Prudent Electricity Procurement by a Load Serving Entity

Abstract

1. Introduction

- (1)

- What factors influence an LSE’s demand for solar and wind energy? The answer to this question informs the nexus between VRE development and an LSE’s procurement of energy from multiple supply sources under wholesale electricity price uncertainty.

- (2)

- Does an LSE tend to procure more solar capacity than wind capacity? An affirmative answer helps mitigate some of the concerns that escalating VRE development may adversely affect an electric system’s operation and reliability. VRE generation depends on random weather conditions. In many areas of the world (e.g., arid areas with ample sunshine), solar irradiance is a more reliable and predictable resource than windspeed.

- (3)

- Do energy price changes induce an LSE to become carbon-free? An affirmative answer complements the major drivers known to accelerate an electric grid’s pathway to deep decarbonisation. Examples of such drivers include electrification [13], low-cost battery storage [14], transmission expansion [15], solar energy cost decline [10], wind energy cost decline [11], and improved VRE integration [16].

- (4)

- Are the solar and wind purchases of an LSE price elastic? An affirmative answer suggests that demands for solar and wind generation can be managed through policies that affect the price of generation from these sources [6].

- (5)

- Is the demand for solar and wind energy by an LSE responsive to changes in factors unrelated to energy price levels (e.g., retail sales by time of day)? An affirmative answer guides policies which might influence VRE development (e.g., R&D funding to improve solar and wind generation’s output performance).

- An LSE’s MWh demands are affected by the energy prices of solar and wind PPAs and forward contracts, daytime and nighttime retail sales, solar and wind capacity factors, and daytime and nighttime spot energy price forecast levels, standard deviations, and correlations.

- An LSE’s solar capacity procurement is about twice the wind capacity procurement, thus corroborating the ratios of projected solar and wind capacity additions noted at the beginning of this section.

- If an LSE has an energy mix that is nearly all renewable, it becomes carbon-free when solar and wind PPAs continue to have declining energy prices or when forward energy price (i.e., the fixed energy price of a forward contract) and spot energy price forecasts increase over time.

- An LSE’s MWh demands are highly price-elastic. The own-price elasticity estimates are −2.63 for solar energy demand, −10.52 for wind energy demand, −13.10 for forward energy demand, −4.49 for daytime spot energy demand, and −1.87 for nighttime spot energy demand. These elasticity estimates are much larger in size than those found by the plethora of commercial electricity demand studies reported by [26]. This makes sense because an LSE’s main line of business is the resale of wholesale electricity, unlike commercial establishments (e.g., grocery stores, restaurants, schools, hospitals, etc.) that use electricity, natural gas, and fuel oil for meeting their end-use requirements for air conditioning, cooking, lighting, refrigeration, space heating, water heating, etc.

- Cross-price elasticity estimates suggest that VRE and non-VRE can be complements or substitutes in an LSE’s procurement plan. This is expected as daytime solar energy and daytime spot energy are substitutes. However, VRE and non-VRE exhibit complementarity when meeting the LSE’s retail sales targets by TOD.

- An LSE’s MWh demands are responsive to changes in factors unrelated to energy price levels (e.g., retail sales by TOD and solar and wind generation’s output performance).

