The Three Musketeers Relationships between Hong Kong, Shanghai and Shenzhen Before and After Shanghai–Hong Kong Stock Connect

Abstract

1. Introduction

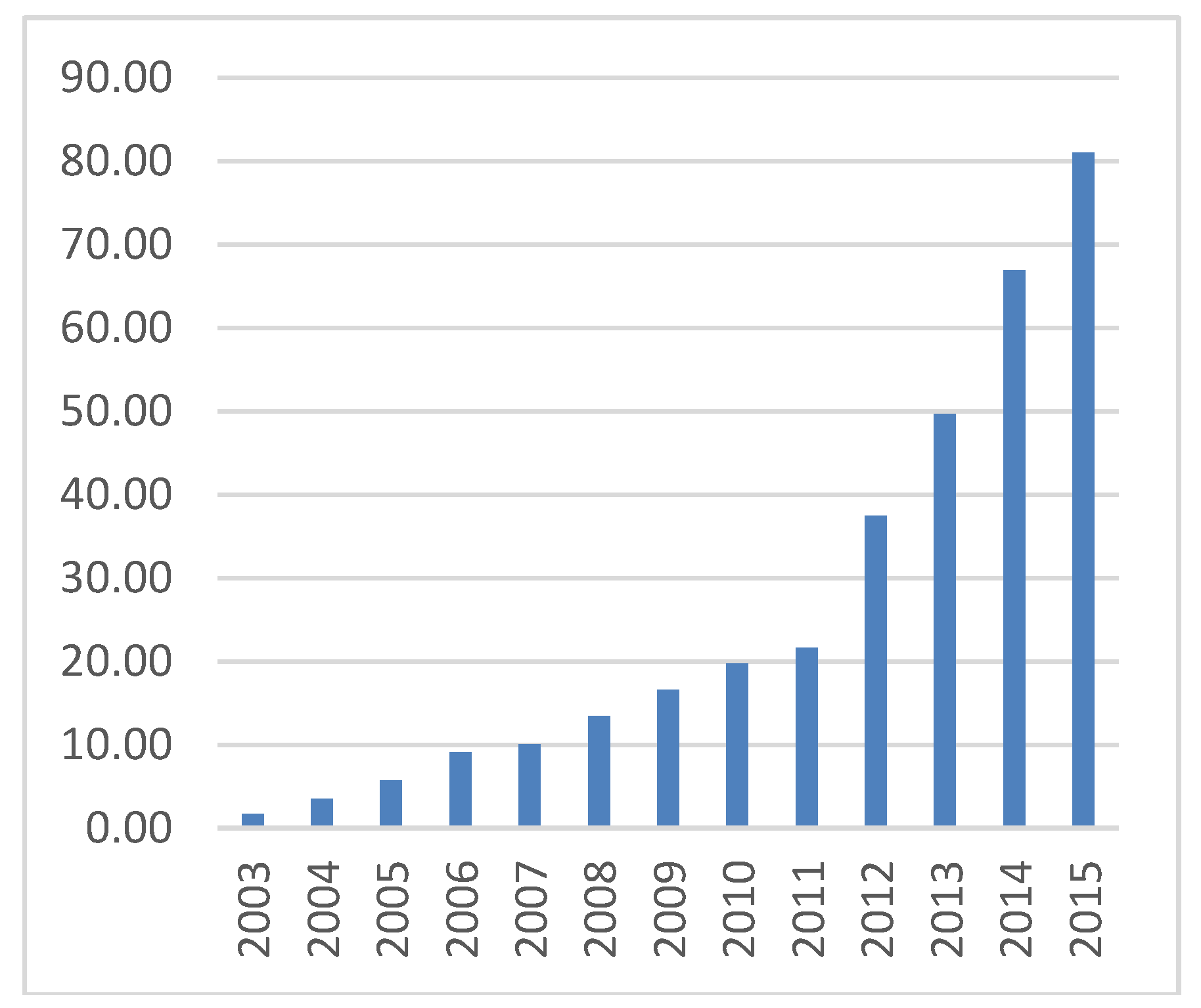

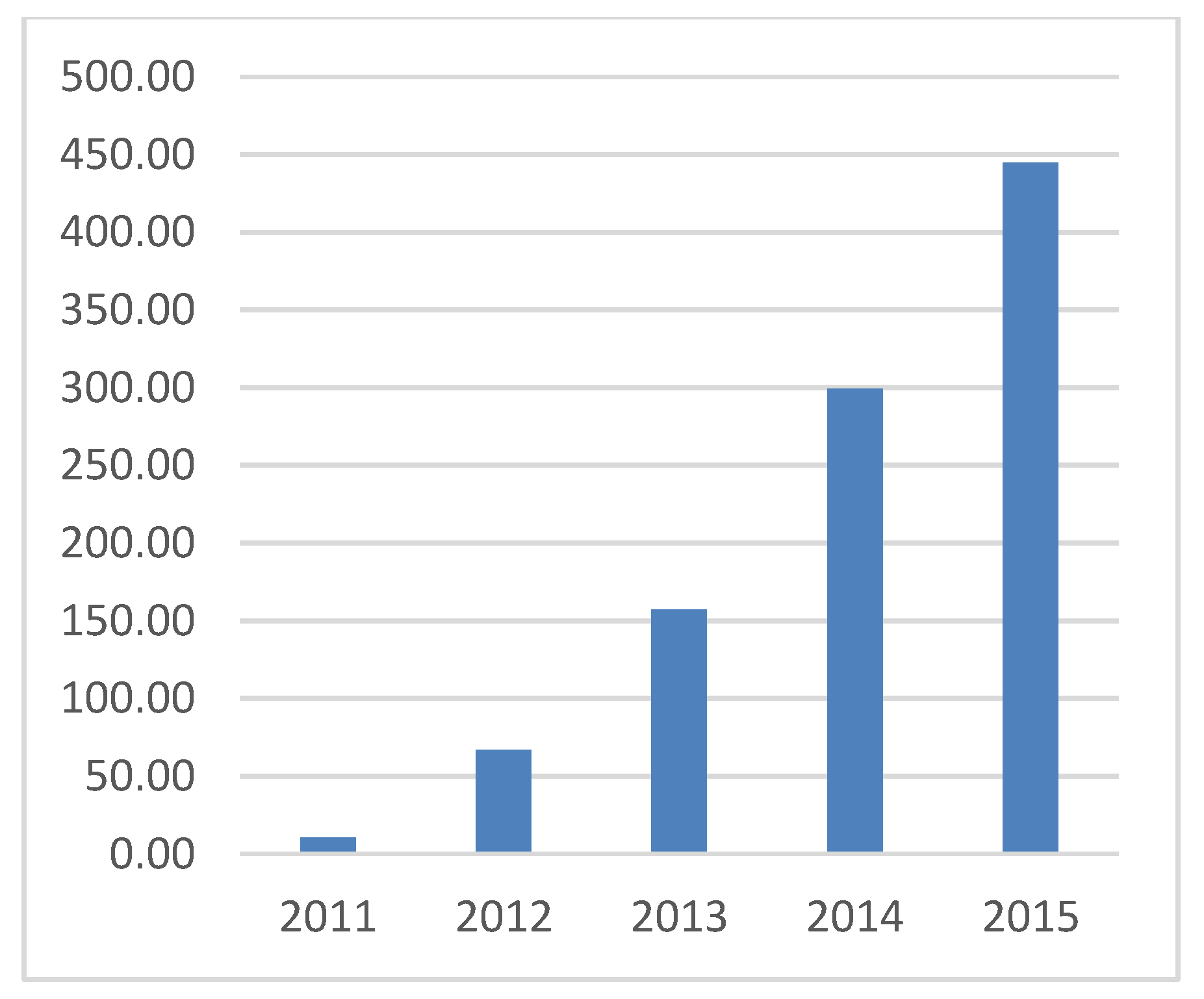

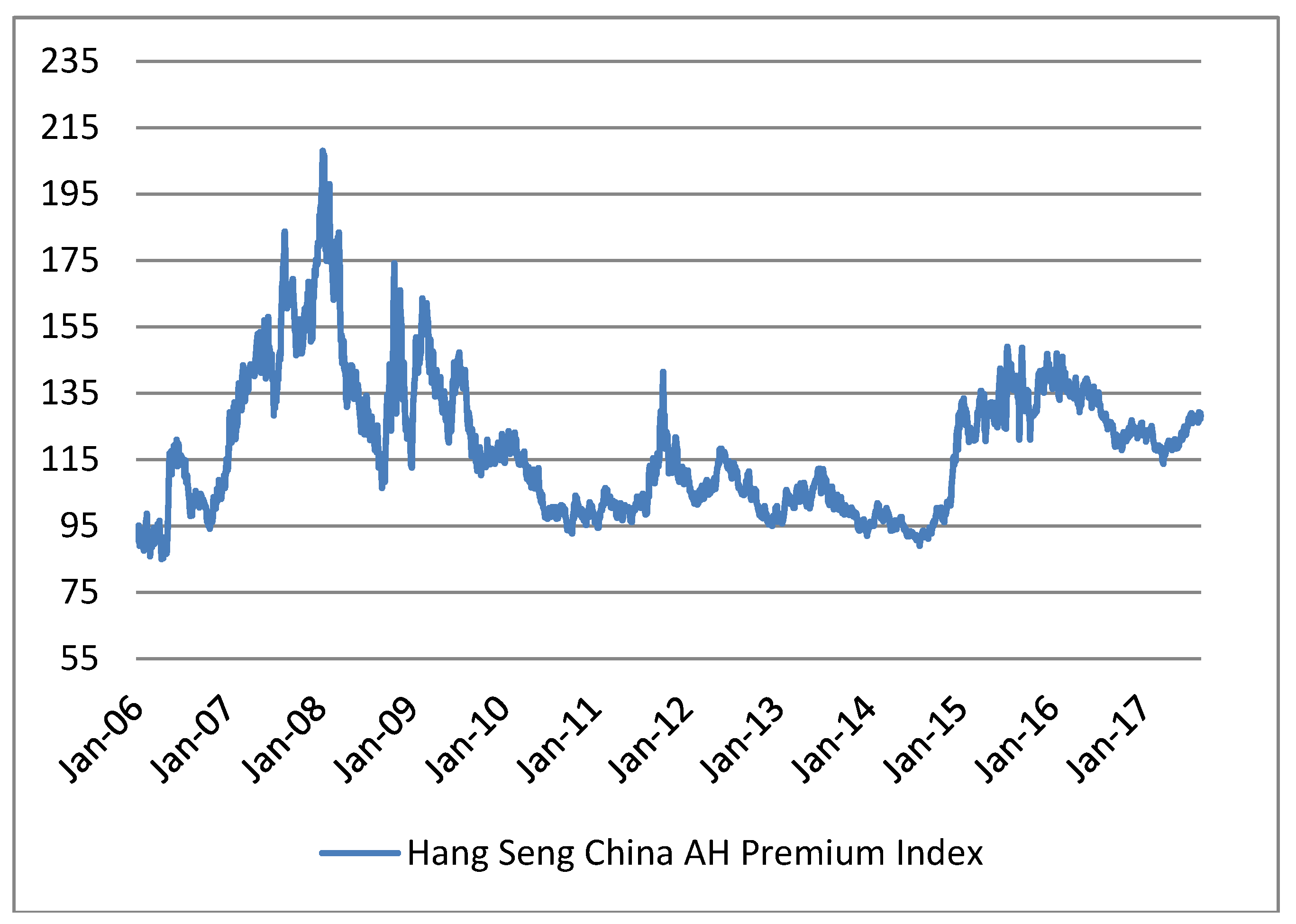

2. Characteristics of the Shanghai–Hong Kong Stock Connect

3. Literature Review

4. Data and Methodology

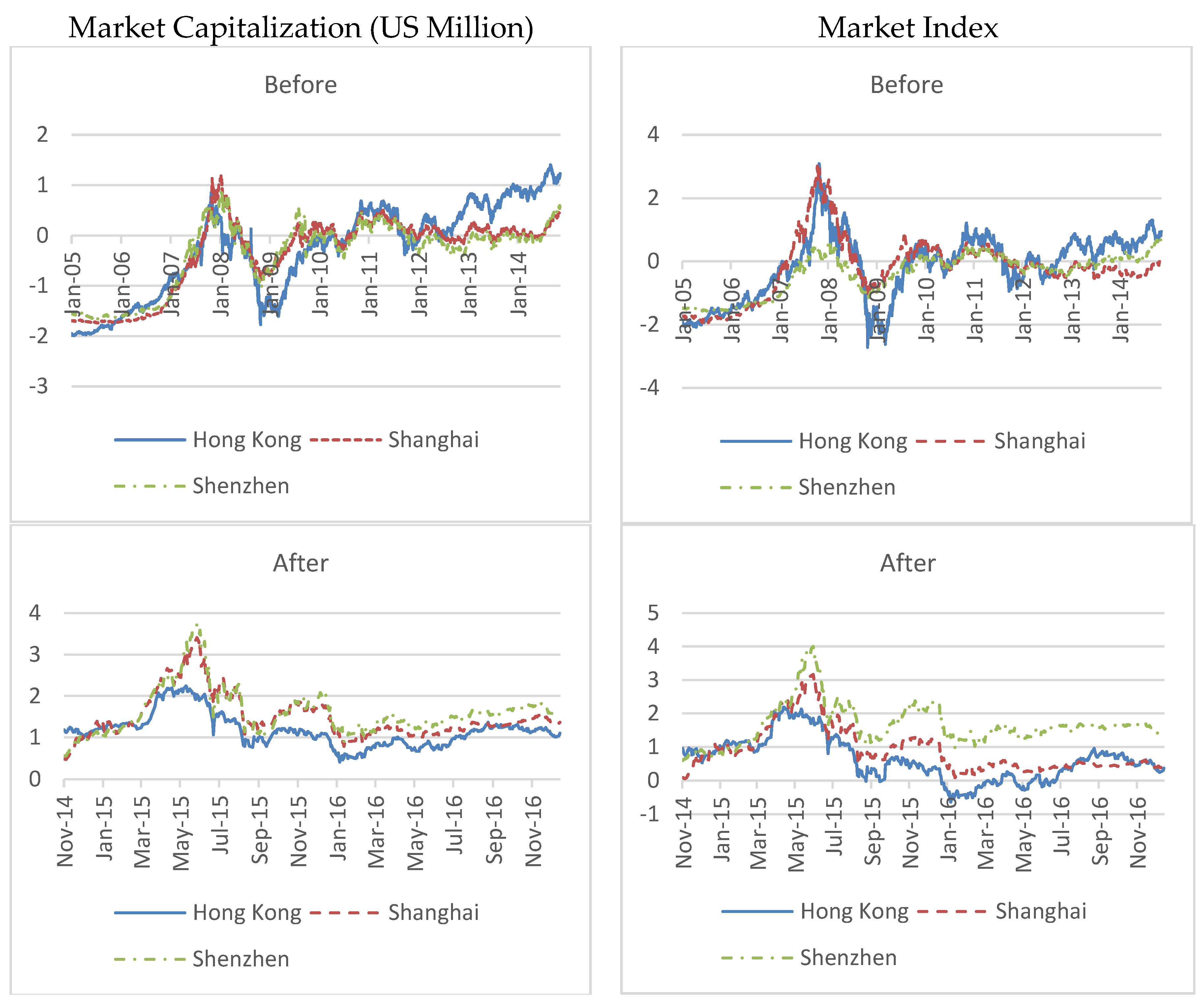

4.1. Data Description

4.2. Methodology

4.2.1. Cointegration

4.2.2. Linear Granger Causality

4.2.3. Nonlinear Granger Causality

5. Empirical Results and Discussion

5.1. Unit Root Test

5.2. Cointegration

5.3. Linear Causality

5.4. Nonlinear Causality

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Click, R.W.; Plummer, M.G. Stock market integration in ASEAN after the Asian financial crisis. J. Asian Econ. 2005, 16, 5–28. [Google Scholar] [CrossRef]

- Demirer, R.; Kutan, A.M. Does herding behavior exist in Chinese stock markets? J. Int. Finac. Mark. Inst. Money 2006, 16, 123–142. [Google Scholar] [CrossRef]

- Cai, C.X.; McGuinness, P.B.; Zhang, Q. The pricing dynamics of cross-listed securities: The case of Chinese A-and H-shares. J. Bank. Finace 2011, 35, 2123–2136. [Google Scholar] [CrossRef]

