In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union?

Abstract

1. Introduction

2. Theoretical Background

2.1. The Deficiencies of Current Direct Payments Financial Mechanism

2.2. Current Political Framework

3. Methodology

- -

- Costs for 1 ha of potentially eligible area (PEA).

- -

- Costs for 1 EUR of agricultural production.

4. Calculation of Direct Payments Values According Production and Cost Ratio Based on the Eurostat

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

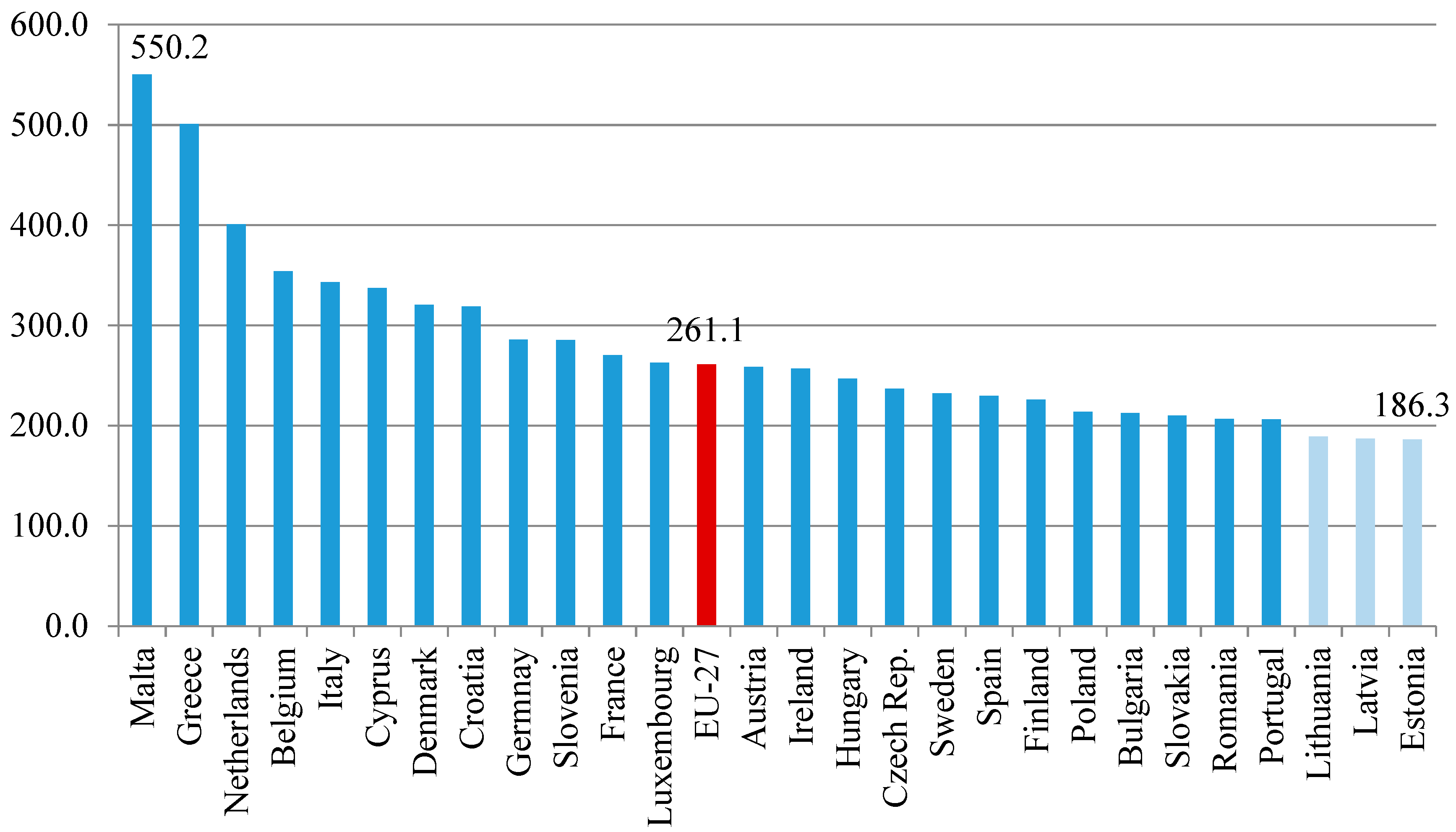

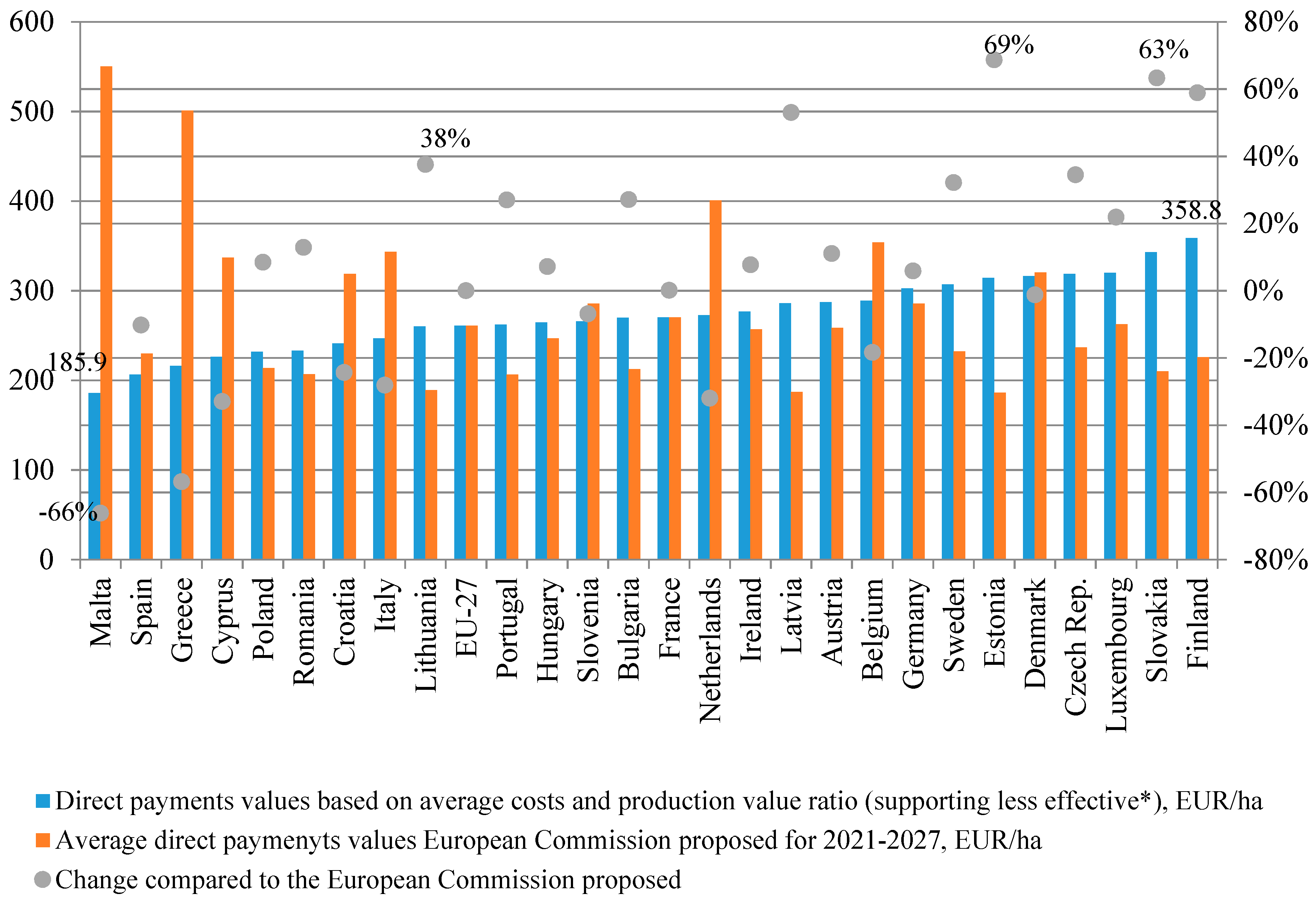

| MS | MFF 2014–2020 | After BREXIT | MFF 2021–2027 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DIRECT PAYMENTS Envelope (2013-2019 cal. Year/2014–2020 fin. year), EUR | DIRECT PAYMENTS Envelope (2014-2020 cal. Year), EUR (2020 after BREXIT) | Potentially Eligible Area of 2016, ha | 2020 cal. Year R1307/2013 | 2020 cal. Year | 2021 cal. Year | 2022 cal. Year | 2023 cal. Year | 2024 cal. Year | 2025 cal. Year | 2026 cal. Year | 2027 cal. Year | ||||||||||

