The Impact of Fossil Energy Prices on Carbon Emissions: The Dual Mediation of Energy Efficiency and Renewable Energy

Abstract

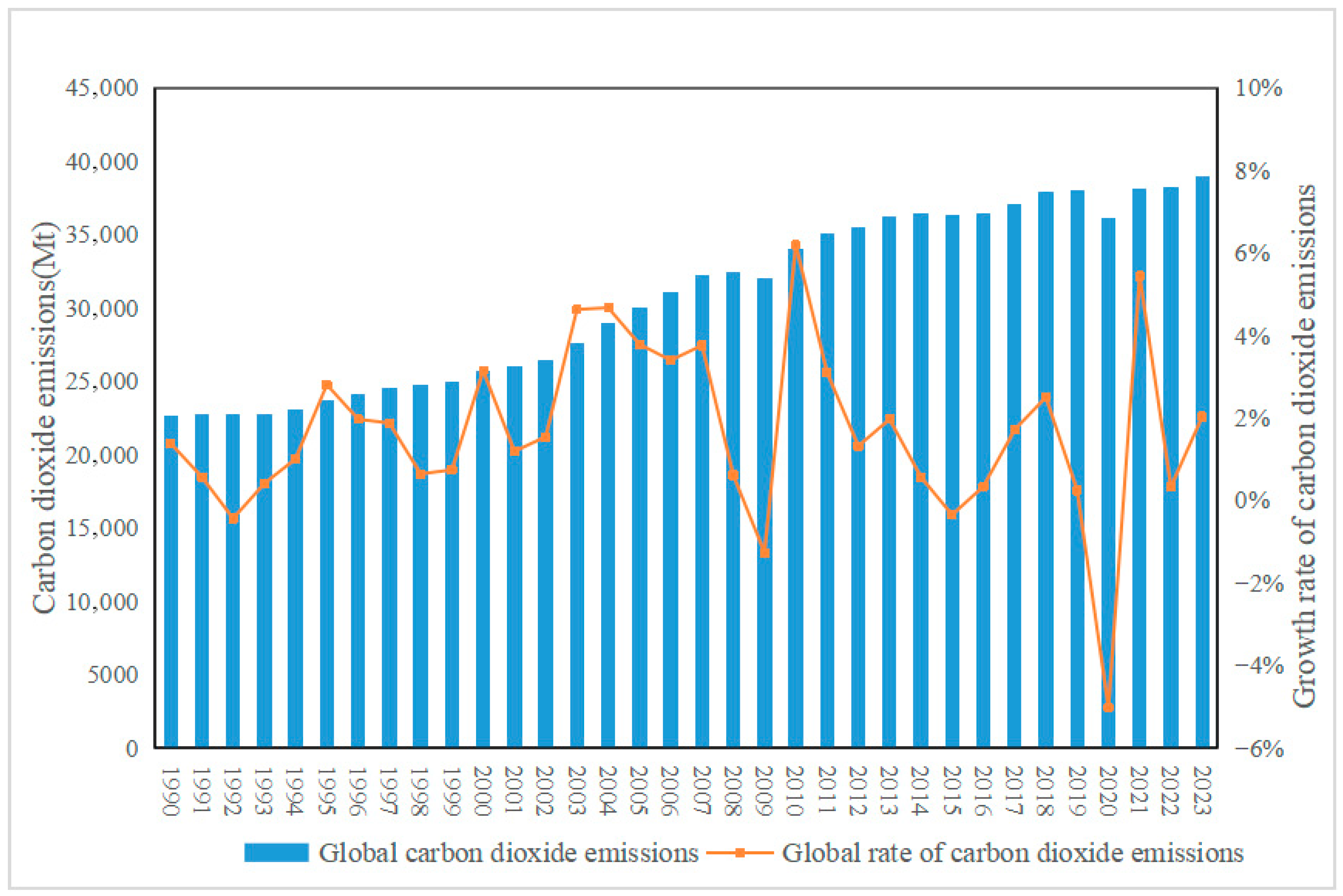

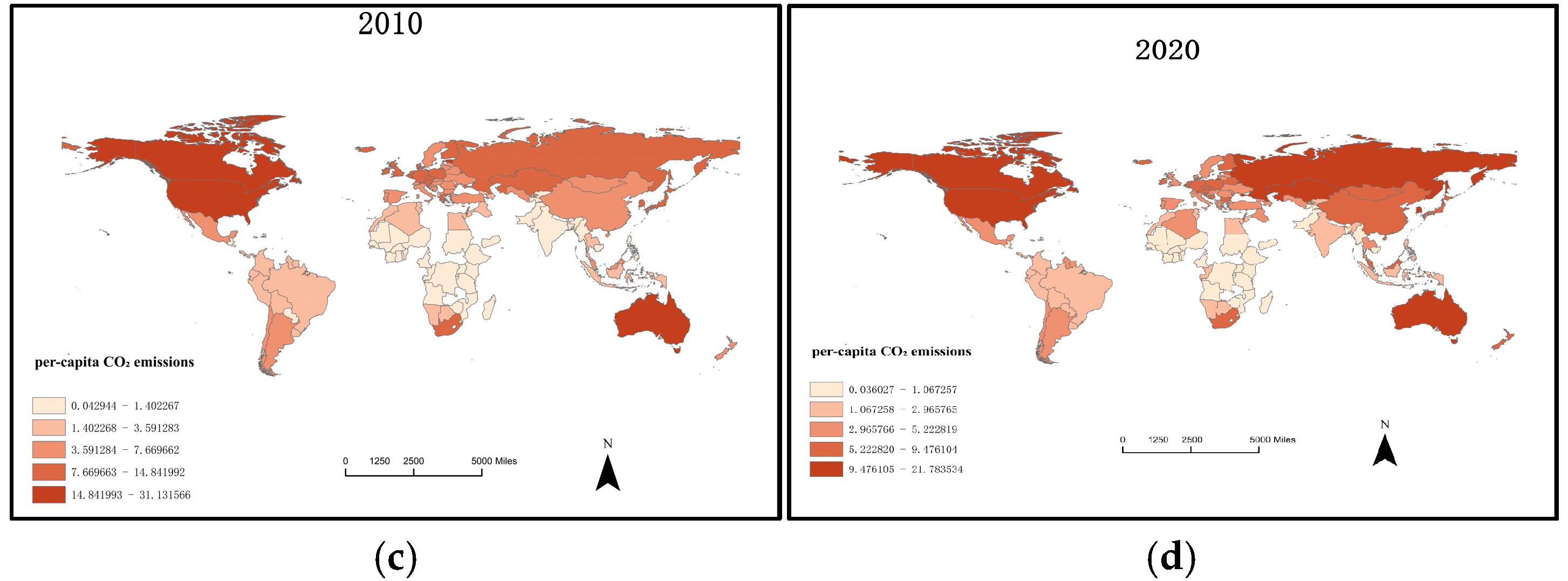

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Direct Effects of Fossil Energy Prices on CO2 Emissions

2.2. Indirect Effects of Fossil Energy Prices on Carbon Emissions

3. Data and Method

3.1. Model Establishment

3.2. Variable Descriptions and Data Sources

4. Results

4.1. Baseline Regression

4.2. Robustness Tests

4.2.1. Core Explanatory Variable Substitution

4.2.2. Experimental Method Substitution

4.2.3. Dependent Variable Substitution

4.3. Heterogeneity Analyses

4.3.1. Income-Group Heterogeneity

4.3.2. Heterogeneity by Net Energy Imports

5. Further Discussion on the Rebound and Mediating Effects

5.1. Rebound Effect

5.2. Mediating Effect

5.2.1. Energy Efficiency Mediation

5.2.2. Renewable Energy Share Mediation

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

6.3. Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Authors | Region | Year | Correlation |

|---|---|---|---|

| Li et al. (2020) | China | 2002–2016 | Negative |

| Umar et al. (2021) | Thirteen African nations | 1990–2017 | Negative |

| Wu et al. (2023) | EU | 2000–2018 | Negative |

| Hammoudeh et al. (2022) | USA | 2006–2013 | inverted U-shape |

| Al-Mulali et al. (2023) | 27 developed economies | 1990–2012 | Negative |

