1. Introduction

Humanity is faced with a multitude of challenges, including climate change, migration, poverty, and illiteracy, among others. The United Nations’ Sustainable Development Goals are evidence of the global attempt and commitment to tackle these issues in a systematic manner. Within this overall effort, social organizations (SOs), irrespective of their legal form, play a key role in addressing the ever-growing sustainability challenges. All around the globe, foundations, social businesses, social entrepreneurs, charities, nongovernmental organizations, and philanthropists are keenly aware of the need to address social issues, to scale their solutions, as well as to increase their social impact [

1,

2].

These organizations require financial resources to fund their activities and to fulfill their mission. Increasingly, funding approaches include impact investing and venture philanthropy [

3,

4,

5,

6]. Both are emergent markets in their own right, and Investopedia estimates that assets in impact investing will grow to

$500 billion—and possibly as high as

$3 trillion—by 2019 (vs.

$50 billion in 2009). As clearly stated by the resource dependency theory, financial providers enjoy a position of power. For those financial providers engaged uniquely for the purpose of scaling social organizations’ social impact, their return is not of a financial but of an impact nature. This affects the relationship between the financial provider and the recipient. Such a financial provider might demand that a certain approach to scaling be used, tying financial tranche payments to reaching certain scaling goals and demanding regular reporting throughout the terms of the scaling agreement. In turn, some financial providers are realizing that some unsatisfactory results are related to their engagement often being more at the level of transaction than collaboration and that they need to listen more closely to their partners [

7,

8].

Although funding for social organizations has become increasingly available, SOs face the challenge of effectively scaling their impact. SOs have three generic scaling strategies at their disposal:

scaling capacities (developing organizational, human resource, and financial capacities) [

2];

scaling up (enhancing reach and the number of beneficiaries) [

9,

10] as well as

scaling deep (improving/enriching the impact process/experience for the beneficiaries) [

9]. Oftentimes, though, funders mistake and falsely equate the organizational growth of an SO with an effective increase in impact [

11]. Some SOs voice discontent with financial providers’ pressure to grow quantitatively (scaling up and scaling capacities) to the detriment of a deeper, more enriching form of impact [

12].

Although SO practitioners and funders alike have started to recognize that scaling up and scaling capacities do not linearly correlate with the quality of the impact, most studies still focus on up-scaling goals and scaling-related capacities [

9,

13,

14]. Despite its contributions, such an approach might unnecessarily neglect the empirical complexities of scaling deep as a complex, organic, and challenging-to-measure scaling strategy [

2,

10].

Measuring and reporting impact is a challenge in its own right and is even more challenging within the context of deep impact. Reporting impact is crucial for both the SOs—as it forms the basis of their continuing acquisition of resources from financial providers—as well as for the financial providers—as impact reporting is the key vehicle to account for a social return on investment.

Our study operates precisely at this nexus of a broader concept of impact scaling and the related challenge of effectively accounting for and reporting such impact. This paper responds—on the basis of initial research on capacity, up-, and deep scaling strategies—to the need for integrated knowledge on financing processes within the context of social organizations’ impact scaling phase. Specifically, we focus on the agreements regarding impact scaling between financial providers and SOs. For analytical purposes, we take the perspective of a financial provider and ask: “How can impact scaling agreements enable effective social impact?”

This research question was studied using a longitudinal archival document analysis method. The analysis qualitatively reconstructs [

15] how the financial provider implements its scaling approach, as seen from its reports on its financial recipients. This paper focuses empirically on a foundation focused on social impact scaling without financial return. The chosen European-based and globally active foundation has had an array of experiences and learned many lessons in its 8+ years in the field of social impact scaling. This foundation defines scaling goals and generates different scaling reports throughout the pre- and per-engagement phases. The analysis is set in a comparative case setting: the sample consists of three financial recipients, each in the broad field of education, operating in three countries on two continents. Written reports avoid the biases and errors associated with self-reporting or retrospective reporting while enabling analysis over time and within the natural environment. This content analysis [

16] covers 178 pages or 79,409 words of reports. These written reports enable a “practical understanding” [

17] of the financial provider’s implementation of its scaling approach through the goals it sets in the engagement contract with its financial recipients, their reporting, and realization over time.

The exploration of this financial provider’s processes uncovered both strengths and struggles, which in turn enabled new levels of understanding related to the research question, “How can impact scaling agreements enable effective social impact?” The fact that the financial provider examined in this empirical study lacked alignment in its scaling approach, goals, and reporting processes over time hampered its effectiveness and sustainability. This study also shows that an overemphasis on scaling in reach works to the disadvantage of impact and can be seen as a critique of the current discussion and practice of social impact scaling. The findings from this qualitative inter-temporal content analysis enable the development of a model for impact scaling agreements. This shows ongoing flows between a provider and recipient of financial and nonfinancial resources and impact information, as well as decision-making and reporting processes. The outcome of exploring the research question “how can impact scaling agreements enable effective social impact?” was the identification of three success enhancers for effective social impact scaling agreements to enable social impact: (1) Financial provider alignment pre- and per-engagement in terms of expectations with regard to scaling approach and goals; (2) Scaling approach coherence in terms of understanding and acting upon the inter-relatedness and, in fact, mutual dependency between capacity, up-, and deep scaling; (3) Impact reporting alignment of the target group with the financial recipient and the financial provider. These success enhancers form a coherent, complex but not complicated space in which resources, expectations, reporting, learning, and decision-making processes can flow organically. This research makes a twofold contribution to the literature. First, the pivotal role of the internal alignment between mission, strategy, reporting, and decision-making processes is explored; second, the three scaling strategies of capacity, up-, and deep scaling are established as interrelated dimensions of the same phenomenon.

The paper is organized as follows. In the next section, we discuss how scaling strategies and impact reporting interrelate and what motivates this study. Then, we present our method. Drawing on Petty and Gruber’s (2011) approach, we investigate our research question by systematically examining the reporting trail of three SOs in the portfolio of a global impact investor. Specifically, we analyze the financial provider’s scaling approach over the course of its engagement by tracking the scaling agreement goals in the regular reports. After a detailed report of our finding, we discuss critical success factors for effective impact scaling agreements and develop a model that enables a more coherent approach to impact scaling. The paper concludes with a discussion of our contribution.

