Charging Ahead: Perceptions and Adoption of Electric Vehicles Among Full- and Part-Time Ridehailing Drivers in California

Abstract

1. Introduction

- Vehicle purchase discount (instant rebate at point of sale): The fixed instant vehicle price reduction at the point of sale applied to all customers.

- Tax credit: A fixed credit that is applied after the vehicle is sold, directly reducing the amount of tax owed by any customer.

- Credit for charging infrastructure (charging credit): A fixed monetary incentive or prepaid allowance provided to offset the cost of EV charging equipment. This type of credit is aimed at individuals, businesses, or property owners who install charging infrastructure. It can help cover charging equipment costs.

- Charging discount: A reduction in the cost of charging an EV, typically offered to encourage EV adoption, manage the energy demand, or promote equitable access to charging infrastructure.

- Income-based instant rebate at point of sale: An instant rebate available at the time of purchase, based on income eligibility. We define it as the ratio of the vehicle purchase discount relative to the driver household income.

- Vehicle price-based instant rebate at point of sale: An instant rebate available at the time of purchase, based on the labeled vehicle price. We define it as the ratio of the vehicle purchase discount relative to the vehicle price.

- Income-based tax credit: A tax benefit where the amount of the credit varies based on the taxpayer’s income. We define it as the ratio of the tax credit relative to the driver household income. Typically, lower-income individuals or households receive a larger credit, while higher-income earners receive a smaller credit or none at all.

- Vehicle price-based tax credit: A tax incentive where the amount of the credit depends on the price of the vehicle being purchased. We define it as the ratio of the tax credit relative to the vehicle price. For instance, lower-priced vehicles receive a larger credit, encouraging affordability and broader access. Higher-priced vehicles receive a smaller credit or no credit at all.

- Fuel cost offset: Estimated savings in charging costs resulting from the offered charging discount.

- Vehicle price-based charging credit: The ratio of the charging credit relative to the vehicle price. A type of incentive for charging that varies based on the price of the EV a driver owns, leases, or rents. We define it as the ratio of the charging credit relative to the driver household income. For instance, low-income drivers receive higher financial support on EV charging [17].

