Export Growth and Quality Determination of Wood Forest Products: Evidence from China

Abstract

1. Introduction

2. Characteristic Facts

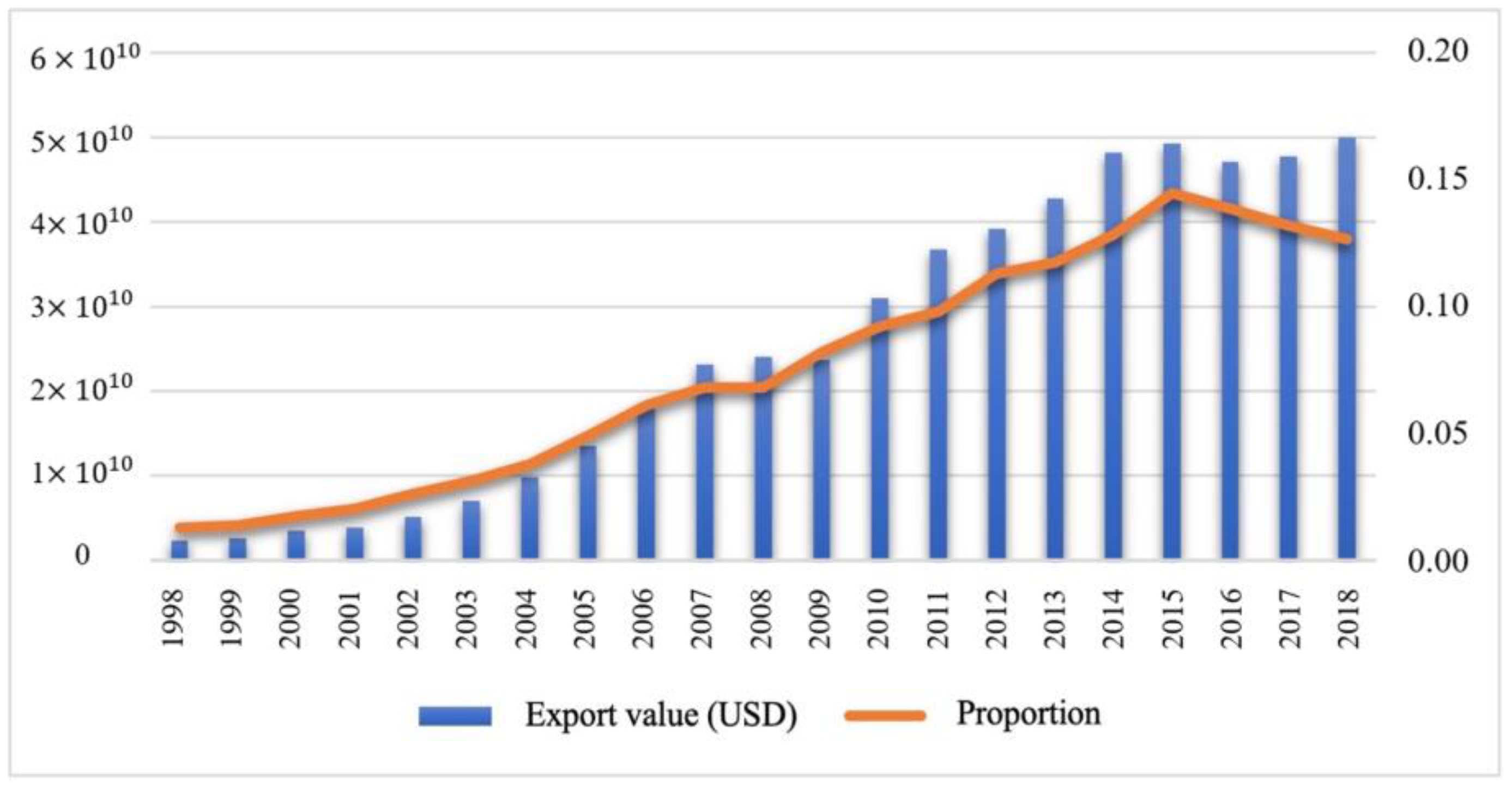

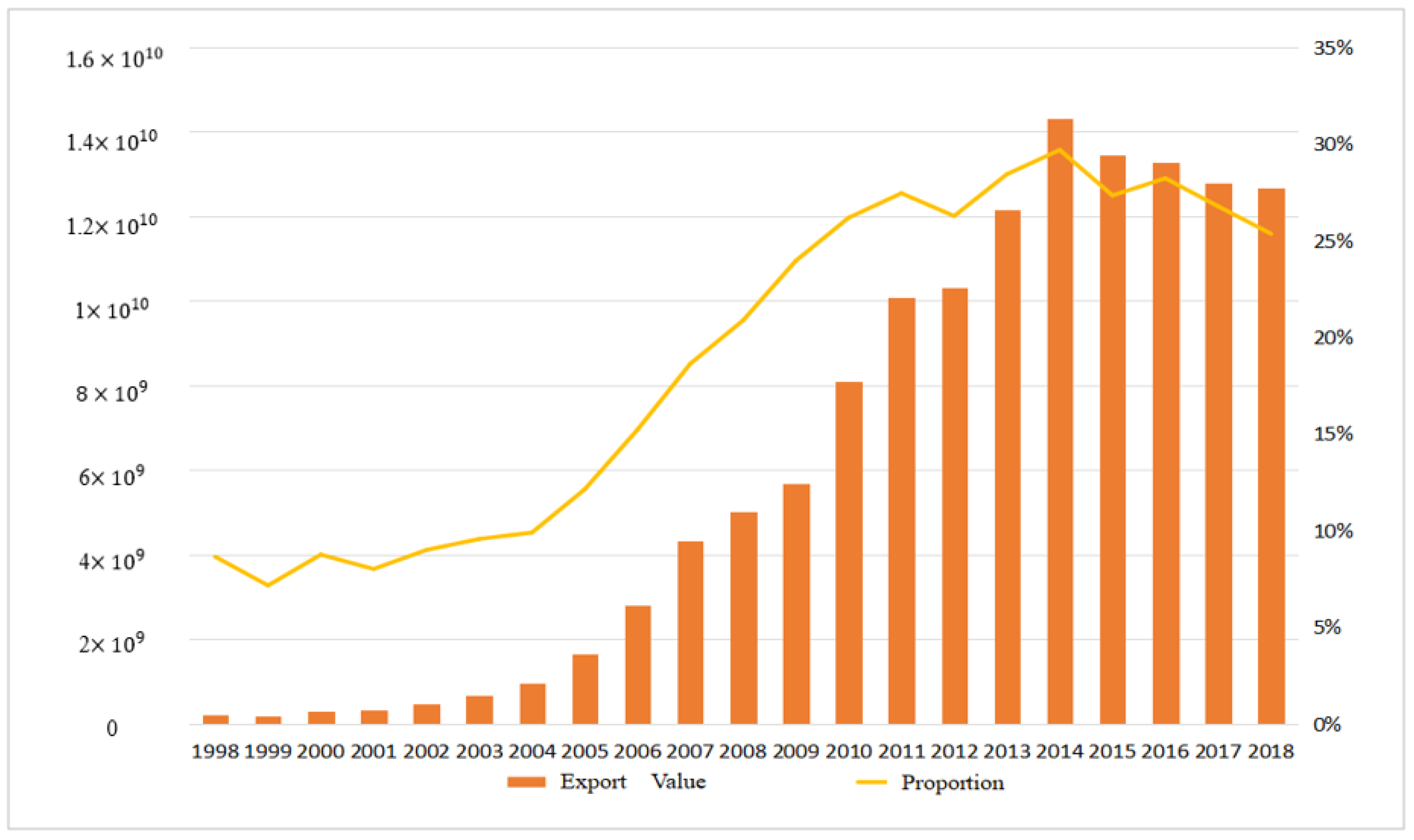

2.1. Slower Growth in Export Trade

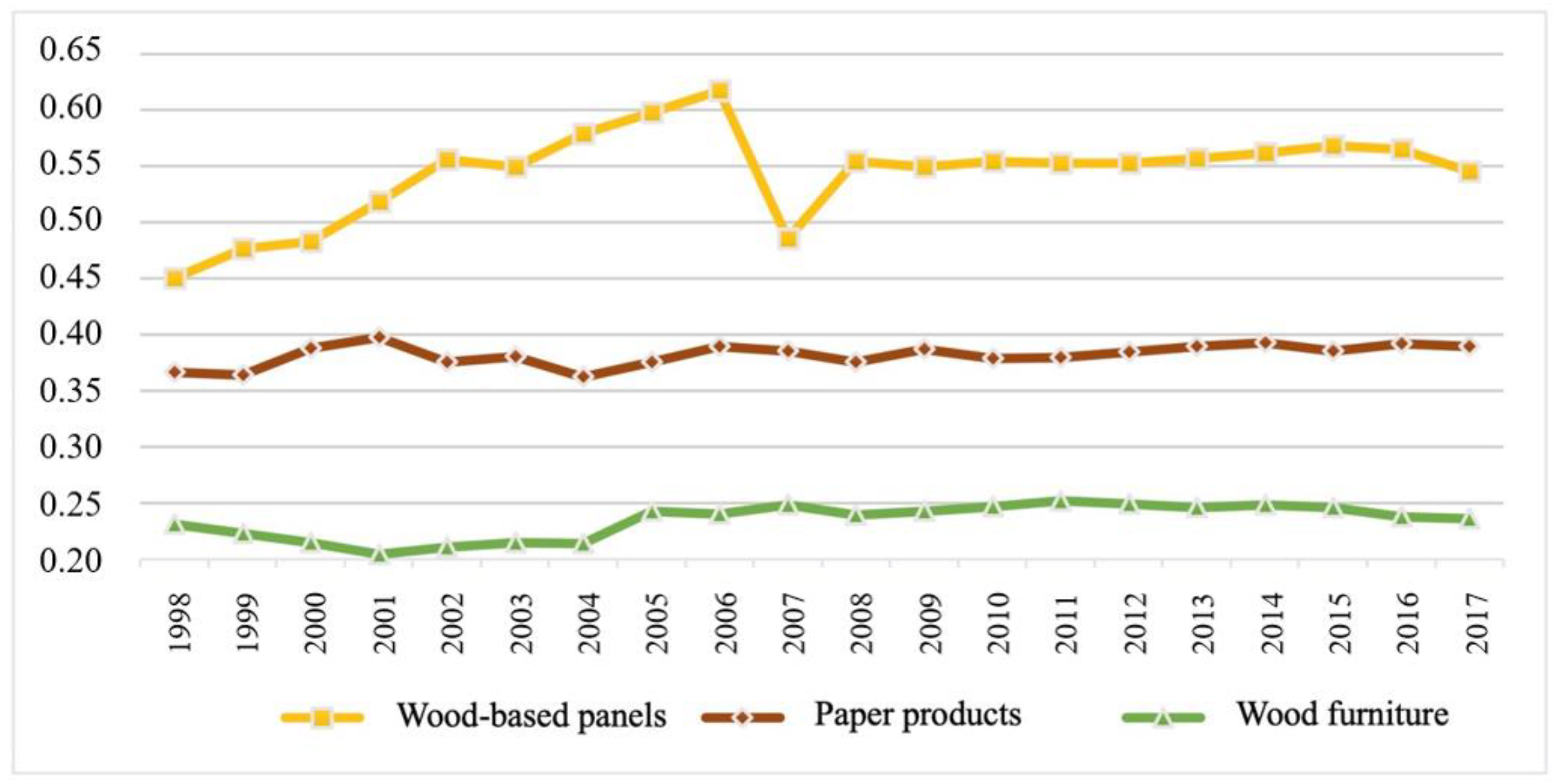

2.2. Export Products Are Dominated by Wood Furniture, Paper Products, and Wood-Based Panels

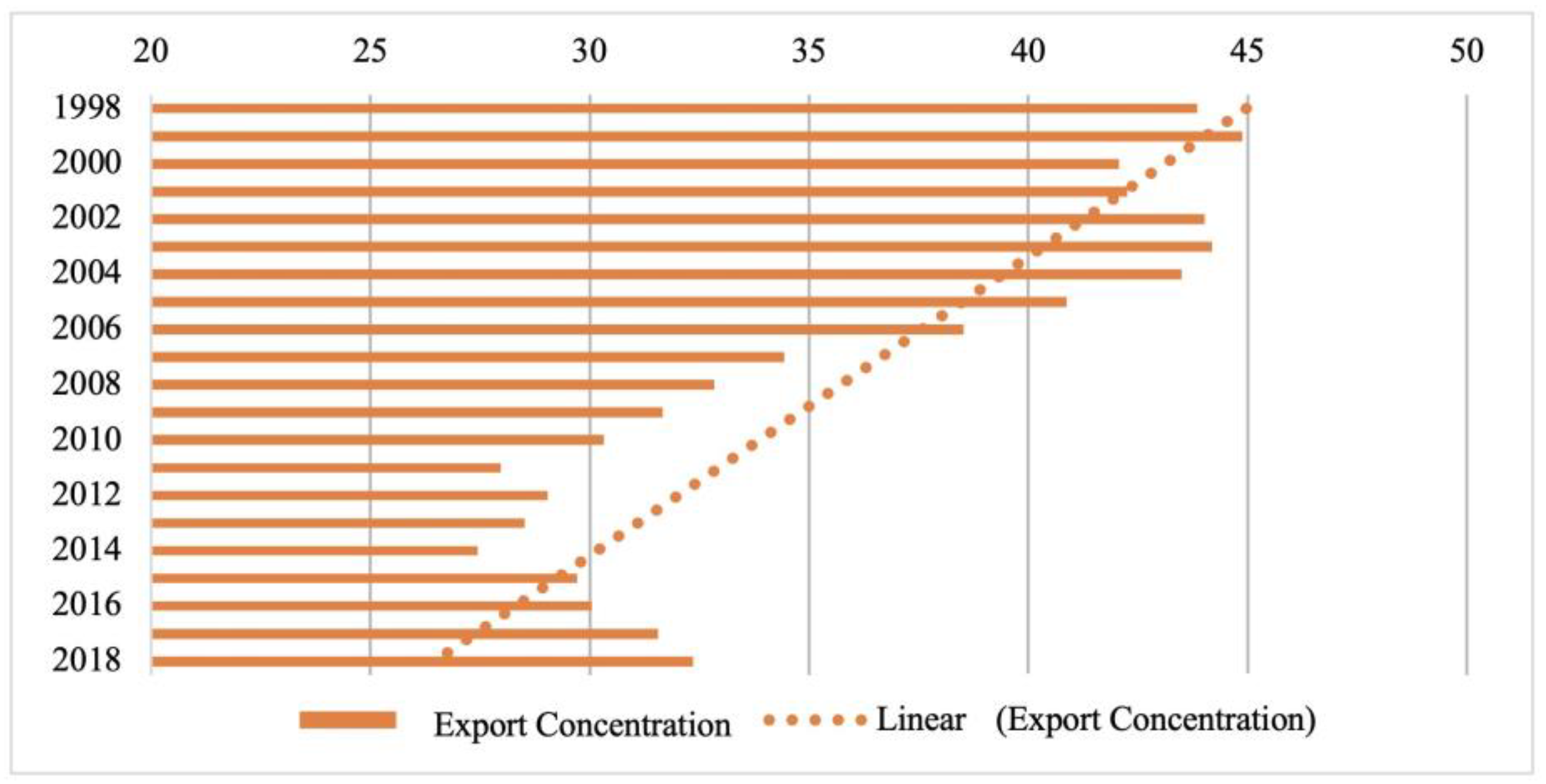

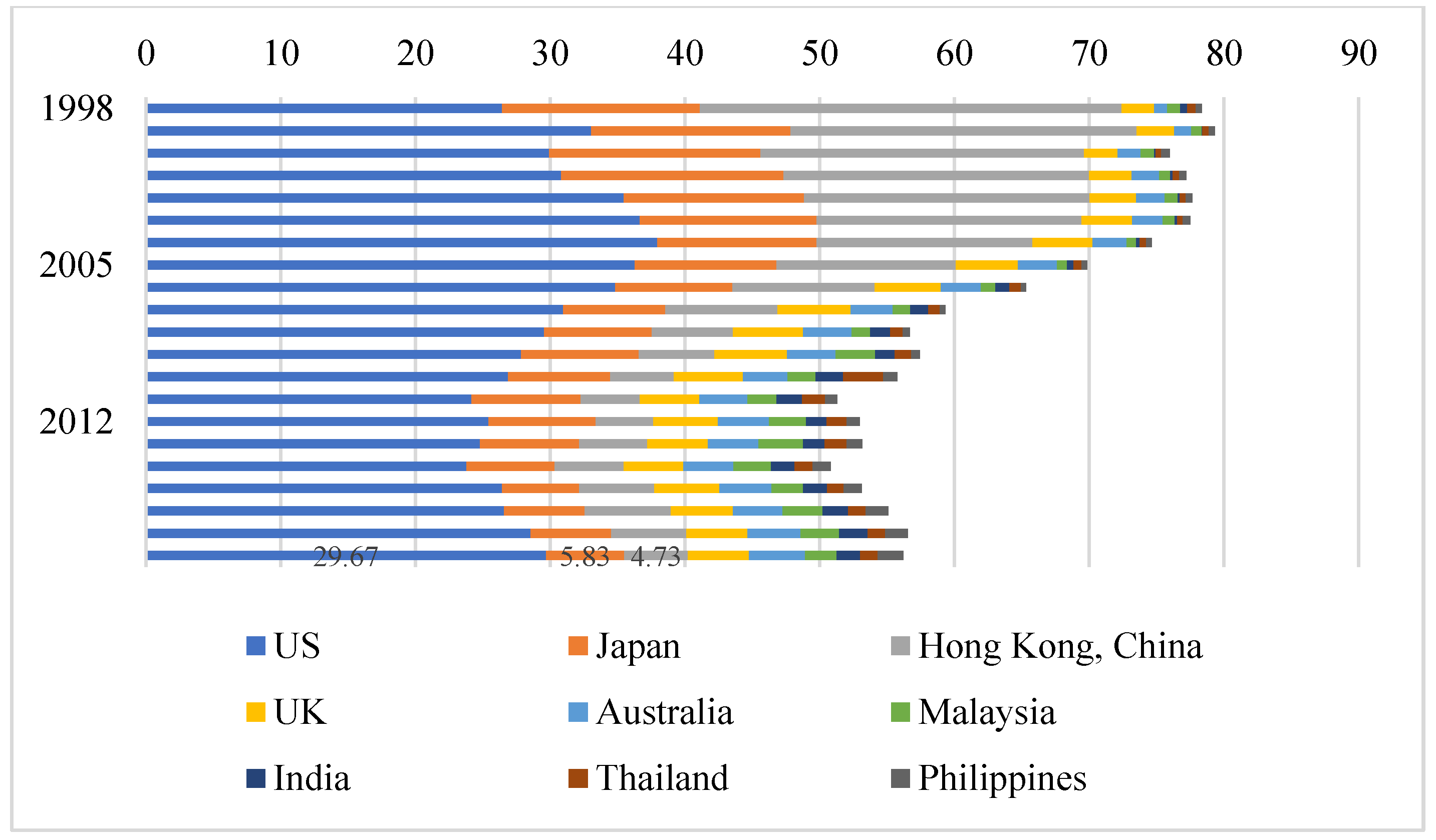

2.3. Export Market Concentration Declined and Major Target Markets Stabilized

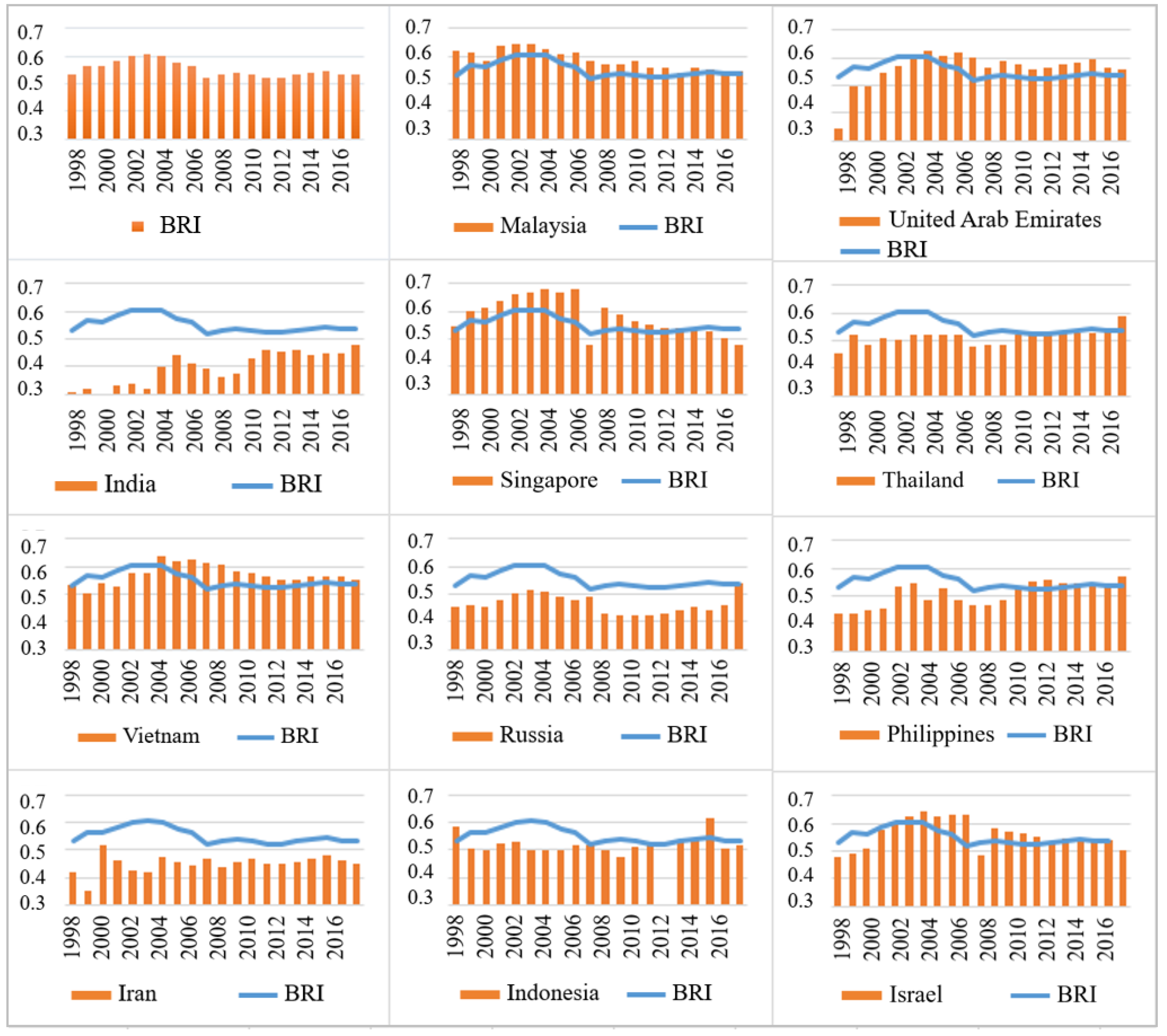

2.4. The Importance of the Belt and Road Initiative Markets Has Been Highlighted

3. Methodology

3.1. Measurement and Determination of Export Product Quality

3.2. Data Source for Export Product Quality Measurement

4. Measurement Results

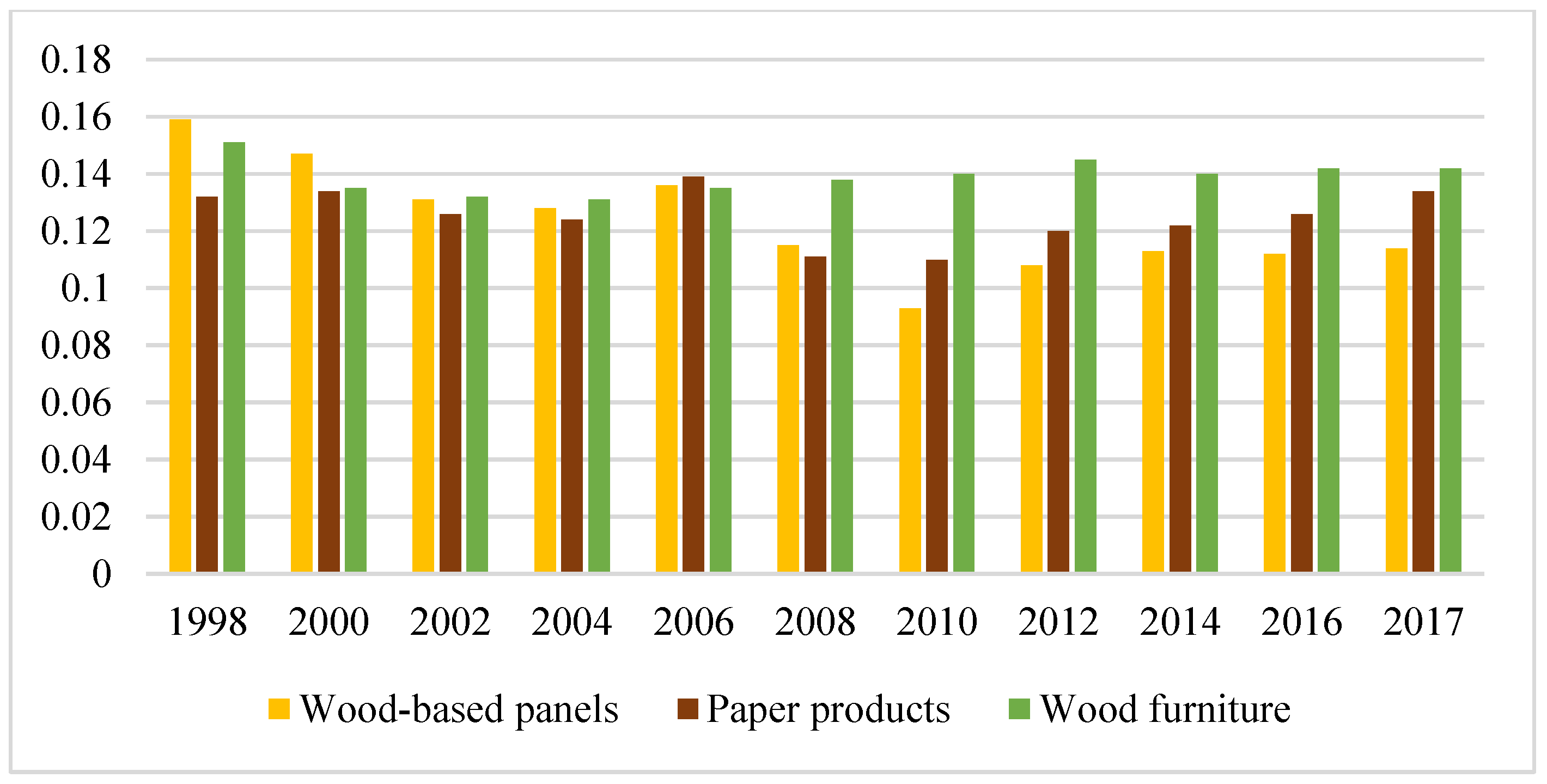

4.1. Measurement Result of Product Quality in the Export of Major Wood Forest Products

