1. Introduction

The structure of the total primary energy supply in Poland is largely based on coal (42%), crude oil (30.2%), and natural gas (14.5%), which poses a significant challenge for the course and dynamics of the energy transition towards climate neutrality in this country [

1]. Consequently, Poland faces significant socio-economic and infrastructural challenges that translate into a relatively slow process of qualitative and quantitative structural changes in the national energy sector compared to other European Union countries [

2,

3]. Although in recent years, the role of natural gas as a transitional fuel has been significantly emphasized at national and EU forums, renewable fuels of non-biological origin (RFNBO), including hydrogen, may enable the transition towards a climate-neutral economy [

4,

5,

6]. Poland is among the largest EU hydrogen producers; however, it is producing this energy carrier almost exclusively through steam methane reforming or coal pyrolysis. In 2022, a total of 1.3 million tons of hydrogen was produced in this country using fossil fuels (compared to a total of 7.5 million tons of hydrogen produced in the European Union) [

7]. In recent years, we have seen increased efforts undertaken in Poland and the EU to boost the supply and consumption of RFNBO fuels, mainly hydrogen, displacing in public debate and partially in investment plans projects related to the development of natural gas infrastructure that do not directly serve the diversification of energy carriers [

8,

9].

This article aims to present a SWOT analysis that thoroughly demonstrates the strengths and weaknesses, as well as the opportunities and threats, of using hydrogen as a renewable fuel of non-biological origin in the energy transition in Poland. To achieve this aim, the following research questions are posed:

What are the key strengths and weaknesses associated with integrating RFNBO hydrogen into Poland’s energy sector?

What opportunities and threats does Poland face in adopting hydrogen as part of its energy transition?

How can the identified factors inform strategic decisions for policymakers and industry stakeholders in promoting hydrogen utilization?

The structure of the paper is organized as follows:

Section 2 provides an overview of the perspectives on using RFNBO hydrogen in the EU and Poland, including an introduction to the concept of the hydrogen economy and a review of EU and Polish legislation determining hydrogen production and use by 2030. It is followed by

Section 3, which presents the methods used in the study, and

Section 4, which demonstrates a detailed SWOT analysis of the use of hydrogen in Poland’s energy transition, focusing on economic, regulatory, technological, and social factors. The last sections include a discussion, policy recommendations, future research directions, and conclusions, with key findings and recommendations, addressing the research questions and suggesting pathways for effectively integrating hydrogen into Poland’s energy strategy.

2. Literature Review

This literature review is organized to provide a comprehensive understanding of RFNBO hydrogen’s evolving role in the European Union and Poland, setting the stage for our subsequent Poland-oriented SWOT analysis. The review begins by tracing the literature on the origins and development of the hydrogen economy concept, highlighting early theoretical models and the evolution of sustainable development principles that now underpin global energy strategies. It then shifts focus to the EU’s regulatory framework, examining key directives, policies, and ambitious targets that drive the decarbonization of industry and transport through RFNBO hydrogen. Next, the review narrows in on Poland, detailing national strategic documents and legislative measures—such as the Polish Hydrogen Strategy—illustrating the challenges and opportunities within a historic fossil fuel-dependent energy system. Finally, the discussion extends to the interplay between the hydrogen economy and the gas industry, exploring how legacy infrastructure and market practices are being adapted for a hydrogen future. The aim of such a structured approach is to eventually integrate diverse perspectives and justify the contribution of this paper as compared to similar studies, providing an in-depth foundation for the SWOT analysis presented in the later sections (as in the four problem domains covered in the results of economic, regulatory, technological, or social areas).

2.1. Introduction to the Concept of Transition Towards a Hydrogen Economy and Indication of the Global Trend in This Area

J. Bockris and A.J. Appleby were among the first to formulate the concept of the hydrogen economy in an article entitled “The Hydrogen Economy—An Ultimate Economy” [

10], in which the authors identified the potential of hydrogen to replace gasoline and electricity and become one of the primary energy carriers for industry (serving mainly as a carrier of energy obtained from nuclear reactors). The term “economy” was used to explain a hypothetical value chain of the production, storage, transport, and use of hydrogen, along with its costs estimated in 1972. Other co-creators of this concept at an early stage were T.N. Veziroglu, D.P. Gregory, D.Y.C. Ng, C.M. Long, and H. Robinson [

11]. The term “hydrogen economy” collectively refers to technologies for producing, storing, distributing, and utilizing hydrogen. This includes centralized and decentralized systems for hydrogen production, storage, and transport using transmission and distribution networks, as well as other forms of transport. Subsequently, hydrogen is used as an end product (in transport [

12,

13,

14,

15,

16], industry [

17,

18], and professional, industrial, and distributed energy systems in electricity generation [

19,

20]) and as a substrate in industrial processes, including within hydrogen energy storage systems, for the production of synthetic fuels and energy carriers [

21].

Over the following decades, this concept underwent further changes under the influence of the increasing importance of mitigating the anthropogenic nature of climate change and biodiversity loss, taking into account the normative postulates of the concept of sustainable development. These transformations led to the consolidation of the commonly emphasized assumption that hydrogen as a renewable fuel of non-biological origin (produced using, for example, water electrolysis according to the EU nomenclature) is to replace hydrogen previously produced using fossil fuels [

22]. The first national strategy for the development of the hydrogen economy, including the normative postulates of sustainable development, was adopted in Japan in 2018 [

23,

24]. Following it, among others, the USA [

25], the EU [

26], Germany [

27], and Poland [

21] adopted their strategic documents, co-creating a global and relatively convergent agenda of actions in this area [

28].

In recent years, numerous analyses have also been conducted, assuming a significant increase in the use of hydrogen as an alternative energy carrier to fossil fuels [

29,

30,

31,

32,

33,

34]. These analyses revealed that hydrogen has the following key applications, among others:

In stabilizing the operation of renewable energy sources (RESs), which are inherently unstable, thereby improving their economic parameters (avoiding shutdowns in cases of periodic excess or a deficit of energy in the transmission network);

In replacing fossil fuels in certain high-emission industrial processes (steel, petrochemical, cement industries), where the use of direct electrification is impractical;

In producing synthetic hydrogen-derived fuels (such as synthetic aviation kerosene, synthetic diesel fuel, and synthetic hydrocarbons for producing chemicals and fertilizers);

In selected transport segments (such as road, rail, and water transport), where there is a need to eliminate diesel engines, but where electrification costs (e.g., railways) are high or the use of battery systems is inefficient.

