The Global Impact of Oil Revenue Dependency: Analysis of Key Indicators from Leading Energy-Producing Countries

Abstract

1. Introduction

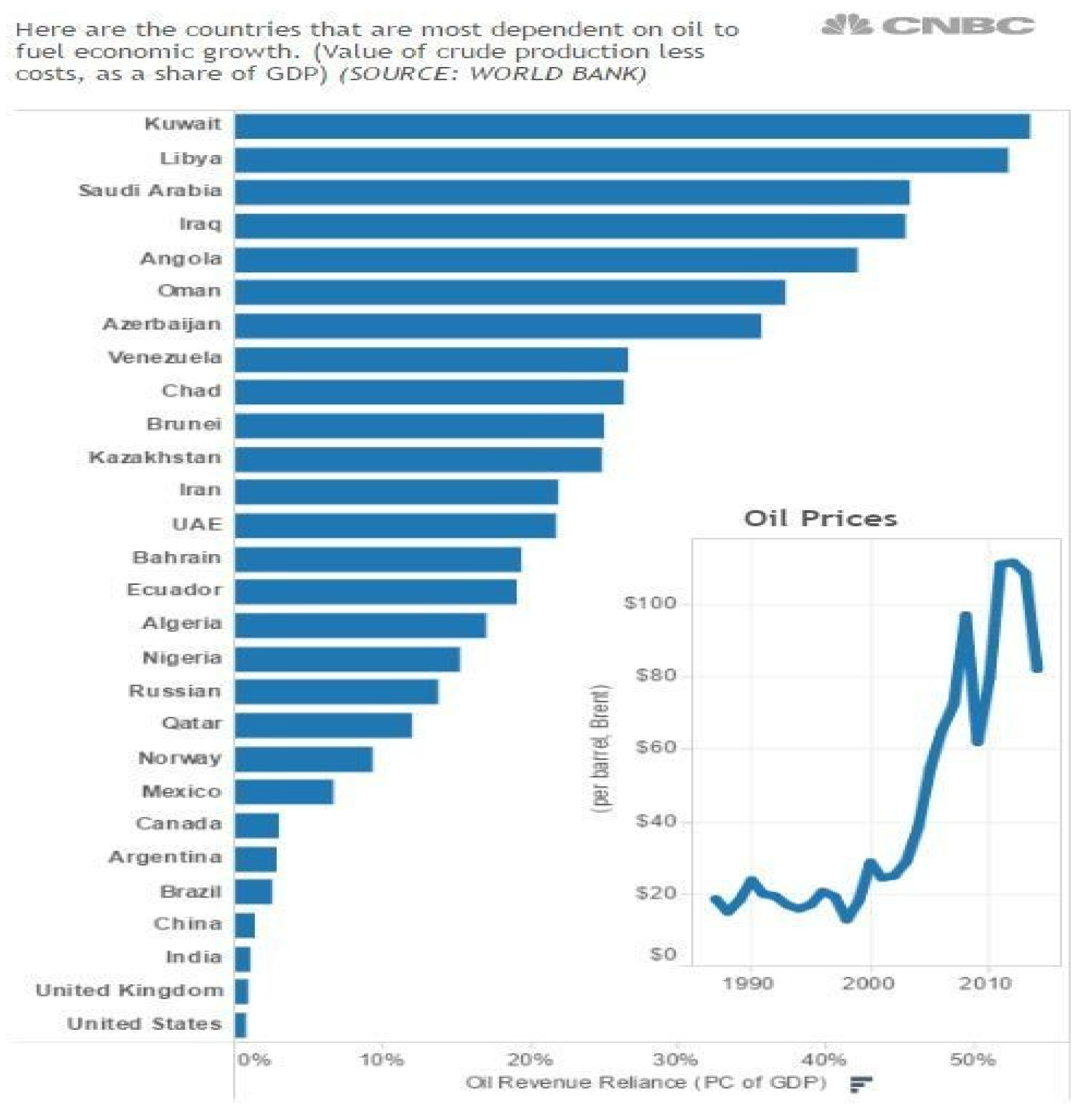

- 2003–2008: China’s growth → Record increase in oil prices.

