Are Sustainable Development Policies Really Feasible? Focused on the Petrochemical Industry in Korea

Abstract

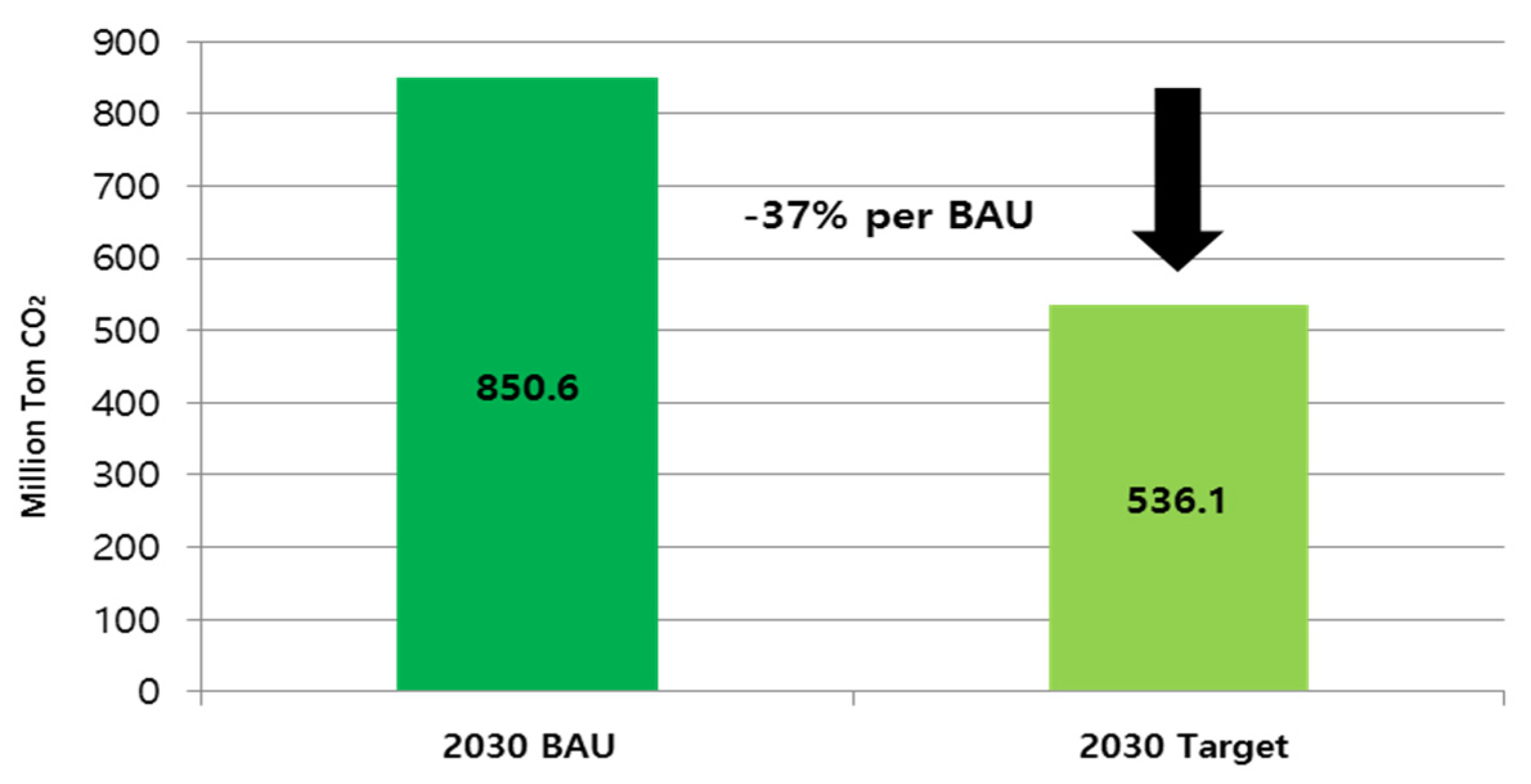

1. Introduction

2. Literature Background of Sustainable Development Policies

3. Methodology

Greenhouse Gas Technical Efficiency and Decomposition

- (i)

- If and , then ,

- (ii)

- If and C0, then .

