Abstract

Alternative fuel vehicles, such as battery electric vehicles and hydrogen fuel cell vehicles, support the imperative to decarbonise the transport sector, but are not yet at a stage in their development where they can successfully compete with conventional fuel vehicles. This paper examines the influence of knowledge and persuasion on the decision to adopt or reject alternative fuel vehicles, a novel and original application of Rogers’ Theory of Diffusion of Innovations. A household questionnaire survey was undertaken with respondents in the Sutton Coldfield suburb of the United Kingdom city of Birmingham. This suburb was previously identified as having a strong spatial cluster of potential early adopters of alternative fuel vehicles. The survey results provide some useful empirical insights around the issues pertaining to the wider adoption of alternative fuel vehicles, even though the data is a bit dated as the survey was conducted in 2013. It is confirmed that respondents have limited knowledge of alternative fuel vehicles and perceptions have led to the development of negative attitudes towards them. The reasons largely relate to three problems: purchase price, limited range and poor infrastructure availability. Most respondents passively rejected alternative fuel vehicles, which confirms that a concerted effort is required to inform the general public about the benefits alternative fuel vehicles.

1. Introduction

Alternative fuel vehicles (electric vehicles and hydrogen fuel cell vehicles) have been proposed to reduce the environmental impact of transport, as well as a solution to overcome oil dependency. Battery electric vehicles and hydrogen fuel cell vehicles are not yet at a stage in their development where they can successfully compete with conventional fuel vehicles. They face a variety of technological hurdles that include range, performance, cost, and infrastructure. Uptake of alternative fuel vehicles is occurring at a slower pace than hoped by policy makers and manufacturers, and this is a familiar story globally. In 2012, the time period of the data collection effort that is reported within this paper, there were 1500 electric cars sold in the United Kingdom, bringing the total of battery electric car registrations to 4100 [1], and equating to 0.014% of the total number of vehicles registered. Targets for vehicle numbers have not been set by the United Kingdom, although the Committee on Climate Change made a recommendation of aiming for 1.7 million electric vehicles to be sold in the United Kingdom by 2020 [2].

In September 2013, the cumulative total of electric vehicles (plug-in hybrids and battery electric vehicles) was just over 130,000 vehicles in the United States of America [3], a figure that was below initial targets. There are now around 870,000 electric vehicles on the road (as of mid-2018), and sales are increasing year-on-year, but they still represent only a small proportion (1.4%) of total new vehicle sales [3]. Globally, the sales of new passenger electric vehicles (plug-in hybrid, battery and fuel cell electric vehicles sold in 2016) are mainly distributed between China (43%), Europe (28%), and the United States (US) (22%) [4]. Higher levels of electric vehicle sales from two of the leading countries in Europe, the Netherlands and Norway, can be at least partly attributed to generous fiscal incentives from national government [4].

There is, therefore, a need to further understand the knowledge, awareness, and decision-making process surrounding the take up of alternative fuel vehicles. Accordingly, the aim of this paper is to examine the influence of knowledge and persuasion on the decision to adopt or reject alternative fuel vehicles. The research applies Rogers’ Theory of Diffusion of Innovations, which is a novel and original framework for the study of alternative fuel vehicles. Birmingham, the second largest city in the United Kingdom, is used as a case study. A household questionnaire survey was undertaken with respondents in the Sutton Coldfield suburb of Birmingham. This suburb was previously identified as having a strong spatial cluster of potential early adopters of alternative fuel vehicles. The survey results provide some useful empirical insights around the issues pertaining to the wider adoption of alternative fuel vehicles, even though the data is a bit dated as the survey was conducted in 2013.

The paper is organised by firstly presenting Roger’s Diffusion of Innovations theory. The focus of the next section, a consumer acceptance literature review, is on the knowledge gaps relating to the characteristics of alternative fuel vehicle early adopters. A materials and methods section describes the spatial identification of potential early adopters in Birmingham, survey design and implementation, and techniques to analyse the survey data. The analysis covers the factors that influence knowledge and persuasion towards the adoption of an alternative fuel vehicle. In addition to research conclusions, the paper presents some policy recommendations to further increase the uptake of alternative fuel vehicles.

2. Theory of Diffusion of Innovations

Alternative fuel vehicles are innovations—they are objects that are perceived as new. It is not unusual for there to be a lengthy time period from when the innovation first becomes available to the point at which it is widely adopted. Understanding what is influencing the diffusion of alternative fuel vehicles may aid in speeding up the rate of diffusion. In this case, it is Rogers’ Theory of Diffusion of Innovations [5] that has been applied to this alternative fuel vehicles’ case study, and principally the Innovation-Decision Process model within the theoretical framework. It is the Innovation-Decision Process model that focuses on how an innovation decision is influenced by the perceived newness of the innovation and the associated uncertainty that arises as a consequence.

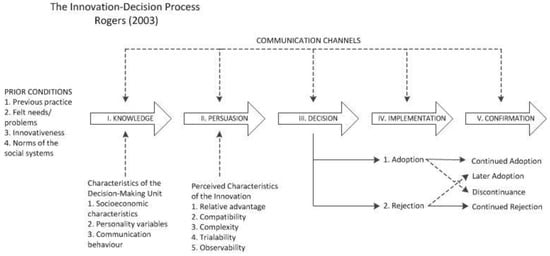

Figure 1 shows the Innovation-Decision Process involving information seeking and information processing, whereby an individual passes through five stages before adopting or rejecting an innovation [5]: (1) knowledge; (2) persuasion; (3) decision; (4) implementation; and (5) confirmation. ‘Knowledge’ and ‘persuasion’ are the two distinct stages that precede the decision. Defined by [5], “knowledge occurs when an individual is exposed to an innovation’s existence and gains an understanding of how it functions” and “persuasion occurs when an individual forms a favourable or unfavourable attitude towards the innovation”. These two constructs of the model are the principal focus of the data analysis within this paper (Section 5.2 and Section 5.3), as well as the ‘prior conditions’ that form the setting for the innovation in the first instance.

Figure 1.

The Innovation-Decision Process [5].

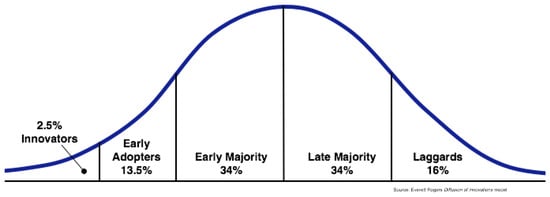

Rogers produced adopter categories that form an innovativeness continuum: the earliest to adopt are innovators, followed by early adopters, the early majority, the late majority, and finally laggards. This is shown in Figure 2. Innovators are considered to be venturesome risk takers who kick-start the diffusion process of an innovation. Early adopters are the next level of adopter; an adopter who is more integrated in the social system and who, having adopted the innovation, gives the go-ahead to the majority that the innovation is safe to adopt. Identifying the early adopters of alternative fuel vehicles is of interest to this research, to recognise how diffusion may be sped up (the second group as shown in Figure 2, suggesting around 13.5% of the general population).

