Critical Raw Materials in Life Cycle Assessment: Innovative Approach for Abiotic Resource Depletion and Supply Risk in the Energy Transition

Abstract

1. Introduction

- -

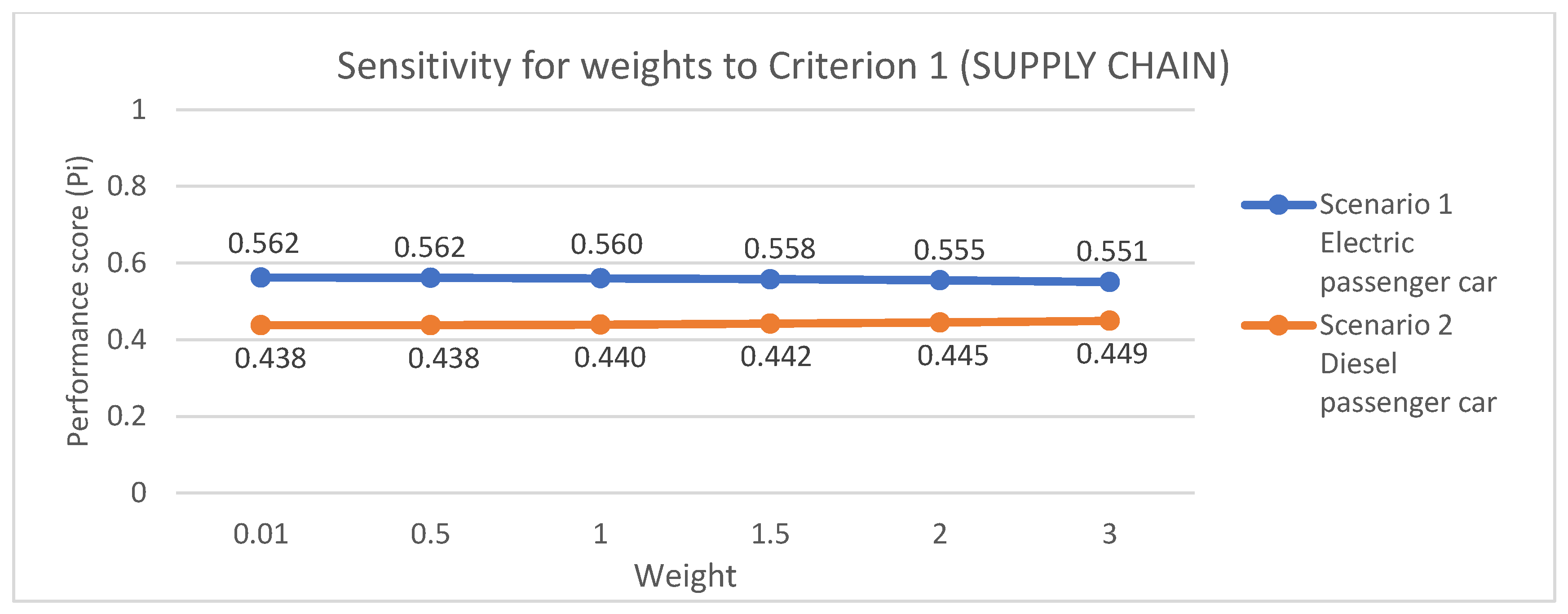

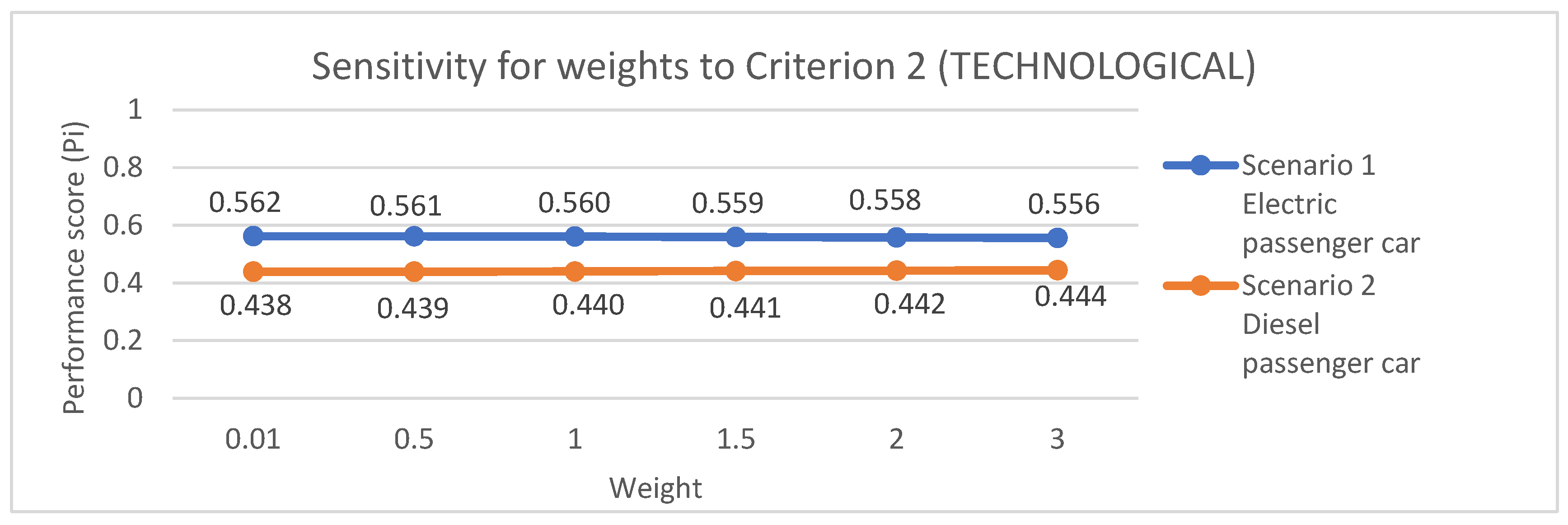

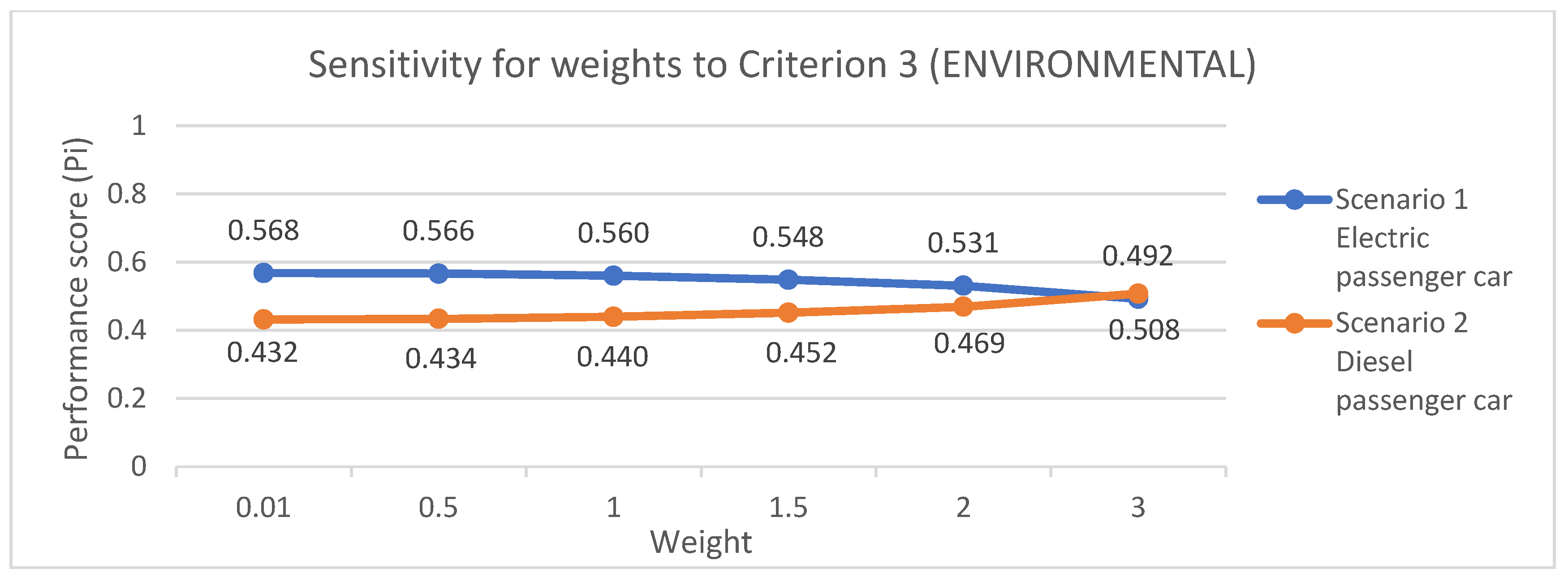

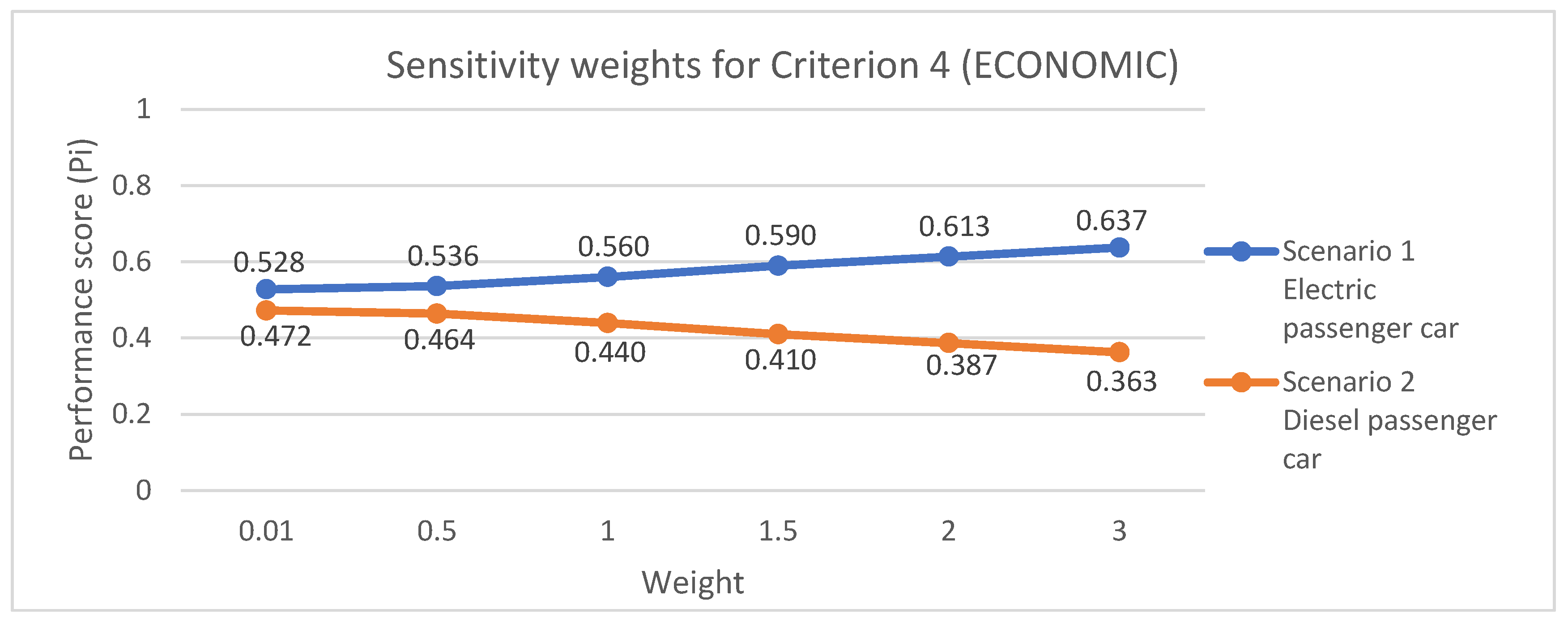

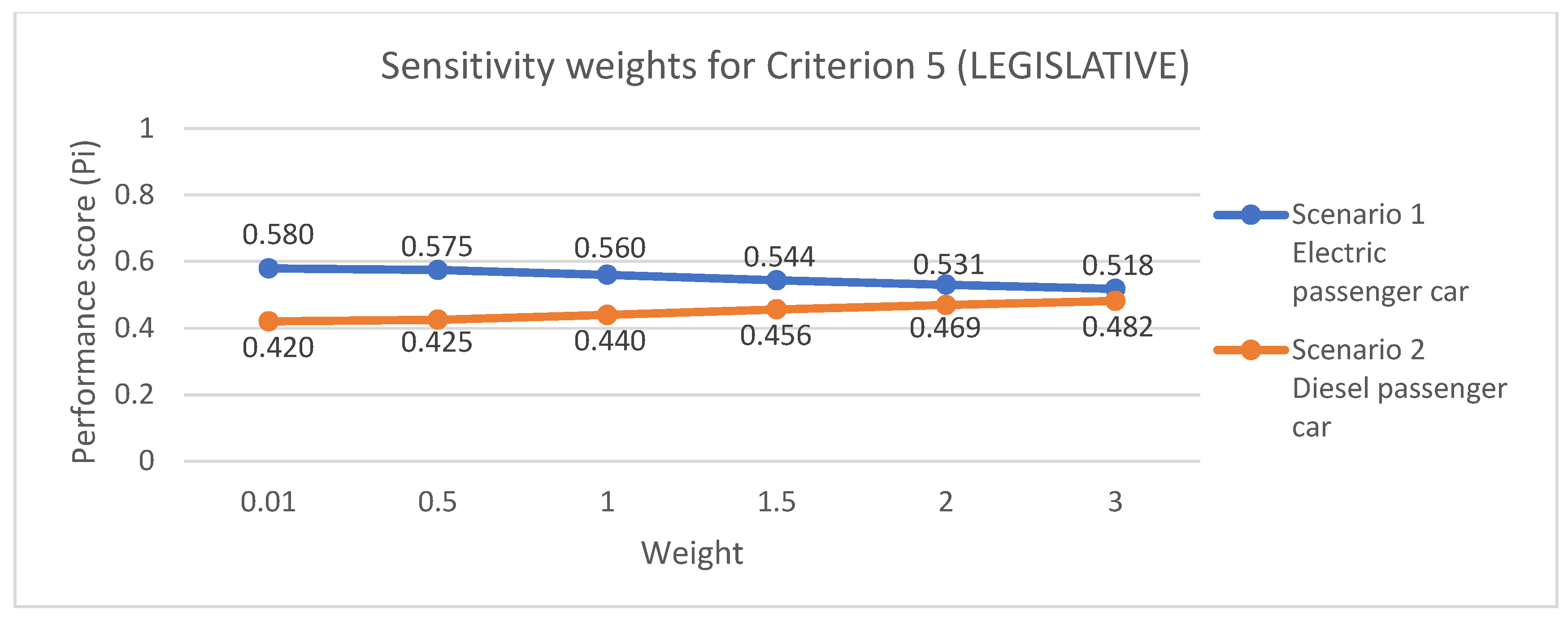

- Multi-criteria analysis. A TOPSIS multi-criteria evaluation was carried out to derive a Performance score (Pi) for the electric- and diesel-vehicle scenarios. The ranking draws on five overarching categories: Supply Chain, Technological, Environmental, Economic, and Legislative, each populated with quantitative indicators.

- -

- Methodological innovation. We designed two new characterisation factors: a Resource-Depletion Index and a Gini Index, quantifying respectively the depletion risk and supply-concentration risk of CRMs in energy-intensive manufacturing processes. Both metrics have been implemented as a custom method in SimaPro, enabling direct application in Life Cycle Assessment studies of energy and transport systems.

