Mandatory Sustainability Reporting in Germany: Does Size Matter?

Abstract

:1. Introduction

2. Theoretical Foundations and Hypotheses Development

2.1. Small Firm–Large Firm CSR and the Role of the CDIA

2.2. The Role of Firm Resources and Capabilities in CSR

2.3. The Role of CSR Strategies and Instruments

3. Materials and Methods

3.1. Operationalization of the Measure

3.2. Sample Description/Data Collection

3.3. Description of the Measure

4. Results and Discussion

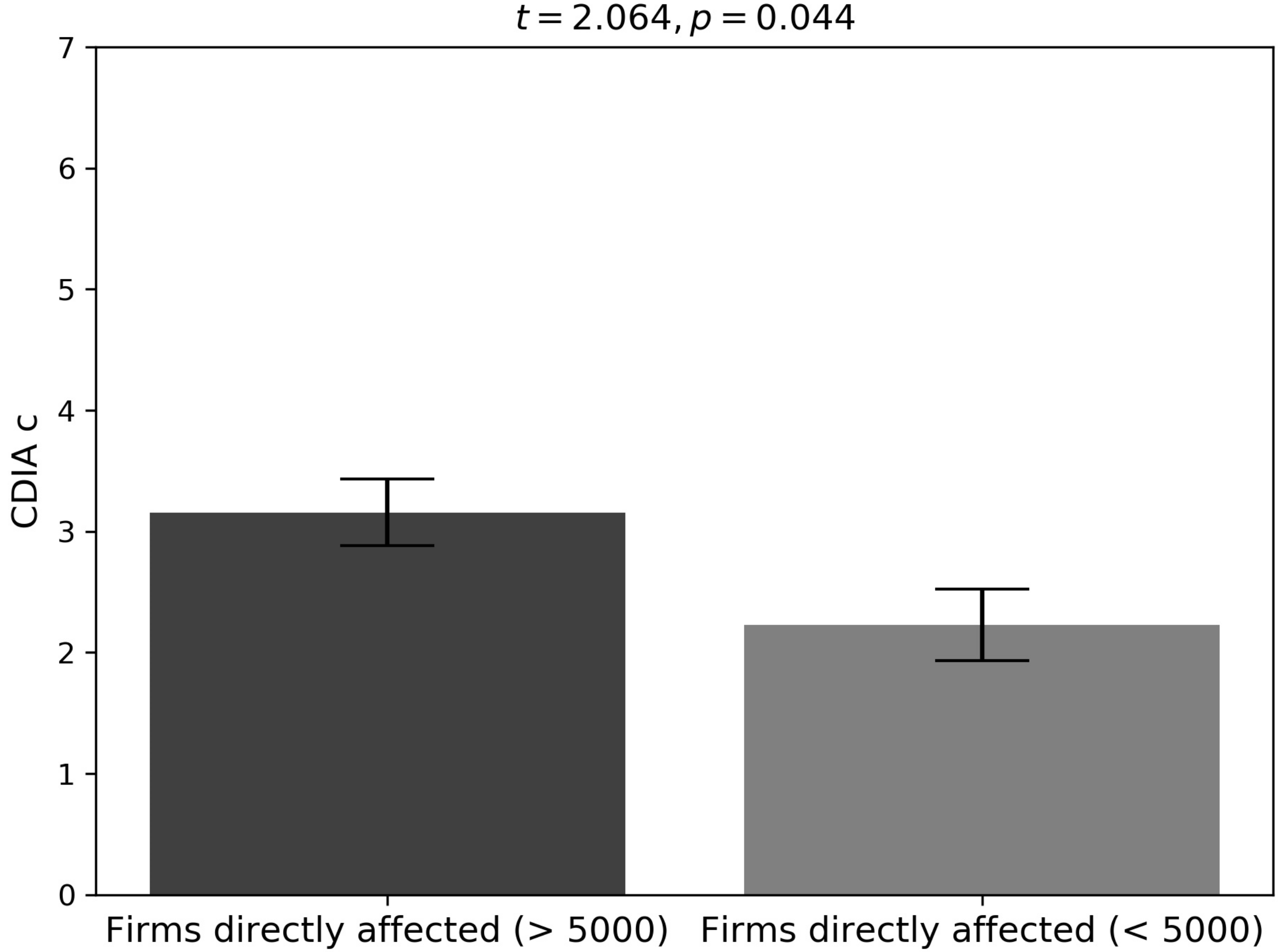

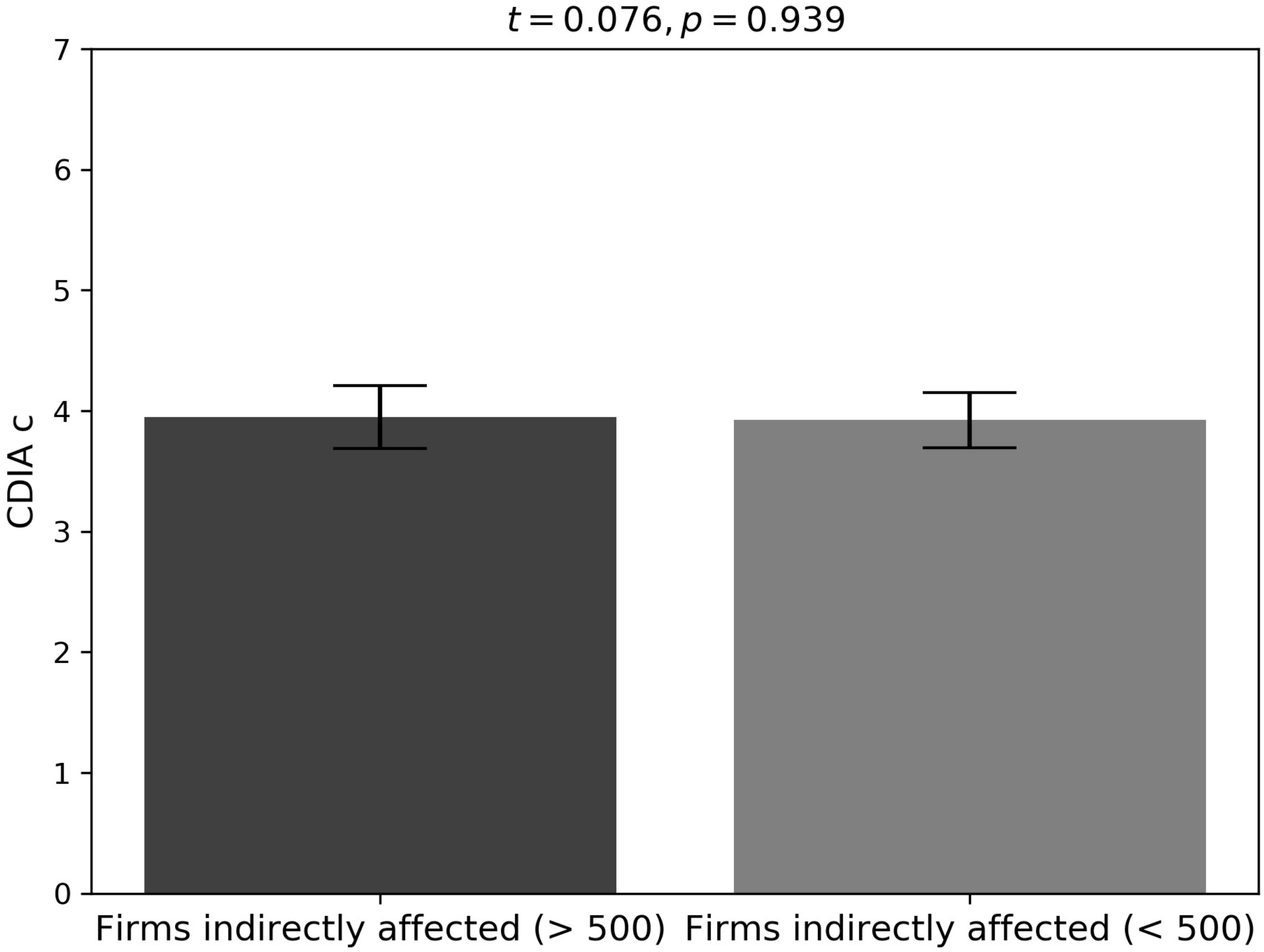

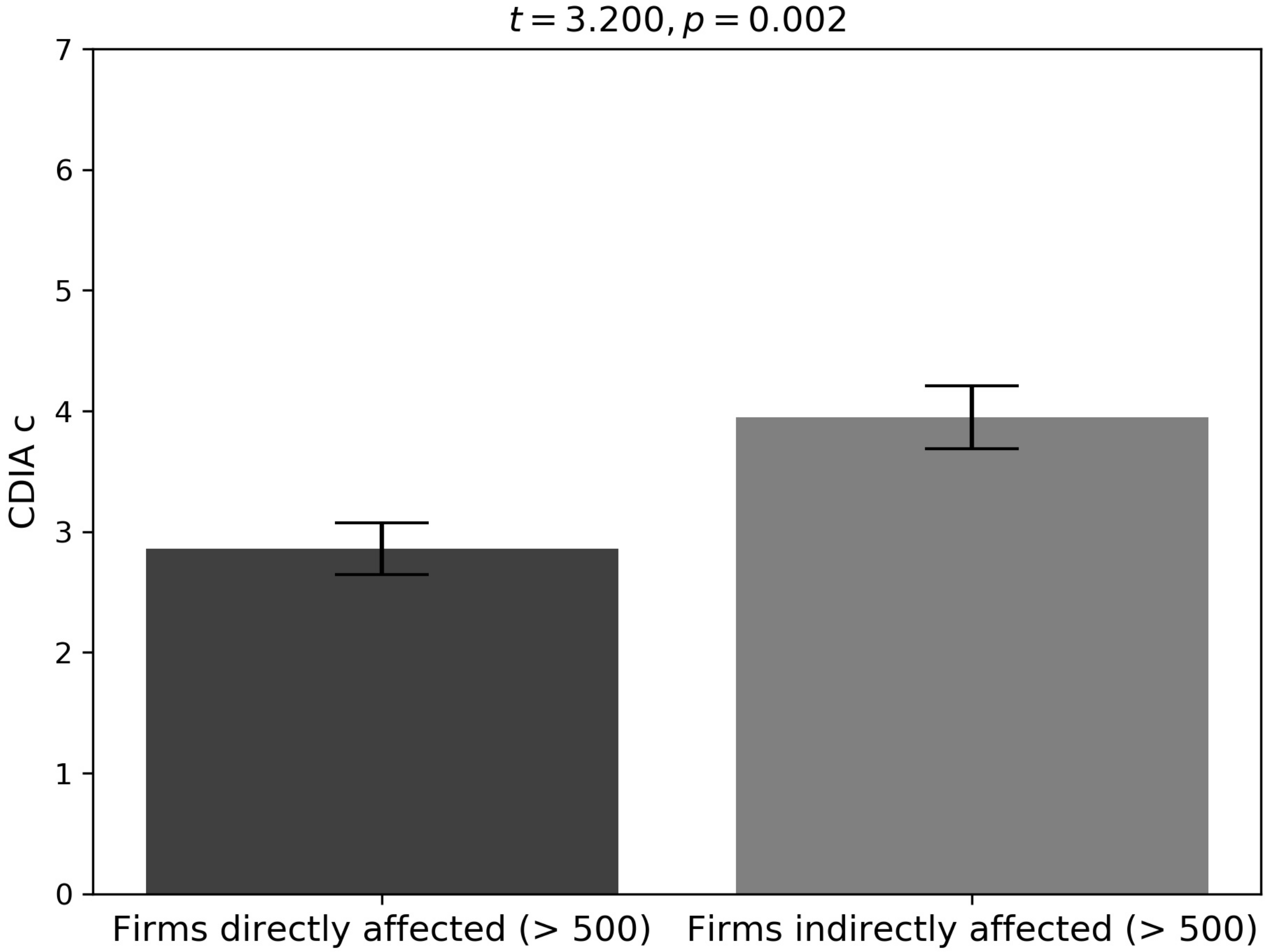

