Socialism and the Blockchain

Abstract

:1. Introduction

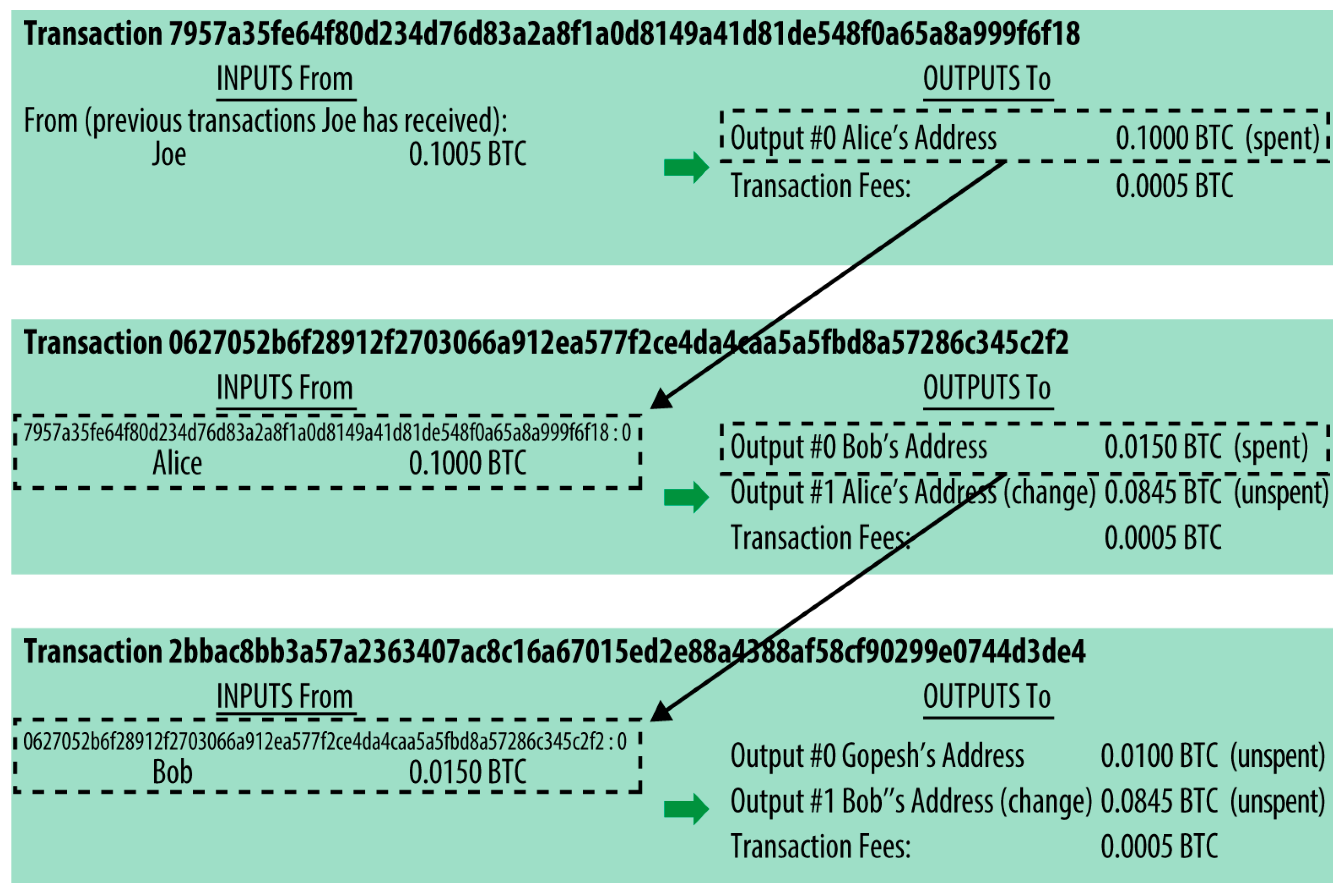

2. Bitcoin

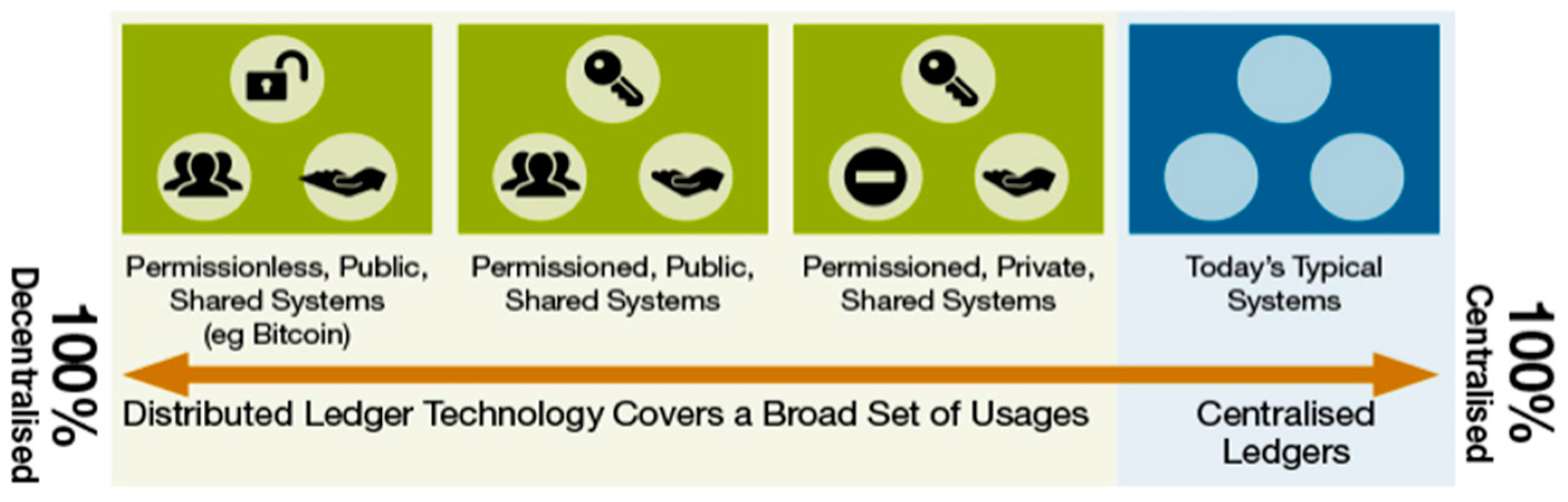