| 2021 fin. Year | 2022 fin. Year | 2023 fin. Year | 2024 fin. Year | 2025 fin. Year. | 2026 fin. Year | 2027 Fin. Year | 2028 fin. Year | ||||||||||||||

| Initial Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | Envelope | DP | ||||

| Belgium | 3.762.256.000 | 3.632.012.153 | 1.371.833 | 505.266.000 | 368 | 485.611.153 | 354 | 485.603.954 | 354 | 485.603.954 | 354 | 485.603.954 | 354 | 485.603.954 | 354 | 485.603.954 | 354 | 485.603.954 | 354 | 485.603.954 | 354 |

| Bulgaria | 5.120.167.000 | 5.305.396.241 | 3.721.524 | 796.292.000 | 214 | 765.236.612 | 206 | 773.771.955 | 208 | 782.239.005 | 210 | 790.706.055 | 212 | 799.173.104 | 215 | 807.640.154 | 217 | 816.107.204 | 219 | 816.107.204 | 219 |

| Czech Rep. | 6.151.231.000 | 6.080.774.730 | 3.541.284 | 872.809.000 | 246 | 838.769.449 | 237 | 838.844.295 | 237 | 838.844.295 | 237 | 838.844.295 | 237 | 838.844.295 | 237 | 838.844.295 | 237 | 838.844.295 | 237 | 838.844.295 | 237 |

