Impact of Trade Restrictions on the Russian Forest Industry: Evidence from Siberian Timber Producers

Abstract

1. Introduction

2. Materials and Methods

3. Results

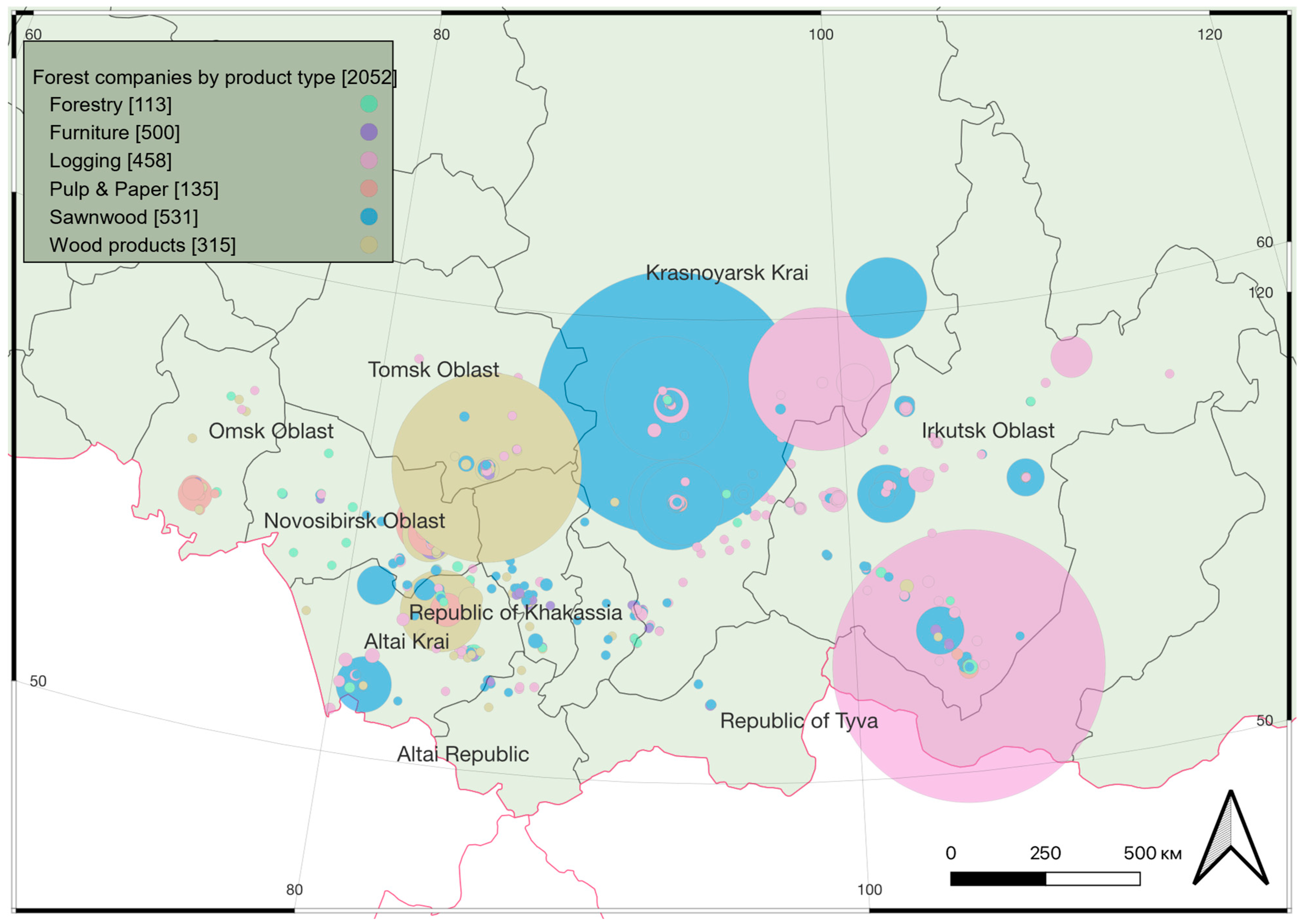

3.1. The Role of Siberian Regions in the Russian Forest Industry

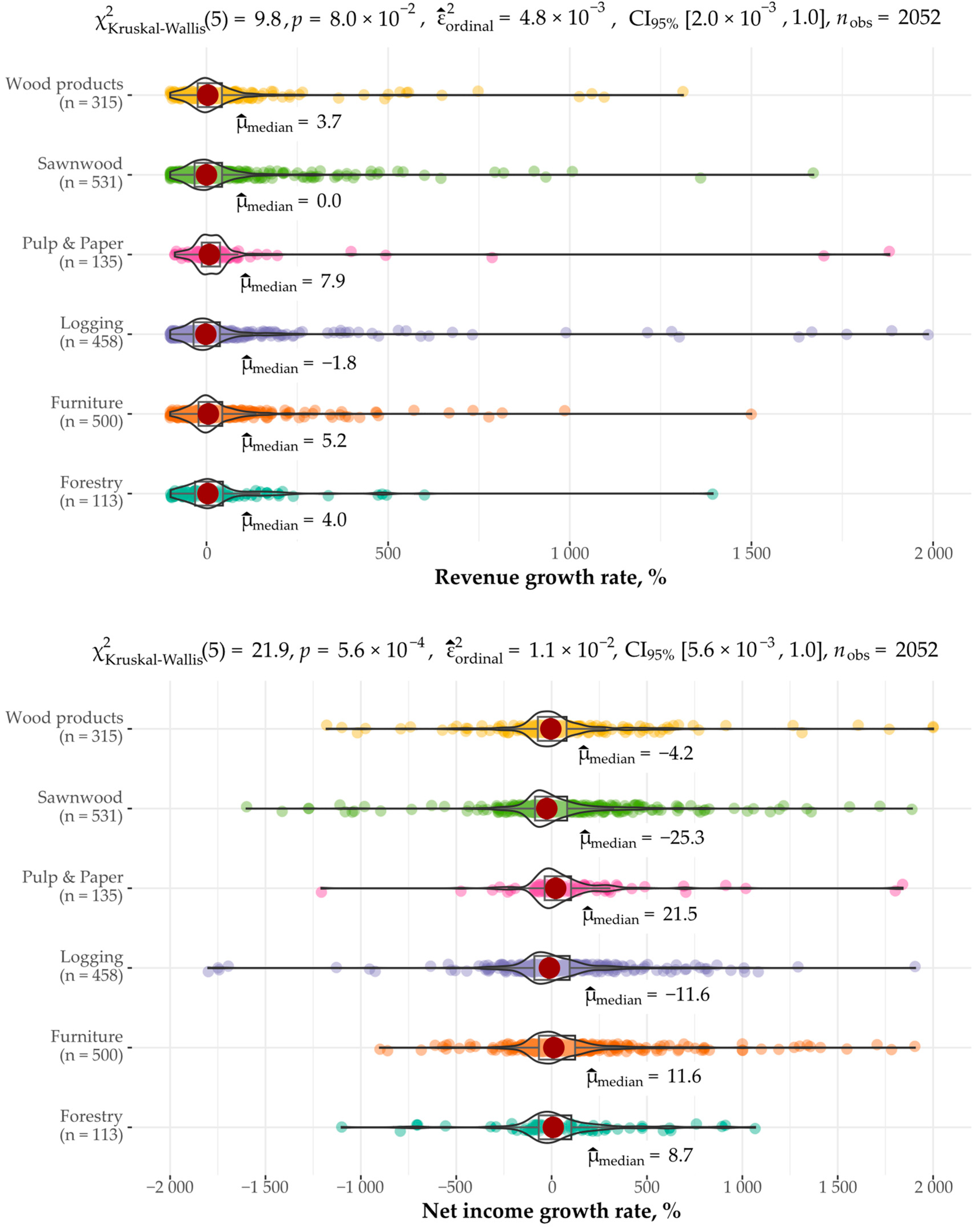

3.2. Differences by Type of Activity

3.3. Differences by Scale of Activity

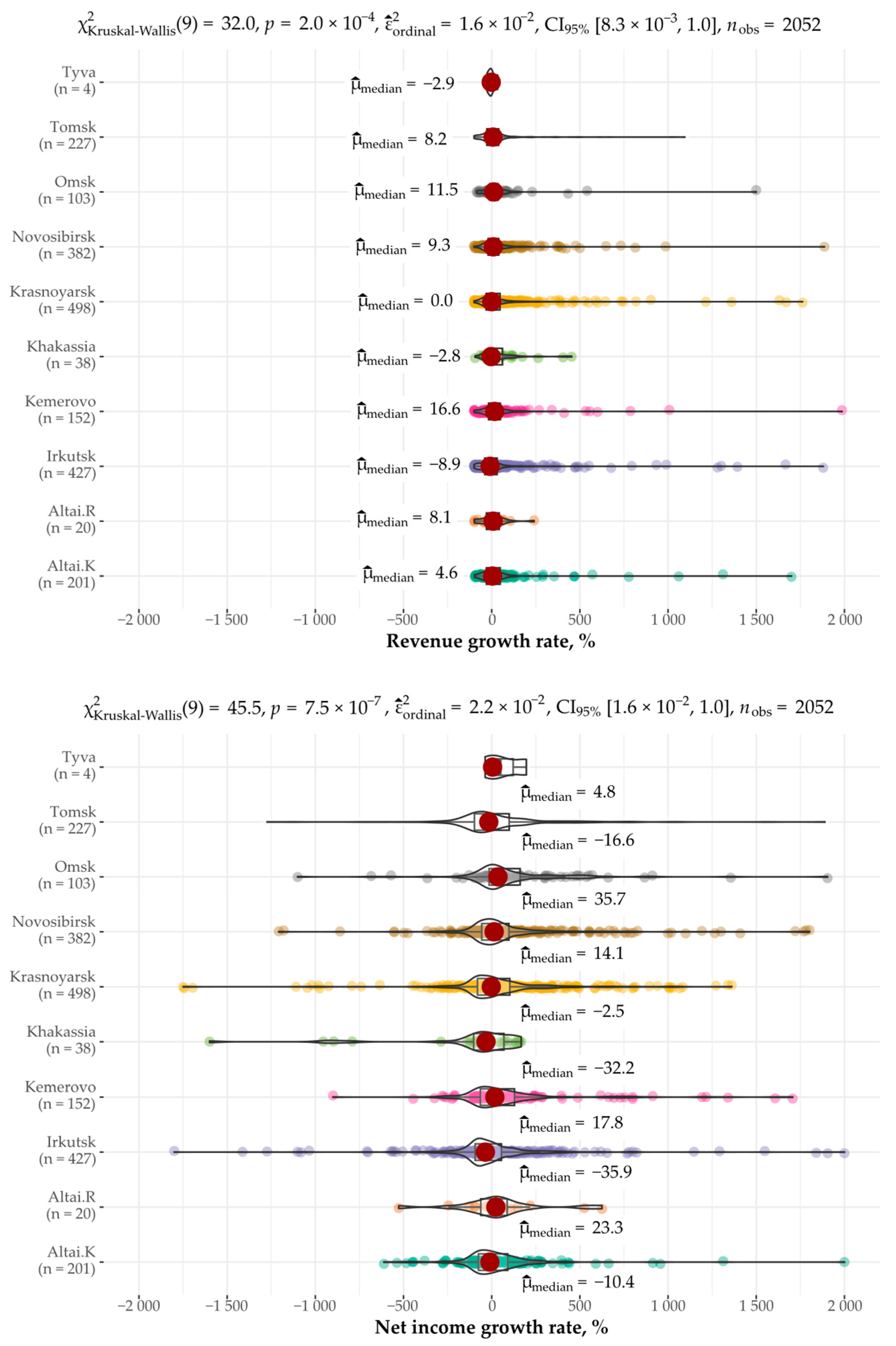

3.4. Spatial Heterogeneity

4. Discussion

5. Conclusions

- The analysis of the financial performance of Siberian forest companies showed that in 2022 the industry experienced a strong impact of internal and external effects. The ban on the export of raw wood combined with trade sanctions has created fundamentally new conditions and incentives for the development of timber companies in Siberia. These effects reflected both the structure of production and the financial results of forest companies.

- The Kruskal–Wallis testing showed a significant difference in the response to the crisis for different sectors of the forest industry. The best financial performance were shown by sectors that are focused on the domestic market (forestry) and have gained new opportunities due to the departure of Western competitors (pulp and paper, furniture manufacturing). The biggest drop in revenue and net profit occurred among companies whose main activity was logging and sawn wood manufacturing, as well as companies focused on the markets of Europe and the USA (plywood, fiberboard, particle board).

- The results demonstrate that the firm scale also had an impact on the financial results of Siberian timber companies in 2022. Large and medium-sized companies suffered more due to the large volumes of forest products that previously went to the world market, as well as due to the high base for comparison, since record export