- -

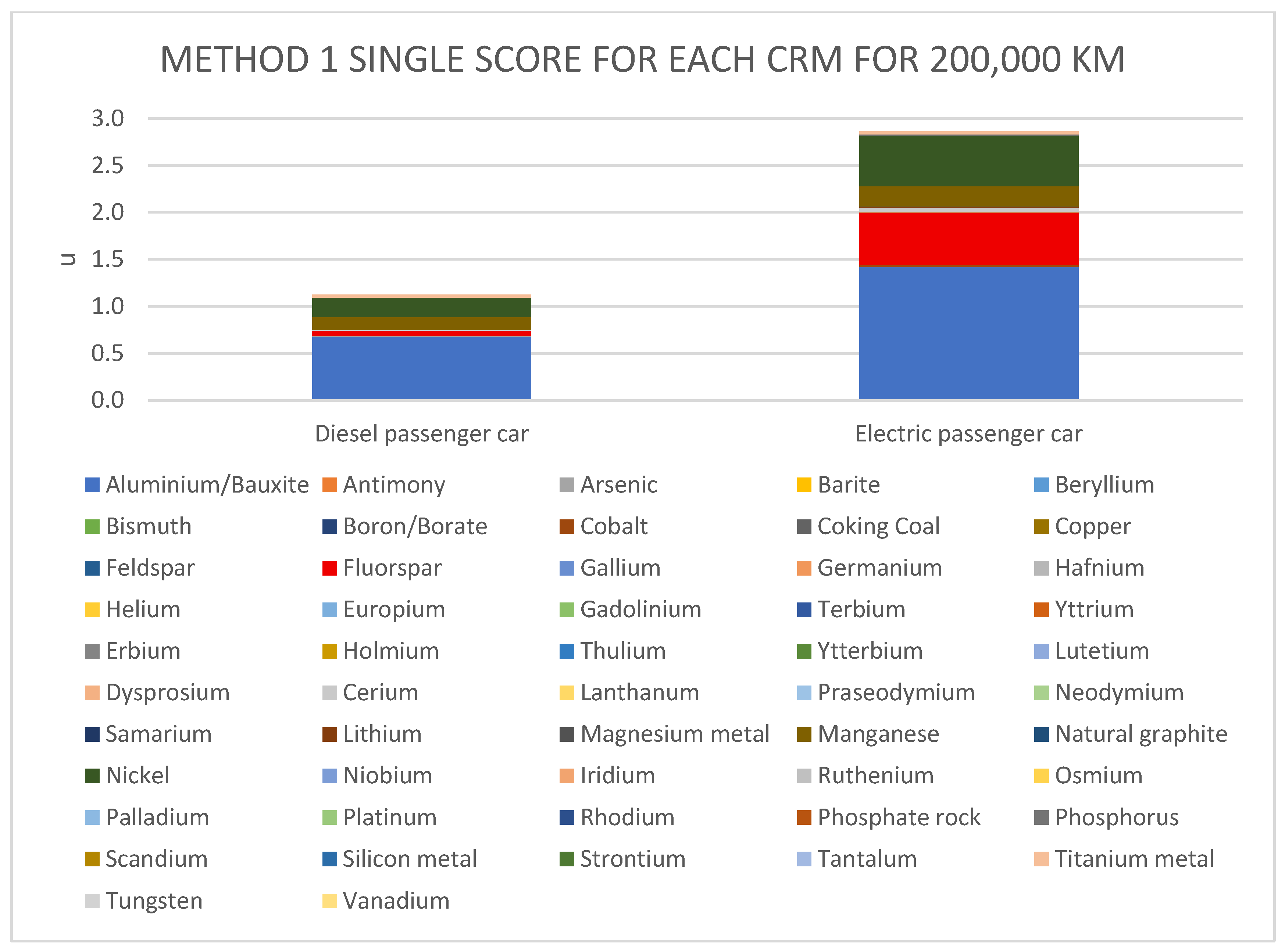

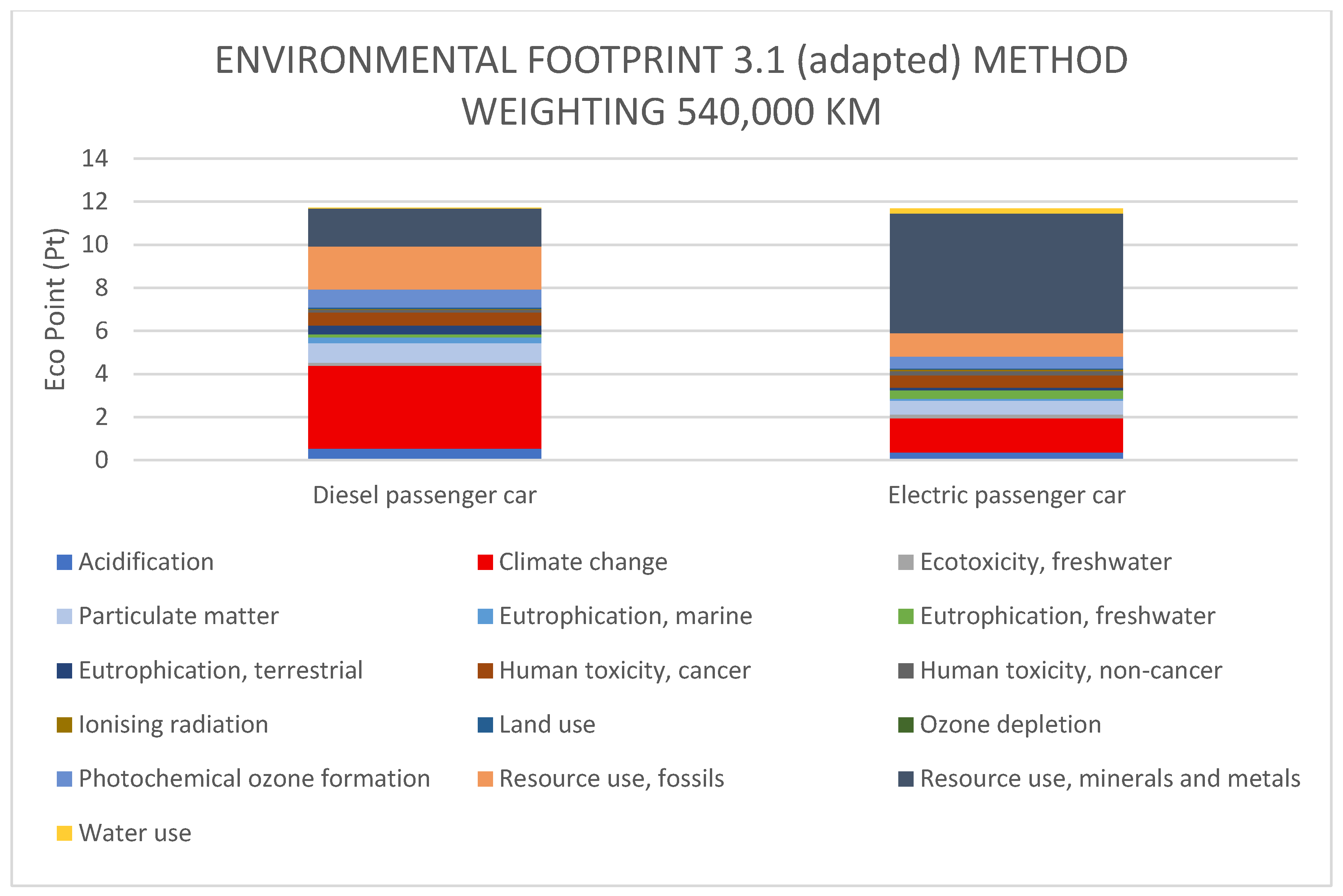

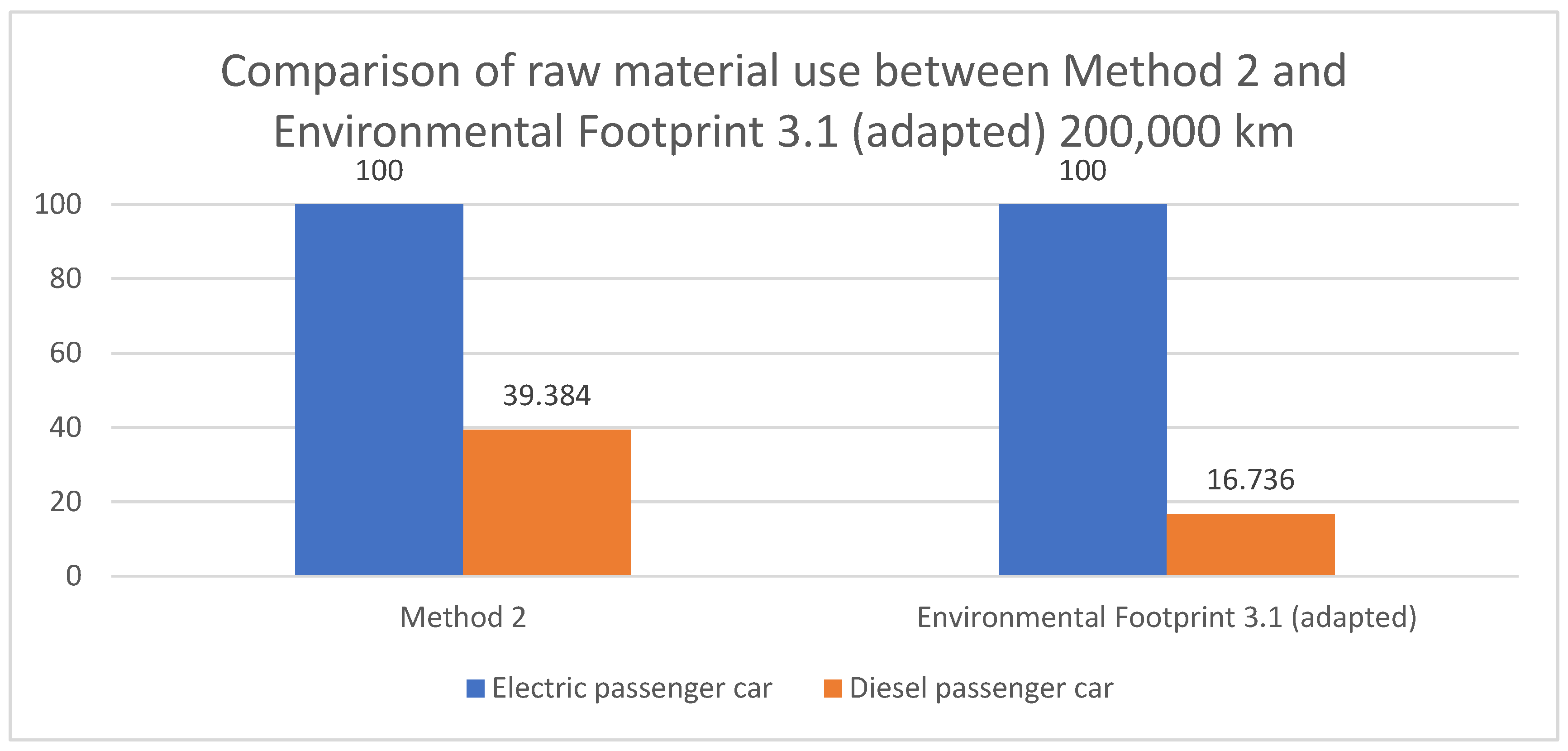

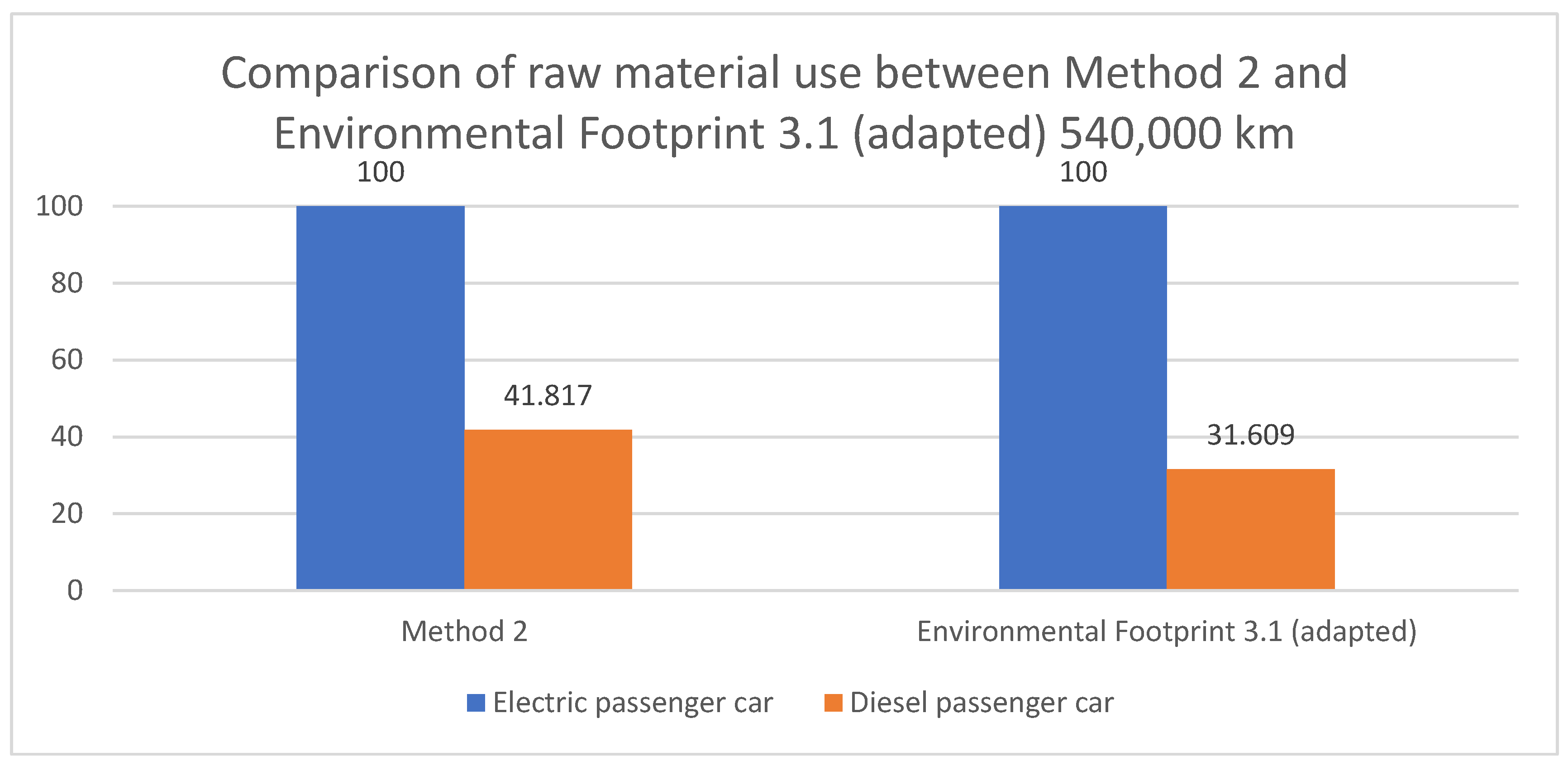

- Case study. We applied the new CRM method to the cradle-to-grave comparative LCA of the Peugeot 308 previously developed by the authors, contrasting the battery-electric and diesel versions over two mileage scenarios (200,000 km and 540,000 km) [9]. Using the same inventory, we reran the assessment with an adapted Environmental Footprint 3.1 impact set plus