Abstract

Although industrial agglomeration and specialization have been studied for more than 100 years, it is still a controversial field. In the era of big data, it is of great significance to study industrial agglomeration and regional specialization by using firm-level data. Based on 3,053,024 pieces of firm-level big data, the spatial evolution and spatial patterns of industrial agglomeration and specialization of 9 major industries in the Yangtze River Delta, China were revealed. Results show that: (1) the degree of industrial agglomeration is highly related to industrial attributes; industries which are directly related to production tend to be geographically concentrated, while industries that serve for production tend to be spatially dispersed; (2) the evolution characteristics and trajectories of industrial agglomeration vary by industries: wholesale and retail trade and real estate are becoming more spatially dispersed; information industries, leasing and commercial services, scientific research and polytechnic services, as well as finance are experiencing continuous spatial agglomeration; construction and manufacturing show a tendency of transfer from spatial agglomeration to spatial dispersion; (3) since 1990, most industries in the Yangtze River Delta have formed distinct spatial patterns of industrial specialization. Most core cities have experienced obvious deindustrialization processes; and high-end industries are clustering to the three biggest core cities of Shanghai, Nanjing, and Hangzhou.

1. Introduction

Industrial agglomeration and specialization have long been the focus of economics, new economic geography, spatial economics, regional economics, and geography. In the 1990s, with the birth of new economic geography, mainstream economists rediscovered the important role of space in economy, industrial agglomeration, and specialization. Industrial agglomeration helps enterprises to share infrastructure and skilled labor, promote knowledge and information spillover, and approach markets and suppliers, thus reducing transportation and transaction costs. Industrial agglomeration can also enhance the competitiveness and innovation ability of enterprises, and promote regional economic growth through the spillover effects of related and unrelated diversification [1]. Industrial agglomeration is also the source of regional or national competition. The famous industrial clusters, such as the Silicon Valley in California, the route 128 high-tech industrial clusters in Massachusetts, the Wall Street financial industry, and the cultural industries in Los Angeles show strong innovation abilities and national competitiveness. Although research on industrial agglomeration and specialization has progressed for more than 100 years, there are still a lot of controversies [2]. For example, what trajectories of industrial agglomeration and specialization does an industry follow? Does the same industry in different countries or regions have the same evolutionary trajectory? What are the differences between various industries in their industrial agglomeration and specialization? In addition, most of the previous studies are based on aggregating data collected at macro-level administrative units; although firm-level data contains more location information than the macro-level statistical data, the firm-level data are always hard to collect and process, which is the main reason why the firm-level data studies are rare [3,4]. Furthermore, many traditional indicators (e.g., Location quotient and Gini coefficient) measuring industrial agglomeration and specialization failed to take neighboring effects or spatial relationships into consideration [5]. In the era of big data, collecting firm-level location-based data to study industrial agglomeration and specialization on a finer spatial scale not only has theoretical implications, but can also provide a foundation for decision-making for regional industrial development policies and industrial spatial distribution. Understanding the spatial patterns and characteristics of industrial development also contributes to the sustainable development of local industry and economy.

This paper is based on 3,053,024 pieces of firm-level big data from the National Enterprise Credit Information Publicity System of China. The Yangtze River Delta of China was taken as an ideal case study area to explore the spatial evolution and spatial patterns of industrial agglomeration and specialization from 1990 to 2018. The research questions are as follows: 1. Since 1990, what industries in the Yangtze River Delta have become more geographically concentrated or more spatially dispersed? 2. What are the characteristics and evolutionary trajectories of industrial agglomeration for different industries? 3. What are the spatial patterns of specialization for different industries in the Yangtze River Delta?

The remainder of this paper is organized as follows: Section 2 reviews the existing theoretical and empirical controversies on industrial agglomeration and specialization. Section 3 introduces the study area, the data sources, and research methods. Section 4 includes analysis of the industrial agglomeration characteristics and evolutionary trajectories of different industries, as well as the spatial pattern of specialization in the Yangtze River Delta. Section 5 discusses the theoretical and policy implications, as well as the limitations and future research directions. Finally, the key conclusions of this research are outlined in Section 6.

2. Theoretical and Empirical Controversies

Research on industrial agglomeration and specialization in the past few decades mainly focused on the causes and mechanisms of industrial agglomeration, the relationship between industrial agglomeration and specialization, the evolutionary paths of industrial agglomeration and specialization of specific industries, as well as the methods of measuring industrial agglomeration and specialization. The theoretical origins of industrial agglomeration and specialization can be traced back to trade theory and location theory. According to classical trade theory, industrial agglomeration and specialization comes from interregional comparative advantages caused by production factors, such as production costs, products, labor productivity, etc. Neoclassical trade theory believes that industrial agglomeration and specialization come from exogenous resource endowment advantages [6]; the new trade theory instead claims that industrial agglomeration and specialization originate from economies of scale, imperfect competition, and market scale effects [7]. Location theory emphasizes the important roles of industrial attributes, transportation costs, and labor costs in industrial agglomeration. Alfred Marshall, the representative of neoclassical economics, attributed industrial agglomeration to shared intermediate inputs, shared labor markets, and knowledge spillover [8]. The new economic geography emphasizes the influences of industrial linkage, knowledge and information sharing on driving industrial agglomeration [6], and claims that agglomeration is the product of the combined effect of centripetal and centrifugal forces [9]. The California School of External Economy attributes industrial agglomeration to the decline in transaction costs [10]. The theory of territorial division of labor especially emphasizes the role of natural resource advantages in industrial agglomeration and regional specialization [11].

Industrial agglomeration and specialization are two closely related but distinct concepts [12,13]. Industrial agglomeration refers to the geographical distribution of industrial share (employment, output value, etc.) of certain industries among different regions [13,14], while regional specialization refers to the structures of industrial share (employment, output value, etc.) within a region. Most previous studies show that industrial agglomeration and specialization are equivalent or even synonymous concepts [15], for example, Kim (1995) analyzed the industrial agglomeration and specialization of manufacturing in the United States from 1860 to 1987, and results showed that the evolutionary trajectories of manufacturing agglomeration and specialization were consistent [16]. Lu (2009) analyzed the evolutionary path of industrial agglomeration and specialization of China’s manufacturing from 1998 to 2005, and the results also supported this point [17]. In contrast, some scholars found that industrial agglomeration and specialization are not the same thing, and that higher industrial agglomeration does not necessarily mean there is higher industrial specialization [18,19,20]. For example, Aiginger (2004) studied the industrial agglomeration and specialization of manufacturing in Europe and found that industrial agglomeration and specialization were not consistent; when the specialization of manufacturing increased, its spatial agglomeration decreased [19]. Both Rossi-Hansberg (2005) and Aiginger (2006) believed that industrial agglomeration and specialization would trend in opposite directions with the decrease of transportation costs [13,21]; the difference is that the former thought that a decrease of transportation costs will lead to an increase of industrial agglomeration and a decrease of specialization, while the latter believed that a decrease of transportation costs will lead to a decrease of industrial agglomeration and an increase of specialization.

