Abstract

Central bank-issued digital currencies have sparked significant interest and are currently the subject of extensive research, owing to their potential for rapid settlement, low fees, accessibility, and automated monetary policies. However, central bank digital currencies are still in their infancy and the levels of adoption vary significantly between nations, with a few countries seeing widespread adoption. We used partial least squares structural equation modeling to investigate the nonlinear relationship between key national development indicators and central bank digital deployment across 67 countries. We explore the technological, environmental, legal, and economic factors that affect central bank digital currency adoption by country. We found a statistically significant and positive correlation between countries’ central bank digital currency adoption status and a country’s level of democracy and public confidence in governance, and a negative association between regulatory quality and income inequality. There was no significant association between countries’ central bank digital currency adoption status and their level of network readiness, foreign exchange reserves, and sustainable development goal rank. Thus, we posit that a country that is highly democratic and has good governance adopts central bank digital currencies more readily than others. Based on our findings, we suggested areas for additional research and highlighted policy considerations related to the wider adoption of central bank digital currency.

1. Introduction

The world is investing and adapting digital technology to build new business practices, cultures, and customer experiences in response to changing economic and consumer needs [,]. Technological advancements have greatly benefited the global economy and the financial stability of countries. Technology adoption in a country is affected by various factors, including economic development and growth []. Owing to the emergence of cryptocurrencies, the banking sector has become increasingly interested in integrating blockchain technology into its operational procedures to improve the customer experience [,]. Cross-border payments face challenges, including slow settlement, high fees, and limited accessibility [].

Central bank-issued digital currencies (CBDCs) have sparked significant interest and are currently the subject of extensive research because of their potential for rapid settlement, low fees, accessibility, and automated monetary policies [,]. In the first quarter of 2021, the global average remittance cost was 6.38 percent of the amount sent []. These high costs significantly impact households that remit money overseas, and small businesses that make international payments to suppliers. Current studies on central bank digital currencies mainly focus on understanding the relationship between CBDC news and the financial market [,,], its impact on other fiat currencies [], users’ perceptions [], cybersecurity risks in CBDCs [], and public acceptance of CBDC adoption [,], among others. Although attempts have been made to understand which countries may participate in CBDC interbank development, e.g., Li et al. [] investigated countries that can potentially collaborate in the new monetary framework developed by China, and the hypothetical influence of CBDCs on financial stability and inflation rates in three leading economies [], the studies were limited to selected countries.

This study explores the technological, environmental, legal, and economic factors that influence central bank digital currency adoption by country, providing new perspectives on technology adoption in various advanced and emerging country contexts. Although technology adoption is commonly examined at the individual level, this study offers an alternative concept by assessing macro-level factors that promote CBDC adoption. Specifically, we studied the effect of a country’s network readiness (NRI), sustainable development goal (SDG) rank, democracy level (DEM), corruption perception (CPI), corruption control (CC), economic freedom (EF), income inequality (GIC), foreign currency reserves (RiS), and the human development index (HDI) on CBDC adoption status. Such a study can help countries to develop suitable policies and initiatives to promote central bank digital currency adoption.

This study fills a significant research gap and makes a theoretical contribution by investigating countries’ CBDC adoption, and how legislators, investors, and business individuals may consider informed investment practices. The findings of this study will benefit authorities, businesses, and investors by properly understanding the factors that influence CBDC adoption by country. The remainder of this paper is organized as follows. Section 2 provides a literature review and a theoretical background. Section 3 presents the materials and the methods used in this study. Section 4 and Section 5 present the results, discussion, and recommendations for future research.

2. Theoretical Foundation and Hypotheses Development

Central bank digital currencies are a type of digital currency issued by a country’s central bank and linked to its fiat currency []. CBDCs can be implemented using both centralized and decentralized architecture []. Several nations are currently investigating the prospective applications of CBDCs, their risks, and the impacts of these advances on their economies, monetary systems, and stability. One potential application of CBDCs is in facilitating cross-border settlement []. Some international payment challenges stem from the currency exchange process, differences in various countries’ legal and technological infrastructure, problems related to time zones, and coordination issues among intermediaries []. The literature on central bank digital currencies addresses various aspects. Some studies have focused on understanding the drivers and inhibitors of the adoption of CBDCs by users. Studies have been conducted to understand the privacy perceptions of consumers [], the role of trust in users’ CBDC adoption [,], the public perception of CBDCs [], and performance expectations []. The other portion of the literature focuses on the relationship between CBDCs and cryptocurrencies. Various studies have investigated the impact of central bank digital currency news on stock and cryptocurrency markets and the directional predictability between CBDCs and major cryptocurrencies [,,].

The literature also addresses the technological risks and benefits of CBDCs. Several technical advantages have been identified, such as the potential of the CBDCs to stabilize the economic fluctuations caused by the negative interest rate policy [], aiding tax officials in keeping track of citizens’ tax payments, and in the battle against tax evasion and fraud []. Furthermore, CBDC design attributes such as budgeting usefulness, anonymity, the bundling of bank services, and rate of return [] are believed to drive demand. However, a digital currency must first comply with state regulations to be adopted in any state. Studies have noted several concerns such as data protection, digital divide [], and cybersecurity risks []. Table 1 summarizes a few noteworthy studies.

Table 1.

Some key studies on CBDCs.

Whether information technologies have distinct penetration and speed trajectories in different countries is still open to investigation and no unified framework currently exists. Central bank digital currencies are gaining traction worldwide because of their potential to address issues such as trust, verification, and cross-border transaction costs []. In this regard, we investigated the technological, legal, environmental, and economic factors that determine the CBDC adoption status in nations, along with corresponding hypotheses.