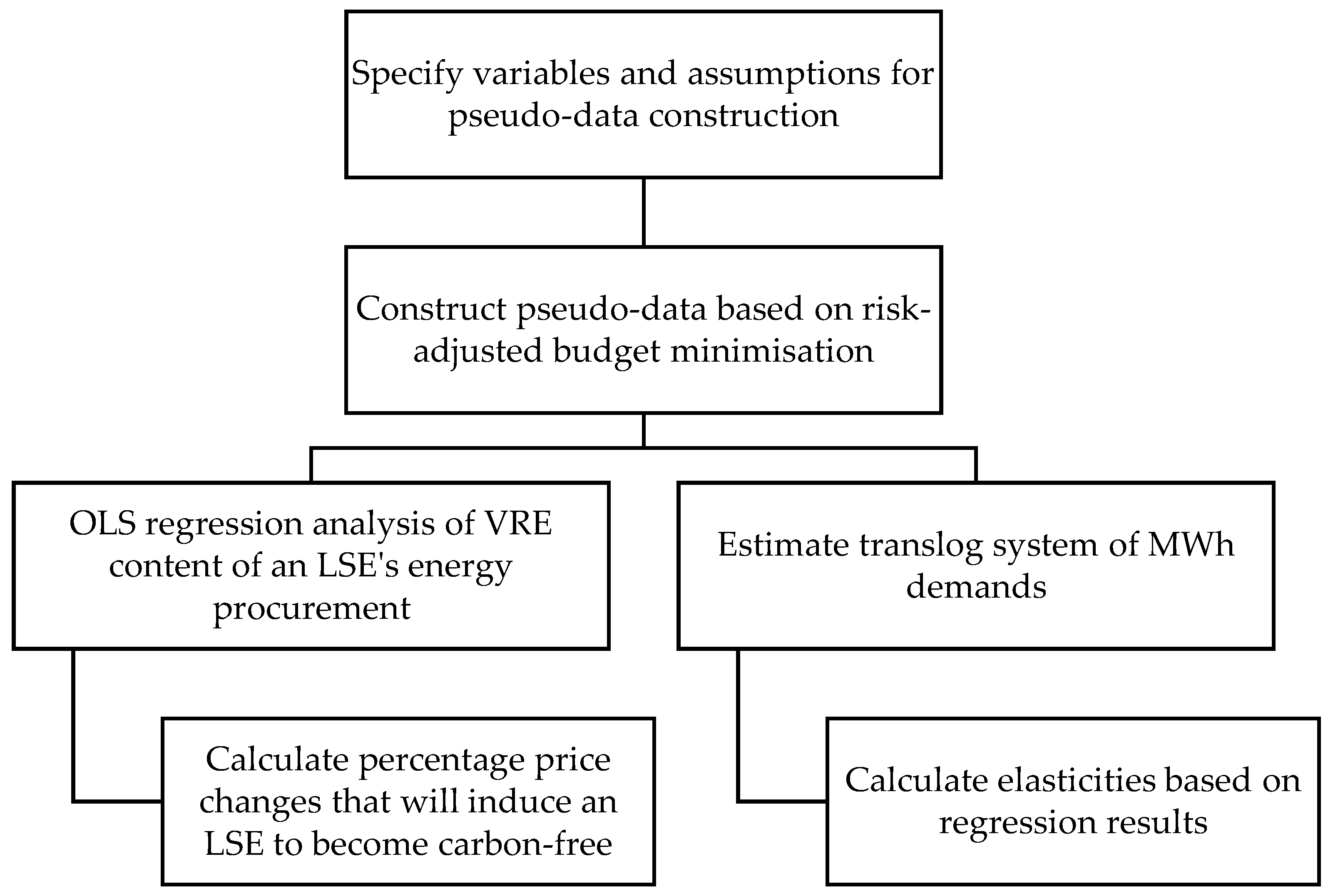

2. Materials and Methods

2.1. Assumptions and Scenarios for Pseudo-Data Construction

2.2. Risk-Adjusted Budget Minimisation

- (1)

- Calculate the B values associated with the 1,030,301 combinations of β, ϕ, and λ for S1 that denote the first possible scenario.

- (2)

- Find the interior solutions for β*, ϕ*, and λ* for S1. To avoid the problem of empirically implausible elasticity estimates, the final sample only contains solutions with energy cost shares ≥ 0.05. These interior solutions realistically reflect that ~50% of Texas’s total installed generation capacity is solar and wind. Due to the need for revenue stability that aids the project financing of VRE developers, a majority of Texas’s total VRE capacity is sold via solar and wind PPAs to LSEs that offer retail pricing plans differentiated by VRE content (https://www.powertochoose.org). Further, unlike power traders, LSEs in Texas do not procure surplus VRE and forward energy on an annual basis for profitable resale in the wholesale spot energy market.

- (3)

- Use the results from Step (2) to calculate K* = optimal VRE capacity = β*Q ÷ H [ϕ∗ α + (1 − ϕ∗) (ω + φ)]; K1* = ϕ* K* = optimal solar capacity; K2* = (1 − ϕ*) K* = optimal wind capacity; Q1* = solar energy demand = H α ϕ* K*; Q2* = wind energy demand = H (ω + φ) (1 − ϕ*) K*; Q3*= forward energy demand = λ* (Q − Q1* − Q2*) = λ* (1 − β*) Q; Q4* = daytime spot energy demand = Z Q − Q1* − [ω/(ω + φ)] Q2* − Q3*/2; Q5* = nighttime spot energy demand = (1 − Z) Q − [φ/(ω + φ)] Q2* − Q3*/2; and β* = (Q1* + Q2*)/Q = optimal VRE content of Q. The resulting K*, K1*, K2*, Q1* to Q5*, and β* constitute the first observation for an LSE’s MWh demands.

