Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC)

Abstract

:1. Introduction

2. Literature Review

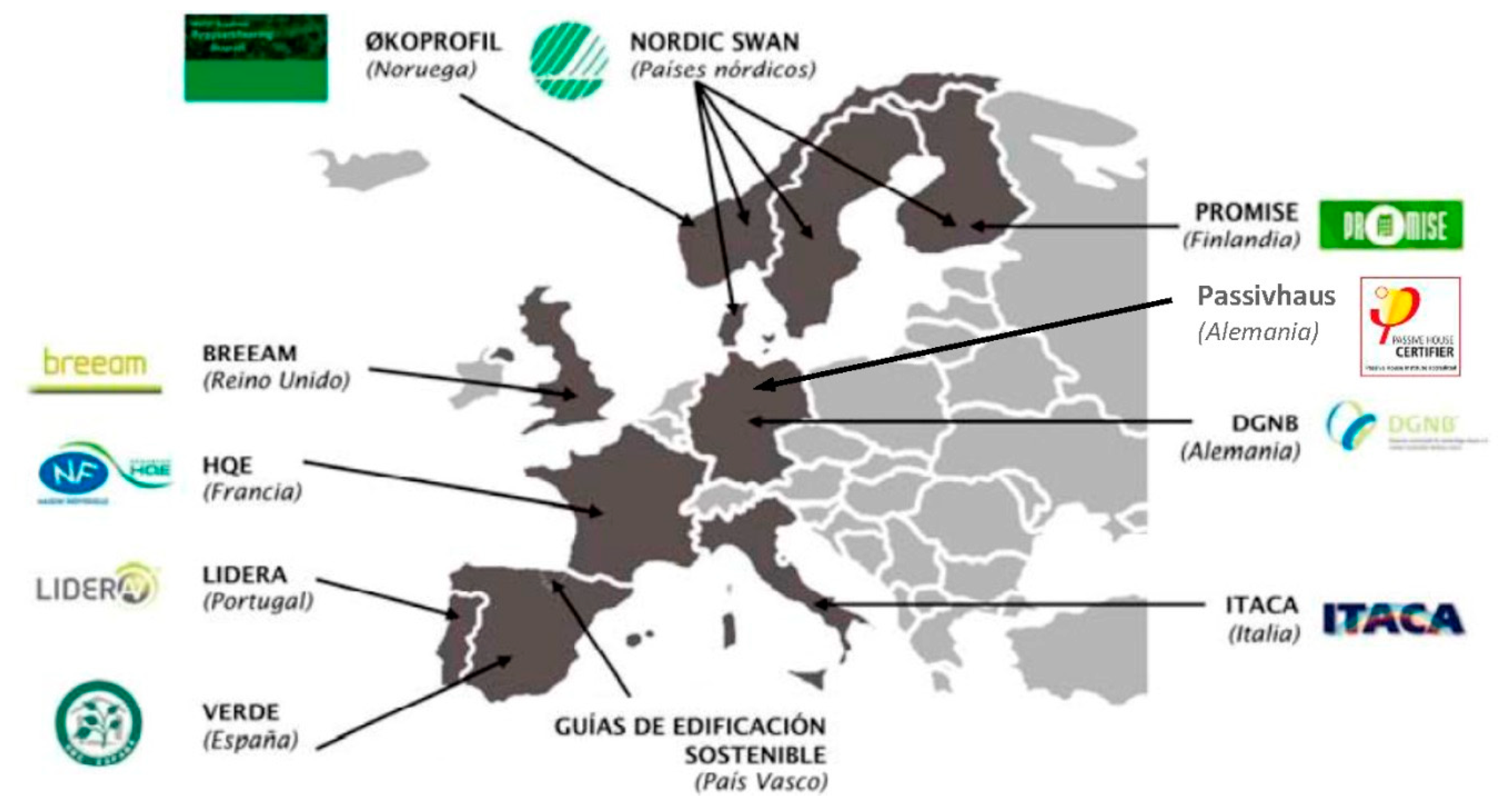

2.1. Energy Certificates

2.2. Background Information

3. Materials and Methods

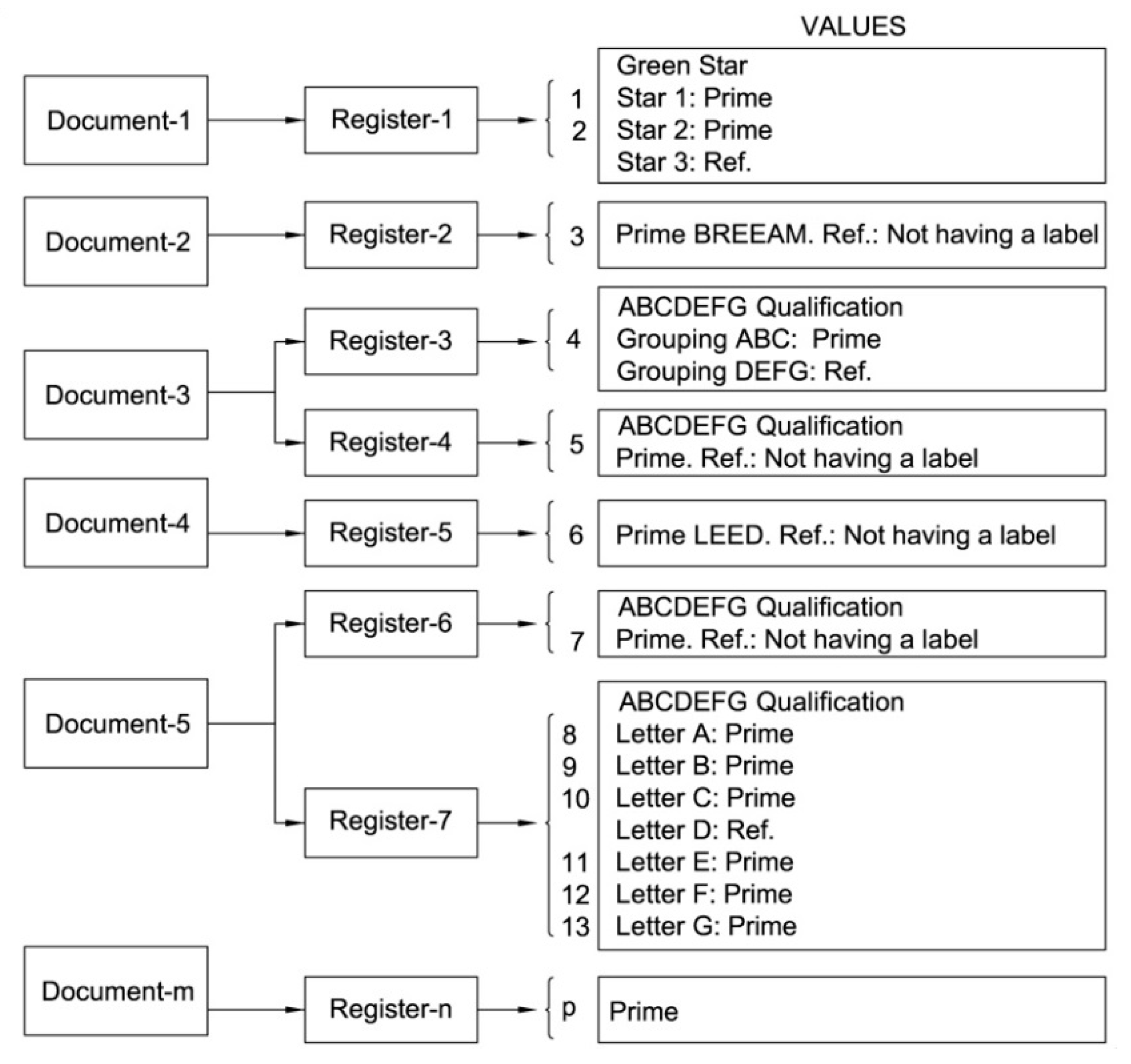

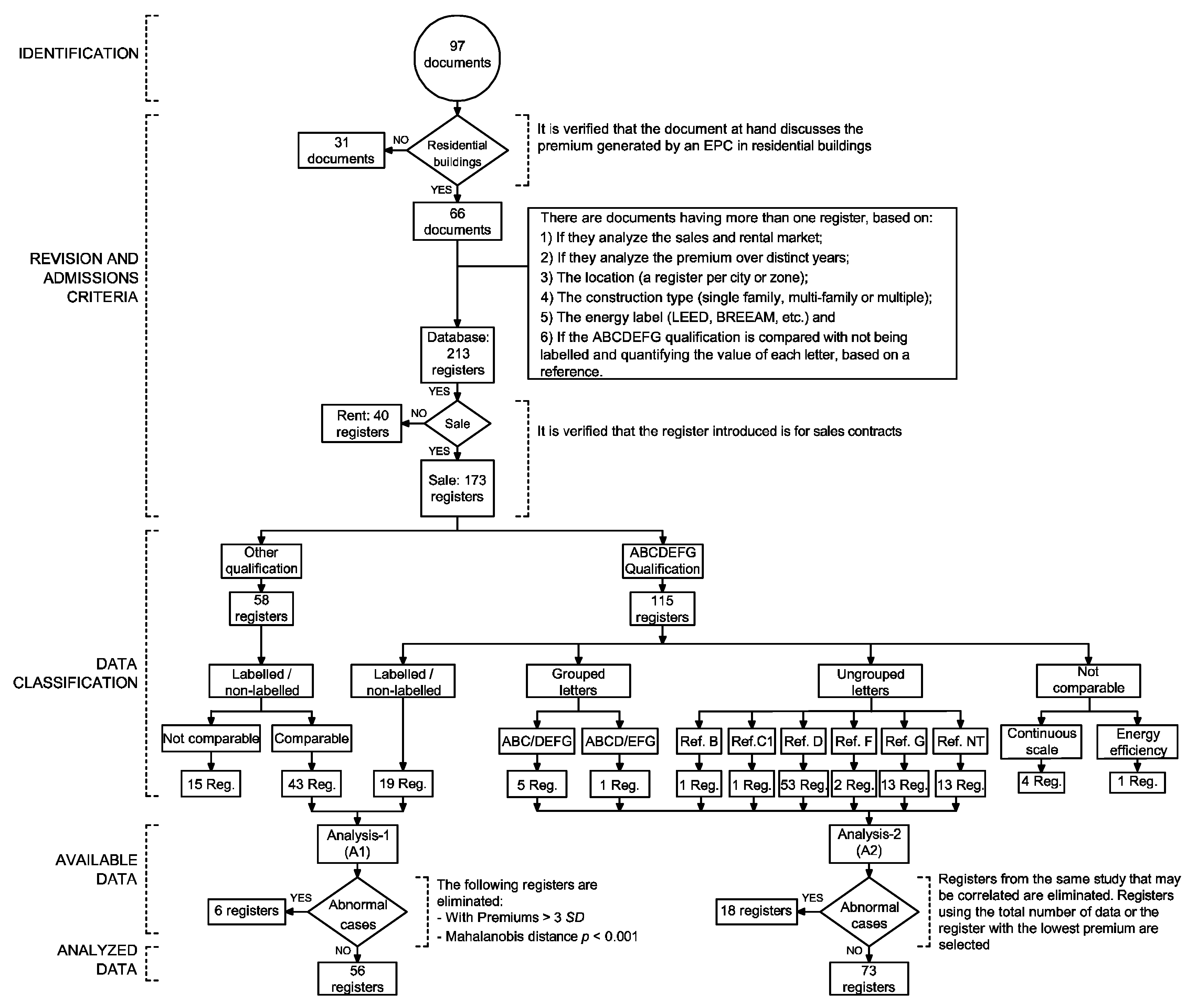

3.1. Search and Selection Criteria

3.2. Selection Criteria

3.3. Measure of Effect

3.4. Assessment of the Quality of the Information Available in the Studies

- If the document offers information on:

- The standard error (SE), it is scored with a 10;

- The Student’s t test, it is scored with a 10;

- The sample size and these values are between: 1000–10,000; 10,000–100,000, or are greater than 100,000, it is scored with a 5.0, 7.5 or 10, respectively; if the study does not report on the sample size or if it is less than 1000, it is scored with a 0; and

- The coefficient of determination, if reporting the R2adj, it is scored with a 10; if the R2 is provided, it is scored with a 5;

- If the effect size (f2) is greater than 0.35, 0.50, or 0.8, it is scored with a 5, 7.5, or 10, respectively, if not, or if it is lower than 0.35, it is scored with a 0.

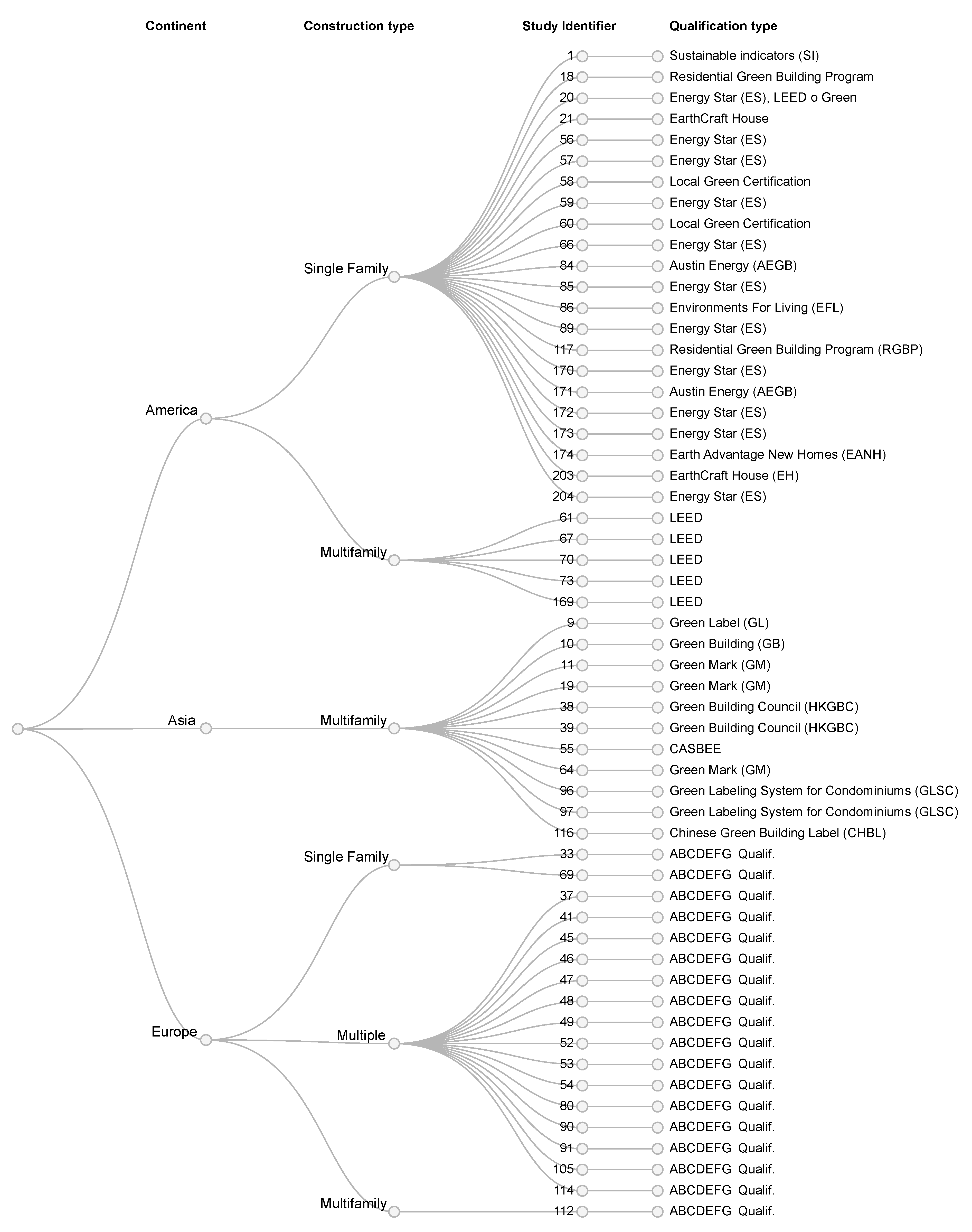

3.5. Data Classification

- -

- Analysis-1 (A1) which analyzes the impact on the prices of housing with an EPC as compared to housing without qualification, for both the ABCDEFG qualification (19 registers), as well as other qualifications (43 registers);

- -

- Analysis-2 (A2) analyzing the impact on the prices of housing with the ABCDEFG qualification (91 registers).