2.1. Technological Factors

Technological Readiness

Technology (network) readiness is a country’s ability to capitalize on opportunities provided by information and communications technology []. A country’s networked readiness is determined by whether it has the resources needed for technological innovations to reach their full potential and whether these developments have an impact on the economy and society []. The speed at which a nation embraces new technology depends on its citizens’ levels of readiness, knowledge, and political leadership []. Consequently, we hypothesize that network readiness affects a country’s central bank’s digital currency acceptance because it assesses individuals, organizations, and macro-level readiness for the availability of facilities, knowledge, and the drives required for technology adoption.

H1.

A country’s technological readiness is positively related to its adoption of CBDCs.

2.2. Environmental Factors

Environmental standards have influenced the functions and operations of various industries worldwide. Environmental concerns may motivate or hinder the adoption of new technology. Below, we discuss the role of the CBDC in accelerating sustainable development goals and the influence of SDGs on countries adopting central bank digital currencies.

Sustainable Development Goals

Sustainable development goals, also known as global goals, are a set of 17 interconnected objectives aimed at providing a shared blueprint for peace and prosperity []. The World Bank and the United Nations have recognized financial inclusion as a factor contributing to the achievement of seven of the 17 SDGs []. Although developed countries diligently pursue SDG goals, the International Monetary Fund (IMF) has taken the lead in helping developing countries achieve these SDGs too. For example, the IMF strives to alleviate poverty in low-income developing nations by providing financial assistance []. Access to financial services and resources is a critical step toward alleviating poverty and inequality and ensuring sustainable national development []. Despite technical advancements and innovations, the World Bank [] reports that more than a billion and a half adults worldwide do not have a bank account. A few studies have highlighted the remarkable potential of CBDCs to achieve universal financial inclusion [,]. Yang et al. [] contend that CBDCs can help promote green finance and sustainable development by improving payment efficiency and financial access. The establishment of a CBDC also indirectly contributes to SDGs by reducing the transactional loop and increasing the efficiency of fund sourcing for investments in activities and initiatives that promote sustainable development []. Consequently, we believe that countries that pursue SDG goals diligently are likely to adopt CBDCs earlier. Therefore, we propose the following hypothesis:

H2.

SDG rank is positively associated with the country’s adoption of CBDCs.

2.3. Legal Factors

The literature on the impact of a country’s legal and political setting has repeatedly demonstrated that good corporate governance leads to improved economic growth and supports technological adoption. Next, we discuss how a country’s level of corruption control, regulatory quality, and democracy affect the adoption of CBDCs.

2.3.1. Corruption Perception and Control

Corruption control refers to the extent to which public power is used for private gain such that the political structure is influenced by the wealthy. Corruption perception refers to how the public perceives and trusts a nation’s leadership structures. Money laundering is one of the most widespread global economic challenges owing to corruption []. Money laundering promotes corruption and is frequently associated with organized crime []. CBDCs that operate on blockchain technology permit the transparent record-keeping and elimination of intermediaries, making them an innovative anti-corruption solution for governing structures [,,]. Furthermore, blockchain-based CBDCs enable countries, international organizations, and law enforcement agencies to work together transparently []. A few studies have evaluated the benefits of central bank digital currencies in dealing with money laundering and criminal activities [,,]. If a country’s public power is exploited for private advantage such that the political structure is influenced by individuals, officials may not value a transparent system. However, countries with a high level of corruption control will opt for a more robust and transparent system and are more likely to implement CBDCs. Considering this, we propose the following hypotheses:

H3.

Corruption control is positively associated with the adoption of a central bank digital currency.

H4.

Corruption perception is positively associated with the adoption of a central bank digital currency.

2.3.2. Democracy Level

Various studies have indicated that technological breakthroughs result from humanity’s search for freedom, democracy, and equality. Comin and Hobijn [] asserted that countries in which the military or other authorities exercise effective executive power adopt technologies more slowly. Compared to authoritarian regimes, democratic governments have promoted widespread Internet access to bridge society’s digital divide []. In addition, an administration headed by democracy is inclined to advocate for a wider trade openness []. Acemoglu [] argues that as trade liberalization expands, more sophisticated technology is used to generate goods and services. A distinguishing feature of blockchain-based solutions is decentralization, which allows for user autonomy by minimizing information discrepancies. Conversely, the adoption of a central bank digital currency by countries can be successful in systems in which institutions and citizens may function freely. As a result, we hypothesize that the issuance of central bank digital currencies is dependent on countries’ democratic practices and that in countries with authoritarian tendencies, the issuance of central bank digital currencies is low.

H5.

Democracy level is positively associated with the adoption of central bank digital currency.

2.3.3. Economic Freedom and Regulatory Quality

Studies suggest that economic freedom and regulatory quality are important factors in analyzing cross-country differences in economic standing [,]. An economic freedom index assesses the degree to which legally acquired assets are protected and individuals are free to engage in open markets. Regulatory quality reflects perceptions of the government’s capacity to establish and enforce solid rules and regulations that allow and support private-sector development. The deployment of CBDCs, notably wholesale CBDCs, requires cooperation between the central banks of various nations, and the economic standing, regulatory quality, and freedom of the nation play a significant role []. Legal systems that rigorously enforce contracts, including government contracts, tend to have better-developed financial intermediaries []. Economically free governments protect legal agreements and private property rights. However, the enforcement of individual rights in these nations is accompanied by regulatory delays that can prevent the launch of a project. Ricci [] investigated the role of economic freedom in the fintech industry and discovered that many cryptocurrency-related activities occur in nations with less stringent capital controls and restrictions. High economic freedom and regulatory quality require various formalities and administrative processes, including the protection of individual rights, such as the General Data Protection Regulation (GDPR), for countries that comply, which is a primary concern with blockchain technology. The literature has long discussed the dichotomy between distributed ledger technology and privacy concerns [,]. Considering this, we propose the following hypotheses:

H6.

