Are Distances Barriers to Sustainability for Venture Capital Syndication?

Abstract

1. Introduction

2. Literature Review and Hypotheses Development

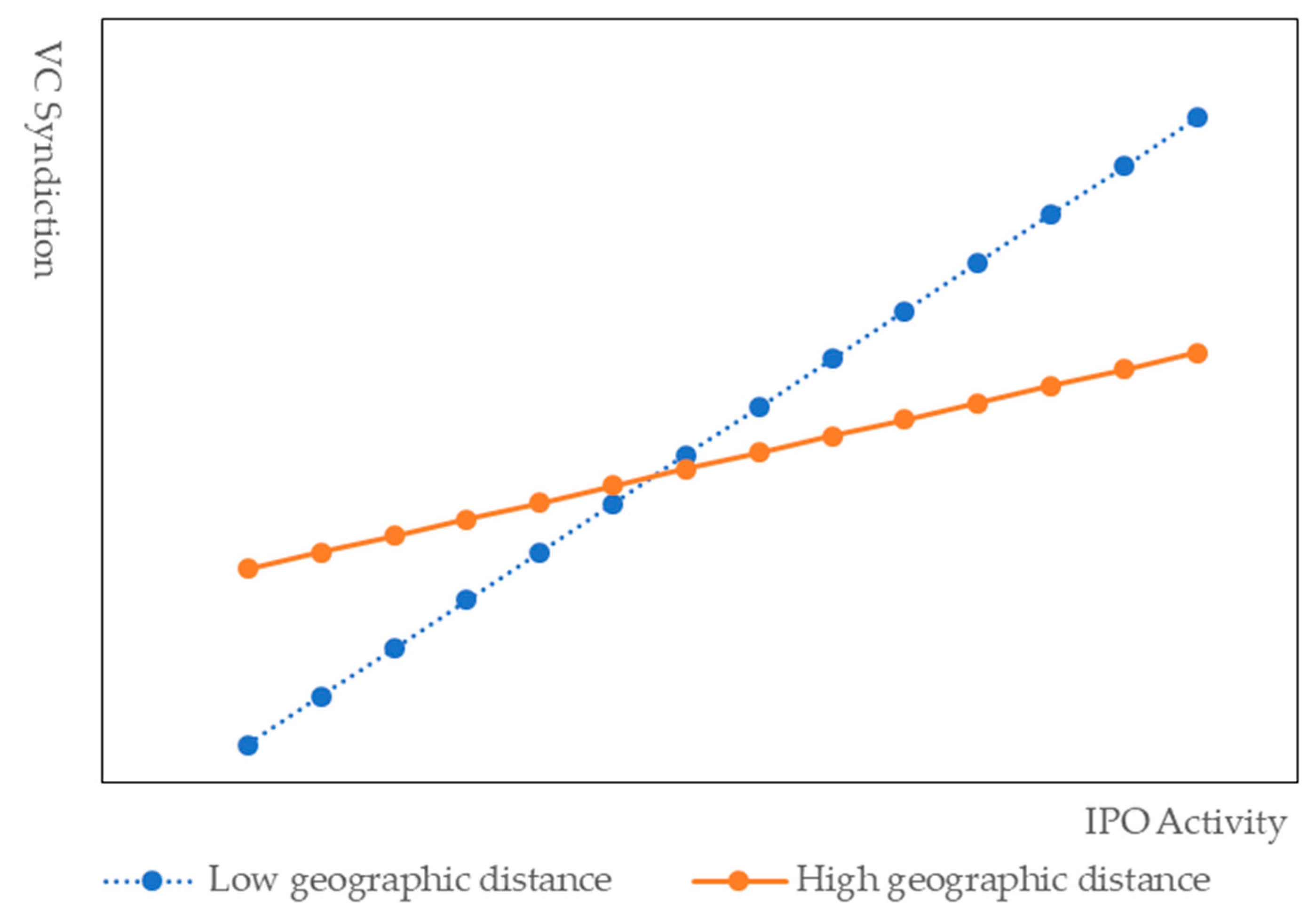

2.1. IPO Activity and VC Syndication

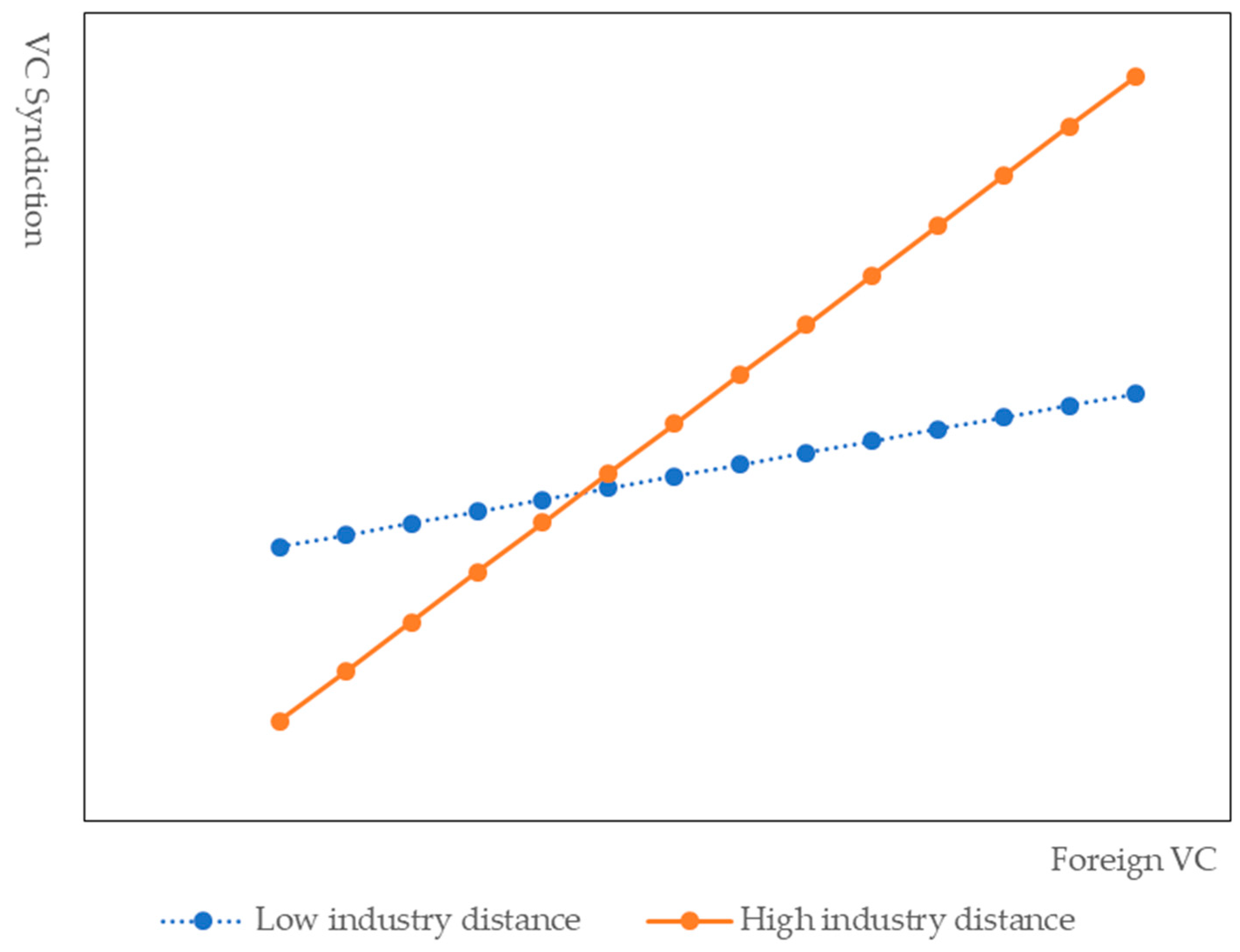

2.2. Foreign VC and VC Syndication

2.3. Geographic Distance and VC Syndication

2.4. Industry Distance and VC Syndication

3. Methods

3.1. Data Collection

3.2. Dependent Variable

3.3. Independent Variables

3.4. Control Variables

3.5. Model Specification

4. Results

5. Conclusions and Discussion

5.1. Conclusions

5.2. Managerial Implications

6. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

References

- Solvoll, S.; Alsos, G.A.; Bulanova, O. Tourism entrepreneurship—Review and future directions. Scand. J. Hosp. Tour. 2015, 15, 120–137. [Google Scholar] [CrossRef]