| Mujtaba et al. (2021) | India | 1986–2014 | two-way impact |

| Mensah et al. (2019) | 22 African countries | 1990–2015 | Negative |

| Yuan et al. (2010) | China’s industrial sector | 1993–2007 | Negative |

| Mukhtarov et al. (2022) | Iran | 1980–2019 | Negative |

| Authors | Specification | Technique | Region | Year | Rebound Effect |

|---|---|---|---|---|---|

| Shao et al. (2019) | Cobb–Douglas | China | 1991–2016 | 93.96% | |

| Adha et al. (2021) | KHREM model | Indonesia | 2002–2018 | 87.2%/45.5% | |

| Kong et al. (2023) | Cobb–Douglas | Beijing | 2015–2019 | 69.64% | |

| Steren et al. (2022) | 2SLS | Israel | 2007–2016 | 62% | |

| Omondi et al. (2023) | Cobb–Douglas | Kenya | 2009–2019 | 15.64% | |

| Baležentis et al. (2021) | OLS | EU | 2011–2015 | 2.55% | |

| Bhringer and Rivers (2018) | CGE | US | 2010 | 63.3% | |

| Berner et al. (2021) | S-FAVAR | Italy, UK, USA | 2008–2019 | 78–101% | |

| Zheng et al. (2022) | 2SLS | China | 2003–2017 | 123% |

| Rebound Efficient | Elasticity | Description |

|---|---|---|

| R > 1 | ξ > 0 | Backfire |

| R = 1 | ξ = 0 | Full rebound |

| 0 < R < 1 | −1 < ξ < 0 | Partial rebound |

| R = 0 | ξ = −1 | Zero rebound |

| R < 0 | ξ < −1 | Super-conservation |

| Variable | Definition | Unite | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| ln CO2 | The amount of CO2 emissions | Kiloton | 10.245 | 1.996 | 5.763 | 16.400 |