revenue was received in 2021. At the same time, this result may be a consequence of selection bias, since the sample did not include companies that ceased operations in 2022. Among such companies, naturally, there is a large proportion of microenterprises with small revenues. Therefore, this issue requires careful further research.

- We confirmed the presence of spatial heterogeneity both in the level of development of the forest industry [33] and in the regions’ resistance to sanctions pressure [72]. Even regions with a similar structure of companies by type of activity such as Krasnoyarsk Krai and Irkutsk Oblast endured the crisis in different ways. It was shown that the financial results of forest companies located in different regions were influenced by their proximity to customs checkpoints and regulatory measures of regional authorities.

- In the short term, Siberian forest companies suffered losses due to the closure of a significant part of the global market, lack of transportation capacity, logistical problems and the inability to export unprocessed timber. However, the new conditions and incentives that have developed in 2022 for Russian forest companies have opened up opportunities for the reindustrialization of the forest sector aimed at increasing added value in the production structure and the development of the domestic market. The drivers of future growth will be wooden housing construction, the transfer of residential heating systems from coal to pellets and the intensification of the transition to paper packaging instead of plastic.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Wood Product | HS Code | Siberian Federal District | Russian Federation | ||||

|---|---|---|---|---|---|---|---|

| Export Volumes in 2021, Thousand Tons | Export Values in 2021, Million US Dollars | Growth Rates of Export Volumes (2016–2021), % | Export Volumes in 2021, Thousand Tons | Export Values in 2021, Million US Dollars | Growth Rates of Export Volumes (2016–2021), % | ||

| Fuel wood | 4401 | 697.2 | 84.6 | 224 | 6034.9 | 487.1 | 95 |

| Wood in the rough | 4403 | 2231.5 | 291.2 | −49 | 11,882.8 | 1021.7 | −25 |

| Sawnwood | 4407 | 8039.0 | 2561.8 | −9 | 16,979.1 | 6048.5 | 5 |

| Particle board | 4410 | 249.7 | 90.2 | 151 | 1671.0 | 676.3 | 58 |

| Fibreboard | 4411 | 129.9 | 59.2 | 124 | 1028.8 | 480.1 | 66 |

| Plywood | 4412 | 86.7 | 76.1 | 21 | 2032.0 | 1932.8 | 22 |

| Pulp | 47 | 1538.9 | 1016.9 | −4 | 2279.0 | 1404.0 | −9 |

| Paper & paperboard | 48 | 289.7 | 197.5 | 105 | 4090.2 | 3149.1 | 34 |

References

- European Union. Council Regulation (EU) 2022/576 of 8 April 2022 Amending Regulation (EU) No 833/2014 Concerning Restrictive Measures in View of Russia’s Actions Destabilising the Situation in Ukraine; European Union: Brussels, Belgium, 2022; Volume 111. [Google Scholar]

- European Union. Council Regulation (EU) 2022/1904 of 6 October 2022 Amending Regulation (EU) No 833/2014 Concerning Restrictive Measures in View of Russia’s Actions Destabilising the Situation in Ukraine; European Union: Brussels, Belgium, 2022; Volume 259I. [Google Scholar]

- US Office of Foreign Assets Control. Specially Designated Nationals and Blocked Persons List; US Office of Foreign Assets Control: Washington, DC, USA, 2022. [Google Scholar]

- Bukina, T.V.; Bukin, E.K.; Tretiakova, E.A. The Transport Framework of Logging as a Key Factor in the Development of the Timber Industry of the Perm Region. ECO 2023, 53, 25–43. [Google Scholar] [CrossRef]

- Pyzhev, A.I. The Forest Industry of the Regions of Siberia and the Far East: Prospects for the Development of the Forest-Climate Sector. Stud. Russ. Econ. Dev. 2022, 33, 402–408. [Google Scholar] [CrossRef]