Figure 2.

Normal adoption distribution curve [5].

With respect to attitudes and the influence that knowledge and degree of persuasion have, this research paper takes into consideration contextual knowledge and attitudes that are held by respondents. This includes attitudes towards climate change as well as knowledge and degree of persuasion specific to the innovation, in this case alternative fuel vehicles.

Rogers’ Diffusion of Innovations theory is the most cited of diffusion theories, with first publications appearing in 1963. The theory has continued to be applied to studies for over 50 years, which is likely due to its simplistic and pragmatic applicability across the academic disciplines. In a review of emerging literature between 1990 and 2012, Ref. [6] found that there have been 1024 publications that include a reference to Rogers’ theory and between 2008 and 2012 the number of annual publications quadrupled.

There are three primary reasons for which the Diffusion of Innovations theory is considered novel, original, and appropriate for this study of alternative fuel vehicles. Firstly, the broad range of applications across a multitude of research disciplines, including eco-innovation diffusion, demonstrates the versatility of the theory. The theory postulates that the characteristics of the technology, the adopter, and the social system are all influential in the adoption decision [5], which makes it a particularly appealing theory in understanding what impacts alternative fuel vehicle adoption. Other than [7], there appear to be relatively few studies that have tested the relationship between pro-environmental attitudes and consumer innovativeness while using Rogers’ theory. A few studies have explored this relationship in the context of alternative fuel vehicles (e.g., [8]), but research has tended to apply other theoretical approaches such as rational choice theory, the theory of planned behaviour and the value-belief-norm theory [9].

Secondly, this theory presents a framework with which to consider the reasons for non-adoption of alternative fuel vehicles, which is especially important for marketing purposes in order to reduce the chances of the innovation failing in the market place [10]. Diffusion of electric vehicles is occurring at a relatively slow rate, and it is of interest, both academically and for the purpose of stakeholders that are involved in new and existing vehicle technologies, to understand consumer acceptance and attitudes, and the reasons for their resistance. The Innovation-Decision Process, therefore, provides a useful framework to identify what is influencing perceptions and attitudes towards alternative fuel vehicles that is stalling their adoption. Non-adoption or rejection is an important part of the diffusion of innovation theory, and a part that is often overlooked in the literature, simply because of the bias towards successful innovations [5].

Thirdly, most applications of Rogers’ Theory have been undertaken post hoc (having tended to focus only on successful innovations) and Rogers’ suggests that there is a need for theoretical contributions that apply the theory at different points in the innovation’s lifetime as a means to understanding more about when an innovation fails or becomes successful in its diffusion. Ideally, it would be undertaken as a longitudinal study and followed up over the entire diffusion period of alternative fuel vehicles, however resource constraints prevented it in the case of this research. Few have tested the theory’s versatility of application at a single point in time during the innovation’s diffusion, rather than at the end of the diffusion period. Ref. [5] notes that there may be a problem in studying diffusion at a single point in time, rather than as a process, suggesting that it will be yesterday’s innovativeness. However, with most studies having been undertaken post hoc and therefore reflecting on past innovativeness, it seems there is scope for trying a novel approach to its application, with the potential for it to provide insight into adoption likelihood and so contribute to the understanding of the ‘process’ of alternative fuel vehicle diffusion.

The analysis in this paper focuses on the ‘early adopters’ i.e., those who adopt an innovation in its early days and who are described by [5] as being innovative in their behaviour. Rogers defines innovativeness as “the degree to which an individual is relatively earlier in adopting new ideas than other members of a (social) system” [5]. However, [11] criticise Rogers’ definition for failing to offer any real insight into understanding the reasoning prior to the adoption of an innovation and therefore offering no indication as to who might adopt a new innovation prior to its launch. They argue that categorisation of adopters cannot occur until after the diffusion process has taken place.

A distinction that has been made regarding early adopters is to do with the information source that influences the adoption decision [11]. For example, the adoption decision of some early adopters is influenced by mass media communications, whereas the adoption by others is influenced by interpersonal communications, such as word-of-mouth [11,12] refers to early adopters as imitators of the innovators. After the innovators, early adopters are the second wave of adopters, and constitute approximately 13.5% of the total of innovation adopters [5].

In understanding acceptance of alternative fuel vehicles, the Innovation-Decision Process is of particular interest in this analysis at the point at which an individual undertakes activities that ultimately lead to the adoption or rejection of the innovation [5]. Adoption does not necessarily need to be complete—it may be only partial adoption, such as trialing the innovation before committing to it completely. The alternative to adoption is rejection, which can occur at any of the five stages of the innovation-decision process. Two types of rejection are identified by [5]: active rejection, whereby the individual considers adopting the innovation but then decides not to, and passive rejection, which is where an individual has never considered using the innovation. Passive rejection is also referred to by Rogers as non-adoption.

3. The Consumer Acceptance of Alternative Fuel Vehicles

This review examines the growing literature into the consumer acceptance of alternative fuel vehicles, with a particular focus on the characteristics of the early adopter group, as identified by applications of the Theory of the Diffusion of Innovations. For a fuller, wider review on the consumer electric vehicle adoption research, see [9].

Alternative fuel vehicles have been referred to as ‘eco-innovations’ in recent diffusion literature in this topic area (e.g., [13,14,15]), due to their ability to contribute to satisfying environmental objectives. The low levels of uptake of electric vehicles are challenged by the difficulties in changing consumer behaviour to adopt more sustainable practices [16,17,18]. The decision-making process that is involved in the consideration of pro-environmental innovations is complex [7], making it problematic to identify how consumers can be influenced to adopt alternative fuel vehicles. The decision is likely to be affected by the risk and uncertainty that are associated with adopting new technology, which concerns financial risk, performance risk, uncertainty of future consequences, image, and the changes to lifestyle that may be required.

The adoption of an alternative fuel vehicle should not be perceived as requiring sacrifices to be made (e.g., [19]), and should, therefore, have characteristics that will be more highly valued than conventional fuel vehicles, particularly cost-minimisation [20]. Barriers to consumer acceptance tend to be low vehicle awareness, high purchase price, limited vehicle range, poor choice of vehicles, concern about supporting infrastructure, and vehicle safety.

Following a study of consumer awareness and purchase barriers of vehicle owners in the United States of America, along with interviews with executives from vehicle manufacturers, car dealers, and energy companies, [21] pinpointed the characteristics of those most likely to purchase electric vehicles between 2011 and 2020. They identified the profile of early adopters as being young, having a very high household income (in excess of $200,000, equivalent to £120,000) and already owning more than one vehicle. Please note that for this currency value, and subsequent ones in the paper, an exchange rate of 1 USD ($) = 0.6 GBP (£) was used. This was the approximate rate between 2010 and 2014, the time period to which all currency values within the paper relate to.