- Erikson, T.; Løvdal, N.; Aspelund, A. Entrepreneurial judgment and value capture, the case of the nascent offshore renewable industry. Sustainability 2015, 7, 14859–14872. [Google Scholar] [CrossRef]

- Bellantuono, N.; Pontrandolfo, P.; Scozzi, B. Capturing the stakeholders’ view in sustainability reporting: A novel approach. Sustainability 2016, 8, 379. [Google Scholar] [CrossRef]

- Ying, Q.; Hassan, H.; Ahmad, H. The role of a manager’s intangible capabilities in resource acquisition and sustainable competitive performance. Sustainability 2019, 11, 527. [Google Scholar] [CrossRef]

- Jin, Y.; Zhang, S. Credit rationing in small and micro enterprises: A theoretical analysis. Sustainability 2019, 11, 1330. [Google Scholar] [CrossRef]

- De Clercq, D.; Dimov, D. Explaining venture capital firms’ syndication behaviour: A longitudinal study. Ventur. Cap. 2004, 6, 243–256. [Google Scholar] [CrossRef]

- Jääskeläinen, M. Venture capital syndication: Synthesis and future directions. Int. J. Manag. Rev. 2012, 14, 444–463. [Google Scholar] [CrossRef]

- Manigart, S.; Lockett, A.; Meuleman, M.; Wright, M.; Landström, H.; Bruining, H.; Desbrières, P.; Hommelet, U. Venture capitalists’ decision to syndicate. Entrep. Theory Pract. 2006, 30, 131–153. [Google Scholar] [CrossRef]

- Wang, L.; Wang, S. Economic freedom and cross-border venture capital performance. J. Empir. Financ. 2012, 19, 26–50. [Google Scholar] [CrossRef]

- Guo, D.; Jiang, K. Venture capital investment and the performance of entrepreneurial firms: Evidence from China. J. Corp. Financ. 2013, 22, 375–395. [Google Scholar] [CrossRef]

- De Lange, D.E. A paradox of embedded agency: Sustainable investors boundary bridging to emerging fields. J. Clean. Prod. 2019, 226, 50–63. [Google Scholar] [CrossRef]

- Vanacker, T.; Collewaert, V.; Paeleman, I. The relationship between slack resources and the performance of entrepreneurial firms: The role of venture capital and angel investors. J. Manag. Stud. 2013, 50, 1070–1096. [Google Scholar] [CrossRef]

- Sorenson, O.; Stuart, T.E. Syndication networks and the spatial distribution of venture capital investments. Am. J. Sociol. 2001, 106, 1546–1588. [Google Scholar] [CrossRef]

- Filep, S. Moving beyond subjective well-being: A tourism critique. J. Hosp. Tour. Res. 2014, 38, 266–274. [Google Scholar] [CrossRef]

- Shepherd, D.A. Party on! A call for entrepreneurship research that is more interactive, activity based, cognitively hot, compassionate, and prosocial. J. Bus. Ventur. 2015, 30, 489–507. [Google Scholar] [CrossRef]

- Pikkemaat, B.; Peters, M. Towards the measurement of innovation—A pilot study in the small and medium sized hotel industry. In Innovation in Hospitality and Tourism; Peters, M., Ed.; Routledge: London, UK, 2012; pp. 101–124. [Google Scholar]

- Bocken, N.M.P. Sustainable venture capital–catalyst for sustainable start-up success? J. Clean. Prod. 2015, 108, 647–658. [Google Scholar] [CrossRef]

- PEdaily. Available online: http://news.pedaily.cn/201701/20170129408461 all.shtml (accessed on 16 April 2018).

