1. Introduction

The world is moving at a faster pace, and globalization, actively driven by technology, is defining nations and their status in the scheme of business globally. As opined by the United Nations Conference on Trade and Development (UNCTAD), E-commerce has advantages in the form of bridging trade gaps between countries, improved and faster access to markets, whilst lowering costs [

1]. It is widely known that the internet and all that it involves provide retailers with opportunities to transform their customers’ buying activities [

2]. The ability to create value relates directly to how efficient a business model is and how good it is at attracting customers and keeping them. It has been reported that companies that use the internet to increase their customer base have the potential to create value. These values include:

Strengthened supply chain with reduced supplier costs;

Provision of a large array of products and services;

Convenience for the customer;

Time savings; and

Reduced asymmetry of information amongst parties [

3].

With time, the lines between conventional and electronic commerce will become indistinct as businesses transfer part of their activities to the Internet [

4]. The combined effect of increasing mobile data usage and network coverage has widened the opportunity for E-commerce markets in Nigeria. This presents various opportunities for the country, as E-commerce and internet connectivity are intricately linked. E-commerce has significantly overhauled the old system and instituted a new order, characterized by speed, convenience and effectiveness. However, while modern retail markets in Nigeria have gone far in their exploration of E-commerce, their traditional counterparts are notably lagging behind.

Traditional retail markets are ubiquitous in Nigeria. They are essentially comprised of retailers who sell from the roadside, and from shops in the open markets [

5]. Traditional markets play a vital role in African life. They are both an economic necessity for populations that cannot afford the more western retail experience, and a cultural phenomenon that has helped to shape ideas of community for centuries. According to The Manufacturers Today 2013 Report [

6],

“… the traditional open markets will continue to exist and thrive because those who would continue to patronize them are in the majority, especially with the prevailing high level of unemployment and poverty; while at the same time and with the existing tendency toward upward social mobility, the middle class will continue to expand thereby promoting the existence and expansion of the formal retail sector which is already being regarded as a status symbol. Invariably, the informal markets will continue to thrive, just as the modern shopping malls continue to spring up in the city centers. This is a clear demonstration of what development economists call “dualism”—the existence of two opposing situations in the same economy”.

Informal channels still account for 98% of transactions, based on a market survey, which the global management consultancy, Deloitte, conducted. These channels amount to 40% and 70% in South Africa and Kenya, respectively. The formal channels of retail contribute only 2% of total retail consumption in Nigeria, and a current lag owing to unsteady oil prices and the exchange rate may slow overall discretionary spending [

7]. Several factors contribute to the preference for traditional markets as a dependable source for purchases in Nigeria. These include:

Limited capital involvement, which makes it possible for retailers to buy from wholesalers;

Prices are cheaper and more negotiable than in alternative retail outlets; and

Indigenous foods are readily available in traditional markets. A wide variety of fresh fruits, vegetables, root crops, fresh fish and meat can be bought at any time by a willing consumer [

8].

Despite these attractions, a characteristic shopping experience in any Nigerian big traditional market takes ample time owing to the long walks involved in trying to get a good bargain, and the ever-present crowd that always get in the way. There are also wheelbarrow pushers (often with high stacked goods) to watch out for while walking around in these markets. A shopper with a long list may devote up to three hours on a mission to find shops with the required items on his/her list.

The paradigm shift in the mode of commercial activities occasioned by the advent of the internet has changed the face of business, making it possible for transactions to take place virtually from anywhere and anytime. It is projected that more than N1 billion worth of transactions occur daily in the traditional open markets in Nigeria [

5]. The significant role that the traditional market plays in boosting the Nigerian economy’s GDP cannot be overemphasized. Conversely, the current market trend towards convenience, time savings and ease of transactions made possible by E-commerce is a sure route to global recognition and acceptance for developing economies like Nigeria. Increased sales, lower costs and enhanced sustainability are potential benefits for the traditional markets when E-commerce is fully embraced. As a strategy, E-commerce cannot be ignored for long by government, society, consumers, traders and every other stakeholder in the traditional Nigeria markets.

1.1. Problem Statement

Indeed, E-commerce has considerably overtaken the old ways of transacting and has brought about new ways of doing business, characterized by speed, convenience and effectiveness. While modern retail markets in Nigeria have gone far in their exploration of E-commerce, their traditional counterparts seem to lag behind.

1.2. Research Questions

From the above problem statement, the researchers focused on answering three key research questions in order to achieve the study’s aim:

To what extent is E-commerce known in the traditional open markets in Enugu State, Nigeria?