The evolutionary trajectories and characteristics of industrial agglomeration and specialization varied by industry. Manufacturing is the industry that scholars have paid most of their attention to; however, due to the differences in measurement methods and spatial scales, scholars’ opinions are divided on whether manufacturing tends to be more geographically concentrated or not. Most empirical studies from China’s manufacturing showed that on the national scale, China’s manufacturing increasingly concentrated on its southeast coastal cities [15,22]. Behrens (2015) analyzed the evolution of specialization of Canada’s manufacturing based on the distance-based method, and the results showed that 40%–60% of the manufacturing in Canada tended to be spatial agglomeration from 2001 to 2009 [3]. Koh (2014) studied the industrial agglomeration of Germany’s manufacturing by using the Duranton-Overman index, and the results showed that 71% of manufacturing in Germany tended to be geographical concentration, and traditional manufacturing was more likely to cluster [23]. Falcio (2008) studied the industrial agglomeration and specialization of Turkey’s manufacturing by using the Gini coefficient, and the results showed that Turkey’s manufacturing became more and more spatially agglomerated and specialized during 1980 to 2000 [7]. As for other industries, Sassen (1994) and Castells (1996) believed that with the progress of communication technology, the dependence of Information and Communications Technology (ICT) industry on location will be weakened and these industries will tend to be spatial dispersion [24,25], while more empirical studies show that the high-tech industries are still affected by the knowledge spillover effect and thus tend to be spatially agglomerated [26,27,28,29,30]. Knowledge-intensive industries also tend to be geographical concentration due to the knowledge spillover effect; the empirical studies that come from the United States [31,32], France [33], and Germany [34] have proved this opinion. Brülhart (2005) conducted a comparative study among different industries. The results showed that service sectors were more geographically agglomerated than manufacturing and agriculture [35], while other studies claimed that manufacturing has a higher degree of spatial agglomeration than service sectors [34]. Due to the confines of natural conditions and agglomeration effects, agriculture and manufacturing tend to be geographically concentrated [12]; labor-intensive industries and industries related to textiles also tend to be spatially concentrated [3,36]; creative industries tend to cluster in a small spatial scale [37].

In terms of research methods, scholars have designed numerous indexes to measure industrial agglomeration and specialization. To determine whether these indexes have spatial dimensions and whether they can provide statistical tests, these indicators can be divided into three generations [38,39]. The first-generation indicators include the Location quotient [40], the Gini coefficient, the Theil indices [41], the Coefficient of variation, the Diversification index [12], the Entropy indices [35], etc. These indicators are generally used to process the aggregating data collected in an official statistical unit. However, these indicators themselves have no spatial dimension and cannot take spatial relationships and neighboring effects between spatial units into account. The second-generation indicators include the Herfindahl index, the Hirschman-Herfendahl index [42], Spatial Gini coefficient [14], Ellison-Glaeser index [43], etc. Such indicators which are represented by the Ellison-Glaeser index, which can not only take the spatial dimension of industrial agglomeration into account, but also can study these issues on a finer spatial scale by using firm-level data. However, the Ellison-Glaeser index can be used to measure industrial agglomeration at a single spatial scale and cannot take the modifiable areal unit problem (MAUP) into consideration [39]. The third generation indicators are distance-based measures, which include the Duranton-Overman index [3], Ripley’s k-functions [44], space-time k-functions [28,30], G function [45], M function [46], and D function [47]. The third-generation indexes represented by the Duranton-Overman index regard space as a non-artificial continuous space, the index can not only take the modifiable areal unit problem into consideration but can also provide a statistical test. In addition, there is another class of methods that combines the first-generation non-spatial indicators indexes (such as Location Quotient, Gini coefficient, etc.) and modern spatial statistical methods, such as Moran’s I or Getis-Ord Gi* [48,49,50], as well as nuclear density analysis [39] to study the spatial evolution of industrial agglomeration and specialization. For example, Carroll et al. (2008) used both location quotients and Gi* to explore the potential cluster regions in the transportation equipment industry [51]. Feser et al. (2010) also used Gi* to identify industries clustered in the USA [52]. Lafourcade (2007) used Moran’s I and the EG index to study whether the geographic distribution of manufacturing activities depends on the size of plants [53]. Similarly, Sohn (2004) used the Moran’s I to identify the intraindustry-intercounty distribution pattern of the feather industry [54].

All in all, due to the differences in research methods, research spatial scales, case study areas and research periods adopted by different scholars, existing empirical research on industrial agglomeration and specialization are quite controversial. Secondly, many studies focused on a single industry, while comparative studies between different industries under the unified methodology framework and spatial scale are scarce. In addition, limited by data availability, most previous research on industrial agglomeration and specialization are based on aggregating data collected at the provincial or prefecture city level, while collecting location-based firm-level data to study these issues at a finer spatial scale is also a big challenge.

3. Study Area, Data Sources and Research Methods

3.1. Study Area

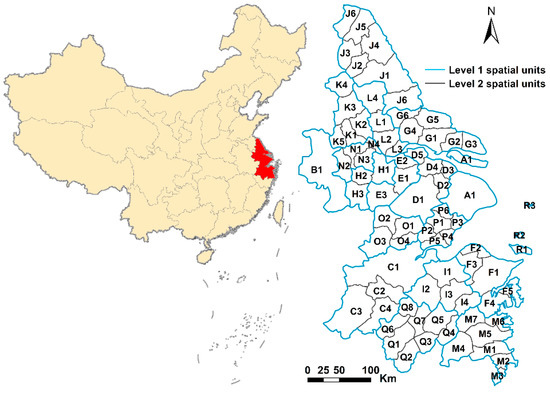

The case study area is the Yangtze River Delta (YRD), China, as shown in Figure 1. The YRD is on the eastern coast of China, which covers the whole of Shanghai, nine southern prefecture-level cities of Jiangsu province, and eight northern prefecture-level cities of Zhejiang province. As shown in Table 1, there is a total of 18 prefecture-level cities (level 1 spatial units), which can be further divided into 80 county-level cities (level 2 spatial units). For a clear map visualization, we named cities using codes. Each code is composed of one letter and one number. Cities with the same initial letter belong to the same level 1 spatial unit, and cities with the suffix of “1” are the core cities of the level 1 spatial unit. Shanghai (A1), Nanjing (B1) and Hangzhou (C1) are the three biggest core cities in YRD. In 2016, the total area of YRD was 21.17 km2, with GDP of 12.67 trillion yuan and total population of 150 million, which accounts for 2.2%, 18.5% and 11.0% of China, respectively. At present, YRD is one of the most developed and economically connected regions in China, which makes it an ideal case study area to explore industrial agglomeration and specialization in China.

Figure 1.

Case study area and the division of spatial units.

Table 1.

Division of spatial units in the Yangtze River Delta (YRD).