2. Literature Review

2.1. EV Adoption Among the General Population and TNC Drivers

2.2. Full- and Part-Time TNC Driver EV Adoption

2.3. Full- and Part-Time TNC Driving Patterns and Concerns

2.4. Research Gaps and Methodological Limitations

3. Methodology

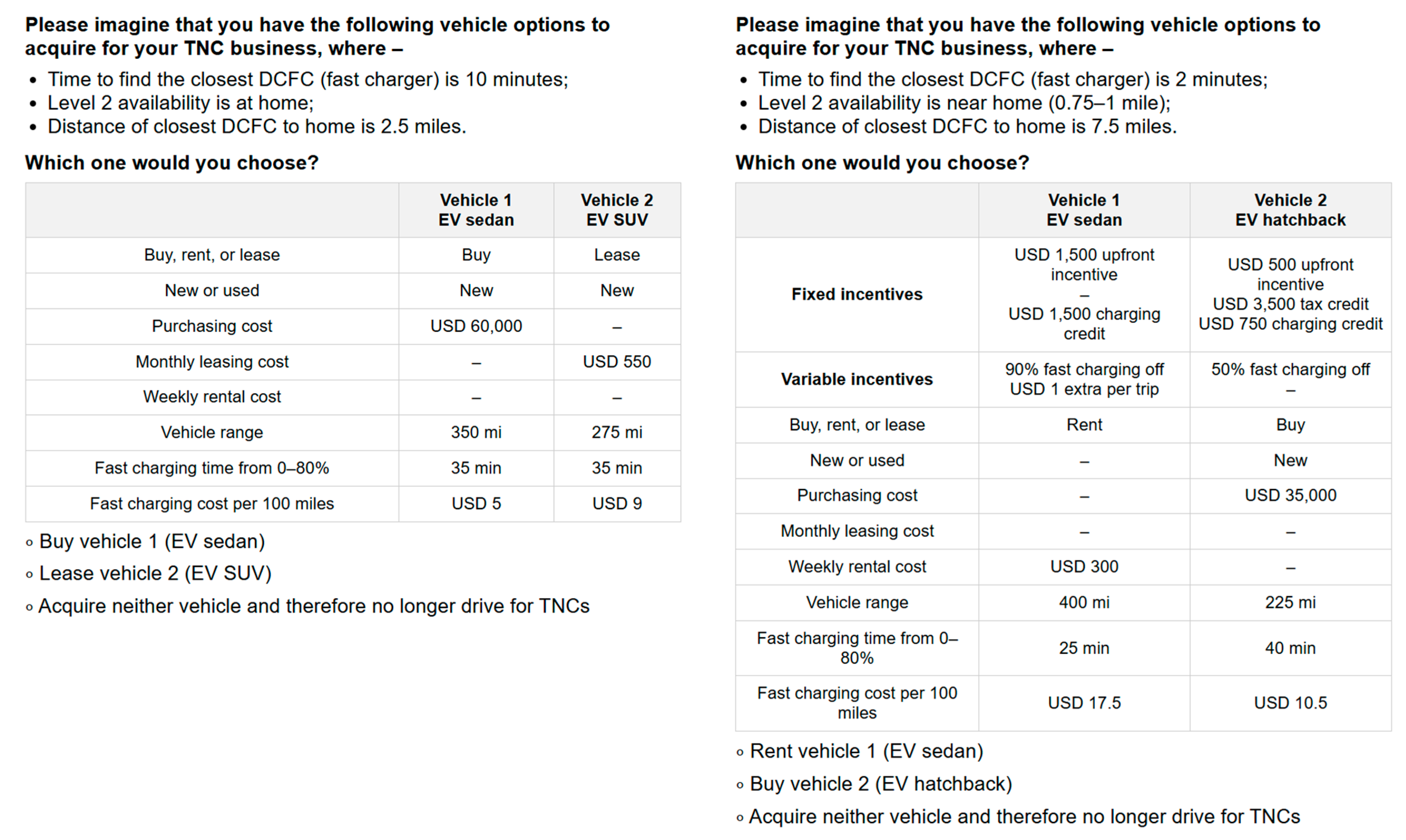

3.1. Stated Preference Survey Implementation

3.2. Expert Interviews

3.3. Small Group Discussions with Full-Time Drivers

3.4. Driver Survey Analysis

3.5. Binomial Discrete Choice Model Specification

3.6. Methodological Summary and Limitations

4. Results and Discussion

4.1. The Descriptive Summary of the Driver Survey

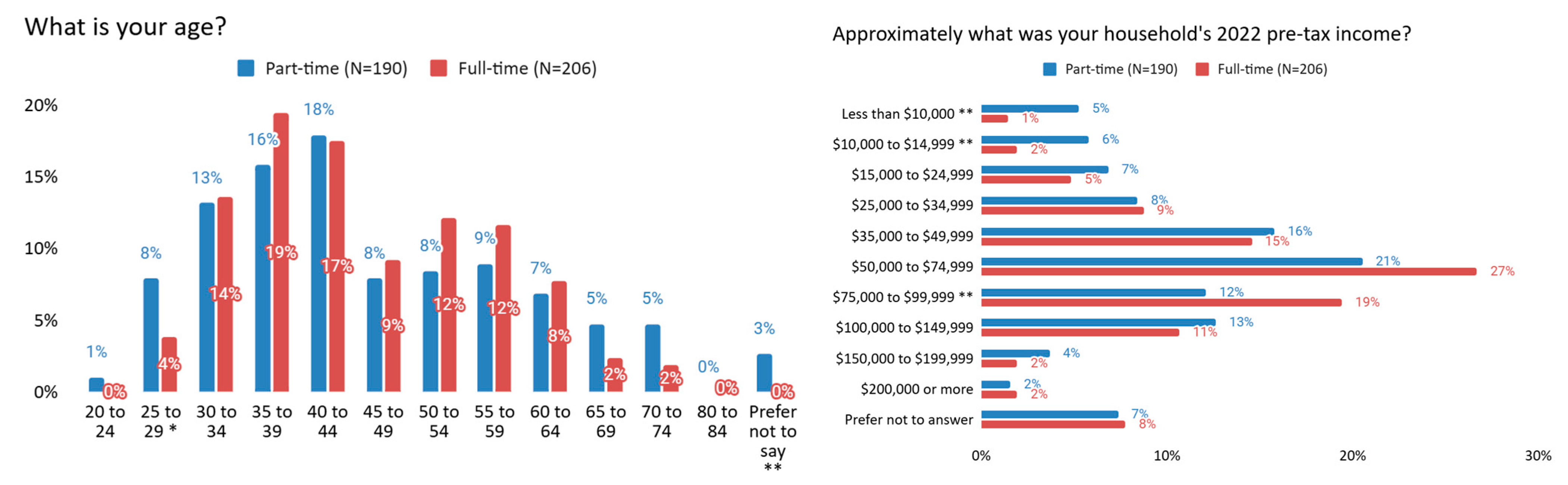

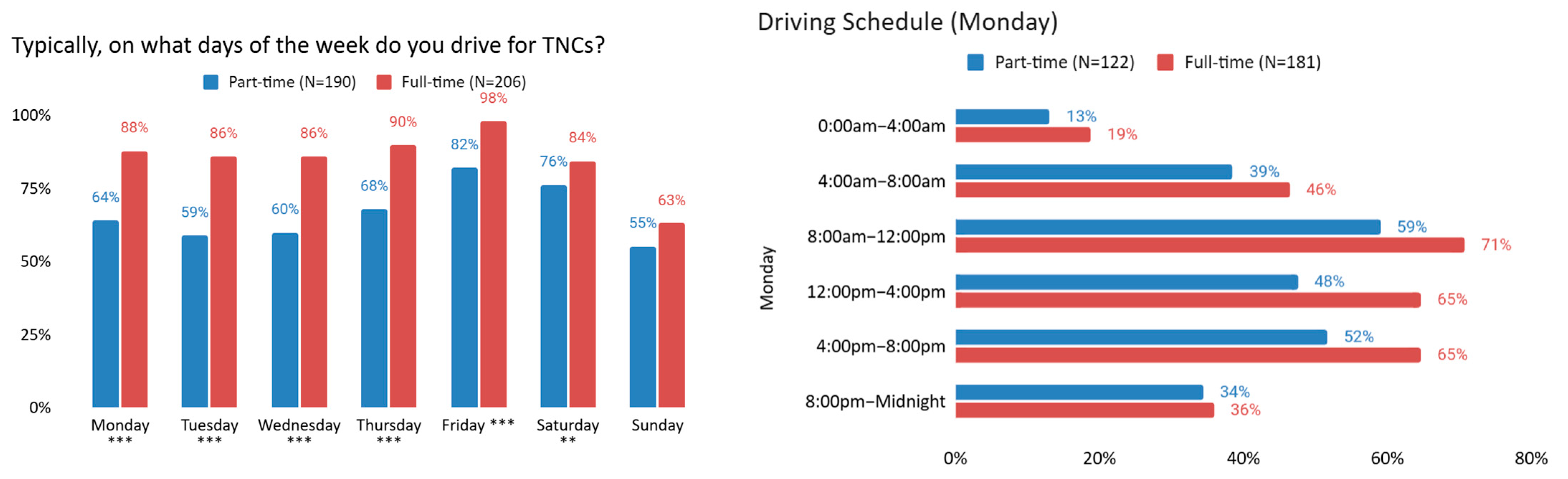

4.1.1. Demographics

4.1.2. Households and Children

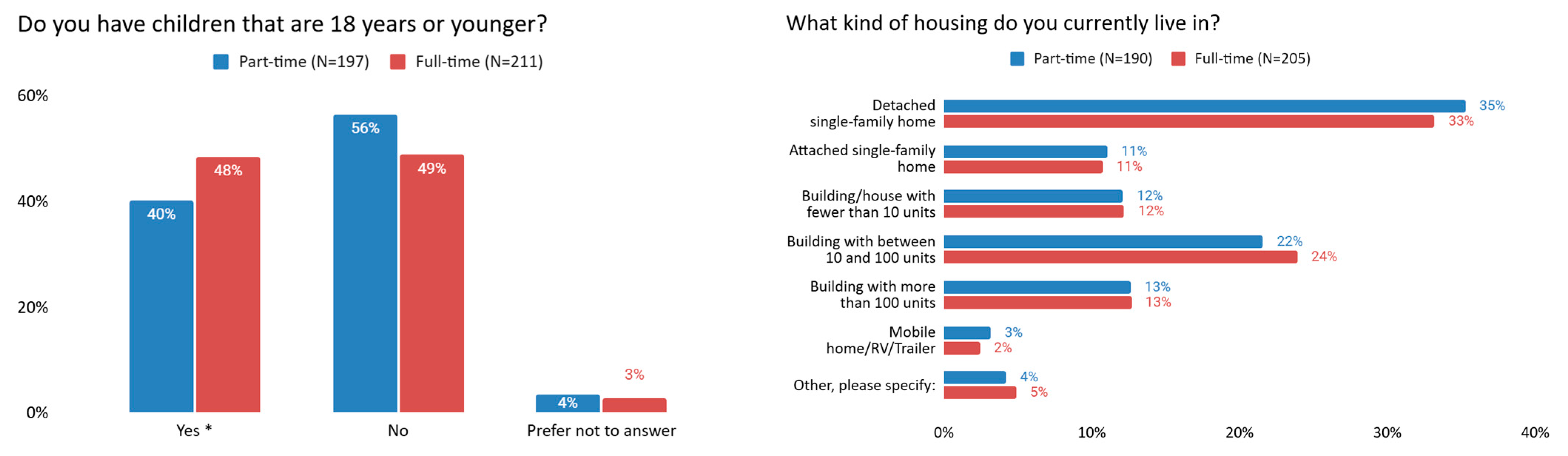

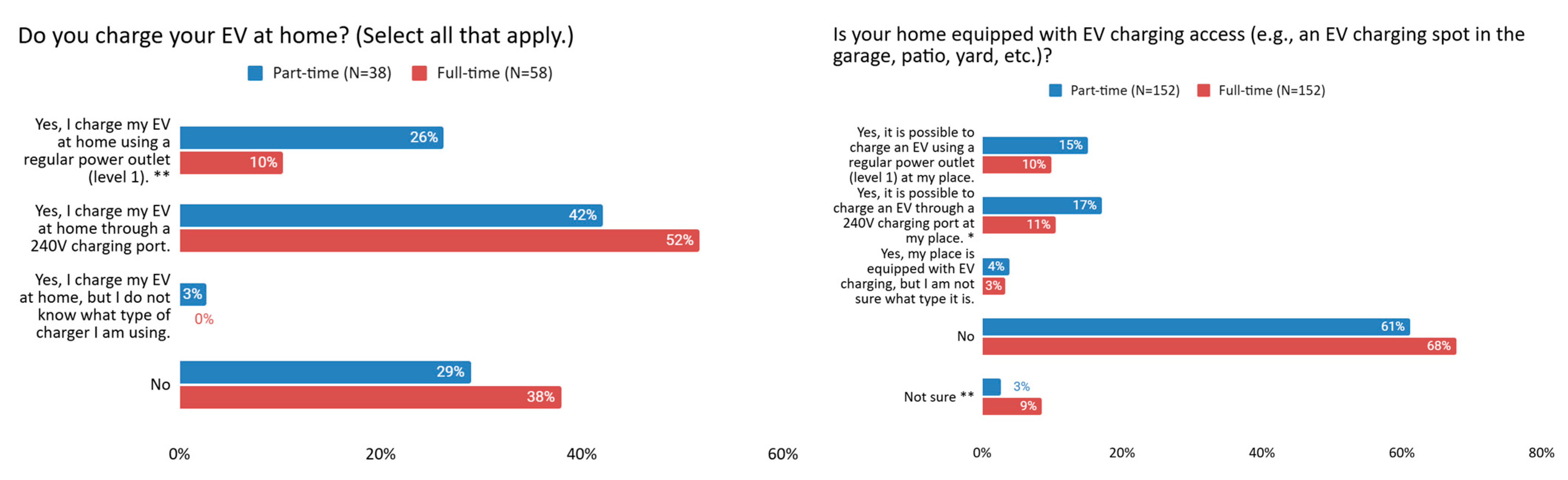

4.1.3. Driving Patterns, Mileage, and Charging Access

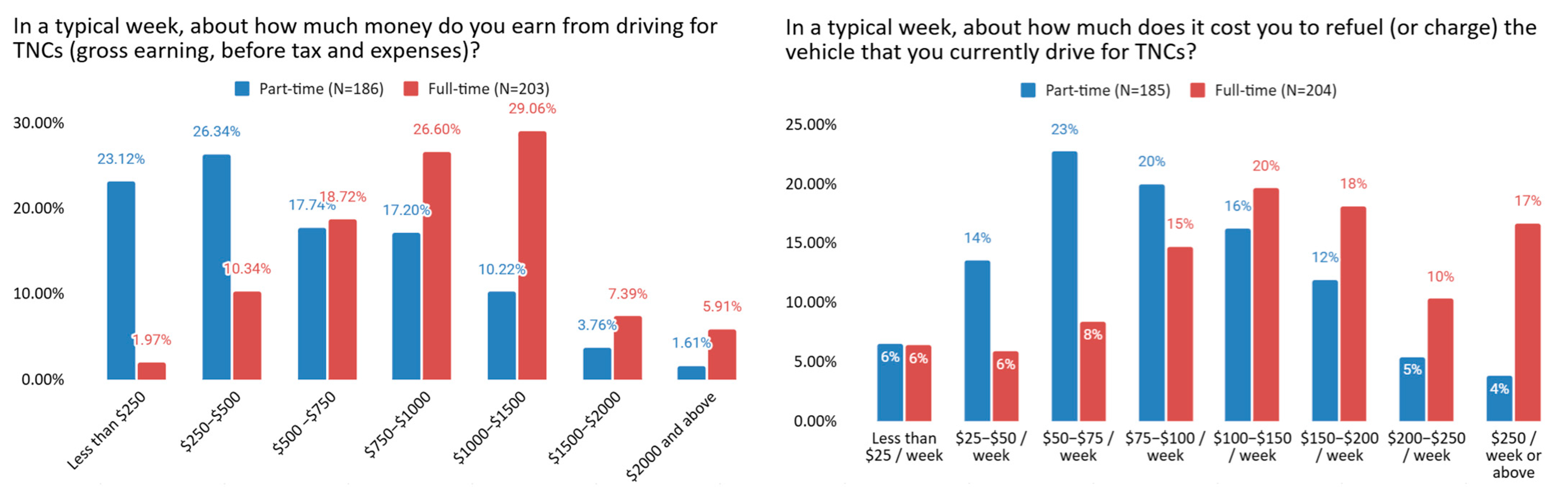

4.1.4. Earnings and Expenses

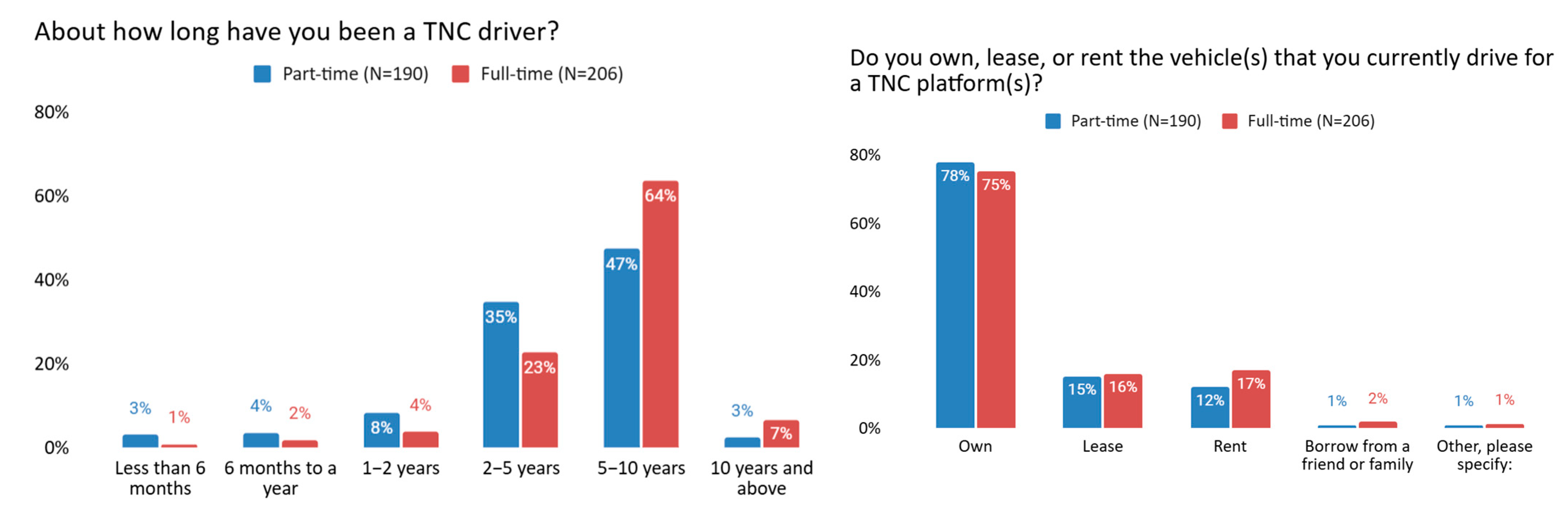

4.1.5. Driver Tenure and Vehicle Ownership

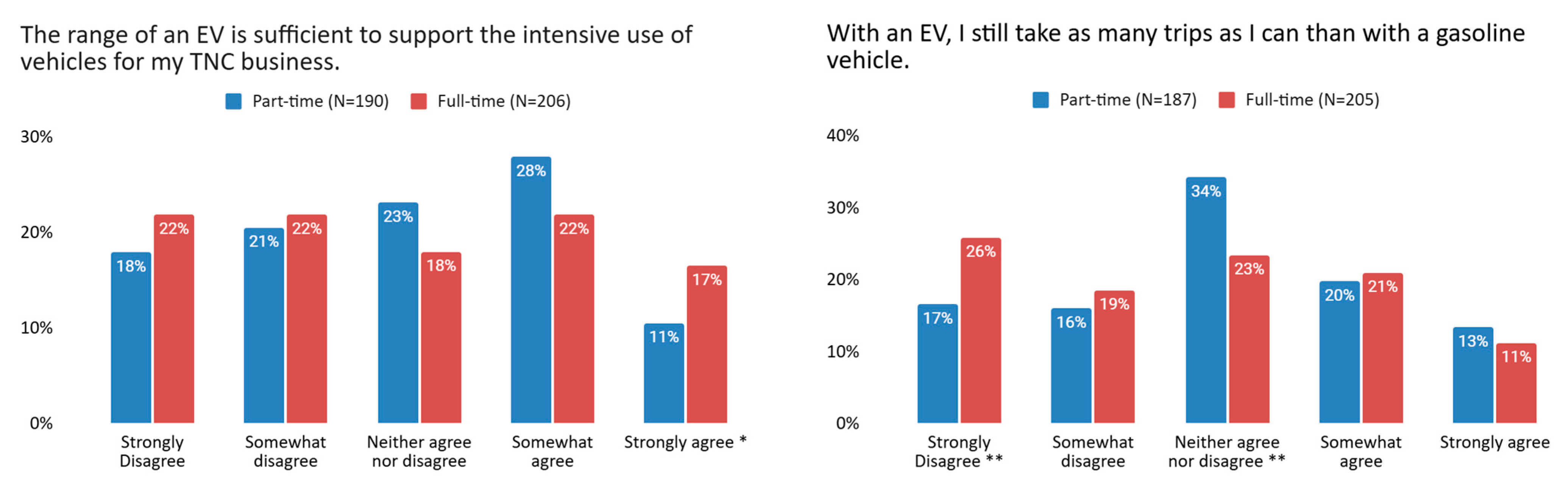

4.1.6. EV and EV Charging Perceptions

4.2. Baseline Choice Models (Model Set 1)

4.2.1. Baseline Applied to All Drivers

4.2.2. Comparison of Baseline Models: Full- vs. Part-Time Drivers

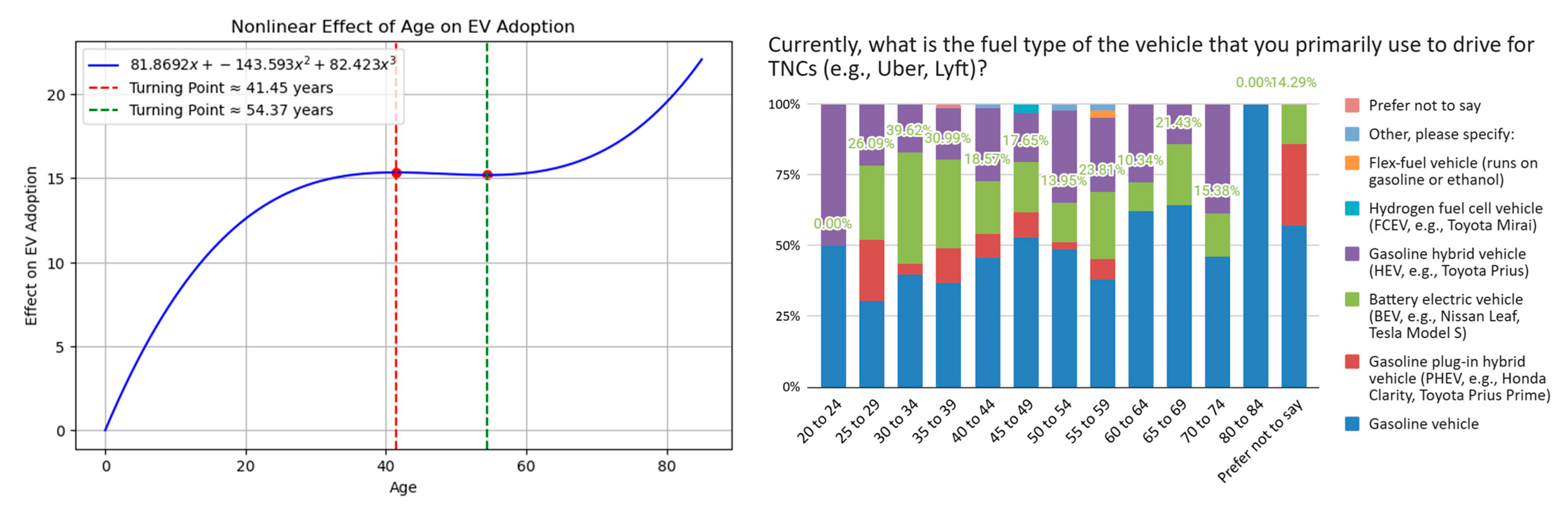

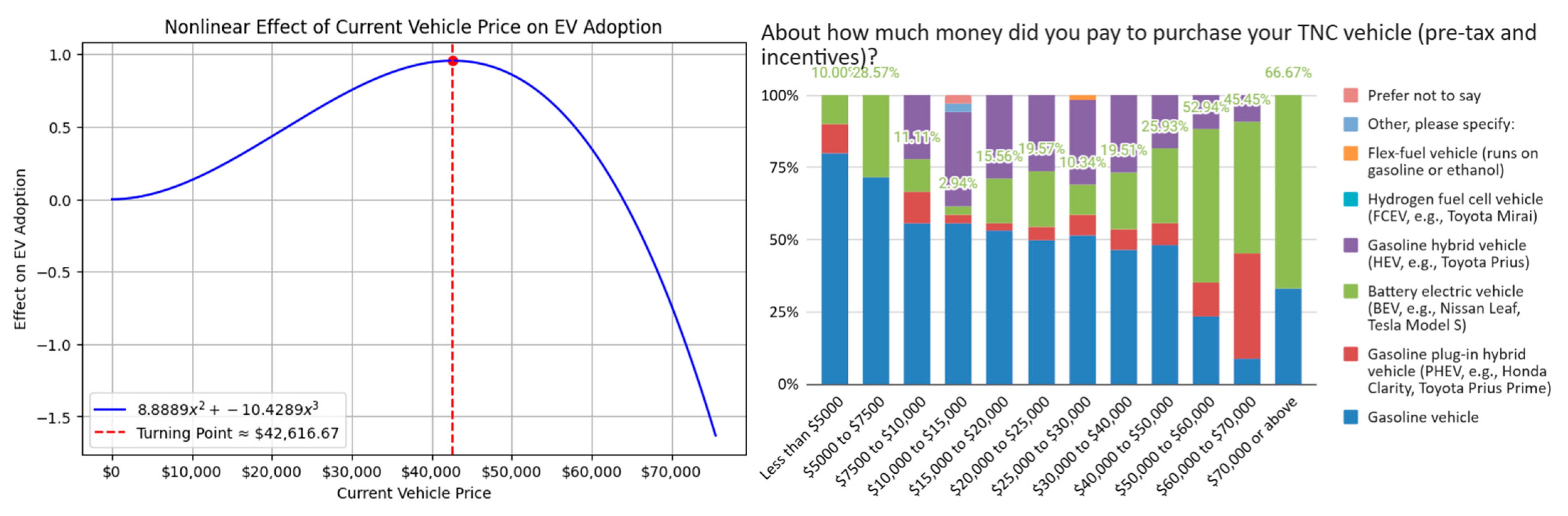

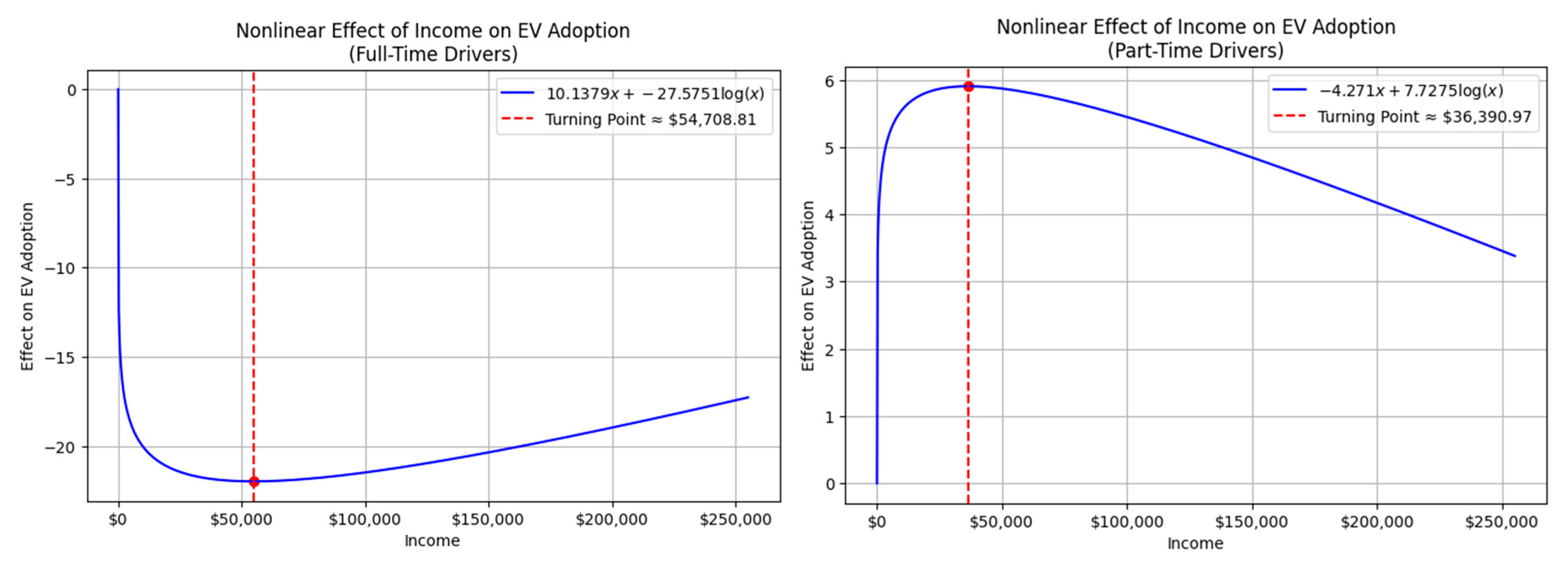

