Sustainability and Firm Performance: A Review and Analysis Using Algorithmic Pathways in the Throughput Model

Abstract

1. Introduction

2. Literature Review

2.1. Positive Relationship between Sustainability and Firm Performance

2.2. Negative Relationship between Sustainability and Firm Performance

2.3. Reasons for Continuing to Implement Sustainability as a Loss Bearing Activity

2.4. No Relationship between Sustainability and Firm Performance

2.5. Reasons for Not Practicing Sustainability

2.6. Summary for Sustainability Research

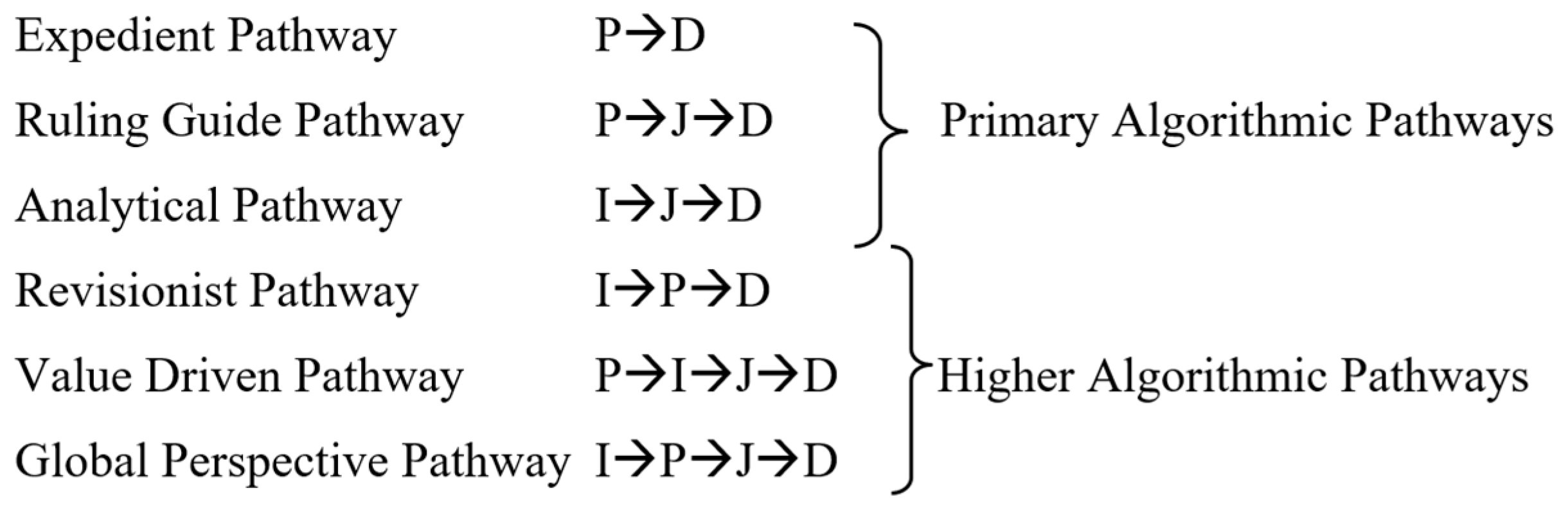

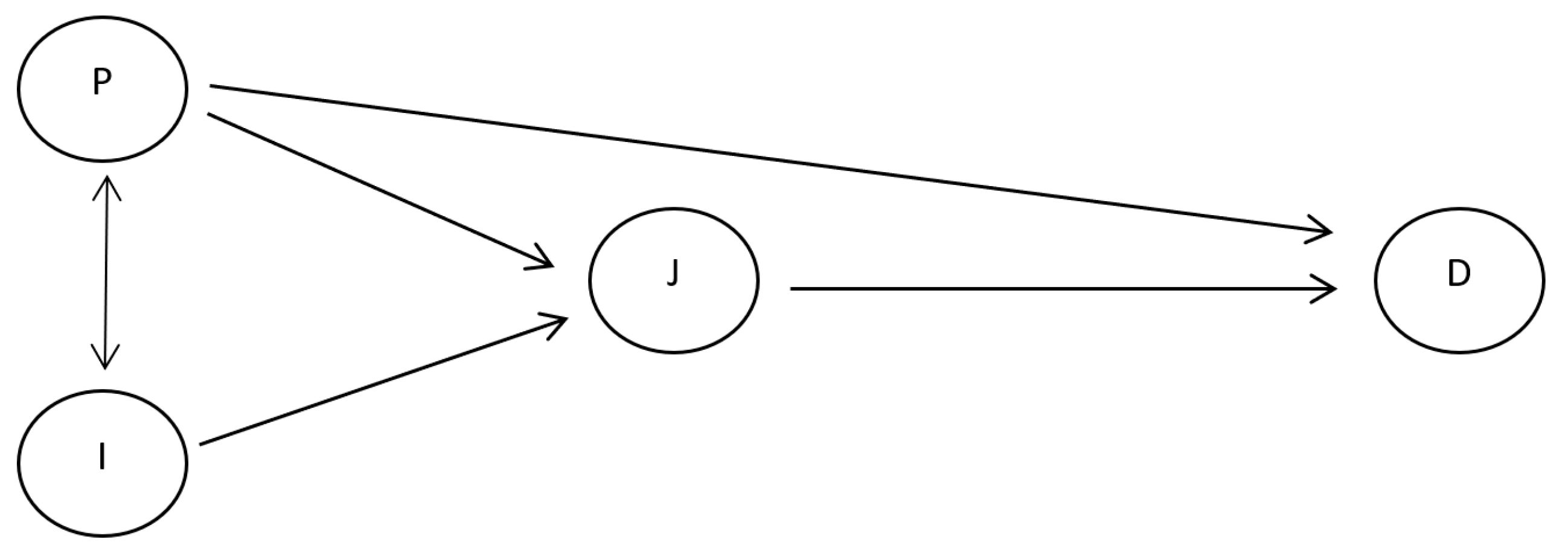

3. The Throughput Model

- Invest need for information (financial and intangible assets).