3.2. Data Sources

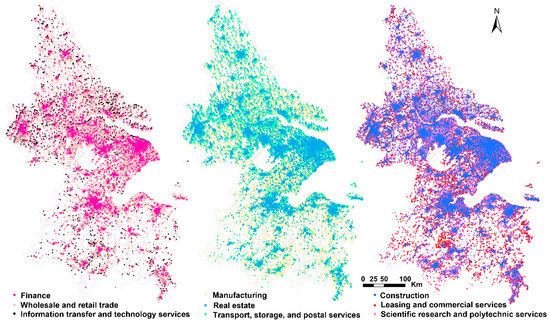

The basic information of each firm (company name, company address, year of registration, registered capital, industry attributes, operating status, etc.) was collected from the business big data platform Qichacha (www.qichacha.com), whose data was based on the National Enterprise Credit Information Publicity System of China (http://sh.gsxt.gov.cn/index.html). In this paper, we used the registered capital of each firm to measure its industrial scale, and 3,053,024 enterprises whose registered capital was greater than ¥500,000 were selected. Then, we converted each company address into latitude and longitude coordinates by geocoding to obtain the location information of each enterprise. In line with the national economic industry classification standard of the People’s Republic of China [55], we selected nine major industries. The data structures which includes the firm number, firm size, as well as the mean value and standard deviations (SD) of each industry are shown in Table 2. To reach a balance between the length of page and the visual effect, we grouped every three industries into one subfigure, making the total number of firms in each subfigure as balanced as possible. The spatial distribution of each industry is shown in Figure 2, where each point represents one firm.

Table 2.

Data structures and descriptive statistics of each industry.

Figure 2.

The spatial distribution of main industries in YRD.

3.3. Research Methods

3.3.1. EG Index

Spatial Gini coefficient fails to take the influence of enterprise scale on industrial agglomeration into consideration. In 1997, Ellison and Glaeser developed the EG index [43] based on a spatial Gini coefficient. The EG index can take both the impacts of natural advantages and spillover effect on industrial agglomeration into consideration. The formula of the EG index is as follows:

where G is the spatial Gini coefficient, M is the level 2 spatial units (i = 1,2,3……80), Si is the proportion of a share of an industry to the shares of all industries in region i, while xi is the proportion of a share of all industries in region i to all the industries in the entire area. H is the Herfindahl coefficient of an industry, N is the number of firms of an industry, and Zj is the proportion of a share of j firm to the whole industry. The share of industrial scale was measured by the registered capital. The EG index can be negative or positive, EG < 0 means there is no industrial agglomeration; EG = 0 for a random distribution. Generally, 0 < EG < 0.02 indicates a low agglomeration, 0.02 < EG < 0.05 indicates a moderate industrial agglomeration, and 0.05 ≤ EG indicates a high industrial agglomeration.

3.3.2. Location Quotient (LQ)

The indexes measuring specialization can be divided into global indicators and local indicators. The local indicator—LQ, combined with spatial statistical analysis can be used to detect the spatial pattern of specialization. The formula of Location quotient is as follows:

where LQij is the LQ of industry i in region j, Xij is the share of industry i in region j. is the share of all industries in region j. is the total share of industry i in all regions; is the share of all industries in all regions. A higher LQ indicates a higher regional specialization.

3.3.3. Moran’s I and Getis-Ord Gi*

Moran’s I is a commonly used statistic in spatial statistics to measure spatial patterns of geographical objects. A positive Moran’s I indicates spatial cluster and a negative Moran’s I represents spatial dispersion; an increase of Moran’s I indicates an enhance of spatial agglomeration; otherwise, it indicates a weakening of spatial agglomeration. The matrix was created by a fixed distance band method in Arcgis10.4 software [56] and the distance was calculated by Euclidean distance, while the default neighborhood search threshold was 56,340.2 m.

Getis-Ord Gi* is another widely used statistic in spatial statistics for detecting spatial pattern; the formula of Getis-Ord Gi* statistic is as follows:

where xj is the attribute value of spatial unit j, wi,j is the spatial weight between spatial unit i and j, n is the total number of spatial units. The spatial patterns can be classified into hot spot, cold spot, and not significant. Hot spot is a spatial unit with a high value and is surrounded by high value neighbors. Cold spot is a spatial unit with a low value and is surrounded by low value neighbors.

4. Results

4.1. Industrial Agglomeration Characteristics and Evolutionary Trajectories of Different Industries

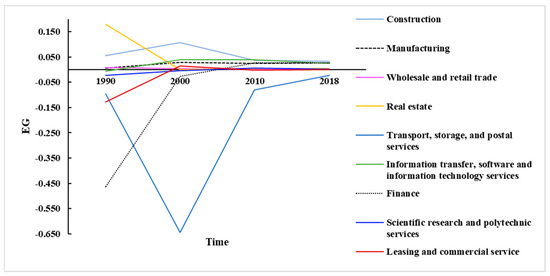

The research period was divided into four timestamps, namely, 1990, 2000, 2010, and 2018, the EG indexes of nine industries and their dynamic changes are shown in Table 3 and Figure 3.

Table 3.

The Ellison-Glaeser (EG) index of different industries during 1990–2018.

Figure 3.

Dynamic changes of EG indexes of different industries from 1990 to 2018.

We found that industrial agglomeration characteristics and its evolutionary trajectories varied by industry. During 1990–2018, the EG indexes of construction, manufacturing, wholesale and retail trade and real estate were always greater than 0, while the EG indexes of the other 5 industries (transport, storage, and postal services; information transfer, software, and information technology services; finance; scientific research and polytechnic services; leasing and commercial services) were less than or close to 0, which indicated that construction, manufacturing, wholesale and retail trade, and real estate were more likely to be geographically concentrated than other industries. In 1990, the EG index of real estate was as high as 0.179, which showed the most significant industrial agglomeration; after 1990, the industrial agglomeration of real estate dropped sharply to a very low level, and then recovered to a moderate level. The construction showed high level of industrial agglomeration and experienced a significant increase from 1990 to 2000, while after 2000, its industrial agglomeration declined and remained at a moderate level. Manufacturing kept a moderate agglomeration level during 1990–2018, its EG index had an obvious increase from 1990 to 2000, and then a small decline from 2000 to 2018. Wholesale and retail trade kept a relatively low level of agglomeration and its EG index showed a continuous slight decline from 1990 to 2018. The transport, storage, and postal services showed spatial dispersion during 1990–2018; its EG dropped from −0.097 to −0.644 during 1990 to 2000, and then increased rapidly by −0.022 in 2018. Although finance, leasing and commercial services, scientific research and polytechnic services, as well as information transfer and information technology services had low levels of initial agglomeration, their spatial agglomeration accelerated. Finance showed the most significant spatial agglomeration; its EG index increased from −0.464 in 1990 to 0.027 in 2018, which increased by 0.49 or 105.7%. The next fastest growth was leasing and commercial services; its EG index increased by 0.129 or 100.8%, while scientific research and polytechnic services also experienced a sustained rapid spatial agglomeration during 1990–2018. From the above analysis, we could conclude that the degree of industrial agglomeration is highly related to industry attributes. Industries that are directly related to production, such as manufacturing, construction and real estate, tend to be geographically concentrated. However, most industries that serve for production, or producer services sectors, such as financial, information transfer and information technology services, leasing, and commercial services tend to be spatially dispersed.

