The Main Drivers of the Raw Materials and ICT Sectors in Poland Using PESTEL Analysis

Abstract

1. Introduction

- Ensuring access to raw materials from mineral deposits;

- Exploration, prospecting, and documentation of mineral deposits;

- Ensuring a favorable legal environment for current and future investors and developing and modernizing the geological and mining industry;

- The protection of mineral deposits;

- International cooperation for securing access to raw materials;

- Sourcing raw materials from anthropogenic deposits and supporting the development of a circular economy;

- Ensuring that the strategies adopted by companies of major importance to the state economy and those pursuing a public mission are consistent with the activities of the Chief National Geologist in his capacity as Government Plenipotentiary for State Raw Materials Policy;

- The dissemination of knowledge.

- Strategic raw materials of fundamental importance for the proper functioning of the economy and for meeting the existing needs of societies whose sustainable supply must be ensured—both materials whose domestic resource base is large and which, thanks to their utilization, are the basis for the operation of industry, and important scarce raw materials (wholly or mostly imported).

- Strategic raw materials of primary importance for national security and innovative technologies—raw materials which are not sufficiently (at least 90%) obtained from domestic sources or whose possibilities of sustainable acquisition from these sources are limited or threatened, and other raw materials not obtained domestically (scarce) that are necessary for national defense and security and the development of innovative technologies.

2. Overview of Mineral Resources in Poland

- their occurrence is linked to the geological past;

- the amount of raw material deposits varies;

- hey are distributed basically throughout the whole country, but there is a greater concentration in the western, southern, and central parts of the country.

- “Fossil fuels: coking coal;

- Metallic raw materials: copper (including silver);

- Construction minerals (crushed and dimension stone);

- Other minerals for various industries (kaolin, feldspar raw materials, glass sand, magnesite, industrial dolomite, foundry sand, elemental sulphur, gypsum and anhydrite)” [22].

