Influence of Reduced Ownership on the Environmental Benefits of the Circular Economy

Abstract

1. Introduction

2. Materials and Methods

2.1. Materials

- (1)

- We split all households into income deciles and observed the level of ownership in each income decile.

- (2)

- We excluded the three highest income deciles from the study, because there are very few households that have high income and low ownership levels. Similarly, we dropped the lowest income decile to keep the income levels of the compared groups similar (the sharers dominate the lowest income decile).

- (3)

- We divided the households with a sufficient amount of both owners and sharers into two income groups based on household income deciles: a low-income group and middle-income group.

- (4)

- We used regression analysis to control for income, household size, and age within the studied two income groups.

2.2. Carbon and Material Footprint Assessments

3. Results: Environmental Benefits of Reduced Ownership

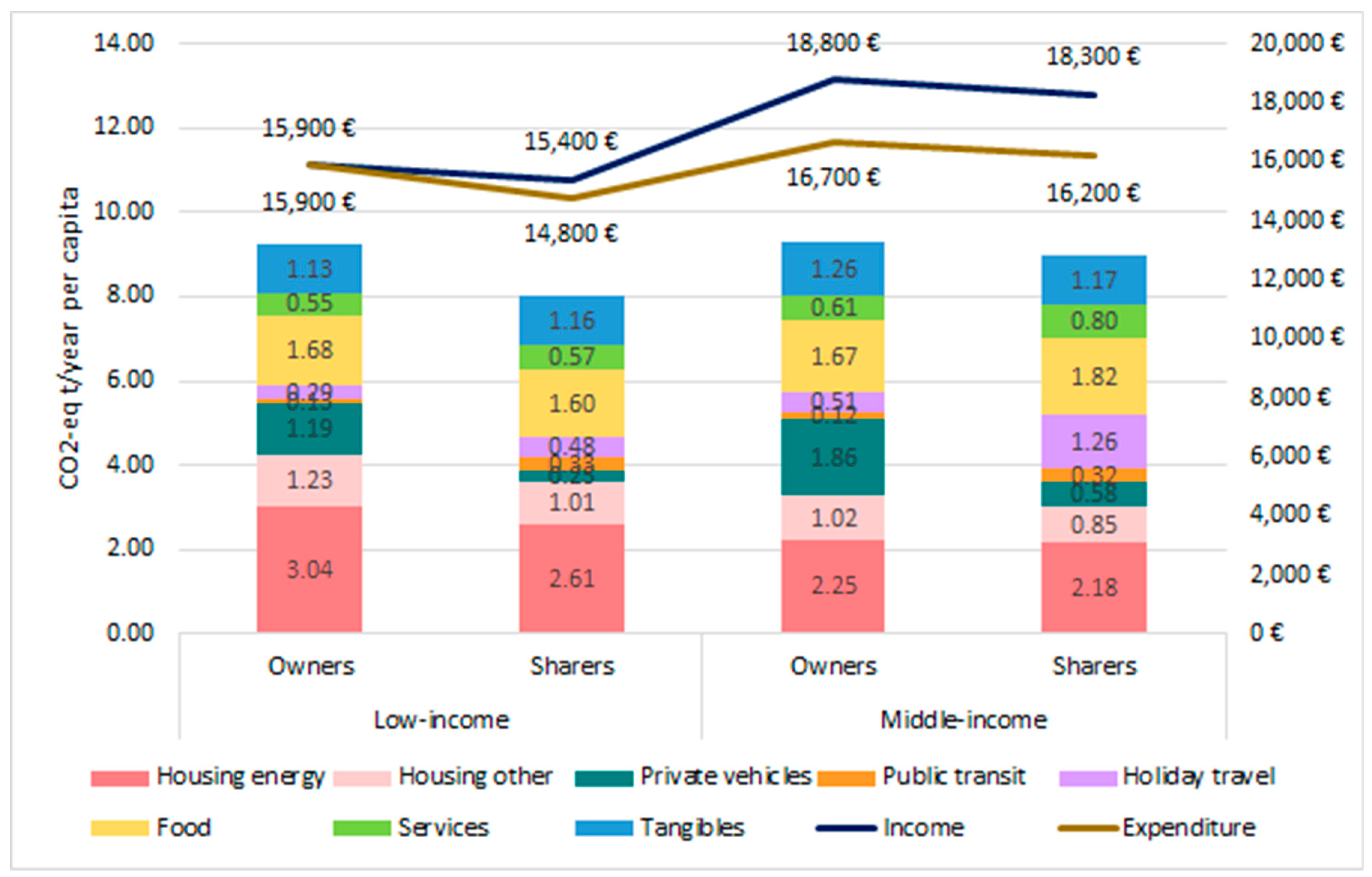

3.1. Carbon Footprint

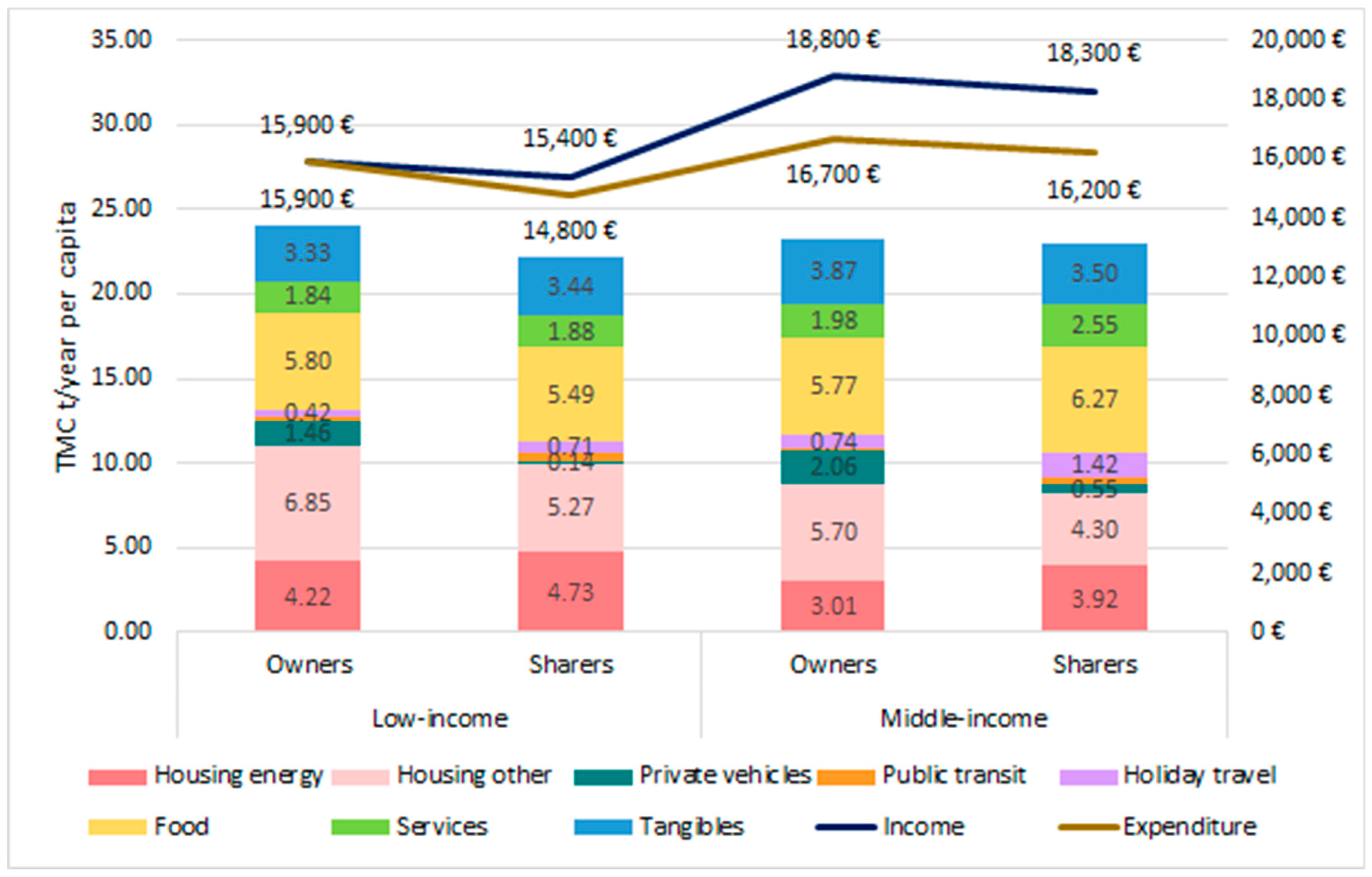

3.2. Material Footprint

3.3. Results of Regression Analysis

4. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- European Commission (COM). Towards a circular economy: A zero waste programme for Europe. In Communication from the Commission to the European Parliament; Council, the European Economic and Social Committee and the Committee of the Regions: Brussels, Belgium, 2014. [Google Scholar]

- Ellen MacArthur Foundation (EMAF). Towards the Circular Economy; EMAF: London, UK, 2013. [Google Scholar]

- Bakker, P. Available online: https://www.circularity-gap.world/ (accessed on 3 May 2018).