- Antonova, N.E. Forestry Complex of Khabarovsk Krai in Search of Development Paths. ECO 2023, 53, 64–85. [Google Scholar] [CrossRef]

- Shvarts, E.A.; Shmatkov, N.M.; Karpachevsky, M.L.; Baibar, A.S. Challenges and problems of reforming the forestry sector in Russia. Izv. St.-Peterbg. Lesoteh. Akad. 2022, 157–172. [Google Scholar] [CrossRef]

- Pyzhev, A.I.; Gordeev, R.V.; Vaganov, E.A. Reliability and Integrity of Forest Sector Statistics—A Major Constraint to Effective Forest Policy in Russia. Sustain. Sci. Pract. Policy 2020, 13, 86. [Google Scholar] [CrossRef]

- Shvidenko, A.; Mukhortova, L.; Kapitsa, E.; Kraxner, F.; See, L.; Pyzhev, A.; Gordeev, R.; Fedorov, S.; Korotkov, V.; Bartalev, S.; et al. A Modelling System for Dead Wood Assessment in the Forests of Northern Eurasia. Forests 2023, 14, 45. [Google Scholar] [CrossRef]

- Smirnov, M.; Andrianov, Y.; Chernyakevich, V. Technological Modernization of Forest Roads Construction in Russia. J. Appl. Eng. Sci. 2018, 16, 328–332. [Google Scholar] [CrossRef]

- Labunets, I.E.; Mayburov, I.A. Rationality of the Tax and Economic Behavior of Enterprises in the Russian Forestry Sector. J. Tax Reform 2023, 9, 110–127. [Google Scholar] [CrossRef]

- Labunets, I.E.; Mayburov, I.A. The Impact of the Size of Enterprises on Tax Evasion in the Forestry Industry of Russia. J. Tax Reform 2022, 8, 88–101. [Google Scholar] [CrossRef]

- Lapo, V.F. Regions’ Competition for Investment Projects in Forest Development. Spat. Econ. 2014, 2, 75–92. (In Russian) [Google Scholar] [CrossRef][Green Version]

- Lapo, V.F. Efficiency of Investment Stimulation Methods in a Timber Industry Complex: An Econometric Research. Appl. Econom. 2014, 1, 30–50. (In Russian) [Google Scholar]

- Ivantsova, E.D.; Pyzhev, A.I. Factors of success of priority investment projects in the sphere of forest exploitation in Russia: Econometric analysis. Russ. J. Econ. Law 2022, 16, 315–330. [Google Scholar] [CrossRef]

- Gordeev, R.V.; Pyzhev, A.I. Social and Economic Importance of Forest Companies in Asian Russia: Evidence from Corporate Financial Reporting. Forests 2022, 13, 2151. [Google Scholar] [CrossRef]

- Transparent Business. Available online: https://pb.nalog.ru/index.html (accessed on 3 November 2023).

- Kontur.Focus Database. Available online: https://focus.kontur.ru/ (accessed on 3 November 2023).

- The Federal Law No 209-FZ On the Development of Small and Medium Entrepreneurship in the Russian Federation. Available online: http://kremlin.ru/acts/bank/25971 (accessed on 12 November 2023).

- Federal State Statistics Service of Russia Unified Interagency Information and Statistical System (EMISS). Available online: https://www.fedstat.ru/ (accessed on 23 September 2021).

- Snedecor, G.W.; Cochran, W.G. Statistical Methods; Iowa State University Press: Ames, IA, USA, 1980; ISBN 978-0-8138-1560-2. [Google Scholar]

- Kruskal, W.H.; Wallis, W.A. Use of Ranks in One-Criterion Variance Analysis. J. Am. Stat. Assoc. 1952, 47, 583–621. [Google Scholar] [CrossRef]

- Kelley, T.L. An Unbiased Correlation Ratio Measure. Proc. Natl. Acad. Sci. USA 1935, 21, 554–559. [Google Scholar] [CrossRef]

- Tomczak, M.; Tomczak, E. The Need to Report Effect Size Estimates Revisited. An Overview of Some Recommended Measures of Effect Size. Trends Sports Sci. 2014, 21, 19–25. [Google Scholar]

- Carroll, R.M.; Nordholm, L.A. Sampling Characteristics of Kelley’s ε and Hays’ ω. Educ. Psychol. Meas. 1975, 35, 541–554. [Google Scholar] [CrossRef]

- Frieman, J.; Saucier, D.A.; Miller, S.S. Principles & Methods of Statistical Analysis, 1st ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2017; ISBN 978-1-4833-5859-8. [Google Scholar]

- Mangiafico, S.S. Kruskal–Wallis Test. Available online: https://rcompanion.org/handbook/F_08.html (accessed on 18 November 2023).

- Patil, I. Visualizations with Statistical Details: The “ggstatsplot” Approach. J. Open Source Softw. 2021, 6, 3167. [Google Scholar] [CrossRef]

- Wickham, H. Ggplot2. Available online: https://ggplot2.tidyverse.org/index.html (accessed on 20 November 2023).

- R Core Team. R: A Language and Environment for Statistical Computing. Available online: https://www.r-project.org/ (accessed on 23 September 2021).

