1. Introduction

In recent years, solar power and other renewable forms of energy, including wind and hydroelectric power, have been attracting attention, because fossil fuel will become difficult to mine in the near future. In contrast with thermal power generation based on fossil fuel, electric power generated by photovoltaic (PV) cells and wind turbines is uncontrollable and unpredictable, because it depends on the weather and climate. Therefore, adapting consumer demand to the fluctuating supply is a key issue when developing our future electricity network. Recently, a decentralized autonomous electricity network has been studied as a way to overcome this problem [

1].

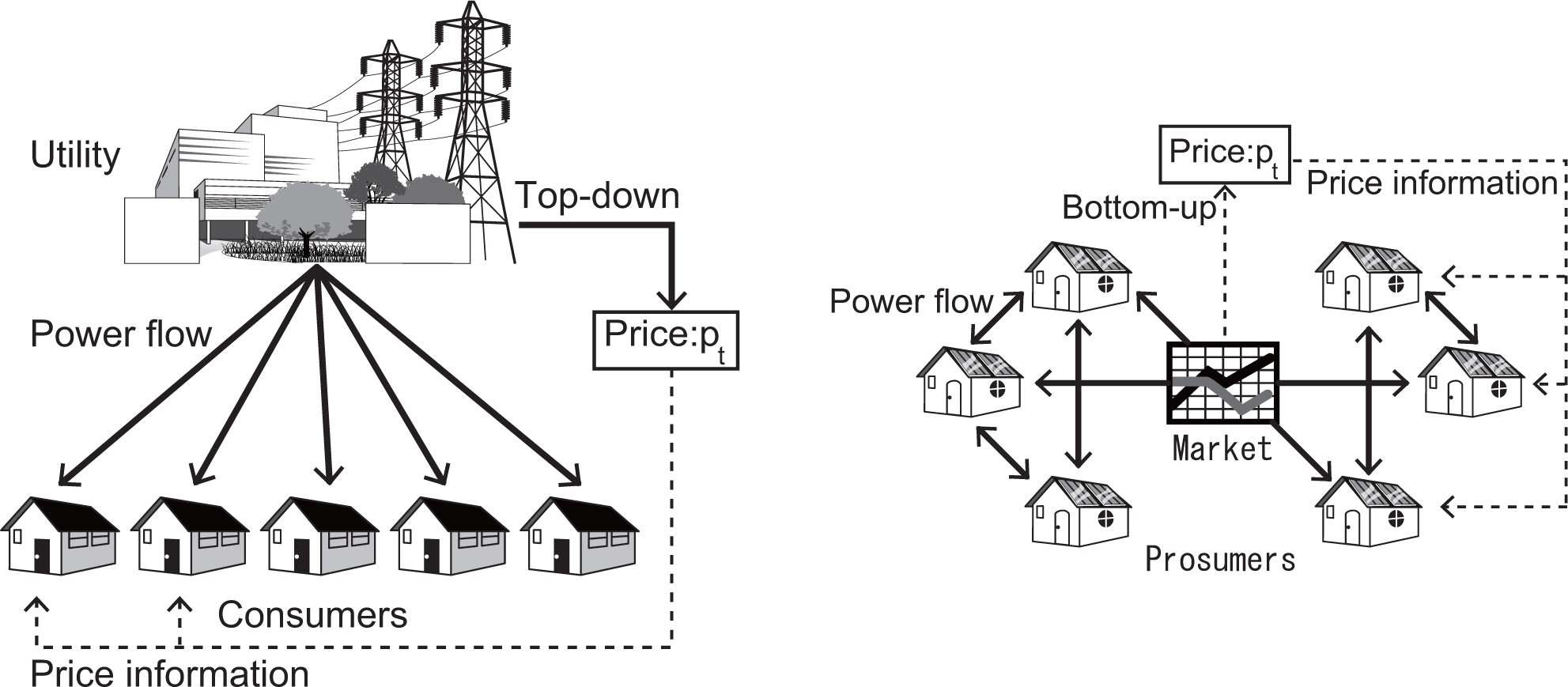

In this paper, we propose a double auction-based demand-side management mechanism for a regional prosumers’ electricity network, named the inter-intelligent renewable energy network (i-Rene) [

2]. A schematic view of i-Rene is shown in

Figure 1. In i-Rene, locally-generated electric power is consumed in the local electricity network. Currently, surplus energy produced by PVs connected to the electricity network in Japan is sold at a fixed high price,

i.e., the price is set as the feed-in tariff, and transferred to a grid managed by a regionally-monopolizing electric power company, almost forcibly. This causes reverse power flow, which could destabilize the global electric power network.

Therefore, i-Rene is designed not to transfer surplus energy to the external grid, to which it is connected via a gateway and which essentially transmits electric power in a single direction. Each house is equipped with a smart meter running intelligent software. The software automatically trades electricity in the regional electricity market and allocates the generated electricity appropriately by referring to the load profile of each house. The regional electricity market is automatically managed by the gateway. We assume that the regional electricity network covers an entire town in which the number of houses is assumed to be between ten and several thousands.

We assume that each house connected to i-Rene contains a generator using renewable energy resources and a battery. The intelligent software in the smart meter automatically trades electricity on behalf of the dweller. However, local power generation, trading and electricity stored in the batteries cannot always satisfy the total demand in the local grid. In such cases, consumers connected to i-Rene would have the option of buying electricity from an outside power grid through the gateway at a high price. i-Rene is not centrally managed in that there is no central utility or large electricity company; instead, the agents in the network simply trade their electricity through double auction. Therefore, designing a double auction mechanism and analyzing its properties are important.