The early majority, which is those who constitute the early phase of mass adoption, also have a very high household income of around $114,000 (£68,400), are more likely to be male, drive an average of 100 miles per week, and have a garage with power. These people live in urban and suburban locations, perceive electric vehicles to be ‘green and clean’, and they are influenced predominantly by the reliability of the vehicle. According to [21], there is a population of 1.3 million people in the United States of America that fit this profile, with a concentration in California where there is already electric vehicle charging infrastructure to support vehicle use. The study [21] also revealed a predicted profile of ‘non adopters’, constituting those who have low household incomes and are price sensitive. The majority of ‘non adopters’ do not have a garage, creating a challenge for secure home charging. Ref. [22] suggest that a lack of charging infrastructure will inhibit market penetration until 2020 at the earliest.

Price is likely to be a major factor in determining who the early adopters of alternative fuel vehicles will be. A survey of 1000 car owners [23] found that the median car price paid by those who had recently bought a new or nearly-new car was between £11,000 and £15,000 ($18,333–$25,000), which falls significantly below the price of an electric vehicle. The high cost of alternative fuel vehicles was found to be a prohibitive factor for individuals when considering plug-in hybrid electric vehicles in research by [24]. They suggest that price premiums need to be significantly reduced to make these vehicles commercially viable. Price was also noted as top of purchase criteria in an opinion survey undertaken in Austin, Texas [25]. However, [26] identify income as not being significantly associated with stated intent to purchase a plug-in vehicle.

Ref. [27] undertook a nationwide survey of the United States of America, part of which looked at the demographics of electric vehicle drivers. Variables which increased a respondent’s electric vehicle orientation include: being of a younger or middle-aged age category; having a Bachelor’s or higher degree; expecting higher fuel prices in the next five years; having made a shopping or lifestyle change to help the environment in the last five years; having a place that they could install an electric vehicle electrical outlet at home; being likely to buy a small or medium-sized passenger car on next purchase; and, having a tendency to buy new products that come on to the market. They note that the number of vehicles per household and the type of residence are important variables in electric vehicle choice. With respect to education, [28] also identified that being highly educated is strongly linked to an individual’s likelihood of having prior knowledge of new vehicle technologies. Being young and well-educated was pin-pointed as an important characteristic by [29], who suggest that such individuals should comprise the target market. Similarly, as education level reduces so does the interest in plug-in vehicles, as shown by [26].

In the early phase of electric vehicles, [30] suggest targeting three market segments: public sector organisations, eco-conscious companies and multi-car households, constituting an early adopter market of over 2.5%. They argue that multi-car households may offer significant opportunities for electric vehicle sales because the household possesses one or more conventional vehicles that can be used for journeys currently beyond the range of electric vehicles. This research supports the work of [31], who, in their Neighbourhood Electric Vehicle Drive Trials study, found that many households would consider an electric vehicle if they incorporated it into their existing ‘household vehicle fleet’, so that there was always an option of an internal combustion engine vehicle for long-range journeys. In a more recent study, [20] found that the same attitudes still remain; consumers find the range of current battery electric vehicles too restrictive to have the electric vehicle as the only household vehicle. They would rather perceive them as a second vehicle that can be used to make short, local journeys. For this reason [29] suggest that marketing strategies should focus on urban consumers.

The age characteristics of a hybrid-electric vehicle driver in research undertaken by [32] in collaboration with Toyota, involving a survey of buyers of the Toyota Prius, contrasts with both [21] predicted ‘early adopter’ age profile and the age characteristics identified in a study of electric vehicle drivers by [27]. The majority of Toyota Prius vehicle owners in this survey were men aged 50 and over, which was found to be a true representation of Toyota hybrid customers in Great Britain. The survey results also showed that household composition of hybrid vehicle owners tends to be retired (couple or single), with a net monthly household income of over £4000 ($6667), and owning more than one vehicle. The contrast in findings between [21,27,32] may have been influenced by other factors, such as branding of the Toyota Prius, perhaps leading to it appealing to a slightly older market. Again, there is a contrast in the results of [27,32] when it comes to income and car ownership, whereby [27] identify income and owning more than one car as not being significant in increasing electric vehicle orientation [32] suggest that their survey results may have been affected by the uncertainties associated with the economic climate at the time of the survey (2009), when the respondents’ financial prospects may not have been as good as when they purchased a Toyota Prius in 2007 or 2008.

With the exception of [33], there has been little research into profiling who the early adopters of hydrogen vehicles are likely to be [33] conducted a study looking at Californian residents to estimate the early market potential for hydrogen fuel cell vehicles. They identified the consumers that were most likely to benefit from ‘mobile energy’ innovations, such as vehicle-to-grid technology to create ‘mobile electricity’. The authors suggest that consumers will be more likely to make supporting modifications and investments in the required infrastructure if they own their homes and have parking facilities close by. They also recognise the initial price premiums that are associated with new vehicle and mobile energy technologies, and therefore choose not to consider unemployed households, or households with no income, as target consumers.

In summary, alternative fuel vehicles have largely been framed in acceptance studies as eco-innovations, focusing on their environmental attributes. There is scope to examine alternative fuel vehicles simply as innovations and the technological attributes should also be a key element. Consumer knowledge and awareness of alternative fuel vehicles is recognised as being limited. However, it is likely to evolve as consumers become increasingly aware of climate change and more alternative fuel vehicles become commercially available. On-going research on consumer knowledge and awareness of alternative fuel vehicles is, therefore, necessary. Consumer perceptions and attitudes towards alternative fuel vehicles must be addressed on an on-going basis in the same way as knowledge and awareness. It is possible that perceptions and attitudes will also evolve in time.

There are limited studies that establish a profile of an early adopter for the purpose of market segmentation. This can be overcome by focusing on the individuals who have the early adopter characteristics, as shown in Table 1. The knowledge and perceptions of these individuals towards alternative fuel vehicles are examined in this study to identify the factors that influence consumers’ adoption of these vehicles.

Table 1.

Summary of alternative fuel vehicle early adopter characteristics.

4. Materials and Methods

4.1. Spatial Identification of Potential Early Adopters of Alternative Fuel Vehicles

This paper builds upon a previous stage of the research that identified the location of potential early adopters of alternative fuel vehicles [34]. Using the city of Birmingham in the United Kingdom as a case study, the socio-demographic characteristics that were distinguished as being most likely to be present in an early alternative fuel vehicle adopter were applied to Census data. Hierarchical cluster analysis was then used to ascertain the areas of Birmingham that contained the highest proportion of individuals that were considered most likely to become early adopters of alternative fuel vehicles.