4. Empirical Results

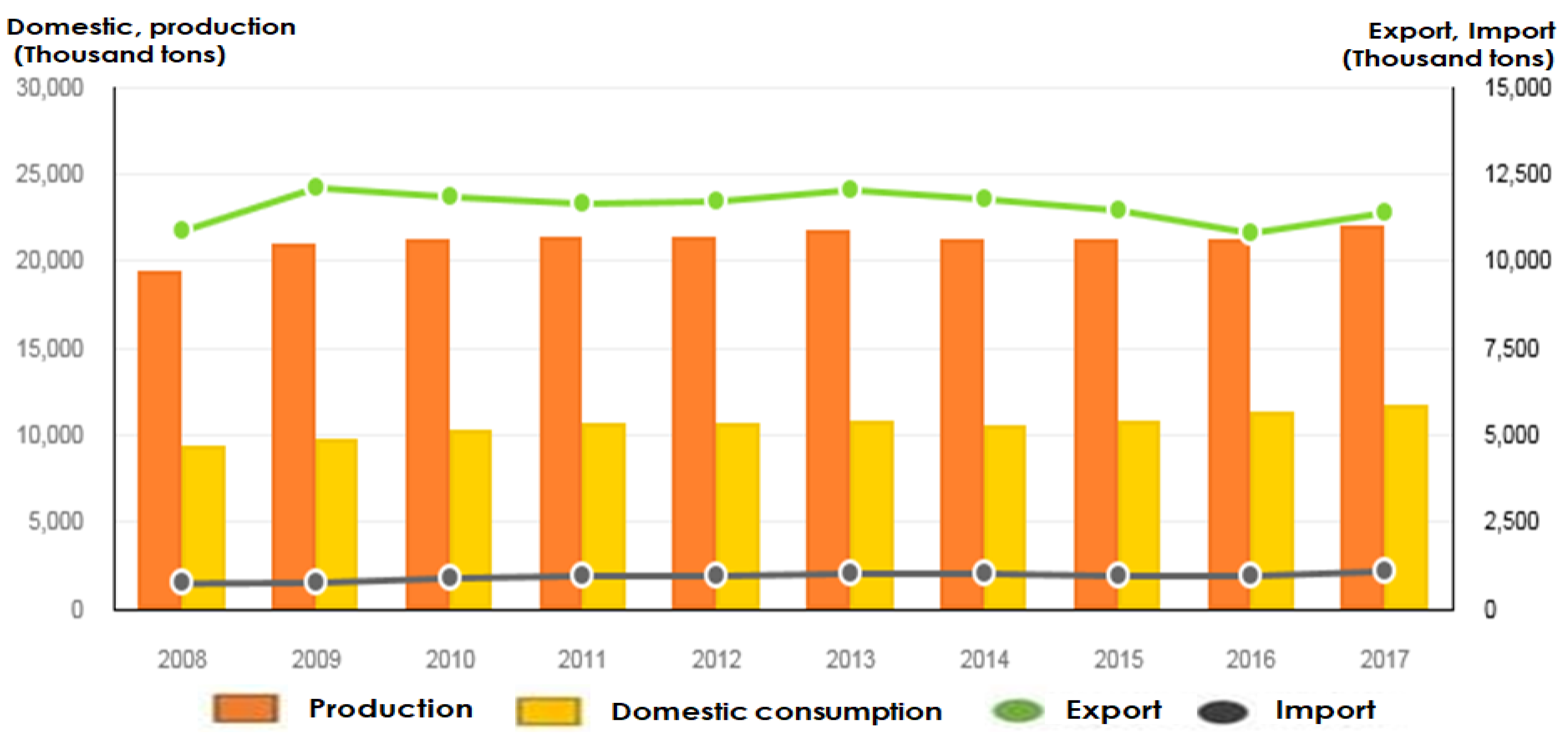

4.1. Data

4.2. Empirical Result

4.2.1. Greenhouse Gas Technical Efficiency (GTE)

4.2.2. Decomposition of GTE and Result of Return to Scale

4.2.3. Benchmark Information

5. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Choi, Y.; Lee, H. Are emissions trading policies sustainable? A study of the petrochemical industry in Korea. Sustainability 2016, 8, 1110. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C.K.; Yaisawarng, S. Derivation of shadow prices for undesirable outputs: A distance function approach. Rev. Econ. Stat. 1993, 75, 374–380. [Google Scholar] [CrossRef]

- Zhang, N.; Choi, Y. A note on the evolution of directional distance function and its development in energy and environmental studies 1997–2013. Renew. Sustain. Energy Rev. 2014, 33, 50–59. [Google Scholar] [CrossRef]

- Shephard, R.W. Theory of Cost and Production Functions; Princeton University Press: Princeton, NJ, USA, 1970. [Google Scholar]

- Chambers, R.G.; Chung, Y.; Färe, R. Benefit and distance functions. J. Econ. Theory 1996, 70, 407–419. [Google Scholar] [CrossRef]

- Fukuyama, H.; Weber, W.L. A directional slacks-based measure of technical inefficiency. Socio Econ. Plan. Sci. 2009, 43, 274–287. [Google Scholar] [CrossRef]

- Zhou, P.; Poh, K.L.; Ang, B.W. A non-radial DEA approach to measuring environmental performance. Eur. J. Oper. Res. 2007, 178, 1–9. [Google Scholar] [CrossRef]

- Chang, T.P.; Hu, J.L. Total-factor energy productivity growth, technical progress, and efficiency change: An empirical study of China. Appl. Energy 2010, 87, 3262–3270. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Wang, H. Energy and CO₂ emission performance in electricity generation: A non-radial directional distance function approach. Eur. J. Oper. Res. 2012, 221, 625–635. [Google Scholar] [CrossRef]

- Wang, K.; Wei, Y.M.; Zhang, X. Energy and emissions efficiency patterns of Chinese regions: A multi-directional efficiency analysis. Appl. Energy 2013, 104, 105–116. [Google Scholar] [CrossRef]

- Barros, C.P.; Managi, S.; Matousek, R. The technical efficiency of the Japanese banks: Non-radial directional performance measurement with undesirable output. Omega 2012, 40, 1–8. [Google Scholar] [CrossRef]

- Jaraitė, J.; Di Maria, C. Efficiency, productivity and environmental policy: A case study of power generation in the EU. Energy Econ. 2012, 34, 1557–1568. [Google Scholar] [CrossRef]

- Zhang, N.; Zhou, P.; Choi, Y. Energy efficiency, CO₂ emission performance and technology gaps in fossil fuel electricity generation in Korea: A meta-frontier non-radial directional distance function analysis. Energy Policy 2013, 56, 653–662. [Google Scholar] [CrossRef]

- Liu, C.H.; Lin, S.J.; Lewis, C. Evaluation of thermal power plant operational performance in Taiwan by data envelopment analysis. Energy Policy 2010, 38, 1049–1058. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C.A., Jr. Environmental production functions and environmental directional distance functions. Energy 2007, 32, 1055–1066. [Google Scholar] [CrossRef]

- Barros, C.P.; Peypoch, N. Technical efficiency of thermoelectric power plants. Energy Econ. 2008, 30, 3118–3127. [Google Scholar] [CrossRef]

- Yu, Y.; Choi, Y. Measuring environmental performance under regional heterogeneity in China: A metafrontier efficiency analysis. Comput. Econ. 2015, 46, 375–388. [Google Scholar] [CrossRef]