4.1. Type of Exposure and the Role of Firm Size

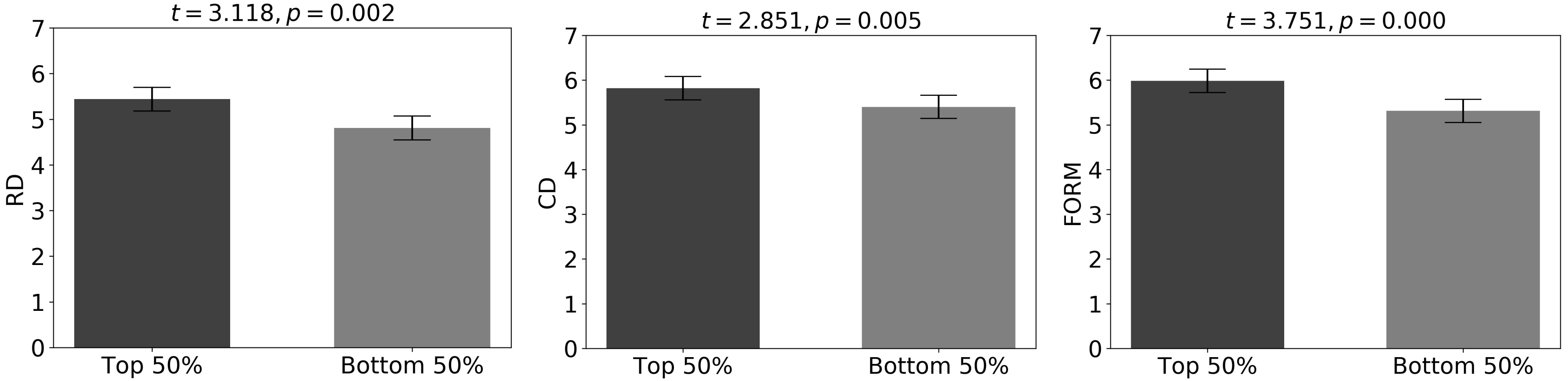

4.2. Analysis of Moderators

4.3. Supporting Analyses

4.4. Hypotheses Results

5. Conclusion and Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Construct | Item Code | Item Description | Source |

|---|---|---|---|

| CSR Directive Implementation Act (CDIAc) | CDIAc_1 | CDIA will be implementable for our firm with little effort. | [71] |

| CDIAc_2 | CDIA will mean additional workload for our firm. | ||

| CDIAc_3 | CDIA will cost our firm money. | ||

| Organizational Resources (RD) | RD_1 | Our firm has made investments in the environmental and social abilities of its employees. | [16] |

| RD_2 | Our firm has made investments in developing the environmental and social skills of the top management. | ||

| RD_3 | Our firm has made investments in organizational abilities which are related to environmental and social issues. | ||

| RD_4 | Our company has made investments in formal (routine-based) management systems and procedures with regards to ecological and social issues. | ||

| Organizational Capabilities (CD) | CD_1 | Our firm has the ability to seek solutions for ecological and social issues from different angles. | [16] |