| Denmark | 6.465.778.000 | 6.262.913.062 | 2.641.779 | 880.384.000 | 333 | 846.049.024 | 320 | 846.124.520 | 320 | 846.124.520 | 320 | 846.124.520 | 320 | 846.124.520 | 320 | 846.124.520 | 320 | 846.124.520 | 320 | 846.124.520 | 320 |

| Germany | 36.428.171.000 | 35.398.442.435 | 16.883.150 | 5.018.395.000 | 297 | 4.822.677.595 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 | 4.823.107.939 | 286 |

| Estonia | 939.059.000 | 1.000.671.663 | 953.576 | 169.366.000 | 178 | 162.760.726 | 171 | 167.721.513 | 176 | 172.667.776 | 181 | 177.614.039 | 186 | 182.560.302 | 191 | 187.506.565 | 197 | 192.452.828 | 202 | 192.452.828 | 202 |

| Ireland | 8.620.336.000 | 8.443.422.533 | 4.530.347 | 1.211.066.000 | 267 | 1.163.834.426 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 | 1.163.938.279 | 257 |

| Greece | 14.225.347.000 | 13.880.245.815 | 3.708.742 | 1.947.177.000 | 525 | 1.871.237.097 | 505 | 1.856.028.894 | 500 | 1.856.028.894 | 500 | 1.856.028.894 | 500 | 1.856.028.894 | 500 | 1.856.028.894 | 500 | 1.856.028.894 | 500 | 1.856.028.894 | 500 |

| Spain | 34.307.578.000 | 33.871.212.456 | 20.558.328 | 4.893.433.000 | 238 | 4.702.589.113 | 229 | 4.710.171.703 | 229 | 4.717.333.830 | 229 | 4.724.495.957 | 230 | 4.731.658.084 | 230 | 4.738.820.212 | 231 | 4.745.982.339 | 231 | 4.745.982.339 | 231 |

| France | 53.570.747.000 | 52.197.403.920 | 26.465.861 | 7.437.200.000 | 281 | 7.147.149.200 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 | 7.147.786.964 | 270 |

| Croatia | 1.065.058.000 | 1.316.001.210 | 1.090.260 | 261.100.000 | 239 | 250.917.100 | 230 | 344.340.000 | 316 | 367.711.409 | 337 | 367.711.409 | 337 | 367.711.409 | 337 | 367.711.409 | 337 | 367.711.409 | 337 | 367.711.409 | 337 |

| Italy | 27.332.076.000 | 26.522.290.291 | 10.371.911 | 3.704.337.000 | 357 | 3.559.867.857 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 | 3.560.185.516 | 343 |

| Cyprus | 353.316.000 | 346.567.787 | 138.683 | 48.643.000 | 351 | 46.745.923 | 337 | 46.750.094 | 337 | 46.750.094 | 337 | 46.750.094 | 337 | 46.750.094 | 337 | 46.750.094 | 337 | 46.750.094 | 337 | 46.750.094 | 337 |

| Latvia | 1.561.038.000 | 1.705.535.869 | 1.695.273 | 302.754.000 | 179 | 290.946.594 | 172 | 299.633.591 | 177 | 308.294.625 | 182 | 316.955.660 | 187 | 325.616.694 | 192 | 334.277.729 | 197 | 342.938.763 | 202 | 342.938.763 | 202 |

| Lithuania | 3.109.882.000 | 3.226.688.611 | 2.849.827 | 517.028.000 | 181 | 496.863.908 | 174 | 510.820.241 | 179 | 524.732.238 | 184 | 538.644.234 | 189 | 552.556.230 | 194 | 566.468.227 | 199 | 580.380.223 | 204 | 580.380.223 | 204 |

| Luxembourg | 238.270.000 | 233.316.534 | 122.377 | 33.431.000 | 273 | 32.127.191 | 263 | 32.131.019 | 263 | 32.131.019 | 263 | 32.131.019 | 263 | 32.131.019 | 263 | 32.131.019 | 263 | 32.131.019 | 263 | 32.131.019 | 263 |

| Hungary | 8.941.281.000 | 8.842.093.754 | 4.942.768 | 1.269.158.000 | 257 | 1.219.660.838 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 | 1.219.769.672 | 247 |

| Malta | 34.874.000 | 34.278.598 | 8.192 | 4.689.000 | 572 | 4.506.129 | 550 | 4.507.492 | 550 | 4.507.492 | 550 | 4.507.492 | 550 | 4.507.492 | 550 | 4.507.492 | 550 | 4.507.492 | 550 | 4.507.492 | 550 |

| Netherlands | 5.472.573.000 | 5.278.702.807 | 1.756.408 | 732.370.000 | 417 | 703.807.570 | 401 | 703.870.373 | 401 | 703.870.373 | 401 | 703.870.373 | 401 | 703.870.373 | 401 | 703.870.373 | 401 | 703.870.373 | 401 | 703.870.373 | 401 |