| lnFEP | Fossil energy prices | $ | 6.702 | 3.020 | 0 | 27.215 |

| lntec | Intellectual property | Thousand $ | 18.754 | 3.019 | 0.634 | 30.289 |

| lnGDP | Total GDP | Trillion $ | 4.229 | 1.910 | 0.343 | 9.988 |

| lnPOP | Population size | 108 | 16.356 | 1.558 | 12.448 | 21.086 |

| lnES | Energy structure | % | 0.661 | 0.280 | 0.020 | 1 |

| lnUR | Urbanization level | % | 0.586 | 0.217 | 0.054 | 1 |

| lnEEI | The energy efficiency index | % | 2.250 | 0.472 | 0.502 | 3.742 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | lnREP | D-K | lnGreen_gas |

| lnFEP | −0.009 ** | −0.007 *** | |

| (0.003) | (0.002) | ||

| lnREP | −0.172 *** | ||

| (0.050) | |||

| lnTEC | −0.007 *** | −0.012 ** | −0.008 *** |

| (0.003) | (0.006) | (0.002) | |

| lnGDP | 0.706 *** | 0.657 *** | 0.617 *** |

| (0.019) | (0.042) | (0.016) | |

| lnPOP | 0.897 *** | 0.873 *** | 0.656 *** |

| (0.035) | (0.108) | (0.028) | |

| lnES | 1.268 *** | 1.437 *** | 1.407 *** |

| (0.053) | (0.380) | (0.044) | |

| lnUR | 1.140 *** | 1.268 *** | 1.157 *** |

| (0.109) | (0.116) | (0.089) | |

| Constant | −8.564 *** | −8.014 *** | −11.110 *** |

| (0.539) | (1.634) | (0.438) | |

| Country FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| Observations | 3051 | 3293 | 3293 |

| R-squared | 0.793 | 0.788 | 0.803 |

| (1) | |

|---|---|

| Variables | IV (FE-2SLS L1–L3 as IV) |

| lnFEP | −0.014 ** |

| (0.006) | |

| lnTEC | 0.005 * |

| (0.003) | |

| lnGDP | 0.426 *** |

| (0.090) | |

| lnPOP | 0.729 *** |

| (0.144) | |

| lnES | 2.671 *** |

| (0.279) | |

| lnUR | 1.223 *** |

| (0.381) | |

| Observations | 3689 |

| Number of id | 119 |

| R-squared | 0.789 |

| Country FE | Yes |

| Year FE | Yes |

| K-P rk Wald F | 19,891 |

| Under-id LM p | 0.000200 |

| Hansen J p | 0.662 |

| (1) | (2) | |

|---|---|---|

| Variables | Income Groups | NEI |

| lnFEP | −0.019 *** | −0.035 *** |

| (0.002) | (0.003) | |

| High#c.lnFEP | 0.010 *** | |

| (0.004) | ||

| Importer#c.lnFEP | 0.027 *** | |

| (0.004) | ||

| lnTEC | 0.004 *** | 0.003 *** |

| (0.001) | (0.001) | |

| lnGDP | 0.408 *** | 0.421 *** |

| (0.016) | (0.015) | |

| lnPOP | 0.845 *** | 0.756 *** |

| (0.030) | (0.028) | |

| lnES | 2.771 *** | 2.851 *** |

| (0.058) | (0.057) | |

| lnUR | 1.123 *** | 0.807 *** |

| (0.101) | (0.099) | |

| Constant | −14.519 *** | −12.971 *** |

| (0.451) | (0.423) | |

| Observations | 4046 | 3842 |

| Number of id | 119 | 113 |

| R-squared | 0.805 | 0.813 |

| Country FE | Yes | Yes |

| Year FE | Yes | Yes |

| Low slope | −0.0193 | |

| High slope | −0.00973 | |

| Exporters slope | −0.0348 | |

| Importers slope | −0.00770 | |

| Difference p-value | 0.00984 | <0.001 |

References

- Fan, J.; Wang, J.; Qiu, J.; Li, N. Stage effects of energy consumption and carbon emissions in the process of urbanization: Evidence from 30 provinces in China. Energy 2023, 276, 127655. [Google Scholar] [CrossRef]

- Duan, K.; Ren, X.; Shi, Y.; Mishra, T.; Yan, C. The marginal impacts of fossil energy prices on carbon price variations: Evidence from a quantile-on-quantile approach. Energy Econ. 2021, 95, 105131. [Google Scholar] [CrossRef]