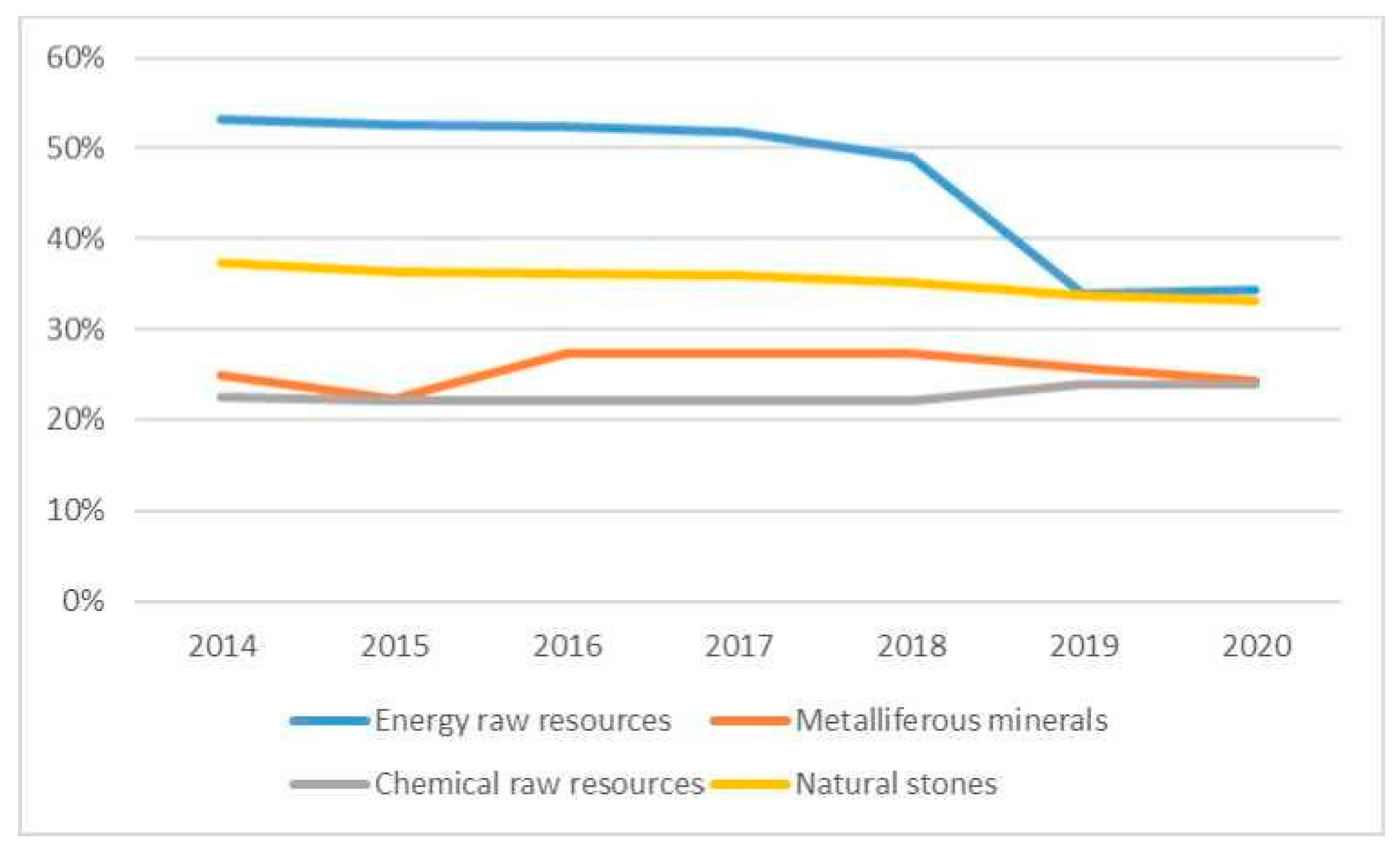

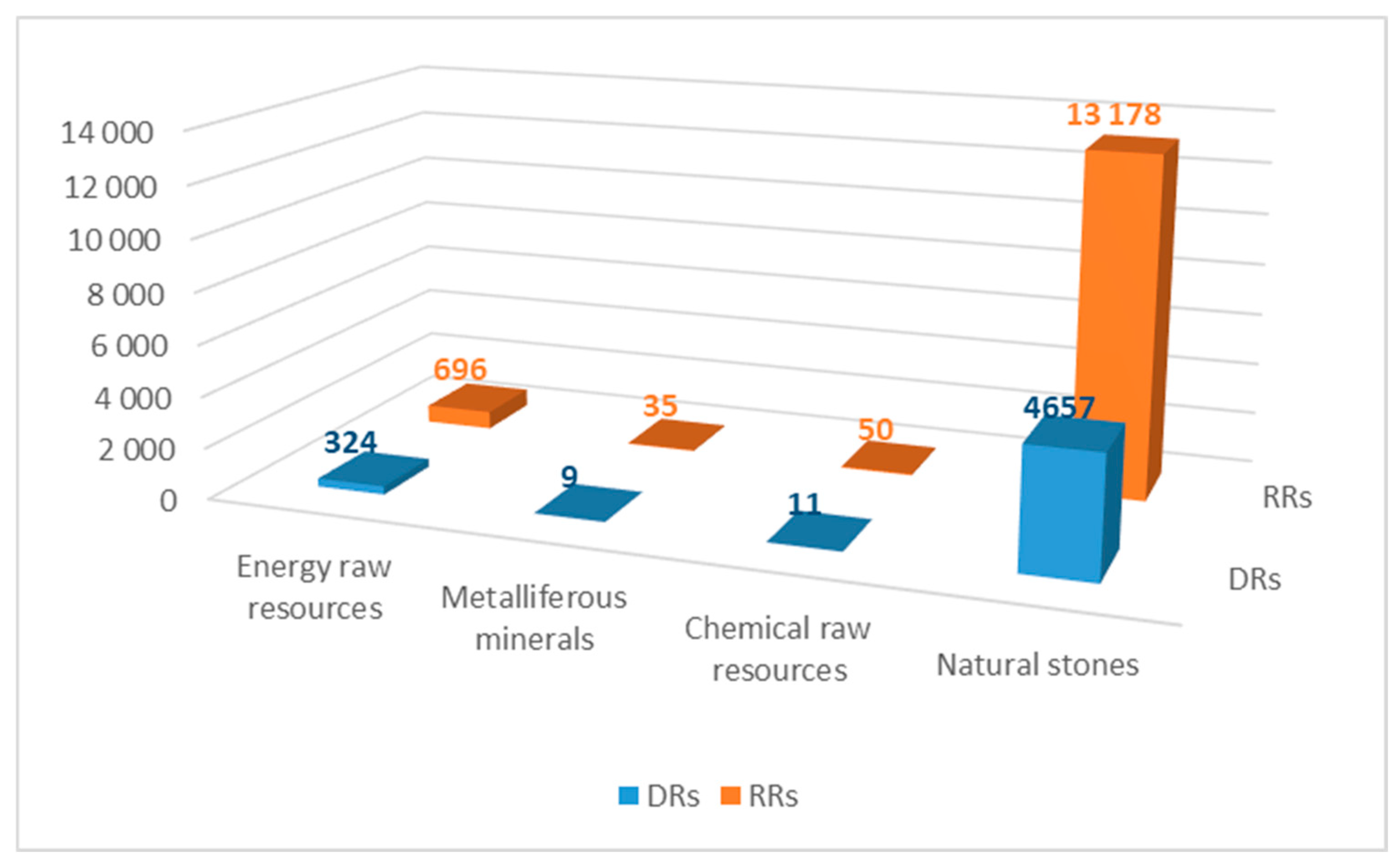

- 324 million of tons out of the available 696 million of tons of energy raw resources (representing 47%);

- 9 million of tons of the available 35 million of tons of metalliferous minerals (26%);

- 11 million of tons from the available 50 million of tons of chemical raw resources (23%);

- 4657 million of tons from the available 13,178 million of tons of natural stone (35%).

3. Literature Review

- -

- Hard coal and lignite—Poland is one of the largest coal producers in Europe;

- -

- Hard coal, especially from Upper Silesia, is the basis for the energy sector, and lignite from the Belchatow basin is used mainly in thermal power generation;

- -

- Copper and silver—Poland is one of the world’s leading producers of copper, which is important not only for industry but also for exports;

- -

- Rock salt, gypsum, and limestone—these raw materials are used in the construction, chemical, and many other industries;

- -

- Natural gas and oil—although Poland is not a large producer of oil and gas, the country is trying to diversify its energy sources and develop shale gas resources.

4. Materials and Methods

4.1. Research Procedure

4.2. PESTEL Method

- Recognizing threats as well as business opportunities;

- Identifying the direction of change in the business environment;

- Avoiding starting projects with potential problems that are out of control;

- Freeing oneself from inevitable risks when entering a new market and helping to define an objective picture of the future working environment.

- P—political;

- E—economic;

- S—socio-cultural;

- T—technological;

- E—environmental;

- L—legislative.

5. PESTEL Analysis of the Raw Materials Sector in Poland

5.1. The Results Obtained from the Study on the Raw Materials Industry in Poland

- The shortcomings of the strategies developed or policies implemented;

- Often, there is misallocation of EU funds which support entrepreneurship in its broadest sense, but mainly in the SME sector and not in strategically important industries;

- Excessive formalization and bureaucratization of support mechanisms leads to spending according to procedures rather than achieving development goals. This even results in the avoidance of innovative and risky pro-development undertakings (currently necessary) in favor of safe and standard measures that do not bring major developmental changes;

- The low level of competence of the public administration;

- The fact that administrative issues take up to 90% of the time at the expense of substantive activities.

5.2. PESTEL Analysis in ICT

6. Discussions of Results

- -

- Energy raw resources;

- -

- Metalliferous minerals;

- -

- Chemical raw resources;

- -

- natural stones.

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ministry of Climate and Environment. National Raw Materials Policy; Annex to Resolution No. 39 of the Council of Ministers of 1 March 2022 (item 371); Ministry of Climate and Environment: Warsaw, Poland, 2022. [Google Scholar]

- Sukiennik, M.; Kowal, B.; Bąk, P. Identification of Market Gap as a Chance for Enterprise Development—Example of Polish Raw Materials Industry. Energies 2021, 14, 4678. [Google Scholar] [CrossRef]

- Domaracká, L.; Seňová, A.; Kowal, D. Evaluation of Eco-Innovation and Green Economy in EU Countries. Energies 2023, 16, 962. [Google Scholar] [CrossRef]

- Kowal, B.; Włodarz, D.; Brzychczy, E.; Klepka, A. Analysis of Employees’ Competencies in the Context of Industry 4.0. Energies 2022, 15, 7142. [Google Scholar] [CrossRef]

- Domaracká, L.; Matuskova, S.; Tausova, M.; Senová, A.; Kowal, B. Efficient Use of Critical Raw Materials for Optimal Resource Management in EU Countries. Sustainability 2022, 14, 6554. [Google Scholar] [CrossRef]

- Taušová, M.; Čulková, K.; Tauš, P.; Domaracká, L.; Seňová, A. Evaluation of the Effective Material Use from the View of EU Environmental Policy Goals. Energies 2021, 14, 4759. [Google Scholar] [CrossRef]

- Taušová, M.; Tauš, P.; Domaracká, L. Sustainable Development According to Resource Productivity in the EU Environmental Policy Context. Energies 2022, 15, 4291. [Google Scholar] [CrossRef]

- Reichl, C.; Schatz, M. World Mining Data 2021; Minerals Production: Vienna, Austria, 2021; Volume 36, Available online: https://www.world-mining-data.info/wmd/downloads/PDF/WMD2021.pdf (accessed on 15 June 2022).

- Sukiennik, M.; Kowal, B. Analysis and Verification of Space for New Businesses in Raw Material Market—A Case Study of Poland. Energies 2022, 15, 3042. [Google Scholar] [CrossRef]

- Szamałek, K.; Zglinicki, K.; Mazurek, S.; Szuflicki, M.; de Sojournet de Rameignies, I.; Tymiński, M. The role of mineral resources knowledge in the economic planning and development in Poland. Resour. Policy 2021, 74, 102354. [Google Scholar] [CrossRef]

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources Deposits in Poland at 31.XII.2014. 2015. Available online: https://infolupki.pgi.gov.pl/sites/default/files/czytelnia_pliki/1/bilans_wg_stanu_na_31.12.2014.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources Deposits in Poland at 31.XII.2015. 2016. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2015/pdf/bilans_2015.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources Deposits in Poland at 31.XII.2016. 2017. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2016/bilans_2016.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources Deposits in Poland at 31.XII.2017. 2018. Available online: https://geoportal.pgi.gov.pl/css/surowce/images/2017/bilans_2017.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources in Poland at 31.XII.2018. 2019. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2018/pdf/bilans_2018.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources in Poland at 31.XII.2019. 2020. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2019/pdf/bilans_2019.pdf (accessed on 23 June 2022). (In Polish)

- Polish Geological Institute, National Research Institute. The Balance of Mineral Resources in Poland at 31.XII.2020. 2021. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2020/bilans_2020.pdf (accessed on 23 June 2022). (In Polish)

- Kowal, B.; Domaracká, L.; Tobór-Osadnik, K. Innovative activity of companies in the raw material industry on the example of Poland and Slovakia—Selected aspects. J. Pol. Miner. Eng. Soc. 2020, 2, 71–77. [Google Scholar] [CrossRef]

- Domaracká, L.; Taušová, M.; Čulková, K.; Pavolová, H.; Bakalár, T.; Seňová, A.; Shejbalová-Muchová, M.; Teplická, K.; Kowal, B. Interdependence of mining industry and industrial sectors in Slovakia. Acta Montan. Slovaca 2020, 25, 494–503. [Google Scholar] [CrossRef]

- Katare, V.D.; Madurwar, M.V. Design and investigation of sustainable pozzolanic material. J. Clean. Prod. 2020, 242, 118431. [Google Scholar] [CrossRef]

- Bełdowicz, A. Udział Węgla w Energetyce: W Europie 14%, w Polsce Ponad 70%. Available online: https://klimat.rp.pl/zielone-technologie/art18469631-udzial-wegla-w-energetyce-w-europie-14-w-polsce-ponad-70 (accessed on 28 June 2022). (In Polish).