- 2008–2010: Global Financial Crisis → Price collapse.

- 2014–2016: Oil oversupply and OPEC conflicts → Second major crash. Furthermore, I would like to remind you that these events created an environment where domestic economic imbalances in countries dependent on rentier income could influence global prices within the framework of the Rentier State Theory [3].

- The study hypothesis is as follows:

- H0 = Global energy prices are affected by the domestic economic, institutional, national security, technological progress, and influence issues of the top 20 oil-exporting countries.

- H1 = Global energy prices are not significantly related to the domestic affairs of the top 20 oil-exporting countries.

- This study analyzes 16 years of annual data from the top 20 oil-exporting countries to examine how domestic factors affect global oil prices. It uses an econometric model similar to that used by the authors [6] in their study on the determinants of entrepreneurship in the Middle East and North Africa. The study categorizes explanatory variables as economic conditions, institutional quality, national security, technological progress, and welfare.

- Key variables include military spending (national security), public spending (welfare), CO2 emissions (technological progress), exchange rates (economic context), and control of corruption (institutional quality). The study’s innovative approach involves examining these local factors as predictors of global oil prices, making it the first study to apply this model to analyze oil prices using these predictors. The quantitative significance of these variables is assessed using various forecasting techniques, as detailed in the Methodology section.

General Overview

2. Theoretical Framework and Literature Review

2.1. Theoretical Framework

2.1.1. Political Fragility and Autocracy

2.1.2. Deterioration of Institutions

2.1.3. Short-Term, Rent-Seeking Behavior

2.2. Literature Review

- One study [26], which is conducted in 2024, focuses on the effects of oil prices on GDP and its components in both oil-exporting and oil-importing countries. The results of the study showed that increasing oil prices tend to stimulate economic growth in oil-exporting countries by increasing government revenues, which in turn facilitates public investment and economic expansion. The findings showed that oil prices have some negative effects on economic growth. In particular, it was noted that excessive dependence on oil exports could reduce growth in the long run due to volatility in oil prices and poor management.

- Another research [27] applied network analysis and quantile regression to examine the impact of oil dependence on political stability in 155 countries from 1995 to 2019. They supported the “resource curse” hypothesis and found that oil-dependent economies, especially those with weak institutions, were more prone to political instability. Their study highlighted the negative effects of oil price volatility on political stability. Similarly, one researcher found that increasing oil prices negatively affected political stability in oil-exporting countries due to economic shocks and civil conflicts. This study also found that although oil price increases can increase government revenues, they can also worsen governance problems such as corruption and mismanagement. One another study [28] examined the economic structure of Bahrain from 1960 to 2010 and focused on the relationship between oil revenues, government expenditures, and economic growth. They concluded that oil revenues are the main driver of economic growth and public expenditures. This is also reflected in the current study, which shows a long-term positive relationship between government spending and oil prices. As can be seen, when the literature is examined, it is seen that there are very few studies similar to our study. The results of our study show that government spending can sometimes contribute to inefficiencies and may not always translate into sustainable economic growth. In a similar study [29,30], it is also found that geopolitical risks, especially wars and conflicts, are effective in affecting military spending and oil price fluctuations. Studies show that there is a positive correlation between oil wealth and military expenditures, especially in oil-exporting regions such as the Middle East and North Africa (1). Another researcher [31] pointed out that there is an inverse relationship between oil price volatility and military expenditures in Gulf Cooperation Council countries [7]. The author stated that oil revenues significantly affect Iran’s military expenditures. These findings confirm the complex interaction between oil prices and military expenditures; geopolitical tensions generally increase oil price volatility. Another study [32,33] investigated the effects of oil price fluctuations on carbon emissions in oil-exporting countries. These studies noted that there was an increase in carbon emissions until 2007, followed by a decrease after the Global Financial Crisis. Ultimately, oil price fluctuations, combined with investments in renewable energy, indicate that the environmental footprint of oil-exporting countries is changing.

