Abstract

In the paper, we tackle the least squares estimators of the Vasicek-type model driven by sub-fractional Brownian motion:

with , where is a sub-fractional Brownian motion whose Hurst index H is greater than , and , are two unknown parameters. Based on the so-called continuous observations, we suggest the least square estimators of and and discuss the consistency and asymptotic distributions of the two estimators.

1. Introduction

Statistical inference for stochastic equations is a main research direction in probability theory and its applications. When the noise is a standard Brownian motion or a Lévy process, such problems have been extensively studied. Some surveys and complete literature for this direction could be found in Bishwal [1], Iacus [2], Kutoyants [3], Liptser and Shiryaev [4], Prakasa Rao [5], and the references therein. However, in contrast to the extensive studies on semimartingale types, other statistical inferences associated with some Gaussian processes are very limited, and a common denominator in all these works is that it is assumed that the equation admits only an unknown parameter. Let us consider the parameter estimates of the Vasicek-type model driven by a Gaussian process G:

where , are two parameters.

When and G is a fractional Brownian motion with Hurst index , the question has been studied by many authors. We mention the works of Berzin et al. [6], Es-Sebaiy [7], Es-Sebaiy and Nourdin [8], Hu and Nualart et al. [9,10], Kleptsyna and Le Breton [11], Prakasa Rao [12], and the references therein for results on parameter estimation of stochastic equations driven by the fractional Brownian motion (fBm). When G is not a fractional Brownian motion, the research for this question is very limited. For and G a sub-fractional Brownian motion, Mendy [13] considered the least squares estimation of and studied the consistency and asymptotic behavior. For and G a Gaussian process, El Machkouri et al. [14] showed the strong consistency and the asymptotic distribution of the least squares estimator of based on the properties of G, and as some examples, the authors also studied the three Vasicek-type models driven by fractional Brownian motion, sub-fractional Brownian motion, and bi-fractional Brownian motion, respectively.

Motivated by these above results and for simplicity, in this paper, we consider the least squares estimation of Equation (1) when G is a sub-fractional Brownian motion with Hurst index and both and are unknown. That is, the parameter estimation of the so-called Vasicek-type model driven by sub-fractional Brownian motion:

where is a sub-fractional Brownian motion and , are two unknown parameters. On the other hand, there exists still a practical motivation for studying the parameter estimation, that is to provide optional tools to understand volatility modeling in finance. In fact, any mean-reverting model in continuous or discrete observations can be regarded as a model for stochastic volatility. We can consult the research monograph [15] for this modeling idea. Since stochastic volatility is not observed for many financial markets and the sub-fractional Brownian motion is a process without ergodicity, the discussions on the parameter estimation based on discrete observations are beyond the scope of this article. For the sake of simplicity, we focus on tackling the least squares estimation of Equation (2) based on the so-called continuous observations.

The so-called sub-fractional Brownian motion (sub-fBm in short) with index is introduced by Bojdecki et al. [16], which arises from occupation time fluctuations of branching particle systems with the Poisson initial condition. It is a mean zero Gaussian process with and:

for all . For , coincides with the standard Brownian motion B. Sub-fBm is neither a semimartingale nor a Markov process unless . The sub-fBm has many properties analogous to those of fractional Brownian motion such as self-similarity, long/short-range dependence, and Hölder paths. However, it has no stationary increments. Moreover, it admits the estimates:

More works for sub-fractional Brownian motion can be found in Bojdecki Y et al. [17,18], Li and Xiao [19], Shen and Yan [20], Sun and Yan [21,22], Tudor [23,24,25,26], Yan et al. [27,28], and the references therein. On the other hand, in contrast to the extensive studies on fractional Brownian motion, there has been little systematic investigation on other self-Gaussian processes. The main reason for this is the complexity of dependence structures, and in general, these Gaussian processes have no stationary increments and the representation based on Wiener integral with respect to a Brownian motion. Therefore, it seems interesting to study the asymptotic behavior associated with other self-Gaussian processes.