2. Financial Providers’ Scaling Strategies and Reporting Processes

Social organizations such as foundations, social businesses, social entrepreneurs, charities, nongovernmental organizations, and philanthropists are keenly aware of the need to scale social impact [

1,

2] to address growing social problems. An increasing number of these social organizations are provided the financing they need to scale by impact investors and venture philanthropists [

3,

14,

18]. Although this market is still emerging, it is not to be ignored. Whether and to what extent social impact in diverse fields—e.g., the environment, education, integration, employment, and health—has grown through the financial engagement of these different actors have not been researched. Growing social organizations must pay attention not only to the synchronization between their internal organization and their growth [

11] but also to their impact. In this research, social organizations are characterized by their primary mission to address societal and environmental problems, all the while coming from a wide range of legal structures and financing strategies. As clearly stated by the resource dependency theory, financial providers enjoy a position of power. For those financial providers engaged uniquely for the purpose of scaling social organizations’ social impact, their return is the growth in social impact, and impact reporting is the key vehicle to account for a social return on investment [

19,

20,

21,

22]. Such a financial provider might demand that a certain approach to scaling be used, tying financial tranche payments to reaching certain scaling goals and demanding regular reporting along the scaling agreement.

Social organizations striving for social impact to mitigate and address the most pressing social issues have three scaling strategies at their disposal [

11]. The

scaling capacity approach focuses on developing organizational capacities, such as replication processes, exit strategies, governmental relations, technology development, and logistics processes; human resource capacities, such as employee management, board members, specialized know-how, leadership skills, and staff training; and financial capacities, such as fundraising, negotiations, budgeting, and income/expense management.

Scaling up is an approach that focuses on the reach of the impact and thus on the development of organizational structures and capacities to increase the number of beneficiaries [

9,

10].

Scaling deep is an approach that focuses on the quality of the impact, thus improving and enriching the impact processes for the beneficiaries. We briefly outline the state of the art for each strategy in turn.

Scaling capacities. The largest strand of research relates to organizational capacities as a critical factor for scaling social impact, with some pointing to more general capacities [

23,

24,

25] and others to more specific capacities [

26,

2]. Capacity development results from a process that some authors acknowledge [

2,

10,

27]. In addition, a trade-off perspective continues to be frequently used [

27]. Oftentimes, an organic step-by-step process to scaling capacities is assumed. While it seems obvious that

capacity development is inherent in the scaling process,

capacity development is neither an end in itself nor a guarantee of scaling success.

Scaling up strategies aim to enhance the reach of the social impact, mainly in terms of the number of beneficiaries. Scaling up is often equated with “growth” [

28] and, at other times, refers to the replication of the SO approach, whether by dissemination, loose affiliation, or another form [

1,

13,

29]. Whereas Heinecke and Mayer (2012) identify financing, human resources, and quality management control as key factors to scaling up, Desa and Koch (2014) demonstrate the need for replicating the entire “business model” of the SO, including its operating causal logic and interrelated routines. André and Pache (2014) acknowledge that the transition from social entrepreneur to scaling social enterprise can be difficult and comes with a trade-off between the initial aspiration of the quality of care and the opportunity to grow the number of potential beneficiaries.

Scaling deep. A third, albeit less prominent, strand delves into

deep scaling, where quality in terms of improving or enriching the impact experience for the beneficiaries is enhanced. For instance, Achleitner [

30], Heister, and Spiess-Knafl (2014) suggest that the perceived utility of the social impact concept and its impact on stakeholders are underestimated. Smith, Kistruck, and Cannatelli (2016) explored why more social entrepreneurs have decided not to scale their SO and found that higher levels of perceived moral intensity represent a positive determinant that, in turn, is negatively moderated by a personal desire for control. In other words, entrepreneurs’ desire for (ethical) control of their service or product might stifle growth. Lastly, Desa and Koch (2014) suggest a culture of learning, inclusion, and adaptive strategies as critical for any deep scaling approach.

While current research on scaling impact has focused primarily on scaling capacities and scaling up, a growing body of literature is attending to the challenges of scaling deep. With the notable exception of André and Pache’s (2014) exploration of how to link a quantitative approach to scaling while accounting for qualitative aspects, research on how the three scaling strategies relate conceptually and empirically seems scarce.

Furthermore, SOs rely on financial resources to accomplish their social mission. Thus, financial providers are key to the social impact value chain. Impact investors and venture philanthropists alike deliberately trade financial return for a credible, visible, and sustainable social return. The role of financial providers in the social impact value chain is a challenging one for at least two reasons. First, and, in this respect, very similar to conventional investors, they would like to see the maximum return on investment. Oftentimes, this explicit or implicit expectation—we refer to it as the scaling approach—of the financial provider with regard to the SO favors scaling capacities or scaling up strategies and tends to neglect the complexity and necessity of the quality of the social impact. Second, and directly related to the above, the results from scaling capacities and scaling up strategies are easier to measure and thus easier to report. Thus, in combination, the financial provider’s social impact scaling approach directly affects the strategic options of the SO, as well as the corresponding reporting practices.

If we are to advance effective strategies of scaling SOs for social impact, we need to better understand the role and relevance of the scaling agreements and reporting practices of financial providers since these practices embody and affect the scaling strategy of SOs. Hence, we ask: “How can impact scaling agreements enable effective social impact?”

3. Method

Given the exploratory nature of our research question, we opted for a qualitative research design: specifically, an embedded comparative case study [

31,

32]. Furthermore, we needed to identify a research site providing a large number of documents reporting on social impact by social organizations. Thus, we identified an international impact investor, “Pegasus” (a pseudonym), which granted us access to its investment portfolio from which we explored three investment targets, i.e., our cases for comparison.

Research into both pre- and per-engagement reporting processes in the field of social finance is unique in academia. Inspired by Petty and Gruber’s (2011) study, we explored how Pegasus’ scaling agreements manifested its scaling approach and goals with regard to its financial recipients’ pre-engagement and the follow-through per-engagement. Specifically, we analyzed by content analysis [

16] the financial provider’s scaling approach over the course of its engagement by tracking the scaling agreement goals in the regular reports of three social organizations.

3.1. Empirical Setting

Pegasus—a non-profit foundation linked to an investment bank via its founder and board members—neither seeks to recoup its financial engagement nor to generate income. In its investment decisions, it employs practices very much informed by venture-capital firms. Pre-engagement, it uses a formalized and thorough due diligence evaluation process on which it bases its financing decisions. Furthermore, most of its managers have investment experience. Quarterly reports on its financial recipients are required, and it focuses on social organizations wishing to scale, which are expected to experience organizational growth and develop financial sustainability. Overall, the investment logic is to enable the target organizations to scale before Pegasus’ planned exit.

