1. Introduction

The rapid decline in real estate prices, following a prolonged boom, is commonly associated as the main underlying reason for the global economic and financial crisis of 2008 to 2009 [

1,

2]. Naturally, understanding what macroeconomic and financial shocks drives the real estate market is of paramount importance, especially for a policymaker aiming to avoid future catastrophic effects observed under the ‘Great Recession’. While there exists a large number of studies that have analyzed the role of both conventional and unconventional (in the wake of the zero lower bound (ZLB) scenario) monetary policy [

3,

4,

5,

6,

7,

8], and more recently, fiscal policy shocks on real estate markets [

9,

10], and the feedback from it in shaping policy decisions, there is dearth of studies that have analyzed the role of aggregate demand, aggregate supply, and bond yield spread shocks on real estate markets. The only exception to this is the recent paper by Plakandaras et al. [

11], where the authors study the effect of macroeconomic shocks in the determination of house prices in the US and the UK by employing time-varying parameter vector autoregressive (TVP-VAR) models covering the historical annual periods of 1830 to 2016 and 1845 to 2016, respectively. From the examination of the impulse responses of house prices on macroeconomic shocks, Plakandaras et al. [

11], found that technology shocks dominate in the U.S. real estate market, while their effect is unimportant in the U.K, where, monetary policy shocks drives most of the house price evolution.

Against this backdrop, realizing that housing markets are regional in nature, with tremendous heterogeneity in terms of their response to (monetary) policy shocks [

12,

13,

14], we analyze the role of various macroeconomic shocks in driving the Real Estate Investment Trusts (REITs) prices of the US, which tends to be homogenous across the country, being based on a broad single index. For our purpose, unlike Plakandaras et al. [

11], we use higher-frequency (monthly) data covering the more recent period 1972:12 of 2016:12. The use of monthly data allows us to identify the shocks in a relatively cleaner manner [

15,

16], based on a change-point vector autoregressive (VAR) model that allows for different regimes throughout the sample period and identifies a variety of shocks (supply, demand, monetary policy, and the spread between long- and short-run maturities), derived from the theoretical reactions of an innovative general equilibrium model developed by Liu et al. [

17]. This approach enables the VAR model to endogenously identify changes to the structure of the real estate market, as widely discussed in Simo-Kengne et al. [

18], as well as variations to the properties of exogenous shocks during the sample period. We prefer to use this approach over the complete TVP-VAR framework used by Plakandaras et al. [

11], as we want to explicitly identify regimes over our high-frequency data, rather than assuming that each point in time is a separate regime, as done in TVP-VARs—which is, perhaps, more appropriate at lower frequency data (like quarterly and annual). It is important to note that the spread shock is important for us, since the time period of our analysis involves the period of ZLB and hence, that of unconventional monetary policy, which in turn involved compression in the long-term yield spread (Beginning in the summer of 2007, money markets around the world experienced sustained periods of dysfunction with sharply higher short-term interest rates for commercial paper and interbank borrowing. This intense liquidity squeeze led the Federal Reserve (Fed) to substantially lower its Federal funds rate (FFR) and act as the liquidity provider of last resort to supply funds to banks and the broader financial system via its Term Auction Facility (TAF). The FFR, the Fed’s traditional policy instrument, reached its effective ZLB in December 2008, and the Fed faced the challenge of how to further ease the stance of monetary policy as the economic outlook deteriorated. While the FFR had reached its effective ZLB, large-scale asset purchases (LSAPs), which reduced the supply of riskier long term assets and increased the supply of safer liquid assets (bank reserve), causing the spread to decline.). To the best of our knowledge, this is the first attempt to analyze the role of various macroeconomic and financial shocks over and above the monetary policy shock, in driving the REITs prices based on a change-point VAR. In this regard, it must be mentioned that the role of macroeconomic news surprises, along with monetary policy surprises for real estate markets have been recently studied by Marfatia et al. [

19] and Nyakabawo et al. [

20], based on single-equation approaches. However, these studies do not make an attempt to identify these shocks in a structural fashion based on a VAR model, and hence, cannot track the impact of these shocks over time, but just its correlation with the real estate returns (and volatility).