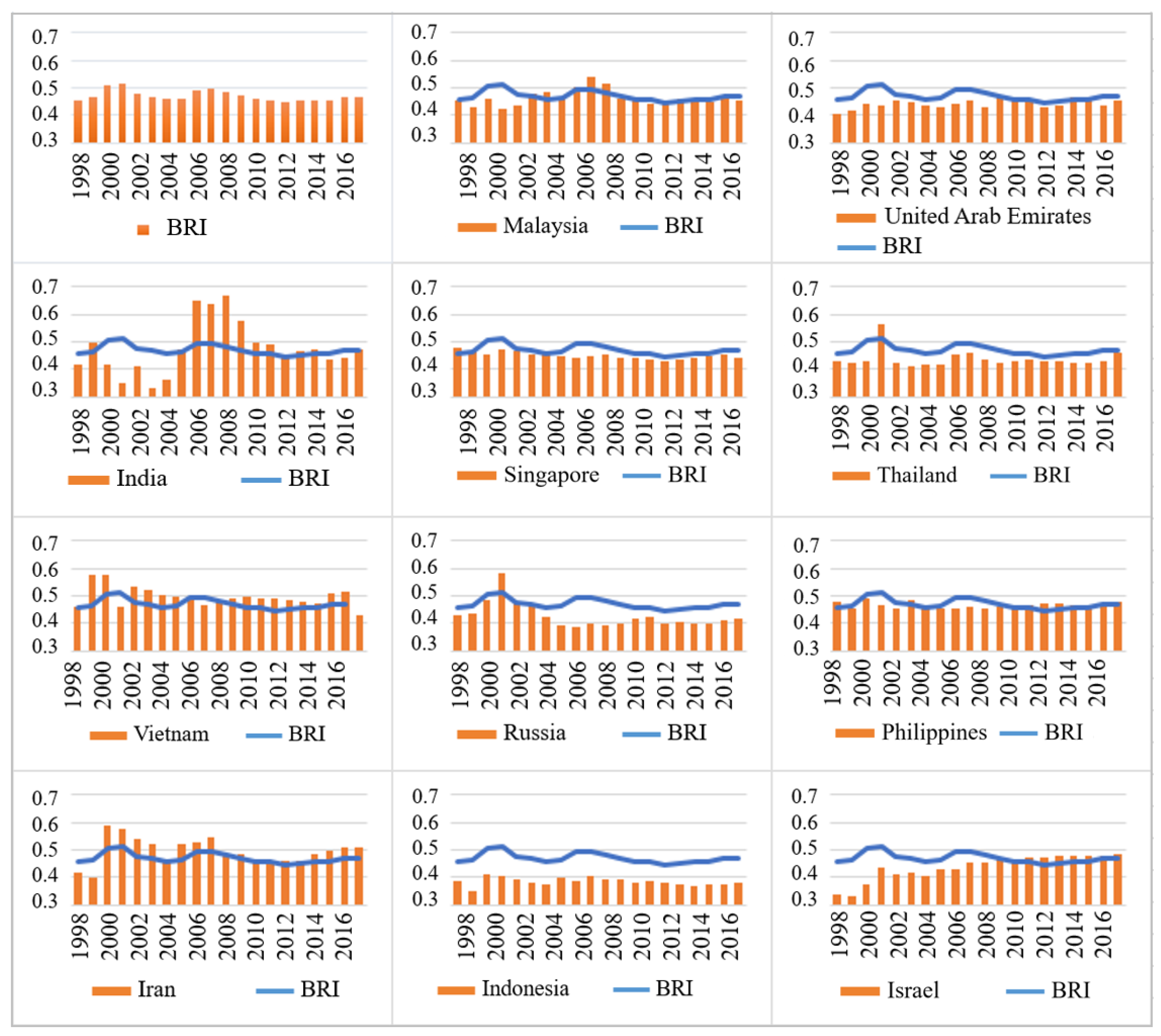

4.2. Changes in the Quality of Wood Forest Products Exported from China to the BRI Countries

4.2.1. Changes in the Quality of Wood-Based Panels Exported from China to the BRI Countries

4.2.2. Changes in the Quality of Paper Products Exported from China to the BRI Countries

4.2.3. Changes in the Quality of Wood Furniture Exported from China to the BRI Countries

5. Determinants Analysis

5.1. Empirical Model

| Variable | Explanation | Anticipated Effect | Data Source |

|---|---|---|---|

| tfp | Total Factor Productivity | + | The industrial added value and fixed asset data come from the China Industry Statistical Yearbook, while the labor force data come from the China Labor Statistics Yearbook. |

| thc | R&D Investment | + | The number of industrial enterprises above a certain scale and internal expenditure on research and development comes from the China Science and Technology Statistics Yearbook. |

