1. Introduction

Under the European Union (EU)’s general energy policy, member states are struggling to reach the assumed national targets regarding energy efficiency, carbon emissions abatement, renewable sources and a decarbonised economy. Tempted to increase the competitiveness of their products in order to ensure a sustained economic growth rate, EU countries are interested in creating new, sophisticated, knowledge-intensive products. Higher complexity of products is a demand in order to face the challenge of the today’s severe world competition. However, more complex and sophisticated exported products may imply an increased energy demand leading to, inevitably, a rise in energy intensity and more pollution. To slow down the growth of energy consumption and increase resources’ efficiency, priority has to be given to large public support for investment in clean energy technologies, development of alternative energy sources (i.e., renewable, nuclear); development of knowledge-intensive sectors of the economy, through investments in fixed capital, and in highly skilled human capital, investments in research and development (R&D) activities and implementation of new energy technologies (i.e., smart grids, carbon capture and storage, carbon capture and use).

The present paper uses the Environmental Kuznets Curve (EKC) model by replacing the variable “income” with “economic complexity” in order to examine the relationship between carbon emissions and economic complexity in the EU countries.

The complexity of an economy is given by the multiplicity of useful knowledge embedded in it. The composition of a country’s productive output and the structure that emerges to hold and combine knowledge are substantiating this concept [

1,

2,

3]. Complex economies are those that can manage relevant knowledge across large networks of people, to generate a diverse mix of knowledge-intensive products, while simpler economies possess a narrow basis of productive knowledge and produce fewer and simpler products, requiring smaller networks for interaction [

3], p. 18.

The advance of complexity in the economy is sustained by structural transformations and shifts: diversification, specialisation and sophistication of industries, technologies, knowledge, products and services [

4,

5]. Several studies were focused on topics related to products, exports and economic and product complexity, such as: constructing an index of “the income level of a country’s export” [

6], explaining why poor countries are not able to develop more competitive exports and fail to converge to income levels of rich countries [

7], highlighting the tendency of countries to converge on the level of income imposed by the complexity of their productive structures [

8], revealing the evolution of the region’s productive structure by using the concept of a “product space” [

9], describing the network structure of economic output by using ecological concepts (“nestedness”) [

10], explaining a country’s export flows [

11] and dynamics of economic complexity [

12], or introduction of metrics of complexity of countries and products [

13].

Economic complexity evolves in correlation with economic growth. The level of income of countries reflects their productive knowledge and structure [

3,

6,

7]. If countries tend to converge on a level of income corresponding to the complexity of their productive structure, as suggested by Hidalgo and Hausmann (2009) [

8], then they must focus on creating conditions leading to higher complexity in order to generate sustained economic growth. Complexity can explain countries’ trade structure and developed countries have comparative advantages in activities demanding coordination of high skilled human capital [

14].

The mix of products that countries make and export has been shown as a driving factor for economic growth [

10]. A more complex productive structure may lead to higher productivity and higher growth rates, while increasing exports shares of the most complex products may be positively associated with income increase [

15]. The process of learning how to produce and export more complex products could be a good and rational explanation of the process of economic development [

7,

8]. The new products that a country may develop depend substantially on the existing capabilities of that country. Products that require more capabilities will be accessible to fewer countries (i.e., will be less ubiquitous), while countries that have more capabilities will have what is required to make more products (i.e., will be more diversified) [

8].

The country’s mix of products cannot alone predict its pattern of diversification and economic growth, as highlighted above, but also income inequality, as revealed by Hartman et al. (2017) [

16].

The economic complexity indicator (ECI) measures how a country can produce and export a complex product. It is a structural measure of the network connecting countries to the products that they export and estimates the amount of productive knowledge embedded in a country. A higher level of ECI reflects a higher capability to produce and to export complex (higher value-added) products [

2,

3].

The values of ECI in different countries suggest that sophisticated economies are diverse and export products that have low ubiquity on average due to the fact that only a few diverse countries can make sophisticated products and less sophisticated economies are expected to produce a few ubiquitous products [

8]. ECI is considered to be an accurate predictor of income per capita growth [

2,

3,

8].

There is a scarcity of bibliographical resources regarding the link between economic complexity and pollution. The study of Can and Gozgor (2017) [

17] highlights the impact of economic complexity index on carbon emissions in France. For the first time, the economic complexity (ECI) is introduced in a model testing the Environmental Kuznets validity in France over the period 1964–2014. ECI was found as a factor of suppressing CO

2 emissions. Another recent study (Neagu and Teodoru, 2019) [

18] investigates the effect of ECI on greenhouse gas emissions in 25 the European Union countries for 1995–2014. Their findings reveal that the speed of reducing pollutant emissions is higher in countries with higher economic complexity of their products, suggesting that differences in energy efficiency and energy mix composition may introduce variations in the impact of economic complexity on pollution. It is worth mentioning that both studies provide evidence for the linear dependency of pollution on economic complexity.

Countries are tempted to increase the complexity of the products they export, which is a valuable comparative advantage in today’s world market competition. However, more intense economic complexity may lead to environmental degradation due to higher pollution (as highlighted by Neagu and Teodoru, 2019) [

18]. Therefore, a discussion of the link between economic complexity and pollution in the EU countries must be framed in the general context of the EU low-carbon strategy, industrial policy and energy technology. A reference paper in the field [

19] mentions that larger investments in clean energy technologies combined with a carbon tax revenue recycling mechanism remain a realistic policy option for the 2050 horizon of carbon emissions abatement targets. It is also added that a higher public support for clean technologies will bring larger economic gains in early adoption of challenging reduction targets.

The recent energy technology research provides several viable solutions to reduce CO

2 emissions. One option is represented by Carbon Capture Storage (CCS) technology. Its use leads to a range of possible actions related not only to climate change mitigation, but also to innovation and competitiveness, reduction of energy intensity and raw material consumption [

20,

21,

22,

23,

24,

25,

26]. In Carbon Capture and Utilisation (CCUS) technology, the captured CO

2 emissions are further re-used or stored [

27,

28]. It provides alternatives for geological storage of CO

2 and opportunities for production of fuels, material or chemicals that can supplement or replace fossil fuel based ones [

29]. In July 2018 there were 37 CCS and CCUS facilities all over the world, five of them being placed in Europe [

30]. An industrial policy responding to the requirements of sustainable development and aligned with energy policy was outlined by Aiginger (2014) [

31] and further developments of the idea belong to Ashord and Renda (2016) [

32]. They suggest policy options to promote systemic innovation that foster decarbonisation in the EU. In their view, “systemic” innovation means technological, institutional, organisational, new business models, societal transformation. They describe a 10 steps plan for sustainable innovation under the EU policy. Busch et al. (2018) [

33] set out the elements of a more systemic low-carbon industrial strategy for the EU: defining and enabling a low-carbon industrial mission, creating and shaping markets demand-pull, stimulating investment, embedding learning approach in governance.

