Abstract

In the context of worldwide internationalization, a new entrepreneurial financing mode has emerged and gained popularity, which has been improved and modified significantly in terms of both form and content. This study selects crowdfunding as its breakthrough point to explore and study the relationships between the backgrounds of initiators, experiences, and financing effects. Through data mining technology, this article introduces a database including 423 entrepreneurial financing projects and entrepreneurs’ information, and entrepreneurs’ locations covering 10 countries and regions. By using the multivariate least square model, we conclude that the entrepreneurs’ technical educational backgrounds, offline entrepreneurial experiences, and online entrepreneurial experiences all have positive effects on internet financing. The weaker the value that the uncertainty avoidance in the entrepreneurs’ host countries has, the stronger the facilitation and promotion from offline and online entrepreneurial experiences on internet financing. Furthermore, the level of uncertainty avoidance in the entrepreneurs’ countries has a moderating effect as well.

1. Introduction

With globalization and the prosperous development of the Internet economy, Internet technology innovation has not only diversified the modes of starting a business, it has also changed entrepreneurs’ methods of financing. Entrepreneurs, who used to rely on a traditional loan or venture capital investment institutions, have changed their financing modes into diversified new financing models in support of the Internet economy (examples of which include Internet micro-finance [1], Internet crowdfunding [1,2], and P2P (person to person) lending [3]). Driven by Internet technologies, these new financing modes are so suitable for medium–small-sized entrepreneurial teams that they are taking the place of the traditional ones gradually. The extension of Internet technology not only decreases entrepreneurs’ financing costs but also makes it possible for entrepreneurs to get their products and projects fully, efficiently, and conveniently displayed to potential investors, and to effectively express their financing demands and report the project progress. Meanwhile, investors can get more details about their invested projects through the Internet [4]. Among them, the entrepreneurial financing platform crowdfunding comes into view and attracts people’s attention for its low threshold and risk, as well as its easy accessibility for small financing projects. For example, among the major Internet crowdfunding platforms, the cost rate of financing on Kickstarter.com is only 5% of the financing amount, and it is only 4% of the financing amount on IndieGoGo.com [5].

The Internet micro-finance is originally designed to tackle the problem that poor people in developing countries have not secured entrepreneurial loans [1]. Therefore, the venture capital financing mode, based on Internet finance, is closely related to the cultural environment of the initiators’ society [6,7]. Based on the principle of Internet openness, the investors and entrepreneurs on the Internet financing platform exhibit diverse characteristics: they come from various countries and regions and have different backgrounds and experiences. These entrepreneurs, relying on new models of Internet entrepreneurial financing platforms, are influenced by different cultural conditions and are faced with the investment demands of different institutions and systems [5]. Compared with traditional ones, the entrepreneurs on the emerging Internet startup platform show more abundant cultural diversity [4].

Thus, compared with traditional entrepreneurial financing theory, there are many updates in form and content in the new venture financing behavior based on the Internet economy in the context of internationalization, regarding both investor characteristics and entrepreneurial leadership characteristics. Traditional theories are not enough to support the development of Internet entrepreneurship practice, especially because the diversity of a web startup’s openness is related to the entrepreneur’s background. This article focuses on the Internet crowdfunding platform and refers to the available statistics of 423 public financed technical programs from IndieGoGo.com. It is found from the aforementioned statistics that the initiators of these programs are from 10 different countries. Thus, the investors and entrepreneurial leaders have more updates, both in form and content, in these new financing activities under the background of internationalization and relying on the Internet economy, which is significantly different from those in the traditional theory. The traditional theory cannot catch up with the development of Internet entrepreneurial practices, especially from the perspective of the diverse entrepreneurs’ backgrounds brought by the openness of the Internet. Therefore, selecting crowdfunding as the breakthrough point and utilizing the international crowdfunding platform IndieGoGo.com, we established an Internet crowdfunding database containing 423 initiators of technical entrepreneurial projects from 10 different countries and regions in order to explore and study the relationships between the backgrounds of initiators, experiences, and financing effects.

However, from O2O (online to offline) and P2P (person to person) to P2B (person to business) modes, these financing markets based on the Internet economy are also facing uncertainty in terms of project operations, investment, and financing processes. Similarly, uncertainty avoidance is also influenced by social and cultural environments in different countries and regions. Thus, in this article, we acknowledge the moderating effects of these uncertainty avoidances on the relationships between the backgrounds, the experiences of initiators from different countries, and the financing effects. This article enriches the content of the studies of new financing modes in the era of the Internet and globalization and provides small enterprises and primary entrepreneurs with theoretical supports for better utilizing Internet advantages and making entrepreneurial financing.

First, in the article, the related theories have been summarized and analyzed. Second, based on relevant theoretical analysis, the research hypotheses have been proposed. Then, according to the theory foundation, it constructs the relational model on the regression analysis and analyses of the empirical results. Finally, conclusions and implications are given. By studying the influence of entrepreneurs’ backgrounds on the Internet financing effect, as well as the moderating effect of the degree of uncertainty avoidance in social culture, this paper provides a further supplement to the study the influence of human capital and cultural factors on entrepreneurial results.

2. Theoretical Analysis

2.1. Research on Crowdfunding

Traditional financial modes, including indirect finance such as bank loans and direct finances like VC (venture capital) and PE (private equity), mean high financing cost, difficulty of obtaining a mortgage, and multifarious procedures for medium-to-small-sized businesses [8]. Nevertheless, along with the cultivation of the Internet and the institutional reforms of entrepreneurial activities promoted by technical innovation, new financing models that are derived from Internet startups have emerged endlessly all over the world. These new models provide sufficient financial support for entrepreneurial innovation. Therefore, because of their low costs and free work environment, they have become popular among entrepreneurs to seek new financing modes [9]. Based on this, a new entrepreneurial financing model known as crowdfunding first showed up in the United States. Based on Internet communication technology, the initiators issue online project information with a given financing goal and gain free donation or paid contribution through social networks [10]. The crowdfunding mode has developed gradually on the basis of developed countries’ decisive innovation of entrepreneurial institution environment after the financial crisis in 2008 [9]. The promulgation of Jumpstart Our Business Startup (JOBS) has confirmed the legality of crowdfunding and boosts its development throughout the whole world.

