The Environmental Strategy of Businesses as an Option under Recession in Greece

Abstract

1. Introduction

- To what extent can Greek companies implement an environmental strategy in a period of economic crisis?

- To what extent can the framework of this study predict the degree of impact of a business environmental strategy on corporate financial performance in periods of economic crisis?

2. Theoretical Framework and Hypotheses Development

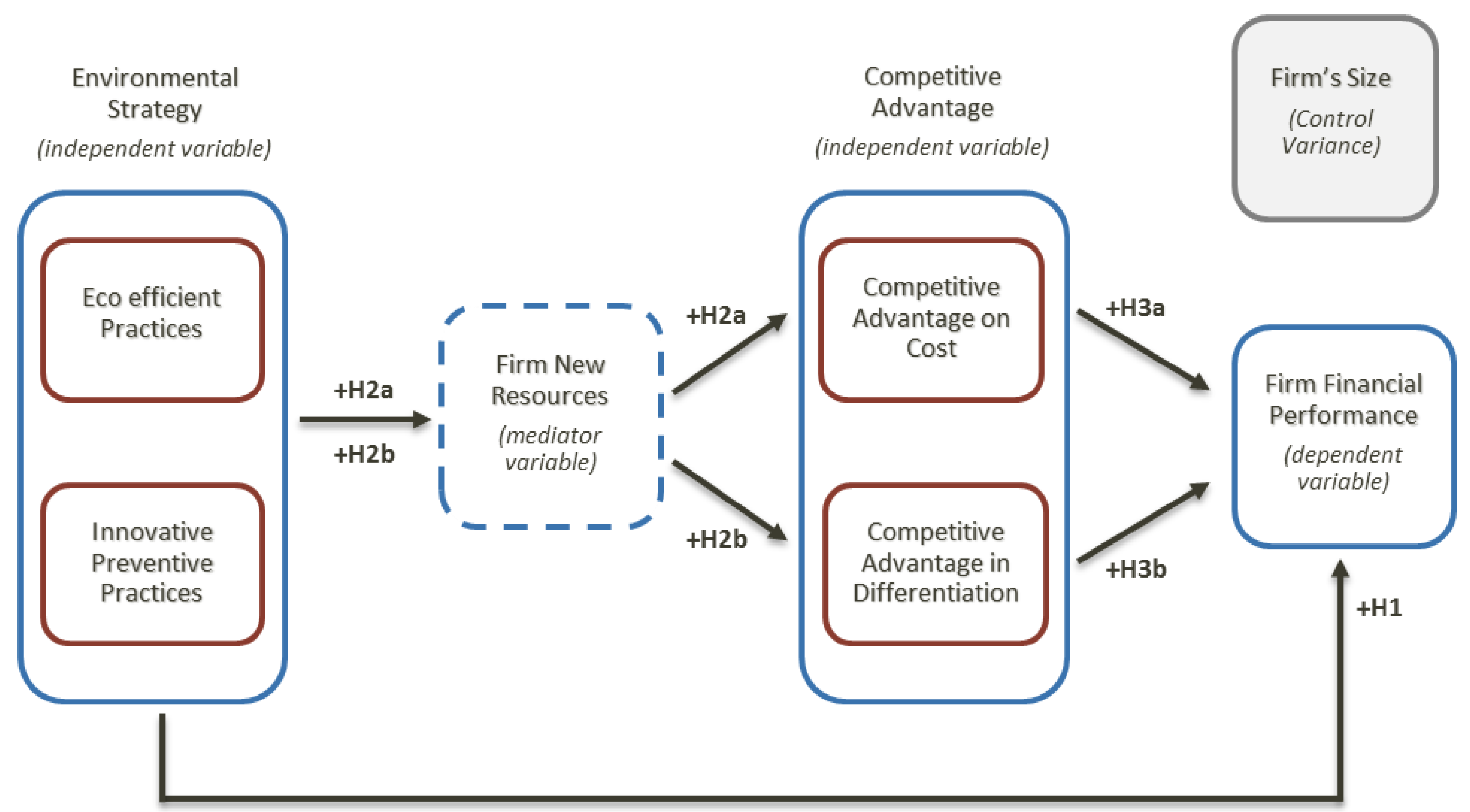

2.1. The Impact of Environmental Strategy on Business Financial Performance

- Hypothesis 1a (H1a):Eco-efficient practices have a positive impact on a firm’s financial performance.

