Stationary Forestry with Human Interference

Abstract

:1. Introduction

2. Methods

2.1. Stationary Stand of Forest Trees

2.2. Empirical Model Applied

2.3. Effects of Human Interference

2.4. Financial Methods

3. Results

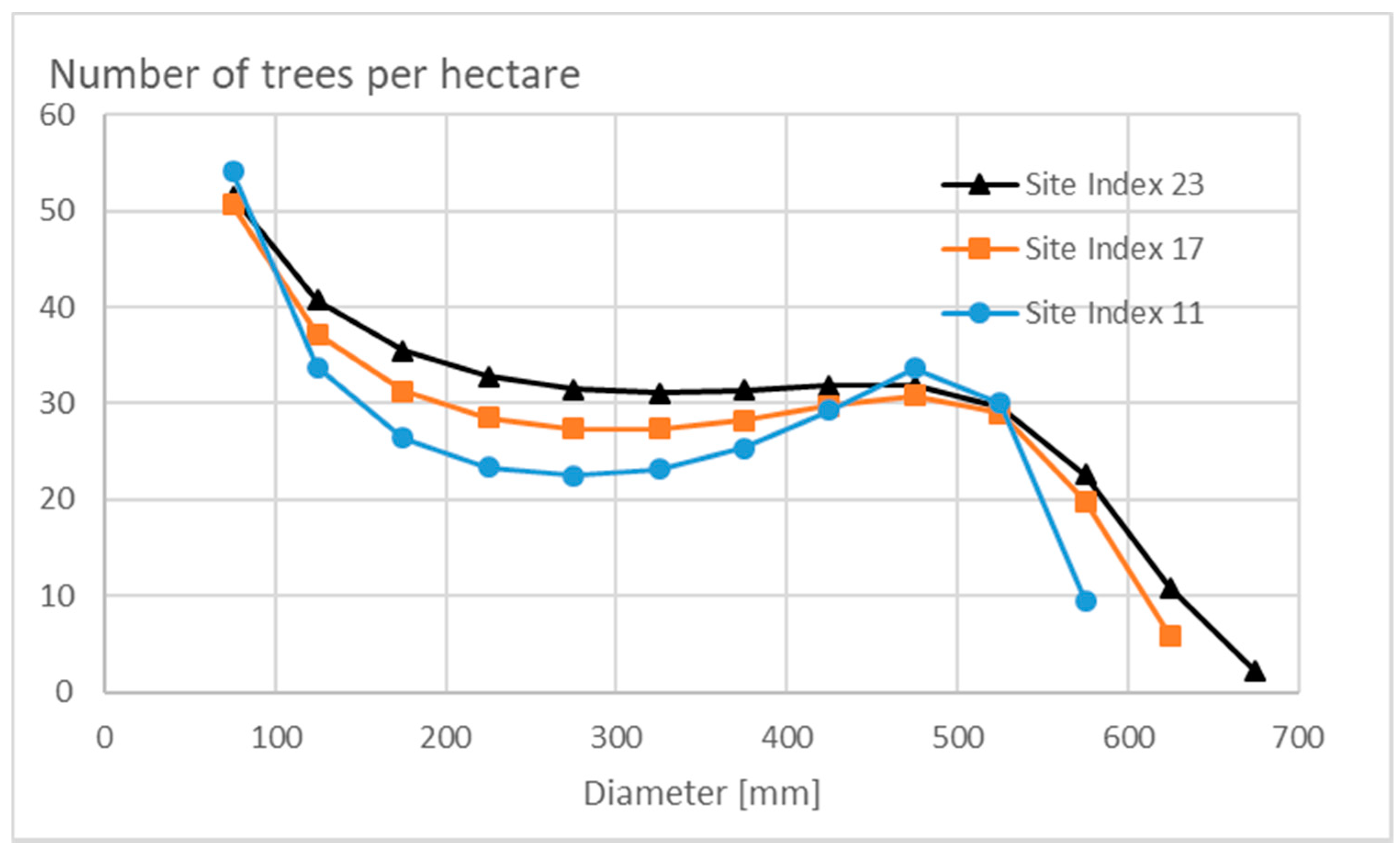

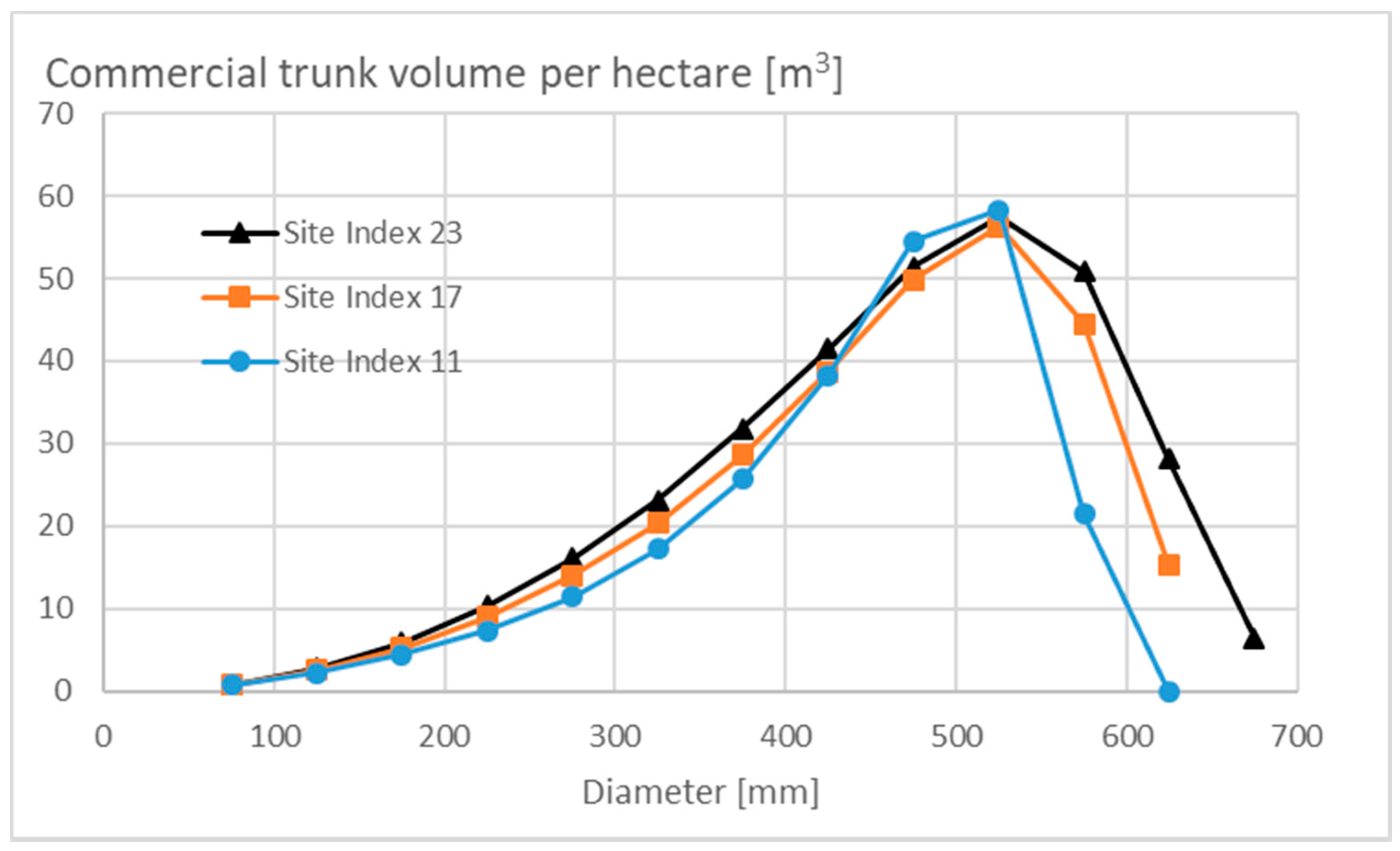

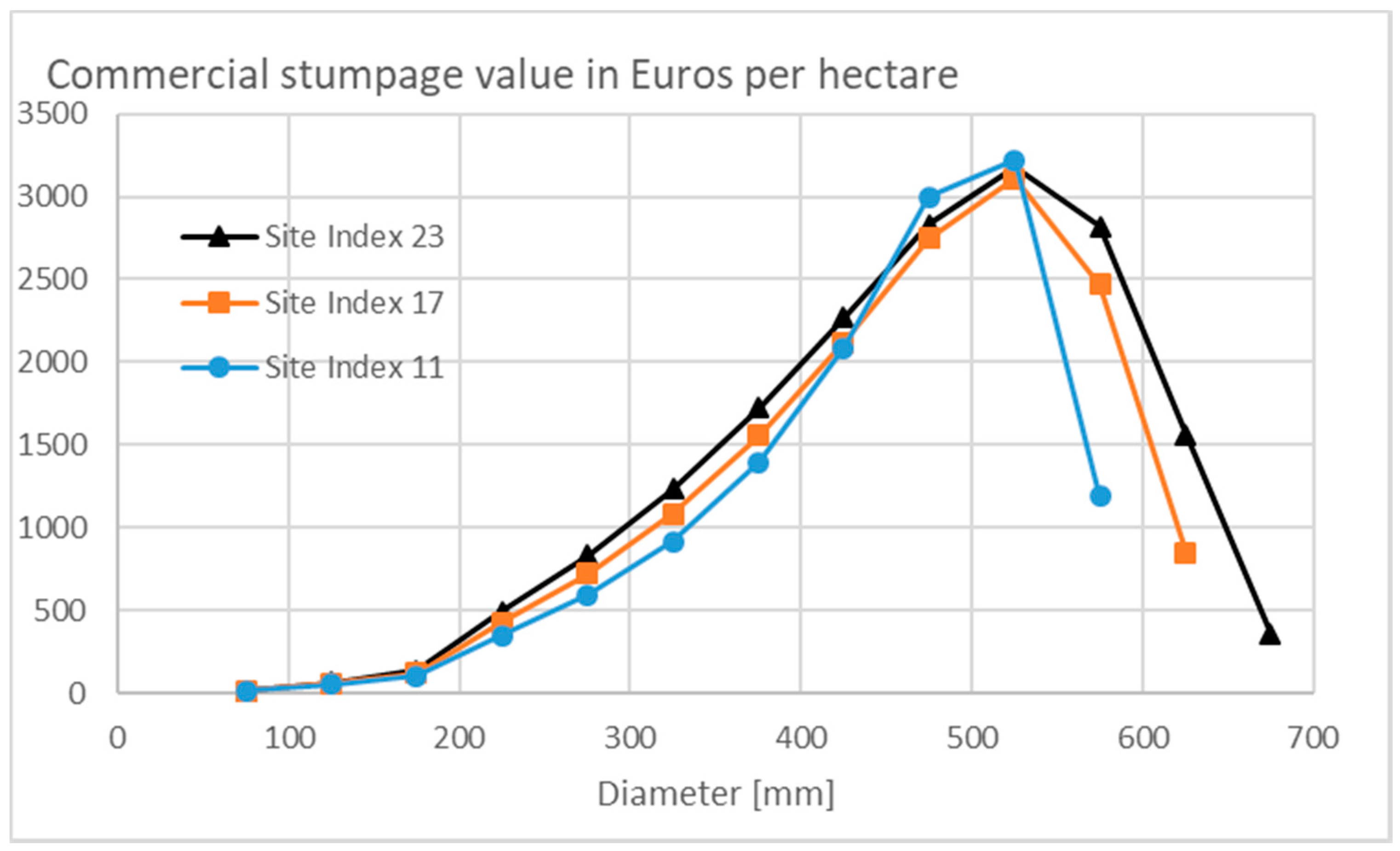

3.1. Properties of the Stationary State

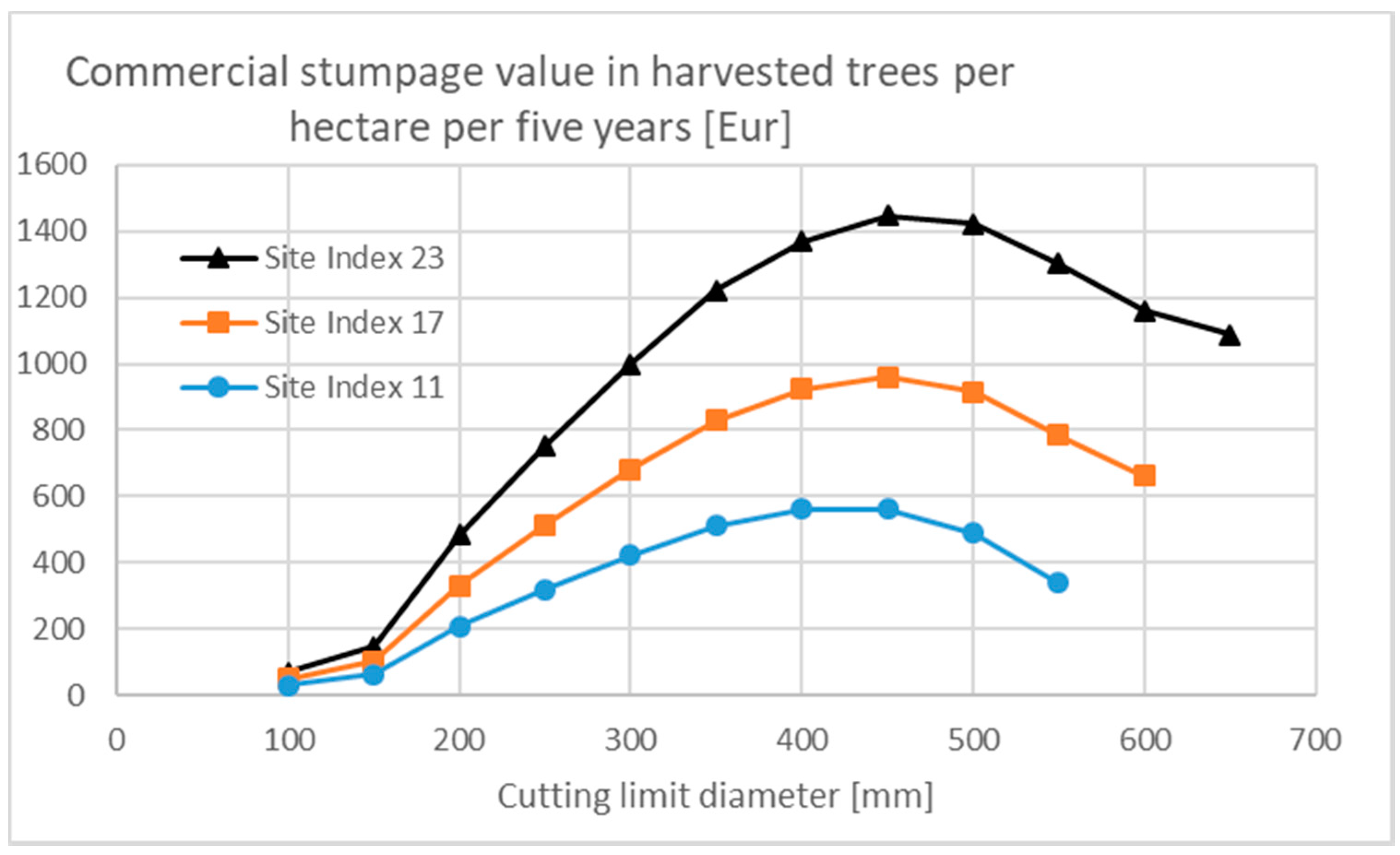

3.2. Effects of Human Interference

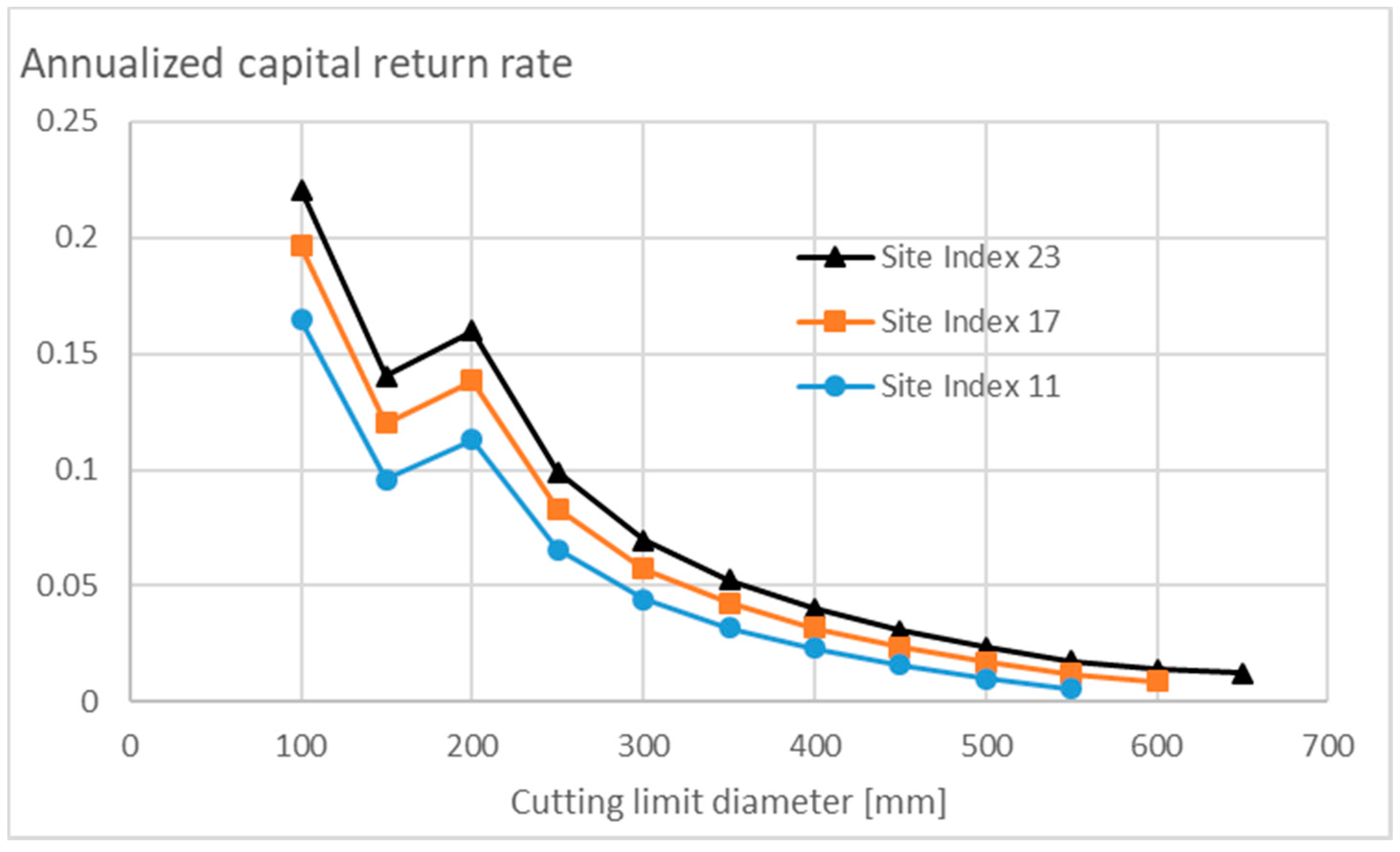

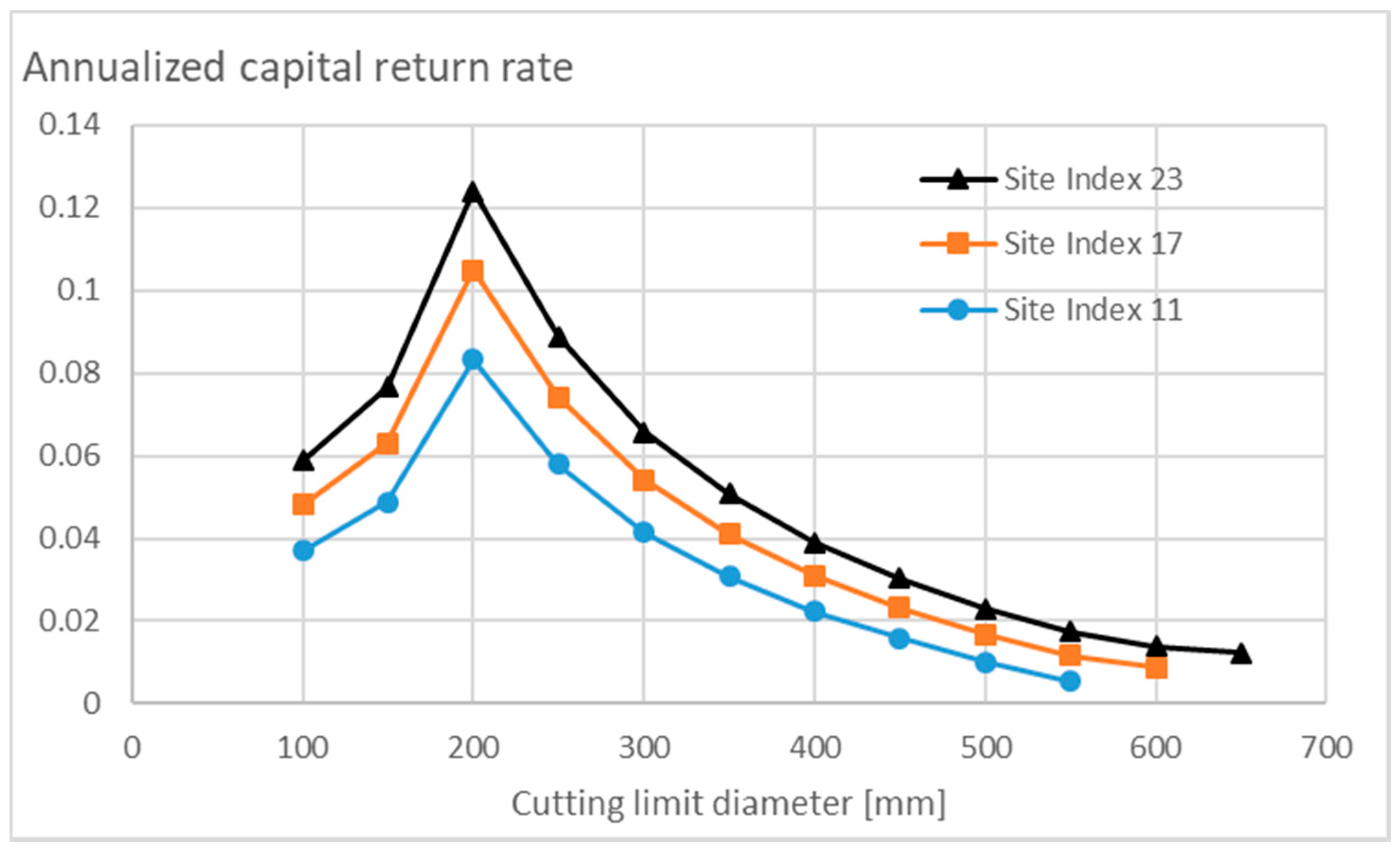

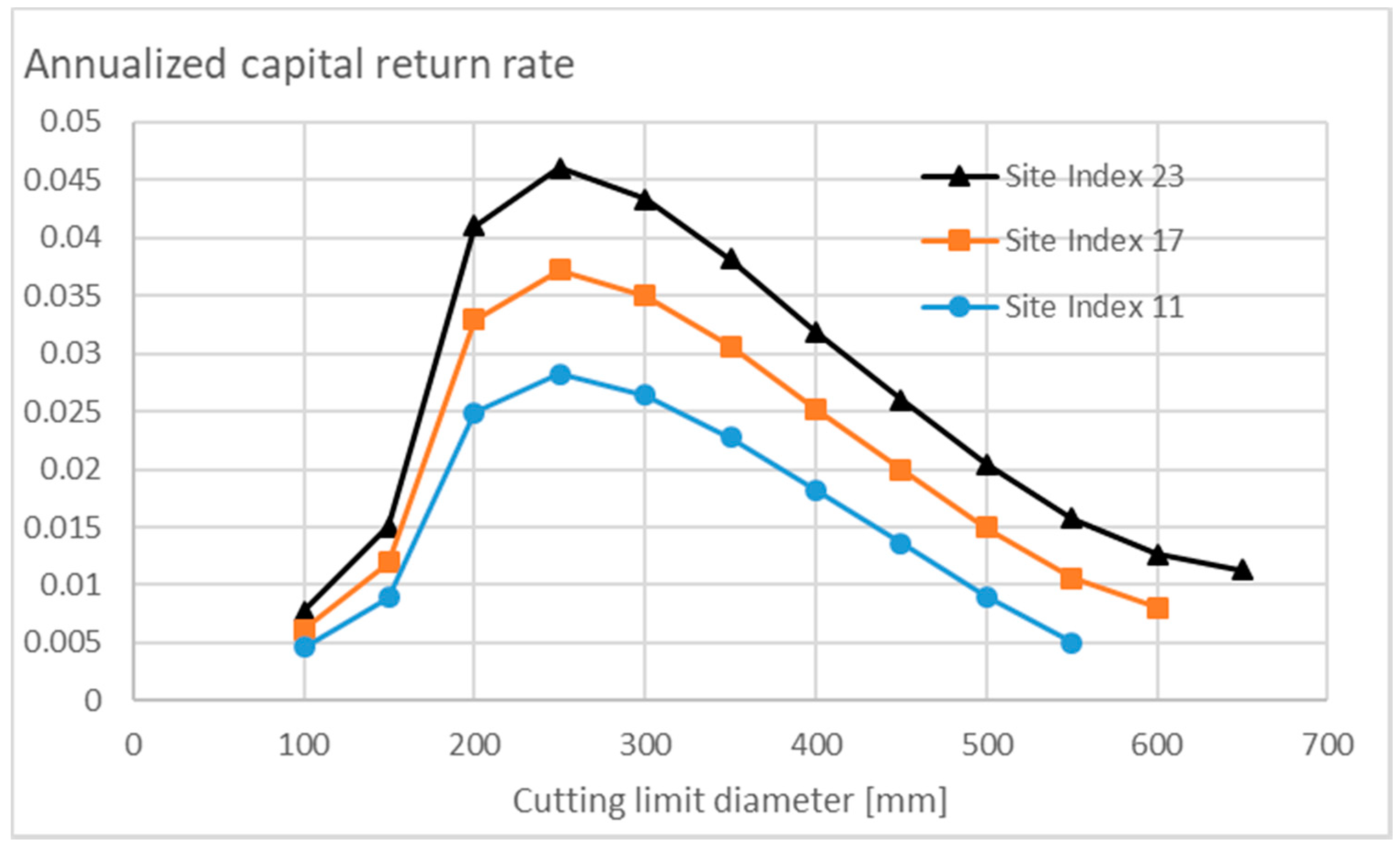

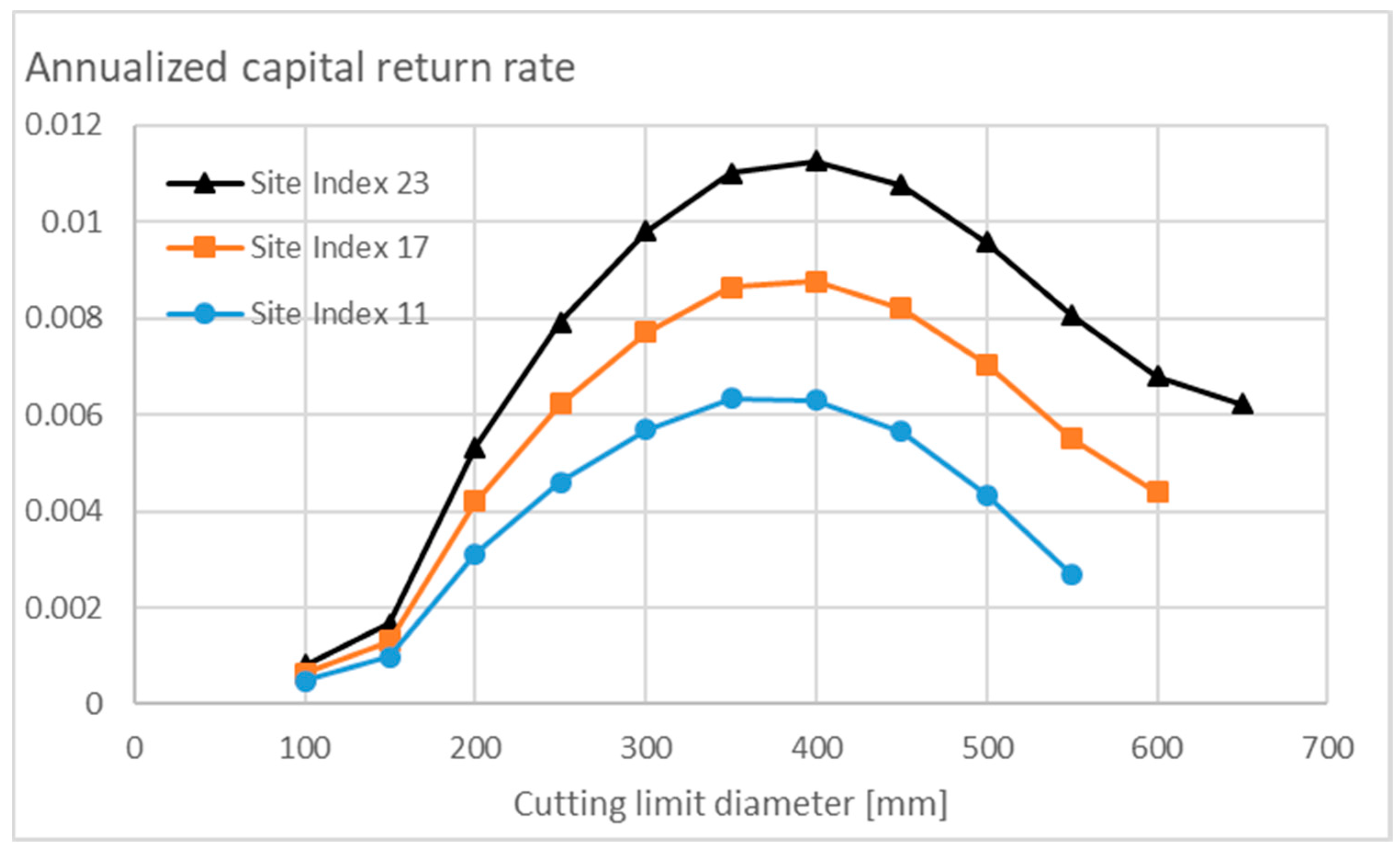

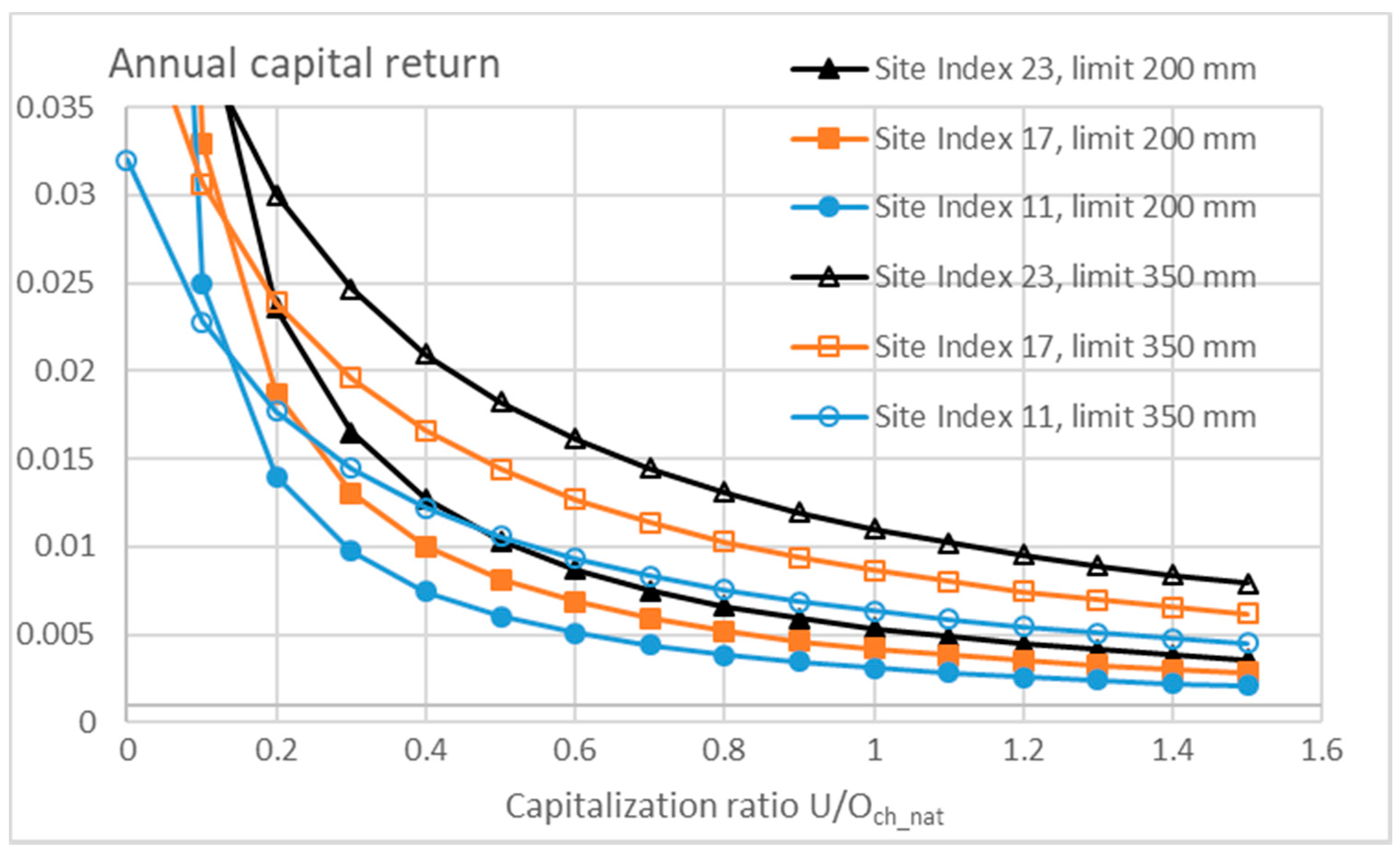

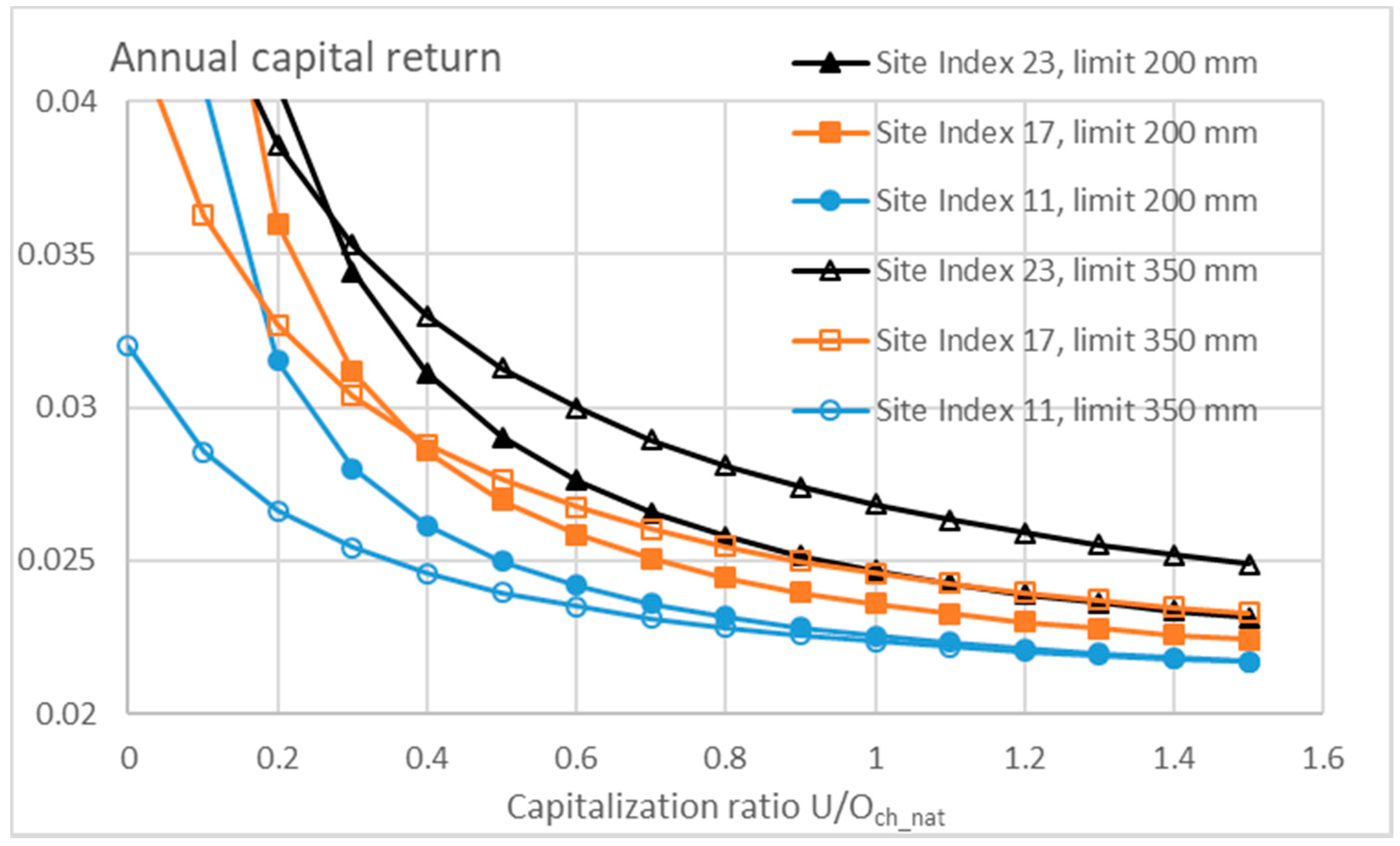

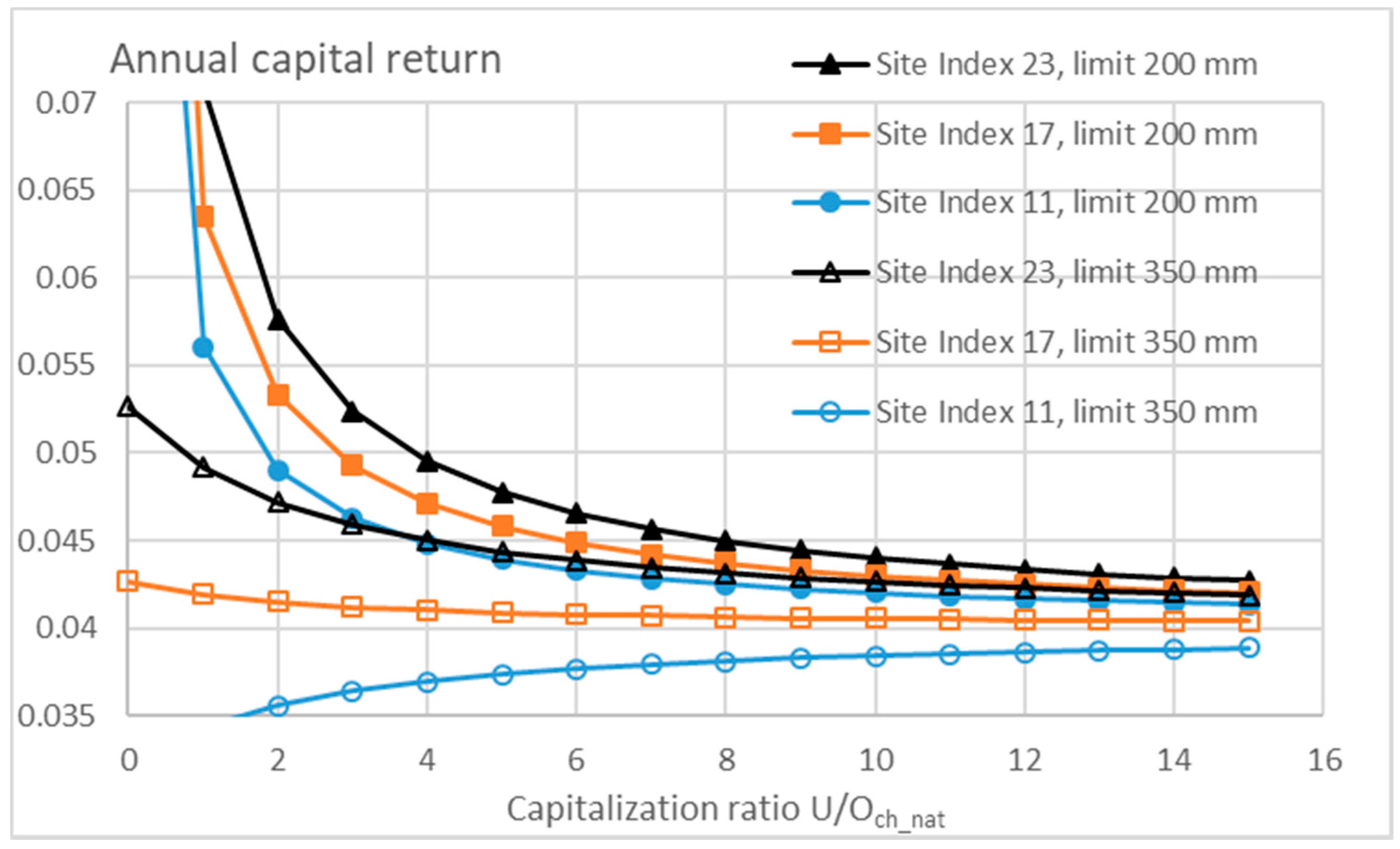

3.3. Financial Return Rate

3.3.1. Nonappreciating Nonoperative Capitalization

3.3.2. Appreciating Nonoperative Capitalization