2.1. Blockchain Technology

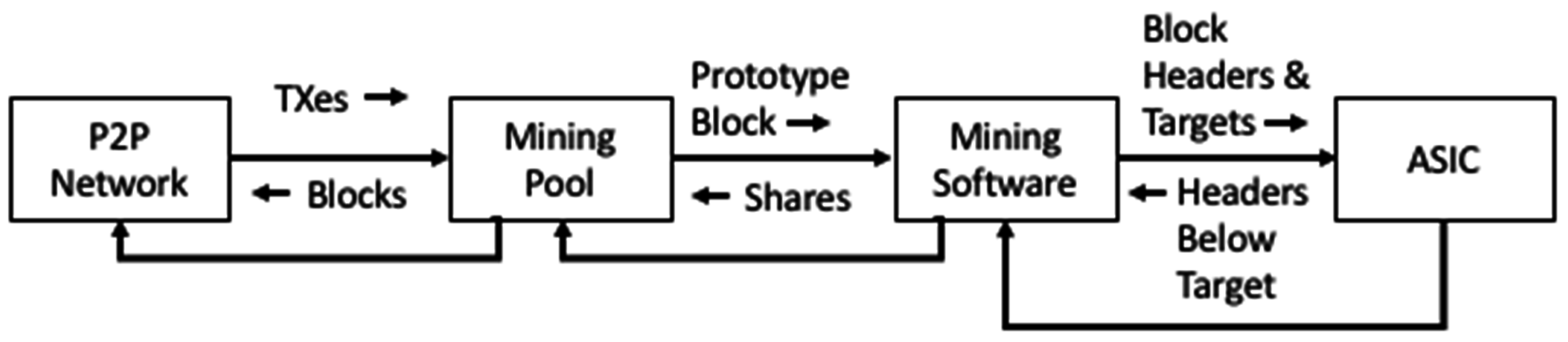

2.2. Bitcoin Mining

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash [12].