Since the subject of this research, product crowdfunding, falls into the category of presale mode, it aims to reimburse investors with products or services. The financing processes of crowdfunding are as follows: first, the initiators post the project information on the public network platform. Then, investors interested in this project decide and invest the amount of money they would like to put in according to the basic information. A crowdfunding project may be regarded as successful once it raises funds over 100% of the funding goal within the restricted time; otherwise, it would be considered a failure. After achieving financial success, the public network platform will follow up and monitor the project’s progress to guarantee the completion of such projects and make sure that investors receive their physical payments in kind in the forms of products or services other than cash and stock.

Compared with other types of financing modes, international crowdfunding financing platforms, which are represented by product crowdfunding, have the following features: first, through public network platforms, crowdfunding initiators of projects can interact with their sponsors to win sponsors’ recognition by having mutual values, and initiators’ profits will rise along with the increase of sponsors’ income [11]. Therefore, the backgrounds and experiences of the initiators play a significant role in the network crowdfunding. The second feature is the investors’ limited accessibility to project information. Investors can only get to know projects through the literal description, pictures, or video, and it is quite difficult to have in-depth information about the entrepreneurs. Unlike traditional financing modes, crowdfunding lacks a strict credit rating system, which results in the uncertainty of projects in the subsequent implementation section.

As for the motivation of crowdfunding participants, initiators aim at financing, program propaganda, building long-term relationships with investors, gaining recognition from others, having control over projects, and learning experiences of financing and management. Investors are motivated by acquisition of products or services, social involvement, or participation in the manufacturing process of new products [12]. These factors will further contribute to the actual and final effects of crowdfunding. Thus, focusing on the experiences and backgrounds of crowdfunding initiators, this article explores factors that influence crowdfunding projects’ financing effects. These factors have quite essential practical significance for initiators: to launch fund-raising, to further optimize the markets, and to decrease the risks of investment and financing innovation modes of Internet finance.

2.2. Research on the Backgrounds of Internet Entrepreneurs

Startup and entrepreneurship are the conducts in which technical knowledge and market knowledge are mutually combined, whose essence is coupling entrepreneurs and entrepreneurial opportunities [13]. According to the Upper Echelons Theories developed in Reference [14], people are influenced by social and cultural environments when making decisions, and different educational backgrounds and experiences will help people form dissimilar values. Therefore, it is possible for human beings to predict decisions in light of individuals’ backgrounds. In the age of a knowledge economy, facing the economic tide of globalization, the way that entrepreneurs transfer their knowledge capital into venture capital is of significance to the success of entrepreneurship. Unlike the traditional startup, entrepreneurship based on an internet economy is about the discovery of new opportunities, as well as the development and exploitation of new technology. Innovating is the conduit of integrating new thinking patterns on the basis of existing knowledge, and the entrepreneurial behavior in the background of the Internet is the output of entrepreneurs’ accumulated knowledge and thinking patterns innovation.

The appearance and breakthrough of crowdfunding largely enriches the sources of potential investors in the entrepreneurial industry. Generally, the platform of crowdfunding is open to investors all over the world, so entrepreneurs’ uses of this platform are inherently characterized with diversification and internationalization [15,16]. Based on the platform, they are interacting with investors when the entrepreneurs utilize the platform for finances. Their educational backgrounds and experiences will, to some extent, play a part in the interaction and decide the success of the financing. According to the statistics collected from the Internet crowdfunding platform IndieGoGo.com, we found that among the technological projects that have raised funds in public, the initiators come from 29 countries, 26.5% of whom have had experience with crowdfunding before. The accumulated experience of entrepreneurs is effective for tackling new problems arising in the project, and their education, knowledge, and skills have positive effects on financing [17,18].

2.3. The Uncertainty Avoidance Tendency in Entrepreneurs’ Cultural Background

There are some regional differences in governance in performance assessments [19]. The unpredictability of project’s future development increases the uncertainty of the startup. Fundraisers and investors, based on the virtual platform, interact with each other, passing on information through a literal description, pictures, and videos. These features of crowdfunding further intensify the perception of uncertainty.

According to Hofstede’s theories on national cultural dimensions, the differences of values resulting from the cultural difference among countries can be measured in six dimensions: power distance, individualism versus collectivism, masculinity versus femininity, uncertainty avoidance, long term orientation versus short term orientation, and indulgence versus restraint. The “uncertainty avoidance” dimension expresses the degree to which members of a society feel uncomfortable with uncertainty and ambiguity. The fundamental issue here is how a society deals with the fact that the future can never be known: should we try to control the future or just let it happen? Countries exhibiting strong UAI (uncertainty avoidance index) maintain rigid codes of belief and behavior and are intolerant of unorthodox behavior and ideas. Weak UAI societies maintain a more relaxed attitude in which practice counts more than principles [20].

The uncertainty caused by cultural factors influences the performance of venture financing to a certain extent. Scholars found that the high cultural distance between entrepreneurial teams and investors could encourage investors to improve the risk evaluation of projects while evaluating projects to be more cautious in making investment choices [21]. Cultural distance and social network are two critical influence factors on internet entrepreneurial financing performance. Based on the theory of social embeddedness, Mu and Geng investigated the impact of cultural distance between entrepreneurs and investors on entrepreneurial financing performance, as well as the role that social network centrality plays in such a process. Their analysis showed that entrepreneurs’ social network centrality plays an intermediary role in the process of influencing financing performance regarding entrepreneurs’ social network and investors’ cultural distance, and proposes that entrepreneurs should pay more attention to their cultural distance from investors, improve their own social network centrality, and try to improve their financing performance by enriching their personal experiences [22].

Usually, people in a cultural background with a high level of uncertainty avoidance tend to resist change and prefer official organization with strict and specific regulations. They will deem innovations as risky and therefore avoid innovation to keep away from risks, even though innovation can improve efficiency. Hence, societies with a high level of uncertainty avoidance are normally less tolerant of ambiguity.