4. Discussion

5. Conclusions

Supplementary Materials

Conflicts of Interest

References

- Kuusela, K. Suurin kestävä hakkuusuunnite ja menetelmä sen arvioimiseksi. Acta For. Fenn. 1961, 71, 1–36. [Google Scholar]

- Pearse, P.H. The optimum forest rotation. For. Chron. 1967, 43, 178–195. [Google Scholar] [CrossRef]

- Goodburn, J.M.; Lorimer, C.G. Population structure in old-growth and managed northern hardwoods: An examination. For. Ecol. Manag. 1999, 118, 11–29. [Google Scholar] [CrossRef]

- Buongiorno, J.; Peyron, J.L.; Houllier, F.; Bruciamacchie, M. Growth and management of mixed-species, uneven-aged forests in the French Jura: Implications for the economic returns and tree diversity. For. Sci. 1995, 41, 397–429. [Google Scholar]

- Pukkala, T.; Lähde, E.; Laiho, O. Growth and yield models for uneven-sized forest stands in Finland. For. Ecol. Manag. 2009, 258, 207–216. [Google Scholar] [CrossRef]

- Pukkala, T.; Lähde, E.; Laiho, O. Optimizing the structure and management of uneven-sized stands in Finland. Forestry 2010, 83, 129–142. [Google Scholar] [CrossRef]

- Valkonen, S.; Lappalainen, S.; Lähde, E.; Laiho, O.; Saksa, T. Tree and stand recovery after heavy diameter-limit cutting in Norway spruce stands. For. Ecol. Manag. 2017, 389, 68–75. [Google Scholar] [CrossRef]

- Pukkala, T. Plenterwald, Dauerwald, or clearcut? For. Policy Econ. 2016, 62, 125–134. [Google Scholar] [CrossRef]

- Hyytiäinen, K.; Hari, P.; Kokkila, T.; Mäkelä, A.; Tahvonen, O.; Taipale, J. Connecting a process- based forest growth model to a stand level economic optimization. Can. J. For. Res. 2004, 34, 2060–2073. [Google Scholar] [CrossRef]