A strong spatial cluster, constituting 59% of all potential early adopters, was identified across four sub areas (wards) in the suburb of Sutton Coldfield [34], located on the outskirts of the Birmingham Metropolitan area and to the north-east of Birmingham city centre. Sutton Coldfield has the highest levels of employment, the highest percentage of the population with two or more cars and the lowest levels of people living in houses owned by the Local Authority. Within this early adopter cluster were 32,000 households and 85,000 residents (as determined from the 2001 UK Census), equating to 9% of the total population of Birmingham Metropolitan District. The proportion of homeowners in the cluster was 94%, with 93% living in detached or semi-detached homes. Over half of the population had two or more cars and 67% of people used their cars for commuting; 39% of people within the output areas were identified as professionals or managers. In contrast, there was a strong spatial cluster of those that were considered to be ‘unlikely adopters’ located in sub areas towards the centre of the city.

4.2. Survey Design and Implementation

The survey questionnaire was designed according to the Innovation-Decision Process framework, and a series of five-point Likert scale attitudinal statements were incorporated. An example of statements relating to personality values and communication behaviour, in accordance with Rogers’ generalisations, is presented in Table 2.

Table 2.

An example of questionnaire attitude statements: personality values and communication behaviour.

The survey was undertaken in February and March in 2013, following a pilot survey in December 2012. The households visited were selected from a list of 1000 addresses (using postcode units) from Sutton Coldfield, which were identified as being part of the ‘early adopter cluster’. Although guided by a pre-compiled address list, respondents were ultimately selected while using two quotas: the house visited must be semi-detached or detached and it must have a driveway. House type was used as a selection criterion in stage one for the reason that a semi-detached or detached house is more likely to have a driveway, which would improve the ability of the household to install an electric-vehicle charging facility (an important factor recognised by [27]). Furthermore, as the United Kingdom Census does not collect income data, and with semi-detached and detached homes more often being of a higher value than other home types, this enabled the selection of individuals more likely to have the finance available to purchase a vehicle.

Two delivery methods were utilised. Face-to-face was the preferred method due to the quality control that it allows, while the call-and-collect method was used if the respondent was willing to participate but could not spend the time at the point of contact. In order to achieve a more representative sample, the survey was conducted on weekdays as well as evenings and weekends. It was stipulated that the respondent should be selected on the basis that they would be involved in the household decision-making process when purchasing a new vehicle.

4.3. Techniques to Analyse the Survey Data

Pearson’s Chi-Square (X2) test and Spearman’s rho (rs) were the two statistical techniques that were applied to the survey data for testing the effect of socio-demographic characteristics on attitudes. Pearson’s Chi-Square (X2) tests for a dependency between two categorical variables while Spearman’s rho (rs) tests the correlations between continuous or scale data. There are similarities between the tests. Pearson’s correlation coefficient is a product-moment correlation coefficient that is used to indicate the strength of the relationship between the two variables being tested, while Spearman’s rho test first ranks the data before applying Pearson’s correlation coefficient to the ranked scores, indicating the shared variance in the ranked order or the data [35].

The analysis is focused on validating, where appropriate, the relationship between the socio-demographic characteristics of respondents and the attitudes and perceptions held about alternative fuel vehicles and their contextual environment. In addition to the use of the statistical approaches and descriptive statistics, the research incorporated a qualitative element, through the analysis of two open-format survey questions. Questions to elicit an unprompted response provided the respondent with an opportunity to identify other factors or influences on their attitudes that might not have previously been identified in the research.

5. Results

5.1. Summary of the Sample

The survey generated a sample size of 413 households from the Birmingham suburb of Sutton Coldfield. There were 256 (62%) responses completed face-to-face and 157 (38%) while using the call-and-collect method.

The representativeness of the sample in relation to the general population needs to be considered. There is an even split of respondents within the survey according to gender. For age, when comparing the representation of the age groups in the survey with those of Sutton Coldfield (from the 2001 Census) it is acknowledged that there is overrepresentation in the older age groups (over 64) and underrepresentation in the youngest age group (18–24). Just under half of the respondents are in retirement, almost four times that for Sutton Coldfield overall (from the 2001 Census).

The proportion of survey respondents in employment (just under half) is representative of Sutton Coldfield overall. There is a much higher level of home ownership among respondents, which is 17% higher than for Sutton Coldfield. All lf the homes surveyed were detached or semi-detached, as pre-determined in the survey, which is a proportion that is 27% higher than for Sutton Coldfield. Naturally, car ownership among survey respondents is greater than that of Sutton Coldfield, with only 2% of respondents being without a car unlike the 16% of the Sutton Coldfield population, as well as vehicle dependency (91% of those surveyed who work commute by car in comparison to 69% of those in Sutton Coldfield).

In accordance with the potential early adopter profile from the previous research stage, Table 3 shows the proportion of respondents that fit each of the characteristics, as aligned with the Table 1 categories. The highlighted characteristics are those considered to be important socio-economic characteristics in alternative fuel vehicle adoption. There is a respectable representation among the survey sample fitting the early adopter profile criteria, as shown in Table 3, with 64% of respondents possessing three or more of the socio-demographic characteristics.

Table 3.

Proportion of respondents according to early-adopter profile characteristics.

5.2. Knowledge of Alternative Fuel Vehicles and the Factors That Influence It

The knowledge characteristics (Stage I of the Innovation-Decision Process, see Figure 1) demonstrate that there is a low level of knowledge of alternative fuel vehicles, as perceived by respondents. Across each of the three vehicle types (electric, hydrogen fuel cell, and hybrid electric), there are fewer than 16% of respondents who considered that they have a good or very good knowledge of the vehicles (the two highest scores on a five-point scale). There is very little difference in the proportion of those with good or very good knowledge between hybrid vehicles (15%) and electric vehicles (14%). This is rather surprising, while considering that hybrid vehicles have been available for purchase over a longer period of time. Hydrogen fuel cell vehicles are even less well understood by respondents; 8% of respondents have good or very good knowledge of these vehicles.

5.2.1. Socio-Demographic Characteristics of Responses (Socioeconomic Characteristics)

As shown in Table 4, there are significant relationships between the socio-demographic characteristics of the decision-making unit (the first characteristic within Stage I—see Figure 1) and knowledge of alternative fuel vehicles. Male respondents, those with higher level of qualifications, and those with a higher socio-economic status are the most knowledgeable about electric vehicles and contextual factors.

Table 4.

Results for knowledge of alternative fuel vehicles.