Double auction mechanisms have been used previously for designing multi-agent software systems to manage regional electricity networks [

2–

6]. A double auction involves the submission of bids by potential buyers and the simultaneous submission of asks by potential sellers to an electricity market. If adequate price balancing demand and supply are determined, the auctioneer clears the market. The determined price allows the participants to buy or sell electricity on the basis of their submitted bids or asks. One example of a double auction-based multi-agent software system for a regional electricity network is PowerMatcher [

3,

4,

7]. Several field tests proved the ability of PowerMatcher to allocate energy resources efficiently in a decentralized manner. In PowerMatcher, each agent submits continuous demand and supply functions directly to an auctioneer in a market. Several multi-agent systems for realizing intelligent electricity networks employ such a function submission-based double auction (FS-DA) [

2–

4,

7,

8]. The advantage of FS-DA is that the auctioneer determines an appropriate clearing price by calculating the intersection between aggregate demand and supply functions without iterative communication between the auctioneer and the agents. This calculation is easily performed using simple agent software without any manual intervention by humans.

On the other hand, a number of studies have been devoted to the use of real-time pricing (RTP) in smart grids [

6,

9–

17]. These studies mainly used game theory and/or control theory to develop RTP algorithms and to prove their optimality and/or robustness. In particular, the dual decomposition framework provides a sophisticated explanation and theoretical foundation for RTP algorithms [

18]. However, the disadvantage of most of the dual decomposition-based RTP algorithms is that an iterative communication between a central utility, which settles the electricity price, and the agents is required to balance demand and supply. In addition, most of the dual decomposition-based RTP algorithms assume that a central utility “does not” behave selfishly, but behaves so as to optimize social welfare,

i.e., it attempts to solve the master problem in a dedicated manner.

The use of the double auction mechanism leads to the automatic generation of a time-varying price profile by simply balancing demand and supply. The consumers and the power producers are expected to change their load, generation and storage profiles by reacting to the time-varying price profile, so as to maximize their profit. This means that the mechanism has an intrinsic RTP mechanism. However, the optimality and the performance of linear function submission (LFS)-DA in a regional prosumers’ electricity network with distributed power resources and batteries have not been proven.

In this paper, we describe a linear function submission-based double auction (LFS-DA) mechanism for a day-ahead power market, in which an adequate price profile is gradually formed to control the demand and supply without any central price controllers. Throughout the learning phase, the LFS-DA is able to achieve an exact balance between electricity demand and supply for each time slot. We show the LFS-DA to be essentially equal to dual decomposition-based RTP from the viewpoint of changes in the price profile. Especially, our main contributions are as follows.

We propose an LFS-DA mechanism for a regional prosumers’ electricity network. The mechanism is able to achieve an exact balance between electricity demand and supply at each moment during iteration.

We prove that the changes in the price profile obtained by the LFS-DA become the same as those obtained by the RTP derived from the dual decomposition framework, except for a constant factor.

Our main result, i.e., Theorem 1, is very simple, but powerful. It shows that simple LFS-DA is sufficient for managing the day-ahead market in i-Rene without the need for a central utility to perform RTP to balance demand and supply and attempts to maximize social welfare by setting an appropriate price profile.

The remainder of this paper is organized as follows. Section 2 provides the background to our research and related work. Section 3 describes the problem definitions and basic assumptions of the target electricity network used in our research, which is a regional electricity network consisting of many prosumers. It also describes an RTP algorithm derived from the dual decomposition framework. Section 4 describes our proposed LFS-DA mechanism and provides proof that the LFS-DA is intrinsically equivalent to dual decomposition-based RTP. Section 5 contains details of a simulation experiment and its results. Finally, Section 6 concludes this paper.

3. Problem Definition

3.1. Basic Assumptions

In this work, we define a target regional electricity network as follows (a schematic diagram is shown in

Figures 1 and

3): we do not distinguish between electricity suppliers and consumers; rather, we assume that all people on the grid are capable of producing and consuming electricity as prosumers. Thus, it is assumed that each house is equipped with a generator powered by renewable energy, e.g., PV cells or wind power generators, and a storage device, e.g., a battery. Furthermore, each house is considered to have a smart meter running software that automatically controls the electricity of the house by managing its battery, transmitting electricity to other houses and communicating with other information systems.

In the regional electricity network, houses are connected through a regional electricity market through which each prosumer can sell and buy electricity. The local electricity price fluctuates on the basis of regional demand and supply. The prosumer attempts to optimize its trading rule, consumption and generation, so as to maximize his/her welfare. Basically, i-Rene is intended to behave as an independent electricity network.

The outside grid provides the prosumer with an optional alternative from which to buy electricity at the fixed high price at any time. In addition, the prosumer can also sell surplus electricity to the outside grid at the fixed low price, which is set so as to inhibit reverse power flow. We assume the outside grid is a unilateral conventional grid, as is common in Japan. Hereafter, we refer to a household, including the prosumers living in the house and the software, simply as an agent.

Suppose there are

N agents in i-Rene, and a set of these agents is represented by

. An agent can consume, generate, charge, discharge, buy and sell electricity through its smart meter during every one of the

T time slots. In addition, the number of time slots for transactions is shared by all of the agents in the grid. The set of time slots is defined as

. The

i-th agent can determine the amount it consumes

, generates

, charges

, discharges

, sells to

and buys from the regional market

and sells to

and buys from the outside grid

during each time slot

t. The variables of the

i-th agent

at time

are defined as shown under the Nomenclature. The relationship among the variables is also schematically shown in

Figure 3.