- Kot-Niewiadomska, A.; Galos, K.; Kamyk, J. Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy. Resources 2021, 10, 48. [Google Scholar] [CrossRef]

- Ministry of Climate and Environment. Energy Policy of Poland Until 2040; Annex to Resolution No. 22/2021 of the Council of Ministers of 2 February 2021; Ministry of Climate and Environment: Warsaw, Poland, 2022. [Google Scholar]

- Manowska, A.; Bluszcz, A.; Chomiak-Orsa, I.; Wowra, R. Towards energy transformation: A case study of EU countries. Energies 2024, 17, 1778. [Google Scholar] [CrossRef]

- Tajduś, A.; Tokarski, S. Risks related to energy policy of Poland until 2040 (EPP 2040)/Archives of Mining Sciences ISSN 0860-7001. Arch. Min. Sci. 2020, 65, 877–899. [Google Scholar]

- The World of Raw Materials 2050 Future Scenarios for the World of Raw Materials in 2050, INTRAW Project International Raw Materials Observatory. Available online: https://intraw.eu/wp-content/uploads/2017/10/The-World-of-Raw-Materials-2050-final_web.pdf (accessed on 10 December 2024).

- Bluszcz, A.; Manowska, A. Differentiation of the Level of Sustainable Development of Energy Markets in the European Union Countries. Energies 2020, 13, 4882. [Google Scholar] [CrossRef]

- Ranosz, R. Mining and its role in the global economy. Miner. Resoures Manag. 2014, 30, 5–20. [Google Scholar] [CrossRef]

- Bluszcz, A.; Ranosz, R. The Use of Multidimensional Exploration Techniques to Assess the Similarity of the Development Level of Energy Markets. J. Pol. Miner. Eng. Soc. 2020, 1, 199–204. [Google Scholar] [CrossRef]

- Bluszcz, A.; Manowska, A. The Use of Hierarchical Agglomeration Methods in Assessing the Polish Energy Market. Energies 2021, 14, 3958. [Google Scholar] [CrossRef]

- Ranosz, R.; Bluszcz, A.; Kowal, D. Conditions for the Innovation Activities of Energy Sector Enterprises Shown on the Example of Mining Companies. J. Pol. Miner. Eng. Soc. 2020, 1, 249–256. [Google Scholar] [CrossRef]

- Manowska, A.; Rybak, A. The future of hard coal in comparison with other energy carriers. IV Polish Mining Congress-Session: Man and the environment in the face of mining challenges. IOP Conf. Ser. Earth Environ. Sci. 2018, 174, 012007. [Google Scholar] [CrossRef]

- Manowska, A.; Mazurek, M. The role of hard coal in national energy security with regard to the energy policy in Poland until 2050. IOP Conf. Ser. Earth Environ. Sci. 2018, 198, 012005. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I. Challenges for long-term industry restructuring in the Upper Silesian Coal Basin: What has Polish coal mining achieved and failed from a twenty-year perspective? Resour. Policy 2015, 44, 135–149. [Google Scholar] [CrossRef]

- Janik, M. Poland’s Commodity Prices Rise in Line with Global Trend. Available online: https://www.rp.pl/ekonomia/art8553371-ceny-surowcow-w-polsce-w-gore-wraz-z-trendem-swiatowym (accessed on 20 December 2024).

- Manowska, A.; Nowrot, A. The Importance of Heat Emission Caused by Global Energy Production in Terms of Climate Impact. Energies 2019, 12, 3069. [Google Scholar] [CrossRef]

- European Commission. Communication on the European Green Deal, 11 December 2019, COM (2019) 640 Final. Available online: https://ec.europa.eu/info/publications/communication-european-green-deal_en (accessed on 20 December 2024).

- Cordis Database. Available online: https://cordis.europa.eu/pl (accessed on 20 December 2024).

- List of EU Co-Funded Research and Innovation Project Databases. Available online: https://ec.europa.eu/info/research-and-innovation/projects/project-databases_pl (accessed on 20 December 2024).

- Project Base NCN; National Science Center: Kraków, Poland. Available online: https://projekty.ncn.gov.pl (accessed on 20 December 2024).

- NCBiR Database. Available online: https://www.ncbr.gov.pl (accessed on 20 December 2024).

- Bąk, P.; Bartha, Z.; Benčoová, B.; Benes, F.; Bereczk, Á.; Čulková, K.; Domaracká, L.; Gubik, A.S.; Horváth, Á.; Kis-Orloczki, M.; et al. Raw Materials Market Report 2020: Entrepreneurial Opportunities in the Raw Materials Sector in Hungary, the Czech Republic, Poland and the Slovak Republic; Domaracká, L., Ed.; University of Miskolc: Miskolc, Hungary, 2020. [Google Scholar]

| Groups of Mineral Resources | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Energy raw resources | RRs | 679 | 685 | 690 | 692 | 701 | 710 | 712 |

| DRs | 361 | 360 | 361 | 359 | 343 | 241 | 244 | |

| Metalliferous minerals | RRs | 36 | 36 | 33 | 33 | 33 | 35 | 37 |

| DRs | 9 | 8 | 9 | 9 | 9 | 9 | 9 | |

| Chemical raw | RRs | 49 | 50 | 50 | 50 | 50 | 50 | 50 |

| resources | DRs | 11 | 11 | 11 | 11 | 11 | 12 | 12 |

| Natural stones | RRs | 12,646 | 12,815 | 12,994 | 13,175 | 13,351 | 13,546 | 13,718 |

| DRs | 4729 | 4647 | 4695 | 4734 | 4681 | 4566 | 4549 | |

| Energy raw materials | hard coal; lignite; crude oil; methane from coal deposit; helium; natural gas; high nitrogen natural gas |

| Metallic raw materials | arsenic; zinc; lead; tin; copper and silver ores; molybdenum-nickel ores; gold ores and native gold; iron; titanium and vanadium ores; elements coexisting in ores; other metallic raw materials |

| Chemical raw materials | barite and fluorite; phosphorites; sulfur; diatomite rock; potassium-magnesium salt; rock salt; loamy raw materials for mineral paint; diatomaceous |

| Stone raw materials | bentonite and bentonite clay; loamy raw materials; kaolin raw materials; sand and gravel; silica sand; filtering gravel; dolomite; gypsum and anthracite calcite; crushed stone and stone blocks chalk; flint; quartz; shale; magnesite; limestone; marl; amber; peat; brine; medicinal water and thermal water |

| Group Number | Factor Group Name | Factor Name | Individual Factor Number |

|---|---|---|---|

| 1 | Political Factors | Lack of economy-wide promotion of the Polish mining machinery industry abroad | 1.1 |

| Acceptance by the Polish government of the EU decarbonization policy | 1.2 | ||

| Lack of government support for investment in the mineral resources sector | 1.3 | ||

| Progressive political marginalization of the mineral resources sector in Poland | 1.4 | ||