Poor knowledge of electric vehicles is further supported in the open-format responses of the questionnaire. A large proportion of individuals indicated that they did not know of any advantages or obstacles to electric vehicle ownership. There is also poor awareness of the incentives that are available for their adoption. Some were aware that electric vehicles are exempt from vehicle excise duty, but there was little evidence of awareness of other savings that can be made, such as the Plug-In Car Grant. Please note that the Plug-in Car Grant was available since 2011 for vehicles that emitted less than 75 g of CO2 per kilometre driven [36]. At the time of the survey, 18 vehicle models were eligible for the Grant, which are a mixture of hybrid electric vehicles and battery electric vehicles. The Grant is available for 25% of the cost of the vehicle up to a maximum of £5000 to both individuals and businesses [36]. As of March 2014, 8724 claims had been made through the Plug-in Car Grant scheme [36].

Despite most survey respondents having an awareness of the environmental impacts of transport, a relatively high proportion of these individuals stated that they are not concerned about climate change and want to continue with conventional vehicle technology. If such issues are not of concern, then it may be unlikely that such individuals would consider learning about environmentally sustainable innovations, like alternative fuel vehicles. Similarly, it is unlikely that they would make behaviour changes to reduce their environmental impact. Many also considered the long-term prospects for electric vehicles to be poor.

5.2.2. Attitude towards New Technologies (Personality Variables)

The individual’s attitude towards new technologies is also indicative of their personality, which has been found by [5] to affect individual innovativeness (i.e., how soon an individual will adopt an innovation). For example, an individual who is able to deal with uncertainty and takes risks is likely to among the earliest adopters of an innovation (‘innovators’ or ‘early adopters’), whereas an individual who is risk averse and sceptical will be among the last adopters of an innovation (‘late majority’ or ‘laggards’).

A strongly positive response to Statements 1–4 in Table 5 is considered, in this research, to be indicative of an individual who is very innovative. In contrast, a strongly positive response to Statements 5–7 is considered to be indicative of an individual who would likely be a much later adopter, perhaps one of the last to adopt an innovation.

Table 5.

Attitudes towards innovations.

Attitudes towards new technologies showed that the majority of respondents are risk averse and less likely to be among earlier adopters of new technologies. There were 50% who disagreed with the statement “You want to be among the first people to try a new technology”. Uncertainty of its long-term success was considered by 62% of respondents to be a factor that would make them uncomfortable about investing in a new technology. The majority (51%) were also sceptical about new technologies, and half of all the respondents stated that they prefer to stick to existing and familiar technologies. These findings are, perhaps, unsurprising given that the majority of adopters of an innovation adopt it later in a product’s lifecycle. In fact, as should be expected, only a small proportion of respondents (4–8%) were confirmed to be highly innovative when it comes to new technologies. Similarity was recognised between Rogers’ Diffusion of Innovation Curve and the distribution of respondents according to their risk aversion when adopting new technologies.

Examination of the relationship between personality and socio-demographic characteristics revealed a significant correlation between personality statements and gender, age, qualifications, and socio-economic status. Those who exhibited greater innovativeness, thus indicating a greater propensity to adopt new technologies, were male, younger (under the age of 60), more highly qualified, and of a higher socio-economic status. Despite 27% of respondents stating that they want to be among the first people to adopt a new technology, none of the respondents have adopted an electric vehicle, which may be an indication that not all technologies or innovations can be considered the same. Being among the first to adopt an ‘eco-innovation’ may not be as important as being among the first to adopt a technology of a different sort, perhaps one requiring a lower degree of product involvement (i.e., a lower-cost innovation). This supports an argument that was made by [13] that an ‘eco-innovation’ is a specific type of innovation and its adoption is likely to be influenced by many other determinants that make it difficult to identify a uniform pattern among consumers.

5.2.3. Communication Behaviour of the Respondents (Knowledge Influence)

Ref. [5] make several generalisations about communication behavior, these being that earlier adopters are likely to be more active in seeking information about innovations, have greater exposure to interpersonal communication channels, have greater exposure to mass media communication channels, and have more contact with change agents. The questionnaire statements specifically refer to electric vehicles due to their availability and therefore increase the likelihood that some degree of communication may have occurred. Three main influences were addressed in this research: media, friends and family. However, there was no clear influence when it came to attitudes towards alternative fuel vehicles. The media appears to have a greater influence over interpersonal communication channels, although most respondents stated they neither agreed nor disagreed with statements about what influenced their attitude. It is unlikely that the respondents had previously been asked to consider their attitudes towards alternative fuel vehicles, and therefore may not yet have formulated an opinion.

Only 8% of respondents stated they have actively sought information about electric vehicles and a large majority of respondents (80%) indicated that they had never had a conversation about electric vehicles. Respondents largely had weak views on alternative fuel vehicles, which is supported by the low levels of knowledge shown in Table 4.

When communication behavior was analysed in conjunction with socio-demographic characteristics, (see Table 6), males were more likely than females to have sourced information on, and also to have previously had a conversation about, electric vehicles. The negative relationship between age and the influence of media and family on attitude towards electric vehicles indicates that the attitudes of younger respondents were more likely to have been affected by these influences. As the level of qualifications increases, so does “follow[ing] the view of experts on matters that are important to you”, and also agreement with the statement “the media has influenced your attitude towards fully electric vehicles”. Apart from socio-economic status, each of the socio-demographic characteristics is significantly correlated with at least two communication behavior variables, suggesting that the communication behaviour of those who are male, are younger, have a higher level of qualifications, and a higher socio-economic status is in alignment with those that are expected to be early adopters.

Table 6.

Results for innovativeness in conjunction with communication behaviour.

5.3. The Degree of Persuasion towards the Adoption of an Alternative Fuel Vehicle and the Factors Which Influence Persuasion

The nature of the data required to capture information about perceptions has led to the inclusion of qualitative analysis, although it also draws on similar techniques to Section 5.2 for examining the relationship between socio-demographic characteristics and perceptions, where applicable.

The use of open-format questions concerning the advantages and disadvantages of owning or leasing an electric vehicle provided useful insight into consumer perceptions. The focus was on electric vehicles due to the likelihood that the respondent would be more familiar with this alternative fuel vehicle than a hydrogen vehicle. Several vehicle characteristics are perceived as better for electric vehicles than for conventional vehicles (relative advantage, the first characteristic within Stage II—see Figure 1). These included the ability to refuel at home, fuel economy, and environmental impact. Importantly, fuel economy was ranked as one of the most important vehicle characteristics when making a new vehicle purchase. In listing the advantages of ownership of electric vehicles, there was mention of tax exemption as an advantage, but not any other Government incentives such as the Plug-In Car Grant. It is stated by 23 respondents that an advantage of an electric vehicle would be the reduced noise, with some even noting how this would contribute to the relaxation of driving. The noise characteristic could be a useful attribute to focus on in marketing to a segment with a need for a more relaxing driving experience.

The greatest barriers to the adoption of electric vehicles are technological and they include vehicle range, length of charging time, frequency of charging, and lack of recharging infrastructure. Economic barriers were mainly related to the cost of the vehicle but also included concerns about the rising costs of electricity and the cost of charging. The social obstacles stated by respondents emphasise a strong concern for the lack of range of the vehicle and the inability to locate charging stations, a finding that is perhaps akin to ‘range anxiety’.