- Zhao, W.; Yin, Y.; Mao, L.; Zhong, K.; Yuan, G.; Huang, H.; Yang, Y. Will Coal Price Fluctuations Affect Renewable Energy Substitution and Carbon Emission? A Computable General Equilibrium-Based Study of China. Energy Eng. 2021, 118, 1009–1026. [Google Scholar] [CrossRef]

- Zhao, Y.; Mao, J. Energy effects of non-energy policies: Minimum wage standard and enterprise energy efficiency in China. Resour. Policy 2022, 79, 102953. [Google Scholar] [CrossRef]

- Hong, Q.; Cui, L.; Hong, P. The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China’s carbon emissions trading pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

- Prodromou, T.; Demirer, R. Oil price shocks and cost of capital: Does market liquidity play a role? Energy Econ. 2022, 115, 106340. [Google Scholar] [CrossRef]

- Rafaty, R.; Dolphin, G.; Pretis, F. Carbon pricing and the elasticity of CO2 emissions. Energy Econ. 2025, 144, 108298. [Google Scholar] [CrossRef]

- Ali, M.; Tursoy, T.; Samour, A.; Moyo, D.; Konneh, A. Testing the impact of the gold price, oil price, and renewable energy on carbon emissions in South Africa: Novel evidence from bootstrap ARDL and NARDL approaches. Resour. Policy 2022, 79, 102984. [Google Scholar] [CrossRef]

- Belaïd, F.; Massié, C. The viability of energy efficiency in facilitating Saudi Arabia’s journey toward net-zero emissions. Energy Econ. 2023, 124, 106765. [Google Scholar] [CrossRef]

- Jiao, Z.; Sharma, R.; Kautish, P.; Hussain, H.I. Unveiling the asymmetric impact of exports, oil prices, technological innovations, and income inequality on carbon emissions in India. Resour. Policy 2021, 74, 102408. [Google Scholar] [CrossRef]

- Antonietti, R.; Fontini, F. Does energy price affect energy efficiency? Cross-country panel evidence. Energy Policy 2019, 129, 896–906. [Google Scholar] [CrossRef]

- Zhao, X.G.; Hu, S.R. Does market-based electricity price affect China’s energy efficiency? Energy Econ. 2020, 91, 104909. [Google Scholar] [CrossRef]

- Kulmer, V.; Seebauer, S. How Robust are Estimates of the Rebound Effect of Energy Efficiency Improvements? A Sensitivity Analysis of Consumer Heterogeneity and Elasticities. Energy Policy 2017, 132, 1–14. [Google Scholar] [CrossRef]

- Rocha, F.F.d.; Almeida, E.L.F.d. A general equilibrium model of macroeconomic rebound effect: A broader view. Energy Econ. 2021, 98, 105232. [Google Scholar] [CrossRef]

- Berner, A.; Bruns, S.; Moneta, A.; Stern, D.I. Do energy efficiency improvements reduce energy use? Empirical evidence on the economy-wide rebound effect in Europe and the United States. Energy Econ. 2022, 110, 105939. [Google Scholar] [CrossRef]

- Zimmermann, M.; Vöhringer, F.; Thalmann, P.; Moreau, V. Do rebound effects matter for Switzerland? Assessing the effectiveness of industrial energy efficiency improvements. Energy Econ. 2021, 104, 105703. [Google Scholar] [CrossRef]

- Akram, R.; Chen, F.; Khalid, F.; Ye, Z.; Majeed, M.T. Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: Evidence from developing countries. J. Clean. Prod. 2020, 247, 119122. [Google Scholar] [CrossRef]

- Malik, M.Y.; Latif, K.; Khan, Z.; Butt, H.D.; Hussain, M.; Nadeem, M.A. Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: Evidence from ARDL and non-linear ARDL approach. Sci. Total Environ. 2020, 726, 138421. [Google Scholar] [CrossRef]

- Tan, W.; Cao, T. Can green technology reduce carbon dioxide emissions? Evidence from G7 and BRICS countries. Heliyon 2023, 9, 15683. [Google Scholar] [CrossRef]

- Wang, C.; Zhao, L.; Papageorgiou, G.N.; Qian, Y.; Xue, J.; Li, D. Embodied carbon emissions generated by international trade of China’s light industry sector based on global supply chains perspective. Energy Strat. Rev. 2023, 47, 101095. [Google Scholar] [CrossRef]

- Zhang, L.; Mu, R.; Zhan, Y.; Yu, J.; Liu, L.; Yu, Y.; Zhang, J. Digital economy, energy efficiency, and carbon emissions: Evidence from provincial panel data in China. Sci. Total Environ. 2022, 852, 158403. [Google Scholar] [CrossRef]

- Ma, B.; Ogata, S. Impact of Urbanization on Carbon Dioxide Emissions—Evidence from 136 Countries and Regions. Sustainability 2024, 16, 7878. [Google Scholar] [CrossRef]

- Considine, T.; Manderson, E. The role of energy conservation and natural gas prices in the costs of achieving California’s renewable energy goals. Energy Econ. 2014, 44, 291–301. [Google Scholar] [CrossRef]

