Abstract

China’s leading development of a complete battery value chain for electric vehicles (EVs) is restructuring the global automotive sector. In contrast with the normal point of view, which emphasizes the role of industrial policy, this article argues that the competitive advantage of China’s EV battery industry lies in firms’ core competency and political economic geography. Based on first-hand empirical material and data obtained from years of fieldwork carried out at an EV battery cluster in south China, this paper identifies the Chinese EV battery industry’s core competency and details how it is built up from below. The current core competency of Chinese battery firms is their mass manufacturing capability, which allows them to supply vehicle manufacturers (OEMs) with lithium-ion batteries of stable and consistent quality at competitive prices. This competency is acquired by firms through technological learning at the workshop level while making use of the experiences they have accumulated while mass producing batteries for consumer electronics sectors. Furthermore, the rapid learning and accumulation of knowledge of battery manufacturing on a large scale is also facilitated by the local industrial cluster environment where firms are embedded. Supported and promoted by local government policies, Chinese EV battery clusters are composed of firms from different segments of a complete battery value chain. The findings have significant implications for battery and car makers in global competition as well as for national and local governments which aim to promote EV battery development.

1. Introduction

The automobile industry is experiencing historic disruptions to the digitalization of products and services, electrification of the powertrain, and transformation of the whole value chain structure [1]. Electrification has reduced the number of components from 1400 for an internal combustion engine powertrain to 200 for a battery electric vehicle powertrain, making batteries and related components key parts of electric vehicles (EVs), and battery firms play key roles in reshaping the automobile industry. The electric powertrain occupies 30–45% of the cost of manufacturing a car, and a power battery occupies 75–80% of the powertrain cost, thus having the highest value added in an electric vehicle [2]. EV battery making is so important in automobile electrification that it is predicted that those who conquer the battery will control the electric vehicle market [3].

In the EV battery sector, China is now the global leading market, the major producer, and a key innovator [4]. In 2020, the number of EV batteries installed in China reached about 63 GWh (gigawatt hours), comprising 46.8% of worldwide installation (63/134.5 GWh). In 2021, China was responsible for 74% (465/631 GWH) of the global EV battery production capacity, which increased by 84% from its level in 2019 [5]. China will continue to be the largest EV battery producer over the next 10 years. Although the rapid expansion of the EV battery sector, along with massive speculative investment globally and in China, is propelling an overcapacity in battery production with the demand for batteries ramping up by 30% in year-over-year growth around the world and reaching 3900 GWh in 2030, additional capacities are still needed from 2023 onward [6]. Relying on increased scale economies and technological advancements, Chinese firms have become cost leaders in global competition. In 2019, the average battery pack price in China reached USD 147/kWh, which was the lowest battery pack price in the world. In 2021, China brought the global average battery pack price down to USD 132/kWh despite the rising prices of materials and cell components.

China’s competitive advantage when it comes to EV batteries is more qualitative than is shown by quantitative indicators [4]. China took advantage of the disruptive transformation of the automobile industry toward digitalization and electrification and gained the leading position by acting as the first mover in EV battery making. This first mover advantage is illustrated by Chinese battery firms’ accumulated experience in mass manufacturing of EV batteries and the steep learning curve effect. China is the first country to create a complete EV battery value chain from upstream materials production to the midstream manufacturing of cells, modules, battery management systems (BMSs), and packaging, as well as downstream applications in mobility and various other fields, such as grid storage, lighting, solar energy, and movable storage, thus forming a vertically specialized new sector of energy storage. (Energy storage applications will play crucial roles in the coming decades. Examples of technology application include lithium-ion battery thermal management via advanced cooling parameters and enhancing vanadium redox flow battery performance using reduced graphene oxide nanofluid electrolyte.) Within the automotive sector, Chinese battery producers are becoming important players as providers of core components, branching out into other battery technologies such as fuel cells [7]. Furthermore, China tightly controls “upstream” activities such as the mining and refining of rare metal material with large state-owned firms, and it is quickly developing “downstream” activities such as battery recharging and recycling sectors, reinforcing its leading role in global supply chains. Global automobile supply chain development, therefore, is no longer a top–down process controlled by the leading global brand-name OEMs (original equipment manufacturers) in industrialized countries, but it is multidimensional in the sense that distributed centers of innovation and industrial players control different segments. As the first country in the world to create a complete EV battery supply chain and a distinctive energy storage sector thanks to the emergence of the EV market, China has gained a whole value chain advantage in global competition.

This competitive advantage of China’s battery sector can be attributed to a variety of factors such as the national industrial policy, the Chinese market size, the existing legislation regarding EVs, the existence of vast natural resources [3], and, in particular, firms’ specific strategy of “specialized vertical integration” [8]. Major firms expand and integrate their activities into different stages of the production system, but vertical integration remains within the battery value chain and around the specialized field of battery or electricity storage. This vertical integration enables related Chinese firms to grow quickly and maintain leading positions in production technology based on long-term strategic investment [3]. However, due to the difficulty of accessing the empirical field, little detail is known about the underlying base of the verticalization strategy of Chinese battery firms as well as the origins of the competitive advantage of the Chinese battery sector [9]. According to strategic management theories, core competency is the very basic foundation of the competitiveness of firms [10,11].

Based on the competency perspective and primary firm-level evidence collected from a case study of a Chinese EV battery cluster, this paper aims to demonstrate the deep roots of the verticalization strategy and the competitive advantage of Chinese battery firms by examining their core competency and describing how it has been built up from the bottom of the value chain. We argue that the nature of the core competency of Chinese EV battery firms is by far their mass manufacturing capacity of LFP (lithium-iron phosphate)-dominated EV battery cells, modules, and packs including battery management systems (BMSs) with a good quality/price ratio, which is accompanied by the ability to quickly ramp up and scale up production through aggressive fixed assets investment. Although local government support is important, this core competency is essentially built up from the bottom by Chinese firms within regional battery clusters. We identify two original mechanisms that determine jointly the formation of such a core competency.

One mechanism, external to firms, is the clustering of EV battery manufacturing activities at the regional level with strong local government policy support across China. Detailed analysis of the EV battery industry in Huizhou shows that an industrial cluster at the regional level is characterized by a quite complete value chain within it with a small number of small and medium-sized firms who establish user–supplier linkages. Therefore, an industrial cluster constitutes a “thick” ecosystem for manufacturing firms which can find easily accessible specialized resources and capabilities, such as skills, funding, precompetitive R&D, suppliers, facilities, and industry knowledge in close proximity [12]. A specialized EV battery cluster creates a favorable microenvironment where local firms can draw on these capabilities and combine them with their own internal resources to learn manufacturing technologies thanks to their interaction with other upstream or downstream firms in the same value chain.

The other mechanism, internal to firms, is the technological learning of the mass production of EV batteries at the shop-floor level. The learning curve effect in EV battery production represents an 18% cost reduction for every doubling of battery production capacity [5]. Through mass production and rapid investment in most advanced equipment, Chinese local battery firms adopt very down-to-earth approaches of learning by doing, by using, and by interacting among suppliers, approaches which meet the intrinsic requirement of mastering collectively matured lithium-ion EV battery technologies. Therefore, China’s EV battery manufacturing has become a complex system using production and assembly lines to achieve a combination of advanced equipment, cell designs, production engineering plans, production procedures and organizations, and workers’ skills and know-how. Chinese battery makers have accumulated significant experience, leading to the decline of prices based on the total volume of battery packs deployed on the market. With these production capabilities in place, they also have the potential to accelerate the rate of cell design improvement and reduce costs.