It is evident that the number of announced low-emission hydrogen production projects (using water electrolysis or steam methane reforming with Carbon Capture, Utilization, and Storage systems—CCUSs) is increasing at a significant pace [

35]. Annual hydrogen production using these processes may reach 38 million tons by 2030, if all announced projects are implemented. Of the total possible production to be achieved in 2030, 27 million tons is based on electrolysis and low-emission electricity, and 10 million tons on fossil fuels with CCUSs [

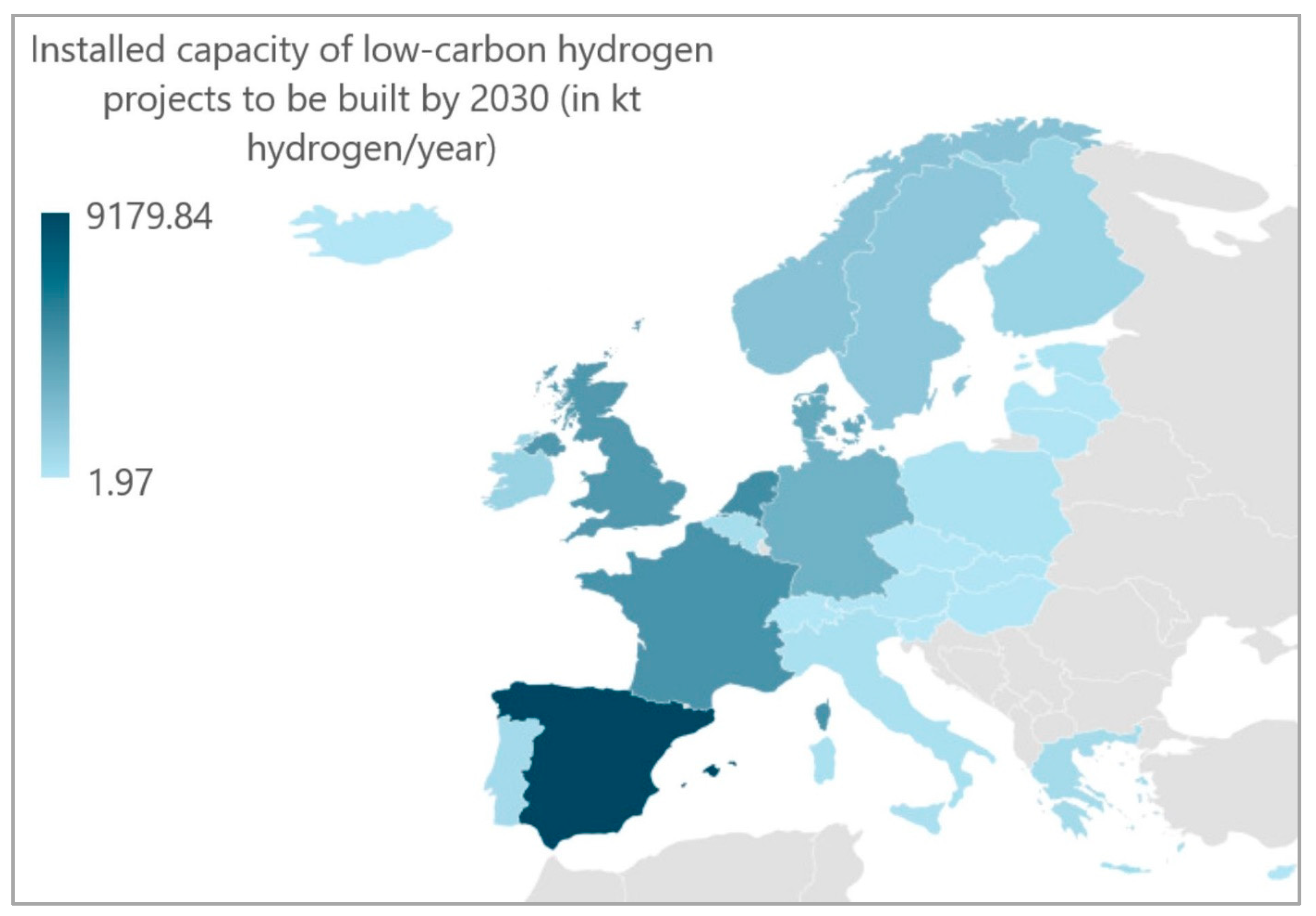

32]. The complexity and ambitious nature of the planned projects among selected countries in Europe are illustrated in

Figure 1. The map reveals notable disparities among EU member states in planned low-carbon hydrogen projects (with some of them meeting the RFNBO criteria). Some countries have announced significantly higher capacities than others, e.g., Spain, France, and Germany stand out with projects that could reach thousands of kilotons of hydrogen per year (which could reflect their early commitment to large-scale electrolyzer deployment). By contrast, several Central European countries show much smaller announced capacities, suggesting either a slower policy momentum or the need for further investment and infrastructure development—Poland being the exact case for both explanations.

The European Union, despite the diverse momentums for low-carbon hydrogen projects deployment, also has the opportunity to strengthen its leading global position in hydrogen and fuel cell technologies, which will be achieved by investments that could reach a value of 180 to 470 billion euros by 2050 and provide up to one million new jobs [

26].

2.2. Overview of EU Legislation Determining the Production and Use of RFNBO Hydrogen by 2030

Hydrogen currently represents the main direction of support for the decarbonization of EU industry and transport in the area of increasing the use of RFNBO, particularly in the context of challenges related to the necessity of achieving climate neutrality and becoming independent from the import of hydrocarbons from outside the EU. The main legal act shaping decisions at the member-state level is the Renewable Energy Directive (RED) III Directive [

36], which specifies mandatory targets for the use of RFNBO in industry (Article 22a) and transport (Article 25). Notably, the increase in the use of RFNBO hydrogen currently represents a secondary direction of transformations occurring in the energy sector. For member states, in the context of hydrogen, the point of reference is the decisions and arrangements at the EU level, adopted under the European Green Deal, and above all, the assumptions of the Hydrogen Strategy for a Climate-Neutral Europe published on 8 July 2020 [

26]. This document drew attention to the growing global interest in hydrogen, resulting from its role as a raw material, fuel, energy carrier, and storage medium, as well as the possibility of using it for the significant decarbonization of industry, transport, energy, and construction. The lack of emissions during its end use and the resulting significance of hydrogen in the EU’s plans to achieve the aforementioned climate neutrality is of key importance. It was also emphasized that hydrogen constitutes only 2% of the EU’s consumption of secondary energy sources and is still mainly produced from fossil fuels (natural gas or coal). The strategy’s authors predicted that this share would increase to 13–14% by 2050, and this hydrogen would mainly be RFNBO hydrogen. To enable this, it was assumed, among other things, that the electrolyzer installed capacity would increase to 40 GW by 2030, thus producing approximately 10 million tons of RFNBO hydrogen [

34]. The European Commission forecasted installing another 40 GW of electrolyzer capacity in countries neighboring the EU to the south and east—Morocco [

37,

38,

39,

40] and Ukraine [

41,

42]. These countries were indicated due to favorable natural conditions—high windiness and solar insolation—as well as sufficient space to build large-scale renewable energy sources. Thanks to their proximity to the EU, they can export hydrogen via pipelines, which is more cost-effective than transmitting electricity over long distances. Unfortunately, the consequences of Russia-Ukraine conflict in 2022 temporarily halted the development of planned projects in Ukraine [

43], forcing the intensification of activities in cooperation with “like-minded” countries in the MENA region and members of the African Union, within the framework of building a strategic partnership for the development of the hydrogen economy [

44,

45,

46,

47,

48]. In 2030, approximately 3 million tons of RFNBO hydrogen (118 TWh) could be transported to the EU, constituting 17% of its total demand [

49]. Regarding utilizing Ukraine in the EU’s hydrogen strategy, Russia-Ukraine conflict significantly thwarted the European Commission’s plans as of 2024.

The implementation of the EU’s hydrogen strategy was divided into three stages within the schedule: 2020–2024, 2025–2030, and 2030–2050. It was assumed that the EU’s priority is the development of RFNBO hydrogen production. In the shorter term, that is, in the initial stage of the development of the EU hydrogen market, the necessity of producing low-emission hydrogen from fossil fuels (i.e., hydrogen produced from natural gas) using CCUS technology was allowed, although, since 2022, significant emphasis has been placed on developing infrastructure for RFNBO hydrogen production. An important challenge for implementing this EU strategy is reducing the production, storage, and distribution costs of RFNBO hydrogen. However, it should be emphasized that in 2023, the cost of producing hydrogen using the steam methane reforming method with natural gas averaged 3.05 EUR/kg H₂ in the EU, while using water electrolysis, it was 4.1 EUR/kg H₂. It is estimated that a reduction in electrolyzer prices, as a result of scaling up their production, will enable the competitive production of RFNBO hydrogen in 2030, achieving a production cost of 2.5 EUR/kg H₂ (compared to 4.1 EUR/kg H₂ for steam methane reforming) [

50]. The results of the pilot auction (conducted for the first time in the history of the EU at the European Hydrogen Bank) were very optimistic. Within this auction, the European Commission selected seven projects that received 720 million EUR for investments, enabling a hydrogen bid price in the range of 0.37–0.45 EUR/kg H₂ [

51].