A high frequency of responses including ‘no idea’ or ‘not sure’ are indicative of a low level of knowledge of electric vehicles, which further supports the findings in Section 5.2 of poor knowledge of alternative fuel vehicles. A United Kingdom Department for Transport study into attitudes towards electric vehicles also reported that lack of knowledge was a significant factor in deterring drivers from purchasing electric vehicles [37].

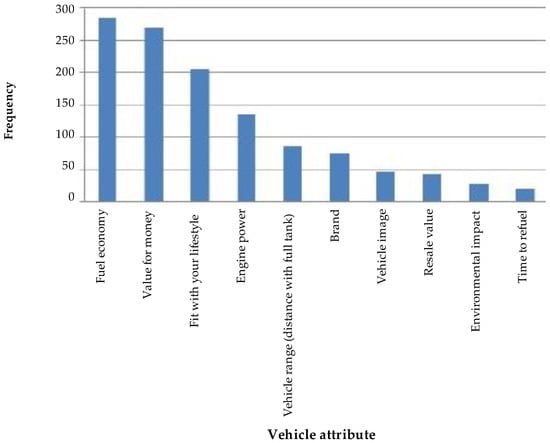

When respondents were asked which specific vehicle attributes they consider to be most important in the context of making a vehicle purchase (see Figure 3), fuel economy, value for money, and fit with lifestyle were the most frequently stated responses. Among the least frequently selected attributes were vehicle image, resale value, environmental impact, and time to refuel.

Figure 3.

Vehicle attributes in order of importance (according to frequency).

There appears to be a distinct barrier to adoption when it comes to compatibility (the second characteristic within Stage II), with few of the respondents considering an electric vehicle as compatible with their lifestyle. Only 20% of respondents indicated that they would not have to make changes to their lifestyle to accommodate an electric vehicle. ‘Fit with lifestyle’ was also ranked as one of the most important characteristics considered in a new vehicle purchase, inferring that compatibility is of great importance in satisfying consumer needs. This supports the value of this perception in influencing the degree of persuasion (Stage II of the Innovation-Decision Process, see Figure 1) towards an innovation [5].

An opportunity for compatibility is established when respondents were asked to consider the possibility of having an electric vehicle as a second household vehicle. It was noted by [31] that an electric vehicle is more likely to be considered if it can be incorporated into the existing household fleet, such that a conventional vehicle is always available for long-range journeys. A relatively large proportion of the sample (just under 40%) recognised this as a possibility, which indicates that the compatibility of these vehicles may increase if they are marketed as ‘run-around’ vehicles. Likewise, [20] found that an electric vehicle was considered better suited as a second vehicle for short, local journeys.

Significant correlation (Table 7) between perceived suitability of an electric vehicle as an additional household vehicle with gender, age, qualifications and socio-economic status, whereby those who are male, under the age of 60, have higher level qualifications and a higher socio-economic status were more likely to consider an electric vehicle as suitable for this purpose.

Table 7.

Results for perceived compatibility of the innovation.

The associated complexity of use (the third characteristic within Stage II) with alternative fuel vehicles is not well evidenced in the literature. Survey results show that perceived confidence when driving and recharging an electric vehicle does not appear to be problematic for most respondents. In both cases, over half of the respondents stated that they would be very confident that they would know how to drive and recharge an electric vehicle. Approximately one-fifth of respondents state that they would not be confident knowing how to undertake these activities.

As shown in Table 8, those who state lower levels of confidence are females, those from an older age group (>60), those with lower level qualifications, and those of a lower socio-economic status. Confidence is found to reduce as age increases. In the open-format question, several individuals remarked that they are too old to learn how to use an alternative fuel vehicle, which also reinforces the need to target a younger audience.

Table 8.

Results for perceived complexity of the innovation.

Relatively few respondents have had exposure to alternative fuel vehicles (trialability, the fourth characteristic within Stage II). Only 6% had previously travelled in an electric vehicle, while 13% had travelled in a hybrid vehicle. Only eleven respondents had actually test driven an electric vehicle, and of the 25 individuals who had travelled in an electric vehicle, only six of them had test driven one. Ref. [5] found that being able to trial an innovation played a significant role in its adoption and, in the case of hydrogen vehicles [38] confirm that direct contact with the vehicles had a positive influence on acceptance.

It is interesting then that only 6 out of 25 individuals who had travelled in an electric vehicle had also test driven one, perhaps suggesting that the initial exposure was sufficient in influencing the decision of the majority that an electric vehicle was not suitable for them.

Less than 5% of respondents knew somebody who uses an electric vehicle and only 10% had seen an electric vehicle being used (observability, which is the fifth characteristic within Stage II). The latter may be affected by an inability to recognise an electric vehicle but may also be affected by the inability to distinguish between a fully electric vehicle and a hybrid vehicle. Considerably more males than females had seen somebody using an electric vehicle, an incidence that may be influenced by males having expressed a greater interest than females in electric vehicles and therefore more likely to recognise one. Charging points in Birmingham and Sutton Coldfield had been seen by just over 10% of people. Public charging points in this area were limited at the time of survey, which will certainly have influenced the likelihood of respondents having seen any. However, there are a number of limited access points (i.e., not public charging points) that may have been observed by respondents.

The visibility of electric vehicles is likely to be one of the current major barriers to their adoption and affecting the perceptions of these vehicles. Without being able to observe their use by others in society sends messages of uncertainty about whether or not to adopt them. Equally, observing that there is supporting infrastructure for electric vehicle recharging will be important in reducing uncertainty, as recommended by [39]. The more charging infrastructure that is visible to the public, the less uncertainty there will be associated with running out of power (i.e., range anxiety) and not having anywhere to recharge the vehicle’s battery.

6. Discussion and Conclusions

The research that is presented in this paper demonstrates that Rogers’ Diffusion of Innovations theory provides a useful framework in the examination of decision-making for the adoption or rejection of alternative fuel vehicles. There are also some interesting empirical insights that emerge from the analysis of the survey data of potential early adopter Sutton Coldfield residents, and a sample size of 413 respondents enabled the analysis to focus on subsamples based on socioeconomic variables.

However, there are some limitations with the survey data collected. Sutton Coldfield was identified as high (59%) in potential early adopters amongst Birmingham suburbs, but perhaps the data collection could have covered a larger spatial area, which, together with stricter quotas, could have enabled more potential early adopter respondents to reached. It is also acknowledged that the sample contains an over-representation of older respondents, with a few of the emergent studies indicating that alternative fuel vehicle early adopters tend to be young and middle-aged (see Table 1).