How relevant is E-commerce to sustainable value creation in the traditional open markets?

What limiting factors exist to E-commerce adoption among open market retailers?

1.3. Research Aim and Objective

This paper aims to ascertain the potential of E-commerce as a strategy for sustainable value creation amongst selected traditional open market retailers in Enugu state, Nigeria. The adoption of E-commerce and its challenges have been well studied in different sectors (manufacturing, construction, small and medium scale enterprises, etc.), but few studies have focused on the African continent with its unique features of rich traditions and an enterprising populace. This study, therefore, also intends to cover that knowledge gap.

1.4. Scope of the Study

This study was conducted in southeastern Nigeria (popularly known for its trading activities) with a specific focus on five open markets in Enugu state. These markets—Ogbete (the biggest of the five), Artisan, Kenyetta, Abakpa and New Haven, share common attributes in the types of goods that they sell. Ogbete market is the 8th among the 20 biggest and most populated markets in Nigeria. It is hugely popular and represents a typical Nigerian open market. It occupies a large expanse of land, selling a variety of goods, which include books, computer accessories, electrical equipment, footwear, phones, canned goods, fabrics and even building materials.

1.5. Theoretical Foundations

The following sections present this paper’s theoretical foundations.

1.5.1. The Traditional Open Market

Traditional open markets play a central role in the business activities of communities [

9], and make up a substantial part (70 percent) of Nigeria’s retail structure [

5]. Their presence creates externalities from which Government and the host area benefit. Historically, traditional market places were associated with shrines, meeting places and cultural arenas. The ‘market square’ is a term that many people from Nigeria can relate to, as it is multi-functional in nature (serving as a location for traditional dancing competitions, cultural events, trade, meetings, royal conferences, and so on). Market days were periodic as four-day or eight-day events. This is still obtainable in most rural parts of Nigeria, where the citizens are predominantly farmers and artisans.

With increased infrastructural development, industrialization and urban migration, daily markets were built to meet the needs of the populace. Daily markets are characteristic of urban cities and can be found situated all over the towns [

10]. In Nigeria, daily markets of different sizes abound with a variety of target customers. Almost every state in Nigeria has one or two major markets that make it popular. In these markets, everything can be found—from luxury goods to fresh vegetables. As the population continues to boom, with 80 percent of them as potential consumers, the markets are expected to expand. However, globalization is changing the dynamics of market places, while E-commerce is an enabler of that process.

The traditional retail markets are attractive for many reasons, namely lower costs, multiple retailers, and multiple products. Customers enjoy traditional shopping for many reasons such as immediate access, aesthetic appeal from immediate surroundings, and an ability to see or touch the product. Lastly, to an extent, shopping also remains a desirable leisure activity for many customers. In addition to all these benefits, traditional markets present inconvenient shopping experience, time wasting and stress. E-commerce is the digital opportunity that beckons traditional retailers [

11].

Traditional markets form a significant ratio of the Nigerian business environment. The structure and design of future marketing activities, considering the niche carved by internet technology and E-commerce, will be largely decided by this ratio. The spread of online shopping is on the increase, with more consumers preferring this route on a daily basis. Like every profit-making business enterprise, the traditional retail businesses in Nigeria must incessantly attract, win and retain customers in order to increase their volume of sales. The traditional approach of venturing in a market, such as joint ventures, owned stores or franchise models are expensive and time-consuming [

12]. Based on above literature, the 2 below was formulated:

Hypothesis 1 (H1). There is a statistically significant association between E-commerce and traditional open markets in Enugu state.