| CD_2 | Our firm pays great attention to satisfying customer demands. | ||

| CD_3 | In our firm, there are formal/informal systems for better coordinating ecological and social issues among departments. | ||

| CD_4 | Our firm always expands its knowledge regarding the interaction between business and its stakeholders. | ||

| CSR Formalization (FORM) | FORM_1 | In our firm we have a clear CSR strategy. | [66,72] |

| FORM_2 | Our company’s awareness of CSR has risen significantly in recent years. | ||

| FORM_3 | The number of instruments/processes (e.g., sustainability report, environmental audit) used to organize CSR in our company has increased significantly in recent years. | ||

| FORM_4 | Our firm has increasingly anchored CSR in its corporate strategy in recent years. | ||

| FORM_5 | Our company integrates ecological and social issues into the strategic planning process. |

References

- German Council for Sustainable Development. News: German Bundestag Passes Law Introducing CSR Reporting Obligations. Available online: https://www.nachhaltigkeitsrat.de/en/news/german-bundestag-passes-law-introducing-csr-reporting-obligations/ (accessed on 25 October 2018).

- European Commission. Non-Financial Reporting Directive—Transposition Status. Available online: https://ec.europa.eu/info/publications/non-financial-reporting-directive-transposition-status_en (accessed on 25 October 2018).

- Coenenberg, A.G.; Fink, C. Die Umsetzung der CSR-Richtlinie in Deutschland. In Langfristige Perspektiven und Nachhaltigkeit in der Rechnungslegung; Wagner, U., Schaffhauser-Linzatti, M., Eds.; Springer Fachmedien: Wiesbaden, Germany, 2017; pp. 51–74. [Google Scholar]

- IfM BONN. Mittelstandsdefinition des IfM Bonn. Available online: https://www.ifm-bonn.org/definitionen/mittelstandsdefinition-des-ifm-bonn/ (accessed on 25 October 2018).

- Statistisches Bundesamt (Destatis). Gesamtwirtschaft & Umwelt—Kleine & Mittlere Unternehmen, Mittelstand. Available online: https://www.destatis.de/DE/ZahlenFakten/GesamtwirtschaftUmwelt/UnternehmenHandwerk/KleineMittlereUnternehmenMittelstand/KleineMittlereUnternehmenMittelstand.html (accessed on 25 October 2018).

- European Commission. Disclosure of Non-Financial and Diversity Information by Large Companies and Groups—Frequently Asked Questions 6. Available online: http://europa.eu/rapid/press-release_MEMO-14-301_de.htm (accessed on 25 October 2018).

- Deinert, S.; Schrader, C.; Stoll, B. Corporate Social Responsibility: Die Richtlinie 2014/95 EU-Chancen und Herausforderungen; Kassel University Press: Kassel, Germany, 2015. [Google Scholar]

- Jenkins, H. Small business champions for corporate social responsibility. J. Bus. Ethics 2006, 67, 241–256. [Google Scholar] [CrossRef]

- Spence, L.J.; Lozano, J.F. Communicating about Ethics with Small Firms: Experiences from the U.K. and Spain. J. Bus. Ethics 2000, 27, 43–53. [Google Scholar] [CrossRef]

- Tilley, F. Small firm environmental ethics: How deep do they go? Bus. Ethics Eur. Rev. 2000, 9, 31–42. [Google Scholar] [CrossRef]

- Murillo, D.; Lozano, J.M. SMEs and CSR: An approach to CSR in their own words. J. Bus. Ethics 2006, 67, 227–240. [Google Scholar] [CrossRef]

- Ayuso, S.; Roca, M.; Colomé, R. SMEs as ‘transmitters’ of CSR requirements in the supply chain. Supply Chain Manag. Int. J. 2013, 18, 497–508. [Google Scholar] [CrossRef]

- Jenkins, H.M. A Critique of Conventional CSR Theory: An SME Perspective. J. Gen. Manag. 2004, 29, 37–57. [Google Scholar] [CrossRef]

- Castka, P.; Balzarova, M.A. ISO 26000 and supply chains—On the diffusion of the social responsibility standard. Int. J. Prod. Econ. 2008, 111, 274–286. [Google Scholar] [CrossRef]

- Knudsen, J.S. The Growth of Private Regulation of Labor Standards in Global Supply Chains: Mission Impossible for Western Small- and Medium-Sized Firms? J. Bus. Ethics 2013, 117, 387–398. [Google Scholar] [CrossRef]

- Leonidou, L.C.; Christodoulides, P.; Kyrgidou, L.P.; Palihawadana, D. Internal drivers and performance consequences of small firm green business strategy: The moderating role of external forces. J. Bus. Ethics 2017, 140, 585–606. [Google Scholar] [CrossRef]

- Torugsa, N.A.; O’Donohue, W.; Hecker, R. Capabilities, proactive CSR and financial performance in SMEs: Empirical evidence from an Australian manufacturing industry sector. J. Bus. Ethics 2012, 109, 483–500. [Google Scholar] [CrossRef]