- Wang, J.; Zhao, T. Regional energy-environmental performance and investment strategy for China’s non-ferrous metals industry: A non-radial DEA based analysis. J. Clean. Prod. 2017, 163, 187–201. [Google Scholar] [CrossRef]

- Smyth, R.; Narayan, P.K.; Shi, H. Substitution between energy and classical factor inputs in the Chinese steel sector. Appl. Energy 2011, 88, 361–367. [Google Scholar] [CrossRef]

- He, F.; Zhang, Q.; Lei, J.; Fu, W.; Xu, X. Energy efficiency and productivity change of China’s iron and steel industry: Accounting for undesirable outputs. Energy Policy 2013, 54, 204–213. [Google Scholar] [CrossRef]

- Wei, Y.M.; Liao, H.; Fan, Y. An empirical analysis of energy efficiency in China’s iron and steel sector. Energy 2007, 32, 2262–2270. [Google Scholar] [CrossRef]

- Matsushita, K.; Yamane, F. Pollution from the electric power sector in Japan and efficient pollution reduction. Energy Econ. 2012, 34, 1124–1130. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Efficiency-based rank assessment for electric power industry: A combined use of data envelopment analysis (DEA) and DEA-discriminant analysis (DA). Energy Econ. 2012, 34, 634–644. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S. Sulfur dioxide allowances: Trading and technological progress. Ecol. Econ. 2010, 69, 623–631. [Google Scholar] [CrossRef]

- Mandal, S.K.; Madheswaran, S. Environmental efficiency of the Indian cement industry: An interstate analysis. Energy Policy 2010, 38, 1108–1118. [Google Scholar] [CrossRef]

- Martini, G.; Manello, A.; Scotti, D. The influence of fleet mix, ownership and LCCs on airports’ technical/environmental efficiency. Transp. Res. Part E Logist. Transp. Rev. 2013, 50, 37–52. [Google Scholar] [CrossRef]

- Yao, X.; Guo, C.; Shao, S.; Jiang, Z. Total-factor CO₂ emission performance of China’s provincial industrial sector: A meta-frontier non-radial Malmquist index approach. Appl. Energy 2016, 184, 1142–1153. [Google Scholar] [CrossRef]

- Faere, R.; Grosskopf, S.; Lovell, C.A.K.; Pasurka, C. Multilateral Productivity Comparisons When Some Outputs are Undesirable: A Nonparametric Approach. Rev. Econ. Stat. 1989, 71, 90. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Data Envelopment Analysis: A Comprehensive Text with Models; Springer: Berlin, Germany, 2007. [Google Scholar]

- Zhang, N.; Xie, H. Toward green IT: Modeling sustainable production characteristics for Chinese electronic information industry, 1980–2012. Technol. Forecast. Soc. Chang. 2015, 96, 62–70. [Google Scholar] [CrossRef]

- Wei, C.; Löschel, A.; Liu, B. An empirical analysis of the CO₂ shadow price in Chinese thermal power enterprises. Energy Econ. 2013, 40, 22–31. [Google Scholar] [CrossRef]

- Lee, H.; Choi, Y. Greenhouse gas performance of Korean local governments based on non-radial DDF. Technol. Forecast. Soc. Chang. 2018, 135, 13–21. [Google Scholar] [CrossRef]

- Hanwha profile. All Public Information in Online. 2017. Available online: https://www.hanwha.com/content/dam/hanwha/download/Hanwha_Profile_2017_en.pdf (accessed on 1 June 2019).

| Variable | Type | Unit | Mean | Std. Dev. | Max. | Min. |

|---|---|---|---|---|---|---|

| Sales turnover | Desirable output | US$ billion | 1,566,278,032,416 | 2,630,226,310,547 | 1,721,714,5192,000 | 30,047,159,567 |

| GHG | Undesirable output | CO2 equivalent tons | 539,525 | 1,090,403 | 5,979,058 | 14,079 |

| Capital | Input | US$ billion | 92,690,553,201 | 157,685,083,607 | 829,665,480,000 | 1,200,000,000 |

| Labor | Input | Per person | 935 | 1339 | 7619 | 29 |

| Energy | Input | Terajoules | 9830 | 20,808 | 115,303 | 256 |

| Variable | Capital | Labor | Energy | Turnover | Carbon |

|---|---|---|---|---|---|

| Capital | 1.000 | ||||

| Labor | 0.250 | 1.000 | |||

| Energy | 0.290 | 0.250 | 1.000 | ||

| Turnover | 0.372 | 0.548 | 0.765 | 1.000 | |

| Carbon | 0.297 | 0.256 | 0.990 | 0.747 | 1.000 |

| Firms | 2011 | 2012 | 2013 | 2014. | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|