2.3. Bitcoin’s Energy Use

2.4. The Problems Addressed by Bitcoin and Blockchain Technology

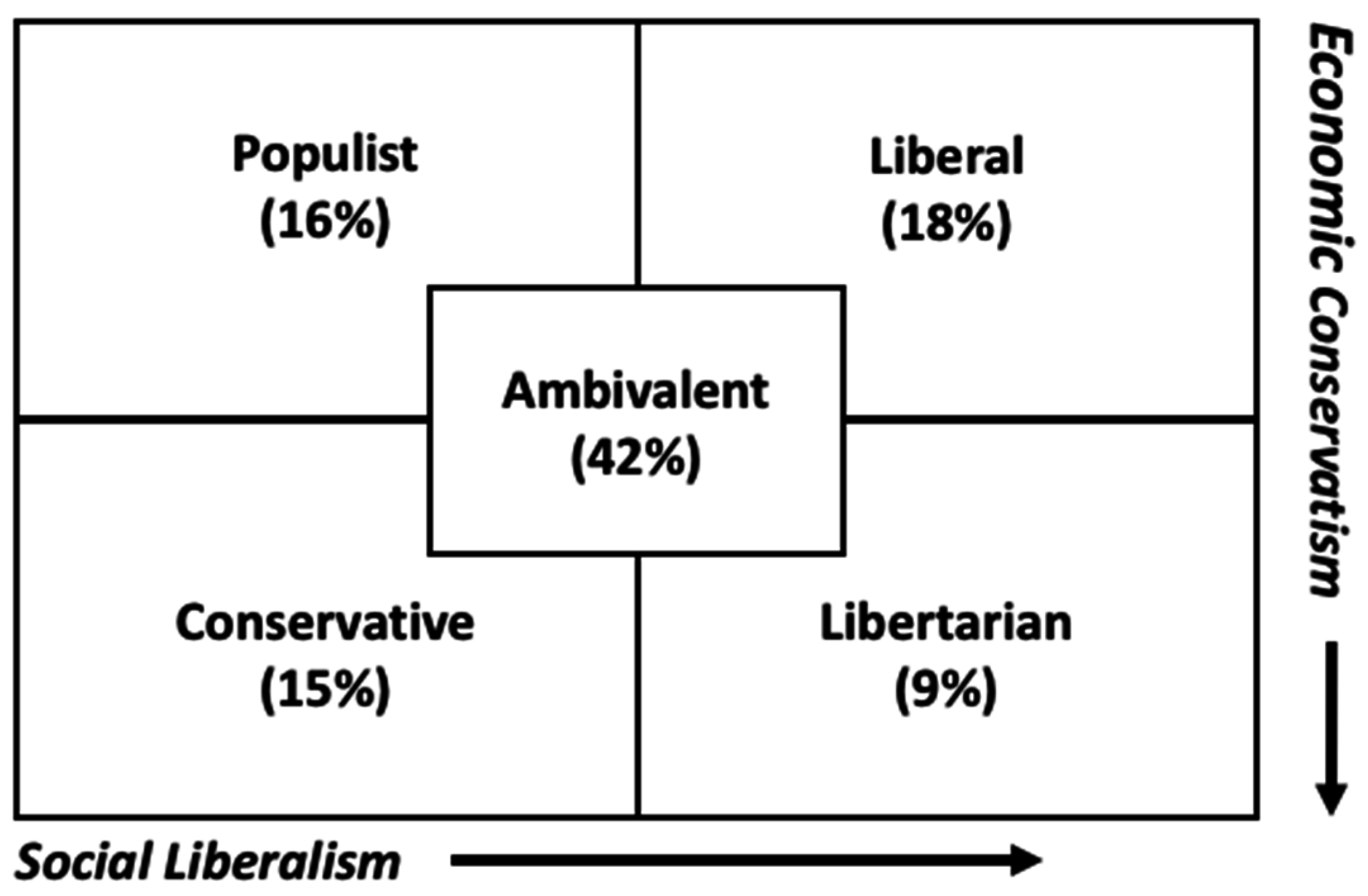

3. Libertarianism and Money

“Candidates who offer a program of big-government spending and aggressive social conservatism will tend to drive away libertarians. More specifically, candidates who favor lower taxes, spending restraint, free trade, Social Security private accounts, reproductive choice, and a welcoming attitude toward working women, immigrants, and gays are going to find favor with libertarian voters. Candidates who support protectionism, tax increases, ever-expanding entitlement programs, and intrusions into personal freedoms will lose the libertarian vote.”