Among the several problems to be explored and analyzed as regards to the low-carbon economy, the pollution generated mainly by the energy production sector, the efficiency of carbon emissions and the role of green investment seem to be placed in the focus of researchers and policy makers.

Advance of economic complexity generates a higher energy demand and one of the main sources of pollution is the energy production sector. For example, in the electricity sector, the reduction of CO

2 emissions can have as sources: emissions intensity of coal and natural gas operations, shifting from coal and fossil fuels to natural gas and renewable energy (as noticed by Palmer et al., 2018 [

34] in the US electricity production sector). As an important mitigation measure against pollution and climate change launched in 2005, the European Union Emissions Trading System (EU ETS) [

35,

36] introduced a complex mechanism linking carbon prices and energy markets. Carbon and energy markets are interconnected and this system strengthened the information and connection between them across the EU. Understanding the price linkage and spillover patterns allow for policy makers to design market mechanisms [

37]. Recent studies [

37,

38] of the ETS highlight the information transmission mechanism and dynamic spillover effect across the two markets and reveal strong information interdependence between carbon price returns and electricity stock returns for companies of this sector.

In the framework of a low-carbon economy, exploring the efficiency of carbon emissions (ratio of inputs to desirable and undesirable outputs) becomes more important. Recent studies explore the role of natural resources abundance as driving factor, among others (e.g., industrial structure) [

39,

40] of efficiency of carbon emissions. A negative correlation between resources abundance, carbon abatement potential (the excess in undesirable outputs) and carbon emissions efficiency) is identified in the Chinese provinces, and industrial structure plays an important role in emission reduction and improvement of carbon emissions efficiency [

39].

Another important issue related to both pollution and economic complexity is green investment, defined by Eyraud et al., 2003 [

41] as: (i) investment in renewable technologies (i.e., hydroelectric projects), (ii) selected energy-efficient technologies and (iii) research and development (R&D) in green technologies. Several economic and policy factors (e.g., industry structure, population, GDP, trade openness, energy mix, carbon markets) and channels (e.g., regulations, public appeal) may stimulate or hinder the promotion and return of such investment in economy (i.e., [

42]).

The contributions to the existing literature of the present paper are the following. First, the effects of economic complexity on environmental sustainability are rarely discussed in the energy-economics literature (only two papers were identified). Second, to the best of the author’s knowledge, a quadratic dependency of environmental pollution on economic complexity was never investigated before in the literature, meaning in fact the replacement of the variable “income” with “economic complexity” in the EKC approach. Third, the model of cointegrating polynomial regression is tested within a panel data framework and also in 25 individual countries.

The rest of the paper is structured as follows.

Section 2 describes materials and methods;

Section 3 provides the results;

Section 4 includes the discussion of results and

Section 5 outlines conclusions and policy implications.

4. Discussion

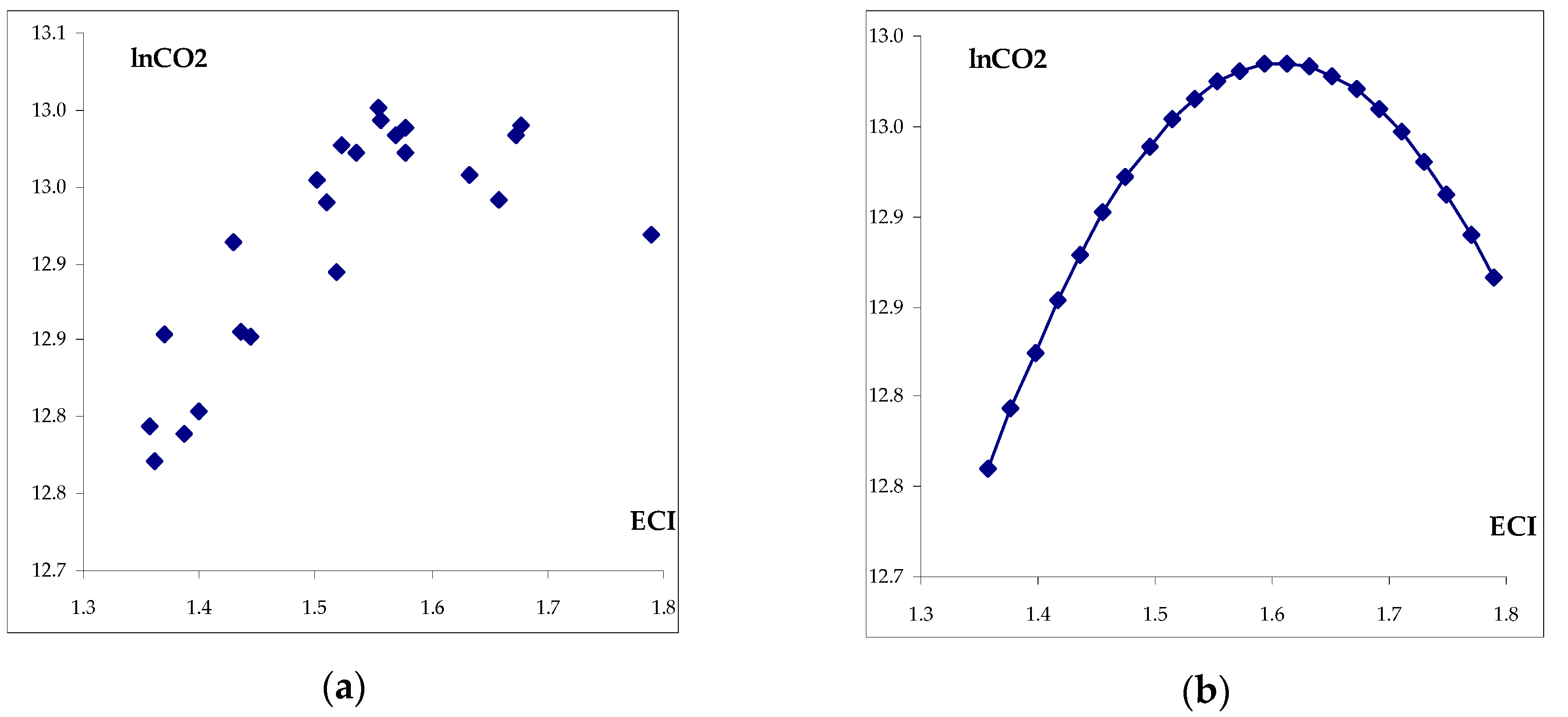

The paper validates a model predicting a quadratic dynamics of carbon emissions depending on the economic complexity in a panel of 25 countries through a cointegrating polynomial regression, as defined by Wagner and Hong (2016) [