4.2.3. Discussion of Variable Nonlinearity

4.3. Policy-Adjusted Models (Model Set 2)

4.3.1. Vehicle-Related Incentives (Model Set 2-1)

4.3.2. Vehicle- and Charging-Related Incentives (Model Set 2-2)

4.3.3. Comparison of Model Set 2-1 and Model Set 2-2

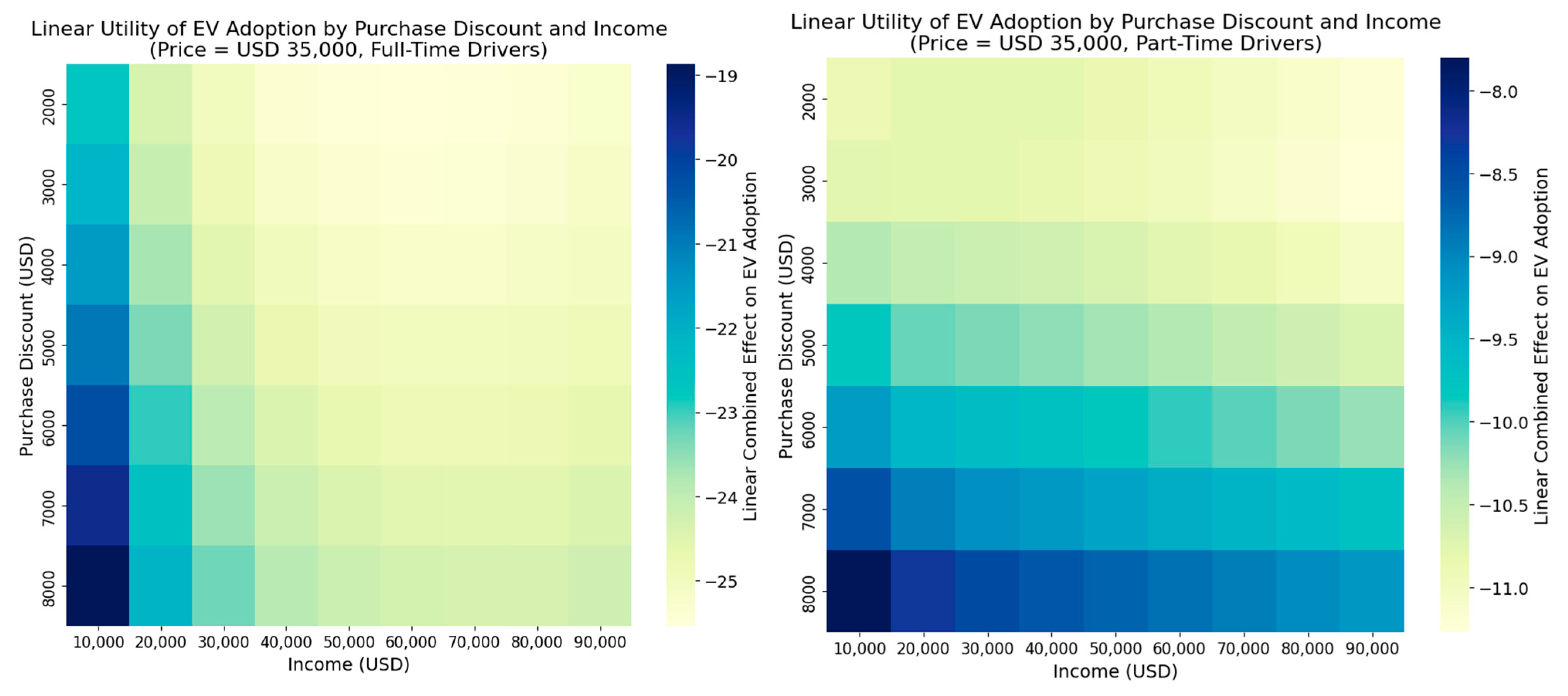

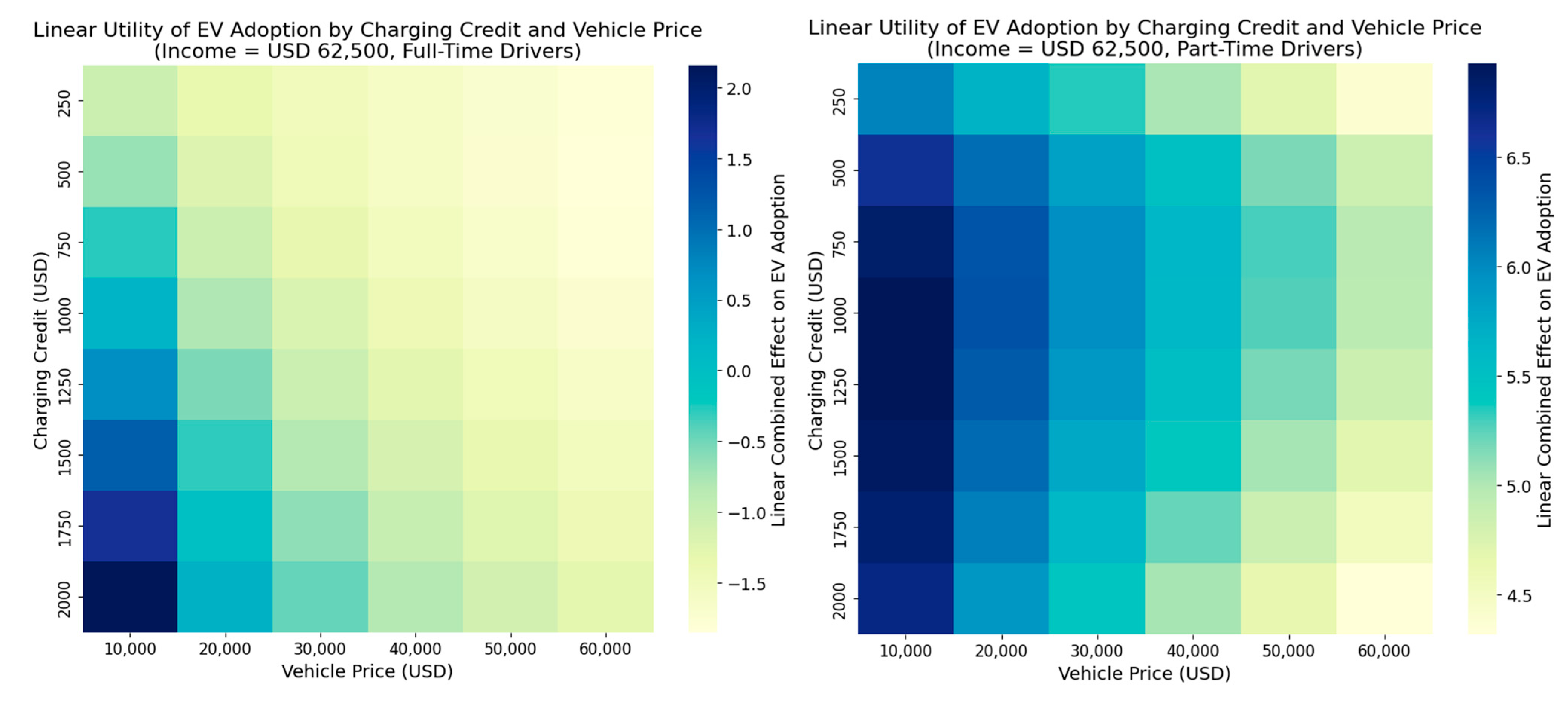

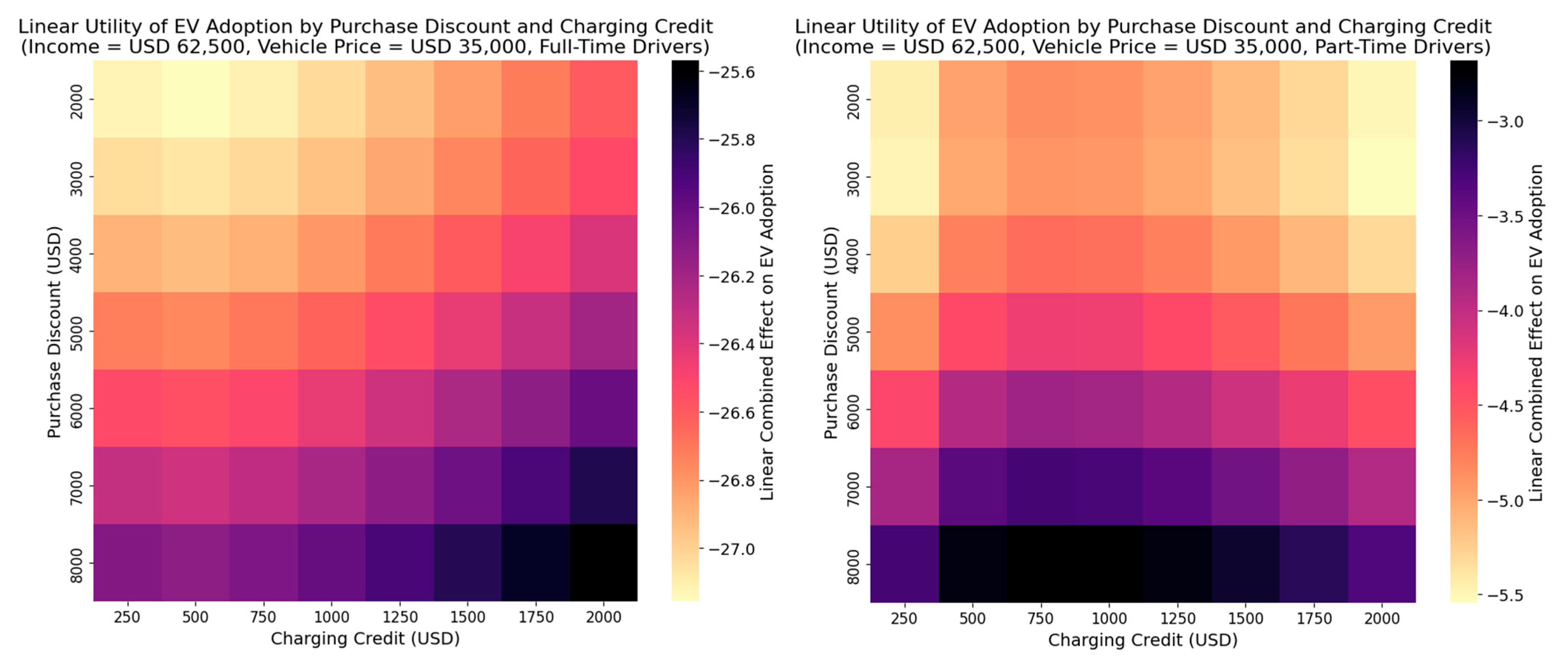

4.4. Policy Simulations and Implications

5. Conclusions

5.1. EV Adoption Predictors

5.2. Incentive Effects on EV Adoption

5.3. Quantitative and Qualitative Finding Divergence

5.4. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- San Francisco County Transportation Authority (SFCTA). TNCs & Congestion. 2018. Available online: https://www.sfcta.org/sites/default/files/2019-05/TNCs_Congestion_Report_181015_Finals.pdf (accessed on 1 May 2022).

- SB 1014; Bill Text—SB-1014 California Clean Miles Standard and Incentive Program: Zero-Emission Vehicles. California Legislature: Sacramento, CA, USA, 2018. Available online: https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180SB1014 (accessed on 1 May 2022).

- Latham and Watkins. 4 Things to Know About CARBs Clean Miles Standard. 24 November 2020. Available online: https://www.jdsupra.com/post/fileServer.aspx?fName=123e974d-4c43-4f46-9c83-d8e40a1c8ff3.pdf (accessed on 1 May 2022).

- California Air Resources Board, Clean Miles Standard. Available online: https://ww2.arb.ca.gov/our-work/programs/clean-miles-standard/about (accessed on 13 May 2025).