New directions for transforming the energy sector, including within the hydrogen economy, proposed by the European Commission, directly result from the REPowerEU [

52]. This plan published on 18 May 2022, assumes the undertaking of intensive actions to reduce energy consumption and transform industrial processes, making it possible to replace gas, crude oil, and coal with renewable electricity and RFNBO hydrogen [

53]. According to the adopted assumptions, RFNBO hydrogen will significantly replace natural gas, coal, and crude oil in industrial sectors and transport, where it is not easy to reduce emissions or electrify. REPowerEU sets the EU target at 10 million tons of the internal production of RFNBO hydrogen and the import of another 10 million tons by 2030 within three corridors—the Mediterranean, the North Sea area, and, in the future, through Ukraine.

Implementing such ambitious plans requires the creation of an appropriate hydrogen infrastructure, with the REPowerEU plan assuming that by 2030, infrastructure sufficient for the production, import, transport, and storage of 20 million tons of hydrogen will be established. Member states will have to make an effort in the above area, which means the need to build both infrastructure for hydrogen production and networks of pipelines transporting this hydrogen, hydrogen storage installations, or terminals for changing its physical state [

54]. To accelerate hydrogen production, the EU introduced new targets in the RED directive and regulations concerning conditions for access to natural gas transmission networks and regarding common rules for the internal market in natural gas. A summary of the legal acts adopted so far and their impact on the increase in demand for RFNBO hydrogen in the EU is presented in

Table 1.

According to a study developed by G. Tchorek et al. [

50], issues related to the development of technologies in the field of RFNBO hydrogen will soon become one of the priority areas of interest for the European Union, which will be reflected in the financial resources available under programs funded from the EU budget. However, the European Court of Auditors conducted an audit in 2024 to assess the actions of the European Commission in creating a market for renewable and low-emission hydrogen, stating that despite partial successes, the EU’s goals for 2030 are unrealistic and a further improvement of legal and financial frameworks, as well as coordination at national and EU levels, is necessary. The Court recommended that the European Commission primarily verify the market situation and make strategic decisions to avoid new dependencies, such as an excessive reliance on hydrogen imports or the raw materials necessary for its production. It is crucial not to repeat the mistakes related to previous energy dependencies.

Another recommendation was to develop a comprehensive EU action plan that will be monitored for progress. This plan should include targets for member states and regularly check how individual countries are coping with implementing assumptions regarding hydrogen production and use. The Court also points to the need to obtain accurate data on national funding and its availability, which will allow for assessing whether the mechanisms of EU financial support are appropriate. Without a complete picture of the demand for funds and available sources, it will be difficult to optimally manage hydrogen projects at the EU level. These recommendations can be broadened by the analysis demonstrated by Talus K. et al. [

60], who advocated for an expanded portfolio of low-carbon hydrogen production methods to achieve the planned volumes.

One of the key challenges is also the process of issuing permits to implement hydrogen projects. The Court recommended that the Commission monitor this process in member states, as excessively long waiting times for permits can delay key investments, threatening climate goal achievement. The last recommendation concerned making clear decisions on supporting and coordinating actions with the hydrogen industry. The Commission should work more closely with the industrial sector to better understand its needs and adjust actions supporting the development of the hydrogen market, which will help build a strong and sustainable hydrogen value chain in the EU [

61].

2.3. Overview of the Main Acts at the Polish Level Determining the Production and Use of RFNBO Hydrogen by 2030

As a consequence of the EU hydrogen strategy, the document “Polish hydrogen strategy until 2030 with an outlook until 2040” (PHS) was implemented into the regulatory environment in Poland and was published on 7 December 2021, as a strategic document defining the main objectives of developing the hydrogen economy in Poland and the directions of actions necessary to achieve them [

62]. The document fits into global, EU, and national actions to achieve climate neutrality. The PHS aims to further develop the Polish hydrogen economy towards hydrogen production in a manner consistent with the expectations contained in EU documents [

63]. The document indicates six specific goals to be achieved: implementation of hydrogen technologies in energy and heating; use of hydrogen as an alternative fuel in transport; support for the decarbonization of industry; production of hydrogen in new installations; efficient and safe transmission, distribution, and storage of hydrogen; and creation of a stable regulatory environment for this energy carrier [

21,

64]. These objectives are gradually being realized, for example, by signing the Sectoral Agreement for the Development of the Hydrogen Economy in Poland, which has involved universities and business representatives in building the hydrogen economy [

65].

In the Polish Hydrogen Strategy, hydrogen is divided into conventional (produced in various processes using fossil fuels), low-emission (produced from non-renewable or renewable energy sources with a low carbon footprint), and renewable (produced in the process of water electrolysis using electricity from RES—currently referred to as RFNBO) [

66]. The PHS is a “map” for Polish authorities to undertake legal and non-legal actions to create the Polish hydrogen economy [

67]. From the beginning, the assumptions adopted on the Polish side were overly optimistic and difficult to achieve. This results from the fact that in Poland, we currently have only a few fully functioning installations of this type, mainly belonging to companies such as ORLEN, ZE PAK, or Promet-Plast in Gaj Oławski. Although many EU member states are prosperous in this area, it can be seen that decades of delays in the field of energy transition slow down the progress of the hydrogen economy in Poland—the outdated power grids hamper the development of renewable energy, and the lack of adaptation of the regulatory environment in this area causes the pace of change to be very slow [

68].

The currently available potential of domestic hydrogen production, estimated at 1–1.4 million tons per year, is insufficient to replace the raw materials currently used, such as coal, crude oil, natural gas, and liquid fuels, as well as electricity imports. Therefore, Poland must consistently develop hydrogen production sources [

68]. The anticipated economic changes in the coming years and the goals indicated in the PHS show the potential to replace about 0.45–2.76% of domestic demand for imported liquid fuels, energy, and energy raw materials with hydrogen by 2030. A detailed analysis showed that from the perspective of 2030, the introduction of hydrogen would not significantly contribute to improving the trade balance due to the expected scale of the hydrogen economy.