- (4)

- Repeat Steps (1) to (3) to obtain K*, K1*, K2*, Q1* to Q5*, and β* for the remaining scenario Sn, where n = 2, …, N. As shown in Table 2, N = 1,062,822, which is lower than 1,594,323, the total number of possible scenarios. This discrepancy arises because some scenarios lack the necessary interior solutions.

| Panel A: Interior solutions for risk-adjusted budget minimisation | |||||

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

| K1* (MW) | 290.20 | 55.71 | 494.13 | 1.17 | 2386.61 |

| K2* (MW) | 189.59 | 33.85 | 361.29 | 0.60 | 1990.33 |

| K1*/K2* | 8.44 | 2.33 | 12.24 | 0.03 | 99.00 |

| Q1* (MWh) | 564,322 | 105,869 | 886,528 | 3532 | 3,150,714 |

| Q2* (MWh) | 696,092 | 129,709 | 1,258,470 | 3389 | 4,578,648 |

| Q3* (MWh) | 561,555 | 126,592 | 1,142,985 | 3776 | 4,164,160 |

| Q4* (MWh) | 313,197 | 104,580 | 630,082 | 3483 | 3,143,878 |

| Q5* (MWh) | 544,834 | 126,039 | 799,643 | 5146 | 2,757,560 |

| β* | 0.47 | 0.50 | 0.29 | 0.05 | 0.91 |

| Panel B: Assumptions underlying the interior solutions shown in Panel A | |||||

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

| Q (GWh) | 2680 | 2680 | 2520 | 160 | 5200 |

| Z | 0.55 | 0.55 | 0.08 | 0.45 | 0.65 |

| α | 0.50 | 0.50 | 0.16 | 0.30 | 0.70 |

| ω | 0.40 | 0.40 | 0.16 | 0.20 | 0.60 |

| ϕ | 0.50 | 0.50 | 0.16 | 0.30 | 0.70 |

| F1 ($/MWh) | 40 | 40 | 12.2 | 25 | 55 |

| F2 ($/MWh) | 40 | 40 | 12.2 | 25 | 55 |

| F3 ($/MWh) | 40 | 40 | 8.2 | 30 | 50 |

| μD ($/MWh) | 40 | 40 | 12.2 | 25 | 55 |

| σD ($/MWh) | 7.50 | 7.50 | 1.22 | 6.00 | 9.00 |

| μN ($/MWh) | 30 | 30 | 8.16 | 20 | 40 |

| σN ($/MWh) | 5.00 | 5.00 | 0.82 | 4.00 | 6.00 |

| ρ | 0.80 | 0.80 | 0.08 | 0.70 | 0.90 |

2.3. What Induces an LSE to Become Carbon-Free?

| Panel A: Regression results | |||||||||

| Variable (Coefficient of Primary Interest) | Estimate | Standard Error | p-Value | ||||||

| Regressand’s mean | 0.4723 | ||||||||

| Adjusted R2 | 0.6687 | ||||||||

| RMSE | 0.1681 | ||||||||

| Intercept | 1.6436 | 0.0057 | <0.001 | ||||||

| lnZ | 0.2608 | 0.0011 | <0.001 | ||||||

| lnα | 0.0033 | 0.0005 | <0.001 | ||||||

| lnω | 0.0049 | 0.0004 | <0.001 | ||||||

| lnϕ | 0.0068 | 0.0005 | <0.001 | ||||||

| lnρ | 0.0035 | 0.0016 | 0.029 | ||||||

| lnQ | −0.0012 | 0.0001 | <0.001 | ||||||

| lnF1 (η1) | −0.2520 | 0.0005 | <0.001 | ||||||

| lnF2 (η2) | −0.6071 | 0.0004 | <0.001 | ||||||

| lnF3 (η3) | 0.3659 | 0.0008 | <0.001 | ||||||

| lnμD (ηD) | 0.2089 | 0.0011 | <0.001 | ||||||

| lnσD | 0.0071 | 0.0010 | <0.001 | ||||||

| lnμN (ηN) | 0.0193 | 0.0011 | <0.001 | ||||||

| lnσN | 0.0064 | 0.0010 | <0.001 | ||||||

| Panel B: Estimated percentage price changes that would induce an LSE to become carbon-free | |||||||||