The remainder of the paper is organized as follows. Following this introduction, Section 2 gives a geographic overview of the industrial clustering of EV battery manufacturing in China, taking into account national and local policies for the battery sector. It introduces the Huizhou battery cluster as a specific case and explains our research methodology. Section 3 identifies the nature of the core competency of local battery manufacturing firms, using the examples of firms in the Huizhou cluster to demonstrate the internal process of practical learning regarding battery production technology. Section 4 discusses some broader implications of the core competency of Chinese battery firms, including the way that core competency constitutes the strategic base of the specialization and verticalization of Chinese battery firms along the value chain, and implications for the EV industry structure, government policies, and automobile OEMs. Section 5 concludes our findings and argument.

2. Chinese EV Battery Clusters as Local Manufacturing Ecosystems

Although the car industry as a whole is not a strategic sector under “Made in China 2025”, electric vehicles (called New Energy Vehicles or NEVs in Chinese policy terms) is selected as one of the ten strategic emerging industries of this program and received massive support from the state. The Chinese government hopes that electric vehicles will help the country transform from a follower to a technological leader in the automobile sector, reduce China’s dependence on imported oil, and improve the country’s overall environment quality. In addition to promoting massive EV market demand, the state made an effort to generate a sufficient supply of EVs, batteries, and other key components for the EV batteries to be regarded as an important industry in the 2020s and beyond. From 2016 to 2018, the central government published the famous “whitelist” of battery producers, which were all Chinese firms, an industrial policy which was established to subsidize only the EVs powered by batteries made by domestic producers. In general, the EV policy of China targeted the supply of raw materials by Chinese mining companies, the production of batteries by Chinese battery makers, and the local production of EVs using Chinese batteries [3]. In 2017, China’s central government published its first national plan for the battery industry, setting the goal of becoming a “technologically independent storage superpower”. It also contains policies aimed at increasing domestic demand for grid-scale storage as part of the energy sector development [13].

2.1. Emerging EV Battery Clusters in China: From National to Local Policies

The national strategy of developing the battery sector as a strategic emerging industry was quickly disseminated and implemented at the provincial, city, township, and district levels. Local governments in China have stronger incentives to support production than consumption, and they generally seek to cultivate large-scale, leap-frogging local champions in order to become suppliers for brand-name car OEM producers [14]. Almost all the provinces have targeted the EV industry as a part of their development strategy. And since it is difficult to obtain OEM projects, most of them have turned to pushing battery production and supply in selected regions or areas. The local implementation of the national EV industry development strategy has resulted in the massive emergence of EV battery manufacturing clusters at the regional level across the whole country, resulting in domestic redundancy and fierce competition. According to Bloomberg New Energy Finance, in 2017, China had 235 firms producing batteries, and 8 out of the 13 major battery manufacturing sites worldwide were in China. In 2018, the “Catalog of Recommended Models for the Promotion and Application of New Energy Vehicles” issued by the Ministry of Industry and Information Technology (from the 5th batch in 2018 to the 11th batch in 2018) listed more than 190 power battery firms. Their geographical distribution is concentrated in the eastern and southern coastal regions, including 112 in East China (59%), 29 in South China (13.7%), 23 in Central China (12%), 13 in North China (6.8%), 9 in Southwest China, 5 in the Northwest and 5 in the Northeast regions. Raw materials mining and extracting are concentrated in the western regions, where cell materials and components are more widely located than mining operations, and many are located near cell and pack production (Table 1).

Table 1.

Geographic distribution of EV battery manufacturing in China.

2.1.1. Policy for Industrial Clustering

The local policy for battery cluster production is normally included in the local governments’ overall strategic planning for the EV industry with clearly defined plans for industrial clusters and financially detailed local support schemes by geographic zone. For example, “Zhejiang Automotive Industry High-quality Development Action Plan (2019–2022)” proposes to make Zhejiang a world-class automotive industry cluster by 2022. Zhejiang will focus on the construction of four major automobile industry clusters, relying on development zones (parks), high-tech parks, and carefully selected towns that already have the necessary foundations, and promote the transformation and upgrading of internal combustion engine (ICE) vehicles and key components to smart vehicles and EVs. Zhejiang supports the establishment of an automobile industry fund, focusing on the R&D underpinning the production, promotion and distribution of smart cars and new energy vehicles, and encourages financial institutions to provide credit, guarantees and other support for EV projects. Fujian Province’s “Modern Industrial System Construction and 100 Billion-Yuan-Level Industrial Clusters Promotion Plan” (2018–2020) prioritized 27 industrial development clusters such as those which specialized in EV batteries and new materials such as rare earth and graphene, as well as high-end equipment industry clusters, automobile industry clusters, and new chemical materials industry clusters. Among them, the cluster construction plan for EV power batteries, rare earth, and the graphene-based new material industry called for five battery industrial parks and two graphene industrial parks. Guangdong Province’s “Opinions on Accelerating the Innovation and Development of New Energy Automobile Industry” (2020) is set to promote the development of the industrial agglomeration of EV industrial clusters. Taking the Pearl River Delta for becoming the world leading base of complete EVs, the policy aims to guide large-scale clustering of the production of key parts and components. During 2018 and 2020, facing a decline of more than 50% of national subsidies on EV purchases, the Guangdong government subsidized the interest on loans of local EV firms—up to CNY 100 million per firm—which produced and sold in the province but had not yet received national purchase subsidies. The government also supported EV firms by issuing special corporate bonds and green bonds. In addition to using the provincial industrial development fund, the Guangdong government also leveraged private and financial capital to support local EV firms.

Chinese local governments have fully mastered the concept of the “EV battery industry chain”. They often identify all the stages from upstream material and components to downstream applications along the battery value chain and decide on which segment to develop as a priority before committing to solicit investment projects along the whole value chain. The approach is called “industry chain investment” in Chinese policy terms, meaning attracting firms to invest in the production of main battery products in addition to supporting raw materials, auxiliary materials, parts, and packaging products in order to construct a whole industry in one region. For example, in terms of developing complete EVs, Zhejiang Province encourages OEMs to guide their suppliers to upgrade from ICE to EV models and encourages pure EV firms to integrate electrification and digitalization to make high-end vehicle products. Digitalization means uniting advanced technologies and automotive engineering to boost the development of intelligent data-driven solutions and connected systems with improved operational efficiencies. Regarding the development of the battery industry, Zhejiang supports developing technologies in fuel cell stacks, engines, and system integration. It supports firms by accelerating the development of fuel cell vehicles and hydrogen refueling stations. In order to promote the application of relevant technologies to fuel cell vehicles, it plans to establish demonstration operations in urban public transport, logistics and transportation. Zhejiang also encourages the adoption of a recycling and reuse service system of the nickel–metal hydride battery, lithium-ion battery, and fuel cell battery within battery clusters.