- The roles of the various stakeholders are associated and supported with an effective communication link [103].

- The assessing sustainability role can provide a constructive link to stakeholders [2].

- The model is formatted in stages to deliver relevant and reliable information for sustainability related intangible assets [113].

4. Discussion of Findings

5. Suggested Research Methodology Improvement

6. Throughput Model used as a Framework for Sustainability Studies

7. Summary and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Freidman, M. The Social Responsibility of Business Is to Increase Its Profits. The New York Times Magazine, 13 September 1970. [Google Scholar]

- Rodgers, W.; Al Fayi, S. Ethical Pathways of Internal Audit Reporting Lines; Routledge: London, UK, 2019. [Google Scholar]

- Rodgers, W. Biometric and Auditing Issues Addressed in a Throughput Model; Information Age Publishing: Charlotte, NC, USA, 2011. [Google Scholar]

- Abduljabbar, R.; Dia, H.; Liyanage, S.; Bagloee, S.A. Applications of Artificial Intelligence in Transport: An Overview. Sustainability 2019, 11, 189. [Google Scholar] [CrossRef]

- Elkinjton, J. Partnerships from Cannibals with Forks: The Triple bottom line of 21st-Century. Bus. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- Norman, W.; MacDonald, C. Getting to The Bottom of “Triple Bottom Line”. Bus. Ethics Q. 2004, 14, 243–262. [Google Scholar] [CrossRef]

- Cohen, J.J.; Holder-Webb, L.; Wood, D.; Nath, L. Corporate reporting of non-financial leading indicators of economic performance and sustainability. Account. Horiz. 2012, 26, 65–90. [Google Scholar] [CrossRef]

- Cohen, J.J.; Simnett, R. CSR and assurance services: A research agenda. Audit. A J. Pract. Theory 2015, 34, 59–74. [Google Scholar] [CrossRef]

- O’Dwyer, B. The case of sustainability assurance: Constructing a new assurance service. Contemp. Account. Res. 2011, 28, 1230–1266. [Google Scholar] [CrossRef]

- O’Dwyer, B.; Owen, D.; Unerman, J. Seeking legitimacy for new assurance forms: The case of assurance on sustainability reporting. Account. Organ. Soc. 2011, 36, 31–52. [Google Scholar] [CrossRef]

- WCED. Our Common Future; Oxford University Press: London, UK, 1987. [Google Scholar]

- Labuschagne, C.; Brent, A.C.; van Erck, R.P.G. Assessing the sustainability performances of industries. J. Clean. Prod. 2005, 13, 373–385. [Google Scholar] [CrossRef]

- White, L.; Lee, G.G. Operational research and sustainable development: Tackling the social dimension. Eur. J. Oper. Res. 2009, 193, 683–692. [Google Scholar] [CrossRef]

- Fifka, M.M. Corporate responsibility reporting and its determinants in comparative perspective—A review of the empirical literature and a meta-analysis. Bus. Strategy Environ. 2013, 22, 1–35. [Google Scholar] [CrossRef]

- Lehtonen, M. The environmental–social interface of sustainable development: Capabilities, social capital, institutions. Ecol. Econ. 2004, 49, 199–214. [Google Scholar] [CrossRef]

- White, L. ‘Effective governance’ through complexity thinking and management science. Syst. Res. Behav. Sci. 2001, 18, 241–257. [Google Scholar] [CrossRef]

- Brent, A.; Labuschagne, C. Social indicators for sustainable project and technology life cycle management in the process industry. Int. J. Life Cycle Assess. 2006, 11, 3–15. [Google Scholar] [CrossRef]

- Hummel, K.; Schlick, C. The relationship between sustainability performance and sustainability disclosure—Reconciling voluntary disclosure theory and legitimacy theory. J. Account. Public Policy 2016, 35, 455–476. [Google Scholar] [CrossRef]

- Owen, D. Editorial Emerging Issues in Sustainability Reporting. Bus. Strategy Environ. 2006, 15, 217–218. [Google Scholar] [CrossRef]

- KPMG. The KPMG Survey of Corporate Responsibility Reporting; KPMG: London, UK, 2013. [Google Scholar]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Wagner, M. The role of corporate sustainability performance for economic performance: A firm-level analysis of moderation effects. Ecol. Econ. 2010, 69, 1553–1560. [Google Scholar] [CrossRef]

- Chang, D.; Kuo, L.L. The Effects of Sustainability Development on Firms’ Financial Performance—An Empirical Approach. Sustain. Dev. 2008, 16, 365–380. [Google Scholar] [CrossRef]

- Konar, S.; Cohen, M.M. Does the market value environmental performance? Rev. Econ. Stat. 2001, 83, 281–289. [Google Scholar] [CrossRef]

- Wagner, M. How to reconcile environmental and economic performance to improve corporate sustainability: Corporate environmental strategies in the European paper industry. J. Environ. Manag. 2005, 76, 105–118. [Google Scholar] [CrossRef]

