Reducing Edible Oil Import Dependency in Tanzania: A Computable General Equilibrium CGE Approach

Abstract

1. Introduction

2. Data and Methodology

2.1. Data

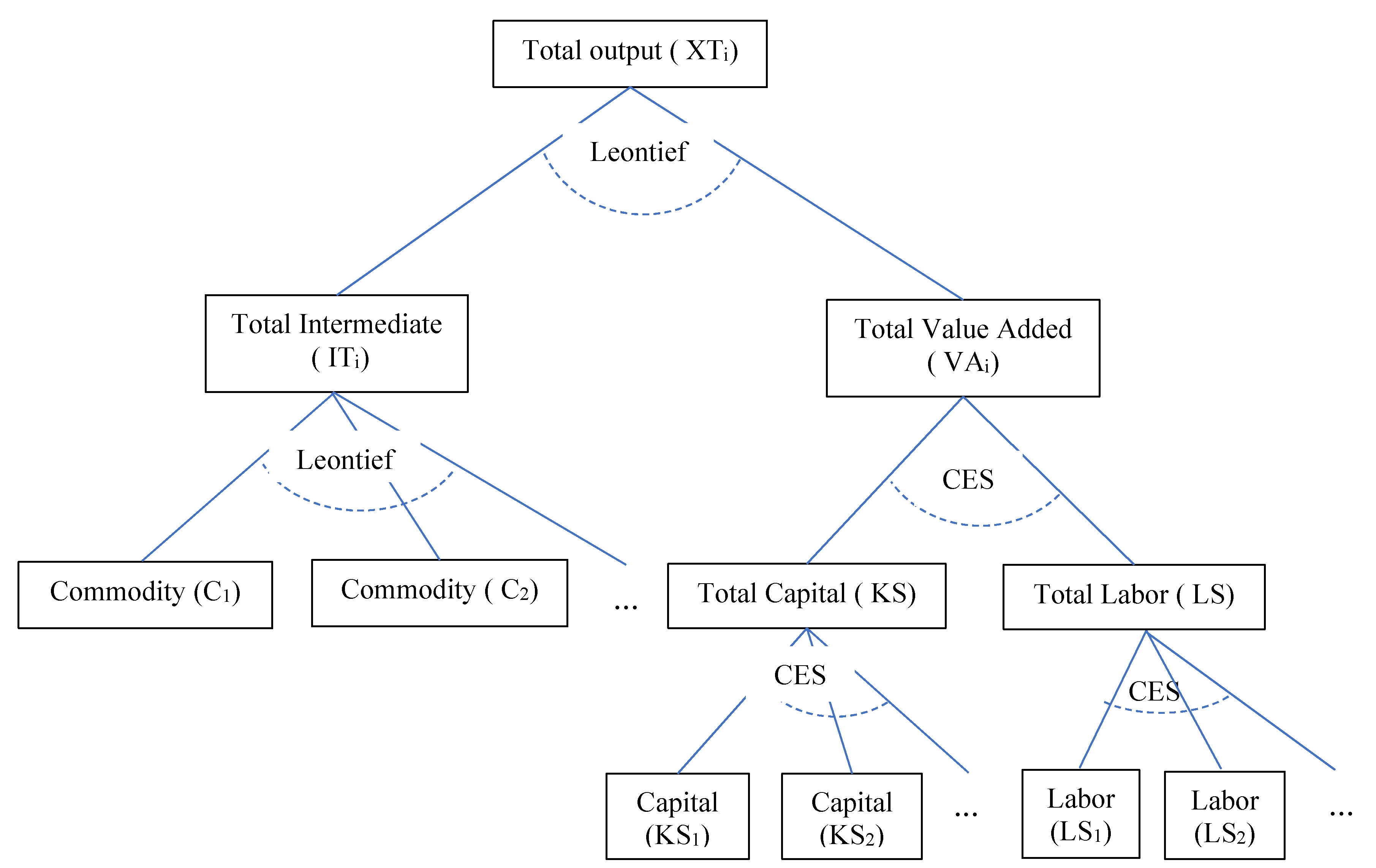

2.2. Model Description

- VAi = Value added for each sector commodity

- = Constant elasticity of substitution (CES) value added scale parameter,

- = CES value added share parameter,

- = CES value added elasticity parameter: −1 < < .