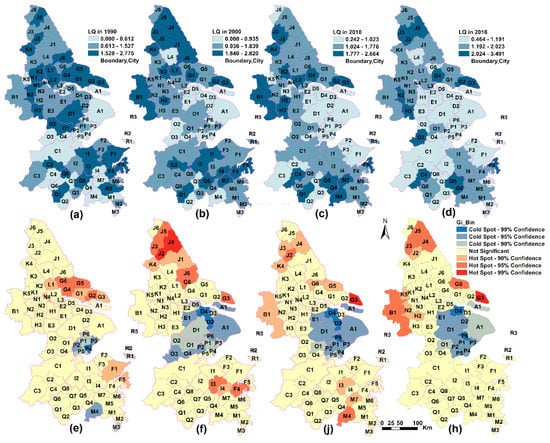

4.2. Spatial Evolution and Spatial Pattern of Specialization in YRD

4.2.1. The Characteristics of Regional Specialization of Different Industries

The LQ of each industry in 1990, 2000, 2010, and 2018 were calculated by formula (3), and the LQ of each industry were divided into three grades (high, medium, and low) by the Jenks natural breaks classification method in Arcgis10.4 software. The mean value and standard deviation (SD) of LQ for each industry are shown in Table 4; we found that construction and manufacturing had higher mean values and SD of LQ than other industries. During 1990–2018, the average LQ of construction and manufacturing were always higher than 1, which indicated that construction and manufacturing had higher regional specialization than other industries. Wholesale and retail trade also had a relatively high regional specialization; both real estate and scientific research and polytechnic services had medium regional specialization. Information transfer and information technology services, transport, storage, and postal services, leasing and commercial services, as well as finance had low regional specialization. Although the construction, manufacturing, wholesale and retail trade had higher levels of specialization, their specialization varied little with time. From 1990 to 2018, the growth rates of the mean value of LQ of these industries were 21.8%, 22.5%, and 22.6%, respectively. In contrast, the industrial specialization of information transfer and information technology services, scientific research and polytechnic services, leasing and commercial services, as well as finance had an obvious increase, the growth rate of the mean value of LQ of these industries were 624.7%, 229.5%, 222.0%, and 280.8%, respectively. For the SD of LQ for each industry, construction and manufacturing had a higher SD, which indicated that construction and manufacturing showed stronger spatial differentiation among cities. Real estate and finance had moderate SD, while information transfer, software, and information technology services, scientific research and polytechnic services, leasing and commercial services had smaller SD, which indicated that the spatial differentiation of these industries among cities were relatively low.

Table 4.

Statistics of Location Quotient (LQ) for different industries.

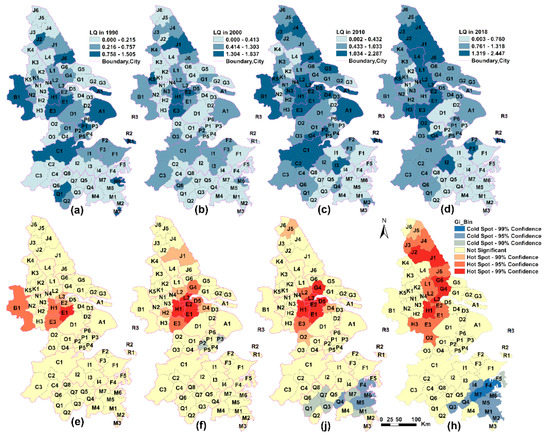

4.2.2. Spatial Evolution and Spatial Patterns of Specialization for Different Industries

Firstly, we used Moran’s I to detect whether an industry showed certain spatial patterns; if certain spatial patterns existed (p ≤ 0.05), we further used the hot spot analysis in Arcgis10.4 to detect what the specific spatial patterns were. The Moran’s I of LQ and its significance test of each industry were shown in Table 5. Among them, wholesale and retail trade, transport, storage, and postal services, as well as real estate did not show a significant spatial pattern at any time (p > 0.05), while the other six industries showed a significant spatial pattern in at least one year. The specialization maps for each industry are shown as follows:

Table 5.

Moran’s I statistics of LQ for different industries.

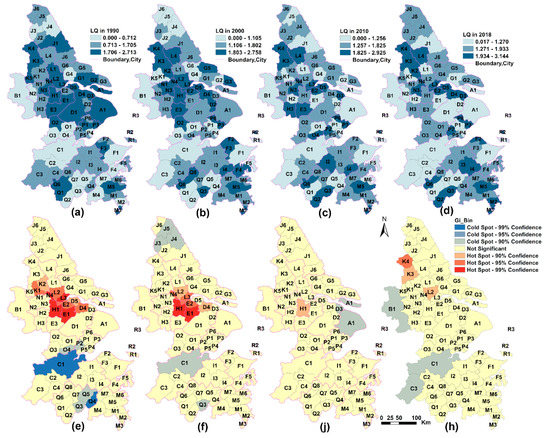

• Construction

As shown in Table 5, from 1990 to 2000, the Moran’s I of construction increased from 0.131 to 0.252, and then decreased to 0.201 in 2018, which indicated that construction experienced a process of transferring from spatial agglomeration to spatial dispersion during this period. Figure 4a–d were the spatial distribution of LQ for construction in each year, and Figure 4e–h were the corresponding hot spot maps for construction in corresponding year. In 1990, the hot spots of construction mainly clustered in cities of G1-G6, F1, and F5, while cities with a low specialization of construction were concentrated in P1-P6. After 1990, the hot spots gradually shifted to northern cities of J2-J5, as well as western cities of B1 and its surrounding areas; while the cold spots clustered to the middle east of YRD, all these cities had very low specializations in construction.

Figure 4.

The spatial evolution and spatial patterns of construction from 1990 to 2018. (a–d) the LQ of construction from 1990 to 2018; (e–h) the hot spot maps of construction from 1990 to 2018.