- Taylor, M.P.; Tonks, I. The internationalisation of stock markets and the abolition of UK exchange control. Rev. Econ. Stat. 1989, 71, 332–336. [Google Scholar] [CrossRef]

- Jin, X. Volatility transmission and volatility impulse response functions among the Greater China stock markets. J. Asian Econ. 2015, 39, 43–58. [Google Scholar] [CrossRef]

- Janakiramanan, S.; Lamba, A.S. An empirical examination of linkages between Pacific-Basin stock markets. J. Int. Finac. Mark. Inst. Money 1998, 8, 155–173. [Google Scholar] [CrossRef]

- Johansson, A.C.; Ljungwall, C. Spillover effects among the Greater China stock markets. World Dev. 2009, 37, 839–851. [Google Scholar] [CrossRef]

- Chan, K.C.; Gup, B.E.; Pan, M.S. An empirical analysis of stock prices in major Asian markets and the United States. Financ. Rev. 1992, 27, 289–307. [Google Scholar] [CrossRef]

- Arshanapalli, B.; Doukas, J. International stock market linkages: Evidence from the pre-and post-October 1987 period. J. Bank. Finace 1993, 17, 193–208. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: Representation, estimation, and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Kasa, K. Common stochastic trends in international stock markets. J. Monet. Econ. 1992, 29, 95–124. [Google Scholar] [CrossRef]

- Phylaktis, K.; Ravazzolo, F. Stock market linkages in emerging markets: Implications for international portfolio diversification. J. Int. Finac. Mark. Inst. Money 2005, 15, 91–106. [Google Scholar] [CrossRef]

- Diamandis, P.F. International stock market linkages: Evidence from Latin America. Glob. Finance J. 2009, 20, 13–30. [Google Scholar] [CrossRef]

- Tan, H.B.; Cheah, E.T.; Johnson, J.E.; Sung, M.C.; Chuah, C.H. Stock market capitalization and financial integration in the Asia Pacific region. Appl. Econ. 2012, 44, 1951–1961. [Google Scholar] [CrossRef]

- Baharumshah, A.Z.; Sarmidi, T.; Tan, H.B. Dynamic linkages of Asian stock markets. J. Asia Pac. Econ. 2003, 8, 180–209. [Google Scholar] [CrossRef]

- Daly, K.J. Southeast Asian stock market linkages: Evidence from pre-and post-October 1997. ASEAN Econ. Bull. 2003, 20, 73–85. [Google Scholar] [CrossRef]

- Cavoli, T.; Rajan, R.; Siregar, R. A Survey of Financial Integration in East Asia: How Far? How Much Further to Go? Centre for International Economic Studies, University of Adelaide: Adelaide, Australia, 2004. [Google Scholar]

- Huyghebaert, N.; Wang, L. The co-movement of stock markets in East Asia: Did the 1997–1998 Asian financial crisis really strengthen stock market integration? China Econ. Rev. 2010, 21, 98–112. [Google Scholar] [CrossRef]

- Ng, H.T. Stock Market Linkages in South–East Asia. Asian Econ. J. 2002, 16, 353–377. [Google Scholar] [CrossRef]

- Yang, J.; Kolari, J.W.; Min, I. Stock market integration and financial crises: The case of Asia. Appl. Financ. Econ. 2003, 13, 477–486. [Google Scholar] [CrossRef]

- Guillaumin, C. Financial integration in East Asia: Evidence from panel unit root and panel cointegration tests. J. Asian Econ. 2009, 20, 314–326. [Google Scholar] [CrossRef]

- Yu, I.W.; Fung, K.P.; Tam, C.S. Assessing financial market integration in Asia–equity markets. J. Bank. Finace 2010, 34, 2874–2885. [Google Scholar] [CrossRef]

- Zhu, H.; Lu, Z.; Wang, S.; Soofi, A.S. Causal linkages among Shanghai, Shenzhen, and Hong Kong stock markets. Int. J. Theor. Appl. Finance 2004, 7, 135–149. [Google Scholar] [CrossRef]

- Tourani-Rad, A.; Yi, Y. A Tale of Three Stock Markets: Timing between Hong Kong, Shanghai and Shenzhen. Manag. Finance 2004, 30, 60–77. [Google Scholar] [CrossRef]

- Cheung, Y.W.; Chinn, M.D.; Fujii, E. China, Hong Kong, and Taiwan: A quantitative assessment of real and financial integration. China Econ. Rev. 2003, 14, 281–303. [Google Scholar] [CrossRef][Green Version]

- Wang, Y.; Di Iorio, A. Are the China-related stock markets segmented with both world and regional stock markets? J. Int. Finac. Mark. Inst. Money 2007, 17, 277–290. [Google Scholar] [CrossRef]

- Wang, Y.; Di Iorio, A. The cross section of expected stock returns in the Chinese A-share market. Glob. Finance J. 2007, 17, 335–349. [Google Scholar] [CrossRef]

- Wang, Y.; Di Iorio, A. The cross-sectional relationship between stock returns and domestic and global factors in the Chinese A-share market. Rev. Quant. Finance Account. 2007, 29, 181–203. [Google Scholar] [CrossRef]

- Huo, R.; Ahmed, A.D. Return and volatility spillovers effects: Evaluating the impact of Shanghai-Hong Kong Stock Connect. Econ. Model. 2017, 61, 260–272. [Google Scholar] [CrossRef]

- Fan, Q.; Wang, T. The impact of Shanghai–Hong Kong Stock Connect policy on AH share price premium. Finance Res. Lett. 2017, 21, 222–227. [Google Scholar] [CrossRef]