- LDi = Labor demand for each sector commodity

- KDi = Capital demand for each sector commodity

- vi = coefficient Leontief of the value-added,

- XTi = Total aggregate output for each sector commodity

- QINTi = Intermediate inputs for each sector commodity

- = Leontief Intermediated commodity consumption coefficient

- XTi = Total output of sector commodity.

- = a set of activities for a commodity with a constant elasticity of transformation (CET) function at the top of the technology nest,

- XTi = Total output of sector commodity,

- VAi = Value-added for sector commodity,

- QINTi = Intermediate inputs for each sector commodity,

- = Efficiency parameter in the CET activity function,= CET activity function share parameter, and

- = CET activity function exponent.

2.3. Scenario Description

- = Efficiency parameter in the total output after technological progress,

- = Initial efficiency parameter in the total output,

- = Percentage change in the efficiency parameter.

3. Results and Discussion

3.1. Multiplier Effects on Commodity Production

3.2. The Effects of Increased Production on Commodity Prices

3.3. The Effects of Increased Production on Domestically Produced Commodities Sales

3.4. The Effects of the Increase in Production on Import Commodities

3.5. The Effects of the Increase in Production on Export Commodities

3.6. The Effects on Sector Capital Investment Demand

3.7. The Effects of Increased Production on Household Income

3.8. The Effects of Increased Production on Government Revenues

4. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Symbol | Parameter/Variable | Description |

|---|---|---|

| PK | Return to capital | |

| PL | Wage rate | |

| ER | Exchange rate | |

| KS | Capital endowment | |

| LS | Supply of labor | |

| Y | Income level | |

| U | Utility level for the household | |

| PCINDEX | Consumer price index (commodities) | |

| Frisch | Value of Frisch parameter in the nested linear expenditure system (LES) utility function | |

| Phillips | Value of Phillips parameter | |

| S0 | Total initial savings | |

| SH | Household savings | |

| SG | Government savings | |

| SF | Foreign savings | |

| CBUD | Household expenditure (commodities) | |

| UNEMP | Involuntary unemployment | |

| KG | Government capital demand | |

| LG | Government labor demand | |

| TRY | Income tax revenues | |

| TAXR | Total tax revenues | |

| ty | The tax rate on income | |

| trep | Replacement rate | |

| TRF | Total transfers | |

| TRO | Other transfers | |

| PD0(sec) | The initial price level of the domestic output of firm (sec) | |

| P0(sec) | The initial price level of domestic sales of composite commodities | |

| PDD0(sec) | The initial price of domestic output delivered to the home market | |

| PWE0(sec) | The initial global price of exports per sector | |

| PWM0Z(sec) | The initial global price of imports per sector | |

| σA | sigmaA(sec) | Substitution elasticities of ARMINGTON function |

| σT | sigmaT(sec) | Constant elasticities of transformation (CET) function |

| σF | sigmaF(sec) | Constant elasticities of substitution (CES) capital-labor of the firm (sec) |

| elasY(sec) | Income elasticities of demand for a commodity (sec) | |

| X0(sec) | The initial domestic sales of a composite commodity (sec) | |

| XD0(sec) | The initial gross domestic production (output) level firm (sec) | |

| XDD0(sec) | The initial domestic production delivered to home markets | |

| KD0(sec) | The initial capital demand per sector | |

| LD0(sec) | The initial labor demand per sector | |

| C0(sec) | The initial consumer demand for commodities and leisure per sec | |

| I0(sec) | The initial investment demand per sector | |

| E0(sec) | The initial export demand per sector | |

| M0(sec) | The initial import demand per sector | |

| PM0(sec) | The initial import price excluding tariffs in local currency per sector | |