the CRM characterisation factors to quantify how critical raw materials alter the sustainability balance between the two powertrain and energy-supply options.

2. Literature Review: State of the Art

2.1. Importance of Critical Raw Materials

Main Critical Issues: Supply Chain, Limited Reserves, Market Volatility

2.2. Classification and Quantification of Raw Materials

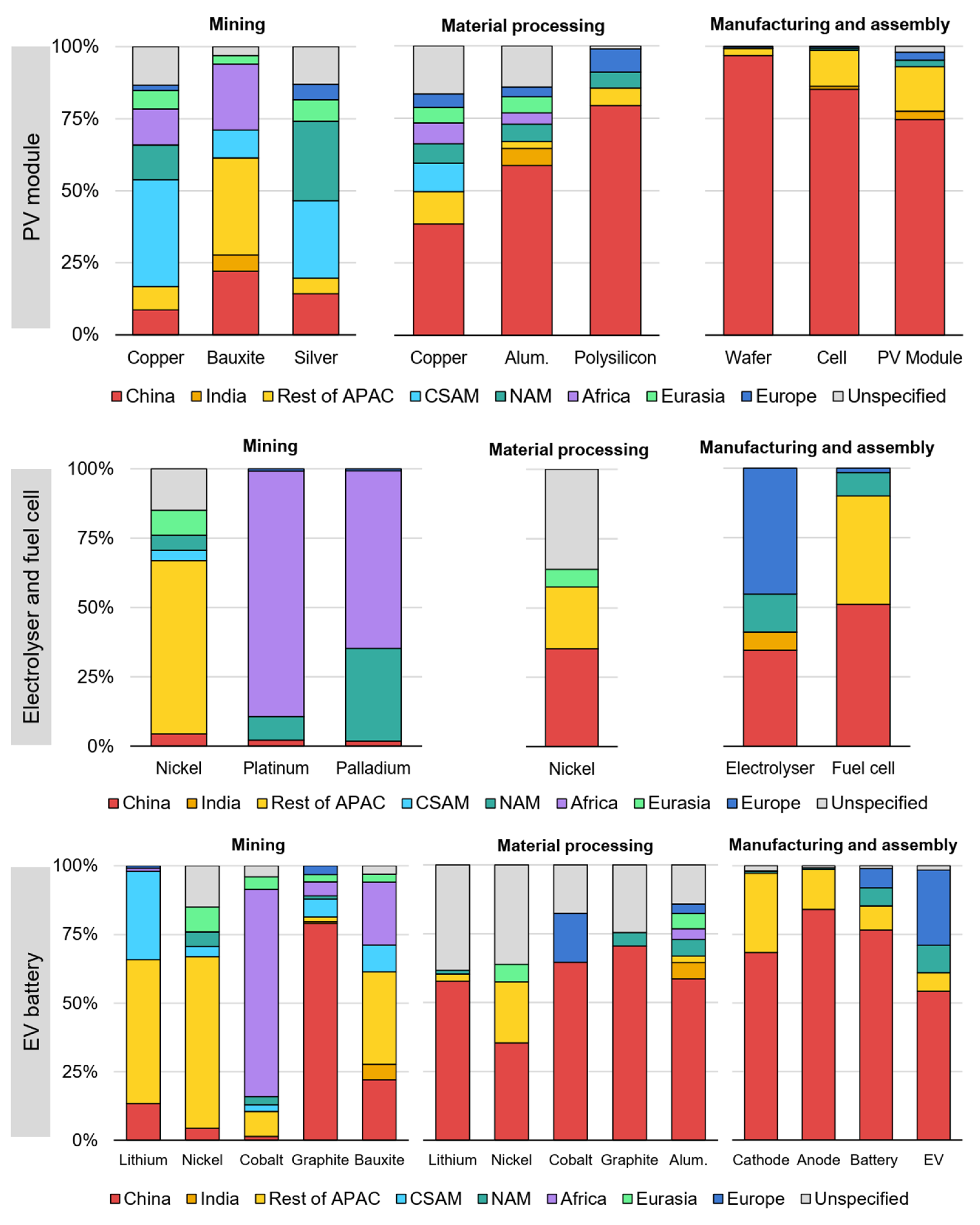

- Renewable power: solar PV, onshore/offshore wind, concentrating solar power, hydropower, geothermal and biomass.