- Baeyens, K.; Vanacker, T.; Manigart, S. Venture capitalists’ selection process: The case of biotechnology proposals. Int. J. Technol. Manag. 2006, 34, 28–46. [Google Scholar] [CrossRef]

- Zheng, Y.; Xia, J. Resource dependence and network relations: A test of venture capital investment termination in China. J. Manage. Stud. 2018, 55, 295–319. [Google Scholar] [CrossRef]

- Fitz-Koch, S.; Nordqvist, M.; Carter, S.; Erik, H. Entrepreneurship in the agricultural sector: A literature review and future research opportunities. Entrep. Theory Pract. 2018, 42, 129–166. [Google Scholar] [CrossRef]

- Lockett, A.; Wright, M. The syndication of venture capital investments. Omega 2001, 29, 375–390. [Google Scholar] [CrossRef]

- De Clercq, D.; Dimov, D. Internal knowledge development and external knowledge access in venture capital investment performance. J. Manag. Stud. 2008, 45, 585–612. [Google Scholar] [CrossRef]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strateg. Manag. J. 1999, 20, 397–420. [Google Scholar] [CrossRef]

- Dimov, D.; Milanov, H. The interplay of need and opportunity in venture capital investment syndication. J. Bus. Ventur. 2010, 25, 331–348. [Google Scholar] [CrossRef]

- De Clercq, D.; Dimov, D. Doing it not alone: Antecedents, dynamics, and outcomes of venture capital syndication. In Venture Capital: Investment Strategies, Structures, and Policies; Cumming, D.J., Ed.; John Wiley & Sons: Hoboken, NJ, USA, 2010; pp. 221–242. [Google Scholar]

- Lerner, J. The syndication of venture capital investments. Financ. Manag. 1994, 23, 16–27. [Google Scholar] [CrossRef]

- Gompers, P.A.; Lerner, J. The Venture Capital Cycle; MIT Press: Cambridge, UK, 2004. [Google Scholar]

- Petty, J.S.; Gruber, M. “In pursuit of the real deal”: A longitudinal study of VC decision making. J. Bus. Ventur. 2011, 26, 172–188. [Google Scholar] [CrossRef]

- Gompers, P.; Kovner, A.; Lerner, J.; Scharfstein, D. Venture capital investment cycles: The impact of public markets. J. Financ. Econ. 2008, 87, 1–23. [Google Scholar] [CrossRef]

- Wang, P. Syndication and foreignness: Venture capital investments in emerging and developed markets. J. Int. Manag. 2017, 23, 1–15. [Google Scholar] [CrossRef]

- Mäkelä, M.M.; Maula, M.V. Attracting cross-border venture capital: The role of a local investor. Entrep. Reg. Dev. 2008, 20, 237–257. [Google Scholar] [CrossRef]

- Dai, N.; Jo, H.; Kassicieh, S. Cross-border venture capital investments in Asia: Selection and exit performance. J. Bus. Ventur. 2012, 27, 666–684. [Google Scholar] [CrossRef]

- Humphery-Jenner, M.; Suchard, J.A. Foreign VCs and venture success: Evidence from China. J. Corp. Financ. 2013, 21, 16–35. [Google Scholar] [CrossRef]

- Gu, Q.; Lu, X. Unraveling the mechanisms of reputation and alliance formation: A study of venture capital syndication in China. Strateg. Manag. J. 2014, 35, 739–750. [Google Scholar] [CrossRef]

- Nachum, L. When is foreignness an asset or a liability? Explaining the performance differential between foreign and local firms. J. Manag. 2010, 36, 714–739. [Google Scholar] [CrossRef]

- Devigne, D.; Vanacker, T.; Manigart, S.; Paeleman, I. The role of domestic and cross-border venture capital investors in the growth of portfolio companies. Small Bus. Econ. 2013, 40, 553–573. [Google Scholar] [CrossRef]

- Li, J.J.; Poppo, L.; Zhou, K.Z. Do managerial ties in China always produce value? Competition, uncertainty, and domestic vs. foreign firms. Strateg. Manag. J. 2008, 29, 383–400. [Google Scholar] [CrossRef]