Each variable has its individual lower limit and/or upper limit owing to the limited capability of each apparatus or system. The superscripts

·+ and ·

− represent the direction from the viewpoint of a smart meter, which is at the center of electric energy flows in an agent’s house. Specifically, ·

+ and ·

− represent outflow and inflow, respectively. We assume that the energy flow through the smart meter adheres to the law of the conservation of energy for each time slot

t as follows.

The amount of electricity demanded has to be balanced against the supply in the regional electricity network for each time slot

t. We assume:

where

γ ∈ [0,1] represents the electricity transmission efficiency. If

γ = 1, there is no electricity energy loss during transmission. In addition, the storage efficiency

ηi ∈ [0,1] must be taken into consideration. If

ηi = 1, the charged electricity can be fully charged without any loss. The storage profile

represents the state of charge (SOC) of the

i-th agent’s storage device at time

t and is expressed by the following equation.

where

is the initial SOC of the

i-th agent’s battery. The storage efficiency

ηi can be different depending on each agent. Each constant of the system,

i.e.,

γ,

ηi,

and

, is fixed when a day-ahead market is held. In the long term, e.g., over several years, they can vary over time.

Agents can buy electricity from and sell electricity to the outside grid at the price of

and

per unit, respectively. The situation for which reverse power flow is completely prohibited is modeled by setting

. An immediate resale behavior between an agent and the outside grid is suppressed by assuming the following constraint.

3.2. Social Welfare

We define the cost for generating electric energy

for the

i-th agent by

, where

is a convex function of class

C2, and define the utility for consuming electric energy

for the

i-th agent by

, where

is a concave function of class

C2. The welfare

Wi: ℝ

8T × ℝ

T → ℝ of the

i-th agent is defined as follows.

where

,

pt is a buyer’s price profile in the regional electricity market at time

and

is a utility function for the

i-th agent at time

t, including payments to an outside grid. Because of the electricity losses in transmission, the seller’s price and buyer’s price become different. To balance the amount of money paid by sellers and buyers, the seller’s price becomes

γpt. The

i-th agents behavior at time

t is represented by

, concisely. We call

a state vector for the

i-th agent at time

t. Next, we define the social welfare of the network by

W(

x, p).

where

. This shows that the social welfare inside of the regional prosumers’ electricity network does not depend on the price profile of the internal regional market. Therefore, maximizing

W(

x, p) is the same as maximizing

, where

φ(

x) is the sum of the individual utility functions

.

3.3. Real-Time Pricing Algorithm

The following problem is defined as the primal problem, which has the purpose of maximizing the social welfare of the regional network.

Problem 1 (Primal problem).

where

z is a feasible set for the

i-th agent, except for the network constraints (see

Appendix A).

The primal problem is numerically solved by a solver. However, no electric power companies, utilities or governments can directly control the behavior of any of the agents. In addition, they cannot obtain information about

and

, because this information is usually private. Even if the central control system could obtain the private information, solving the primal problem requires a huge computational cost when the number of agents N becomes large. In reality, solving the primal problem centrally is impossibly difficult in the current economic environment. Therefore, a decentralized optimization method using price information is gathering attention in the context of smart grid management.

Based on the dual decomposition framework, an RTP mechanism maximizing social welfare, in which each agent maximizes its welfare selfishly, can be derived, and the price profile is updated centrally using a sub-gradient. The RTP algorithm is outlined in

Algorithm 1.

Algorithm 1.

Iterative solution of the dual problem: real-time pricing (RTP) algorithm.

Algorithm 1.

Iterative solution of the dual problem: real-time pricing (RTP) algorithm.

| k ← 0 |

| Initialize the price profile

|

| repeat |

| // Each agent solves its sub-problem (A7) and obtains its solution. |

| Update

. |

| // A central utility solves the master problem (A9) under the condition that

. |

| Update

, for each t. |

| k ← k + 1 |

| until a predefined stopping criterion is satisfied. |

| return Transact

with p(k) as the price profile. |

The price profile

is updated by using a known sub-gradient method [

10,

18] Adopting this method,

is updated as follows:

where

is the learning rate of the sub-gradient method. Iterative updating of

xi and

p provides the numerical solution of the dual problem (see

Appendix A). This solution is also a solution of the primal problem

Equations (13)–(

16). Therefore, the social welfare of the network is expected to be maximized. Further details are provided in

Appendix A. From the viewpoint of the pricing mechanism, solving the dual problem equates to the determination of a price profile by a utility, so as to maximize the social welfare. Therefore, we refer to this algorithm as an RTP algorithm.

Although this algorithm presents a feasible solution for the decentralized energy dispatch problem, it is unable to achieve an exact balance between demand and supply before converging to an optimal solution, despite the necessity of such a balance in an electricity network. In each step,

is not exactly a zero vector in most cases. Therefore, a heuristic process should be applied when aiming to compensate the difference δmt. One of the simplest methods is that the utility compensates this difference when it is not zero by selling or buying δmt to or from the outside grid at the price of

or

, respectively. In this work, we assume that the i-Rene gateway employs this heuristic procedure if i-Rene adopts the RTP algorithm.

In practical situations, the iteration cannot be performed many times, and only a small number of iterations is permitted. In such cases, the effect of δmt cannot be ignored. In this context, a mechanism that would be able to achieve an exact balance between the demand and supply is desirable. The LFS-DA is such a mechanism, as it has the ability to balance demand and supply exactly for each time slot and every iteration step and is guaranteed to solve the problem in the same way as the dual decomposition-based RTP algorithm.

4. The Linear Function Submission-Based Double Auction

The LFS-DA mechanism works as follows. A prosumer submits their individual linear demand and supply functions parametrized by two parameters,

i.e.,

and

, described in

Equations (20) and (

21). Then, the market-clearing price

pt is determined exactly by calculating the point at which the aggregate demand and supply functions intersect. After several iterations between an auctioneer and the prosumers, all prosumers transact their electricity using the determined clearing price. In this section, we formulate the LFS-DA mechanism and disclose its theoretical properties.