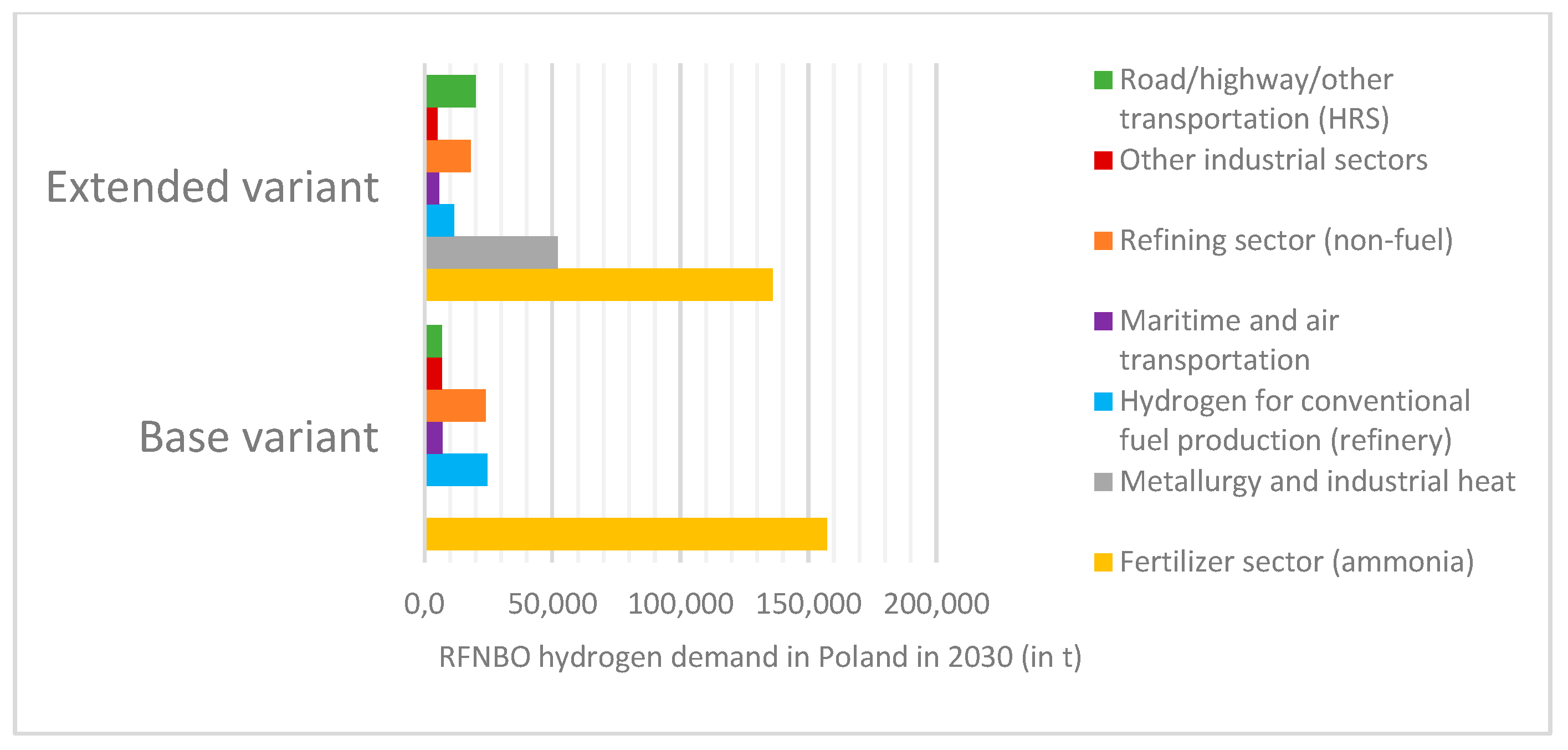

Figure 2 compares two projected scenarios (“base variant” vs. “extended variant”) for Poland’s RFNBO hydrogen demand by 2030, broken down by end-use sectors [

50]. Notably, the fertilizer sector (ammonia production) shows the highest demand in both scenarios, reflecting its prominent role as a hydrogen consumer in chemical processes. Metallurgy and industrial heat also appear as significant users in the extended scenario, indicating the growing potential for RFNBO hydrogen in heavy industry if supportive policies and infrastructure develop at scale. Additionally, smaller yet important shares are allocated to road/highway transport (especially via hydrogen refueling stations), maritime and air transport, and other industrial applications. The presented breakdown underscores that while traditional chemical sectors may dominate the initial demand, a more ambitious trajectory (the “extended variant” of the RED III implementation) could see hydrogen adoption expand substantially into hard-to-electrify industrial processes and multiple transport modes. In the scenario of achieving the PHS goals in a perspective up to 2030, the use of hydrogen in the transport sector can bring annual savings as a result of replacing imports of energy raw materials and liquid fuels of about 36.5–38.5 million euros; in the case of energy and heating, 43.3–45.8 million euros; and in the case of industry, 234.8–248.0 million euros, which gives a total annual value at the level of 314.6–332.35 million euros. On the other hand, savings are expected in the decade after 2030, depending on the adopted scenario, from 3.5 to 7 billion euros. In conclusion, the Ministry of Climate and Environment claims that in the next few years, hydrogen will not have a key impact on climate neutrality or on improving Poland’s energy security. Still, after 2030, this impact may be crucial [

69]. According to data from 2022,

Figure 2 presents the projected demand for RFNBO hydrogen in Poland in 2030, following the RED III targets.

Currently, the Polish government aims to implement the hydrogen Contracts for Difference (hCfD) mechanism, which aims to support the market for RFNBO hydrogen through subsidies for its production and consumption, replacing high-emission hydrogen in industry and supporting the development of zero-emission transport. A consultation group has also been established, and efforts are being made to obtain funds from the EU Modernization Fund and update the PHS. By 2030, Poland plans to build RFNBO hydrogen production capacities at 43,000 tons per year, financed by the Recovery and Resilience Facility, and 136,000 tons under the hCfD mechanism. The costs of supporting RFNBO hydrogen production may range from PLN 11 billion (indexed subsidy) to PLN 20 billion (fixed subsidy) over 10 years, depending on the chosen support variant [

70].

2.4. Development of the Hydrogen Economy and the Gas Industry

An important role in the planned energy transition using RFNBO hydrogen should also be played by gas companies, which, on the one hand, will have to adapt to the new reality. On the other hand, implementing new technologies may serve as an impetus for their further development. It may also allow them to play a significant role in building so-called multi-energy systems (MESs), i.e., integrated gas and power systems [

54]. Therefore, when analyzing hydrogen economy issues from an infrastructural perspective, it is worth noting that for the purposes of hydrogen transport and storage, both the existing natural gas system and a system dedicated exclusively to hydrogen—which would have to be built from scratch in the coming years—can be utilized.

A significant diversity of opinions has emerged regarding the percentage of hydrogen that can be injected into the gas network. According to the International Energy Agency, in the initial phase of development, by 2030, low-emission hydrogen will be used in a way that does not require constructing new transmission or distribution infrastructure. When mixing hydrogen with natural gas in gas networks, the average amount of added hydrogen will be 15% (by volume), which will reduce CO₂ emissions resulting from gas consumption by about 6% [

71]. Under the German model, in the so-called transitional regulation on hydrogen networks in Germany, it is assumed that an autonomous and dedicated transport infrastructure for hydrogen should be built, where the allowed hydrogen admixture in gas pipelines is not higher than 10%. Generally, at the EU level, the modified gas directive, which is part of the Hydrogen and Gas Package and came into force on 4 August 2024, introduces, among other things, separate regulations and definitions for hydrogen infrastructure and hydrogen infrastructure operators. The new gas regulation, constituting the second element of the mentioned package, provides for the obligation of the gas operator to allow the introduction into the gas system of gaseous fuels with a hydrogen content not exceeding 2% by volume [

72].