Countries with low economic freedom are highly likely to issue and engage in the adoption of a central bank digital currency.

H7.

Countries with low regulatory quality are highly likely to issue central bank digital currencies.

2.4. Economic Factors

2.4.1. Income Disparity

Over the past few decades, the adoption of modern technologies has repeatedly been attributed to widening income disparities. Technology has the potential to widen social and economic divides by disrupting certain business sectors and increasing the productivity gap between skilled and unskilled jobs [,]. However, income inequality might occasionally be considered necessary for a free-market economy because it encourages workers to work hard and entrepreneurs to innovate. In a competitive developed market economy, income disparity may not be an issue of significant concern. Technology and income inequality have been extensively studied. After studying the causal relationship between the rapid expansion of trade and financial globalization, and the widening of economic disparities between nations over the past 20 years, Jaumotte et al. [] found that advances in technology had a more significant effect on inequality. Novak [] explored how distributed ledger technology may affect income disparity and concluded that there is evidence of wealth concentration and inequality among cryptocurrency users. Considering this, we proposed the following hypothesis:

H8.

The Gini coefficient has a negative association with a country’s central bank digital currency adoption.

2.4.2. Human Development and Currency Reserve

The human development index is a statistical index that combines data on per capita income, education, and life expectancy. A country’s HDI score is influenced by factors such as a longer life expectancy, higher levels of education, and higher gross national income (PPP) per capita. Technology adoption rates are more rapid in nations with high per capita income []. Human development has been extensively researched and is considered crucial to a country’s ability to absorb new technologies and to technologically advance [,]. Lee [] found that the level of education is crucial in influencing how quickly information and communication technology advances in nations.

Foreign exchange reserves are another crucial economic component in accelerating the implementation of innovation and facilitating international trade ties. Different nations have distinct demands for foreign currency reserves based on their income levels []. While low-income countries retain reserves for transactional purposes, higher-income nations do so for speculative motives []. Owing to trade deficits and imbalances, low-income countries must maintain a certain amount of foreign exchange reserves to satisfy imports []. Numerous studies suggest that CBDCs could help central banks set up a different cross-border payment system []. Countries with low foreign reserves may be interested in exploring earlier ways to adopt central bank digital currencies as a faster and more effective means of increasing remittances and international trade. Thus, we propose the following hypotheses:

H9.

Human development is positively associated with a country’s central bank digital currency adoption.

H10.

Currency reserves are negatively associated with a country’s central bank digital currency adoption.

3. Materials and Methods

The dependent variable in this study is an ordinal variable with values of 1, 2, and 3. To examine the factors influencing countries’ adoption of blockchain-enabled CBDCs, a value of 1 was assigned to countries in the research stage; 2 to countries that have published proof of concept; and 3 to countries that have advanced to the pilot and launch stages of CBDCs. The data were obtained from the CBDC tracker []. We considered central bank digital currencies issued for retail usage (CBDCs issued for end users).

The independent variables in this study are as follows: The human development index was obtained from the United Nations Development Program [], which ranked countries on a scale of 0–1, where a score close to 1 denotes high human development. The data for the network readiness index are obtained from Portulans Institute [], which ranks countries from 0 to 100, whereby the higher the score, the higher the country’s readiness. Sustainable development goals rank data are obtained from the report by Sachs et al. [,], which assign country scores between 0 and 100 based on their commitment to sustainability. The Gini coefficient, which measures income inequality, assesses each country with a score between 0 and 100, whereby a value closer to 100 translates as greater disparity [].

Data on countries’ GDP per capita were obtained from the World Bank [] and foreign exchange reserve per capita from Global Industry Market Sizing [], which ranks countries according to their purchasing power parity and level of foreign currency reserve per capita, respectively. Countries’ levels of democracy were rated, spanning 0 to 10, with higher scores signifying higher levels of democracy []. The corruption perception index scores nations on a scale of 0 to 100 [], with a higher score indicating greater public confidence in the leadership of a nation (from the public’s perspective) and a lower score indicating lower confidence (lack of trust) in the leadership of the nation. The regulatory quality and corruption control index ranks countries on a scale from 0 to 100, where high numbers signify high levels of the regulatory quality index and corruption control []. The economic freedom index ranks countries from 0 to 100, with a high number indicating that the countries exercise higher economic freedom [].

A nonlinear model of structural equations (SEM) was used to evaluate the validity of the hypotheses. Structural equation modeling (SEM) is a statistical modeling technique used to analyze complex relationships among variables, allowing for the development of models involving observed and latent (unobservable) variables such as intelligence, intentions, or customer satisfaction. These models are often represented using path diagrams, visually depicting the relationships between the variables, and are estimated, most commonly, by maximum likelihood. They apply to various research questions, such as testing theories, examining causal relationships, and exploring complex interactions among variables. They are a valuable tool for understanding data’s underlying structures and dynamics. The hypotheses were examined with statistical estimates derived from the PLS regression analysis using Warp PLS 7.0 to observe the effect of the various constructs on countries’ adoption of central bank digital currency. Table 2 presents the variables, their labels, and their expected association with countries’ CBDC adoption.