To summarize, given the importance of the real estate sector in the recent financial crisis, it is important to study the role of macroeconomic shocks driving the sector. However, existing studies have primarily concentrated on the role of monetary policy shocks and, in this regard, we deviate from the current literature by developing a change-point VAR model and then analyzing, for the first time, regime-specific impact of demand, supply, monetary policy, and spread yield shocks, identified using sign-restrictions, on US REITs returns. As indicated, based on our analysis over the monthly period of 1972:12 to 2016:12, aggregate supply shocks have dominated in the early part of the sample period, and monetary policy and spread shocks at the end. Our results imply that ignoring other possible shocks in the model is likely to lead to incorrect inferences, and over-reliance on (conventional) monetary policy in correcting for possible bubbles in the REITs sector, which it will fail to rectify, given the importance of other shocks driving the REITs sector. The remainder of the paper is organized as follows:

Section 2 presents the data and the methodology, with

Section 3 discussing the results, and

Section 4 concluding the paper.

3. Empirical Results

Figure 1 shows the estimated probability of the four regimes, with them corresponding to the periods of June 1973 to January 1985, February 1985 to January 2009, February 2009 to May 2013, and June 2013 to December 2016. The VAR model was estimated based on six lags, as suggested by the Bayesian Information Criterion (BIC), and hence the first regime starts from June, 1972. The estimate for the first breakpoint is consistent with financial liberalization in the US, with the second one corresponding to the end of the global financial crisis, and the third one with the ‘tapering’ of the unconventional monetary policies.