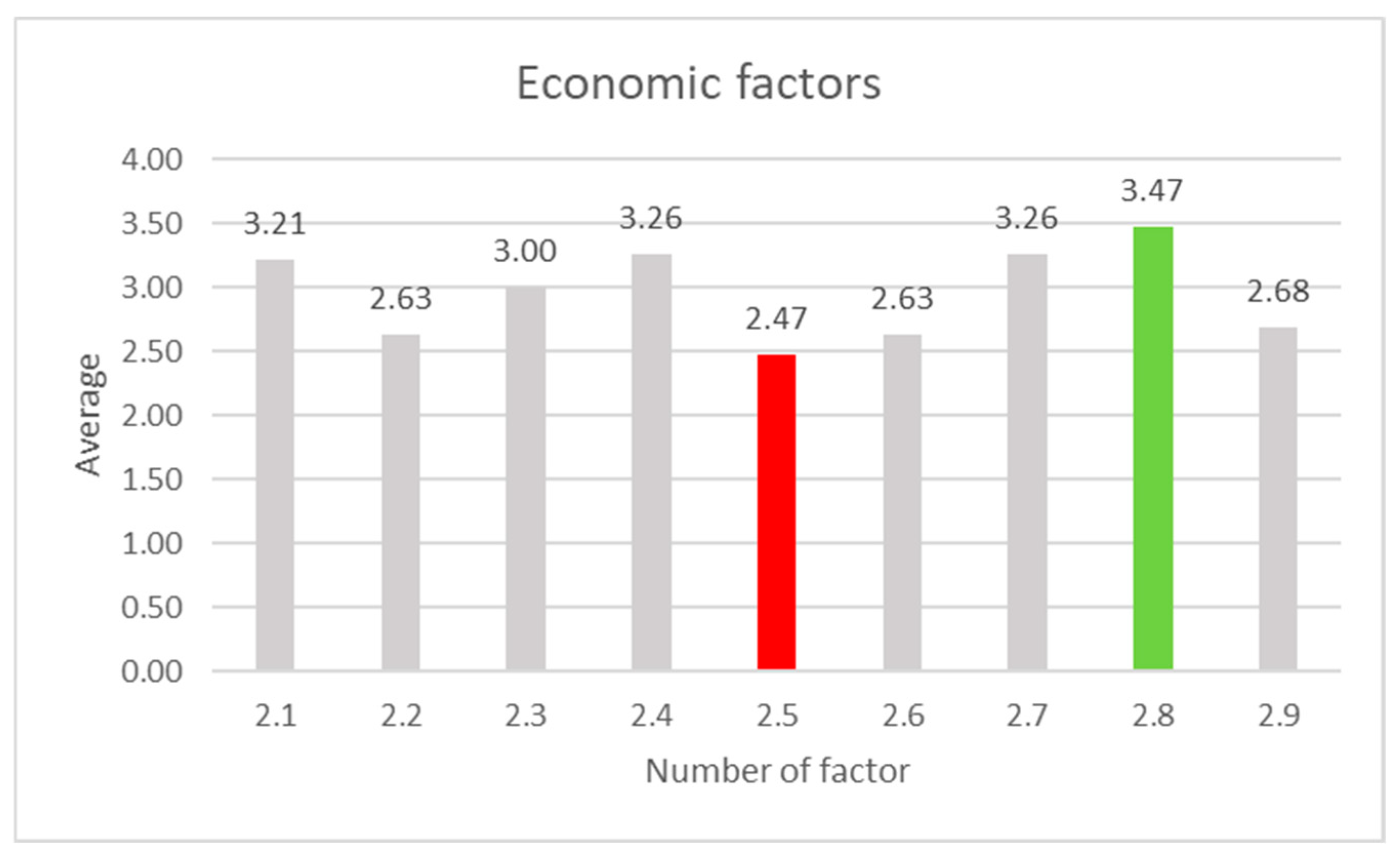

| 2 | Economic Factors | Economic growth | 2.1 |

| Exchange rate | 2.2 | ||

| Access to finance | 2.3 | ||

| Production costs (wages, materials) | 2.4 | ||

| Sales costs (promotion, agents) | 2.5 | ||

| Transport costs | 2.6 | ||

| Investment costs | 2.7 | ||

| Tax burden | 2.8 | ||

| Other costs related to the specifics of the raw materials industry (mining and geological risks) | 2.9 | ||

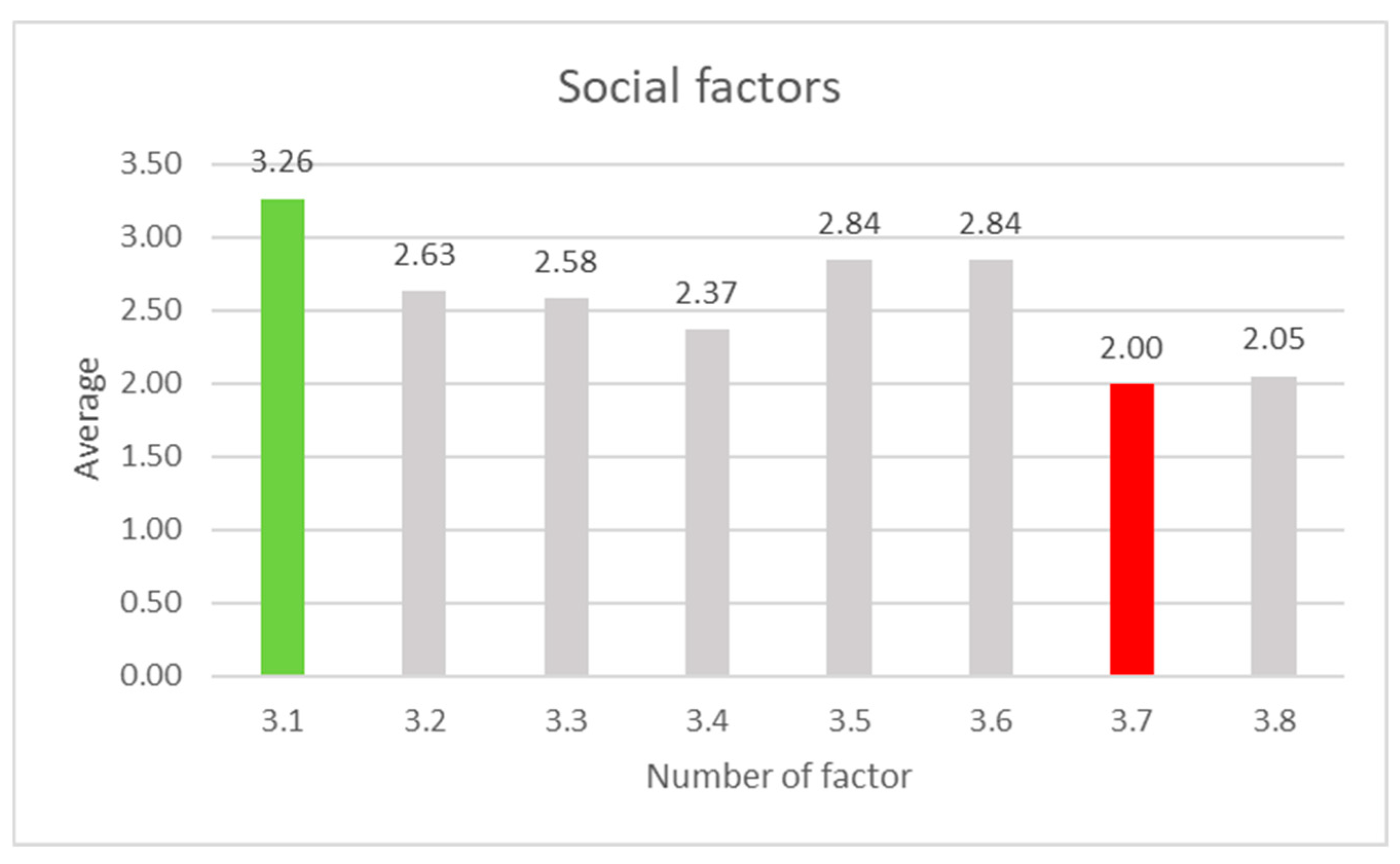

| 3 | Social Factors | Failure to train human resources for mining | 3.1 |

| Professional qualifications required | 3.2 | ||

| Emphasis on safety | 3.3 | ||

| Health awareness | 3.4 | ||

| Generation gap | 3.5 | ||

| Increased environmental awareness | 3.6 | ||

| The “hygge” philosophy of life | 3.7 | ||

| Organizational culture—CSR | 3.8 | ||

| 4 | Technological Factors | Lack of government financial support for innovation activities | 4.1 |