- Lomakina, N.V.; Antonova, N.E. Institutional Innovations for the Development of the East of Russia: Effects of Implementation in the Resource Region. J. Sib. Fed. Univ. Humanit. Soc. Sci. 2020, 442–452. [Google Scholar] [CrossRef]

- Dobrynin, D.; Jarlebring, N.Y.; Mustalahti, I.; Sotirov, M.; Kulikova, E.; Lopatin, E. The Forest Environmental Frontier in Russia: Between Sustainable Forest Management Discourses and ‘Wood Mining’ Practice. Ambio 2021, 50, 2138–2152. [Google Scholar] [CrossRef]

- Gordeev, R.; Pyzhev, A.; Yagolnitser, M. Drivers of Spatial Heterogeneity in the Russian Forest Sector: A Multiple Factor Analysis. Forests 2021, 12, 1635. [Google Scholar] [CrossRef]

- Gordeev, R.V.; Pyzhev, A.I. The Russian timber industry at a crossroads. ECO 2023, 53, 169–191. [Google Scholar] [CrossRef]

- Lukin, E.V.; Shirokova, E.Y. Manufacturing sector of the economy of North-West Russia: A year of functioning under the conditions of strengthening sanctions. Econ. Manag. 2023, 29, 927–937. [Google Scholar] [CrossRef]

- Forests, Forestry and Logging. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Forests,_forestry_and_logging (accessed on 3 November 2023).

- Vaganov, E.A.; Porfiryev, B.N.; Shirov, A.A.; Kolpakov, A.Y.; Pyzhev, A.I. Assessment of the Contribution of Russian Forests to Climate Change Mitigation. Ekon. Reg. 2021, 17, 1096–1109. [Google Scholar] [CrossRef]

- List of Priority Investment Projects for the Development of the Forest Sector. Available online: https://minpromtorg.gov.ru/docs/list/?pdfModalID=b9eabff7-f735-4241-80ab-8b670ac10589&fileModalID=252c0719-1ced-4b14-8674-9d2385c2e24a (accessed on 20 November 2023).

- The Strength Is Not in the Ruble: How a Strengthening Currency Hinders Timber Exports. Available online: https://forestcomplex.ru/finasy-2/kak-ukreplenie-rublya-meshaet-eksportu-drevesiny/ (accessed on 3 December 2023).

- Results of the 3rd Quarter in the Timber and Wood Processing Industry of the Country. Available online: https://krasnoyarsk.hh.ru/article/30930 (accessed on 3 December 2023).

- The Number of Vacancies in the Forestry and Woodworking Industry Increased by 34%. Available online: https://lpk-sibiri.ru/news/kolichestvo-vakansiy-v-sfere-lesnoy-promyshlennosti-i-derevoobrabotki-vyroslo-na-34/ (accessed on 3 December 2023).

- In Russia, Timber Harvesting in 2022 Decreased by 13.5%. Available online: https://tass.ru/ekonomika/17146669 (accessed on 14 November 2023).

- Gordeev, R.V.; Pyzhev, A.I. The timber industry in Russia under sanctions: Losses and opportunities. Vopr. Ekon. 2023, 4, 45–66. [Google Scholar] [CrossRef]

- Thurner, T.; Kuzminov, I.; Lobanova, P. The Russian Forest Industry: Declining Wood Production and Emerging Opportunities in Bioenergy. Balt. For. 2022, 28, 623. [Google Scholar] [CrossRef]

- The Plant Was Pushed Back in Terms of Deadlines. Available online: https://www.kommersant.ru/doc/6321918 (accessed on 15 November 2023).

- Production of Wood-Based Panels and Plywood in Russia in 2022 Reduced by a Third. Available online: https://proderevo.net/news/indst/amdpr-proizvodstvo-drevesnykh-plit-i-fanery-v-rossii-v-2022-godu-sokratilos-na-tret.html (accessed on 15 November 2023).

- Pellets Are Caught in a Bind. Available online: https://www.rbc.ru/newspaper/2022/06/24/62b1c1519a7947bfefea7dc6 (accessed on 16 November 2023).

- Syrtsova, E.; Pyzhev, A.; Zander, E. Social, Economic, and Environmental Effects of Electricity and Heat Generation in Yenisei Siberia: Is There an Alternative to Coal? Energies 2023, 16, 212. [Google Scholar] [CrossRef]

- Pomorye Became the First Region Where People from Emergency Housing Will Be Relocated to Wooden High-Rise Buildings. Available online: https://rg.ru/2023/09/04/svai-v-dosku.html (accessed on 16 November 2023).

- Segezha Group Announced the Construction of Wooden High-Rise Buildings in Sokol. Available online: https://lpk-sibiri.ru/news/segezha-group-anonsirovala-stroitelstvo-derevyannyh-mnogoetazhek-v-sokole/ (accessed on 16 November 2023).

- Perevoshchikova, M. Chips Will Take off: Russia Will Start Developing Wooden High-Rise Buildings. Available online: https://iz.ru/1513687/mariia-perevoshchikova/shchepki-vzletiat-v-rossii-nachnut-stroit-dereviannye-mnogoetazhki (accessed on 16 November 2023).

- IKEA Said Goodbye to the Factories. Available online: https://www.kommersant.ru/doc/5899090 (accessed on 17 November 2023).

- Nemtseva, M. I’d like Furniture: IKEA’s Departure Has Lifted Revenue for Marketplaces. Available online: https://iz.ru/1405434/mariia-nemtceva/mne-mebel-ukhod-ikea-podnial-vyruchku-marketpleisam (accessed on 17 November 2023).

- Housing Development. Available online: https://rosstat.gov.ru/folder/14458 (accessed on 17 November 2023).

- Trubilina, M. Furniture Production Grew by 15 Percent over the Year. Available online: https://rg.ru/2023/01/20/proizvodstvo-mebeli-vyroslo-za-god-na-15-procentov.html (accessed on 16 November 2023).

- Pyzhev, A.I. Russian pulp and paper industry: In search of new points of growth. Econ. Manag. 2023, 29, 917–926. [Google Scholar] [CrossRef]

- Western Investors Have Withdrawn from the Woodworking Industry. Available online: https://www.kommersant.ru/doc/6223711 (accessed on 17 November 2023).