The European Commission, although it allows and considers it desirable to inject hydrogen into existing gas networks, considers such a model less efficient than creating a hydrogen market separate from the natural gas market. Therefore, it emphasizes creating separate infrastructure dedicated exclusively to hydrogen. The European Commission plans to implement separate regulations dedicated to the natural gas and hydrogen markets. At the same time, it is envisaged that the infrastructure should be separate from the gas infrastructure, which will serve exclusively for hydrogen transport, storage, and phase change. It is worth noting that building the hydrogen system from scratch may be accelerated, as the modified directive emphasizes the necessity of converting gas infrastructure into hydrogen infrastructure. The directive explicitly states that European Union member states may provide for enabling hydrogen distribution system operators to lease or rent hydrogen network assets from other owners of natural gas distribution systems, natural gas distribution system operators, or hydrogen distribution network operators operating within the same enterprise. However, leasing or renting may not lead to cross-subsidization between different operators. (Such a solution has been proposed in the Draft Law on Amendments to the Law—Energy Law and Certain Other Laws, which is currently under review within the Council of Ministers. The draft allows the transfer of gas assets to develop hydrogen infrastructure between companies remaining in one group of companies; see Draft Law on Amendments to the Law—Energy Law and Certain Other Laws (UD36). Source:

https://legislacja.rcl.gov.pl/projekt/12385551. Accessed on 25 March 2025). Importantly, such infrastructure will not transport a mixture of natural gas and hydrogen; it will only transport high-purity hydrogen. Moreover, separate operators will be appointed to manage such infrastructure, and additionally, a legal separation of gas and hydrogen network operators is planned (the adoption of such solutions may prevent existing gas operators—transmission system operators (TSOs) and distribution system operators (DSOs)—from building and operating hydrogen networks).

A slightly different approach to regulatory issues has been proposed nationally. The PHS emphasizes a model in which the existing natural gas system can be used for hydrogen transport and storage. Undoubtedly, implementing such an approach will require gas system operators to carry out many investments that will allow for the safe blending of hydrogen into natural gas in existing gas networks (an additional challenge will be adapting end-user equipment to burn this type of fuel). Such a model would also allow for the storage of gas mixtures with a hydrogen admixture in existing storage facilities, as well as for the faster development of hydrogen technologies, as it does not require the time-consuming construction of separate infrastructure and allows for the utilization of the existing structures and competencies of gas companies. However, analyzing recent domestic legislative actions, it can be assumed that Polish legislation will replicate the solutions provided in EU law, including the pursuit of separating the hydrogen system operated by assigned TSOs and DSOs (Cf. the Draft Law on Amendments to the Energy Law and Certain Other Laws (UD36). Source:

https://legislacja.rcl.gov.pl/projekt/12385551 (accessed on 25 March 2025)).

In summary, constructing a network infrastructure dedicated to renewable gases, including adapting the existing gas infrastructure to blend in RFNBO hydrogen, is a serious investment challenge for gas operators. To meet such challenges, it will be necessary to redefine the regulatory approach of the Polish Energy Regulatory Office (URE) to tariff proceedings and agreements on the development plans of DSOs and TSOs, rebuild the tariff system in the distribution area—where the implementation of a dedicated entry–exit system is postulated—or change the financing model of connections and efforts to obtain external funding [

54].

2.5. Contribution of This Study

Building on the review in the preceding subsections—ranging from the origins of the hydrogen economy concept, through Poland’s fossil fuel-heavy energy mix to the evolving EU directives on RFNBO hydrogen and the relevance of the hydrogen economy to the natural gas industry—this paper’s primary contribution lies in delivering an up-to-date Poland-focused identification of factors related to a SWOT analysis. Existing studies often address hydrogen’s potential at a broader global scale, showcasing more technology and infrastructure-oriented SWOT approaches [

73] or emphasizing specific regional organizations, like the GCC [

74], or non-EU countries, like Turkey [

75]. The case of Poland has been studied in the past, focusing on techno-economic [

68] or political and legal components [

76]. In contrast, this analysis integrates economic, social, regulatory, and technological dimensions in a single evaluative framework relevant to the contemporary framework conditions at the beginning of 2025. By harmonizing insights from Poland’s current policy landscape (e.g., the Polish Hydrogen Strategy, the RED III directive, and AFIR regulations at the EU levels), infrastructure realities (e.g., blending hydrogen into existing gas networks), and emerging EU-level funding and regulatory mechanisms, we offer policy-relevant guidance tailored to national conditions. In doing so, this paper fills a notable gap in understanding how a historically coal- and gas-dependent market can pivot to hydrogen, while meeting ambitious climate neutrality goals established on the EU and national levels. The next section outlines our research design and methodology, detailing the use of a SWOT analysis to assess hydrogen’s viability in the Polish context from these four distinct but interrelated perspectives.

3. Materials and Methods

This study employs a SWOT (strengths, weaknesses, opportunities, and threats) analysis framework to identify the key factors that can describe the feasibility and challenges of adopting RFNBO fuels—specifically hydrogen—in Poland’s energy transition. This study builds on a comprehensive review of the relevant literature, legislative documents, and policy frameworks (presented in

Section 2), as well as official data from national and European institutions.

Four core dimensions—economic, regulatory, technological, and social—emerged as vital for understanding the complexities of hydrogen integration in Poland. To assemble the necessary evidence, official EU and national policy documents (for instance, RED III and REPowerEU), government reports, and academic studies on hydrogen technologies were examined to pinpoint recurring themes relevant to the Polish context. These materials were further supplemented with statistical data collected from domestic sources such as the Ministry of Climate and Environment and from international organizations, including the IEA, to substantiate the analysis with current market figures. In addition, company reports (for example, gas infrastructure operators or hydrogen consortia) helped capture practical, business-oriented perspectives on RFNBO hydrogen rollouts.

Upon compiling this information, a SWOT procedure was followed. Findings were initially classified into categories corresponding to strengths, weaknesses, opportunities, and threats. In line with the established methodology, national or internal factors (including existing infrastructure or policy frameworks) were grouped under strengths and weaknesses, whereas opportunities and threats comprised external factors such as EU-level directives and global price trends. These classifications underwent iterative refinement.

The consolidated results appear in four thematic tables (

Table 2,

Table 3,

Table 4 and

Table 5), each focusing on one dimension of analysis (economic, regulatory, technological, or social). Presenting findings in this manner allows for a clear linkage between the identified factors and the subsequent discussion. Although the specific scope is Poland’s transition, the analysis also contrasts domestic circumstances with broader European Union developments.

4. Results

The adopted comparative lens (presented below with a division for each dimension) underscores how Poland’s infrastructural and socio-economic landscape shapes both the possibilities and constraints in scaling up RFNBO hydrogen.

4.1. Economic Area

Within the economic area, strengths can be observed related to Poland’s independence from fossil fuels, including natural gas. The prospect of developing the RFNBO hydrogen market thus gains particular significance in the face of Russia-Ukraine conflict and the embargo on energy carriers from Russia. Developing low- and zero-emission hydrogen technologies also implies increased investment expenditures in the country up to 2050, ranging from 180 billion to 470 billion euros. Additionally, RFNBO hydrogen becomes a fundamental raw material necessary for conducting an effective energy transition and decarbonization for Polish energy corporations, which is included in their strategies up to 2030. It is also worth mentioning the application of RFNBO hydrogen where electrification is difficult or impossible to achieve (e.g., the chemical/metallurgical sectors, and transport, including heavy-duty, aviation, and maritime transport).

As a result of scaling up their production, a radical reduction in the prices of electrolyzers will enable the competitive production of RFNBO hydrogen in 2030 in regions with cheap renewable energy sources. The application of the pyrolysis process can also become an economically justified and scalable solution for hydrogen production. During the pyrolysis process, i.e., dry distillation, gas products like hydrogen and materials like fiberglass can be produced. In the pyrolysis process, solid carbon, known as graphite carbon, is produced, which can be used by advanced technology industries such as lithium-ion battery production or in innovative materials like graphene. Europe currently consumes 10% of the world’s resources of this raw material (producing only 1% of this type of carbon), and the main source of imports is China, producing 70% of global production [

77]. A strength may also be the possibility of financing large-scale hydrogen investments by bypassing domestic intermediary institutions within the funds of the European Hydrogen Bank. It should also be noted that developing low- and zero-emission hydrogen technologies implies an increase in investment expenditures up to 2050, ranging from 180 billion to 470 billion euros.