4.1. Transaction with LFS-DA

In LFS-DA, each agent has a linear demand function

and a linear supply function

for each time slot

t. These two functions are determined by using the two parameters

and

.

where ⌊

x⌋ := max(

x,0). In the LFS-DA, each agent submits the two parameters,

i.e.,

and

, to the auctioneer in the regional market to provide information about the linear demand and supply functions. In this work, we assume

is a fixed positive constant, and

is a flexible variable that is optimized by each agent.

When each agent submits the two parameters

to the market, an adequate price

pt is determined that would suffice to clear the market by searching for the point at which the aggregate demand and supply functions intersect. The constraint for balancing demand and supply

Equation (2) becomes:

The price

pt divides the agents into two groups. If for the

i-th agent

, the agent becomes a seller,

i.e.,

and

. In contrast, if for the

i-th agent

, the agent becomes a buyer,

i.e.,

and

. We define the set of suppliers at time

t by

and the set of consumers at time

t by

. In this case, on the basis of the constraint

Equation (22), an appropriate clearing price has to satisfy the following equation.

By solving the above equation for

pt, we obtain:

where

,

,

,

. The price

pt satisfying

Equation (24) exactly balances demand and supply and fulfills the constraint in

Equation (22).

Lemma 1 (The clearing price).

The clearing price pt that satisfies Equation (24) uniquely exists and is calculated exactly. Proof.

is a piecewise linear and monotonically increasing function of

pt, and its value at

pt = 0 is negative. Therefore,

is also a piecewise linear and monotonically increasing function of

pt, and its value at

pt = 0 is negative. Therefore, the solution of

Equation (22) uniquely exists and can be calculated exactly.

In the LFS-DA, when the auctioneer in the market receives

from all of the agents at the

k-th iteration, the auctioneer determines the price

by solving

Equation (24). Based on the price

, each agent either transmits

or receives

. After determining the amount of

, each agent has to reconfigure its

for the given

so as to satisfy the constraint

. Under the condition that each agent behaves rationally,

i.e., selfishly, the process of the LFS-DA mechanism is described as

Algorithm 2.

Algorithm 2.

Iterative update in LFS-DA.

Algorithm 2.

Iterative update in LFS-DA.

| k ← 0 |

| Initialize the price profile

|

| repeat |

| // Each agent solves its sub-problem (A7) and obtains its solution. |

| Update

. |

| // Each agent submits to

the market.. |

| Update p(k + 1) ← market_clearing, |

| Update

|

| // Reconfiguration by each agent |

| Update

, for each i |

| k ← k + 1 |

| until a predefined stopping criterion is satisfied. |

| return Transact

with p(k) as the price profile. |

4.2. LFS-DA as a bottom-up RTP Method

In the same way as RTP, communications between an auctioneer and prosumers are required by the LFS-DA to maximize social welfare. When a price profile

is observed, each rational agent tries to maximize its welfare by optimizing

on the basis of the announced price profile

(Note that

is fixed in this work.).

When

and

p are fixed,

can be determined uniquely from

as follows.

Equations (20), (

21) and (

25) show that

and

have a bijective relation under the condition that

and

pt are fixed. Therefore, the optimal solution

can be obtained using the following procedure.

where

and

Equation (26) corresponds to an optimal solution of the sub-problem of the dual problem introduced in the

Appendix A.

Here, we formalize each agent’s iterative learning process. The changes in the price profile and the agents’ behavior are determined as shown in

Algorithm 2. In the

k-th iteration, the price profile is assumed to be

. Each agent selfishly maximizes its welfare and obtains

, before obtaining

. The clearing price settled by

market_clearing can be obtained by solving

Equation (24).

On the basis of the new price profile

p(k+1), the amount of electricity for transacting through the regional electricity market

is updated as follows.

After the update, the state vector becomes:

This state vector usually violates the constraints, i.e.,

. Therefore, each agent has to reconfigure

to ensure the satisfaction of the constraints under the condition that

. The map

denotes a projection to

satisfying

for all

. In the paper, the reconfiguration is performed by solving the sub-problem with the additional constraints, i.e.,

.

The following Lemma 2 indicates that the changes in the price profile obtained by market_clearing can be regarded as an update formula as follows.

Lemma 2 (Change of price profile in LFS-DA).

The price profile of the LFS-DA is updated as follows if.

where,

and.

□

Theorem 1. This update Formula (30) of the LFS-DA is the same as that of the dual decomposition-based RTP algorithm Equation (17), except for the constant factork, if.

Therefore, if we consider the determination of the price in LFS-DA as a type of price update

Equation (17) in dual decomposition-based RTP, the price change in LFS-DA becomes equal to that of RTP where

.

In summary, in LFS-DA, if the auctioneer simply settles a clearing price profile to balance demand and supply, it implicitly solves the master problem of the dual problem

Equation (A9) in the same way as in the RTP algorithm. This means that the changes in the price profile obtained by the LFS-DA mechanism become the same as those obtained by the RTP derived from the dual decomposition framework. Note that the sub-problems in RTP and in LFS-DA are completely the same and are solved in the same way (see

Equations (26) and (

A7)). Therefore, both of the master problems and the sub-problems are the same and are solved in the same way in the RTP and the LFS-DA, except for the constant factor of the sub-gradient in the master problem. Our main theorem therefore indicates that LFS-DA can increase social welfare in the same way as the conventional RTP without requiring any central price controller.

5. Experiment

This section describes our numerical example of the LFS-DA mechanism. In addition, we compare its results with those obtained for the dual decomposition-based RTP algorithm through a simulation experiment.