- Prieto-Sandoval, V.; Jaca, C.; Ormazabal, M. Towards a consensus on the circular economy. J. Clean. Prod. 2018, 179, 605–615. [Google Scholar] [CrossRef]

- Ramani, K.; Ramanujan, D.; Bernstein, W.Z.; Zhao, F.; Sutherland, J.; Handwerker, C.; Choi, J.-K.; Kim, H.; Thurston, D. Integrated sustainable life cycle design: A review. J. Mech. Des. 2010, 132, 091004. [Google Scholar] [CrossRef]

- Bakker, C.; Wang, F.; Huisman, J.; Den Hollander, M. Products that go round: Exploring product life extension through design. J. Clean. Prod. 2014, 69, 10–16. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- van Loona, P.; Delagardea, C.; Van Wassenhovea, L. The role of second-hand markets in circular business: A simple model for leasing versus selling consumer products. Int. J. Prod. Res. 2017. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q. Environmental sustainability and production: Taking the road less travelled. Int. J. Prod. Res. 2017. [Google Scholar] [CrossRef]

- Mayers, C.K.; France, C.M.; Cowell, S.J. Extended producer responsibility for waste electronics: An example of printer recycling in the United Kingdom. J. Ind. Ecol. 2005, 9, 169–189. [Google Scholar] [CrossRef]

- Xue, B.; Chen, X.P.; Geng, Y.; Guo, X.J.; Lu, C.P.; Zhang, Z.L.; Lu, C.Y. Survey of officials’ awareness on circular economy development in China: Based on municipal and county level. Resour. Conserv. Recycl. 2010, 54, 1296–1302. [Google Scholar] [CrossRef]

- Richter, J.L.; Koppejan, R. Extended producer responsibility for lamps in Nordic countries: Best practices and challenges in closing material loops. J. Clean. Prod. 2016, 123, 167–179. [Google Scholar] [CrossRef]

- Lahti, T.; Wincent, J.; Parida, V. A definition and theoretical review of the circular economy, value creation, and sustainable business models: Where are we now and where should research move in the future? Sustainability 2018, 10, 2799. [Google Scholar] [CrossRef]

- Tukker, A. Product services for a resource-efficient and circular economy—A review. J. Clean. Prod. 2015, 97, 76–91. [Google Scholar] [CrossRef]

- Korhonen, J.; Honkasalao, A.; Seppälä, J. Circular economy: The concept and its limitations. Ecol. Econ. 2018, 143, 37–46. [Google Scholar] [CrossRef]

- Smith, D. Power-by-the-hour: The role of technology in reshaping business strategy at Rolls-Royce. Technol. Anal. Strat. Manag. 2013, 25, 987–1007. [Google Scholar] [CrossRef]

- Beuren, F.; Ferreira, M.; Miguel, P. Product-service systems: A literature review on integrated products and services. J. Clean. Prod. 2013, 47, 222–231. [Google Scholar] [CrossRef]

- Reim, W.; Parida, V.; Örtqvist, D. Product-Service Systems (PSS) business models and tactics–a systematic literature review. J. Clean. Prod. 2015, 97, 61–75. [Google Scholar] [CrossRef]

- Kjaer, L.L.; Pigosso, D.C.A.; Niero, M.; Bech, N.M.; Mcaloone, T.C. Product/service-systems for a circular economy: the route to decoupling economic growth from resource consumption? J. Ind. Ecol. Early View 2018. [Google Scholar] [CrossRef]

- Kjaer, L.L.; Høst-Madsen, N.K.; Schmidt, J.H.; McAloone, T.C. Application of environmental input-output analysis for corporate and product environmental footprints-learnings from three case. Sustainability 2015, 7, 11438–11461. [Google Scholar] [CrossRef]