| Delays in knowledge and technology transfer | 4.2 | ||

| Lack of equipment with appropriate technology | 4.3 | ||

| Lack of qualified technical staff | 4.4 | ||

| Large scale of investment projects | 4.5 | ||

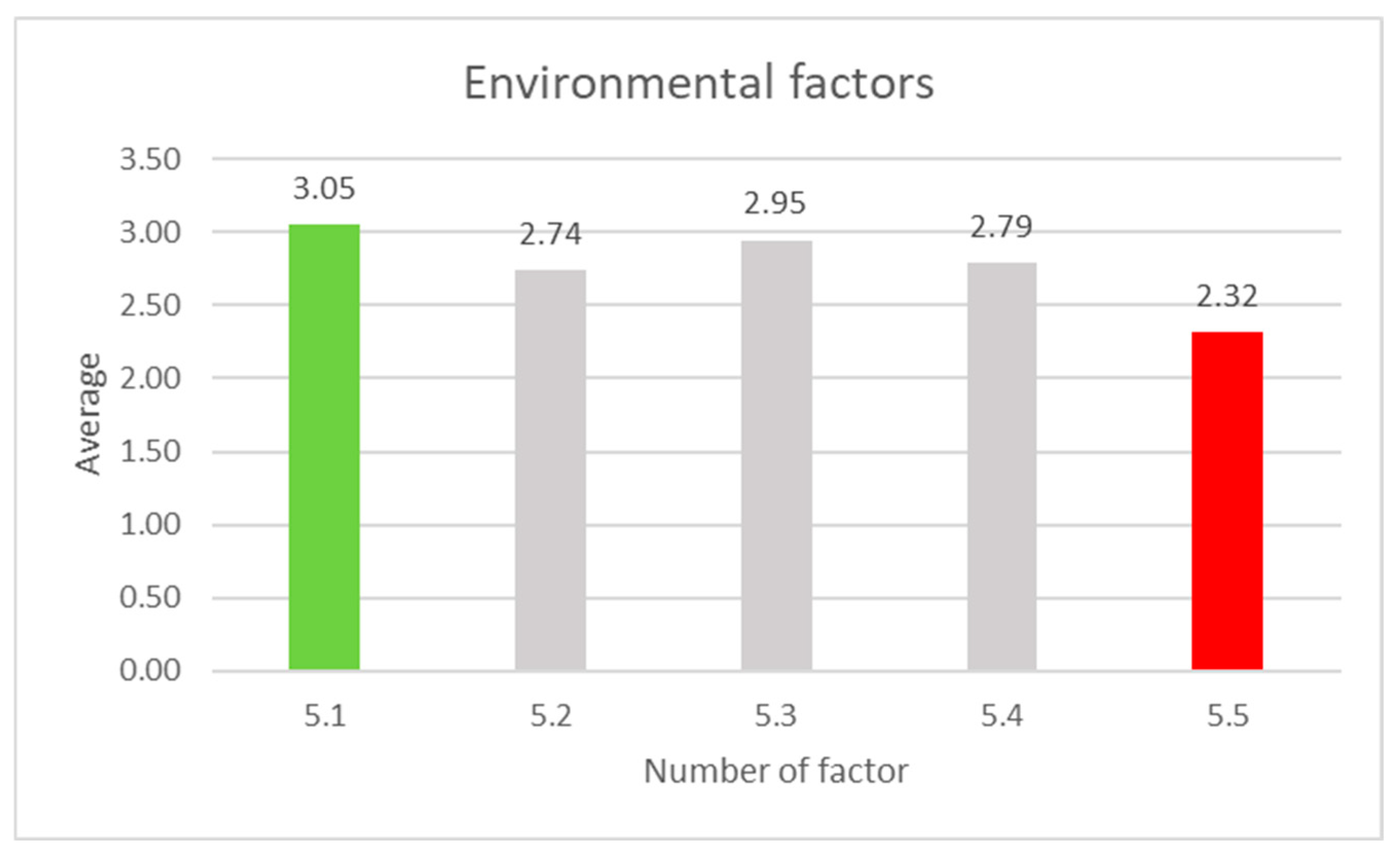

| 5 | Environmental Factors | Environmental policy | 5.1 |

| Climate change—global warming | 5.2 | ||

| Depletion of raw materials | 5.3 | ||

| Environmental pollution and greenhouse gas emissions | 5.4 | ||

| Promoting positive business ethics and sustainable development | 5.5 | ||

| 6 | Legal Factors | Global and EU regulations | 6.1 |

| Regional and local legislation | 6.2 | ||

| Geological and Mining Law | 6.3 | ||

| Environmental law | 6.4 | ||

| Energy law | 6.5 | ||

| Labor code | 6.6 |

| Individual Factor Number | Average | Individual Factor Number | Average | Individual Factor Number | Average | Individual Factor Number | Average | Individual Factor Number | Average | Individual Factor Number | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Political Factors | Economic Factors | Social Factors | Technological Factors | Environmental Factors | Legal Factors | ||||||

