Sustainable Growth and Token Economy Design: The Case of Steemit

Abstract

:1. Introduction

2. Theoretical Background

2.1. Token Economy

2.2. Mechanism Design

3. Methodology

4. Steemit Case Analysis

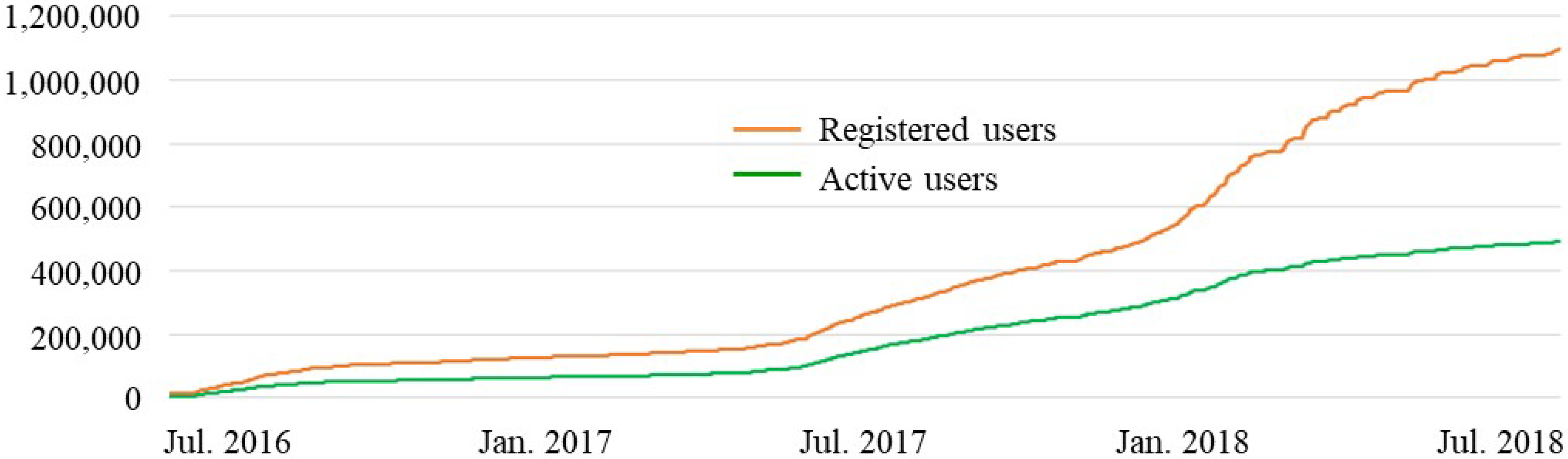

4.1. Steemit

4.2. Token Economy Design of Steemit

4.2.1. Token-Business Fit

“As a major of psychology and economics, I have always been interested if people can have a new behavior pattern. I started to conceive this project to give good influence on people with cryptocurrencies. I thought you need to have users, traders, and a community for them to create value for a cryptocurrency.”Excerpt from an interview with Ned Scott, the co-founder of Steemit

4.2.2. Determining the Chance of Business Success

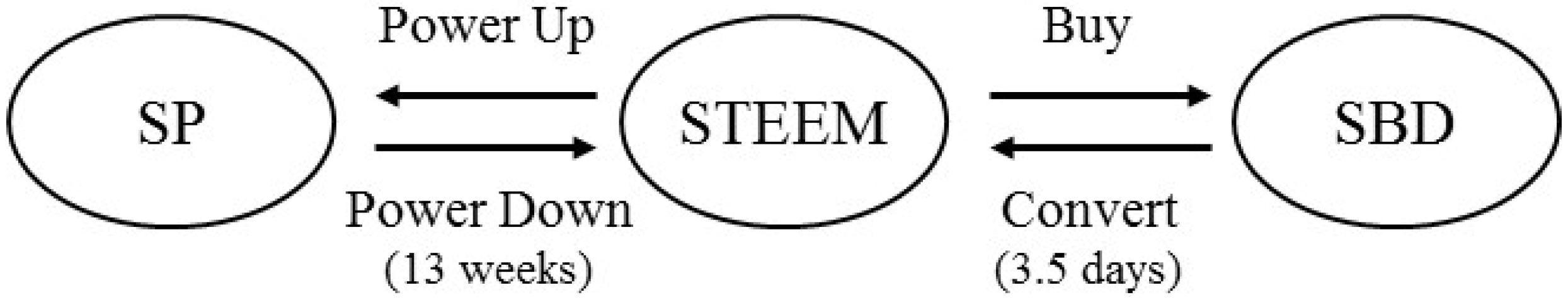

4.2.3. Determining Token Properties

4.2.4. Giving Tokens Intrinsic Value

4.2.5. Strategies to Raise Token Value

4.2.6. Management Strategies of the Token Economic System

4.2.7. Strategies for Token Liquidation

4.2.8. Continuous Modification of the Operational Base

5. Conclusions and Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Buterin, V. Ethereum White Paper: A Next Generation Smart Contract & Decentralized Application Platform. 2014. Available online: https://blockchainlibrary.org/2017/10/most-cited-ethereum-publications/ (accessed on 10 May 2018).