| PE0(sec) | The initial price of exports in local currency per sector | |

| IO0(sec,secc) | The initial intermediate commodity demand per sector | |

| CG0(sec) | The initial government commodity demand per sector | |

| TRC0(sec) | The initial tax revenue on consumer commodities per sector | |

| TRK0(sec) | The initial tax revenue on capital use per sector | |

| TRL0(sec) | The initial tax revenue on labor use per sector | |

| TRM0(sec) | The initial tax revenue on imports per sector | |

| Tc0(sec) | The initial tax rate on consumer commodities in the Price index (PCINDEX) | |

| tc(sec) | The tax rate on consumer commodities | |

| tk(sec) | The tax rate on capital use | |

| tl(sec) | Tax rate on labor use | |

| tm(sec) | Tariff rate on imports | |

| io(sec,secc) | Technical coefficients | |

| γF | gammaF(sec) | CES distribution parameter in the production function of the firm (sec) |

| aF(sec) | Efficiency parameter of CES production function of firm (sec) | |

| γA | gammaA(sec) | CES distribution parameter of ARMINGTON function of commodity (sec) |

| aA(sec) | Efficiency parameter of ARMINGTON function of commodity (sec) | |

| γT | gammaT(sec) | CET distribution parameter regarding the destination of domestic output |

| aT(sec) | Shift parameter in the CET function of the firm (sec) | |

| αHLES | alphaHLES(sec) | Power in the nested linear expenditure system (LES) household utility function |

| µH | muH(sec) | Subsistence household consumption quantities (sec) |

| mps | Household’s marginal propensity to save | |

| αI | alphaI(sec) | Cobb-Douglas power in the bank’s utility function |

| αCG | alphaCG(sec) | Cobb-Douglas power in government utility function (commodities) |

| αKG | alphaKG | Cobb-Douglas power in the government utility function (capital) |

| αLG | alphaLG | Cobb-Douglas power in the government utility function (labor) |

| Equation | Description |

|---|---|

| Household block | |

| Household commodity demand from each sector | |

| Household savings | |

| Price index | |

| Investment block | |

| Total savings | |

| = | Investment per sector |

| Firms block | |

| Capital demand per sector | |

| Labor demand per sector | |

| Foreign Sector block | |

| Gross domestic output | |

| Total import per sector | |

| Domestic produced commodity demand per sector | |

| Export domestic commodity per sector | |

| Price import in local currency | |

| Price export in local currency | |

| Total import commodity value | |

| Government block | |

| Government commodity demand | |

| Government capital demand | |

| Government labor demand | |

| Total tax revenues | |

| Total government transfers | |

| Market Clearing | |

| Capital supply equilibrium | |

| Labor supply equilibrium | |

| Commodity supply equilibrium | |

| Income block | |

| Total household income | |

| Household commodity expenditure | |

| Total value domestic output | |

| National commodity demand per sector | |

| National commodity supply | |

References

- BoT. Bank of Tanzania Annual Report 2016/17. 254; BoT: Dar es salaam, Tanzania, 2018; Available online: https://www.bot.og.tz (accessed on 10 March 2019).

- Wangwe, S.; Mmari, D.; Alkaeli, J.; Rutatina, N.; Mboghoina, T.; Kinyondo, A. The Performance of the Manufacturing Sector in Tanzania: Challenges and Way Forward; Working Paper; UNU-WIDER: Helsinki, Finland, 2014. [Google Scholar]

- Mufuruki, A.A.; Mawji, R.; Kasiga, G.; Marwa, M. Tanzania’s Industrialisation Journey, 2016–2056, from an Agrarian to a Modern Industrialised State in Forty Years; Moran (E.A.): Nairobi, Kenya, 2017; Volume 1, p. 169. [Google Scholar]

- URT. Agricultural Sector Development Programme Phase Two (ASPD II), Government Programme Document; United Republic of Tanzania (URT): Dar es salaam, Tanzania, 2016; Available online: http://www.tzdpg.or.tz/fileadmin/documents/external/national_development_frameworks/ASDP2_Final_Document_20_May._2016__after_edit__1_.pdf. (accessed on 5 January 2019).