71]. For the first time in the existing literature of EKC, the variable “income” as main determinant of pollution, was replaced by economic complexity in a panel data framework. The model is also tested for simple time series, in 25 individual economies.

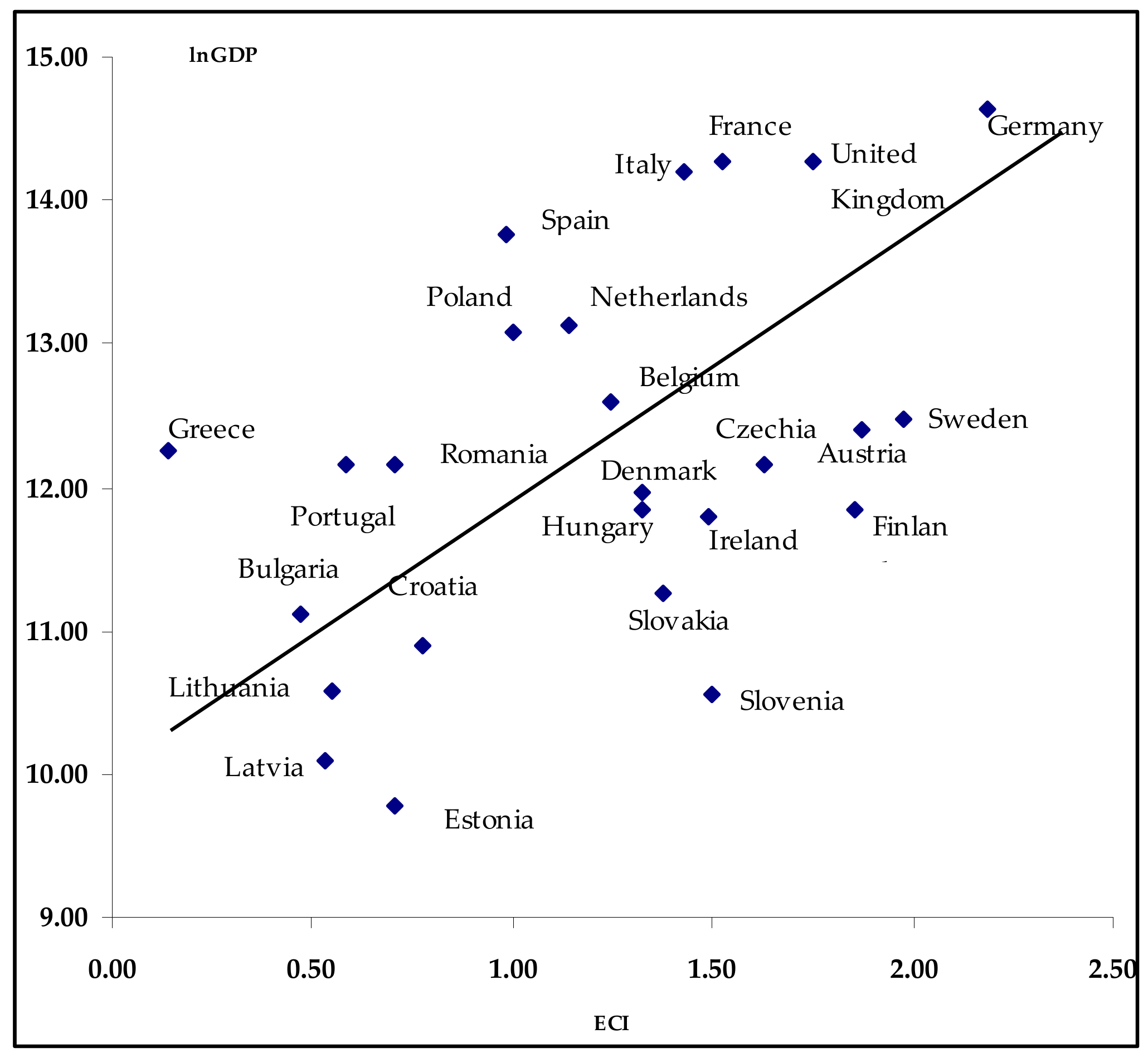

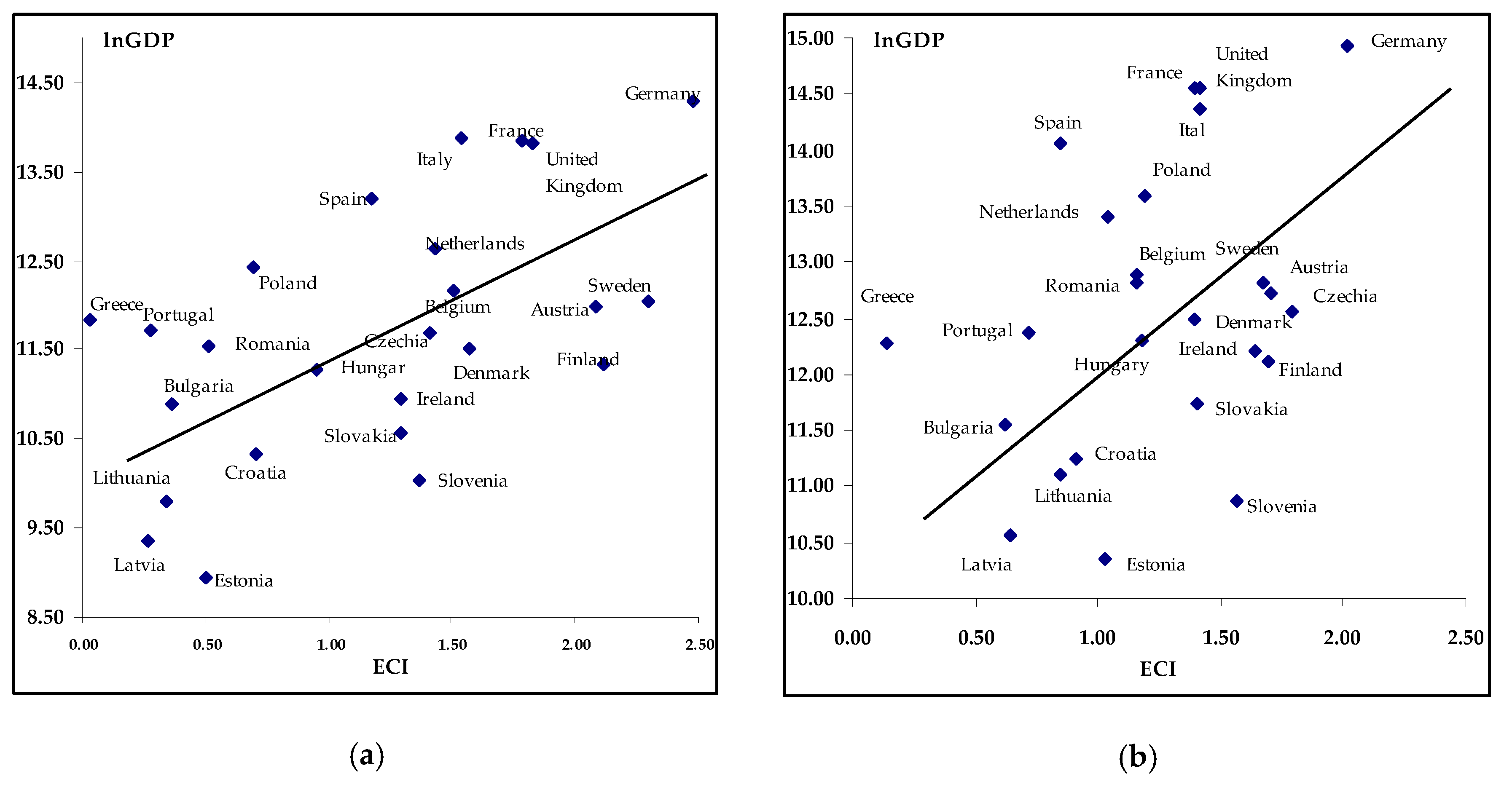

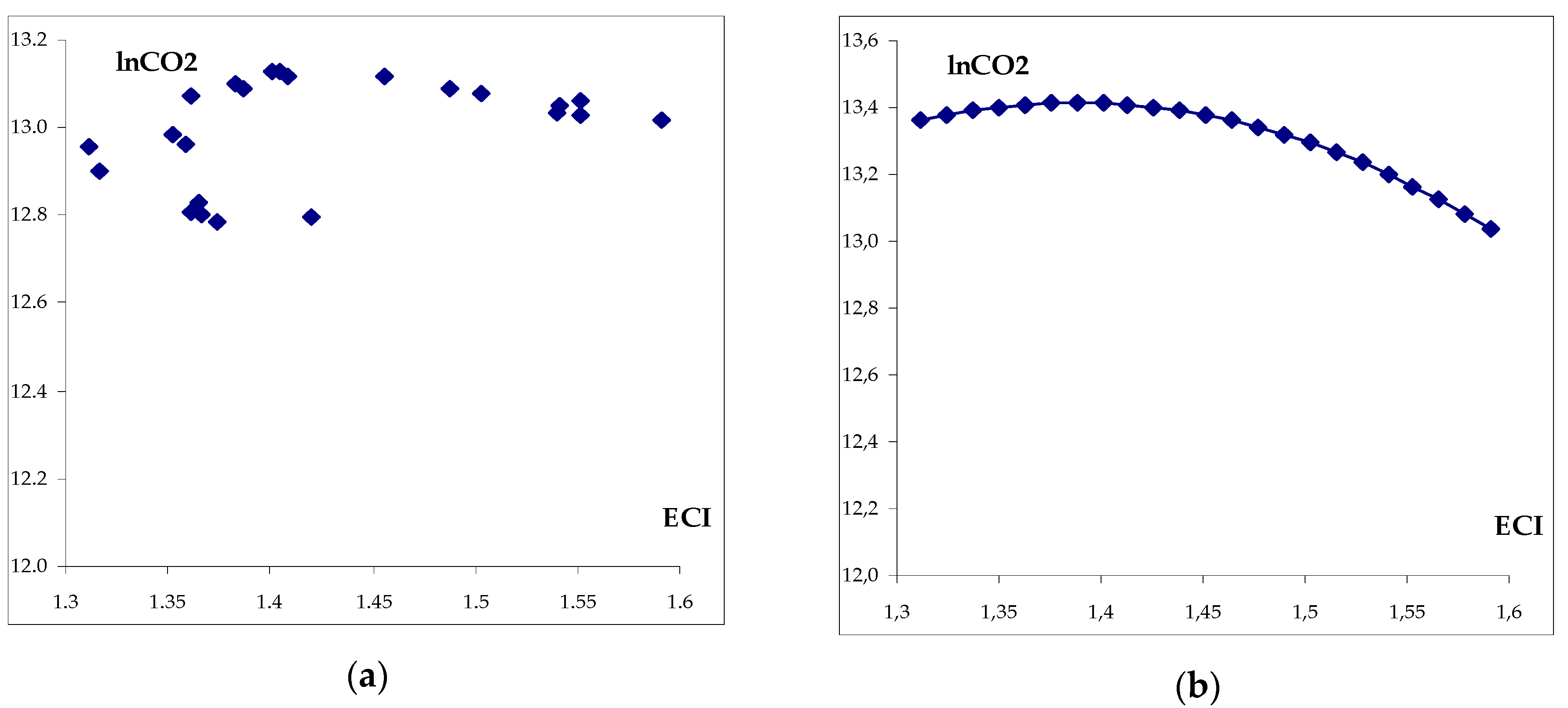

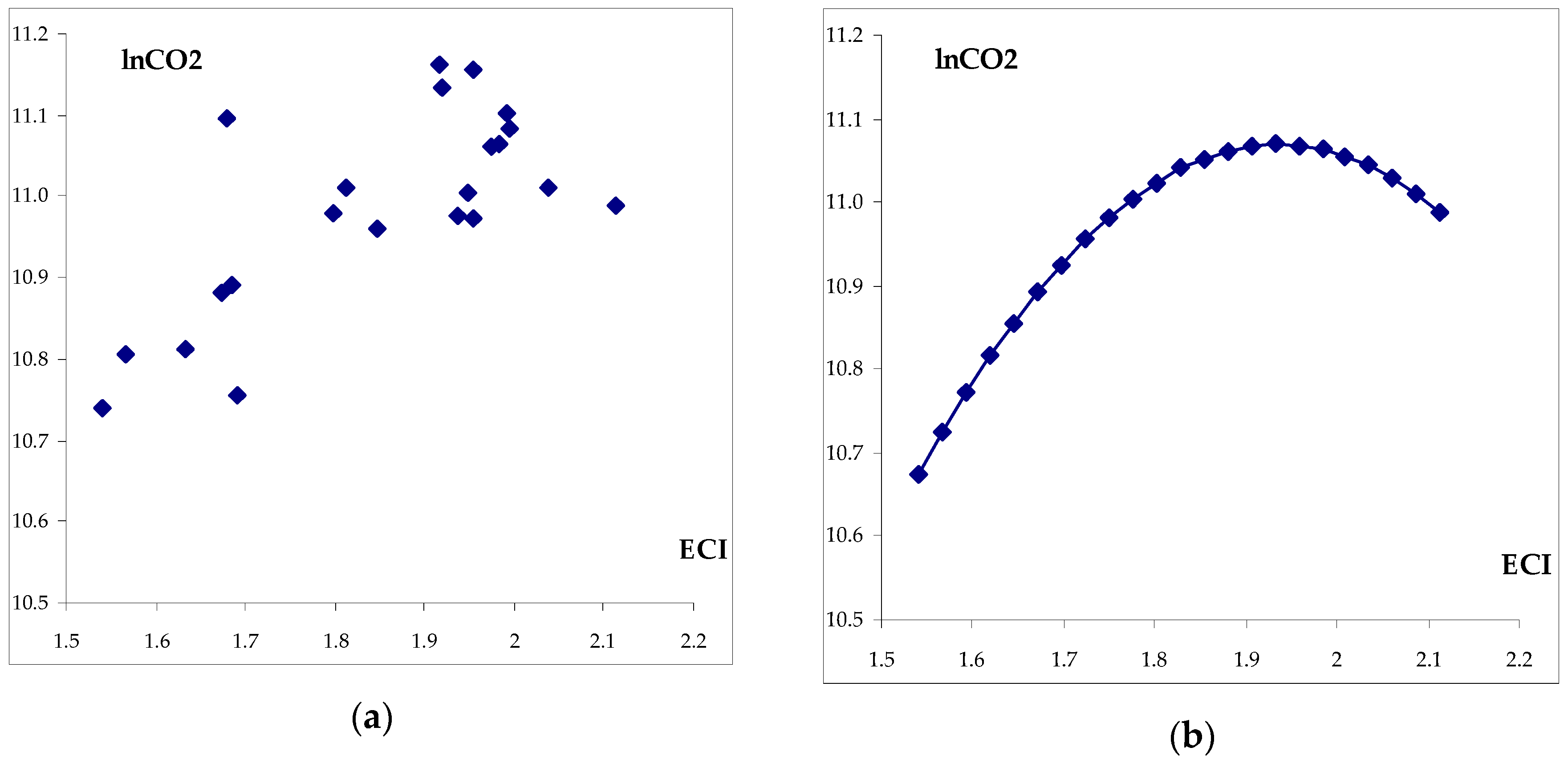

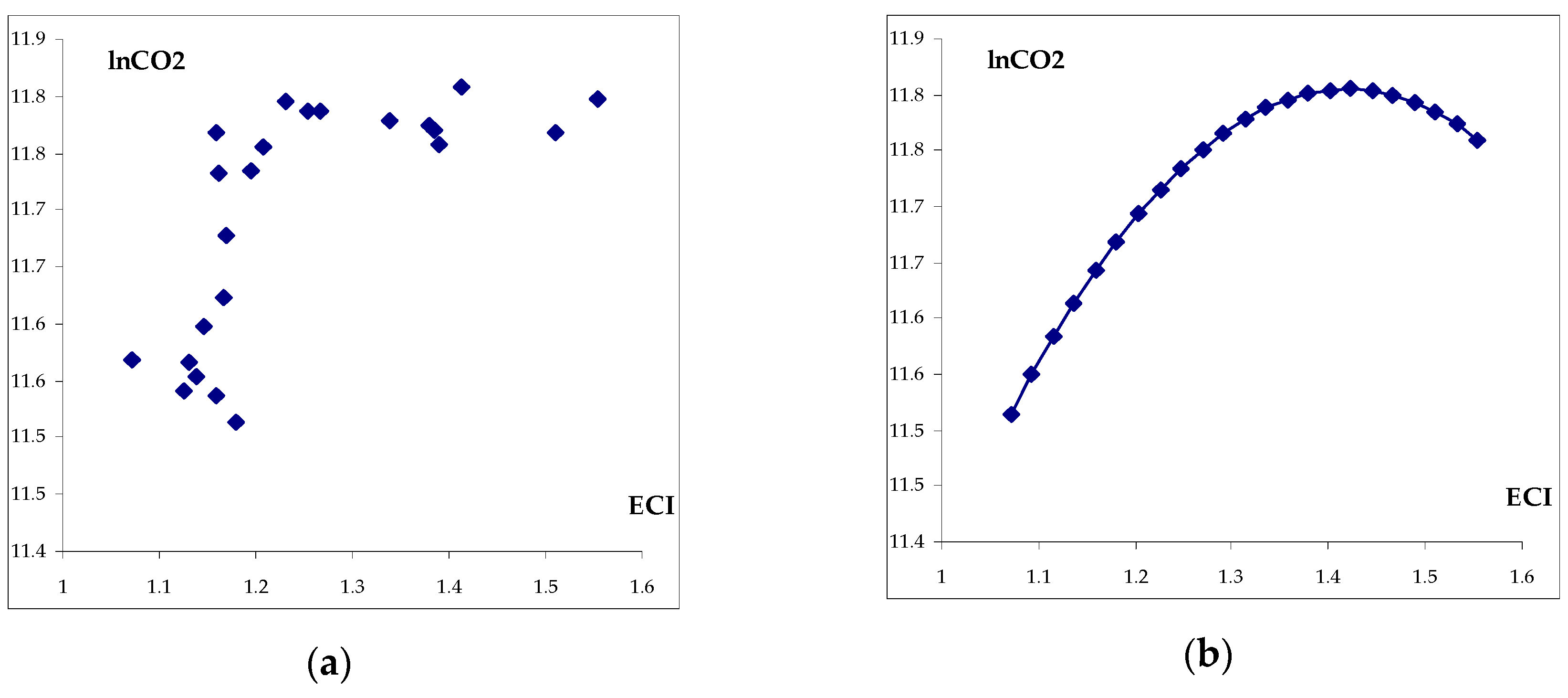

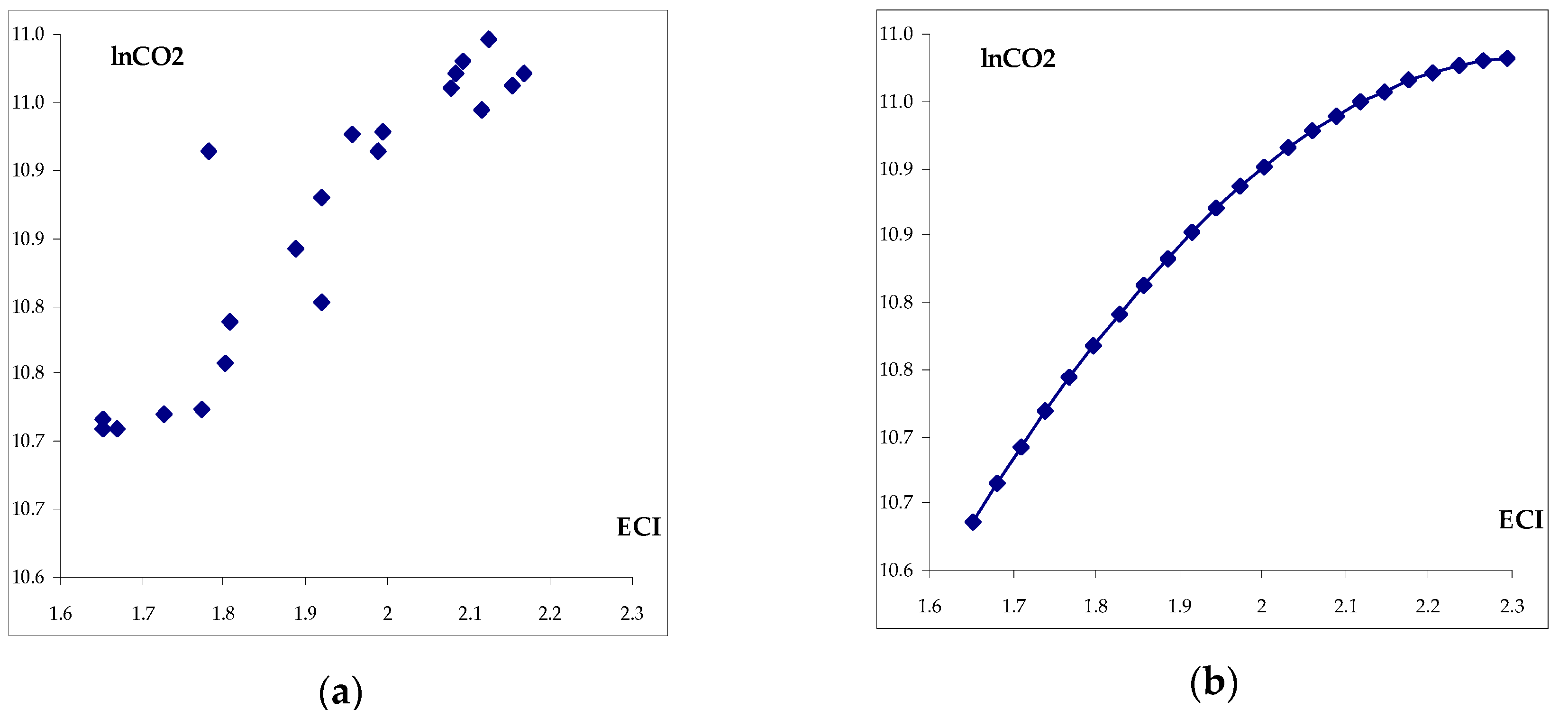

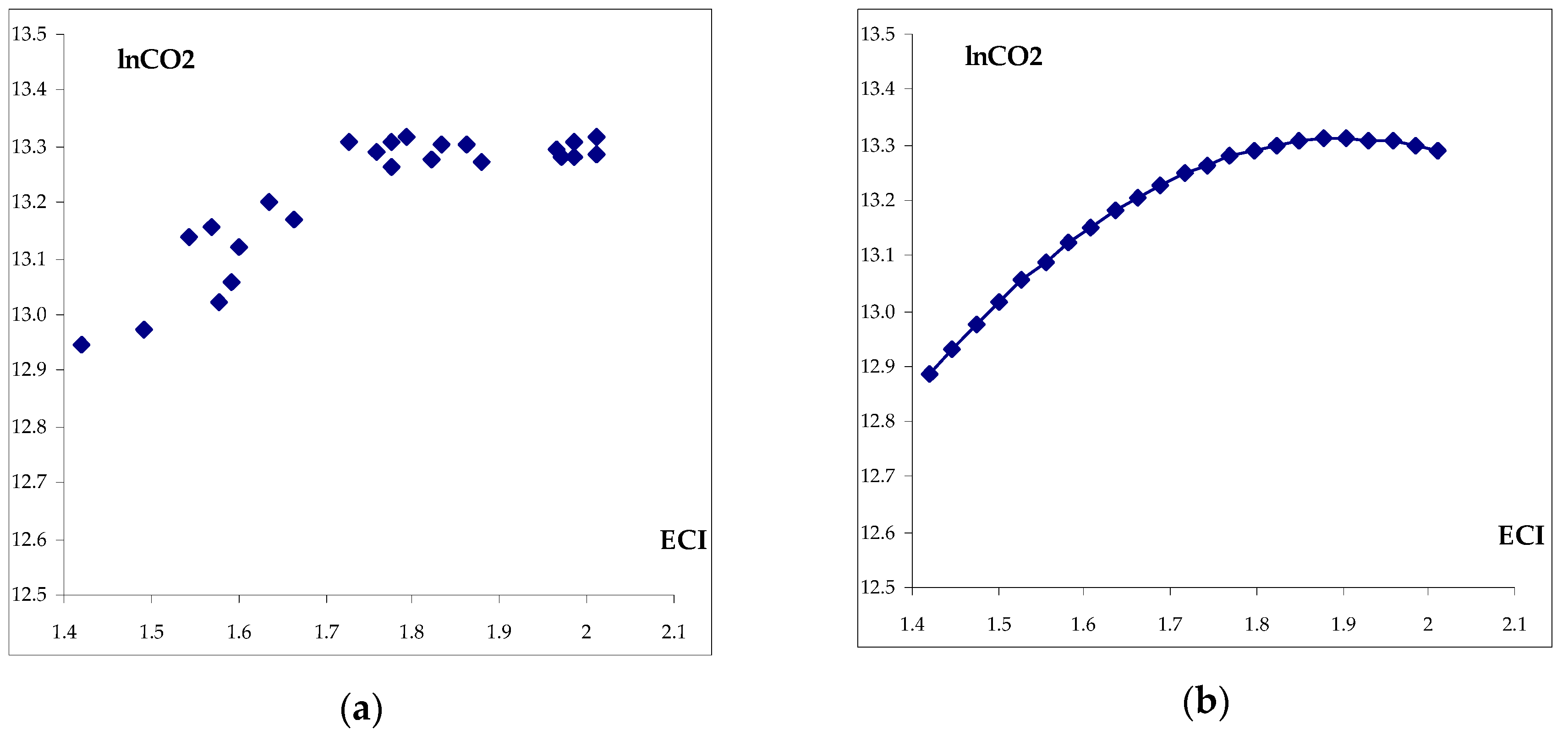

The estimation results for the six validated cases (Belgium, France, Italy, Finland, Sweden and the United Kingdom) in

Table 9, are displayed graphically in

Figure 4,

Figure 5,

Figure 6,

Figure 7,

Figure 8 and

Figure 9. The (a) version shows the dots of lnCO

2 and ECI observations for 1995–2017. The (b) version is the graphical representation of the analytical estimated EKC model for each country. The graphics resulted through the inserting equidistantly spaced points from the sample range of ECI, with corresponding values of the trend, using the estimated coefficients.