- Wagner, M.; Schaltegger, S. The Effect of Corporate Environmental Strategy Choice and Environmental Performance on Competitiveness and Economic Performance: An Empirical Study of EU Manufacturing. Eur. Manag. J. 2004, 22, 557–572. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.S. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Rodgers, W.; Choy, H.; Guiral, A. Do Investors Value a Firm’s Commitment to social Activities? J. Bus. Ethics 2013, 113, 607–623. [Google Scholar] [CrossRef]

- Scholtens, B. A note on the interaction between corporate social responsibility and financial performance. Ecol. Econ. 2008, 68, 46–55. [Google Scholar] [CrossRef]

- García-Benau, M.M.; Sierra-Garcia, L.; Zorio, A. Financial crisis impact on sustainability reporting. Manag. Decis. 2013, 51, 1528–1542. [Google Scholar] [CrossRef]

- Kartadjumena, E.; Rodgers, W. Executive Compensation, Sustainability, Climate, Environmental Concerns, and Company Financial Performance: Evidence from Indonesian Commercial Banks. Sustainability 2019, 11, 1673. [Google Scholar] [CrossRef]

- O’Dwyer, B. Managerial perceptions of corporate social disclosure: An Irish story. Account. Audit. Account. J. 2002, 15, 406–436. [Google Scholar] [CrossRef]

- Ballou, B.; Casey, R.J.; Grenier, J.H.; Heitger, D.L. Exploring the strategic integration of sustainability initiatives: Opportunities for accounting research. Account. Horiz. 2012, 26, 265–288. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.M. The Link Between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2007, 84, 78–93. [Google Scholar]

- Schadewitz, H.; Niskala, M. Communication via responsibility reporting and its effect on firm value in Finland. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 96–106. [Google Scholar] [CrossRef]

- Guidry, R.P.; Patten, D.D. Market reactions to the first-time issuance of corporate sustainability reports: Evidence that quality matters. Sustain. Account. Manag. Policy J. 2010, 1, 33–50. [Google Scholar] [CrossRef]

- Berthelot, S.; Coulmont, M.; Serret, V. Do investors value sustainability reports? A Canadian study. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 355–363. [Google Scholar] [CrossRef]

- Richardson, A.J.; Welker, M. Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 2001, 26, 597–616. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. The revisited contribution of environmental reporting to investors’ valuation of a firm’s earnings: An international perspective. Ecol. Econ. 2007, 62, 613–626. [Google Scholar] [CrossRef]

- Shane, P.B.; Spicer, B.B. Market response to environmental information produced outside the firm. Account. Rev. 1983, 58, 521–538. [Google Scholar]

- Spicer, B.B. Investors, corporate social performance and information disclosure: An empirical study. Account. Rev. 1978, 53, 94–111. [Google Scholar]

- Dowell, G.; Hart, S.; Yeung, B. Do Corporate Standards Global Create Environmental or destroy Market Value? Manag. Sci. 2000, 46, 1059–1074. [Google Scholar] [CrossRef]

- Chabowski, B.B.; Mena, J.A.; Gonzalez-Padron, T.T. The structure of sustainability research in marketing, 1958–2008: A basis for future research opportunities. J. Acad. Mark. Sci. 2011, 39, 55–70. [Google Scholar] [CrossRef]

- Cruz, L.L.; Pedrozo, E.Á.; Estivalete, V.; de Fátima Barros Estivalete, V. Towards sustainable development strategies: A complex view following the contribution of Edgar Morin. Manag. Decis. 2006, 44, 871–891. [Google Scholar] [CrossRef]

- Buhr, N. Histories of and Rationales for Sustainability Reporting; Routledge: London, UK, 2007. [Google Scholar]

- Brown, D.D.; Guidry, R.P.; Patten, D.D. Sustainability reporting and perceptions of corporate reputation: An analysis using fortune. Adv. Environ. Account. Manag. 2010, 4, 83–104. [Google Scholar]

- Schaltegger, S.; Burritt, R. Corporate sustainability. In The International Yearbook of Environmental and Resource Economics 2005/2006: A Survey of Current Issues; Edward Elgar Publishing: Cheltenham, UK, 2005. [Google Scholar]

- Khanna, M.; Anton, W.R.Q. Corporate environmental management: Regulatory and market-based incentives. Land Econ. 2002, 78, 539–558. [Google Scholar] [CrossRef]

- Velde, E.; Van de Vermeir, W.; Corten, F. Corporate social responsibility and financial performance. Corp. Gov. 2005, 5, 129–138. [Google Scholar] [CrossRef]

- Greenwald, B.C.; Stiglitz, J.J. Asymmetric Information and the New Theory of the Firm: Financial Constraints and Risk Behavior; National Bureau of Economic Research: Cambridge, MA, USA, 1990. [Google Scholar]

- Cormier, D.; Ledoux, M.-J.; Magnan, M. The informational contribution of social and environmental disclosures for investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.J. Corporate social performance and firm risk: A meta-analytic review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- Kim, O.; Verrecchia, R.R. Market liquidity and volume around earnings announcements. J. Account. Econ. 1994, 17, 41–67. [Google Scholar] [CrossRef]

- Lang, M.; Lundholm, R. Cross-sectional determinants of analyst ratings of corporate disclosures. J. Account. Res. 1993, 31, 246–271. [Google Scholar] [CrossRef]