| Percentage Price Change | β0 = Existing VRE Content | ||||||||

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | |

| VRE: ζ = (1 − β0)/(η1 + η2) | −104.8% | −93.1% | −81.5% | −69.8% | −58.2% | −46.6% | −34.9% | −23.3% | −11.6% |

| Non-VRE: ν = (1 − β0)/(η3 + ηD + ηN) | 151.5% | 134.7% | 117.8% | 101.0% | 84.2% | 67.3% | 50.5% | 33.7% | 16.8% |

2.4. Translog Specification of a System of MWh Demands

| Variable | Equation (1): Regressand = W1 | Equation (2): Regressand = W2 | Equation (3): Regressand = W3 | Equation (4): Regressand = W4 | ||||

|---|---|---|---|---|---|---|---|---|

| Estimate | Standard Error | Estimate | Standard Error | Estimate | Standard Error | Estimate | Standard Error | |

| Sample mean of Wj | 0.2281 | 0.2528 | 0.2118 | 0.121 | ||||

| Adjusted R2 | 0.5140 | 0.6348 | 0.5291 | 0.4227 | ||||

| RMSE | 0.1338 | 0.1586 | 0.1750 | 0.1060 | ||||

| Intercept | 0.3543 | 0.0013 | 0.4615 | 0.0016 | 0.3348 | 0.0018 | 0.1026 | 0.0012 |

| lnF1 | −0.2296 | 0.0004 | 0.0825 | 0.0003 | 0.1496 | 0.0004 | 0.1700 | 0.0003 |

| lnF2 | 0.0825 | 0.0003 | −0.5963 | 0.0005 | 0.2685 | 0.0004 | 0.0467 | 0.0003 |

| lnF3 | 0.1496 | 0.0004 | 0.2685 | 0.0004 | −0.6997 | 0.0007 | 0.0846 | 0.0004 |

| lnμD | 0.1700 | 0.0003 | 0.0467 | 0.0003 | 0.0846 | 0.0004 | −0.1866 | 0.0004 |

| lnμN | −0.1726 | 0.0002 | 0.1986 | 0.0003 | 0.1971 | 0.0004 | −0.1147 | 0.0003 |

| lnZ | 0.4439 | 0.0009 | −0.1724 | 0.0010 | −0.1145 | 0.0011 | 0.2025 | 0.0007 |

| lnVD | −0.0313 | 0.0004 | 0.0491 | 0.0005 | 0.0394 | 0.0006 | −0.0157 | 0.0004 |

| lnVN | −0.0185 | 0.0004 | 0.0931 | 0.0005 | 0.0335 | 0.0006 | −0.0393 | 0.0004 |

| lnρ | 0.0008 | 0.0013 | 0.0028 | 0.0015 | 0.0079 | 0.0017 | −0.0065 | 0.0010 |

| lnα | 0.0060 | 0.0004 | −0.0009 | 0.0004 | −0.0019 | 0.0005 | −0.0037 | 0.0003 |

| lnω | −0.0506 | 0.0003 | 0.0498 | 0.0003 | −0.0107 | 0.0004 | −0.0263 | 0.0002 |

| lnϕ | 0.0508 | 0.0004 | −0.0382 | 0.0004 | 0.0064 | 0.0005 | 0.0246 | 0.0003 |

| MWh Demand | Elasticities of Qj* with Respect to the Variables Listed Below | ||||

|---|---|---|---|---|---|

| F1 | F2 | F3 | μD | μN | |

| Q1* | −2.63 | 1.57 | 2.82 | 3.42 | −1.50 |

| Q2* | 0.95 | −10.52 | 4.90 | 0.97 | 2.24 |

| Q3* | 1.54 | 4.42 | −13.10 | 1.69 | 2.18 |

| Q4* | 1.45 | 0.81 | 1.57 | −4.49 | −0.98 |

| Q5* | −1.22 | 3.47 | 3.66 | −1.93 | −1.87 |

2.5. Elasticities

3. Empirics

| MWh Demand | Elasticities of Qj* with Respect to the Variables Listed Below | ||||||