- Valdes, R. How Much Are Electric Cars? Kelley Blue Book. Available online: https://www.kbb.com/car-advice/how-much-electric-car-cost/ (accessed on 23 June 2025).

- Ju, M.; Martin, E.; Shaheen, S. Transitioning Ridehailing Fleets to Zero Emission: Economic Insights for Electric Vehicle Acquisition. World Electr. Veh. J. 2025, 16, 3. [Google Scholar] [CrossRef]

- City of Seattle. TNC Driver Outreach and Engagement—Final Report. 2020. Available online: https://durkan.seattle.gov/wp-content/uploads/sites/9/2020/08/Final-Outreach-Report.pdf (accessed on 1 May 2022).

- Benner, C.; Johansson, E.; Feng, K.; Witt, H. On-Demand and On-The-Edge: Ride-Hailing and Delivery Workers in San Francisco; UCSC Institute for Social Transformation: Santa Cruz, CA, USA, 4 May 2020; Available online: https://transform.ucsc.edu/on-demand-and-on-the-edge/ (accessed on 1 May 2022).

- Waheed, S.; Herrera, L.; Gonzalez-Vasquez, A.L.; Shadduck-Hernández, J.; Koonse, T.; Leynov, D. More Than a Gig: A Survey of Ride-hailing Drivers in Los Angeles. UCLA Labor Center: Los Angeles, CA, USA, 2018. Available online: https://escholarship.org/uc/item/4w6112md (accessed on 1 May 2022).

- Hunt, J.; McKearnan, S. Accelerating Ride-Hailing Electrification: Challenges, Benefits, and Options for State Action; Northeast States for Coordinated Air Use Management: Boston, MA, USA, 2020. [Google Scholar]