5.1. Experimental Conditions

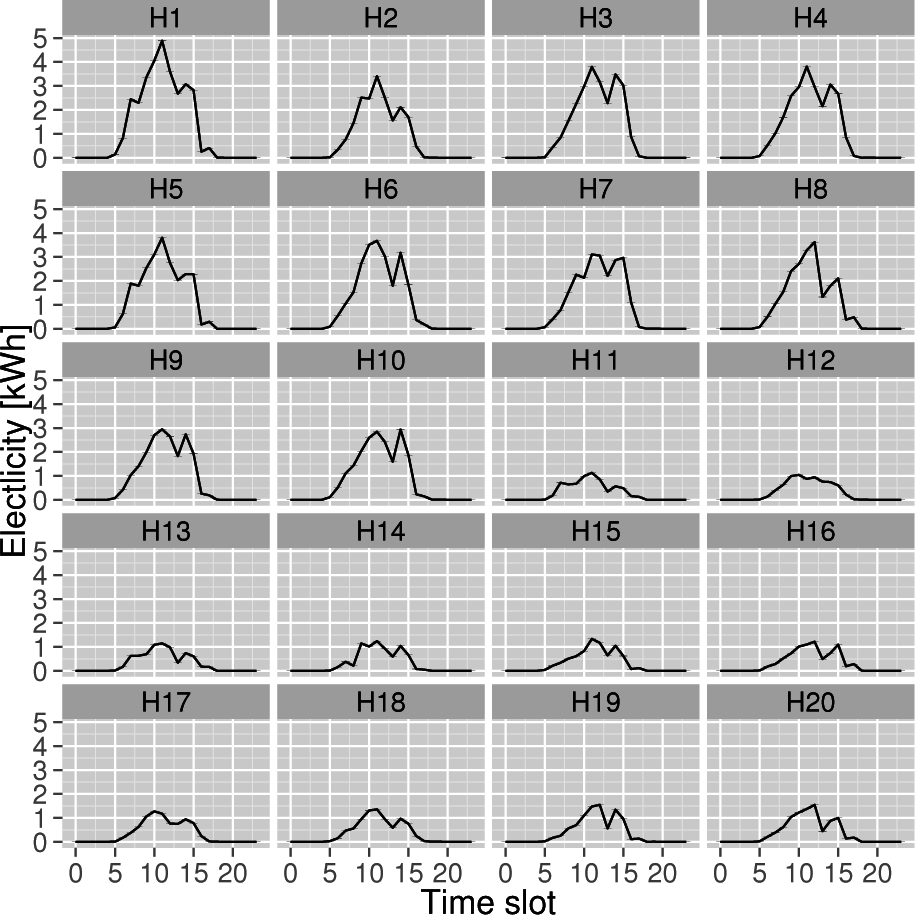

In this experiment, we set the number of prosumers to

N = 20 and the number of time slots to

T = 24. We assume that the time slot corresponds to 1 h in the real world. If the grid requires a shorter interval to balance demand and supply, the time slot interval can be shorter provided the computational cost of the sub-problem allows it. Even if the time interval becomes short, e.g., 1 s, all of the theoretical results are satisfied. The utility functions are set to be:

where

and

are given constants [

10,

36]. In addition, we set

and

for all

,

.

We considered all generators to be PV systems; therefore, no variable costs were taken into account. The generation costs

are defined by

. We used the PV generation profiles that were measured at 20 houses in Higashi Ohmi city during autumn 2010 as the maximum value of the per-slot energy production profile

[

37].

Figure 4 shows

for each prosumer

i. We set

,

,

,

and

ηi = 0.7 for all

. We set the efficiency of transmitting electricity within i-Rene to

γ = 0.8, and the parameters of the sub-gradient method to

θk = 0.1. We set the maximum values to

and

for all

,

. We set the prices of the outside grid to

and

for all

.

In this experiment, two baseline methods were compared with the LFS-DA. The first, RTP (dual composition), employed

Algorithm 1. However, the demand and supply were usually not balanced before the algorithm converged to the optimal solution, in which case the utility conducting the RTP would compensate the difference by buying the deficit electricity from or selling the surplus electricity to the outside grid, respectively. The cost for the compensation was assumed to be redistributed equally among the agents. RTP without compensation shows the social welfare before the difference is compensated. Although dual decomposition-based RTP could increase prosumers’ welfare, it was reduced because of compensation by the utility. The second method is without trading, that is electricity trading does not occur in the regional market. Instead, agents attempt to increase their welfare by using their batteries and elasticity of demand. The optimal is numerically obtained by solving the primal problem using a solver.