- The ‘Dutch Disease’, first proposed in connection with the Groningen gas discovery, describes how a resource boom can lead to currency appreciation and reduce the competitiveness of other exports [34]. While many studies focus on the US dollar exchange rate, this research is based on [2,35] adopting the swap terms of trade index to assess how currency fluctuations affect the decision-making processes of oil exporters. Corruption remains a significant problem in resource-rich countries, where poor governance and institutional weaknesses can undermine economic growth [36,37]. This study offers a unique perspective by examining how local governance issues, including corruption, affect global oil prices and resource management practices. The literature review reveals a complex and multifaceted relationship between oil prices, economic growth, political stability, renewable energy development, and governance. While oil wealth can stimulate economic growth and public spending, volatility, management influence, and misuse of planned resources, especially in oil-exporting countries outside the Gulf Cooperation Council, affect economic success. Effective governance, strategic investments in renewable energy, and diversification efforts are vital to ensure sustainable development of oil-dependent economies. Our research also highlights the need for robust institutional frameworks to effectively manage oil revenues and mitigate the negative impacts of oil price volatility on political stability and economic growth.

3. Data and Methodology

- 2000–2003: This period saw oil prices rise steadily from USD20 to USD30 due to the recovery of global demand and limited spare capacity.

- 2003–2008: This period, marked by strong demand from China, speculative investments in commodities, tight supply, and geographical tensions (e.g., the Iraq War), saw oil prices reach an all-time high of USD147 per barrel. This period is known as the “Super Peak.”

- 2008–2009: This period is marked by a price decline due to the sharp decline in demand caused by the Global Financial Crisis (GFC).

- 2009–2011: This is the recovery period following the Global Financial Crisis. The recovery in global energy demand brought prices back to USD100 per barrel.

- 2014–2016: This period was affected by the US shale oil boom, OPEC’s supply glut, and the slowdown in demand, particularly from China. Oil prices fell by 25% during this period.

Methodology Overview

- United Kingdom, Oman, Angola, Algeria, Nigeria, Mexico, Norway, Kuwait, Brazil, United Arab Emirates, Iran, China, Canada, Saudi Arabia, Russia, United States; Countries Excluded: Iraq, Kazakhstan, Qatar, Libya.

- In this study, Iraq, Kazakhstan, Qatar, and Libya were excluded from the country sample due to a lack of reliable data. Specifically, while the period we studied for Iraq and Libya coincided with periods of war, it was not possible to obtain consistent data for Kazakhstan and Qatar, and these countries were excluded from our study.