3. Research Hypotheses

3.1. Influence of Entrepreneurs’ Backgrounds on Financing Effect

Internet entrepreneurship is the innovation of a thinking mode based on current knowledge and skills. Entrepreneurial leaders start their business on the basis of recognizing entrepreneurial opportunities. Shane [23] pointed out that this recognition is based on capturing opportunities and understanding pertinent information. According to Individual Learning Theory, individuals can gain new knowledge and skills through theoretical learning, including both conceptual and behavioral learning. The former is the process of learning explicit knowledge through education, while the latter is the process of learning tacit knowledge embedded in social networks through observation and participation. The knowledge structure, accumulation, and former accumulated experiences of the entrepreneurs are the main sources of ensuring the implementation of entrepreneurial conduct. Previous working experiences will impose persistent influences on the entrepreneurial process, performance, and results [24]. An individual’s education level and experiences are symbols of personal capability and thus convey credible information about entrepreneurs and help them to obtain necessary resources [25]. Therefore, this article studies and measures the influences of entrepreneurial leaders’ educational backgrounds and experiences on financing effect of the crowdfunding platform.

Investing in sustainable projects can help one to deal with current sustainability challenges. VC investments can contribute significantly to the growth of sustainable start-ups [26]. In the traditional investment environment, entrepreneurs’ preparedness has a significant impact on investors’ investments. Compared with traditional patterns of investment, crowdfunding platforms occur in a virtual environment, in which investors can only perceive and assume the qualities of projects through entrepreneurs’ literal descriptions, pictures, and videos [27]. In this way, it is exceedingly important to take the understanding of projects, precise description, and accurate prediction on consumer’s demands. If the project leader, who has a technical educational background, knows more about how existing professional knowledge would transfer into new technology, processes, and products [28], it will help them demonstrate more clearly the product’s specialties and technical advantages and make them more competitive in attracting investors. Since leaders with marketing educational backgrounds know more about the marketing niches and consumer psychology, they can meet the interests of investors better during the description process of projects, so that they can “decorate” their products in a more attractive way. Accurate description is helpful to convey enterprises’ identical characteristics and the significance of grabbing opportunities and the logic behind them, as well as for manifesting the hard work of entrepreneurs; thus it is valuable for them to obtain more entrepreneurial resources.

Besides the professional knowledge gained through educational backgrounds, relevant experiences have a significant influence on entrepreneurs’ success [29,30,31]. Entrepreneurs’ experiences could not only provide more knowledge and skills to solve problems in the procedure of entrepreneurship but could also ensure that the entrepreneurs could better interact with investors in crowdfunding communities. Moreover, the various networks formed on the basis of entrepreneurs’ diversified experiences will produce better resource advantages to promote financing. More importantly, relevant experiences can legally legitimize entrepreneurs and bring them more recognition from the outside investors to gain more requisite resources [28,32]. For more traditional venture investors, entrepreneurs’ experiences are so essential that they have been one of the standards for deciding whether to invest or not [33,34]. Inferring from different entrepreneurs’ previous successful crowdfunding experiences can help them to obtain investments. Despite the gaps between offline entrepreneurial experiences and internet financing, offline and online experiences still share some common characteristics concerning entrepreneurial knowledge, experiences, resources, and human interactions. Thus, previous crowdfunding experiences can legally legitimize entrepreneurs and earn investors’ trust.

Hypothetical 1a.

An entrepreneur’s background of technological education has a positive effect on Internet financing.

Hypothetical 1b.

An entrepreneur’s background of marketing education has a positive effect on Internet financing.

Hypothetical 1c.

An entrepreneur’s offline entrepreneurial experience has a positive effect on Internet financing.

Hypothetical 1d.

An entrepreneur’s online entrepreneurial experience has a positive effect on Internet financing.

3.2. Influence of Entrepreneur’s Host Country’s Uncertainty Avoidance on Financing Effects

Culture, in the context of management, can be defined as a deep value system in specific groups or societies and includes the cognition and behavior modes of individual members. It encourages individuals to commit engage in conduct that does not usually occur in other societies [35,36]. On one hand, culture endows individuals with traits to drive innovation and entrepreneurial orientation; on the other hand, it motivates people to transfer these traits and this orientation into effective actions [37], since one of the most important attributes of a startup is to take risks [38]. In Hofstede’s cultural dimension theory, uncertainty avoidance is most closely related to the startup of new business.

Uncertainty avoidance represents an individual’s attitudes and values regarding risk and uncertainty. In cultures with a low level of uncertainty avoidance, individuals appear to be more accepting of uncertainty and endure a higher level of business uncertainty. Therefore, individuals in the culture with lower uncertainty avoidance are more willing to take risks and more likely to accept novel behavior, to deviate from traditional standards, and to seek a sense of achievement from pioneering a business. Meanwhile, cultures with higher uncertainty avoidance avoid and reduce uncertainty as much as possible and are intolerant of unorthodox behavior and ideas [39,40]. Therefore, in a cultural context with lower uncertainty avoidance, members’ entrepreneurial and innovative orientations are more evident, and they can accept new models and risky technologies in entrepreneurship [36,41].

Besides improving members’ entrepreneurial orientations and accepting capabilities in new situations, a cultural environment with lower uncertainty avoidance can provide more entrepreneurial opportunities and resources to improve its chances of success. In countries with lower uncertainty avoidance, members are more innovative [42]; hence, entrepreneurs in this cultural context may have more favorable and more novel entrepreneurial opportunities. Moreover, in countries where uncertainty is more acceptable, it costs less to persuade others to accept innovative activities or thoughts [39,41]. In other words, lower uncertainty avoidance further provides entrepreneurs with a supportive social environment to help them bear vagueness and uncertainty, encourage them to apply resources to venture investment, and motivate their members to transfer their entrepreneurial orientation into effective action [43]. Therefore, we can conclude that, for this new form of financing, namely, Internet entrepreneurial financing, entrepreneurs in a cultural context with lower uncertainty avoidance are more able to accept and positively make use of uncertainty, which helps them to put forward more innovative projects and set up more efficient crowdfunding networks, which in turn contributes to acquiring funds.

Hypothetical 2.