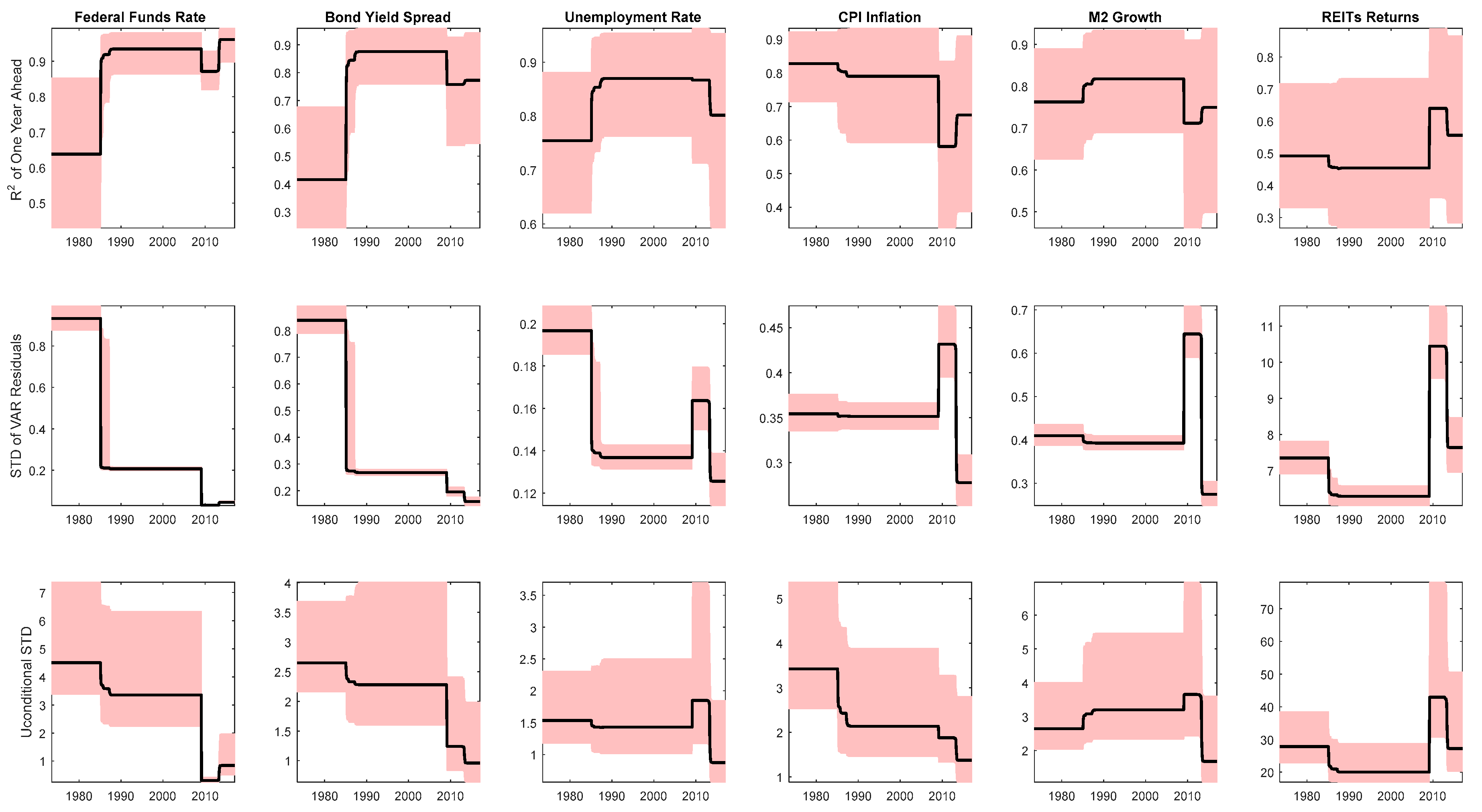

To tie these breakpoints to changing macroeconomic dynamics,

Figure 2 plots some key reduced form summary statistics from the change-point VAR. The top panel of

Figure 2 presents the persistence of each of the endogenous variables in the change-point VAR for each regime. The FFR, bond yield spread, and M2 growth performed very similarly throughout the sample period. These variables increased from regime 1 to regime 2 and decreased during regime 3, and then increased in regime 4. Moreover, the unemployment rate showed a similar trend in the first three regimes. The persistence of inflation and REITs return changed over all four regimes, and during the financial crisis, the persistence of inflation reached its lowest value, while the persistence of REITs returns reached its highest value.

The second panel of

Figure 2 shows the diagonal elements of the error covariance matrix in each regime. We observed that the volatility of the reduced-form errors declined for all the time series, with a different extent from regime 1 to regime 2. Furthermore, during the last two regimes covering the financial crisis and unconventional monetary policies due to the ZLB, the volatility of the reduced-form errors increased for all the variables, except for the bond yield spread and the FFR.

The last panel of

Figure 2 shows the unconditional volatility of each variable in each regime. The volatility of the bond yield spread, and CPI inflation were extremely similar throughout the whole sample period. In general, all the plots were consistent to the second panel, except the behavior of the CPI inflation in regime 3.

The empirical framework is well-suited to investigate changes in macroeconomic dynamics across the sample horizon, since the change-point VAR model allows the coefficients in the model to vary across regimes.