- Hopp, C. When do venture capitalists collaborate? Evidence on the driving forces of venture capital syndication. Small Bus. Econ. 2010, 35, 417–431. [Google Scholar] [CrossRef]

- Jääskeläinen, M.; Maula, M. Do networks of financial intermediaries help reduce local bias? Evidence from cross-border venture capital exits. J. Bus. Ventur. 2014, 29, 704–721. [Google Scholar] [CrossRef]

- Tian, X. The causes and consequences of venture capital stage financing. J. Financ. Econ. 2011, 101, 132–159. [Google Scholar] [CrossRef]

- Tian, X. The role of venture capital syndication in value creation for entrepreneurial firms. Rev. Financ. 2012, 16, 245–283. [Google Scholar] [CrossRef]

- Cumming, D.; Dai, N. Local bias in venture capital investments. J. Empir. Financ. 2010, 17, 362–380. [Google Scholar] [CrossRef]

- Chen, H.; Gompers, P.; Kovner, A.; Lerner, J. Buy local? The geography of venture capital. J. Urban Econ. 2010, 67, 90–102. [Google Scholar] [CrossRef]

- Cumming, D.; Johan, S. Preplanned exit strategies in venture capital. Eur. Econ. Rev. 2008, 52, 1209–1241. [Google Scholar] [CrossRef]

- Chang, S.J. Venture capital financing, strategic alliances, and the initial public offerings of Internet startups. J. Bus. Ventur. 2004, 19, 721–741. [Google Scholar] [CrossRef]

- Gompers, P.A. Optimal investment, monitoring, and the staging of venture capital. J. Financ. 1995, 50, 1461–1489. [Google Scholar] [CrossRef]

- Brander, J.A.; Amit, R.; Antweiler, W. Venture-capital syndication: Improved venture selection vs. the value-added hypothesis. J. Econ. Manag. Strategy 2002, 11, 423–452. [Google Scholar] [CrossRef]

- Gompers, P.A.; Mukharlyamov, V.; Xuan, Y. The cost of friendship. J. Financ. Econ. 2016, 119, 626–644. [Google Scholar] [CrossRef]

- Black, B.S.; Gilson, R.J. Venture capital and the structure of capital markets: Banks versus stock markets. J. Financ. Econ. 1998, 47, 243–277. [Google Scholar] [CrossRef]

- Yung, C.; Çolak, G.; Wang, W. Cycles in the IPO market. J. Financ. Econ. 2008, 89, 192–208. [Google Scholar] [CrossRef]

- Guo, H.; Brooks, R.; Shami, R. Detecting hot and cold cycles using a Markov regime switching model—Evidence from the Chinese A-share IPO market. Int. Rev. Econ. Financ. 2010, 19, 196–210. [Google Scholar] [CrossRef]

- Ragozzino, R.; Reuer, J.J. Geographic distance and corporate acquisitions: Signals from IPO firms. Strateg. Manag. J. 2011, 32, 876–894. [Google Scholar] [CrossRef]

- Fan, G.; Wang, X.; Zhu, H. NERI Index of Marketization of China’s Provinces: 2009 Report; Economic Science Press: Beijing, China, 2010. (In Chinese) [Google Scholar]

- Shi, W.S.; Sun, S.L.; Peng, M.W. Sub-national institutional contingencies, network positions, and IJV partner selection. J. Manag. Stud. 2012, 49, 1221–1245. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Institutions and organizational structure: The case of state-owned corporate pyramids. J. Law Econ. Organ. 2013, 29, 1217–1252. [Google Scholar] [CrossRef]

- Podolny, J.M. A status-based model of market competition. Am. J. Sociol. 1993, 98, 829–872. [Google Scholar] [CrossRef]

- Chung, S.; Singh, H.; Lee, K. Complementarity, status similarity and social capital as drivers of alliance formation. Strateg. Manag. J. 2000, 21, 1–22. [Google Scholar] [CrossRef]

- Hassan, S.S. Determinants of market competitiveness in an environmentally sustainable tourism industry. J. Trav. Res. 2000, 38, 239–245. [Google Scholar] [CrossRef]