Similarly, Guangdong plans to build new EV clusters in its eastern, western, and coastal areas while expanding the production scale of EV batteries and key materials in the Pearl River Delta. In 2018, Jiangmen, a prefectural level city in the Pearl River Delta, successfully attracted twelve projects with a CNY 12 billion investment, covering cathode materials, anode materials, electrode materials, separators, equipment, energy storage batteries and other fields. With a big investment in nickel–hydrogen battery cathode materials (spherical nickel hydroxide) for hybrid electric vehicles in particular, Jiangmen is becoming the province’s main production base for EV battery raw materials. The “industrial chain investment” approach results in the emergence of local battery clusters with longer or shorter value chains but always covering the main stages of the EV battery process. The small and medium-sized Chinese battery firms in a cluster thus constitute relatively complete supply chains for OEMs, giving China localized advantages in EV battery materials, components, cells, packs, drive control and electrical systems, and even mechanical components. Furthermore, local governments emphasize “matching and connecting” battery supply firms within and beyond clusters with OMEs as clients of the supply chains. Zhejiang has established an incentive scheme to coordinate OEM and battery suppliers with the aim of enhancing core component suppliers’ skills. At the provincial level, Guangdong organizes one or two so-called “matchmaking meetings” for the new energy automobile industry every year to actively guide OEMs to cooperate with key parts and materials suppliers to promote the upstream and downstream integration of the EV value chain. The policy of “industrial chain investment” and “matchmaking meetings” generates multiplier effects and enhances the comprehensive competitiveness of products, firms, and industries in the entire region.

2.1.2. Policy for Technology and Innovation

Another emphasis of the Chinese local cluster policy is on technology development and innovation. Local governments mainly use a policy approach to building “science and technology innovation platforms” such as public R&D centers, research institutes, technology alliances, and other forms of intermediary hybrid organizations to reach this goal [15]. For example, Zhejiang Province, like many EV clusters in China, focuses on developing pure electric and hydrogen fuel cell EVs. It identifies ten key technologies in the fields of long-life battery packs, fuel cell power systems, and their integration into the whole vehicle. The targeted technologies include high-reliability membranes, catalysts and bipolar plates, hydrogen supply systems and key components, the integration and optimization of the fuel cell system in the whole car, high-pressure hydrogen storage products and production technologies, etc. To develop these technologies but also other technologies related to energy-saving devices, solid-state batteries, electric engines, electric control, and autonomous driving, Zhejiang Province has built up a number of innovation platforms, including national and local joint engineering centers, national and provincial enterprise technology centers, engineering laboratories (engineering research centers), provincial (key) enterprise research institutes, innovation service complexes, and other related research and development organizations. The province has also built some testing and standard service institutions to strengthen expertise in standards research, basic databases, complete vehicle and safety systems for pure and hydrogen fuel cell EVs. A platform for professional talent incubation has also been organized. Guangdong Province has compiled technological roadmaps for pure electric vehicles, hydrogen fuel cell vehicles, and intelligent connected vehicles. The province has also set up major technological research and development programs. From 2018 to 2020, CNY 300 million was allocated to R&D projects for key EV components such as electric motors, electronic controls and smart terminals, fuel cell systems and core components, battery electrolytes, anode and cathode materials, and other materials. Implementation policy measures have established three to four innovation platforms of EV and key components each year. Financially, using its provincial industrial innovation platform funds, Guangdong subsidized the newly recognized national and provincial innovation platforms for launching. The province also coordinates OEMs, universities, scientific research institutes, and key component firms to form several industrial alliances for joint technology development in the fields of EV manufacturing, key component production, intelligent systems, and charging and replacement facilities.

At the battery cluster level, the widely adopted policy approach by Chinese local governments is called the “five-one program”, meaning that each cluster shall construct one R&D institute, one testing and quality facility, one engineering center, one professional training center, and one venture capital fund. When more and more related and supportive firms join in to be closer to battery makers, the Chinese battery clusters progressively mature into “thick” battery manufacturing ecosystems [16,17]. With this government policy of constructing innovation platforms, the Chinese battery clusters benefit from abundant institutions, information, resources, and capabilities which are very accessible and supportive to local firms. Therefore, in fact, battery clusters become small-scaled sectoral innovation systems which provide a local environment favorable to technological learning in cell design as well as in the improvement of the production process [18], as these two dimensions are often intertwined. The reason that industrial clusters are important to mastering the technology of battery manufacturing is firstly because in reality, battery makers producing cells and packs provide their clients, the OEMs, with technical solutions. Connected to the raw material suppliers and cell component suppliers, battery makers integrate hardware parts and software battery management systems to provide OEMs with pack products and service. The working voltage of an EV battery is 12 V or 24 V, but the working voltage of a single lithium-ion cell is 3.7 V, so multiple cell units are connected in series to increase the voltage. However, it is difficult for the whole battery to have uniformly complete charging and discharging. If the quality of the single cells in multiple battery cell units and modules connected in series is affected by problems of uniformity and homogeneity, they become unbalanced during charge and discharge, and the whole battery pack will experience undercharge and over-discharge during usage. This situation will lead to the drastic deterioration of battery performance, which eventually causes the entire battery module to fail to work normally or to even have to be scrapped. Therefore, to solve the problem of battery durability and reliability, the technical issues of materials, battery management systems, and mechanical processing are considered at the same time. It is often necessary for upstream firms that produce materials, management systems and other components to work together with midstream firms producing cell, module, and battery packs, forming an industrial cluster that is more conducive to technological progress and overall cost reduction. Within an industrial cluster, battery producers can easily contact lead users and obtain network support in terms of production capacity and site assistance. Clusters create a kind of collective efficiency in stabilizing and homogenizing the quality of single cells integrated into cell units, modules, and packs, thus improving the quality of finished battery products for OEMs.

2.1.3. Policy for Geographic Expansion

Chinese industrial clusters have become the bedrocks of creation, growth, and market competitiveness of battery producers. Organizing small and medium sized firms in clusters to become specialized leading companies in national and global markets is both the effect and target of the cluster policy. Chinese local governments carry out direct government–business cooperation with specific firms. In addition to attracting foreign investment in the EV industry, Zhejiang Province has a general policy to support leading domestic firms in the areas of mergers and acquisitions and strategic cooperation. The government of its capital city Hangzhou helped big firms such as Geely and Ali carry out acquisitions and cooperation in the global market. Fujian Province worked out specific support measures to help promising firms such as CATL, Dense Lion New Energy, Giant Power New Energy, Xiamen Tungsten Industrial Group, Shanshan Technology, and Jinlong Rare Earth, who deal with battery packs, rare earth functional materials and application products, graphene, and other new materials. The fast-growing firms then not only build more parks and districts around the existing clusters to expand their production capacity but also begin to invest vertically in other stages of the battery value chain, which are often located in other regions and provinces or even abroad. For example, CATL is headquartered in Ningde, which is a city in the Fujian province. There, it constructed three manufacturing sites before expanding to two other areas in the province. During 2018 and 2021, in order to expand its lithium-ion phosphate battery production capacity, CATL made equity investments in four cathode material firms, two anode material firms, two mine extraction and sales firms, one manufacturing equipment firm, and one battery recycling firm, in different provinces. This geographic expansion contributes to the formation of more battery clusters in China, creating a dynamic interactive process among local government, large firms, and industrial clusters. Outside of China, through six equity investments in American, Canadian, Australian, and African firms, CATL acquired access to metal mines such as lithium and copper.

With the emergence of specialized battery industrial clusters, often located outside traditional centers of car manufacturing but embedded in electronics manufacturing bases, China has formed the most complete supply chain for EV batteries covering all of the relevant segments. Some battery firms having achieved global competitiveness also emerge from clusters and are well prepared for the future global division of labor. The cluster in Huizhou, the focus of the next section, reflects these characteristics of industrial clusters at the heart of China’s value chain advantage in EV batteries, as we dive deeper to show how such an advantage is built at the firm level.

