Coal Power Environmental Stress Testing in China

Abstract

:1. Introduction

2. Research Methods and Data Description

2.1. Stress Testing Model

2.2. Discounted Cash Flow Model

2.3. Data Sources and Indicators Selection

3. Empirical Results

3.1. Reasonable Return of Enterprise Value

3.2. Environmental Stress Test Results

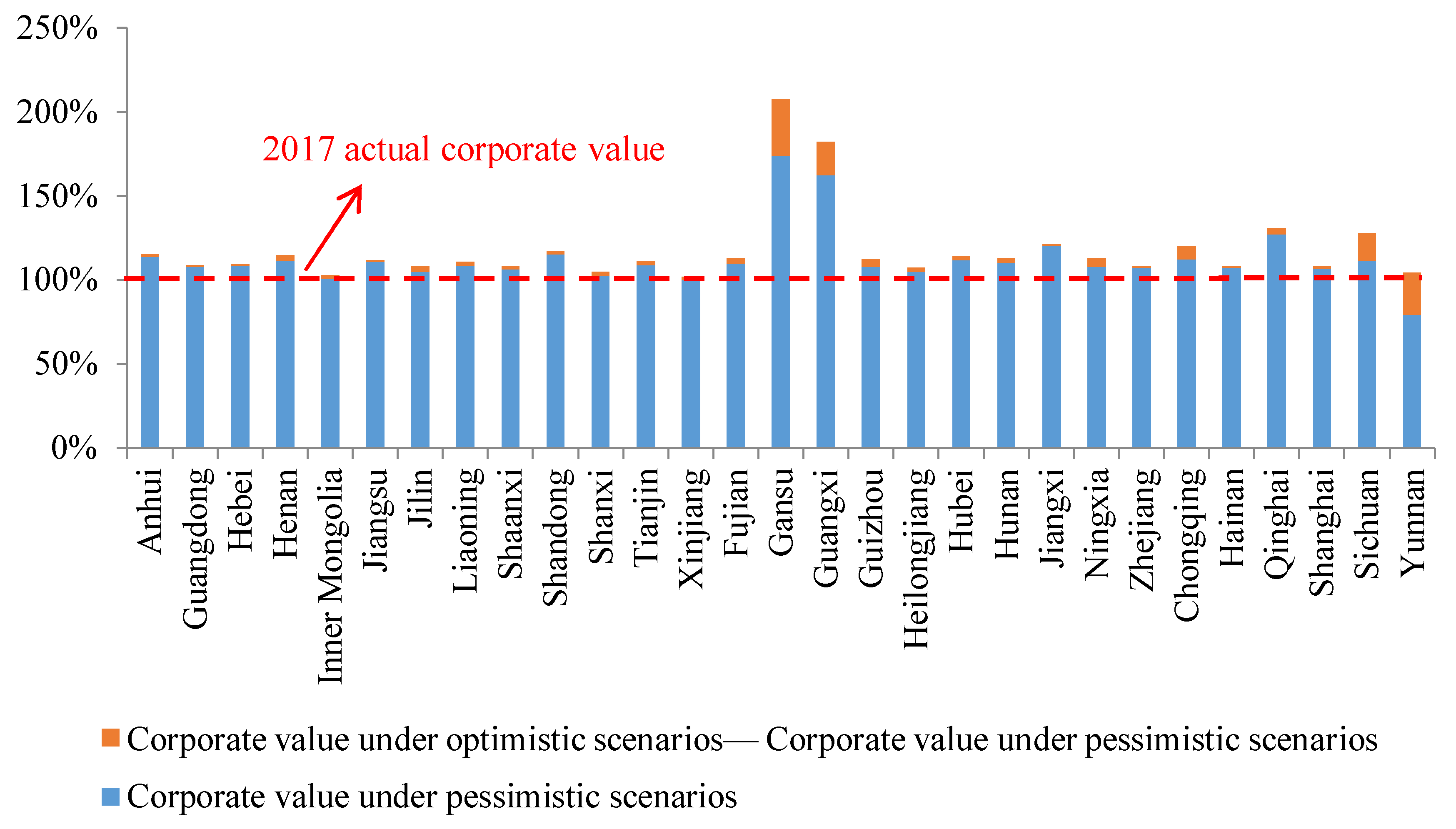

3.2.1. Single Risk Stress Test Results

3.2.2. Comprehensive Risk Stress Test Results

4. Conclusions and Policy Implications

4.1. Conclusions

4.2. Implications

Author Contributions

Acknowledgments

Conflicts of Interest

References

- United Nations Framework Convention on Climate Change (UNFCCC). Intended Nationally Determined Contributions (INDCs). 2015. Available online: http://www4.unfccc.int/submissions/indc/Submission%20Pages/submissions.aspx (accessed on 4 November 2017).