- Shan, S.; Ahmad, M.; Tan, Z.; Adebayo, T.S.; Li, R.Y.M.; Kirikkaleli, D. The role of fossil energy prices and non-linear fiscal decentralization in limiting carbon emissions: Tracking environmental sustainability. Energy 2021, 234, 121243. [Google Scholar] [CrossRef]

- Okwanya, I.; Abah, P.O.; Amaka, E.-O.G.; Ozturk, I.; Alhassan, A.; Bekun, F.V. Does carbon emission react to oil price shocks? Implications for sustainable growth in Africa. Resour. Policy 2023, 82, 103610. [Google Scholar] [CrossRef]

- Martinsson, G.; Sajtos, L.; Strömberg, P.; Thomann, C. The Effect of Carbon Pricing on Firm Emissions: Evidence from the Swedish CO2 Tax. Rev. Financ. Stud. 2024, 37, 1848–1886. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy structure, digital economy, and carbon emissions: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 64606–64629. [Google Scholar] [CrossRef] [PubMed]

- Umar, B.; Alam, M.; Al-Amin, A.Q. Exploring the contribution of energy price to carbon emissions in African countries. Environ. Sci. Pollut. Res. 2021, 28, 1973–1982. [Google Scholar] [CrossRef]

- Wu, J.; Abban, O.J.; Boadi, A.D.; Charles, O. The effects of energy price, spatial spillover of CO2 emissions, and economic freedom on CO2 emissions in Europe: A spatial econometrics approach. Environ. Sci. Pollut. Res. 2022, 29, 63782–63798. [Google Scholar] [CrossRef] [PubMed]

- Yakymchuk, A.; Rataj, M.A. Economic Analysis of Fossil CO2 Emissions: A European Perspective on Sustainable Development. Energies 2025, 18, 2106. [Google Scholar] [CrossRef]

- Mensah, I.A.; Sun, M.; Gao, C.; Omari-Sasu, A.Y.; Zhu, D.; Ampimah, B.C.; Quarcoo, A. Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J. Clean. Prod. 2019, 228, 161–174. [Google Scholar] [CrossRef]

- Yuan, C.; Liu, S.; Wu, J. The relationship among fossil energy prices and energy consumption in China. Energy Policy 2010, 38, 197–207. [Google Scholar] [CrossRef]

- Zhou, D.; Siddik, A.B.; Guo, L.; Li, H. Dynamic relationship among climate policy uncertainty, oil price and renewable energy consumption—Findings from TVP-SV-VAR approach. Renew. Energy 2023, 204, 722–732. [Google Scholar] [CrossRef]

- Keppler, J.H.; Mansanet-Bataller, M. Causalities between CO2, electricity, and other energy variables during phase I and phase II of the EU ETS. Energy Policy 2010, 38, 3329–3341. [Google Scholar] [CrossRef]

- Weigt, H.; Ellerman, D.; Delarue, E. CO2 abatement from renewables in the German electricity sector: Does a CO2 price help? Energy Econ. 2013, 40, S149–S158. [Google Scholar] [CrossRef]

- Batten, J.A.; Maddox, G.E.; Young, M.R. Does weather, or fossil energy prices, affect carbon prices? Energy Econ. 2021, 96, 105016. [Google Scholar] [CrossRef]

- Chun, D.; Cho, H.; Kim, J. The relationship between carbon-intensive fuel and renewable energy stock prices under the emissions trading system. Energy Econ. 2022, 114, 106257. [Google Scholar] [CrossRef]

- Ding, X.; Wang, M. The Impact of Oil Price on Carbon Dioxide Emissions in the Transport Sector: The Threshold Effect of Environmental Policy Stringency. Energies 2024, 17, 4496. [Google Scholar] [CrossRef]

- Valizadeh, J.; Sadeh, E.; Javanmard, H.; Davodi, H. The effect of fossil energy prices on energy consumption efficiency in the petrochemical industry in Iran. Alex. Eng. J. 2018, 57, 2241–2256. [Google Scholar] [CrossRef]

- Wang, C.; Nie, P.Y. How rebound effects of efficiency improvement and price jump of energy influence energy consumption? J. Clean. Prod. 2018, 202, 497–503. [Google Scholar] [CrossRef]

- Peng, L.; Zeng, X.; Wang, Y.; Hong, G.B. Analysis of energy efficiency and carbon dioxide reduction in the Chinese pulp and article industry. Energy Policy 2015, 80, 65–75. [Google Scholar] [CrossRef]

- Steren, A.; Rubin, O.D.; Rosenzweig, S. Energy-efficiency policies targeting consumers may not save energy in the long run: A rebound effect that cannot be ignored. Energy Res. Soc. Sci. 2022, 90, 102600. [Google Scholar] [CrossRef]