Table 2.

The variables’ labels and expected effects.

4. Results

A structural model was created to confirm the accuracy of the model. Various fit and reliability indices were calculated to assess the overall fit and suitability of the proposed model. Table 3 presents an overview of the obtained and widely accepted values.

Table 3.

Indices of the model’s fit and reliability.

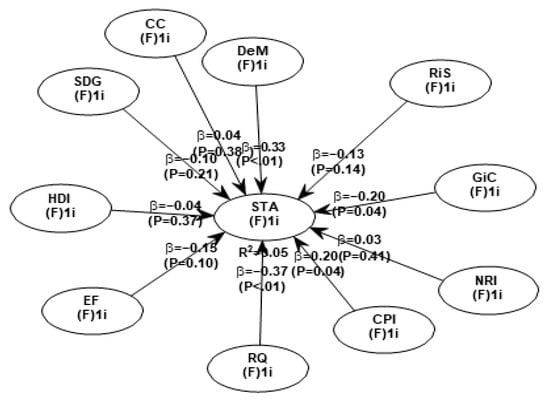

Figure 1 provides a visual representation of the proposed model together with the estimated parameter values and associated p-values.

Figure 1.

Structural relationship model between countries’ CBDC adoption status (STA) with the independent variables.

The results show that, with a confidence level greater than 95%, four of the ten proposed hypotheses were accepted (p < 0.05). Table 4 presents the findings for each of the hypotheses.

Table 4.

Testing the hypotheses.

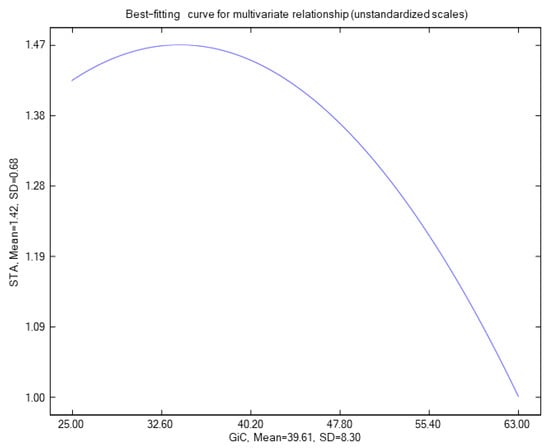

The graphs (Figure 2) below illustrate the most significant findings.

Figure 2.

A graphical illustration of the relationship between the Gini coefficient and a country’s adoption of the CBDC.

The above graph in Figure 2 indicates that the relationship between GiC, which represents income inequality (H8), and CBDC adoption is negative (β = −0.2, p < 0.04). Central bank digital currencies are more widespread in nations with moderate to small income inequalities compared to those with wide wealth gaps.

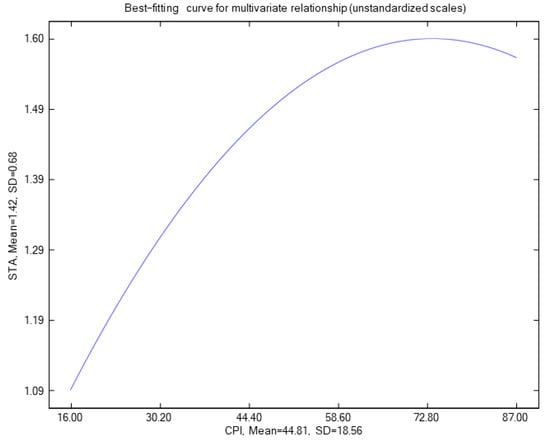

The relationship between the corruption perception index (CPI) (H3) and the adoption of CBDCs is strong and positive (β = 0.2, p = 0.04). The graph in Figure 3 illustrates how the variable “CPI” is positively correlated with the variable “STA”, indicating that as the public view of governance and trust in the government improves, CBDC adoption correspondingly increases.

Figure 3.

A graphic illustration of the association between the public’s perception of the government and the implementation of CBDCs.

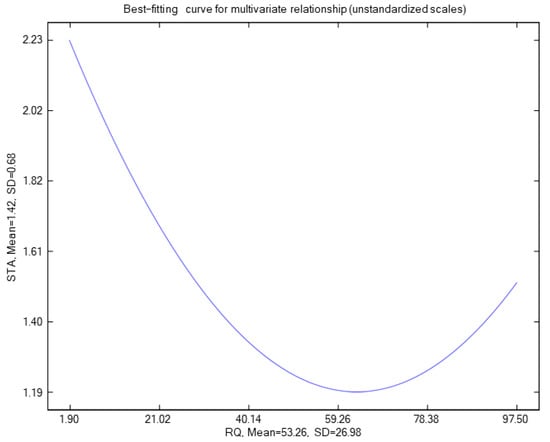

The curve in the graph in Figure 4 indicates that countries with very poor regulatory quality (RQ) have a significantly positive link with CBDC adoption, whereas countries with medium levels of RQ have a relatively weak association. However, when the level of regulatory quality reaches its highest point, adoption rates further increase.

Figure 4.

A graphic illustration of the relationship between the country’s regulatory strength and the adoption of CBDCs.