- ICOdata. Funds Raised in 2016. Available online: https://www.icodata.io/stats/2016 (accessed on 10 May 2018).

- ICOdata. Funds Raised in 2017. Available online: https://www.icodata.io/stats/2017 (accessed on 10 May 2018).

- Nelson, A. Cryptocurrency Regulation in 2018: Where the World Stands Right Now. Bitcoin Magazine. 1 February 2018. Available online: https://bitcoinmagazine.com/articles/cryptocurrency-regulation-2018-where-world-stands-right-now (accessed on 10 May 2018).

- Kampakis, S. Why do we need tokenomics? JBBA 2018, 1, 1–4. [Google Scholar] [CrossRef]

- Abadi, J.; Brunnermeier, M. Blockchain Economics. 2018. Available online: https://scholar.princeton.edu/markus/publications/blockchain-economics (accessed on 1 December 2018).

- Moisteiro, A.M. Financial Incentives in Crowdsourced Content Curation. Master’s Thesis, University of Edinburgh, Edinburgh, UK, 2018. [Google Scholar]

- Gartner. Maverick Research: The Programmable Economy Is the Ultimate Destination for Digital Business; Gartner: Stamford, CT, USA, 2015. [Google Scholar]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://bitcoin.org/en/bitcoin-paper (accessed on 9 May 2018).

- Babbitt, D.; Dietz, J. Crypto-Economic Design: A Proposed Agent-Based Modeling Effort; Conference Talk; University of Notre Dame: Notre Dame, IN, USA, 2014. [Google Scholar]

- Mougayar, W. The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Conley, J.P. Blockchain and the Economics of Crypto-Tokens and Initial Coin Offerings. Vanderbilt University Department of Economics Working Papers; Vanderbilt University: Nashville, TN, USA, 2017. [Google Scholar]

- Metcalfe, B. Metcalfe’s law after 40 years of Ethernet. Computer 2013, 46, 26–31. [Google Scholar] [CrossRef]

- Ayllon, T.; Azrin, N. The Token Economy: A Motivational System for Therapy and Rehabilitation; Appleton Century Crofts: New York, NY, USA, 1968. [Google Scholar]

- Ritchie, R.J. A token economy system for changing controlling behavior in the chronic pain patient. J. Behav. Ther. Exp. Psychiatry 1976, 7, 341–343. [Google Scholar] [CrossRef]

- Phillips, E.L.; Phillips, E.A.; Fixsen, D.L.; Wolf, M.M. Achievement place: Modification of the behaviors of pre-delinquent boys within a token economy. J. Appl. Behav. Anal. 1971, 4, 45–59. [Google Scholar] [CrossRef] [PubMed]

- Kazdin, A.E.; Bootzin, R.R. The token economy: An evaluative review. J. Appl. Behav. Anal. 1972, 5, 343–372. [Google Scholar] [CrossRef] [PubMed]

- Atthowe, J.M., Jr.; Krasner, L. Preliminary report on the application of contingent reinforcement procedures (token economy) on a “chronic” psychiatric ward. J. Abnorm. Psychol. 1968, 73, 37–43. [Google Scholar] [CrossRef] [PubMed]

- FINMA. Guidelines for Enquiries Regarding the Regulatory Framework for Initial Coin Offerings (ICOs); FINMA: Bern, Switzerland, 2018. [Google Scholar]

- Rooney, K. ICOs Are So 2017, Now There’s a New Term to Fundraise with Cryptocurrencies: The ‘STO’, CNBC, 27 April 2018. Available online: https://www.cnbc.com/2018/04/27/theres-a-new-way-to-fundraise-with-cryptocurrency-overstock-ceo-says.html (accessed on 9 May 2018).

- Anand, M. Decoding Token Economics: Insights from Our Token Engineering & Token Economy Design Workshop at Berlin Blockchain Week. Available online: https://medium.com/ostdotcom/decoding-token-economics-insights-from-our-token-engineering-token-economy-design-workshop-at-cfd1a0e39421 (accessed on 6 September 2018).