| labor | Labor Cost | +/− | The total wage and the number of employees on-site at the end of the year come from the China Labor Statistics Yearbook. |

| invest | Foreign Direct Investment | + | The amount of foreign investment, investment from Hong Kong, Macao, and Taiwan regions of China, and the actual capital come from the China Industry Statistical Yearbook. |

| scale | Industry Scale | + | The number of employees on-site at the end of the year comes from the China Labor Statistics Yearbook. |

| z | Capital Intensity | + | The fixed asset data come from the China Industry Statistical Yearbook, while the number of employees comes from the China Labor Statistics Yearbook. |

| finance | Financing Constraints | − | The interest expense and total assets data come from the China Industry Statistical Yearbook. |

| Q | Whether Signing a Free Trade Agreement | +/− | The data on whether or not a free trade agreement is signed comes from the China Free Trade Area Service Website. |

| Variable | Observations | Mean | Std. Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| quality | 10,039 | 0.5005187 | 0.1363858 | 0 | 1 |

| tfp | 8644 | 12.41399 | 4.501433 | 8.17706 | 19.90974 |

| lnthc | 9668 | 9.33594 | 3.521916 | 3.612103 | 14.75769 |

| lnlabor | 9856 | 10.87705 | 1.663369 | 8.459352 | 14.24928 |

| invest | 8644 | 0.3735321 | 0.1812412 | 0.0817856 | 0.9021394 |

| lnscale | 10,039 | 12.97402 | 0.448866 | 11.98916 | 13.93909 |

| lnz | 8644 | 12.5466 | 0.7351631 | 10.96491 | 13.64527 |

| finance | 8286 | 0.0139098 | 0.0027566 | 0.009 | 0.0191179 |

| Q | 10,039 | 0.0354617 | 0.1849529 | 0 | 1 |

5.2. Data and Variables

5.2.1. Total Factor Productivity

5.2.2. R&D Investment

5.2.3. Labor Cost

5.2.4. Foreign Direct Investment

5.2.5. Industry Scale

5.2.6. Capital Intensity

5.2.7. Financing Constraints

5.2.8. Whether Signing a Free Trade Agreement

5.3. Empirical Results

5.3.1. Regression Results for Different Products

- (1)