4. Empirical Estimation

4.1. Unit Root Tests Results

4.2. Cointegration Tests

4.3. Lag Length Results

4.4. Long-Run Effects for Equations RGDP and Ordinary Least Squares (OLS) for Other Dependent Variables

4.5. Wald Test Results, Short-Run Effects

4.6. Results and Discussion

5. Conclusions

5.1. Short-Term Policy Recommendations

5.2. Long-Term Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| CADT | Climate Analysis Indicators Tool |

| dlnOil | natural logarithm of the Brent Petro Crude oil prices globally |

| dlnGX | natural logarithm of the government expenditures |

| dlnGDP | natural logarithm of the gross domestic product |

| dlnCO2 | natural logarithm of carbon dioxide emissions |

| dXC | exchange rate |

| dCC | corruption score |

| GDP | Gross Domestic Product |

| LPG | Liquefied Petroleum Gas |

| OECD | Organization for Economic Cooperation and Development |

| PVECM | Panel Vector Error Correction Model |

| RST | Rentier State Theory |

| PPP | Purchasing Power Parity |

| WGI | Worldwide Governance Indicators |

Appendix A

| Coefficient | Std. Error | t-Statistic | Probability | |

|---|---|---|---|---|

| DLNOIL C(1) | −0.024278 | 0.042818 | −0.567006 | 0.5714 |

| C(2) | −0.793497 | 0.124622 | −6.367214 | 0.0000 |

| C(3) | −0.401732 | 0.130489 | −3.078674 | 0.0024 |

| C(4) | −0.001990 | 0.001288 | −1.545364 | 0.1240 |

| C(5) | −0.000203 | 0.001286 | −0.158088 | 0.8746 |

| C(6) | 0.089356 | 0.130887 | 0.682693 | 0.4957 |

| C(7) | 0.036815 | 0.116411 | 0.316251 | 0.7522 |

| C(8) | 0.419649 | 0.345270 | 1.215423 | 0.0258 |

| C(9) | −0.104845 | 0.307108 | −0.341395 | 0.0432 |

| C(10) | 0.152598 | 0.309188 | 0.493546 | 0.6222 |

| C(11) | 0.290584 | 0.325336 | 0.893182 | 0.3730 |

| C(12) | −0.032237 | 0.230858 | −0.139638 | 0.8891 |

| C(13) | −0.159206 | 0.147185 | −1.081677 | 0.2809 |

| C(14) | −0.093423 | 0.021880 | −4.269700 | 0.0000 |

| DLNXC, C(15) | −2.787952 | 4.216629 | −0.661180 | 0.5094 |

| C(16) | 5.175954 | 12.27258 | 0.421749 | 0.6737 |

| C(17) | −1.773713 | 12.85030 | −0.138029 | 0.8904 |

| C(18) | −0.907248 | 0.126804 | −7.154723 | 0.0000 |

| C(19) | −0.323088 | 0.126634 | −2.551355 | 0.0116 |

| C(20) | 16.32579 | 12.88955 | 1.266591 | 0.2070 |

| C(21) | 9.984320 | 11.46395 | 0.870932 | 0.3850 |

| C(22) | −0.845596 | 34.00155 | −0.024869 | 0.9802 |

| C(23) | −21.96560 | 30.24347 | −0.726292 | 0.4686 |

| C(24) | −24.61857 | 30.44829 | −0.808537 | 0.4199 |

| C(25) | 26.74971 | 32.03850 | 0.834924 | 0.4049 |

| C(26) | −2.395435 | 22.73452 | −0.105366 | 0.9162 |

| C(27) | −14.88142 | 14.49448 | −1.026696 | 0.3060 |

| C(28) | −4.976273 | 2.154749 | −2.309444 | 0.0221 |

| DLNGX, C(29) | −0.058145 | 0.020538 | −2.831033 | 0.0052 |

| C(30) | −0.097930 | 0.059778 | −1.638238 | 0.1031 |

| C(31) | −0.072940 | 0.062591 | −1.165327 | 0.2454 |

| C(32) | 0.000316 | 0.000618 | 0.511442 | 0.6097 |

| C(33) | 0.000924 | 0.000617 | 1.498395 | 0.1358 |

| C(34) | −0.582386 | 0.062783 | −9.276215 | 0.0000 |

| C(35) | −0.314635 | 0.055839 | −5.634707 | 0.0000 |

| C(36) | 0.192266 | 0.165615 | 1.160918 | 0.2472 |

| C(37) | −0.102584 | 0.147310 | −0.696383 | 0.4871 |

| C(38) | −0.378470 | 0.148308 | −2.551917 | 0.0116 |

