4. Comparative Analysis

In order to extend the validity of the results and to take into account the different characteristics of the national electricity systems, the analysis was extended by comparing three countries with different resource mixes and market behaviour. The selection of countries was guided by the desire to capture contrasting approaches to renewable energy development and their impact on pricing.

Germany is a country with a high penetration of renewables, especially wind and solar, and at the same time, frequent negative electricity prices. The high price volatility makes Germany a good case for testing hypotheses about the impact of RESs and the effectiveness of smart charging.

France’s dominance in nuclear power has given it a more stable production profile and less dependence on short-term flexibility. It serves as a contrasting case, with a lower probability of extreme price fluctuations.

The Czech Republic represents a country with a gradually increasing share of RESs and an electricity system undergoing transformation. Due to its location in Central Europe and moderate price volatility, it serves as a transitional case between Germany and France.

The inclusion of these three countries creates room for testing hypotheses in different contexts and also opens up the possibility of a comparative evaluation that will contribute to the formulation of more generalizable conclusions.

Hypothesis H1. The correlation between the RES share and the electricity price.

The objective of this part of the analysis is to quantitatively test the assumption that a higher share of renewables in the electricity system leads to lower spot electricity prices in the daily market. Thus, Hypothesis H1 assumes that there is a negative linear correlation between the RES share and the electricity price in a given hour.

The calculations do not consider the absolute amount of generation from wind and solar resources (e.g., in megawatt hours), but their share of total hourly generation, which takes into account the current demand and system context. This approach is methodologically sounder, as it eliminates seasonal and volume biases that could arise when analysing disproportionate or incomparable electricity volumes between different time periods or countries.

The proportion of RESs in each hour was calculated using the following formula:

where

PRES is renewable energy generation,

PW is wind generation, and

PT is total electricity generation. Based on this proportion, a pair of values,

RatioRES and Day Ahead price, was constructed for each hour in the period 2015–2025. For each calendar year, the hourly Pearson correlation between these two variables was then calculated using the standard correlation coefficient (1).

The results (

Figure 1 and

Table 2) of the correlation analysis between the hourly share of generation from renewable energy sources and the spot price of electricity in the period 2015 to 2025 confirm a consistent negative linear dependence in all the countries analysed—Germany, France, and the Czech Republic. The calculations were carried out separately for each year, thus taking into account the dynamics of the energy mix evolution over time.

Germany (GE), as the country with the highest penetration of RESs, observed the most significant negative correlation coefficients throughout the period. The values ranged from −0.51 (in 2021) to −0.88 (2023 and 2025), indicating a consistently strong negative relationship between the RES share and price. This trend reflects a strong market response to high volumes of nearly cost-free generation from wind and solar, which often leads to prices falling into negative territory.

In France (FR), where nuclear power dominates, the correlations are also mostly negative, but less pronounced. The weakest correlation was in 2015 (r = −0.21), while in 2018 and 2025, they were already around −0.70. This suggests that even in a system with a stable base, the gradual integration of the RES can affect price dynamics, albeit less directly and with more inertia than in the case of Germany.

In the Czech Republic (CZ), the correlation values were initially weaker (e.g., −0.27 in 2015), but have strengthened with the increasing integration of renewables. From 2020 onwards, correlations dropped below −0.50, reaching −0.79 in 2025, the strongest negative correlation in the whole decade. This development confirms that as the RES share also increases in Central European systems, conditions for greater price sensitivity to renewable generation emerge.

A graphical representation of the evolution of the correlation coefficients is presented in

Figure 1. It is clear that, despite short-term fluctuations (e.g., 2022), there is an amplifying trend of a negative relationship between the RES share and electricity price in the long term in almost all countries. These results confirm the validity of hypothesis H1 and also highlight the importance of adaptive consumer behaviour and market mechanisms in an environment with increasing renewable generation dynamics. The bar chart clearly shows the persistent presence of a negative relationship in all three countries, with Germany consistently showing the strongest negative relationship throughout the period. France and the Czech Republic show more variability from year to year, which may be due to the different stability of production and the structure of the resource mix. Temporary weakening of the correlation is visible in 2022–2023, which may be related to exceptional market events (e.g., energy crisis, instability in supply). Despite these fluctuations, the long-term trend confirms the increasing influence of RESs on pricing across Central Europe.

Table 1 shows the values of the Pearson correlation coefficient between the hourly RES share and the spot electricity price on the daily market, calculated separately for each calendar year in the period 2015 to 2025 and for the three countries analysed: Germany (GE), France (FR), and the Czech Republic (CZ). Negative correlation values document an inverse relationship between the share of renewables and price, while more significant negative values indicate a higher price sensitivity to a change in the RES share. The strongest negative correlation was observed in Germany, where r-values during the period under review were below −0.85 in some years. In contrast, in the Czech Republic, the trend of an amplifying correlation was particularly pronounced after 2020.