| JW Life Science | 0.528 | 0.531 | 0.528 | 0.530 | 0.531 | 0.527 | 0.529 |

| KPX green chemical | 0.643 | 0.633 | 0.630 | 0.618 | 0.562 | 0.585 | 0.597 |

| LG MMA | 0.629 | 0.608 | 0.581 | 0.565 | 0.574 | 0.577 | 0.646 |

| OCI | 0.526 | 0.507 | 0.506 | 0.506 | 0.506 | 0.508 | 0.511 |

| SK Chemicals | 0.742 | 0.715 | 0.681 | 0.617 | 0.514 | 0.518 | 0.539 |

| SK Global Chemical | 1 | 0.953 | 0.961 | 0.989 | 0.808 | 0.744 | 0.807 |

| SK chemical | 0.529 | 0.518 | 0.522 | 0.513 | 0.509 | 0.512 | 0.500 |

| Ganggnam Hwasung | 0.621 | 0.611 | 0.629 | 0.627 | 0.609 | 0.614 | 0.665 |

| Kukdo chemical | 0.970 | 0.889 | 0.885 | 0.667 | 0.658 | 0.609 | 0.633 |

| Kumho Mitsui | 0.594 | 0.674 | 0.761 | 0.735 | 0.660 | 0.647 | 0.801 |

| Kumho Petrochemical | 0.630 | 0.611 | 0.589 | 0.575 | 0.546 | 0.533 | 0.554 |

| Kumho tire | 0.551 | 0.553 | 0.546 | 0.546 | 0.540 | 0.538 | 0.537 |

| Kumho Polychem | 0.581 | 0.580 | 0.543 | 0.548 | 0.541 | 0.532 | 0.539 |

| Kumho P&B | 0.607 | 0.579 | 0.566 | 0.572 | 0.547 | 0.541 | 0.573 |

| Namhae Chemical | 1 | 0.961 | 1 | 0.920 | 0.808 | 0.733 | 0.811 |

| Nexen tire | 0.563 | 0.569 | 0.557 | 0.550 | 0.549 | 0.550 | 0.558 |

| Green cross | 0.707 | 0.701 | 0.68 | 0.693 | 0.701 | 0.665 | 0.691 |

| Daerim Ind. | 0.849 | 0.931 | 0.896 | 0.851 | 0.872 | 0.881 | 0.990 |

| Daesung Ind.gas | 0.504 | 0.504 | 0.504 | 0.505 | 0.515 | 0.505 | 0.505 |

| Daehan Chemicals | 0.634 | 0.638 | 0.627 | 0.630 | 0.584 | 0.570 | 0.583 |

| Lotte Chemical | 0.618 | 0.622 | 0.692 | 0.667 | 0.606 | 0.600 | 0.640 |

| Baekgwang Ind. | 0.541 | 0.540 | 0.526 | 0.503 | 0.508 | 0.508 | 0.509 |

| Samnam petrochemical | 1 | 0.913 | 0.865 | 0.789 | 0.703 | 0.706 | 0.729 |

| Samyang | 0.568 | 0.560 | 0.556 | 0.563 | 0.545 | 0.541 | 0.549 |

| SYC | 0.538 | 0.529 | 0.526 | 0.520 | 0.516 | 0.515 | 0.514 |

| Sundo chemical | 0.518 | 0.532 | 0.569 | 0.569 | 0.541 | 0.524 | 0.527 |

| Songwon Ind. | 0.692 | 0.696 | 0.688 | 0.698 | 0.689 | 0.703 | 0.699 |

| Yeocheon NCC | 0.701 | 0.710 | 0.702 | 0.685 | 0.597 | 0.584 | 0.615 |

| Yongsan chemical | 0.504 | 0.505 | 0.507 | 0.505 | 0.503 | 0.503 | 0.505 |

| Wooksung chemical | 0.538 | 0.539 | 0.541 | 0.536 | 0.535 | 0.537 | 0.544 |

| Unid | 0.535 | 0.520 | 0.521 | 0.521 | 0.520 | 0.511 | 0.519 |

| Youlchon chemical | 0.552 | 0.555 | 0.580 | 0.589 | 0.579 | 0.587 | 0.636 |

| ISU chemical | 0.737 | 0.765 | 0.751 | 0.698 | 0.592 | 0.576 | 0.600 |

| Jaewon Ind | 0.723 | 0.874 | 0.972 | 1 | 0.835 | 0.715 | 0.728 |

| CKD bio | 0.507 | 0.507 | 0.506 | 0.506 | 0.506 | 0.507 | 0.507 |

| KOC | 0.503 | 0.503 | 0.503 | 0.503 | 0.503 | 0.503 | 0.504 |

| Cosmo AM&T | 0.516 | 0.519 | 0.524 | 0.525 | 0.531 | 0.536 | 0.582 |

| Cosmo chemical | 0.506 | 0.507 | 0.508 | 0.507 | 0.506 | 0.506 | 0.508 |

| KOLON Ind. | 0.585 | 0.582 | 0.568 | 0.579 | 0.541 | 0.535 | 0.535 |

| Polymirae | 1 | 0.916 | 0.922 | 0.944 | 0.868 | 0.847 | 0.896 |

| Praxair | 0.503 | 0.504 | 0.505 | 0.507 | 0.509 | 0.510 | 0.511 |

| Filmax | 0.520 | 0.520 | 0.520 | 0.520 | 0.519 | 0.517 | 0.516 |

| Basf | 0.553 | 0.555 | 0.56 | 0.547 | 0.538 | 0.544 | 0.572 |

| Solvay | 0.597 | 0.587 | 0.590 | 0.579 | 0.571 | 0.575 | 0.591 |

| Korea stirolution | 1 | 0.957 | 0.981 | 0.915 | 0.816 | 0.787 | 0.898 |

| KEPITAL | 0.532 | 0.524 | 0.518 | 0.521 | 0.522 | 0.531 | 0.537 |

| Hansol Chemical | 0.525 | 0.523 | 0.524 | 0.516 | 0.516 | 0.518 | 0.518 |

| Hanil chemical | 0.750 | 0.697 | 0.714 | 0.734 | 0.746 | 0.734 | 0.848 |

| Hanhwa | 1 | 0.947 | 0.939 | 0.821 | 0.725 | 0.714 | 0.722 |

| Hanhwa Advanced materials | 0.805 | 0.800 | 0.631 | 0.626 | 0.623 | 0.627 | 0.627 |