Libertarianism, Bitcoin and Blockchain Technology

4. Socialism and Money

Socialism, Bitcoin and Blockchain Technology

5. Applications of Blockchain Technology to the Socialist Paradigm

5.1. Bitcoin and Marx’s Labour Theory of Value

5.2. Bitcoin Community Development

- Fork the GitHub repository and clone it locally.

- Check out the master branch.

- Create a topic branch.

- Write patches.

- Stage and commit patches.

- Push the new branch back up to the GitHub fork.

- Send a Pull Request.

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Bitcoin Wiki. Category:History. Available online: https://en.bitcoin.it/wiki/Category:History (accessed on 16 July 2015).

- Coinmarketcap.com. Crypto-Currency Market Capitalizations. Available online: http://coinmarketcap.com/ (accessed on 16 February 2016).

- UK Government Chief Scientific Adviser. Distributed Ledger Technology: Beyond Block Chain; UK Government Office for Science: London, UK, 2015.

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015. [Google Scholar]

- The Libertarian Party. Make a Bitcoin Contribution. Libertarian Party. Available online: https://www.lp.org/make-a-bitcoin-contribution (accessed on 4 August 2016).

- Karlstrom, H. Do libertarians dream of electric coins? The material embeddedness of Bitcoin. Distinktion Scand. J. Soc. Theory 2014, 15, 23–36. [Google Scholar] [CrossRef]

- Yermack, D. Is Bitcoin a Real Currency? An Economic Appraisal; National Bureau of Economic Research: Cambridge, MA, USA, 2013. [Google Scholar]

- Brett Scott. How Can Cryptocurrency and Blockchain Technology Play a Role in Building Social and Solidarity Finance? United Nations Research Institute for Social Development: Geneva, Switzerland, 2016. [Google Scholar]

- Oxford Dictionary. Libertarianism. Available online: http://www.oxforddictionaries.com/definition/english/libertarianism (accessed on 7 July 2016).

- Oxford Dictionary. Socialism. Available online: http://www.oxforddictionaries.com/definition/english/socialism (accessed on 7 July 2016).

- UK Parliament. Parliamentary Sovereignty. UK Parliament. Available online: https://www.parliament.uk/about/how/role/sovereignty/ (accessed on 4 August 2016).

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 10 February 2016).

- Antonopoulos, A.M. Mastering Bitcoin, 1st ed.; O’Reilly: Sebastopol, CA, USA, 2015. [Google Scholar]

- Bitcoin. Choose Your Wallet—Bitcoin. Available online: https://bitcoin.org/en/choose-your-wallet (accessed on 7 September 2016).

- Bitcoin Wiki. How to Accept Bitcoin, for Small Businesses—Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/How_to_accept_Bitcoin,_for_small_businesses (accessed on 7 September 2016).

- BitFury Group; Garzik, J. Public versus Private Blockchains Part 1: Permissioned Blockchains White Paper. Available online: http://bitfury.com/content/5-white-papers-research/public-vs-private-pt1–1.pdf (accessed on 2 March 2016).

- Harvey, C.R. Bitcoin Myths and Facts. Available online: http://bit.ly/2cHRu90 (accessed on 24 February 2016).

- Nakamoto, S. Bitcoin v0.1 Released. Available online: http://www.mail-archive.com/cryptography@metzdowd.com/msg10142.html (accessed on 12 February 2016).

- Hal, F. Re: Bitcoin v0.1 Released. Available online: http://www.mail-archive.com/cryptography@metzdowd.com/msg10184.html (accessed on 12 February 2016).

- Bitcoin. Bitcoin Developer Guide. Available online: https://bitcoin.org/en/developer-guide#block-chain (accessed on 29 February 2016).

- Guadamuz, A.; Marsden, C. Blockchains and Bitcoin: Regulatory responses to cryptocurrencies. First Monday 2015, 20. [Google Scholar] [CrossRef]

- Ethereum. Ethereum Project. Available online: https://www.ethereum.org/ (accessed on 23 July 2016).

- Ripple. Welcome to Ripple. Ripple. 2016. Available online: https://ripple.com/ (accessed on 4 August 2016).

- Litecoin. Litecoin—Open Source P2P Digital Currency. Available online: https://litecoin.org/ (accessed on 29 February 2016).

- Stellar. Stellar. 2016. Available online: https://www.stellar.org (accessed on 29 February 2016).

- Eris Industries. Explainer | Smart Contracts. Eris Ind. Doc. 2016. Available online: https://docs.erisindustries.com/explainers/smart_contracts/ (accessed on 29 February 2016).