- Vassileva, I.; Campillo, J. Adoption Barriers for Electric Vehicles: Experiences from Early Adopters in Sweden. Energy 2017, 120, 632–641. [Google Scholar] [CrossRef]

- Hardman, S.; Fleming, K.L.; Khare, E.; Ramadan, M.M. A Perspective on Equity in the Transition to Electric Vehicles. MIT Sci. Policy Rev. 2021, 2, 46–54. [Google Scholar] [CrossRef]

- Reich, M.; Parrott, J.A. A Minimum Compensation Standard for Seattle TNC Drivers. 2020. Available online: https://escholarship.org/uc/item/1fw4q65g (accessed on 1 May 2022).

- Anderson, D.N. “Not Just a Taxi”? For-Profit Ridesharing, Driver Strategies, and VMT. Transportation 2014, 41, 1099–1117. [Google Scholar] [CrossRef]

- Uber. Uber Comfort Electric. Available online: https://www.uber.com/us/en/drive/services/comfort-electric/ (accessed on 8 April 2025).

- Uber. Uber Green—Sustainable Rides in Electric or Hybrid Vehicles on Uber. Available online: https://www.uber.com/ca/en/ride/ubergreen/ (accessed on 3 May 2025).

- CPUC. CARE/FERA Program. 2024. Available online: https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/electric-costs/care-fera-program (accessed on 1 May 2025).

- Choi, S.J.; Jiao, J.; Mendez, T. Who Owns Electric Vehicles (EVs)? The Relationship between EV Adoption and Socio-Demographic Characteristics across Different Price Segments and Brands in the Texas Triangle. Res. Transp. Bus. Manag. 2024, 57, 101225. [Google Scholar] [CrossRef]