Now, we consider Equation (2) with and . Clearly, we have:

for all , and the trajectory of X is -Hölder continuous for all (see Section 3). As an immediate result, we see that the Young integral is well defined for all . Let now the system Equation (2) be observed continuously, and let H be known. By using the least squares method due to Hu and Nualart [10], the least squares estimators of and can be motivated by minimizing the contrast function:

Minimizing the above contrast function , we introduce estimators of and as follows:

and:

where the stochastic integral is a Young integral for . Our main statement is as follows:

• The least squares estimators and are strong consistent, and we have:

and:

in distribution, as T tends to infinity, where are mutually independent, , , and:

2. Preliminaries

In this section, we briefly recall some basic definitions and results of sub-fBm. Throughout this paper, we assume that is arbitrary, but fixed, and let be a one-dimensional sub-fBm with Hurst index H and defined on . can be written as a Volterra process, and it is also possible to construct a stochastic calculus of variations with respect to the Gaussian process , which will be related to the Malliavin calculus. Some surveys and complete literature for Malliavin calculus of the Gaussian process could be found in Alòs et al. [29], Nualart [30], and Tudor [25,26].

Recall that a mean zero Gaussian process with Hurst index is called the sub-fractional Brownian motion (sub-fBm) if and the covariance:

for all . Consider the kernel by:

where denotes the Erdély–Kober-type fractional integral operator defined by:

for all measurable functions , , . Some basic properties of this fractional integral can be found in Samko et al. [31]. By using the kernel , we have the Wiener integral representation (in distribution) of sub-fBm as follows:

for some standard Brownian motion, where:

Let be the family of elementary functions of the form:

and let be the completion of the linear space with respect to the inner product:

When , we can characterize as:

with . When , we have:

and , and:

As usual, we define the linear mapping on by:

for all . Then, the linear mapping is an isometry from to the Gaussian space generated by , and it can be extended to and:

for any , which is called the Wiener integral with respect to , denoted by:

for any . If the Wiener integral is well defined for every , we then can define the integral:

for any satisfying:

Thus, we can call Equation (12) the indefinite Wiener integral. Denote by the set of smooth functionals of the form:

where (f and all its derivatives are bounded) and . Denote by and the Malliavin derivative and divergence integral operator associated with sub-fractional Brownian motion , respectively. Then, we have:

We denote by the closure of with respect to the norm:

for . The divergence integral is the adjoint of derivative operator and:

for . We will use the notation:

to express the Skorohod integral of an adapted process u, and the indefinite Skorohod integral is defined as . Clearly, the divergence integral is closed in .

Finally, we recall Young’s integration and some results established in Bertoin [32] and Föllmer [33]. A Borel function f on is said to be of bounded p-variation with if:

where the supremum is taken over all partitions of . The estimates Equation (4) and the normality imply that the sub-fractional Brownian motion admits almost surely a bounded -variation on any finite interval for any sufficiently small . That is, we have:

for all and . The definition of p-variation for processes is slightly different. We say that the continuous adapted process Z has a locally-bounded p-variation if there exists an increasing sequence of stopping times such that , a.s., as and has a bounded p-variation for all n. It is easy to prove that if Y is an adapted continuous process, such that for P-a.s. and all positive , the function has a bounded p-variation on , then the process Y has a locally-bounded p-variation.

Let X and Y be two adapted continuous processed with locally-bounded p and q variations, respectively, such that , then one can define (see, for example, Bertoin [32]):

as the limit in probability of a Riemann sum, which generalizes the usual integral when X or Y are semimartingales, and Z has a locally-bounded p-variation. Moreover, Bertoin [32] showed that has a locally-bounded q-variation and:

provided is an adapted continuous process with locally-bounded q-variation.

Lemma 1

(Föllmer [33]). Let U and V be two continuous adapted processes with locally-bounded p-variation (). Then, and have locally-bounded two-variations, and It’s formula:

holds for all . In particular, we have the integration by parts formula:

for all .

Corollary 1.

Let . If u is a continuous adapted process with bounded q-variations with , then Young’s integral:

is well-defined and:

for all .

Corollary 2

(Alós et al. [29]). Let . If u is a continuous adapted process with bounded q-variations with and , we then have:

for all .

3. The Consistency of the Least Squares Estimator

In this section, our main objective is to expound and to prove the next theorem, which gives the consistency of the estimators given by Equations (5) and (6).

Theorem 1.

For , we have:

- (1)

- , as T tends to infinity, almost surely.

- (2)

- , as T tends to infinity, almost surely.

Then, Equation (18) can be rewritten as below:

It follows from the above equation that:

for all .