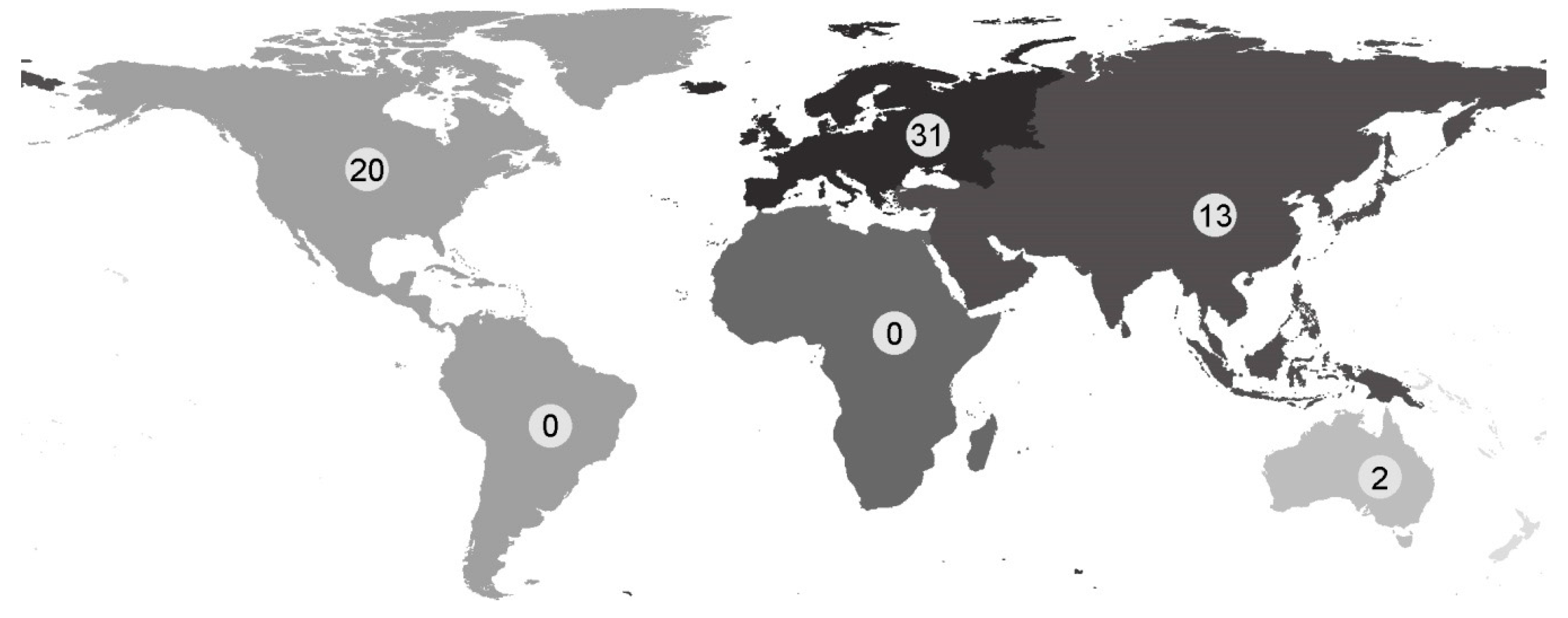

3.6. Geographical Framework

3.7. Available Data

3.7.1. Analysis-1

3.7.2. Analysis-2

3.8. Methodology

3.8.1. Analysis-1

- Q is the test of the X2 to assess the heterogeneity of the studies included in a meta-analysis, where the magnitude of the effect of each individual study is compared with the combined estimator;

- k − 1 are the degrees of freedom, where k is the number of studies.

- is the dependent variable or the measurement of the effect (Premium_EPC), obtained from the results of the distinct registers analyzed, from i = 1, …, k;

- is the error committed in the observation i upon approaching ;

- , is the fixed overall effect, which may be estimated with a weighted mean of the individual effects of each study:

- are the weights or weighting carried out by the inverse variance method (;

- is the variance of each estimator of the meta-sample.

- is the dependent variable or measurement of the effect (Premium_EPC), obtained from the results of the distinct registers analyzed, from i = 1, …, k;

- is the effect to estimate in the ith study of the meta-sample;

- is the error committed in the observation i upon approaching ;

- is the fixed overall effect that can be estimated as a weighted mean of the individual effects of each study:

- wi is the weight associated with each estimator of the sample ();

- is the variance of each estimator of the meta-sample;

- is the variance between studies.