| C(39) | −0.114271 | 0.156054 | −0.732252 | 0.4650 |

| C(40) | 0.119165 | 0.110736 | 1.076122 | 0.2833 |

| C(41) | −0.001033 | 0.070600 | −0.014637 | 0.9883 |

| C(42) | −0.035624 | 0.010495 | −3.394221 | 0.0008 |

| DLNGDP, C(43) | 0.015614 | 0.022397 | 0.697160 | 0.4866 |

| C(44) | −0.127919 | 0.065186 | −1.962383 | 0.0513 |

| C(45) | −0.047615 | 0.068254 | −0.697613 | 0.4863 |

| C(46) | −0.001307 | 0.000674 | −1.939990 | 0.0540 |

| C(47) | 0.000233 | 0.000673 | 0.346072 | 0.7297 |

| C(48) | 0.002549 | 0.068463 | 0.037227 | 0.9703 |

| C(49) | 0.032447 | 0.060891 | 0.532871 | 0.5948 |

| C(50) | −0.183016 | 0.180599 | −1.013382 | 0.3123 |

| C(51) | −0.366662 | 0.160638 | −2.282540 | 0.0236 |

| C(52) | −0.176332 | 0.161726 | −1.090313 | 0.2770 |

| C(53) | 0.085089 | 0.170172 | 0.500016 | 0.6177 |

| C(54) | −0.203061 | 0.120754 | −1.681612 | 0.0944 |

| C(55) | −0.152899 | 0.076987 | −1.986027 | 0.0486 |

| C(56) | −0.040423 | 0.011445 | −3.531924 | 0.0005 |

| DLNCO2, C(57) | 0.006343 | 0.011165 | 0.568178 | 0.5706 |

| C(58) | 0.027602 | 0.032495 | 0.849425 | 0.3968 |

| C(59) | 0.042376 | 0.034024 | 1.245467 | 0.2146 |

| C(60) | 0.000191 | 0.000336 | 0.567513 | 0.5711 |

| C(61) | −0.000305 | 0.000335 | −0.908544 | 0.3648 |

| C(62) | 0.043000 | 0.034128 | 1.259969 | 0.2093 |

| C(63) | 0.000601 | 0.030354 | 0.019800 | 0.9842 |

| C(64) | −0.164091 | 0.090027 | −1.822686 | 0.0700 |

| C(65) | −0.040972 | 0.080077 | −0.511661 | 0.6095 |

| C(66) | −0.606609 | 0.080619 | −7.524380 | 0.0000 |

| C(67) | −0.389056 | 0.084830 | −4.586329 | 0.0000 |

| C(68) | −0.065955 | 0.060195 | −1.095684 | 0.2747 |

| C(69) | −0.002238 | 0.038378 | −0.058310 | 0.9536 |

| C(70) | 0.008694 | 0.005705 | 1.523918 | 0.1293 |

| DCC, C(71) | −0.094101 | 0.015987 | −5.885947 | 0.0000 |

| C(72) | 0.087688 | 0.046531 | 1.884485 | 0.0611 |

| C(73) | 0.010737 | 0.048722 | 0.220376 | 0.8258 |

| C(74) | 0.000992 | 0.000481 | 2.063508 | 0.0405 |

| C(75) | 0.000829 | 0.000480 | 1.727151 | 0.0859 |

| C(76) | 0.243367 | 0.048871 | 4.979817 | 0.0000 |

| C(77) | 0.106622 | 0.043465 | 2.453028 | 0.0151 |

| C(78) | −0.607503 | 0.128917 | −4.712375 | 0.0000 |

| C(79) | −0.209325 | 0.114668 | −1.825493 | 0.0696 |

| C(80) | −0.308725 | 0.115444 | −2.674226 | 0.0082 |

| C(81) | −0.081417 | 0.121474 | −0.670240 | 0.5036 |

| C(82) | −0.314699 | 0.086198 | −3.650893 | 0.0003 |

| C(83) | −0.057352 | 0.054956 | −1.043609 | 0.2981 |

| C(84) | 0.007102 | 0.008170 | 0.869283 | 0.3859 |

Appendix B

References

- Khan, I.; Zakari, A.; Dagar, V.; Singh, S. World energy trilemma and transformative energy developments as determinants of economic growth amid environmental sustainability. Energy Econ. 2022, 108, 105884. [Google Scholar] [CrossRef]

- Reboredo, J.C. Modelling oil price and exchange rate co-movements. J. Policy Model. 2012, 34, 419–440. [Google Scholar] [CrossRef]

- Mahdavy, H. The Patterns and Problems of Economic Development in Rentier States: The Case of Iran. In Studies in the Economic History of the Middle East; Cook, M.A., Ed.; Oxford University Press: Oxford, UK, 1970. [Google Scholar]

- Eia. United States Energy Information Administration. 2023. Available online: https://www.Eia.Gov/ (accessed on 13 November 2025).