- Total factor productivity has a significant positive impact on the quality of all three exported products, which is consistent with expectations. Among them, the impact on paper product quality is the greatest, while the impact on wood furniture quality is the least;

- (2)

- R&D investment has a significant positive impact on the quality of three types of products, and the impact on the quality of wood-based panels is higher than that of the other two types of products, indicating that wood-based panel companies have high efficiency in the use of R&D investment funds;

- (3)

- Labor costs have a significant negative impact on the quality of wood-based panels and wood furniture while having a significant positive impact on the quality of paper products. The rise in labor costs significantly increases the operating costs of labor-intensive industries such as wood-based panels and wood furniture. In order to maintain the original market competitiveness of products, companies reduce their investment in other areas, which has a negative impact on the quality of export products. For capital-intensive industries such as paper products, the impact of rising labor costs is relatively small. In this case, companies will choose to hire highly skilled employees, which has a positive impact on product quality;

- (4)

- Foreign direct investment has no significant impact on the quality of three types of export products;

- (5)

- The impact coefficient of industrial scale on wood furniture is positive and significant at the 10% level, indicating that the expansion of the wood furniture industry scale has brought the required capital, human resources, and other production factors for the development of the industry, while the impact on the quality of wood-based panels and paper products is not significant;

- (6)

- Capital intensity has a significant positive impact on the quality of paper products but no significant impact on the quality of wood-based panels and wood furniture, indicating that increasing the abundance of capital factors in the paper products industry can improve product quality;

- (7)

- The financing factor has a significant constraining impact on wood-based panels at the 10% level. Wood-based panel companies face strong financing constraints, which have an adverse impact on the quality improvement of export products. This may be an important reason why the quality of wood-based panels, although at a high level, has remained stable after the financial crisis, making it difficult to achieve a rapid increase in quality, like in the early 20th century. However, financing constraints do not significantly affect the quality of other products;

- (8)

- The signing of free trade agreements significantly negatively impacts paper product quality. Trade costs decrease, and some low-efficiency enterprises participate in international trade, decreasing the quality of exported products. However, signing free trade agreements does not significantly affect the quality of wood-based panels and furniture.

5.3.2. Endogeneity and Robustness Tests

- (1)

- Endogeneity Test

- (2)

- Robustness Test

6. Conclusions and Discussions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | Roundwood | Sawnwood | Wood-Based Panels | Wood Pulp | Paper Products | Wood Furniture | Share of Top Three Products (%) |

|---|---|---|---|---|---|---|---|

| 1998 | 0.125 | 1.143 | 1.172 | 0.099 | 9.908 | 10.847 | 0.941 |

| 1999 | 0.080 | 1.375 | 1.823 | 0.034 | 9.249 | 13.095 | 0.942 |

| 2000 | 0.079 | 1.780 | 2.637 | 0.106 | 14.058 | 16.685 | 0.944 |

| 2001 | 0.056 | 1.949 | 3.274 | 0.083 | 14.831 | 18.521 | 0.946 |

| 2002 | 0.032 | 1.900 | 5.588 | 0.156 | 17.079 | 27.063 | 0.960 |

| 2003 | 0.029 | 2.340 | 6.469 | 0.213 | 23.062 | 38.155 | 0.963 |

| 2004 | 0.020 | 2.176 | 15.172 | 0.163 | 28.457 | 52.293 | 0.976 |

| 2005 | 0.020 | 2.786 | 24.220 | 0.357 | 39.288 | 68.432 | 0.977 |

| 2006 | 0.014 | 3.527 | 37.425 | 0.587 | 53.971 | 87.837 | 0.977 |

| 2007 | 0.012 | 3.899 | 48.992 | 0.920 | 71.198 | 106.848 | 0.979 |

| 2008 | 0.010 | 4.014 | 47.855 | 0.984 | 77.450 | 110.187 | 0.979 |

| 2009 | 0.046 | 3.451 | 36.123 | 0.910 | 75.671 | 120.352 | 0.981 |

| 2010 | 0.105 | 3.404 | 47.687 | 1.401 | 95.612 | 161.565 | 0.984 |

| 2011 | 0.068 | 3.590 | 61.053 | 2.310 | 129.055 | 171.151 | 0.984 |

| 2012 | 0.017 | 3.295 | 67.123 | 1.278 | 137.218 | 183.309 | 0.988 |

| 2013 | 0.067 | 3.240 | 68.882 | 1.063 | 159.877 | 194.392 | 0.990 |

| 2014 | 0.081 | 2.953 | 78.600 | 1.177 | 178.185 | 220.915 | 0.991 |

| 2015 | 0.041 | 2.052 | 73.078 | 1.131 | 187.524 | 228.485 | 0.993 |

| 2016 | 0.298 | 1.932 | 69.067 | 1.097 | 176.101 | 222.068 | 0.993 |

| 2017 | 0.302 | 2.021 | 67.224 | 1.350 | 179.886 | 226.871 | 0.992 |

| 2018 | 0.236 | 1.785 | 72.629 | 1.313 | 194.606 | 229.644 | 0.993 |

| Trend year by year |  |  |  |  |  |  |  |

| Year | Singapore | Malaysia | UAE | Thailand | India | Vietnam | Philippines | Indonesia | Russia | Iran |

|---|---|---|---|---|---|---|---|---|---|---|

| 1998 | 34.519 | 11.088 | 4.012 | 7.068 | 6.213 | 5.595 | 5.403 | 3.306 | 3.313 | 0.302 |

| 1999 | 33.547 | 10.823 | 3.456 | 6.385 | 0.739 | 3.361 | 6.911 | 6.181 | 1.615 | 0.224 |

| 2000 | 23.369 | 11.375 | 3.876 | 4.818 | 1.400 | 3.967 | 6.933 | 5.459 | 1.883 | 8.834 |

| 2001 | 16.682 | 10.427 | 7.009 | 6.169 | 2.025 | 3.080 | 6.693 | 4.631 | 2.764 | 4.968 |

| 2002 | 16.093 | 10.542 | 7.568 | 5.193 | 1.665 | 3.541 | 5.339 | 5.316 | 3.713 | 1.740 |

| 2003 | 12.612 | 9.285 | 8.851 | 4.387 | 1.920 | 3.238 | 5.913 | 6.927 | 4.499 | 2.160 |

| 2004 | 9.738 | 7.048 | 10.792 | 4.925 | 2.560 | 4.307 | 4.261 | 5.628 | 4.378 | 1.873 |

| 2005 | 7.273 | 6.128 | 9.570 | 4.843 | 3.965 | 4.570 | 3.239 | 4.337 | 5.677 | 3.558 |

| 2006 | 5.502 | 7.151 | 9.422 | 5.590 | 6.827 | 3.813 | 2.418 | 3.628 | 5.357 | 4.757 |

| 2007 | 5.939 | 7.003 | 10.017 | 4.655 | 7.074 | 4.194 | 2.216 | 3.782 | 5.948 | 5.091 |

| 2008 | 5.017 | 6.729 | 11.552 | 4.491 | 7.018 | 3.751 | 2.463 | 3.334 | 7.698 | 3.721 |

| 2009 | 15.286 | 12.255 | 9.675 | 5.146 | 6.110 | 3.254 | 2.534 | 3.636 | 3.722 | 3.567 |