The estimated EKC for France exhibits a clearly inverted U-shape. The turning point corresponds to an ECI value around 1.6. As ECI increase above this level, the continual reduction of carbon emission is achieved. The allure of graph in the case of France suggests that there are three main periods in the dependency of pollution on ECI, similarly to pollution on income. In a first stage, the increase of economic complexity induces the rise of pollution. This is the period of extensive use of resources in order to sustain the complexity advance of exported products. It lasts until to a turning point, when the economic complexity shifts to the stage of efficiency and effectiveness in the use of resources and when more complex products are embedding sophisticated and less pollutant technologies. This stage reflects also a higher rate of return to investments in knowledge-intensive sectors, human capital and R&D and innovation activities related to energy production and manufacture industries.

The case of Italy is very different from other countries; the curve is slightly shaped as an inverted U. Even if the negative coefficient of is the highest of all cases (−8.28), due to the negative value of the constant term) (−2.38) the ascending stage is short and the turning point is less noticeable due to a little bit long stage of stationary trend of lnCO2. When ECI becomes higher than 1.45, the downturn of lnCO2 is more visible.

The estimated EKC curve for Finland is somehow similar to Belgium; the negative coefficient of has closed values (−2.41 in Belgium and −2.55 in Finland). The value of ECI corresponding to the curve’s turning point is different: in Finland the carbon emissions start to decrease when ECI reaches values higher than 1.9 and in Belgium when ECI attained 1.4.

Sweden and the United Kingdom evolve both in an ascending stage. The case of Sweden expresses an ascending line, with a very slight sign of stagnation of pollution when ECI is higher than 2.2. The graph of the United Kingdom shows that the economy is positioned on the descending stage of the dependency of carbon emissions on ECI. A slight decreasing stage with a low rate can be noticed due to the reduced value of the ’s coefficient (1.82).