- Nuclear power: provides dispatchable, low-carbon, and reliable electricity generation.

- Electricity networks (transmission and distribution): must be expanded and modernised as electrification accelerates and energy demand rises.

- Battery energy storage: stabilises electric grids with high shares of variable renewables and enhances energy-system flexibility.

- Electric vehicles: replace conventional cars and cut CO2 emissions from road transport while promoting energy diversification in mobility.

- Hydrogen technologies (electrolysers and fuel cells): supply a low-carbon and energy-dense carrier for hard-to-abate sectors.

Classification Parameters (Criticality, Availability, Recyclability)

2.3. Current Methods for the Analysis of Critical Raw Materials

2.3.1. Review of Existing Methodologies

2.3.2. Research Gaps and Study Objectives

3. Materials and Methods

3.1. Multicriteria Analysis (TOPSIS)

- The initial decision matrix values Xij are normalised to obtain ij values using the following relationship:

- 2.

- The elements of the weighted decision matrix V are calculated as Vij = Wj × ij, where Wj denotes the weight assigned to the j-th criterion. If equal weights are assumed for all criteria, then Vij = ij.

- 3.

- The ideal variant composed of criteria values (, , …, ) and the basal variant composed of criteria values (, , …, ) where = maxi (Vij) and = mini (Vij), j = 1, 2, …, k are determined based on elements of matrix V.

- 4.

- The distances of variants from the ideal and basal variants are calculated pursuant to formulas:

- 5.

- The Performance score Pi is finally determined as relative distance of variants from the basal variant using the relationship below.

3.2. Gini Index and Raw Material Extraction/Reserve Index (RERI)

- Define the dataset: Consider a set of values x1, x2, …, xn, where each xi represents the annual production of the CRM in country I (n being the total number of producing countries). The values are arranged in ascending order, such that x1 ≤ x2 ≤ ⋯ ≤ xn.

- Create the absolute difference matrix: Construct a matrix D where each element represents the absolute difference between every pair of production values:where Dij denotes the absolute difference between the production values xi and xj.

- Calculate the sum of absolute differences: Add up all the elements of the absolute difference matrix:where S represents the total sum of all absolute differences.

- Calculate the average of the values: Compute the arithmetic mean of the production values x1, x2, …, xn:where T represents the average of the production values.

- Normalise the sum of absolute differences. The total sum is then normalised by the average value T and by the square of the number of countries. The Gini Index is thus calculated as:orwhere G denotes the Gini Index, S is the sum of all absolute differences, n is the number of countries, and T is the average production value.

3.3. Life Cycle Assessment (LCA)

3.3.1. LCA Methodology Introduction and Description

- Selection of impact categories. Impact categories are selected to reflect the assessment parameters defined in the scope. For each category, a representative indicator is identified, along with an environmental model used to quantify the contribution of elementary flows to that indicator.

- Classification. Elementary flows from the inventory are allocated to impact categories based on their potential contribution to the corresponding category indicators.

- Characterisation. For each impact category, environmental models are used to quantify the contribution of the assigned elementary flows to the category indicator, typically through characterisation factors (e.g., conversion of greenhouse gases into CO2-equivalents).

- Normalisation. It provides information on the relative magnitude of the characterised values across different impact categories by expressing them in relation to a common set of reference impacts, one for each category. The outcome is a normalised impact profile of the product system, in which all category indicator values are presented on a comparable scale.

- Grouping and weighting. These procedures facilitate the comparison of impact categories either by grouping and ranking them according to their perceived significance, or by applying weighting factors that express the relative importance of each category in quantitative terms.

3.3.2. Development of an Innovative Methodology for Assessing CRMs in LCA

4. Results and Discussion

4.1. TOPSIS Analysis

Interpretation of the Rankings and Weightings of the Indicators

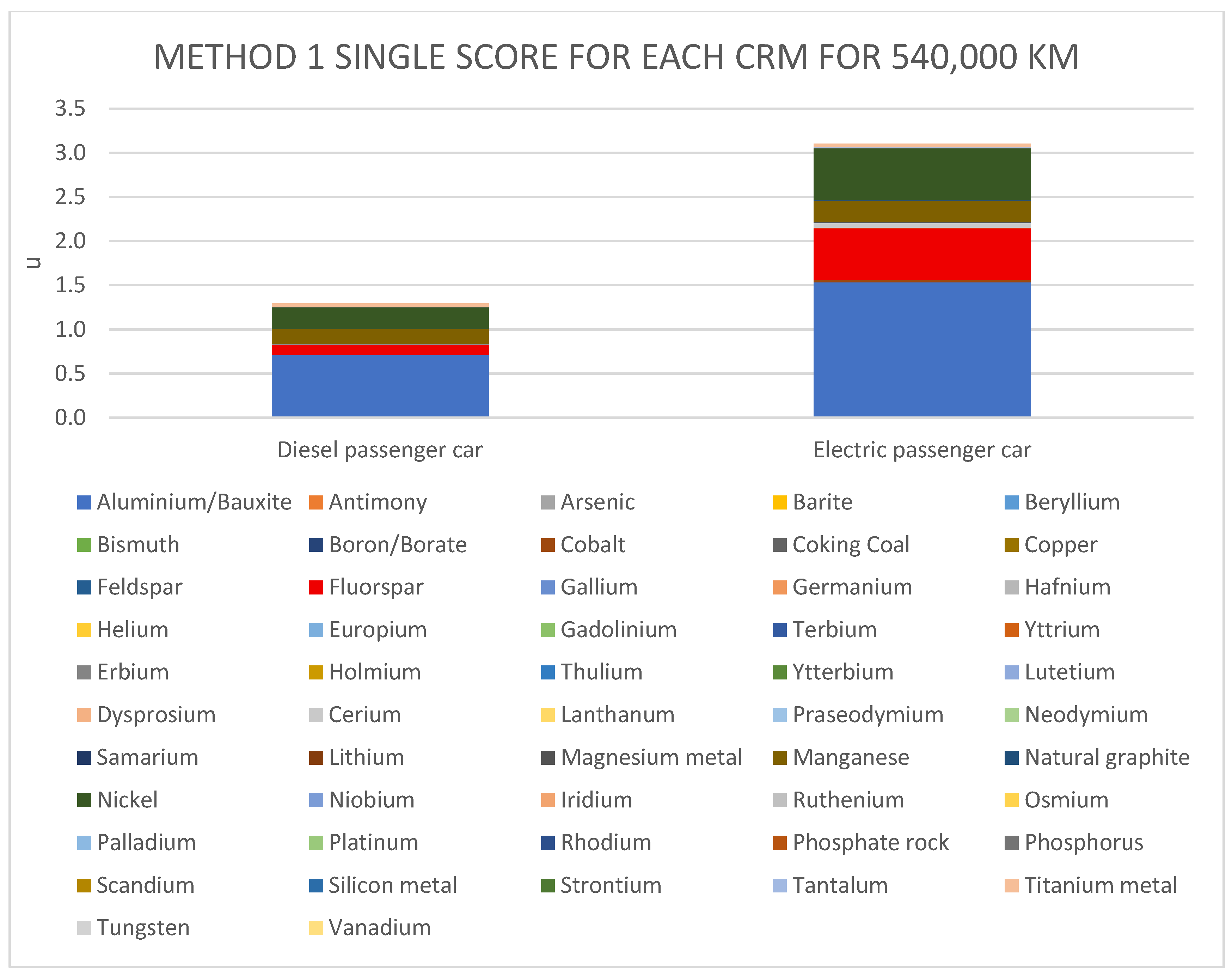

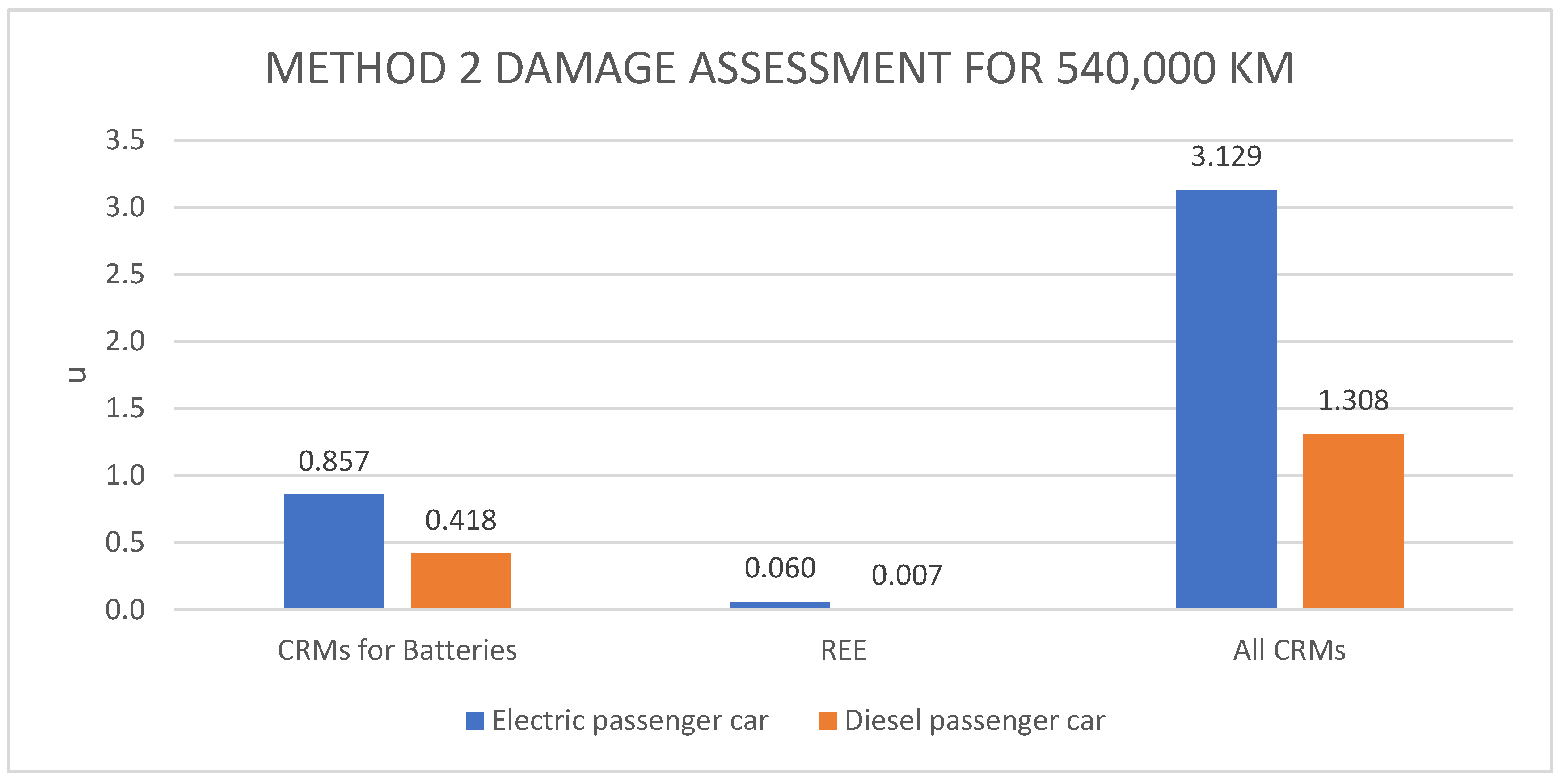

4.2. Implementation of the Proposed Method in SimaPro

- -

- -

- -

- REEs: this category includes Europium, Gadolinium, Terbium, Yttrium, Erbium, Holmium, Thulium, Ytterbium, Lutetium, Dysprosium, Cerium, Lanthanum, Praseodymium, Neodymium, Samarium and Scandium [2].