- Kjaer, L.L.; Pagoropoulos, A.; Schmidt, J.H.; McAloone, T.C. Challenges when evaluating Product/Service-Systems through Life Cycle Assessment. J. Clean. Prod. 2016, 120, 95–104. [Google Scholar] [CrossRef]

- Rashid, A.; Asif, F.M.; Krajnik, P.; Nicolescu, C. Resource conservative manufacturing. J. Clean. Prod. 2013, 57, 166–177. [Google Scholar] [CrossRef]

- Gutierrez, A.; Thornton, T.F. Can consumers understand sustainability through seafood eco-labels? A U.S. and UK case study. Sustainability 2014, 6, 8195–8217. [Google Scholar] [CrossRef]

- Jonell, M.; Crona, B.; Brown, K.; Rönnbäck, P.; Troell, M. Eco-labeled seafood: determinants for (blue) green consumption. Sustainability 2016, 8, 884. [Google Scholar] [CrossRef]

- Molina-Moreno, V.; Núñez-Cacho Utrilla, P.; Cortés-García, F.J.; Peña-García, A. The use of led technology and biomass to power public lighting in a local context: The case of Baeza (Spain). Energies 2018, 11, 1783. [Google Scholar] [CrossRef]

- Guajardo, J.; Cohen, M.; Kim, S.-H.; Netessine, S. Impact of performance-based contracting on product reliability: An empirical analysis. Manag. Sci. 2012, 58, 961–979. [Google Scholar] [CrossRef]

- Lieder, M.; Asif, F.; Rashid, A.; Mihelic, A.; Kotnik, S. A conjoint analysis of circular economy value propositions for consumers: Using “washing machines in Stockholm” as a case study. J. Clean. Prod. 2018, 172, 264–273. [Google Scholar] [CrossRef]

- Agrawal, V.; Bellos, I. The potential of servicizing as a green business model. Manag. Sci. 2017, 63, 1545–1562. [Google Scholar] [CrossRef]

- Chun, Y.Y.; Lee, K.M. Environmental impacts of the rental business model compared to the conventional business model: A Korean case of water purifier for home use. Int. J. Life Cycle Assess. 2017, 22, 1096–1108. [Google Scholar] [CrossRef]

- Mont, O. Institutionalisation of sustainable consumption patterns based on shared use. Ecol. Econ. 2004, 50, 135–153. [Google Scholar] [CrossRef]

- Zink, T.; Geyer, R. Circular economy rebound. J. Ind. Ecol. 2017, 21, 593–602. [Google Scholar] [CrossRef]

- Druckman, A.; Jackson, T. The carbon footprint of UK households 1990–2004: A socio-economically disaggregated, quasi-multi-regional input–output model. Ecol. Econ. 2009, 68, 2066–2077. [Google Scholar] [CrossRef]

- Wiedenhofer, D.; Lenzen, M.; Steinberger, J.K. Energy requirements of consumption: Urban form, climatic and socio-economic factors, rebounds and their policy implications. Energy Policy 2013, 63, 696–707. [Google Scholar] [CrossRef]

- Heinonen, J.; Jalas, M.; Juntunen, J.K.; Ala-Mantila, S.; Junnila, S. Situated lifestyles: I. How lifestyles change along with the level of urbanization and what the greenhouse gas implications are—A study of Finland. Environ. Res. Lett. 2013, 8, 025003. [Google Scholar] [CrossRef]

- Jones, C.; Kammen, D.M. Spatial distribution of US household carbon footprints reveals suburbanization undermines greenhouse gas benefits of urban population density. Environ. Sci. Technol. 2014, 48, 895–902. [Google Scholar] [CrossRef] [PubMed]

- Nässén, J.; Andersson, D.; Larsson, J.; Holmberg, J. Explaining the variation in greenhouse gas emissions between households: Socioeconomic, motivational, and physical factors. J. Ind. Ecol. 2015, 19, 480–489. [Google Scholar] [CrossRef]

- Ottelin, J.; Heinonen, J.; Junnila, S. New energy efficient housing has reduced carbon footprints in outer but not in inner urban areas. Environ. Sci. Technol. 2015, 49, 9574–9583. [Google Scholar] [CrossRef] [PubMed]

- Ala-Mantila, S.; Ottelin, J.; Heinonen, J.; Junnila, S. To each their own? The greenhouse gas impacts of intra-household sharing in different urban zones. J. Clean. Prod. 2016, 135, 356–367. [Google Scholar] [CrossRef]