- Hypothesis 1b (H1b):Innovative preventive practices have a positive impact on a firm’s financial performance.

2.2. Environmental Strategy and Competitive Advantage

- Hypothesis 2a1 (H2a1):Corporate resources generated through an environmental business strategy mediate in the positive correlation between eco-efficient business practices and competitive cost advantage.

- Hypothesis 2a2 (H2a2):Corporate resources generated through an environmental business strategy mediate in the positive correlation between innovative preventive corporate practices and competitive cost advantage.

- Hypothesis 2b1 (H2b1):Corporate resources generated through an environmental business strategy mediate in the positive correlation between eco-efficient business practices and competitive differentiation advantage.

- Hypothesis 2b2 (H2b2):Corporate resources generated through an environmental business strategy mediate in the positive correlation between innovative preventive corporate practices and competitive differentiation advantage.

2.3. Competitive Advantage and Business Financial Performance

3. Methodology

3.1. Sample and Data Collection

3.2. Measures

3.2.1. Environmental Strategy

3.2.2. Development/Creation of New Firm Resources

3.2.3. Competitive Advantage

3.2.4. Firm Financial Performance

3.2.5. Control Variables

4. Analysis and Results

4.1. Analysis

4.2. Results

5. Discussion, Conclusions, and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Levene’s Test | t-test | ||||

|---|---|---|---|---|---|---|

| F | Sig. | t | df | Sig. (2-tailed) | Difference in Means | |

| IPP1 | 0.298 | 0.587 | 0.567 | 59 | 0.573 | 0.16022 |

| IPP2 | 0.391 | 0.534 | −0.304 | 59 | 0.762 | −0.07419 |

| IPP3 | 0.786 | 0.379 | −0.023 | 59 | 0.982 | −0.00538 |

| IPP4 | 0.606 | 0.439 | −0.022 | 59 | 0.982 | −0.00645 |

| IPP5 | 0.501 | 0.482 | −0.436 | 59 | 0.665 | −0.14731 |

| IPP6 | 1.274 | 0.264 | 0.296 | 59 | 0.769 | 0.04301 |

| IPP7 | 0.663 | 0.419 | −0.163 | 59 | 0.871 | −0.03871 |

| IPP8 | 0.777 | 0.382 | 0.020 | 59 | 0.984 | 0.00645 |

| IPP9 | 0.851 | 0.360 | 0.052 | 59 | 0.959 | 0.01613 |

| IPP10 | 0.134 | 0.716 | 0.430 | 59 | 0.669 | 0.13118 |

| IPP11 | 0.586 | 0.447 | −0.041 | 59 | 0.967 | −0.0129 |

| IPP12 | 0.003 | 0.959 | 0.396 | 59 | 0.694 | 0.11828 |

| IPP13 | 0.548 | 0.462 | −0.014 | 59 | 0.989 | −0.0043 |

| IPP14 | 0.217 | 0.643 | −0.162 | 59 | 0.872 | −0.05591 |

| EEP1 | 0.155 | 0.695 | 0.103 | 59 | 0.918 | 0.0172 |

| EEP2 | 2.028 | 0.16 | 0.898 | 59 | 0.373 | 0.12151 |

| EEP3 | 0.670 | 0.416 | −0.485 | 59 | 0.629 | −0.12473 |

| EEP4 | 0.001 | 0.974 | 0.409 | 59 | 0.684 | 0.08065 |

| EEP5 | 0.206 | 0.651 | 0.423 | 59 | 0.674 | 0.07634 |

| EEP6 | 0.006 | 0.940 | 0.598 | 59 | 0.552 | 0.19677 |

| EEP7 | 0.000 | 0.993 | 0.301 | 59 | 0.764 | 0.04839 |

| EEP8 | 0.278 | 0.600 | 0.535 | 59 | 0.594 | 0.08495 |

| EEP9 | 0.006 | 0.939 | 0.273 | 59 | 0.786 | 0.04731 |

| FR1a | 0.018 | 0.895 | 0.004 | 59 | 0.997 | 0.00108 |

| FR1b | 0.369 | 0.546 | −0.139 | 59 | 0.890 | −0.03763 |

| FR1c | 0.041 | 0.840 | −0.333 | 59 | 0.740 | −0.05269 |