| 1.1 | 2.58 | 2.1 | 3.21 | 3.1 | 3.26 | 4.1 | 2.74 | 5.1 | 3.05 | 6.1 | 3.00 |

| 1.2 | 3.37 | 2.2 | 2.63 | 3.2 | 2.63 | 4.2 | 3.05 | 5.2 | 2.74 | 6.2 | 2.58 |

| 1.3 | 2.95 | 2.3 | 3.00 | 3.3 | 2.58 | 4.3 | 2.89 | 5.3 | 2.95 | 6.3 | 2.68 |

| 1.4 | 3.26 | 2.4 | 3.26 | 3.4 | 2.37 | 4.4 | 2.58 | 5.4 | 2.79 | 6.4 | 2.84 |

| 2.5 | 2.47 | 3.5 | 2.84 | 4.5 | 2.95 | 5.5 | 2.32 | 6.5 | 2.42 | ||

| 2.6 | 2.63 | 3.6 | 2.84 | 6.6 | 1.89 | ||||||

| 2.7 | 3.26 | 3.7 | 2.00 | ||||||||

| 2.8 | 3.47 | 3.8 | 2.05 | ||||||||

| 2.9 | 2.68 | ||||||||||

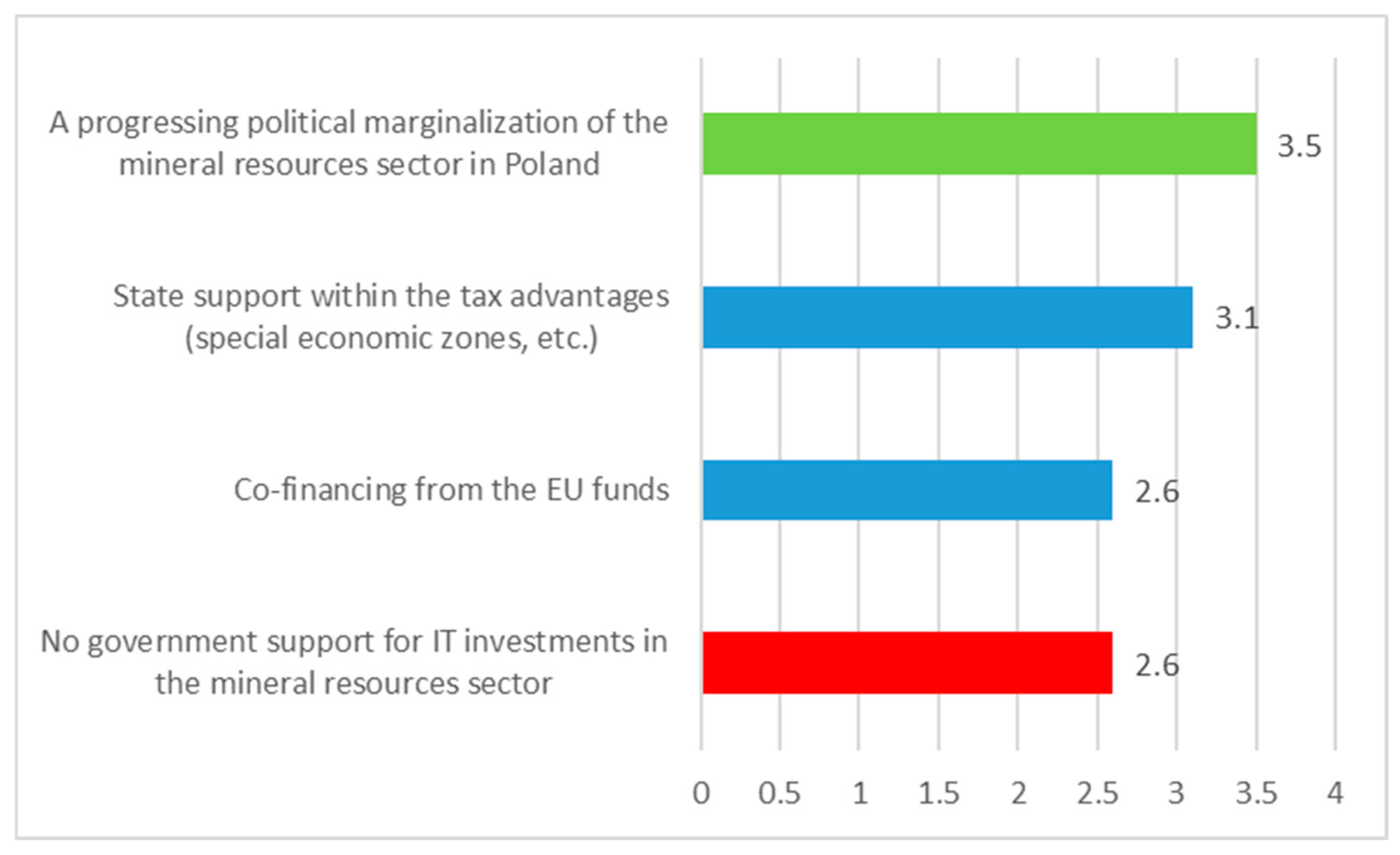

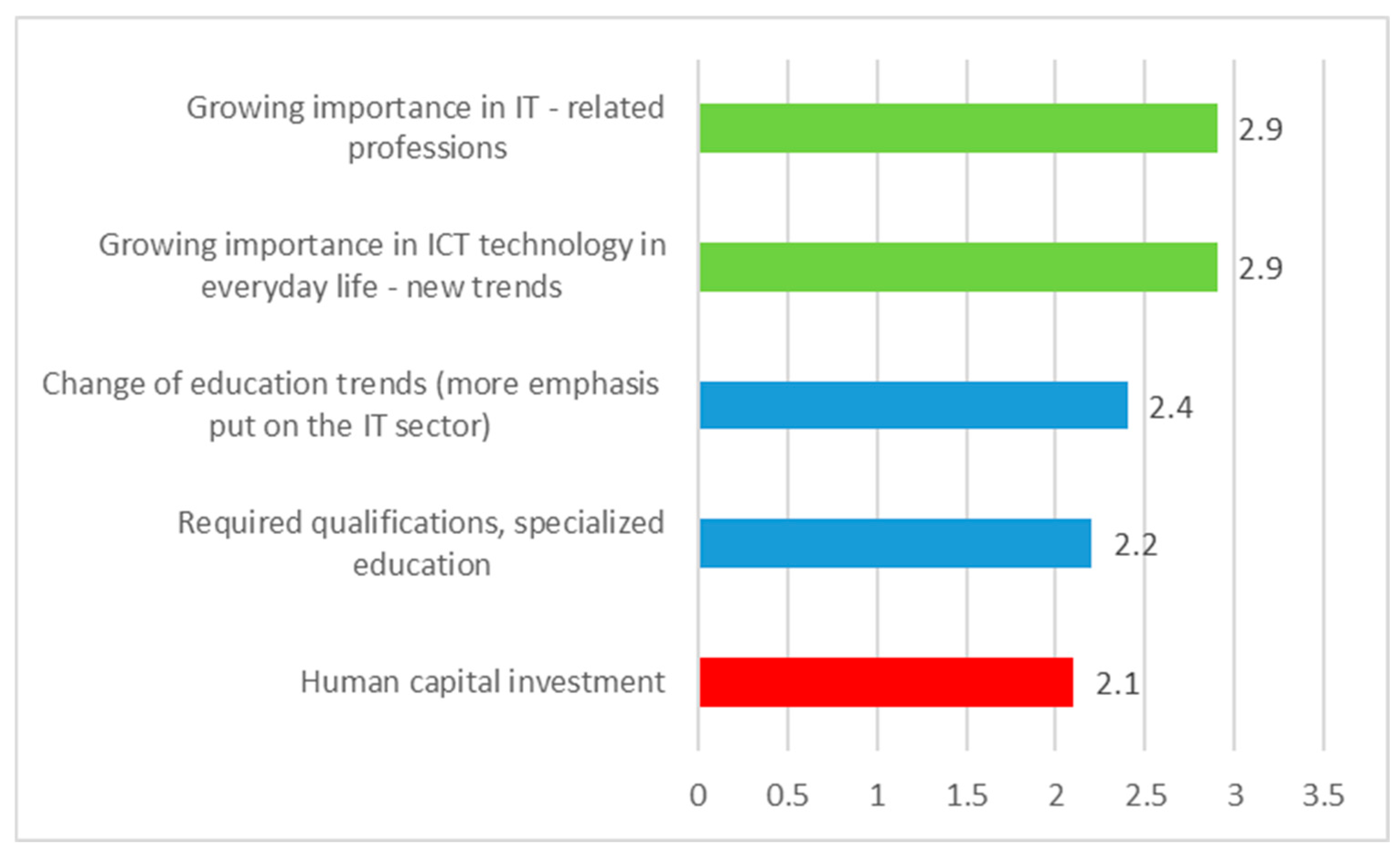

| Group Number | Factor Group Name | Factor Name | Scores |

|---|---|---|---|

| 1 | Political Factors | State support within tax advantages (special economic zones, etc.) | 3.1 |

| No government support for IT investments in the mineral resources sector | 2.6 | ||

| Co-financing from EU funds | 2.6 | ||

| A progressing political marginalization of the mineral resources sector in Poland | 3.5 | ||