- Rekiso, Z.S. Economics of Late Development and Industrialization: Putting Gebrehiwot Baykedagn (1886–1919) in Context. Cambr. J. Econ. 2019, 43, 223–248. [Google Scholar] [CrossRef]

- Rougier, M.; Odisio, J. The “Swan Song” of Argentinian Industrialization. Performance and Alternatives in the Final Stage of ISI. Rev. Estud. Soc. 2019, 51–67. [Google Scholar] [CrossRef]

- Sandonato, S.; Willebald, H. Natural Capital, Domestic Product and Proximate Causes of Economic Growth: Uruguay in the Long Run, 1870–2014. Sustainability 2018, 10, 715. [Google Scholar] [CrossRef]

- Galiani, S.; Somaini, P. Path-dependent import-substitution policies: The case of Argentina in the twentieth century. Lat. Amer. Econ. Rev. 2018, 27, 53. [Google Scholar] [CrossRef]

- Omosegbon, O.; Okeke, C. The Integration of Africa: Commodity-Based Industrialization Examined. In Private Sector Development in West Africa; Seck, D., Ed.; Springer: Cham, Switzerland, 2014; pp. 111–128. [Google Scholar]

- Adewale, A.R. Does Import Substitution Industrialisation Strategy Hurt Growth? New Evidence from Brazil and South Africa. Afr. Asian Stud. 2012, 11, 288–314. [Google Scholar] [CrossRef]

- Weiss, J. Lewis on Industrialisation and Industrial Policy. J. Inter. Dev. 2018, 30, 61–79. [Google Scholar] [CrossRef]

- Kombe, C.; Mpemba, Z.; Yabu, N.; Kazi, M.; Machemba, J.; Kibesse, B.; Mwita, D.; Mgangaluma, E.; Mashine, S.; Chaula, A.; et al. The Potentiality of Sunflower Sub-Sector in Tanzania; Bank of Tanzania Working Paper; Bank of Tanzania (BoT): Dar es salaam, Tanzania, 2017; Volume 10. [Google Scholar]

- Balchin, N.; Kweka, J.; Mendez-Parra, M. Tariff Setting for Development of Edible Oil Sector in Tanzania. In Proceedings of the Agricultural State Actors Forum(ANSAF), Dar es salaam, Tanzania, 10 February 2018; p. 79. Available online: http://dev.ansaf.or.tz/wp-content/uploads/2018/04/I4ID-Tariff-setting-in-Tanzanias-edible-oil-sector_FINAL-Report_26-Feb-2018.pdf. (accessed on 5 January 2019).

- Khan, H.; Ali, S.; Ahmad, I.; Khan, I.; Hussain, S.; Khan, B.A.; Suhaib, M. Agronomic and Qualitative Evaluation of Different Local Sunflower Hybrids. Pak. J. Agric. Res. 2018, 31. [Google Scholar] [CrossRef]

- McArthur, J.W.; McCord, G.C. Fertilizing growth: Agricultural inputs and their effects on economic development. J. Dev. Econ. 2017, 127, 133–152. [Google Scholar] [CrossRef] [PubMed]

- Jonasson, E.; Filipski, M.; Brooks, J.; Taylor, J.E. Modeling the welfare impacts of agricultural policies in developing countries. J. Policy Mod. 2014, 36, 63–82. [Google Scholar] [CrossRef]

- Mgeni, C.P.; Müller, K.; Sieber, S. Tariff impact on industrialization in Tanzania: Evidence from edible oil sub-sector. J. Econ. Sust. Dev. 2019, 10, 15–30. [Google Scholar] [CrossRef]