| FR2a | 0.011 | 0.918 | −0.673 | 59 | 0.503 | −0.19462 |

| FR2b | 0.114 | 0.737 | −0.412 | 59 | 0.682 | −0.09032 |

| FR2c | 0.373 | 0.544 | −0.496 | 59 | 0.622 | −0.0828 |

| FR3a | 0.067 | 0.796 | −0.785 | 59 | 0.435 | −0.16237 |

| FR3b | 0.113 | 0.738 | −0.782 | 59 | 0.438 | −0.16022 |

| CAC1 | 0.210 | 0.648 | 0.235 | 59 | 0.815 | 0.04409 |

| CAC2 | 0.424 | 0.517 | 0.413 | 59 | 0.681 | 0.08172 |

| CAC3 | 0.308 | 0.581 | −0.354 | 59 | 0.724 | −0.06129 |

| CAC4 | 0.571 | 0.453 | 0.135 | 59 | 0.893 | 0.02258 |

| CAC5 | 0.106 | 0.745 | 0.073 | 59 | 0.942 | 0.01398 |

| CAC6 | 0.154 | 0.696 | 0.14 | 59 | 0.889 | 0.03871 |

| CAC7 | 0.212 | 0.647 | 0.326 | 59 | 0.746 | 0.05914 |

| CAD1 | 0.014 | 0.906 | 0.027 | 59 | 0.979 | 0.0043 |

| CAD2 | 0.036 | 0.85 | 0.375 | 59 | 0.709 | 0.06344 |

| CAD3 | 0.114 | 0.736 | 0.271 | 59 | 0.787 | 0.05699 |

| CAD4 | 0.125 | 0.725 | 0.397 | 59 | 0.693 | 0.08602 |

| CAD5 | 0.353 | 0.555 | −0.04 | 59 | 0.968 | −0.00645 |

| CAD6 | 0.686 | 0.411 | 0.169 | 59 | 0.867 | 0.02473 |

| CAD7 | 0.439 | 0.510 | 0.087 | 59 | 0.931 | 0.01613 |

| CAD8 | 1.080 | 0.303 | −0.572 | 59 | 0.570 | −0.07312 |

| FFP1a | 1.092 | 0.300 | −0.043 | 59 | 0.966 | −0.0086 |

| FFP1b | 0.035 | 0.852 | 0.154 | 59 | 0.878 | 0.03118 |

| FFP1c | 0.139 | 0.711 | −0.354 | 59 | 0.724 | −0.06667 |

| FFP2a | 0.009 | 0.926 | −0.081 | 59 | 0.936 | −0.01505 |

| FFP2b | 0.163 | 0.688 | −0.05 | 59 | 0.961 | −0.00753 |

| FFP2c | 0.092 | 0.763 | −0.537 | 59 | 0.594 | −0.07312 |

References

- Van den Bergh, J.C. Environment versus growth—A criticism of “degrowth” and a plea for “a-growth”. Ecol. Econ. 2011, 70, 881–890. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. Economic growth and the environment: A review of theory and empirics. In Handbook of Economic Growth; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, pp. 1749–1821. [Google Scholar]

- Spangenberg, J.H. Biodiversity pressure and the driving forces behind. Ecol. Econ. 2007, 61, 146–158. [Google Scholar] [CrossRef]

- Heikkurinen, P.; Bonnedahl, K.J. Corporate responsibility for sustainable development: A review and conceptual comparison of market-and stakeholder-oriented strategies. J. Clean. Prod. 2013, 43, 191–198. [Google Scholar] [CrossRef]

- Husted, B.W. A contingency theory of corporate social performance. Bus. Soc. 2000, 39, 24–48. [Google Scholar] [CrossRef]

- Ho, F.N.; Wang, H.-M.D.; Vitell, S.J. A global analysis of corporate social performance: The effects of cultural and geographic environments. J. Bus. Ethics 2012, 107, 423–433. [Google Scholar] [CrossRef]

- Lo, S.F.; Sheu, H.J. Is corporate sustainability a value-increasing strategy for business? Corp. Gov. Int. Rev. 2007, 15, 345–358. [Google Scholar] [CrossRef]

- Lamberti, L.; Noci, G. The relationship between CSR and corporate strategy in medium-sized companies: Evidence from Italy. Bus. Ethics A Eur. Rev. 2012, 21, 402–416. [Google Scholar] [CrossRef]

- Munro, D.A.; Holdgate, M.W. Caring for the Earth: A Strategy for Sustainable Living; Routledge: Abingdon, UK, 1991. [Google Scholar]