3.8.2. Analysis-2

4. Results

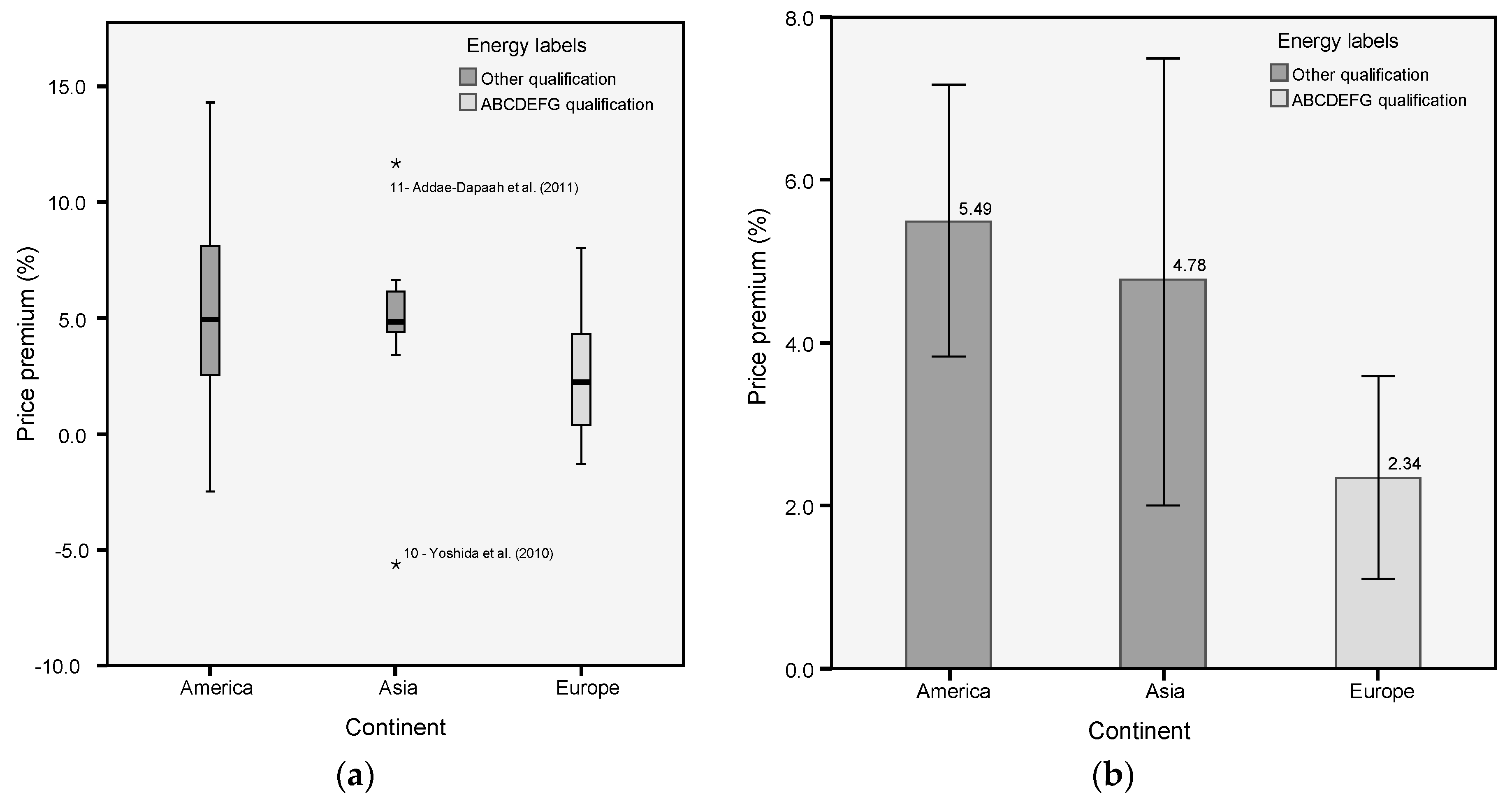

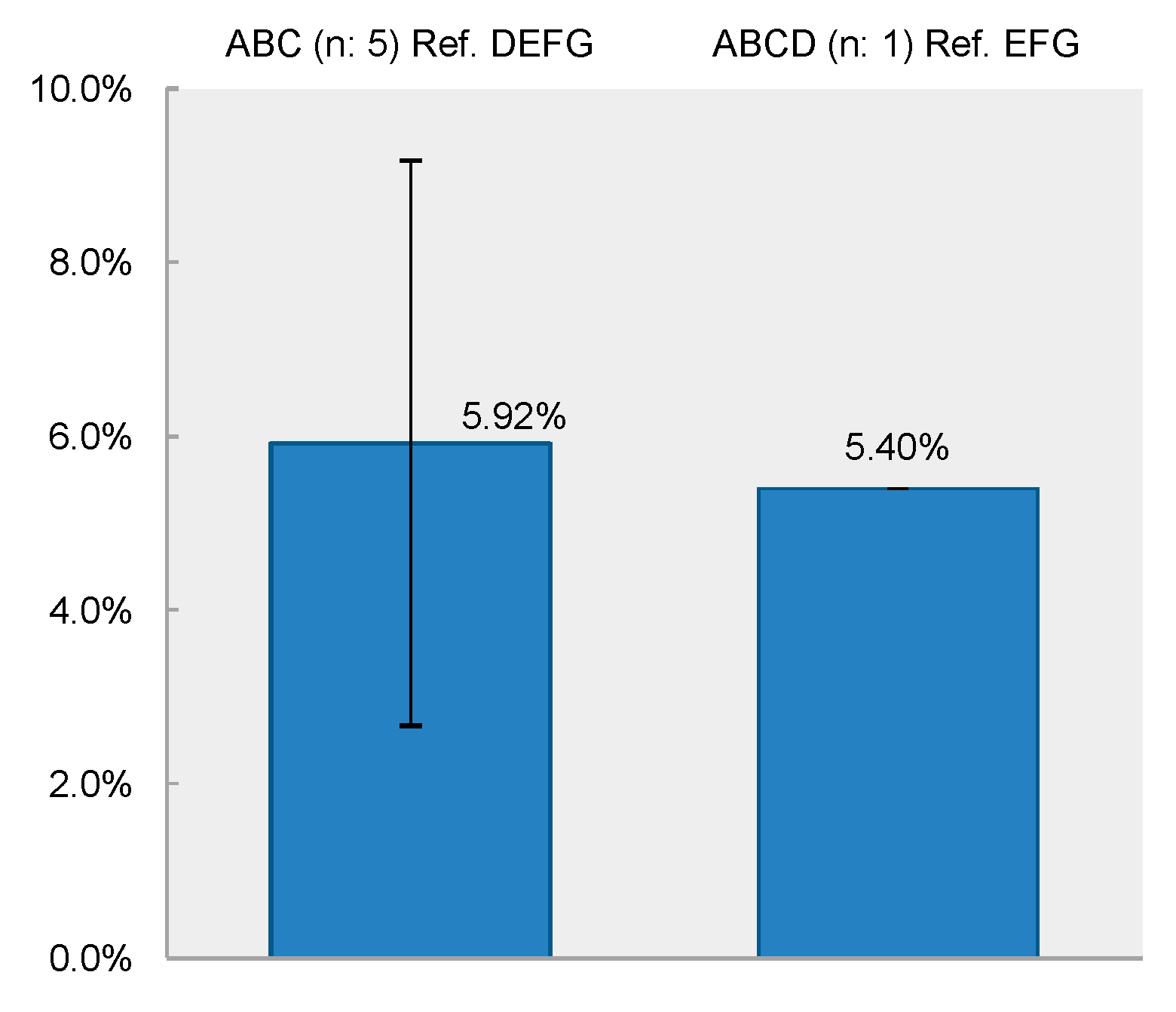

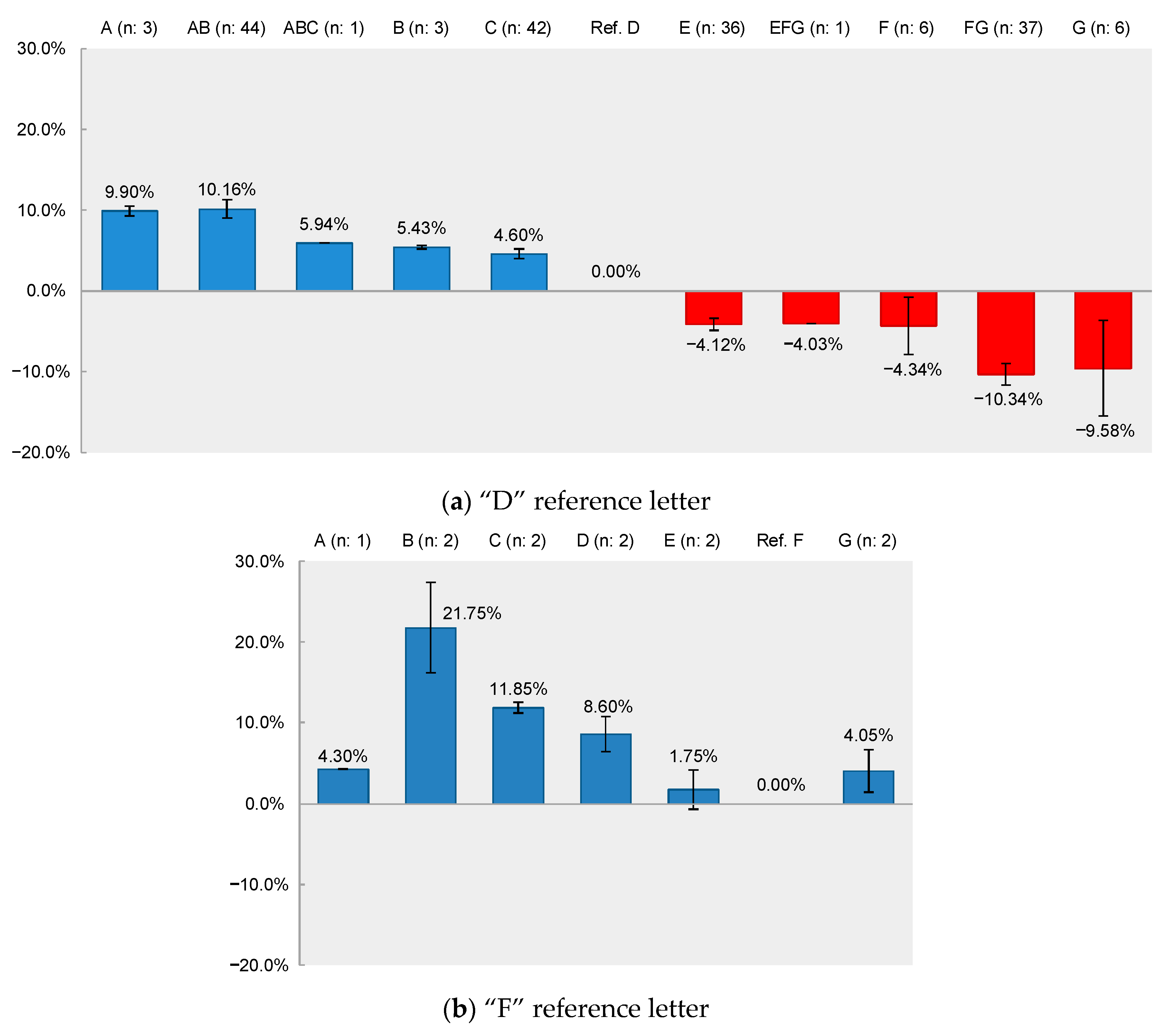

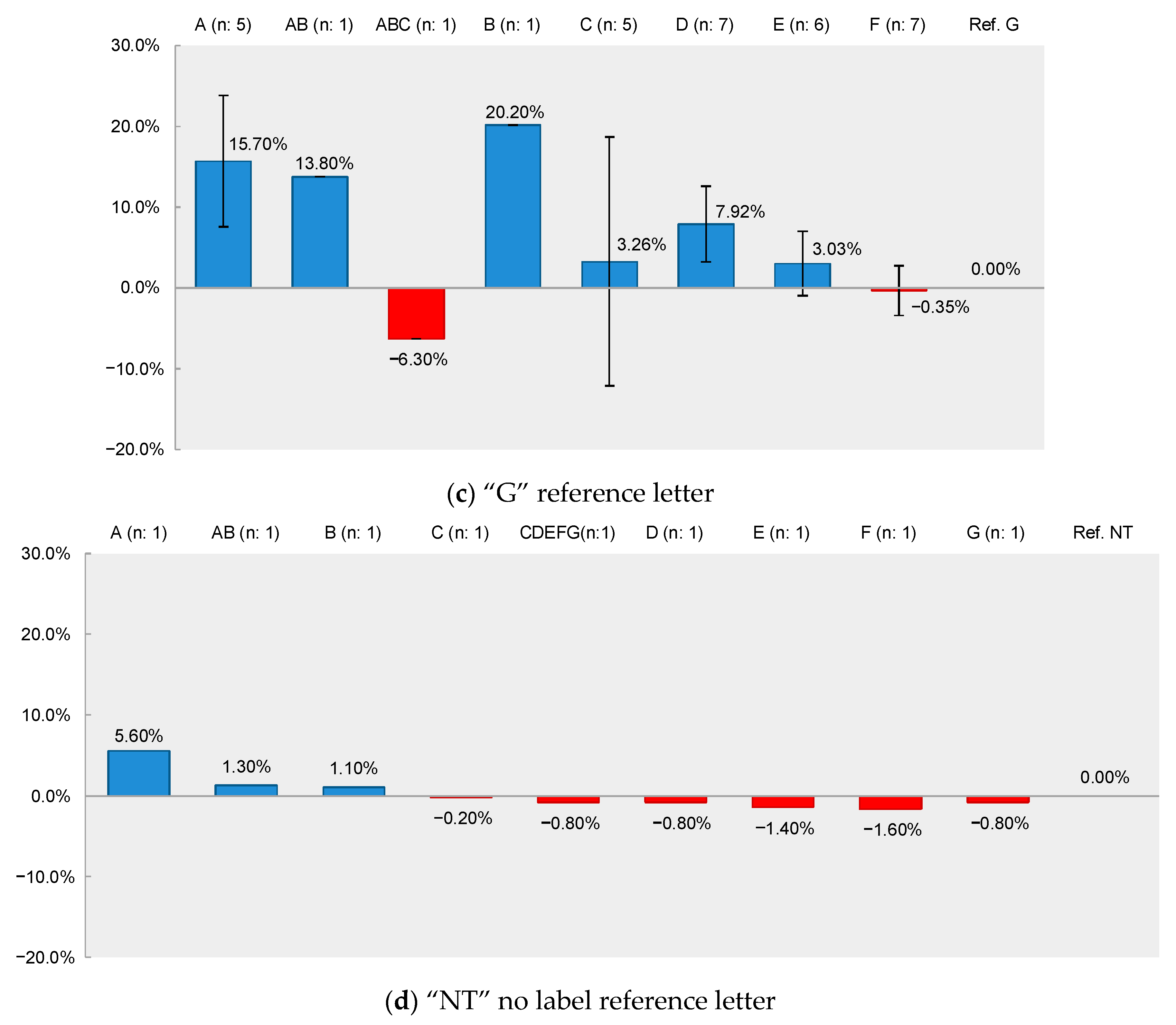

4.1. Analysis-1: Analysis of the Impact on Prices of Housing with an EPC as Compared to Housing without Qualifications

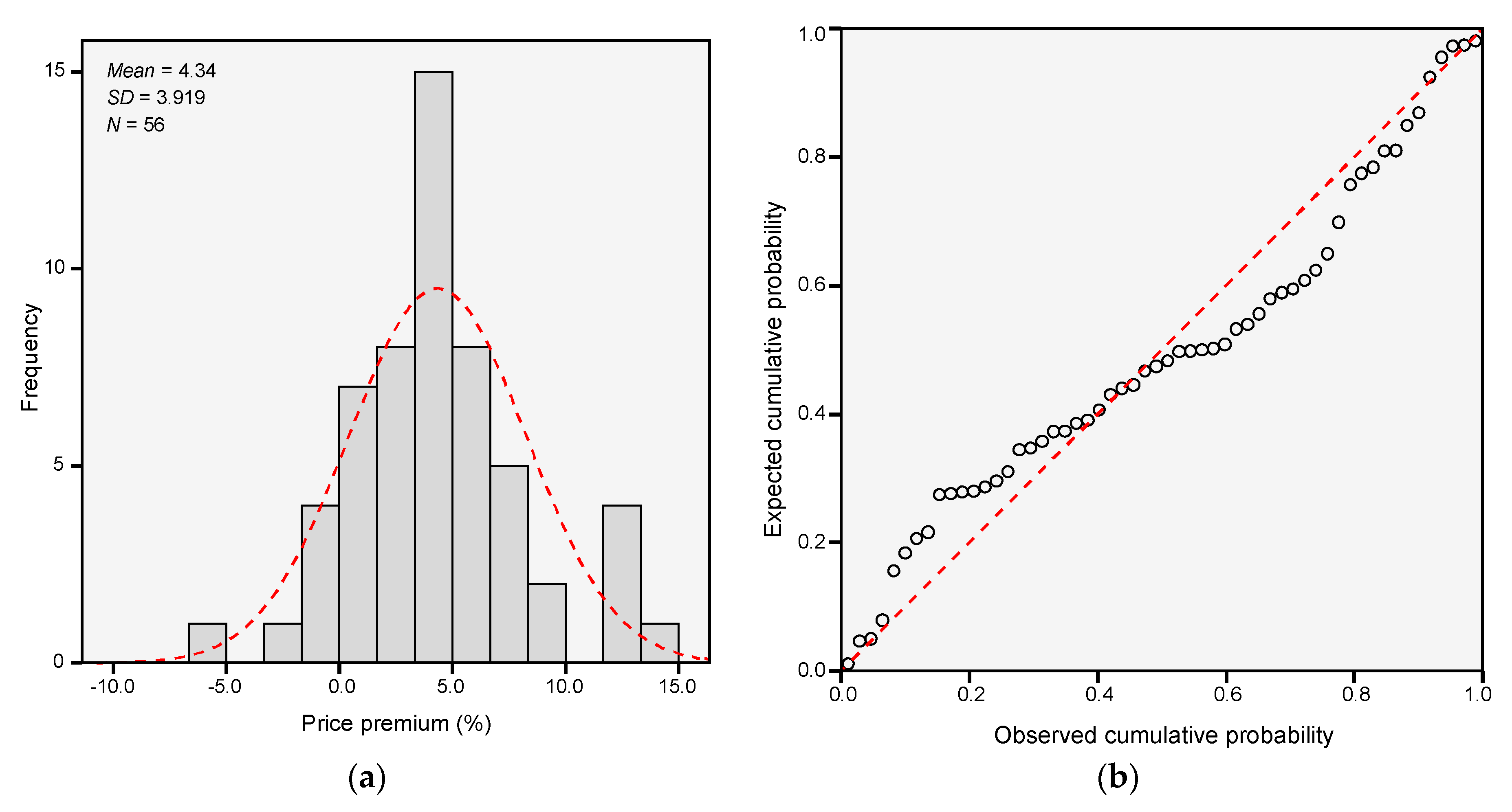

4.1.1. Normality and Heteroscedasticity

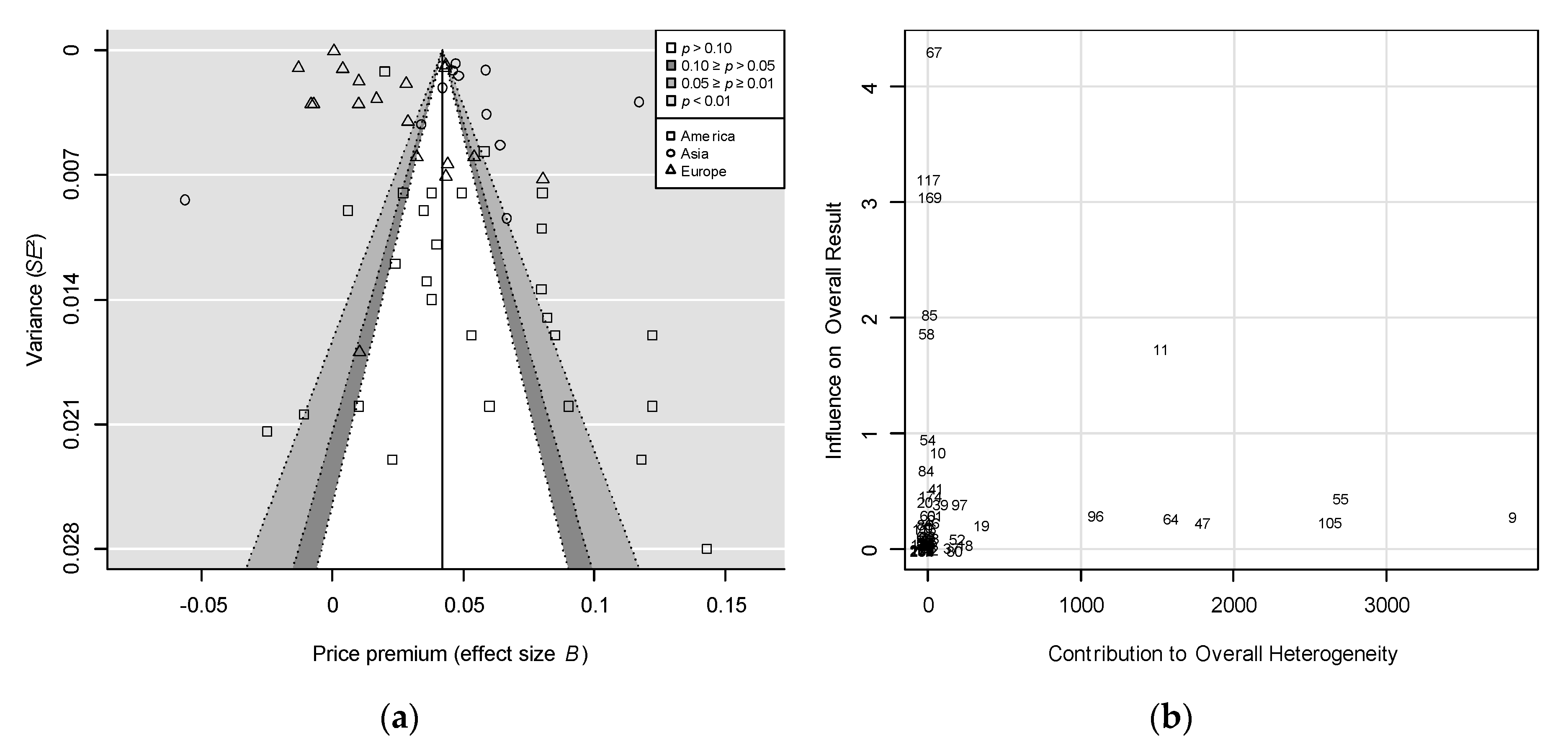

4.1.2. Heterogeneity and Publication Bias

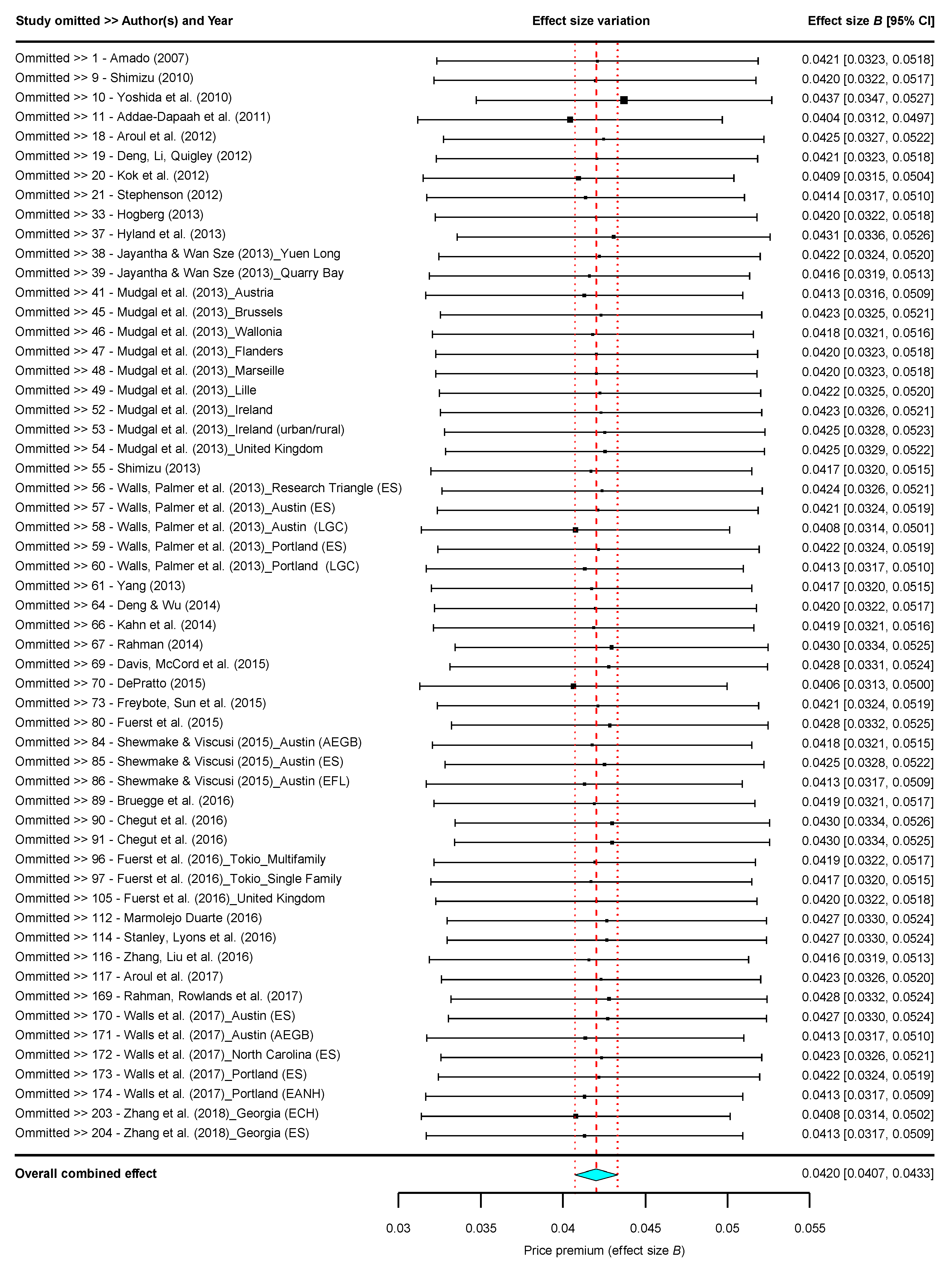

4.1.3. Sensitivity Analysis

4.1.4. Meta-Analysis

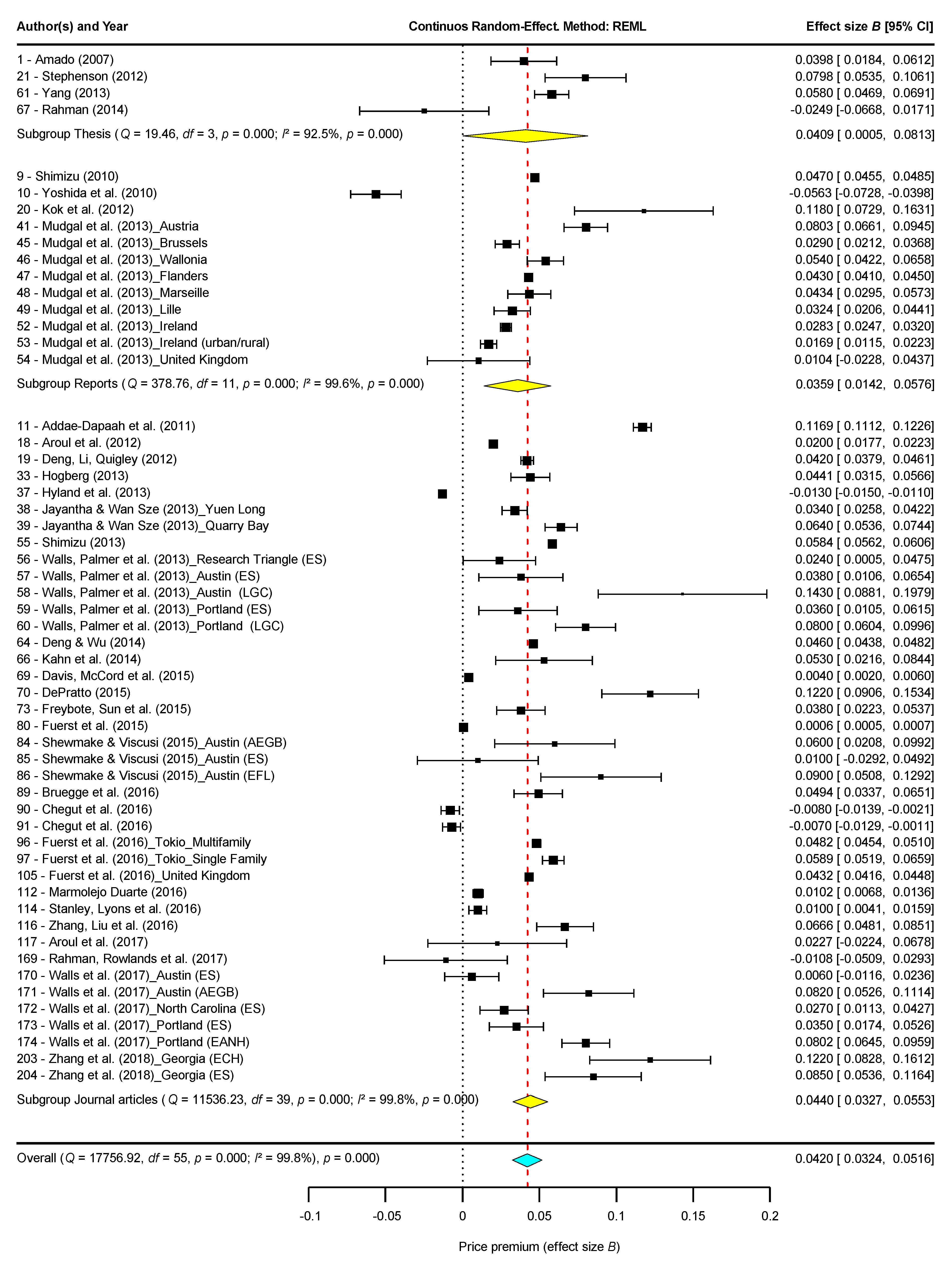

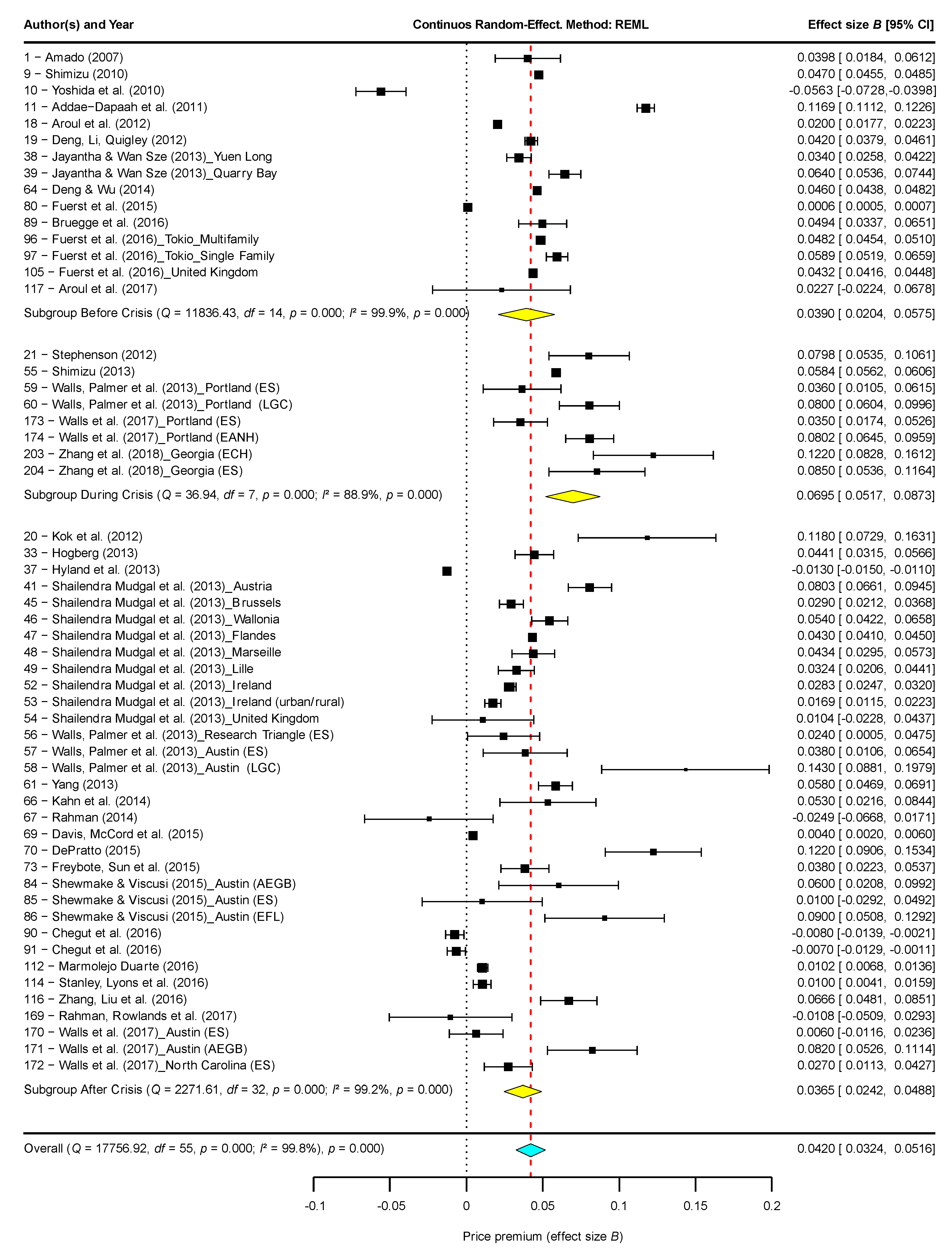

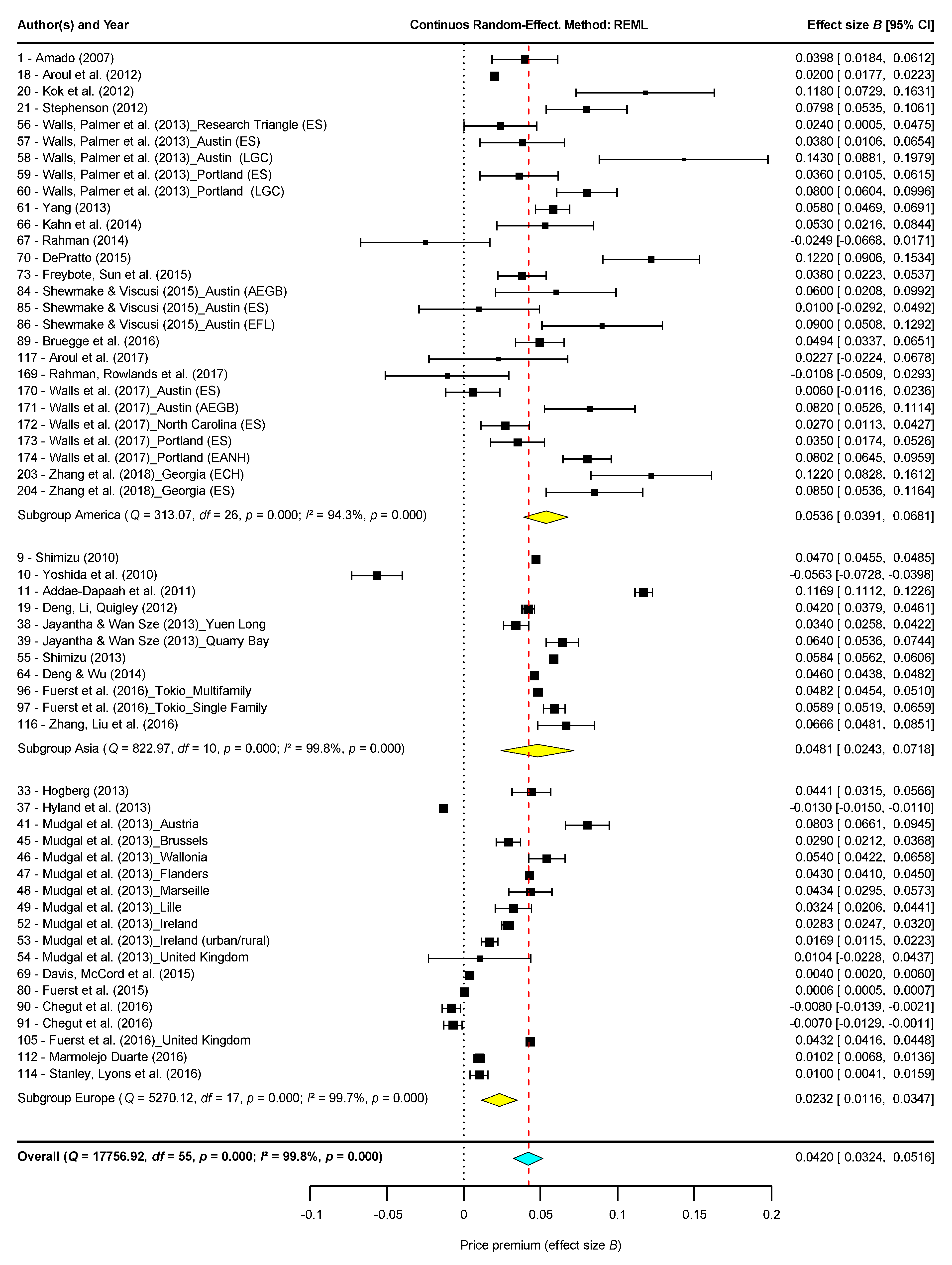

” Result of the combined effect, by sub-groups (type of study, data period or continents) and “

” Result of the combined effect, by sub-groups (type of study, data period or continents) and “  ” result of the overall combined effect, both are to be interpreted as the weighted average effect or “combined” effect size, obtained according to Equations (6) and (7). “¦” Red dashed line that represents the value of the overall combined effect.

” result of the overall combined effect, both are to be interpreted as the weighted average effect or “combined” effect size, obtained according to Equations (6) and (7). “¦” Red dashed line that represents the value of the overall combined effect.4.1.5. Meta-Regression

4.2. Analysis-2

5. Discussion

5.1. Analysis-1

5.2. Analysis-2

6. Conclusions

- Housing with an EPC has an overall combined effect on the sales price premium of 4.20% more than housing of similar characteristics that does not have this qualification;

- The housing location and the type of EPC condition the value of the premium, with significant differences existing between the continents that were analyzed, mainly America and Asia, as compared to Europe. It has been estimated that the highest premiums are found in America at 5.36% and in Asia with 4.81%, while in Europe they are 2.32%;

- That of the data obtained in the analyzed documents, a meta-regression was conducted with various estimators, considering, as in the literature, that the REML is the most appropriate. It is observed that the variable having the greatest influence on the price premium is type of energy qualification (Qualif_ABCDEFG), with a decrease of 5.4% (B = −0.054) in the EPC with ABCDEFG qualifications as compared to other qualification types, as a result of the previous conclusion;

- That in housing with ABCDEFG qualifications, where the premium is analyzed upon changing from one value to another within the scale, the results are not conclusive, but they do suggest a trend, with the highest qualifications having higher premiums.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Acronyms and Abbreviations