- Albertini, E. Does Environmental Management Improve Financial Performance? A Meta-Analytical Review. Organ. Environ. 2013, 26, 431–457. [Google Scholar] [CrossRef]

- Reverte, C. Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. J. Bus. Ethics 2009, 88, 351–366. [Google Scholar] [CrossRef]

- Perrini, F.; Vurro, C. Corporate sustainability, intangible assets accumulation and competitive advantage. Symph. Emerg. Issues Manag. 2010, 25–38. [Google Scholar] [CrossRef]

- Freedman, M.; Stagliano, A.A. Differences in social-cost disclosures: A market test of investor reactions. Account. Audit. Account. J. 1991, 4, 68–82. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Barnett, M.M. Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Acad. Manag. Rev. 2007, 32, 794–816. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Ullmann, A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- McGuire, J.J.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar]

- Waddock, S.A.; Graves, S.S. The corporate social performance. Strateg. Manag. J. 1997, 8, 303–319. [Google Scholar] [CrossRef]

- Clarkson, P.P.; Li, Y.; Richardson, G.G.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Becchetti, L.; Di Giacomo, S.; Pinnacchio, D. Corporate social responsibility and corporate performance: Evidence from a panel of US listed companies. Appl. Econ. 2008, 40, 541–567. [Google Scholar] [CrossRef]

- Palmer, K.; Oates, W.E.; Portney, P.P. Tightening environmental standards: The benefit-cost or the no-cost paradigm? J. Econ. Perspect. 1995, 9, 119–132. [Google Scholar] [CrossRef]

- Mahapatra, S. Investor reaction to a corporate social accounting. J. Bus. Financ. Account. 1984, 11, 29–40. [Google Scholar] [CrossRef]

- Jensen, M. Value maximisation, stakeholder theory, and the corporate objective function. Eur. Financ. Manag. 2001, 7, 297–317. [Google Scholar] [CrossRef]

- Rodgers, W.; Housel, T.T. The effects of environmental risk information on auditors’ decisions about prospective financial statements. Eur. Account. Rev. 2004, 13, 523–540. [Google Scholar] [CrossRef]

- Moneva, J.M.; Cuellar, B. The Value Relevance of Financial and Non-Financial Environmental Reporting. Environ. Resour. Econ. 2009, 44, 441–456. [Google Scholar] [CrossRef]

- Shawn, H.; Kim, Y.-W.; Jung, J. Company’s Sustainability and Accounting Conservatism: Firms Delisting from KOSDAQ. Sustainability 2019, 11, 1775. [Google Scholar] [CrossRef]

- O’Dwyer, B. Conceptions of corporate social responsibility: The nature of managerial capture. Account. Audit. Account. J. 2003, 16, 523–557. [Google Scholar] [CrossRef]

- Hassel, L.; Nilsson, H.; Nyquist, S. The value relevance of environmental performance. Eur. Account. Rev. 2005, 14, 41–61. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.W. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.D. The corporate social-financial performance relationship. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- Ilinitch, A.A.; Soderstrom, N.S.; Thomas, T.E. Measuring corporate environmental performance. J. Account. Public Policy 1998, 17, 383–408. [Google Scholar] [CrossRef]

- Diltz, J. Does social screening affect portfolio performance? J. Invest. 1995, 4, 64–69. [Google Scholar] [CrossRef]

- Sauer, D.D. The impact of social-responsibility screens on investments performance: Evidence from Domini 400 Social Index and Domini Equity Mutual Fund. Rev. Financ. Econ. 1997, 6, 137–149. [Google Scholar] [CrossRef]

- Sethi, S.P. A conceptual framework for environmental analysis of social issues and evaluation of business response patterns. Acad. Manag. Rev. 1979, 4, 63–74. [Google Scholar] [CrossRef]

- Manetti, G. The quality of stakeholder engagement in sustainability reporting: Empirical evidence and critical points. Corp. Soc. Responsib. Environ. Manag. 2001, 18, 110–122. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Anton, W.R.Q.; Deltas, G.; Khanna, M. Incentives for environmental self-regulation and implications for environmental performance. J. Environ. Econ. Manag. 2004, 48, 632–654. [Google Scholar] [CrossRef]

- Berthelot, S.; Cormier, D.; Magnan, M. Environmental disclosure research: Review and synthesis. J. Account. Lit. 2003, 22, 1–44. [Google Scholar]

- Frost, G.G. The introduction of mandatory environmental reporting guidelines: Australian evidence. Abacus 2007, 43, 190–216. [Google Scholar] [CrossRef]

- Solomon, A.; Lewis, L. Disincentives for Corporate Environmental Disclosure. Bus. Strategy Environ. 2002, 169, 154–169. [Google Scholar] [CrossRef]

- Gray, R.; Kouhy, R.; Lavers, S. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Account. Audit. Account. J. 1995, 8, 47–77. [Google Scholar] [CrossRef]

- Adams, C.C.; Hill, W.-Y.; Roberts, C.C. Corporate social reporting practices in Western Europe: Legitimating corporate behaviour? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Roberts, R.R. Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef]

- Deegan, C.; Gordon, B. A study of the environmental disclosure practices of Australian corporations. Account. Bus. Res. 1996, 26, 187–199. [Google Scholar] [CrossRef]

- Moneva, J.M.; Llena, F. Environmental disclosures in the annual reports of large companies in Spain. Eur. Account. Rev. 2000, 9, 7–29. [Google Scholar] [CrossRef]