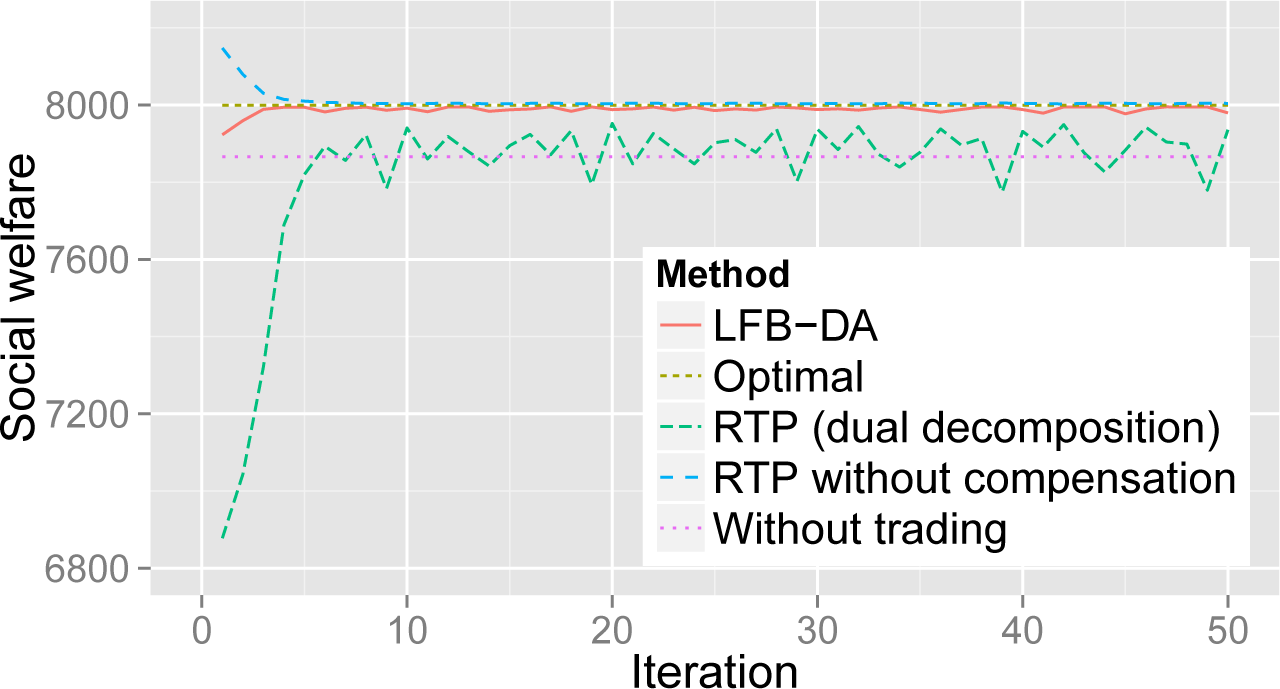

5.2. Result

The value of the social welfare is shown in

Figure 5 as a function of time. This clearly shows that the LFS-DA outperforms the RTP algorithm based on dual decomposition. Especially, in the early stages of the iteration, the LFS-DA was found to outperform the RTP algorithm significantly. Although the LFS-DA mechanism was able to obtain an exact balance between demand and supply, the RTP algorithm was unable to modify prosumers’ bids and asks reactively. The cost associated with the lack of compensation had a negative impact on the overall social welfare, although each agent would still be able to increase its own welfare.

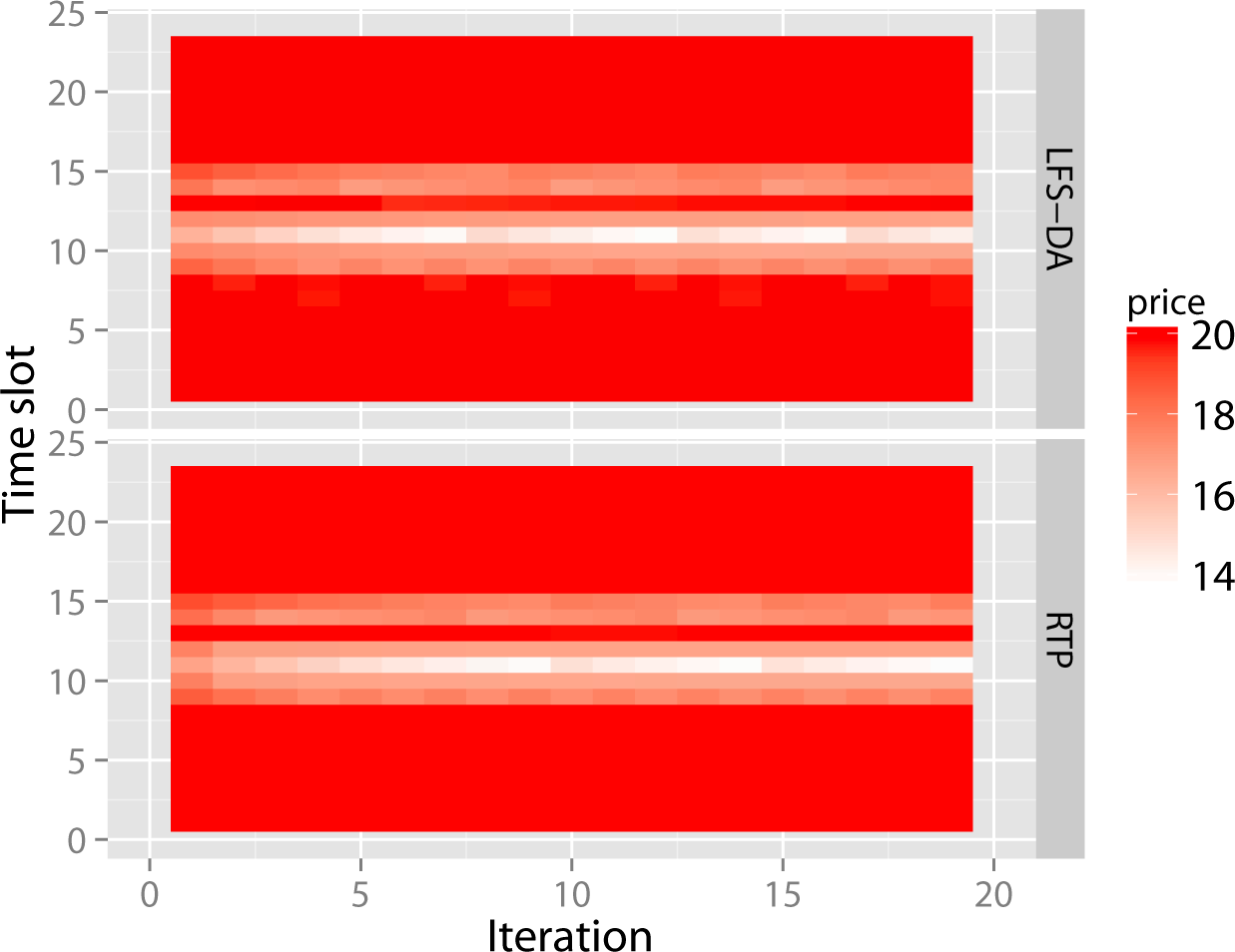

The changes in price profiles are shown in

Figure 6. These figures show that the RTP algorithm and the LFS-DA obtained the same price profile, except for numerical errors, as our theory suggested.