Hypothesis H2. The occurrence of negative prices depending on the level of RESs.

The aim of this section is to test hypothesis H2, according to which a higher share of electricity generated from renewable sources correlates with a higher incidence of negative spot prices in the daily market. The theoretical basis for this hypothesis is based on the well-known mechanisms of the merit-order effect, which causes resources with higher marginal costs to be driven out of the market during periods of high generation from wind or solar resources. When demand becomes saturated with low-cost generation from RECs, a situation can arise where the remaining demand is met exclusively by near-zero-cost resources, which, combined with low system flexibility, can result in negative price signals. Aggregated hourly data was used to empirically test this hypothesis, as follows:

- −

The share of RES production in total consumption;

- −

The spot price of electricity (Day-Ahead Price).

The data covers the period 2015–2025 and has been analysed for three countries, Germany (DE), France (FR), and the Czech Republic (CZ), which differ in terms of RES penetration rates, generation structure, and regulatory frameworks. For each country, the hourly data were divided into intervals of RES share of 10% (0–10%, 10–20%, and up to 90–100%). Within each interval, the frequency of occurrence of negative prices was then calculated. This approach allows for capturing the non-linear behaviour of the market while providing an intuitive visual overview of which RES share ranges are most likely to have negative prices.

The results can then be interpreted in terms of:

- −

The economic consequences of high RES production;

- −

System flexibility and market response;

- −

Cross-country differences in price sensitivity to RES generation.

The analysis of Hypothesis H2, which focuses on the association between the occurrence of negative electricity prices and the share of renewables in total generation, yielded clear and consistent patterns both within and across country comparisons. The results were analysed on the basis of histograms in which hourly values were divided according to the RES share into 10% intervals (0–10%, 10–20%, …, 90–100%). Within each interval, the proportion of hours with a negative electricity market price (Day Ahead Price < 0 EUR/MWh) was detected. Detailed tables of the results are presented in

Appendix A.

In the case of Germany, the results clearly show an increasing probability of negative prices with a higher share of RESs. For intervals below 50%, negative prices are practically non-existent. However, their incidence starts to increase sharply for RESs above 60%, with the share of negative prices in the 70–80% category reaching more than 40% in several years, and in the 80–90% category reaching almost 100% (e.g., 2019). A cumulative analysis over the entire 2015–2025 period shows that the highest proportion of negative prices (34.76%) occurred in hours with an RESs share between 80–90%, which contrasts sharply with the zero occurrence of negative prices for RESs shares below 40%. These results clearly support Hypothesis H2.

In France, the incidence of negative prices is generally very low, being practically insignificant until 2019. It is only in recent years (2020–2025) that higher proportions of negative prices are starting to be recorded, with a higher share of RESs. For example, in 2025, the share of negative prices reaches 21.42% at RES shares of 30–40%, and as high as 37.66% at RES shares of 40–50%. However, these figures remain isolated and appear only in very small numbers of hours. Overall, France confirms that, although the increasing share of RESs may create the preconditions for negative prices, their occurrence is likely to be dampened by the different structure of the electricity system and the flexibility of demand or exports. Aggregate data for the period 2015–2025 show that only when the RES share is above 30% does the share of negative prices approach or exceed 5%.

For the Czech Republic, the results are in a sense between Germany and France, although closer to France. In years with a low RES share, negative prices are rare, but at a share of 30–40% they are already more frequent in some years (e.g., 18.96% in aggregate over the whole period). The increase in the share of negative prices is particularly pronounced for RESs in the 40–60% range, reaching up to 57.14% (40–50%) and 73.33% (50–60%) in the aggregate data. Given that the Czech electricity system has a lower share of RESs than Germany, these figures suggest that even with lower network load, negative prices can occur if there is insufficient flexibility in generation regulation or export possibilities.

These results support Hypothesis H2 in the sense that the occurrence of negative prices is strongly associated with a high share of RESs. However, the magnitude of this phenomenon varies considerably between countries, highlighting the importance of national market structures and the technical flexibility of energy systems. The results of Hypothesis H2 clearly confirm that a higher share of RESs in the generation mix significantly increases the probability of negative spot prices, especially in countries with high renewable penetration and limited system flexibility. However, it is important to recognise that the occurrence of negative prices is not solely a function of renewable output. Market design elements, such as minimum bid price thresholds, limited cross-border transmission capacity, and a lack of responsive demand-side flexibility, also play a critical role in amplifying price inversions. For example, in Germany, even with high RES production, negative prices often arise only when export options are constrained or when the system is saturated with inflexible base-load generation. Similarly, in France and the Czech Republic, structural differences in market configuration and interconnection levels help explain why negative prices are less frequent or more contained, despite growing RES shares. These findings suggest that while the correlation between RESs and negative prices is statistically strong, a complete understanding of the phenomenon requires integrating market architecture and regulatory conditions into the analysis. Future research could, therefore, benefit from including variables related to grid congestion, bidding rules, or export dynamics to further refine the causal framework underlying price volatility and market imbalance. It is important to recognise that price formation within the integrated electricity market is not determined solely by local imbalances between generation and demand. Network constraints also play a critical role and are explicitly captured in flow-based market models using Power Transfer Distribution Factors (PTDFs). These matrices quantify how cross-zonal commercial exchanges affect loading on individual transmission elements and, in turn, determine the available cross-border capacities. As a result, even if there is a renewable generation surplus in one bidding zone, negative prices may not occur in neighbouring countries due to limited transmission capacity and congestion risks defined by the PTDF structure.