- Bacon, R. The Brent Market Analysis of Recent Developments; Oxford Institute for Energy Studies: Oxford, UK, 1963; pp. 247–272. [Google Scholar]

- Zmami, M.; Salha, O.B. On the Determinants of Entrepreneurship in Middle East and North Africa. Int. J. Comput. Sci. Netw. Secur. 2021, 21, 181–187. [Google Scholar] [CrossRef]

- Farzanegan, M.R. Oil revenue shocks and government spending behavior in Iran. Energy Econ. 2011, 33, 1055–1069. [Google Scholar] [CrossRef]

- Zaghdoudi, T. Oil prices, renewable energy, CO2 emissions and economic growth in OECD countries. Econ. Bull. 2017, 37, 1844–1850. [Google Scholar]

- Vézina, P.-L. The Oil Nouveau-Riche and Arms Imports. J. Afr. Econ. 2021, 30, 349–369. [Google Scholar] [CrossRef]

- Li, P.; Wang, Y.; Liu, J.; Liang, M. Evaluation of Carbon Emission Efficiency and Analysis of Influencing Factors of Chinese Oil and Gas Enterprises. Energy Sci. Eng. 2025, 13, 1156–1170. [Google Scholar] [CrossRef]

- Available online: https://www.statista.com/chart/4284/the-economies-most-dependent-on-oil/ (accessed on 13 November 2025).

- Corden, W.M. Booming Sector and Dutch Disease Economics: Survey and Consolidation. Oxf. Econ. Pap. 1984, 36, 359–380. [Google Scholar] [CrossRef]

- World Bank 2024 Database. 2024. Available online: https://data.worldbank.org/ (accessed on 13 November 2025).

- Mohammed, S.; Desha, C.; Goonetilleke, A. Investigating the potential of low-carbon pathways for hydrocar-bon-dependent rentier states: Sociotechnical transition in Qatar. Technol. Forecast. Soc. Change 2023, 189, 122337. [Google Scholar] [CrossRef]

- Vakulchuk, R.; Overland, I.; Scholten, D. Renewable energy and geopolitics: A review. Renew. Sustain. Energy Rev. 2020, 122, 109547. [Google Scholar] [CrossRef]

- Sim, L.-C. Low-carbon energy in the Gulf: Upending the rentier state? Energy Res. Soc. Sci. 2020, 70, 101752. [Google Scholar] [CrossRef]

- Al-Sarihi, A. Political economy of renewable energy transition in rentier states: The case of Oman. Environ. Policy Gov. 2023, 33, 423–439. [Google Scholar] [CrossRef]

- Bhattarai, U. Assay of renewable energy transition: A systematic review. Sci. Total Environ. 2022, 833, 155159. [Google Scholar] [CrossRef]

- Blondeel, M.; Bradshaw, M.J.; Bridge, G.; Kuzemko, C. The geopolitics of energy system transformation: A review. Geogr. Compass 2021, 15, e12580. [Google Scholar] [CrossRef]

- Osunmuyiwa, O.; Biermann, F.; Kalfagianni, A. Applying the multi-level perspective on socio-technical transitions to rentier states: The case of renewable energy transitions in Nigeria. J. Environ. Policy Plan. 2018, 20, 143–156. [Google Scholar] [CrossRef]