1.5.2. E-Commerce as a Business Strategy

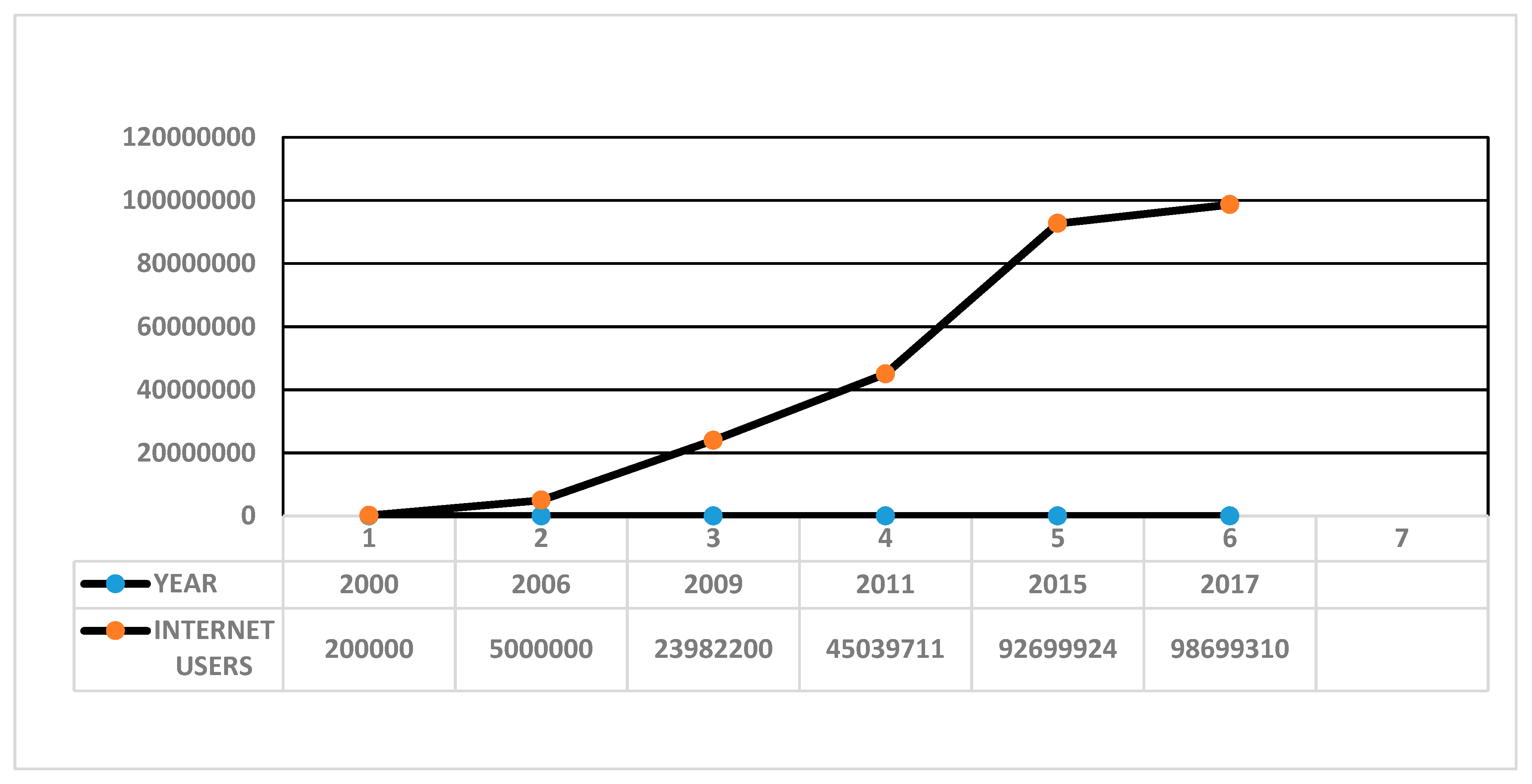

Like the rest of Africa, Nigerians are embracing E-commerce as an avenue to buy, sell and obtain information. The high number of internet users in the country—ninety-eight million and still growing, shows that the e-market will continue to grow (see

Figure 1). The indicators of this potential abound. No sector should be left behind. Even large brick and mortar companies are re-strategizing their business models owing to the highly competitive market environment that electronic commerce has created [

13]. Alignment with innovative opportunities as a result of the internet has catapulted businesses into an era of boundless customer/supplier reach. Benefits far outweigh challenges, considering the steady increase of online stores and internet users. These and many more reasons make E-commerce a must-do affair for growth and sustainability.

It is no longer news that E-commerce will change the economy, or how business is done in Nigeria. This necessitates the utmost need for traditional retailers to key into digital means of expanding their sales volumes, whilst redesigning their business practices to satisfy and retain customers [

14]. E-commerce displays an entirely new way of transacting business with entirely new rules. It is, therefore, far more about approach and plans than it is about expertise and technological knowledge [

15]. Advantages of E-commerce over the traditional business model have been well researched. E-commerce has the ability to simplify distribution (by not making use of middle men), lower costs of doing business, remove time restrictions and has the added advantage of being easy-to-learn and flexible to operate, thereby improving business performance [

16]. From the above literature, the following hypothesis can be deduced:

Hypothesis 2 (H2). There is a statistically significant association between E-commerce adoption and sustainable value creation in the traditional open Markets.