Hypothesis H3. Impact of smart charging on average charging costs.

The development of electromobility is driving a growing demand for efficient and cost-optimised electric vehicle (EV) charging. From a consumer perspective, charging represents a significant item of total operating costs, and it is the price volatility in the electricity spot market that creates scope for cost reduction through the optimisation of the timing of off-take. In this context, the concept of ‘smart’ charging is increasingly being promoted, which responds flexibly to current price and network signals and makes targeted use of periods of low electricity prices—for example, at night or during high RESs on the grid.

The object of testing hypothesis H3 is to quantify the difference in the average price of electricity that would be consumed for EV charging in two contrasting scenarios:

- −

Dumb charging represents a rigid, time-fixed charging profile that does not take into account price signals (e.g., regular charging from 17:00 to 20:00),

- −

Smart charging implies flexible charging management that targets the three hourly intervals with the lowest spot electricity price each day.

In both cases, the same daily volume of energy needed to recharge the vehicle is considered, allowing direct cost comparability without being affected by the overall consumption range. The calculations are based on historical hourly prices from the Day-Ahead market and assume ideal conditions in terms of charging availability and user (or automated system) responsiveness.

The aim of this analysis is to identify whether smart charging leads to a statistically significant reduction in the average price per kWh compared to traditional fixed charging, and to observe how this difference evolves over time and between countries with different market and production profiles. The results will be presented in the form of clear tables, graphs, and their scientific interpretation.

4.1. Monthly Cost Savings (∆C)—Heatmap 2015–2025

To test hypothesis H3, an analysis of the monthly cost savings of charging electric vehicles using a smart charging algorithm compared to a conventional fixed charging mode was performed. As a baseline scenario, the fixed mode was chosen between 17:00 and 21:00, with a daily charging requirement of 4 h. For each day in the period 2015–2025, a cost difference ∆

C was calculated, defined as the difference between the average price in a given fixed interval and the lowest possible average price in any four-hour window of that day. Subsequently, these daily values were aggregated into monthly totals to produce a cumulative monthly savings metric. The results are visualised in the form of heatmaps, where each row represents a month (1–12) and each column represents the corresponding calendar year (2015–2025). The intensity of the colour represents the amount of monthly savings, allowing for the identification of time periods with the highest potential for cost reduction through a smart charging strategy. The heatmaps prepared in this way were created separately for each of the countries studied—Germany (

Table 3), France (

Table 4), and the Czech Republic (

Table 5)—and provide a comprehensive picture of the temporal and spatial variability of smart charging efficiency.

Based on simulations of the cost difference between fixed charging (17:00–21:00) and smart charging, heatmaps for Germany, France, and the Czech Republic for the period 2015–2025 have been produced. These maps visualise the monthly sum of the daily cost difference (∆C), with each cell representing the cumulative cost saving for a specific month of a given year, expressed in EUR/MWh.

The results for Germany show a stable and consistent benefit of smart charging across the entire period under review. Savings average between EUR 300 and EUR 600/month until 2020, with the exception of slightly lower values in 2020 and 2021, which may reflect reduced price volatility during the COVID-19 pandemic. However, a sharp increase in savings is observed from 2022 onwards, with monthly ∆C values reaching as high as EUR 2000–2900 in some months in 2023 and 2024, indicating extreme price volatility during this period. Such developments confirm that the potential of smart charging grows with increasing price dynamics.

In the case of France, there is significantly higher year-to-year variability. The most significant savings are concentrated in the period 2022–2024, when monthly ∆C values in the summer and autumn months (e.g., July to October) often exceed EUR 4000, and in extreme cases, up to EUR 5700. This evolution is in line with the significant price fluctuations on the French market, mainly due to the nuclear generation crisis and the increased reliance on imports during 2022–2023. In contrast, the period 2015–2019 shows savings of a lower order (EUR 300–800), suggesting that the smart charging effect is more pronounced in times of market turbulence.

For the Czech Republic, the results are consistent, but on average slightly lower than for the previous countries. Until 2020, monthly savings are mostly in the EUR 300–600 range, with a slight increase after 2021. A significant increase in ∆C occurs especially in 2023–2024, where monthly savings reach up to EUR 2600 (e.g., May 2025), which correlates with increasing penetration of renewables and increased price volatility. Although the Czech market is smaller and less volatile, the benefits of smart charging are still evident here, especially during periods of high load or regional price fluctuations.