The lower the uncertainty avoidance of an entrepreneur’s host country, the stronger the promotion on Internet financing is.

3.3. Moderating Effects of Entrepreneurs’ Level of Uncertainty Avoidance on Financing Effects

As stated above, entrepreneurs’ educational backgrounds and previous startup experiences promote Internet financing effects. However, entrepreneurs are embedded in specific national environments, which might enhance or repress the formation of new investments [27,43]. Younghwan and Junseok, by analyzing an online survey, found that social influence, effort expectancy, and perceived trust had significant effects on the use intention of backers for crowdfunded appropriate technology projects [44]. The characteristics of entrepreneurs are certainly important [27], but supportive cultural environments also play critical roles in cultivating potential entrepreneurial consciousness and behaviors [32]. Existing studies have verified that cultures have significant moderating effects on the efficiency of entrepreneurship, as well as the difficulty of starting up business [36,41]. In the context of lower uncertainty avoidance, entrepreneurs are more motivated and innovative, while being more likely to get support from the surrounding environment and turn motives into efficient entrepreneurship [41,42,45].

Moreover, compared with traditional forms of financing, Internet financing platforms may have higher uncertainty avoidance for fundraisers and investors. It seems that a culture of low uncertainty avoidance is particularly important, under which entrepreneurs’ educational backgrounds and experiences can play a more positive role in promoting the success of financing. On the contrary, in countries with higher uncertainty avoidance, entrepreneurs are not inclined to adopt internet financing, as they have a higher level of risk; on the other hand, the business environment may not be able to provide enough support and suppress the promotion and function of entrepreneurs’ educational backgrounds and experiences of financing. Therefore, host countries’ levels of uncertainty avoidance could adjust the effect of entrepreneurs’ educational backgrounds and experiences of Internet financing.

Hypothetical 3a.

The lower the value of uncertainty avoidance in the cultures of entrepreneurial leaders’ host countries is, the stronger the promotion of technical educational backgrounds on Internet financing is.

Hypothetical 3b.

The lower the value of uncertainty avoidance in the cultures of entrepreneurial leaders’ host countries is, the stronger the promotion of marketing educational backgrounds on Internet financing is.

Hypothetical 3c.

The lower the value of uncertainty avoidance in the cultures of entrepreneurial leaders’ host countries is, the stronger the function of offline entrepreneurial experience on Internet financing is.

Hypothetical 3d.

The lower the value of uncertainty avoidance in the cultures of entrepreneurial leaders’ host countries is, the stronger the function of online entrepreneurial experience on Internet financing is.

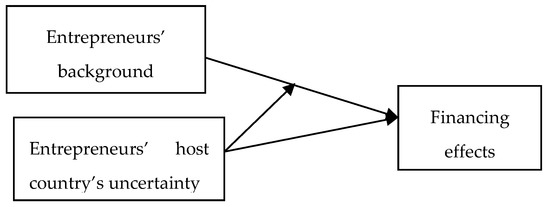

In conclusion, the logical relationship between variables in this paper can be expressed as the following model (see Figure 1).

Figure 1.

Internet entrepreneur background theoretical model.

4. Research Design

4.1. Data Collection

The data of this study was sourced from the internet crowdfunding website “IndieGoGo.com”, which was founded by S&T (sales and trading) financial enterprise IndieGoGo Inc. Since its establishment in 2008, IndieGoGo has positioned itself as a large and diversified Internet venture capital corporation. Compared with other Internet crowdfunding companies that serve for the specific objects, IndieGoGo does not limit its customer types. Besides, IndieGoGo’s crowdfunding business is more international. There are no requirements as to what venture projects are allowed and which countries the project team members come from.

Using data mining techniques, the authors of this article chose projects from 1 May 2014 to 30 April 2015 and collected data from other social network websites containing available project information of venture project leaders, such as Wikipedia, Facebook, and LinkedIn, and then downloaded the data and texts of team leaders’ personal education and entrepreneurial experience information that was accessible to visitors. In order to explore the influences of leaders’ education, entrepreneurial experience, and the host country’s uncertainty evasion on startup funding performances, this article introduced a database including 423 entrepreneurial financing projects and entrepreneurs’ information, and entrepreneurs’ locations covering 10 countries and regions, with the invalid data removed.

4.2. Variable Structures

4.2.1. Dependent Variables

According to the sales target of the venture project, the contribution ratio (that is, the ratio of the investor’s final investment contribution to the project financing target) was taken as the dependent variable. IndieGoGo asks entrepreneurs to open their financing goals, and the website will mark the amounts of funds that the investors actually subscribed and that are successfully charged when the crowdfunding period is over. According to IndieGoGo’s crowdfunding rules, if the final subscribed amounts are higher than the project goals, crowdfunding will be launched, and all of the funds will be delivered to the entrepreneurial teams as venture capital after deducting expenses. On the contrary, if the crowdfunding projects and entrepreneurial financing have failed, then the charged money will be returned to investors. Therefore, we use the proportion of final financing amounts and the financing goal as dependent variables.

4.2.2. Explanatory Variables

This article assigned values to entrepreneurial leaders’ educational background on the basis of traditional demographic research methods. From the average education level of entrepreneurs themselves and social network members, relevant model explanatory variables were generated [46,47]. Leaders were divided into four classes based on their marketing and technical education levels. Each class was assigned corresponding scores: 3 points for entrepreneurs with doctorate degrees, 2 points for one with a master’s degree, 1 point for ones with bachelor’s degree, and 0 points for ones with lower or no degree. As for the leaders’ offline and online entrepreneurial experiences, relevant social networking sites provided all entrepreneurs and their social network members with occupational attributes, and this study matched entrepreneurs and their social network members after deleting unlabeled occupational information and unrecognized entrepreneurs. This article represented entrepreneurs’ previous online entrepreneurial experience concerning whether they had run a self-owned business on Indiegogo before and whether their previous offline entrepreneurial experience included running a self-owned business offline; Yes was given value of 1, and No was given a value of 0 [29].