What do these six EU economies have in common? We discuss below country features related to possible factors and developments that may enable the decreasing stage of CO2 curve, when suppression of emissions is possible with the advance of economic complexity.

The countries for which the EKC model with economic complexity as explanatory variable was been validated are developed EU Member States, with high levels of economic complexity index (above 1) in the period of 1995–2017.

The export products basket of these countries mainly includes: refined petroleum (the United Kingdom, Sweden, Italy, Denmark and Finland), packaged medicaments (France, Belgium, Italy, Sweden and the United Kingdom), kaolin coated paper (Finland and Sweden), planes/helicopters/aircraft (France and United Kingdom), cars and vehicle parts (the United Kingdom, Sweden, Italy, France and Finland) [

93]. The structure of exports indicates a specific development of chemical (refined petroleum, medicaments, and paper), manufacture (cars, machinery) and high tech-sectors, which are based on energy-intensive activities. The highest shares of high technology products in total exports in 2017 were reached in: France (20%), the United Kingdom (18.1%), Sweden (11.9%) and Belgium (10.3%) [

112].

The competitiveness such products is based on high investments in R&D and human capital. According to EUROSTAT [

113] the levels of R&D expenditures in these countries were in 2017 higher than the EU’s average (2.06% of GDP) (i.e., 3.4% in Sweden, 2.76% in Finland, 2.58% in Belgium and 2.19% in France). The share of human resources in science and technology (as % of active population) is also above the 2017 EU’s average of 46.6%: 58.6% Sweden, 57.7% Finland, 57% the United Kingdom, 54.3% Belgium and 50.8% France [

114].

They also massively invest in innovation activities related to energy production. For example, the public funding for Energy Technology Research, Development and Demonstration (ETRDD) (as ratio of GDP) is the highest of the EU in Finland, France, Belgium, Sweden, Italy and the United Kingdom [

115].