4.2. The Evolution of the Daily Saving ∆C over Time (2015–2025)

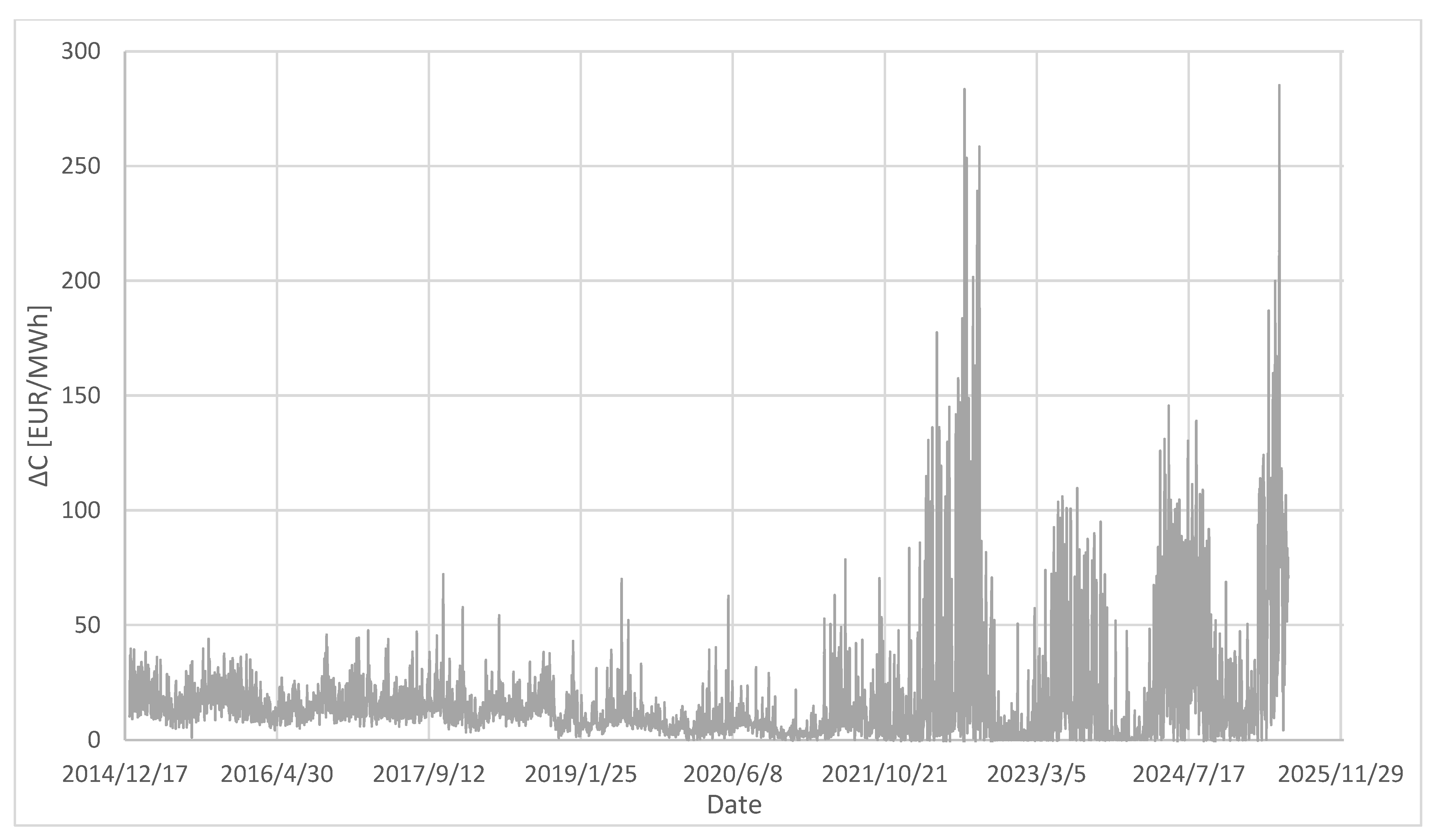

To better understand the dynamics of the impact of smart charging on daily costs, the differences between fixed and smart charging were calculated for each day of the analysis period. The resulting daily ∆

C values (in EUR/MWh) are visualised over time through a trio of graphs, each corresponding to one country under study—Germany (

Figure 2), France (

Figure 3), and the Czech Republic (

Figure 4).

The evolution of ∆C in Germany shows relatively stable values between 2015–2019, with slight fluctuations mainly related to price seasonality. From 2020 onwards, there is a gradual increase in variability and in the value of the ∆C itself, culminating in 2022 and 2023—periods of high electricity prices. In these years, extreme savings peaks of more than 60 EUR/MWh are visible. This trend shows the growing economic potential of the smart charging approach at a time of increasing price volatility.