- Sharma, S.; Aragón-Correa, J.A.; Rueda-Manzanares, A. The contingent influence of organizational capabilities on proactive environmental strategy in the service sector—An analysis of North American and European Ski Resorts. Can. J. Adm. Sci. 2007, 24, 268–283. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Hurtado-Torres, N.; Sharma, S.; García-Morales, V.J. Environmental strategy and performance in small firms: A resource-based perspective. J. Environ. Manag. 2008, 86, 88–103. [Google Scholar] [CrossRef] [PubMed]

- Fassin, Y. SMEs and the fallacy of formalising CSR. Bus. Ethics Eur. Rev. 2008, 17, 364–378. [Google Scholar] [CrossRef]

- Perrini, F. The practitioner’s perspective on non-financial reporting. Calif. Manag. Rev. 2006, 48, 73–103. [Google Scholar] [CrossRef]

- Velte, P. Die nichtfinanzielle erklärung nach dem regierungsentwurf zum CSR-Richtlinie-Umsetzungsgesetz. Zeitschrift für das Gesamte Genossenschaftswes 2017, 67, 112–119. [Google Scholar] [CrossRef]

- Saenger, I. Disclosure and auditing of corporate social responsibility Standards: The impact of directive 2014/95/EU on the german companies act and the german corporate governance code. In Corporate Governance Codes for the 21st Century; Du Plessis, J.J., Low, C.K., Eds.; Springer International Publishing: Basel, Switzerland, 2017; pp. 261–273. [Google Scholar]

- Fiechter, P.; Hitz, J.-M.; Lehmann, N. Real Effects in Anticipation of Mandatory Disclosures: Evidence from the European Union’s CSR Directive. Available online: https://ssrn.com/abstract=3033883 (accessed on 25 October 2018).

- Venturelli, A.; Caputo, F.; Cosma, S.; Leopizzi, R.; Pizzi, S. Directive 2014/95/EU: Are Italian companies already compliant? Sustainability 2017, 9, 1385. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The Consequences of Mandatory Corporate Sustainability Reporting. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1799589 (accessed on 25 October 2018).

- Jackson, G.; Bartosch, J.; Kinderman, D.P.; Knudsen, J.S.; Avetisyan, E. Regulating self-regulation? The Politics and Effects of Mandatory CSR Disclosure in Comparison. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2925055 (accessed on 25 October 2018).

- Perrini, F.; Minoja, M. Strategizing corporate social responsibility: Evidence from an Italian medium-sized, family-owned company. Bus. Ethics Eur. Rev. 2008, 17, 47–63. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A. CSR strategies of SMEs and large firms. Evidence from Italy. J. Bus. Ethics 2007, 74, 285–300. [Google Scholar] [CrossRef]

- Brown, H.S.; De Jong, M.; Levy, D.L. Building institutions based on information disclosure: Lessons from GRI’s sustainability reporting. J. Clean. Prod. 2009, 17, 571–580. [Google Scholar] [CrossRef]

- Corbett, C.J.; Kirsch, D.A. International diffusion of ISO 14000 certification. Prod. Oper. Manag. 2001, 10, 327–342. [Google Scholar] [CrossRef]

- Hahn, R. ISO 26000 and the standardization of strategic management processes for sustainability and corporate social responsibility. Bus. Strateg. Environ. 2013, 22, 442–455. [Google Scholar] [CrossRef]

- Hashem, G.; Tann, J. The adoption of ISO 9000 standards within the Egyptian context: A diffusion of innovation approach. Total Qual. Manag. Bus. Excell. 2007, 18, 631–652. [Google Scholar] [CrossRef]

- Nawrocka, D. Environmental Supply Chain Management, ISO 14001 and RoHS. How are small companies in the electronics sector managing? Corp. Soc. Responsib. Environ. Manag. 2008, 15, 349–360. [Google Scholar] [CrossRef]

- Siew, R.Y.J. A review of corporate sustainability reporting tools (SRTs). J. Environ. Manag. 2015, 164, 180–195. [Google Scholar] [CrossRef] [PubMed]

- Hahn, R.; Kühnen, M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 2013, 59, 5–21. [Google Scholar] [CrossRef]

- Stiller, Y.; Daub, C.H. Paving the way for sustainability communication: Evidence from a Swiss study. Bus. Strateg. Environ. 2007, 16, 474–486. [Google Scholar] [CrossRef]

- Manes-Rossi, F.; Tiron-Tudor, A.; Nicolò, G.; Zanellato, G. Ensuring more sustainable reporting in Europe using non-financial disclosure-de facto and de jure evidence. Sustainability 2018, 10, 1162. [Google Scholar] [CrossRef]

- Bebbington, J.; Kirk, E.A.; Larrinaga, C. The production of normativity: A comparison of reporting regimes in Spain and the UK. Account. Organ. Soc. 2012, 37, 78–94. [Google Scholar] [CrossRef]

- Chauvey, J.N.; Giordano-Spring, S.; Cho, C.H.; Patten, D.M. The Normativity and Legitimacy of CSR Disclosure: Evidence from France. J. Bus. Ethics 2015, 130, 789–803. [Google Scholar] [CrossRef]