- Lerner, M.; Haber, S. Performance factors of small tourism ventures: The interface of tourism, entrepreneurship and the environment. J. Bus. Ventur. 2001, 16, 77–100. [Google Scholar] [CrossRef]

- Choongo, P.; Van Burg, E.; Paas, L.; Masurel, E. Factors influencing the identification of sustainable opportunities by SMEs: Empirical evidence from Zambia. Sustainability 2016, 8, 81. [Google Scholar] [CrossRef]

- Moore, B.; Wüstenhagen, R. Innovative and sustainable energy technologies: The role of venture capital. Bus. Strat. Environ. 2004, 13, 235–245. [Google Scholar] [CrossRef]

- Bürer, M.J.; Wüstenhagen, R. Cleantech venture investors and energy policy risk: An exploratory analysis of regulatory risk management strategies. In Sustainable Innovation and Entrepreneurship; Wüstenhagen, R., Hamschmidt, J., Sharma, S., Starik, M., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2008; pp. 290–309. [Google Scholar]

- De Lange, D.E. Start-up sustainability: An insurmountable cost or a life-giving investment? J. Clean. Prod. 2017, 156, 838–854. [Google Scholar] [CrossRef]

- Bygrave, W.; Timmons, J. Venture and Risk Capital: Practice and Performance, Promises and Policy; Harvard Business School Press: Boston, MA, USA, 1991. [Google Scholar]

- Dimov, D.P.; Shepherd, D.A. Human capital theory and venture capital firms: Exploring “home runs” and “strike outs”. J. Bus. Ventur. 2005, 20, 1–21. [Google Scholar] [CrossRef]

- Lundberg, D.E.; Krishnamoorthy, M.; Stavenga, M.H. Tourism Economics; Wiley: New York, NY, USA, 1995. [Google Scholar]

- Mill, R.C.; Morrison, A.M. The Tourism System: An Introductory Text; Prentice Hall: Upper Saddle River, NJ, USA, 1992. [Google Scholar]

- Haber, S.; Reichel, A. The cumulative nature of the entrepreneurial process: The contribution of human capital, planning and environment resources to small venture performance. J. Bus. Ventur. 2007, 22, 119–145. [Google Scholar] [CrossRef]

- Seasholes, M.S.; Zhu, N. Individual investors and local bias. J. Financ. 2010, 65, 1987–2010. [Google Scholar] [CrossRef]

- Hall, J.K.; Daneke, G.A.; Lenox, M.J. Sustainable development and entrepreneurship: Past contributions and future directions. J. Bus. Ventur. 2010, 25, 439–448. [Google Scholar] [CrossRef]

- McIntosh, R.W.; Goeldner, C.R.; Ritchie, J.R.B. Tourism: Principles, Practices, Philosophies; Wiley: New York, NY, USA, 1995. [Google Scholar]

| Type | Code | Name | Description |

|---|---|---|---|

| Dependent variable | vcsyn | VC syndication | The occurrence of more than one VC firms co-investing in a target business. Dummy variable set to 1 if the lead VC firm syndicate with partners. |

| IPO | IPO activity | The number of IPO in the location of a venture company in the past 5 years before the deal year. | |

| forvc | Foreign VC | The origin of capital of the lead VC firm. Dummy variable set to 1 if the lead VC firm is foreign venture capitalist. | |

| Independent variable | geodis | Geographic distance | The number of miles between the lead VC firm’s main office and the location of the venture company, through matching the latitude and longitude data for each dyad. For foreign VC, the main office refers to the general representative office in China. See Equation (1). |

| inddis | Industry distance | The percentage of previous investments that the lead VC firm had made in industries other than the one in which the venture company operated in the past five years. | |

| Control variable | vcage | VC age | The difference between the deal year and the year in which the lead VC firm was founded. |

| vcsize | VC size | The five-year average total amount of the lead VC firm’s capital under management before the deal year. | |

| vchis | VC syndication history | The number of prior syndicate investments of the lead VC firm before the deal year. | |

| vcexp | VC investment experience | Dummy variable set to 1 if the lead VC firm had previous investment in the city where the venture company is located; otherwise, the value “0” is assigned. | |

| vcsup | VC supply | The number of VC firms in the city where the venture company is located before the deal year. | |

| mkt | Market change | The annual increase or decrease rate of marketization index of the venture company’s local market. | |

| mktdif | Market difference | The absolute value of marketization index differences between the lead VC firm’s local market and the venture company’s local market in the deal year. |