- Barbier, E.B. The concept of sustainable economic development. Environ. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Borga, F.; Citterio, A.; Noci, G.; Pizzurno, E. Sustainability report in small enterprises: Case studies in Italian furniture companies. Bus. Strategy Environ. 2009, 18, 162–176. [Google Scholar] [CrossRef]

- Gladwin, T.N.; Kennelly, J.J.; Krause, T.-S. Shifting paradigms for sustainable development: Implications for management theory and research. Acad. Manag. Rev. 1995, 20, 874–907. [Google Scholar] [CrossRef]

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortes, E. The whole relationship between environmental variables and firm performance: Competitive advantage and firm resources as mediator variables. J. Environ. Manag. 2009, 90, 3110–3121. [Google Scholar] [CrossRef] [PubMed]

- Choudri, B.; Baawain, M.; Al-Zeidi, K.; Al-Nofli, H.; Al-Busaidi, R.; Al-Fazari, K. Citizen perception on environmental responsibility of the corporate sector in rural areas. Environ. Dev. Sustain. 2017, 19, 2565–2576. [Google Scholar] [CrossRef]

- Moravcikova, D.; Krizanova, A.; Kliestikova, J.; Rypakova, M. Green Marketing as the Source of the Competitive Advantage of the Business. Sustainability 2017, 9, 2218. [Google Scholar] [CrossRef]

- Fund, I.M. Greece: Staff Report on Request for Stand-by Arrangement; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Greece, B.O. Governor’s Report for the Year 2010; Bank of Greece: Athens, Greece, 2011. [Google Scholar]

- González-Benito, J.; González-Benito, Ó. Environmental proactivity and business performance: An empirical analysis. Omega 2005, 33, 1–15. [Google Scholar] [CrossRef]

- Wagner, M.; Schaltegger, S. The effect of corporate environmental strategy choice and environmental performance on competitiveness and economic performance: An empirical study of EU manufacturing. Eur. Manag. J. 2004, 22, 557–572. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Hurtado-Torres, N.; Sharma, S.; García-Morales, V.J. Environmental strategy and performance in small firms: A resource-based perspective. J. Environ. Manag. 2008, 86, 88–103. [Google Scholar] [CrossRef] [PubMed]

- Ryszko, A. Proactive environmental strategy, technological eco-innovation and firm performance—Case of poland. Sustainability 2016, 8, 156. [Google Scholar] [CrossRef]

- Bansal, P. Evolving sustainably: A longitudinal study of corporate sustainable development. Strat. Manag. J. 2005, 26, 197–218. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Genç, K.Y. Natural environment as a strategic issue for firms: Theoretical perspectives. Procedia Soc. Behav. Sci. 2013, 99, 143–153. [Google Scholar] [CrossRef]

- Carballo-Penela, A.; Castromán-Diz, J.L. Environmental policies for sustainable development: An analysis of the drivers of proactive environmental strategies in the service sector. Bus. Strategy Environ. 2015, 24, 802–818. [Google Scholar] [CrossRef]

- Lucato, W.C.; Costa, E.M.; de Oliveira Neto, G.C. The environmental performance of SMEs in the Brazilian textile industry and the relationship with their financial performance. J. Environ. Manag. 2017, 203, 550–556. [Google Scholar] [CrossRef] [PubMed]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Russo, M.V.; Fouts, P.A. A resource-based perspective on corporate environmental performance and profitability. Acad. Manag. J. 1997, 40, 534–559. [Google Scholar]

- Annandale, D.; Morrison-Saunders, A.; Bouma, G. The impact of voluntary environmental protection instruments on company environmental performance. Bus. Strategy Environ. 2004, 13, 1–12. [Google Scholar] [CrossRef]

- Melnyk, S.A.; Sroufe, R.P.; Calantone, R. Assessing the impact of environmental management systems on corporate and environmental performance. J. Oper. Manag. 2003, 21, 329–351. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar] [CrossRef]

- Majumdar, S.K.; Marcus, A.A. Rules versus discretion: The productivity consequences of flexible regulation. Acad. Manag. J. 2001, 44, 170–179. [Google Scholar]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strat. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar] [CrossRef]

- Lehni, M. Eco-Efficiency: Creating More Value with Less Impact; World Business Council for Sustainable Development: Geneva, Switzerland, 2000. [Google Scholar]

- Flannery, B.L.; May, D.R. Environmental ethical decision making in the US metal-finishing industry. Acad. Manag. J. 2000, 43, 642–662. [Google Scholar]