4.2.3. Moderating Variables

We also use the uncertainty avoidance value as one of Hofstede’s cultural dimensions as the moderating variable in measuring the value of entrepreneurs’ cultural uncertainty avoidance (Shane, 1995) [45]. Then, we added the following cross effects as variables to consider the uncertainty avoidance’s moderating effects on entrepreneurial experience: the cross effect of uncertainty avoidance and entrepreneurial leaders’ technical education level, the cross effect of uncertainty avoidance and leaders’ marketing education level, the cross effect of uncertainty avoidance and leaders’ online entrepreneurial experience, and the cross effect of uncertainty avoidance and leaders’ offline experience.

4.2.4. Control Variables

While IndieGoGo marks the financing goals of entrepreneurial projects, it determines explicit public financing duration as well. The financing goals (in 104 US$) and duration (in days) will undoubtedly influence the success and proportion of financing to some extent [5]. Therefore, in this article, we regard them as control variables. Moreover, through the research of social platforms’ impact factors, Kwak & Lee [48] have found that fans of internet platform users can reflect the recognition of views on Weibo or Twitter. According to the inherent features of Internet social networks, this article further measured the entrepreneurial members’ social network recognition level based on the numbers of positive comments on their personal websites, and therefore we set the positive comment numbers from potential investors as the control variable [49,50,51,52,53,54,55]. In the meantime, this article added the technical dummy variable as a control variable. Finally, it has been proved by experts that different state systems would influence entrepreneurial teams’ performances, so in this article we introduce the host country project as a dummy variable or control variable [56,57,58,59,60,61,62].

5. Findings and Discussion

After calculating with STATA, we found that the model’s correlation coefficient showed that the selected explanatory variables and moderating variable in this article had a significant correlation coefficient with dependent variables.

Most of the correlation coefficients between explanatory variables, the moderating variable, and control variables were lower than 0.3, which means the correlation between each independent variable was relatively insignificant, and multicollinearity problems could be avoided (see Table 1). Furthermore, we have done the VIF (variance inflation factor) test, and all VIF values gave a result less than 2, which indicates that there were no obvious multicollinearity problems.

Table 1.

Descriptive Statistics and Correlations.

Further, we used an OLS (ordinary least squares) model and undertook a regression analysis. In order to further study the moderating effects of entrepreneurial leaders’ uncertainty avoidance on education level and entrepreneurial experience, we added the cross-effects of moderator variables and explanatory variables. For the specific regression results, see Table 2.

Table 2.

Regression Models of Main Effects.

According to the above empirical results, a summary has been made in Table 3 below that contains all the hypothetical results in order to give a more intuitive observation.

Table 3.

Hypothetical Results.

As is seen in the model regression results, technical education level and online/offline entrepreneurial experiences show a significant positive regression coefficient, which demonstrate that technical education level and online/offline entrepreneurial experiences all have positive effects regarding entrepreneurs’ ability to obtain a higher financing proportion, and thus influence the financing performances. The model regression results have supported Hypotheses H1a, H1c, and H1d. However, regression results showed that that marketing education level had no significant effect on the financing performances, and the model regression results have rejected Hypothesis H1b.

Besides, according to the model regression results, we can draw the conclusion that the leaders’ uncertainty avoidance had no direct influence on entrepreneurial financing, and the model results have rejected Hypothesis H2.

At last, there were no significant regression coefficients in both the cross effect between the uncertainty avoidance and leaders’ technical education level, and between the uncertainty avoidance and leaders’ marketing education level. The value of uncertainty avoidance exhibited no influence on entrepreneurs’ education effect of online financing. Therefore, Hypotheses H3a and H3b were rejected by the models.

The cross effect between uncertainty avoidance and online entrepreneurial experiences, as well as the cross effect between uncertainty avoidance and online entrepreneurial experiences, had significant negative regression coefficients. This illustrates that the uncertainty avoidance of leaders’ cultural backgrounds moderated the influence of entrepreneurial leaders’ two different startup experiences on venture financing performance. The stronger the uncertainty avoidance tendency was, the weaker the positive impacts of entrepreneurial experiences on financing performances were. Hence, Hypotheses H3c and H3d were supported.

This article was prepared for exploring the influences of entrepreneurs’ educational backgrounds and entrepreneurial experiences on Internet startup financing performance and exploring the moderating effects of uncertainty avoidance in host countries’ cultures during the Internet startup. Based on Internet crowdfunding data, this article draws the following conclusions through empirical analysis:

First, entrepreneurs’ technical educational backgrounds, as well as their offline/online entrepreneurial experiences, had positive impacts on online crowd finding, while marketing education backgrounds did not. It is possible that the research object of this article is product crowdfunding, and therefore the entrepreneurs’ technical knowledge backgrounds and startup experiences could endow themselves with more legitimacy in the process of financing [32,33,34]. Moreover, previous successful entrepreneurial experiences may extend entrepreneurs’ startup networks, which would benefit their entrepreneurial project by obtaining necessary resources. Unlike with traditional methods, the potential investors can evaluate projects through literal description, pictures, and videos on crowdfunding platform. Consequently, the legitimacy of entrepreneurs’ backgrounds to some extent may reduce potential investors’ perception of uncertainty, to promote the success of financing.

Second, cultural uncertainty avoidance had no direct impact on Internet financing, in spite of the fact that existing research shows positive results that the uncertainty avoidance level plays an essential role in traditional entrepreneurial orientation [43,44,45]. Entrepreneurs on online entrepreneurial financing platforms are facing richer cultural diversity during online financing, and cultural influences of their host countries have diminished under this background [15]. As a result, this article has discovered that the uncertainty avoidance level does not directly influence the results of online entrepreneurial financing, such as online crowdfunding. On the other hand, this might be the reason that crowdfunding is relatively hard for people to accept as an emerging financing form for entrepreneurs regarding cultural backgrounds with higher uncertainty avoidance level. On account of entrepreneurs’ characteristics, their attitudes towards uncertainty have deviated from the host country’s culture. Therefore, despite the negative influence of uncertainty avoidance on Internet financing, the differences were not significant. Uncertainty avoidance also had no moderating effects on the relationship between entrepreneurs’ educational backgrounds and their financing performances, possibly because entrepreneurs’ educational backgrounds in terms of acquiring funds had more symbolic meaning, which was to pass on entrepreneurs’ credibility [25], which can hardly be influenced by cultural value.