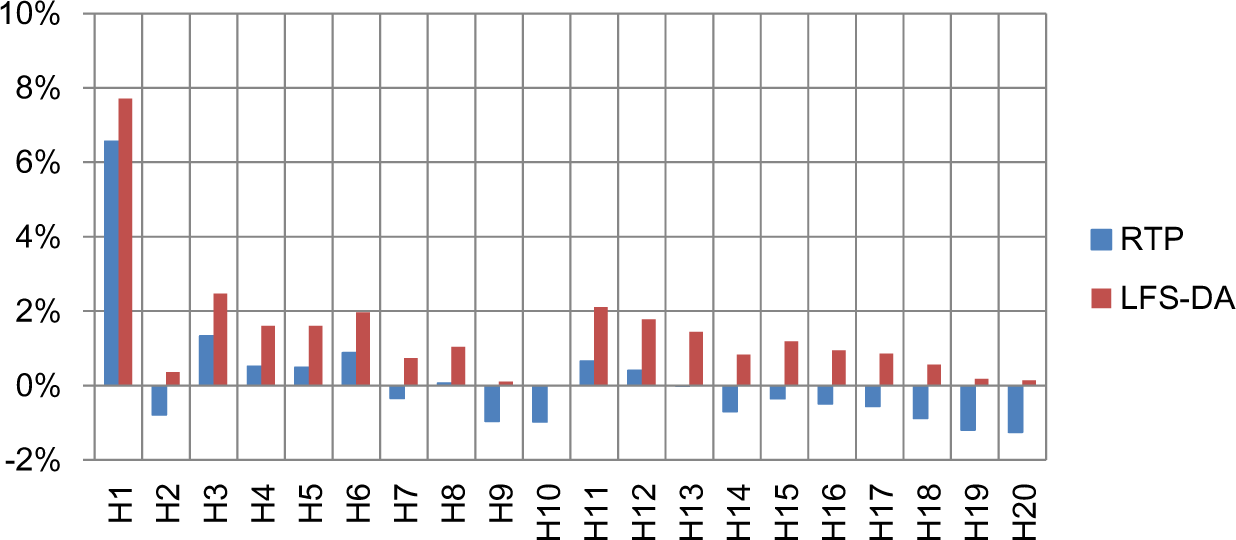

Figure 7 shows the rate at which each agent’s welfare increased compared with the without trading condition. As shown, LFS-DA increased the welfare of all of the agents in contrast to the RTP algorithm, which caused several agents to reduce their welfare because of the compensation for the imbalance in demand and supply.