- Kashyap, R. Hong Kong–Shanghai Connect/Hong Kong–Beijing Disconnect? Scaling the Great Wall of Chinese Securities Trading Costs. J. Trading 2016, 11, 81–134. [Google Scholar] [CrossRef]

- Yang, K.; Wei, Y.; He, J.; Li, S. Dependence and risk spillovers between mainland China and London stock markets before and after the Stock Connect programs. Phys. A Stat. Mech. Its Appl. 2019, 526, 120883. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Bai, Z.D.; Wong, W.K.; Zhang, B.Z. Multivariate linear and non-linear causality tests. Math. Comput. Simul. 2010, 81, 5–17. [Google Scholar] [CrossRef]

- Bai, Z.D.; Li, H.; Wong, W.K.; Zhang, B.Z. Multivariate causality tests with simulation and application. Stat. Probab. Lett. 2011, 81, 1063–1071. [Google Scholar] [CrossRef]

- Chow, S.C.; Cunado, J.; Gupta, R.; Wong, W.K. Causal Relationships between Economic Policy Uncertainty and Housing Market Returns in China and India: Evidence from Linear and Nonlinear Panel and Time Series Models. Stud. Nonlinear Dyn. Econom. 2018, 22. [Google Scholar] [CrossRef]

- Scheinkman, J.A.; LeBaron, B. Nonlinear dynamics and stock returns. J. Bus. 1989, 62, 311–337. [Google Scholar] [CrossRef]

- Brock, W.A.; Hsieh, D.A.; LeBaron, B.D. Nonlinear Dynamics, Chaos, and Instability: Statistical Theory and Economic Evidence; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Hsieh, D.A. Chaos and nonlinear dynamics: Application to financial markets. J. Finance 1991, 46, 1839–1877. [Google Scholar] [CrossRef]

- Baek, E.; Brock, W. A General Test for Nonlinear Granger Causality: Bivariate Model; Iowa State University and University of Wisconsin at Madison Working Paper; Iowa State University and University of Wisconsin: Madison, WI, USA, 1992. [Google Scholar]

- Chow, S.C.; Gupta, R.; Suleman, T.; Wong, W.K. Long-Run Movement and Predictability of Bond Spread for BRICS and PIIGS: The Role of Economic, Financial and Political Risks. J. Rev. Glob. Econ. 2019, 8, 239–257. [Google Scholar] [CrossRef]

- Chow, S.C.; Vieito, J.P.; Wong, W.K. Do both demand-following and supply-leading theories hold true in developing countries? Phys. A Stat. Mech. Appl. 2019, 513, 536–554. [Google Scholar] [CrossRef]

- Hiemstra, C.; Jones, J.D. Testing for linear and nonlinear Granger causality in the stock price-volume relation. J. Finance 1994, 49, 1639–1664. [Google Scholar]

- Brocato, J.; Smith, K.L. Velocity and the Variability of Money Growth: Evidence from Granger-Causality Tests: Comment. J. Money Credit Bank. 1989, 21, 258–261. [Google Scholar] [CrossRef]

- Chung, P.J.; Liu, D.J. Common stochastic trends in Pacific Rim stock markets. Q. Rev. Econ. Finance 1994, 34, 241–259. [Google Scholar] [CrossRef]

- Wong, W.K.; Lean, H.H.; McAleer, M.; Tsai, F.-T. Why are Warrant Markets Sustained in Taiwan but not in China? Sustainability 2018, 10, 3748. [Google Scholar] [CrossRef]

- Gupta, R.; Lv, Z.H.; Wong, W.K. Macroeconomic Shocks and Changing Dynamics of the U.S. REITs Sector. Sustainability 2019, 11, 2776. [Google Scholar] [CrossRef]

- Demirer, R.; Gupta, R.; Lv, Z.H.; Wong, W.K. Equity Return Dispersion and Stock Market Volatility: Evidence from Multivariate Linear and Nonlinear Causality Tests. Sustainability 2019, 11, 351. [Google Scholar] [CrossRef]

- Batmunkh, M.-U.; McAleer, M.; Moslehpour, M.; Wong, W.K. Confucius and Herding Behaviour in the China and Taiwan Stock Markets. Sustainability 2018, 10, 4413. [Google Scholar] [CrossRef]

- Li, Z.; Li, X.; Hui, Y.C.; Wong, W.K. Maslow Portfolio Selection for Individuals with Low Financial Sustainability. Sustainability 2018, 10, 1128. [Google Scholar] [CrossRef]

- Mou, W.M.; Wong, W.K.; McAleer, M. Financial Credit Risk Evaluation Based on Core Enterprise Supply Chains. Sustainability 2018, 10, 3699. [Google Scholar] [CrossRef]

| Market Capitalization | Market Index | |||||

|---|---|---|---|---|---|---|

| Hong Kong | Shanghai | Shenzhen | Hong Kong | Shanghai | Shenzhen | |

| Before | ||||||

| Mean | 2149.56 | 1999.64 | 485.12 | 2603.88 | 364.12 | 133.30 |

| Maximum | 3424.25 | 3891.59 | 864.10 | 4082.25 | 810.67 | 223.21 |

| Minimum | 818.13 | 254.36 | 99.97 | 1420.72 | 122.21 | 28.66 |

| Std. Dev. | 694.35 | 915.89 | 196.73 | 464.31 | 131.82 | 53.71 |

| Skewness | −0.40 *** | −0.85 *** | −0.82 *** | −0.30 *** | 0.44 *** | −0.70 *** |

| Kurtosis | 2.03 *** | −7.06 *** | 2.41 *** | 2.69 *** | 3.93 *** | 2.21 *** |

| Jarque–Bera | 153.81 *** | 306.93 *** | 292.79 *** | 43.184 *** | 156.95 *** | 247.58 *** |