| Austria | 4.906.046.000 | 4.819.269.392 | 2.571.981 | 691.738.000 | 269 | 664.760.218 | 258 | 664.819.537 | 258 | 664.819.537 | 258 | 664.819.537 | 258 | 664.819.537 | 258 | 664.819.537 | 258 | 664.819.537 | 258 | 664.819.537 | 258 |

| Poland | 21.130.986.000 | 21.028.892.950 | 14.207.400 | 3.061.518.000 | 215 | 2.942.118.798 | 207 | 2.972.977.807 | 209 | 3.003.574.280 | 211 | 3.034.170.753 | 214 | 3.064.767.227 | 216 | 3.095.363.700 | 218 | 3.125.960.174 | 220 | 3.125.960.174 | 220 |

| Portugal | 4.075.517.000 | 4.045.595.091 | 2.916.806 | 599.355.000 | 205 | 575.980.155 | 197 | 584.650.144 | 200 | 593.268.733 | 203 | 601.887.323 | 206 | 610.505.913 | 209 | 619.124.503 | 212 | 627.743.093 | 215 | 627.743.093 | 215 |

| Romania | 11.755.149.000 | 12.319.837.715 | 9.245.118 | 1.903.195.000 | 206 | 1.828.970.395 | 198 | 1.856.172.601 | 201 | 1.883.211.603 | 204 | 1.910.250.604 | 207 | 1.937.289.605 | 210 | 1.964.328.606 | 212 | 1.991.367.607 | 215 | 1.991.367.607 | 215 |

| Slovenia | 963.622.000 | 948.440.586 | 452.193 | 134.278.000 | 297 | 129.041.158 | 285 | 129.052.673 | 285 | 129.052.673 | 285 | 129.052.673 | 285 | 129.052.673 | 285 | 129.052.673 | 285 | 129.052.673 | 285 | 129.052.673 | 285 |

| Slovakia | 2.702.556.000 | 2.693.423.424 | 1.872.808 | 394.385.000 | 211 | 379.003.985 | 202 | 383.806.378 | 205 | 388.574.951 | 207 | 393.343.524 | 210 | 398.112.097 | 213 | 402.880.670 | 215 | 407.649.243 | 218 | 407.649.243 | 218 |

| Finland | 3.712.736.000 | 3.646.410.854 | 2.256.444 | 524.631.000 | 233 | 504.170.391 | 223 | 505.999.667 | 224 | 507.783.955 | 225 | 509.568.242 | 226 | 511.352.530 | 227 | 513.136.817 | 227 | 514.921.104 | 228 | 514.921.104 | 228 |

| Sweden | 4.957.747.000 | 4.859.388.025 | 2.898.642 | 699.768.000 | 241 | 672.477.048 | 232 | 672.760.909 | 232 | 672.984.762 | 232 | 673.208.615 | 232 | 673.432.468 | 232 | 673.656.321 | 232 | 673.880.175 | 232 | 673.880.175 | 232 |

| EU-27 | 271.903.397.000 | 267.939.228.503 | 143.773.515 | 38.613.766.000 | 269 | 37.107.879.653 | 258 | 37.305.347.730 | 259 | 37.444.898.388 | 260 | 37.561.077.636 | 261 | 37.677.256.884 | 262 | 37.793.436.134 | 263 | 37.909.615.383 | 264 | 37.909.615.383 | 264 |

| Country | Output/Input | Output | Input | |||||

|---|---|---|---|---|---|---|---|---|

| Output of the Agricultural ‘Industry’ | Total Intermediate Consumption | Fixed Capital Consumption | Compensation of Employees | Rents and other real Estate Rental Charges to be Paid | Interest Paid | Interest Received | ||

| Finland | 0.832 | 4419.2 | 3230.6 | 1145.0 | 625.3 | 217.4 | 94.7 | 0.0 |

| Slovakia | 0.870 | 2314.5 | 1747.4 | 255.2 | 547.1 | 71.1 | 43.2 | 4.2 |

| Luxembourg | 0.933 | 424.5 | 313.4 | 97.0 | 25.0 | 17.9 | 1.9 | 0.0 |

| Czech Republic | 0.937 | 4868.5 | 3336.1 | 623.2 | 983.8 | 227.3 | 47.6 | 20.8 |

| Denmark | 0.943 | 10396.8 | 7859.1 | 1353.4 | 1043.3 | 491.9 | 382.5 | 110.8 |

| Estonia | 0.950 | 861.7 | 604.2 | 119.5 | 132.0 | 32.6 | 19.7 | 0.9 |

| Sweden | 0.972 | 6108.4 | 4377.9 | 1063.3 | 352.7 | 307.9 | 232.7 | 52.2 |

| Germany | 0.987 | 54839.8 | 37270.7 | 9330.3 | 5003.9 | 2915.3 | 1118.8 | 68.0 |