| AEGB | Austin Energy Green Building |

| Bayes | Bayes estimators |

| BCA | Building and Construction Authority |

| BRE Global | Building Research Establishment |

| BREEAM | Building Research Establishment’s Environmental Assessment Method |

| CASBEE | Comprehensive Assessment System for Building Environmental Efficiency |

| CI | Confidence Interval |

| DL | DerSimonian y Laird |

| EANH | Earth Advantage New Homes |

| ECH | Earth Craft House |

| EE | Energy efficiency |

| EFL | Environments for Living |

| EPC | Energy Performance Certificate |

| ES | Energy Star |

| GMC | Green Mark Certified |

| GMG | Green Mark Gold |

| GMGP | Green Mark Gold Plus |

| GMPL | Green Mark Platinum |

| HO | Hedges and Olkin |

| HPM | Hedonic Pricing Model |

| HS | Hunter and Schmidt |

| iiSBE | International Initiative for Sustainable Building Environment |

| JaGBC | Japan Green Building Council |

| JSBC | Japan Sustainable Consortium |

| LEED | Leadership in Energy & Environmental Design |

| LGC | Local Green Certification |

| ML | Maximum likelihood |

| MSE | Mean Squared Error |

| NABERS | National Australian Built Environment Rating System |

| REML | Restricted maximum likelihood |

| SBA | Sustainable Building Alliance |

| WGBC | World Green Building Council |

References

- International Energy Agency. World Energy Outlook 2016; IEA Publications: Paris, France, 2016; p. 15. [Google Scholar]

- IHOBE. Green Building Rating Systems: ¿Cómo Evaluar la Sostenibilidad en la Edificación? IHOBE Sociedad Pública de Gestión Ambiental: Bilbao, Spain, 2010; p. 72. [Google Scholar]

- BREGlobal Limited. BREEAM International New Construction 2016; BREGlobal Limited: Watford/Hertfordshire, UK, 2016. [Google Scholar]

- U.S. Green Building Council. LEED v4 for Homes Design and Construction; U.S. Green Building Council: Washington, DC, USA, 2013.

- The European Parliament and the Council of the European Union. Directive 2002/91/EC of the European Parliament and of the Council of 16 December 2002 on the energy performance of buildings; European Union, Ed.; Official Journal of the European Communities: Aberdeen, UK, 2003; pp. 65–71. [Google Scholar]

- The European Parliament and the Council of the European Union. Directive 2010/31/EU of the European Parliament and of the Council of 19 May 2010 on the Energy Performance of Buildings; European Union, Ed.; Official Journal of the European Union: Aberdeen, UK, 2010; pp. 13–35. [Google Scholar]

- Passive House Institute. Passive House. Available online: https://passivehouse.com/index.html (accessed on 4 June 2019).