| 2010 | 9.773 | 8.024 | 6.899 | 11.412 | 7.801 | 3.775 | 3.889 | 7.131 | 4.127 | 3.828 |

| 2011 | 9.876 | 7.906 | 8.040 | 6.187 | 6.862 | 4.359 | 3.361 | 4.940 | 5.131 | 4.232 |

| 2012 | 7.080 | 10.542 | 9.334 | 5.604 | 5.813 | 4.474 | 3.710 | 4.296 | 5.814 | 3.596 |

| 2013 | 7.909 | 11.657 | 10.248 | 5.800 | 5.554 | 4.683 | 3.995 | 4.938 | 5.639 | 4.069 |

| 2014 | 9.123 | 9.375 | 10.152 | 4.510 | 5.834 | 5.252 | 4.476 | 4.648 | 5.996 | 5.871 |

| 2015 | 13.064 | 8.639 | 9.765 | 4.461 | 6.507 | 6.729 | 4.898 | 3.102 | 2.918 | 3.990 |

| 2016 | 12.896 | 10.588 | 7.908 | 4.683 | 6.694 | 7.515 | 5.893 | 3.156 | 2.662 | 3.767 |

| 2017 | 9.375 | 10.721 | 7.182 | 4.848 | 7.944 | 8.714 | 6.219 | 3.600 | 2.914 | 3.247 |

| 2018 | 8.229 | 9.150 | 7.076 | 5.143 | 6.901 | 9.839 | 7.428 | 4.062 | 3.421 | 2.409 |

| Average | 12.995 | 9.355 | 8.210 | 5.539 | 5.115 | 4.858 | 4.676 | 4.573 | 4.247 | 3.610 |

| Trend year by year |  |  |  |  |  |  |  |  |  |  |

| Product | HS Code | Average Quality | Average Annual Export Value Proportion | Quality Change Trend |

|---|---|---|---|---|

| Wood-based panels | 441214 | 0.788 | 26.857% |  |

| 441213 | 0.560 | 16.972% |  | |

| 441119 | 0.514 | 6.012% |  | |

| 441219 | 0.510 | 13.752% |  | |

| 440890 | 0.468 | 11.101% |  | |

| 441019 | 0.464 | 1.570% |  | |

| 441129 | 0.336 | 9.899% |  | |

| 441299 | 0.319 | 13.837% |  |

| Product | HS Code | Average Quality | Average Annual Export Value Proportion | Quality Change Trend |

|---|---|---|---|---|

| Paper products | 480100 | 0.718 | 0.768% |  |

| 482050 | 0.663 | 3.479% |  | |

| 480529 | 0.634 | 0.176% |  | |

| 481960 | 0.617 | 1.208% |  | |

| 481139 | 0.597 | 1.027% |  | |

| 481121 | 0.592 | 0.867% |  | |

| 482090 | 0.572 | 0.809% |  | |

| 481032 | 0.572 | 1.279% |  | |

| 480300 | 0.563 | 1.524% |  | |

| 480580 | 0.559 | 0.272% |  | |

| 481011 | 0.551 | 6.416% |  | |

| 481420 | 0.550 | 0.762% |  | |

| 481810 | 0.548 | 2.403% |  | |

| 481029 | 0.528 | 1.663% |  | |

| 481820 | 0.515 | 2.092% |  | |

| 481131 | 0.513 | 0.510% |  | |

| 481091 | 0.493 | 2.010% |  | |

| 481710 | 0.486 | 0.698% |  | |

| 482020 | 0.486 | 0.866% |  | |

| 481690 | 0.480 | 0.148% |  | |

| 480560 | 0.480 | 0.454% |  | |

| 480252 | 0.475 | 4.401% |  | |

| 480920 | 0.455 | 0.606% |  | |

| 482110 | 0.447 | 3.681% |  | |

| 481620 | 0.445 | 0.135% |  | |

| 480439 | 0.432 | 0.253% |  | |

| 482311 | 0.431 | 0.809% |  | |

| 482360 | 0.431 | 2.266% |  | |

| 482190 | 0.410 | 0.767% |  | |

| 482320 | 0.398 | 0.357% |  | |

| 481840 | 0.392 | 3.724% |  | |

| 480810 | 0.386 | 0.281% |  | |

| 481830 | 0.379 | 0.655% |  | |

| 480260 | 0.376 | 0.459% |  | |

| 481390 | 0.324 | 0.228% |  | |

| 481190 | 0.306 | 2.927% |  | |

| 481920 | 0.304 | 7.355% |  | |

| 482010 | 0.302 | 13.576% |  | |

| 480570 | 0.298 | 0.223% |  | |

| 482030 | 0.284 | 2.053% |  | |

| 482370 | 0.273 | 0.578% |  | |

| 481910 | 0.272 | 4.408% |  | |

| 481890 | 0.249 | 1.239% |  | |

| 481940 | 0.245 | 11.179% |  | |

| 482390 | 0.222 | 6.564% |  | |

| 481950 | 0.180 | 1.844% |  |

| Product | HS Code | Average Quality | Average Annual Export Value Proportion | Quality Change Trend |

|---|---|---|---|---|

| Wood furniture | 940161 | 0.245 | 26.515% |  |

| 940169 | 0.267 | 6.345% |  | |

| 940330 | 0.702 | 4.257% |  | |

| 940340 | 0.244 | 4.136% |  | |

| 940350 | 0.219 | 14.407% |  | |

| 940360 | 0.184 | 44.339% |  |

References

- Li, J.L.; Jiang, H.; Chen, Q.H. Study on wood forest products Trade Between China and RCEP Member Countries. Asia Pac. Econ. Rev. 2022, 6, 114–122. [Google Scholar]

- Nasrullah, M.; Chang, L.; Khan, K.; Rizwanullah, M.; Zulfiqar, F.; Ishfaq, M. Determinants of forest product group trade by gravity model approach: A case study of China. For. Policy Econ. 2020, 113, 102117. [Google Scholar] [CrossRef]

- Ministry of Commerce. High Quality Development Plan for Foreign Trade during the 14th Five Year Plan Period. 2021. Available online: http://www.gov.cn/zhengce/zhengceku/2021-11/24/5653009/files/2b503a03727a459eb49fe8e620461744. (accessed on 1 July 2023).

- Ke, S.F.; Qiao, D.; Zhang, X.X.; Feng, Q.Y. Changes of China’s forestry and forest products industry over the past 40 years and challenges lying ahead. For. Policy Econ. 2019, 106, 101949. [Google Scholar] [CrossRef]

- Wu, H.M.; Wan, L.; Tian, H.; Chen, Z.F.; Zhang, Y. The ternary margins of China’s forest products export and their determinants. For. Policy Econ. 2021, 123, 102378. [Google Scholar] [CrossRef]

- Su, H.Y.; Hou, F.M.; Yang, Y.X.; Han, Z.; Liu, C. An assessment of the international competitiveness of China’s forest products industry. For. Policy Econ. 2020, 119, 102256. [Google Scholar] [CrossRef]

- Wu, T.B.; Sun, T.J. A Study on the Export Trade Potential and Influencing Factors of Wood Forest Products from China to Countries Along the Belt and Road. Reg. Res. Dev. 2021, 40, 1–5. [Google Scholar]

- Zhao, L.Z.; Geng, Y.D. Comparison of the Endowment Advantages of Wood Forest Products Trade between China and the United States. J. Northwest Agric. For. Univ. Soc. Sci. Ed. 2020, 20, 137–144. [Google Scholar]

- Andrew, M.; Keithly, G.J. The end of the trade war? Effects of tariff exclusions on U.S. Forest products in China. For. Policy Econ. 2021, 122, 102350. [Google Scholar]

- Klarić, K.; Pirc Barčić, A.; Basarac Sertić, M. Assessing the role of forest certification and macroeconomic indicators on croatian wood exports to the EU: A panel data approach. Forests 2023, 14, 1908. [Google Scholar] [CrossRef]

- Su, L.; Yuan, C.; Cao, Y.K. Analysis on the Growth Model of China’s Export of Wood Forest Products to Northeast Asia: Based on the Calculation of the Triple Marginal Model. World For. Res. 2018, 31, 81–85. [Google Scholar]

- Michaely, M. Trade, Income Levels, and Dependence; Elsevier Science Publishers B.V.: Amsterdam, The Netherlands; New York, NY, USA, 1984; p. 16. [Google Scholar]