As a net importer of energy (coal, crude oil, oils products), Sweden has the highest share of renewable sources in the energy mix and an almost carbon-free electricity supply. It is integrated within the Nordic and Baltic electricity markets and developed a joint renewable certificate market with Norway, providing a unique model for other countries [

116]. A similar situation of import dependency in Finland has driven to national targets of renewable sources to be set out above 50% for 2020s, the Finland’s industry on second generation bio-fuels is leading globally and the renewable sources in manufacturing sector reached almost 40% in 2016 [

115,

117]. France has a significant low-carbon electricity mix due to the key role of nuclear energy. Large investments in renewable energy and efficiency are planned while security of supply, low-carbon footprint and growth of renewable electricity are goals for the long-term [

118]. Italy has made notable progress on renewable sources development, market liberalisation and infrastructure for electricity and also to become a southern European gas hub [

119]. The participation of these countries to the EU STS scheme, a good platform of carbon market to electricity companies as assessed by Ji et al., 2019 [

38], could partially explain the abatement of carbon emissions in these countries.

The United Kingdom is leading by example, as regarding the low-carbon investments in various technologies, carbon capture and storage technologies and electricity market reform [

120]. A Clean Growth Strategy was set out as well as a Modern Industrial Strategy [

121,

122], which integrates a green growth perspective considered to be necessary to achieve economic and environmental goals and investment in low-carbon transformation. One of the five electric vehicles driven in Europe is made in the UK and more than 430,000 jobs were created in low-carbon business [

122]. Belgium is committed to decarbonise the economy, by reducing the use of fossil fuels and increasing the use of renewable energy. In 2016 the nuclear energy accounted for around half of Belgium’s electricity generation [

123].

5. Conclusions

The present paper provides a study of the EKC model, by replacing the log GDP per capita with economic complexity. As discussed, the presence of ECI power renders the usage of methods developed for linear cointegration problematic. We used therefore a cointegrating panel regression [

70,

71], which was estimated through heterogeneous panel techniques. The quadratic dependence between CO

2 emissions, economic complexity and energy intensity is identified in a panel of 25 EU countries. The analysis of individual countries revealed that for only six EU economies the EKC hypothesis based on cointegrating panel regression incorporating ECI is validated.

The main findings of the paper are the following. The long-run dependency between economic complexity and carbon emissions is illustrated as an inverted U-shaped curve, similarly to the EKC for income, and this is the novel contribution of the paper to the existing literature of EKC hypothesis. In a first period of economic complexity advance, the carbon emissions increase due to the extension of resources and activities embedded in more complex and sophisticated products. In a second stage, when the efficiency in diversifying exported products increases, the raise of economic complexity does not lead to higher carbon emissions. Moreover, it may induce a decrease of pollution, due to the less pollutant technologies embedded in the more complex and sophisticated products. In this stage, a higher economic complexity can suppress the level of carbon emissions. The cointegrating polynomial regression model including economic complexity index and energy intensity is validated within the panel of 25 EU countries. The energy intensity remains a main determinant of pollution: a rise of 10% can lead to an increase of 3.72–3.93% of carbon emissions. The cointegrating polynomial regression coefficients are also validated in ten countries (Belgium, Greece, Italy, Hungary, Spain, France, Slovenia, Finland, Sweden and the United Kingdom). Furthermore, when the variable “energy intensity” is removed from the regression, in a first stage, the coefficients of regressors are statistically validated in the ten countries, but finally, the validation of cointegrating polynomial regression is obtained for only six of them (Belgium, Italy, France, Finland, Sweden and the United Kingdom). The graphical representation of the EKC curve with economic complexity as explanatory variable in these countries is provided.

Taken into consideration that the advance of economic complexity is accompanied by higher energy demand and energy intensity in manufacture and industrial sectors, the paper’s results are validated by the studies of and Wang et al., 2019 [

39] and Li et al., 2019 [

40], demonstrating that the manufacturing and industrial structure rationalisation and upgrading can help to curb CO

2 emissions. As Cheong et al. (2018) [

124] underlined, energy saving policy interventions may reduce energy intensity and improve energy efficiency in economy. In addition, the promotion of green investments in economy could not just introduce new sophisticated products on the market and contribute to the advance of economic complexity, but also reduces the share of pollutant technologies, as suggested by Liao and Shi (2018) [

42]. Furthermore, promoting green lifestyles and green consumption behaviours in the population, as well as social awareness regarding environmental degradation, may not just lower emissions [

125], but also to increase the demand for more complex green products.

The paper’s results have also general policy implications, as follows. Firstly, in the general frame of the EU energy policy, the examined countries had already set out national commitments related to carbon emission reduction (i.e., The Energy Road Map 2050 Initiative, European Strategic Energy Technologic Plan, 2030 EU Strategy) [

126,

127,

128,

129] and others that are specific to economic complexity (i.e., Ecodesign Directive [

130]). The paper’s results suggest that economic complexity (i.e., the energy demand corresponding to the structure of basket exports) must be taken into consideration. It is important to mention, for example, that if the energy requirements for a given export basket are unaffordable in terms of pollution, then the export structure has to be adapted (i.e., shifts on imports).

Secondly, without a coherent and realistic plan on carbon emissions abatement (under the EU low carbon strategy commitments) the EU countries cannot stem the advance of energy intensity in chemical and machinery and energy production sectors. Therefore, they must monitor the energy intensity and all policy options regarding regulatory and financial measures, such as: carbon tax, EU-STS mechanism, subsidies and incentives for investments in renewable and nuclear energy infrastructure, investments in clean energy technologies, implementation of the latest development in fields like CCS and CCUS, smart grids and green technologies. Moreover, there is a need to conceive and implement effective industrial low-carbon strategies, with realistic objectives related to boosting innovation in low-carbon technologies, business models and practice, actions to manage energy demand and supply, and enabling flexibility for systemic change in the economy, as Busch et al. (2018) [

33] suggested, and following the example of the United Kingdom [

121] of a well-grounded Industrial Strategy.

This paper intended to shed lights on understanding the ECI-carbon emissions relationship, indicating only a start on this process and the need for further research to overcome the limitations of this study (i.e., the short time span). Further developments are possible, not only for integrating the latest methodological findings related to EKC model, but also by using different data sets.