- -

- Characterisation: All CRMs are included under the Impact category. For each material, the respective Substance is selected from the Ecoinvent v3.10 database, and the characterisation factor is defined as the Raw Material Extraction/Reserve Index (RERI) described and calculated above. The unit is expressed in kilograms (kg).

- -

- Damage assessment: All CRMs are included under the Damage category. For each material, the corresponding Impact category defined in the characterisation step is selected, and the Gini Index, described and calculated above, is applied as the characterisation factor.

- -

- Weighting: Three categories are created within the Normalisation/Weighting set: all CRMs, CRMs for batteries, and REEs. Each element defined in the damage-assessment step is assigned a value of 1 if it belongs to the group, and 0 if it does not.

- -

- Characterisation: Identical to Method 1, with all CRMs included and the characterisation factor defined as the Raw Material Extraction/Reserve Index (RERI).

- -

- Damage assessment: The three categories defined in Method 1 (CRMs for batteries, REEs, and all CRMs) are created under the Damage category. Each CRM is assigned to the corresponding group, where the respective Impact category defined in the characterisation step is selected, and the Gini Index is applied as the characterisation factor.

- -

- Weighting: Three categories are created within the Normalisation/weighting set: all CRMs, CRMs for batteries, REEs. For each group, a value of 1 is assigned to the Damage category to which the element belongs, and 0 to the others.

4.3. Case Study

4.3.1. Goal and Scope Definition

- -

- Diesel vehicle total weight: 1361 kg

- -

- Electric vehicle total weight: 1684 kg

- -

- Diesel vehicle estimated fuel consumption: 5 L/100 km

- -

- Electric vehicle estimated electricity consumption: 0.15 kWh/km

- -

- Electric vehicle Li-ion battery pack details: Cathode material—NMC811, number of cells—102, nominal capacity: 54.0 kWh.

- -

- Electric vehicle Li-ion battery pack weight: NMC811 batteries have a cell energy density in the range of 244–300 Wh/kg. For the case study, this ratio is assumed to be valid for the battery pack, and a standard value of 300 Wh/kg is adopted. Based on this assumption, the battery weight is calculated as proportional to the nominal capacity, resulting in 180 kg.

- -

- Glider weight for diesel vehicles and powertrain weight for electric vehicles: The glider and powertrain weights are calculated using the Ecoinvent “Passenger car production, diesel” process, which specifies the distribution of the total car weight as 69.5% for the glider and 30.5% for the internal-combustion engine. Since the selection criteria for the case study require the vehicle to be available in both electric and diesel versions, it is assumed that the glider composition and weight are the same for both models. Consequently, the EV drivetrain weight is determined by subtracting the glider weight and the Li-ion battery weight from the total weight of the electric car.

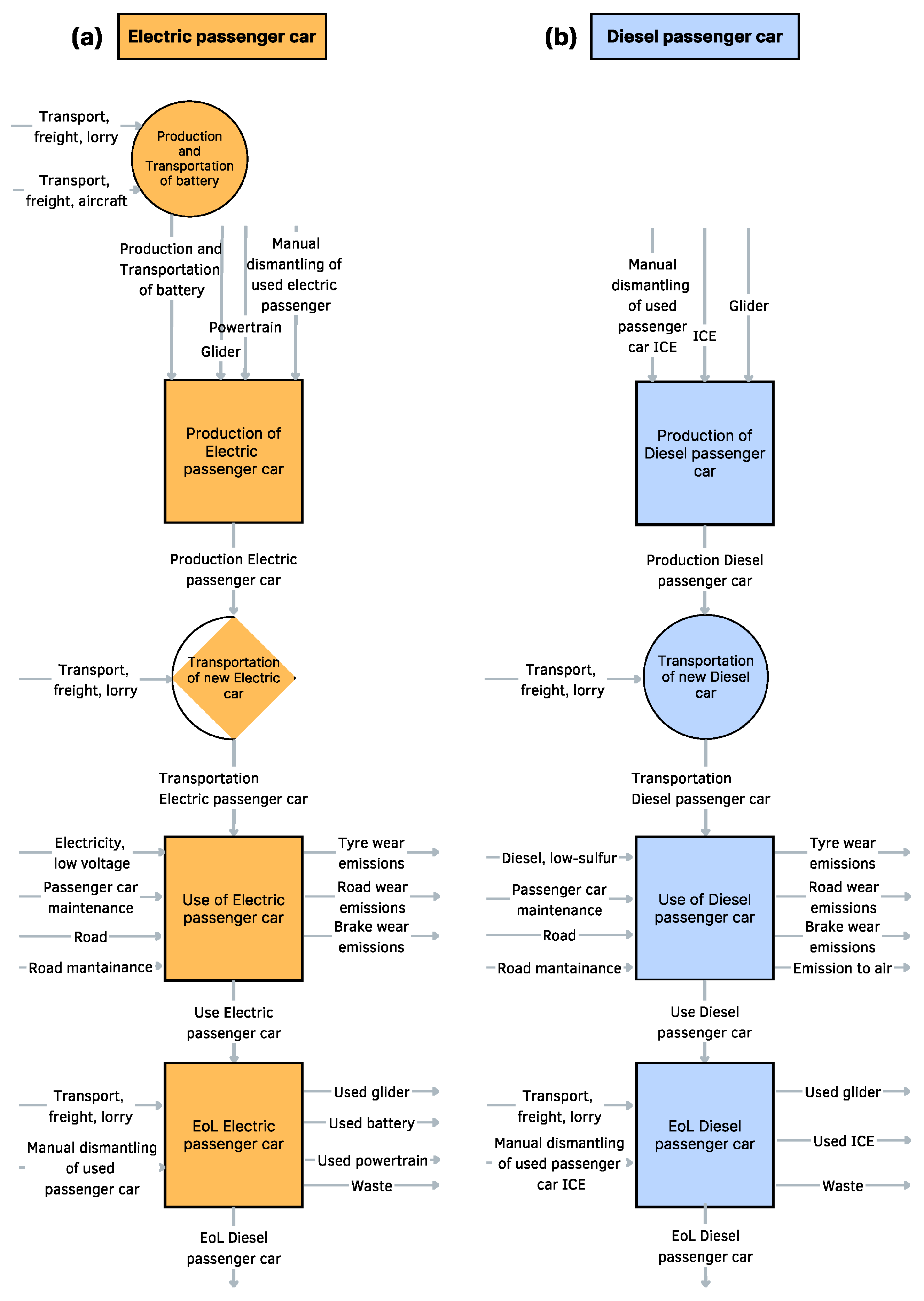

4.3.2. Life Cycle Inventory (LCI)

- Electric passenger car: (glider + powertrain) + Li-ion battery;

- Diesel passenger car: glider + internal-combustion engine.

- -

- Production and transportation of Li-ion battery (NMC811), rechargeable, prismatic—This dataset represents the production of 1 kg of a Li-ion battery pack, typically used for the mechanical drive of an electric vehicle. The cells consist of a nickel-manganese-cobalt (NMC811) cathode, a silicon-coated graphite anode, a liquid electrolyte, and a porous plastic separator. The dataset also includes the required infrastructure, modelled as an “electronic component factory”. In addition, the dataset accounts for the transport of one tonne of freight over a distance greater than 4000 km using a dedicated freight aircraft (i.e., an aircraft carrying only cargo). The transport process covers the entire life cycle, including the production of the aircraft, the operation of the transport service, and the construction and operation of the airport. The system boundary of this dataset is the operation of the aircraft, with inputs for both aircraft and airport. Fuel consumption and major emissions (SOx, NOx, NMHC, PM and CO) are calculated for 99.5% of all scheduled flights in 2016, based on OAG (2016) data.

- -

- Production of electric passenger car—In this dataset, entries are reported on a per-kilogram basis. The model is optimised for a vehicle of approximately 1200 kg, including the battery, and is divided into three modules: glider, drivetrain and battery. Each module incorporates specific material inputs, production processes, and emissions, with the battery represented by the dataset “Production and transportation of battery”. The activity concludes with the assembly of the three modules to form the complete car, with the unit of measurement expressed as “item” to match the functional unit.

- -

- Passenger car production, diesel—This dataset describes the production of a compact diesel passenger car. Entries are reported on a per-kilogram basis, and the model is optimised for a vehicle of approximately 1314 kg. It is divided into two modules: glider and drivetrain. Each module includes specific material inputs, production processes, and emissions. The dataset takes as inputs the two modules (glider and drivetrain) that constitute the vehicle. The activity concludes with the assembly of the car, with the unit of measurement expressed as “item” to match the functional unit.

- -

- Transport of new passenger car, freight, lorry >32 metric tons—This dataset represents the service of 1 tkm freight transport by a lorry with a gross vehicle weight (GVW) of more than 32 metric tons and Euro VI emissions class. The dataset covers the entire transport life cycle, including the construction, operation, maintenance, and end-of-life of both the vehicle and the road infrastructure. Fuel consumption and emissions are modelled for average European journeys and load factors, and are therefore not representative of a specific transport scenario.

- -

- Lifetime usage, passenger car, electric—This dataset describes a journey of 1 km with an electric passenger car. It is parameterised with respect to the mass of the vehicle, the mass of the battery, the electricity consumption, and the lifetimes of both the vehicle and the battery. The construction of the dataset allows these key parameters to vary to cover a wide range of situations. The inputs considered are the vehicle with battery, maintenance activity, and the electricity consumed for the journey. Both the vehicle and the battery are treated as infrastructure elements, even though they are expressed in kilograms. For this study, an addition to the output of the predefined process was introduced: to link the impacts of car use to the subsequent life-cycle stage, the electric car was added as an output product at the end of its lifetime, serving as the initial input for the end-of-life treatment processes.