- Baležentis, T.; Butkus, M.; Štreimikienė, D.; Shen, Z. Exploring the limits for increasing energy efficiency in the residential sector of the European Union: Insights from the rebound effect. Energy Policy 2021, 149, 112063. [Google Scholar] [CrossRef]

- Kong, L.; Mu, X.; Hu, G.; Tu, C. Will energy efficiency improvements reduce energy consumption? Perspective of rebound effect and evidence from Beijing. Energy 2023, 263, 125665. [Google Scholar] [CrossRef]

- Shao, S.; Guo, L.; Yu, M.; Yang, L.; Guan, D. Does the rebound effect matter in energy import-dependent mega-cities? Evidence from Shanghai (China). Appl. Energy 2019, 241, 212–228. [Google Scholar] [CrossRef]

- Adha, R.; Hong, C.Y.; Firmansyah, M.; Paranata, A. Rebound effect with energy efficiency determinants: A two-stage analysis of residential electricity consumption in Indonesia. Sustain. Prod. Consum. 2021, 28, 556–565. [Google Scholar] [CrossRef]

- Omondi, C.; Njoka, F.; Musonye, F. An economy-wide rebound effect analysis of Kenya’s energy efficiency initiatives. J. Clean. Prod. 2022, 385, 135730. [Google Scholar] [CrossRef]

- Berner, A.; Lange, S.; Silbersdorff, A. Firm-level energy rebound effects and relative efficiency in the German manufacturing sector. Energy Econ. 2022, 109, 105903. [Google Scholar] [CrossRef]

- Zheng, Y.; Xu, H.; Jia, R. Endogenous energy efficiency and rebound effect in the transportation sector: Evidence from China. J. Clean. Prod. 2022, 335, 130310. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Holdren, J.P. Impact of population growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Science. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef]

- Lv, T.; Hu, H.; Xie, H.; Zhang, X.; Wang, L.; Shen, X. An empirical relationship between urbanization and carbon emissions in an ecological civilization demonstration area of China based on the STIRPAT model. Environ. Dev. Sustain. 2022, 25, 2465–2486. [Google Scholar] [CrossRef]

- Adetutu, M.O.; Glass, A.J.; Weyman-Jones, T.G. Economy-wide estimates of rebound effects: Evidence from panel data. Energy J. 2016, 37, 251–270. [Google Scholar] [CrossRef]

- Bruns, S.B.; Moneta, A.; Stern, D.I. Estimating the economy-wide rebound effect using empirically identified structural vector autoregressions. Energy Econ. 2021, 97, 105158. [Google Scholar] [CrossRef]

- Li, H.; Bao, Q.; Ren, X.; Xie, Y.; Ren, J.; Yang, Y. Reducing rebound effect through fossil subsidies reform: Acomprehensive evaluation in China. J. Clean. Prod. 2017, 141, 305–314. [Google Scholar] [CrossRef]

- Horobet, A.; Vrinceanu, G.; Popescu, C.; Belascu, L. Oil Price and Stock Prices of EU Financial Companies: Evidence from Panel Data Modeling. Energies 2019, 12, 4072. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I. The investigation of environmental Kuznets curve hypothesis in the advanced economies: The role of fossil energy prices. Renew. Sustain. Energy Rev. 2016, 54, 1622–1631. [Google Scholar] [CrossRef]

- Alaganthiran, J.R.; Anaba, M.I. The effects of economic growth on carbon dioxide emissions in selected Sub-Saharan African (SSA) countries. Heliyon 2022, 8, e11193. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Fang, L.; He, L. The impact of energy price on CO2 emissions in China: A spatial econometric analysis. Sci. Total Environ. 2020, 706, 135942. [Google Scholar] [CrossRef] [PubMed]

- Luqman, M.; Rayner, P.J.; Gurney, K.R. On the impact of urbanisation on CO2 emissions. npj Urban Sustain. 2023, 3, 6. [Google Scholar] [CrossRef]

- Rehman, A.; Ma, H.; Chishti, M.Z.; Ozturk, I.; Irfan, M.; Ahmad, M. Asymmetric investigation to track the effect of urbanization, energy utilization, fossil fuel energy and CO2 emission on economic efficiency in China: Another outlook. Environ. Sci. Pollut. Res. 2021, 28, 17319–17330. [Google Scholar] [CrossRef]

- Amer, E.A.A.A.; Meyad, E.M.A.; Meyad, A.M.; Mohsin, A. Impacts of renewable and disaggregated non-renewable energy consumption on CO2 emissions in GCC countries: A STIRPAT model analysis. Heliyon 2024, 10, e30154. [Google Scholar] [CrossRef]

- Chen, S.; Ding, D.; Shi, G.; Chen, G. Digital economy, industrial structure, and carbon emissions: An empirical study based on a provincial panel data set from China. Chin. J. Popul. Resour. Environ. 2022, 20, 316–323. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Z. Imported technology and CO2 emission in China: Collecting evidence through bound testing and VECM approach. Renew. Sustain. Energy Rev. 2018, 82, 4204–4214. [Google Scholar] [CrossRef]