2.2. The Case of the EV Battery Cluster in Huizhou: From a Supply Chain to an Industry Value Chain

In southern China, Guangdong Province has a total of 26 EV battery firms which are geographically concentrated in its core region—the Pearl River Delta. The Pearl River Delta, designated as a pilot region by the Chinese industrial master plan “Made in China 2025”, is composed of nine prefecture-level cities such as Shenzhen, Guangzhou, Foshan, Dongguan, Huizhou, etc. Together with Hong Kong and Macau, they constitute what is now defined as the Guangdong–Hong Kong–Macau Great Bay Area in China. To understand the nature and dynamics of the EV battery sector in China, our research focuses on the case of the city of Huizhou. Neighboring Shenzhen and Dongguan, Huizhou is located in the eastern part of the Pearl River Delta and boasts the fifth largest economy in the province with a GDP of 77.2 billion US dollars in 2021, to which its 2509 industrial firms contributed 52%.

2.2.1. Local Industrial Policy

Huizhou has a long history in consumer electronics manufacturing, which is one of the two pillars of this sectors, with the petrochemical industry as the other. In 2019, 67% of Huizhou’s manufacturing added value was created by so-called “advanced manufacturing firms”, and 42% was created by “Hi-Tech manufacturing firms”, both belonging mainly to the consumer electronics industry which follows a distinct trajectory. This industry has maintained a strong base of local network of suppliers for a long time. In terms of market share in China, Huizhou has been number one for years in the field of automotive on-board information service and products (in-car GPS). Its electronic and information technology sector was traditionally dominated by large state-owned enterprises or holdings, such as the TCL group, the Desay group and the Huayang group [19]. But most local firms are small and medium-sized entities which contribute to the large manufacturing operations of leading firms. They are often parts and components suppliers in the upstream portions of the electronics industry value chain with low added value compared to OEM producers. They carry out little R&D activities and focus mainly on the manufacturing of raw materials, key components, modular parts, and semi-finished products, although some produce finished products. Even before 2010, many firms in Huizhou were already major producers of batteries for telecommunications, computers, cell phones, and other IT-related or digital products. These firms had been deeply involved in the national and global competition in the sectors of battery materials, cells, and cell components such as cathodes, anodes, and electrolytes. For many years, Huizhou positioned itself as “secondary city with strong industrial development orientation” and attracted a lot of investment that spilled over from Shenzhen or Dongguan when the costs of land and labor became too high. Many private and foreign-invested firms relocated their plants and production facilities to Huizhou, thus forming geographical specialized clusters of supply chains serving a wide variety of industries. In recent years, thanks to new investment, new industrial sectors have emerged in Huizhou, especially those related to electronic and digital products, such as new energy vehicles and batteries, environmental protection, new energy equipment, new building materials, medicines, as well as the high-end advanced equipment, etc., providing Huizhou with unique opportunities to deepen its manufacturing knowledge and assets in IT-related product battery supply chains.

But Huizhou’s real jump into EV battery production was triggered and facilitated by the conjunction of a series of national industrial policies and local government cluster policies for developing the EV battery sector. In the EV sector, China’s overall strategy was to generate domestic market demand by subsidizing electric cars (New Energy Vehicles in official terms) on the one hand and supporting domestic battery suppliers’ efforts to pursue technological catch up and international competition on the other hand. For this purpose, in 2011, the National Development and Reform Commission published the “Foreign Investment Guiding Catalog”, stipulating that firms whose major shareholders were foreign investors could not enter EV battery production. At the end of 2015, the Ministry of Industry and Information Technology introduced a catalogue of “Regulations on the Standards of Automotive Power Battery Industry” (commonly referred to as ‘whitelist’) including only battery models fully owned by domestic battery makers and chasing foreign competitors out of the market. Although the new “whitelist” has included Chinese joint ventures with foreign battery makers since 2018, this policy of protecting a budding industry did create a window for Chinese battery firms to quickly ratchet up their production capacity and reach economies of scale. In 2016, the Ministry of Industry and Information Technology published “Norms and Conditions of the Automobile Power Battery Sector”, setting 8 GWh (gigawatt hours) as the sector entry barrier in order to promote the expansion of production capacity. Later, the Chinese government also used subsidies to push battery makers to increase the energy density, i.e., by upgrading battery product technology.

At the local level, the Huizhou government always places a priority on its policies for the automobile industry. Although it had long sought to but failed to attract the investment of major automobile OEMs, Huizhou successfully developed an auto parts industry composed of firms manufacturing power batteries, automotive electronics, auto parts, wire harnesses, engines, etc. The total output value of the automobile industry in 2015 was more than CNY 35 billion. When the EV market demand began to surge thanks to the national subsidy policy, the Huizhou government quickly offered its full support to the development of the EV-battery supply chain by leveraging its long experience and strong foundation in the production of consumer electronic components. The battery cluster policy encompasses a wide range of actions, including massive financial support from the provincial government; permission to establish an industrial park and various related supportive policies; developing a complete local industrial chain to create conditions for the migration of corporate headquarters from Shenzhen to Huizhou; providing talent and financial support for the expansion of production; speeding up project approval and simplifying approval procedures; providing financial support for technology research and development and encouraging enterprises to expand R&D centers; attracting OEMs to set up subsidiaries; tax incentives for innovative start-ups; financial subsidies and loan facilities, etc. [7].

2.2.2. Local Battery Firms and Industry Value Chain

Incentivized by policy support, numerous firms in Huizhou with consumer electronics backgrounds have converted their activities to EV battery production or supply by investing in new manufacturing equipment and production lines. In a short time, Huizhou has emerged as an important industrial cluster specialized in EV battery manufacturing both domestically and internationally. The vehicle-scale power battery value chain is long and composed of many specialized segments. The upstream segments include raw materials and precursors extracted from mines and the manufacturing of cell components which mainly include cathodes (metals), anodes (graphite), electrolytes, and separators. Battery manufacturing and assembling are middle segments, including cell production, module assembly, battery management systems (BMSs), battery packs, thermal management system, etc. Related and supportive products such as battery structural frames, precision parts, and manufacturing equipment can also be regarded as specialized middle segments. The downstream segments are customized applications and installations of finished power batteries in various markets, such as electric vehicles, movable energy storages, electric grids, etc., as well as battery recharging, reuse, recycling, etc.

In the EV battery sector, Huizhou has 10 firms, forming a large local cluster with a complete value chain in south China: BYD Corporation; Battery New Material; EVE Lithium Energy; Yineng Electronics; Desay Blue Micro New Energy; E-Power Energy; Sunwoda; Haopeng Technology; Yinghe Technology; and Kedali. Most of the firms are medium-sized and not well known externally, but they are hidden champions in domestic or world markets. In terms of installed batteries in the Chinese EV market in 2019, BYD, EVE, and Sunwoda were, respectively, number 2, 6, and 9. E-Power was number 1 in the bus market, Yinghe was number 1 in the battery equipment market in China, and Kedali was number 1 in the battery structural parts market in the world.

In Huizhou, as illustrated in Table 2, from upstream through the middle stream to downstream of the battery value chain, almost every specialized stage or segment is occupied by local manufacturing firms with cell production and pack assembly as the focal and key segments. For example, BYD, EVE and EPOWER are all leading firms producing cells and packs in their respective target markets. EVE manufactures battery cells and packs and adapts battery products to EV power train and energy storage systems. EPOWER is experimenting with new cathode materials designed to replace imports and is developing battery management systems with its own property rights. Its products are used to supply hybrid power for regular buses. As for BYD, it specialized for a long time in battery production for consumer electronics before entering the EV industry [7]. BYD was originally a supplier of Li-batteries for computers and smartphones for Foxconn and other large electronics manufacturers. Now, it is fully engaged in all segments of the battery value chain, supplying batteries for its own branded electric cars and energy storage applications. These fast growing and innovative local firms have made Huizhou one of the largest EV battery production clusters in the Pearl River Delta and, indeed, in China [19]. It means that even at the local level, the industrial cluster constitutes a rather complete EV battery value chain which can provide OEM car makers with a one-stop power solution.