- The Economist. The Trust Machine; The Economist: St. Louis, MO, USA, 2015. [Google Scholar]

- Bitcoin Wiki. Proof of Burn—Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Proof_of_burn (accessed on 26 February 2016).

- Harvey, C.R. Cryptofinance. 2016. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2438299 (accessed on 27 April 2016).

- bitcoinmining.com. Best Bitcoin Mining Hardware ASICs Comparison. Available online: https://www.bitcoinmining.com/bitcoin-mining-hardware/ (accessed on 26 September 2016).

- Ethereum. Ethereum White Paper. Available online: https://github.com/ethereum/wiki/wiki/White-Paper (accessed on 20 March 2016).

- Andresen, G. Seventy-Five, Twenty-Eight. Gavin Andresen on Svbtle. 2015. Available online: http://gavinandresen.ninja/seventyfive-twentyeight (accessed on 27 April 2015).

- Bitcoin. Bitcoin Core. Available online: https://bitcoin.org/en/bitcoin-core/ (accessed on 29 February 2016).

- Amazon.com. Amazon.com: Antminer S7~4.73TH/S with 2 Fans @ .25W/GH 28nm ASIC Bitcoin Miner: Computers & Accessories. Available online: https://www.amazon.com/Antminer-~4–73TH-Fans-Bitcoin-Miner/dp/B014OGCP6W (accessed on 29 September 2016).

- Blockchain.info. Bitcoin Hash Rate. Available online: https://blockchain.info/charts/hash-rate (accessed on 22 July 2016).

- International Energy Agency. Key World Energy Statistics. Available online: http://www.iea.org/publications/freepublications/publication/KeyWorld2016.pdf (accessed on 29 September 2016).

- W3C. Common Markup for Micropayment Per-Fee-Links: A W3C Public Working Draft. Available online: https://www.w3.org/TR/Micropayment-Markup/ (accessed on 4 August 2016).

- Bitcoin Wiki. Double-Spending—Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Double-spending (accessed on 4 August 2016).

- Buterin, V. On Public and Private Blockchains. Available online: https://blog.ethereum.org/2015/08/07/on-public-and-private-blockchains/ (accessed on 15 February 2016).

- Lamport, L.; Shostak, R.; Pease, M. The Byzantine Generals Problem. ACM Trans. Programm. Lang. Syst. 1982, 4, 382–401. [Google Scholar] [CrossRef]

- Douceur, J.R. The Sybil Attack; Microsoft Research: Redmond, WA, USA, 2002. [Google Scholar]

- Andrychowicz, M.; Dziembowski, S. Distributed Cryptography Based on the Proofs of Work; University of Warsaw: Warsaw, Poland, 2014. [Google Scholar]

- David Boaz. Libertarianism | politics | Britannica.com. Available online: http://www.britannica.com/topic/libertarianism-politics (accessed on 26 June 2016).

- Woodcock, G. Anarchism: A History of Libertarian Ideas and Movements; Broadview: Peterborough, ON, Canada; Orchard Park, NY, USA, 2004. [Google Scholar]

- Libertarian Party. Libertarian Party Platform; Libertarian Party: London, UK; Available online: https://www.lp.org/platform (accessed on 11 July 2016).

- Martin, F. Money: The Unauthorised Biography; Vintage: New York, NY, USA, 2014. [Google Scholar]

- Huber, J. What Is Sovereign Money? Sover. Money. 2016. Available online: http://www.sovereignmoney.eu/what-is-sovereign-money/ (accessed on 23 July 2016).

- Key, F.S. Star Spangled Banner Lyrics. Available online: http://www.usa-flag-site.org/song-lyrics/star-spangled-banner/ (accessed on 30 June 2016).

- Elliott, N.; Libertarian Alliance. The Uses and Abuses of Money; Libertarian Alliance: London, UK, 1992. [Google Scholar]

- Boaz, D.; Kirby, D. The Libertarian Vote; Cato Institute: Washington, DC, USA; Available online: http://www.cato.org/publications/policy-analysis/libertarian-vote (accessed on 30 June 2016).

- Smith, A. The Wealth of Nations: An Inquiry into the Nature and Causes of the Wealth of Nations; Wordsworth: Hertfordshire, UK, 2012. [Google Scholar]

- Bitcoin Wiki. Controlled Supply—Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Controlled_supply (accessed on 27 April 2016).