The large proportion of respondents who have not given consideration to an electric vehicle confirms that these individuals are passively rejecting electric vehicles. The confirmed low levels of knowledge about electric vehicles are likely to be responsible for the low level of consideration given to the purchase of an electric vehicle (passive rejection). Equally, the largely poor perceptions of electric vehicles in addition to their technological inferiority (relative to conventional vehicles) is creating substantial barriers for consumers and leading to active rejection. Therefore, major barriers, as also identified in the literature review, need to be overcome to enhance the perceptions of electric vehicles that will lead to faster diffusion.

The findings, therefore, confirm that there is misalignment between consumers’ vehicle (and use) preferences and the characteristics that are offered by alternative fuel vehicles, which leads to their non-adoption. However, some of this misalignment is shaped by misperceptions and a lack of information rather than incompatibility. While previous research focused on purchase intentions with respect to alternative fuel vehicles (as shown in the literature review), this research considered choices that have already been made with respect to current household vehicle characteristics, in addition to the preferences for a future alternative vehicle purchase.

An important contribution has been made through the application of Rogers’ theory to an ‘eco-innovation’. There are few applications of Rogers’ theory for such innovations (e.g., [13,14,15]), particularly where the Innovation-Decision Process has been applied holistically. Through the incorporation of need-recognition and broader context-knowledge related attributes, innovation-specific concerns were overcome and the theory was successful in identifying those who are most likely to consider an alternative fuel vehicle, such that five of the most innovative respondents indicated that their next household vehicle purchase would be an alternative fuel vehicle.

A further novel and original contribution is the addition to knowledge with regards to the rejection of innovations within Rogers’ theory, and, in particular, whether the rejection is active or passive. Findings have highlighted how it is largely passive rejection that is inhibiting the diffusion of alternative fuel vehicles. Low levels of knowledge and understanding of alternative fuel vehicles were found to cause passive rejection.

There are several ways to extend this research. An understanding of the role of opinion leaders could be better developed. There was evidence that the public follow the view of experts on matters that are important. There are public figures who may have the ability to shape opinions on alternative fuel vehicles and identifying these individuals may prove advantageous in speeding up the diffusion of new vehicle technologies. Another research extension could be to focus on the potential adoption of alternative fuel vehicles amongst relevant younger population segments, say those aged 25–40 who possess higher education qualifications and potentially high levels income to open up the possibility of purchasing such a vehicle. New innovative technologies, such as those that are associated with alternative fuel vehicles, could be better suited to future generations than older population groups, who may be more sceptical towards new technologies and resistant to change. This could have been the case in the risk averse Sutton Coldfield sample, which contained a high proportion of older respondents.

In addition, future studies must continue to monitor the diffusion of alternative fuel vehicles, as they may prove to be distinct (e.g., as an eco-innovation) from other innovations previously studied.

7. Policy Recommendations

A series of policy recommendations have emerged from the research. Regulation, such as increasing vehicle excise duty on conventional fuel vehicles and increasing fuel duty, may provide a solution, particularly in the early stages to stimulate demand, by making the cost of an electric vehicle more comparable with a conventional vehicle.

It was evident that the public is unaware of how an electric vehicle could be incorporated with minimal interference with lifestyle, such that in many households there was only one vehicle required for journeys exceeding the range of an electric vehicle on a regular basis. Policies in this respect need to focus on demonstrating the compatibility of alternative fuel vehicles with lifestyles. In order to reduce uncertainty for every part of alternative fuel vehicle ownership, it may be necessary to produce a guide to ownership, such as:

- Where to buy an electric vehicle, including a list of models available.

- Electric vehicle running costs (with examples of conventional vehicle costs).

- How to obtain the Plug-In Vehicle Grant.

- How and where to install charging infrastructure at home.

- Local and national charging points.

- How to use and access public charging points (i.e., registration and costs).

Policies that focus on educating the public about alternative fuel vehicles would be an essential part of increasing their adoption. It was evident from the Sutton Coldfield data that knowledge about alternative fuel vehicles is relatively poor. The open-response questions showed that, given the opportunity to express their views, the public has many unanswered questions about electric vehicles and the better provision of information would largely help to answer these as well as address any misperceptions. Few have actively sought information about alternative fuel vehicles, and this means that an approach delivering the information to the general public with minimal perceived effort on their part is likely to be necessary. This might be achieved through vehicle showcasing events, including opportunities to test-drive alternative fuel vehicles.

Author Contributions

A.F. was the primary investigator and this included project administration, methodology development and formal analysis. T.R. and R.T. provided the resources and project supervision. A.F. conducted the original writing. T.R. edited the drafts for paper submission and review, subject to checks and proof-reading by the two co-authors.

Funding

The Engineering and Physical Sciences Research Council (EPSRC) in the United Kingdom provided funding for this work through the Doctoral Training Centre for Hydrogen and Fuel Cells Technology across Birmingham University, Loughborough University and Nottingham University. This financial support is gratefully acknowledged.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Department for Transport’s National Transport Model. Road Transport Forecasts. 2013. Available online: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/260700/road-transport-forecasts-2013-extended-version.pdf (accessed on 2 August 2018).

- Parliamentary Office of Science and Technology (POST). Electric Vehicles. Available online: http://www.parliament.uk/documents/post/postpn365_electricvehicles.pdf (accessed on 2 August 2018).

- Electric Drive Transportation Association. Electric Drive Vehicle Sales Figures. Available online: http://www.electricdrive.org/index.php?ht = d/sp/i/20952/pid/20952 (accessed on 2 August 2018).

- The International Council on Clean Transportation. European Vehicle Market Statistics. Pocketbook 2017/18. Available online: https://www.theicct.org/sites/default/files/publications/ICCT_Pocketbook_2017_Web.pdf (accessed on 2 August 2018).

- Rogers, E.M. Diffusion of Innovations, 5th ed.; The Free Press: New York, NY, USA, 2003. [Google Scholar]

- Karakaya, E.; Hidalgo, A.; Nuur, C. Diffusion of eco-innovations: A review. Renew. Sustain. Energy Rev. 2014, 33, 392–399. [Google Scholar] [CrossRef]

- Englis, B.G.; Phillips, D.M. Does Innovativeness Drive Environmentally Conscious Consumer Behavior? Psychol. Mark. 2013, 30, 160–172. [Google Scholar] [CrossRef]

- Morton, C.; Anable, J.; Nelson, J.D. Exploring consumer preferences towards electric vehicles: The influence of consumer innovativeness. Res. Transp. Bus. Manag. 2016, 18, 18–28. [Google Scholar] [CrossRef]

- Rezvani, Z.; Jansson, J.; Bodin, J. Advances in consumer electric vehicle adoption research: A review and research agenda. Transp. Res. Part D Transp. Environ. 2015, 34, 122–136. [Google Scholar] [CrossRef]

- Roehrich, G. Consumer innovativeness: Concepts and measurements. J. Bus. Res. 2004, 57, 671–677. [Google Scholar] [CrossRef]