- Flam, H.; Helpman, E. Vertical Product Differentiation and North-South Trade. Am. Econ. Rev. 1987, 77, 810–822. [Google Scholar]

- Hallak, J.C.; Schott, P.K. Estimating Cross-Country Differences in Product Quality; NBER Working Paper 13807; Oxford University Press: Oxford, UK, 2011; Volume 126, pp. 417–474. [Google Scholar]

- Hallak, J.C.; Sivadasan, J. Product and process productivity: Implications for quality choice and conditional exporter premia. J. Int. Econ. 2013, 91, 53–67. [Google Scholar] [CrossRef]

- Fan, H.; Li, Y.A.; Yeaple, S.R. Trade Liberalization, Quality, and Export Prices. Rev. Econ. Stat. 2015, 97, 1033–1051. [Google Scholar] [CrossRef]

- Spencer, B.J.; Zhou, D.; Vertinsky, I. Strategic Trade Policy with Endogenous Choice of Quality and Asymmetric Costs. J. Int. Econ. 2002, 56, 205–232. [Google Scholar]

- Harding, T.; Javorcik, B. A Touch of Sophistication: FDI and Unit Values of Exports; CEPR Discussion Paper No. 7596; CEPR Press: Paris, France; London, UK, 2009; Available online: https://cepr.org/publications/dp7596 (accessed on 1 June 2023).

- Geng, Y.Q.; Zhang, S.Z. Has industrial agglomeration improved the quality of exported products: Empirical evidence from Chinese manufacturing enterprises. J. Shandong Univ. Philos. Soc. Sci. Ed. 2018, 1, 92–101. [Google Scholar]

- Manova, K.; Yu, Z. Multi-product firms and product quality. Qual. J. Int. Econ. 2017, 109, 116–137. [Google Scholar] [CrossRef]

- Peluffo, A.; Scasso, J.I. Destination and source countries: Do they have a role on product quality? SSRN Electron. J. 2016, 1, 3–48. [Google Scholar] [CrossRef][Green Version]

- Bernini, M.; Guillou, S.; Bellone, F. Financial leverage and export quality: Evidence from France. J. Bank. Financ. 2015, 59, 280–296. [Google Scholar] [CrossRef]

- Baldwin, R.; Harrigan, J. Zeros, Quality, and Space: Trade Theory and Trade Evidence. Am. Econ. J. Microecon. 2011, 3, 60–88. [Google Scholar] [CrossRef]

- Hallak, J.C.; Sivadasan, J. Firms’ Exporting Behavior Under Quality Constraints; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Kugler, M.; Verhoogen, E. Prices, Plant Size, and Product Quality. Rev. Econ. Stud. 2012, 79, 307–339. [Google Scholar] [CrossRef]

- Manova, K.; Zhang, Z.W. Export Prices across Firms and Destinations. Q. J. Econ. 2012, 127, 379–436. [Google Scholar] [CrossRef]

- Schott, P.K. Across-Product versus Within-Product Specialization in International Trade. Q. J. Econ. 2004, 119, 647–678. [Google Scholar] [CrossRef]

- Hummels, D.; Klenow, P.J. The Variety and Quality of a Nation’s Exports. Am. Econ. Rev. 2005, 95, 704–723. [Google Scholar] [CrossRef]

- Amit, K. The Long and Short of Quality Ladders. Rev. Econ. Stud. 2011, 779, 1450–1476. [Google Scholar]

- Shi, B. The Product Quality Heterogeneity of China Firms Export: Measurement and Facts. China Econ. Q. 2013, 13, 263–284. [Google Scholar]

- Wan, L.; Ban, N.; Fu, Y.; Yuan, L. Product Quality Measurement, Dynamic Changes, and the Belt and Road Initiative Distribution Characteristics: Evidence from Chinese wood furniture Exports. Forests 2022, 13, 1153. [Google Scholar] [CrossRef]

- Shi, B.; Shao, W. Measurement and Determinants of Export Product Quality for Chinese Enterprises: A Micro perspective on Cultivating New Competitive Advantages in Export. Manag. World 2014, 9, 90–106. [Google Scholar]

- Melitz, M. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Grossman, G.; Helpman, E. Quality Ladders and Product Cycles. Q. J. Econ. 1991, 106, 557–586. [Google Scholar] [CrossRef]

- Melitz, J.; Toubal, F. Native language, spoken language, translation and trade. J. Int. Econ. 2014, 93, 351–363. [Google Scholar] [CrossRef]

- Coniglio, N.D.; Vurchio, D.; Cantore, N.; Clara, M. On the evolution of comparative advantage: Path-dependent versus path-defying changes. J. Int. Econ. 2021, 133, 103522. [Google Scholar] [CrossRef]

- Zhu, S.; Liu, Y.; Zhong, T. Financing Constraints, Product Ranking and Product Markup of Multi-product Exporters. J. Int. Trade 2019, 6, 1–15. [Google Scholar]

- Van Kooten, G.C.; Schmitz, A. COVID-19 impacts on U.S. lumber markets. For. Policy Econ. 2022, 135, 102665. [Google Scholar] [CrossRef]

- Zhang, X.; Haviarova, E.; Zhou, M. A welfare analysis of China’s tariffs on U.S. hardwood products. For. Policy Econ. 2020, 113, 102085. [Google Scholar] [CrossRef]

- Chen, J.; Yang, C.C. The impact of the COVID-19 pandemic on consumers’ preferences for wood furniture: An accounting perspective. Forests 2021, 12, 1637. [Google Scholar] [CrossRef]

- Dai, X.L.; Liu, W. Research on the problems of Sino-US trade friction—Take furniture industry as an example. China For. Prod. Ind. 2021, 58, 107–109. [Google Scholar]

- Zhang, Y.; Wan, L. Whether the new green infrastructure can optimize the export structure of Chinese forest environmental products: Based on the economic perspective of the scope of “Belt and Road” trade products. J. Beijing For. Univ. Soc. Sci. Ed. 2022, 21, 56–64. [Google Scholar]

- Xiong, L.C.; Zhao, H.Y.; Wang, F.T.; Cheng, B.D. Genuine performance of China’s forest products trade: An evaluation from the perspective of global value chains. For. Policy Econ. 2022, 144, 102823. [Google Scholar] [CrossRef]

- Saraswati, R.I.; Rifin, H.A. Factors Affecting Forest Production Exports. J. Manaj. Agribisnis 2023, 20, 2407–2524. [Google Scholar]

- Jiang, B.; Dai, Y. Analysis on the development trend of forest product export quality and its influencing factors based on improved Nested-Logit model. World For. Res. 2020, 33, 20–22. [Google Scholar]

- Sui, H.; Geng, S.; Zhou, J.; Raza, A.; Aziz, N. Fiscal institutional reform and export product quality: A Quasi-experimental research on counties managed directly by provinces. Econ. Model. 2023, 126, 10638. [Google Scholar] [CrossRef]

- Liu, Q.; Ning, Z. Impact of Global Supply Chain Crisis on Chinese Forest Product Enterprises: Trade Trends and Literature Review. Forests 2023, 14, 1247. [Google Scholar] [CrossRef]

- Liu, X.; Dong, Y. Quantity, Quality or Price-performance Ratio—On the Impetus and Transformation of China’s Agri-product Exports. J. Int. Trade 2019, 11, 100–115. [Google Scholar]

- da Silva, J.C.G.L.; de Souza Macie, A. International trade standards and competitiveness of the chemical wood pulp and conifer sawn wood sectors do Brazil and Chile front of major world exporters. For. Policy Econ. 2022, 137, 102706. [Google Scholar] [CrossRef]