- Khosravi, H.; Raihan, A.S.; Islam, F.; Nimbarte, A.; Ahmed, I. A Comprehensive Approach to CO2 Emissions Analysis in High-Human-Development-Index Countries Using Statistical and Time Series Approaches. Sustainability 2025, 17, 603. [Google Scholar] [CrossRef]

- Marin, G.; Vona, F. The impact of fossil energy prices on socioeconomic and environmental performance: Evidence from French manufacturing establishments, 1997–2015. Eur. Econ. Rev. 2021, 135, 103739. [Google Scholar] [CrossRef]

- Rehman, E.; Rehman, S. Modeling the nexus between carbon emissions, urbanization, population growth, energy consumption, and economic development in Asia: Evidence from grey relational analysis. Energy Rep. 2022, 8, 5430–5442. [Google Scholar] [CrossRef]

- Liang, H.; Lin, S.; Wang, J. Impact of technological innovation on carbon emissions in China’s logistics industry: Based on the rebound effect. J. Clean. Prod. 2022, 377, 134371. [Google Scholar] [CrossRef]

- Sun, X.; Jia, M.; Xu, Z.; Liu, Z.; Liu, X.; Liu, Q. An investigation of the determinants of energy intensity in emerging market countries. Energy Strat. Rev. 2022, 39, 100790. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, M.; Tian, L. The market-linkage of the volatility spillover between traditional energy price and carbon price on the realization of carbon value of emission reduction behavior. J. Clean. Prod. 2020, 245, 118682. [Google Scholar] [CrossRef]

- Agbanike, T.F.; Nwani, C.; Uwazie, U.I.; Anochiwa, L.I.; Onoja, T.-G.C.; Ogbonnaya, I.O. Oil price, energy consumption and carbon dioxide (CO2) emissions: Insight into sustainability challenges in Venezuela. Lat. Am. Econ. Rev. 2019, 28, 8. [Google Scholar] [CrossRef]

- Naimoğlu, M. The impact of nuclear energy use, fossil energy prices and energy imports on CO2 emissions: Evidence from energy importer emerging economies which use nuclear energy. J. Clean. Prod. 2022, 373, 133937. [Google Scholar] [CrossRef]

- Böhringer, C.; Rivers, N. The Energy Efficiency Rebound Effect in General Equilibrium. J. Environ. Econ. Manag. 2021, 109, 102508. [Google Scholar] [CrossRef]

- Atems, B.; Mette, J.; Lin, G.; Madraki, G. Estimating and forecasting the impact of nonrenewable fossil energy prices on US renewable energy consumption. Energy Policy 2023, 173, 113374. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Maharramov, S.; Aliyev, J.; Suleymanov, E. Higher oil prices, are they good or bad for renewable energy consumption: The case of Iran? Renew. Energy 2022, 186, 411–419. [Google Scholar] [CrossRef]

- Mukhtarov, S. Oil prices and the renewable energy transition: Empirical evidence from China. Util. Policy 2024, 91, 101840. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy and CO2 emissions: New evidence with the panel threshold model. Renew. Energy 2022, 194, 117–128. [Google Scholar] [CrossRef]

- Aldubyan, M.; Gasim, A. Energy price reform in Saudi Arabia: Modeling the economic and environmental impacts and understanding the demand response. Energy Policy 2020, 148, 111941. [Google Scholar] [CrossRef]

- Berndt, E.R. Aggregate Energy, Efficiency, and Productivity Measurement. Annu. Rev. Energy 1978, 3, 225–273. [Google Scholar] [CrossRef]

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Methods | OLS | Fixed Effect | Random Effect | Lag 1 | Lag 2 | Lag 3 |

| lnFEP | −0.005 | −0.009 *** | −0.008 *** | |||

| (0.003) | (0.002) | (0.002) | ||||

| L.lnFEP | −0.009 *** | |||||

| (0.002) | ||||||

| L2.lnFEP | −0.008 *** | |||||

| (0.002) | ||||||

| L3.lnFEP | −0.007 *** | |||||

| (0.002) | ||||||

| lnTEC | 0.012 ** | −0.012 *** | −0.015 *** | −0.012 *** | −0.013 *** | −0.013 *** |

| (0.005) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | |

| lnGDP | 0.638 *** | 0.657 *** | 0.600 *** | 0.657 *** | 0.658 *** | 0.659 *** |

| (0.013) | (0.018) | (0.016) | (0.019) | (0.019) | (0.019) | |

| lnPOP | 0.342 *** | 0.873 *** | 0.583 *** | 0.878 *** | 0.873 *** | 0.870 *** |

| (0.011) | (0.033) | (0.022) | (0.034) | (0.034) | (0.035) | |

| lnES | 2.323 *** | 1.437 *** | 1.693 *** | 1.424 *** | 1.410 *** | 1.398 *** |

| (0.037) | (0.052) | (0.049) | (0.053) | (0.053) | (0.053) | |

| lnUR | −0.224 *** | 1.268 *** | 1.373 *** | 1.257 *** | 1.253 *** | 1.275 *** |