- Miller, C. What the arrival of Bitcoin means for society, politics and you. WIRED UK. 2013. Available online: http://www.wired.co.uk/article/bitcoin-demos (accessed on 20 July 2016).

- Bank of Canada. Seigniorage. Available online: http://www.bankofcanada.ca/wp-content/uploads/2010/11/seigniorage.pdf (accessed on 4 August 2016).

- Martinez, J. XRP: Math-Based Currency. Available online: https://ripple.com/knowledge_center/math-based-currency-2/ (accessed on 23 July 2016).

- Gehring, B. How Ripple Works. Available online: https://ripple.com/knowledge_center/how-ripple-works/ (accessed on 23 July 2016).

- Rifkin, J. The Zero Marginal Cost Society: The Internet of Things, the Collaborative Commons, and the Eclipse of Capitalism; Palgrave Macmillan: New York, NY, USA, 2014. [Google Scholar]

- Pozsar, Z.; Singh, M. The Nonbank-Bank Nexus and the Shadow Banking System; IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2011; pp. 1–18. [Google Scholar]

- Laeven, L.; Valencia, F. Systemic Banking Crises Database: An Update; International Monetary Fund: Washington, DC, USA, 2012. [Google Scholar]

- Alessandri, P.; Haldane, A.G. Banking on the State; Bank of England: London, UK, 2009. [Google Scholar]

- Pëtr Kropotkin. Anarchism: Its Philosophy and Ideal. The Anarchist Library. Available online: http://theanarchistlibrary.org/library/petr-kropotkin-anarchism-its-philosophy-and-ideal (accessed on 30 June 2016).

- Arnold, N.S. Marx, Central Planning, and Utopian Socialism. Soc. Philos. Policy 1989, 6, 160–199. [Google Scholar] [CrossRef]

- Graziani, A.; Vale, M. Let’s Rehabilitate the Theory of Value. Int. J. Political Econ. 1997, 27, 21–25. [Google Scholar] [CrossRef]

- Bakunin, M. On the International Workingmen’s Association and Karl Marx. Available online: https://www.marxists.org/reference/archive/bakunin/works/1872/karl-marx.htm (accessed on 7 July 2016).

- Ollman, B.; Schweickart, D. (Eds.) Market Socialism: The Debate among Socialists; Routledge: New York, NY, USA, 1998.

- Tressell, R. The Ragged Trousered Philanthropists; Wordsworth Editions: Ware, UK, 2012. [Google Scholar]

- Marx, K. Critique of the Gotha Programme. Available online: https://www.marxists.org/archive/marx/works/1875/gotha/index.htm (accessed on 7 July 2016).

- Chang, H.-J. Economics: The User’s Guide: A Pelican Introduction; Pelican Books: London, UK, 2014. [Google Scholar]

- Marx, K. Capital: A Critique of Political Economy; Progress Publishers: Moscow, Russia, 1887; Volume 1. [Google Scholar]

- Ernest Mandel. Karl Marx—6. Marx’s Theory of Money. Available online: http://www.ernestmandel.org/en/works/txt/1990/karlmarx/6.htm (accessed on 7 July 2016).

- Frederick Engels. Capital and Surplus Value. Available online: https://www.marxists.org/archive/marx/works/1877/anti-duhring/ch19.htm (accessed on 7 July 2016).

- Marx, K.; Engels, F. Manifesto of the Communist Party; Progress Publishers: Moscow, Russia, 1848. [Google Scholar]

- The Socialist Party of Great Britain. Why We Don’t Need Money. The Socialist Party of Great Britain. Available online: http://www.worldsocialism.org/spgb/education/depth-articles/socialism/why-we-dont-need-money (accessed on 7 July 2016).

- Graziani, A.; Vale, M. The Marxist Theory of Money. Int. J. Political Econ. 1997, 27, 26–50. [Google Scholar] [CrossRef]

- Karl Marx. The Power of Money. Available online: https://www.marxists.org/archive/marx/works/1844/manuscripts/power.htm (accessed on 14 July 2016).

- Oxford Dictionary. Utopian Socialism. Available online: http://www.oxforddictionaries.com/definition/english/utopian-socialism (accessed on 7 July 2016).

- Draper, H. Karl Marx’s Theory of Revolution. 4: Critique of Other Socialisms; Monthly Review Press: New York, NY, USA, 1990. [Google Scholar]

- Frederick Engels. Socialism: Utopian and Scientific (Chapter 1). Available online: https://www.marxists.org/archive/marx/works/1880/soc-utop/ch01.htm (accessed on 14 July 2016).