Currently, the portfolio—consisting of 35 projects—has been formed and has reached an optimization phase. Financial and social impact evaluations and reports are taken seriously throughout the pre- and per-engagement phases that form the basis of regular review meetings within the executive team, as well as with the board. Over 7 years, Pegasus screened approximately 7000 candidate organizations, ran due diligence on approximately 50 of them, and decided to invest in 35. It is from this portfolio that we drew our three comparative case studies.

3.2. Data Selection

The sampling was based on an overview of Pegasus’ financial recipients and was carried out with the kind support of the chief operating officer (COO). The inclusion criteria were driven by our research question. Aware of the strong effects of social organizations’ characteristics, such as field and region of financing [

33,

34], and intending to focus on this foundation’s scaling approach, we needed cases that were sufficiently comparable in terms of organizational field, phase, and focus-group in a non-western region and for which sufficient data were available.

Based on these criteria, three cases from the education field in three countries on two continents were chosen. Investment memos were available for all from early 2009 to mid-2011 and reports through 2015. The three cases are presented below—all names are pseudonyms.

Case 1, “ELEKTRA”: In a Southeast Asian country in 2009, more than 100,000 children either accused of crimes or in need of care were placed in state-run institutions for an average period of 3 years. These homes tended to have inhumane and jail-like conditions, a problem that was not being addressed before ELEKTRA commenced in 2002. To improve the quality of life for the “detained” children, ELEKTRA created a cost-effective and replicable model combining a monitoring and evaluation tool, an operational manual, and capacity-building workshops for the staff of state-run homes. It also engages in prevention and community-based programs. ELEKTRA enjoys a close partnership with the government, aiming to transform the homes and bringing about stronger government interventions.

Case 2, “MINOS”: In 2010, in a Southeast Asian country, more than 304 million people (or 66%) could not read or write, with girls and women in rural areas particularly affected. Governmental and international funding (approx. USD 13 billion since 2007) was not addressing this problem. The issue is not merely poverty: cultural and social barriers and poor-quality education also play a role. MINOS aims to improve girls’ enrollment, retention, and academic performance in government schools by leveraging existing community and government resources. Its goals are to increase community ownership of educational issues, increase learning levels through teacher training, and empower girls to become more confident, make sound decisions, and lead healthy and productive lives.

Case 3, “NESTOR”: In 2011, in a South American country, 1.9 million low-income pupils performed poorly in public schools, and only 30% completed high school. This situation perpetuates the cycle of poverty. NESTOR provides quality education to high-school students by selecting and hiring outstanding university graduates with leadership skills. After a 2-month “teacher certification” training program, these graduates are placed as teachers for 2 years in poor areas. NESTOR is also developing a career development program and an alumni network for these new teachers in the belief that, independent of their chosen careers, they will mutually support each other and influence the national educational system. Through this intervention, there is an improvement in students’ school performance and non-cognitive abilities, such as self-esteem, self-efficacy, and motivation to learn, all of which help break the cycle of poverty.

Pegasus provided access to two types of data sources for each case (

Table 1):

- -

Documents: all internally written reports related to each case, including investment memos with due diligence assessments, a scaling agreement contract, as well as quarterly and yearly reports.

- -

Pegasus also facilitated contact with each case manager for interviews of approximately 45 min to contextualize our interpretation and substantiate our findings.

3.3. Data Analysis Procedure

The aforementioned documents allowed us to gain privileged and detailed insight into Pegasus’ “practical understanding” [

17] of social impact scaling. Our first analytical step consisted of a within-case analysis [

17] in which we gained a detailed understanding of the case specifics. For each case, the investment memo, scaling agreement contract, and evaluation of the potential financial recipient and its programmatic approach, including its mission, strategies, inputs, outputs, aimed outcomes, and measurement indicators, were aggregated into a log spreadsheet.