- Yang, X. Measuring the Effects of Environmental Certification on Residential Property Values-Evidence from Green Condominiums in Portland. Ph.D. Thesis, Portland State University, Portland, OR, USA, 2013. [Google Scholar]

- Yoshida, J.; Sugiura, A. The effects of multiple green factors on condominium prices. J. Real Estate Financ. Econ. 2015, 50, 412–437. [Google Scholar] [CrossRef]

- Smith, M.L.; Glass, G.V. Meta-analysis of psychotherapy outcome studies. Am. Psychol. 1977, 32, 752–760. [Google Scholar] [CrossRef]

- Hedges, L.V.; Olkin, I. Statistical Methods for Meta-Analysis; Press, A., Ed.; Academic Press: San Diego, CA, USA, 1985; p. 369. [Google Scholar] [CrossRef]

- Lipsey, M.W.; Wilson, D.B. Practical Meta-Analysis; Sage Publications: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Borenstein, M.; Hedges, L.V.; Higgins, J.P.T.; Rothstein, H.R. A basic introduction to fixed-effect and random-effects models for meta-analysis. Res. Synth. Methods 2010, 1, 97–111. [Google Scholar] [CrossRef]

- Borenstein, M.; Higgins, J.P.T.; Hedges, L.V.; Rothstein, H.R. Basics of meta-analysis: I2 is not an absolute measure of heterogeneity. Res. Synth. Methods 2017, 8, 5–18. [Google Scholar] [CrossRef]

- Rubio Aparicio, M.; Sánchez Meca, J.; Marín Martínez, F.; López López, J.A. Guidelines for reporting systematic reviews and meta-analyses. An. Psicol. 2018, 34, 412–420. [Google Scholar] [CrossRef]

- Hunter, J.E.; Schmidt, F.L. Methods of Meta-Analysis: Correcting Error and Bias in Research Findings, 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2004. [Google Scholar] [CrossRef]

- Schmidt, F. What do data really mean? Research findings, meta-analysis, and cumulative knowledge in psychology. Am. Psychol. 1992, 47, 1173–1181. [Google Scholar] [CrossRef]

- Eden, D. From the editors: Replication, meta-analysis, scientific progress, and AMJ’s publication policy. Acad. Manag. J. 2002, 45, 841–846. [Google Scholar] [CrossRef]

- Ankamah-Yeboah, I.; Rehdanz, K. Explaining the Variation in the Value of Building Energy Efficiency Certificates: A Quantitative Metaanalysis; Kiel Working Papers 1949; Kiel Institute for the World Economy (IfW): Kiel, Germany, August 2014. [Google Scholar]

- Brown, M.J.; Watkins, T. The “Green Premium” for Environmentally Certified Homes: A Meta-Analysis and Exploration. Researchgate Working Paper. 2016. Available online: https://www.researchgate.net/publication/294090858 (accessed on 11 July 2019).

- Kim, S.; Lim, B.T.H.; Kim, J. Green features, symbolic values and rental premium: Systematic review and meta-analysis. Procedia Eng. 2017, 180, 41–48. [Google Scholar] [CrossRef]

- Fizaine, F.; Voye, P.; Baumont, C. Does the literature support a high willingness to pay for green label buildings? An answer with treatment of publication bias. Rev. D’économie Polit. 2018, 128, 1013–1046. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.A.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. PLoS Med. 2009, 6, e1000100. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; The, P.G. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Hyland, M.; Lyons, R.C.; Lyons, S. The value of domestic building energy efficiency - evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef]

- Mudgal, S.; Lyons, L.; Cohen, F.; Lyons, R.C.; Fedrigo-Fazio, D. Energy Performance Certificates in Buildings and their Impact on Transaction Prices and Rents in Selected EU Countries; Bio Intelligence Service: Paris, France, 2013; Volume 2013, p. 158. [Google Scholar]

- Fuerst, F.; Warren-Myers, G. Does voluntary disclosure create a green lemon problem? Energy-efficiency ratings and house prices. Energy Econ. 2018, 74, 1–12. [Google Scholar] [CrossRef]

- Soriano, F. Energy Efficiency Rating and House Price in the ACT; Commonwealth of Australia: Canberra, Australia, 2008; p. 56. ISBN 978-0-642-55422-2.

- Olaussen, J.O.; Oust, A.; Solstad, J.T. Energy performance certificates—Informing the informed or the indifferent? Energy Policy 2017, 111, 246–254. [Google Scholar] [CrossRef]

- Zheng, S.; Wu, J.; Kahn, M.E.; Deng, Y. The nascent market for “green” real estate in Beijing. Eur. Econ. Rev. 2012, 56, 974–984. [Google Scholar] [CrossRef]

- Jensen, O.M.; Hansen, A.R.; Kragh, J. Market response to the public display of energy performance rating at property sales. Energy Policy 2016, 93, 229–235. [Google Scholar] [CrossRef]

- Walls, M.; Gerarden, T.; Palmer, K.; Bak, X.F. Is energy efficiency capitalized into home prices? Evidence from three U.S. cities. J. Environ. Econ. Manag. 2017, 82, 104–124. [Google Scholar] [CrossRef]

- Im, J.; Seo, Y.; Cetin, K.S.; Singh, J. Energy efficiency in U.S. residential rental housing: Adoption rates and impact on rent. Appl. Energy 2017, 205, 1021–1033. [Google Scholar] [CrossRef]

- Salvi, M.; Horehájová, A.; Müri, R. Minergie Macht Sich Bezahlt; Universität Zürich: Zürich, Switzerland, 2008; p. 11. [Google Scholar]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Energy performance ratings and house prices in Wales: An empirical study. Energy Policy 2016, 92, 20–33. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef] [Green Version]

- Shewmake, S.; Viscusi, W.K. Producer and consumer responses to green housing labels. Econ. Inq. 2015, 53, 681–699. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Stephenson, R.; Ashuri, B. Valuation of energy efficient certificates in buildings. Energy Build. 2018, 158, 1226–1240. [Google Scholar] [CrossRef]

- de Ayala, A.; Galarraga, I.; Spadaro, J.V. The price of energy efficiency in the Spanish housing market. Energy Policy 2016, 94, 16–24. [Google Scholar] [CrossRef] [Green Version]

- Shimizu, C. Will green Buildings Be Appropriately Valued by the Market? Reitaku University: Chiba, Japan, 2010; p. 30. [Google Scholar]

- Yoshida, J.; Sugiura, A. Which “Greenness” is Valued? Evidence from Green Condominiums in Tokyo; Munich Personal RePEc Archive, MPRA: Munich, Germany, 2010; p. 33. [Google Scholar]

- Aroul, R.R.; Hansz, J.A. The Value of “Green”: Evidence from the first mandatory residential green building program. J. Real Estate Res. 2012, 34, 27–50. [Google Scholar]

- Högberg, L. The impact of energy performance on single-family home selling prices in Sweden. J. Eur. Real Estate Res. 2013, 6, 242–261. [Google Scholar] [CrossRef]

- Davis, P.T.; McCord, J.; McCord, M.J.; Haran, M. Modelling the effect of energy performance certificate rating on property value in the Belfast housing market. Int. J. Hous. Mark. Anal. 2015, 8, 292–317. [Google Scholar] [CrossRef]

- Notaries-France. La Valeur Verte des Logements en 2017; Étude Statistiques Immobilières, Métropolitaine: Paris, France, 2018; p. 11. [Google Scholar]

- Neyeloff, J.L.; Fuchs, S.C.; Moreira, L.B. Meta-analyses and Forest plots using a microsoft excel spreadsheet: Step-by-step guide focusing on descriptive data analysis. BMC Res. Notes 2012, 5, 52. [Google Scholar] [CrossRef]

- Martín Vallejo, J. Métodos Estadísticos en Meta-Análisis. Ph.D. Thesis, Universidad de Salamanca, Salamanca, Spain, 1995. [Google Scholar]

- Faul, F. G*Power: Statistical Power Analyses for Windows and Mac; 3.1.9.2; Computer Programme: Kiel, Germany, 2014. [Google Scholar]

- Amado, A.R. Capitalization of Energy Efficient Features Into Home Values in the Austin. Texas Real Estate Market. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2007. [Google Scholar]

- Salvi, M.; Horehájová, A.; Neeser, J. Der Minergie-Boom unter der Lupe; Universität Zürich: Zürich, Switzerland, 2010; p. 16. [Google Scholar]

- Addae-Dapaah, K.; Chieh, S.J. Green mark certification: Does the market understand? J. Sustain. Real Estate 2011, 3, 162–191. [Google Scholar] [CrossRef]

- Bloom, B.; Nobe, M.C.; Nobe, M.D. Valuing green home designs: A study of Energy Star® Homes. J. Sustain. Real Estate 2011, 3, 18. [Google Scholar]

- Brounen, D.; Kok, N. On the economics of energy labels in the housing market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef] [Green Version]

- Deng, Y.; Li, Z.; Quigley, J.M. Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg. Sci. Urban Econ. 2012, 42, 506–515. [Google Scholar] [CrossRef] [Green Version]

- Kahn, M.E.; Kok, N. The Value of Green Labels in the California Housing Market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Stephenson, R.M. Quantifying the Effect of Green Building Certification on Housing Prices in Metropolitan Atlanta. Ph.D. Thesis, Georgia Institute of Technology, Atlanta, GA, USA, 2012. [Google Scholar]

- Cajias, M.; Piazolo, D. Green performs better: Energy efficiency and financial return on buildings. J. Corp. Real Estate 2013, 15, 53–72. [Google Scholar] [CrossRef]

- Feige, A.; McAllister, P.; Wallbaum, H. Rental price and sustainability ratings: Which sustainability criteria are really paying back? Constr. Manag. Econ. 2013, 31, 322–334. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. An Investigation of the Effect of EPC Ratings on House Prices; 13D/148; Department of Energy & Climate Change: London, UK, 2013; p. 41.

- Jayantha, W.M.; Wan Sze, M. Effect of green labelling on residential property price: A case study in Hong Kong. J. Facil. Manag. 2013, 11, 31–51. [Google Scholar] [CrossRef]

- Shimizu, C. Sustainable measures and economic value in green housing. Open House Int. 2013, 38, 57–63. [Google Scholar]

- Walls, M.; Palmer, K.; Gerarden, T. Is Energy Efficiency Capitalized into Home Prices? Evidence from Three US Cities. SSRN Electron. J. 2013. [Google Scholar] [CrossRef] [Green Version]

- Cerin, P.; Hassel, L.G.; Semenova, N. Energy performance and housing prices. Sustain. Dev. 2014, 22, 404–419. [Google Scholar] [CrossRef]

- Deng, Y.; Wu, J. Economic returns to residential green building investment: The developers’ perspective. Reg. Sci. Urban Econ. 2014, 47, 35–44. [Google Scholar] [CrossRef]

- Fuerst, F.; Shimizu, C. The rise of eco-labels in the Japanese housing market. J. Jpn. Int. Econ. 2016, 39, 108–122. [Google Scholar] [CrossRef]

- Kahn, M.E.; Kok, N. The capitalization of green labels in the California housing market. Reg. Sci. Urban Econ. 2014, 47, 25–34. [Google Scholar] [CrossRef]

- Rahman, F. Do Green Buildings Capture Higher Market-Values and Prices? A Case-Study of LEED and BOMA-BEST Properties. Ph.D. Thesis, University of Waterloo, Waterloo, ON, Canada, 2014. [Google Scholar]

- Bonifaci, P.; Copiello, S. Price premium for buildings energy efficiency: Empirical findings from a hedonic model. Valori E Valutazioni 2015, 14, 5–15. [Google Scholar]

- DePratto, B. The Market Benefits of Green Condos in Toronto for Educational Purposes, Special Report TD Economics. 2015. Available online: https://www.td.com/document/PDF/economics/special/GreenCondos.pdf (accessed on 15 June 2019).

- Fregonara, E.; Rolando, D.; Semeraro, P.; Vella, M. The impact of Energy Performance Certificate level on house listing prices. First evidence from Italian real estate. Aestimum 2015, 65, 143–163. [Google Scholar] [CrossRef]

- Freybote, J.; Sun, H.; Yang, X. The Impact of LEED Neighborhood Certification on Condo Prices. Real Estate Econ. 2015, 43, 586–608. [Google Scholar] [CrossRef]

- Ramos, A.; Pérez Alonso, A.; Silva, S. Valuing energy performance certificates in the Portuguese residential. Work. Pap. Rscas 2015, 2015, 36. [Google Scholar]

- Bond, S.A.; Devine, A. Certification matters: Is green talk cheap talk? J. Real Estate Financ. Econ. 2016, 52, 117–140. [Google Scholar] [CrossRef]

- Bruegge, C.; Carrión Flores, C.E.; Pope, J.C. Does the housing market value energy efficient homes? Evidence from the energy star program. Reg. Sci. Urban Econ. 2016, 57, 63–76. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Holtermans, R. Energy efficiency and economic value in affordable housing. Energy Policy 2016, 97, 39–49. [Google Scholar] [CrossRef]

- Fuerst, F.; Shimizu, C. Green luxury goods? The economics of eco-labels in the Japanese housing market. J. Jpn. Int. Econ. 2016, 39, 108–122. [Google Scholar] [CrossRef]

- Kempf, C. How Green Buildings Mitigate Risk. Ph.D. Thesis, University of Zurich, Zurich, Switzerland, 2016. [Google Scholar]

- Marmolejo Duarte, C. La incidencia de la calificación energética sobre los valores residenciales: Un análisis para el mercado plurifamiliar en Barcelona. Inf. Construcción 2016, 68, e156. [Google Scholar] [CrossRef]

- Stanley, S.; Lyons, R.C.; Lyons, S. The price effect of building energy ratings in the Dublin residential market. Energy Effic. 2016, 9, 875–885. [Google Scholar] [CrossRef]

- Zhang, L.; Liu, H.; Wu, J. The price premium for green-labelled housing: Evidence from China. Urban Stud. 2016, 54, 3524–3541. [Google Scholar] [CrossRef]

- Aroul, R.R.; Rodríguez, M. The increasing value of green for residential real estate. J. Sustain. Real Estate 2017, 9, 19. [Google Scholar]

- Dressler, L.; Cornago, E. The Rent Impact of Disclosing Energy Performance Certificates: Energy Efficiency and Information Effects; ECARES Working Paper; Université Libre de Bruxelles: Bruxelles, Belgium, 2017; p. 44. [Google Scholar]

- Hui, E.C.-m.; Tse, C.-k.; Ka-hung, Y. The effect of beam plus certification on property price in Hong Kong. Int. J. Strateg. Prop. Manag. 2017, 21, 384–400. [Google Scholar] [CrossRef]

- Kholodilin, K.A.; Mense, A.; Michelsen, C. The market value of energy efficiency in buildings and the mode of tenure. Urban Stud. 2017, 54, 3218–3238. [Google Scholar] [CrossRef]

- Notaries-France. La Valeur Verte des Logements en 2016; Étude Statistiques Immobilières, Métropolitaine: Paris, France, 2017; p. 4. [Google Scholar]

- Pride, D.J.; Little, J.M.; Mueller-Stoffels, M. The value of energy efficiency in the anchorage residential property market. J. Sustain. Real Estate 2017, 9, 23. [Google Scholar]

- Rahman, F.; Rowlands, I.; Weber, O. Do green buildings capture higher market valuations and lower vacancy rates? A Canadian case study of LEED and BOMA-BEST properties. Smart Sustain. Built Environ. 2017, 6, 102–115. [Google Scholar] [CrossRef]

- Cornago, E.; Dressler, L. Incentives to (not) Disclose Energy Performance Information in the Housing Market; ECARES Working Paper; Université libre de Bruxelles: Bruxelles, Belgium, 2018; p. 50. [Google Scholar]

- Cajias, M.; Fuerst, F.; Bienert, S. Tearing down the information barrier: The price impacts of energy efficiency ratings for buildings in the German rental market. Energy Res. Soc. Sci. 2019, 47, 177–191. [Google Scholar] [CrossRef]

- Taltavull de La Paz, P.; Perez-Sanchez, R.V.; Mora-Garcia, R.-T.; Perez-Sanchez, J.-C. Green premium evidence from climatic areas: A case in Southern Europe, Alicante (Spain). Sustainability 2019, 11, 686. [Google Scholar] [CrossRef]