| After | ||||||

| Mean | 3249.04 | 4274.35 | 1065.69 | 2954.59 | 518.35 | 306.35 |

| Maximum | 4069.50 | 6623.38 | 1684.08 | 3669.84 | 832.07 | 505.82 |

| Minimum | 2665.16 | 3002.20 | 752.91 | 2373.58 | 400.53 | 215.68 |

| Std. Dev. | 300.25 | 679.62 | 163.69 | 292.65 | 94.27 | 53.67 |

| Skewness | 0.91 *** | 1.32 *** | 1.46 *** | 0.49 *** | 1.40 *** | 1.33 *** |

| Kurtosis | 3.70 *** | 4.58 *** | 5.79 *** | 2.81 | 4.37 *** | 5.53 *** |

| Jarque–Bera | 80.22 *** | 197.98 *** | 341.85 *** | 21.04 *** | 204.03 *** | 282.46 *** |

| Level | First Difference | |||||

|---|---|---|---|---|---|---|

| Variable/Market | Without a Constant and Trend | With a Constant | With a Constant and Trend | Without a Constant and Trend | With a Constant | With a Constant and Trend |

| Market Capitalization—Before | ||||||

| Hong Kong | 1.682711 | −1.919425 | −2.205666 | −52.60101 *** | −52.65588 *** | −52.66070 *** |

| Shanghai | 2.353194 | −2.180448 | −1.120584 | −48.22354 *** | −48.34105 *** | −48.40782 *** |

| Shenzhen | 1.694196 | −1.698022 | −1.354723 | −45.59289 *** | −45.64103 *** | −45.65093 *** |

| Market Capitalization—After | ||||||

| Hong Kong | −0.086144 | −1.584134 | −1.763568 | −20.45296 *** | −20.43241 *** | −20.41225 *** |

| Shanghai | 0.612571 | −2.410414 | −2.848671 | −16.90724 *** | −16.91163 *** | −16.98909 *** |

| Shenzhen | 0.627730 | −2.566980 | −2.583824 | −20.38275 *** | −20.37833 *** | −20.41032 *** |

| Market Index—Before | ||||||

| Hong Kong | 0.626803 | −2.371107 | −2.637028 | −49.52579 *** | −49.52618 *** | −49.51887 *** |

| Shanghai | 1.066231 | −1.934023 | −1.517596 | −47.77306 *** | −47.79211 *** | −47.81669 *** |

| Shenzhen | 1.563084 | −1.661637 | −1.471991 | −45.09358 *** | −45.14931 *** | −45.15690 *** |

| Market Index—After | ||||||

| Hong Kong | −0.334852 | −1.494780 | −1.686786 | −21.77970 *** | −21.76091 *** | −21.73916 *** |

| Shanghai | 0.167181 | −1.673607 | −2.844149 | −16.82485 *** | −16.81046 *** | −16.88770 *** |

| Shenzhen | 0.456605 | −2.337842 | −2.277986 | −20.02130 *** | −20.01022 *** | −20.04949 *** |

| Trace statistic | Maximal Eigenvalue Statistic | |||||||

|---|---|---|---|---|---|---|---|---|

| Lags | 1 | 2 | 3 | 4 | 1 | 2 | 3 | 4 |

| Market Capitalization—Before | ||||||||

| 50.41438 *** | 49.85247 *** | 50.27316 *** | 48.99552 ** | 26.82384 ** | 26.53612 ** | 27.53781 ** | 28.16635 ** | |

| Market Capitalization—After | ||||||||

| 40.62609 * | 41.72919 * | 43.53722 ** | 43.44726 ** | 23.51745 * | 25.62289 * | 25.46559 * | 24.03629 * | |

| Market Index—Before | ||||||||

| 31.64630 | 30.98641 | 30.39318 | 28.58406 | 15.41028 | 15.02911 | 14.67202 | 13.22303 | |

| Market Index—After | ||||||||

| 41.76066 * | 43.02648 ** | 46.48707 ** | 47.99164 ** | 28.48594 ** | 29.83725 ** | 32.73789 *** | 34.94959 *** | |

| Dependent Variable | Independent Variable | Tau-Statistic for ADF Test | |

|---|---|---|---|

| Before | After | ||

| Market Capitalization | |||

| Hong Kong | Shanghai | −1.807367 | −3.702708 *** |

| Shanghai | Hong Kong | −1.812675 | −3.697735 *** |

| Hong Kong | Shenzhen | −2.366831 | −3.428527 *** |

| Shenzhen | Hong Kong | −2.375368 | −3.422214 *** |

| Market Index | |||

| Hong Kong | Shanghai | −1.909637 | −2.507151 * |

| Shanghai | Hong Kong | −1.871656 | −2.499474 * |

| Hong Kong | Shenzhen | −1.765747 | −2.694529 * |

| Shenzhen | Hong Kong | −1.630341 | −2.676564 * |

| Lags | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| Market Capitalization—Before | ||||

| Shanghai, Shenzhen do not linear cause Hong Kong | 7.38371 | 9.375204 | 10.72305 | 13.5075 |

| Hong Kong does not linear cause Shanghai, Shenzhen | 10.91606 | 11.3073 | 12.10023 | 15.50066 |

| Market Capitalization—After | ||||

| Shanghai, Shenzhen do not linear cause Hong Kong | 24.53035 *** | 25.04021 *** | 25.89332 ** | 27.30361 ** |

| Hong Kong does not linear cause Shanghai, Shenzhen | 7.541288 | 10.57955 | 10.38692 | 12.52102 |