- Gray, R.; Javad, M.; Power, D.M.; Sinclair, C.D. Social and Environmental Disclosure and Corporate Characteristics: A Research Note and Extension. J. Bus. Financ. Account. 2001, 28, 327–356. [Google Scholar] [CrossRef]

- Murray, A.; Sinclair, D.; Power, D.; Gray, R. Do financial markets care about social and environmental disclosure? Further evidence and exploration from the UK. Account. Audit. Account. J. 2006, 19, 228–255. [Google Scholar] [CrossRef]

- Stubbs, W.; Higgins, C.; Milne, M. Why Do Companies Not Produce Sustainability Reports? Bus. Strategy Environ. 2013, 22, 456–470. [Google Scholar] [CrossRef]

- Vormedal, I.; Ruud, A. Sustainability Reporting in Norway—An Assessment of Performance in the Context of Legal Demands and Socio-Political Drivers. Bus. Strategy Environ. 2009, 18, 207–222. [Google Scholar] [CrossRef]

- Cupertino, S.; Consolandi, C.; Vercelli, A. Corporate Social Performance, Financialization, and Real Investment in US Manufacturing Firms. Sustainability 2019, 11, 1836. [Google Scholar] [CrossRef]

- Masocha, R. Does Environmental Sustainability Impact Innovation, Ecological and Social Measures of Firm Performance of SMEs? Evidence from South Africa. Sustainability 2018, 10, 3855. [Google Scholar] [CrossRef]

- Xue, M.; Boadu, F.; Xie, Y. The Penetration of Green Innovation on Firm Performance: Effects of Absorptive Capacity and Managerial Environmental Concern. Sustainability 2019, 11, 2455. [Google Scholar] [CrossRef]

- Rodgers, W. Throughput Modeling: Financial Information Used by Decision Makers; JAI Press: Greenwich, CT, USA, 1997. [Google Scholar]

- Rodgers, W. Process Thinking: Six Pathways to Successful Decision Making; iUniverse: Bloomington, IN, USA, 2006. [Google Scholar]

- Rodgers, W. The influence of conflicting information on novices and loan officers’ actions. J. Econ. Psychol. 1999, 20, 123–145. [Google Scholar] [CrossRef]

- Rodgers, W.; Gago, S. Cultural and ethical effects on managerial decisions: Examined in a throughput model. J. Bus. Ethics 2001, 31, 355–367. [Google Scholar] [CrossRef]

- Rodgers, W.; Guiral, A.; Gonzalo, J.A. Trusting/distrusting auditors’ opinion. Sustainability 2019, 11, 1666. [Google Scholar] [CrossRef]

- Foss, K.; Rodgers, W. Enhancing information usefulness by line managers’ involvement in cross-unit activities. Org. Stud. 2011, 32, 683–703. [Google Scholar] [CrossRef]

- Culbertson, A.; Rodgers, W. Improving Managerial Effectiveness in the Workplace: The Case of Sexual Harassment of Navy Women. J. Appl. Soc. Psychol 1997, 27, 1953–1971. [Google Scholar] [CrossRef]

- O’Shaughnessy, D.B. Tax Compliance Determinants: A Proposed Model for Cross-Country Analysis; University of Texas at El Paso: El Paso, TX, USA, 2014; unpublished dissertation. [Google Scholar]

- Ishaque, M. Cognitive Approach to Understand the Impact of Conflict of Interests on Accounting Professionals’ Decision-Making Behavior; Routledge: London, UK, 2019. [Google Scholar]

- Rodgers, W.; Söderbom, A.; Guiral, A. Corporate Social Responsibility Enhanced Control Systems Reducing the likelihood of fraud. J. Bus. Ethics 2015, 131, 871–882. [Google Scholar]

- Rodgers, W.; McFarlin, T. Decision Making for Personal Investments: Real Estate Financing, Foreclosures and Other Issues; Palgrave Macmillan: New York, NY, USA, 2017. [Google Scholar]

- Rodgers, W. Knowledge Creation: Going Beyond Published Financial Information; Nova Publications: Delhi, India, 2010. [Google Scholar]

- Rogers, W.; Guiral, A.; Gonzalo, J.A. Different pathways that suggest whether auditors’ going concern opinions are ethically based. J. Bus. Ethics 2009, 86, 347–361. [Google Scholar] [CrossRef]

- Rodgers, W. Three primary trust pathways underlying ethical considerations. J. Bus. Ethics 2010, 91, 83–93. [Google Scholar] [CrossRef]

- Rodgers, W. Measurement and reporting of knowledge-based assets. J. Intellect. Cap. 2003, 4, 181–190. [Google Scholar] [CrossRef]

- Pava, M.L.; Krausz, J. The association between corporate social-responsibility and financial performance: The paradox of social cost. J. Bus. Ethics 1996, 15, 321–357. [Google Scholar] [CrossRef]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Kolk, A. Trends in sustainability reporting by the Fortune Global 250. Bus. Strategy Environ. 2003, 12, 279–291. [Google Scholar] [CrossRef]

- Kolk, A.; Walhain, S.; van de Wateringen, S. Environmental Reporting by The Fortune Global 250. Bus. Strategy Environ. 2001, 10, 15–28. [Google Scholar] [CrossRef]

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate sustainability performance and firm performance research: Literature review and future research agenda. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Poolthong, Y.; Mandhachitara, R. Customer expectations of CSR, perceived service quality and brand effect in Thai retail banking. Int. J. Bank Mark. 2009, 27, 408–427. [Google Scholar] [CrossRef]