- Marmolejo Duarte, C.; Chen, A. La incidencia de las etiquetas energéticas EPC en el mercado plurifamiliar español: Un análisis para Barcelona, Valencia y Alicante. Ciudad Territ. Estud. Territ. 2019, 51, 101–118. [Google Scholar]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Análisis Multivariante, 5th ed.; Prentice Hall: Madrid, Spain, 2008. [Google Scholar]

- Doucouliagos, H.; Stanley, T.D. Publication selection bias in minimum-wage research? a meta-regression analysis. Br. J. Ind. Relat. 2009, 47, 406–428. [Google Scholar] [CrossRef]

- Begg, C.B. Publication bias. In The Handbook of Research Synthesis; Russell Sage Foundation: New York, NY, USA, 1994; pp. 399–409. [Google Scholar]

- Greene, W.H. Econometric Analysis, 5th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2003. [Google Scholar]

- Sousa, M.R.d.; Ribeiro, A.L.P. Revisão sistemática e meta-análise de estudos de diagnóstico e prognóstico: Um tutorial. Arq. Bras. Cardiol. 2009, 92, 241–251. [Google Scholar] [CrossRef] [PubMed]

- Núñez Serrano, J.A. El Efecto de la Accesibilidad a Los Mercados en la Eficiencia Empresarial. Una Aproximación Microeconómica. Ph.D. Thesis, Complutense de Madrid, Madrid, Spain, 2013. [Google Scholar]

- Adame García, V.; Alonso Meseguer, J.; Pérez Ortiz, L.; Tuesta, D. Infraestructuras y Crecimiento: Un Ejercicio de Meta-Análisis; BBVA Research: Madrid, Spain, 2017; p. 30. [Google Scholar]

- Pértega Díaz, S.; Pita Fernández, S. Revisiones sistemáticas y Metaanálisis (II). Cad. Aten. Primaria 2005, 12, 166–171. [Google Scholar]

- López Cuadrado, M.T. Meta-Análisis: Aportación Metodológica en la Investigación de Resultados de Salud. Ph.D. Thesis, Universidad Autonoma de Madrid, Madrid, Spain, 2011. [Google Scholar]

- DerSimonian, R.; Laird, N. Meta-analysis in clinical trials. Control. Clin. Trials 1986, 7, 177–188. [Google Scholar] [CrossRef]

- Viechtbauer, W. Bias and efficiency of meta-analytic variance estimators in the random-effects model. J. Educ. Behav. Stat. 2005, 30, 261–293. [Google Scholar] [CrossRef]

- Veroniki, A.A.; Jackson, D.; Viechtbauer, W.; Bender, R.; Bowden, J.; Knapp, G.; Kuss, O.; Higgins, J.P.; Langan, D.; Salanti, G. Methods to estimate the between-study variance and its uncertainty in meta-analysis. Res. Synth. Methods 2016, 7, 55–79. [Google Scholar] [CrossRef]

- Wallace, B.C.; Lajeunesse, M.J.; Dietz, G.; Dahabreh, I.J.; Trikalinos, T.A.; Schmid, C.H.; Gurevitch, J. OpenMEE: Intuitive, open-source software for meta-analysis in ecology and evolutionary biology. Methods Ecol. Evol. 2017, 8, 941–947. [Google Scholar] [CrossRef]

- Viechtbauer, W. Conducting Meta-Analyses in R with the metafor Package. J. Stat. Softw. 2010, 36, 48. [Google Scholar] [CrossRef]

- Daryanto, A. Test de Breusch-Pagan y Koenker 2. Computer programme. 2018. Available online: https://www.statisticshowto.datasciencecentral.com/breusch-pagan-godfrey-test/ (accessed on 25 May 2019).

- Peters, J.L.; Sutton, A.J.; Jones, D.R.; Abrams, K.R.; Rushton, L. Contour-enhanced meta-analysis funnel plots help distinguish publication bias from other causes of asymmetry. J. Clin. Epidemiol. 2008, 61, 991–996. [Google Scholar] [CrossRef]

- Baujat, B.; Mahé, C.; Pignon, J.-P.; Hill, C. A graphical method for exploring heterogeneity in meta-analyses: Application to a meta-analysis of 65 trials. Stat. Med. 2002, 21, 2641–2652. [Google Scholar] [CrossRef]

- Servicio Gallego de Salud. Meta-Análisis; Servicio Gallego de Salud: Galicia, Spain, 2015; p. 31.

- Iberoamericano, C.C. Manual Cochrane de Revisiones Sistemáticas de Intervenciones; Centro Cochrane Iberoamericano: Barcelona, Spain, 2011; Volume 5.1.0. [Google Scholar]

- Camilli Trujillo, C. Aprendizaje Cooperativo e Individual en el Rendimiento Académico en Estudiantes Universitarios: Un Meta-Análisis. Ph.D. Thesis, Universidad Complutense de Madrid, Madrid, Spain, 2015. [Google Scholar]

- Higgins, J.P.T.; Thompson, S.G.; Deeks, J.J.; Altman, D.G. Measuring inconsistency in meta-analyses. BMJ Clin. Res. Ed. 2003, 327, 557–560. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mauri, M.; Elli, T.; Caviglia, G.; Uboldi, G.; Azzi, M. RAWGraphs: A visualisation platform to create open outputs. In Proceedings of the 12th Biannual Conference on Italian SIGCHI Chapter, Cagliari, Italy, 18–20 September 2017; pp. 1–5. [Google Scholar]

- Thompson, S.G.; Sharp, S.J. Explaining heterogeneity in meta-analysis: A comparison of methods. Stat. Med. 1999, 18, 2693–2708. [Google Scholar] [CrossRef]

- Nelson, J.P.; Kennedy, P.E. The Use (and Abuse) of Meta-analysis in environmental and natural resource economics: An assessment. Environ. Resour. Econ. 2009, 42, 345–377. [Google Scholar] [CrossRef]

| Year | Study | Country | Label | Date Data | En. | Compares | Typology | Sales/Rent | Premium | Reg. Nº | Rating | Analysis |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | [49] | U.S. | Sustainable indicators | 1998–2004 | NO | Efficient housing/NOT efficient housing | Single family | Sale | 3.98% | 1 | 40.0 | A1 |

| 2008 | [34] | Switzerland | Minergie | 1998–2008 | NO | Labeled/non-labeled | Single family | Sale | 7.00% | 2 | 0.0 | A1* |

| 1998–2008 | NO | Labeled/non-labeled | Multifamily | Sale | 3.50% | 3 | 0.0 | A1* | ||||

| 2008 | [28] | Australia | ACTHER S (1–10) | 2005 | YES | Stars 1–6 (0.5 increment) | Single family | Sale | 1.23% | 4 | 45.0 | A0 |

| 2006 | 1.91% | 5 | 45.0 | A0 | ||||||||

| 2005–2006 |

| 6 | 45.0 | A0 | ||||||||

| 2010 | [50] | Switzerland | Minergie | 2002–2010 | NO | Labeled/non-labeled | Multifamily | Net Rent | 6.00% | 7 | 5.0 | A0 |

| Gross Rent | 4.90% | 8 | 5.0 | A0 | ||||||||

| 2010 | [40] | Japan | Green Label | 2005–2008 | NO | Labeled/non-labeled | Multifamily | Sale | 4.70% | 9 | 37.5 | A1 |

| 2010 | [41] | Japan | Green Building | 2002–2009 | YES | Labeled/non-labeled | Multifamily | Sale | −5.63% | 10 | 37.5 | A1 |

| 2011 | [51] | Singapore | Green Mark Certified | 2005–2009 | NO | Labeled/non-labeled | Multifamily | Sale | 11.69% | 11 | 37.5 | A1 |

|

| 12 | 27.5 | A0 | ||||||||

| 2011 | [52] | U.S. | Energy Star | 1995–2005 | NO | Labeled/non-labeled | Single family | Sale | $8.66/pie2 | 13 | 15.0 | A0 |

| 2011 | [53] | Netherlands | ABCDEFG qualification | 2008–2009 | YES | Qualification: ABC/DEFG (without thermal characteristics) ① | Multiple | Sale |

| 14 | 37.5 | A2 |

| Qualification: A/B/C/D/E/F/G (without thermal characteristics) ① | Multiple | Sale |

| 15 | 37.5 | A2 | ||||||

| Qualification: ABC/DEFG (with thermal characteristics) ① | Multiple | Sale |

| 16 | 37.5 | A2 | ||||||

| Qualification: A/B/C/D/E/F/G (with thermal characteristics) ① | Multiple | Sale |

| 17 | 37.5 | A2 | ||||||

| 2012 | [42] | U.S. | Residential Green Building Program | 2002–2009 | YES | Labeled/non-labeled | Single Family | Sale | 2.00% | 18 | 37.5 | A1 |

| 2012 | [54] | Singapore | Green Mark | 2000–2010 | NO | Labeled/non-labeled | Multifamily | Sale | 4.00% | 19 | 37.5 | A1 |

| 2012 | [55] | U.S. | Energy Star, LEED o Green | 2007–2012 | NO | Labeled/non-labeled | Single Family | Sale | 11.80% | 20 | 40.0 | A1 |

| 2012 | [56] | U.S. | EarthCraft House | 2007–2010 | NO | Labeled/non-labeled | Single Family | Sale | 7.98% | 21 | 47.5 | A1 |

| 2012 | [30] | China | Google Green Index | 2011 | NO | Labeled/non-labeled | Multifamily | Sale | −0.25% | 22 | 30.0 | A0 |

| 2003–2008 | NO | Labeled/non-labeled | Sale | 0.35% | 23 | 30.0 | A1* | |||||

| 2013 | [57] | Germany | ABCDEFG qualification | 2008–2010 | NO | Qualification: B/C/D/E/F/G | Multifamily | Rent |

| 24 | 35.0 | A0 |

| 2013 | [58] | Switzerland | Sustainable indicators | 2010–2011 | NO | Different items | Multifamily | Rent |

| 25 | 20.0 | A0 |

| 2013 | [59] | United Kingdom | ABCDEFG qualification | 1995–2012 | YES | Qualification AB/C/D/E/F/G | Single family (Full sample.) | Sale |

| 26 | 40.0 | A2 |

| Qualification AB/C/D/E/F/G | Single family (Detached) | Sale |

| 27 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Semi-detached) | Sale |

| 28 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Terraced) | Sale |

| 29 | 40.0 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Multifamily (Flat) | Sale |

| 30 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Detached dense) | Sale |

| 31 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Detached sparse) | Sale |

| 32 | 37.5 | A2* | ||||||

| 2013 | [43] | Sweden | ABCDEFG qualification | 2009 | YES | Energy efficiency | Single Family | Sale |

| 33 | 40.0 | A1 |

| 2013 | [25] | Ireland | ABCDEFG qualification | 2008–2012 | YES | Qualification: A/B/C/D/E/F/G | Multiple | Rent |

| 34 | 17.5 | A0 |

| 2008–2013 | Labeled/non-labeled | Multiple | Rent | −0.50% | 35 | 17.5 | A0 | |||||

| 2008–2012 | Qualification: A/B/C/D/E/F/G | Multiple | Sale |

| 36 | 17.5 | A2 | |||||

| 2008–2013 | Labeled/non-labeled | Multiple | Sale | 1.30% | 37 | 17.5 | A1 | |||||

| 2013 | [60] | China. Yuen Long District | Green Building Council (HKGBC) | - | NO | Labeled/non-labeled | Multifamily | Sale | 7.05% | 38 | 45.0 | A1 |

| China. Quarry Bay District | 2.98% | 39 | 45.0 | A1 | ||||||||

| 2013 | [26] | Austria | ABCDEFG qualification | 2012 | YES | Labeled/non-labeled | Multiple | Rent | 4.41% | 40 | 30.0 | A0 |

| Austria | Sale | 8.03% | 41 | 30.0 | A1 | |||||||

| Belgium. Brussels | ABCDEFG qualification | 2012 | YES | Labeled/non-labeled | Multiple | Rent | 2.60% | 42 | 25.0 | A0 | ||

| Belgium. Wallonia | 1.50% | 43 | 25.0 | A0 | ||||||||

| Belgium. Flanders | 3.20% | 44 | 30.0 | A0 | ||||||||

| Belgium. Brussels | ABCDEFG qualification | 2012 | YES | Labeled/non-labeled | Multiple | Sale | 2.90% | 45 | 30.0 | A1 | ||

| Belgium. Wallonia | 5.40% | 46 | 25.0 | A1 | ||||||||

| Belgium. Flanders | 4.30% | 47 | 32.5 | A1 | ||||||||

| France. Marseille | ABCDEFG qualification | 2011–2012 | YES | Labeled/non-labeled | Multiple | Sale | 4.34% | 48 | 30.0 | A1 | ||

| France. Lille | 3.24% | 49 | 30.0 | A1 | ||||||||

| Ireland | ABCDEFG qualification | 2008–2012 | YES | Labeled/non-labeled | Multiple | Rent | 1.15% | 50 | 32.5 | A0 | ||

| 1.52% ③ | 51 | 32.5 | A0 | |||||||||

| Ireland | Sale | 2.83% | 52 | 32.5 | A1 | |||||||

| 1.69% ③ | 53 | 32.5 | A1 | |||||||||

| United Kingdom | ABCDEFG qualification | 2012 | YES | Labeled/non-labeled | Multiple | Sale | 1.04% | 54 | 25.0 | A1 | ||

| 2013 | [61] | Japan | CASBEE | 2005–2010 | YES | Labeled/non-labeled | Multifamily | Sale | 5.84% | 55 | 37.5 | A1 |

| 2013 | [62] | U.S. Research Triangle | Energy Star | 2009–2011 | NO | Labeled/non-labeled | Single Family | Sale | 2.40% | 56 | 32.5 | A1 |

| U.S. Austin | Energy Star | 2008–2011 | 3.80% | 57 | 32.5 | A1 | ||||||

| U.S. Austin | Local green certification | 2008–2011 | 14.30% | 58 | 32.5 | A1 | ||||||

| U.S. Portland | Energy Star | 2005–2011 | 3.60% | 59 | 35.0 | A1 | ||||||

| U.S. Portland | Local green certification | 2005–2011 | 8.00% | 60 | 35.0 | A1 | ||||||

| 2013 | [8] | U.S. | LEED | 2009–2012 | NO | Labeled/non-labeled | Multifamily | Sale | 5.80% | 61 | 35.0 | A1 |

| Single Family | Sale | 16.00% | 62 | 35.0 | A0 | |||||||

| 2014 | [63] | Sweden | ABCDEFG qualification | 2009–2010 | YES | Energy efficiency | Multifamily | Sale |

| 63 | 30.0 | A0 |

| 2014 | [64] | Singapore | Green Mark | 2000–2010 | NO | Labeled/non-labeled | Multifamily | Sale | 4.60% | 64 | 42.5 | A1 |

| 2014 | [65] | Japan | Green Building | 2001–2011 | YES | Stars 2-3 | Multifamily | Sale | 1.60% | 65 | 47.5 | A0 |

| 2014 | [66] | U.S. | Energy Star | 2007–2012 | NO | Labeled/non-labeled | Multiple | Sale | 5.30% | 66 | 40.0 | A1 |

| 2014 | [67] | Canada | LEED | 2013 | NO | Labeled/non-labeled | Multifamily | Sale | −2.49% ② | 67 | 35.0 | A1 |

| 2015 | [68] | Italy | ABCDEFG qualification | 2013 | YES | Qualification: A/B/C/D/E/F/G | Single Family | Sale |

| 68 | 30.0 | A2 |

| 2015 | [44] | Ireland (North) | ABCDEFG qualification | - | YES | Labeled/non-labeled | Single Family | Sale | 0.40 | 69 | 45.0 | A1 |

| 2015 | [69] | Canada | LEED | 2006–2014 | NO | Labeled/non-labeled | Multifamily | Sale |