- Chang, S.J.; Gadow, K.V. Application of the generalized Faustmann model to uneven-aged forest management. J. For. Econ. 2010, 16, 313–325. [Google Scholar] [CrossRef]

- Tahvonen, O. Optimal structure and development of uneven-aged Norway spruce forests. Can. J. For. Res. 2011, 41, 2389–2402. [Google Scholar] [CrossRef]

- Buongiorno, J.; Halvorsen, E.A.; Bollandsås, O.M.; Gobakken, T.; Hofstad, O. Optimizing management regimes for carbon storage and other benefits in uneven-aged stands dominated by Norway spruce, with a derivation of economic supply of carbon storage. Scand. J. For. Res. 2012, 27, 460–473. [Google Scholar] [CrossRef]

- Tahvonen, O. Economics of rotation and thinning revisited: The optimality of clearcuts versus continuous cover forestry. For. Policy Econ. 2016, 62, 88–94. [Google Scholar] [CrossRef]

- Rämö, J.; Tahvonen, O. Economics of harvesting boreal uneven-aged mixed-species forests. Can. J. For. Res. 2015, 45, 1102–1112. [Google Scholar] [CrossRef]

- Tahvonen, O.; Rämö, J. Optimality of continuous cover vs. clearcut regimes in managing forest resources. Can. J. For. Res. 2016, 46, 891–901. [Google Scholar] [CrossRef]

- Rämö, J.; Tahvonen, O. Optimizing the Harvest Timing in Continuous Cover Forestry. Environ. Resour. Econ. 2016, 67, 853–868. [Google Scholar] [CrossRef]

- Sinha, A.; Rämö, J.; Malo, P.; Kallio, M.; Tahvonen, O. Optimal management of naturally regenerating uneven-aged forests. Eur. J. Oper. Res. 2017, 256, 886–900. [Google Scholar] [CrossRef] [Green Version]

- Schütz, J.-P. Dynamique et conditions d’équilibre de peuplements jardinés sur les stations de la hêtraie à sapin. Schweizerische Zeitschrift fur Forstwesen 1975, 126, 637–671. [Google Scholar]

- Buongiorno, J.; Michie, B.R. A matrix model of uneven-aged forest management. For. Sci. 1980, 26, 609–625. [Google Scholar]