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.vcsyn | 0.481 | 0.500 | 1 | |||||||||||

| 2.vcage | 5.446 | 5.866 | 0.040 | 1 | ||||||||||

| 3.vcsize | 3.815 | 10.179 | 0.008 | 0.359 *** | 1 | |||||||||

| 4.vchis | 78.564 | 141.435 | 0.043 | 0.555 *** | 0.421 *** | 1 | ||||||||

| 5.vcexp | 0.606 | 0.489 | 0.077 * | 0.324 *** | 0.167 *** | 0.383 *** | 1 | |||||||

| 6.vcsup | 3519.394 | 2898.805 | −0.092 ** | −0.164 *** | −0.139 *** | −0.01 | 0.208 *** | 1 | ||||||

| 7.mkt | 0.049 | 0.069 | −0.032 | −0.019 | −0.101** | −0.031 | −0.017 | 0.166 *** | 1 | |||||

| 8.mktdif | 0.573 | 1.040 | 0.015 | −0.020 | −0.040 | 0.046 | 0.016 | −0.066 | 0.007 | 1 | ||||

| 9.IPO | 56.150 | 36.641 | 0.017 | −0.122 *** | −0.110 *** | −0.018 | 0.247 *** | 0.736 *** | 0.039 | −0.076 * | 1 | |||

| 10.forvc | 0.203 | 0.402 | 0.103 ** | 0.433 *** | 0.040 | 0.267 *** | 0.183 *** | −0.221 *** | −0.074* | −0.031 | −0.114 *** | 1 | ||

| 11.geodis | 4096.804 | 3919.699 | 0.031 | 0.155 *** | 0.074 * | 0.110 *** | −0.064 | −0.217 *** | −0.010 | −0.009 | −0.265 *** | 0.134 *** | 1 | |

| 12.inddis | 0.947 | 0.128 | 0.007 | 0.025 | 0.042 | 0.025 | 0.058 | −0.036 | 0.040 | 0.008 | −0.069 * | 0.023 | 0.009 | 1 |

| Variables | M1 | M2 | M3 | M4 | M5 | M6 | M7 | M8 | M9 | M10 |

|---|---|---|---|---|---|---|---|---|---|---|

| vcage | −0.0053 | −0.0044 | −0.0020 | −0.0044 | −0.0021 | −0.0157 | −0.0161 | −0.0150 | −0.0155 | −0.0111 |

| (0.0179) | (0.0180) | (0.0182) | (0.0180) | (0.0183) | (0.0191) | (0.0191) | (0.0192) | (0.0192) | (0.0195) | |

| vcsize | −0.0061 | −0.0057 | −0.0051 | −0.0059 | −0.0053 | −0.0032 | −0.0037 | −0.0041 | −0.0043 | −0.0040 |

| (0.0092) | (0.0093) | (0.0093) | (0.0093) | (0.0093) | (0.0094) | (0.0094) | (0.0094) | (0.0095) | (0.0095) | |

| vchis | 0.0003 | 0.0004 | 0.0002 | 0.0005 | 0.0002 | 0.0002 | 0.0003 | 0.0003 | 0.0004 | 0.0003 |

| (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | (0.0008) | |

| vcexp | 0.4291 * | 0.3466 * | 0.3698 | 0.3475 † | 0.3697 † | 0.4001 ** | 0.4013 ** | 0.4251 ** | 0.4297 ** | 0.3666 † |

| (0.1947) | (0.1978) | (0.1993) | (0.1986) | (0.2000) | (0.1958) | (0.1968) | (0.1975) | (0.1985) | (0.2023) | |