- Adeniyi, F. Unlocking renewables amid rentierism: Market constraints and policy options in Nigeria. Energy Res. Soc. Sci. 2023, 104, 103248. [Google Scholar] [CrossRef]

- Zhang, X.; Lai, K.K.; Wang, S. A new approach for crude oil price analysis based on Empirical Mode Decomposition. Energy Econ. 2008, 30, 905–918. [Google Scholar] [CrossRef]

- Miao, H.; Ramchander, S.; Wang, T.; Yang, D. Influential factors in crude oil price forecasting. Energy Econ. 2017, 68, 77–88. [Google Scholar] [CrossRef]

- Matallah, S. MENA oil exporters need a renewable energy transition before the oil wells run dry: A special focus on innovation, financial development, and governance. Geol. J. 2024, 59, 838–853. [Google Scholar] [CrossRef]

- Chen, S.; Chang, B.H.; Fu, H.; Xie, S.Q. Dynamic analysis of the relationship between exchange rates and oil prices: A comparison between oil exporting and oil importing countries. Humanit. Soc. Sci. Commun. 2024, 11, 801. [Google Scholar] [CrossRef]

- Ben Salem, L.; Nouira, R.; Saafi, S.; Rault, C. How do oil prices affect the GDP and its components? New evidence from a time-varying threshold model. Energy Policy 2024, 190, 114162. [Google Scholar] [CrossRef]

- Cappelli, F.; Carnazza, G.; Vellucci, P. Crude oil, international trade and political stability: Do network relations matter? Energy Policy 2023, 176, 113479. [Google Scholar] [CrossRef]

- Hamdi, H.; Sbia, R. Dynamic relationships between oil revenues, government spending and economic growth in an oil-dependent economy. Econ. Model. 2013, 35, 118–125. [Google Scholar] [CrossRef]

- Kaufmann, R.K. Does OPEC Matter? An Econometric Analysis of Oil Prices. Energy J. 2004, 25, 67–90. [Google Scholar] [CrossRef]

- Akpolat, A.G.; Bakirtas, T. The relationship between crude oil exports, crude oil prices and military expenditures in some OPEC countries. Resour. Policy 2020, 67, 101659. [Google Scholar] [CrossRef]

- Erdoğan, S.; Çevik, E.İ.; Gedikli, A. Relationship between oil price volatility and military expenditures in GCC countries. Environ. Sci. Pollut. Res. 2020, 27, 17072–17084. [Google Scholar] [CrossRef]

- Ashraf, S.; Jithin, P.; Umar, Z. The asymmetric relationship between foreign direct investment, oil prices and carbon emissions: Evidence from Gulf Cooperative Council economies direct investment, oil prices and carbon emissions: Evidence from Gulf Cooperative Council economies. Cogent Econ. Financ. 2022, 10, 2080316. [Google Scholar] [CrossRef]

- Wong, S.L.; Chia, W.; Chang, Y. Energy consumption and energy R & D in OECD: Perspectives from oil prices and economic growth. Energy Policy 2013, 62, 1581–1590. [Google Scholar] [CrossRef]

- Brady, G.L.; Clark, J.R.; Davis, W.L. The Political Economy of Dissonance. Public Choice 2014, 82, 37–51. [Google Scholar] [CrossRef]

- Touitou, M.; Djellit, T.; Boudeghdegh, A. The Role of Export and Terms of Trade for an Economy with Resource Dependence, Case of Algeria. Eur. J. Sustain. Dev. 2018, 7, 218–228. [Google Scholar] [CrossRef]

- Shafer, D.M.; Ross, M.L.; Ross, B.M.L. The Political Economy of Resource Curse. World Politics 1999, 51, 297–322. [Google Scholar] [CrossRef]

- Madathil, J.C. Crude oil price and government effectiveness: The determinants of corruption in oil abundant states. J. Public Aff. 2022, 22, e2767. [Google Scholar] [CrossRef]