| Hanhwa Chemical | 0.530 | 0.524 | 0.523 | 0.519 | 0.517 | 0.520 | 0.523 |

| HyundaiEP | 0.905 | 0.910 | 1 | 0.990 | 0.875 | 0.859 | 0.942 |

| Hwaseung R&A | 0.909 | 0.918 | 1 | 0.685 | 0.688 | 0.709 | 0.693 |

| Hwaseung Ind | 0.537 | 0.532 | 0.528 | 0.531 | 0.739 | 0.877 | 0.960 |

| Hyucamps | 0.648 | 1 | 0.807 | 0.713 | 0.607 | 0.594 | 0.633 |

| Average | 0.656 | 0.657 | 0.656 | 0.634 | 0.607 | 0.601 | 0.627 |

| Firm’s Name | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PTE | SE | PTE | SE | PTE | SE | PTE | SE | PTE | SE | PTE | SE | PTE | SE | |

| JW Life Science | 0.949 | 0.557 | 0.962 | 0.551 | 0.903 | 0.584 | 0.807 | 0.656 | 0.770 | 0.689 | 0.713 | 0.739 | 0.711 | 0.744 |

| KPX green chemical | 0.867 | 0.742 | 0.744 | 0.851 | 0.704 | 0.895 | 0.678 | 0.912 | 0.608 | 0.924 | 0.631 | 0.927 | 0.645 | 0.926 |

| LG MMA | 0.639 | 0.984 | 0.618 | 0.983 | 0.590 | 0.984 | 0.573 | 0.984 | 0.583 | 0.984 | 0.586 | 0.984 | 0.653 | 0.988 |

| OCI | 0.540 | 0.974 | 0.509 | 0.996 | 0.507 | 0.996 | 0.508 | 0.996 | 0.507 | 0.997 | 0.510 | 0.996 | 0.521 | 0.981 |

| SK Chemicals | 0.813 | 0.913 | 0.765 | 0.934 | 0.718 | 0.948 | 0.709 | 0.871 | 0.568 | 0.906 | 0.570 | 0.908 | 0.589 | 0.914 |

| SK Global Chemical | 1 | 1 | 0.963 | 0.989 | 0.968 | 0.992 | 1 | 0.989 | 0.833 | 0.969 | 0.788 | 0.944 | 0.834 | 0.968 |

| SK chemical | 0.531 | 0.995 | 0.520 | 0.996 | 0.523 | 0.997 | 0.514 | 0.999 | 0.511 | 0.996 | 0.514 | 0.996 | 0.507 | 0.986 |

| Ganggnam Hwasung | 0.810 | 0.765 | 0.800 | 0.764 | 0.791 | 0.794 | 0.829 | 0.757 | 0.822 | 0.741 | 0.797 | 0.770 | 0.782 | 0.851 |

| Kukdo chemical | 1 | 0.970 | 0.911 | 0.975 | 0.904 | 0.979 | 0.670 | 0.996 | 0.658 | 0.999 | 0.610 | 0.998 | 0.634 | 0.999 |

| Kumho Mitsui | 0.619 | 0.958 | 0.697 | 0.966 | 0.786 | 0.969 | 0.761 | 0.966 | 0.690 | 0.957 | 0.676 | 0.957 | 0.822 | 0.974 |

| Kumho Petrochemical | 0.697 | 0.904 | 0.677 | 0.903 | 0.650 | 0.906 | 0.632 | 0.908 | 0.595 | 0.917 | 0.569 | 0.936 | 0.592 | 0.935 |

| Kumho tire | 0.559 | 0.987 | 0.563 | 0.982 | 0.546 | 0.999 | 0.546 | 0.999 | 0.541 | 0.997 | 0.539 | 0.997 | 0.538 | 0.996 |

| Kumho Polychem | 0.600 | 0.967 | 0.600 | 0.967 | 0.557 | 0.974 | 0.562 | 0.976 | 0.550 | 0.983 | 0.542 | 0.982 | 0.548 | 0.984 |

| Kumho P&B | 0.631 | 0.962 | 0.606 | 0.954 | 0.586 | 0.965 | 0.597 | 0.957 | 0.556 | 0.984 | 0.552 | 0.980 | 0.587 | 0.977 |

| Namhae Chemical | 1 | 1 | 0.962 | 0.999 | 1 | 1 | 0.921 | 0.998 | 0.809 | 0.999 | 0.733 | 0.999 | 0.818 | 0.991 |

| Nexen tire | 0.569 | 0.989 | 0.582 | 0.978 | 0.569 | 0.978 | 0.561 | 0.980 | 0.562 | 0.977 | 0.561 | 0.980 | 0.563 | 0.990 |

| Green cross | 0.872 | 0.810 | 0.844 | 0.830 | 0.772 | 0.879 | 0.777 | 0.891 | 0.773 | 0.907 | 0.688 | 0.966 | 0.715 | 0.967 |

| DaerimInd. | 0.911 | 0.932 | 1 | 0.931 | 0.977 | 0.916 | 0.915 | 0.930 | 0.934 | 0.933 | 0.952 | 0.925 | 1 | 0.990 |

| DaesungInd.gas | 0.507 | 0.993 | 0.506 | 0.994 | 0.506 | 0.996 | 0.506 | 0.996 | 0.517 | 0.997 | 0.506 | 0.997 | 0.505 | 0.998 |

| Daehan Chemicals | 0.634 | 0.999 | 0.638 | 0.999 | 0.627 | 0.999 | 0.630 | 0.999 | 0.585 | 0.998 | 0.573 | 0.995 | 0.584 | 0.999 |

| Lotte Chemical | 0.650 | 0.951 | 0.645 | 0.964 | 0.723 | 0.957 | 0.688 | 0.969 | 0.626 | 0.968 | 0.619 | 0.970 | 0.652 | 0.981 |

| Baekgwang Ind. | 0.549 | 0.985 | 0.546 | 0.989 | 0.530 | 0.991 | 0.517 | 0.973 | 0.526 | 0.964 | 0.524 | 0.968 | 0.525 | 0.969 |