1.5.3. The Nigeria Situation

It is an e-revolution era with western firms seeking to outdo each other. However, can this also be said of their Nigerian counterparts? Despite potentials in the country’s demographics, significant progress is yet to be made in the area of E-commerce adoption. The UNCTAD 2015 report ranks Nigeria 101 out of 130 countries based on E-commerce readiness. This means that substantial efforts still need to be made within the country. It is a given that the advent of E-commerce will profoundly change the methods of retail and distribution going forward [

17]. Despite the continued growth of internet usage in Nigeria, businesses are yet to fully benefit from it. It is possible that most traditional retailers will be overwhelmed with the prospect of geographical barrier erosion, considering the historical pattern of owner-does-it-all. To overcome this challenge, there is a need for systematic training and enlightenment that address cultural and non-infrastructural issues, which are unique to Nigerians and may act as potential threats to E-commerce adoption [

18].

1.5.4. Government and E-commerce

The importance of E-commerce to the economic growth of nations cannot be overemphasized [

21]. Since the economy is an important indicator of the functionality of any Government, it is pertinent that every visionary in Government pursues E-commerce in every sector of the economy with vigor and calculable effort. A functional E-commerce policy, supported by good application technologies, is essential for its implementation [

16]. Without these in place, interested retailers will continue to struggle in their adoption of E-commerce trends, and this is where Government plays a role. Provision of basic and affordable internet services will give form to the various policies that have already been established to encourage E-commerce activities in Nigeria. E-commerce adoption requires a synergy between technical preparedness and professional preparedness [

22]. Government policies and legislations invariably dictate the pace of E-commerce in any country. A supportive legal and regulatory framework ensures that barriers are tackled headlong. This includes facilitating E-commerce laws, protecting the consumer, and instituting a justice system that handles cybercrimes [

23].

The Nigerian Government has achieved some milestones by creating an enabling environment for the digitization of the country’s economy. In July 2018 (as reported on Channels Television), Google, in partnership with the Federal Government, introduced Wi-Fi in major business areas of Lagos state (Ikeja City Mall, Computer village, etc.) in a bid to ensure seamless internet access for traders and consumers alike. This is commendable and will go a long way if replicated in other business districts throughout the country.

In Nigeria, however, consumers of online transactions (e-consumers) face a lot of challenges in the course of, and even after, conducting online transactions [

24]. The Government is yet to put in place an all-embracing policy document for the security of e-consumers. Scholars abound who assert that a majority of the statutes that will address legal issues in E-commerce and consumer protection in the country are yet to be finalized [

25]. It is important that, in a developing economy like Nigeria’s, laws and regulations should be established to facilitate the growth of technological advances.

Various literature cite trust and security as huge factors that inhibit E-commerce adoption by both suppliers and consumers [

15,

21,

22,

26,

27]. This brings to view the need for an effective legal and regulatory framework, which promotes security and promptly punishes offenders.

This study is hinged on three theoretical frameworks, namely the theory of creative destruction, the innovation diffusion theory, and the contingency theory. These three theories are discussed below.

1.5.5. The Theory of Creative Destruction

The theory of Creative Destruction, as propounded by Joseph Schumpeter, deals with the innovative trend that E-commerce presents. Creative destruction is an important tool that tackles the economic and sociological aspects of capitalism. According to Schumpeter, as written by [

28], in the long-term, evolution produces economic development as a fallout from sets of innovative solutions, giving rise to enhancements of living standards. This theory explained the industrial mutation process, which persistently transforms the structure of the economy from within, thereby extinguishing the previous economic order, and ushering in a new one. The creative destruction process, in both the original work by Schumpeter, and in his very recent treatises, is a process by which advanced technological innovations were recognized as the key source of growth in an economy, the corollary of which is improvements in living standards [

29].

This theory is relevant to the study, as E-commerce is an evolving trend spontaneously overhauling the traditional model of business and creating a new digital technological model that ensures economic growth and improvements in quality of life. It is also common knowledge that the evolution of E-commerce will make obsolete certain aspects of the traditional model (like manual invoicing). This will occur as new modern methods are introduced.

1.5.6. The Innovation Diffusion Theory

The innovation diffusion theory was propounded by Everett Rogers in 1962 and deals with the acceptance of new technologies and its sustainability. This theory seeks to explain how, why, and at what rate new ideas and technology spread in a social system [

30]. Rogers used technology and innovation as synonyms and defined innovation as new knowledge, new ways of doing things, or something that is perceived by an individual or group as new and adopted by others [

30]. The process of moving from knowing about an innovation, developing an outlook about it, to accepting or rejecting, to implementing and to finally confirming it is known as the innovation–decision process [

31].