- -

- Lifetime usage, passenger car, diesel: This dataset represents the transport service of a passenger car over a journey length of 1 km and is valid for Europe. It is parameterised with respect to vehicle size, fuel consumption, and vehicle lifetime. Exhaust emissions for fuel combustion are divided into two categories: fuel-dependent emissions (determined by fuel type and quantity) and Euro-class-dependent emissions, which reflect the standards the vehicle complies with. This dataset refers to a small diesel passenger car of Euro 5 class. Non-exhaust emissions, resulting from tyre, brake, and road wear, are included as by-products. Inputs to the system are the vehicle and road-network infrastructure, the materials and efforts needed for their maintenance, and the fuel consumed during the journey. The activity ends with the provision of 1 km of transport service and the release of both exhaust and non-exhaust emissions to air. For this study, an addition to the default process output was introduced: to link the transport impacts to the subsequent life-cycle stage, the diesel passenger car was added as an output product at the end of its lifetime, serving as the initial input for the end-of-life treatment processes.

4.3.3. Life Cycle Impact Assessment (LCIA)

4.3.4. Results of the Case Study from LCA Analysis

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zanoletti, A.; Massa, M.; Depero, L.E.; Bontempi, E. The Power Law of Resource Abundance and Their Corresponding Extraction: Evidence to Be Accounted in the Frame of the Critical Raw Materials Initiatives for the Energy Transition. Sustain. Energy Technol. Assess. 2024, 72, 104022. [Google Scholar] [CrossRef]

- European Commission. Directorate General for Internal Market, Industry, Entrepreneurship and SMEs. In Study on the Critical Raw Materials for the EU 2023: Final Report; Publications Office: Luxembourg, 2023. [Google Scholar]

- Simas, M.; Aponte, F.; Wiebe, K. The Future Is Circular: Circular Economy and Critical Minerals for the Green Transition. 2022. Available online: https://www.sintef.no/en/publications/publication/2073636/ (accessed on 20 June 2025).

- International Energy Agency. Securing Clean Energy Technology Supply Chains; OECD: Paris, France, 2022; ISBN 978-92-64-95325-3. [Google Scholar]

- Husmann, J.; Beylot, A.; Perdu, F.; Pinochet, M.; Cerdas, F.; Herrmann, C. Towards Consistent Life Cycle Assessment Modelling of Circular Economy Strategies for Electric Vehicle Batteries. Sustain. Prod. Consum. 2024, 50, 556–570. [Google Scholar] [CrossRef]

- Yusuf Bicer, I.D. 1.27 Life Cycle Assessment of Energy. In Comprehensive Energy Systems; Elsevier: Amsterdam, The Netherlands, 2018; Volume 1. [Google Scholar]

- Ellen MacArthur Foundation; Granta Design. Circularity Indicators: An Approach to Measuring Circularity—Methodology; Ellen MacArthur Foundation: Cowes, UK, 2015; Available online: https://content.ellenmacarthurfoundation.org/m/77e62bc9924c20d0/original/circularity-indicators-methodology.pdf (accessed on 16 July 2025).

- Cilleruelo Palomero, J.; Freboeuf, L.; Ciroth, A.; Sonnemann, G. Integrating Circularity into Life Cycle Assessment: Circularity with a Life Cycle Perspective. Clean. Environ. Syst. 2024, 12, 100175. [Google Scholar] [CrossRef]

- Cappelli, A.; Trimarchi, N.S.; Marzeddu, S.; Paoli, R.; Romagnoli, F. A Comparative Life Cycle Assessment of an Electric and a Conventional Mid-Segment Car: Evaluating the Role of Critical Raw Materials in Potential Abiotic Resource Depletion. Energies 2025, 18, 3698. [Google Scholar] [CrossRef]

- International Energy Agency. Net Zero by 2050—A Roadmap for the Global Energy Sector; IEA: Paris, France, 2021. [Google Scholar]

- International Energy Agency. The Role of Critical Minerals in Clean Energy Transitions; IEA: Paris, France, 2022. [Google Scholar]

- KU Leuven. Metals for Clean Energy: Pathways to Solving Europe’s Raw Materials Challenge 2022; KU Leuven: Leuven, Belgium, 2022. [Google Scholar]

- Kamran, M.; Raugei, M.; Hutchinson, A. Critical Elements for a Successful Energy Transition: A Systematic Review. Renew. Sustain. Energy Transit. 2023, 4, 100068. [Google Scholar] [CrossRef]

- Chen, X.; Li, L.; Jiang, Y.; Feng, Z.; Li, Q.; Jiang, L.; Dai, L.; Wang, L.; He, Z. Manipulating the Local Electronic Structure Microenvironment at the MXene Interface to Achieve Efficient Anode for Vanadium Redox Flow Battery. J. Energy Chem. 2025, 104, 118–126. [Google Scholar] [CrossRef]

- Manjong, N.B.; Usai, L.; Orangi, S.; Clos, D.P.; Strømman, A.H. Exploring Raw Material Contributions to the Greenhouse Gas Emissions of Lithium-Ion Battery Production. J. Energy Storage 2024, 100, 113566. [Google Scholar] [CrossRef]

- Ragonnaud, G. Securing Europe’s Supply of Critical Raw Materials; European Parliamentary Research Service: Brussels, Belgium, 2023. [Google Scholar]

- Tedesco, R.; Kostrowski, A.; Bodo, E. How to Reduce Our Dependency on Critical Raw Materials by Stimulating Circularity. 2023. Available online: https://www.rreuse.org/publications/how-to-reduce-our-dependency-on-critical-raw-materials-by-stimulating-circularity (accessed on 20 June 2025).

- Purdy, C.; Castillo, R. The Future of Mining in Latin America 2022; Brookings Institution: Washington, DC, USA, 2022. [Google Scholar]

- Gao, W.; Zhang, L.; Zhang, H.; Zhang, H. The Role of Trade Policy Uncertainty on Contemporaneous and Lagged Connectedness Between Critical Raw Materials and High-Tech Markets: Evidence from China. Resour. Policy 2024, 98, 105356. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2024; IEA: Paris, France, 2024. [Google Scholar]

- U.S. Department of the Interior. U.S. Geological Survey Mineral Commodity Summaries 2024; USGS: Reston, VA, USA, 2024.

- Petavratzi, E.; Gunn, G.; Kresse, C. BGS Commodity Review—Cobalt. 2019. Available online: https://nora.nerc.ac.uk/id/eprint/534461 (accessed on 20 June 2025).

- International Energy Agency. Global Electric Vehicle Outlook 2022; IEA: Paris, France, 2022. [Google Scholar]

- Seck, G.S.; Hache, E.; Barnet, C. Potential Bottleneck in the Energy Transition: The Case of Cobalt in an Accelerating Electro-Mobility World. Resour. Policy 2022, 75, 102516. [Google Scholar] [CrossRef]

- Petavratzi, E.; Josso, P. Global Material Flows of Lithium for the Lithium-Ion and Lithium Iron Phosphate Battery Markets; British Geological Survey: Nottingham, UK, 2021. [Google Scholar]

- Graham, J.D.; Rupp, J.A.; Brungard, E. Lithium in the Green Energy Transition: The Quest for Both Sustainability and Security. Sustainability 2021, 13, 11274. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I. Central Asia Is a Missing Link in Analyses of Critical Materials for the Global Clean Energy Transition. One Earth 2021, 4, 1678–1692. [Google Scholar] [CrossRef]

- Viebahn, P.; Soukup, O.; Samadi, S.; Teubler, J.; Wiesen, K.; Ritthoff, M. Assessing the Need for Critical Minerals to Shift the German Energy System towards a High Proportion of Renewables. Renew. Sustain. Energy Rev. 2015, 49, 655–671. [Google Scholar] [CrossRef]

- Hache, E.; Seck, G.S.; Simoen, M.; Bonnet, C.; Carcanague, S. Critical Raw Materials and Transportation Sector Electrification: A Detailed Bottom-up Analysis in World Transport. Appl. Energy 2019, 240, 6–25. [Google Scholar] [CrossRef]

- Klimenko, V.V.; Ratner, S.V.; Tereshin, A.G. Constraints Imposed by Key-Material Resources on Renewable Energy Development. Renew. Sustain. Energy Rev. 2021, 144, 111011. [Google Scholar] [CrossRef]

- Greim, P.; Solomon, A.A.; Breyer, C. Assessment of Lithium Criticality in the Global Energy Transition and Addressing Policy Gaps in Transportation. Nat. Commun. 2020, 11, 4570. [Google Scholar] [CrossRef]

- U.S. Department of the Interior. U.S. Geological Survey Mineral Commodity Summaries 2022; USGS: Reston, VA, USA, 2022.

- Calvo, G.; Valero, A. Strategic Mineral Resources: Availability and Future Estimations for the Renewable Energy Sector. Environ. Dev. 2022, 41, 100640. [Google Scholar] [CrossRef]

- De Koning, A.; Kleijn, R.; Huppes, G.; Sprecher, B.; Van Engelen, G.; Tukker, A. Metal Supply Constraints for a Low-Carbon Economy? Resour. Conserv. Recycl. 2018, 129, 202–208. [Google Scholar] [CrossRef]

- Bobba, S.; Bianco, I.; Eynard, U.; Carrara, S.; Mathieux, F.; Blengini, G.A. Bridging Tools to Better Understand Environmental Performances and Raw Materials Supply of Traction Batteries in the Future EU Fleet. Energies 2020, 13, 2513. [Google Scholar] [CrossRef]

- Guohua, Y.; Elshkaki, A.; Xiao, X. Dynamic Analysis of Future Nickel Demand, Supply, and Associated Materials, Energy, Water, and Carbon Emissions in China. Resour. Policy 2021, 74, 102432. [Google Scholar] [CrossRef]

- The Assay. Manganese Steeling for Significant Demand Growth 2021; The Assay: Hong Kong, China, 2021. [Google Scholar]

- Li, S.; Yan, J.; Pei, Q.; Sha, J.; Mou, S.; Xiao, Y. Risk Identification and Evaluation of the Long-Term Supply of Manganese Mines in China Based on the VW-BGR Method. Sustainability 2019, 11, 2683. [Google Scholar] [CrossRef]

- European Commission. Joint Research Centre. In The Role of Rare Earth Elements in Wind Energy and Electric Mobility: An Analysis of Future Supply/Demand Balances; Publications Office: Luxembourg, 2020. [Google Scholar]

- Smith Stegen, K. Heavy Rare Earths, Permanent Magnets, and Renewable Energies: An Imminent Crisis. Energy Policy 2015, 79, 1–8. [Google Scholar] [CrossRef]

- Li, J.; Peng, K.; Wang, P.; Zhang, N.; Feng, K.; Guan, D.; Meng, J.; Wei, W.; Yang, Q. Critical Rare-Earth Elements Mismatch Global Wind-Power Ambitions. One Earth 2020, 3, 116–125. [Google Scholar] [CrossRef]

- Xie, L.; Wu, W.; Huang, X.; Ou, P.; Lin, Z.; Zhiling, W.; Song, Y.; Lang, T.; Huangfu, W.; Zhang, Y.; et al. Mining and Restoration Monitoring of Rare Earth Element (REE) Exploitation by New Remote Sensing Indicators in Southern Jiangxi, China. Remote Sens. 2020, 12, 3558. [Google Scholar] [CrossRef]

- Junne, T.; Wulff, N.; Breyer, C.; Naegler, T. Critical Materials in Global Low-Carbon Energy Scenarios: The Case for Neodymium, Dysprosium, Lithium, and Cobalt. Energy 2020, 211, 118532. [Google Scholar] [CrossRef]