- Edvinsson, L.; Sullivan, P. Developing a model for managing intellectual capital. Eur. Manag. J. 1996, 14, 356–364. [Google Scholar] [CrossRef]

- Edvinsson, L. Developing intellectual capital at Skandia. Long Range Plan. 1997, 30, 320–373. [Google Scholar] [CrossRef]

- Brooking, A. Intellectual Capital. Core Asset for the Third Millennium Enterprise; International Thomson Business Press: London, UK, 1996. [Google Scholar]

- Kaplan, R.S.; Norton, D.D. Using the balanced scorecard as a strategic management system. Harv. Bus. Rev. 1996, 74, 75–85. [Google Scholar]

- Edvinsson, L.; Malone, M.M. Intellectual Capital: Realizing Your Company’s True Value by Finding Its Hidden Brainpower; Harper Business: New York, NY, USA, 1997. [Google Scholar]

- Sveiby, K.K. The New Organizational Wealth: Managing and Measuring Knowledge-Based Assets; Berrett-Koehler Publishers: San Francisco, CA, USA, 1997. [Google Scholar]

- Grayson, D. Corporate Responsibility, Market Valuation and Measuring the Financial and Non-Financial Performance of the Firm; European Academy of Business in Society (EABIS): Brussels, Belgium, 2009. [Google Scholar]

- Rodgers, W. Problems and resolutions to future knowledge-based assets reporting. J. Intellect. Cap. 2007, 8, 205–215. [Google Scholar] [CrossRef]

- Lev, B. Intangibles: Management, Measurement, and Reporting; Brookings Institution Press: Washington, DC, USA, 2000. [Google Scholar]

- Volkov, D.; Garanina, T. Value Creation in Russian Companies: The Role of Intangible Assets. Electr. J. Knowl. Manag. 2008, 6, 63–74. [Google Scholar]

- Ballow, J.J.; Burgman, R.; Molnar, M.M. Managing for shareholder value: Intangibles, future value and investment decisions. J. Bus. Strategy 2004, 25, 26–34. [Google Scholar] [CrossRef]

- Lev, B.; Daum, J.J. The dominance of intangible assets: Consequences for enterprise management and corporate reporting. Meas. Bus. Excell. 2004, 8, 6–17. [Google Scholar] [CrossRef]

| Author(s) | Sample | Topic Area | Method | Main Contribution | Results | Relation to Throughput Model |

|---|---|---|---|---|---|---|

| García-Benauet et al. [30] | Spanish Stock Market companies (Bolsa de Madrid, Spain), before crisis (2005–2007) and the crisis (2008–2010), companies’ websites, 127 companies. DataStream for financial information (Toronto, CA) | Sustainability reporting | Kolmogorov–Smirnov test, descriptive statistics Mann–Whitney test-rank | The impacts of financial crisis on the reporting of corporate social responsibility and assurance strategies | They found that during the financial crisis there were significant increases of CSR reports, with no significant changes on assurance strategies but number of assured reports increases. | The research follows the analytical pathway as it uses the financial information available to judge and compare the corporate social responsibilities and assurance strategies during the financial crisis, and reaches the decision that the CSR reports and assurance increased during financial crisis. |

| Stubbs et al. [94] | 23 top public listed Australian companies (Sydney, Australia) | Sustainability reporting | Semi-structured interviews | Analyzing the reasons why Australian firms were not issuing sustainability reports | They found a lack of external pressure; the traditional view that the aim of any business is to increase the shareholder wealth; no benefit seen by issuing those reports by the companies; costs outweigh benefits; increase risks by issuing those reports; it is not the business obligation; not enough resources; not mandatory; organization culture and structure do not support issuing those reports. | The research seems to follow the expedient pathway in data collection on managers’ perceptions on whether to issue sustainability reports or not. |

| Rodgers et al. [28] | Data from KLD (Philadelphia, US) from 2000 to 2006. 497 sample observation | Firms commitment to social activities | Partial least squares. | Examining the impact of corporate social activities on a firm’s financial health and market value. | They found that social responsibility activities impacts financial performance even after controlling for innovation. Customer perceptions have positive impacts on both financial and market value, while employee perception only has an impact on financial health and community only affects high innovation firms’ market value. | The research follows the throughput model as they use innovation and CSR (measured only by customers, employees and community) as perception while the current study will use sustainability (environmental, social and economic) to judge investor decisions. |

| Berthelot et al. [37] | 146 companies from Toronto Stock Exchange S&P/TSX Composite Index (Toronto, CA) and Bloomberg database (New York, US) | Sustainability reports | Weighted least square Regression | Impacts of issuing separate sustainability reports on investors’ decisions. | They found that investors positively value sustainability reports in Canada. | The research seems to employ the global perspective pathway as the information was used from the financial reports and the perception on investors’ reaction to stock market on the sustainability reports issued by companies, then they judged and compare and reach to a final decision as investors react to sustainability report more positively than those who don’t issue. |

| Clarkson et al. [65]. | Sample from 1990–2003 for Pulp & Paper, Chemical, Oil & Gas, Metal & Mining. Compustat (Philadelphia, US), US Environmental Protection Agency (Washington, US) | Proactive environmental strategies | Econometric Granger for causality. | Analyzing the factors that move firms to implement proactive environmental strategies and the relationship between environmental strategies and financial performance. | They found that a firm’s positive (negative) changes in financial resources in prior period lead to positive (negative) changes in environmental performance in the future periods, which lead to positive (negative) financial performance. There is a positive relationship between financial performance and environmental performance. | The research is related to analytical pathway, as they use the information financial reports and judge by comparing the proactive environmental strategies to reach a conclusion on the relationship between environmental strategy and financial performance. |