- Hsu, C.-W.; Fingerman, K. Public Electric Vehicle Charger Access Disparities across Race and Income in California. Transp. Policy 2021, 100, 59–67. [Google Scholar] [CrossRef]

- Qiao, S.; Huang, G.; Yeh, A.G.-O. Who Are the Gig Workers? Evidence from Mapping the Residential Locations of Ride-Hailing Drivers by a Big Data Approach. Cities 2023, 132, 104112. [Google Scholar] [CrossRef]

- Jia, W.; Chen, T.D. Are Individuals’ Stated Preferences for Electric Vehicles (EVs) Consistent with Real-World EV Ownership Patterns? Transp. Res. Part D 2021, 93, 102728. [Google Scholar] [CrossRef]

- Kajanova, M.; Bracinik, P. Definition of Discrete Choice Models of EV Owners Based on Different Socio-Demographic Aspects. Appl. Sci. 2021, 11, 8. [Google Scholar] [CrossRef]

- Westin, K.; Jansson, J.; Nordlund, A. The Importance of Socio-Demographic Characteristics, Geographic Setting, and Attitudes for Adoption of Electric Vehicles in Sweden. Travel Behav. Soc. 2018, 13, 118–127. [Google Scholar] [CrossRef]

- Sanguinetti, A.; Kurani, K. Electrifying Ridehailing: Characteristics and Experiences of Transportation Network Company Drivers Who Adopted Electric Vehicles Ahead of the Curve; UC Office of the President: University of California Institute of Transportation Studies: Oakland, CA, USA, 2022; Available online: https://doi.org/10.7922/G2HM56RD (accessed on 9 June 2022).