| 70 | 35.0 | A1 |

| 71 | 35.0 | A0 | |||||||||

| 2015 | [70] | Italy | ABCDEFG qualification | 2012 | YES | Qualification B/C/D/E/F/G | Multifamily | Sale |

| 72 | 40.0 | A2 |

| 2015 | [71] | U.S. | LEED | 2007–2013 | NO | Labeled/non-labeled | Multifamily | Sale | 3.80% | 73 | 35.0 | A1 |

| 2015 | [36] | United Kingdom | ABCDEFG qualification | 1995–2012 | YES | Qualification AB/C/D/E/F/G | Multifamily | Sale |

| 74 | 40.0 | A2 |

| Qualification AB/C/D/E/F/G | Single Family (Semi-detached) | Sale |

| 75 | 40.0 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single Family (Terraced) | Sale |

| 76 | 40.0 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Multifamily (Flat) | Sale |

| 77 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Detached dense) | Sale |

| 78 | 37.5 | A2* | ||||||

| Qualification AB/C/D/E/F/G | Single family (Detached sparse) | Sale |

| 79 | 37.5 | A2* | ||||||

| Labeled/non-labeled | Multifamily | Sale | 0.06% | 80 | 50.0 | A1 | ||||||

| 2015 | [72] | Portugal | ABCDEFG qualification | 2015 | YES | Qualification ABC/D/EFG | Multifamily | Sale |

| 81 | 17.5 | A2 |

| Portugal. Lisbon/Oporto | Qualification ABC/D/EFG | Single family | Sale |

| 82 | 15.0 | A2* | |||||

| 2015 | [37] | U.S. | Some AEGB, ES or EFL | 2008–2012 | NO | Labeled/non-labeled | Single family | Sale | 5.00% | 83 | 32.5 | A0 |

| Austin Energy (AEGB) | 6.00% | 84 | 32.5 | A1 | ||||||||

| Energy Star | 1.00% | 85 | 32.5 | A1 | ||||||||

| Environments for Living (EFL) | 9.00% | 86 | 32.5 | A1 | ||||||||

| 2015 | [9] | Japan | Green Building | 2002–2009 | YES | Labeled/non-labeled | Multifamily | Sale | −10.80% | 87 | 37.5 | A1* |

| 2016 | [73] | U.S. | LEED | 2000–2012 | NO | Labeled/non-labeled | Single family | Rent | 7.00% | 88 | 35.0 | A0 |

| 2016 | [74] | U.S. | Energy Star | 1998–2009 | NO | Labeled/non-labeled | Single family | Sale | 4.94% | 89 | 30.0 | A1 |

| 2016 | [75] | Netherlands | ABCDEFG qualification | 2008–2013 | YES | Labeled/non-labeled | Multiple | Sale | −0.80% | 90 | 37.5 | A1 |

| Labeled/non-labeled | −0.70% | 91 | 37.5 | A1 | ||||||||

| Qualification AB/CDEFG (with thermal characteristics) ① |

| 92 | 37.5 | A2 | ||||||||

| Qualification A/B/C/D/E/F/G (with thermal characteristics) ① |

| 93 | 37.5 | A2 | ||||||||

| 2016 | [39] | Spain | ABCDEFG qualification | 2013 | YES | Qualification ABC/DEFG | Multifamily | Sale |

| 94 | 27.5 | A2 |

| Qualification ABCD/EFG |

| 95 | 27.5 | A2 | ||||||||

| 2016 | [76] | Japan | Green Labeling System for Condominiums | 2003–2011 | YES | Labeled/non-labeled | Multifamily | Sale | 4.82% | 96 | 47.5 | A1 |

| Multifamily | Sale | 5.89% | 97 | 45.0 | A1 | |||||||

| 2016 | [35] | United Kingdom | ABCDEFG qualification | 2003–2014 | YES | Qualification AB/C/D/E/F/G | Multifamily | Sale |

| 98 | 37.5 | A2 |

| Single family (Detached) | Sale |

| 99 | 32.5 | A2* | |||||||

| Single family (Detached rural) | Sale |

| 100 | 25.0 | A2* | |||||||

| Single family (Detached urban) | Sale |

| 101 | 35.0 | A2* | |||||||

| Single family (Semi-detached) | Sale |

| 102 | 35.0 | A2* | |||||||

| Single family (Terraced) | Sale |

| 103 | 37.5 | A2* | |||||||

| Multifamily (Flat) | Sale |

| 104 | 30.0 | A2* | |||||||

| YES | Labeled/non-labeled | Multifamily | Sale | 4.32% | 105 | 47.5 | A1 | |||||

| 2016 | [31] | Denmark | ABCDEFG qualification | 2007–2010 | YES | Qualification ABC/DEFG | Single family before 1 July 2010 | Sale |

| 106 | 37.5 | A2 |

| 2010–2012 | Single family after 1 July 2010 | Sale |

| 107 | 37.5 | A2 | ||||||

| 2007–2012 | Qualification AB/C/D/E/F/G | Single family before 1 July 2010 | Sale |

| 108 | 37.5 | A2 | |||||

| 2010–2012 | Single family after 1 July 2010 | Sale |

| 109 | 37.5 | A2 | ||||||

| 2016 | [77] | Switzerland | Minergie | - | NO | Labeled/non-labeled | Multiple | Rent | 15.08% | 110 | 35.0 | A0 |

| Multiple | Sale | 21.5% | 111 | 42.5 | A1* | |||||||

| 2016 | [78] | Spain | ABCDEFG qualification | 2014 | YES | Labeled/non-labeled | Multifamily | Sale | 1.02% | 112 | 35.0 | A1 |

| Qualification: A/B/C/D/E/F/G |

| 113 | 25.0 | A2 | ||||||||

| 2016 | [79] | Ireland | ABCDEFG qualification | 2009–2014 | YES | Labeled/non-labeled | Multiple | Sale | 1% | 114 | 30.0 | A1 |

| Qualification A3/B1/B2/B3/C1/C2/C3/D1/D2/E1/E2/F/G |

| 115 | 30.0 | A2 | ||||||||

| 2016 | [80] | China | Chinese Green Building Label | 2013 | NO | Labeled/non-labeled | Multifamily | Sale | 6.66% | 116 | 20.0 | A1 |

| 2017 | [81] | U.S. | Residential Green Building Program | 2002–2009 | YES | Labeled/non-labeled | Single family | Sale | 2.27% | 117 | 32.5 | A1 |

| 2017 | [82] | Belgium | ABCDEFG qualification | 2010–2014 | YES | Qualification ABC/DE/FG | Single family | Rent |

| 118 | 17.5 | A0 |

| 2017 | [83] | China | BEAM Plus | 2012–2014 | NO | Classification: Gold, silver and bronze | Multifamily | Sale | 4.40% | 119 | 30.0 | A0 |

| Classification: low | Sale | −5.90% | 120 | 20.0 | A0 | |||||||

| Classification: Gold, silver and bronze | Single family | Sale | 6.20% | 121 | 30.0 | A0 | ||||||

| 2017 | [33] | U.S. Atlanta | - | 2016–2017 | NO | Features that enhance the EE | Single family | Rent | 14.10% | 122 | 0.0 | A0 |

| U.S. Chicago | 13.40% | 123 | 0.0 | A0 | ||||||||

| U.S. Washington DC | 6.90% | 124 | 0.0 | A0 | ||||||||

| U.S. Indianapolis | −0.50% | 125 | 0.0 | A0 | ||||||||

| U.S. Las Vegas | 5.30% | 126 | 0.0 | A0 | ||||||||

| U.S. Miami | 0.60% | 127 | 0.0 | A0 | ||||||||

| U.S. Minneapolis | 6.00% | 128 | 0.0 | A0 | ||||||||

| U.S. Oklahoma | 5.60% | 129 | 0.0 | A0 | ||||||||

| U.S. Philadelphia | 6.30% | 130 | 5.0 | A0 | ||||||||

| U.S. San Francisco | 7.20% | 131 | 0.0 | A0 | ||||||||

| U.S. Atlanta | - | 2016–2017 | NO | Features that enhance the EE | Multifamily | Rent | 16.10% | 132 | 0.0 | A0 | ||

| U.S. Chicago | 13.90% | 133 | 0.0 | A0 | ||||||||

| U.S. Washington DC | 6.60% | 134 | 0.0 | A0 | ||||||||

| U.S. Indianapolis | −3.20% | 135 | 0.0 | A0 | ||||||||

| U.S. Las Vegas | 2.30% | 136 | 0.0 | A0 | ||||||||

| U.S. Miami | −0.10% | 137 | 0.0 | A0 | ||||||||

| U.S. Minneapolis | 5.90% | 138 | 0.0 | A0 | ||||||||

| U.S. Oklahoma | 2.60% | 139 | 0.0 | A0 | ||||||||

| U.S. Philadelphia | 5.20% | 140 | 5.0 | A0 | ||||||||

| U.S. San Francisco | 5.60% | 141 | 0.0 | A0 | ||||||||

| 2017 | [84] | Germany | ABCDEFG qualification | 2011–2014 | YES | Energy consumption | Multifamily | Rent | −0.02% | 142 | 35.0 | A0 |

| Sale | −0.05% | 143 | 35.0 | A1* | ||||||||

| 2017 | [85] | France. Grande Couronne | ABCDEFG qualification | 2016 | YES | Qualification AB/C/D/E/FG | Single family | Sale |

| 144 | 30.0 | A2 |

| France. Petite Couronne |

| 145 | 30.0 | A2 | ||||||||

| France. Hauts de France |

| 146 | 10.0 | A2 | ||||||||

| France. Normandie |

| 147 | 10.0 | A2 | ||||||||

| France. Grand Est |

| 148 | 10.0 | A2 | ||||||||

| France. Bretagne |

| 149 | 10.0 | A2 | ||||||||

| France. Pays de la Loire |

| 150 | 10.0 | A2 | ||||||||

| France. Centre Val de Loire |

| 151 | 10.0 | A2 | ||||||||

| France. Bourgogne Franche-Comté |

| 152 | 10.0 | A2 | ||||||||

| France. Nouvelle Aquitaine |

| 153 | 10.0 | A2 | ||||||||

| France. Auvergne Rhone-Alpes |

| 154 | 10.0 | A2 | ||||||||

| France. Occitanie |

| 155 | 10.0 | A2 | ||||||||

| France. Provence-Alpes-Côte d’Azur |

| 156 | 10.0 | A2 | ||||||||

| France. Grande Couronne | Multifamily | Sale |

| 157 | 30.0 | A2 | ||||||

| France. Grand Est |

| 158 | 10.0 | A2 | ||||||||

| France. Pays de la Loire |

| 159 | 10.0 | A2 | ||||||||

| France. Centre Val de Loire |

| 160 | 10.0 | A2 | ||||||||

| France. Bourgogne Franche-Comté |

| 161 | 10.0 | A2 | ||||||||

| France. Nouvelle Aquitaine |

| 162 | 10.0 | A2 | ||||||||

| France. Auvergne Rhone-Alpes |

| 163 | 10.0 | A2 | ||||||||

| France. Occitanie |

| 164 | 10.0 | A2 | ||||||||

| France. Provence-Alpes-Côte d’Azur |

| 165 | 10.0 | A2 | ||||||||

| 2017 | [29] | Norway | ABCDEFG qualification | 2014 | YES | Qualification: A/B/C/D/E/F/G | Multiple | Sale |

| 166 | 25.0 | A2 |

| 2000–2014 | YES | Qualification: A/B/C/D/E/F/G | Multiple | Sale |

| 167 | 25.0 | A2 | ||||

| 2017 | [86] | U.S. | Home Energy Rebate | 2008–2015 | NO | Stars 1-4 | Single family | Sale | 4.20% | 168 | 30.0 | A0 |

| 2017 | [87] | Canada | LEED | 2013 | NO | Labeled/non-labeled | Multifamily | Sale | −1.08% ② | 169 | 35.0 | A1 |

| 2017 | [32] | U.S. Austin | Energy Star | 2008–2011 | NO | Labeled/non-labeled | Single family | Sale | 0.60% | 170 | 37.5 | A1 |

| U.S. Austin | Austin Energy (AEGB) | 2008–2011 | 8.20% | 171 | 37.5 | A1 | ||||||

| U.S. North Carolina | Energy Star | 2009–2011 | 2.70% | 172 | 32.5 | A1 | ||||||

| U.S. Portland | Energy Star | 2005–2011 | 3.50% | 173 | 35.0 | A1 | ||||||

| U.S. Portland | Earth Advantage New Homes | 2005–2011 | 8.02% | 174 | 35.0 | A1 | ||||||

| 2018 | [88] | Belgium | ABCDEFG qualification | 2010–2014 | YES | Qualification ABC/DE/FG | Single family | Rent |

| 175 | 17.5 | A0 |

| YES | Qualification B/C/D/E/F/G | Single family | Rent |

| 176 | 17.5 | A0 | |||||

| 2018 | [27] | Australia | ACTHER S (1-10) | 2011–2017 | YES | Stars 1-10 | Single family | Rent |

| 177 | 27.5 | A0 |

| 2011–2016 | Sale |

| 178 | 27.5 | A0 | |||||||

| 2018 | [45] | France. Grande Couronne | ABCDEFG qualification | 2017 | YES | Qualification AB/C/D/E/FG | Single family | Sale |

| 179 | 30.0 | A2 |

| France. Petite Couronne |

| 180 | 30.0 | A2 | ||||||||

| France. Hauts de France |

| 181 | 10.0 | A2 | ||||||||

| France. Normandie |

| 182 | 10.0 | A2 | ||||||||

| France. Grand Est |

| 183 | 10.0 | A2 | ||||||||

| France. Bretagne |

| 184 | 10.0 | A2 | ||||||||

| France. Pays de la Loire |

| 185 | 10.0 | A2 | ||||||||

| France. Centre Val de Loire |

| 186 | 10.0 | A2 | ||||||||

| France. Bourgogne Franche-Comté |

| 187 | 10.0 | A2 | ||||||||

| France. Nouvelle Aquitaine |

| 188 | 10.0 | A2 | ||||||||

| France. Auvergne Rhone-Alpes |

| 189 | 10.0 | A2 | ||||||||

| France. Occitanie |

| 190 | 10.0 | A2 | ||||||||

| France. Provence-Alpes-Côte d’Azur |

| 191 | 10.0 | A2 | ||||||||

| France. Petite Couronne |

| 192 | 30.0 | A2 | ||||||||

| France: Grande Couronne |

| 193 | 30.0 | A2 | ||||||||

| France. Hauts de France |

| 194 | 30.0 | A2 | ||||||||

| France. Grand Est |

| 195 | 10.0 | A2 | ||||||||

| France. Bretagne |

| 196 | 10.0 | A2 | ||||||||

| France. Pays de la Loire |

| 197 | 10.0 | A2 | ||||||||

| France. Bourgogne Franche-Comté |

| 198 | 10.0 | A2 | ||||||||

| France. Nouvelle Aquitaine |

| 199 | 10.0 | A2 | ||||||||

| France. Auvergne Rhone-Alpes |

| 200 | 10.0 | A2 | ||||||||

| France. Occitanie |

| 201 | 10.0 | A2 | ||||||||

| France. Provence-Alpes-Côte d’Azur |

| 202 | 10.0 | A2 | ||||||||

| 2018 | [38] | U.S. | EarthCraft House | 2007–2010 | NO | Labeled/non-labeled | Single family | Sale | 12.20% | 203 | 35.0 | A1 |

| Energy Star | 8.50% | 204 | 35.0 | A1 | ||||||||

| 2019 | [89] | Germany | ABCDEFG qualification | YES | Qualification A/B/C/D/E/F/G/H/NT | Single family | Rent |

| 205 | 35.0 | A0 | |

| 2019 | [90] | Spain | ABCDEFG qualification | YES | Qualification ABC/D/E/F/G | Multifamily | Sale |

| 206 | 35.0 | A2 | |

| 2019 | [91] | Spain | ABCDEFG qualification | 2016 | YES | Continuous variable | Multifamily | Sale | 1.54% | 207 | 27.5 | A0 |