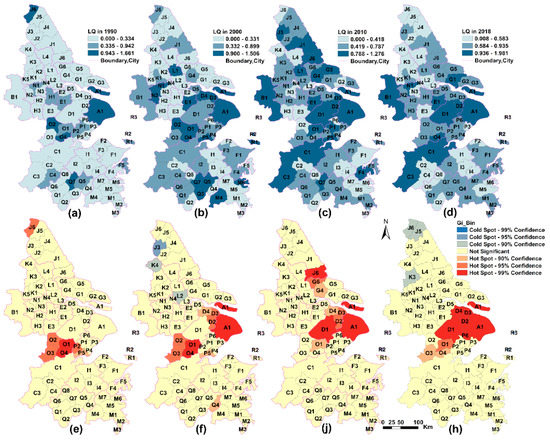

• Manufacturing

As shown in Table 5, the Moran’s I of LQ for manufacturing decreased from 0.128 to −0.074 from 1990 to 2018, which showed that the manufacturing was more and more spatially dispersed. As shown in Figure 5, in 1990, there were 28 cities with a LQ > 1.7, and these cities mainly clustered in the north-central and eastern areas of YRD. The hot spots of manufacturing clustered in cities of D4-D5, E1-E2, H1, L2-L3 and the cold spots of manufacturing clustered in regions centered by C1 and O4. After 1990, both the hot spots and cold spots began to shrink, and specialization of manufacturing in most of the core cities with suffix of “1” such as A1, D1, E1, G1, H1, J1, etc., kept decreasing. In 2010, only one hot spot of H1 and one cold spot A1 were left; in 2018, the hot spots further extended to the northern cities of K3, K4, and L2. Cities of B1, CI, and C2 became new cold spots in 2018. Overall, from 1990 to 2018, the spatial agglomeration and specialization of manufacturing kept declining, the hot spots of manufacturing were shifting from the north-central region of YRD to the north of YRD, and most of the main core cities were experiencing deindustrialization processes.

Figure 5.

The spatial evolution and spatial patterns of manufacturing from 1990 to 2018. (a–d) the LQ of manufacturing from 1990 to 2018; (e–h) the hot spot maps of manufacturing from 1990 to 2018.

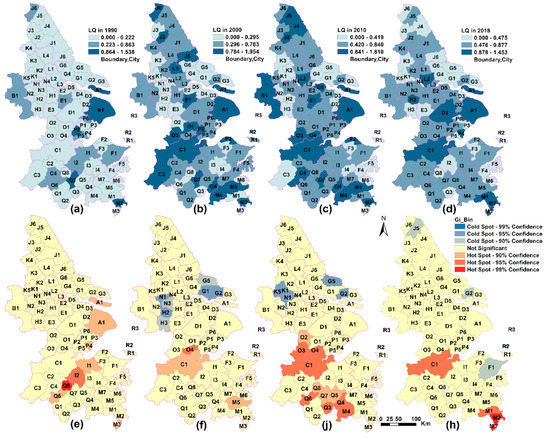

• Leasing and commercial services

As shown in Table 5 and Figure 6, from 1990 to 2018, leasing and business services showed significant spatial agglomeration in eastern YRD; its Moran’s I increased from 0.052 to 0.175 from 1990 to 2018. In 1990, cities of A1, J6, O2, O4, and Q7 had higher specialization for leasing and business services, and the hot spots of leasing and business services were cities of O1–O4, P2, P5, and J6. After 1990, the spatial agglomeration of leasing and business services strengthened, while the specialization of leasing and business services in B1 and C1 increased significantly. The hot spots began to transfer to eastern cities of A1, D1–D4 and northern cities of G4–G5 and J6. By 2018, the hot spots further clustered to cities of A1 and D1–D4, as these regions had higher industrial specialization in leasing and business services.

Figure 6.

The spatial evolution and spatial patterns of leasing and commercial services. (a–d) the LQ of leasing and commercial services from 1990 to 2018; (e–h) the hot spot maps of leasing and commercial services from 1990 to 2018.

• Finance

As shown in Table 5 and Figure 7, from 1990 to 2010, finance experienced a significant spatial agglomeration, its Moran’s I increased from 0.043 to 0.142; while after 2010, finance showed a slight spatial dispersion, its Moran’s I decreased by 0.072 in 2018. In 1990, only four cities had a higher specialization for finance, which were A1, P2, Q7, and M2. The hot spots of finance were A1, Q6, Q8, and I1–I2. In 2000, the number of cities with a high LQ of finance increased to 18, and the hot spots transferred to the south-central cities of C1, O4,, and the southern city of M5; the cold spots appeared in the western cities of H2–H3, N1 and N3, as well as the eastern cities G1–G2 and G5. In 2010, the hot spots of finance further clustered to south-central cities of C1, O2–O4, and southern cities of Q5–Q7, O3–O4, and M4. After 2010, both hot spots and cold spots began to shrink, and by 2018, only hot spots C1 and M1–M3 as well as cold spots F1, G2, and J5 were left. It is worth noting that although Shanghai (A1) had a very high LQ of finance in each year, it was not a hot spot in 2000, 2010, and 2018. That was because, on the one hand, since the 1990s, the administrative division within the jurisdiction of Shanghai has been altered frequently. In 2016, all the towns and sub-districts under the jurisdiction of Shanghai were merged into the main Shanghai district. For clear comparations of the spatial patterns of specialization in the YRD in different years, we had to merge all the sub-districts under the jurisdiction of Shanghai into one spatial unit, so the spatial relationships of intra-Shanghai cannot be detected. On the other hand, although Shanghai (A1) had very high specialization of finance from 1990 to 2018, some of its surrounding cities (D2 and D3) had a low LQ. Influenced by these neighbors, Shanghai was not a hot spot from the perspective of spatial statistics. But Shanghai is undoubtedly the financial center of the YDR and even the whole country.

Figure 7.

The spatial evolution and spatial patterns of finance from 1990 to 2018. (a–d) the LQ of finance from 1990 to 2018; (e–h) the hot spot maps of finance from 1990 to 2018.

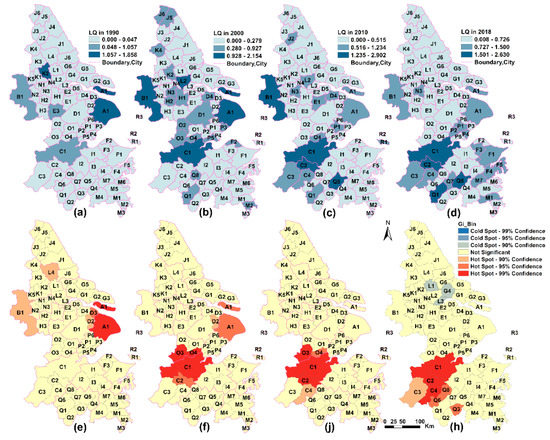

• Information transfer, software, and information technology services

As shown in Table 5 and Figure 8, the information transfer, software, and information technology services experienced a continuous spatial concentration; its Moran’s I kept increasing from −0.047 in 1990 to 0.189 in 2018. In 1990, only two cities, A1 and K2, had a higher specialization of the information industry, with the hot spots highly clustered in A1 and D2–D3. In 2000, the specialization of the information industry in core cities B1 and C1 increased significantly, and new hot spots began to emerge in C1 and its surrounding areas. After 2010, the specialization of information industries in A1 decreased and the hot spot further clustered in C1 and its surrounding areas. Overall, the information industries became more and more geographically concentrated and specialized in southern cities of C1 and its surrounding areas.

Figure 8.

The spatial evolution and spatial patterns of information industry from 1990 to 2018. (a–d) the LQ of information industry from 1990 to 2018; (e–h) the hot spot maps of information industry from 1990 to 2018.