| (0.068) | (0.104) | (0.094) | (0.106) | (0.109) | (0.111) | |

| Constant | 0.361 * | −8.014 *** | −3.268 *** | −8.105 *** | −8.004 *** | −7.976 *** |

| (0.202) | (0.513) | (0.348) | (0.523) | (0.533) | (0.543) | |

| Observations | 3293 | 3293 | 3293 | 3243 | 3191 | 3137 |

| R-squared | 0.943 | 0.788 | 0.782 | 0.775 | 0.768 |

| (1) | |

|---|---|

| Variables | In AEC |

| lnEEI | −0.864 *** |

| (0.010) | |

| lnFEP | −0.001 |

| (0.001) | |

| lnTEC | 0.002 ** |

| (0.001) | |

| lnGDP | 0.839 *** |

| (0.009) | |

| lnPOP | −0.073 *** |

| (0.015) | |

| lnES | −0.085 *** |

| (0.022) | |

| lnUR | −0.205 *** |

| (0.044) | |

| Constant | 2.341 *** |

| (0.232) | |

| Country FE | Yes |

| Time FE | Yes |

| Observations | 3293 |

| R-squared | 0.912 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ln CO2 | ln EEI | ln CO2 |

| lnEEI | −0.917 *** | ||

| (0.019) | |||

| lnFEP | −0.009 *** | 0.009 *** | −0.001 |

| (0.002) | (0.001) | (0.001) | |

| lnTEC | −0.012 *** | 0.002 | −0.010 *** |

| (0.003) | (0.002) | (0.002) | |

| lnGDP | 0.657 *** | 0.445 *** | 1.064 *** |

| (0.018) | (0.013) | (0.016) | |

| lnPOP | 0.873 *** | −0.516 *** | 0.401 *** |

| (0.033) | (0.024) | (0.027) | |

| lnES | 1.437 *** | −0.325 *** | 1.139 *** |

| (0.052) | (0.038) | (0.040) | |

| lnUR | 1.268 *** | −1.080 *** | 0.278 *** |

| (0.104) | (0.075) | (0.081) | |

| Constant | −8.014 *** | 9.482 *** | 0.677 |

| (0.513) | (0.370) | (0.424) | |

| Country FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| Observations | 3293 | 3393 | 3293 |

| R-squared | 0.788 | 0.689 | 0.881 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ln CO2 | ln RES | ln CO2 |

| lnRES | −1.766 *** | ||

| (0.075) | |||

| lnFEP | −0.009 *** | 0.002 *** | −0.006 *** |

| (0.002) | (0.000) | (0.002) | |

| lnTEC | −0.012 *** | 0.003 *** | −0.007 *** |

| (0.003) | (0.001) | (0.002) | |

| lnGDP | 0.657 *** | −0.066 *** | 0.549 *** |

| (0.018) | (0.004) | (0.018) | |

| lnPOP | 0.873 *** | −0.087 *** | 0.777 *** |

| (0.033) | (0.008) | (0.033) | |

| lnES | 1.437 *** | −0.564 *** | 0.337 *** |

| (0.052) | (0.012) | (0.065) | |

| lnUR | 1.268 *** | −0.408 *** | 0.486 *** |

| (0.104) | (0.025) | (0.105) | |

| Constant | −8.014 *** | 2.533 *** | −4.426 *** |

| (0.513) | (0.123) | (0.532) | |

| Country FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| Observations | 3293 | 3090 | 3090 |

| R-squared | 0.788 | 0.675 | 0.821 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, X.; Liu, T.; Zhai, Y.; Zhang, Y.; Shi, H. The Impact of Fossil Energy Prices on Carbon Emissions: The Dual Mediation of Energy Efficiency and Renewable Energy. Energies 2025, 18, 6186. https://doi.org/10.3390/en18236186

Sun X, Liu T, Zhai Y, Zhang Y, Shi H. The Impact of Fossil Energy Prices on Carbon Emissions: The Dual Mediation of Energy Efficiency and Renewable Energy. Energies. 2025; 18(23):6186. https://doi.org/10.3390/en18236186

Chicago/Turabian StyleSun, Xiangdong, Ting Liu, Yuexiao Zhai, Yitong Zhang, and Hongxu Shi. 2025. "The Impact of Fossil Energy Prices on Carbon Emissions: The Dual Mediation of Energy Efficiency and Renewable Energy" Energies 18, no. 23: 6186. https://doi.org/10.3390/en18236186

APA StyleSun, X., Liu, T., Zhai, Y., Zhang, Y., & Shi, H. (2025). The Impact of Fossil Energy Prices on Carbon Emissions: The Dual Mediation of Energy Efficiency and Renewable Energy. Energies, 18(23), 6186. https://doi.org/10.3390/en18236186