Among the weaknesses in the economic area of Poland one can include the low share of hydrogen in the energy mix, and the fact that it is still mainly produced from fossil fuels, i.e., natural gas or coal. Currently, hydrogen constitutes only 2% of the EU’s energy mix. Additionally, it should be mentioned that the model preferred by the European Commission for creating autonomous hydrogen operators will require the commencement of building transport and storage infrastructure, which does not yet exist, and this is associated with a significant investment expenditure and is time-consuming. This will necessitate the socialization of the network’s expenditure and operating costs by hydrogen end users—which will significantly increase the cost of acquiring this energy carrier. A weakness is also the necessity to allocate high budgetary funds to develop hydrogen technologies with the support of R&D programs—which may discourage legislative authorities from further implementing aid programs, assuming the lack of a clear technological breakthrough.

Among the threats concerning the pace of the energy transition using RFNBO hydrogen, its price should be mentioned. The estimated price of RFNBO hydrogen currently oscillates around 15 euros/kg (in the case of RFNBO hydrogen, production costs are derived from the price of electricity), which hinders the application of hydrogen technologies in transport. Large price increases of high-emission hydrogen in the range of 8 to 15 euros/kg, i.e., fuel produced from natural gas, are associated with price fluctuations in the European natural gas market, and until this market stabilizes in the perspective of the next two years, it will generate high risks for applying technologies for producing this type of hydrogen in the country as well. (For instance, the price of gas fuel on the TTF exchange has fluctuated between a min 37.7 (EUR/MWh) on 2 May 2023, to a max price of 339.2 (EUR/MWh) on 26 August 2022.)

An opportunity for the development of the hydrogen market both domestically and in Europe is the planned significant increase in the share of RFNBO hydrogen in the global economy by 2030 and the use of RFNBO hydrogen in the world’s energy demand at a level of 24% by 2050 [

71]. Significant for the development of the EU market is the launch of the support system of hydrogen auctions (with a budget of 800 million euros (auction winners are to receive a fixed bonus added to the revenue from the sale of each kilogram of RFNBO hydrogen for 10 years) within the EU Innovation Fund), which is dedicated to building electrolyzers and established by the European Commission of the European Hydrogen Bank (EHB), integrating financing mechanisms for investments related to the production, transport, and consumption of RFNBO hydrogen.

4.2. Social Area

In the social area (see

Table 3), among the strengths, one can include the use of P2G (Power-to-Gas) and P2G2P (Power-to-Gas-to-Power) technologies by gas operators as installations for providing energy conversion services. This allows the socialization of costs associated with the integration of energy systems and increases the possibility of ensuring third-party access to new infrastructure. Additionally, a strength is the increasingly frequent education programs of higher education institutions for future engineering staff in hydrogen technologies and the emergence at the level of local government units of energy clusters developing hydrogen technologies and engaged in R&D&I activities in the field of commercial hydrogen application.

As a weakness in the domestic market, one should point out the stereotype present in the media space of hydrogen as an explosive fuel and thus posing a threat to public safety (an example is the publication by W. Mielcarski, where the author cites well-known examples from history (including modern history) of disasters caused by the action of hydrogen, thus sustaining the impression of an alleged threat with the use of this fuel on a wider scale to public safety [

78]), as well as the inability of network operators to guarantee the safe use of a hydrogen admixture above 20% of the gas volume in currently operated natural gas networks.

An opportunity for market development in the social area is providing one million new jobs in the EU [

79], enabling clean hydrogen technologies to be developed. Hydrogen, alongside other technologies such as photovoltaic panels, offshore wind farms, CCUS (Carbon Capture, Utilization, and Storage), and biofuels, has gained full political and social acceptance as an instrument to counteract the negative effects of climate change [

29]. As a threat (external factor), the lack of social acceptance for the current price of RFNBO hydrogen at the current level of technological development appears.

4.3. Technological Area

As the third aspect, we should discuss the technological aspect. Its strengths in the energy transition towards a climate-neutral economy include, firstly, the significant importance of hydrogen in storing energy from inherently unstable RESs. Secondly, assuming 100% energy from RESs, it will be necessary to store 25–30% of the energy, and hydrogen today (at least conceptually) is the only potential energy storage medium on such a scale [

80]. Thirdly, RFNBO hydrogen will replace fossil fuels in some high-emission industrial processes, such as the steel, chemical, and cement industries, where the use of direct electrification is impractical. Fourthly, the potential of RFNBO hydrogen for the energy transition process results from the fact that both during its combustion (in pure oxygen) and its reactions in electrochemical devices (e.g., fuel cells), no substances harmful to the environment or climate are emitted.

Additionally, considering the application of hydrogen technologies, it will be possible to produce synthetic hydrogen-derived fuels such as synthetic aviation kerosene, synthetic diesel fuel, and synthetic hydrocarbons for producing chemicals and fertilizers, which also belong to the RFNBO category. RFNBO hydrogen will find applications in selected transport segments (i.e., road, rail, water transport) where diesel engines need to be eliminated, electrification costs (e.g., railways) are high, or the use of battery systems is inefficient [

34]. (It is worth mentioning here, as an example, a project already implemented by a private holding company in the city of Konin, where an installation using a PEM-based electrolyzer with a capacity of 2.5 MW has been built—enabling the production of 1000 kg of hydrogen as RFNBO fuel per day. Such a volume provides fuel for 40 hydrogen-powered buses per day [

81]).

It should be emphasized that there is a prospect of using hydrogen in Polish large-scale heating, given the current lack of technology that can power domestic heating networks, assuming the complete elimination of fossil fuels [

80]. Implementing modern hydrogen technologies can serve as an impetus for developing current gas operators (DSOs, TSOs) to build so-called integrated polygeneration systems, i.e., gas and power systems. An example of the investment planned by Green Capital S.A., which will build hydrogen as RFNBO fuel production facilities worth €1.28 billion. The investment will consist of a 400 MW wind farm, an 800 MW photovoltaic farm, energy storage facilities, and electrolyzers and will produce about 2.2 million MWh per year. The heat produced in the process of obtaining hydrogen will be utilized by the heating system of the so-called Tri-City (the cities of Gdansk, Gdynia, and Sopot located on the eastern coast of Poland) [

82]. For hydrogen transport purposes, the existing gas pipeline infrastructure for natural gas transport can be used, but potential leakages and diffusions must be considered [

83]. In addition, for hydrogen storage purposes, the underground natural gas storage infrastructure in salt caverns can be utilized. New energy units planned for launch in Poland are being designed and built using a formula that assumes the use of technology enabling the future co-firing of hydrogen. (Such an example is PKN Orlen’s investment in CCGTs in Ostrołęka, Grudziądz, or Kozienice, where it plans to use a plant based on H2 Ready technology, which allows for the co-firing of hydrogen. ZE PAK, as part of its investment in a 600 MW gas-fired unit to be built at the Adamów Power Plant, is planning to supply the gas-steam turbine unit during operation also with modified fuel, consisting of a mixture of 70% natural gas and 30% hydrogen supplied to the unit from an external source via a DN200 transmission pipeline [

80]).

Another strength is also the necessity of conducting intensive research by the manufacturers of turbines burning hydrogen to ensure the stability of the combustion process with changing proportions of the fuel mixture composition, maintaining low nitrogen oxide emissions, using materials with increased corrosion resistance, and solving the problem of cooling exhaust gases (due to the significantly higher water vapor content in the exhaust gases) [

84].