5. Discussion and Directions for Future Research

Currency use has diminished in many developed countries. For example, in Sweden, cash payments in retail purchases fell from 40% to 15% between 2010 and 2016 []. Consequently, numerous countries are investigating the possibility of issuing digital currencies as future alternatives to cash. In addition, pilot programs are being tested in a few nations to evaluate how central bank-issued digital currencies might work if introduced. We used structural equation modeling to examine the effect of ten variables, namely, countries’ technological readiness, sustainable development goal rank, corruption perception index, corruption control, regulatory quality, democracy level, economic freedom, Gini coefficient, human development index, and foreign currency reserve across 67 countries, to understand the nonlinear association of these factors with the status of CBDC adoption in the respective countries. Various studies have highlighted the relationship between countries’ technological and environmental factors/policies and their technology adoption preferences. Particularly, a country’s network readiness has been reported to positively influence how rapidly it embraces new technology [].

Environmental factors such as SDG implementation by country have also been found to influence the adoption of new technology [,]. Essentially, the World Bank and the United Nations have recognized financial inclusion as a key factor contributing to the achievement of seven of the 17 SDGs []. In addition, some studies have indicated that CBDC adoption by countries can potentially promote green finance and accelerate the achievement of universal financial inclusion [,]. Furthermore, human development has been extensively researched and is considered a major determinant of a country’s ability to adopt new technologies and technologically advance [,]. However, as shown in Table 4, we did not find a statistically significant relationship between countries’ technological readiness, sustainable development goal ranking, human development index, corruption control, and foreign currency reserves with the current state of countries’ CBDC adoption. Our results did not confirm the assertion that these factors are crucial determinants of a country’s adoption of technology [,,]. This may be because CBDC technology is still in its early stages and there are still uncertainties regarding its technological aspects and ethical framework, such as conformity with privacy regulations and individual rights.

On the other hand, as shown in Figure 1, our results revealed that there is a statistically significant relationship between countries’ CBDC adoption status with regulatory quality, level of democracy, corruption perception index, and income disparity. These findings align with previous reports that have found legal factors to be crucial elements in the adoption of new technologies. For instance, Milner [] reported that in contrast to authoritarian regimes, democratic governments promote widespread Internet access to bridge society’s digital divide. Moreover, as illustrated in Table 4, a negative coefficient is found for regulatory quality and the economic freedom index, which is in strong agreement with previous findings that countries with higher economic freedom and regulatory quality follow various formalities and administrative processes before adopting new technology [,,]. This is because these countries prioritize individual data protection rights, which remains a primary concern in the applications of blockchain technology such as CBDCs [,]. This may explain the delay in the adoption of CBDCs in such countries.

Moreover, other reports have shown that the launch of technology projects can lead to regulatory delays in countries with economically free governments because of the laws that enforce the protection of legal agreements and private property rights. Ricci [] investigated the role of economic freedom in the fintech industry and discovered that many cryptocurrency-related activities occur in nations with less stringent capital controls and restrictions. As illustrated in Figure 4, countries with low regulatory quality deploy CBDCs more quickly than those with a medium regulatory quality. However, the curve in the RQ graph indicates that CBDC adoption rates increase further when regulatory quality reaches its highest point. This curve can be explained by the possibility that some countries with high regulatory standards have effective regulations and guidelines for governing central bank digital currencies.

Furthermore, as illustrated in Table 4, the results of our study revealed a statistically significant and positive association between countries’ democracy levels and corruption perceptions (see Figure 3) with CBDC implementation. These findings signify that democratic nations with free-functioning institutions and citizens are proactive in developing central bank digital currencies. This further indicates that a high level of corruption perception (the perception of the public that the government is not corrupt) and public confidence in the nation’s political system are important factors in the adoption of CBDCs. Essentially, these facts are strongly aligned with previous reports in the literature, which suggest that blockchain-based CBDCs are an innovative anti-corruption option for countries that enable transparent record-keeping and eliminate the role of intermediaries [,].

Finally, as illustrated in Figure 2, a negative association was found between income inequality GiC and countries’ CBDC adoption. This result shows that, in nations with wide income inequality, the rising level of disparity might be of high concern and may decelerate the issuance of central bank digital currencies. In contrast, income disparity may not be a significant concern in nations with dynamic and mature market economies and, hence, are more likely to be proactive in issuing CBDCs. Notably, these findings are also aligned with previous reports in the literature [,,], which show that the adoption of modern technologies has repeatedly contributed to widening income disparities. One limitation of this study was the use of data from the previous year to fill in any values that were not present in the current year. Another limitation is that the CBDC status was manually recorded, leaving room for error. Future research may include additional parameters, such as worldwide findex data, the use of smartphones in society, the acceptance rate of cryptocurrencies in various nations, inflation rate, sociological factors, and other factors that might improve the level of explanation.

Author Contributions

Conceptualization, M.A.M.; methodology, J.L.M.B.; software, J.L.M.B.; validation, M.A.M., J.L.M.B. and C.D.-P.-H.; data curation, M.A.M.; writing—original draft preparation, M.A.M.; writing—review and editing, C.D.-P.-H.; supervision, C.D.-P.-H. and J.L.M.B. All authors have read and agreed to the published version of the manuscript.

Funding

The study was supported by the Universidad Rey Juan Carlos (Ref: PREDOC22-001).