- Seppälä, J.; Mäenpää, I.; Koskela, S.; Mattila, T.; Nissinen, A.; Katajajuuri, J.; Härmä, T.; Korhonen, M.; Saarinen, M.; Virtanen, Y. Suomen Kansantalouden Materiaalivirtojen Ympäristövaikutusten Arviointi ENVIMAT-Mallilla; Finnish Environment Institute: Helsinki, Finland, 2009. [Google Scholar]

- Ottelin, J.; Heinonen, J.; Junnila, S. Carbon and material footprints of a welfare state: Why and how governments should enhance green investments. Environ. Sci. Policy 2018, 86, 1–10. [Google Scholar] [CrossRef]

- Statistics Finland. Household Budget Survey; Statistics Finland: Helsinki, Finland, 2012. [Google Scholar]

- Suh, S.; Lenzen, M.; Treloar, G.J.; Hondo, H.; Horvath, A.; Huppes, G.; Jolliet, O.; Klann, U.; Krewitt, W.; Moriguchi, Y. System boundary selection in life-cycle inventories using hybrid approaches. Environ. Sci. Technol. 2004, 38, 657–664. [Google Scholar] [CrossRef] [PubMed]

- Junnila, S. Empirical comparison of process and economic input-output life cycle assessment in service industries. Environ. Sci. Technol. 2006, 40, 7070–7076. [Google Scholar] [CrossRef] [PubMed]

- Lenzen, M.; Murray, J.; Sack, F.; Wiedmann, T. Shared producer and consumer responsibility—Theory and practice. Ecol. Econ. 2007, 61, 27–42. [Google Scholar] [CrossRef]

- Wiedmann, T. Editorial: Carbon footprint and input-output analysis—An introduction. Econ. Syst. Res. 2009, 21, 175–186. [Google Scholar] [CrossRef]

- Leontief, W. Environmental repercussions and the economic structure: An input-output approach. Rev. Econ. Stat. 1970, 52, 262–271. [Google Scholar] [CrossRef]

- Hubacek, K.; Feng, K. Comparing apples and oranges: Some confusion about using and interpreting physical trade matrices versus multi-regional input–output analysis. Land Use Policy 2016, 50, 194–201. [Google Scholar] [CrossRef]

- Lutter, S.; Giljum, S.; Bruckner, M. A review and comparative assessment of existing approaches to calculate material footprints. Ecol. Econ. 2016, 127, 1–10. [Google Scholar] [CrossRef]

- Seppälä, J.; Mäenpää, I.; Koskela, S.; Mattila, T.; Nissinen, A.; Katajajuuri, J.; Härmä, T.; Korhonen, M.; Saarinen, M.; Virtanen, Y. An assessment of greenhouse gas emissions and material flows caused by the Finnish economy using the ENVIMAT model. J. Clean. Prod. 2011, 19, 1833–1841. [Google Scholar] [CrossRef]

- Statistics Finland. Finance of Housing Companies [e-Publication]; Statistics Finland: Helsinki, Finland, 2017. [Google Scholar]

- Säynäjoki, A.; Heinonen, J.; Junnonen, J.; Junnila, S. Input–output and process LCAs in the building sector: Are the results compatible with each other? Carbon Manag. 2017, 8, 155–166. [Google Scholar] [CrossRef]

- Kyrö, R.; Heinonen, J.; Säynäjoki, A.; Junnila, S. Occupants have little influence on the overall energy consumption in district heated apartment buildings. Energy Build. 2011, 43, 3484–3490. [Google Scholar]

- Wier, M.; Lenzen, M.; Munksgaard, J.; Smed, S. Effects of household consumption patterns on CO2 requirements. Econ. Syst. Res. 2001, 13, 259–274. [Google Scholar] [CrossRef]

- Ala-Mantila, S.; Heinonen, J.; Junnila, S. Relationship between urbanization, direct and indirect greenhouse gas emissions, and expenditures: A multivariate analysis. Ecol. Econ. 2014, 104, 129–139. [Google Scholar] [CrossRef]

- Camacho-Otero, J.; Boks, C.; Pettersen, I.N. Consumption in the circular economy: A literature review. Sustainability 2018, 10, 2758. [Google Scholar] [CrossRef]