- G20 Green Finance Study Group. G20 Green Finance Synthesis Report; G20 Green Finance Study Group: Hamburg, Germany, 2017. [Google Scholar]

- Fender, I.; Gibson, M.S.; Mosser, P.C. An International Survey of Stress Tests. Curr. Issues Econ. Financ. 2001, 7, 233–246. [Google Scholar]

- Alexander, C.; Sheedy, E. Developing a stress testing framework based on market risk models. J. Bank. Financ. 2008, 32, 2220–2236. [Google Scholar] [CrossRef]

- Blashke, W.; Jones, M.T.; Majnoni, G.; Peria, S.M. Stress Testing of Financial Systems: An Overview of Issues, Methodologies, and FSAP Experiences; IMF WP, No. 88; IMF: Washington, DC, USA, 2001. [Google Scholar]

- Goldstein, M. Bank Stress Tests and Financial Stability: Lessons from the 2009-14 US and EU_Wide Tests for Asian Emerging Economics; Peterson Institute for International Economics Working Paper; Peterson Institute for International Economics: Washington, DC, USA, 2015. [Google Scholar]

- Peura, S.; Jokivuolle, S. Simulation based stress tests of banks’ regulatory capital adequacy. J. Bank. Financ. 2004, 28, 1801–1824. [Google Scholar] [CrossRef]

- Ba, S.S.; Zhu, Y.Q. Application of Stress Test in Bank Risk Management. Economist 2010, 2, 70–79. [Google Scholar]

- Xu, M.D.; Liu, X.X. Financial system stability assessment: An international comparison based on macro stress testing methods. Int. Financ. Res. 2008, 2, 39–46. [Google Scholar]

- ICBC of China Environmental Stress Test Group; Zhang, H.L.; Zhou, Y.Q.; Ma, J.; Yin, H.; Ma, S.H.; Le, Y.; Yang, X.; Qiu, M.Y. Influence of environmental factors on credit risk of commercial banks—Research and application of stress test based on industrial and commercial bank of China. Financ. Forum 2016, 21, 3–16. [Google Scholar]

- TRUCOST, ICBC. Environmental Cost Internalization and Environmental Risk Analysis: A Case Study of Aluminum Industry in China; TRUCOST, ICBC: Beijing, China, 2017. [Google Scholar]

- International Institute of Green Finance. Asset Management Industry Environmental Stress Test Research Report; International Institute of Green Finance: Beijing, China, 2017. [Google Scholar]

- TRUCOST. Potential Costs of China’s Coal Chemical Industry: Pressure Testing Framework for Environmental Risk Investment; TRUCOST: London, UK, 2017. [Google Scholar]

- Zhao, X.L.; Cai, Q.; Ma, C.; Hu, Y.; Luo, K.; Li, W. Economic evaluation of environmental externalities in China’s coal-fired power generation. Energy Policy 2017, 102, 307–317. [Google Scholar] [CrossRef]

- Krautz, H.-J.; Lisk, A.; Posselt, J.; Katzer, C. Impact of renewable energies on the operation and economic situation of coal fired power stations: Actual situation of coal fired power stations in Germany. Front. Energy 2017, 11, 119–125. [Google Scholar] [CrossRef]

- Yuan, J.H.; Zhao, C.H.; Yu, S.; Hu, Z. Electricity consumption and economic growth in China: Cointegration and co-feature analysis. Energy Econ. 2007, 29, 1179–1191. [Google Scholar] [CrossRef]

- Yuan, J.H.; Xu, Y.; Hu, Z.; Zhao, C.; Xiong, M.; Guo, J. Peak energy consumption and CO2 emissions in China. Energy Policy 2014, 68, 508–523. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). Notice on Doing well the Work of Planning and Construction after Decentralization of Power Project Approval. 2015. Available online: http://www.nea.gov.cn/2015-11/26/c_134856367.htm (accessed on 4 November 2017).

- NDRC. Notice on Promoting Orderly Development of Coal Electricity in China. 2016. Available online: http://www.ndrc.gov.cn/zcfb/zcfbtz/201604/t20160425_798979.html (accessed on 17 March 2016).

- Polaris Power Net. Global Coal-Fired Power Plant Tracking 2018: China Continues to Rank First in the World in the Construction of Coal-Fired Power Capacity (95 GW) and There Are Still 116 GW of Planned Production Capacity! 2018. Available online: http://news.bjx.com.cn/html/20180327/888023.shtml (accessed on 27 March 2018).