Table 2.

Battery firms and industry value chain in the Huizhou cluster.

This kind of battery cluster in Huizhou, covering the segments of almost the whole value chain, creates an environment favoring firm competitiveness [20] and an ecosystem favorable to cooperative relations among local players [12]. With government support policies and accessible capitals and institutions, firms in Huizhou can reduce their production costs collectively. Geographic concentration and proximity favor their exchange of information, resources, and capabilities. It is easier for local firms to learn from each other and for OEMs to contact the whole supply chain, thus forming local production networks. Industrial clusters attract the interest and investment of more specialized firms. Kedali, the precision structural frame maker, said it would have never come to Huizhou if there had not been such a specialized battery cluster. Like in many other Chinese places, battery clusters in Huizhou have become the bedrock of the creation, business growth, and market competitiveness of the regional economy.

2.2.3. Research Method

With the help of the Huizhou municipal government, we were able to gain rare access to the cluster in Huizhou and carry out face-to-face interviews with all these firms. Primary data were collected during three rounds of rigorous fieldwork in September 2016 (visits to 4 firms), May 2018 (visits to 9 firms), and August 2019 (visits to 10 firms). Each round of fieldwork consisted of interviews with managers, factory visits, and focus group discussions. In-depth semi-structured interviews were conducted in each firm with top leaders and recorded with permission, lasting on average 2.5 h, and touching all aspects of firm operations. Shop-floor visits were guided by managers with further explanations on production lines, in testing labs, and in control rooms. At the end of each week of fieldwork, there were focus group meetings organized by the local government with the participation of firm representatives and relevant officials. Each focus group session lasted 2 hours with an average of six firms or government officials. Supplementary information regarding firms was then provided during these focus group discussions. In addition to data from face-to-face interviews and site visits, we also gathered and analyzed numerous documents such as internal company reports, product catalogs and brochures, as well as government policy documents and strategic plans. The multiple sources of data, together with the transcripts of interviews and meetings allowed triangulation to strengthen the internal validity of our research. Finally, the multiple-source information of each firm was cross-checked and collated in the form of a case profile document. The analysis in the following sections is based on the data from these case profiles.

3. Mass Manufacturing: Core Competency of Chinese EV Battery Firms

In strategic management theory, a core competency is defined as a harmonized combination of multiple capabilities, resources, and skills that distinguish a firm from its competitors in the marketplace [10,21]. Contrary to Porter’s theory of the five competitive forces, which takes the external environment as a key factor to analyze performance, the concept of core competency focuses on firms’ internal capabilities. Numerous authors consider core competency as the source of competitive advantage of an individual firm [10,11,22,23]. The value chain structure of the Huizhou battery cluster clearly shows that its industry-level competitive advantage is concentrated in the key business segments of cells, BMS, and packs. A deep dive within each firm’s value chain reveals that this advantage is rooted in its manufacturing activity and the corresponding production capacity in growth, which constitute the firm’s most crucial primary activities at the heart of the development of core and expanded products for end users. Local EV battery firms have developed the entire supply chain and aggressively scaled up their production capacity by limiting market access to the world’s leading producers for the benefit of Chinese firms. In fact, these technological achievements—mass manufacturing and rapidly ramping up production capacity—are becoming a “core competency” for local EV battery producers in China. Since the whole EV battery industry is still emerging and firms are all “newcomers”, their core competency is considered as a process which delivers a unique and more highly recognized value for customers compared to other primary or support activities within a firm’s value chain and with foreign firms. It is worth noting that the mastery of the large-scale manufacturing process is a characteristic that these firms have in common with Chinese battery firms in general as a result of pragmatic technological learning carried out at the level of the workshop floor.

3.1. Characteristics of Mass Manufacturing Competency

A firm’s value chain is composed of both primary activities such as logistics, operation, production, marketing and sales, service, and support activities such as procurement, human resources, and technology development [24]. In a relatively short period of time, the EV battery firms in the Huizhou cluster have developed all the value chain activities considerably and have been particularly dynamic in forming capabilities and resources in production, sales, and technology development. Table 3 describes their main characteristics.

Table 3.

Key value chain activities of battery firms in Huizhou.

In the upstream segments of the battery industry chain, i.e., battery materials, equipment and structural parts, local firms in Huizhou are all market champions. In the downstream segments, i.e., the products of battery cells, battery packs, and battery management systems, firms in Huizhou have also entered the supply system of well-known domestic OEMs. These EV components and parts producers achieved a total sales revenue of CNY 12.45 billion in 2017, selling more than 800,000 units. They produce all three forms or pack designs of final battery products: cylindrical, prismatic, and pouch designs. Prismatic and pouch designs are mainstream products in Chinese markets. The pouch design is most adaptable to the installation space in vehicles. In the field of product technology, the electrochemistry of the EV battery is the same as the battery for consumer electronics products (MP3, cell phones, and laptops). NMC (lithium nickel manganese cobalt) and LFP (lithium iron phosphate) are the two dominant lithium-ion cell electrochemical formulas. NMC is higher in energy density but more expensive, while LFP is lower in energy density but cheaper. Battery producers in Huizhou made few radical breakthroughs in cell chemistry based on fundamental research. Their product innovation lies either in sourcing more efficient materials from better material suppliers to make incremental progress in product quality, or in redesigning battery pack architecture, like the “blade battery” design of BYD. This was also the general situation at the national level. According to the International Patent Classification in 2017, the global top ten companies in EV battery patents were all from Japan, the United States, South Korea, and Germany with a total of 3278 patents. Chinese battery firms focused on developing manufacturing and engineering processes within the existing technology paradigm of lithium-ion batteries.

It is in this field of manufacturing and production that the battery firms in Huizhou have built their strength and reached a world level. Those who produce battery cells, modules, and packs in particular have already formed a kind of distinctive mass manufacturing capability of quality battery products and gained a substantial market share in the competition. Their high-volume production capability has become the competitive advantage of the Chinese EV battery sector, which is reflected in three achievements:

(1) The production capacity realized by reliable mass manufacturing and production engineering activities is huge. Even in 2017, the production capacity of the Huizhou cluster’s EV battery reached 12.1 GWh, which meant 196,700 sets of EV battery parks, almost 7% of national production capacity, and the eventual annual output of 31,800 sets. BYD, Sunwoda, EVE Lithium, E-Power Energy, Yineng Electronics, and Haopeng Technology have all converted to automatic large-scale manufacturing. The production capacity of each firm has continued to increase rapidly. For example, in 2019, BYD reached 40 GWh, EVE 20 GWh, and E-Power 2.8 GWh.