• Scientific research and polytechnic services

Since 1990, as shown in Table 5 and Figure 9, the scientific research and polytechnic services industries have kept concentrating in the northern cities; its Moran’s I has increased from 0.077 in 1990 to 0.227 in 2018. In 1990, cities with high industrial specialization of scientific research and polytechnic services were A1, B1, C1, E1, E3, J2, J6, H1, P1, and Q1; the western city B1 and central cities E1-E3, L3, and H1 were hot spots. From 2000 to 2010, the hot spots continued to cluster in the north-central cities of YRD, while the cold spots shifted to the southeastern cities of YRD. In 2018, the hot spots further extended to northern cities of YRD, while the cold spots further concentrated to the southeastern cities. From 1990 to 2018, the specialization of scientific research and polytechnic services in YRD showed a distinct north-south differentiation spatial pattern where northern cities became specialized in this industry than in the southeastern cities.

Figure 9.

The spatial evolution and spatial patterns of scientific research and polytechnic services from 1990 to 2018. (a–d) the LQ of scientific research and polytechnic services from 1990 to 2018; (e–h) the hot spot maps of scientific research and polytechnic services from 1990 to 2018.

5. Discussions

The main contributions of this paper are in the following aspects. Firstly, most of previous studies mainly used statistical data collected in macro-level administrative units; studies which are based on firm-level data are rare [3,4]. In this paper we used more granular firm-level location-based data to investigate spatial patterns of industrial agglomeration and specialization over a relative long-time span (1990–2018) in the Yangtze River Delta. Secondly, findings from this article contribute to ongoing debates in the existing literature on industrial geography, especially spatial patterns and characteristics of industrial agglomeration across space and transition over time. Currently, scholars’ opinions are divided on which industries tend to be geographically concentrated and which industries tend to be spatially dispersed, as well as which industries are more specialized than others. In this paper, we found some interesting findings that contribute to solve these disputes to some extent.

As early as the 1990s, some scholars noticed the impact of modern transportation and communication technologies on industrial agglomeration. Sassen (1994) and Castells (1996) believed that with the progress of transportation and communication technology, the transportation and transaction costs of enterprises will decrease rapidly, thus, enterprises can have more freedom and flexibility in their location choice [24,25], which generates both agglomeration and decentralization forces. Some scholars think that industries will be more geographically concentrated, while others think that industries will be more spatially diverse. In Krugman’s new economic geography model of “two-region, two-good”, a reduction of transport cost would first foster industrial agglomeration and specialization, but then industrial dispersion emerges in the extremely low transport costs case [57]. In another general equilibrium model of the “two-city system” developed by Takatoshi in 1998, industrial dispersion happens in both higher and lower levels of transportation costs, while agglomeration appears in the intermediate level situation [58]. From a theoretical perspective, this study finds that whether an industry tends to spatial cluster or disperse is highly related to its industry attributes, and different industries have different industrial agglomeration characteristics and evolution trajectories. Industries which are directly related to production are still affected by transportation costs and spillover effects and have a higher level of industrial agglomeration and specialization, while most industries which serve for production have a low industrial agglomeration and specialization and tend to be spatially dispersed. Furthermore, scholars’ opinions are divided on whether manufacturing tends to be more geographically concentrated or not, as well as whether manufacturing has higher degree of spatial agglomeration than service sectors. This paper found that manufacturing in YRD showed a tendency of transfer from spatial agglomeration to spatial dispersion, and manufacturing has higher degree of spatial agglomeration than service sectors. These findings supported previous scholars’ conclusion that “services sectors are more spatially dispersed than manufacturing” [23,34,59].

The finance, scientific research, and polytechnic services, as well as information transfer and information technology services have a very low original spatial agglomeration. This finding, at first glance, seems to contradict existing theories suggesting that knowledge, technology and capital intensive industries tend to cluster in locations where these factors are the highest [60]. But it makes sense, when we realize the basic fact that China’s industrialization and industrial upgrading started very late compared with most developed countries. Although these industries have very low initial spatial agglomeration, they are agglomerating to the core cities at an alarming speed.

From a policy perspective, revealing the spatial evolution trajectories of industrial agglomeration and specialization has significant implications for individual cities to integrate themselves into regional production networks and make place-based industrial development policies. We found that since 1990, most industries in the YRD have formed distinct spatial patterns of specialization and spatial division of labor. For example, the manufacturing has transferred from the north-central region to the north, and most regional core cities have experienced deindustrialization processes, this finding stands in line with recent studies on manufacturing relocation in YRD [61]. High-end industries are clustering to the three biggest core cities of Shanghai (A1), Nanjing (B1), and Hangzhou (C1), while the northern cities of YRD are more specialized in scientific research and polytechnic services. Knowing these overall evolutionary spatial patterns and characteristics of industrial development in YRD help peripheral cities to better undertake industrial transfer from core cities and realize the sustainability of regional industrial transformation and upgrading.

This paper does have some limitations. Firstly, the spatial weighting matrix is critical to spatial analysis and there are many ways to create it [62]. The matrix used in this paper was created by the fixed distance band method and the results are also based on it. We did not further explore the matrix issue, because it is out of the scope of this paper, and it is extremely hard to prove which method is the best. Secondly, most of the existing research adopted employment or industrial output data to measure industrial scale. But China’s national enterprise credit information public system did not record firm-level employment data, thus, we can only use the registered capital instead of employment to measure industrial scale. Thirdly, spatial scale matters, as due to the modifiable areal unit problem, conclusions may vary with spatial scales [63]. All of our conclusions are drawn at the regional scale, namely, the 80 county-level cities, whether these conclusions are applicable to upper spatial scales are questions deserving further study. The distance-based methods, such as Duranton-Overman index and Ripley’s K-functions, can be used to solve the modifiable areal unit problem. In the future, we will use the distance-based methods to explore how industrial agglomeration and specialization vary with spatial scales.

6. Conclusions

The degree of industrial agglomeration is highly related to industrial attributes. Industries that are directly related to production tend to be geographically concentrated, while most industries that serve for production tend to be spatially dispersed. Manufacturing, construction, real estate, wholesale, and retail trade have a higher degree of industrial agglomeration, while the industries of transport, storage, and postal services, information transfer and information technology services, leasing and commercial services, scientific research and polytechnic services, as well as finance are relatively spatially dispersed.

Different industries have different evolutionary trajectories of industrial agglomeration. From 1990 to 2018, the industrial agglomeration of wholesale and retail trade and real estate kept declining; however, information transfer and information technology services, leasing and commercial services, scientific research and polytechnic services, as well as finance experienced continuous spatial agglomeration; construction and manufacturing showed a tendency of transfer from spatial agglomeration to spatial dispersion. However, transport, storage, and postal services first showed a tendency of spatial dispersion, and then spatial agglomeration.