- Delbard, O. CSR legislation in France and the European regulatory paradox: An analysis of EU CSR policy and sustainability reporting practice. Corp. Gov. Int. J. Bus. Soc. 2008, 8, 397–405. [Google Scholar] [CrossRef]

- Spence, L.; Schmidpeter, R.; Habisch, A. Assessing Social Capital: Small and Medium Sized Enterprises in Germany and the U.K. J. Bus. Ethics 2003, 47, 17–29. [Google Scholar] [CrossRef]

- Spence, L.J.; Rutherfoord, R. Small business and empirical perspectives in business ethics: Editorial. J. Bus. Ethics 2003, 47, 1–5. [Google Scholar] [CrossRef]

- Enderle, G. Global competition and corporate responsibilities of small and medium-sized enterprises. Bus. Ethics Eur. Rev. 2004, 13, 50–63. [Google Scholar] [CrossRef]

- Sen, S.; Cowley, J. The Relevance of Stakeholder Theory and Social Capital Theory in the Context of CSR in SMEs: An Australian Perspective. J. Bus. Ethics 2013, 118, 413–427. [Google Scholar] [CrossRef]

- Hudson, M.; Lean, J.; Smart, P.A. Improving control through effective performance measurement in SMEs. Prod. Plan. Control 2001, 12, 804–813. [Google Scholar] [CrossRef]

- Hyvonen, S.; Tuominen, M. Entrepreneurial innovations, market-driven intangibles and learning orientation: Critical indicators for performance advantages in SMEs. Int. J. Manag. Decis. Mak. 2006, 7, 643–660. [Google Scholar] [CrossRef]

- Hahn, T.; Scheermesser, M. Approaches to corporate sustainability among German companies. Corp. Soc. Responsib. Environ. Manag. 2006, 13, 150–165. [Google Scholar] [CrossRef]

- Spence, L.J.; Schmidpeter, R. SMEs, Social Capital and the Common Good. J. Bus. Ethics 2003, 45, 93–108. [Google Scholar] [CrossRef]

- Hitchens, D.; Thankappan, S.; Trainor, M.; Clausen, J.; De Marchi, B. Environmental performance, competitiveness and management of small businesses in Europe. Tijdschr. Voor Econ. Soc. Geogr. 2005, 96, 541–557. [Google Scholar] [CrossRef]

- Hörisch, J.; Johnson, M.P.; Schaltegger, S. Implementation of Sustainability Management and Company Size: A Knowledge-Based View. Bus. Strateg. Environ. 2015, 24, 765–779. [Google Scholar] [CrossRef]

- European Parliament and Council. Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 Amending Directive 2013/34/EU as Regards Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32014L0095 (accessed on 17 November 2017).

- Deutscher Bundestag. Gesetz zur Stärkung der Nichtfinanziellen Berichterstattung der Unternehmen in ihren Lage- und Konzernlageberichten. Available online: https://www.bgbl.de/xaver/bgbl/start.xav?startbk=Bundesanzeiger_BGBl&jumpTo=bgbl117s0802.pdf#__bgbl__%2F%2F*%5B%40attr_id%3D%27bgbl117s0802.pdf%27%5D__1510129029347 (accessed on 19 November 2017).

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Hamman, J.R.; Loewenstein, G.; Weber, R.A. Self-interest through delegation: An additional rationale for the principal-agent relationship. Am. Econ. Rev. 2010, 100, 1826–1846. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Grant, R.M. The resource-based theory of competitive advantage: Implications for strategy formulation. Calif. Manag. Rev. 1991, 33, 114–135. [Google Scholar] [CrossRef]

- Hart, S. A natural resource based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wernerfelt, B. A Resource based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Lepoutre, J.; Heene, A. Investigating the impact of firm size on small business social responsibility: A critical review. J. Bus. Ethics 2006, 67, 257–273. [Google Scholar] [CrossRef]

- Schrettle, S.; Hinz, A.; Scherrer-Rathje, M.; Friedli, T. Turning sustainability into action: Explaining firms’ sustainability efforts and their impact on firm performance. Int. J. Prod. Econ. 2014, 147, 73–84. [Google Scholar] [CrossRef]

- Perrini, F. SMEs and CSR theory: Evidence and implications from an Italian perspective. J. Bus. Ethics 2006, 67, 305–316. [Google Scholar] [CrossRef]

- Fernández-Guadaño, J.; Sarria-Pedroza, J.H. Impact of corporate social responsibility on value creation from a stakeholder perspective. Sustainability 2018, 10, 2062. [Google Scholar]

- Graafland, J.J. Profits and principles: Four perspectives. J. Bus. Ethics 2002, 35, 293–305. [Google Scholar] [CrossRef]

- Graafland, J.; Van de Ven, B.; Stoffele, N. Strategies and instruments for organising CSR by small and large businesses in the Netherlands. J. Bus. Ethics 2003, 47, 45–60. [Google Scholar] [CrossRef]

- Hsu, J.-L.; Cheng, M.-C. What prompts small and medium enterprises to engage in corporate social responsibility? A study from Taiwan. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 288–305. [Google Scholar] [CrossRef]