- McDonald, H.; Alpert, F. Who are “innovators” and do they matter? A critical review of the evidence supporting the targeting of “innovative” consumers. Mark. Intel. Plan. 2007, 25, 421–435. [Google Scholar] [CrossRef]

- Bass, F.M. A new product growth for model consumer durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Jansson, J. Consumer eco-innovation adoption: Assessing attitudinal factors and perceived product characteristics. Bus. Strategy Environ. 2011, 20, 192–210. [Google Scholar] [CrossRef]

- Albino, V.; Balice, A.; Dangelico, R.M. Environmental strategies and green product development: An overview on sustainability-driven companies. Bus. Strategy Environ. 2009, 18, 83–96. [Google Scholar] [CrossRef]

- Hellström, T. Dimensions of environmentally sustainable innovation: The structure of eco-innovation concepts. Sustain. Dev. 2007, 15, 148–159. [Google Scholar] [CrossRef]

- Schwanen, T.; Banister, D.; Anable, J. Scientific research about climate change mitigation in transport: A critical review. Transp. Res. Part A Policy Pract. 2011, 45, 993–1006. [Google Scholar] [CrossRef]

- Steg, L.; Gifford, R. Sustainable transportation and quality of life. J. Transp. Geogr. 2005, 13, 59–69. [Google Scholar] [CrossRef]

- Thøgerson, J. How may consumer policy empower consumers for sustainable lifestyles? J. Consum. Policy 2005, 28, 143–178. [Google Scholar] [CrossRef]

- Ricci, M.; Bellaby, P.; Flynn, R. What do we know about public perceptions and acceptance of hydrogen? A critical review and new case study evidence. Int. J. Hydrogen Energy 2008, 33, 5868–5880. [Google Scholar] [CrossRef]

- Graham-Rowe, E.; Gardner, B.; Abraham, C.; Skippon, S.; Dittmar, H.; Hutchins, R.; Stannard, J. Mainstream consumers driving plug-in battery-electric and plug-in hybrid electric cars: A qualitative analysis of responses and evaluations. Transp. Res. Part A Policy Pract. 2012, 46, 140–153. [Google Scholar] [CrossRef]

- Giffi, C.; Hill, R.; Gardner, M.; Hasegawa, M. Gaining Traction: A Customer View of Electric Vehicle Mass Adoption in the U.S. Automotive Market; Deloitte Consulting LLP: New York, NY, USA, 2010. [Google Scholar]

- Nemry, F.; Brons, M. Plug-In Hybrid and Battery Electric Vehicles. Market Penetration Scenarios of Electric Drive Vehicles; European Commission, Joint Research Centre: Brussels, Belgium, 2010; pp. 1–36. [Google Scholar]

- Lane, B.; Banks, N. LowCVP Car Buyer Survey: Improved Environmental Information for Consumers; Research Conducted by Ecolane and Sustain on Behalf of the Low Carbon Vehicle Partnership (LowCVP); Low Carbon Partnership: London, UK, 2010; Available online: https://www.lowcvp.org.uk/assets/reports/LowCVP-Car-Buyer-Survey-2010-Final-Report-03-06-10-vFINAL.pdf (accessed on 2 August 2018).

- Karplus, V.J.; Paltsev, S.; Reilly, J.M. Prospects for plug-in hybrid electric vehicles in the United States and Japan: A general equilibrium analysis. Transp. Res. Part A Policy Pract. 2010, 44, 620–641. [Google Scholar] [CrossRef]

- Musti, S.; Kockelman, K.M. Evolution of the household vehicle fleet: Anticipating fleet composition, PHEV adoption and GHG emissions in Austin, Texas. Transp. Res. Part A Policy Pract. 2011, 45, 707–720. [Google Scholar] [CrossRef]

- Carley, S.; Krause, R.M.; Lane, B.W.; Graham, J.D. Intent to purchase a plug-in electric vehicle: A survey of early impressions in large US cites. Transp. Res. Part D Transp. Environ. 2013, 18, 39–45. [Google Scholar] [CrossRef]

- Hidrue, M.K.; Parsons, G.R.; Kempton, W.; Gardner, M.P. Willingness to pay for electric vehicles and their attributes. Resour. Energy Econ. 2011, 33, 686–705. [Google Scholar] [CrossRef]

- O’Garra, T.; Mourato, S.; Pearson, P. Analysing awareness and acceptability of hydrogen vehicles: A London case study. Int. J. Hydrogen Energy 2005, 30, 649–659. [Google Scholar] [CrossRef]

- Hackbarth, A.; Madlener, R. Consumer preferences for alternative fuel vehicles: A discrete choice analysis. Transp. Res. Part D Transp. Environ. 2013, 25, 5–17. [Google Scholar] [CrossRef]

- Gärling, A.; Thøgerson, J. Marketing of electric vehicles. Bus. Strategy Environ. 2001, 10, 53–65. [Google Scholar] [CrossRef]

- Kurani, K.S.; Sperling, D.; Lipman, T.E.; Stanger, D.; Turrentine, T.; Stein, A. Household Markets for Neighborhood Electric Vehicles in California. Available online: https://escholarship.org/uc/item/5pn7z5r9 (accessed on 2 August 2018).

- Ozaki, R.; Sevastyanova, K. Going hybrid: An analysis of consumer purchase motivations. Energy Policy 2011, 39, 2217–2227. [Google Scholar] [CrossRef]

- Williams, B.D.; Kurani, K.S. Estimating the early household market for light-duty hydrogen-fuel-cell vehicles and other “Mobile Energy” innovations in California: A constraints analysis. J. Power Sources 2006, 160, 446–453. [Google Scholar] [CrossRef]

- Campbell, A.R.; Ryley, T.J.; Thring, R.H. Identifying the early adopters of alternative fuel vehicles: A case study of Birmingham, United Kingdom. Transp. Res. Part A Policy Pract. 2012, 46, 1318–1327. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using SPSS, 3rd ed.; SAGE Publications Ltd.: London, UK, 2009. [Google Scholar]

- Office for Low Emissions Vehicles. Plug-In CAR Grant Vehicles List and Eligibility Guidance; Office for Low Emissions Vehicles: London, UK, 2014. Available online: https://www.gov.uk/government/publications/plug-in-car-grant/plug-in-car-grant-vehicles (accessed on 12 July 2014).

- Department for Transport. Public Attitudes to Electric Vehicles. Available online: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/321157/electric-vehicles-2014.pdf (accessed on 2 August 2018).

- Altmann, M.; Gräsel, C. The Acceptance of Hydrogen Technologies. Available online: http://www.hyweb.de/accepth2/index.html (accessed on 2 August 2018).

- Egbue, O.; Long, S. Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions. Energy Policy 2012, 48, 717–729. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).