Policy Hotspots for Sustainability: Changes in the EU Regulation of Sustainable Business and Finance

Abstract

1. Introduction: Scaling Up Sustainable Business and Finance

2. Materials and Methods

3. Analysis of the Findings: Institutional Network Analysis and Policy Hotspots

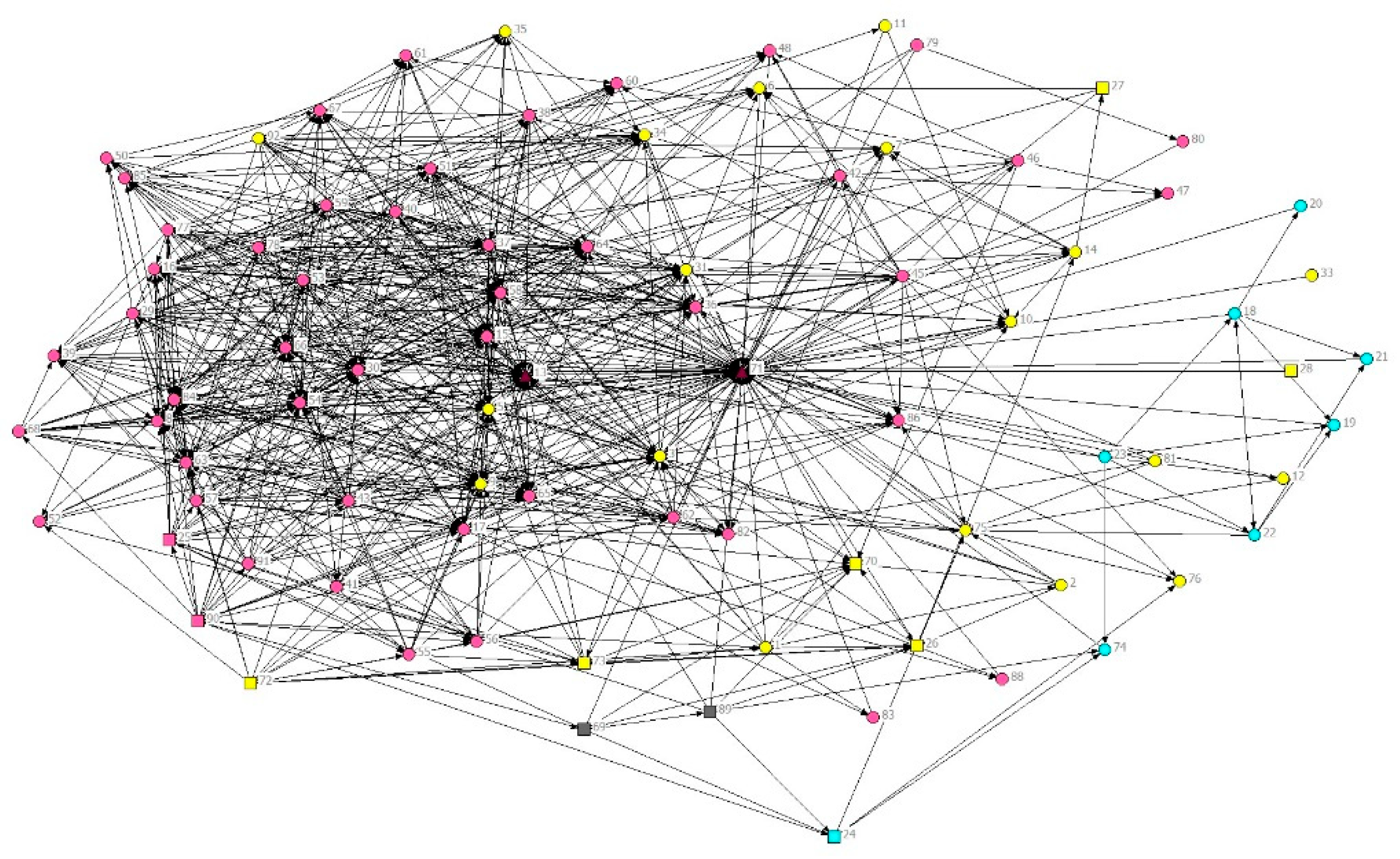

3.1. The Citation Network of EU Business and Financial Market Law

3.2. Policy Hotspots for Change

3.2.1. EU Action on CSR and the Links to Agenda 2030

Several Commission services wanted to announce that the Commission will publish an updated action plan in spring 2017, but the College of Commissioners decided not to do it within the EU Communication of November 2016 on "Next steps for a sustainable European future European action for sustainability".(I9)