French data show even higher volatility than German data. Between 2017 and 2021–2023, significant daily savings, often in excess of EUR 50/MWh, repeatedly appear. Particularly high values were recorded during 2022, which corresponds to the energy crisis and the reduced availability of nuclear generation. These developments suggest that charging flexibility can be a key tool for households and fleet operators to reduce costs in the face of market shocks.

In the Czech Republic, the daily differences between fixed and smart charging are generally lower than in the previous two countries. However, the development is similar—stable and lower ∆C in 2015–2019, a gradual increase in variability after 2020, and clear price peaks in 2022 and 2023. Although absolute savings are smaller on average, the increasing benefit of smart charging management is also confirmed here with increasing price volatility.

4.3. The Effect of Charging Duration on the Amount of ∆C Saving

To assess the impact of charging duration on the cost difference (∆C) between fixed and smart charging, an analysis was performed for a range of 2 to 6 h of charging per day. For each country (Germany, France, and the Czech Republic), aggregated heatmaps were created, capturing the ∆C for each month over the period 2015–2025. Smart charging was always optimised to select the cheapest hourly intervals corresponding to a fixed charging duration. The results show a clear trend: as the charging length increases, the total monthly saving (∆C) increases in most cases. This phenomenon is due to the fact that for longer intervals, the smart charging algorithm has a wider choice of prices and can select the cheapest hourly blocks more efficiently. In particular, the highest ∆Cs were obtained at the 6 h charging interval, while the lowest differences were observed at the 2 h interval.

At the same time, there were significant differences between countries. France showed the highest monthly savings at all intervals, reflecting greater price volatility and differences between peak and off-peak hours. Germany showed a more stable increase in ∆C with increasing charging duration, while the Czech Republic showed lower but still consistent savings, especially after 2020.

An important insight also emerges from the comparison between years: in years with extreme price fluctuations (e.g., 2022–2023), the differences between fixed and smart charging were most pronounced, confirming the benefit of dynamic strategies in times of market uncertainty.

These findings support hypothesis H3 that the expansion of flexible smart charging can lead to significant savings, especially if the user is able to adjust the time range of charging to the current price conditions.

In the next part of this research, hypothesis H3, the dependency between the length of the daily charging interval and the amount of potential savings brought about by intelligent (smart) charging of electric vehicles compared to fixed charging, was analysed. The aim was to investigate how the cost difference between the two modes varied with the amount of time flexibility the user had.

The simulation was carried out for five scenarios:

- −

2 h of charging (e.g., 17:00–19:00),

- −

3 h (17:00–20:00),

- −

4 h (17:00–21:00),

- −

5 h (17:00–22:00),

- −

6 h (17:00–23:00).

In each case, the fixed mode assumed that the user charges the vehicle daily at a fixed interval. In contrast, in smart mode, the cheapest continuous period of time with a corresponding length was identified individually for each day, using the sliding window principle. Thus, for each day, the smart algorithm selected the time window that minimised the average price for the desired number of hours. The daily cost difference was calculated according to Formula (6).

The obtained daily ∆C values were subsequently:

- −

Aggregated into monthly totals and visualised in the form of heatmaps;

- −

Averaged over the whole period 2015–2025 from the values for different charging times (2 h to 6 h).

Since displaying all ∆

C traces for each day and all charging regimes at once would be graphically opaque, an alternative form of visualisation was chosen. For each state, the average value of daily ∆

C was calculated separately for each scenario (2 to 6 h). The result was a single waveform (

Figure 5) for each state, which captures the trend of the relationship between the length of charging and the amount of economic benefit of the smart mode. The three waveforms were then plotted in a common graph, allowing for direct comparison between countries.

This analysis provides a comprehensive view of how the amount of flexibility provided (in hours) affects the cost difference between traditional and cost-optimised charging.

In order to complement the previous analysis, the average daily value of the cost difference ∆

C (in EUR/MWh) over time was processed separately for Germany (GE), France (FR), and the Czech Republic (CZ). The graph in

Figure 5 shows the individual time series for each country over the period 2015 to 2025. Each point represents the average of the daily ∆

C values across all the tested charging lengths (2 to 6 h), thus suppressing excessive variability and making the overall trends stand out more clearly.

This analysis confirms significant volatility over the period under review. The most significant increases in ∆C are observed during the energy crisis in 2022 and 2023, which is consistent with the extreme increase in electricity prices in spot markets. It is during this period that smart charging achieves the greatest relative advantage over fixed mode.

A comparison between countries shows that:

- −

France (FR) had the highest ∆C values at the time of the crisis, with peaks exceeding EUR 300/MWh, indicating a high potential for savings in smart charging. However, fluctuations are relatively frequent and dispersed.

- −

The Czech Republic (CZ) shows a similar trend to France, albeit with lower peaks. The trend is smoother and less extreme.