(2) There has been a large build-up of fixed assets through a massive and rapid investment in new equipment and production lines. Through years of experience, battery firms in Huizhou have developed strong capabilities thanks to their investment in production projects. They are quick and skillful in every stage of investment, including capacity planning, facilities building, production engineering, scaling up, as well as implementing the advanced manufacturing system with the newest equipment imported from different sources. In 2009, in order to commercialize its lithium-ion batteries, BYD built its first fully automatic LFP production line. Its mass production of EVs started in 2013–2014, and at that point, the production capacity was only 2 GWh, but within four years, its battery production capacity reached 16 GWh. Now, the BYD battery production workshop is totally automatic: cars are welded by robots, and mechanical manipulators are used to make metal exterior parts. EVE began its lithium-ion EV battery projects in 2014, investing CNY 600 million to build a fully automatic 18,650 power battery factory with an annual output of 1 GWh. In 2015, it built a production line with the highest level of automation for cylindrical batteries in China. Then, from early 2016 to the end of 2017, EVE invested CNY 5 billion in order to reach the scale of 9 GWh and sales of CNY 6 billion. As for E-Power, it invested CNY 200 million in equipment, including 150 million for production use and 20 million for R&D. The key production equipment and process equipment are almost all imported, especially from Japan. Desay Blue Micro New Energy invested CNY 100 million from 2015 to 2016 to build two automatic production lines of BMS. Now, it has a total of three BMS production lines with an annual output of 200,000 sets and five automatic lines for pack assembly in a 10,000-square-meter workshop. As a structural part producer, Kedali’s production lines are also highly automatic. Equipment is imported from Japan, South Korea, and Germany. For cleaning and circulating discharges, all equipment is imported. For the shell pulling machine and high-speed stamping equipment imported from Japan, Kedali even bought out in advance all the anticipated output of the Japanese supplier over the following 4 years, thus monopolizing the market order.

(3) There have been continuous practices in production optimization, quality improvement, and cost control. In EV battery production, good quality basically means homogeneity among cells, which requires stability and the standardization of manufacturing processes. After production lines are built, local firms in Huizhou also engage in continuous efforts regarding the production process to increase efficiency, improve quality, and reduce costs. For example, in order to benchmark the production technology of Panasonic, EVE invited Panasonic’s expert team to guide the construction of the product design and the production line. Its internal “high-quality programs” emphasized strict quality control and the high success rate upon final inspection. A better quality of EV batteries often means product adaptation, adjustment, and redesign according to the changes in customer needs. Regarding the existing safety parameters, the optimization of battery quality often depends on the weight, the volume and the energy density of battery modules which can directly reduce battery costs. In addition to using the learning curve effect, battery firms in Huizhou also widely use “machines to replace manpower”. Production costs are well controlled thanks to decreasing the number of workers on the production line.

3.2. Why Manufacturing Competency Is the “Core”

The mass manufacturing capabilities of quality battery products described above constitute the core competency of Chinese local battery firms. Theoretically, a firm’s core competency should make a significant contribution to the perceived benefits of the end product, provide potential access to a wide variety of market segments, and offer a barrier to imitation by competitors [10]. The mass manufacturing capabilities of the Chinese battery firms meet all these criteria at this stage.

First, as the battery accounts for 35% of the cost of EVs, customers need reliable and durable EV batteries. A standardized mass production process can guarantee a stable supply of cells, modules, packs, integrated BMS as well as thermal control systems, so as to deliver products of exceptional values to EV makers. The huge production capacity, modularization and adoption of a chemical formula for LFPs contribute to Chinese battery firms’ competitive advantage in pricing, while a new product design such as cell-to-pack increases battery energy density, improving the quality.

Secondly, the mass manufacturing capability of lithium-ion batteries of all capacities can be applied to diverse end markets other than electric cars, such as smart grids, urban transportation, solar panels, and movable storages. Even within the electric vehicle segment, lithium-ion batteries are used in buses, trucks, and even urban trams in the public sectors. Before entering the EV passenger car industry, BYD supplied lithium batteries and metallic accessories to name-brand consumer electronics firms, personal computer manufacturers, and mobile phone makers, such as Foxconn. In 2003, BYD entered the electric passenger car industry by acquiring a domestic name-brand car firm thanks to its core technological competency in batteries [19]. BYD is active in other energy segments than EV powertrains, such as solar panels, LED and energy storage, accounting for 20% of the total revenue. EVE also produces various energy storage systems, such as rooftop energy absorption, power banks, emergency power sources, etc.

Finally, the mass manufacturing as a core competency of Chinese battery firms is more about scale and process than about product and technological innovation, constructing some barriers to imitation. Although the lithium-ion battery chemistry is not revolutionary new technology, achieving such a large size and large volume of units with a high energy capacity requires considerable investments in new and automatic equipment for production, controlling, and testing. At present, there is not much technological difference between the cell design of various firms, as competition is based on the mastering of large-scale production and manufacturing. Chinese firms have developed core assets through huge capital expenditure within a relatively short period. Purchasing and using the most advanced manufacturing equipment from various sources also provides an opportunity for Chinese firms to learn skills and accumulate experience in implementing large-scale production processes in EV battery making. Related to Made in China 2025, battery production has seen a significant push for digital automation. For Chinese firms, automation is mostly introduced to improve quality standards. This information, as well as the developed skills in production engineering, system integration and quality control, are then reinforced by the firms’ external environments, which provide access to various supplies inside or outside the cluster. The time-consuming experience and specialized cluster environment are difficult to be replicated elsewhere.

4. Technological Learning: The Mechanism of Core Competency

The emergence of mass manufacturing as a core competency of Chinese battery firms did not simply allow for a large production capacity; it also allowed for technological progress, i.e., it led to a kind of technological capability [25]. By nature or origin, this technological capability was obtained through a process of “technological learning”, which encompassed the following in general:

- -

- The way firms gained knowledge from the environment;

- -

- The way this knowledge was managed and diffused into the organization;

- -

- The way knowledge coming from the suppliers or the clients was processed and transformed into new capabilities [26].

The so-called technological capability was embodied in the collective process of research, implementation, exploration and development of technologies; it was therefore synonymous with technological learning [27]. C. K. Prahalad and Gary Hamel (1990) [10] also pointed out that core competencies are the “collective learning across the corporation” and are often developed through the process of continuous improvements over a period rather than simply a large production capacity. There are numerous approaches to technological learning, but the dominant approaches adopted by Chinese battery firms were based on their manufacturing practice at the factory level: learning-by-doing, by-using, and by-interacting, corresponding to the DUI mode in the innovation system literature [28].

4.1. Learning-by-Using

The first approach used by the Chinese battery firms was “learning-by-using”. As mentioned earlier, a major technological challenge of the mass production of EV batteries was not about the cell chemistry redesign but rather the much larger size of the compound pack to be installed in vehicles. Lithium-ion batteries, first commercialized by Sony for use in consumer electronics in 1991, now dominate power batteries for EV use. The compound electrode and electrolyte structure of lithium-ion batteries are similar to the alkaline batteries that have been used to power consumer electronics for decades. But lithium-ion batteries are lighter and significantly more energy-dense than their alkaline counterparts, which makes them suitable for EV applications by enlarging the battery size to supply enough power [12]. Initially, EV-grade lithium-ion batteries faced several constraints when produced in large volumes. The production had to be localized near EV OEMs due to the high costs of transportation and custom duties. The low degree of standardization of the manufacturing process led to the unstable quality of cells and packs, especially for pouch and cylindrical batteries. The most difficult part came from the manufacturing process. EV battery making contains several steps. First, the unitary cells are assembled into small modules one by one. The combination of cells includes series and parallels. The series combination increases the voltage, and the parallel increases the energy intensity. Single cells are welded into small modules, which are then connected to form a large battery system. The battery system is connected to the battery management system (BMS) through many pressure sensors and wires that monitor the voltage and temperature of the battery. This integrated battery system which is installed in EVs is called a “pack”. During the whole production process, key technical tasks serve to maintain the unitary cells at the exact same quality level; otherwise, a single cell with a different quality level will quickly exhaust the whole battery during usage. The production process of EV batteries must thus be much more stable and consistent than the production process for IT products that use small batteries such as smartphones or laptops.