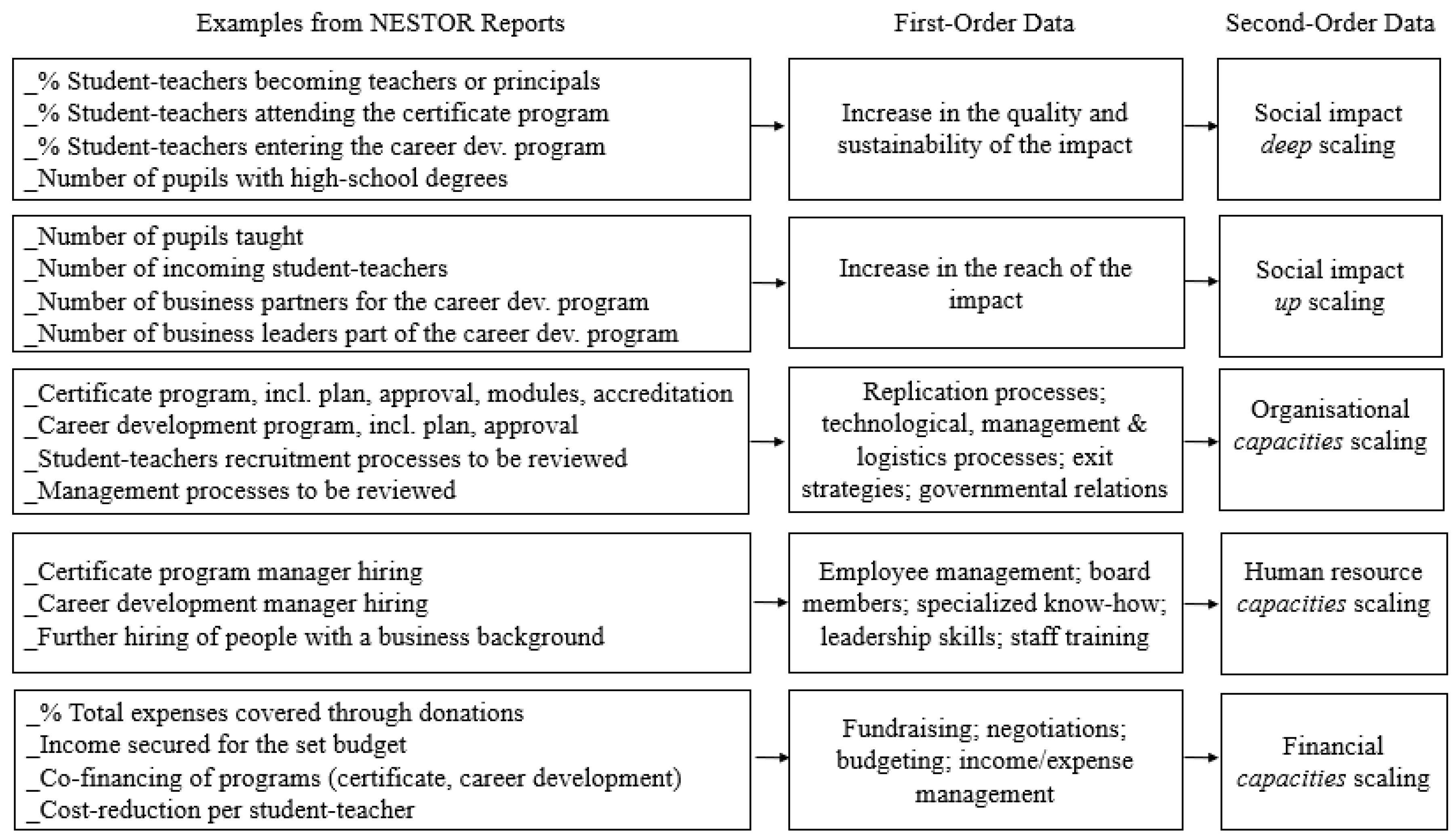

Table 2 exemplifies this for NESTOR.

To adequately record the agreed-upon goals and milestones into the log spreadsheet for comparison, we developed a general data structure in terms of the three generic scaling strategies, whereby we accounted for organizational, financial, and human resource capacities separately. For example, if an agreed-upon goal referred to an increase in the number of pupils or schools, it was categorized as a scaling up goal. If the goal was to train teachers to raise the quality of teaching, it was categorized as a scaling deep goal. If the goal related to managerial, replicability, employment, or fundraising issues, it was categorized as a capacity scaling goal.

Figure 1 exemplifies this protocol for NESTOR.

Next, the content relating to the scaling goals set in the pre-engagement contract of all the reports was integrated into the log spreadsheet in a longitudinal manner according to scaling goals. For example, a statement in a year-end report of ELEKTRA regarding the number of engaged state-run homes was entered into the log spreadsheet in the row related to the specific up-scaling goal of numbers of homes engaged and in the column for the 4th quarter of that year. This information being confidential, it is not shared in a figure. These steps of the process were reiterated three times to ensure both accuracy and coherence.

In the second phase, the analysis shifted to the log spreadsheet content. The analysis then focused on the scaling goals’ implementation and realization, with the review of each goal’s implementation and realization over time, including whether and how the scaling goal’s implementation and realization had been reported on.

Interviews of approximately 45 min with each regional manager were conducted. These inputs further helped qualify the interpretation of potential insights gained from the analysis, for example, when a deep scaling goal of MINOS did not appear once in the per-engagement reports. Notes on these interview inputs were incorporated into each case’s log spreadsheet. This concluded the within-case analysis.

Next, we engaged in a

cross-case analysis [

17] to identify similarities and differences of the three cases. Issues were explored, including the backgrounds of Pegasus’ regional managers, the quantity and quality of the reports’ content, the nature of Pegasus’ support, the pre-engagement evaluation, the milestones set in the investment memo, the scaling goals’ evaluation per-engagement, the milestones’ evolution over time, and the financial installments. For each of these issues, similarities were noted in one column, differences in another, and questions in a third.

The last analytical step consisted of reflecting on both the within- and cross-case analyses in terms of abstracting data into broader conceptual considerations that, in turn, allowed us to develop a model for impact scaling agreements.

4. Findings

We analyzed Pegasus’ scaling approach over the course of its engagement by tracking the scaling agreement goals in the regular reports of three social organizations. The individual and comparative analyses relate to the ongoing flow of financial and nonfinancial resources and impact information, as well as decision-making and reporting processes.

We start with an overview analysis of how many established capacity, up-, and deep scaling goals were reported and realized by the social organization over the course of Pegasus’ engagement. Within a time span of 3–4 years, Pegasus allocates its financial installments based on the achievement of agreed-upon milestones over time. On this basis, we set three time-brackets:

T1: number of scaling goals identified in the investment agreement

T2: number of scaling goals reported in T1 + 2 years

T3: number of scaling goals reported as realized in T1 + 4 years

In the following tables find the result of this analysis of the development of the scaling goals over the defined three time brackets, both for each case (

Table 3,

Table 4 and

Table 5) and for an aggregated perspective (

Table 6).

We critically reflect on and discuss the individual cases and aggregate findings (

Table 3,

Table 4,

Table 5 and

Table 6) in terms of (1) accounting for scaling goals, (2) use of milestones, and (3) reporting practices.

First and foremost, we need to understand whether and how certain scaling goals were pursued, reported, and achieved. Second, it is important to get a sense of how milestones were used to govern the engagement, and third, whether and how certain reporting practices affected the former two.

4.1. Accounting for Scaling Goals

Scaling capacities: Across all cases, the

capacity scaling goals were the most numerous (23), and they benefitted from the highest rate of reporting and realization—87.5% (

Table 6). However, cases varied in the type of capacities. ELEKTRA, for instance, operated on rather general goals of developing management capacities by optimizing processes and strategies, strengthening the core team through hiring, and team training and increasing financial health through fundraising. In contrast, NESTOR had very specific

capacity goals, such as the conclusion of a governmental contract to cover 50% of certification program expenses and a partner contract to cover 50% of career development expenses.

Our analysis indicates that goals relating to capacities are coupled strongly with scaling-up goals and coupled less strongly with scaling-deep goals. Organizational capacities often related to up goals, such as increasing replication, exit strategies, and logistics. Hiring a manager for a certification program is a human resource capacity goal and enables both up and deep scaling. Within Pegasus, this inextricable link between the scaling goals has been understood but is implemented in a fairly pragmatic manner, as a regional manager in charge of NESTOR observes: “The focus is on financial, organizational capacities development and reach, not on impact depth.”