- Birch Bark Is Canceled: How Russia Is Looking for a Replacement for Bleached Office Paper. Available online: https://forestcomplex.ru/cbp/kak-v-rossii-ishhut-zamenu-beloj-ofisnoj-bumage/ (accessed on 17 November 2023).

- The Reply to Tetra Pak: How Does the Russian Packaging Market Live under Sanctions? Available online: https://forestcomplex.ru/cbp/chem-zhivjot-rossijskij-rynok-upakovki-v-usloviyah-sankcij/ (accessed on 17 November 2023).

- Packaging Production near Moscow Continues to Develop with Regional Support. Available online: https://www.vedomosti.ru/press_releases/2023/01/13/podmoskovnoe-proizvodstvo-upakovki-prodolzhaet-razvivatsya-pri-podderzhke-regiona (accessed on 17 November 2023).

- ILIM Group Regained Its Leadership among Timber Loggers. Available online: https://roslesinforg.ru/news/all/gruppa-ilim-vernula-sebe-liderstvo-sredi-zagotoviteley-drevesiny-/ (accessed on 3 December 2023).

- Strategy Partners. Expectations of Forest Companies in 2023. 2023. Available online: https://strategy.ru/research/research/43 (accessed on 3 December 2023).

- In the Irkutsk Region in 2022, Timber Harvesting Decreased by 20%. Available online: https://tass.ru/ekonomika/16823225 (accessed on 18 November 2023).

- Zabotina, A. Expert Siberia Top-400: Rating of Companies in the Real Sector of the Economy of Siberia and the Far East. Available online: https://expertsibdv.com/ekonomika/top-400-reyting-kompaniy-realnogo-sektora-ekonomiki-sibiri-i-dalnego-vostoka/ (accessed on 19 November 2023).

- Sidorova, M. A Record for Memory. Available online: https://www.lesindustry.ru/issues/li_164/%D0%A0%D0%B5%D0%BA%D0%BE%D1%80%D0%B4_%D0%BD%D0%B0_%D0%BF%D0%B0%D0%BC%D1%8F%D1%82%D1%8C_2260/ (accessed on 19 November 2023).

- Pavlovskiy, V.E.; Panteleev, V.I. The Krasnoyarsk Timber Industry Is Crying out for Help. Available online: https://krasrab.ru/news/ekonomika/27058 (accessed on 19 November 2023).

- List of Instructions Based on the Results of the Meeting on the Development of the Timber Industry Complex. Available online: http://www.kremlin.ru/acts/assignments/orders/70764 (accessed on 3 December 2023).

- Panteleev, V. How to Save the Forest Industry. Available online: https://krasrab.ru/news/davayte-obsudim/25905 (accessed on 19 November 2023).

- Tomsk Forestry Enterprises Began to Withdraw Capacity from Inactivity after Solving Problems with Exports. Available online: https://obzor.city/news/666036---tomskie-predprijatija-lpk-nachali-vyvodit-moshchnosti-iz-prostoja-posle-reshenija-problem-s-eksporto (accessed on 20 November 2023).

- Expert: Onions in Tomsk Have Risen in Price Due to the Ban on the Export of Timber to Kazakhstan. Available online: https://www.riatomsk.ru/article/20230110/ekspert-luk-v-tomskoj-oblasti-podorozhal-iz-za-pilomaterialov/ (accessed on 20 November 2023).

- Shida, Y. Russian Business under Economic Sanctions: Is There Evidence of Regional Heterogeneity? Post-Communist Econ. 2019, 1–21. [Google Scholar] [CrossRef]

- Li, Z.; Li, T. Economic Sanctions and Regional Differences: Evidence from Sanctions on Russia. Sustainability 2022, 14, 6112. [Google Scholar] [CrossRef]

- Dementieva, E. Irkutsk Forest Industry Is Ready to Ban the Export of Roundwood. Available online: https://rg.ru/2022/02/17/reg-sibfo/irkutskij-lpk-gotov-k-zapretu-na-eksport-krugloj-drevesiny.html (accessed on 19 November 2023).

- Knobel, A.Y.; Proka, K.A.; Bagdasaryan, K.M. The Theory and Practice of International Economic Sanctions. JNEA 2019, 43, 152–162. [Google Scholar] [CrossRef]

- Bapat, N.A.; Heinrich, T.; Kobayashi, Y.; Morgan, T.C. Determinants of Sanctions Effectiveness: Sensitivity Analysis Using New Data. Int. Interact. 2013, 39, 79–98. [Google Scholar] [CrossRef]

- Hufbauer, G.C.; Schott, J.J.; Elliott, K.A.; Oegg, B. Economic Sanctions Reconsidered, 3rd ed.; Peterson Institute for International Economics: Washington, DC, USA, 2007; ISBN 978-0-88132-407-5. [Google Scholar]

- Ata, N.K.; Ismailov, N.; Volkova, I. Sanctions and the Russian Federation’s Economy: A Systematic Literature Review and Analysis of Global Energy Sector. Ege Acad. Rev. 2023, 23, 377–392. [Google Scholar] [CrossRef]

- Liu, Q.; Ning, Z. Impact of Global Supply Chain Crisis on Chinese Forest Product Enterprises: Trade Trends and Literature Review. Forests 2023, 14, 1247. [Google Scholar] [CrossRef]

- Ponsse’s Interim Report for 1 January–30 September 2022—Ponsse. Available online: https://www.ponsse.com/company/investors/releases/-/asset_publisher/XbANRjhQNz7o/content/ponsse-s-interim-report-for-1-january-30-september-2022#/ (accessed on 19 November 2023).