Lemma 2

(Lemma 2.1 in El Machkouri et al. [14]). Let . Then, the sub-fractional OUprocess is γ-Hölder continuous for all , and the Young integral:

is well-defined for all if u is an adapted continuous process with bounded p-variation with for any sufficiently small . Moreover,

almost surely and in , as T tends to infinity. Thus, as ,

almost surely and in .

Lemma 3

(Hu-Nualart [10]). For all , we have:

Lemma 4.

Let . We then have that:

Proof of Lemma 4.

This is a simple calculus exercise. ☐

Corollary 3.

Let . We then have that:

almost surely, and in , as T tends to infinity.

Proof of Corollary 3.

Lemma 5.

Let . Then, the convergence:

hold almost surely and in , as T tends to infinity.

Proposition 1.

Let . We have that:

almost surely, as T tends to infinity.

Proof of Proposition 1.

By Equation (18) and Lemma 1, we have:

for all . Clearly, an elementary calculus can show that:

as T tends to infinity. For , we have:

by integration by parts, which gives:

for all by integration by parts. It follows from Lemma 1 and Lemma 5 that:

almost surely, as T tends to infinity. For , we have:

and:

for all by integration by parts. It follows from Lemma 1 and Lemma 5 that:

almost surely, as T tends to infinity. Thus, we have showed that:

by Equation (25), almost surely, as T tends to infinity. ☐

Now, we can prove Theorem 1.

Proof of Theorem 1.

Denote:

for . By Equation (18) and Lemma 1, we obtain:

and:

almost surely, as T tends to infinity, which imply that:

almost surely, as T tends to infinity.

On the other hand, we have:

almost surely, as T tends to infinity. Combining this with Proposition 1 and Equation (26), we get:

almost surely, as T tends to infinity. Thus, we have completed the proof. ☐

4. Asymptotic Distribution of the Least Squares Estimator

In this section, we consider the asymptotic normality of the LSE and . We start with some preliminaries and let .

Lemma 6

(El Machkouri et al [14]). Let F be any -measurable random variable such that . Then, we have:

as , where is independent of and .

Proof of Lemma 6.

The lemma is introduced in El Machkouri et al. [14]. In fact, we need to check that:

and:

for all fixed , as T tends to infinity. However, the proof of the first convergence given by them is incomplete.

In order to introduce the first convergence, by Lemma 3, we have that:

Notice that:

as T tends to infinity. We get , and the lemma follows.

Lemma 7

(I. Mendy [13]). Suppose that . Then, as ,

in and:

as .

Theorem 2.

For , the convergence:

and:

hold in distribution, as T tends to infinity, where are mutually independent, , and:

Remark 1.

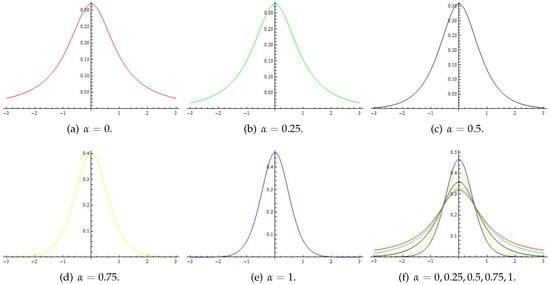

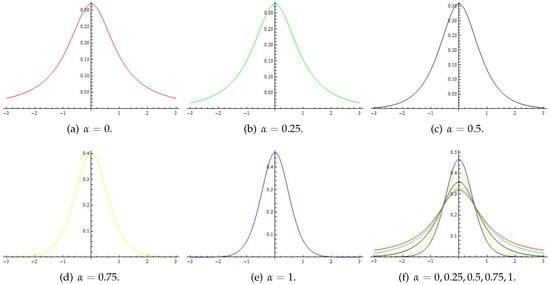

It is not difficult to show that the density of is:

where are mutually independent and . In particular, as we know that admits a standard Cauchy distribution, provided , when , we have:

The next figures give the plots of the density functions with , respectively, and in Figure 1f, we give the graphs of the five density functions in a common coordinate system.

Figure 1.

The graphs of the density function with different α.

Proof of Theorem 2.