Based on a time factor, innovation adopters have been grouped into five distinct clusters, which are shown below:

The theory is relevant to this study on several grounds. E-commerce is a relatively new technology among traditional retailers. The innovators among them have keyed in and aligned their businesses to certain aspects of E-commerce like mobile banking, while the laggards are still postponing adoption dates owing to one reason or another. The innovation diffusion theory also emphasizes the role of change agents and leaders in championing the adoption of an innovative trend, and tackling the limiting factors to adoption.

1.5.7. The Contingency Theory

This is a theory in organizational research, which accepts that an ideal situation is dependent on a myriad of factors such as the structure of the organization, the technology, and prevalent market conditions [

33]. The theory was developed by Woodward in 1958 and posits that there is no best way to manage. This simply means that no two situations are the same [

34], making it imperative that different approaches should be employed, depending on situational factors.

The basic premise of Contingency theory, as it relates to Innovation, is that there is no one best way to successful execution. The contingency theory relates to this study with respect to the penetrance of E-commerce in Nigeria vis-à-vis its developed counterparts. The differences in their history and culture contribute to varying E-commerce interests. Other factors like command over the English language play a huge role in E-commerce. What is a walkover in a particular geographical location may prove to be an insurmountable task in another.

2. Research Method

Using a concurrent mixed method, this research adopted a descriptive survey design. Raw data were collected from randomly selected retailers in the traditional open markets, using personal interviews and structured questionnaires (see

Appendix A). The secondary sources of data utilized in this study were journals, seminar papers, organizational records, news reports and institutional reports that were obtained from the internet. The population of this study consists of retailers in selected traditional markets drawn from the following sectors: clothing, mobile and technology, books and articles. Figures from mapping records, obtained from market authorities, were given as 410 for the Ogbete market; 65 for the Abakpa market; 62 for the Kenyetta market; 25 for the New Haven market; and 32 for the Artisan market, giving a total of 594 retailers that were studied. Using the Bill Godden formula, a sample size of two hundred and thirty-four (234) people was used for the study. Four questionnaires were not returned.

The reason for the choice of these retailers is hinged on where E-commerce transformation is likely to begin. Retailers who deal with fresh vegetables were consciously omitted from this study. Over a period of one year, we gathered facts about the research topic by reviewing journals, statistical reports and by conducting in-depth interviews. Hence, the study incorporated the views of a total of 230 respondents.

3. Data Analyses

Descriptive statistics were used to analyse the data. Chi-square tests were utilized to test the hypotheses.

Table 1 summarizes the demographic variables that the study used. Retailers aged 40–50 years comprised the majority, followed by those aged 20–39 years. This is a teachable pool and can be expected to drive the rapid growth of E-commerce activities in the markets and the country at large. Almost all of the respondents (97.38%) have had one form of formal education or another. In addition, 103 (44.78%) respondents have secondary school education, while 72 (31.30%) respondents have been to higher institutions (University/Polytechnic). Only a paltry 2.61% can be termed as ‘illiterates’. Some of these respondents are not familiar with the term ‘E-commerce’, and only understood the concept as its colloquial substitute ‘Online Business’. This reveals a knowledge gap that must be bridged for traditional retailers to be in tune with their modern counterparts. Training and enlightenment programs on E-commerce must start from a basic level for it to be effective. Of the 230 respondents, 89 (38.70%) are males, while 141 (61.30%) are females. There are generally more women in the traditional markets in urban cities than men. Historically, trading is an occupation, which is ascribed to women, while the men engage in artisanship. Ogbete is the biggest market in Enugu state and acts as a feeder market to smaller markets in the city. A total of 68% of the respondents were drawn from Ogbete market based on the population distribution of retailers that the study used.