| Market Index—Before | ||||

| Shanghai, Shenzhen do not linear cause Hong Kong | 29.53564 *** | 32.25287 *** | 41.44762 *** | 45.33166 *** |

| Hong Kong does not linear cause Shanghai, Shenzhen | 26.19195 *** | 35.55226 *** | 40.05167 *** | 50.15208 *** |

| Market Index—After | ||||

| Shanghai, Shenzhen do not linear cause Hong Kong | 16.33123 ** | 18.64942 ** | 21.32368 ** | 23.37843 * |

| Hong Kong does not linear cause Shanghai, Shenzhen | 8.691268 | 15.81915 * | 19.27024 * | 22.04703 |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not linear cause Hong Kong | 0.978580 | 2.012203 | 2.192758 | 2.387463 |

| Hong Kong does not linear cause Shanghai | 8.537985 *** | 8.480986 ** | 9.559701 ** | 10.36996 ** |

| Shenzhen does not linear cause Hong Kong | 5.348578 ** | 6.381996 ** | 6.677565 * | 8.543683 * |

| Hong Kong does not linear cause Shenzhen | 5.051887 ** | 4.996726 * | 4.784889 | 5.999298 |

| Null Hypothesis (After) | ||||

| Shanghai does not linear cause Hong Kong | 3.879897 ** | 5.268828 * | 7.771181 * | 11.00691 ** |

| Hong Kong does not linear cause Shanghai | 2.926277 * | 4.441486 | 6.289897 * | 8.776270 * |

| Shenzhen does not linear cause Hong Kong | 0.012944 | 1.287811 | 1.721678 | 4.355685 |

| Hong Kong does not linear cause Shenzhen | 3.585345 * | 4.261239 | 5.759532 | 10.40691 ** |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not linear cause Hong Kong | 8.893183 *** | 9.610947 *** | 10.01526 *** | 9.858900 ** |

| Hong Kong does not linear cause Shanghai | 1.427837 | 1.441529 | 1.406733 | 2.249378 |

| Shenzhen does not linear cause Hong Kong | 16.52512 *** | 16.90540 *** | 17.56947 *** | 17.47762 *** |

| Hong Kong does not linear cause Shenzhen | 0.191262 | 1.128381 | 1.054686 | 1.968744 |

| Null Hypothesis (After) | ||||

| Shanghai does not linear cause Hong Kong | 1.650946 | 3.070147 | 4.425512 | 6.041571 |

| Hong Kong does not linear cause Shanghai | 1.099184 | 3.331752 | 4.805973 | 5.678313 |

| Shenzhen does not linear cause Hong Kong | 0.309486 | 0.787259 | 0.978551 | 2.257896 |

| Hong Kong does not linear cause Shenzhen | 0.426839 | 0.524547 | 1.352728 | 2.567101 |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not linear cause Hong Kong | n/a | n/a | n/a | n/a |

| Hong Kong does not linear cause Shanghai | n/a | n/a | n/a | n/a |

| Shenzhen does not linear cause Hong Kong | n/a | n/a | n/a | n/a |

| Hong Kong does not linear cause Shenzhen | n/a | n/a | n/a | n/a |

| Null Hypothesis (After) | ||||

| Shanghai does not linear cause Hong Kong | −0.004669 | −0.005398 | −0.006306 | −0.006973 |

| Hong Kong does not linear cause Shanghai | −0.044791 *** | −0.046493 *** | −0.048387 *** | −0.048581 *** |

| Shenzhen does not linear cause Hong Kong | −0.007094 | −0.007855 | −0.009215 | −0.010231 |

| Hong Kong does not linear cause Shenzhen | −0.039959 *** | −0.040460 *** | −0.042351 *** | −0.043781 *** |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not linear cause Hong Kong | n/a | n/a | n/a | n/a |

| Hong Kong does not linear cause Shanghai | n/a | n/a | n/a | n/a |

| Shenzhen does not linear cause Hong Kong | n/a | n/a | n/a | n/a |

| Hong Kong does not linear cause Shenzhen | n/a | n/a | n/a | n/a |

| Null Hypothesis (After) | ||||

| Shanghai does not linear cause Hong Kong | −0.000644 | −0.001230 | −0.001977 | −0.003281 |

| Hong Kong does not linear cause Shanghai | −0.028955 *** | −0.029045 *** | −0.030224 *** | −0.031811 *** |

| Shenzhen does not linear cause Hong Kong | −0.003705 | −0.004845 | −0.006024 | −0.007039 |

| Hong Kong does not linear cause Shenzhen | −0.020618 *** | −0.021161 *** | −0.021848 *** | −0.023016 *** |

| Lags | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| Market Capitalization—Before | ||||

| Shanghai, Shenzhen do not nonlinearly cause Hong Kong | 4.210291 *** | 4.920050 *** | 5.380364 *** | 4.844110 *** |

| Hong Kong does not nonlinearly cause Shanghai, Shenzhen | 4.687631 *** | 5.005889 *** | 5.065219 *** | 4.561966 *** |

| Market Capitalization—After | ||||

| Shanghai, Shenzhen do not nonlinearly cause Hong Kong | 2.116468 ** | 2.820839 *** | 2.350409 *** | 1.308816 * |

| Hong Kong does not nonlinearly cause Shanghai, Shenzhen | 0.653933 | 1.520695 * | 0.199958 | 0.971179 |

| Market Index—Before | ||||

| Shanghai, Shenzhen do not nonlinearly cause Hong Kong | 4.542631 *** | 4.828466 *** | 4.973165 *** | 4.293640 *** |