Scaling up: Across all cases, the

up-scaling goals came third in number (15) but second in reporting and realization—84% (

Table 6). An exception to this pattern was MINOS, which seemed to struggle more with realizing

up goals: 62.5% versus 100% reporting and realization in all other cases. It is noteworthy that MINOS (

Table 4) initially had eight

up goals (ELEKTRA: 3—

Table 3; NESTOR: 4—

Table 5), of which three were no longer reported on in T2, such as the number of school management committee meetings or number of villages with trained “leaders” mobilizing community engagement. Both of these goals related to community mobilization, which is more challenging than increasing individual engagement and depends on change at the level of community culture. Nevertheless, MINOS realized five of its eight

up-scaling goals, in line with the regional managers’ focus on up-scaling: “

The focus is on scaling enrolment numbers and school numbers.”

Scaling deep: Across all cases, the

deep scaling goals were second in number (16) but a clear and distant third in reporting and realization—18% (

Table 6). Two vignettes exemplify this challenge. First, some

deep scaling goals were both realized and reported: MINOS saw an increase in academic performance with respect to both pre-engagement performance and a control group, as reported by external collaborators that conducted randomized control trials (RCT). Some

deep goals were reported but not realized: at MINOS, an increased retention rate for girls proved to be an issue. The only monitoring of retention occurred 2 years after engagement when the above-mentioned external collaborator conducted a randomized control trial using enrollment and participation data for the previous 2 years and found that the retention rate increased by 5.5% compared with a control group. The investment memo is clear about the central role of retention as part of the solution; however, this is not apparent in the reports. In both of these vignettes, we can only speculate as to whether Pegasus would have tracked these goals if the tracking had not been financed and executed by third parties.

In some instances, deep goals were not reported. Again, a MINOS example concerns the establishment of programs to empower girls, including education and testing on life skills, which was not mentioned in a single written report.

There seems to be a gap not only in terms of set vs. realized deep scaling goals (18%) but in terms of scaling priorities espoused in the investment memos (which include a depth-of-impact diagram and rationale for social impact depth) versus Pegasus’ “theory-in-use” of a quasi-sequence (capacities-reach-depth), well summarized by one of the regional managers in charge of NESTOR: “First you ascertain that the social organization has an inherent social impact, then you focus on growing the organization and its reach, and then you spend resources on the depth of social impact and its analysis. It is not seen as a simultaneous process.”

4.2. Use of Milestones

Pegasus’ use of milestones has evolved over the course of the engagements—within and across cases. We note a variety of milestone formats, including quantitative, qualitative, or process measures. We also note increasing specificity in goal formulation over time and across cases. Whereas ELEKTRA operated on rather underspecified goals (e.g., “strengthen management capabilities”; “ensure handover in 2013”), NESTOR had a specific goal to “develop a certificate programme” that further branched into three more detailed subgoals.

We also note that the use of milestones relates to the measurability of the goals set. For instance, narrowly focusing on quantifiable social impact (e.g., number of schools, pupils; improvement in reading and counting using standardized curricula and teacher training materials) seems to foster financial stability and milestone achievement (

Table 3). In contrast, focusing on impacting complex and deep-seated cultural habits—as in the MINOS case, including girls’ enrollment, retention, and learning performance in a caste system—renders the achievement of milestones difficult. As one regional manager points out: “

Change is deeper, with culture, with attitude towards education, with education quality, with caste system. … It is a long-term process. It is more subjective. It needs more patience.”

On a related topic, Pegasus reacted differently to failing milestones. Whereas financial installments were postponed for NESTOR for not meeting an up-scaling milestone, ELEKTRA or MINOS were not sanctioned for equal milestone failures. More broadly, Pegasus developed a repertoire of ways of dealing with milestone failure, including patience, reduction of goals, postponing of goals, ceasing the tracking of goals, delay of payment, or changes in strategy. Apart from an obvious pragmatism, it seems wise for Pegasus to account for the fact that both Pegasus and the social organization are on a (more or less) joint learning journey. As one regional manager acknowledges: “Milestones are never linear, they are context-based, involving local people. The local reality needs to be taken into consideration. Flexibility and understanding are needed. It is not easy to change an education system and culture. Milestones are ambitious and flexible. Some things happen differently or later.”

4.3. Reporting Practices

We noted that how one reports results or expects them to be reported is important to the implementation success of impact agreements. For instance, a venture-capital-informed practice of quarterly reporting might not fit the context of a social organization in an emergent country. As the social organization develops, additional goals emerge because they become a new, previously unrecognized possibility. In turn, this affects the milestones and their monitoring, which leads to discrepancies, as noted by one regional manager: “Yes, there is redundancy in some of the quarterly reports: some things take longer than a quarter to resolve or change. Further, headquarters are anyhow mostly interested in the numbers. The current reporting is not optimal.”

Furthermore, the nature and measurability of a scaling goal matters. As we saw above, deep scaling goals had the lowest rate of accomplishment. On the one hand, the complexity of such goals is inherent in their nature. On the other hand, measurement is an issue. Third, we also observed that deep scaling was achieved but not reported. We learned through our conversations with the regional managers that social organizations themselves aspired—irrespective of the reporting protocol—to scale deep. Overall, one up (MINOS) and nine deep (two in ELEKTRA—

Table 3; three in MINOS—

Table 4; three in NESTOR—

Table 5) social impact scaling goals were realized despite not having been reported. It seems to us that Pegasus’ corporate logic and the projects’ local logic were somewhat disconnected. As intermediaries, the regional managers understand that it is neither required nor desired to report these milestones and goals. As one regional manager outlines compellingly: “

Teacher trainings and curriculum implementation are happening: these are highly important. However, they are not part of the immediate focus, which is the scaling of the number of schools. Headquarters does not prioritize tracking retention, teachers’ curriculum use, or life skills learning.”

In conclusion, and somewhat to be expected, accomplishing deep social impact proves the most challenging “by nature”. Importantly, however, we saw how the reporting of social impact influences organizational and reporting behavior—not always to the benefit of deep scaling. Social organizations orient their reporting obviously to what has been formally agreed upon but also to what they believe the funders’ are interested in learning. If the financial provider does not credibly signal a strong interest in the rather hairy and ambiguous reporting items on deep scaling, both parties will likely fall back on the capacities and up-scaling strategies that are easier to implement and measure. In the following, we wish to offer a model for impact scaling agreements that accounts for these potential biases and ineffectiveness.