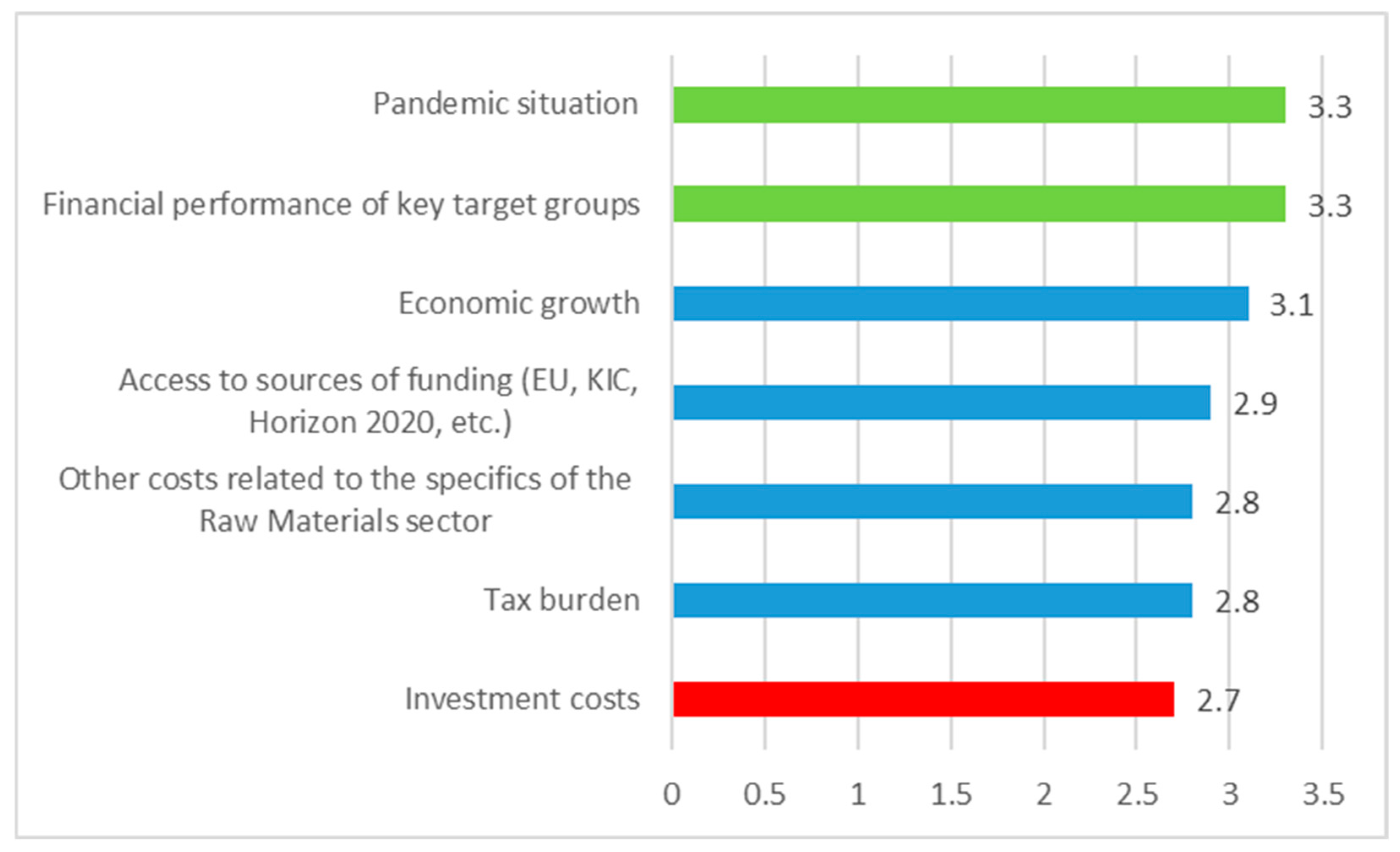

| 2 | Economic Factors | Economic growth | 3.1 |

| Financial performance of key target groups | 3.3 | ||

| Pandemic situation | 3.3 | ||

| Access to sources of funding (EU, KIC, Horizon 2020, etc.) | 2.9 | ||

| Investment costs | 2.7 | ||

| Tax burden | 2.8 | ||

| Other costs related to the specifics of the raw materials sector | 2.8 | ||

| 3 | Social Factors | Change in education trends (more emphasis put on the IT sector) | 2.4 |

| Required qualifications, specialized education | 2.2 | ||

| Growing importance of ICT technology in everyday life—new trends | 2.9 | ||

| Growing importance of IT-related professions | 2.9 | ||

| Human capital investment | 2.1 | ||

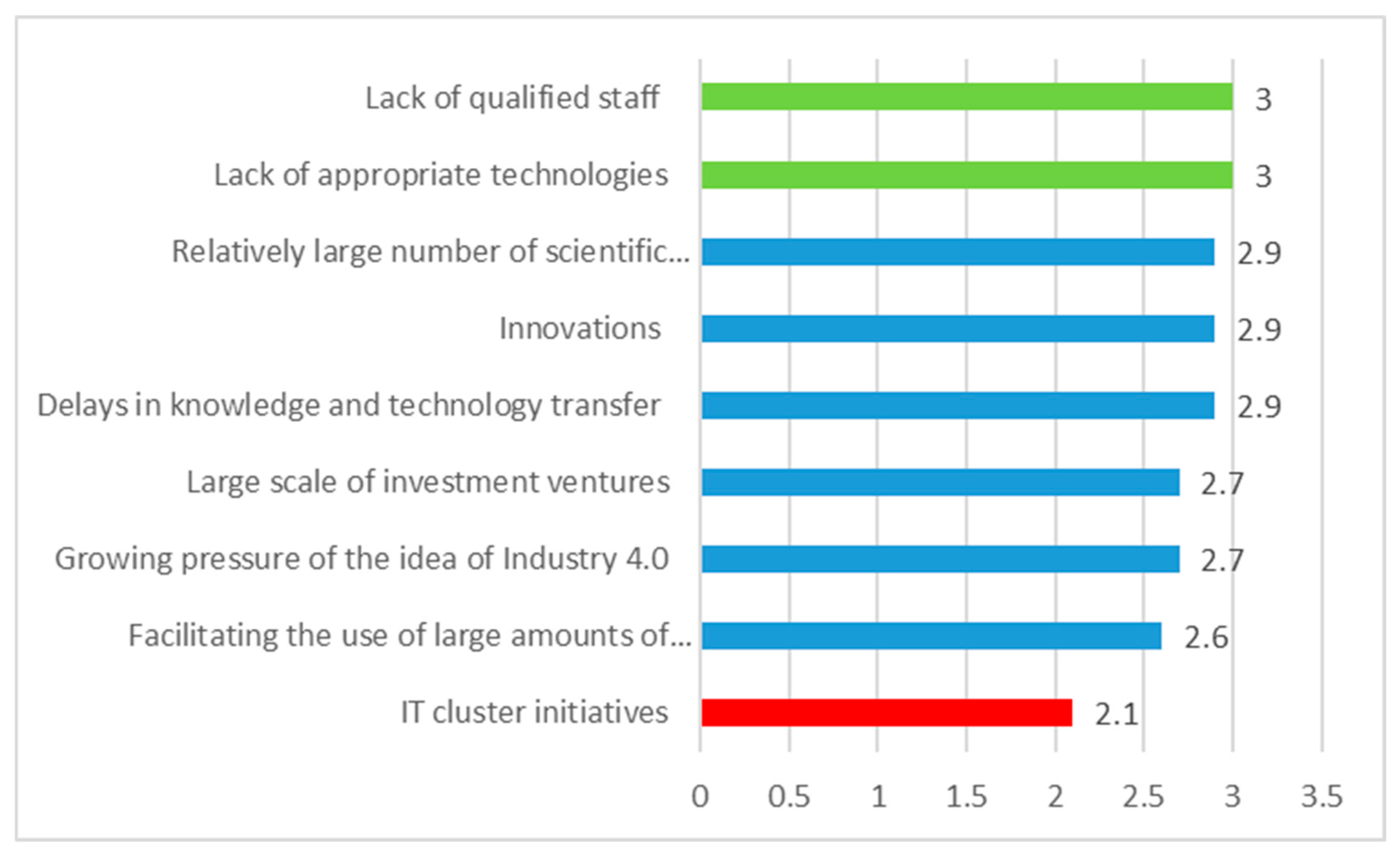

| 4 | Technological Factors | Facilitating the use of large amounts of data (cloud computing) | 2.6 |

| Delays in knowledge and technology transfer | 2.9 | ||

| Innovations | 2.9 | ||

| Lack of appropriate technologies | 3 | ||

| Lack of qualified staff | 3 | ||

| IT cluster initiatives | 2.1 | ||

| Growing pressure of the idea of Industry 4.0 | 2.7 | ||

| Relatively large number of scientific centers (access to specialists, technologies, computing power) | 2.9 | ||