Finally, uncertainty avoidance had moderating effects on entrepreneurs’ experience accumulation and financing performance. In cultural contexts with lower uncertainty avoidance, entrepreneurs’ online financing and offline startup experiences were more likely to promote financing success. This conclusion shows that the host country’s culture could not only influence the entrepreneurs’ motivation and relative characteristics but also provide a supportive environment and cause entrepreneurs’ experiences to play a more significant role in the success of Internet financing.

6. Conclusions

Among the resources needed for entrepreneurial activities, venture capital is an indispensable resource, which is the core of the resource integration of entrepreneurs. This paper aimed to explore the influence of educational background and entrepreneurial experience on the financing effects of Internet entrepreneurship, as well as the regulatory role of uncertainty avoidance in social culture.

For small enterprises or startup entrepreneurs, we also provided managerial implications to make full use of the online financing platform. First, entrepreneurs are supposed to obtain resources from symbolic management [25]. Because the information of Internet financing modes was more limited, the symbolic meanings of entrepreneurs’ educational backgrounds and experiences are even more important than the financing modes of the past. Their educational backgrounds and experiences could be regarded as a symptom of abilities, which would demonstrate entrepreneurs’ ability to promote projects to potential investors and the reliability of startups. Therefore, when financing on an online platform, entrepreneurs are supposed to highlight the advantages of themselves or their team members regarding education or entrepreneurial experience in this respect. Second, entrepreneurs should attach great importance to cultural influences. Although culture had no direct effects on financing performance in a supportive cultural environment, entrepreneurs could better take their advantages of experience and promote the success of financing. For entrepreneurs whose countries had higher uncertainty avoidance, they should enhance the impacts of culture when starting a business. They should get rid of the uncertainty of this new type of financing, accept and actively make use of the convenience of Internet entrepreneurial financing, and, meanwhile, shape and fully play their advantages for the success of financing.

Since Internet financing represented by Internet crowdfunding is just getting started, related studies, especially empirical research, are insufficient. In terms of content, this article has enriched relevant research on new modes of entrepreneurial financing in the era of Internet and globalization. Current studies on influencing factors of crowdfunding are mostly focused on inspecting uncertainty, the investment risk of the product, and organizational forms of products in terms of environmental factors [63]. From the perspective of participants, most focus on investors’ investment decision-making and pay less attention to entrepreneurs themselves. Moreover, although it has been realized that geographic location influences crowdfunding, few have tried to introduce culture in empirical research. This article, through empirical research on the impact of entrepreneurs’ backgrounds on online financing performance and the moderating effects of uncertainty avoidance in Hofstede’s cultures dimensions, has further supplemented the study’s results with respect to the influences of human capital and cultural factors on the financial outcomes of entrepreneurship.

Admittedly, this study has limitations that might constrain the generalizability of the findings. First, this paper has not been able to distinguish educational background from entrepreneurial experience regarding the financing success of the mechanism. From the conclusion, the degree of uncertainty avoidance has different regulatory effects on educational background and entrepreneurial experience, which may indicate that educational background and entrepreneurial experience have different mechanisms that influence the financing effect. Although both educational background and entrepreneurial experience can promote financing by improving the legitimacy of entrepreneurial projects, entrepreneurial experience may also promote financing through the entrepreneurial network established previously and specific knowledge related to entrepreneurship. Second, this paper only focused on product crowdfunding. Product crowdfunding is a kind of pre-sale crowdfunding, which is different from lending and equity investment. When potential investors make investment decisions, they will not only evaluate start-up projects but also make investment decisions based on their own demand for return products. Therefore, there may be differences between the mechanism of the influence of the entrepreneur’s background on the financing effect and borrowing and equity investment. Besides that, we collect data on the surviving entrepreneurial projects in an ex-post manner. However, we cannot track projects that have stopped using the portal, thus inducing a survivor bias [64]. Finally, the special features of online crowdfunding entrepreneurs and investors in emerging markets need to be incorporated for potentially insightful findings. We will leave these aspects for future research. Future research can further focus on how entrepreneurs’ knowledge and skills promote the success of different forms of Internet financing and explore the different mechanisms and the role of more situational factors.

Author Contributions

Writing: Z.Y.; Providing case and idea: Z.Y., S.-B.T.; Revising and editing: K.W., S.-B.T., and L.Z.

Funding

This research was funded by [Tianjin City philosophy and social science planning] grant number [TJGL15-051] Zhongshan City Science and Technology Bureau Project (No. 2017B1015) and Beijing Social Science Fund Project (Grant No. 18GLC076).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Khavul, S. Microfinance: Creating opportunities for the poor? Acad. Manag. Perspect. 2010, 24, 58–72. [Google Scholar] [CrossRef]

- Schwienbacher, A. The entrepreneur’s investor choice: The impact on later-stage firm development. J. Bus. Ventur. 2013, 28, 528–545. [Google Scholar] [CrossRef]

- Moenninghoff, S.C.; Wieandt, A. The future of peer-to-peer finance. Z. Betriebswirtsch. Forsch. 2013, 65, 466–487. [Google Scholar] [CrossRef]

- Lehner, O.M. Crowdfunding social ventures: A model and research agenda. Ventur. Cap. 2013, 15, 289–311. [Google Scholar] [CrossRef]

- Tomczak, A.; Brem, A. A conceptualized investment model of crowdfunding. Ventur. Cap. 2013, 15, 335–359. [Google Scholar] [CrossRef]

- Khavul, S.; Bruton, G.D.; Wood, E. Informal family business in Africa. Entrep. Theory Pract. 2009, 33, 1219–1238. [Google Scholar] [CrossRef]

- Khavul, S.; Chavez, H.; Bruton, G.D. When institutional change outruns the change agent: The contested terrain of entrepreneurial microfinance for those in poverty. J. Bus. Ventur. 2013, 28, 30–50. [Google Scholar] [CrossRef]

- Berger, A.N.; Saunders, A.; Scalise, J.M.; Udell, G.F. The effects of bank mergers and acquisitions on small business lending. J. Financ. Econ. 1998, 50, 187–229. [Google Scholar] [CrossRef]