- −

Germany (GE) has the most stable pattern with relatively lower ∆C values over most of the period under study. Nevertheless, more pronounced fluctuations are observed in 2022–2023, which correspond to turbulent market conditions.

In the period before 2021, differences between modes were, on average, low and relatively stable, suggesting lower price volatility and less benefit from smart charging optimisation. From 2021 onwards, however, there is a rapid increase in the contribution of smart algorithms due to extreme market fluctuations.

In conclusion, this graph confirms the ability of smart charging to respond flexibly to price signals in the market, and also highlights an important insight: the more volatile the market, the greater the economic difference between fixed and smart modes can be achieved.

To assess the impact of charging duration on the cost difference (∆

C) between fixed and smart charging, an analysis was performed for a range of 2 to 6 h per day. Summary heatmaps were created for each country (Germany, France, and the Czech Republic), capturing the ∆

C for each month over the period 2015–2025, which can be seen in

Appendix B. Smart charging was always optimised to select the cheapest hourly intervals corresponding to a fixed charging duration.

The heatmap visualisations for Germany clearly show that the cost savings from smart charging (∆C) increase systematically with increasing charging duration. This relationship is consistent across the entire analysis period (2015–2025), although the degree varies depending on market conditions and price volatility in specific years.

From the heatmap results, it can be observed that the highest ∆C values for Germany were between 2015 and 2017. On the other hand, between 2018 and 2021, the ∆C parameter reached its lowest values. For France, however, the situation is different. The highest ∆C values were observed between 2022 and 2025, and partly in the second half of 2021. This is true for all charging periods. From the results, it can be observed that the highest ∆C values were reached in the first years of the period under study, and the ∆C values gradually decrease.

The heatmaps of France show that from 2015 to 2025, ∆C values increased steadily. While in 2015, the ∆C values were in the order of hundreds of EUR/MWh, later, higher values in the order of thousands started to appear.

In the case of the Czech Republic, the situation is slightly different. The highest ∆C values were reached in 2022, 2024, and 2025. The ∆C values first decreased over the period under consideration and started to increase again after 2021.

The results of the analysis clearly demonstrate that extending the charging interval significantly increases the potential cost savings when switching from fixed to smart charging. In all the countries analysed—Germany, France, and the Czech Republic—a positive correlation between the length of daily charging and the value of the cost difference ∆C was identified. This correlation is a consequence of the wider optimisation possibilities for longer intervals, which smart charging makes efficient use of.

However, the dynamics of the ∆C vary considerably across countries and time periods, highlighting the importance of specific market conditions. For Germany in particular, the highest ∆C values were recorded in the early years of the analysis period (2015–2017), reflecting the price volatility and opportunities for price arbitrage at the time. In contrast, the years 2018 to 2021 were characterised by lower levels of savings, which may be a consequence of a more stable price profile in the market. In France, an inverse trajectory was identified—the value of the ∆C increased systematically during the period under review, with the highest savings recorded between 2022 and 2025. This trend suggests a gradual increase in price volatility in later years, creating favourable conditions for smart charging to operate effectively. In the case of the Czech Republic, the development has been non-linear. After an initial decline in savings in 2015–2020, the value of the ∆C increased again from 2021 onwards, with peaks particularly in 2022, 2024, and 2025. This evolution reflects the changing price structure in the market and shows that the benefits of smart charging are highly context-dependent.

Overall, smart charging brings significant economic benefits, and these benefits increase as the daily charging window lengthens. At the same time, however, the market environment in a particular country and time must be taken into account, which significantly influences the resulting ∆C. This knowledge is crucial for the design of flexible charging strategies and their successful implementation in different energy contexts.

Hypothesis H4. A higher share of renewable energy sources (RESs) in the daily energy mix increases the cost differential between fixed and smart charging (∆C), thereby reinforcing the efficiency of flexible consumer behaviour.

The deployment of renewable energy sources (RESs) in the electricity grid is one of the main pillars of the energy transformation in Europe. However, RES generation, in particular from solar and wind sources, is characterised by a high degree of variability and forecast uncertainty. This volatility has a direct impact on price signals in the daily electricity market, which in turn affects consumers’ ability to optimise their behaviour.

One form of flexible consumption that responds to these price signals is intelligent (smart) charging of electric vehicles. This concept allows charging to be shifted to times of lower electricity prices, thereby reducing the average cost of charging. As RES production often leads to a drop in market prices, it is assumed that it is on days with a higher share of RESs that the price differences between hours are more pronounced. This creates more room for optimisation through smart charging.

This implies for Hypothesis H4 that higher daily RESs lead to a higher difference between the cost of fixed and smart charging (∆C). In other words, when the energy mix is more “green”, smart charging allows for achieving higher savings compared to charging at fixed times. This hypothesis can be tested by a correlation analysis between the daily RESs (expressed as % of total generation) and the ∆C cost difference calculated for different charging scenarios.