- Aria, A. Foreign workers, product quality, and trade: Evidence from a natural experiment. J. Int. Econ. 2022, 139, 103686. [Google Scholar] [CrossRef]

| Wood-Based Panels | Paper Products | Wood Furniture | |

|---|---|---|---|

| Hausman test (fixed effect/random effect) | 0.7075 | 0.0376 | 0.0001 |

| F test (fixed effect/pooled model) | - | 0.0000 | 0.0000 |

| LM test (random effect/pooled model) | 0.0000 | - | - |

| Model choice | Random-effect model | Fixed-effect model | Fixed-effect model |

| Wood-Based Panels | Paper Products | Wood Furniture | |

|---|---|---|---|

| tfp | 0.0887 *** | 0.106 *** | 0.0558 *** |

| (0.0296) | (0.0386) | (0.0193) | |

| lnthc | 0.0204 *** | 0.00600 *** | 0.00413 ** |

| (0.00506) | (0.00174) | (0.00180) | |

| lnlabor | −0.0854 *** | 0.0276 * | −0.0554 *** |

| (0.0277) | (0.0166) | (0.0197) | |

| invest | 0.0910 | −0.0346 | −0.0197 |

| (0.294) | (0.0543) | (0.0146) | |

| lnscale | 0.0351 | −0.0175 | 0.0293 * |

| (0.0318) | (0.0153) | (0.0172) | |

| lnz | −0.0218 | 0.0944 * | 0.00627 |

| (0.0152) | (0.0523) | (0.0294) | |

| finance | 1.528 * | 0.188 | 0.731 |

| (0.880) | (1.585) | (1.032) | |

| Q | 0.00798 | −0.0412 *** | −0.000938 |

| (0.0131) | (0.0135) | (0.0101) | |

| _cons | −0.787 | 0.207 | −0.0225 |

| (0.646) | (0.349) | (0.230) |

| Wood-Based Panels | Paper Products | Wood Furniture | |

|---|---|---|---|

| tfp | 0.0550 *** | 0.154 ** | 0.168 *** |

| (0.0163) | (0.0654) | (0.0517) | |

| lnthc | 0.609 *** | 0.00605 * | 0.133 * |

| (0.151) | (0.00325) | (0.0737) | |

| lnlabor | −0.753 *** | 0.0412 * | −0.0588 *** |

| (0.162) | (0.0240) | (0.0199) | |

| invest | −3.223 *** | 0.0798 | −0.153 ** |

| (0.658) | (0.181) | (0.0643) | |

| lnscale | 0.0242 * | −0.0146 | 0.0479 * |

| (0.0128) | (0.0189) | (0.0273) | |

| lnz | 0.211 *** | 0.140 ** | 0.000288 |

| (0.0481) | (0.0644) | (0.00515) | |

| finance | 8.410 | −1.659 | 0.105 |

| (5.140) | (1.308) | (1.804) | |

| Q | −0.00514 | −0.0349 *** | −0.0917 *** |

| (0.00675) | (0.00822) | (0.0117) | |

| _cons | −2.777 ** | −0.121 | 0.490 |

| (1.163) | (0.437) | (0.330) |

| Wood-Based Panels | Paper Products | Wood Furniture | ||||

|---|---|---|---|---|---|---|

| Developed Economy | Developing Economy | Developed Economy | Developing Economy | Developed Economy | Developing Economy | |

| tfp | 0.168 *** | 0.212 *** | 0.0630 ** | 0.104 *** | 0.0275 * | 0.0621 *** |

| (0.0575) | (0.0402) | (0.0234) | (0.0331) | (0.0133) | (0.0209) | |

| lnthc | 0.0208 *** | 0.00283 * | 0.00739 * | 0.00584 *** | 0.00459 *** | 0.00459 ** |

| (0.00426) | (0.00159) | (0.00416) | (0.00162) | (0.00109) | (0.00206) | |

| lnlabor | −0.186 *** | −0.239 *** | 0.0171 * | 0.0335 ** | −0.0778 *** | −0.0547 *** |

| (0.0370) | (0.0445) | (0.00880) | (0.0129) | (0.0132) | (0.0185) | |

| invest | −0.958 ** | −0.242 *** | −0.218 | 0.0302 | −0.0338 *** | −0.0186 |

| (0.389) | (0.0475) | (0.131) | (0.0597) | (0.00836) | (0.0171) | |

| lnscale | 0.0221 * | −0.0738 *** | 0.0736 ** | −0.0252 | 0.0509 *** | 0.0256 * |

| (0.0113) | (0.0156) | (0.0309) | (0.0392) | (0.0102) | (0.0141) | |

| lnz | 0.193 *** | 0.0595 ** | 0.0541 * | 0.0862 *** | 0.0485 *** | 0.0404 |

| (0.0435) | (0.0282) | (0.0262) | (0.0301) | (0.0111) | (0.347) | |

| finance | −1.048 *** | 3.065 *** | 0.0118 | −1.066 | −0.129 | 0.933 |

| (0.268) | (0.644) | (0.00818) | (0.838) | (0.504) | (1.153) | |

| Q | −0.0499 | 0.0256 * | −1.357 ** | −0.0436 *** | −0.0201 | 0.00244 |

| (0.0372) | (0.0149) | (0.564) | (0.0123) | (0.0126) | (0.0113) | |

| _cons | −2.166 * | −0.995 ** | −0.841 | 0.302 | −0.458 *** | −0.0790 |

| (1.154) | (0.497) | (0.586) | (0.497) | (0.101) | (0.951) | |

| Replacement of Foreign Direct Investment | Replacement of Financing Constraints | |||||

|---|---|---|---|---|---|---|

| Wood-Based Panels | Paper Products | Wood Furniture | Wood-Based Panels | Paper Products | Wood Furniture | |

| invest | −0.252 * | −0.00323 | −0.0237 | |||

| (0.131) | (0.0246) | (0.0167) | ||||

| invest2 | −0.390 *** | 0.302 ** | 0.0496 | |||

| (0.145) | (0.144) | (0.0370) | ||||

| finance | 2.806 * | 2.141 ** | 1.214 | |||

| (1.623) | (0.951) | (1.036) | ||||

| finance2 | −0.0842 *** | −0.0812 | −0.0130 | |||

| (0.0253) | (0.134) | (0.0579) | ||||

| tfp | 0.0703 *** | 0.116 *** | 0.0416 *** | 0.127 *** | 0.0872 *** | 0.0588 ** |

| (0.0202) | (0.0283) | (0.0125) | (0.0327) | (0.0293) | (0.0242) | |

| lnthc | 0.00650 * | 0.00219 * | 0.00183 * | 0.0116 *** | 0.00483 *** | 0.00413 ** |

| (0.00389) | (0.00129) | (0.00110) | (0.00358) | (0.00147) | (0.00185) | |

| lnlabor | −0.0727 * | 0.0882 *** | −0.0258 ** | −0.0605 ** | 0.0483 *** | −0.0505 *** |

| (0.0402) | (0.0211) | (0.0110) | (0.0271) | (0.0147) | (0.0155) | |

| lnscale | 0.00248 | −0.0289 * | 0.0194 * | 0.0243 | −0.0406 | 0.0266 ** |

| (0.00690) | (0.0150) | (0.0104) | (0.0283) | (0.0252) | (0.0134) | |

| lnz | 0.0703 ** | 0.0261 ** | 0.00222 | 0.735 *** | 0.0351 * | 0.000667 |

| (0.0327) | (0.0130) | (0.0196) | (0.146) | (0.0188) | (0.0289) | |

| Q | 0.0195 | −0.0404 *** | −0.00108 | 0.0144 | −0.0423 *** | −0.00263 |

| (0.0136) | (0.0135) | (0.0109) | (0.0142) | (0.0115) | (0.00604) | |

| _cons | −1.087 * | 0.699 *** | −0.00413 | −0.784 | 0.916 *** | 0.0161 |

| (0.563) | (0.206) | (0.144) | (0.587) | (0.317) | (0.192) | |

| N | 2503 | 2711 | 2660 | 2669 | 3031 | 2944 |

| R2 | 0.054 | 0.022 | 0.027 | 0.061 | 0.017 | 0.048 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wan, L.; Ban, N.; Fu, Y.; Yuan, L. Export Growth and Quality Determination of Wood Forest Products: Evidence from China. Forests 2023, 14, 2451. https://doi.org/10.3390/f14122451

Wan L, Ban N, Fu Y, Yuan L. Export Growth and Quality Determination of Wood Forest Products: Evidence from China. Forests. 2023; 14(12):2451. https://doi.org/10.3390/f14122451

Chicago/Turabian StyleWan, Lu, Nannan Ban, Yizhong Fu, and Luyao Yuan. 2023. "Export Growth and Quality Determination of Wood Forest Products: Evidence from China" Forests 14, no. 12: 2451. https://doi.org/10.3390/f14122451

APA StyleWan, L., Ban, N., Fu, Y., & Yuan, L. (2023). Export Growth and Quality Determination of Wood Forest Products: Evidence from China. Forests, 14(12), 2451. https://doi.org/10.3390/f14122451