Among the weaknesses, we currently include the fact that injecting 100% hydrogen into the existing natural gas transmission and distribution networks is very dangerous, considering the use of materials of different characteristics (mainly steel [

80] and PVC) in their construction. The burners of natural gas-consuming devices at the end user (e.g., gas stoves, gas furnaces) were not designed to burn pure hydrogen; therefore, there are currently no technical standards and certifications allowing the safe use of hydrogen. (Hydrogen causes a reduced mechanical strength and increased brittleness in metals and alloys [

85]. The aforementioned problem particularly affects TSOs, whose gas pipelines are mainly constructed of steel, which is not resistant to the phenomenon of metal degradation (hydrogen embrittlement).)

Among the opportunities for the development of the hydrogen market, it can be noted that the British HyDeploy Project demonstrated that a hydrogen admixture up to 20% by volume does not negatively affect the materials used in network infrastructure such as gas pipes and internal installations in buildings—boilers, cooktops, stoves, measurement systems—which implies the possibility of increasing the percentage of hydrogen content in the mixture with natural gas. Additionally, the development of hydrogen technologies—P2G and P2G2P—will allow for the construction of polygeneration systems. (Building a P2G or P2G2P plant at the connection of the electricity system and the gas or hydrogen system can allow surplus electricity to be introduced into the gas or hydrogen system, where it can either be stored (in integral storage systems) or delivered to end users of the gas or hydrogen network. If necessary (e.g., amid an increase in demand for electricity with a decrease in energy production from RESs), hydrogen can be converted into electricity. It can again be fed from the gas system into the electricity grid, meeting the increased demand [

54].) RFNBO hydrogen will be of key importance in the European energy transition for replacing natural gas, crude oil, and coal in industrial sectors and transport where it is difficult to reduce emissions.

On the other hand, threats are associated with the physical properties of hydrogen as an energy carrier, such as hydrogen embrittlement and explosive combustion with a flashback effect (manifesting as the movement of the flame in the hydrogen burner “backward” along the supply line). At the current stage of technological development, these factors eliminate hydrogen from large-scale applications in the energy sector [

78]. The volumetric calorific value of hydrogen is three times lower compared to natural gas, and the flame propagation speed is significantly higher (i.e., 10 times) than that characteristic of methane [

84]. Hydrogen does not occur in a free state and requires extraction from other compounds. The carbon footprint associated with hydrogen depends on its acquisition method; thus, its production may generate high ecological and economic costs.

Other threats are related to the commercialization of technologies at the national and EU levels. The two main technologies used for energy production from hydrogen, i.e., fuel cells and gas turbines (which would have to burn hydrogen instead of gas), have been known for about 200 years but to this day have not found large-scale applications in the energy sector. The inability to store hydrogen in above-ground storage facilities for energy purposes means that large-scale hydrogen storage is currently only possible in underground salt caverns [

86]. (From an energy point of view, only underground gas storage in salt caverns offers the possibility of storing hydrogen on an industrial scale. Currently, the world’s largest liquid hydrogen tank is at the disposal of NASA in Florida. It allows the storage of 3.2 million liters of hydrogen, which allows the operation of the 430 MW GE7H gas turbine for only 8 h [

84]. This critically determines the location of potential power installations using gas-hydrogen turbines only to areas close to salt caverns, which may imply environmental (e.g., devastation of protected areas) or social (e.g., safety concerns) barriers.)

4.4. Regulatory Area

In the regulatory area, five strengths can be distinguished. The first is the possibility of developing a dedicated tariff system for hydrogen transport “from scratch”, utilizing good regulatory practices implemented and tested in gas fuel distribution and transmission. The second concerns the possibility of applying existing tariff solutions for storage, transmission, and distribution operators in the case of storing and injecting a mixture of natural gas and hydrogen into the gas network. The third strength is the adoption within the PHS of a model utilizing the existing gas network for transporting a mixture containing up to 10% of gases other than natural gas—e.g., biomethane or hydrogen. The fourth is related to recognizing hydrogen installations (based on ENTSOG’s postulate of P2G or P2G2P technologies) as energy conversion installations rather than hydrogen production installations. This will allow gas system operators to provide such services not as energy production services but as energy conversion services into another carrier, i.e., converting electricity into hydrogen for its use or storage in the associated gas or hydrogen system (a more likely scenario in the national legislator’s approach than the EU’s). Finally, a strength is the acceptance of the possibility for gas companies to operate in the hydrogen market, including allowing gas system operators to manage hydrogen infrastructure (a more likely scenario in the national legislator’s approach than the EU’s).

A weakness is adapting the existing gas infrastructure for hydrogen blending. This involves redefining the regulatory approach of the Energy Regulatory Office (URE) to tariff proceedings and development plan agreements and, above all, rebuilding the tariff system in the distribution area by creating an entry–exit system or changing the financing model for connections.

The acceptance by the European Commission of the possibility of injecting hydrogen into the existing natural gas network is an important opportunity for the development of the hydrogen market, as are new EU funds for financing investments in hydrogen technologies.

As a threat, one can point to the EC’s promotion of creating a hydrogen market separate from the natural gas market, thus emphasizing the creation of a separate infrastructure dedicated exclusively to transporting and storing high-purity hydrogen. The second threat is the EC’s plan to appoint separate hydrogen network operators and legally separate gas networks from hydrogen networks, which may prevent gas operators from building their own hydrogen transport system. The third is the EC’s recognition of the model of using the existing gas network to transport a mixture of natural gas and hydrogen as less efficient. The fourth threat is the EC’s establishment of a maximum hydrogen admixture limit at interconnection points at 2% by volume, and the fifth is allowing a hydrogen admixture to natural gas at about 10% by volume in most EU countries. The last threat is the EC’s limitation of the role of gas companies in the hydrogen market, which eliminates the possibility of utilizing these enterprises’ technological and organizational competencies.

5. Discussion

The analysis conducted in this paper reveals that integrating RFNBO hydrogen into Poland’s energy sector presents both significant opportunities and notable challenges, directly addressing the research questions posed.

Firstly, regarding the key strengths and weaknesses associated with integrating RFNBO hydrogen, the strengths include the potential for Poland to reduce its reliance on fossil fuels, particularly natural gas, and to advance toward energy independence. Hydrogen’s applicability in hard-to-electrify sectors such as heavy industry, transport, and large-scale heating positions it as a vital component in decarbonizing the economy. The prospect of substantial investments of up to 470 billion euros by 2050 can stimulate economic growth and technological innovation. Moreover, existing infrastructure like gas pipelines and underground storage can be repurposed for hydrogen, leveraging the current competencies of gas operators [

87]. However, weaknesses are evident in the current low share of hydrogen in Poland’s energy mix and its predominant production from fossil fuels, which undermines its environmental benefits. Significant infrastructural developments are required, including building new transport and storage facilities or adapting existing gas networks for hydrogen use, which is both time-consuming and capital-intensive. Technological challenges, such as ensuring the safe combustion and storage of hydrogen and the lack of standards for end-user equipment, present barriers to widespread adoption. Additionally, high initial costs and the need for substantial budget allocations without immediate technological breakthroughs may deter legislative support.