In

Table 2, the descriptive statistics are as summarized. Out of 230 respondents, 66 (28.7%) accept no other form of payment except cash. Furthermore, 141 (61.30%) in addition to collecting cash, accept mobile transfer of funds. This particular group forms the majority, which shows that M-commerce, which is a subset of E-commerce, has gained ground, and is well accepted by traditional retailers. Only three (1%) respondents have their goods on online platforms. This is quite a negligible number when compared to the level of awareness of E-commerce as observed in the markets. In some cases, two or three shops combined to use one POS (point of sale) machine in order to share the cost. There is a widespread understanding of what E-commerce is all about among the traditional retailers in open markets. Only 18 (7.83%) respondents claimed ignorance of the concept of E-commerce. While 67 (29.1%) understand E-commerce as an online shop that sells around the world, 68 (29.6%) understand it as any transaction done on the internet. Another 77 (33.5%) understand E-commerce as a service that allows business transactions without physical presence of buyers and sellers. In summary, a total of 212 (92%) respondents have an idea of what E-commerce is all about. This result emphasizes the gap between knowledge/awareness and actual practice. Furthermore, 141 (61.30%) respondents have never bought or sold goods over the internet. Out of the 89 respondents who have, 6.09% trade daily on line, 6.96% trade weekly online, while 26% trade online occasionally. E-commerce practice amongst the traditional retailers is still quite low. There is opportunity for growth if obstacles are identified and tackled.

However, there seems to be a high preference for mobile money transfers/ATM payments by customers. For instance, 183 (79.6%) retailers said their customers prefer this mode of payment and frequently use it. Interestingly, 191 respondents representing 83%, use internet-enabled phones, while 39 (17%) respondents use phones that are not connected to the internet. This confirms the opportunity that exists for E-commerce amongst traditional retailers, which supports the report of [

14], that the internet is a huge factor in promoting E-commerce. Internet users are important data sources because they are potential consumers in electronic commerce. Retailers need to be trained on other useful aspects of the internet outside social media. Many retailers (137) (59.57%) believe that moving their businesses to online platforms will boost their businesses, while 19 (8.26%) retailers think otherwise. In addition, 65 (28.26%) respondents are not sure whether online adoption will make any difference to their business, while nine (3.9%) respondents have no idea of the effect of moving their business online. The ‘No’ and ‘Not Sure’ respondents believe people prefer to touch and feel whatever they are buying. These respondents are in the minority. This shows that a majority of retailers believe in the positive effects of E-commerce. They listed some of the E-commerce gains as follows:

More customers,

More business opportunities from different places,

Ease of doing business,

Wider reach and coverage,

Faster business transactions,

Global access since we now operate in a digital world,

Reduction of debt incidences, and

Higher Profit.

On the perceived challenges to E-commerce, 63 (27.4%) respondents rank security as the major challenge, while 77 (33.5%) respondents rank trust issues as the major challenge to E-commerce adoption. Only 13 (5.7%) respondents view connectivity as a major challenge, while 51 (22.2%) respondents see cost as a major inhibitor to E-commerce adoption. Others, namely 26 (11.30%) respondents, cited logistics and a knowledge gap as the major challenge to E-commerce adoption. On needed support, 77 (33.5%) respondents need Government infrastructural support to move their business online, while 73 (31.7%) respondents need education and training to go online, another 44 (19.1%) respondents see protection laws as the most needed support to move their businesses online. The remaining 28 (15.7%) respondents, specified capital, subsidized cost and funds provision (in form of loans and grants) as the most needed support. It was also very interesting to know that a huge population of traditional retailers, 173 (75.2%) retailers feels considerably threatened by their modern counterparts. The respondents gave reasons for this situation. A total of 57 (24.8%) retailers who do not share this position also gave their reasons as summarized below in

Table 3.

This shows that a good percentage of open market retailers know the preferences of present age consumers, which are hinged on convenience, speed and value for money.

Table 4 shows the cross tabulation of E-commerce and Understanding of traditional retailers.

From the cross tabulation above, there is a widespread understanding of what E-commerce is all about among the traditional retailers in open markets. Out of 67 retailers who understand E-commerce as an online shop that sell to people around the world, 10 (14.9%) respondents are from Abakpa market, 46 (68.7%) of them are from Ogbete market, four (6.0%) of them are from Kenyetta market, while three (4.5%) and four (6.0%) of them are from Artisan and New heaven markets respectively. Those who understand E-commerce as transactions done on the internet are 68 in number distributed as follows: Abakpa market has six (8.8%) respondents, Ogbete market has 49 (72.1%) respondents, Kenyetta market has seven (10.3%) respondents, Artisan market has four (5.9%) respondents and New heaven market has two (2.9%) respondents. Respondents in different markets who understand E-commerce as a service that allows transactions without physical presence are as follows: Abakpa market has 10 (13.0%) respondents, Ogbete market has 47 (61.0%), Kenyetta market has 12 (15.6%), Artisan market has four (5.2%), and New Haven market four respondents (5.2%). All of the respondents in Abakpa and New Haven markets knew/understood the concept of E-commerce in its various forms. Of eighteen respondents, 15 (83.3%) from Ogbete market, one (5.6%) respondent from Kenyetta, and two (11.1%) respondents from Artisan, claimed ignorance of the concept of E-commerce. This realisation emphasizes the gap between knowledge/awareness and actual practice.