- Schütz, J.-P. Conditions of Equilibrium in fully irregular, uneven-aged forests: The state-of-the-art in European plenter forests. In Proceedings of the IUFRO Interdisciplinary Uneven-Aged Management Symposium, Corvallis, OR, USA, 15–26 September 1997. [Google Scholar]

- Schütz, J.-P. Modelling the demographic sustainability of pure beech plenter forests in Eastern Germany. Ann. For. Sci. 2006, 63, 93–100. [Google Scholar] [CrossRef] [Green Version]

- Brzeziecki, B.; Pommerening, A.; Miścicki, S.; Drozdowski, S.; Żybura, H. A common lack of demographic equilibrium among tree species in Białowieża National Park (NE Poland): Evidence from long-term plots. J. Veg. Sci. 2016, 27, 460–469. [Google Scholar] [CrossRef]

- Kärenlampi, P.; Kuuluvainen, T. Stationary tree size and age distributions are missing in old-growth boreal forest. Ecol. Complex. 2018. submitted. [Google Scholar]

- Bollandsås, O.M.; Buongiorno, J.; Gobakken, T. Predicting the growth of stands of trees of mixed species and size: A matrix model for Norway. Scand. J. For. Res. 2008, 23, 167–178. [Google Scholar] [CrossRef]

- Aakala, T.; Kuuluvainen, T.; Wallenius, T.; Kauhanen, H. Contrasting patterns of tree mortality in late-successional Picea abies stands in two areas of northern Fennoscandia. J. Veg. Sci. 2009, 20, 1016–1026. [Google Scholar] [CrossRef]

- de Liocourt, F. De l’amenagement des sapinières. In Bulletin Trimestriel, Société Forestière de Franche-Comté et Belfort, Juillet 1898; The School of Natural Resources University of Missouri-Columbia: Columbia, MO, USA, 1898; pp. 396–409. Available online: http://oak.snr.missouri.edu/silviculture/online/deLiocourt.pdf (accessed on 12 October 2018).