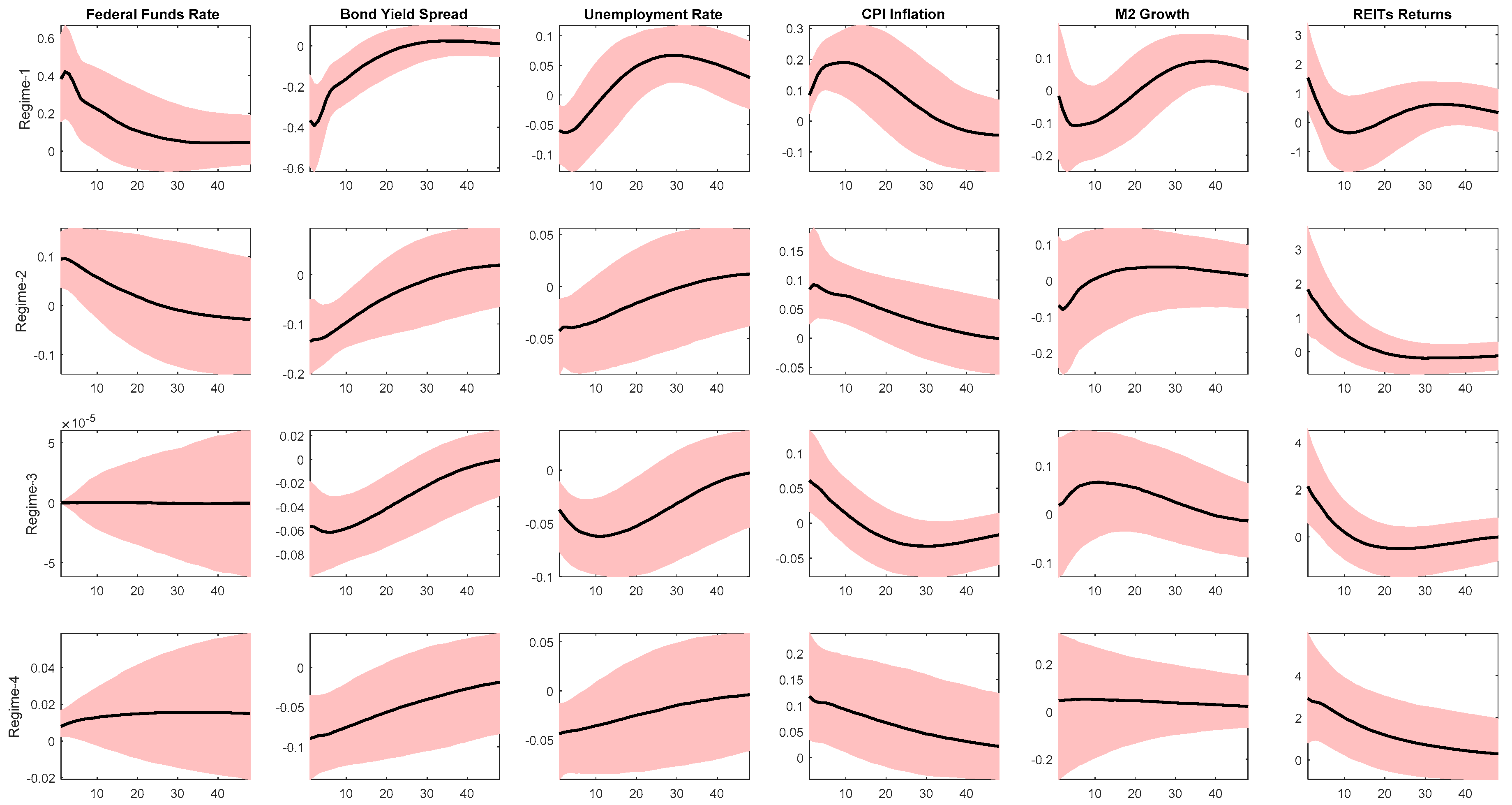

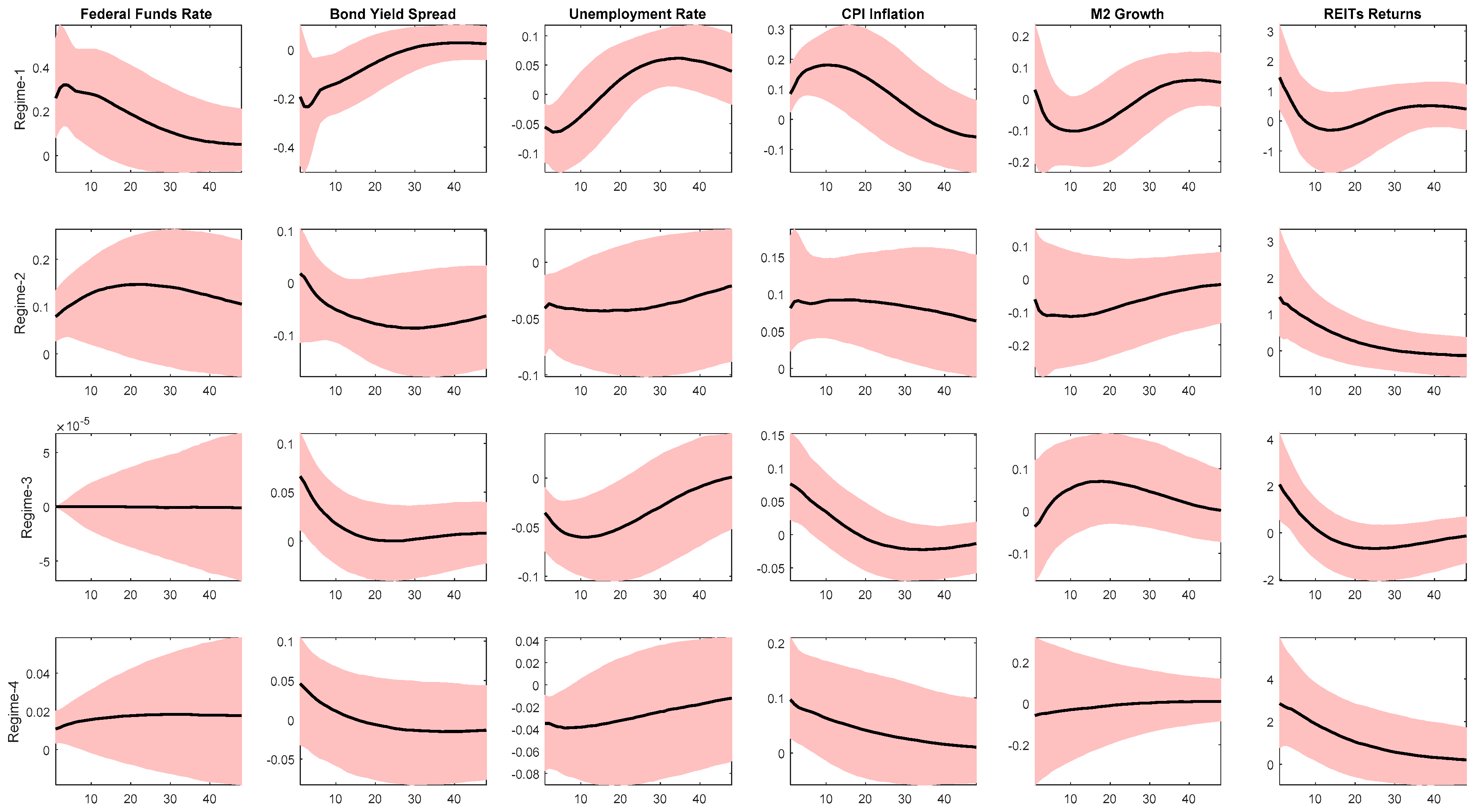

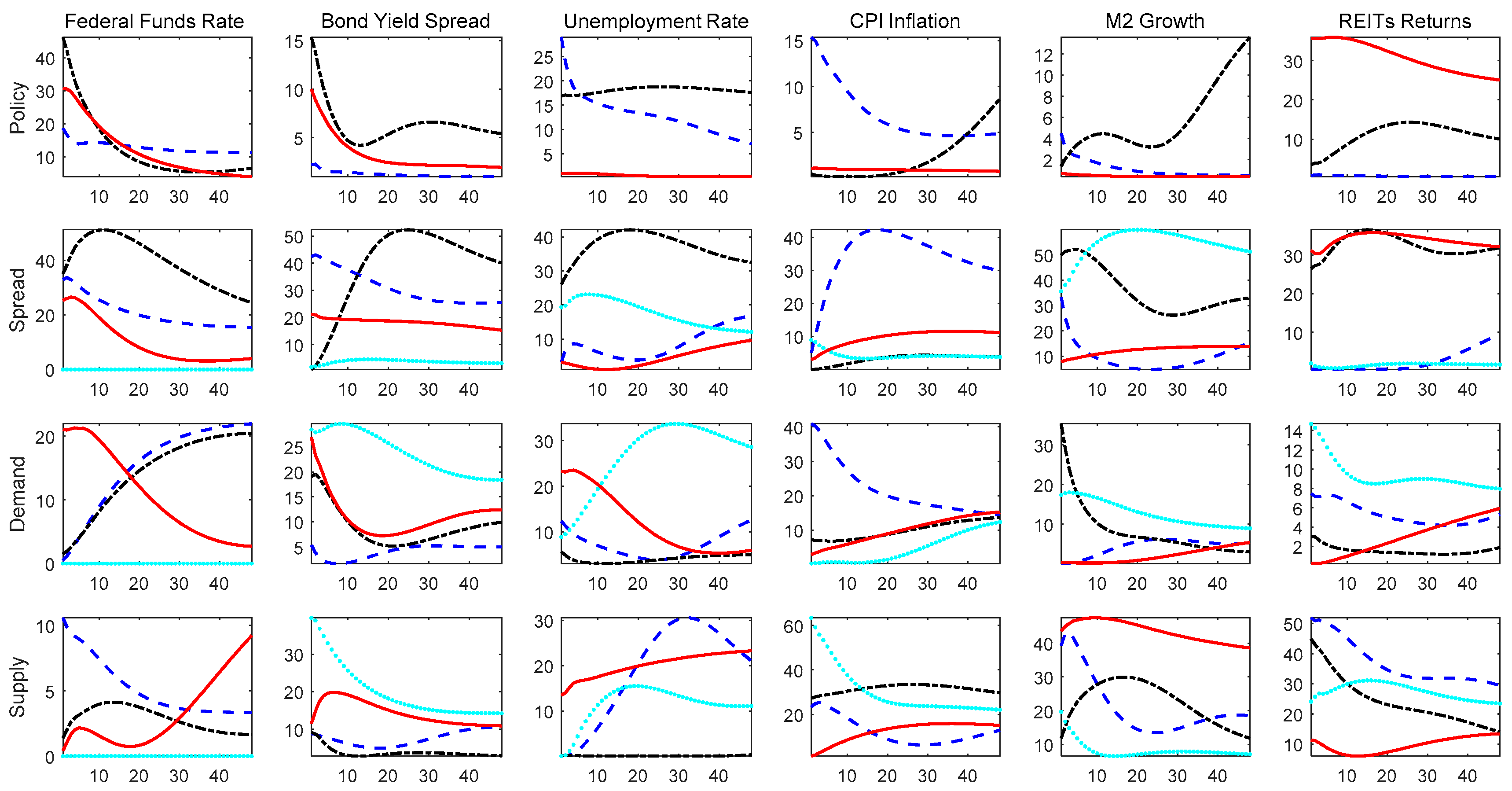

Figure 3,

Figure 4,

Figure 5 and

Figure 6 plot the impulse response functions (IRFs) of the six endogenous variables to a one-standard-deviation shock for the four identified shocks across the four regimes. We obtained the median and 68% confidence bands based on 5000 retained Gibbs replications. Since our focus is the REITs returns, we concentrate on discussing the effect of the various shocks on this variable. The effects on the other variables for the four shocks were similar to those obtained by Liu et al. [

17], and the reader can refer to that paper for a more detailed discussion.

Figure 3 presents the responses of the variables to a contractionary monetary policy shock (i.e., an increase in the nominal interest rate). For the third regime, this shock was absent since the nominal interest rate was set at approximately zero, corresponding to the ZLB scenario. The size of the