The focus on sustainability has been pushed forward by the UN agenda on SDGs adopted in September 2015. The European Commission endorsed this agenda in November 2016.(I9)

UN Guiding Principles on Business and Human Rights were only mentioned once in point 67 of the Resolution on the UN SDG agenda. They were not referred to in the EU Communication in 2016, but they were endorsed by the Commission in the EU 2011 Strategy on CSR, as well as the OECD guidelines for multinational enterprises.(I9)

3.2.2. Growing Interest in Sustainable Finance

The most important and central legislative instruments are the new Pension Funds Directive [IORP II] and the Shareholders Rights Directive. But the idea is to integrate sustainability more widely to the banking, solvency, insurance, and asset manager rules—[integrate sustainability] into MiFID and to the fund managers rules and usage; AIFM Directive.(I7)

The Euro crisis has made it possible to work more with financial markets and it has opened up for a discussion that ‘if we still have to work with this, let us take this opportunity and make sure it contributes to sustainable development.’(I11)

After the financial crisis, we have been focusing on sustainability issues because we realised that financial markets, particularly capital markets, are too short term. (…) Many rules have been adopted in this period to somehow foster more long-termism.(I7)

The Commission will explore the feasibility of the inclusion of risks associated with climate and other environmental factors.

3.2.3. The Emerging Circular Economy Policy Hotspot

It is not just one actor who has said that this is a positive agenda—on the contrary, quite a number of players including companies, organisations, NGOs and the Member States think that this is the right way forward. I would say that Circular Economy as a basic concept and orientation have a rather broad positive support.(I11)

There are discussions on how to create more harmonised rules for more products that can be manufactured by recycled materials. (…) There is a need to develop more standards of properties of different secondary raw materials. This development is facilitated by the creation of volumes and the creation of business opportunities.(I11)

I imagine that part of the ambitions that the Commission has is to use the Circular Economy concept in order to strengthen the single market, thus increasing the possibility of opening up for products that can be approved everywhere. (…) This may affect new product areas that will be harmonised. Certain businesses can then grow and participate in the whole EU market.(I11)

I see synergies in the innovation funding by EFSI (…). And synergies can easily be seen with pension funds with long term investments and sustainability finance; a way to show that sustainability is necessary and to fund the transformation to a Circular Economy.(I14)

4. Policy Hotspots: Two Possible Pathways to Enhance Sustainability?

4.1. Should the EU Rely on Finance to Tackle Unsustainable Business?

The proposal will aim to (i) explicitly require institutional investors and asset managers to integrate sustainability considerations in the investment decision-making process and (ii) increase transparency towards end-investors on how they integrate such sustainability factors in their investment decisions, in particular as concerns their exposure to sustainability risks.

4.2. Alternative Strategies? Looking at the ‘Real Economy’ to Address Unsustainable Business

5. Conclusions

Supplementary Materials

Funding

Acknowledgments

Conflicts of Interest

References

- Rockström, J.; Steffen, W.; Noone, K.; Persson, A.; Folke, C.; Nykvist, B.; Sörlin, S.; Costanza, R.; Svedin, U.; Falkenmark, M.; et al. Planetary Boundaries: Exploring the Safe Operating Space for Humanity. Ecol. Soc. 2009, 14, 32. [Google Scholar] [CrossRef]

- Steffen, W.; Richardson, K.; Rockström, J.; Cornell, S.E.; Fetzer, I.; Bennett, E.M.; Biggs, R.; Carpenter, S.R.; de Vries, W.; de Wit, C.A.; et al. Planetary boundaries: Guiding human development on a changing planet. Science 2015, 347, 1259855. [Google Scholar] [CrossRef] [PubMed]

- Biermann, F.; Abbott, K.; Andresen, S.; Bäckstrand, K.; Bernstein, S.; Betsill, M.M.; Bulkeley, H.; Cashore, B.; Clapp, J.; Folke, C.; et al. Navigating the Anthropocene: Improving earth system governance. Science 2012, 335, 1306–1307. [Google Scholar] [CrossRef] [PubMed]

- Wiesbrock, A.; Sjåfjell, B. The importance of Article 11 TFEU for regulating business in the EU: Securing the very basis of our existence. In The Greening of European Business under EU Law: Taking Article 11 TFEU Seriously; Sjåfjell, B., Wiesbrock, A., Eds.; Routledge: New York, NY, USA, 2015; pp. 1–12. [Google Scholar]