- Kerr, G. The management of silver fir forests: De Liocourt (1898) revisited. For. Int. J. For. Res. 2014, 87, 29–38. [Google Scholar] [CrossRef]

- Picard, N.; Gasparotto, D. Liocourt’s law for tree diameter distribution in forest stands. Ann. For. Sci. 2016, 73, 751. [Google Scholar] [CrossRef]

- Helliwell, D.R. Dauerwald. Forestry 1997, 70, 375–379. [Google Scholar] [CrossRef]

- Schütz, J.-P. The Swiss Experience: More than one hundred years of experience with a single-tree-selection management system in mountainous mixed-forests of spruce, fir and beech. From an empirically developped utilization in small-scale private forests to an elaborate and original concept of silviculture. In Proceedings of the IUFRO Interdisciplinary Uneven-Aged Management Symposium, Corvallis, OR, USA, 15–29 September 1997. [Google Scholar]

- Schütz, J.-P.; Saniga, M.; Diaci, J.; Vrška, T. Comparing close-to-nature silviculture with processes in pristine forests: Lessons from Central Europe. Ann. For. Sci. 2016, 73, 911–921. [Google Scholar] [CrossRef]

- O’hara, K.L.; Hasenauer, H.; Kindermann, G. Sustainability in multi-aged stands: An analysis of long-term plenter systems. For. Int. J. For. Res. 2007, 80, 163–181. [Google Scholar] [CrossRef]

- Clark, C.W.; De Pree, J.D. A simple linear model for the optimal exploitation of renewable resources. Appl. Math. Opt. 1979, 5, 181–196. [Google Scholar] [CrossRef]

- Halvorsen, E.; Buongiorno, J.; Ole-Martin Bollandsås, O.-M. NorgePro: A Spreadsheet Program for the Management of All-Aged, Mixed-Species Norwegian Forest Stands; Department of Forest and Wildlife Ecology: Madison, WI, USA, 2015; Available online: labs.russell.wisc.edu/buongiorno/files/NorgePro/NorgeProManual_4_24_15.doc (accessed on 12 October 2018).

- Chang, S.J. A generalized Faustmann model for the determination of optimal harvest age. Can. J. For. Res. 1998, 28, 652–659. [Google Scholar] [CrossRef]

- Chang, S.J.; Deegen, P. Pressler’s indicator rate formula as a guide for forest management. J. For. Econ. 2011, 17, 258–266. [Google Scholar] [CrossRef]

- Heinonen, J. Koealojen puu-ja puustotunnusten laskentaohjelma KPL. In Käyttöohje (Software for Computing Tree and Stand Characteristics for Sample Plots. User’s Manual); Research Reports; Finnish Forest Research Institute: Vantaa, Finland, 1994. (In Finnish) [Google Scholar]

- Kärenlampi, P.P. The effect of capitalization on financial return in multiannual growth. 2018; submitted. [Google Scholar]

- Newbery, D.; Burgt, X.; Moravie, M.-A.D. Structure and inferred dynamics of a large grove of Microberlinia bisulcata trees in central African rain forest: The possible role of periods of multiple disturbance events. J. Trop. Ecol. 2004, 20, 131–143. [Google Scholar] [CrossRef]

- Lundqvist, L. Changes in the stand structure on permanent Picea abies plots managed with single-tree selection. Scand. J. For. Res. 1993, 8, 510–517. [Google Scholar] [CrossRef]

- Vlam, M.; van der Sleen, P.; Groenendijk, P.; Zuidema, P.A. Tree Age Distributions Reveal Large-Scale Disturbance-Recovery Cycles in Three Tropical Forests. Front. Plant Sci. 2016, 7, 1984. [Google Scholar] [CrossRef] [PubMed]

- Lundqvist, L. Some notes on the regeneration of Norway spruce on six permanent plots managed with single-tree selection. For. Ecol. Manag. 1991, 46, 49–57. [Google Scholar] [CrossRef]

- Lundqvist, L.; Nilson, K. Regeneration dynamics in an uneven-aged virgin Norway spruce forest in northern Sweden. Scand. J. For. Res. 2007, 22, 304–309. [Google Scholar] [CrossRef]

- Ahlström, M.A. Stand Development and Growth in Uneven-Aged Norway Spruce and Multi-Layered Scots Pine Forests in Boreal Sweden. Ph.D. Thesis, Faculty of Forest Science, Department of Forest Ecology and Management, Swedish University of Agricultural Sciences, Uppsala, Sweden, 2016. [Google Scholar]

- Pukkala, T. Puun hinta ja taloudellisesti optimaalinen hakkuun ajankohta. Metsätieteen Aikakauskirja 2006, 1, 33–48. [Google Scholar] [CrossRef]

- Lundqvist, L. Tamm Review: Selection system reduces long-term volume growth in Fennoscandic uneven-aged Norway spruce forests. For. Ecol. Manag. 2017, 391, 362–375. [Google Scholar] [CrossRef]

- Drössler, L.; Nilsson, U.; Lundqvist, L. Simulated transformation of even-aged Norway spruce stands to multi-layered forests: An experiment to explore the potential of tree size differentiation. For. Int. J. For. Res. 2013, 87, 239–248. [Google Scholar]

- Lundqvist, L.; Spreer, S.; Karlsson, C. Volume production in different silvicultural systems for 85 years in a mixed Picea abies–Pinus sylvestris forest in central Sweden. Silva Fenn. 2013, 47, 897. [Google Scholar] [CrossRef]

- Trasobares, A.; Tome, M.; Miina, J. Growth and yield model for Pinus halepensis Mill in Catalonia, north-east Spain. For. Ecol. Manag. 2004, 203, 49–62. [Google Scholar] [CrossRef]

- Trasobares, A.; Pukkala, T.; Miina, J. Growth and yield model for uneven-aged mixtures of Pinus sylvestris L. and Pinus nigra Arn. in Catalonia, north-east Spain. Ann. For. Sci. 2004, 61, 9–24. [Google Scholar] [CrossRef]

- Rosa, R.; Soares, P.; Tomé, M. Evaluating the Economic Potential of Uneven-aged Maritime Pine Forests. Ecol. Econ. 2018, 143, 210–217. [Google Scholar] [CrossRef]

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kärenlampi, P.P. Stationary Forestry with Human Interference. Sustainability 2018, 10, 3662. https://doi.org/10.3390/su10103662

Kärenlampi PP. Stationary Forestry with Human Interference. Sustainability. 2018; 10(10):3662. https://doi.org/10.3390/su10103662

Chicago/Turabian StyleKärenlampi, Petri P. 2018. "Stationary Forestry with Human Interference" Sustainability 10, no. 10: 3662. https://doi.org/10.3390/su10103662

APA StyleKärenlampi, P. P. (2018). Stationary Forestry with Human Interference. Sustainability, 10(10), 3662. https://doi.org/10.3390/su10103662