- Dean, T.J.; Brown, R.L.; Bamford, C.E. Differences in large and small firm responses to environmental context: Strategic implications from a comparative analysis of business formations. Strat. Manag. J. 1998, 19, 709–728. [Google Scholar] [CrossRef]

- Dean, T.J.; Brown, R.L.; Stango, V. Environmental regulation as a barrier to the formation of small manufacturing establishments: A longitudinal examination. J. Environ. Econ. Manag. 2000, 40, 56–75. [Google Scholar] [CrossRef]

- Rutherfoord, R.; Blackburn, R.A.; Spence, L.J. Environmental management and the small firm: An international comparison. Int. J. Entrep. Behav. Res. 2000, 6, 310–326. [Google Scholar] [CrossRef]

- Miles, M.P.; Munilla, L.S.; McClurg, T. The impact of ISO 14,000 environmental management standards on small and medium sized enterprises. J. Qual. Manag. 1999, 4, 111–122. [Google Scholar] [CrossRef]

- Henri, J.-F.; Journeault, M. Environmental performance indicators: An empirical study of Canadian manufacturing firms. J. Environ. Manag. 2008, 87, 165–176. [Google Scholar] [CrossRef] [PubMed]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

- Wagner, M. How to reconcile environmental and economic performance to improve corporate sustainability: Corporate environmental strategies in the European paper industry. J. Environ. Manag. 2005, 76, 105–118. [Google Scholar] [CrossRef] [PubMed]

- Galdeano-Gomez, E.; Céspedes-Lorente, J.; Martínez-del-Río, J. Environmental performance and spillover effects on productivity: Evidence from horticultural firms. J. Environ. Manag. 2008, 88, 1552–1561. [Google Scholar] [CrossRef] [PubMed]

- Shrivastava, P. Environmental technologies and competitive advantage. Strat. Manag. J. 1995, 16, 183–200. [Google Scholar] [CrossRef]

- Fraj-Andrés, E.; Martínez-Salinas, E.; Matute-Vallejo, J. Factors affecting corporate environmental strategy in Spanish industrial firms. Bus. Strategy Environ. 2009, 18, 500–514. [Google Scholar] [CrossRef]

- Weng, H.-H.R.; Chen, J.-S.; Chen, P.-C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Zhang, Y.-J.; Peng, Y.-L.; Ma, C.-Q.; Shen, B. Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 2017, 100, 18–28. [Google Scholar] [CrossRef]

- Long, X.; Chen, Y.; Du, J.; Oh, K.; Han, I. Environmental innovation and its impact on economic and environmental performance: Evidence from Korean-owned firms in China. Energy Policy 2017, 107, 131–137. [Google Scholar] [CrossRef]

- Lankoski, L. Corporate responsibility activities and economic performance: A theory of why and how they are connected. Bus. Strategy Environ. 2008, 17, 536–547. [Google Scholar] [CrossRef]

- Ecker, S.; Coote, L. BestFarms-An Integrated Approach to Environmentally Sustainable Farming in the South-west Region of Western Australia. Australas. J. Environ. Manag. 2005, 12, 215–220. [Google Scholar]

- Walley, K.; Custance, P.; Parsons, S. UK consumer attitudes concerning environmental issues impacting the agrifood industry. Bus. Strategy Environ. 2000, 9, 355–366. [Google Scholar] [CrossRef]

- Azzone, G.; Bertelè, U. Exploiting green strategies for competitive advantage. Long Range Plan. 1994, 27, 69–81. [Google Scholar] [CrossRef]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 33, 5. [Google Scholar]

- Wubben, E.F. The Dynamics of the Eco-Efficient Economy: Environmental Regulation and Competitive Advantage; Edward Elgar Publishing: Cheltenham, UK, 2000. [Google Scholar]

- Witjes, S.; Vermeulen, W.J.; Cramer, J.M. Assessing Corporate Sustainability integration for corporate self-reflection. Resour. Conserv. Recycl. 2017, 127, 132–147. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. New venture strategic posture, structure, and performance: An industry life cycle analysis. J. Bus. Ventur. 1990, 5, 123–135. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Rubio-Lopez, E.A. Proactive corporate environmental strategies: Myths and misunderstandings. Long Range Plan. 2007, 40, 357–381. [Google Scholar] [CrossRef]