Compared with other industries, wholesale and retail trade, manufacturing and construction have higher initial degree of industrial agglomeration and specialization, but their industrial agglomeration and specialization changed less over time. Although finance, leasing and commercial services, scientific research and polytechnic services, as well as information industry have a very low initial degree of spatial agglomeration and specialization, their spatial agglomeration and specialization increase rapidly over time.

Since 1990, most industries in YRD have formed distinct spatial patterns of specialization. The specialization of construction in middle east cities of YRD has continued to decrease, and finance has clustered to Hangzhou (C1) and its neighboring cities. Since 1990, the specialization of manufacturing has continued to weaken, the hot spots of manufacturing have shifted from the central-northern to the north of YRD, and most core cities have experienced obvious deindustrialization process. Leasing and commercial services have become highly concentrated in the middle east of YRD; the information transfer and information technology services have clustered to Hangzhou (C1) and its nearby cities; the scientific research and polytechnic services industry has shown a distinct north-south differentiation spatial pattern where the northern cities of YRD are more specialized in it.

Author Contributions

S.H., W.S. and C.L. conceived and designed the study; S.H. performed data analysis; S.H., W.S. and C.H.Z. analyzed the results. All authors have read and approved the final manuscript.

Funding

This research was funded by National Natural Science Foundation of China (Granted No. 41871158).

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Henderson, V. Externalities and Industrial Development. J. Urban Econ. 1997, 42, 449–470. [Google Scholar] [CrossRef]

- Solvell, O.; Ketels, C.; Lindqvist, G. Industrial specialization and regional clusters in the ten new EU member states. Compet. Rev. 2008, 18, 104–130. [Google Scholar] [CrossRef]

- Behrens, K.; Bougna, T. An anatomy of the geographical concentration of Canadian manufacturing industries. Reg. Sci. Urban Econ. 2015, 51, 47–69. [Google Scholar] [CrossRef]

- Arbia, G.; Espa, G.; Giuliani, D.; Dickson, M.M. Spatio-temporal clustering in the pharmaceutical and medical device manufacturing industry: A geographical micro-level analysis. Reg. Sci. Urban Econ. 2014, 49, 298–304. [Google Scholar] [CrossRef]

- Arbia, G. The role of spatial effects in the empirical analysis of regional concentration. J. Geogr. Syst. 2001, 3, 271–281. [Google Scholar] [CrossRef]

- He, C.; Wei, Y.H.D.; Pan, F. Geographical Concentration of Manufacturing Industries in China: The Importance of Spatial and Industrial Scales. Eurasian Geogr. Econ. 2007, 48, 603–625. [Google Scholar] [CrossRef]

- Falcioğlu, P.; Akgüngör, S. Regional Specialization and Industrial Concentration Patterns in the Turkish Manufacturing Industry: An Assessment for the 1980–2000 Period. Eur. Plan. Stud. 2008, 16, 303–323. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics: Unabridged Eighth Edition; Cosimo, Inc.: New York, NY, USA, 2009. [Google Scholar]

- Krugman, P. What’s new about the new economic geography? Oxf. Rev. Econ. Policy 1998, 14, 7–17. [Google Scholar] [CrossRef]

- Long, C.; Zhang, X. Cluster-based industrialization in China: Financing and performance. J. Int. Econ. 2011, 84, 112–123. [Google Scholar] [CrossRef]

- Pilipenko, I. Clusters and Territorial-Industrial Complexes—Similar Approaches or Different Concepts?—first Evidence from Analysis of Development of Russian Regions. In Proceedings of the European Regional Science Association’Land Use and Water Management in a Sustainable Network Society, Amsterdam, The Netherlands, 23–27 August 2005. [Google Scholar]

- Chapman, S.A. Specialization and agglomeration patterns in Eastern Europe. Eur. J. Comp. Econ. 2013, 1, 49–79. [Google Scholar]

- Aiginger, K.; Rossi-Hansberg, E. Specialization and concentration: A note on theory and evidence. Empirica 2006, 33, 255–266. [Google Scholar] [CrossRef]

- Goschin, Z.; Constantin, D.; Roman, M.; Ileanu, B. Regional specialization and geographic concentration of industries in Romania. South-East. Eur. J. Econ. 2009, 1, 99–113. [Google Scholar]

- Long, C.; Zhang, X. Patterns of China’s industrialization: Concentration, specialization, and clustering. China Econ. Rev. 2012, 23, 593–612. [Google Scholar] [CrossRef]

- Kim, S. Expansion of Markets and the Geographic Distribution of Economic Activities: The Trends in U. S. Regional Manufacturing Structure, 1860–1987. Q. J. Econ. 1995, 110, 881–908. [Google Scholar] [CrossRef]

- Lu, J.; Tao, Z. Trends and determinants of China’s industrial agglomeration. J. Urban Econ. 2009, 65, 167–180. [Google Scholar] [CrossRef]

- Midelfart-Knarvik, K.H.; Overman, H.G.; Redding, S.J.; Venables, A.J. The Location of European Industry; SNF: Berne, Switzerland, 2000. [Google Scholar]

- Aiginger, K.; Pfaffermayr, M. The Single Market and Geographic Concentration in Europe. Rev. Int. Econ. 2004, 12, 1–11. [Google Scholar] [CrossRef]

- Bertinelli, L.; Decrop, J. Geographical agglomeration: Ellison and Glaeser’s index applied to the case of Belgian manufacturing industry. Reg. Stud. 2005, 39, 567–583. [Google Scholar] [CrossRef]

- Rossi-Hansberg, E. A Spatial Theory of Trade. Am. Econ. Rev. 2005, 95, 1464–1491. [Google Scholar] [CrossRef]

- Wen, M. Relocation and agglomeration of Chinese industry. J. Dev. Econ. 2004, 73, 329–347. [Google Scholar] [CrossRef]

- Koh, H.-J.; Riedel, N. Assessing the Localization Pattern of German Manufacturing and Service Industries: A Distance-based Approach. Reg. Stud. 2014, 48, 823–843. [Google Scholar] [CrossRef]

- Sassen, S. Cities in a World Economy, 5th ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2019. [Google Scholar]

- Castells, M. The Rise of the Network Society, 2nd ed.; Blackwell Publishers: Oxford, UK, 2000. [Google Scholar]

- Kowalski, A.M.; Marcinkowski, A. Clusters versus Cluster Initiatives, with Focus on the ICT Sector in Poland. Eur. Plan. Stud. 2014, 22, 20–45. [Google Scholar] [CrossRef]

- Dumais, G.; Ellison, G.; Glaeser, E.L. Geographic Concentration as a Dynamic Process. Rev. Econ. Stat. 2002, 84, 193–204. [Google Scholar] [CrossRef]

- Arbia, G.; Espa, G.; Giuliani, D.; Mazzitelli, A. Clusters of firms in an inhomogeneous space: The high-tech industries in Milan. Econ. Model. 2012, 29, 3–11. [Google Scholar] [CrossRef]