| Samnam petrochemical | 1 | 1 | 0.914 | 0.998 | 0.870 | 0.994 | 0.795 | 0.992 | 0.710 | 0.990 | 0.716 | 0.986 | 0.738 | 0.987 |

| Samyang | 0.598 | 0.949 | 0.588 | 0.953 | 0.586 | 0.948 | 0.591 | 0.952 | 0.583 | 0.935 | 0.581 | 0.930 | 0.586 | 0.937 |

| SYC | 0.635 | 0.847 | 0.644 | 0.822 | 0.652 | 0.808 | 0.640 | 0.812 | 0.662 | 0.779 | 0.651 | 0.791 | 0.645 | 0.796 |

| Sundo chemical | 1 | 0.518 | 0.977 | 0.545 | 1 | 0.569 | 1 | 0.569 | 0.907 | 0.596 | 0.891 | 0.588 | 0.902 | 0.584 |

| Songwon Ind. | 0.693 | 0.999 | 0.697 | 0.998 | 0.690 | 0.996 | 0.701 | 0.996 | 0.691 | 0.996 | 0.706 | 0.995 | 0.703 | 0.994 |

| Yeocheon NCC | 0.718 | 0.976 | 0.723 | 0.981 | 0.717 | 0.979 | 0.702 | 0.975 | 0.626 | 0.954 | 0.610 | 0.957 | 0.640 | 0.961 |

| Yongsan chemical | 0.538 | 0.937 | 0.538 | 0.938 | 0.541 | 0.937 | 0.539 | 0.936 | 0.538 | 0.935 | 0.537 | 0.937 | 0.541 | 0.933 |

| Wooksung chemical | 0.874 | 0.615 | 0.935 | 0.576 | 0.846 | 0.639 | 0.958 | 0.559 | 0.932 | 0.573 | 0.938 | 0.573 | 1 | 0.544 |

| Unid | 0.536 | 0.998 | 0.521 | 0.998 | 0.522 | 0.999 | 0.522 | 0.999 | 0.521 | 0.998 | 0.511 | 0.999 | 0.520 | 0.998 |

| Youlchon chemical | 0.606 | 0.911 | 0.605 | 0.917 | 0.608 | 0.954 | 0.603 | 0.977 | 0.628 | 0.922 | 0.631 | 0.930 | 0.640 | 0.995 |

| ISU chemical | 0.769 | 0.959 | 0.810 | 0.944 | 0.796 | 0.942 | 0.735 | 0.949 | 0.611 | 0.968 | 0.582 | 0.988 | 0.621 | 0.966 |

| Jaewon Ind | 0.794 | 0.910 | 0.897 | 0.974 | 1 | 0.972 | 1 | 1 | 0.848 | 0.983 | 0.726 | 0.985 | 0.741 | 0.982 |

| CKD bio | 0.550 | 0.922 | 0.545 | 0.929 | 0.548 | 0.924 | 0.547 | 0.925 | 0.546 | 0.928 | 0.549 | 0.924 | 0.544 | 0.931 |

| KOC | 0.583 | 0.861 | 0.592 | 0.849 | 0.600 | 0.839 | 0.602 | 0.836 | 0.610 | 0.825 | 0.614 | 0.820 | 0.597 | 0.843 |

| Cosmo AM&T | 0.589 | 0.877 | 0.638 | 0.814 | 0.643 | 0.815 | 0.661 | 0.795 | 0.748 | 0.710 | 0.689 | 0.778 | 0.638 | 0.913 |

| Cosmo chemical | 0.529 | 0.957 | 0.532 | 0.953 | 0.538 | 0.944 | 0.540 | 0.938 | 0.544 | 0.931 | 0.551 | 0.917 | 0.562 | 0.903 |

| KOLON Ind. | 0.618 | 0.946 | 0.611 | 0.952 | 0.595 | 0.955 | 0.615 | 0.941 | 0.555 | 0.976 | 0.548 | 0.976 | 0.548 | 0.977 |

| Polymirae | 1 | 1 | 0.928 | 0.987 | 0.935 | 0.986 | 0.953 | 0.990 | 0.875 | 0.991 | 0.867 | 0.976 | 0.917 | 0.977 |

| Praxair | 0.509 | 0.988 | 0.509 | 0.990 | 0.508 | 0.993 | 0.508 | 0.997 | 0.511 | 0.997 | 0.513 | 0.994 | 0.514 | 0.995 |

| Filmax | 0.659 | 0.789 | 0.663 | 0.784 | 0.670 | 0.775 | 0.676 | 0.768 | 0.682 | 0.761 | 0.676 | 0.764 | 0.669 | 0.772 |

| Basf | 0.625 | 0.884 | 0.634 | 0.875 | 0.643 | 0.870 | 0.618 | 0.885 | 0.579 | 0.929 | 0.601 | 0.904 | 0.664 | 0.862 |

| Solvay | 0.605 | 0.986 | 0.597 | 0.984 | 0.603 | 0.978 | 0.593 | 0.976 | 0.587 | 0.973 | 0.592 | 0.971 | 0.610 | 0.969 |

| Korea stirolution | 1 | 1 | 0.962 | 0.994 | 0.981 | 0.999 | 0.924 | 0.990 | 0.834 | 0.978 | 0.802 | 0.980 | 0.905 | 0.992 |

| KEPITAL | 0.544 | 0.979 | 0.535 | 0.979 | 0.528 | 0.982 | 0.530 | 0.982 | 0.530 | 0.983 | 0.540 | 0.983 | 0.544 | 0.986 |

| Hansol Chemical | 0.551 | 0.953 | 0.547 | 0.956 | 0.548 | 0.956 | 0.548 | 0.942 | 0.546 | 0.945 | 0.546 | 0.947 | 0.540 | 0.959 |