- Hugé, J.; Waas, T.; Dahdouh-Guebas, F.; Koedam, N.; Block, T. A discourse-analytical perspective on sustainability assessment: Interpreting sustainable development in practice. Sustain. Sci. 2013, 8, 187–198. [Google Scholar] [CrossRef]

- Neumayer, E. Weak Versus Strong Sustainability: Exploring the Limits of Two Opposing Paradigms, 2nd ed.; Edward Elgar: Cheltenham, UK, 2003. [Google Scholar]

- Roome, N. Looking back, thinking forward: Distinguishing between weak and strong sustainability. In The Oxford Handbook of Business and the Natural Environment; Bansal, P., Hoffman, A.J., Eds.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Ackoff, R. Ackoff’s Best: His Classic Writings on Management; Wiley: Chichester, UK, 1999. [Google Scholar]

- Daly, H.E. Elements of environmental macroeconomics. In Ecological Economics: The Science and Management of Sustainability; Costanza, R., Ed.; Columbia University Press: New York, NY, USA, 1991. [Google Scholar]

- Ekins, P.; Simon, S.; Deutsch, L.; Folke, C.; De Groot, R. A framework for the practical application of the concepts of critical natural capital and strong sustainability. Ecol. Econ. 2003, 44, 165–185. [Google Scholar] [CrossRef]

- Raworth, K. A Doughnut for the Anthropocene: humanity’s compass in the 21st century. Lancet Planet. Health 2017, 1, e48–e49. [Google Scholar] [CrossRef]

- Cullen, J.; Mähönen, J. Taming unsustainable finance: The perils of modern risk management. In Cambridge Handbook of Corporate Law, Corporate Governance and Sustainability; Sjåfjell, B., Bruner, C., Eds.; Cambridge University Press: Cambridge, UK, in press.

- Sjåfjell, B.; Taylor, M.B. Planetary Boundaries and Company Law: Towards a Regulatory Ecology of Corporate Sustainability. University of Oslo Faculty of Law Legal Studies Research Paper Series 2015, No. 2015-11. Available online: https://ssrn.com/abstract=2610583 (accessed on 28 November 2018).

- Grimeaud, D. Integration of Environmental concerns into EC Policies: A Genuine Policy Development, The. Eur. Environ. Law Rev. 2000, 9, 207. [Google Scholar] [CrossRef]

- Durán, G.M.; Morgera, E. Environmental Integration in the EU’s External Relations: Beyond Multilateral Dimensions; Bloomsbury Publishing: London, UK, 2012. [Google Scholar]

- Solana, J. The Power of the Eurosystem to promote environmental protection. Eur. Bus. Law Rev. 2018, accepted. [Google Scholar] [CrossRef]

- Jans, J.H.; Vedder, H.H.B. European Environmental Law: After Lisbon, 4th ed.; European Law Publishing: Groningen, The Netherlands, 2012; pp. 16–23. [Google Scholar]

- Sustainable Finance. Available online: https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance (accessed on 28 November 2018).

- Ireland, P. Company law and the myth of shareholder ownership. Mod. Law Rev. 1999, 62, 32–57. [Google Scholar] [CrossRef]

- Stout, L.A. The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the Public; Berrett-Koehler Publishers: Oakland, CA, USA, 2012. [Google Scholar]

- Stout, L.A. The toxic side effects of shareholder primacy. Univ. Pa. Law Rev. 2013, 161, 2003–2023. [Google Scholar]

- Sjåfjell, B.; Johnston, A.; Anker-Sørensen, L.; Millon, D. Shareholder Primacy: The Main Barrier to Sustainable Companies. In Company Law and Sustainability: Legal Barriers and Opportunities; Sjåfjell, B., Richardson, J.B., Eds.; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Sjåfjell, B. Dismantling the Legal Myth of Shareholder Primacy: The Corporation as a Sustainable Market Actor. In Shaping the Corporate Landscape: Towards Corporate Reform and Enterprise Diversity; Boeger, N., Villiers, C., Eds.; Bloomsbury Publishing: New York, NY, USA, 2018. [Google Scholar]