- Zheng, D.; Kuroda, T. The impact of economic policy on industrial specialization and regional concentration of China’s high-tech industries. Ann. Reg. Sci. Int. J. UrbanReg. Environ. Res. Policy 2013, 50, 771–790. [Google Scholar] [CrossRef]

- Arbia, G.; Espa, G.; Giuliani, D.; Mazzitelli, A. Detecting the existence of space-time clustering of firms. Reg. Sci. Urban Econ. 2010, 40, 311–323. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Trajtenberg, M.; Henderson, R. Geographic Localization of Knowledge Spillovers as Evidenced by Patent Citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Feldman, M.P. R&D Spillovers and the Geography of Innovation and Production. Am. Econ. Rev. 1996, 86, 630–640. [Google Scholar]

- Maurel, F.O.; Béatrice, S.D. A measure of the geographic concentration in French manufacturing industries. Reg. Sci. Urban Econ. 1999, 29, 575–604. [Google Scholar] [CrossRef]

- Dauth, W.; Fuchs, M.; Otto, A. Long-run processes of geographical concentration and dispersion: Evidence from Germany. Pap. Reg. Sci. 2018, 97, 569–593. [Google Scholar] [CrossRef]

- Brülhart, M.; Traeger, R. An account of geographic concentration patterns in Europe. Reg. Sci. Urban Econ. 2005, 35, 597–624. [Google Scholar] [CrossRef]

- Fan, C.C.; Scott, A.J. Industrial Agglomeration and Development: A Survey of Spatial Economic Issues in East Asia and a Statistical Analysis of Chinese Regions. Econ. Geogr. 2003, 79, 295–319. [Google Scholar] [CrossRef]

- Coll-Martínez, E.; Moreno-Monroy, A.-I.; Arauzo-Carod, J.-M. Agglomeration of creative industries: An intra-metropolitan analysis for Barcelona. Pap. Reg. Sci. 2019, 98, 409–431. [Google Scholar] [CrossRef]

- Arbia, G.; Espa, G.; Quah, D. A class of spatial econometric methods in the empirical analysis of clusters of firms in the space. Empir. Econ. 2008, 34, 81–103. [Google Scholar] [CrossRef]

- Cao, W.; Li, Y.; Cheng, J.; Millington, S. Location patterns of urban industry in Shanghai and implications for sustainability. J. Geogr. Sci. 2017, 27, 857–878. [Google Scholar] [CrossRef]

- Liu, Z. Global and Local: Measuring Geographical Concentration of China’s Manufacturing Industries. Prof. Geogr. 2014, 66, 284–297. [Google Scholar] [CrossRef]

- Nakajima, K.; Saito, Y.U.; Uesugi, I. Measuring economic localization: Evidence from Japanese firm-level data. J. Jpn. Int. Econ. 2012, 26, 201–220. [Google Scholar] [CrossRef]

- Koech, J.; Wynne, M.A. Diversification and specialization of U.S. states. Rev. Reg. Stud. 2017, 47, 63–91. [Google Scholar] [CrossRef]

- Ellison, G.; Glaeser, E.L. Geographic Concentration in U.S. Manufacturing Industries: A Dartboard Approach. J. Political Econ. 1997, 105, 889–927. [Google Scholar] [CrossRef]

- Ripley, B.D. The Second-Order Analysis of Stationary Point Processes. J. Appl. Probab. 1976, 13, 255–266. [Google Scholar] [CrossRef]

- Marcon, E.; Puech, F. A typology of distance-based measures of spatial concentration. Reg. Sci. Urban Econ. 2017, 62, 56–67. [Google Scholar] [CrossRef]

- Marcon, E.; Puech, F. Measures of the geographic concentration of industries: Improving distance-based methods. J. Econ. Geogr. 2010, 10, 745–762. [Google Scholar] [CrossRef]

- Arbia, G.; Piras, G. A new class of spatial concentration measures. Comput. Stat. Data Anal. 2009, 53, 4471–4481. [Google Scholar] [CrossRef]

- Guimarães, P.; Figueiredo, O.; Woodward, D. Accounting for neighboring effects in measures of spatial concentration. J. Reg. Sci. 2011, 51, 678–693. [Google Scholar] [CrossRef]

- Sternberg, R.; Litzenberger, T. Regional clusters in Germany—Their geography and their relevance for entrepreneurial activities. Eur. Plan. Stud. 2004, 12, 767–791. [Google Scholar] [CrossRef]

- Sohn, J. Industry classification considering spatial distribution of manufacturing activities. Area 2014, 46, 101–110. [Google Scholar] [CrossRef]

- Carroll, M.; Reid, N.; Smith, B. Location quotients versus spatial autocorrelation in identifying potential cluster regions. Ann. Reg. Sci. 2008, 42, 449–463. [Google Scholar] [CrossRef]

- Feser, E.J.; Sweeney, S.H.; Renski, H.C. A Descriptive Analysis of Discrete U.S. Industrial Complexes. J. Reg. Sci. 2010, 45, 395–419. [Google Scholar] [CrossRef]

- Lafourcade, M.; Mion, G. Concentration, agglomeration and the size of plants. Reg. Sci. Urban Econ. 2007, 37, 46–68. [Google Scholar] [CrossRef]

- Sohn, J. Do birds of a feather flock together?: Economic linkage and geographic proximity. Ann. Reg. Sci. 2004, 38, 47–73. [Google Scholar] [CrossRef]

- Holz, C.A. Chinese statistics: Classification systems and data sources. Eurasian Geogr. Econ. 2013, 54, 532–571. [Google Scholar] [CrossRef]

- Mitchell, A. The Esri Guide to Gis Analysis: Geographic Patterns & Relationships: Vol 1; Esri Inc.: Redlands, CA, USA, 1999. [Google Scholar]

- Krugman, P.R. Geography and Trade; Leuven University Press: Leuven, Belgium; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Tabuchi, T. Urban Agglomeration and Dispersion: A Synthesis of Alonso and Krugman. J. Urban Econ. 1998, 44, 333–351. [Google Scholar] [CrossRef]

- Barlet, M.; Briant, A.; Crusson, L. Location patterns of service industries in France: A distance-based approach. Reg. Sci. Urban Econ. 2013, 43, 338–351. [Google Scholar] [CrossRef]

- Iammarino, S.; McCann, P. The structure and evolution of industrial clusters: Transactions, technology and knowledge spillovers. Res. Policy 2006, 35, 1018–1036. [Google Scholar] [CrossRef]

- Wu, J.; Wei, Y.D.; Li, Q.; Yuan, F. Economic transition and changing location of manufacturing industry in China: A study of the Yangtze River Delta. Sustainability 2018, 10. [Google Scholar] [CrossRef]

- Dray, S.; Legendre, P.; Peres-Neto, P.R. Spatial modelling: A comprehensive framework for principal coordinate analysis of neighbour matrices (PCNM). Ecol. Model. 2006, 196, 483–493. [Google Scholar] [CrossRef]

- Arbia, G. Modelling the geography of economic activities on a continuous space*. Pap. Reg. Sci. 2005, 80, 411–424. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).