| Spain. Alicante | −1.0% | 208 | 27.5 | A0 | ||||||||

| Spain. Barcelona | 2.0% | 209 | 27.5 | A0 | ||||||||

| Spain. Valencia | 3.0% | 210 | 27.5 | A0 | ||||||||

| Spain. Alicante | Qualification A/C/D/E/F/G |

| 211 | 25.0 | A2 | |||||||

| Spain. Barcelona | Qualification A/C/D/E/F/G |

| 212 | 25.0 | A2 | |||||||

| Spain. Valencia | Qualification A/C/D/E/F/G |

| 213 | 25.0 | A2 |

| Category | Characteristics | Unit | Variable Description | Used |

|---|---|---|---|---|

| Financial characteristics (I) | Premium_EPC | numerical | Premium in the sales price of the housing (effect size: β) | Dependent variable |

| SE | numerical | Standard error of the estimate | NO | |

| VAR | numerical | Variance of the estimate = SE2 | Weighting variable | |

| Characteristics of the publication (II) | Date_publication | numerical | Year of the document’s publication | YES |

| Date_Before_Crisis | dummy | Indicates whether the data date is before, during or after the 2008 economic crisis | YES | |

| Date_During_Crisis | dummy | |||

| Date_After_Crisis | dummy | |||

| Num_Autor | numerical | Number of authors of the document | YES | |

| Journal_Article | dummy | Indicates if the document is a journal article or another type of document (report, congress, or thesis) 1 = Journal article; 0 = Other document | YES | |

| JCR | dummy | If the document is indexed in the Journal Citation Reports 1 = JCR; 0 = NO JCR | YES | |

| SJR | dummy | If the document is indexed in the Scimago Journal Rank 1 = SJR; 0 = NO SJR | YES | |

| Continent (III) | America | dummy | Continent identifier: America, Asia, and Europe | NO |

| Asia | dummy | |||

| Europe | dummy | |||

| Construction type (IV) | Single_Family | dummy | Indicates if the document uses this type of data: Single family, multifamily, or multiple (combination of both) | NO |

| Multifamily | dummy | |||

| Multiple | dummy | |||

| Energy label (V) | Date_Label | numerical | Date of onset of energy label | YES |

| Qualif_ABCDEFG | dummy | Indicates if the property has an ABCDEFG qualification = 1; or another qualification = 0 (CASBEE, Energy Star, LEED, Green, etc.) | YES | |

| Obligatory | dummy | Indicates if the label is mandatory (=1) or voluntary (=0) | NO | |

| Model predictors (VI) | C_Dwelling | dummy | Indicates if any variable defining elements on the housing (surface area, number of baths or rooms, etc.) is included in the document | NO |

| C_Building | dummy | Indicates if any variable defining building elements (existence of parking, elevator, swimming pool, garden, sporting areas, etc.) is included in the document | YES | |

| C_Neighborhood | dummy | Indicates if any variable defining the neighborhood where the housing is located (socio-economic level, type of residents, safety, etc.) is included in the document | YES | |

| C_Location | dummy | Indicates if any variable defining the location of the housing (residential area, distance to metro stops, etc.) is included in the document | YES | |

| C_Zone | dummy | Indicates if any variable defining the area or surroundings (density of the construction, types of activities, permitted land uses, etc.) is included in the document | YES | |

| C_Market | dummy | Indicates if any variable defining the real estate market (type of seller, time of sale on the market, etc.) is included in the document | YES | |

| C_Financing | dummy | Indicates if any variable defining the type of financing of the property, foreclosure, etc., are included | YES | |

| Statistical data (VII) | Sample_size | numerical | Sample size used in the analyzed register | YES |

| Data_web | dummy | Indicates if the sales prices have been obtained from a real estate portal (=1) or from another source (=0) | YES | |

| Price_area | dummy | Indicates if the dependent variable is introduced in the model as a price/surface area unitary value (=1) or not (=0) | YES | |

| R2fin | numerical | Determination coefficient of the analyzed register | NO | |

| f2 | numerical | Statistical power of the analyzed register (see Equation (2)) | NO | |

| t-test | numerical | Student’s t test | NO |

| Category | Characteristics | Continuous Variables | Dummies Variables | ||||

|---|---|---|---|---|---|---|---|

| Mean | SD | Min. | Max. | Frec. (=1) | Percent (%) | ||

| Financial characteristics (I) | Premium_EPC | 0.043406 | 0.039194 | −0.056300 | 0.143000 | ||

| SE | 0.010441 | 0.015311 | 0.000042 | 0.109095 | |||

| VAR | 0.000339 | 0.001583 | 0.000000 | 0.011902 | |||

| Characteristics of the publication (II) | Date_publication | 2014.1 | 2.2 | 2007 | 2018 | ||

| Date_Before_Crisis | 15 | 26.8 | |||||

| Date_During_Crisis | 8 | 14.3 | |||||

| Date_After_Crisis | 33 | 58.9 | |||||

| Num_Autor | 2.9 | 1.3 | 1 | 5 | |||

| Journal_Article | 40 | 71.4 | |||||

| JCR | 27 | 48.2 | |||||

| SJR | 32 | 57.1 | |||||

| Continent (III) | America | 27 | 48.2 | ||||

| Asia | 11 | 19.6 | |||||

| Europe | 18 | 32.2 | |||||

| Construction type (IV) | Single_Family | 24 | 42.8 | ||||

| Multifamily | 17 | 30.4 | |||||

| Multiple | 15 | 26.8 | |||||

| Energy label (V) | Date_Label | 2003.5 | 4.4 | 1991 | 2012 | ||

| Qualif_ABCDEFG | 18 | 32.1 | |||||

| Obligatory | 25 | 44.6 | |||||

| Model predictors (VI) | C_Dwelling | 56 | 100.0 | ||||

| C_Building | 18 | 32.1 | |||||

| C_Neighborhood | 5 | 8.9 | |||||

| C_Location | 40 | 71.4 | |||||

| C_Zone | 4 | 7.1 | |||||

| C_Market | 24 | 42.9 | |||||

| C_Financing | 4 | 7.1 | |||||

| Statistical data (VII) | Sample_size | 85,632.2 | 300,537.3 | 125 | 1,609,879 | ||

| Data_web | 12 | 21.4 | |||||

| Price_area | 18 | 32.1 | |||||

| R2fin | 0.8080 | 0.0799 | 0.5040 | 0.9040 | |||

| f2 | 5.0063 | 2.1899 | 1.0161 | 9.4167 | |||

| t-test | 7.9288 | 6.9352 | −1.1600 | 22.0200 | |||

| Method | Estimator | Considerations |

|---|---|---|

| Method of moments estimators | DerSimonian and Laird (DL) | It is acceptable when the real levels of the variance between studies is small or almost zero, but when the variance is large, the DL estimator may produce estimates having significant negative bias. |

| Hedges and Olkin (HO) | The HO functions well in the presence of substantial variation between studies, especially when the number of studies is large (that is, k ≥ 30), but produces a large MSE. In general, it produces estimates that are slightly greater than those produced in the DL and REML methods. | |

| Hunter and Schmidt (HS) | If the sample is negatively or positively biased, it leads to an under-estimation or over-estimation of the real variation between studies. When the sample size is small, an under-estimation may be produced in the heterogeneity. | |

| Maximum likelihood estimators | Maximum likelihood (ML) | This is an asymptotically efficient method that requires an iterative solution; thus, it depends on the selection of the maximization method. In addition, it has the smallest MSE in comparison with the REML and HO methods, but the greatest quantity of negative bias between them. |

| Restricted maximum likelihood (REML) | It may be used to correct the negative bias associated with the ML method. It is not adequate when there are few observations. It has less bias with dichotomous data than the ML, but has a greater MSE. For continuous data, REML is the preferred approach when large studies are included in the meta-analysis. | |

| Bayes estimators | Bayes estimators (Bayes) | It is recommended when there are samples with less than 5 observations, since less bias is generated as compared to other stimulators (DL, HO, or REML). |

| Category | Characteristics | DL | HO | HS | ML | REML | Bayes | |

|---|---|---|---|---|---|---|---|---|

| (Constant) | B | −18.582 ** | −19.006 * | −14.976 *** | −18.718 ** | −18.967 * | −18.987 * | |

| SE | 6.409 | 9.259 | 1.012 | 7.033 | 8.834 | 9.049 | ||

| Z | −2.899 | 2.053 | −14.792 | −2.661 | −2.147 | −2.098 | ||

| Characteristics of the publication (II) | Date_publication | B | 0.006 * | 0.005 | 0.007 *** | 0.006 | 0.005 | 0.005 |

| SE | 0.003 | 0.004 | 0.000 | 0.003 | 0.004 | 0.004 | ||

| Z | 2.129 | 1.442 | 16.712 | 1.929 | 1.515 | 1.477 | ||

| Date_Before_Crisis | B | −0.013 | −0.014 | −0.008 * | −0.013 | −0.014 | −0.014 | |

| SE | 0.013 | 0.018 | 0.004 | 0.014 | 0.017 | 0.018 | ||

| Z | −1.033 | −0.760 | −2.201 | −0.958 | −0.792 | −0.775 | ||

| Date_After_Crisis | B | −0.002 | 0.001 | −0.033 *** | −0.001 | 0.000 | 0.001 | |

| SE | 0.012 | 0.017 | 0.004 | 0.013 | 0.016 | 0.017 | ||

| Z | −0.173 | 0.047 | −7.471 | −0.095 | 0.030 | 0.039 | ||

| Num_Autor | B | 0.010 * | 0.010 | 0.002 | 0.010 * | 0.010 | 0.010 | |

| SE | 0.004 | 0.006 | 0.001 | 0.004 | 0.006 | 0.006 | ||

| Z | 2.427 | 1.793 | 1.891 | 2.254 | 1.867 | 1.829 | ||

| Journal_Article | B | 0.023 | 0.023 | 0.049 *** | 0.023 | 0.023 | 0.023 | |

| SE | 0.016 | 0.022 | 0.004 | 0.017 | 0.021 | 0.022 | ||

| Z | 1.501 | 1.036 | 13.834 | 1.362 | 1.085 | 1.060 | ||

| JCR | B | −0.022 | −0.019 | −0.024 *** | −0.021 | −0.019 | −0.019 | |

| SE | 0.015 | 0.021 | 0.003 | 0.016 | 0.020 | 0.021 | ||

| Z | −1.437 | −0.883 | −7.820 | −1.264 | −0.937 | −0.909 | ||

| SJR | B | −0.035 * | −0.037 | −0.065 *** | −0.035 * | −0.037 | −0.037 | |

| SE | 0.016 | 0.023 | 0.004 | 0.018 | 0.022 | 0.022 | ||

| Z | −2.154 | −1.608 | −16.138 | 2.006 | −1.672 | −1.639 | ||

| Energy label (V) | Date_Label | B | 0.004 ** | 0.004 * | 0.000 | 0.004 ** | 0.004 * | 0.004 * |

| SE | 0.001 | 0.002 | 0.000 | 0.001 | 0.002 | 0.002 | ||

| Z | 2.988 | 2.352 | 0.973 | 2.833 | 2.434 | 2.392 | ||

| Qualif_ABCDEFG | B | −0.054 *** | −0.054 ** | −0.038 *** | −0.054 *** | −0.054 ** | −0.054 ** | |

| SE | 0.015 | 0.021 | 0.003 | 0.016 | 0.020 | 0.021 | ||

| Z | −3.665 | −2.580 | −12.207 | −3.354 | −2.698 | −2.637 | ||

| Model predictors (VI) | C_Building | B | −0.000 | −0.000 | −0.004 * | −0.000 | −0.000 | −0.000 |

| SE | 0.010 | 0.015 | 0.002 | 0.011 | 0.014 | 0.015 | ||

| Z | −0.032 | −0.024 | −2.291 | −0.030 | −0.025 | −0.024 | ||

| C_Neighborhood | B | 0.022 | 0.023 | −0.005 | 0.023 | 0.023 | 0.023 | |

| SE | 0.015 | 0.021 | 0.005 | 0.016 | 0.020 | 0.020 | ||

| Z | 1.504 | 1.115 | −0.975 | 1.400 | 1.161 | 1.137 | ||

| C_Location | B | −0.023 * | −0.023 | −0.014 *** | −0.023 * | −0.023 | −0.023 | |

| SE | 0.010 | 0.014 | 0.002 | 0.011 | 0.014 | 0.014 | ||

| Z | −2.380 | −1.604 | −8.772 | −2.154 | −1.687 | −1.644 | ||

| C_Zone | B | 0.022 | 0.022 | 0.020 *** | 0.022 | 0.022 | 0.022 | |

| SE | 0.017 | 0.025 | 0.004 | 0.019 | 0.024 | 0.024 | ||

| Z | 1.276 | 0.876 | 5.034 | 1.160 | 0.919 | 0.897 | ||

| C_Market | B | 0.032 ** | 0.033 * | 0.020 *** | 0.032 ** | 0.033 * | 0.033 * | |

| SE | 0.011 | 0.016 | 0.003 | 0.012 | 0.015 | 0.016 | ||

| Z | 2.926 | 2.051 | 7.993 | 2.676 | 2.146 | 2.097 | ||

| C_Financing | B | −0.045 * | −0.048 | −0.009 | −0.046 * | −0.048 | −0.048 | |

| SE | 0.019 | 0.026 | 0.011 | 0.021 | 0.025 | 0.026 | ||

| Z | −2.341 | −1.843 | −0.805 | −2.220 | −1.908 | −1.875 | ||

| Statistical data (VII) | Sample_size | B | 0.000 * | 0.000 | −0.000 *** | 0.000 | 0.000 | 0.000 |

| SE | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Z | 2.055 | 1.585 | −9.966 | 1.936 | 1.644 | 1.614 | ||

| Data_web | B | −0.004 | −0.008 | 0.018 *** | −0.005 | −0.008 | −0.008 | |

| SE | 0.010 | 0.015 | 0.002 | 0.011 | 0.014 | 0.014 | ||

| Z | −0.388 | −0.541 | 7.745 | −0.461 | −0.538 | −0.540 | ||

| Price_area | B | −0.016 | −0.018 | 0.009 *** | −0.017 | −0.018 | −0.018 | |

| SE | 0.013 | 0.019 | 0.002 | 0.015 | 0.018 | 0.019 | ||

| Z | −1.212 | −0.941 | 3.994 | −1.146 | −0.976 | −0.958 | ||

| Mixed-Effects Model | Tau2: | 0.000 (0.000) | 0.001 (0.000) | 0.000 (0.000) | 0.001 (0.000) | 0.001 (0.000) | 0.001 (0.000) | |

| I2: | 96.24% | 98.34% | 8.97% | 96.95% | 98.16% | 98.25% | ||

| H2: | 26.63 | 60.07 | 1.10 | 32.80 | 54.25 | 57.15 | ||

| R2: | 47.79% | 29.93% | 94.75% | 55.75% | 27.51% | 28.48% | ||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cespedes-Lopez, M.-F.; Mora-Garcia, R.-T.; Perez-Sanchez, V.R.; Perez-Sanchez, J.-C. Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC). Sustainability 2019, 11, 6303. https://doi.org/10.3390/su11226303

Cespedes-Lopez M-F, Mora-Garcia R-T, Perez-Sanchez VR, Perez-Sanchez J-C. Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC). Sustainability. 2019; 11(22):6303. https://doi.org/10.3390/su11226303

Chicago/Turabian StyleCespedes-Lopez, Maria-Francisca, Raul-Tomas Mora-Garcia, V. Raul Perez-Sanchez, and Juan-Carlos Perez-Sanchez. 2019. "Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC)" Sustainability 11, no. 22: 6303. https://doi.org/10.3390/su11226303

APA StyleCespedes-Lopez, M.-F., Mora-Garcia, R.-T., Perez-Sanchez, V. R., & Perez-Sanchez, J.-C. (2019). Meta-Analysis of Price Premiums in Housing with Energy Performance Certificates (EPC). Sustainability, 11(22), 6303. https://doi.org/10.3390/su11226303