|---|---|---|---|---|---|---|---|

| Z | VD | VN | ρ | α | ω | ϕ | |

| Q1* | 3.56 | −0.23 | −0.13 | 0.01 | 0.05 | −0.40 | 0.41 |

| Q2* | −2.68 | 0.82 | 1.54 | 0.05 | −0.01 | 0.80 | −0.61 |

| Q3* | −1.84 | 0.70 | 0.60 | 0.14 | −0.03 | −0.19 | 0.11 |

| Q4* | 3.83 | −0.28 | −0.71 | −0.12 | −0.07 | −0.50 | 0.46 |

| Q5* | −3.02 | −0.37 | −0.61 | −0.05 | 0.01 | 0.32 | −0.37 |

- The daytime share of an LSE’s annual sales target matters. Specifically, a 1% increase in Z tends to raise Q1* and Q4* by 3.6% to 3.8% and reduce Q2*, Q3*, and Q5* by 1.8% to 3.0%.

- The coefficients of variation in the energy price forecasts by TOD matter. A 1% increase in VD tends to reduce Q1* by 0.23% but increase Q2* by 0.82%. A 1% increase in VN tends to reduce Q1* by 0.13% but increase Q2* by 1.54%. Hence, stabilizing spot energy prices by TOD due to an increase in ERCOT’s operating and planning reserves tends to have relatively small effects on solar and wind MWh demands.

- Changes in solar and wind capacity factors have mixed effects on solar and wind MWh demands. To wit, a 1% increase in α tends to increase solar MWh demand by 0.05% and reduce wind MWh demand by 0.01%. Hence, marginally improving VRE generation’s output performance is unlikely to materially increase solar and wind MWh demands. This makes sense because of an LSE’s focus on VRE delivery, implying that the LSE’s procurement of VRE capacities has already accounted for the delivery effects of VRE capacity factor improvements.

4. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

Appendix A. Formula for Calculating EjX

References

- Mahone, A.; Subin, Z.; Orans, R.; Miller, M.; Regan, L.; Calviou, M.; Saenz, M.; Bacalao, N. On the path of decarbonization. IEEE Power Energy Mag. 2018, 16, 58–68. [Google Scholar] [CrossRef]

- Poudyal, R.; Loskot, P.; Nepal, R.; Parajuli, R.; Khadka, S.K. Mitigating the current energy crisis in Nepal with renewable energy sources. Renew. Sustain. Energy Rev. 2019, 116, 109388. [Google Scholar] [CrossRef]

- Simshauser, P. Merchant renewables and the valuation of peaking plant in energy-only markets. Energy Econ. 2020, 91, 104888. [Google Scholar] [CrossRef]

- Peña, J.I.; Rodríguez, R.; Mayoral, S. Cannibalization, depredation, and market remuneration of power plants. Energy Policy 2022, 167, 113086. [Google Scholar] [CrossRef]

- Li, Y.; Tang, X.; Liu, M.; Chen, G. The benefits and burdens of wind power systems in reaching China’s renewable energy goals: Implications from resource and environment assessment. J. Clean. Prod. 2024, 481, 144134. [Google Scholar] [CrossRef]

- Woo, C.K.; Cao, K.H.; Qi, H.S.; Zarnikau, J.; Li, R. Price responsiveness of solar and wind capacity demands. J. Clean. Prod. 2024, 462, 142705. [Google Scholar] [CrossRef]

- Energy Institute. Statistical Review of World Energy 2024. Available online: https://www.energyinst.org/statistical-review (accessed on 20 January 2025).

- Kapica, J.; Canales, F.A.; Jurasz, J. Global atlas of solar and wind resources temporal complementarity. Energy Convers. Manag. 2021, 246, 114692. [Google Scholar] [CrossRef]

- Alagappan, L.; Orans, R.; Woo, C.K. What drives renewable energy development? Energy Policy 2011, 39, 5099–5104. [Google Scholar] [CrossRef]

- Bolinger, M.; Seel, J.; Warner, C.; Robson, D. Utility-Scale Solar, 2021 Edition: Empirical Trends in Deployment, Technology, Cost, Performance, PPA Pricing, and Value in the United States. 2021. Lawrence Berkeley National Laboratory. Available online: https://escholarship.org/content/qt080872q5/qt080872q5.pdf (accessed on 9 December 2024).