- Lindell, M.; Karagozoglu, N. Corporate environmental behaviour–a comparison between Nordic and US firms. Bus. Strategy Environ. 2001, 10, 38–52. [Google Scholar] [CrossRef]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson Education: London, UK, 2009. [Google Scholar]

- Dillman, D.A.; Smyth, J.D.; Christian, L.M. Internet, Phone, Mail and Mixed-Mode Surveys: The Tailored Design Method. Reis 2016, 154, 161–176. [Google Scholar]

- COTE. General Report on the Activities of the European Union; European Commission: Brussels, Belgium, 2003. [Google Scholar]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A. Strategic proactivity and firm approach to the natural environment. Acad. Manag. J. 1998, 41, 556–567. [Google Scholar] [CrossRef]

- Sharma, S. Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar]

- Marcus, A.A.; Anderson, M.H. A general dynamic capability: Does it propagate business and social competencies in the retail food industry? J. Manag. Stud. 2006, 43, 19–46. [Google Scholar] [CrossRef]

- Schmidheiny, S. Changing Course: A Global Business Perspective on Development and the Environment; MIT Press: Cambridge, MA, USA, 1992; Volume 1. [Google Scholar]

- Smith, M.; Kemp, R. Small Firms and the Environment: A Grounded Report; Grounded in Birmingham: Birmingham, AL, USA, 1998. [Google Scholar]

- Judge, W.Q.; Douglas, T.J. Performance implications of incorporating natural environmental issues into the strategic planning process: An empirical assessment. J. Manag. Stud. 1998, 35, 241–262. [Google Scholar] [CrossRef]

- Gitman, L.J.; Zutter, C.J. Principles of Managerial Finance, 14th ed.; Pearson: Boston, MA, USA, 2015; Volume 1, (various pagings). [Google Scholar]

- Trochim, W.; Donnelly, J.P.; Arora, K. Research Methods: The Essential Knowledge Base; Nelson Education: Scarborough, ON, Canada, 2015. [Google Scholar]

- Kass, R.A.; Tinsley, H.E.A. Factor Analysis. J. Leis. Res. 1979, 11, 120–138. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using IBM SPSS Statistics; Sage: Newcastle upon Tyne, UK, 2013. [Google Scholar]

- Sekaran, U.; Bougie, R. Research Methods for Business: A Skill Building Approach; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Kaiser, H.F. An index of factorial simplicity. Psychometrika 1974, 39, 31–36. [Google Scholar] [CrossRef]

- Hair, J., Jr.; Black, W.; Babin, B.; Anderson, R.; Tatham, R. SEM: An introduction. In Multivariate Data Analysis: A Global Perspective; Pearson Education: London, UK, 2010; pp. 629–686. [Google Scholar]

- DiStefano, C.; Zhu, M.; Mindrila, D. Understanding and using factor scores: Considerations for the applied researcher. Pract. Assess. Res. Eval. 2009, 14, 1–11. [Google Scholar]

- Cheng, C.C.; Yang, C.-L.; Sheu, C. The link between eco-innovation and business performance: A Taiwanese industry context. J. Clean. Prod. 2014, 64, 81–90. [Google Scholar] [CrossRef]

| Characteristics | Frequency (%) |

|---|---|

| Gender | |

| Male | 162 (86.2) |

| Female | 26 (13.8) |

| Age | |

| 25–34 | 15 (8) |

| 35–44 | 43 (22.9) |

| 45–54 | 55 (29.3) |

| 55–64 | 51 (27.1) |

| >65 | 24 (12.7) |

| Education | |

| High school diploma | 17 (9) |

| Bachelor degree | 72 (38.3) |

| Master degree | 90 (47.9) |

| Ph.D. | 9 (4.8) |

| Sector | |

| Transportation | 6 (3.2) |

| Commerce | 34 (18.1) |

| Industry | 89 (47.3) |

| Medical services | 16 (8.5) |

| Information technology | 2 (1.1) |

| Tourism | 4 (2.1) |

| Constructions | 8 (4.3) |

| Business services | 6 (3.2) |

| Private education | 4 (2.1) |

| Telecommunications | 6 (3.2) |

| Energy–water | 6 (3.2) |

| Logistics | 2 (1.1) |

| Financial services | 5 (2.7) |

| Size | |

| Medium | 83 (44.1) |

| Large | 105 (55.9) |

| Home country | |

| Greece | 143 (76.1) |

| Abroad | 45 (23.9) |

| Questions | Section Description | Variables |

|---|---|---|

| 1–3 | Natural environment | - |

| 4–26 | Strategic proactivity—environmental strategy (innovative environmental practices and eco-efficient practices) | IPP, EEP |