5. Toward a Model for Effective Impact Scaling Agreements

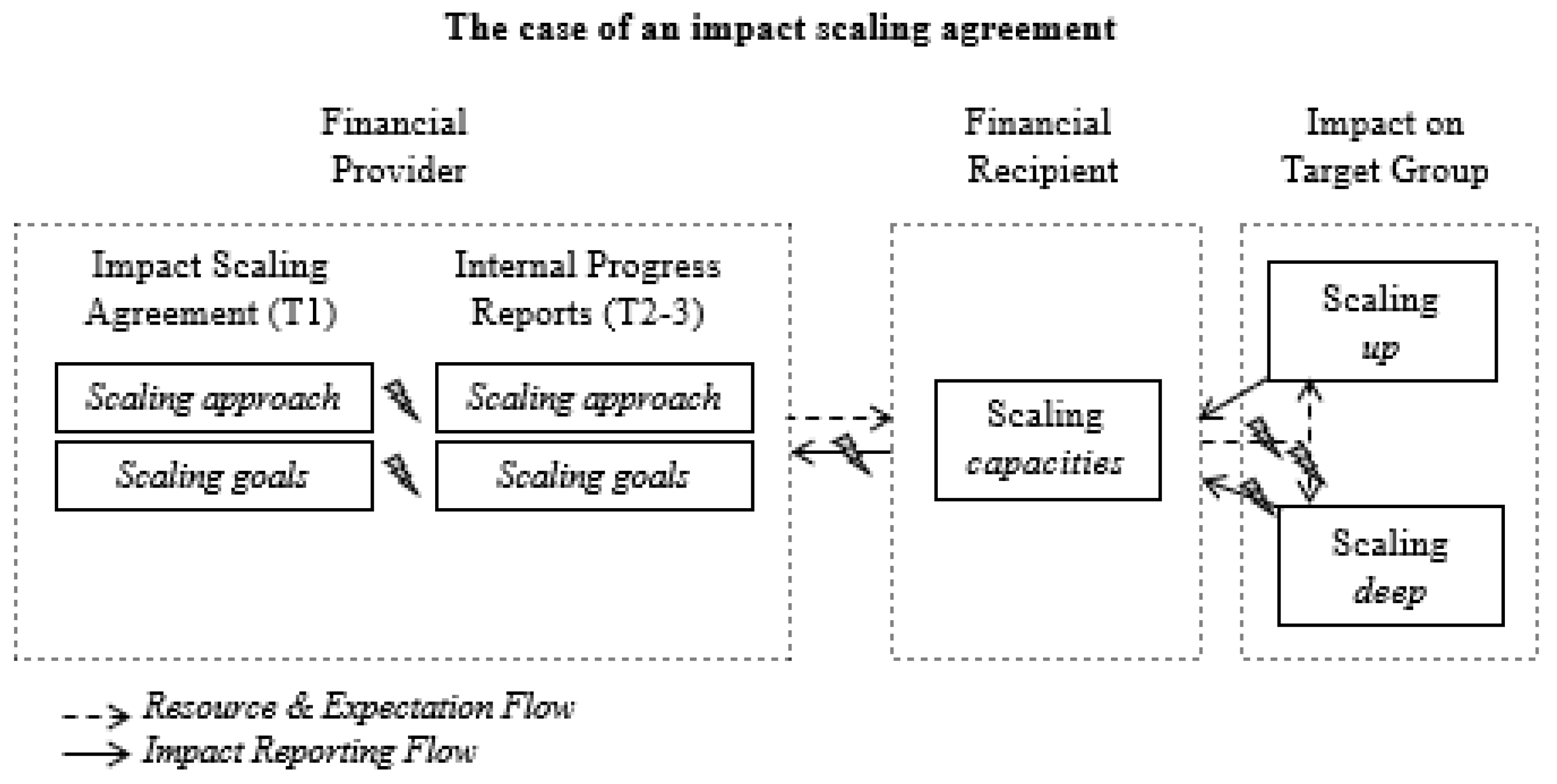

As depicted above, we learned about Pegasus’ experience in accounting for scaling goals using milestones and reporting practices. Our inter-temporal analysis enables the emergence of a learning roadmap. The following figure highlights the fundamental aspects of Pegasus’ resource, expectation, and reporting flows in the context of its impact scaling agreements with SOs.

We learned a considerable amount from Pegasus’ experience, including its challenges—see the “thunder-symbols” in

Figure 2 relating to our analysis above—that we see as success enhancers for effective social impact scaling agreements to enable social impact. These we have grouped into three fields:

- ▪

Financial provider alignment pre- and per-engagement in terms of expectations with regard to scaling approach and goals.

- ▪

Scaling approach coherence in terms of understanding and acting upon the inter-relatedness and, in fact, mutual dependency among capacity, up-, and deep scaling.

- ▪

Impact reporting alignment of the target group with the financial recipient and the financial provider.