| Artiach et al. [21] | US Firms in DJSI (2002–2006) and non DJSI firms (Troy, US) | The determinates of corporate sustainability performance | Regression model | Factors influencing firm’s to invest in CSP | In terms of size, growth rate and profitability there is significant different between DJSI firms and non-DJSI firms. No significant differences between the samples in terms of leverage and cash resources. | Their research is related to Analytical pathway of the throughput model as they use the information from financial statements to judge the DJSI and Non DJSI in reaching the decision of investment in sustainability activities. |

| Wagner [22] | Compustat (Philadelphia, US), Worldscope Disclosure (Toronto, CA), BankerOne (Toronto, CA) and KLD (Philadelphia, US) from 1992 to 2003. US firms | Corporate sustainability performance | Panel estimation technique | It analyzes the link between corporate sustainability performance and economic performance | The relationship between corporate sustainability and economic performance are moderated by advertising intensity, with no moderating effects for R&D. | The research follows the Global perspective pathway as the information from the financial reports have been used and the perception on advertising and innovation were used to judge if there is relationship between CSP and Economic performance in reaching the final decision. |

| Poolthong and Mandhachitara [118] | Sample from questionnaires of 275 banking customers from Thailand | Corporate social responsibility and customer expectations | PLS | Analyzing how CSR impacts customer perspectives on the service quality and brand moderated by trust in banking sector. | They found that CSR has positive impacts on customers’ views on service quality and brand effect, which are moderated by building trust between customer and banks. Also they found there is direct relationship between CSR and brand effect. | Appears to follow the ruling guide pathway as customers’ perception on CSR in judging the quality and brand effects on the banking sectors, and reach a decision on the relationship between them. |

| Vormedal and Ruud [95] | The 100 largest Norwegian firms 2004 Paper-based reports; firm data provided by DN, a Norwegian newspaper (Oslo, Norway) | Sustainability reporting | Content analysis. | Analyzed the influence of social, political, and regulatory characteristics on the quality of sustainability reporting | They found that 94% of the companies do not follow legal requirements for disclosing environmental and gender equality issues, and that most of companies would not disclose the information about environmental social and economic dimensions. They found only 14% issue sustainability reports, with varying contents. Firm size has no association with the reporting requirements while industry and degree of internationalization have association, with no clear picture for the sector. | Appears to follow the analytical pathway as it uses the information available to judge the quality of sustainability reports and reach a decision on whether the content of those reports cover the legal requirements or not. |

| Moneva and Cuellar [71] | 44 Spanish companies listed in Madrid Stock Exchange (Bolsa de Madrid, Spain) 1996–2004 Annual reports and Compustat Global Data database (Philadelphia, US) | Environmental disclosure | Valuation model, price model regression | Analyzing the value relevance of financial and non-financial environmental information on the firm value. | They found that non-financial environmental information is treated by the market as irrelevant in decision-making while financial environmental information is relevant. Also they found an increase in market value vis. environmental issues after the introduction of obligatory environmental reports in Spain in 2002. | The research seems to follow the analytical pathway as they use information to judge and compare the financial and non-financial environmental issues to reach the final decision on whether market value non-financial environmental information. |

| Chang and Kuo [23] | 2003–2005 SAM (Sustainable Asset Management) (New York, US) Hoover’s Company Record (New Jersey, US) | Sustainable development | Structural equation model (SEM) | The analysis of sustainable development on financial performance | Better sustainability has a positive relationship with profitability in same or later period/sustainable groups. There is reciprocal relationship between them. Profitability has a positive influence on corporate sustainability in lower/higher groups. Sustainability negatively influences lower group profitability. | The research appears to follow the analytical pathway as it use the information available to judge the relationship between sustainability performance and firms’ financial performance, and reach to a decision that there is relationship between them. |

| Velde et al. [49] | Data from Vigeo corporate social scores 2000–2003 (New York, US) | Corporate social responsibility | OLS | Analyzed the interaction between sustainability and financial performance. | They found that high-sustainability portfolios perform better than low-sustainability portfolios. Also they found that investors are willing to pay more for the companies that have good relationship with stakeholders. | The research seems to follow Analytical pathway as it uses financial information to judge and compare on both high and low sustainability portfolios and reaches a decision on a positive relation between financial performance and high sustainability portfolio and negative relation with low sustainability portfolio. |

| Wagner [25] | European paper industry firms from UK, Germany, Italy and Netherlands. Data from financial reports and ER-I (The Hague, Netherlands), TRI (Washington, US) and UK Pollution Inventory From 1995–1997 (Bristol, England) | Corporate environmental strategies | Ordinary Least Square Regression (OLS) | Analyzes the relationship between environmental and economic performance in the paper industry, and the effects of environmental strategies on the relationship between the two. | The author found a positive relationship between environmental and economic performance for the firms that adopt pollution prevention strategies that lead to enhanced sustainability. | The research appears to follow the analytical pathway as it uses the information from annual reports and judging firms that use pollution control and those that don’t to reach the final decision on the relationship between the environmental and economic performance. |