| 27–29 | Development/creation of new resources | FR |

| 30–45 | Competitive advantage (cost competitive advantage, competitive differentiation advantage) | CAC, CAD |

| 46–47 | Business economic performance | FFP |

| - | General comments (respondent’s comments on the research) | - |

| - | Corporate identity/demographics (business sector, number of employees, turnover, staff position, level of study) | SIZE |

| - | Respondent’s contact information (research findings available upon request) | – |

| Variables | # Items | Cronbach’s Alpha (>0.7) | Determinant of the Correlation Matrix (>0.00001) | KMO (>0.5) | Bartlett’s Test of Sphericity | Z-Test (1.96) | ||

|---|---|---|---|---|---|---|---|---|

| Approx. Chi-Square | df | Values for Asymmetry | Values for Kyrtosis | |||||

| Innovative preventive practices [IPP] | 14 | 0.933 | 0.00001251 | 0.865 | 2048.878 | 91 | −0.404 | 0.609 |

| Eco-efficient practices [EEP] | 9 | 0.869 | 0.001 | 0.75 | 1208.965 | 36 | −0.498 | −0.548 |

| Development/creation of new resources [FR] | 8 | 0.861 | 0.013 | 0.817 | 802.487 | 28 | −0.506 | −0.531 |

| Competitive advantage on cost [CAC] | 7 | 0.86 | 0.025 | 0.746 | 678.948 | 21 | −0.347 | 0.537 |

| Competitive advantage on differentiation [CAD] | 8 | 0.85 | 0.013 | 0.788 | 797.548 | 28 | −0.128 | 0.436 |

| Firm financial performance [FFP] | 6 | 0.893 | 0.011 | 0.697 | 832.597 | 15 | −0.321 | 0.647 |

| IPP | EEP | FR | CAC | CAD | FFP | SIZE | ||

|---|---|---|---|---|---|---|---|---|

| IPP | Pearson correlation | 1 | ||||||

| Sig. (2-tailed) | ||||||||

| N | 188 | |||||||

| EEP | Pearson correlation | 0.496 ** | 1 | |||||

| Sig. (2-tailed) | 0 | |||||||

| N | 188 | 188 | ||||||

| FR | Pearson correlation | 0.406 ** | .131 | 1 | ||||

| Sig. (2-tailed) | 0 | 0.074 | ||||||

| N | 188 | 188 | 188 | |||||

| CAC | Pearson correlation | 0.307 ** | 0.256 ** | 0.459 ** | 1 | |||

| Sig. (2-tailed) | 0 | 0 | 0 | |||||

| N | 188 | 188 | 188 | 188 | ||||

| CAD | Pearson correlation | 0.329 ** | 0.264 ** | 0.575 ** | 0.707 ** | 1 | ||

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | ||||

| N | 188 | 188 | 188 | 188 | 188 | |||

| FFP | Pearson correlation | 0.399 ** | 0.302 ** | 0.577 ** | 0.558 ** | 0.636 ** | 1 | |

| Sig. (2-tailed) | 0 | 0 | 0 | 0 | 0 | |||

| N | 188 | 188 | 188 | 188 | 188 | 188 | ||

| SIZE | Pearson correlation | 0.298 ** | 0.122 | 0.248 ** | 0.209 ** | 0.119 | 0.282 ** | 1 |