| Hanil chemical | 1 | 0.750 | 0.953 | 0.732 | 0.978 | 0.729 | 0.939 | 0.782 | 0.940 | 0.793 | 0.948 | 0.774 | 1 | 0.848 |

| Hanhwa | 1 | 1 | 0.954 | 0.992 | 0.956 | 0.982 | 0.965 | 0.851 | 0.975 | 0.744 | 0.881 | 0.810 | 0.769 | 0.938 |

| Hanhwa Advanced materials | 0.857 | 0.938 | 0.849 | 0.942 | 0.733 | 0.861 | 0.703 | 0.891 | 0.687 | 0.906 | 0.689 | 0.910 | 0.701 | 0.894 |

| HanhwaChemical | 0.596 | 0.888 | 0.569 | 0.920 | 0.563 | 0.928 | 0.556 | 0.934 | 0.549 | 0.941 | 0.561 | 0.928 | 0.574 | 0.910 |

| HyundaiEP | 0.992 | 0.912 | 0.938 | 0.970 | 1 | 1 | 0.991 | 0.999 | 0.876 | 0.998 | 0.861 | 0.997 | 0.947 | 0.994 |

| HwaseungR&A | 0.910 | 0.998 | 0.923 | 0.994 | 1 | 1 | 0.794 | 0.862 | 0.793 | 0.867 | 0.801 | 0.885 | 0.785 | 0.882 |

| Hwaseung Ind | 0.617 | 0.869 | 0.617 | 0.861 | 0.614 | 0.860 | 0.619 | 0.857 | 0.747 | 0.990 | 0.881 | 0.995 | 0.961 | 0.998 |

| Hyucamps | 0.678 | 0.956 | 1 | 1 | 0.894 | 0.901 | 0.795 | 0.896 | 0.627 | 0.968 | 0.611 | 0.971 | 0.643 | 0.984 |

| Average | 0.722 | 0.916 | 0.720 | 0.920 | 0.715 | 0.922 | 0.698 | 0.917 | 0.668 | 0.919 | 0.657 | 0.923 | 0.677 | 0.933 |

| Firms (2107) | RTS | Efficient DMU (Number of Reference Sets) | Benchmark (λ) |

|---|---|---|---|

| JW Life Science | Increasing | Hanhwa2011 * 23 Namhae Chemical2011 * 17 Samnam Petrochemical2011 * 15 Korea stirolution2011 * 8 SK Global Chemical 2011 * 7 Polymirae2011 * 5 Hyucamps2012 * 1 Namhae Chemical2013 * 12 HyundaiEP2013 * 10 HwaseungR&A2013 * 24 Jaewon Ind2014 * 7 | Hanhwa 2011 (0.048561) |

| KPX green chemical | Increasing | Namhae Chemical 2011 (0.093555); Samnam petrochemical2011 (0.032129); HyundaiEP2013 (0.257384) | |

| LG MMA | Increasing | Namhae Chemical2011 (0.283217); Samnam petrochemical 2011 (0.164708); HyundaiEP 2013 (0.301541) | |

| OCI | Decreasing | Namhae Chemical 2013 (1.317825); HyundaiEP 2013 (1.098502); HwaseungR&A 2013 (1.328494) | |

| SK Chemicals | Increasing | Namhae Chemical 2011 (0.091120); Korea stirolution 2011 (0.116544) | |

| SK Global Chemical | Decreasing | SK Global Chemical 2011 (0.456638); Samnam petrochemical 2011 (2.005343) | |

| SK chemical | Increasing | Hanhwa 2011 (0.030053) | |

| Ganggnam Hwasung | Increasing | Jaewon Ind 2014 (0.346036); HwaseungR&A 2013 (0.185762) | |

| Kukdo chemical | Decreasing | Namhae Chemical 2013 (0.277076); HyundaiEP 2013 (0.688459); HwaseungR&A 2013 (0.106776) | |

| Kumho Mitsui | Increasing | Namhae Chemical 2011 (0.268066); Polymirae 2011 (0.327331); Korea stirolution 2011 (0.144913) | |

| Kumho Petrochemical | Decreasing | Namhae Chemical 2011 (2.282235); Samnam petrochemical 2011 (1.269622); Polymirae 2011 (0.460889) | |

| Kumho tire | Increasing | Hanhwa 2011 (0.747052) | |

| Kumho Polychem | Increasing | Namhae Chemical 2011 (0.359559); Samnam petrochemical 2011 (0.064860); HyundaiEP 2013 (0.102880) | |

| Kumho P&B | Decreasing | Samnam petrochemical 2011 (0.328405); Korea stirolution 2011 (1.157770) | |

| Namhae Chemical | Increasing | Namhae Chemical 2011 (0.795987); Hanhwa 2011 (0.022958); HwaseungR&A 2013 (0.029142); Hyucamps 2012 (0.013084) | |

| Nexen tire | Decreasing | Jaewon Ind 2014 (0.359655); HwaseungR&A 2013 (1.643121) | |

| Green cross | Increasing | Hanhwa 2011 (0.100143); HwaseungR&A 2013 (0.640011) | |

| Daerim Ind. | Decreasing | SK Global Chemical 2011 (0.002074); Samnam petrochemical 2011 (0.005912); Jaewon Ind 2014 (4.507030); HwaseungR&A 2013 (6.350246) | |

| Daesung Ind.gas | Increasing | Namhae Chemical 2013(0.113909); Hanhwa 2011 (0.017673); HwaseungR&A 2013 (0.453252) | |

| Daehan Chemicals | Decreasing | SK Global Chemical 2011 (0.028732); Samnam petrochemical 2011 (0.652468); HwaseungR&A 2013 (0.572287) | |

| Lotte Chemical | Decreasing | SK Global Chemical 2011 (0.582863); Samnam petrochemical 2011 (0.984766); HwaseungR&A 2013 (2.083099) | |