Chinese battery firms solved the problem of the transition to the standardized volume production of large-size batteries by investing heavily in substantial automation and the most advanced equipment, especially in the mechanical parts of the cell production process and materials handling.

(1) In the workshops, standard procedures such as using ultrasonic welding machines to connect battery components were automated to improve quality. The production process of silicon-carbonized anode materials at Battery NM Company was customized using precision equipment to correct for the lack of standardization and stability. To reduce manual operations, Battery NM invested CNY 10 million in automatic equipment imported from Japan. Thanks to its experience with this advanced equipment, the firm learnt the value of importing more equipment from Japan, Germany, and other countries. They debugged and installed equipment for transportation pipelines and three-dimensional warehouses with the goal of fully automating the whole production line. Like Battery NM, many Chinese battery firms adopted the policy of integrating, installing, operating, and maintaining equipment from different countries and regions. They acquired skills in engineering and automation to achieve process standardization.

(2) In parallel with the importation of equipment, Chinese battery firms have also tried to introduce an intelligent manufacturing system or Industry 4.0 to support equipment operations with new digital technologies such as big data and the Industrial Internet of Things (IIoT). There were national and local policy programs to back up this form of industrial and technological upgrading. For example, BYD managed to fully automate its front production processes through importing cell-making equipment such as feeders, coating machines, and winding machines from Japan and South Korea. From 2008 to 2016, through three major programs of technological transformation, EVE upgraded its EV lithium-ion battery production line from manual to automatic and then to the so-called Industry 4.0 level. The main expenditure of programs was for capital goods.

(3) Thanks to the progress made by learning to use the purchased equipment, battery firms began to adapt machinery or even develop their own equipment, especially for the conventional customized processes. BYD set up a special manufacturing plant to develop its own equipment for the end processes in pack assembly lines. Much of EVE’s automation equipment was also developed by the firm itself. In 2015, it took a year for EVE to successfully develop the first automatic production line for cylindrical batteries. For that automatic line, EVE applied for a total of 20 patents (7 invention patents and 13 utility model patents, of which 7 utility model patents have been authorized). Automation doubled the production capacity, reduced manpower by 80 workers, increased the average product qualification rate from 89.8% to 92%, and reduced the manufacturing cost by 21.76%. By July 2023, Chinese battery producers Gotion, BYD and CATL were among the top ten patent filing companies in lithium-ion battery technology; their foreign counterparts in the top ten list include Samsung SDI (top1), LG Chemistry (top 3), and Robert Bosch (top 4).

4.2. Learning-by-Doing

The second technological learning approach of Chinese battery firms was “learning-by-doing” or more precisely, “learning-by-producing”. In terms of products, the technological trajectory of the lithium-ion battery cell is rather science-based [29]. The Japanese industry was the first to find a realistic alternative to lead-acid batteries, developing the first lithium-ion batteries in the late 1980s. The development of the battery cell design is a combination of chemical, electrochemical, and mechanical know-how applied to materials, electronics, electricity, mechanics, etc. Cell design simultaneously involves the different aspects of materials, mechanical processing, the digital management of batteries, etc. There exist many alternative EV energy storage technologies which are always the R&D targets of leading firms, such as solid-state battery cells, hydrogen cells, fuel cells, “flow” batteries that utilize zinc, and other chemistries. But the electrochemistry of lithium-ion EV batteries has generated a considerable first mover advantage thanks to East Asian lithium-ion battery producers, notably Chinese makers that were able to make massive and rapid investments in production capacity, allowing them to profit massively from economies of scale and learning-by-doing. Although the lithium-ion battery seems to secure the EV industry’s dominant technological role in cell design, the sibling chemistries within the lithium-ion family such as NCA, NMC, LMO, LFP, LTO and LCO have their own specific composition of chemicals and are different in energy density, safety, and reliability.

China’s technological choice of a lithium-ion battery was greatly influenced by the choice of EV types. In China, new entrants, particularly those who had an IT background, all chose pure battery electric vehicles, while traditional OEMs mainly chose hybrid electric vehicles. As for plug-in hybrid electric vehicles, the battery was required to independently provide an autonomy of at least 50 km in China. As for fuel-cell vehicles, the power system was always equipped with a battery. Finally, pure battery vehicles became the mainstream EV on the Chinese market and received government subsidies. All these technological choices created an excessive market demand for lithium-ion batteries and boosted the emergence of the EV battery industry in China. For cell chemistry, at the beginning, Chinese battery firms chose mainly NMC, greatly increasing the energy intensity, but it was expensive because it used precious and non-ferrous metals. With the continuous adjustment of cell ratios and the improvement of materials, recently, many firms have shifted to LFP, which has reduced the cost significantly. In 2021, the installation of LFP outpaced NMC.

As the lithium-ion battery becomes the dominant cell design for EVs, further technological opportunities are to be found in the manufacturing processes for good-quality batteries in large volume. In addition to the challenge of quality stability, performance reliability, and consistency among cells during mass production as mentioned above, quite a lot of the EV battery process technology involves know-how, skills, experience, and implicit knowledge by nature without a strong legal protection of intellectual property. The knowledge sources are always related to production activities, including product and process engineering, equipment operation and maintenance, organization of workflow, product testing, assembling, quality control, the purchase of cell components, etc. The EV battery manufacturing process can be improved through the incremental integration of practical knowledge from the workshop floor for the improvement of components, machinery, and pack assembly. Thus, the appropriate ways of obtaining and assimilating this implicit knowledge are just experiencing all aspects of the production process, trying, drawing lessons, and accumulating as much know-how as possible—activities that are often referred to as ‘learning by doing’.

The dynamic development of Chinese battery firms, especially expanding production capacity, moving to new sites of production, and introducing new equipment, provide repetitive occasions for intensive technological learning by producing. For example, EVE drastically increased its production capacity and automated the assembly lines. During the process, the firm obtained valuable production and engineering know-how. Its engineers relied on accumulated experience to set technical parameters for large-scale operations. For cell production, E-Power mainly used domestic equipment, such as slicing and tableting machines. Its specific cell structure for pouch packs made it difficult to achieve complete production automation, although the entire factory was designed for production on assembly lines. Many processes rely on manual operations by workers. In Yinghe Technology, the processing of precision parts was automated mainly with robotic arms imported from Japan, which accounted for about 10–20% of the investment in equipment. However, since much of its own equipment was non-standard and the equipment that it produced for clients was always customized, the overall degree of automation was not very high. Equipment production required a lot of manual assembly, so Yinghe Technology focused on workforce training and talent development. In 2016, Yinghe Technology created its own university, which was composed of a management school, a professional college, and a school for mechanical–electric training. The core technical ability of Kedali originated from the professional mold industry founded in 2009. The company kept development molds even after focusing on producing precision parts for EV batteries. Now, Kedali has purchased complete sets of equipment, but mold development and part production still rely much on the accumulated technical know-how of professionals from the mold industry.