This analysis makes it possible to quantify the extent to which RESs increase the economic incentive to use flexibility. A strong positive correlation between RESs and ∆C would signal that smart charging has the greatest benefit on “green” days. Conversely, a weak or no correlation would suggest that factors other than RESs (e.g., market structure, consumption, or exports/imports) have a dominant influence on ∆C.

In addition to the relationship between RESs and ∆C, a complementary analysis of the correlation between the ∆C values themselves was performed for different charging durations (2 h to 6 h per day). The aim of this analysis was to investigate the extent to which these scenarios are interdependent, or whether the behaviour of electricity prices is consistent, regardless of the length of the charging window.

The high degree of correlation between individual ∆Cs would suggest that the differences in savings between fixed and smart charging evolve similarly over time, regardless of whether the vehicle is charged for two, three, or six hours per day. Such a result would be particularly important for the robustness of the smart charging model, as it would confirm its consistent benefits across different user profiles.

Conversely, if the correlation between the different ∆

Cs turns out to be weak, this would suggest that the economic benefits of smart charging depend not only on price variability but also on charging duration. In such a case, charging strategies would need to be more carefully tailored to specific conditions and user needs. The correlation matrices are presented in

Appendix C. The designation GE_2 means that this is the correlation for Germany and two-hour charging. Similarly, for France, where, for example, the designation FR_4 indicates a correlation for 4 h charging. This is similar for the Czech Republic.

4.4. Results of Hypothesis H4 for Germany

The deployment of renewable energy sources (RESs) is changing the nature of the operation of the electricity system, particularly in terms of price variability in short-term markets. The assumption tested under Hypothesis H4 is that a higher daily RES share could lead to higher price volatility and hence a higher difference between the cost of fixed and smart charging of electric vehicles (denoted as ∆C).

To assess this hypothesis, a correlation analysis was performed for Germany between the daily RESs and the ∆C value for different charging durations from 2 to 6 h per day. The results for the whole period 2015–2025 show the following correlation coefficients:

- −

2 h charging (GE_2): −0.22;

- −

3 h (GE_3): −0.21;

- −

4 h (GE_4): −0.18;

- −

5 h (GE_5): −0.16;

- −

6 h (GE_6): −0.13.

All correlation coefficients are slightly negative, indicating that the ∆C tends to be lower on average on days with a higher proportion of RESs. This result contradicts the original assumption that a higher share of RESs (and hence more price variability) leads to higher savings opportunities due to smart charging.

One possible explanation is that on high RES days, the overall price level is low during most hours, so the difference between fixed and optimised charging is reduced. Conversely, on days with a lower share of RESs, price fluctuations can be more pronounced, creating more room for optimisation by an intelligent algorithm.

These results suggest that the RES share alone may not be a direct determinant of the benefits of smart charging. A more significant influence may be the nature of the daily price profile—for example, the occurrence of extremely cheap or expensive hours—without necessarily being linked to RESs.

For completeness, a correlation between the ∆C scenarios was also performed (e.g., a correlation between the ∆C for 2 and 6 h). These correlations were highly positive, indicating that days that achieve higher savings in one scenario are also favourable for other charging lengths. This consistency supports the stability of the results across different modes and underlines the robustness of the methodology.

4.5. Results of Hypothesis H4 for France

A correlation analysis between the daily share of renewable energy generation (RESs) and the cost difference between fixed and smart charging (∆C) reveals interesting and time-varying relationships in the case of France.

Over the whole period 2015–2025, the Pearson correlation coefficients reach slightly positive values, increasing with increasing charging duration: from 0.09 for 2 h charging (FR_2) to 0.20 for 6 h charging (FR_6). This trend indicates that the more flexible hours smart charging has available, the more it can respond to price fluctuations caused by production from RESs. Although this is a weak correlation, it is consistent and positive across charging lengths.

However, a detailed look at the individual years reveals an important fact—the correlations are overwhelmingly negative, with the most significant negative values observed in 2021 (e.g., FR_2 to FR_6: −0.42 to −0.38). Negative correlations also appear in 2015–2018, 2020, 2024, and 2025, suggesting that in these years, higher RES shares were paradoxically not related to higher ∆C values, but rather to their decline.

The exception is 2019, where the correlations were close to zero (e.g., FR_2 = 0.06, FR_6 = 0.03) and thus do not show a significant linear relationship between the RES and ∆C ratios. In 2022, the correlations were close to zero and even equal to zero for 6 h charging (FR_6 = 0.00), indicating the absence of a clear relationship.

These results suggest that, within France, the relationship between RES production and the benefit of smart charging is not clear-cut, but is slightly positive on average in the long term. However, the significant year-on-year differences in correlations indicate that this relationship is strongly influenced by the specific market and operating conditions in a given year. For example, in years with extreme price volatility or specific supply and demand dynamics, inverse relationships may have occurred.