- Bruton, G.; Khavul, S.; Siegel, D.; Wright, M. New Financial Alternatives in Seeding Entrepreneurship: Microfinance, Crowdfunding, and Peer-to-Peer Innovations. Entrep. Theory Pract. 2015, 39, 9–26. [Google Scholar] [CrossRef]

- Ordanini, A.; Miceli, L.; Pizzetti, M.; Parasuraman, A. Crowd-funding: Transforming customers into investors through innovative service platforms. J. Serv. Manag. 2011, 22, 443–470. [Google Scholar] [CrossRef]

- Belleflamme, P.; Lambert, T.; Schwienbacher, A. Crowdfunding: Tapping the right crowd. J. Bus. Ventur. 2014, 29, 585–609. [Google Scholar] [CrossRef]

- Gerber, E.M.; Hui, J.S.; Kuo, P.Y. Crowdfunding: Why people are motivated to post and fund projects on crowdfunding platforms. In Proceedings of the Computer Supported Cooperative Work 2012, Seattle, WA, USA, 11–15 February 2012. [Google Scholar]

- Storey, D.J.; Tether, B.S. New technology-based firms in the European Union: An introduction. Res. Policy 1998, 26, 933–946. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Korsgaard, S. Entrepreneurship as translation: Understanding entrepreneurial opportunities through actor-network theory. Entrep. Reg. Dev. 2011, 23, 661–680. [Google Scholar] [CrossRef]

- Meyskens, M.; Paul, K. The evolution of corporate social reporting practices in Mexico. J. Bus. Ethics 2010, 91, 211–227. [Google Scholar] [CrossRef]

- Huckman, R.S.; Staats, B.R. Fluid tasks and fluid teams: The impact of diversity in experience and team familiarity on team performance. Manuf. Serv. Oper. Manag. 2011, 13, 310–328. [Google Scholar] [CrossRef]

- Van Osnabrugge, M. A comparison of business angel and venture capitalist investment procedures: An agency theory-based analysis. Ventur. Cap. 2000, 2, 91–109. [Google Scholar] [CrossRef]

- Pinto, F.; Simões, P.; Marques, R. Raising the bar: The role of governance in performance assessments. Util. Policy 2017, 49, 38–47. [Google Scholar] [CrossRef]

- Kirkman, B.L.; Lowe, K.B.; Gibson, C.B. A quarter century of culture’s consequences: A review of empirical research incorporating Hofstede’s cultural values framework. J. Int. Bus. Stud. 2006, 37, 285–320. [Google Scholar] [CrossRef]

- Gray, S.; Kang, T.; Yoo, Y. National culture and international differences in the cost of equity capital. Manag. Int. Rev. 2013, 53, 899–916. [Google Scholar] [CrossRef]

- Mu, R.; Geng, T. Cultural distance, network centrality and internet entrepreneurial financing—Empirical test based on crowdfunding data. J. Beijing Technol. Bus. Univ. Soc. Sci. 2017, 32, 94–103. [Google Scholar]

- Shane, S. Prior Knowledge and the Discovery of Entrepreneurial Opportunities. Organ. Sci. 2000, 11, 448–469. [Google Scholar] [CrossRef]

- Beckman, C.M.; Burton, M.D. Founding the Future: Path Dependence in the Evolution of Top Management Teams from Founding to IPO. Organ. Sci. 2008, 19, 3–24. [Google Scholar] [CrossRef]

- Zott, C.; Huy, Q.N. How entrepreneurs use symbolic management to acquire resources. Adm. Sci. Q. 2007, 52, 70–105. [Google Scholar] [CrossRef]

- Antarciuc, E.; Zhu, Q.; Almarri, J.; Zhao, S.; Feng, Y.; Agyemang, M. Sustainable Venture Capital Investments: An Enabler Investigation. Sustainability 2018, 10, 1204. [Google Scholar] [CrossRef]

- Mollick, E. The dynamics of crowdfunding: An exploratory study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef]

- Cooper, A.C.; Bruno, A.V. Success among high-technology firms. Bus. Horiz. 1977, 20, 16–22. [Google Scholar] [CrossRef]

- Stuart, R.W.; Abetti, P.A. Impact of entrepreneurial and management experience on early performance. J. Bus. Ventur. 1990, 5, 151–162. [Google Scholar] [CrossRef]

- Jo, H.; Lee, J. The relationship between an entrepreneur’s background and performance in a new ventur. Technovation 1996, 16, 161–211. [Google Scholar] [CrossRef]

- Ramayah, T.; Ahmad, N.H.; Fei, T.H.C. Entrepreneur education: Does prior experience matter? J. Entrep. Educ. 2012, 15, 65. [Google Scholar]

- Zimmerman, M.A. The Influence of Top Management Team Heterogeneity on the Capital Raised through an Initial Public Offering. Entrep. Theory Pract. 2008, 32, 391–414. [Google Scholar] [CrossRef]

- MacMillan, I.C.; Siegel, R.; Narasimha, P.N.S. Criteria used by venture capitalists to evaluate new venture proposals. J. Bus. Ventur. 1986, 1, 119–128. [Google Scholar] [CrossRef]

- Tyebjee, T.T.; Bruno, A.V. A model of venture capitalist investment activity. Manag. Sci. 1984, 30, 1051–1066. [Google Scholar] [CrossRef]

- Erez, M.; Earley, P.C. Culture, Self-Identity, and Work; Oxford University Press: Oxford, UK, 1993. [Google Scholar]

- Mueller, S.L.; Thomas, A.S. Culture and entrepreneurial potential: A nine country study of locus of control and innovativeness. J. Bus. Ventur. 2001, 16, 51–75. [Google Scholar] [CrossRef]

- Baughn, C.C.; Neupert, K.E. Culture and national conditions facilitating entrepreneurial start-ups. J. Int. Entrep. 2003, 1, 313–330. [Google Scholar] [CrossRef]

- Cooper, A.C.; Dunkelberg, W.C. Entrepreneurship and paths to business ownership. Strateg. Manag. J. 1986, 7, 53–68. [Google Scholar] [CrossRef]