| Rodgers and Housel [70] | 84 senior auditors | Environmental risk information | Regression | Analyzing auditors’ decision making when provided with environmental risk information. | Auditors are focusing on traditional financial information and ignoring environmental information in making their decision. | The research follows the throughput model as the auditors were given information on financial reports and environmental risk to gather their knowledge, then make judgment about those companies and finally decision. However the study uses only environmental risk information, not the overall sustainability issue. Also it focuses on auditors while the existing paper focusing on investors’ decision. |

| Wagner and Schaltegger [26] | Data from EBEB (Brussels, Belgium) and questionnaires to 135 UK and 166 German firms. | Corporate environmental strategy | OLS regression | Researched whether Environmental Shareholder Value strategy impacts the relationship between economic and environmental performance of a firm. | For the firms that have environmental shareholder- oriented strategy, there are positive and significant effects between environmental impact reduction and the four dimensions of competitiveness (market, internally, profitability and risk related). While for the firms not having Environmental Shareholders Value Strategy, no significant influence was found. Also, the choice of strategy has a positive impact on the relationship between environmental and economic performance. | The research follows the analytical pathway as it has used the information available and judged by comparing the firms with environmental shareholders value strategy to those that don’t to reach the final conclusion on relationship between economic and environmental performance of firms. |

| O’Dwyer [73] | Irish companies from Irish stock Exchange (Dublin, Ireland), 29 senior executives. 1997 | Corporate social responsibility | Semi-structured interview | Examining managerial conceptions on the issue of corporate social responsibility. | The author found that managers understand corporate social responsibility as antagonistic to maximizing shareholders’ wealth. Also the constraints on the pressure groups make managers not think about social responsibility broadly. Also, the author concludes that managers find the concept of CSR complex and difficult to apply. | Follows the expedient pathway as it uses managers’ perceptions on the decision of corporate social issues. |

| Solomon and Lewis [86] | Questionnaires to 625 UK organizations and individuals in 1995 | Corporate environmental disclosure | Wilcoxon, Kruskal–Wallis descriptive statistics | Investigated the incentives and disincentives of corporate environmental disclosure for preparers and users | They found a difference in the incentives and disincentives between users and preparers of that information. The preparers (companies) view environmental disclosure much differently than do the users (interested and normative group). | The research follows the expedient pathway as it searches for the perception of corporate environmental disclosure for preparers and users and reaches a decision that there are different incentives and disincentives for prepares and users. |

| O’Dwyer [32] (2002) | 27 Irish public limited companies from major company sectors quoted on the Irish Stock Exchange (Dublin. Ireland) | Corporate social disclosure | Semi structured interview | Analyzes managerial perceptions for the motives to disclose corporate social responsibility reports. | The author found that disclosing CSR raises more doubts about environmental issues that are sensitive to external pressure, and some companies decide to quit issuing such reports. Also found negative perception generates extreme pressure from interested groups and causes confusion for managers. They also find some managers have Positive perception to the corporate social responsibility disclosure like symbolic, protect from ant damage and educate citizens about the company. | The research follows the expedient pathway as it uses the managers’ perception to reach a decision on whether to disclose the CSR reports or not. |

| Richardson and Welker [38] | Canadian firms, 1990-1992. Data from SMAC/UQAM (Toronto, CA), Statscan (Ottawa CA), I/B/E/S (Toronto, CA), Datastream (Toronto, CA), Compustat (Philadelphia, US). | Social and financial disclosure | Regression | Analysis of the relationship of financial and social disclosure on the cost of equity capital. | They found that financial disclosure has negative relationship with cost of equity capital, while social disclosure has a positive relationship with the cost of equity capital. | The research is related to follow the Analytical pathway as it uses information available and judges by comparing financial and social disclosure to reach a decision on whether there is positive or negative relationship with the cost of equity capital. |

| Dowell et al. [42] (2000) | Sample from U.S. Standard and Poor’s 500 from 1994–1997 (New York, US.) Investors Responsibility Research Center (IRRC) (New York, US) Compustat (Philadelphia, US), and Wordscope (Toronto, CA) | Corporate Global environmental. | Multiple Regression | Analyzed the impact of stringent environmental standards on market value for MNEs firms | They found that MNEs that have stringent environmental standard have more market value than those firms that follow poor environmental standards. They found an insignificant relationship for lagged effects between the environmental standards and market value. | The research follows the Analytical pathway as it uses the available information to compare the firms with stringent environmental standards and those that they don’t to reach on the decision on whether the investors value those information. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodgers, W.; Al Habsi, M.; Gamble, G. Sustainability and Firm Performance: A Review and Analysis Using Algorithmic Pathways in the Throughput Model. Sustainability 2019, 11, 3783. https://doi.org/10.3390/su11143783

Rodgers W, Al Habsi M, Gamble G. Sustainability and Firm Performance: A Review and Analysis Using Algorithmic Pathways in the Throughput Model. Sustainability. 2019; 11(14):3783. https://doi.org/10.3390/su11143783

Chicago/Turabian StyleRodgers, Waymond, Mouza Al Habsi, and George Gamble. 2019. "Sustainability and Firm Performance: A Review and Analysis Using Algorithmic Pathways in the Throughput Model" Sustainability 11, no. 14: 3783. https://doi.org/10.3390/su11143783

APA StyleRodgers, W., Al Habsi, M., & Gamble, G. (2019). Sustainability and Firm Performance: A Review and Analysis Using Algorithmic Pathways in the Throughput Model. Sustainability, 11(14), 3783. https://doi.org/10.3390/su11143783