| Belgium | 1.033 | 8109.7 | 5879.0 | 799.0 | 642.3 | 231.9 | 298.2 | 0.0 |

| Austria | 1.040 | 6851.7 | 4171.9 | 1842.0 | 405.4 | 201.5 | 57.2 | 87.8 |

| Latvia | 1.043 | 1355.6 | 1012.0 | 114.9 | 142.0 | 23.1 | 9.0 | 1.6 |

| Ireland | 1.079 | 7370.2 | 5081.5 | 793.5 | 497.5 | 215.0 | 245.9 | 0.0 |

| Netherlands | 1.095 | 26954.8 | 16843.4 | 3712.8 | 2405.7 | 646.6 | 1148.8 | 132.0 |

| France | 1.104 | 73645.7 | 45015.4 | 10518.5 | 7753.9 | 2670.8 | 783.4 | 24.8 |

| Bulgaria | 1.105 | 4112.9 | 2403.3 | 401.5 | 399.8 | 492.0 | 35.4 | 11.0 |

| Slovenia | 1.123 | 1241.9 | 743.9 | 258.1 | 78.1 | 19.9 | 6.4 | 0.7 |

| Hungary | 1.128 | 8096.0 | 4785.5 | 926.8 | 1123.5 | 332.9 | 21.8 | 15.6 |

| Portugal | 1.139 | 6959.9 | 4395.8 | 735.1 | 815.1 | 47.3 | 125.1 | 8.0 |

| Lithuania | 1.148 | 2870.8 | 1824.0 | 289.7 | 309.6 | 70.2 | 8.0 | 0.3 |

| Italy | 1.209 | 54521.9 | 23302.5 | 11996.4 | 7312.2 | 1492.6 | 975.3 | 0.0 |

| Croatia | 1.237 | 2105.0 | 1225.1 | 309.5 | 112.9 | 40.0 | 25.0 | 11.3 |

| Romania | 1.280 | 15893.3 | 9175.8 | 2525.4 | 480.0 | 158.1 | 90.3 | 9.3 |

| Poland | 1.288 | 22606.6 | 14410.9 | 1651.3 | 1146.5 | 56.4 | 310.0 | 25.5 |

| Cyprus | 1.321 | 677.5 | 394.3 | 16.4 | 84.9 | 9.7 | 7.9 | 0.0 |

| Greece | 1.380 | 10632.4 | 5247.8 | 1248.0 | 579.5 | 486.0 | 143.0 | 0.0 |

| Spain | 1.447 | 45908.9 | 21099.8 | 5155.9 | 4001.1 | 1020.6 | 455.7 | 0.0 |

| Malta | 1.606 | 127.3 | 66.9 | 7.1 | 4.1 | 0.6 | 0.6 | 0.0 |

References

- Annoni, P.; Weziak-Bialowolska, D. A measure to target antipoverty policies in the European Union regions. Appl. Res. Qual. Life 2016, 11, 181–207. [Google Scholar] [CrossRef] [PubMed]

- Dall’Erba, S.; Fang, F. Meta-analysis of the impact of European Union Structural Funds on regional growth. Reg. Stud. 2017, 51, 822–832. [Google Scholar] [CrossRef]

- European Commission. Agriculture in the European Union and the Member States—Statistical Factsheets 2017. Available online: https://ec.europa.eu/agriculture/statistics/factsheets_en (accessed on 9 May 2019).

- Trondal, J.; Gänzle, S.; Leruth, B. Differentiated Integration and Disintegration in the European Union: State-of-the-Art and Ways for Future Research; University of Agder: Kristiansand, Norway, 2017. [Google Scholar]

- Breidenbach, P.; Mitze, T.; Schmidt, C.M. Eu Structural Funds and Regional Income Convergence: A Sobering Experience; Ruhr Economic Papers, No. 608; Rheinisch-Westfälisches Institut für Wirtschaftsforschung (RWI): Essen, Germany, 2016. [Google Scholar]

- Tocco, B.; Davidova, S.; Bailey, A. The Impact of CAP Payments on the Exodus of Labour from Agriculture in Selected EU Member States; Factor Markets, Centre for European Policy Studies: Brussels, Belgium, 2013. [Google Scholar]

- Gorton, M.; Douarin, E.; Davidova, S.; Latruffe, L. Attitudes to agricultural policy and farming futures in the context of the 2003 CAP reform: A comparison of farmers in selected established and new Member States. J. Rural Stud. 2008, 24, 322–336. [Google Scholar] [CrossRef]

- Csaba, L. Crisis in Economics: Studies in European Political Economy; Akadémiai kiadó: Budapest, Hungary, 2009. [Google Scholar]

- Macartney, H. Variegated Neoliberalism: Eu Varieties of Capitalism and International Political Economy; Routledge: New York, NY, USA, 2010; 208p. [Google Scholar]

- Diaz del Hoyo, J.L.; Dorrucci, E.; Heinz, F.F.; Muzikarova, S. Real Convergence in the Euro Area: A Long-Term Perspective; ECB Occasional Paper, No. 203; European Central Bank (ECB): Frankfurt, German, 2017. [Google Scholar]

- Barrett, G. European economic governance: Deficient in democratic legitimacy? J. Eur. Integr. 2018, 40, 249–264. [Google Scholar] [CrossRef]

- Quiroga, S.; Suárez, C.; Fernández-Haddad, Z.; Philippidis, G. Levelling the playing field for European Union agriculture: Does the Common Agricultural Policy impact homogeneously on farm productivity and efficiency? Land Use Policy 2017, 68, 179–188. [Google Scholar] [CrossRef]

- European Commission. Income Support Explained Overview of Direct Payments for Farmers 2017. Available online: https://ec.europa.eu/info/food-farming-fisheries/key-policies/common-agricultural-policy/income-support/income-support-explained (accessed on 3 April 2019).