- Hofstede, G. Motivation, leadership, and organization: Do American theories apply abroad? Organ. Dyn. 1980, 9, 42–63. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: International Differences in Work-Related Values; Sage: Newcastle upon Tyne, UK, 1984. [Google Scholar]

- Lee, S.M.; Peterson, S.J. Culture, entrepreneurial orientation, and global competitiveness. J. World Bus. 2001, 35, 401–416. [Google Scholar] [CrossRef]

- Shane, S. Cultural influences on national rates of innovation. J. Bus. Ventur. 1993, 8, 59–73. [Google Scholar] [CrossRef]

- Busenitz, L.W.; Gomez, C.; Spencer, J.W. Country institutional profiles: Unlocking entrepreneurial phenomena. Acad. Manag. J. 2000, 43, 994–1003. [Google Scholar]

- Moon, Y.; Hwang, J. Crowdfunding as an Alternative Means for Funding Sustainable Appropriate Technology: Acceptance Determinants of Backers. Sustainability 2018, 10, 1456. [Google Scholar] [CrossRef]

- Shane, S. Uncertainty avoidance and the preference for innovation championing roles. J. Int. Bus. Stud. 1995, 26, 47–68. [Google Scholar] [CrossRef]

- Hoang, H.; Antoncic, B. Network-Based Research in Entrepreneurship: A Critical Review. J. Bus. Ventur. 2003, 18, 165–187. [Google Scholar] [CrossRef]

- Witt, P. Entrepreneurs’ Networks and the Success of Start-Ups. Entrep. Reg. Dev. 2004, 16, 391–412. [Google Scholar] [CrossRef]

- Kwak, H.; Lee, C.; Park, H.; Moon, S. What is Twitter, a social network or a news media? In Proceedings of the 19th international conference on World Wide Web, Raleigh, NC, USA, 26–30 April 2010; pp. 591–600. [Google Scholar]

- Tsai, S.-B. Using the DEMATEL Model to Explore the Job Satisfaction of Research and Development Professionals in China’s Photovoltaic Cell Industry. Renew. Sustain. Energy Rev. 2018, 81, 62–68. [Google Scholar] [CrossRef]

- Lee, Y.C.; Hsiao, Y.C.; Peng, C.F.; Tsai, S.B.; Wu, C.H.; Chen, Q. Using Mahalanobis-Taguchi System, Logistic Regression and Neural Network Method to Evaluate Purchasing Audit Quality. Proc. Inst. Mech. Eng. Part B J. Eng. Manuf. 2015, 229 (Suppl. 1), 3–12. [Google Scholar] [CrossRef]

- Lee, Y.C.; Chen, C.Y.; Tsai, S.B.; Wang, C.T. Discussing green environmental performance and competitive strategies. Pensee 2014, 76, 190–198. [Google Scholar]

- Liu, B.; Li, T.; Tsai, S.B. Low carbon strategy analysis of competing supply chains with different power structures. Sustainability 2017, 9, 835. [Google Scholar] [CrossRef]

- Qu, Q.; Tsai, S.B.; Tang, M.; Xu, C.; Dong, W. Marine ecological environment management based on ecological compensation mechanisms. Sustainability 2016, 8, 1267. [Google Scholar] [CrossRef]

- Lee, Y.C.; Wang, Y.C.; Chien, C.H.; Wu, C.H.; Lu, S.C.; Tsai, S.B.; Dong, W. Applying revised gap analysis model in measuring hotel service quality. SpringerPlus 2016, 5, 1191. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Yang, J.M.; Chen, Q.; Tsai, S.B. Collaborative Production Structure of Knowledge Sharing Behavior in Internet Communities. Mob. Inf. Syst. 2016. [Google Scholar] [CrossRef]

- Tsai, S.B.; Lee, Y.C.; Guo, J.J. Using modified grey forecasting models to forecast the growth trends of green materials. Proc. Inst. Mech. Eng. Part B J. Eng. Manuf. 2014, 228, 931–940. [Google Scholar] [CrossRef]

- Tsai, S.B.; Zhou, J.; Gao, Y.; Wang, J.; Li, G.; Zheng, Y.; Ren, P.; Xu, W. Combining FMEA with DEMATEL Models to Solve Production Process Problems. PLoS ONE 2017, 12, e0167710. [Google Scholar] [CrossRef] [PubMed]

- Ge, B.; Jiang, D.; Gao, Y.; Tsai, S.B. The influence of legitimacy on a proactive green orientation and green performance: A study based on transitional economy scenarios in china. Sustainability 2016, 8, 1344. [Google Scholar] [CrossRef]

- Lee, S.C.; Su, J.M.; Tsai, S.B.; Lu, T.L.; Dong, W. A comprehensive survey of government auditors’ self-efficacy and professional Development for improving audit quality. SpringerPlus 2016, 5, 1263. [Google Scholar] [CrossRef] [PubMed]

- Chen, H.M.; Wu, C.H.; Tsai, S.B.; Yu, J.; Wang, J.; Zheng, Y. Exploring key factors in online shopping with a hybrid model. SpringerPlus 2016, 5, 2046. [Google Scholar] [CrossRef] [PubMed]

- Lee, Y.C.; Wang, Y.C.; Lu, S.C.; Hsieh, Y.F.; Chien, C.H.; Tsai, S.B.; Dong, W. An empirical research on customer satisfaction study: A consideration of different levels of performance. SpringerPlus 2016, 5, 1577. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Yang, J.; Chen, Q.; Tsai, S.B. Creating the sustainable conditions for knowledge information sharing in virtual community. SpringerPlus 2016, 5, 1019. [Google Scholar] [CrossRef] [PubMed]

- Schwienbacher, A.; Larralde, B. Crowdfunding of small entrepreneurial ventures. In Handbook of Entrepreneurial Finance; Oxford University Press: Oxford, UK, 2010; Forthcoming. [Google Scholar]

- VanderWerf, P.A.; Mahon, J.F. Meta-analysis of the impact of research methods on findings of first-mover advantage. Manag. Sci. 1997, 43, 1510–1519. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).