Table 5 depicts the cross tabulation of E-commerce adoption and value creation.

The cross tabulation above shows that out of 230 respondents, 89 (38.7%) have either bought or sold online. Of these, 58 (65.2%) respondents believe that the adoption E-commerce will result in value creation, while merely 10 (11.2%) respondents think otherwise. However, 16 (18.0%) respondents were not sure about that, while five (5.6%) respondents did not have a clue regarding that. In addition, 141 (61.30%) respondents in the traditional markets have never bought or sold goods over the internet. Of these, 79 (56.0%) respondents believe that E-commerce adoption will result to value creation, while 9 (6.4%) respondents think otherwise. However, 49 (34.8%) respondents were not sure, while 4 (2.8%) respondents did not have a clue on the matter. Majority of the retailers, including those who have never bought or sold goods over the internet agree with the value creation indices of E-commerce, namely strengthening supply chain, with reduced supplier cost, provision of a large array of products and service, convenience for the customer, time savings, and reduced asymmetry of information amongst parties [

3]. There is indeed immense opportunity for growth as a result of E-commerce adoption, if obstacles can be identified and addressed.

Inferential Statistics and Test of Hypotheses

This section tests the formulated hypotheses 1and 2, stated in the preceding section of this paper. The hypotheses derived from literature have been restated below to accommodate the null hypotheses as follows:

Hypothesis 1 (H1). There is no statistically significant association between E-commerce and traditional open markets in Enugu state.

Hypothesis 1 (H1). There is a statistically significant association between E-commerce and traditional open markets in Enugu state.

Based on the chi-square test table above, since the p-value is 0.518, which is greater than 0.05 (p = 0.518 > 0.05), we failed to reject the null hypothesis (H1) and thus conclude that there is no statistically significant association between E-commerce and traditional open markets.

Hypothesis 2 (H2). There is no statistically significant association between E-commerce adoption and sustainable value creation in the traditional open markets.

Hypothesis 2 (H2). There is a statistically significant association between E-commerce adoption and sustainable value creation in the traditional open markets.

Based on the chi-square test table above, since the p-value is 0.032, which is less than 0.05 (p = 0.032 < 0.05), we reject the null hypothesis (H2) and thus conclude that there is statistically significant association between E-commerce adoption and sustainable value creation in the traditional open market in Enugu State.

4. Discussion of Findings

The result of the tested hypothesis 1 reveals that there is no statistically significant association between E-commerce and traditional open markets in Enugu state. It is obvious that, despite the level of E-commerce awareness amongst retailers in the traditional open markets, few have fully embraced it in their business operations. This could be as a result of some of the identified challenges (security, trust, connectivity, etc.) associated with E-commerce adoption. As a matter of fact, the majority of the open market retailers know and understand what E-commerce is all about, but their perceptions differ. The major perception, however, is that E-commerce involves transactions done on the internet. This emphasizes the need for training so as to have a unified perspective. E-commerce as an integral way of running a business is a long way off in the traditional open markets. This outcome revalidates the result of the study by [

22] who sought to find out the common understanding of E-commerce concepts among traditional retailers in Jordan. Their results showed that traditional retailers are fully aware of E-commerce and its benefits.

The second tested hypothesis reveals that E-commerce is significantly relevant towards value creation in traditional open markets. Indeed, E-commerce helps in eliminating intermediaries [

16]. The elimination of intermediaries ensures that more is achieved in less time. This brings down the cost of doing business [

35]. In other words, E-commerce reduces business cost, improves operational efficiency, increases customer base, better caters to the needs of foreigners and ultimately results in higher profit [

36]. More than that, E-commerce showcases opportunities to transform traditional tasks and helps to create unprecedented value for all stakeholders involved [

17].