negative impact was quite similar in regimes 1 and 2, though it was relatively stronger under regime 1, with the effect being significant for about a year. The recovery was faster in regime 1 relative to regime 2, though the effect in the former regime increased again from three-years onwards. However, the strongest negative effect was observed in regime 4, with the effect being significant for over one and half years. This strong impact is probably an indication of the recovery that took place in the US real estate sector, and the economy in general, post the ‘Great Recession’. In all cases, however, the effect on REITs returns was negative over the entire horizons of the 50 months considered.

Next,

Figure 4 presents the responses of the variables to a negative interest rate spread shock. To implement the analysis, we made it so that the short-term interest rate was exogenous to the spread shock in the third regime. Unsurprisingly, the positive impact on REITs returns tended to increase both in magnitude and length of the periods for which the effect was significant as we move from regimes 1 to 4. These results highlight the enhanced role of unconventional monetary policies in the third and fourth regimes aiming to reduce borrowing costs, as well as attempts made to directly stimulate the real estate sector, especially in the last identified sub-sample.

Figure 5 presents the responses of the variables to an expansionary demand shock. The positive impact of REITs returns continued to increase in magnitude over the regimes, with the statistical significance also lasting for a longer number of horizons, especially in the last regime (where the effect was significant for over a year). While in

Figure 6, we can see that the aggregate supply shock tended to positively affect the REITs returns, with the strongest effects observed in regimes 1, 3, and 4, with the effect declining during regime 2, with the effect being statistically longest-lasting (for over a year) in regime 3, i.e., right after the depth of financial crisis.