- Ottelin, J.; Heinonen, J.; Junnila, S. Greenhouse gas emissions from flying can offset the gain from reduced driving in dense urban areas. J. Transp. Geogr. 2014, 41, 1–9. [Google Scholar] [CrossRef]

- Ottelin, J.; Heinonen, J.; Junnila, S. Rebound effect for reduced car ownership and driving. In Nordic Experiences of Sustainable Planning: Policy and Practice; Kristjansdottir, S., Ed.; Routledge: London, UK, 2017. [Google Scholar]

- Leth-Petersen, S.; Togeby, M. Demand for space heating in apartment blocks: Measuring effect of policy measures aiming at reducing energy consumption. Energy Econ. 2001, 23, 387–403. [Google Scholar] [CrossRef]

- Underwood, A.; Fremstad, A. Does sharing backfire? A decomposition of household and urban economies in CO2 emissions. Energy Policy 2018, 123, 404–413. [Google Scholar] [CrossRef]

| Low Income | Middle Income | |||

|---|---|---|---|---|

| Owners | Sharers | Owners | Sharers | |

| Sample size (households) | 338 | 114 | 1364 | 75 |

| Income deciles (0–9) | 1–2 | 1–2 | 3–6 | 3–6 |

| Average income (€/year per capita) | €15,900 | €15,400 | €18,800 | €18,300 |

| Average expenditure (€/year per capita) | €15,900 | €14,800 | €16,700 | €16,200 |

| Apartment or house ownership (% of households) | 60% | 0% | 78% | 0% |

| District heating | 49% | 100% | 48% | 100% |

| Car ownership | 62% | 0% | 87% | 0% |

| Average household size | 1.2 | 1.2 | 2.0 | 1.7 |

| Average age of respondent | 58 | 47 | 54 | 39 |

| Dependent Variable | ln (CF Per Capita) | ln (MF Per Capita) | ||||||

|---|---|---|---|---|---|---|---|---|

| Income Group | Low Income | Middle Income | Low Income | Middle Income | ||||

| Explanatory power of the model (Prob > F = 0.000 in all models) | R2 = 0.38 | R2 = 0.50 | R2 = 0.25 | R2 = 0.48 | ||||

| Coef. | p | Coef. | p | Coef. | p | Coef. | p | |

| ln (disposable income per capita) | 0.58 | 0.000 | 0.73 | 0.000 | 0.58 | 0.000 | 0.63 | 0.000 |

| Household size: 1 person (ref.) | ||||||||

| 2 people | −0.15 | 0.174 | −0.05 | 0.236 | −0.15 | 0.227 | −0.08 | 0.030 |

| 3 people | −0.26 | 0.286 | −0.14 | 0.034 | −0.22 | 0.366 | −0.17 | 0.003 |

| >3 people | 0.01 | 0.976 | −0.20 | 0.017 | −0.02 | 0.945 | −0.23 | 0.002 |

| Seniors (>64 years) | −0.05 | 0.328 | −0.14 | 0.000 | −0.09 | 0.103 | −0.12 | 0.000 |

| Young (<25 years) | 0.08 | 0.328 | −0.07 | 0.362 | 0.07 | 0.281 | −0.01 | 0.908 |

| Sharers | −0.11 | 0.023 | −0.08 | 0.152 | −0.07 | 0.168 | −0.04 | 0.358 |

| Constant | 3.46 | 0.023 | 1.96 | 0.001 | 4.44 | 0.007 | 3.95 | 0.000 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Junnila, S.; Ottelin, J.; Leinikka, L. Influence of Reduced Ownership on the Environmental Benefits of the Circular Economy. Sustainability 2018, 10, 4077. https://doi.org/10.3390/su10114077

Junnila S, Ottelin J, Leinikka L. Influence of Reduced Ownership on the Environmental Benefits of the Circular Economy. Sustainability. 2018; 10(11):4077. https://doi.org/10.3390/su10114077

Chicago/Turabian StyleJunnila, Seppo, Juudit Ottelin, and Laura Leinikka. 2018. "Influence of Reduced Ownership on the Environmental Benefits of the Circular Economy" Sustainability 10, no. 11: 4077. https://doi.org/10.3390/su10114077

APA StyleJunnila, S., Ottelin, J., & Leinikka, L. (2018). Influence of Reduced Ownership on the Environmental Benefits of the Circular Economy. Sustainability, 10(11), 4077. https://doi.org/10.3390/su10114077