- Coleman, W.D.; Grant, W.P. Policy convergence and policy feedback: Agricultural finance policies in a globalizing era. Eur. J. Political Res. 1998, 34, 225–247. [Google Scholar] [CrossRef]

- Hansen, H.; Teuber, R. Assessing the impacts of EU’s common agricultural policy on regional convergence: Sub-national evidence from Germany. Appl. Econ. 2011, 43, 3755–3765. [Google Scholar] [CrossRef]

- Pálné Kovács, I. Cohesion Policy in Central and Eastern Europe: The Challenge of Learning. In Handbook on Cohesion Policy in the EU; Piattoni, S., Polverari, L., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 302–322. [Google Scholar]

- Muravska, T.; Aprāns, J.; Dahs, A. Cohesion policy in the sparsely populated countries. In Handbook on Cohesion Policy in the EU; Piattoni, S., Polverari, L., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 285–301. [Google Scholar]

- Czyżewski, B.; Matuszczak, A.; Miśkiewicz, R. Public goods versus the farm price-cost squeeze: shaping the sustainability of the EU’s common agricultural policy. Technol. Econ. Dev. Eco. 2019, 25, 82–102. [Google Scholar] [CrossRef]

- Boulanger, P.; Philippidis, G. The EU budget battle: Assessing the trade and welfare impacts of CAP budgetary reform. Food Policy 2015, 51, 119–130. [Google Scholar] [CrossRef]

- Papadopoulos, A.G. The impact of the CAP on agriculture and rural areas of EU member states. Agrar. South J. Political Econ. 2015, 4, 22–53. [Google Scholar] [CrossRef]

- Pellegrini, G.; Terribile, F.; Tarola, O.; Muccigrosso, T.; Busillo, F. Measuring the effects of European Regional Policy on economic growth: A regression discontinuity approach. Pap. Reg. Sci. 2013, 92, 217–233. [Google Scholar] [CrossRef]

- Gagliardi, L.; Percoco, M. The impact of European Cohesion Policy in urban and rural regions. Reg. Stud. 2017, 51, 857–868. [Google Scholar] [CrossRef]

- Barwise, A.; Juhn, Y.J.; Wi, C.I.; Novotny, P.; Jaramillo, C.; Gajic, O.; Wilson, M.E. An Individual Housing-Based Socioeconomic Status Measure Predicts Advance Care Planning and Nursing Home Utilization. Am. J. Hosp. Palliat. Med. 2018, 36. [Google Scholar] [CrossRef] [PubMed]

- Wójcik, P. Was Poland the next Spain? Parallel analysis of regional convergence patterns after accession to the European Union. Equilib. Q. J. Econ. Econ. Policy 2017, 12, 593–611. [Google Scholar] [CrossRef]

- Becker, S.O.; Egger, P.H.; von Ehrlich, M. Effects of EU Regional Policy: 1989–2013. Reg. Sci. Urban Econ. 2018, 69, 143–152. [Google Scholar] [CrossRef]

- Muscio, A.; Reid, A.; Rivera Leon, L. An empirical test of the regional innovation paradox: Can smart specialisation overcome the paradox in Central and Eastern Europe? J. Econ. Policy Reform 2015, 18, 153–171. [Google Scholar] [CrossRef]

- Baráth, L.; Fertő, I. Productivity and convergence in European agriculture. J. Agric. Econ. 2017, 68, 228–248. [Google Scholar] [CrossRef]

- Poznańska, J.; Poznański, K. Comparison of patterns of convergence among “emerging markets” of Central Europe, Eastern Europe and Central Asia. Comp. Econ. Res. 2015, 18, 5–23. [Google Scholar] [CrossRef][Green Version]

- Gaynor, K.B.; Karakitsos, E. Economic Convergence in a Multispeed Europe; Springer: New York, NY, USA, 2016. [Google Scholar]

- Iammarino, S.; Rodriguez-Pose, A.; Storper, M. Regional inequality in Europe: Evidence, theory and policy implications. J. Econ. Geogr. 2018, 19, 273–298. [Google Scholar] [CrossRef]

- Staehr, K. Economic growth and convergence in the baltic states: Caught in a middle-income trap? Intereconomics 2015, 50, 274–280. [Google Scholar] [CrossRef]