- Sjåfjell, B. Corporate Governance for Sustainability. The Necessary Reform of EU Company Law. In The Greening of European Business under EU Law: Taking Article 11 TFEU Seriously; Sjåfjell, B., Wiesbrock, A., Eds.; Routledge: Oxford, UK, 2015; pp. 97–117. [Google Scholar]

- Abbott, K.W.; Snidal, D. Hard and soft law in international governance. Int. Organ. 2000, 54, 421–456. [Google Scholar] [CrossRef]

- Argyris, C.; Schön, D.A. Theory in Practice: Increasing Professional Effectiveness; Jossey-Bass: San Fransisco, CA, USA, 1974. [Google Scholar]

- Argyris, C.; Schön, D.A. Organizational learning: A theory of action perspective. Reis: Rev. Esp. Investig. Sociol. 1997, 345–348. [Google Scholar] [CrossRef]

- Argyris, C. Single-loop and double-loop models in research on decision making. Adm. Sci. Q. 1976, 21, 363–375. [Google Scholar] [CrossRef]

- Argyris, C. Knowledge for Action: A Guide to Overcoming Barriers to Organizational Change; Jossey-Bass Inc.: San Francisco, CA, USA, 1993. [Google Scholar]

- De Schutter, O.; Lenoble, J. Reflexive Governance: Redefining the Public Interest in a Pluralistic World; Bloomsbury Publishing: New York, NY, USA, 2010. [Google Scholar]

- Voß, J.P.; Kemp, R. Sustainability and reflexive governance: Introduction. In Reflexive Governance for Sustainable Development; Voß, J.P., Bauknecht, D., Kemp, R., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2006; pp. 3–30. [Google Scholar]

- Voß, J.P.; Bauknecht, D.; Kemp, R. Reflexive Governance for Sustainable Development; Edward Elgar Publishing: Cheltenham, UK, 2006. [Google Scholar]

- Lenoble, J.; Maesschalck, M. Renewing the Theory of Public Interest. In Reflexive Governance: Redefining the Public Interest in a Pluralistic World; De Schutter, O., Lenoble, J., Eds.; Bloomsbury Publishing: New York, NY, USA, 2010; pp. 3–21. [Google Scholar]

- Aalbers, M.B. Corporate financialization. In People, the Earth, Environment, and Technology; Castree, N., Ed.; Wiley: Oxford, UK, 2015; pp. 1–11. [Google Scholar]

- Krippner, G.R. Capitalizing on Crisis; Harvard University Press: Cambridge, MA, USA, 2011. [Google Scholar]

- Sweezy, P.M. Economic reminiscences. Mon. Rev. 1995, 47, 1–12. [Google Scholar] [CrossRef]

- Aalbers, M.B. Corporate financialization. In The International Encyclopedia of Geography; Richardson, D., Castree, N., Goodchild, M.F., Kobayashi, A., Liu, W., Marston, R.A., Eds.; John Wiley & Sons Ltd.: New York, NY, USA, 2017. [Google Scholar]

- Martínez-Blanco, J.; Lehmann, A.; Chang, Y.J.; Finkbeiner, M. Social organizational LCA (SOLCA)—A new approach for implementing social LCA. Int. J. Life Cycle Assess. 2015, 20, 1586–1599. [Google Scholar] [CrossRef]

- Tsalis, T.; Avramidou, A.; Nikolaou, I.E. A social LCA framework to assess the corporate social profile of companies: Insights from a case study. J. Clean. Prod. 2017, 164, 1665–1676. [Google Scholar] [CrossRef]

- UNEP/SETAC Life Cycle Initiative. Towards a Life Cycle Sustainability Assessment. Making Informed Choices on Products. 2011. Available online: https://www.lifecycleinitiative.org/wp-content/uploads/2012/12/2011%20-%20Towards%20LCSA.pdf (accessed on 6 April 2018).

- Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M.; Ferrero-Ferrero, I.; Escrig-Olmedo, E.; Gisbert-Navarro, J.V.; Marullo, M.C. An Assessment Tool to Integrate Sustainability Principles into the Global Supply Chain. Sustainability 2018, 10, 535. [Google Scholar] [CrossRef]

- Kim, R.E. The emergent network structure of the multilateral environmental agreement system. Glob. Environ. Chang. 2013, 23, 980–991. [Google Scholar] [CrossRef]

- Ahlström, H.; Cornell, S.E. Governance, polycentricity and the global nitrogen and phosphorus cycles. Environ. Sci. Policy 2018, 79, 54–65. [Google Scholar] [CrossRef]