- Worldwide Pulp Shortage Raises Risk of Higher Tissue Prices. Available online: https://www.bloomberg.com/news/articles/2022-05-06/worldwide-pulp-shortage-raises-risk-of-higher-tissue-prices (accessed on 19 November 2023).

- Fastmarkets. How an EU Ban on Russian-Made Paper Could Transform the European Sack Kraft Market. 2022. Available online: https://www.fastmarkets.com/insights/how-an-eu-ban-on-russian-made-paper-could-transform-the-european-sack-kraft-market/ (accessed on 3 December 2023).

- Galbraith, J.K. The Gift of Sanctions: An Analysis of Assessments of the Russian Economy, 2022–2023; Institute for New Economic Thinking: New York City, NY, USA, 2023. [Google Scholar]

- Horak, J. Sanctions as a Catalyst for Russia’s and China’s Balance of Trade: Business Opportunity. J. Risk Financ. Manag. 2021, 14, 36. [Google Scholar] [CrossRef]

- Six Months into War, Russian Goods Still Flowing to US. Available online: https://apnews.com/article/russia-ukraine-putin-biden-baltimore-only-on-ap-81a34ce2eecebe491f52ace380ce87fb (accessed on 25 October 2022).

- How Russian Timber Bypasses U.S. Sanctions by Way of Vietnam. Available online: https://www.washingtonpost.com/world/2022/10/01/russia-sanctions-birch-wood-vietnam-china/ (accessed on 25 October 2022).

- Lehren, A.W. The U.S. Put Punishing Tariffs on Russian Plywood after the Ukraine Invasion. Did It Actually Cut Imports? Available online: https://www.nbcnews.com/news/world/us-tariffs-russian-plywood-ukraine-invasion-cut-imports-rcna71914 (accessed on 2 December 2023).

- Kuvalin, D.B.; Zinchenko, Y.V.; Lavrinenko, P.A.; Ibragimov, S.S. Russian Enterprises at the End of 2022: Countering Sanctions, Relations with Banks and Reaction to the Climate Agenda. Stud. Russ. Econ. Dev. 2023, 3, 200–216. [Google Scholar] [CrossRef]

- Bezrukikh, O.A. Formation of a Highly Efficient Wooden Housing Construction Sector in Russia. IOP Conf. Ser. Earth Environ. Sci. 2021, 751, 012088. [Google Scholar] [CrossRef]

- Skorlygina, N. The Third Went. Available online: https://www.kommersant.ru/doc/6197185 (accessed on 19 November 2023).

- Mishechkina, M. Facts Passed through the Heart. Available online: https://krasrab.ru/news/stati/6640 (accessed on 3 December 2023).

- 1.5 Million Tons via the Northern Sea Route. Available online: http://lesregion.ru/slider/6048-15-mln-tonn-produkcii-cherez-sevmorput.html (accessed on 3 December 2023).

- In August, a Test Delivery of Timber along the Northern Sea Route from Pomorie to China Will Take Place. Available online: https://nationalforest.ru/en/news/v-avguste-sostoitsya-testovaya-dostavka-lesa-po-sevmorputi-iz-pomorya-v-kitaj (accessed on 3 December 2023).

- Shvidenko, A.Z.; Schepaschenko, D.G. Climate Change and Wildfires in Russia. Contemp. Probl. Ecol. 2013, 6, 683–692. [Google Scholar] [CrossRef]

- Loupian, E.; Balashov, I.V.; Bartalev, S.A.; Burtsev, M.A.; Dmitriev, V.V.; Senko, K.S.; Krasheninnikova, Y.S. Forest Fires in Russia: Specifics of the 2019 Fire Season. Sovrem. Probl. Distantsionnogo Zondirovaniya Zemli Iz Kosmosa 2019, 16, 356–363. (In Russian) [Google Scholar] [CrossRef]

- Korená Hillayová, M.; Holécy, J.; Korísteková, K.; Bakšová, M.; Ostrihoň, M.; Škvarenina, J. Ongoing Climatic Change Increases the Risk of Wildfires. Case Study: Carpathian Spruce Forests. J. Environ. Manag. 2023, 337, 117620. [Google Scholar] [CrossRef]

- Ivantsova, E.D.; Pyzhev, A.I.; Zander, E.V. Economic Consequences of Insect Pests Outbreaks in Boreal Forests: A Literature Review. J. Sib. Fed. Univ. Humanit. Soc. Sci. 2019, 12, 627–642. [Google Scholar] [CrossRef]

- Mezei, P.; Potterf, M.; Škvarenina, J.; Rasmussen, J.G.; Jakuš, R. Potential Solar Radiation as a Driver for Bark Beetle Infestation on a Landscape Scale. Forests 2019, 10, 604. [Google Scholar] [CrossRef]

- Chugunkova, A.V. Modeling of Logging Industry Dynamics Under the Global Climate Change: The Evidence from Siberian Regions. J. Sib. Fed. Univ. Humanit. Soc. Sci. 2020, 13, 1870–1879. [Google Scholar] [CrossRef]

- Exports and Imports of Russian Regions: Customs Statistics for 2016–2021. Available online: https://data.rcsi.science/data-catalog/datasets/201/ (accessed on 3 December 2023).