- Feher, A.; Goșa, V.; Raicov, M.; Haranguș, D.; Condea, B.V. Convergence of Romanian and Europe Union agriculture–evolution and prospective assessment. Land Use Policy 2017, 67, 670–678. [Google Scholar] [CrossRef]

- Läpple, D.; Renwick, A.; Thorne, F. Measuring and understanding the drivers of agricultural innovation: Evidence from Ireland. Food Policy 2015, 51, 1–8. [Google Scholar] [CrossRef]

- Galluzzo, N. The Common Agricultural Policy and employment opportunities in Romanian rural areas: The role of agritourism. Bulg. J. Agric. Sci. 2017, 23, 14–21. [Google Scholar]

- Volkov, A.; Balezentis, T.; Morkunas, M.; Streimikiene, D. Who Benefits from CAP? The Way the Direct Payments System Impacts Socioeconomic Sustainability of Small Farms. Sustainability 2019, 11, 2112. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, D.A.; Espinosa, M. The impact of the 2013 CAP reform on the decoupled payments’ capitalisation into land values. J. Agric. Econ. 2018, 69, 306–337. [Google Scholar] [CrossRef]

- Greer, A. Post-exceptional politics in agriculture: An examination of the 2013 CAP reform. J. Eur. Public Policy 2017, 24, 1585–1603. [Google Scholar] [CrossRef]

- Kijek, A.; Kijek, T.; Nowak, A.; Skrzypek, A. Productivity and its convergence in agriculture in new and old European Union member states. Agric. Econ. 2019, 65, 1–9. [Google Scholar] [CrossRef]

- Severini, S.; Biagini, L.; Finger, R. Modeling agricultural risk management policies–The implementation of the Income Stabilization Tool in Italy. J. Policy Model. 2019, 41, 140–155. [Google Scholar] [CrossRef]

- Trestini, S.; Giampietri, E.; Boatto, V. Toward the implementation of the Income Stabilization Tool: An analysis of factors affecting the probability of farm income losses in Italy. New Medit 2017, 16, 24–30. [Google Scholar]

- European Commission. Agriculture Statistics—Family Farming in the EU 2017. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Agriculture_statistics_-_family_farming_in_the_EU (accessed on 11 May 2019).

- Henke, R.; Severini, S.; Sorrentino, A. From the Fischler reform to the future CAP. In The Common Agricultural Policy after the Fischler Reform: National Implementations, Impact Assessment and the Agenda for Future Reforms; Routledge: New York, NY, USA, 2011; 544p. [Google Scholar]

- Vera, A.C.; Colmenero, A.G. Evaluation of risk management tools for stabilising farm income under CAP 2014–2020. Econ. Agrar. Y Recur. Nat. 2017, 17, 3–23. [Google Scholar]

- European Commission. Annual EU Budget 2019. Available online: https://ec.europa.eu/info/about-european-commission/eu-budget/documents/annual-budget/2019_en (accessed on 27 April 2019).

- Latruffe, L.; Davidova, S.; Douarin, E.; Gorton, M. Farm expansion in Lithuania after accession to the EU: The role of CAP payments in alleviating potential credit constraints. Eur. Asia Stud. 2010, 62, 351–365. [Google Scholar] [CrossRef]

- Hartmann, M.; Frohberg, K. Baltic Agricultural Competitiveness and Prospects under European Union Accession. In Agriculture and East-West European Integration; Hartell, J.G., Swinnen, J.F.M., Eds.; Routledge: London, UK, 2017; pp. 33–64. [Google Scholar]

- European Commission. CAP Post-2013: Key Graphs & Figures: Share of Direct Payments and Total Subsidies in Agricultural Factor Income; DG Agriculture and Rural Development, Agricultural Policy Analysis and Perspectives Unit: Brussels, Belgium, 2017. [Google Scholar]

- Zekić, S.; Matkovski, B. New CAP reform and Serbian agriculture. In Proceedings of the Sustainable Agriculture and Rural Development in Terms of the Republic of Serbia Strategic Goals Realization within the Danube Region, Rural Development and (UN) Limited Resources, Belgrade, MT, USA, 5–6 June 2014. [Google Scholar]

- Sinabell, F.; Schmid, E.; Hofreither, M.F. Exploring the distribution of direct payments of the Common Agricultural Policy. Empirica 2013, 40, 325–341. [Google Scholar] [CrossRef]

- European Council. Cover Note Conclusions (Multiannual Financial Framework). 2013. Available online: http://data.consilium.europa.eu/doc/document/ST-37-2013-INIT/en/pdf (accessed on 12 May 2019).

- Matthews, A. The CAP in the 2021–2027 MFF Negotiations. Intereconomics 2018, 53, 306–311. [Google Scholar] [CrossRef]

- European Parliament. Research for AGRI Committee–CAP Reform post-2020–Challenges in Agriculture. Study 2016. Available online: http://www.europarl.europa.eu/RegData/etudes/STUD/2016/585898/IPOL_STU(2016)585898_EN.pdf (accessed on 15 June 2019).