- Zhang, Q.; Liu, Y. Promoting Electric Vehicle Adoption in Ride-Hailing Platforms: To Control or Subsidize? Comput. Ind. Eng. 2024, 191, 110146. [Google Scholar] [CrossRef]

- Rye, J.; Sintov, N.D. Predictors of Electric Vehicle Adoption Intent in Rideshare Drivers Relative to Commuters. Transp. Res. Part A 2024, 179, 103943. [Google Scholar] [CrossRef]

- Hao, X.; Wang, H.; Lin, Z.; Ouyang, M. Seasonal Effects on Electric Vehicle Energy Consumption and Driving Range: A Case Study on Personal, Taxi, and Ridesharing Vehicles. J. Clean. Prod. 2020, 249, 119403. [Google Scholar] [CrossRef]

- Tu, W.; Santi, P.; Zhao, T.; He, X.; Li, Q.; Dong, L.; Wallington, T.J.; Ratti, C. Acceptability, Energy Consumption, and Costs of Electric Vehicle for Ride-Hailing Drivers in Beijing. Appl. Energy 2019, 250, 147–160. [Google Scholar] [CrossRef]

- Shaheen, S.; Wolfe, B.; Cohen, A.; Broader, J. Challenges and Opportunities Facing App-Based Gig Drivers Extend Beyond Driver Pay. 2024. Available online: https://escholarship.org/uc/item/514205n7 (accessed on 1 May 2025).

- Shetty, A.; Li, S.; Tavafoghi, H.; Qin, J.; Poolla, K.; Varaiya, P. An Analysis of Labor Regulations for Transportation Network Companies. Econ. Transp. 2022, 32, 100284. [Google Scholar] [CrossRef]

- Zakir, T. Working for Uber: Full-Time Employment or Just a Side ‘Gig’? NYUJLB, 13 October 2022. Available online: https://www.nyujlb.org/single-post/working-for-uber-full-time-employment-or-just-a-side-gig (accessed on 1 May 2022).

- Parrott, J.A.; Reich, M. An Earnings Standard for New York City’s App-Based Drivers; The New School: Center for New York City Affairs: New York, NY, USA, 2018; Available online: https://www.centernyc.org/s/Parrott-Reich-NYC-App-Drivers-TLC-Jul-2018jul1.pdf (accessed on 16 October 2024).

- Ma, N.F.; Hanrahan, B.V. Part-Time Ride-Sharing: Recognizing the Context in Which Drivers Ride-Share and Its Impact on Platform Use. Proc. ACM Hum. Comput. Interact. 2019, 3, 1–17. [Google Scholar] [CrossRef]

- Campbell, H. Is Driving Uber/Lyft Full Time A Viable Option in 2024? LinkedIn. 12 May 2024. Available online: https://www.linkedin.com/pulse/driving-uberlyft-full-time-viable-option-2024-harry-campbell-ny9df/ (accessed on 17 October 2024).

- McFadden, D. Conditional Logit Analysis of Qualitative Choice Behavior; UC Berkeley: Berkeley, CA, USA, 1972; Available online: https://escholarship.org/content/qt61s3q2xr/qt61s3q2xr.pdf (accessed on 7 April 2025).

- Ben-Akiva, M.E.; Lerman, S.R. Discrete Choice Analysis: Theory and Application to Travel Demand; MIT Press: Cambridge, MA, USA, 1985; Available online: https://books.google.com/books?hl=en&lr=&id=oLC6ZYPs9UoC (accessed on 23 March 2025).

- Allison, P.D. Comparing Logit and Probit Coefficients Across Groups. Sociol. Methods Res. 1999, 28, 186–208. [Google Scholar] [CrossRef]

- SFCTA. TNCs 2020: A Profile of Ride-Hailing in California; San Francisco County Transportation Authority: San Francisco, CA, USA, 2023; Available online: https://www.sfcta.org/sites/default/files/2023-04/SFCTA_Board_TNCs%202020%20Report_2023-04-25.pdf (accessed on 23 March 2025).

| Model Set One (1) (Baseline) | Model Set Two (2) (Policy-Adjusted) | |||

|---|---|---|---|---|

| Model Set 2-1 | Model Set 2-2 | |||

| SP Questions Utilized | Q1, Q2 (No Incentive) | Q3, Q4 (Incentives Available) | ||

| Key Variables | Demographics | Age, Gender, Education, Income, Housing Type, etc. | ||

| Contextual Attributes | Time to Find the Closest Fast Charging Station Level 2 Charger Availability Closest Fast Charging Station from Home | |||

| EV Characteristics | New/Used Purchasing Cost, Leasing Cost, Rental Cost EV Range 0 to 80% Fast Charging Time 100-mile Fast Charging Cost | |||

| EV Incentives | -- | Purchase Discount Tax Credit | Purchase Discount Tax Credit Charging Credit Charging Discount EV Trip Bonus | |

| Study Sample | All Drivers Full-Time Drivers Part-Time Drivers | |||

| Original Choice Set | Original Selection Set | New Choice Set(s) | New Selection Set | |

|---|---|---|---|---|

| Vehicle 1 chosen | ||||

| Vehicle 2 chosen | ||||

| Neither chosen |

| Full Model | Reduced Model | |||

|---|---|---|---|---|

| Model Type | Standard Logit | Cross-Validated Lasso | Standard Logit | Cross-Validated Lasso |

| Number of Variables | 51 | 35 | ||

| Significant Variables | 19 | 34 | 22 | 34 |

| McFadden’s | 0.3093 | 0.3079 | 0.3055 | 0.3054 |

| Test Set Accuracy | 75.46% | 75.93% | 76.39% | 76.39% |

| Category | Variable | Coefficient |

|---|---|---|

| Constant | -- | −6.3469 *** |

| EV experience and charging access | Home charging availability | 1.5492 *** |

| EV history | 1.6593 *** | |

| Income and TNC income | TNC as main income source | 1.2404 *** |

| Income | 1.9092 *** | |

| Log income | −4.819 *** | |

| Housing conditions | Using EV and own home | 2.0217 *** |

| Housing value | −3.9073 *** | |

| Log housing value | 22.7081 *** | |

| Own home | −19.7481 *** | |

| Attached single-family home | −0.6513 *** | |

| Detached single-family home | −0.9107 *** | |

| Apartment building | 0.2544 *** | |

| Driving patterns | Weekly TNC hours | 5.2324 *** |

| Age times weekly TNC hours | −9.8606 *** | |

| Highly urban operation | −0.6405 *** | |

| Vehicle mileage | −0.8362 ** | |

| Vehicle mileage squared | 1.2227 *** | |

| Driver tenure squared | −1.4184 *** | |

| Age effects | Age | 82.0725 *** |

| Age squared | −143.9289 *** | |

| Age cubed | 82.6014 *** | |

| Vehicle costs, range, and fast charging time | Current vehicle price squared | 8.8913 *** |

| Current vehicle price cubed | −10.43 *** | |

| Purchase price | −1.1133 *** | |

| Leasing cost | −1.6054 *** | |

| Rental cost | −1.5825 *** | |

| EV range | 1.012 *** | |

| Fast charging time 0 to 80% | −0.967 *** | |

| Fast charging distance from home | 0.1808 * | |

| Driver socio-demographics | Asian | 0.9579 *** |

| Hispanic | 0.8169 *** | |

| White | 0.5933 *** | |

| Female | 0.3798 *** | |

| Married | 0.2601 *** |

| Full-Time Model (546 “Pseudo” Drivers) | Part-Time Model (533 “Pseudo” Drivers) | |