- Ngenoh, E.; Kurgat, B.K.; Bett, H.K.; Kebede, S.W.; Bokelmann, W. Determinants of the competitiveness of smallholder African indigenous vegetable farmers in high-value agro-food chains in Kenya: A multivariate probit regression analysis. Agric. Food Econ. 2019, 7, 2. [Google Scholar] [CrossRef]

- Sani, S.; Kemaw, B. Analysis of households food insecurity and its coping mechanisms in Western Ethiopia. Agric. Food Econ. 2019, 7, 5. [Google Scholar] [CrossRef]

- Habtemariam, L.T.; Mgeni, C.P.; Mutabazi, K.D.; Sieber, S. The farm income and food security implications of adopting fertilizer micro-dosing and tied-ridge technologies under semi-arid environments in central Tanzania. J. Arid Environ. 2019, 166. [Google Scholar] [CrossRef]

- Kaliba, A.R.; Mazvimavi, K.; Gregory, T.L.; Mgonja, F.M.; Mgonja, M. Factors affecting the adoption of improved sorghum varieties in Tanzania under information and capital constraints. Agric. Food Econ. 2018, 6, 18. [Google Scholar] [CrossRef]

- Gabagambi, D.; George, V. Sunflower Production Situation in the Central Corridor of Tanzania; Final Report; Rural Livelihood Development Company: Tanzania, East Africa, 2010. [Google Scholar]

- Henningsen, A.; Mpeta, D.F.; Adem, A.S.; Kuzilwa, J.A.; Czekaj, T.G. The Effects of Contract Farming on Efficiency and Productivity of Small-Scare Sunflower Farmers in Tanzania. In Proceedings of the International Conference of Agricultural Economists, Milan, Italy, 8–14 August 2015. [Google Scholar]

- Paltasingh, K.R.; Goyari, P. Impact of farmer education on-farm productivity under varying technologies: The case of paddy growers in India. Agric. Food Econ. 2018, 6, 7. [Google Scholar] [CrossRef]

- International Food Policy Research Institute (IFPRI). 2015 Social Accounting Matrix for Tanzania; Dataverse, V1; IFPRI: Washington, DC, USA, 2017. [Google Scholar] [CrossRef]

- Decaluwé, B.; Lemelin, A.; Robichaud, V.; Maisonnave, H. The PEP 1-1 Standard Computable General Equilibrium Model: Single-country, static (Version 2.1). In Politique Économique et Pauvreté/Poverty and Economic Policy Network; Université Laval: Québec, QC, Canada, 2013. [Google Scholar]

- Laborde, D.; Traore, F. The Sensitivity of Computable General Equilibrium Models to Macroeconomics Closure Rules: Evidence from IFPRI Standard Model; AGRODEP Technical Notes; IFPRI: Washington, DC, USA, 2017. [Google Scholar]

- Hübler, M.; Pothen, F. Trade-induced productivity gains reduce incentives to impose strategic tariffs. Econ. Mod. 2017, 61, 420–431. [Google Scholar] [CrossRef]

- Pothen, F.; Welsch, H. Economic development and material use. Evidence from international panel data. World Dev. 2019, 115, 107–119. [Google Scholar] [CrossRef]

- Lectard, P.; Rougier, E. Can Developing Countries Gain from Defying Comparative Advantage? Distance to Comparative Advantage, Export Diversification and Sophistication, and the Dynamics of Specialization. World Dev. 2018, 102, 90–110. [Google Scholar] [CrossRef]

- Clapp, J. Food self-sufficiency: Making sense of it, and when it makes sense. Food Policy 2017, 66, 88–96. [Google Scholar] [CrossRef]

- Flentø, D.; Ponte, S. Least-Developed Countries in a World of Global Value Chains: Are WTO Trade Negotiations Helping? World Dev. 2017, 94, 366–374. [Google Scholar] [CrossRef]