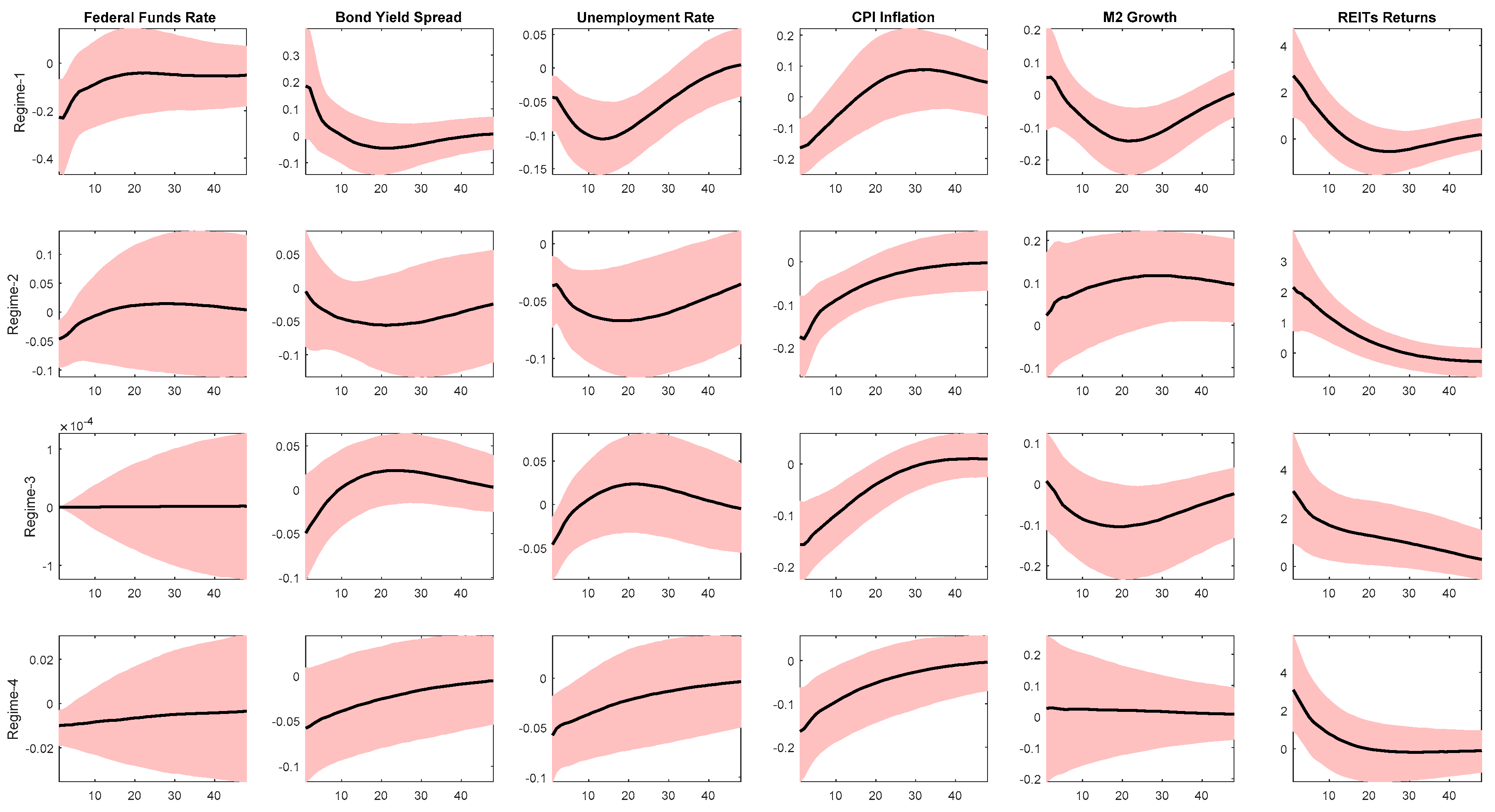

In summary, looking across all these impulse responses suggests that the transmission mechanism of the different shocks on REITs returns changed across the four regimes. To understand the extent to which movements of REITs returns can be explained by each shock and how the contribution of shocks changed across regimes,

