan, Toyota, Sumitomo Chemical, etc. | Nanjing University of Science and Technology, Southeast University, Fudan University, Jiangsu Province (CEC Panda) Flat Panel Display Engineering Technology Research Center, etc. | National and local government | Nanjing Flat Panel Display Industry Association | Bank | LCD Valley |

| Innovation Subjects | ||||||

|---|---|---|---|---|---|---|

| Core Subjects | Auxiliary Subjects | |||||

| Core Enterprise | Related Cooperative Enterprise | Scientific Research Institution | Government | Intermediaries | Financial Institution | Science and Technology Park |

| CEC Panda LCD Company (G6), CEC Panda Tablets Company (G8.5) | Sharp, Hefei Rainbow, Beijing Youyan, Lida Optoelectronics, Collide, Jiangyin Runma, Beixu Electronics Chengzhi Yonghua, Shenzhen Shengbo, Shenzhen Sanlipu, etc. | Flat Panel Display Engineering Technology Research and Development Center | National and local government | Nanjing Flat Panel Display Industry Association | Bank | LCD Valley |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gan, J.; Qi, Y.; Tian, C. The Construction and Evolution of Technological Innovation Ecosystem of Chinese Firms: A Case Study of LCD Technology of CEC Panda. Sustainability 2019, 11, 6373. https://doi.org/10.3390/su11226373

Gan J, Qi Y, Tian C. The Construction and Evolution of Technological Innovation Ecosystem of Chinese Firms: A Case Study of LCD Technology of CEC Panda. Sustainability. 2019; 11(22):6373. https://doi.org/10.3390/su11226373

Chicago/Turabian StyleGan, Jingxian, Yong Qi, and Chen Tian. 2019. "The Construction and Evolution of Technological Innovation Ecosystem of Chinese Firms: A Case Study of LCD Technology of CEC Panda" Sustainability 11, no. 22: 6373. https://doi.org/10.3390/su11226373

APA StyleGan, J., Qi, Y., & Tian, C. (2019). The Construction and Evolution of Technological Innovation Ecosystem of Chinese Firms: A Case Study of LCD Technology of CEC Panda. Sustainability, 11(22), 6373. https://doi.org/10.3390/su11226373