- David Graeber. Are You an Anarchist? The Answer May Surprise You! Available online: https://theanarchistlibrary.org/library/david-graeber-are-you-an-anarchist-the-answer-may-surprise-you (accessed on 22 July 2016).

- Infoshop. An Anarchist FAQ—I.1 Isn’t Libertarian Socialism an Oxymoron? Available online: http://www.infoshop.org/AnarchistFAQSectionI1 (accessed on 29 June 2016).

- Ludlow, P. (Ed.) Crypto Anarchy, Cyberstates, and Pirate Utopias; MIT Press: Cambridge, MA, USA, 2001.

- Graham, R. (Ed.) Anarchism: A Documentary History of Libertarian Ideas; Black Rose Books: Montreal, QC, Canada; New York, NY, USA, 2005.

- Wright, A.; de Filippi, P. Decentralized Blockchain Technology and the Rise of Lex Cryptographia. Available online: http://bit.ly/2cDOiqT (accessed on 3 August 2016).

- Van Valkenburgh, P.; Dietz, J.; de Filippi, P.; Shadab, H.; Xethalis, G.; Bollier, D. Distributed Collaborative Organisations. Available online: http://bollier.org/sites/default/files/misc-file-upload/files/DistributedNetworksandtheLaw%20report,%20Swarm-Coin%20Center-Berkman.pdf (accessed on 3 August 2016).

- Fairfield, J.A.T. BitProperty. South. Calif. Law Rev. 2015, 88, 805. [Google Scholar]

- Shelter. Bedroom Tax: Are You Affected? Shelter Engl. 2016. Available online: http://england.shelter.org.uk/get_advice/housing_benefit_and_local_housing_allowance/changes_to_housing_benefit/bedroom_tax (accessed 3 August 2016).

- BBC News. Family of disabled grandson: ‘Bedroom tax unfair’. BBC News. 2016. Available online: http://www.bbc.co.uk/news/uk-wales-south-west-wales-35419211 (accessed on 16 January 2016).

- Good Governance. What Is Good Governance—Good Governance Guide. Available online: http://www.goodgovernance.org.au/about-good-governance/what-is-good-governance/ (accessed on 23 July 2016).

- Coindesk. Bitcoin Price Index—Real-time Bitcoin Price Charts. CoinDesk. 2016. Available online: http://www.coindesk.com/price/ (accessed on 14 July 2016).

- Western Oregon University. Energy Basics. Available online: https://www.wou.edu/las/physci/GS361/EnergyBasics/EnergyBasics.htm (accessed on 29 September 2016).

- BBC News. Bitcoin Rewards Halve for Virtual Cash Money Miners. BBC News. 2016. Available online: http://www.bbc.co.uk/news/technology-36763524 (accessed on 22 July 2016).

- Aguirre, K.; Eisenhardt, L.; Lim, C.; Nelson, B.; Norring, A.; Slowik, P.; Tu, N. Lifecycle analysis comparison of a battery electric vehicle and a conventional gasoline vehicle. In Full Lifetime Cost Analysis of Battery, Plug-in Hybrid and FCEVs in China in the Near Future, Frontiers in Energy; Cai, Z., Ou, X., Zhang, Q., Zhang, X., Eds.; California Air Resources Board: Sacramento, CA, USA, 2012; Volume 6, pp. 107–111. [Google Scholar]

- Bitcoin Wiki. Bitcoin Improvement Proposals—Bitcoin Wiki. Available online: https://en.bitcoin.it/wiki/Bitcoin_Improvement_Proposals (accessed on 19 February 2016).

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huckle, S.; White, M. Socialism and the Blockchain. Future Internet 2016, 8, 49. https://doi.org/10.3390/fi8040049

Huckle S, White M. Socialism and the Blockchain. Future Internet. 2016; 8(4):49. https://doi.org/10.3390/fi8040049

Chicago/Turabian StyleHuckle, Steve, and Martin White. 2016. "Socialism and the Blockchain" Future Internet 8, no. 4: 49. https://doi.org/10.3390/fi8040049

APA StyleHuckle, S., & White, M. (2016). Socialism and the Blockchain. Future Internet, 8(4), 49. https://doi.org/10.3390/fi8040049