This phenomenon also supports the need to analyse individual years separately, not just in aggregate, and highlights the complexity of the interactions between demand flexibility and the integrative impacts of RESs in national electricity systems.

4.6. The Results of Hypothesis H4 for the Czech Republic

The results of the correlation analysis for the Czech Republic show a relatively stable positive relationship between the share of renewable energy generation (RESs) and the cost difference between fixed and smart charging (∆C) over the period 2015–2025. Looking at the aggregated correlations over the whole period, all values are positive and increase gradually with increasing charging duration:

- −

CZ_2: 0.20;

- −

CZ_3: 0.23;

- −

CZ_4: 0.26;

- −

CZ_5: 0.30;

- −

CZ_6: 0.33.

This trend suggests that the longer the charging duration, the greater the potential for smart charging to respond to price fluctuations caused by the RES share. In other words, longer flexible charging windows allow for better use of the lower prices caused by renewable generation.

Looking at individual years, however, there are considerable fluctuations. In the early years (2015–2017), correlations between RESs and ∆Cs are often negative, especially for shorter charging intervals:

- −

2015: correlation for CZ_2 = −0.37, CZ_3 = −0.30;

- −

2016: CZ_2 = −0.37, CZ_3 = −0.25;

- −

2017: CZ_2 = −0.25, CZ_3 = −0.14.

These values suggest that in the early years, either there was not a strong relationship between the share of RES and price fluctuations, or that RES did not create conditions conducive to significant savings in smart charging.

However, from 2018 onwards, there is a clear turning point—correlations are gradually increasing, and from 2019 onwards, they are positive and stable in most years:

- −

Year 2022: CZ_2 = 0.30, CZ_6 = 0.21;

- −

Year 2023: CZ_2 = 0.30, CZ_6 = 0.25;

- −

Year 2024: CZ_2 = 0.33, CZ_6 = 0.24;

- −

Year 2025: CZ_2 = 0.25, CZ_6 = 0.13.

Thus, the highest correlations were reached in 2022–2024, which may be related to the increasing share of renewables in the Czech electricity mix, as well as to the higher price volatility that increased the smart charging effect.

The overall trend suggests that in the Czech Republic, the effect of the RES share on the ∆C strengthens over time. The initially weak or inverse relationship has been gradually replaced by a stable positive trend, which is especially evident at longer charging intervals (5–6 h). The results support hypothesis H4—a higher share of RESs increases price variability, thus increasing the potential for smart charging to generate savings.

Hypothesis H4 predicted that a higher share of electricity generation from renewable energy sources (RESs) leads to a higher difference between fixed and smart charging costs (∆Cs), i.e., that there is a positive correlation between the daily share of RESs and ∆Cs. This hypothesis was tested using correlation analysis over the time period 2015–2025, separately for each country and with different charging duration scenarios (2 to 6 h per day).

Germany

Overall period (2015–2025): the results showed consistently positive correlations that increased with the charging duration (from 0.10 for 2 h to 0.22 for 6 h). This confirms that greater charging flexibility allows for better use of the lower prices caused by a higher share of RESs. The positive correlations were particularly strong between 2021 and 2025, with values often above 0.30–0.50 for 5–6 hr charging. In contrast, correlations were weak or insignificant in the 2015–2017 period. In Germany, hypothesis H4 is confirmed—smart charging is more efficient at higher RES shares, especially in more recent years with higher market volatility.

France

Overall period (2015–2025): the correlations were positive but very low, ranging from 0.09 to 0.20. This suggests a weak average impact of RESs on the ∆C difference in the long run. In 2015–2018, the correlations were clearly negative (e.g., −0.42 in 2021), which may be related to the low share of variable RESs or their specific structure. However, from 2022 onwards, the correlations are positive, albeit moderate (e.g., 0.25–0.30). In the case of France, hypothesis H4 was only supported in later years. Before 2020, the impact of RESs on ∆Cs was rather opposite or insignificant, which may be related to the dominance of nuclear power, which dampens price volatility.

Czech Republic

Overall period (2015–2025): the correlations increased with the charging length from 0.20 (2 h) to 0.33 (6 h), indicating good agreement with hypothesis H4. The development is similar to Germany—weak or negative correlations in 2015–2017, slightly increasing after 2018, and clearly positive after 2020 (e.g., up to 0.33 in 2024 for CZ_2). For the Czech Republic, hypothesis H4 is also confirmed, with the effect being more pronounced in the last four years, especially at longer charging intervals.

In general, therefore, the following can be argued:

- −

Hypothesis H4 has been confirmed in Germany and the Czech Republic, especially since 2020.

- −

France is a specific case—the impact of RESs has only become positive in recent years, which may be related to the different mix of resources in the electricity mix.

- −

The length of the charging window plays a key role—the longer the flexible window, the higher the correlation with the RES ratio.

- −

The results support the importance of smart charging in an environment of increasing integration of RESs and confirm its economic potential for cost reduction in an environment of high electricity price volatility.