| Hong Kong does not nonlinearly cause Shanghai, Shenzhen | 5.358980 *** | 5.774119 *** | 4.827240 *** | 5.010060 *** |

| Market Index—After | ||||

| Shanghai, Shenzhen do not nonlinearly cause Hong Kong | 2.037944 ** | 2.242687 ** | 1.624614 * | 1.186182 |

| Hong Kong does not nonlinearly cause Shanghai, Shenzhen | −0.221909 | 0.426697 | −0.855035 | 0.523144 |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not nonlinearly cause Hong Kong | 3.795365 *** | 4.551167 *** | 5.164434 *** | 4.694305 *** |

| Hong Kong does not nonlinearly cause Shanghai | 4.619768 *** | 5.187093 *** | 5.304950 *** | 4.865725 *** |

| Shenzhen does not nonlinearly cause Hong Kong | 3.804926 *** | 4.500830 *** | 5.043632 *** | 4.707949 *** |

| Hong Kong does not nonlinearly cause Shenzhen | 4.225535 *** | 5.039040 *** | 5.194823 *** | 4.742640 *** |

| Null Hypothesis (After) | ||||

| Shanghai does not nonlinearly cause Hong Kong | 1.468207 * | 2.749260 *** | 2.277180 ** | 1.434418 * |

| Hong Kong does not nonlinearly cause Shanghai | 0.800458 | 1.572935 * | 0.540221 | 1.133238 |

| Shenzhen does not nonlinearly cause Hong Kong | 2.458619 *** | 2.952265 *** | 2.404669 *** | 1.366114 * |

| Hong Kong does not nonlinearly cause Shenzhen | 1.977940 ** | 2.261325 ** | 0.900703 | 1.065920 |

| Null Hypothesis (Before) | Lag 1 | Lag 2 | Lag 3 | Lag 4 |

|---|---|---|---|---|

| Shanghai does not nonlinearly cause Hong Kong | 4.337560 *** | 4.680782 *** | 4.778670 *** | 3.847159 *** |

| Hong Kong does not nonlinearly cause Shanghai | 5.296137 *** | 5.917483 *** | 5.496391 *** | 5.363044 *** |

| Shenzhen does not nonlinearly cause Hong Kong | 3.972803 *** | 4.353763 *** | 4.490202 *** | 4.149760 *** |

| Hong Kong does not nonlinearly cause Shenzhen | 4.303810 *** | 5.414131 *** | 5.009831 *** | 4.677395 *** |

| Null Hypothesis (After) | ||||

| Shanghai does not nonlinearly cause Hong Kong | 1.565120 * | 2.511137 *** | 1.870381 ** | 1.411452 * |

| Hong Kong does not nonlinearly cause Shanghai | −0.117091 | 0.654299 | −0.268652 | 0.819147 |

| Shenzhen does not nonlinearly cause Hong Kong | 2.348446 *** | 2.349964 *** | 1.817364 ** | 1.465420 * |

| Hong Kong does not nonlinearly cause Shenzhen | 1.401143 * | 1.890706 ** | 0.670792 | 0.896187 |

| Variables | Cointegration | Causality | ||

|---|---|---|---|---|

| Market Capitalization | Strongly | Linear | x | x |

| (Before) | Nonlinear | strongly | strongly | |

| Market Capitalization | Strongly | Linear | strongly | x |

| (After) | Nonlinear | strongly | weakly | |

| Market Index | X | Linear | strongly | strongly |

| (Before) | Nonlinear | strongly | strongly | |

| Market Index | Strongly | Linear | strongly | weakly |

| (After) | Nonlinear | strongly | x |

| Variables | Cointegration | Cointegration | Causality | ||||

|---|---|---|---|---|---|---|---|

| Market Capitalization | x | x | Linear | x | strongly | strongly | strongly |

| (Before) | Nonlinear | strongly | strongly | strongly | strongly | ||

| Market Capitalization | ✓ | ✓ | Linear | strongly | x | strongly | strongly |

| (After) | Nonlinear | strongly | strongly | weakly | strongly | ||

| Market Index | x | x | Linear | strongly | strongly | x | x |

| (Before) | Nonlinear | strongly | strongly | strongly | strongly | ||

| Market Index | ✓ | ✓ | Linear | x | x | x | x |

| (After) | Nonlinear | strongly | strongly | x | strongly |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, A.W.-W.; Chow, N.S.-C.; Chui, D.K.-H.; Wong, W.-K. The Three Musketeers Relationships between Hong Kong, Shanghai and Shenzhen Before and After Shanghai–Hong Kong Stock Connect. Sustainability 2019, 11, 3845. https://doi.org/10.3390/su11143845

Cheng AW-W, Chow NS-C, Chui DK-H, Wong W-K. The Three Musketeers Relationships between Hong Kong, Shanghai and Shenzhen Before and After Shanghai–Hong Kong Stock Connect. Sustainability. 2019; 11(14):3845. https://doi.org/10.3390/su11143845

Chicago/Turabian StyleCheng, Andy Wui-Wing, Nikolai Sheung-Chi Chow, David Kam-Hung Chui, and Wing-Keung Wong. 2019. "The Three Musketeers Relationships between Hong Kong, Shanghai and Shenzhen Before and After Shanghai–Hong Kong Stock Connect" Sustainability 11, no. 14: 3845. https://doi.org/10.3390/su11143845

APA StyleCheng, A. W.-W., Chow, N. S.-C., Chui, D. K.-H., & Wong, W.-K. (2019). The Three Musketeers Relationships between Hong Kong, Shanghai and Shenzhen Before and After Shanghai–Hong Kong Stock Connect. Sustainability, 11(14), 3845. https://doi.org/10.3390/su11143845