- Wiser, R.; Bolinger, M.; Hoen, B.; Millstein, D.; Rand, J.; Barbose, G.; Darghouth, N.; Gorman, W.; Jeong, S.; Mills, A.; et al. Land-Based Wind Market Report: 2021 Edition. 2021. Lawrence Berkeley National Laboratory. Available online: https://escholarship.org/content/qt4sb6r5mz/qt4sb6r5mz.pdf (accessed on 9 December 2024).

- Carvallo, J.P.; Murphy, S.P.; Sanstad, A.; Larsen, P.H. The use of wholesale market purchases by U.S. electric utilities. Energy Strategy Rev. 2020, 30, 100508. [Google Scholar] [CrossRef]

- Williams, J.H.; DeBenedictis, A.; Ghanadan, R.; Mahone, A.; Moore, J.; Morrow, W.R.; Price, S.; Torn, M.S. The technology path to deep greenhouse gas emissions cuts by 2050: The pivotal role of electricity. Science 2012, 6064, 53–59. [Google Scholar] [CrossRef] [PubMed]

- Milstein, I.; Asher, A.; Woo, C.K. Carbon-free electricity supply in a Cournot wholesale market: Israel. Energy J. 2024, 45, 69–89. [Google Scholar] [CrossRef]

- Davis, L.; Hausman, C.; Rose, N. Transmission impossible? Prospects for decarbonizing the US grid. J. Econ. Perspect. 2023, 37, 155–180. [Google Scholar] [CrossRef]

- Holttinen, H.; Groom, A.; Kennedy, E.; Woodfin, D.; Barroso, L.; Orths, A.; Ogimoto, K.; Wang, C.; Moreno, R.; Parks, K.; et al. Variable renewable energy integration: Status around the world. IEEE Power Energy Mag. 2021, 19, 86–96. [Google Scholar] [CrossRef]

- Public Utility Commission of Texas. Scope of Competition in Electric Markets in Texas: Report to the 86th Legislature. 2019. Available online: https://ftp.puc.texas.gov/public/puct-info/industry/electric/reports/scope/2019/2019scope_elec.pdf (accessed on 28 January 2025).

- Ela, E.; Billimoria, F.; Ragsdale, K.; Moorty, S.; O’Sullivan, J.; Gramlich, R.; Rothleder, M.; Rew, B.; Supponen, M.; Sotkiewicz, P. Future electricity markets: Designing for massive amounts of zero-variable-cost renewable resources. IEEE Power Energy Mag. 2021, 17, 58–66. [Google Scholar] [CrossRef]

- Roselund, C. Is the U.S. Solar Market Slipping towards Merchant? 2019. Available online: https://www.pv-magazine.com/2019/06/24/is-the-u-s-solar-market-slipping-towards-merchant/ (accessed on 9 December 2024).

- Gohdes, N.; Simshauser, P.; Wilson, C. Renewable entry costs, project finance and the role of revenue quality in Australia’s National Electricity Market. Energy Econ. 2022, 114, 106312. [Google Scholar] [CrossRef]

- Cao, K.H.; Qi, H.S.; Woo, C.K.; Zarnikau, J.; Li, R. Efficient frontiers for short-term sales of spot and forward wind energy in Texas. Energy J. 2024, 45, 37–60. [Google Scholar] [CrossRef]

- Qi, H.S.; Cao, K.H.; Woo, C.K.; Zarnikau, J.; Li, R. Revenue analysis of spot and forward solar energy sales in Texas. J. Energy Mark. 2024, 17, 1–38. [Google Scholar] [CrossRef]

- Wolak, F.A.; Kolstad, C.D. A model of homogeneous input demand under price uncertainty. Am. Econ. Rev. 1991, 81, 514–538. [Google Scholar]

- Woo, C.K.; Karimov, R.; Horowitz, I. Managing electricity procurement cost and risk by a local distribution company. Energy Policy 2004, 32, 635–645. [Google Scholar] [CrossRef]

- Jorion, P. Value at Risk; Irwin: Chicago, IL, USA, 1997. [Google Scholar]

- Li, R.; Woo, C.K. How price responsive is commercial electricity demand in the US? Electr. J. 2022, 35, 107066. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 8th ed.; Pearson: New York, NY, USA, 2017. [Google Scholar]

- Griffin, J.M. Long-run production modeling with pseudo data: Electric power generation. Bell J. Econ. 1977, 8, 112–127. [Google Scholar] [CrossRef]