- Bresnahan, L.; Coxhead, I.; Foltz, J.; Mongues, T. Does Freer Trade Really Lead to Productivity Growth? Evidence from Africa. World Dev. 2016, 86, 18–29. [Google Scholar] [CrossRef]

- Bezemer, D.; Headey, D. Agriculture, Development, and Urban Bias. World Dev. 2008, 36, 1342–1364. [Google Scholar] [CrossRef]

- Boulanger, P.; Dudu, H.; Ferrari, E.; Mainar Causape, A.J.; Balle, J.; Battaglia, L. Policy Options to Support. Agriculture Sector Growth and Transformation Strategy in Kenya: A CGE analysis, EUR 29231; Publications Office of the European Union: Luxembourg, 2018; ISBN 978-92-79-85949-6. [Google Scholar] [CrossRef]

- Zidouemba, P.R.; Gerard, F. Does Agricultural Productivity Actually Matter for Food Security in a Landlocked Sub-Saharan African Country? The Case of Burkina Faso. Can. J. Agric. Econ. 2018, 66, 103–142. [Google Scholar] [CrossRef]

- Wangari, M.J.; Richard, V.S.; Kemboi, K. A study of the impact of agricultural development and efficiency on Sudan Economy. Afr. J. Agric. Econ. Rural Dev. 2016, 4, 351–358. [Google Scholar]

- Page, J. Can Africa Industrialize? J. Afr. Econ. 2012, 21, 86–124. [Google Scholar] [CrossRef]

- Ivanic, M.; Martin, W. Sectoral Productivity Growth and Poverty Reduction: National and Global Impacts. World Dev. 2018, 109, 429–439. [Google Scholar] [CrossRef]

- Morris, M.; Fessehaie, J. Making the Most of Africa’s Commodities: Linkage Development, Value Addition, and Industrialization; Report for the United Nations Economic Commission on Africa: Economic Report of Africa 2013; University of Cape Town: Cape Town, South Africa, 2012. [Google Scholar]

- Mwang’onda, E.S.; Mwasebaand, S.L.; Juma, M.S. Industrialization in Tanzania: The Fate of the Manufacturing sector Lies upon Policies Implementations. Intern. J. Bus. Econ. Res. 2018, 7, 71–78. [Google Scholar] [CrossRef]

- Msami, J.; Wangwe, S. Industrial Development in Tanzania. In Manufacturing Transformation: Comparative Studies of Industrial Development in Africa and Emerging Asia. 6; Newman, C., Page, J., Rand, J., Shimeles, A., Söderbom, M., Tarp, F., Eds.; Oxford University Press: Oxford, UK, 2016; pp. 45–66. [Google Scholar] [CrossRef]

- Mkubwa, H.M.; Mtengwa, B.A.; Babiker, S.A. The Impact of Trade Liberalization on Economic Growth in Tanzania. Inter. J. Acad. Res. Bus. Soc. Sci. 2014, 4. [Google Scholar] [CrossRef]

- Chang, H.J. Kicking away the ladder: Neoliberalism and the ‘Real’ History of capitalism. In Developmental Politics in Transition—The Neoliberal Era and Beyond; Chang, K.-S., Weiss, L., Fine, B., Eds.; Palgrave Macmillan: Hampshire, UK, 2012; pp. 43–50. [Google Scholar]

- Samouel, B.; Aram, B. The Determinants of Industrialization: Empirical Evidence for Africa. Eur. Sci. J. 2016, 1, 219–239. [Google Scholar]

- Diao, X.; McMillan, M. Toward an understanding of economic growth in Africa: A reinterpretation of the Lewis Model. World Dev. 2018, 109, 511–522. [Google Scholar] [CrossRef]

- Christiaensen, L.; Martin, W. Agriculture, structural transformation and poverty reduction: Eight new insights. World Dev. 2018, 109, 413–416. [Google Scholar] [CrossRef]