Data Availability Statement

Links and information about the data source can be found in the materials and methods section of the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Yun, J.H.J.; Won, D.K.; Jeong, E.S.; Park, K.B.; Yang, J.H.; Park, J.Y. The relationship between technology, business model, and market in autonomous car and intelligent robot industries. Technol. Forecast. Soc. Chang. 2016, 103, 142–155. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Behera, P.; Sethi, N. Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ. Sci. Pollut. Res. 2022, 29, 52940–52953. [Google Scholar] [CrossRef] [PubMed]

- Hassani, H.; Huang, X.; Silva, E. Banking with blockchain-ed big data. J. Manag. Anal. 2018, 5, 256–275. [Google Scholar] [CrossRef]

- Jena, R.K. Examining the Factors Affecting the Adoption of Blockchain Technology in the Banking Sector: An Extended UTAUT Model. Int. J. Financ. Stud. 2022, 10, 90. [Google Scholar] [CrossRef]

- Demmou, L.; Sagot, Q. Central Bank Digital Currencies and payments: A review of domestic and international implications. OECD Econ. Dep. Work. Pap. 2021. [Google Scholar] [CrossRef]

- Armas, A.; Ruiz, L.; Vásquez, J.L. Assessing CBDC potential for developing payment systems and promoting financial inclusion in Peru. BIS Pap. Chapters 2022, 123, 131–151. [Google Scholar]

- Davoodalhosseini, S.M. Central bank digital currency and monetary policy. J. Econ. Dyn. Control 2022, 142, 104150. [Google Scholar] [CrossRef]

- Remittance Prices Worldwide Quarterly. 2023. Available online: https://remittanceprices.worldbank.org/ (accessed on 15 June 2023).

- Helmi, M.H.; Çatık, A.N.; Akdeniz, C. The impact of central bank digital currency news on the stock and cryptocurrency markets: Evidence from the TVP-VAR model. Res. Int. Bus. Financ. 2023, 65, 101968. [Google Scholar] [CrossRef]

- Wang, Y.; Wei, Y.; Lucey, B.M.; Su, Y. Return spillover analysis across central bank digital currency attention and cryptocurrency markets. Res. Int. Bus. Financ. 2023, 64, 101896. [Google Scholar] [CrossRef]

- Ayadi, A.; Ghabri, Y.; Guesmi, K. Directional predictability from central bank digital currency to cryptocurrencies and stablecoins. Res. Int. Bus. Financ. 2023, 65, 101909. [Google Scholar] [CrossRef]

- Kuehnlenz, S.; Orsi, B.; Kaltenbrunner, A. Central bank digital currencies and the international payment system: The demise of the US dollar? Res. Int. Bus. Financ. 2023, 64, 101834. [Google Scholar] [CrossRef]

- Gupta, S.; Pandey, D.K.; El Ammari, A.; Sahu, G.P. Do perceived risks and benefits impact trust and willingness to adopt CBDCs? Res. Int. Bus. Financ. 2023, 66, 101993. [Google Scholar] [CrossRef]

- Tian, S.; Zhao, B.; Olivares, R.O. Cybersecurity risks and central banks’ sentiment on central bank digital currency: Evidence from global cyberattacks. Financ. Res. Lett. 2023, 53, 103609. [Google Scholar] [CrossRef]

- Ngo, V.M.; Van Nguyen, P.; Nguyen, H.H.; Tram, H.X.T.; Hoang, L.C. Governance and monetary policy impacts on public acceptance of CBDC adoption. Res. Int. Bus. Financ. 2023, 64, 101865. [Google Scholar] [CrossRef]

- Li, J. Predicting the demand for central bank digital currency: A structural analysis with survey data. J. Monet. Econ. 2023, 134, 73–85. [Google Scholar] [CrossRef]

- Li, F.; Yang, T.; Du, M.; Huang, M. The development fit index of digital currency electronic payment between China and the one belt one road countries. Res. Int. Bus. Financ. 2023, 64, 101838. [Google Scholar] [CrossRef]

- Rehman, M.A.; Irfan, M.; Naeem, M.A.; Lucey, B.M.; Karim, S. Macro-financial implications of central bank digital currencies. Res. Int. Bus. Financ. 2023, 64, 101892. [Google Scholar] [CrossRef]

- Jabbar, A.; Geebren, A.; Hussain, Z.; Dani, S. Ul-Durar. Investigating individual privacy within CBDC: A privacy calculus perspective. Res. Int. Bus. Financ. 2023, 64, 101826. [Google Scholar] [CrossRef]

- Sethaput, V.; Innet, S. Blockchain application for central bank digital currencies (CBDC). Cluster Comput. 2023, 26, 2183–2197. [Google Scholar] [CrossRef]

- The World Bank. Financial Inclusion on the Rise, but Gaps Remain, Global Findex Database Shows; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Soilen, K.S.; Benhayoun, L. Household acceptance of central bank digital currency: The role of institutional trust. Int. J. Bank Mark. 2022, 40, 172–196. [Google Scholar] [CrossRef]

- Xin, B.; Jiang, K. Central bank digital currency and the effectiveness of negative interest rate policy: A DSGE analysis. Res. Int. Bus. Financ. 2023, 64, 101901. [Google Scholar] [CrossRef]

- Scarcella, L. The implications of adopting a European Central Bank Digital Currency: A Tax Policy Perspective. EC TAX Rev. 2021, 30, 177–188. [Google Scholar] [CrossRef]

- Radic, A.; Quan, W.; Koo, B.; Chua, B.-L.; Kim, J.J.; Han, H. Central bank digital currency as a payment method for tourists: Application of the theory of planned behavior to digital Yuan/Won/Dollar choice. J. Travel\Tour. Mark. 2022, 39, 152–172. [Google Scholar] [CrossRef]