| Large scale of investment ventures | 2.7 | ||

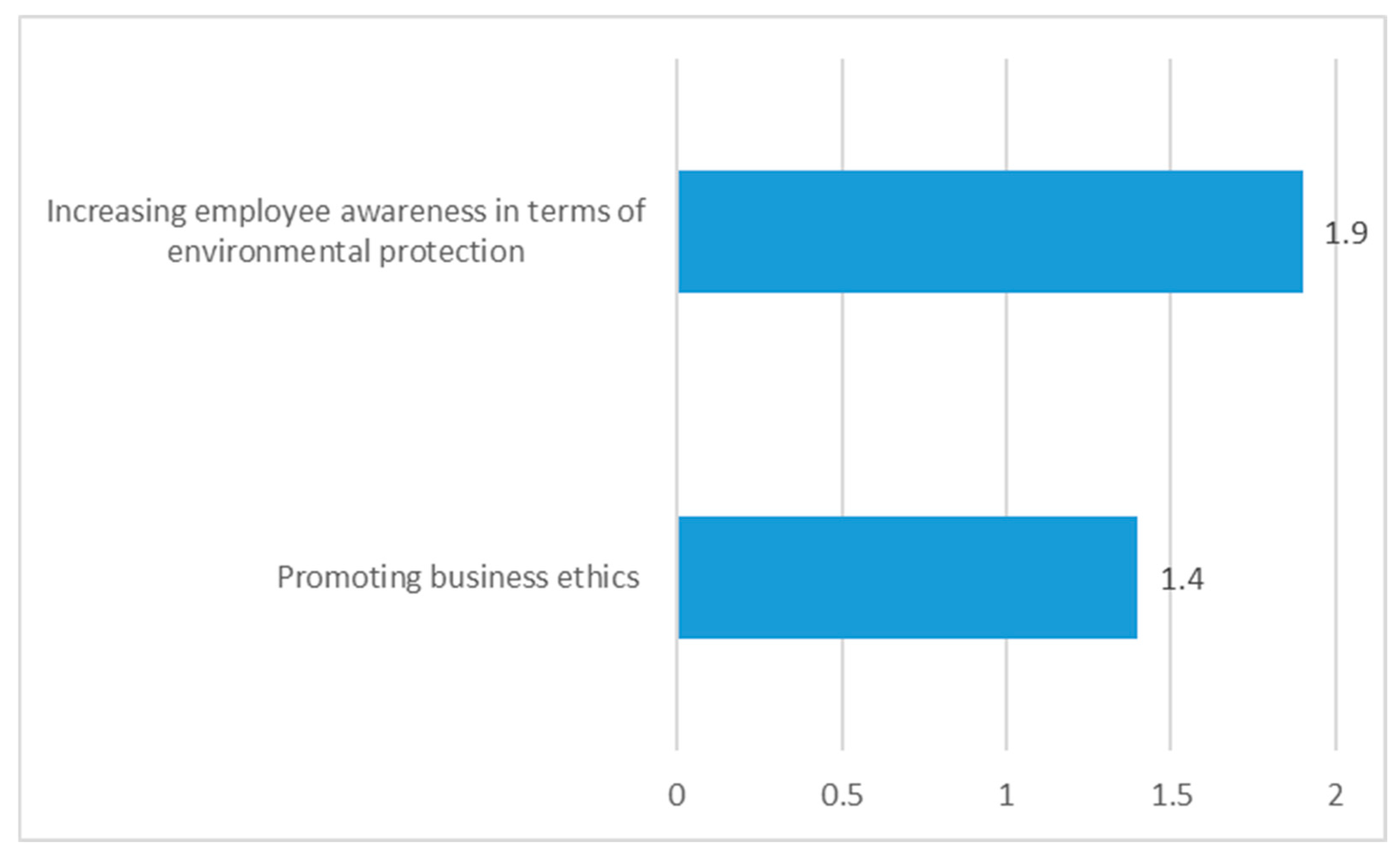

| 5 | Environmental Factors | Increasing employee awareness in terms of environmental protection | 1.9 |

| Promoting business ethics | 1.4 | ||

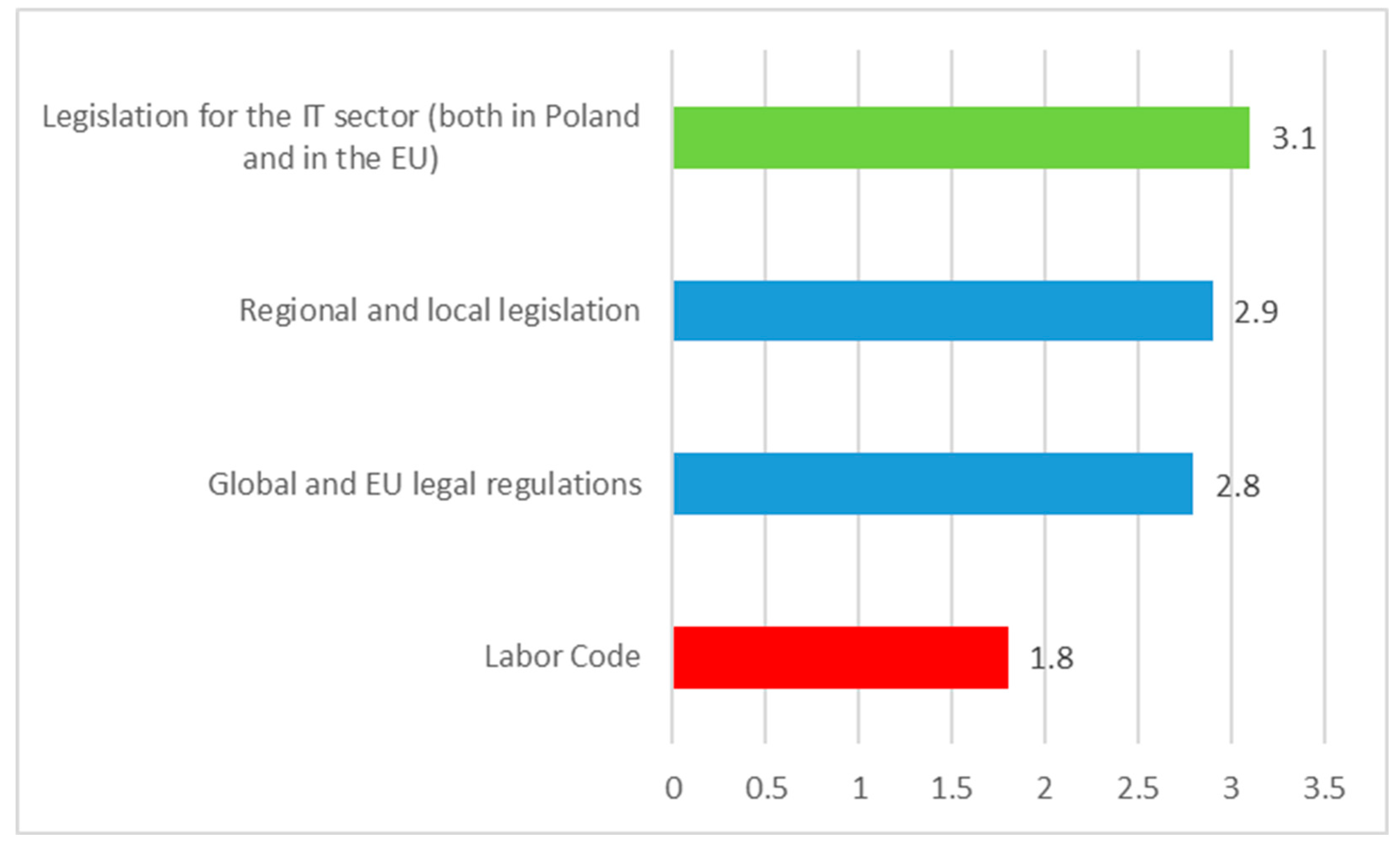

| 6 | Legal Factors | Global and EU legal regulations | 2.8 |

| Regional and local legislation | 2.9 | ||

| Labor code | 1.8 | ||

| Legislation for the IT sector (both in Poland and in the EU) | 3.1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bąk, P.; Sukiennik, M.; Kowal, B. The Main Drivers of the Raw Materials and ICT Sectors in Poland Using PESTEL Analysis. Energies 2025, 18, 1987. https://doi.org/10.3390/en18081987

Bąk P, Sukiennik M, Kowal B. The Main Drivers of the Raw Materials and ICT Sectors in Poland Using PESTEL Analysis. Energies. 2025; 18(8):1987. https://doi.org/10.3390/en18081987

Chicago/Turabian StyleBąk, Patrycja, Marta Sukiennik, and Barbara Kowal. 2025. "The Main Drivers of the Raw Materials and ICT Sectors in Poland Using PESTEL Analysis" Energies 18, no. 8: 1987. https://doi.org/10.3390/en18081987

APA StyleBąk, P., Sukiennik, M., & Kowal, B. (2025). The Main Drivers of the Raw Materials and ICT Sectors in Poland Using PESTEL Analysis. Energies, 18(8), 1987. https://doi.org/10.3390/en18081987