- Dorosh, P.; Thurlow, J. Beyond agriculture versus non-agriculture: Decomposing sectoral growth–poverty linkages in five African countries. World Dev. 2018, 109, 440–451. [Google Scholar] [CrossRef]

- Le Billon, P.; Sommerville, M. Landing capital and assembling ‘investable land’ in the extractive and agricultural sectors. Geoforum 2017, 82, 212–224. [Google Scholar] [CrossRef]

- McMillan, M.S.; Rodrik, D.; Verduzco-Gallo, I. Globalization, structural change, and productivity growth, with an update on Africa. World Dev. 2017, 63, 11–32. [Google Scholar] [CrossRef]

- Tlhalefang, J.; Mangadi, K. Potential welfare benefits of agricultural transformation in Botswana: A computable general equilibrium model analysis. J. Afr. Stud. 2012, 26, 46. [Google Scholar]

- Naranpanawa, A.; Arora, R. Does Trade Liberalization Promote Regional Disparities? Evidence from a Multiregional CGE Model of India. World Dev. 2014, 64, 339–349. [Google Scholar] [CrossRef]

- Le Goff, M.; Singh, R.J. Does trade reduce poverty? A view from Africa. J. Afr. Trade 2014, 1, 5–14. [Google Scholar] [CrossRef]

- Emran, S.; Shilpi, F. Agricultural Productivity, Hired Labor, Wages, and Poverty: Evidence from Bangladesh. World Dev. 2017, 109, 470–482. [Google Scholar] [CrossRef]

- Dorward, A.; Morrison, J.; Wobst, P.; Lofgren, H.; Tchale, H. Modeling Pro-Poor Agricultural Growth Strategies in Malawi: Lessons for Policy and Analysis. African Development and Poverty Reduction: The Macro-Micro Linkage; Forum Paper: Somerset West, South Africa, 2004. [Google Scholar]

- Mgeni, C.P.; Sieber, S.; Amjath-Babu, T.S.; Mutabazi, K.D. Can protectionism improve food security? Evidence from an imposed tariff on imported edible oil in Tanzania. Food Secur. 2018, 10, 799–806. [Google Scholar] [CrossRef]

| Sectors/Sub-Sectors | Production | Import | Export | Domestic Sales | Domestic Prices | Import Price |