- European Commission. EU Budget: Commission Proposes a Modern Budget for a Union that Protects, Empowers and Defends. Press Release. Available online: http://europa.eu/rapid/press-release_IP-18-3570_en.htm (accessed on 12 February 2019).

- European Commission CAP Explained Direct Payments for Farmers 2015–2020. Available online: https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/direct-payments-schemes_en.pdf (accessed on 11 June 2019).

- Tamm, T. Estonia asks for Uniform Direct Payments to EU Farmers. Press Release of Minister of Rural Affairs of Estonia. 2018. Available online: https://news.err.ee/691191/estonia-asks-for-uniform-direct-payments-to-eu-farmers (accessed on 14 June 2019).

- De Lauwere, C.; Malak-Rawlikowska, A.; Stalgiene, A.; Klopcic, M.; Kuipers, A. Entrepreneurship and Competencies of Dairy Farmers in Lithuania, Poland and Slovenia. Transform. Bus. Econ. 2018, 17, 237–257. [Google Scholar]

- European Commission. EU Budget: The Common Agricultural Policy beyond 2020 Press Release. Available online: http://europa.eu/rapid/press-release_MEMO-18-3974_en.htm (accessed on 11 January 2019).

- Debertin, D.L. Agricultural Production Economics. In Agricultural Economics Textbook Gallery, 3rd ed.; University of Kentucky: Lexington, KY, USA, 2014. [Google Scholar]

- Matthews, A. Does Capping Direct Payments Make Sense. In CAP Reform. Eu. 2017. Available online: http://capreform.eu/does-capping-direct-payments-make-sense/ (accessed on 02 June 2019).

- Nas, T.F. Cost-Benefit Analysis: Theory and Application, 2nd ed.; Lexington Books: London, UK, 2016; p. 252. [Google Scholar]

- Buller, H.; Wilson, G.A.; Holl, A. Agri-Environmental Policy in the European Union; Routledge: London, UK, 2017. [Google Scholar]

- Posner, R.A. Theories of Economic Regulation. NBER Working Paper. 1974. Available online: https://www.nber.org/papers/w0041.pdf (accessed on 15 June 2019).

- Hall, B.F.; LeVeen, E.P. Farm size and economic efficiency: The case of California. Am. J. Agric. Econ. 1978, 60, 589–600. [Google Scholar] [CrossRef]

- Chavas, J.P.; Aliber, M. An analysis of economic efficiency in agriculture: A nonparametric approach. J. Agric. Resour. Econ. 1993, 18, 1–16. [Google Scholar]

- Álvarez, A.; del Corral, J.; Solís, D.; Pérez, J.A. Does intensification improve the economic efficiency of dairy farms? J. Dairy Sci. 2008, 91, 3693–3698. [Google Scholar] [CrossRef]

- Sharma, S.K. Domestic Support Under Agreement on Agriculture. In The WTO and Food Security; Springer: Singapore, 2016; pp. 15–26. [Google Scholar]

- Grant, W. The Common Agricultural Policy; Macmillan International Higher Education: London, UK, 1997; 256p. [Google Scholar]

- Morkūnas, M.; Volkov, A.; Pazienza, P. How resistant is the agricultural sector? Economic resilience exploited. Econ. Sociol. 2018, 11, 321–332. [Google Scholar] [CrossRef]

- Pandey, B.; Bandyopadhyay, P.; Kadam, S.; Singh, M. Bibliometric study on relationship of agricultural credit with farmer distress. Manag. Environ. Qual. 2018, 29, 278–288. [Google Scholar] [CrossRef]

| Total Production Costs (Intermediate Consumption) (I) | External Factors (II) | Depreciation (III) |

|---|---|---|

| Seeds and seedlings | Compensation of employees Rents and other real estate rental charges to be paid Interests paid and received | Equipment Buildings Plantations Others |

| Electricity | ||

| Gas | ||

| Other fuels and propellant | ||

| Other energy sources | ||

| Fertilizers | ||

| Plant protection products | ||

| Veterinary costs | ||

| Feed for animals | ||

| Building maintenance costs | ||

| Equipment/material maintenance costs | ||

| Financial intermediation services, indirectly measured | ||

| Other operating costs |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Volkov, A.; Balezentis, T.; Morkunas, M.; Streimikiene, D. In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union? Sustainability 2019, 11, 3462. https://doi.org/10.3390/su11123462

Volkov A, Balezentis T, Morkunas M, Streimikiene D. In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union? Sustainability. 2019; 11(12):3462. https://doi.org/10.3390/su11123462

Chicago/Turabian StyleVolkov, Artiom, Tomas Balezentis, Mangirdas Morkunas, and Dalia Streimikiene. 2019. "In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union?" Sustainability 11, no. 12: 3462. https://doi.org/10.3390/su11123462

APA StyleVolkov, A., Balezentis, T., Morkunas, M., & Streimikiene, D. (2019). In a Search for Equity: Do Direct Payments under the Common Agricultural Policy Induce Convergence in the European Union? Sustainability, 11(12), 3462. https://doi.org/10.3390/su11123462