- Roussou, I.; Stiakakis, E.; Sifaleras, A. An empirical study on the commercial adoption of digital currencies. Inf. Syst. E-Bus. Manag. 2019, 17, 223–259. [Google Scholar] [CrossRef]

- Alfar, A.J.K.; Kumpamool, C.; Nguyen, D.T.K.; Ahmed, R. The determinants of issuing central bank digital currencies. Res. Int. Bus. Financ. 2023, 64, 101884. [Google Scholar] [CrossRef]

- Koziuk, V. Confidence in digital money: Are central banks more trusted than age is matter? Investig. Manag. Financ. Innov. 2021, 18, 12–32. [Google Scholar] [CrossRef]

- Afonasova, M.A.; Panfilova, E.E.; Galichkina, M.A.; Ślusarczyk, B. Digitalization in economy and innovation: The effect on social and economic processes. Polish J. Manag. Stud. 2019, 19, 22–32. [Google Scholar] [CrossRef]

- World Economic Forum. The Global Information Technology Report. Available online: http://reports.weforum.org/global-information-technology-report-2016/ (accessed on 22 July 2023).

- Venter, I.M.; Cranfield, D.J.; Tick, A.; Blignaut, R.J.; Renaud, K.V. ‘Lockdown’: Digital and Emergency eLearning Technologies—A Student Perspective. Electronics 2022, 11, 2941. [Google Scholar] [CrossRef]

- Filho, W.L.; Vidal, D.G.; Chen, C.; Petrova, M.; Dinis, M.A.P.; Yang, P.; Rogers, S.; Álvarez-Castañón, L.; Djekic, I.; Sharifi, A.; et al. An assessment of requirements in investments, new technologies, and infrastructures to achieve the SDGs. Environ. Sci. Eur. 2022, 34, 58. [Google Scholar] [CrossRef]

- Alonso, S.L.N.; Jorge-Vazquez, J.; Forradellas, R.F.R. Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability 2020, 12, 7480. [Google Scholar] [CrossRef]

- Abbott, P.; Andersen, T.B.; Tarp, F. IMF and economic reform in developing countries. Q. Rev. Econ. Financ. 2010, 50, 17–26. [Google Scholar] [CrossRef]

- Levesque, B.; Godfrey, N.; Miller, M.; Stark, E. The Case for Financial Literacy in Developing Countries: Promoting Access to Finance by Empowering Consumers; World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Ozili, P.K. CBDC, Fintech and cryptocurrency for financial inclusion and financial stability. Digit. Policy Regul. Gov. 2023, 25, 40–57. [Google Scholar] [CrossRef]

- Banerjee, S.; Sinha, M. Promoting Financial Inclusion through Central Bank Digital Currency: An Evaluation of Payment System Viability in India. Australas. Account. Bus. Financ. J. 2023, 17, 176–204. [Google Scholar] [CrossRef]

- Yang, Q.; Zheng, M.; Wang, Y. The Role of CBDC in Green Finance and Sustainable Development. Emerg. Mark. Financ. Trade 2023, 1–16. [Google Scholar] [CrossRef]

- Ozili, P.K. Using Central Bank Digital Currency to Achieve the Sustainable Development Goals. SSRN Electron. J. 2023, 111C, 143–153. [Google Scholar] [CrossRef]

- Rose-Ackerman, S.; Palifka, B.J. Corruption, Organized Crime, and Money Laundering. In Institutions, Governance and the Control of Corruption; Springer International Publishing: Cham, Switzerland, 2018; pp. 75–111. [Google Scholar]

- Atako, N. Privacy Beyond Possession: Solving the Access Conundrum in Digital Dollars. Vanderbilt J. Entertain. Technol. Law 2020, 23, 821. [Google Scholar]

- Zulfikri, Z.; Sa’ad, A.A.; Kassim, S.; Othman, A.H.A. Feasibility of Central Bank Digital Currency for Blockchain-Based Zakat in Indonesia. In Innovation of Businesses, and Digitalization during COVID-19 Pandemic. ICBT 2021; Lecture Notes in Networks and Systems; Springer: Cham, Switzerland, 2023; Volume 488. [Google Scholar] [CrossRef]

- Sarker, S.; Henningsson, S.; Jensen, T.; Hedman, J. Use Of Blockchain As A Resource For Combating Corruption in Global Shipping: An Interpretive Case Study. J. Manag. Inf. Syst. 2021, 38, 338–373. [Google Scholar] [CrossRef]

- Lee, D.K.C.; Yan, L.; Wang, Y. A global perspective on central bank digital currency. China Econ. J. 2021, 14, 52–66. [Google Scholar] [CrossRef]

- Dupuis, D.; Gleason, K.; Wang, Z. Money laundering in a CBDC world: A game of cats and mice. J. Financ. Crime 2022, 29, 171–184. [Google Scholar] [CrossRef]

- Abu, N.A. Keynote Paper Digital Ringgit: A New Digital Currency with Traditional Attributes. In Proceedings of the 8th International Cryptology and Information Security Conference, Putrajaya, Malaysia, 26–28 July 2022. [Google Scholar]

- Elsayed, A.H.; Nasir, M.A. Central bank digital currencies: An agenda for future research. Res. Int. Bus. Financ. 2022, 62, 101736. [Google Scholar] [CrossRef]

- Comin, D.; Hobijn, B. Cross-country technology adoption: Making the theories face the facts. J. Monet. Econ. 2004, 51, 39–83. [Google Scholar] [CrossRef]