- Ballinger, B.; Schmeda-Lopez, D.; Kefford, B.; Parkinson, B.; Stringer, M.; Greig, C.; Smart, S. The Vulnerability of Electric-Vehicle and Wind-Turbine Supply Chains to the Supply of Rare-Earth Elements in a 2-Degree Scenario. Sustain. Prod. Consum. 2020, 22, 68–76. [Google Scholar] [CrossRef]

- Grandell, L.; Höök, M. Assessing Rare Metal Availability Challenges for Solar Energy Technologies. Sustainability 2015, 7, 11818–11837. [Google Scholar] [CrossRef]

- Hao, H.; Geng, Y.; Tate, J.E.; Liu, F.; Sun, X.; Mu, Z.; Xun, D.; Liu, Z.; Zhao, F. Securing Platinum-Group Metals for Transport Low-Carbon Transition. One Earth 2019, 1, 117–125. [Google Scholar] [CrossRef]

- Rasmussen, K.D.; Wenzel, H.; Bangs, C.; Petavratzi, E.; Liu, G. Platinum Demand and Potential Bottlenecks in the Global Green Transition: A Dynamic Material Flow Analysis. Environ. Sci. Technol. 2019, 53, 11541–11551. [Google Scholar] [CrossRef]

- Tong, X.; Dai, H.; Lu, P.; Zhang, A.; Ma, T. Saving Global Platinum Demand While Achieving Carbon Neutrality in the Passenger Transport Sector: Linking Material Flow Analysis with Integrated Assessment Model. Resour. Conserv. Recycl. 2022, 179, 106110. [Google Scholar] [CrossRef]

- Oberly, A.; Singerling, S.; Schulte, R.F. Platinum-Group Metals. In Mineral Commodity Summaries 2018; U.S. Geological Survey: Reston, VA, USA, 2018. [Google Scholar]

- Minke, C.; Suermann, M.; Bensmann, B.; Hanke-Rauschenbach, R. Is Iridium Demand a Potential Bottleneck in the Realization of Large-Scale PEM Water Electrolysis? Int. J. Hydrogen Energy 2021, 46, 23581–23590. [Google Scholar] [CrossRef]

- Mulvaney, D.; Richards, R.M.; Bazilian, M.D.; Hensley, E.; Clough, G.; Sridhar, S. Progress towards a Circular Economy in Materials to Decarbonize Electricity and Mobility. Renew. Sustain. Energy Rev. 2021, 137, 110604. [Google Scholar] [CrossRef]

- Huang, C.-L.; Xu, M.; Cui, S.; Li, Z.; Fang, H.; Wang, P. Copper-Induced Ripple Effects by the Expanding Electric Vehicle Fleet: A Crisis or an Opportunity. Resour. Conserv. Recycl. 2020, 161, 104861. [Google Scholar] [CrossRef]

- Watari, T.; McLellan, B.; Ogata, S.; Tezuka, T. Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios. Minerals 2018, 8, 156. [Google Scholar] [CrossRef]

- Henckens, M.L.C.M.; Worrell, E. Reviewing the Availability of Copper and Nickel for Future Generations. The Balance between Production Growth, Sustainability and Recycling Rates. J. Clean. Prod. 2020, 264, 121460. [Google Scholar] [CrossRef]

- U.S. Department of the Interior. U.S. Geological Survey Mineral Commodity Summaries 2011; USGS: Reston, VA, USA, 2011.

- Watari, T.; Northey, S.; Giurco, D.; Hata, S.; Yokoi, R.; Nansai, K.; Nakajima, K. Global Copper Cycles and Greenhouse Gas Emissions in a 1.5 °C World. Resour. Conserv. Recycl. 2022, 179, 106118. [Google Scholar] [CrossRef]

- Seck, G.S.; Hache, E.; Bonnet, C.; Simoën, M.; Carcanague, S. Copper at the Crossroads: Assessment of the Interactions between Low-Carbon Energy Transition and Supply Limitations. Resour. Conserv. Recycl. 2020, 163, 105072. [Google Scholar] [CrossRef]

- Vidal, O.; Rostom, F.; François, C.; Giraud, G. Global Trends in Metal Consumption and Supply: The Raw Material–Energy Nexus. Elements 2017, 13, 319–324. [Google Scholar] [CrossRef]

- Månberger, A.; Johansson, B. The Geopolitics of Metals and Metalloids Used for the Renewable Energy Transition. Energy Strategy Rev. 2019, 26, 100394. [Google Scholar] [CrossRef]

- European Commission. The Raw Materials Initiative—Meeting Our Critical Needs for Growth and Jobs in Europe; European Commission: Luxembourg, 2008. [Google Scholar]

- Manjong, N.B.; Marinova, S.; Bach, V.; Burheim, O.S.; Finkbeiner, M.; Strømman, A.H. Approaching Battery Raw Material Sourcing through a Material Criticality Lens. Sustain. Prod. Consum. 2024, 49, 289–303. [Google Scholar] [CrossRef]

- Almansour, S. Criticality and Life Cycle Assessment of Lithium-Ion-Battery Raw Materials. Master’s Thesis, University of Liège, Liège, Belgium, 2022. [Google Scholar]

- Beylot, A.; Dewulf, J.; Greffe, T.; Muller, S.; Blengini, G.-A. Mineral Resources Depletion, Dissipation and Accessibility in LCA: A Critical Analysis. Int. J. Life Cycle Assess. 2024, 29, 890–908. [Google Scholar] [CrossRef]

- Van Oers, L.; Guinée, J.B.; Heijungs, R.; Schulze, R.; Alvarenga, R.A.F.; Dewulf, J.; Drielsma, J.; Sanjuan-Delmás, D.; Kampmann, T.C.; Bark, G.; et al. Top-down Characterization of Resource Use in LCA: From Problem Definition of Resource Use to Operational Characterization Factors for Dissipation of Elements to the Environment. Int. J. Life Cycle Assess. 2020, 25, 2255–2273. [Google Scholar] [CrossRef]

- Owsianiak, M.; Van Oers, L.; Drielsma, J.; Laurent, A.; Hauschild, M.Z. Identification of Dissipative Emissions for Improved Assessment of Metal Resources in Life Cycle Assessment. J. Ind. Ecol. 2022, 26, 406–420. [Google Scholar] [CrossRef]

- Charpentier Poncelet, A.; Loubet, P.; Helbig, C.; Beylot, A.; Muller, S.; Villeneuve, J.; Laratte, B.; Thorenz, A.; Tuma, A.; Sonnemann, G. Midpoint and Endpoint Characterization Factors for Mineral Resource Dissipation: Methods and Application to 6000 Data Sets. Int. J. Life Cycle Assess. 2022, 27, 1180–1198. [Google Scholar] [CrossRef]

- Beylot, A.; Ardente, F.; Sala, S.; Zampori, L. Mineral Resource Dissipation in Life Cycle Inventories. Int. J. Life Cycle Assess. 2021, 26, 497–510. [Google Scholar] [CrossRef]

- Ardente, F.; Beylot, A.; Zampori, L. A Price-Based Life Cycle Impact Assessment Method to Quantify the Reduced Accessibility to Mineral Resources Value. Int. J. Life Cycle Assess. 2023, 28, 95–109. [Google Scholar] [CrossRef]

- Conrad, C.; Kleen, O. Two Are Better than One: Volatility Forecasting Using Multiplicative Component GARCH-MIDAS Models. J. Appl. Econom. 2020, 35, 19–45. [Google Scholar] [CrossRef]

- Helbig, C.; Bruckler, M.; Thorenz, A.; Tuma, A. An Overview of Indicator Choice and Normalization in Raw Material Supply Risk Assessments. Resources 2021, 10, 79. [Google Scholar] [CrossRef]

- Černý, I.; Krčmarská, L.; Špakovská, K.; Rolčíková, M. Multi-Criteria Decision-Making Analysis of Critical Raw Materials in the European Union. Int. Multidiscip. Sci. GeoConf. SGEM 2016, 2, 619–626. [Google Scholar]

- Qualtrics Likert Scale. Qualtrics. 2024. Available online: https://www.qualtrics.com/articles/strategy-research/likert-scale/ (accessed on 20 June 2025).

- Bruijn, H.; Duin, R.; Huijbregts, M.A.J.; Guinee, J.B.; Gorree, M.; Heijungs, R.; Huppes, G.; Kleijn, R.; Koning, A.; Oers, L.; et al. Handbook on Life Cycle Assessment: Operational Guide to the ISO Standards; Eco-Efficiency in Industry and Science; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2004; ISBN 978-0-306-48055-3. [Google Scholar]

- Guinée, J.B.; Heijungs, R. A Proposal for the Definition of Resource Equivalency Factors for Use in Product Life-cycle Assessment. Environ. Toxic Chem. 1995, 14, 917–925. [Google Scholar] [CrossRef]

- Van Oers, L.; Guinée, J.B.; Heijungs, R. Abiotic Resource Depletion Potentials (ADPs) for Elements Revisited—Updating Ultimate Reserve Estimates and Introducing Time Series for Production Data. Int. J. Life Cycle Assess. 2020, 25, 294–308. [Google Scholar] [CrossRef]

- U.S. Geological Survey. Mineral Commodity Summaries 2024—Magnesium Compounds: Data Release; U.S. Department of the Interior: Reston, VA, USA, 2024. Available online: https://catalog.data.gov/dataset/mineral-commodity-summaries-2024-magnesium-compounds-data-release (accessed on 7 November 2025).

- U.S. Geological Survey. Mineral Commodity Summaries 2024—Phosphate Rock: Data Release; U.S. Department of the Interior: Reston, VA, USA, 2024. Available online: https://data.usgs.gov/datacatalog/data/USGS%3A65b7d847d34e36a39045b503 (accessed on 7 November 2025).

- Frenzel, M.; Ketris, M.P.; Gutzmer, J. On the Geological Availability of Germanium. Min. Depos. 2014, 49, 471–486. [Google Scholar] [CrossRef]

- Han, Z.; Liu, Q.; Ouyang, X.; Song, H.; Gao, T.; Liu, Y.; Wen, B.; Dai, T. Tracking Two Decades of Global Gallium Stocks and Flows: A Dynamic Material Flow Analysis. Resour. Conserv. Recycl. 2024, 202, 107391. [Google Scholar] [CrossRef]

- Foosoon Trading Co., Ltd. Global Silicon Metal Reserves Revealed; Foosoon Trading: Hong Kong, China, 2021; Available online: https://foosoonhk.com/news/industry-news/global-silicon-metal-reserves-revealed/ (accessed on 7 November 2025).

- Center on Global Energy Policy at Columbia University, School of International and Public Affairs. Materials Powering the Future of Energy Dataset; Center on Global Energy Policy: New York, NY, USA, 2023. [Google Scholar]

- Idoine, N.E.; Raycraft, E.R.; Hobbs, S.F.; Everett, P.; Evans, E.J.; Mills, A.J.; Currie, D.; Horn, S.; Shaw, R.A. World Mineral Production 2018–2022; British Geological Survey: Keyworth, Nottingham, UK, 2024; Available online: https://www.bgs.ac.uk/mineralsuk/statistics/world-mineral-statistics/ (accessed on 7 November 2025).