| Sig. (2-tailed) | 0 | 0.094 | 0.001 | 0.004 | 0.105 | 0 | ||

| N | 188 | 188 | 188 | 188 | 188 | 188 | 188 |

| Variable | B | B (SE) | β | t | p |

|---|---|---|---|---|---|

| Constant | −1.774 | 0.492 | −3.604 | 0.00 | |

| Control variables | |||||

| Size | 0.5 | 0.137 | 0.249 | 3.646 | 0.00 |

| Independent Variables | |||||

| EEP | 0.271 | 0.068 | 0.271 | 3.977 | 0.00 |

| F = 16.579, p = 0.00, R2 = 0.152 | |||||

| Variable | B | B (SE) | β | t | p |

|---|---|---|---|---|---|

| Constant | −1.278 | 0.500 | −2.555 | 0.00 | |

| Control Variables | |||||

| Size | 0.359 | 0.139 | 0.179 | 2.578 | 0.00 |

| Independent Variable | |||||

| IPP | 0.346 | 0.069 | 0.346 | 4.990 | 0.00 |

| F = 21.514, p = 0.00, R2 = 0.189 | |||||

| Model | Symbol | Coeff. | S.E. | t | p | |

| 1 | Constant | I1 | 0.000 | 0.0668 | 0.000 | 1.00 |

| IPP | a | 0.406 | 0.0670 | 60.595 | 0.00 | |

| R2 = 0.1649 | ||||||

| F(1.186) = 36.7178 p < 0.001 | ||||||

| Model | Symbol | Coeff. | S.E. | t | p | |

| 2 | Constant | I1 | 0.000 | 0.0644 | 0.000 | 1.00 |

| IPP | c | 0.1446 | 0.0707 | 20.461 | 0.0422 | |

| FFP | b | 0.4004 | 0.0707 | 56.656 | 0.000 | |

| R2 = 0.2283 | ||||||

| F(2.185) = 27.3602 p < 0.001 | ||||||

| Dependent variable: CAC | ||||||

| Variable | Effect | BootSE | 95% CI Bootstrap | |

|---|---|---|---|---|

| BootLLCI | BootULCI | |||

| FR | 0.1626 | 0.0363 | 0.0941 | 0.2366 |

| Model | Symbol | Coeff. | S.E. | t | p | ||

| 1 | Constant | I1 | 0.000 | 0.0668 | 0.000 | 1.00 | |

| IPP | a | 0.406 | 0.0670 | 60595 | |||

| R2 = 0.1649 | |||||||

| F(1.186) = 36.7178 p < 0.001 | |||||||

| Model | Symbol | Coeff. | S.E. | t | p | ||

| 2 | Constant | I2 | 0.000 | 0.0595 | 0.000 | 1.00 | |

| IPP | C | 0.1142 | 0.0653 | 17489 | |||

| FFP | B | 0.5284 | 0.0653 | 80929 | 0.00 | ||

| R2 = 0.3413 | |||||||

| F(2.185) = 47.9249 p < 0.001 | |||||||

| Dependent variable: CAD | |||||||

| Variable | Effect | BootSE | 95% CI Bootstrap | |

|---|---|---|---|---|

| BootLLCI | BootULCI | |||

| FR | 0.2146 | 0.0475 | 0.1302 | 0.3114 |

| Variable | B | B (SE) | β | t | p |

|---|---|---|---|---|---|

| Constant | −1.234 | 0.441 | −2.802 | 0.00 | |

| Control Variables | |||||

| Size | 0.347 | 0.123 | 0.173 | 2.828 | 0.00 |

| Independent Variable | |||||

| CAC | 0.522 | 0.061 | 0.522 | 8.547 | 0.00 |

| F = 47.668, p = 0.00, R2 = 0.340 | |||||

| Variable | B | B (SE) | β | t | p |

|---|---|---|---|---|---|

| Constant | −1.497 | 0.397 | −3.77 | 0.00 | |

| Control Variables | |||||

| Size | 0.421 | 0.111 | 0.209 | 3.806 | 0.00 |

| Independent Variable | |||||

| CAD | 0.611 | 0.055 | 0.611 | 11.107 | 0.00 |

| F = 74.996, p = 0.00, R2 = 0.448 | |||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fousteris, A.E.; Didaskalou, E.A.; Tsogas, M.-M.H.; Georgakellos, D.A. The Environmental Strategy of Businesses as an Option under Recession in Greece. Sustainability 2018, 10, 4399. https://doi.org/10.3390/su10124399

Fousteris AE, Didaskalou EA, Tsogas M-MH, Georgakellos DA. The Environmental Strategy of Businesses as an Option under Recession in Greece. Sustainability. 2018; 10(12):4399. https://doi.org/10.3390/su10124399

Chicago/Turabian StyleFousteris, Andreas E., Eleni A. Didaskalou, Markos-Marios H. Tsogas, and Dimitrios A. Georgakellos. 2018. "The Environmental Strategy of Businesses as an Option under Recession in Greece" Sustainability 10, no. 12: 4399. https://doi.org/10.3390/su10124399

APA StyleFousteris, A. E., Didaskalou, E. A., Tsogas, M.-M. H., & Georgakellos, D. A. (2018). The Environmental Strategy of Businesses as an Option under Recession in Greece. Sustainability, 10(12), 4399. https://doi.org/10.3390/su10124399