| vcsup | −0.0001 ** | −0.0002 *** | −0.0002 *** | −0.0002 *** | −0.0002 *** | −0.0001 * | −0.0001 * | −0.0001 * | −0.0001 * | −0.0002 ** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| mkt | −0.3761 | 0.0132 | 0.0385 | 0.0045 | 0.0204 | −0.2694 | −0.2846 | −0.3835 | −0.3993 | 0.0036 |

| (1.2265) | (1.2343) | (1.2370) | (1.2360) | (1.2389) | (1.2328) | (1.2335) | (1.2449) | (1.2459) | (1.2514) | |

| mktdif | 0.0067 | 0.0169 | 0.0229 | 0.0150 | 0.0212 | 0.0143 | 0.0132 | 0.0155 | 0.0152 | 0.0273 |

| (0.0807) | (0.0811) | (0.0812) | (0.0811) | (0.0812) | (0.0808) | (0.0809) | (0.0810) | (0.0811) | (0.0817) | |

| IPO | 0.0095 ** | 0.0271 ** | 0.0216 | 0.0388 † | 0.0385 † | |||||

| (0.0035) | (0.0103) | (0.0190) | (0.0212) | (0.0212) | ||||||

| forvc | 0.3957 † | 0.9022 | −7.4108 † | −7.0695 † | −6.7225 † | |||||

| (0.2396) | (1.0062) | (3.8063) | (4.0128) | (3.9133) | ||||||

| geodis | 0.1845 † | 0.1858 † | 0.0226 | 0.0235 | 0.1956 † | |||||

| (0.0966) | (0.0968) | (0.0505) | (0.0506) | (0.1012) | ||||||

| inddis | 0.8755 | 0.9284 | −0.3749 | −0.3793 | 0.5605 | |||||

| (1.3938) | (1.4046) | (0.6721) | (0.6732) | (1.3992) | ||||||

| IPO × geodis | −0.0024 † | −0.0023 † | −0.0023 † | |||||||

| (0.0013) | (0.0013) | (0.0013) | ||||||||

| IPO × inddis | −0.0126 | −0.0123 | −0.0122 | |||||||

| (0.0196) | (0.0198) | (0.0197) | ||||||||

| Forvc × geodis | −0.0670 | −0.0404 | −0.0672 | |||||||

| (0.1280) | (0.1296) | (0.1331) | ||||||||

| Forvc × inddis | 8.1707 ** | 8.1317 ** | 7.9472 ** | |||||||

| (3.9665) | (3.9787) | (3.8526) | ||||||||

| Constant | −0.0036 | −0.2221 | −1.6781 * | −1.0577 | −2.5741 | −0.0584 | −0.2230 | 0.2852 | 0.1150 | −2.3554 |

| (0.1855) | (0.2024) | (0.7918) | (1.3456) | (1.5764) | (0.1888) | (0.4240) | (0.6585) | (0.7564) | (1.5899) | |

| Log likelihood | −404.1179 | −400.3274 | −398.4117 | −400.1082 | −398.1847 | −402.7432 | −402.5693 | −399.9816 | −399.8619 | −394.0772 |

| Pseudo R2 | 0.0142 | 0.0234 | 0.0281 | 0.0240 | 0.0287 | 0.0175 | 0.0180 | 0.0243 | 0.0246 | 0.0387 |

| N | 592 | 592 | 592 | 592 | 592 | 592 | 592 | 592 | 592 | 592 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, B.; Jiang, H. Are Distances Barriers to Sustainability for Venture Capital Syndication? Sustainability 2019, 11, 4126. https://doi.org/10.3390/su11154126

Liu B, Jiang H. Are Distances Barriers to Sustainability for Venture Capital Syndication? Sustainability. 2019; 11(15):4126. https://doi.org/10.3390/su11154126

Chicago/Turabian StyleLiu, Bing, and Hui Jiang. 2019. "Are Distances Barriers to Sustainability for Venture Capital Syndication?" Sustainability 11, no. 15: 4126. https://doi.org/10.3390/su11154126

APA StyleLiu, B., & Jiang, H. (2019). Are Distances Barriers to Sustainability for Venture Capital Syndication? Sustainability, 11(15), 4126. https://doi.org/10.3390/su11154126