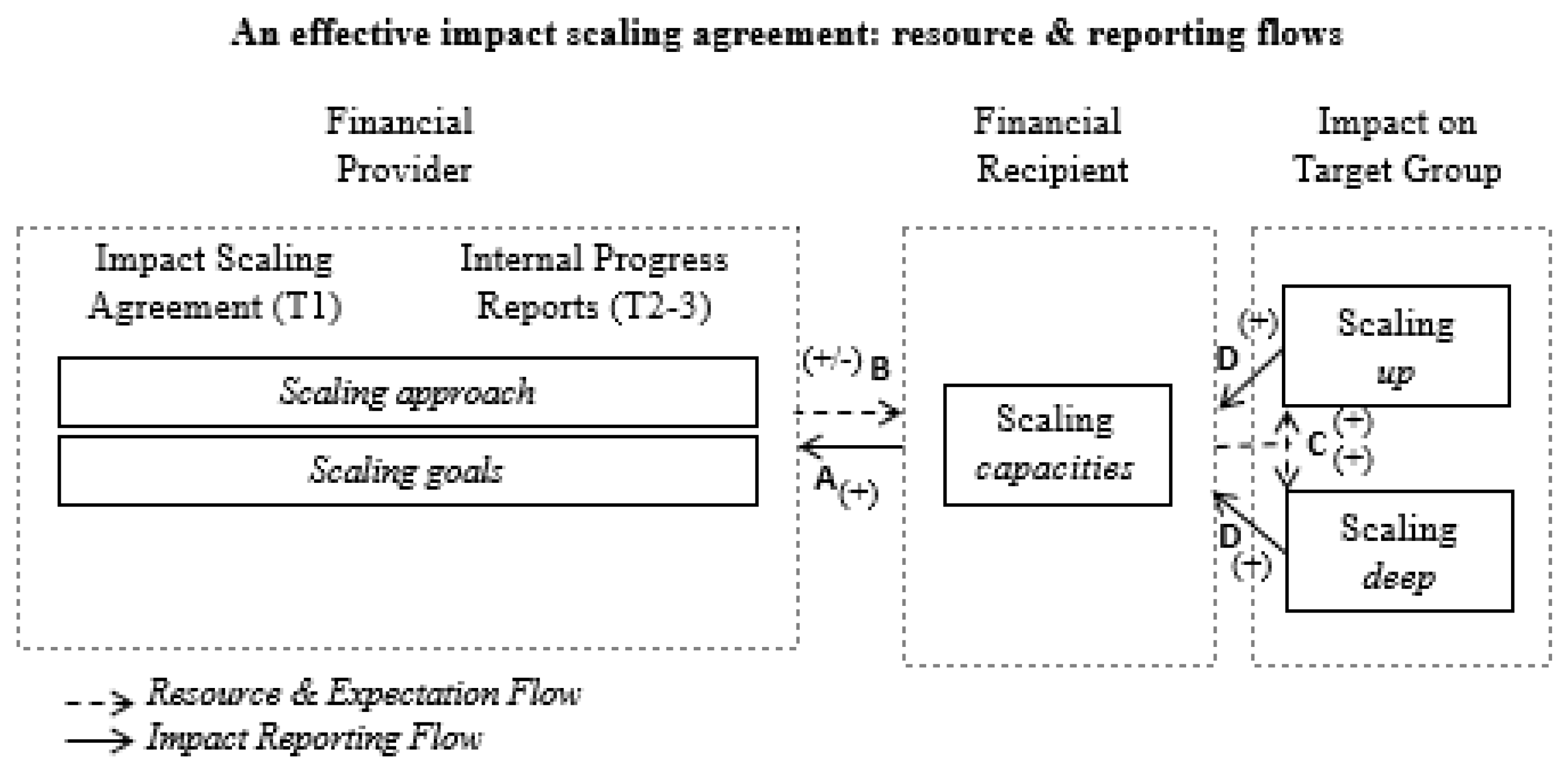

Based on our learning and the previous depiction (

Figure 2), we developed a model for the inter-temporal flow of expectations, resources, and impact reporting within the context of an effective impact scaling agreement. This model addresses the different roles that financial providers and recipients are playing. The financial provider supplies resources so that the financial recipient can—as an intermediary [

35]—develop its organizational capacities and increase its social impact on the target group. These roles establish the context for understanding the flows of resources and impact information.

The flow of impact reporting—Flow A—refers to the ongoing flow of information about the financial recipient and the impact that the financial provider receives and on the basis of which financial decisions are made. This reporting process starts in the pre-engagement phase with the due diligence step. A successful due diligence process develops into a scaling agreement that then becomes the basis for the ongoing impact reporting process.

The flow of expectations and resources—Flow B—from the financial provider to the financial recipient is formalized in the impact scaling agreement. Its content can vary from very general to very precise goals, affecting this flow accordingly. The flow of financial resources can be set per contract to consist of resource installments over time according to milestones reached. The financial provider can decide—based on its reports—to delay, limit, or stop the flow of resources, not only pre-engagement but also per-engagement (thus +/− flow). Flow B also reflects the financial recipient’s intermediary role: field implementation of goals requires knowledge of the local reality. The flow of resources is first channeled into the capacity development of the financial recipient as the enabler of social impact scaling. Here, the term capacity is meant very generally, including the learning assimilated by taking on new responsibilities or fields of action, as well as very concrete assignments, such as hiring processes or developing replication strategies.

Flow C includes the financial and nonfinancial resources supplied by the financial provider, as well as the newly generated

capacity resources that are channeled into

up and

deep scaling goals. Flow C can be channeled into

up-scaling,

deep scaling, or both. As André and Pache (2014) note, there are severe risks in channeling all resources into

up-scaling. Ignoring

deep scaling can hamper, if not endanger, grassroots collective ownership and sustainable growth. On the other hand, Smith, Kistruck, and Cannatelli (2016) warn of social entrepreneurs who have a personal desire to control, which tends to occur most often when there is excessive focus on value creation [

18] rather than value capture, thereby stifling growth.

Flow D is that of the financial recipient’s information on the social impact generated. Knowledge of the quality and quantity of this flow depends on the qualitative and quantitative evaluation and reporting processes. In some cases, this flow is barely evaluated. In other cases, resources are invested in the development of organizational

capacities to gather and analyze social impact data. In further cases, resources are used for external social impact assessment, which has advantages if resource intensity (financial and skill-set) is needed and disadvantages if it is not embedded in the organization’s reflective learning process. This flow of impact information can be an organic source of social impact growth [

10]: it can flow directly into the impact process and stimulate an increase in

capacity development and in either or both

up- and

deep scaling.

The financial recipient reports to the financial provider through Flow A. Flows D and A are usually dissimilar: the financial recipient might have more and/or differently defined social impact goals than the financial provider, and financial providers might be using different reporting systems and processes. The content of the reports to the financial provider is based on those goals and expectations delineated in the impact scaling agreement.

The figure below (

Figure 3) depicts the above-mentioned flows (A, B, C, D) between the financial provider, the financial recipient, and the impact on the target group.

The model showcases the inter-temporal flows of expectations, resources, and impact reporting in the context of a social impact scaling agreement between a financial provider and its financial recipient, as identified through qualitative analysis. Its flows of expectations, resources, and impact information are aligned with decision-making and reporting processes, scaling agreements, and the implementation of the scaling approach and goals of the financial provider. Such a transparent process and internal alignment fulfill Jackson’s (2013) and Ormiston and Seymour’s (2014) recommendations and heighten sustainability.

6. Discussion

As noted above, there have been a number of research insights into the fundamentally problematic aspects of social impact scaling processes [

9,

5]. These studies have focused on the internal processes of social entrepreneurs and their social organizations. This study uses a different lens by taking the perspective of the financial provider financing the scaling of a social organization’s social impact. This is a critical perspective, as very few social organizations internally finance their social impact scaling. This longitudinal qualitative study demonstrates the importance of alignment for the financial provider. The fact that the financial provider followed in this empirical study lacked alignment in its scaling approach, goals, and reporting processes over time hampered its effectiveness and sustainability. The method used in this study enabled an exploration of processes that uncovered both strengths and struggles, which in turn enabled new levels of understanding. This research makes a twofold contribution to the literature through its exploration of (1) the pivotal role of the internal alignment between mission, strategy, reporting, and decision-making processes [

22] and (2) the three scaling strategies of

capacity,

up-, and

deep scaling as interrelated dimensions of the same phenomenon [

9,

10,

11,

36].