- Johnson, M.P. Sustainability management and small and medium-sized enterprises: Managers’ awareness and implementation of innovative tools. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 271–285. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Free Press: New York, NY, USA, 2003. [Google Scholar]

- Danneels, E. Organizational antecedents of second-order competences. Strateg. Manag. J. 2008, 29, 519–543. [Google Scholar] [CrossRef]

- Baden, D.A.; Harwood, I.A.; Woodward, D.G. The effect of buyer pressure on suppliers in SMEs to demonstrate CSR practices: An added incentive or counter productive? Eur. Manag. J. 2009, 27, 429–441. [Google Scholar] [CrossRef]

- Gallo, P.J.; Christensen, L.J. Firm size matters: An empirical investigation of organizational size and ownership on sustainability-related behaviors. Bus. Soc. 2011, 50, 315–349. [Google Scholar] [CrossRef]

- Sekaran, U. Research Methods for Business: A Skill-Building Approach; John Wiley & Sons: New York, NY, USA, 2003. [Google Scholar]

- Lee, S. Drivers for the participation of small and medium-sized suppliers in green supply chain initiatives. Supply Chain Manag. Int. J. 2008, 13, 185–198. [Google Scholar] [CrossRef]

- Johnson, M.P.; Schaltegger, S. Two decades of sustainability management tools for SMEs: how far have we come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Bansal, P. Evolving sustainably: A longitudinal study of corporate sustainable development. Strateg. Manag. J. 2005, 26, 197–218. [Google Scholar] [CrossRef]

- Huber, G.P.; Power, D.J. Retrospective reports of strategic-level managers—Guidelines for increasing their accuracy. Strateg. Manag. J. 1985, 6, 171–180. [Google Scholar] [CrossRef]

- Delmas, M.A. The diffusion of environmental management standards in Europe and in the United States: An institutional perspective. Policy Sci. 2002, 35, 91–119. [Google Scholar] [CrossRef]

- Junquera, B.; Barba-Sánchez, V. Environmental proactivity and firms’ performance: Mediation effect of competitive advantages in Spanish wineries. Sustainability 2018, 10, 2155. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Muller, A.; Kolk, A. Extrinsic and intrinsic drivers of corporate social performance: Evidence from foreign and domestic firms in Mexico. J. Manag. Stud. 2010, 47, 1–26. [Google Scholar] [CrossRef]

- Graafland, J.; Smid, H. Reconsidering the relevance of social license pressure and government regulation for environmental performance of European SMEs. J. Clean. Prod. 2017, 141, 967–977. [Google Scholar] [CrossRef]

- Armstrong, S.J.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Wu, G.-C. Effects of socially responsible supplier development and sustainability-oriented innovation on sustainable development: Empirical evidence from SMEs. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 661–675. [Google Scholar] [CrossRef]

- Guerci, M.; Longoni, A.; Luzzini, D. Translating stakeholder pressures into environmental performance—The mediating role of green HRM practices. Int. J. Hum. Resour. Manag. 2016, 27, 262–289. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Turker, D. Measuring corporate social responsibility: A scale development study. J. Bus. Ethics 2009, 85, 411–427. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis; Pearson: New York, NY, USA, 2014. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Kucuk, S.U. Negative double jeopardy revisited: A longitudinal analysis. J. Brand Manag. 2010, 18, 150–158. [Google Scholar] [CrossRef]

- Sweetin, V.H.; Knowles, L.L.; Summey, J.H.; McQueen, K.S. Willingness-to-punish the corporate brand for corporate social irresponsibility. J. Bus. Res. 2013, 66, 1822–1830. [Google Scholar] [CrossRef]

- Van De Ven, B. An ethical framework for the marketing of corporate social responsibility. J. Bus. Ethics 2008, 82, 339–352. [Google Scholar] [CrossRef]

- Maignan, I.; Ferrell, O.C.; Ferrell, L. A Stakeholder model for implementing social responsability in marketing. Eur. J. Mark. 2005, 39, 956–977. [Google Scholar] [CrossRef]

- Elsayed, K. Reexamining the expected effect of available resources and firm size on firm environmental orientation: An empirical study of UK firms. J. Bus. Ethics 2006, 65, 297–308. [Google Scholar] [CrossRef]

- Baumann-Pauly, D.; Wickert, C.; Spence, L.J.; Scherer, A.G. Organizing corporate social responsibility in small and large firms: Size matters. J. Bus. Ethics 2013, 115, 693–705. [Google Scholar] [CrossRef] [Green Version]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef] [Green Version]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Matten, D.; Moon, J. ‘Implicit’ and ‘explicit’ CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- Cantele, S.; Tsalis, T.A.; Nikolaou, I.E. A new framework for assessing the sustainability reporting disclosure of water utilities. Sustainability 2018, 10, 433. [Google Scholar] [CrossRef]