| Baekgwang Ind. | Increasing | Namhae Chemical 2013 (0.125532); Hanhwa 2011 (0.020293) | |

| Samnam petrochemical | Increasing | Namhae Chemical 2011 (0.061857); Samnam petrochemical 2011 (0.162388); Polymirae 2011 (0.554011) | |

| Samyang | Increasing | Namhae Chemical 2011 (0.287392); Korea stirolution 2011 (0.047018) | |

| SYC | Increasing | Hanhwa 2011 (0.031505) | |

| Sundo chemical | Increasing | Samnam petrochemical 2011 (0.003805); HyundaiEP 2013 (0.007622); HwaseungR&A 2013 (0.029718) | |

| Songwon Ind. | Decreasing | SK Global Chemical 2011 (0.008470); Jaewon Ind 2014 (2.375792); HwaseungR&A 2013 (0.124196) | |

| Yeocheon NCC | Decreasing | SK Global Chemical 2011 (0.075411); Samnam petrochemical 2011 (2.945498); HwaseungR&A 2013 (0.166235) | |

| Yongsan chemical | Increasing | Hanhwa 2011 (0.009686); HwaseungR&A 2013 (0.072694) | |

| Wooksungchemical | Increasing | Hanhwa 2011 (0.003512); HwaseungR&A 2013 (0.095427) | |

| Unid | Increasing | Namhae Chemical 2013 (0.383458); Hanhwa 2011 (0.061025); HwaseungR&A 2013 (0.073768) | |

| Youlchon chemical | Increasing | Jaewon Ind 2014 (0.453109); HwaseungR&A 2013 (0.417042) | |

| ISUchemical | Decreasing | Namhae Chemical 2011 (0.748763); Korea stirolution 2011 (0.530164) | |

| Jaewon Ind | Increasing | Jaewon Ind 2014 (0.899241); HwaseungR&A 2013 (0.009052) | |

| CKD bio | Increasing | Hanhwa 2011 (0.031379); HwaseungR&A 2013 (0.038350) | |

| KOC | Increasing | Hanhwa 2011 (0.014351) | |

| Cosmo AM&T | Increasing | Namhae Chemical 2013 (0.135035); Hanhwa 2011 (0.064811) | |

| Cosmo chemical | Increasing | Hanhwa 2011 (0.040064) | |

| KOLON Ind. | Decreasing | Namhae Chemical 2013 (0.326343); Hanhwa 2011 (0.060752); HwaseungR&A 2013 (3.189857) | |

| Polymirae | Increasing | Namhae Chemical 2011 (0.121997); Samnam petrochemical 2011 (0.108101); Polymirae 2011 (0.495369) | |

| Praxair | Increasing | Namhae Chemical 2013 (0.570592); Hanhwa 2011 (0.011743) | |

| Filmax | Increasing | Hanhwa 2011 (0.034096) | |

| Basf | Decreasing | Namhae Chemical 2011 (2.146136); Korea stirolution 2011 (0.615560) | |

| Solvay | Increasing | Namhae Chemical 2011 (0.239045); Namhae Chemical 2013 (0.183106); HyundaiEP 2013 (0.260430) | |

| Korea stirolution | Increasing | Namhae Chemical 2011 (0.128825); Korea stirolution 2011 (0.799330) | |

| KEPITAL | Increasing | Namhae Chemical 2011 (0.004619); Samnam petrochemical 2011 (0.045602); HyundaiEP 2013 (0.642860) | |

| Hansol Chemical | Increasing | Namhae Chemical 2013 (0.016250); Hanhwa 2011 (0.117349) | |

| Hanil chemical | Increasing | SK Global Chemical 2011 (0.001383); Jaewon Ind 2014 (0.457927); HwaseungR&A 2013 (0.007660) | |

| Hanhwa | Decreasing | Hanhwa 2011 (1.182940) | |

| Hanhwa Advanced materials | Increasing | Hanhwa 2011 (0.059321); HwaseungR&A 2013 (0.391092) | |

| Hanhwa Chemical | Decreasing | Namhae Chemical 2013 (4.996734); Hanhwa 2011 (0.115686) | |

| Hyundai EP | Increasing | Samnam petrochemical 2011 (0.014120); HyundaiEP 2013 (0.813576); HwaseungR&A 2013 (0.086734) | |

| Hwaseung R&A | Increasing | Hanhwa 2011 (0.043678); HwaseungR&A 2013 (0.489630) | |

| Hwaseung Ind | Increasing | Namhae Chemical 2011 (0.255379); Namhae Chemical 2013 (0.071045); HyundaiEP 2013 (0.665327) | |

| Hyucamps | Increasing | Namhae Chemical 2011 (0.541026); Polymirae 2011 (0.057508); Korea stirolution 2011 (0.185203) |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, Y.; Lee, H.S.; Mastur, A. Are Sustainable Development Policies Really Feasible? Focused on the Petrochemical Industry in Korea. Sustainability 2019, 11, 3980. https://doi.org/10.3390/su11143980

Choi Y, Lee HS, Mastur A. Are Sustainable Development Policies Really Feasible? Focused on the Petrochemical Industry in Korea. Sustainability. 2019; 11(14):3980. https://doi.org/10.3390/su11143980

Chicago/Turabian StyleChoi, Yongrok, Hyoung Seok Lee, and Ahmed Mastur. 2019. "Are Sustainable Development Policies Really Feasible? Focused on the Petrochemical Industry in Korea" Sustainability 11, no. 14: 3980. https://doi.org/10.3390/su11143980

APA StyleChoi, Y., Lee, H. S., & Mastur, A. (2019). Are Sustainable Development Policies Really Feasible? Focused on the Petrochemical Industry in Korea. Sustainability, 11(14), 3980. https://doi.org/10.3390/su11143980