|---|---|---|

| Model Type | Cross-Validated Lasso ( ) | Cross-Validated Lasso () |

| Number of Variables | 35 | 35 |

| Significant Variables | 28 | 27 |

| McFadden’s | 0.3696 | 0.3701 |

| Test Set Accuracy | 78.81% | 79.59% |

| Category | Variable | Coefficient (Full-Time) | Coefficient (Part-Time) | Wald Diff |

|---|---|---|---|---|

| Constant | -- | 3.6933 | −10.2686 *** | 9.72 *** |

| EV experience and charging access | Home charging availability | 1.49 *** | 1.99 *** | 8.5 *** |

| EV history | 1.43 *** | 2.82 *** | 55.15 *** | |

| Income and TNC income | TNC as main income source | 0.95 *** | 1.69 *** | 15.53 *** |

| Income | 10.14 *** | −4.27 *** | 233.33 *** | |

| Log income | −27.57 *** | 7.73 *** | 150 *** | |

| Housing conditions | Using EV and own home | 2.45 *** | 2.23 *** | 0.4 |

| Housing value | −4.3576 ** | −2.1001 | 0.85 | |

| Log housing value | 3.059 | 28.0854 *** | 3.13 * | |

| Own home | −0.84 | −25.76 ** | 4.15 ** | |

| Attached single-family home | −0.29 | −1.33 *** | 16.06 *** | |

| Detached single-family home | −1.07 *** | −1.06 *** | 0 | |

| Apartment building | 0.3246 ** | 0.0241 | 2.19 | |

| Driving intensity | Weekly TNC hours | 4.02 ** | −1.13 | 5.97 ** |

| Highly urban operation | −0.2574 ** | −1.0998 *** | 26.14 *** | |

| Age times weekly TNC hours | −7.79 *** | −0.96 | 3.65 * | |

| Vehicle mileage | −1.6438 *** | −0.914 | 0.89 | |

| Vehicle mileage squared | 2.0307 *** | 1.2326 ** | 0.86 | |

| Driver tenure squared | −0.3194 | −2.3404 *** | 27.47 *** | |

| Age effects | Age | 68.39 *** | 90.22 *** | 1.26 |

| Age squared | −118.94 *** | −172.39 *** | 2.72 * | |

| Age cubed | 65.37 *** | 103.64 *** | 4.65 ** | |

| Vehicle costs and range | Current vehicle price squared | 5.5621 *** | 10.1301 *** | 4.64 ** |

| Current vehicle price cubed | −8.0805 *** | −10.3091 *** | 0.88 | |

| Purchase price | −0.53 | −2.03 *** | 7.51 *** | |

| Leasing cost | −1.79 *** | −1.97 *** | 0.12 | |

| Rental cost | −1.4 *** | −2.12 *** | 1.88 | |

| EV range | 1.57 *** | 0.78 ** | 2.78 * | |

| Fast charging time (0 to 80%) | −1.10 *** | −1.09 *** | 0.00 | |

| Fast charging distance from home | 0.1014 | 0.1276 | 0.02 | |

| Driver socio-demographics | Asian | 1.07 *** | 0.92 *** | 0.36 |

| Hispanic | 0.44 *** | 1.71 *** | 29.58 *** | |

| White | 0.75 *** | 0.46 *** | 2.21 | |

| Female | 0.90 *** | −0.07 | 20.72 *** | |

| Married | 0.46 *** | 0.15 | 3.21 * |

| Variable | Coefficient (All Drivers) | Coefficient (Full-Time) | Coefficient (Part-Time) | |

|---|---|---|---|---|

| Model performance metrics | Model type | Cross-validated Lasso () | Cross-validated Lasso () | Cross-validated Lasso () |

| Number of observations | 837/1047 | 425/536 | 412/511 | |

| Significant variables | 37 out of 63 | 43 out of 63 | 35 out of 63 | |

| McFadden’s | 0.3291 | 0.5073 | 0.4716 | |

| Test set accuracy | 73.33% | 75.68% | 71.72% | |

| Purchase discounts | Purchase discount | 3.2747 | −3.1563 | 0 |

| Income-based instant rebate | 1.2727 | 11.7468 *** | 0.3998 | |

| Price-based instant rebate | −0.1144 | 2.1946 *** | −2.1353 *** | |

| Purchase discount squared | 0.0779 | 2.5303 | 3.2921 * | |

| Log purchase discount | −7.5589 ** | 0 | −6.6354 | |

| High purchase discount | −0.9762 *** | −0.5215 ** | −1.0006 *** | |

| Tax credits | Tax credit | −2.5541 | −3.7501 | 0 |

| Income-based tax credit | −1.5854 * | −5.0081 ** | −6.6339 *** | |

| Price-based tax credit | 3.2568 *** | 3.7386 *** | 1.334 | |

| Tax credit squared | 2.5657 * | 3.7159 ** | 4.6275 ** | |

| Log tax credit | 0.1722 | −0.3306 | 0.4794 | |

| High tax credit | −0.9289 *** | −0.1071 | −2.9294 *** |

| Variable | Coefficient (All Drivers) | Coefficient (Full-Time) | Coefficient (Part-Time) | |

|---|---|---|---|---|

| Model performance metrics | Model type | Cross-validated Lasso | Cross-validated Lasso | Cross-validated Lasso |

| Number of observations | 837/1047 | 425/536 | 412/511 | |

| Significant variables | 37 out of 61 | 47 out of 61 | 43 out of 61 | |

| McFadden’s | 0.3277 | 0.5056 | 0.4885 | |

| Test set accuracy | 73.33% | 77.48% | 70.71% | |

| Purchase discounts | Purchase discount | 3.2125 *** | 1.3423 * | 7.0379 *** |

| Income-based instant rebate | 1.5433 * | 8.3958 *** | 3.0699 *** | |

| Price-based instant rebate | 0.4097 | 1.5546 ** | −0.7149 | |

| Log purchase discount | −7.8016 *** | −4.6556 ** | −20.6165 *** | |

| High purchase discount | −0.8937 *** | −0.5094 ** | −1.1176 *** | |

| Tax credits | Income-based tax credit | −0.8459 | −1.137 | −3.4044 *** |

| Charging incentives | Charging credit | −1.14 *** | 0.6258 | −3.0813 *** |

| Fuel cost offset | 0.2425 | −0.3294 | 1.8793 *** | |

| Price-based charging credit | 1.3121 *** | 2.3798 *** | 0.6442 | |

| Log charging credit | 2.8424 *** | −2.1537 * | 9.5909 *** |

| Model Set | McFadden’s | Test Accuracy | McFadden’s Improvement | Test Accuracy Improvement | |

|---|---|---|---|---|---|

| All Drivers | Set 2-1 | 0.3291 | 73.33% | −0.0014 | 0 |

| Set 2-2 | 0.3277 | 73.33% | |||

| Full-Time | Set 2-1 | 0.5073 | 75.68% | −0.0016 | 0.018 |

| Set 2-2 | 0.5057 | 77.48% | |||

| Part-Time | Set 2-1 | 0.4716 | 70.71% | 0.0169 | 0.0303 |

| Set 2-2 | 0.4885 | 73.74% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ju, M.; Martin, E.; Shaheen, S. Charging Ahead: Perceptions and Adoption of Electric Vehicles Among Full- and Part-Time Ridehailing Drivers in California. World Electr. Veh. J. 2025, 16, 368. https://doi.org/10.3390/wevj16070368

Ju M, Martin E, Shaheen S. Charging Ahead: Perceptions and Adoption of Electric Vehicles Among Full- and Part-Time Ridehailing Drivers in California. World Electric Vehicle Journal. 2025; 16(7):368. https://doi.org/10.3390/wevj16070368

Chicago/Turabian StyleJu, Mengying, Elliot Martin, and Susan Shaheen. 2025. "Charging Ahead: Perceptions and Adoption of Electric Vehicles Among Full- and Part-Time Ridehailing Drivers in California" World Electric Vehicle Journal 16, no. 7: 368. https://doi.org/10.3390/wevj16070368

APA StyleJu, M., Martin, E., & Shaheen, S. (2025). Charging Ahead: Perceptions and Adoption of Electric Vehicles Among Full- and Part-Time Ridehailing Drivers in California. World Electric Vehicle Journal, 16(7), 368. https://doi.org/10.3390/wevj16070368