- Cong, L.; Li, Y.; Wang, N. Tokenomics: Dynamic adoption and valuation. SSRN 2018. [Google Scholar] [CrossRef]

- Lundy, L.; John, J.; McLaverty, H.; Noor, S. The Convergence Ecosystem; Outlier Ventures: London, UK, 2018. [Google Scholar]

- Hurwicz, L. The design of mechanisms for resource allocation. Am. Econ. Rev. 1973, 63, 1–30. [Google Scholar]

- Maskin, E. Nash equilibrium and welfare optimality. Rev. Econ. Stud. 1999, 66, 23–38. [Google Scholar] [CrossRef]

- Myerson, R.B. Optimal auction design. Math. Oper. Res. 1981, 6, 58–73. [Google Scholar] [CrossRef]

- Roth, A.E. The economist as engineer: Game theory, experimentation, and computation as tools for design economics. Econometrica 2002, 70, 1341–1378. [Google Scholar] [CrossRef]

- Dasgupta, P.; Hammond, P.; Maskin, E. The implementation of social choice rules: Some general results on incentive compatibility. Rev. Econ. Stud. 1979, 46, 185–216. [Google Scholar] [CrossRef]

- Myerson, R.B. Incentive compatibility and the bargaining problem. Econometrica 1979, 47, 61–73. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Scott, N. My Talk at IT Chosun. Available online: https://steemit.com/kr/@ned/my-talk-at-it-chosun (accessed on 22 October 2018).

- Diamantopoulos, A.; Schlegelmilch, B.B.; Du Preez, J.P. Lessons for pan-European marketing? The role of consumer preferences in fine-tuning the product-market fit. Int. Market. Rev. 1995, 12, 38–52. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. The fit between product market strategy and business model: Implications for firm performance. Strateg. Manag. J. 2008, 29, 1–26. [Google Scholar] [CrossRef]

- Newton Partners. Token Economy Design. Available online: https://www.newtownpartners.com/blockchain-advisory-services/token-economy-design/ (accessed on 22 November 2018).

- Steemit. Steem: An Incentivized, Blockchain-Based, Public Content Platform; Steemit: Virginia, VA, USA, 2018. [Google Scholar]

- Steemit. Available online: https://steem.io/ (accessed on 22 October 2018).

- McGrattan, E.R.; Prescott, E.C. Expensed and Sweat Equity; Working Paper 636; Federal Reserve Bank of Minneapolis: Minneapolis, MN, USA, 2005. [Google Scholar]

- Arcange. Steemit Statistics. Available online: https://steemit.com/statistics/@arcange/steemit-statistics-20180730-en (accessed on 22 October 2018).

- ICOGuide. What Are the Different Types of Token? Available online: https://icoguide.com/en/blog/what-are-the-different-types-of-token (accessed on 27 February 2018).

- Zipf, G.K. Human Behavior and the Principle of Least Effort; Addison-Wesley: Cambridge, MA, USA, 1949. [Google Scholar]

- Buterin, V. On Medium-of-Exchange Token Valuations. Available online: https://vitalik.ca/general/2017/10/17/moe.html (accessed on 17 October 2017).

- Burniske, C. Cryptoasset Valuations. Available online: https://medium.com/@cburniske/cryptoasset-valuations-ac83479ffca7 (accessed on 25 September 2017).

- Kilroe, J. Velocity of Tokens. Available online: https://medium.com/newtown-partners/velocity-of-tokens-26b313303b77 (accessed on 31 October 2017).

- Blanc, J.O. Free money for social progress: Theory and practice of Gesell’s accelerated money. Am. J. Econ. Sociol. 1998, 57, 469–483. [Google Scholar] [CrossRef]

- Cuofano, G. What Is Steemit? The Decentralized Social Network That Is Challenging Facebook Business Model. Available online: https://fourweekmba.com/steemit-decentralized-social-network/ (accessed on 22 November 2018).

- Wei, W.C. Liquidity and market efficiency in cryptocurrencies. Econ. Lett. 2018, 168, 21–24. [Google Scholar] [CrossRef]

- Chohan, U.W. The concept and criticisms of Steemit. SSRN 2018. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, M.S.; Chung, J.Y. Sustainable Growth and Token Economy Design: The Case of Steemit. Sustainability 2019, 11, 167. https://doi.org/10.3390/su11010167

Kim MS, Chung JY. Sustainable Growth and Token Economy Design: The Case of Steemit. Sustainability. 2019; 11(1):167. https://doi.org/10.3390/su11010167

Chicago/Turabian StyleKim, Moon Soo, and Jee Yong Chung. 2019. "Sustainable Growth and Token Economy Design: The Case of Steemit" Sustainability 11, no. 1: 167. https://doi.org/10.3390/su11010167

APA StyleKim, M. S., & Chung, J. Y. (2019). Sustainable Growth and Token Economy Design: The Case of Steemit. Sustainability, 11(1), 167. https://doi.org/10.3390/su11010167