- Ming, Z.; Delgado, D.; Schlag, N.; Olson, A.; Wintermantel, N.; Dombrowky, A.; Amitava, R. Assessment of Market Reform Options to Enhance Reliability of the ERCOT System; Report Prepared by Energy and Environmental Economics, Inc. (E3) for the Public Utility Commission of Texas; Energy and Environmental Economics, Inc.: San Francisco, CA, USA, 2022. [Google Scholar]

- Sioshansi, F.P. Evolution of Global Electricity Markets: New Paradigms, New Challenges, New Approaches; Elsevier: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Menezes, C.F.; Hanson, D.L. On the theory of risk aversion. Int. Econ. Rev. 1970, 11, 481–487. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R. Global properties of flexible functional forms. Am. Econ. Rev. 1980, 70, 422–432. [Google Scholar]

- Sioshansi, R.; Hurlbut, D. Market protocols in ERCOT and their effect on wind generation. Energy Policy 2010, 38, 3192–3197. [Google Scholar] [CrossRef]

- Wilkerson, J.; Larsen, P.; Barbose, G. Survey of Western U.S. electric utility resource plans. Energy Policy 2014, 66, 90–103. [Google Scholar] [CrossRef]

- Kleindorfer, P.R.; Li, L. Multi-period VaR-constrained portfolio optimization with applications to the electric power Sector. Energy J. 2005, 26, 1–26. [Google Scholar] [CrossRef]

- Haar, L.; Haar, L. An option analysis of the European Union renewable energy support mechanisms. Econ. Energy Environ. Policy 2017, 6, 131–148. [Google Scholar] [CrossRef]

- Varian, H.R. Microeconomic Analysis, 3rd ed.; Norton: New York, NY, USA, 1992. [Google Scholar]

| Variable | Definition | Assumed Values | Remark | ||

|---|---|---|---|---|---|

| Low | Medium | High | |||

| Q (GWh) | An LSE’s annual retail sales target | 1 | 160 | 5200 | Q’s values are based on the range of retail sales of LSEs in Texas. |

| Z | Daytime share of Q | 0.45 | 0.55 | 0.65 | Z’s values are based on the range of retail sales by time of day of LSEs in Texas. |

| α | Daytime solar capacity factor | 0.3 | 0.5 | 0.7 | These capacity factor ranges are based on a sample of 47 solar plants and 272 wind farms already in commercial operation. |

| ω | Daytime wind capacity factor | 0.2 | 0.4 | 0.6 | |

| ϕ | Nighttime wind capacity factor | 0.3 | 0.5 | 0.7 | |

| F1 ($/MWh) | Solar energy price | 25 | 40 | 55 | These price ranges match those recently observed in Texas. |

| F2 ($/MWh) | Wind energy price | 25 | 40 | 55 | |

| F3 ($/MWh) | Forward energy price | 30 | 40 | 50 | |

| μD ($/MWh) | Daytime spot energy price forecast | 25 | 40 | 55 | These ranges are based on the spot energy price forecast results for Texas. |

| σD ($/MWh) | Standard deviation of μD | 6 | 7.5 | 9 | |

| μN ($/MWh) | Nighttime spot energy price forecast | 20 | 30 | 40 | |

| σN ($/MWh) | Standard deviation of μN | 4 | 5 | 6 | |

| r | Correlation of μD and μN | 0.7 | 0.8 | 0.9 | r’s values are based on the correlation of ERCOT’s daytime and nighttime spot energy prices. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, K.H.; Qi, H.S.; Woo, C.-K.; Zarnikau, J.W.; Li, R. Prudent Electricity Procurement by a Load Serving Entity. Energies 2025, 18, 726. https://doi.org/10.3390/en18030726

Cao KH, Qi HS, Woo C-K, Zarnikau JW, Li R. Prudent Electricity Procurement by a Load Serving Entity. Energies. 2025; 18(3):726. https://doi.org/10.3390/en18030726

Chicago/Turabian StyleCao, Kang Hua, Han Steffan Qi, Chi-Keung Woo, Jay William Zarnikau, and Raymond Li. 2025. "Prudent Electricity Procurement by a Load Serving Entity" Energies 18, no. 3: 726. https://doi.org/10.3390/en18030726

APA StyleCao, K. H., Qi, H. S., Woo, C.-K., Zarnikau, J. W., & Li, R. (2025). Prudent Electricity Procurement by a Load Serving Entity. Energies, 18(3), 726. https://doi.org/10.3390/en18030726