Figure 7 highlights the forecast error variance decompositions of the six endogenous variables for each of the four shocks. Concentrating on REITs returns, we observed that, the policy shock played an important role in the last regime (compared to the first two regimes), explaining over 30% of the variation in REITs returns. The spread shock was found to have quite a strong impact on regimes 2 and 4, with it explaining over 30% of the fluctuations in the real estate returns. Demand shocks explain about 14% and 8% of the variations in REITs returns in regimes 3 and 1, respectively. But the importance of the aggregate supply shocks stand out in regimes 1 and 2, with it explaining over 50% and 40% of the variations in regimes 1 and 2, and over 20% and 10% of the fluctuations of the REITs returns in regimes 3 and 4, respectively. The importance of the supply shocks is in line with Plakandaras et al. [

11]. Overall, while supply shocks have been shown to be important in the early part of the sample, the spread and monetary shocks seem to dominate towards the end of the sample period under consideration.

These results tend to suggest the importance of technical progress, i.e., the aggregate supply shocks, post-World War II in the US, which in turn led to a growth in productivity and hence output growth. This output growth is likely to have been driven by the consistently booming real estate market, until the collapse in 2007. The importance of the monetary policy and the spread shock in the last two regimes, basically coincided with the post-crisis period, where various measures of unconventional monetary policies were undertaken to boost the housing market and the overall macroeconomy. Our analysis thus indicates that while the role of monetary policy is important in driving the real estate sector of the US, it is also necessary to identify the role of other shocks, so that researchers do not overemphasize the role of monetary policy shocks.

4. Conclusions

Given the importance of the real estate sector in causing the recent financial crisis, this paper uses a flexible change-point VAR model to analyze the regime-specific impact of various macroeconomic and financial shocks, identified based on sign-restrictions, on the US REITs returns. We deviate from the existing literature, which merely analyzes the role of monetary policy shocks on the US REITs sector and ignores the possible influence and importance of other shocks. The empirical model identifies three break points (four regimes) over the monthly sample period from 1972:12 to 2016:12. The third regime, coincides with the crisis period. The analysis discloses a range of important changes in the statistical and dynamic properties of REITs returns over the sample period. Statistical properties, such as persistence and volatility of fluctuations in REITs returns and the volatility of the reduced-form errors are found to have changed throughout the different regimes, with the crisis period being characterized by higher volatility. In addition, although quantitative changes are recorded throughout the whole period, supply, monetary policy, and spread shocks generate movements in REITs returns at the early and last parts of the sample period under consideration, respectively.

Hence, while the role of monetary policy is important in driving the real estate sector of the US, it is also necessary to identify the role of other shocks, in particular aggregate supply shocks to capture the role of productivity on the real estate sector, so that researchers do not overemphasize the role of monetary policy shocks. As we show, monetary policy shocks are only dominant in terms of moving the REITs sector post the recent financial crisis, in the wake of wide-array of unconventional monetary policy measures. This result also tends to suggest that, compared to productivity shocks, the role of monetary policy was minimal in heating up the US real estate market [

30] before its collapse that led to the ‘Great Recession’. Hence, loose monetary policy cannot be blamed for the real estate market bubble alone, though it is indeed true that post the financial liberalization in the US, the importance of monetary policy in affecting the real estate sector did increase [

14].

From a policy perspective, our results have important implications. The relatively weaker role of conventional monetary policy, in affecting the REITs sector, tends to suggest that if there are bubbles in the US REITs sector, the Federal Reserve will not be successful in preventing it from bursting. In other words, besides the limited role of monetary policy on the REITs sector, the fact that interest rates are a blunt instrument to prick a bubble resulting in unintended collateral damage, the main policy message from our analysis is that the Federal Reserve should focus on stabilizing inflation and the output gap only—an observation in line with Bernanke and Gertler [

31,

32].

One limitation of this study is that we consider the overall REITs sector of the US. However, REITs data is available in a sector-specific manner involving equities and mortgages, which in turn could be affected differently from these shocks compared to the overall market. These possible dissimilarities could be studied as part of future research. Moreover, we ignore the role of fiscal policies in the paper, which also played an important role in the US macroeconomy, especially during the ZLB. In addition, our current study can be extended by analyzing REITs markets of other developed countries or regions like the UK, Euro Area, and Japan, which also faced a ZLB situation. Finally, our approach can also be applied to study the possible heterogenous impact of these shocks across the regional housing markets of the US.