Although China has never developed a world-class technological breakthrough in lithium-ion cell design or material innovation, the accumulation of manufacturing experience and sharing of best practices in engineering, design and distribution created a significant “learning curve” effect, leading to the decline of prices spread over the total volume of battery packs deployed on the market. It is estimated that there was an 18% cost reduction for every doubling of battery production capacity [4]. Another effect was an increase in efficiency. After the battery was produced, there was usually a static depolarization process to test the battery self-discharge and identify defective cells. For this process, some Chinese battery firms reduced the time from 10 days to 6 days by repeatedly practicing and establishing large-scale test centers with charging and discharging test channels that could test more than 1000 batteries at the same time. It should be noted that although the effects of learning and economies of scale often overlap in practice, each has clearly defined parameters in economic theory. Economies of scale are cost decreases that result from an expanding production. Economies of scale are frequently found in industries that require large capital expenditures on plant and equipment or the establishment of a large infrastructure before setting up services. For its part, the benefits of a learning curve can be attributed to greater labor efficiency due to an improvement in workers’ dexterity, standardization, specialization and work methods, the improved use of tools and equipment, product redesigns that improve assembly efficiency and productivity, material substitutions and the more efficient use of inputs, and the effect of a shared experience when multiple products use common resources [30]. Both effects can be found in Chinese battery firms.

4.3. Learning-by-Interacting

The mass production of quality goods also necessitated a search for technological information, the negotiation of technology, and establishing linkages with ecosystem actors such as suppliers, customers, distributors, technical centers, research institutes, etc. Thus, the third way that Chinese local battery firms mastered manufacturing was “learning-by-interacting”, including “learning from the market”, “learning from alliances”, “learning by monitoring” supply chains, etc. By tracking the needs of lead users and constantly adjusting the cell chemistry and pack structure to be more aligned with those of the leading OEM producers, Chinese EV battery producers became better manufacturers that were more and more able to achieve the quality standards their customers demanded. For example, when EVE became a potential supplier of BMW and entered into the “apprentice” stage, it was also given very demanding standards to meet regarding quality and technical standards for installing batteries in specific models. When selling materials to CATL, Battery NM first gave samples for testing. Then, there was an exchange between technical personnel from the two sides. After the order was placed, the quality departments conducted a joint quality audit, after which regular communication between production staff started. CATL regularly sent personnel to conduct one or two audits every year, and the sales staff of Battery NM also had to pay a return visit. Samsung SDI was the most important customer of Desay Blue Micro New Energy. In order to participate in Samsung’s battery supply to Volkswagen’s small batch car models on the MQL/MQB platform and bid for models on the new MEB platform, Desay Blue Micro New Energy elaborated an R&D plan jointly with Samsung and adopted a Design of Experiments method to develop a customized BMS. E-Power mainly supplied public bus companies with pouch packs. In order to better track the end users’ information and to identify possible modifications and improvements to products, E-Power signed after-sales agreements on quality assurance with users, set up a dedicated after-sales service and maintenance team, and installed an alarm system in each battery. The alarm system enabled the firm to obtain timely feedback on technical issues related to usage as well as monitor and respond to customer needs.

Battery firms also learnt new technical knowledge regarding setting up an alliance and partnerships with car makers and key component suppliers. Each year, BYD invited Japanese experts to conduct training on issues like lightweight cars and organized seminars on electronics topics such as molds. In 2010, BYD set up a 50/50 joint venture with Daimler AG to develop electric vehicles. BYD was responsible for batteries, electric engines, and electric control, while Daimler AG was responsible for complete vehicle design, molds, and safety, which are areas that BYD wanted to learn more about. Since the EV battery value chain contains numerous specialized producers for materials, components, battery management systems, cells, modules and battery packs, an industrial cluster which covers a complete value chain can greatly facilitate cooperation among upstream and downstream firms and is ideal for local learning by interacting with all kinds of suppliers. Knowledge and experience can be easily diffused within a cluster.

4.4. Technological Trajectory of Making EV Batteries

The technological learning paths of Chinese firms reveal to some degree the emerging technological trajectory of lithium-ion EV batteries. In a battery value chain, cell and pack producers play a central role. In supplying lithium-ion battery packs to EV car makers, they act in fact as system integrators or solution providers by cooperating with various technical partners and specialized suppliers of raw materials, components, parts, hardware, and software. Due to their electric–chemical nature, product innovation and process innovation are intertwined and inseparable for EV battery production. Process innovation is often incremental and embedded in key manufacturing activities including product detailed design, testing, engineering design, and quality control, which must meet high technical standards for equipment and input materials. Therefore, in addition to the help of external partners for technology development, the technological upgrading of battery firms depends heavily on internal experience and know-how accumulated during its own technical engineering processes and mass production. After production reaches a certain scale, smooth mass manufacturing can create a feedback loop of professional information between customers and the company’s product design teams, which is followed by testing activities and engineering design. The information on the needs of users, especially of lead users, can inspire battery firms to develop new technologies to match the users’ requirements.

If there exists a technological basis for the competitive advantage of Chinese battery firms, it is their shop-floor technological learning which occurred during a period of explosive expansion of mass manufacturing and production capacity. From a macro perspective of the EV battery sector in China, innovation happens not mainly at the product level but more precisely during the production process. Traditionally, indigenous Chinese suppliers have been very good at manufacturing needed parts and components for foreign multinational companies in the initial phase and then entering into newly emerging and more sophisticated foreign multinationals’ supply chains [31]. The electrification of the automobile powertrain has its technological roots in battery electrochemistry, a cross-field of chemistry, electronics, electricity, materials, and mechanics, which is not included in the mainstream technological domains of the old automobile industry and its supply chains. But the EV battery needed by Chinese and foreign OEMs was not a product innovation in a strict technological sense; rather, the Chinese battery makers caught this surging business opportunity and quickly applied and adapted their mass manufacturing capabilities to the new field. Mass manufacturing and technological learning are the two sides of the same coin of their core competency. After achieving an adequate technological level in the mass production process, Chinese firms allocated more resources to tackling new product or component development; these components included silicon–carbon anode material, high nickel cathode material, the coating die of battery equipment, cell-to-pack design, solid-state batteries, etc. Many also consolidated their cooperation with research institutes and academia in search of more radical technological breakthroughs. For example, E-Power cooperated with Beijing Polytechnic University to conduct research on optimizing anode materials and using ceramic separators to replace expensive imported materials. The firm also invented a new “active liquid cooling technology” to dispatch the heat inside packs.

5. Discussion and Implications: The Future of the EV Battery and Automobile Sectors

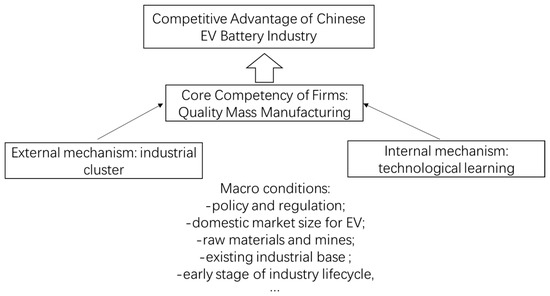

The above analysis of the nature and origins of the core competency of indigenous Chinese battery firms as shown in Figure 1 provides a vantage point to understand some broader issues regarding the global and Chinese automobile industry undergoing electrification. The strategies of both vertical integration and segment specialization adopted by battery firms are based on the logic of competency development. The emergence of Chinese battery firms is restructuring the traditional automobile value chain. This core competency in battery mass manufacturing also has implications for the competitiveness of Chinese and global electric vehicle makers in the long run.

Figure 1.

Roots of the competitive advantage of Chinese EV battery firms.

5.1. Implications of Battery Makers