| Activity | Number of Firms by Revenue, Million Rubles | Total Number | |||

|---|---|---|---|---|---|

| Large (>2000) | Medium (800–2000) | Small (120–800) | Micro (<120) | ||

| Forestry | NA | NA | 105 | 8 | 113 |

| Logging | 3 | 11 | 364 | 80 | 458 |

| Sawing and planing of wood | 9 | 11 | 448 | 63 | 531 |

| Manufacturing of wood products | 3 | 6 | 275 | 31 | 315 |

| Manufacturing of furniture | NA | 3 | 471 | 26 | 500 |

| Manufacturing of pulp, paper and paper products | 4 | 8 | 93 | 30 | 135 |

| All | 19 | 39 | 1756 | 238 | 2052 |

| Region | Number of Priority Investment Projects | Growing Stock | Cuts | ||

|---|---|---|---|---|---|

| Volume, Million cbm | Share, % | Volume, Million cbm | Share, % | ||

| Siberian federal district | 41 | 27,957.1 | 33.9 | 61.0 | 31.4 |

| Krasnoyarsk Krai | 21 | 11,512.5 | 13.9 | 19.6 | 10.1 |

| Irkutsk Oblast | 14 | 8704.7 | 10.5 | 27.9 | 14.4 |

| Tomsk Oblast | 3 | 2802.9 | 3.4 | 5.8 | 3.0 |

| Republic of Tyva | NA | 1164.1 | 1.4 | 0.2 | 0.1 |

| Altai Republic | NA | 765.2 | 0.9 | 0.4 | 0.2 |

| Kemerovo Oblast | NA | 748.0 | 0.9 | 1.6 | 0.8 |

| Omsk Oblast | 1 | 639.8 | 0.8 | 1.4 | 0.7 |

| Novosibirsk Oblast | NA | 584.4 | 0.7 | 1.2 | 0.6 |

| Altai Krai | 2 | 562.5 | 0.7 | 2.5 | 1.3 |

| Republic of Khakassia | NA | 472.9 | 0.6 | 0.3 | 0.2 |

| Descriptive Statistics | Revenue, Million Rubles | Net Income, Million Rubles | ||

|---|---|---|---|---|

| 2021 | 2022 | 2021 | 2022 | |

| Minimum | 0.006 | 0.001 | −981.6 | −1646.0 |

| 1st quartile | 3.2 | 3.4 | 0.02 | 0.01 |

| Median | 14.0 | 13.4 | 0.4 | 0.3 |

| Mean | 126.2 | 121.5 | 13.9 | 2.6 |

| 3rd quartile | 55.7 | 54.4 | 2.9 | 2.2 |

| Maximum | 14,088.5 | 15,158.5 | 3955.3 | 813.5 |

| Std.dev | 616.0 | 656.9 | 131.4 | 58.3 |

| Skewness | 12.2 | 15.4 | 18.5 | −11.8 |

| Kurtosis | 196.3 | 295.7 | 463.7 | 376.4 |

| Shapiro–Wilk test | 0.2 | 0.1 | 0.1 | 0.2 |

| p-value (SW) | 0.000 | 0.000 | 0.000 | 0.000 |

| Product | Measurement Units | Production Volumes | Growth Rate, % | Share, 2021, % | Share, 2022, % | |

|---|---|---|---|---|---|---|

| 2021 | 2022 | |||||

| Coniferous timber | million cbm | 40.9 | 40.0 | −2.0 | 37.0 | 36.9 |

| Hardwood timber | million cbm | 15.1 | 13.9 | −8.1 | 25.0 | 24.0 |

| Fuel wood | million cbm | 2.0 | 1.6 | −17.9 | 12.5 | 10.7 |

| Pulp | thousands of metric tons | 2325.0 | 2377.9 | 2.3 | 26.3 | 27.1 |

| Paper and paperboard | thousands of metric tons | 420.5 | 433.2 | 3.0 | 4.1 | 4.3 |

| Sawnwood | million cbm | 12.4 | 10.6 | −14.4 | 41.1 | 36.6 |

| Pellets | thousands of metric tons | 649.6 | 607.5 | −6.5 | 27.3 | 29.3 |

| Plywood | thousands of cbm | 285.8 | 153.8 | −46.2 | 6.4 | 4.7 |

| Particle board | thousands of cbm | 720.6 | 726.4 | 0.8 | 6.3 | 7.0 |

| Fibreboard | million squared meters | 107.3 | 97.6 | −9.0 | 14.5 | 15.0 |

| Furniture | billions rubles | 23.2 | 28.0 | 20.6 | 7.5 | 7.9 |

| Prefabricated wooden buildings | million rubles | 381.1 | 1075.3 | 182.2 | 6.8 | 7.1 |

| Wooden houses | thousands of squared meters | 1.5 | 2.9 | 94.7 | 0.7 | 1.4 |

| Garden houses and buildings | units | 297.0 | 1420.0 | 378.1 | 4.1 | 14.9 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gordeev, R.V.; Pyzhev, A.I. Impact of Trade Restrictions on the Russian Forest Industry: Evidence from Siberian Timber Producers. Forests 2023, 14, 2452. https://doi.org/10.3390/f14122452

Gordeev RV, Pyzhev AI. Impact of Trade Restrictions on the Russian Forest Industry: Evidence from Siberian Timber Producers. Forests. 2023; 14(12):2452. https://doi.org/10.3390/f14122452

Chicago/Turabian StyleGordeev, Roman V., and Anton I. Pyzhev. 2023. "Impact of Trade Restrictions on the Russian Forest Industry: Evidence from Siberian Timber Producers" Forests 14, no. 12: 2452. https://doi.org/10.3390/f14122452

APA StyleGordeev, R. V., & Pyzhev, A. I. (2023). Impact of Trade Restrictions on the Russian Forest Industry: Evidence from Siberian Timber Producers. Forests, 14(12), 2452. https://doi.org/10.3390/f14122452