- Phoung, S.; Williams, E.; Gaustad, G.; Gupta, A. Exploring Global Supply and Demand of Scandium Oxide in 2030. J. Clean. Prod. 2023, 401, 136673. [Google Scholar] [CrossRef]

- U.S. Geological Survey. Mineral Commodity Summaries 2024; U.S. Department of the Interior: Reston, VA, USA, 2024. Available online: https://pubs.usgs.gov/publication/mcs2024 (accessed on 7 November 2025). [CrossRef]

- ISO 14040:2006; Environmental Management—Life Cycle Assessment—Principles and Framework. ISO: Geneva, Switzerland, 2006. Available online: https://www.iso.org/standard/37456.html (accessed on 7 November 2025).

- ISO 14044:2006; Environmental Management—Life Cycle Assessment—Requirements and Guidelines. International Organization for Standardization: Geneva, Switzerland, 2006.

- Database & Support team at PRé Sustainability. SimaPro Database Manual—Methods Library 2024; PRé Sustainability: Amersfoort, The Netherlands, 2024. [Google Scholar]

- Xiarchos, I.; Morozinis, A.K.; Charitidis, C. Life-Cycle Assessment and Possible Impacts of CFRPs for Space Applications; EDP Sciences: Les Ulis, France, 2019. [Google Scholar]

- Chen, Q.; Lai, X.; Chen, J.; Huang, Y.; Guo, Y.; Wang, Y.; Han, X.; Lu, L.; Sun, Y.; Ouyang, M.; et al. A Critical Comparison of LCA Calculation Models for the Power Lithium-Ion Battery in Electric Vehicles during Use-Phase. Energy 2024, 296, 131175. [Google Scholar] [CrossRef]

- Zackrisson, M.; Avellán, L.; Orlenius, J. Life Cycle Assessment of Lithium-Ion Batteries for Plug-in Hybrid Electric Vehicles—Critical Issues. J. Clean. Prod. 2010, 18, 1519–1529. [Google Scholar] [CrossRef]

- Shen, K.; Zhai, Q.; Gu, Y.; Wang, W.; Cao, H.; Hauschild, M.; Yuan, C. Life Cycle Assessment of Lithium Ion Battery from Water-Based Manufacturing for Electric Vehicles. Resour. Conserv. Recycl. 2023, 198, 107152. [Google Scholar] [CrossRef]

- Kim, J.-H.; Woo, S.C.; Park, M.-S.; Kim, K.J.; Yim, T.; Kim, J.-S.; Kim, Y.-J. Capacity Fading Mechanism of LiFePO4-Based Lithium Secondary Batteries for Stationary Energy Storage. J. Power Sources 2013, 229, 190–197. [Google Scholar] [CrossRef]

- Verme, M.D.; Lipari, D.; Lucido, G.; Maio, V.; Surace, V.; Liberatore, P. Rapporto Statistico 2021 Energia Da Fonti Rinnovabili in Italia; Gestore dei Servizi Energetici SpA: Rome, Italy, 2023. [Google Scholar]

- Pagnanelli, F.; Altimari, P.; Schiavi, P.G. Process Development for End-of-Life Li-Ion Batteries. Chim. Ind. 2021, 103, 24. Available online: https://www.soc.chim.it/sites/default/files/chimind/pdf/2021_5_24_ca.pdf (accessed on 20 June 2025).

- Hawkins, T.R.; Singh, B.; Majeau-Bettez, G.; Strømman, A.H. Comparative Environmental Life Cycle Assessment of Conventional and Electric Vehicles. J. Ind. Ecol. 2013, 17, 53–64. [Google Scholar] [CrossRef]

- Ellingsen, L.A.-W.; Singh, B.; Strømman, A.H. The Size and Range Effect: Lifecycle Greenhouse Gas Emissions of Electric Vehicles. Environ. Res. Lett. 2016, 11, 054010. [Google Scholar] [CrossRef]

- Das, P.K.; Bhat, M.Y.; Sajith, S. Life Cycle Assessment of Electric Vehicles: A Systematic Review of Literature. Environ. Sci. Pollut. Res. 2024, 31, 73–89. [Google Scholar] [CrossRef] [PubMed]

- Bieker, G. A Global Comparison of the Life-Cycle Greenhouse Gas Emissions of Combustion Engine and Electric Passenger Cars; International Council on Clean Transportation (ICCT): Washington, DC, USA; Berlin, Germany, 2021; Available online: https://theicct.org/sites/default/files/publications/Global-LCA-passenger-cars-jul2021_0.pdf (accessed on 7 November 2025).

- Idris, M.; Koestoer, R.H. Environmental Life Cycle Assessment of Conventional and Electric Vehicles: Lessons Learned from Selected Countries. J. Innov. Mater. Energy Sustain. Eng. 2023, 1, 1–19. [Google Scholar] [CrossRef]

| 2023 Critical Raw Materials | |||

|---|---|---|---|

| Aluminium/Bauxite | Coking Coal | Lithium | Phosphorous |

| Antimony | Feldspar | LREE | Scandium |

| Arsenic | Fluorspar | Magnesium | Silicon metal |

| Baryte | Gallium | Manganese | Strontium |

| Beryllium | Germanium | Natural graphite | Tantalum |

| Bismuth | Hafnium | Niobium | Titanium metal |

| Boron/Borate | Helium | PGM | Tungsten |

| Cobalt | HREE | Phosphate rock | Vanadium |

| Copper * | Nickel * | ||

| 2023 CRM | Resource—Depletion Index 2022 | GINI Index 2022 | |

|---|---|---|---|

| Aluminium/bauxite | 0.0133 | 0.58 | |

| Antimony | 0.0416 | 0.56 | |

| Arsenic | 0.0500 | 0.50 | |

| Baryte | 0.0297 | 0.47 | |

| Beryllium | 0.0028 | 0.50 | |

| Bismuth | 0.0691 | 0.68 | |

| Boron/borate | 0.0031 | 0.63 | |

| Cobalt | 0.0179 | 0.70 | |

| Coking coal | 0.0015 | 0.41 | |

| Copper | 0.0219 | 0.41 | |

| Feldspar | 0.0116 | 0.46 | |

| Fluorspar | 0.0297 | 0.66 | |

| Gallium | 0.0004 | 0.73 | |

| Germanium | 0.0003 | 0.73 | |

| Hafnium | 9.59 × 10−7 | 0.45 | |

| Helium | 0.0132 | 0.59 | |

| HREE | Europium | 0.0024 | 1 |

| Gadolinium | 0.0024 | 1 | |

| Terbium | 0.0013 | 1 | |

| Yttrium | 0.0208 | 1 | |

| Erbium | 0.0008 | 1 | |

| Holmium | 0.0005 | 1 | |

| Thulium | 0.0018 | 1 | |

| Ytterbium | 0.0002 | 1 | |

| Lutetium | 0.0009 | 1 | |

| Dysprosium | 0.0011 | 1 | |

| TOTAL HREE | 0.0028 | 1 | |

| LREE | Cerium | 0.1045 | 0.54 |

| Lanthanum | 0.0021 | 0.54 | |

| Praseodymium | 0.0013 | 0.54 | |

| Neodymium | 0.0009 | 0.54 | |

| Samarium | 0.0004 | 0.54 | |

| TOTAL LREE | 0.0038 | 0.39 | |

| REE | 0.0068 | 0.42 | |

| Lithium | 0.0052 | 0.55 | |

| Magnesium metal | 0.0004 | 0.74 | |

| Manganese | 0.0104 | 0.62 | |

| Natural graphite | 0.0060 | 0.63 | |

| Nickel | 0.0252 | 0.51 | |

| Niobium | 0.0049 | 0.59 | |

| PGM | Iridium | 0.0016 | 0.45 |

| Ruthenium | 0.0016 | 0.45 | |

| Osmium | 0.0016 | 0.45 | |

| Palladium | 0.0071 | 0.28 | |

| Platinum | 0.0061 | 0.48 | |

| Rhodium | 0.0032 | 0.50 | |

| TOTAL | 0.0061 | 0.67 | |

| Phosphate rock | 0.0031 | 0.61 | |

| Phosphorus | 0.0033 | 0.56 | |

| Scandium | 0.00001 | 0.59 | |

| Silicon metal | 0.000001 | 0.62 | |

| Strontium | 0.0271 | 0.30 | |

| Tantalum | 0.0051 | 0.57 | |

| Titanium metal | 0.0125 | 0.41 | |

| Tungsten | 0.0181 | 0.65 | |

| Vanadium | 0.0054 | 0.49 |

| Indicators | Scenario 1 Electric Passenger Car | Scenario 2 Diesel Passenger Car | Ideal Target Min or Max |

|---|---|---|---|

| Supply chain | |||

| Extraction of Critical Raw Materials | 5 | 3 | Min |

| EOL Recycling Rate | 5 | 4 | Max |

| Gini Index | 4 | 2 | Max |

| Resources diversification | 4 | 3 | Min |

| Dependency on Import | 4 | 4 | Min |

| Future demand for CRMs using recycled material | 4 | 2 | Max |

| Technological | |||

| Lifespans of CRMs | 5 | 3 | Max |

| Dependence of the technological system on specific characteristics of CRMs | 5 | 2 | Min |

| Substitutability | 5 | 4 | Max |

| Research and innovation | 5 | 3 | Max |

| Advanced recycling processes | 5 | 4 | Max |

| Ease of manufacturing raw materials | 4 | 2 | Max |

| Environmental | |||

| Sustainable mining activities | 4 | 3 | Max |

| Raw Material Extraction/Reserve Index | 5 | 3 | Min |

| GHG emissions from CRMs extraction/production | 3 | 3 | Min |

| Energy intensity to produce secondary material | 4 | 3 | Min |

| Application of circularity practices | 4 | 3 | Max |

| Environmental Footprint | 3 | 4 | Min |

| Economic | |||

| Market volatility | 5 | 3 | Min |

| Market incentives for improvement | 4 | 3 | Max |

| Market for secondary raw materials | 4 | 3 | Max |

| High-tech market | 5 | 2 | Max |

| Legislative | |||

| Trade policy uncertainty | 4 | 3 | Min |

| Political instability | 5 | 3 | Min |

| Military vulnerability | 4 | 2 | Min |

| Export restrictions | 4 | 2 | Max |

| Innovation to diversify products on the market | 4 | 2 | Max |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cappelli, A.; Barbini, F.; Paoli, R.; Marzeddu, S.; Romagnoli, F. Critical Raw Materials in Life Cycle Assessment: Innovative Approach for Abiotic Resource Depletion and Supply Risk in the Energy Transition. Energies 2025, 18, 6103. https://doi.org/10.3390/en18236103

Cappelli A, Barbini F, Paoli R, Marzeddu S, Romagnoli F. Critical Raw Materials in Life Cycle Assessment: Innovative Approach for Abiotic Resource Depletion and Supply Risk in the Energy Transition. Energies. 2025; 18(23):6103. https://doi.org/10.3390/en18236103

Chicago/Turabian StyleCappelli, Andrea, Federica Barbini, Riccardo Paoli, Simone Marzeddu, and Francesco Romagnoli. 2025. "Critical Raw Materials in Life Cycle Assessment: Innovative Approach for Abiotic Resource Depletion and Supply Risk in the Energy Transition" Energies 18, no. 23: 6103. https://doi.org/10.3390/en18236103

APA StyleCappelli, A., Barbini, F., Paoli, R., Marzeddu, S., & Romagnoli, F. (2025). Critical Raw Materials in Life Cycle Assessment: Innovative Approach for Abiotic Resource Depletion and Supply Risk in the Energy Transition. Energies, 18(23), 6103. https://doi.org/10.3390/en18236103