- Yuan, J.H.; Li, P.; Wang, Y.; Liu, Q.; Shen, X.; Zhang, K.; Dong, L. Coal power overcapacity and investment bubble in China during 2015–2020. Energy Policy 2016, 97, 136–144. [Google Scholar] [CrossRef]

- Zhao, C.H.; Zhang, W.R.; Wang, Y.; Liu, Q.; Guo, J.; Xiong, M.; Yuan, J. The economics of coal power generation in China. Energy Policy 2017, 105, 1–9. [Google Scholar] [CrossRef]

- Yuan, J.H.; Wang, Y.; Zhang, W.R.; Zhao, C.H.; Liu, Q.; Shen, X.; Zhang, K.; Dong, L. Will recent boom in coal power lead to a bust in China? A micro-economic analysis. Energy Policy 2017, 108, 645–656. [Google Scholar] [CrossRef]

- Polaris Power Net. Current Situation and Development Trend of Energy Saving Technology in Coal Power Plants. 2016. Available online: http://huanbao.bjx.com.cn/news/20160321/717860.shtml (accessed on 21 March 2016).

- Copeland, T.; Koller, T.; Murrin, J. Valuation: Measuring and Managing the Value of Companies; John Wiley & Sons: New York, NY, USA, 2000; pp. 212–214. [Google Scholar]

- Copeland, T.; Koller, T.; Murrin, J. Valuation; John Wiley & Sons: New York, NY, USA, 1990. [Google Scholar]

- Shiller, R.J. Do stock prices move too much to be justified by subsequent changes in dividends. Am. Econ. Rev. 1981, 71, 421–436. [Google Scholar]

- Yao, J.-S.; Ouyang, L.-Y.; Chang, H.-C. Models for a fuzzy inventory of two replaceable merchandises without backorder based on the signed distance of fuzzy sets. Eur. J. Oper. Res. 2003, 150, 601–616. [Google Scholar] [CrossRef]

- Frank, M.Z.; Shen, T. Investment and the weighted average cost of capital. J. Financ. Econ. 2016, 119, 300–315. [Google Scholar] [CrossRef]

- NDRC. Coal Energy Saving and Emission Reduction Upgrade and Transformation Action Plan (2014–2020). 2014. Available online: http://www.ndrc.gov.cn/gzdt/201409/t20140919_626240.html (accessed on 12 September 2014).

- Ministry of Ecology and Environment of the People’s Republic of China. People’s Republic of China Environmental Protection Tax Law. 2017. Available online: http://www.zhb.gov.cn/gzfw_13107/zcfg/fl/201704/t20170417_411610.shtml (accessed on 17 April 2017).

- Polaris Power Net. What Is the Operation of the “Countdown” to “Tax” in the Countdown of Environmental Taxes? 2017. Available online: http://huanbao.bjx.com.cn/news/20171103/859464.shtml (accessed on 3 November 2017).

- NDRC. China Submits National Independent Contribution Document to Address Climate Change. 2015. Available online: http://zys.ndrc.gov.cn/xwfb/201506/t20150630_710182.html (accessed on 30 June 2015).

- NDRC. Notice on Printing and Distributing the “National Carbon Emission Trading Market Construction Plan (Power Generation Industry)”. 2017. Available online: http://www.ndrc.gov.cn/gzdt/201712/t20171220_871134.html (accessed on 18 December 2017).

- Sohu net. Suggestions on the National Carbon Market: Reference and Significance of RGGI. 2017. Available online: http://www.sohu.com/a/211684932_289755 (accessed on 20 December 2017).

- Polaris Power Net. National Carbon Trading Quota Allocation Plan (Discussion Draft) Announced. 2017. Available online: http://news.bjx.com.cn/html/20170511/824893.shtml (accessed on 11 May 2017).

- Greenpeace. China Coal Power Overcapacity and Water Resources Pressure Study Report; Greenpeace: Amsterdam, The Netherlands, 2017. [Google Scholar]

- Greenpeace; Sierra Club; Coal Swarm. Boom and Bust 2018: Tracking the Global Coal Plant Pipeline. 2018. Available online: https://endcoal.org/global-coal-plant-tracker/reports/boom-bust-2018/ (accessed on 8 March 2018).

- China Electricity Council. Preventing Overcapacity and Overcapacity and Continuously Optimizing Thermal Power Structure. 2018. Available online: http://www.cec.org.cn/xinwenpingxi/2018-02-08/177882.html (accessed on 8 February 2018).