We first introduce the convergence Equation (30). Recall that:

for . It follows from the identities:

and:

that:

for all . Clearly, we have and:

almost surely, as , by Lemma 5 and Equation (22), which imply that:

and:

almost surely, as by Equation (26). To prove the statement Equation (30), we need to estimate:

Notice that:

for every by the relationship Equation (17). We see that:

for all . Clearly, Lemma 7 and Equation (26) imply that the convergence:

holds almost surely, as . For , by Lemma 6, we have also that:

in distribution, as , where is independent of . Combining this with Equations (33)–(36), and Slutsky’s theorem, we have introduced the desired conclusion:

in distribution, as .

For the convergence Equation (31), we have:

for all and:

in distribution, as T tends to infinity, by the convergence Equation (30) and Slutsky’s theorem.

For the convergence Equation (32), noticing that the proof of the convergence Equation (31), we have:

for all , and it is easy to see that:

as T tends to infinity, in probability. In fact, by Equations (2), (18) and Lemma 2, we have:

almost surely, as T tends to infinity. Combining this with the convergence Equation (30), we have that in probability, as T tends to infinity. Thus, the convergence Equation (32) follows from the fact:

for all . This completes the proof of Theorem 2. ☐

5. Conclusions

In this paper, we discuss the least squares estimation for the Vasicek-type model driven by a sub-fraction Brownian motion with Hurst index . Based on the so-called continuous observation, we introduce the least squares estimators of the two unknown parameters and in the Vasicek-type model and prove in detail the consistency and asymptotic distributions of the two estimators. In general, however, there exists a gap between the results we introduce and their applicability. For instance, one must take into account the so-called discrete observations and then choose an observation frequency for any practical problem in finance. Hence, in our current study, we are considering the parametric estimation of the Vasicek-type model under the so-called discrete observations. Moreover, in the future, we will attempt to give the least squares estimators of the Vasicek-type model driven by a general Gaussian process.

Author Contributions

Joint work, S.L. and Y.D. All authors read and approved the submitted manuscript, agreed to be listed, and accepted this version for publication.

Funding

This research was funded by the Project of Leading Talent Introduction and Cultivation in Colleges and Universities of the Education Department of Anhui Province (Grant No. gxfxZD2016270) and the Incubation Project of the National Scientific Research Foundation of Bengbu University (Grant No. 2018GJPY04).

Acknowledgments

The authors are thankful to the anonymous reviewers for their valuable comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bishwal, J.P. Parameter Estimation in Stochastic Differential Equations; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Iacus, S.M. Simulation and Inference for Stochastic Differential Equations; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Kutoyants, Y.A. Statistical Inference for Ergodic Diffusion Processes; Springer: Berlin/Heidelberg, Germany, 2004. [Google Scholar]

- Liptser, R.S.; Shiryaev, A.N. Statistics of Random Processes II: Applications. In Applications of Mathematics; Springer: Berlin/Heidelberg, Germany, 2001. [Google Scholar]

- Prakasa Rao, B.L.S. Statistical Inference for Diffusion type Processes; Oxford University Press: New York, NY, USA, 1999. [Google Scholar]

- Berzin, C.; Latour, A.; Leon, J.R. Inference on the Hurst Parameter and the Variance of Diffusions Driven by Fractional Brownian Motion; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Es-Sebaiy, K. Berry-Esséen bounds for the least squares estimator for discretely observed fractional Ornstein-Uhlenbeck processes. In Malliavin Calculus and Stochastic Analysis; Springer: Berlin/Heidelberg, Germany, 2013; pp. 2372–2385. [Google Scholar]

- Es-Sebaiy, K.; Nourdin, I. Parameter estimation for α fractional bridges. Springer Proc. Math. Stat. 2013, 34, 385–412. [Google Scholar]

- Hu, Y.Z.; Nualart, D.; Zhou, H.J. Parameter estimation for fractional Ornstein–Uhlenbeck processes of general Hurst parameter. arXiv, 2017; arXiv:1703.09372. [Google Scholar]

- Hu, Y.Z.; Nualart, D. Parameter estimation for fractional Ornstein-Uhlenbeck processes. Stat. Prob. Lett. 2010, 80, 1030–1038. [Google Scholar] [CrossRef]

- Kleptsyna, M.L.; Le Breton, A. Statistical analysis of the fractional Ornstein-Uhlenbeck type processes. Stat. Inference Stoch. Process. 2002, 5, 229–248. [Google Scholar] [CrossRef]