- Kiss, A.; Shelton, D. Guide to International Environmental Law; Martinus Nijhoff Publishers: Leiden, The Netherlands, 2007; p. 87. [Google Scholar]

- Churchill, R.R.; Ulfstein, G. Autonomous institutional arrangements in multilateral environmental agreements: A little-noticed phenomenon in international law. Am. J. Int. Law 2000, 94, 623–659. [Google Scholar] [CrossRef]

- Ulfstein, G. Treaty bodies and regimes. In The Oxford Guide to Treaties; Hollis, D.B., Ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Kim, R.E.; Mackey, B. International environmental law as a complex adaptive system. Int. Environ. Agreem. Polit. Law Econ. 2014, 14, 5–24. [Google Scholar] [CrossRef]

- Kim, R.E. Transnational Sustainability Law-Whither International Environmental Law? Environ. Policy Law 2016, 46, 405. [Google Scholar]

- EUR-Lex—Access to European Union Law. Available online: https://eur-lex.europa.eu/homepage.html?locale=en (accessed on 28 November 2018).

- Closing the Loop—An EU Action Plan for the Circular Economy. Available online: http://ec.europa.eu/environment/circular-economy/index_en.htm (accessed on 28 November 2018).

- Sustainable Development Goals. Available online: https://ec.europa.eu/info/strategy/international-strategies/global-topics/sustainable-development-goals_en (accessed on 28 November 2018).

- Corporate Social Responsibility (CSR). Available online: http://ec.europa.eu/growth/industry/corporate-social-responsibility_en (accessed on 28 November 2018).

- Arber, S. Secondary Analysis of survey data. In Researching Social Life; Gilbert, G.N., Ed.; SAGE: London, UK, 2001. [Google Scholar]

- Grundmann, S.; Möslein, F. European Company Law. Organization, Finance and Capital Markets; Intersentia: Cambridge, UK, 2007. [Google Scholar]

- Hopt, K.; Wymeersch, E. European Company and Financial Law: Texts and Leading Cases; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Borgatti, S.P.; Everett, M.G.; Freeman, L.C. Ucinet for Windows: Software for Social Network Analysis; Analytic Technologies: Harvard, MA, USA, 2002. [Google Scholar]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Ortiz-Arroyo, D. Discovering sets of key players in social networks. In Computational Social Network Analysis—Trends, Tools and Research Advances; Abraham, A., Hassanien, A.E., Snášel, V., Eds.; Springer: London, UK, 2010; pp. 27–47. [Google Scholar]

- Action Plan on Building a Capital Markets Union (2000/60/EC). Available online: http://ec.europa.eu/finance/capital-markets-union/docs/building-cmu-actionplan_ en.pdf (accessed on 28 November 2018).

- MIFID II. Available online: https://www.esma.europa.eu/policy-rules/mifid-ii-and-mifir (accessed on 28 November 2018).

- European Commission—Press Release European Commission Appoints Members of the High-Level Expert Group on Sustainable Finance. Available online: http://europa.eu/rapid/press-release_IP-16-4502_en.htm (accessed on 28 November 2018).

- Final Report of the High-Level Expert Group on Sustainable Finance. Available online: https://ec.europa.eu/info/publications/180131-sustainable-finance-report_en (accessed on 28 November 2018).

- Commission Legislative Proposals on Sustainable Finance. Available online: https://ec.europa.eu/info/publications/180524-proposal-sustainable-finance_en (accessed on 28 November 2018).

- Sjåfjell, B. Achieving Corporate Sustainability: What is the Role of the Shareholder? In Shareholders’ Duties; Birkmose, H., Ed.; Kluwer Law International: Alphen aan den Rijn, The Netherlands, 2017. [Google Scholar]

- Twining, W. Social science and diffusion of law. J. Law Soc. 2005, 32, 203–240. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- European Commission—Press Release #InvestEU: Commission and European Investment Bank Group Welcome Final Adoption of Extended and Improved European Fund for Strategic Investments. Available online: http://europa.eu/rapid/press-release_IP-17-5169_en.htm (accessed on 28 November 2018).

- Sjåfjell, B.; Mähönen, J.; Johnston, A.; Cullen, J. D2.4. Obstacles to Sustainable Global Business: Towards EU Policy Coherence for Sustainable Development; Public Report, SMART H2020 Project; 2018. Available online: https://www.smart.uio.no/publications/reports/smartcomprehensive-analysis-31august2018-final.pdf (accessed on 28 November 2018).