- Yuan, J.H.; Zhang, W.H. Research on the scale of coal and electricity surplus and the path of capacity reduction in China. Energy China 2017, 39, 14–20. [Google Scholar]

- National Energy Administration. Guiding Opinions on Establishing Guiding System for Target Development of Renewable energy Development. 2016. Available online: http://zfxxgk.nea.gov.cn/auto87/201603/t20160303_2205.htm (accessed on 29 February 2016).

| Risk Factors | Optimistic Scenario | Pessimistic Scenario |

|---|---|---|

| Energy efficiency level [24] | Slightly improves inlet parameters | Greatly improves inlet parameters |

| Environmental protection tax (SO2, NOX) | Raise 3 yuan/pollution equivalent on the basis of provincial air pollutant tax | Upper limit of air pollution tax (12 yuan/equivalent) |

| National carbon market | The price of carbon was 30 yuan/ton, and gradually increased to around 200 yuan per ton in 2030. Free allocation of quotas, 2025 paid distribution, the proportion of 20% | The price of carbon was 30 yuan/ton, and gradually increased to around 300 yuan per ton in 2030. Free allocation of quotas, 2025 starting distribution |

| Water resources tax | According to the pilot project in Hebei, suppose the national water resources tax is implemented (0.005 yuan/kWh. | Appropriately raise the water resources tax ($0.03/kWh) in an optimistic situation. |

| Overcapacity | Reasonable coal electricity utilization hours | Actual coal electricity utilization hours |

| Non-water renewable energy planning goals | Actual coal electricity utilization hours | Considering the impact of non-water renewable energy consumption targets by 2020 on the basis of actual utilization hours |

| Common Parameters | Value | Common Parameters | Value |

|---|---|---|---|

| Proprietary Funds Ratio (%) | 30 | Vat (%) | 17 |

| Term of Loan (Year) | 15 | Income Tax (%) | 25 |

| Annual Interest Rate (%) | 6 | Housing Property Tax (%) | 1.2 |

| Operation Life (Year) | 30 | Urban Maintenance and Construction Tax (%) | 5 |

| Ratio of Residual Value of Asset (%) | 5 | Education Surcharge (%) | 0.5 |

| Depreciation Rate (%) | 5 | VAT for Water and Fuel (%) | 13 |

| Reduction Rate of Coal Consumption in Generation (%) | 0.10 | VAT for Materials (%) | 17 |

| Water Consumption Rate in Generation (kg/kWh) | 1.6 | Overhaul Fee Rate (%) | 2 |

| Pollution Control Costs (yuan/kWh) | 0.006 | Premium Rate (%) | 0.25 |

| Escalation Rate of Employees’ Salary (%) | 6 | Materials Costs and Other Expenses (yuan/kWh) | 0.02 |

| Welfare labor coefficient | 60% | Escalation Rate of Materials Costs and Other Expenses (%) | 2 |

| Region | Province | 300 MW | 600 MW | 1000 MW |

|---|---|---|---|---|

| North China Power Grid | Hebei | 2,977,768,484 | 5,080,932,043 | 7,278,743,505 |

| Inner Mongolia | ||||

| Shandong | ||||

| Shanxi | ||||

| Tianjin | ||||

| Northeast Power Grid | Heilongjiang | 3,024,162,110 | 4,929,560,909 | 7,208,636,172 |

| Jilin | ||||

| Liaoning | ||||

| Northwest Power Grid | Gansu | 2,844,098,155 | 4,767,211,427 | 7,347,820,102 |

| Ningxia | ||||

| Qinghai | ||||

| Shaanxi | ||||

| Xinjiang | ||||

| East China Power Grid | Anhui | 2,811,042,600 | 4,700,843,256 | 7,144,251,168 |

| Fujian | ||||

| Jiangsu | ||||

| Shanghai | ||||

| Zhejiang | ||||

| Central China Power Grid | Chongqing | 2,837,242,382 | 4,721,853,189 | 6,584,387,717 |

| Henan | ||||

| Hubei | ||||

| Hunan | ||||

| Jiangxi | ||||

| Sichuan | ||||

| China Southern Power Grid | Guangdong | 3,006,060,443 | 4,986,860,726 | 7,279,010,069 |

| Guangxi | ||||

| Guizhou | ||||

| Hainan | ||||

| Yunnan |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, J.; Wu, M.; Zhang, W.; Guo, Y.; Xiong, M. Coal Power Environmental Stress Testing in China. Sustainability 2018, 10, 2151. https://doi.org/10.3390/su10072151

Yuan J, Wu M, Zhang W, Guo Y, Xiong M. Coal Power Environmental Stress Testing in China. Sustainability. 2018; 10(7):2151. https://doi.org/10.3390/su10072151

Chicago/Turabian StyleYuan, Jiahai, Mengya Wu, Weirong Zhang, Yu Guo, and Minpeng Xiong. 2018. "Coal Power Environmental Stress Testing in China" Sustainability 10, no. 7: 2151. https://doi.org/10.3390/su10072151

APA StyleYuan, J., Wu, M., Zhang, W., Guo, Y., & Xiong, M. (2018). Coal Power Environmental Stress Testing in China. Sustainability, 10(7), 2151. https://doi.org/10.3390/su10072151