Secondly, regarding the opportunities and threats Poland faces in adopting hydrogen, opportunities arise from European Union support mechanisms, including funding from the European Hydrogen Bank and the Innovation Fund dedicated to building electrolyzers. Global trends indicate a significant increase in the share of RFNBO hydrogen in the economy by 2030, with expectations of hydrogen meeting 24% of global energy demand by 2050. Technological advancements, such as the decreasing costs of electrolyzers and successful demonstrations of safe hydrogen blending in gas networks, increase the case for hydrogen adoption. Conversely, threats include the high production costs of RFNBO hydrogen, currently around 15 euros/kg, which hinders its competitiveness and widespread use, especially in transport. Regulatory uncertainties posed by the European Commission’s preference for creating a separate hydrogen market and infrastructure may limit the ability of existing gas companies to leverage their competencies. They could result in increased costs and duplication of efforts. The physical properties of hydrogen, such as its lower energy density, and safety concerns, such as hydrogen embrittlement and explosive combustion, pose significant technical challenges. Societal acceptance may be hindered by stereotypes and the lack of public understanding of hydrogen’s safety and benefits.

6. Policy Implications

Thirdly, this analysis underscores the necessity for a coordinated and strategic approach regarding how the identified factors should inform strategic decisions for policymakers and industry stakeholders. Policymakers should focus on creating supportive regulatory frameworks that facilitate investment and address infrastructural challenges. This includes aligning national strategies with EU directives, while advocating for flexibility to utilize existing gas infrastructure where feasible. Investment in R&D&I is crucial to overcome technological barriers, improve safety standards, and reduce production costs. Emphasizing education and training programs can prepare a skilled workforce to support the hydrogen economy. Industry stakeholders, particularly in the energy and gas sectors, can capitalize on opportunities by investing in hydrogen technologies, participating in pilot projects, and forming partnerships with research institutions and international bodies. They can reduce costs and accelerate the transition by leveraging existing infrastructures and competencies. Another challenge to the large-scale deployment of hydrogen technologies in Poland (and beyond) is overcoming public resistance linked to safety misconceptions. To address this, policymakers could implement targeted social campaigns that explain how hydrogen is produced, stored, and transported, emphasizing rigorous safety standards and successful real-world applications. Public engagement efforts—such as interactive workshops, site visits to demonstration projects, or partnerships with local educational institutions—would increase transparency and foster trust. Addressing societal concerns through transparent communication and demonstrating hydrogen’s safety and environmental benefits can contribute to public acceptance.

In conclusion, while integrating RFNBO hydrogen into Poland’s energy sector presents substantial challenges, the potential benefits of decarbonization, energy independence, and economic growth are significant. Strategic investments, supportive policies, and technological innovation are essential to capitalize on hydrogen’s potential. Given the urgency of the energy transition and the limitations of solely relying on renewable energy sources, hydrogen stands out as a critical component in achieving Poland’s climate neutrality goals, especially in sectors where renewable energy integration is challenging. Developing large-scale energy storage technologies and addressing regulatory and societal barriers will be pivotal in realizing hydrogen’s benefits. The findings suggest that with coordinated efforts, Poland can effectively integrate hydrogen into its energy strategy, both advancing its national interests and contributing to global climate objectives. Future research should focus on detailed pathway analyses, techno-economic assessments, and policy development to facilitate the effective adoption of hydrogen technologies and to overcome the identified challenges.

The energy transition of the Polish economy will involve exceptionally high economic and social costs, and without the implementation of renewable gas production technologies—including RFNBO hydrogen—it will be difficult to carry out.

However, developing RFNBO hydrogen production technologies requires implementing many regulatory and support tools, including subsidizing hydrogen production or financing the research and development of hydrogen technologies by the State. The current level of development of large-scale, above-ground hydrogen storage technologies, as well as the development of hydrogen combustion technologies using gas turbines, requires a significant amount of time for research from the perspective up to 2030.

Policymakers should support RFNBO market development through legislative initiatives in the logistic area (transport and storage facilities). Local governments need to face the lack of standards for end-user equipment and start to develop new technological solutions to support the final chain of the hydrogen industry.

7. Future Prospects

However, hydrogen is becoming an alternative for Polish district heating, given the current lack of technology to power domestic heating networks, assuming fossil fuel is eliminated. Also, blending hydrogen into natural gas and transporting such fuel gives the Polish gas industry a chance to maintain the role of a transitional fuel in the EU’s energy transition, despite the geopolitical and transactional risks that have materialized in Europe due to Russia-Ukraine conflict. However, further discussion and prospective research to illustrate how Poland’s specific regulations—particularly those concerning the blending of hydrogen with natural gas infrastructure and the Polish Hydrogen Strategy—differ from or align with the policies in other EU member states is required.

It should be remembered that replacing energy based on fossil fuels with energy based solely on renewable sources—such as wind, solar, geothermal energy, or biomass energy—will not be possible until large-scale energy storage technologies are developed.

Future studies should be concerned with the environmental benefits of hydrogen, addressing the life-cycle emissions associated with different hydrogen production methods, and considering crucial elements such as water use, waste creation, greenhouse gas emissions, and land needs. Potential environmental hot spots should be identified; the assessment should include the process from raw material extraction to the final product. Research should primarily include the pricing of carbon processes. To increase the effectiveness and environmental sustainability of hydrogen production, emphasis should be placed on electrolysis methods and thermochemical and biomass gasification. It is crucial to assess the environmental consequences of hydrogen-generating processes for their long-term viability.

Future research should also focus on systematically measuring the social acceptance of hydrogen across diverse regions and demographic groups. This could involve nationwide surveys, in-depth interviews, and focus groups to identify specific risk perceptions and information gaps. By combining community-based outreach with evidence-based insights into public perceptions, policymakers, industry leaders, and researchers can design communication strategies that resonate with local contexts and effectively address safety concerns. These efforts will be critical in ensuring that hydrogen’s environmental and economic benefits are understood and widely embraced.

According to the economics issues, statistics research can provide models and simulations to comprehensively assess the uncertainties in demand and hydrogen production costs. Future investigations should be concerned with conducting sensitivity analyses for various scenarios, such as technological breakthroughs, policy changes, and market demand fluctuations.

8. Conclusions

The SWOT analysis revealed four main areas in which weaknesses, strengths, opportunities, and threats can be distinguished:

8.1. Economic Area

In this area, it will be crucial to use the opportunity that hydrogen has as a recommended technology, a fundamental raw material necessary for conducting an effective energy transition for Polish energy corporations. This process can be supported by the European Hydrogen Bank and other measures, but hydrogen will need to be integrated alongside other renewable solutions and storage technologies to effectively contribute to Poland’s transition. A major weakness may still be the low share of hydrogen in the country’s energy mix and the fact that the country’s hydrogen production is mainly from fossil sources.

8.2. Social Area

In the social area, great opportunities are seen in emerging scientific units educating engineers, technologists, and R&D&I activities in commercial hydrogen applications. Additionally, hydrogen technologies can provide one million new jobs in the EU. The stereotype of the community of hydrogen as an explosive fuel may be a substantial social concern.

8.3. Technological Area

The technological part indicates hydrogen as one of the viable options for collecting and storing energy produced from RESs in the country. It can play a key role in energy transformation as RFNBO is an ecological energy source. However, investments in appropriate infrastructure, technical standards, and certifications that allow the safe use of hydrogen seem necessary.

8.4. Regulatory Area

The regulatory area indicates the possibility of developing a dedicated tariff system for hydrogen transport in Poland utilizing good regulatory practices. New EU funds for financing investments in hydrogen technologies can significantly speed up the process of adapting new technologies to the specifics of a given country.

Hydrogen RFNBO shows promise as a future-proof, ecological energy carrier but faces notable cost, infrastructural, and policy challenges that may slow its adoption. Still, comprehensive support is necessary if hydrogen is to become a significant part of Poland’s energy portfolio, particularly in meeting stringent climate targets, economic and financial viability, and ensuring public acceptance.