|---|---|---|---|---|---|---|

| Agriculture | 25.10 | 23.21 | ||||

| Cereals | 24.41 | −27.08 | 69.76 | 28.09 | −26.69 | 4.03 |

| Oilseeds | 37.21 | −66.19 | 95.06 | 20.68 | −28.37 | 7.09 |

| Roots and Tubers | 25.99 | −31.89 | 37.91 | 23.63 | −43.17 | 3.98 |

| Cotton | 10.86 | −35.79 | 25.55 | 1.78 | −13.23 | 7.08 |

| Tobacco | 22.23 | −29.79 | 30.55 | 11.21 | −9.35 | 7.05 |

| Tea | 20.59 | −7.93 | 22.07 | 18.34 | −4.06 | 6.45 |

| Sisal | 1.43 | 1.43 | −29.22 | |||

| Sugar | 27.54 | −8.59 | 51.84 | 25.64 | −10.23 | 3.45 |

| Fruits and Vegetables | 26.09 | −43.14 | 77.26 | 22.44 | −28.05 | 7.40 |

| Other crops | 29.91 | -8.56 | 33.87 | 17.99 | −10.46 | 3.89 |

| Livestock | 21.62 | −61.41 | 96.28 | 18.73 | −37.25 | 2.82 |

| Fishery | 26.65 | −10.39 | 50.25 | 21.21 | −22.44 | 2.85 |

| Forestry | 26.79 | −11.81 | 52.00 | 21.19 | −30.03 | 3.17 |

| Industry | 5.48 | 6.03 | ||||

| Mining and Gas | −0.53 | −5.82 | −3.51 | −0.02 | 0.93 | 2.93 |

| Food processing | 13.58 | 34.43 | −12.26 | 13.56 | 12.36 | 1.93 |

| Beverages | 7.50 | 48.22 | −53.36 | 7.56 | 26.55 | 6.22 |

| Clothing | 1.43 | 62.61 | −65.12 | 4.18 | 17.74 | 2.16 |

| Wood products | −3.98 | 11.27 | −24.05 | −3.21 | 5.92 | 1.67 |

| Chemicals | −19.65 | 28.89 | −71.72 | −17.42 | 14.08 | 1.73 |

| Petroleum | −3.92 | 15.12 | −29.99 | −3.82 | 11.85 | 2.83 |

| Other manufacturing | −8.94 | 7.91 | −30.75 | −7.98 | 5.83 | 1.59 |

| Services | 1.95 | 3.53 | ||||

| Utilities | 4.00 | 4.00 | 27.88 | |||

| Construction | 1.55 | 26.98 | 1.55 | 13.38 | 3.01 | |

| Trade | 9.96 | 9.96 | 71.81 | |||

| Hotels and Restaurants | 7.08 | 7.08 | 24.19 | |||

| Transportation | −5.31 | 9.84 | −6.58 | 1.63 | 4.32 | 3.01 |

| Real estate | 5.87 | 5.31 | 61.43 | |||

| Public Administration | −3.14 | 35.21 | −38.19 | −1.49 | 19.31 | 3.01 |

| Other Services | −11.82 | 25.96 | −29.86 | −1.95 | 14.69 | 3.01 |

| Sector | % Change |

|---|---|

| Agriculture | 39.2 |

| Food | 49.3 |

| Agro-processing | 34.5 |

| Industry | 28.5 |

| Service | 39.2 |

| Land | 35.4 |

| Total investment demand | 37.6 |

| Household Categories | SIM |

|---|---|

| Aggregate Rural | 15.10 |

| Rural Poor | 14.04 |

| Rural attain basic needs | 14.55 |

| Rural uneducated | 14.46 |

| Rural have completed primary education | 14.62 |

| Rural have not completed secondary education | 15.81 |

| Rural have completed secondary education | 15.25 |

| Aggregate Urban | 16.07 |

| Urban Poor | 16.59 |

| Urban attain basic needs | 17.78 |

| Urban uneducated | 16.30 |

| Urban have completed primary education | 16.41 |

| Urban have not completed secondary education | 16.61 |

| Urban have completed secondary education | 14.29 |

| Aggregate (Rural and Urban) | 15.42 |

| Revenue Sources | % Change from the base |

|---|---|

| Direct taxes | 16.89 |

| Indirect tax | 18.79 |

| Tariff | 11.04 |

| Tax on production | 20.85 |

| GDP | 2.7 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peter Mgeni, C.; Müller, K.; Sieber, S. Reducing Edible Oil Import Dependency in Tanzania: A Computable General Equilibrium CGE Approach. Sustainability 2019, 11, 4480. https://doi.org/10.3390/su11164480

Peter Mgeni C, Müller K, Sieber S. Reducing Edible Oil Import Dependency in Tanzania: A Computable General Equilibrium CGE Approach. Sustainability. 2019; 11(16):4480. https://doi.org/10.3390/su11164480

Chicago/Turabian StylePeter Mgeni, Charles, Klaus Müller, and Stefan Sieber. 2019. "Reducing Edible Oil Import Dependency in Tanzania: A Computable General Equilibrium CGE Approach" Sustainability 11, no. 16: 4480. https://doi.org/10.3390/su11164480

APA StylePeter Mgeni, C., Müller, K., & Sieber, S. (2019). Reducing Edible Oil Import Dependency in Tanzania: A Computable General Equilibrium CGE Approach. Sustainability, 11(16), 4480. https://doi.org/10.3390/su11164480