- Milner, H.V. The Digital Divide. Comp. Polit. Stud. 2006, 39, 176–199. [Google Scholar] [CrossRef]

- Acemoglu, D. Patterns of Skill Premia. Rev. Econ. Stud. 2003, 70, 199–230. [Google Scholar] [CrossRef]

- de Vanssay, X.; Spindler, Z.A. Freedom and growth: Do constitutions matter? Public Choice 1994, 78, 359–372. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A.; Vishny, R.W. Legal Determinants of External Finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- de Haan, J.; Sturm, J.-E. On the relationship between economic freedom and economic growth. Eur. J. Polit. Econ. 2000, 16, 215–241. [Google Scholar] [CrossRef]

- Levine, R.; Loayza, N.; Beck, T. Financial intermediation and growth: Causality and causes. J. Monet. Econ. 2000, 46, 31–77. [Google Scholar] [CrossRef]

- Ricci, P. How economic freedom reflects on the Bitcoin transaction network. J. Ind. Bus. Econ. 2020, 47, 133–161. [Google Scholar] [CrossRef]

- Tatar, U.; Gokce, Y.; Nussbaum, B. Law versus technology: Blockchain, GDPR, and tough tradeoffs. Comput. Law Secur. Rev. 2020, 38, 105454. [Google Scholar] [CrossRef]

- Freund, G.P.; Fagundes, B.; de Macedo, D.D.J. An Analysis of Blockchain and GDPR under the Data Lifecycle Perspective. Mob. Netw. Appl. 2021, 26, 266–276. [Google Scholar] [CrossRef]

- Acemoglu, D. Technical Change, Inequality, and the Labor Market. J. Econ. Lit. 2002, 40, 7–72. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P.; Violante, G.L. General Purpose Technology and Wage Inequality. J. Econ. Growth 2002, 7, 315–345. [Google Scholar] [CrossRef]

- Jaumotte, F.; Lall, S.; Papageorgiou, C. Rising Income Inequality: Technology, or Trade and Financial Globalization? IMF Econ. Rev. 2013, 61, 271–309. [Google Scholar] [CrossRef]

- Novak, M. The implications of blockchain for income inequality. In Blockchain Economics: Implications of Distributed Ledgers-Markets, Communications Networks, and Algorithmic Reality; World Scientific: Singapore, 2019. [Google Scholar]

- Lee, J.-W. Education for Technology Readiness: Prospects for Developing Countries. J. Hum. Dev. 2001, 2, 115–151. [Google Scholar] [CrossRef]

- Andriyani, K.; Marwa, T.; Adnan, N.; Muizzuddin, M. The Determinants of Foreign Exchange Reserves: Evidence from Indonesia. J. Asian Financ. Econ. Bus. 2020, 7, 629–636. [Google Scholar] [CrossRef]

- Ahmad, I.; Azam, A.; Mehmood, K.A.; Faridi, M.Z.; Aurmaghan, M. Vulnerabilities of Developing Countries to Foreign Exchange Reserves and Remittances: A Case Study of Pakistan economy. Int. J. Manag. 2020, 11, 646–659. [Google Scholar]

- CBDC Tracker. Available online: https://cbdctracker.org/timeline (accessed on 15 June 2023).

- Human Development Index. Available online: https://hdr.undp.org/data-center/human-development-index#/indicies/HDI (accessed on 15 June 2023).

- Network Readiness Index. Available online: https://networkreadinessindex.org/ (accessed on 15 June 2023).

- Sustainable Development Goal Rank. Available online: https://dashboards.sdgindex.org/ (accessed on 15 June 2023).

- Sachs, J.D.; Lafortune, G.; Fuller, G.; Drumm, E. Implementing the SDG Stimulus. In Sustainable Development Report 2023; Sustainable Development Solutions Network: Paris, France, 2023. [Google Scholar] [CrossRef]

- Gini Coefficient by Country. 2023. Available online: https://worldpopulationreview.com/ (accessed on 15 June 2023).

- GDP per Capita. Available online: https://www.worldbank.org/en/home (accessed on 15 June 2023).

- Foreign Currency Reserve per Capita. Available online: https://www.nationmaster.com/ (accessed on 15 June 2023).

- Democracy Index. Available online: https://www.eiu.com/n/ (accessed on 15 June 2023).

- Corruption Perception Index. Available online: https://www.transparency.org.uk/ (accessed on 15 June 2023).

- World Governance Indicators. Available online: https://info.worldbank.org/governance/wgi/Home/Reports (accessed on 15 June 2023).

- Economic Freedom. Available online: https://indexdotnet.azurewebsites.net/index (accessed on 15 June 2023).

- Riksbank, S. The Riksbank’s E-Krona Project. 2017. Available online: https://www.riksbank.se/en-gb/payments--cash/e-krona/e-krona-reports/e-krona-project-report-1/ (accessed on 15 June 2023).

- Centobelli, P.; Cerchione, R.; Esposito, E. Pursuing supply chain sustainable development goals through the adoption of green practices and enabling technologies: A cross-country analysis of LSPs. Technol. Forecast. Soc. Change 2020, 153, 119920. [Google Scholar] [CrossRef]

- Shahzad, U.; Radulescu, M.; Rahim, S.; Isik, C.; Yousaf, Z.; Ionescu, S. Do Environment-Related Policy Instruments and Technologies Facilitate Renewable Energy Generation? Exploring the Contextual Evidence from Developed Economies. Energies 2021, 14, 690. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).