- Prakasa Rao, B.L.S. Statistical Inference for Fractional Diffusion Processes; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Mendy, I. Parametric estimation for sub-fractional Ornstein-Uhlenbeck process. J. Stat. Plan. Infer. 2013, 143, 663–674. [Google Scholar] [CrossRef]

- Machkouri, E.; Es-Sebaiy, K.; Ouknine, Y. Least squares estimator for non-ergodic Ornstein-Uhlenbeck processes driven by Gaussian processes. J. Korean Stat. Soc. 2016, 45, 329–341. [Google Scholar] [CrossRef]

- Fouque, J.P.; Papanicolaou, G.; Sircar, R.; Sølna, K. Multiscale Stochastic Volatility for Equity, Interest Rate, and Credit Derivatives; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- Bojdecki, T.; Gorostiza, L.G.; Talarczyk, A. Sub-fractional Brownian motion and its relation to occupation times. Stat. Probab. Lett. 2004, 69, 405–419. [Google Scholar] [CrossRef]

- Bojdecki, T.; Gorostiza, L.G.; Talarczyk, A. Limit theorems for occupation time fluctuations of branching systems (I): Long-range dependence. Stochastic. Process. Appl. 2006, 116, 1–18. [Google Scholar] [CrossRef]

- Bojdecki, T.; Gorostiza, L.G.; Talarczyk, A. Some extension of fractional Brownian motion and sub-fractional Brownian motion related to particle systems. Elect. Comm. Probab. 2007, 12, 161–172. [Google Scholar] [CrossRef]

- Li, Y.; Xiao, Y. Occupation time fluctuations of weakly degenerate branching systems. J. Theo. Probab. 2012, 25, 1119–1152. [Google Scholar] [CrossRef]

- Shen, G.; Yan, L. Estimators for the drift of sub-fractional Brownian motion. Comm. Stat. Theory Methods 2014, 43, 1601–1612. [Google Scholar] [CrossRef]

- Sun, X.; Yan, L. Weak convergence to a class of multiple stochastic integrals. Comm. Stat. Theory Methods 2017, 46, 8355–8368. [Google Scholar] [CrossRef]

- Sun, X.; Yan, L. A central limit theorem associated with sub-fractional Brownian motion and an application. Sci. Sin. Math. 2017, 47, 1055–1076. (In Chinese) [Google Scholar] [CrossRef]

- Tudor, C. Some properties of the sub-fractional Brownian motion. Stochastics 2007, 79, 431–448. [Google Scholar] [CrossRef]

- Tudor, C. Inner product spaces of integrands associated to sub-fractional Brownian motion. Stat. Probab. Lett. 2008, 78, 2201–2209. [Google Scholar] [CrossRef]

- Tudor, C. Some aspects of stochastic calculus for the sub-fractional Brownian motion. Ann. Univ. Bucuresti Math. 2007, 199–230. Available online: http://fmi.unibuc.ro/ro/anale/matematica/mate_anul_LVII_2008_nr_2_art_7.pdf (accessed on 1 November 2018).

- Tudor, C. On the Wiener integral with respect to a sub-fractional Brownian motion on an interval. J. Math. Anal. Appl. 2009, 351, 456–468. [Google Scholar] [CrossRef]

- Yan, L.; He, K.; Chen, C. The generalized Bouleau-Yor identity for a sub-fBm. Sci. China Math. 2013, 56, 2089–2116. [Google Scholar] [CrossRef]

- Yan, L.; Shen, G. On the collision local time of sub-fractional Brownian Motions. Stat. Probab. Lett. 2010, 80, 296–308. [Google Scholar] [CrossRef]

- Alós, E.; Mazet, O.; Nualart, D. Stochastic calculus with respect to Gaussian processes. Ann. Probab. 2001, 29, 766–801. [Google Scholar]

- Nualart, D. Malliavin Calculus and Related Topics; Springer: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Samko, S.G.; Kilbas, A.A.; Marichev, O.I. Fractional Integrals and Fractional Derivatives; Gordan and Breach Science: Yverdon, Switzerland, 1993. [Google Scholar]

- Bertoin, J. Sur une intégrale pour les processus á α-variation borné. Ann. Probab. 1989, 17, 1521–1535. (In French) [Google Scholar] [CrossRef]

- FöIllmer, H. Calcul d’Itô sans probabilités. In Séinaire de Probabilités XV; Springer: Berlin/Heidelberg, Germany, 1981. (In French) [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).