| Firm Characteristics (n = 135) | |||||

|---|---|---|---|---|---|

| Number of Employees | Industry | Impact of the CDIA | |||

| <10 | 5.2% | Finance & insurance | 19.1% | Direct effect | 37.0% |

| 10–49 | 11.1% | Services | 8.1% | Indir. effect expected | 53.3% |

| 50–249 | 12.6% | Energy/Water/Waste | 7.4% | No indir. effect expect. | 9.6% |

| 250–500 | 8.2% | Manufacturing | 7.4% | ||

| 501–1000 | 14.1% | Real estate/Hotels | 6.6% | ||

| 1001–5000 | 16.3% | Chemicals | 5.9% | ||

| >5000 | 32.6% | Food & consumer products | 5.1% | ||

| Transport & logistics | 5.1% | ||||

| Wholesale/Retail | 4.4% | ||||

| Tourism | 3.7% | ||||

| IT & telecommunications | 2.9% | ||||

| Pharma & healthcare | 2.9% | ||||

| Other | 21.3% | ||||

| Interviewer characteristics (n = 135) | |||||

| Position | Department | Years within firm | |||

| CEO/Top management | 5.2% | CSR/Sustainability | 48.9% | <1 | 3.0% |

| Director/Sr Manager | 28.1% | PR/Communication | 11.9% | 1–3 | 16.3% |

| Manager | 25.2% | Business development | 5.2% | 4–10 | 34.8% |

| Other | 41.5% | Finance/Accounting | 3.7% | >10 | 45.9% |

| Marketing/Sales | 2.2% | ||||

| Production/Operations | 2.2% | ||||

| Purchase/Procurement | 0.7% | ||||

| Other | 25.2% | ||||

| Construct | Scale Items | Loading λ | AVE | Alpha | Eigenvalue | Mean Score | SD | Items Mean | Items SD |

|---|---|---|---|---|---|---|---|---|---|

| CDIAc | CDIAc_1 | 0.67 | 0.54 | 0.80 | 1.62 | 3.49 | 1.57 | 3.83 | 1.84 |

| CDIAc_2 | 0.81 | 3.22 | 1.91 | ||||||

| CDIAc_3 | 0.71 | 3.43 | 1.81 | ||||||

| RD | RD_1 | 0.85 | 0.53 | 0.82 | 2.13 | 5.12 | 1.16 | 5.16 | 1.26 |

| RD_2 | 0.76 | 4.76 | 1.52 | ||||||

| RD_3 | 0.75 | 5.39 | 1.27 | ||||||

| RD_4 | 0.52 | 5.22 | 1.69 | ||||||

| CD | CD_1 | 0.65 | 0.44 | 0.78 | 1.76 | 5.61 | 0.83 | 5.55 | 1.08 |

| CD_2 | 0.60 | 6.32 | 0.78 | ||||||

| CD_3 | 0.65 | 5.04 | 1.33 | ||||||

| CD_4 | 0.74 | 5.55 | 1.05 | ||||||

| FORM | FORM_1 | 0.68 | 0.52 | 0.84 | 2.60 | 5.65 | 1.04 | 5.57 | 1.40 |

| FORM_2 | 0.67 | 6.08 | 1.08 | ||||||

| FORM_3 | 0.55 | 5.55 | 1.41 | ||||||

| FORM_4 | 0.90 | 5.63 | 1.40 | ||||||

| FORM_5 | 0.86 | 5.43 | 1.34 |

| Construct | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| 1 CDIAc (evaluation of the law) | 1.00 | |||

| 2 RD (resources) | 0.27 * | 1.00 | ||

| 3 CD (capabilities) | 0.31 ** | 0.47 ** | 1.00 | |

| 4 FORM (formalization) | 0.31 ** | 0.47 ** | 0.53 ** | 1.00 |

| Hypothesis | Observed Results | Status | |

|---|---|---|---|

| Main Hypotheses | H1.1 | Larger firms directly affected (low burden) vs. smaller firms directly affected (high burden) | Supported |

| H1.2 | Large firms indirectly affected (neutral to burden) vs. SMEs indirectly affected (neutral to burden) | Rejected | |

| H2 | Large firms indirectly affected (neutral to burden) vs. .large firms directly affected (low burden) | Supported | |

| H3 | Large firms indirectly affected (no need to adapt) vs. SMEs indirectly affected (need to adapt) | Supported | |

| Moderating Hypotheses | H4 | Higher deployment of organizational resources & lower expected burden | Supported |

| H5 | Higher deployment of organizational capabilities & lower expected burden | Supported | |

| H6 | More formal CSR strategy & lower expected burden | Supported |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bergmann, A.; Posch, P. Mandatory Sustainability Reporting in Germany: Does Size Matter? Sustainability 2018, 10, 3904. https://doi.org/10.3390/su10113904

Bergmann A, Posch P. Mandatory Sustainability Reporting in Germany: Does Size Matter? Sustainability. 2018; 10(11):3904. https://doi.org/10.3390/su10113904

Chicago/Turabian StyleBergmann, Alexander, and Peter Posch. 2018. "Mandatory Sustainability Reporting in Germany: Does Size Matter?" Sustainability 10, no. 11: 3904. https://doi.org/10.3390/su10113904

APA StyleBergmann, A., & Posch, P. (2018). Mandatory Sustainability Reporting in Germany: Does Size Matter? Sustainability, 10(11), 3904. https://doi.org/10.3390/su10113904