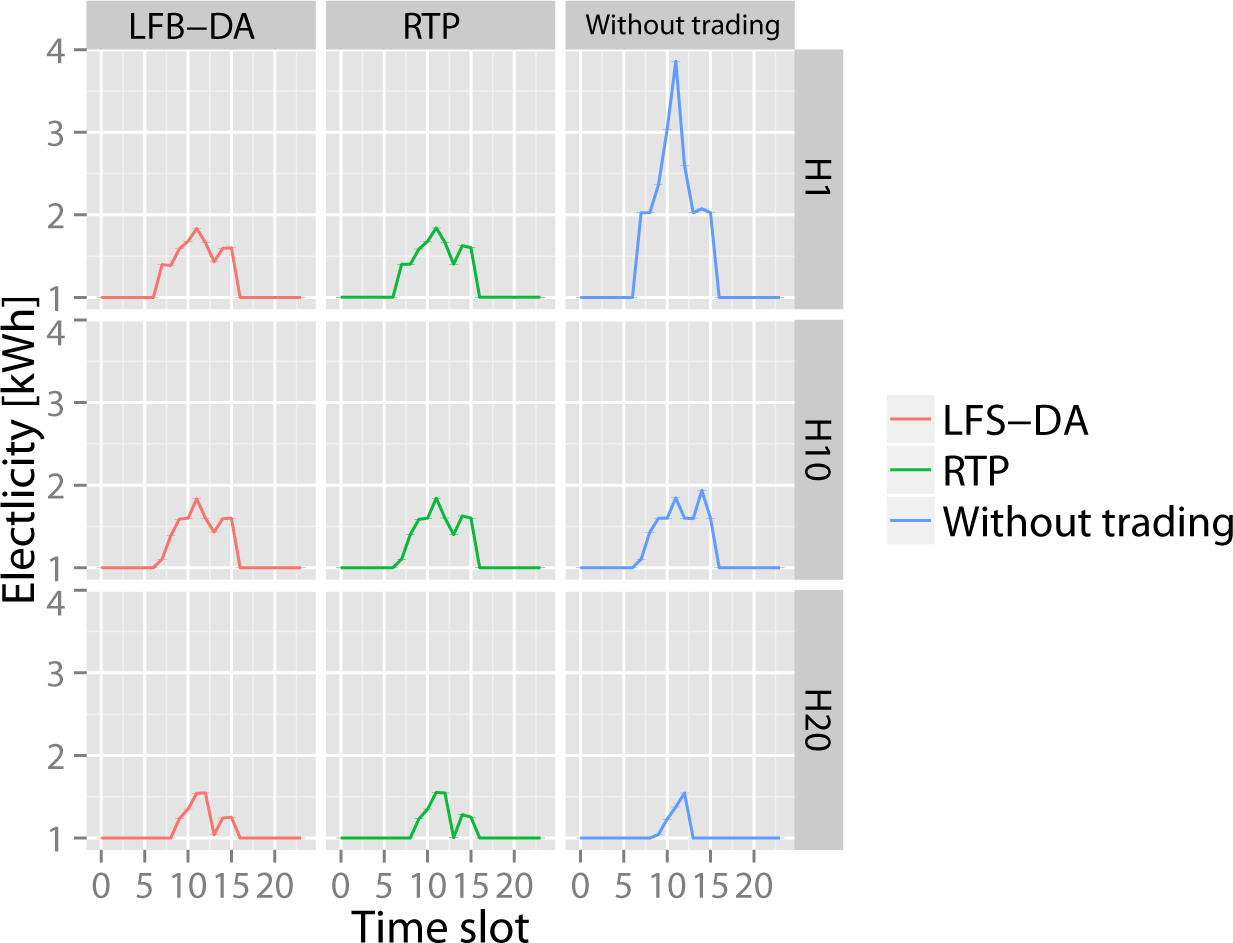

Figure 8 shows the electricity consumption of three representative agents. For the without trading condition, the electricity price for agents is fixed at

. In contrast, RTP and LFS-DA resulted in fluctuating price profiles and leveled consumption profiles. This figure shows that LFS-DA functions in the same way as the RTP by controlling electricity consumption using price signals.

6. Conclusions

This paper presents a linear function submission-based double auction (LFS-DA) algorithm for a regional prosumers’ electricity network named i-Rene. This mechanism can achieve an exact balance between electricity demand and supply for each time slot throughout the learning phase. It was proven that LFS-DA can solve the primal problem of maximizing the social welfare of the regional electricity network in the same way as the RTP algorithm, but without any central price setter, i.e., a utility or a large electricity company. This means that the price controller for RTP formed in a bottom-up manner as a result of the use of the double auction mechanism can maximize the social welfare of the regional prosumers’ electricity network. This paper presents a clarification of the relationship between the RTP algorithm derived on the basis of a dual decomposition framework.

The relationship between the dual decomposition-based RTP algorithm and the simple LFS-DA algorithm for i-Rene was clarified. Specifically, we proved that the changes in the price profile with the LFS-DA mechanism are equal to those achieved by RTP controlled by the algorithm derived from the dual decomposition framework, except for a constant factor. A simulation experiment was used to demonstrate the proposed mechanism numerically.

Our main result, i.e., Theorem 1, is very simple, but powerful. We used it to show that the simple LFS-DA is sufficient for achieving day-ahead optimization and planning for i-Rene. We also showed that there is no need for a central utility to perform RTP to balance demand and supply; instead, social welfare was maximized by setting an appropriate price profile. Thus, the mechanism functions in a fully decentralized manner.

In our proposed economic, electrical and information system, i.e., i-Rene, each household is presumed to install a PV and a storage device in its home. However, based on the current economic and technological situation, i.e., battery efficiency, battery size and the price of related devices, installing a storage device in households may not be an economically profitable decision, being dependent on many economical, technological and political situations. Most people agree that in the future, the price of storage will decrease and the price of electricity will increase, making adding a battery to each home a more and more reasonable decision. We believe that i-Rene will become economically viable in the future.

The legal implications of i-Rene are also important. Attempting to implement our system in the current electricity network, especially in Japan, poses several challenges. First, electricity deregulation must be thoroughly achieved, so that many local grids can freely utilize the market mechanism as “decentralized controllers”. Electricity markets are still almost monopolized in Japan. Second, the legal framework for feed-in tariff (FIT) must be reformed completely, because FIT makes

. The relationship between the two prices is not allowed in i-Rene, because it inevitably produces obvious nonsensical solutions, i.e., each agent buys electricity from the outside grid and sells it to the outside grid. This completely destroys i-Rene’s advantages. Third, there are also problems associated with how to prepare the regional electricity market, how to maintain it and who should manage it. Currently, there are very strict legal requirements with respect to storing and communicating the actual electricity rate. Fourth, determining the size of the regional network might become a problem. The number of entities within the low power grid, i.e., regional network, is less than a few hundred in the current network. Fifth, a consideration of the phases in the power system is also important. What is generated through one phase is not available during the other phase. In addition, several problems remain to be solved to realize the future prosumer electricity network in which renewable energy is efficiently utilized in a decentralized manner.

In this paper, we fixed

, which are the coefficients of the first order of the linear demand and supply functions. The parameters originally represented the price elasticity of prosumers’ demand and supply. Interestingly, our main result showed these parameters to perform the function of the learning rate in RTP. This means that the price elasticity of prosumers’ demand and supply affects the convergence of the iterative calculation of the price profile in i-Rene.

Our main theorem showed the theoretical connection between research pertaining to a multi-agent-based microgrid using linear function-bidding, e.g., PowerMatcher [

7], and a control theoretical approach to RTP. The connection is expected to lead to renewed collaboration and fruitful integration between the two research areas. This formulation also provides us with the possibility to extend the LFS-DA mechanism beyond its current capabilities. For example, Yo

et al. introduced chance constraints to dual decomposition-based RTP [

26], and a similar extension should be possible for the LFS-DA approach. In the future, we aim to develop a double auction mechanism, which could automatically control a regional electricity network of prosumers, even in a noisy environment.