As indicated earlier, there are limiting factors to the adoption of E-commerce by traditional retailers in the open markets. These limiting factors hinged on security and trust issues (which entails deviations from specified or ordered requisitions in terms of actual colour, actual size and actual design). Other limitations included logistical hitches and the time involved, cost of take-off and lack of requisite knowledge. There is also lack of trust in the Government and its policies. Moreover, the general challenges of E-commerce in Nigeria include infrastructural issues, risks and security, education and awareness, finance and cost, trust and confidence [

26]. Logistics and requisite education were recurring challenges pointed out by the respondents during the oral interviews [

18]. We, however, take it that the ingrained idea of owner-does-it-all makes traditional retailers perceive logistics as a huge challenge presented by E-commerce. Logistic firms that handle dispatch and delivery of goods currently abound in Nigeria. This emphasizes the need for E-commerce education among the traditional retailers. The current findings are in tandem with the studies of [

37], which sought to find out whether E-commerce is right for businesses. The results show that E-commerce is beneficial to the firm’s profitability and sustainability.

4.1. Theoretical and Practical Implications of the Findings

This current study adds to previous studies on E-commerce by looking at the concept of E-commerce from a new perspective. Previous studies on E-commerce have mainly focused their attention on consumers’ experiences and challenges. The current study made an effort to shift the focus. The traditional open market is one segment of the economy that has been expressly ignored by Nigerian Government when making plans for sustainable economic growth. This is evident in the gap that exists between Nigeria and its counterparts, such as Kenya, Ghana and South Africa in terms of E-commerce readiness. The contribution of retail business to the gross domestic product of a nation shows that traditional retail needs more attention than it is presently getting, particularly within the domain of technological innovations.

The current study has supported existing literature on E-commerce value-adding variables for traditional open markets [

37]. Most retailers are willing to adopt E-commerce if supported by Government and its agencies. Therefore, government needs to play an active role in providing the necessary infrastructure that will enhance the development and adoption of E-commerce as a mechanism for effective business operation, particularly amongst retailers in the traditional open market. Moreover, academic and financial institutions have a major role to play in promoting E-commerce amongst retailers in the traditional open markets. The traditional retailers in Enugu, despite their historical heritage, feel threatened by their modern counterparts, who have embraced E-commerce. This is a sign that the traditional retailers recognize the present day consumer quest for convenience, speed and hassle free shopping experience and will endeavor to achieve the same if the limitations towards E-commerce adoption are drastically reduced. Of course, traditional and modern retail will continue to exist side by side. However, the future will be determined not only by values related to price but convenience and easy shopping experience.

4.2. Limitations of the Study

Key limitations encountered in the course of this study include time and fund constraints. Time and funds constrained the spread or area of coverage. Nigeria boasts of many traditional open markets, but, because of time and funds constraints, the study was limited to traditional open markets in Enugu state. Hence, the results of the study cannot be generalized to other geographic zones in Nigeria, for instance, the Northern part of the country.

Another limitation is the limited educational background of some respondents. As such, in some cases where questionnaires would have been faster in generating data, oral interviews were employed (to further explain what is required) due to the educational limitations of some of the respondents. Moreover, it was difficult to collect data smoothly due to the informal nature of traditional retail, as interviews were frequently disrupted by customers who consistently haggled to get a good bargain for their purchases, which prompted the researchers cancelled and rescheduled appointments with respondents based on availability of free hours.

4.3. Areas for Future Research

Future researchers are encouraged to explore/investigate some possible research areas, which the current study skipped owing to time and cost constraints. For instance, future researchers can explore the critical roles of financial institutions in promoting E-commerce adoption within the traditional open market. In addition, researchers can also investigate the challenges affecting E-commerce policy-execution in Nigeria. Researchers can also endeavor to research a way to bridge the technological divide between different markets as well as retailers operating within them. In addition, similar research can also be carried out in other sectors of the economy, such as tourism and hospitality.

5. Conclusions

E-commerce growth amongst traditional retailers in Nigeria will be boosted by training on online business transactions. Priority needs to be given to personnel trainings via workshops and seminars. This is because the fourth industrial revolution leverages on technology and digitization. There is a need for a robust and enduring Government policy in the retail industry. Such policies should be designed with retailers in mind and those that encourage E-commerce adoption. Protection laws and legislations should be strengthened and brought to bear on business transactions over the internet. There is a need for the Nigerian Government to be trusted by its citizens when it comes to the execution of laws. Consistency in policy formation and execution is very imperative.

More than that, the E-commerce and logistics arms of the Nigerian Postal Service should take awareness campaigns to the open markets. A business partnership that tackles logistical problems will create a win–win situation for both parties. Traditional retailers, who wish to maintain both online and offline presence, can utilise the Omni-channel strategy as well. Developing an Omni-channel strategy should be at the top of every traditional retailer’s management goals. This strategy allows retailers to keep their brick-and-mortar shops and replicate a satisfying shopping experience for consumers both online and offline, and, through this, achieve business sustainability.