- Dimitrakopoulos, G.D. The Changing European Commission; Manchester University Press: Manchester, UK, 2004. [Google Scholar]

- Kassim, H.; Dimitrakopoulos, D.G. The European Commission and the future of Europe. J. Eur. Public Policy 2007, 14, 1249–1270. [Google Scholar] [CrossRef]

- Better Regulation: Why and How. Available online: https://ec.europa.eu/info/law/law-making-process/planning-and-proposing-law/better-regulation-why-and-how_en (accessed on 28 November 2018).

- Radaelli, C.M. Whither better regulation for the Lisbon agenda? J. Eur. Public Policy 2007, 14, 190–207. [Google Scholar] [CrossRef]

- Smith, J.; Haniffa, R.; Fairbrass, J. A conceptual framework for investigating ‘capture’ in corporate sustainability reporting assurance. J. Bus. Eth. 2011, 99, 425–439. [Google Scholar] [CrossRef]

- O’Dwyer, B.; Owen, D. Seeking stakeholder-centric sustainability assurance. J. Corp. Citizensh. 2007, 25, 77–94. [Google Scholar] [CrossRef]

- Ruggie, J. Protect, Respect, and Remedy: A Framework for Business and Human Rights; Report of the Special Representative of the Secretary-General on Human Rights and Transnational Corporations and Other Business Enterprises, 7 April, A/HRC/8/5. Available online: https://www2.ohchr.org/english/bodies/hrcouncil/docs/8session/A-HRC-8-5.doc (accessed on 28 November 2018).

- Locke, R.; Amengual, M.; Mangla, A. Virtue out of necessity? Compliance, commitment, and the improvement of labor conditions in global supply chains. Polit. Soc. 2009, 37, 319–351. [Google Scholar] [CrossRef]

- Amaeshi, K.M.; Osuji, O.K.; Nnodim, P. Corporate social responsibility in supply chains of global brands: A boundaryless responsibility? Clarifications, exceptions and implications. J. Bus. Eth. 2008, 81, 223–234. [Google Scholar] [CrossRef]

- Nolan, J. Business and human rights: The challenge of putting principles into practice and regulating global supply chains. Altern. Law J. 2017, 42, 42–46. [Google Scholar] [CrossRef]

- Van Marrewijk, M. Concepts and definitions of CSR and corporate sustainability: Between agency and communion. J. Bus. Eth. 2003, 44, 95–105. [Google Scholar] [CrossRef]

- Munilla, L.S.; Miles, M.P. The corporate social responsibility continuum as a component of stakeholder theory. Bus. Soc. Rev. 2005, 110, 371–387. [Google Scholar] [CrossRef]

- Sjåfjell, B. Internalizing externalities in EU law: Why neither corporate governance nor corporate social responsibility provides the answers. George Wash. Int. Law Rev. 2008, 40, 977–1024. [Google Scholar]

| Legislative instruments | EU business law | EU financial market law |

| Review of relevant website | Review of relevant website | |

| Review of EU company law mapped out and analysed in the literature [54,55] | EUR-Lex database | |

| EUR-Lex database | Data from interviews | |

| Data from interviews | Search for additional agreements that implicitly deal with financial and insurance products | |

| Keywords for different kinds of agreement and searches in each legislative document. | Keywords for different kinds of agreement and searches in each legislative document. | |

| Policy instruments & documents | Data from interviews | Data from interviews |

| Keywords in different kinds of communication and strategy | Keywords in different kinds of communication and strategy |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahlström, H. Policy Hotspots for Sustainability: Changes in the EU Regulation of Sustainable Business and Finance. Sustainability 2019, 11, 499. https://doi.org/10.3390/su11020499

Ahlström H. Policy Hotspots for Sustainability: Changes in the EU Regulation of Sustainable Business and Finance. Sustainability. 2019; 11(2):499. https://doi.org/10.3390/su11020499

Chicago/Turabian StyleAhlström, Hanna. 2019. "Policy Hotspots for Sustainability: Changes in the EU Regulation of Sustainable Business and Finance" Sustainability 11, no. 2: 499. https://doi.org/10.3390/su11020499

APA StyleAhlström, H. (2019). Policy Hotspots for Sustainability: Changes in the EU Regulation of Sustainable Business and Finance. Sustainability, 11(2), 499. https://doi.org/10.3390/su11020499