This research contributes by highlighting the importance of internal alignment between approach, goals, reporting, and decision-making processes. The impact information flows and their interrelations, along with the impact scaling agreements, all need to be aligned with the internal approach and goals. All three constituents—the target group, the financial recipient, and the financial provider—are needed for the coherent flow of impact information and organic growth. The impact scaling agreement is fundamental to the resource decisions to be made by the financial provider. In this empirical study, the problem was not with the scaling agreement but rather with the misalignment that emerged during the implementation and tracking of the deep scaling goals. The outcome of examining the research question—“how can impact scaling agreements enable effective social impact?”—was the identification of three success enhancers for effective social impact scaling agreements to enable social impact: (1) Financial provider alignment pre- and per-engagement in terms of expectations with regard to scaling approach and goals; (2) Scaling approach coherence in terms of understanding and acting upon the inter-relatedness and, in fact, mutual dependency between capacity, up-, and deep scaling; (3) Impact reporting alignment of the target group with the financial recipient and the financial provider. These success enhancers form a coherent, complex but not complicated space in which resources, expectations, reporting, learning, and decision-making processes can flow organically.

There is a fundamental need to better understand the nature of the depth of impact. The paradox of the situation is that neither financial providers nor financial recipients are openly discussing this challenge. The development of

capacities is a core part of all scaling strategies, but it is not an end in itself. It is also not that the same capacities are initially needed regardless of whether

up or

deep strategies are in place. Neither a trade-off nor a dichotomizing approach between embedded, qualitative

deep scaling, on the one hand, and quantitative

up-scaling, on the other hand, is seen to be conducive to social impact scaling. A coherent approach in which these different social impact scaling strategies and processes are complementary and interrelated is recommended. This study views

capacity,

up-, and

deep scaling strategies and processes as puzzle pieces of the same phenomenon. Inherent in this approach is the development of a deeper understanding so that in the face of each reality and typical resource constraints, sound decisions can be made. The model developed in this study supports such processes. Scaling social impact is a challenging goal, especially when it is to be organic and sustainable. A related issue is that of impact-measurement practices [

24]. Here, some research, such as that by Ebrahim and Rangan [

37], considers the complexity of social impact when delineating corresponding impact measurement practices. This study’s model contributes to the literature’s understanding of the nature of the depth of impact.

This research enabled a practical understanding of pre- and per-engagement financial processes between financial provider and recipient. The perspective of the financial provider gives insight with regard to determining characteristics—e.g., field, internal and external scaling readiness, demonstrated theory of change, depth of impact, goal and milestone affinity, reporting processes, collaboration potential, etc.—of the financial recipients for the above-mentioned pre- and per- financial processes. The model developed in this study provides insight into how a financial provider’s scaling approach can be implemented through its agreements with and reports on its financial recipients. The phenomenon studied and the insights generated are fundamental to the fields of social finance, impact investment, and social impact scaling.

6.1. Limitations

The longitudinal reconstruction of the reporting and evaluation processes enabled a qualitative and relatively less-biased analysis over a span of 4–6 years. However, the quality of the written reports was lower than expected. Regularly delivered oral reports were not recorded in writing. The interviews with the regional managers were pivotal for the qualitative interpretation of the analysis. The fact that all the regional managers independently made overlapping statements counteracted the natural bias inherent in an interview. This study was conducted solely from the perspective of the financial provider and its own reporting documentation. As a result, any form of window dressing on the part of the financial recipient pre- or per-engagement was not explored. The regional managers’ performance of thorough due diligence pre-engagement and the close relations with the financial recipients per-engagement reduced the general risk of such an issue. Although parallels to a non-hybrid context certainly exist, the focus of this research was limited to the hybrid context.

6.2. Future Research

Further research on the interrelations between the

capacity,

up-, and

deep scaling strategies is needed so that if priorities need to be set, one will know how to go about it and what to keep in mind. For example, which different combinations of

up-,

deep, and

capacity scaling strategies are more effective according not only to the nature of the desired social impact and/or its ecosystem but also to the stage of scaling? A contingency framework could be developed, as Ebrahim and Rangan [

37] did by linking the theory of change, operational strategy, and corresponding type of impact measurement to be applied.

A different research focus would be to explore how the financial provider’s proximity to both its financial recipients and its own market/civil rationale influence the alignment between the mission and impact measurement and the realized growth of the social impact. Additionally, it would be worthwhile to conduct qualitative research on the relationship between the financial provider’s regional managers and the financial recipients and how the identified hybrid tension is managed from both sides.

A further research lens would build on the insights of VanSandt, Sud, and Marmé (2009) and Desa and Koch (2014) and look for additional ways to stay on and yet stimulate an organic development path. There could be an investigation into how to increase collective ownership, grassroots decision-making processes, collaboration, learning, and support.

6.3. Concluding Remarks

Scaling social impact is currently a critical field. Heightened social crises are creating pressure for improvement; however, although there are myriad options, there is little clarity. Whether scaling

up or

deep, organizational capacities will be challenged and grow organically as enablers [

10,

24]. Excess focus on

up-scaling can result in mission loss and/or deep social impact loss [

9]. Excess focus on

deep scaling strategies can lead to narrowness and a lack of growth [

5]. This study is critical of the current emphasis on

up-scaling found both in the scaling discussion and in practice. In this empirical study, although the financial provider was aware of the need for

deep impact in the pre-engagement phase, most of the resources were consciously focused on

up-scaling strategies and related

capacities. This divergence is apparent in reports on the provider’s financial recipients.

This study demonstrates that although the financial provider may be in a financially independent position, it can still struggle to implement its approach and goals via a financial recipient. Additionally, as Abercrombie [

38] writes, the resource provider has a fundamental responsibility to learn about and contribute to the field. This study’s insights are highly relevant for practitioners: not only financial providers but also financial recipients can learn from these insights for their own access to financial providers, instruments, and pre- and per-financing processes.

This study’s approach to exploring the implementation and realization of a financial provider’s scaling approach via

capacity,

up-, and

deep scaling goals in concert is unique. Extrapolating, one can envision similar discussions that might not be about “either/or” but rather “and”, such as in the context of sustainability. In all markets, it truly is not about a “small” or “big” size [

12] but rather about optimizing organic and sustainable social impact as it develops and contributes increasing value to society.