- Hutt, R. Which Economies are Most Reliant on Oil? World Economic Forum. Available online: https://www.weforum.org/stories/2016/05/which-economies-are-most-reliant-on-oil/ (accessed on 13 November 2025).

| Country | µ | 2001 | 2003 | 2004 | 2005 | 2006 | 2007 | 2009 | 2010 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 96.91 | 92.23 | 97.92 | 97.91 | 98.37 | 98.22 | 97.72 | 94.02 | 92.70 | |||||

| UAE | 54.12 | 91.78 | 48.27 | 54.06 | 57.73 | 62.25 | 63.72 | 43.52 | 49.99 | 47.23 | 55.85 | 50.76 | 37.65 | 31.56 |

| Brazil | 7.57 | 3.59 | 5.19 | 4.57 | 5.99 | 7.68 | 8.32 | 9.00 | 9.90 | 11.02 | 7.66 | 9.35 | 7.36 | 6.45 |

| Canada | 21.99 | 15.30 | 16.12 | 17.76 | 21.40 | 21.14 | 22.11 | 24.42 | 25.32 | 25.62 | 26.36 | 28.89 | 20.60 | 17.63 |

| China | 1.93 | 3.16 | 2.54 | 2.44 | 2.31 | 1.83 | 1.71 | 1.70 | 1.69 | 1.51 | 1.53 | 1.47 | 1.23 | 1.28 |

| Algeria | 97.73 | 97.62 | 98.04 | 98.16 | 98.40 | 98.05 | 98.38 | 98.34 | 98.31 | 98.40 | 98.34 | 97.23 | 95.84 | 95.31 |

| UK | 10.04 | 8.03 | 8.18 | 8.74 | 9.35 | 9.52 | 10.28 | 11.01 | 12.37 | 13.87 | 11.42 | 10.90 | 7.02 | 6.26 |

| Iran | 73.88 | 85.21 | 79.48 | 78.96 | 83.08 | 83.28 | 70.80 | 71.72 | 67.80 | 57.79 | 67.59 | |||

| Kuwait | 94.18 | 93.23 | 93.44 | 94.60 | 96.48 | 96.30 | 93.21 | 92.75 | 94.22 | 95.22 | 92.50 | 92.74 | ||

| Mexico | 12.17 | 7.97 | 11.23 | 12.39 | 14.89 | 15.46 | 15.67 | 13.28 | 13.77 | 14.06 | 12.81 | 10.41 | 5.89 | 4.82 |

| Nigeria | 92.05 | 99.66 | 97.90 | 98.24 | 93.67 | 90.36 | 87.13 | 84.04 | 87.62 | 90.85 | 87.87 | 96.48 | ||

| Norway | 64.00 | 61.75 | 61.17 | 63.62 | 67.68 | 67.80 | 64.30 | 63.66 | 63.70 | 69.82 | 67.62 | 64.88 | 57.69 | 52.97 |

| Oman | 81.98 | 80.56 | 76.82 | 91.09 | 91.83 | 91.39 | 89.06 | 74.97 | 77.76 | 83.54 | 82.61 | 81.67 | 76.16 | 76.05 |

| Russia | 61.41 | 51.81 | 54.51 | 54.70 | 61.78 | 62.88 | 61.46 | 63.01 | 65.65 | 70.29 | 70.56 | 69.53 | 62.84 | 48.29 |

| Saudi A | 87.73 | 89.47 | 89.68 | 89.82 | 91.04 | 90.98 | 90.17 | 87.80 | 87.62 | 88.63 | 87.57 | 85.17 | 78.43 | 77.55 |

| USA | 6.01 | 1.88 | 2.11 | 2.57 | 3.31 | 3.74 | 3.96 | 5.80 | 7.18 | 10.06 | 10.76 | 10.99 | 8.00 | 7.58 |

| Variable | Description | Source | Unit |

|---|---|---|---|

| lnOIL | Natural logarithm of Brent Crude Oil Prices. | SIPRI | Current USD |

| lnGX | Natural logarithm of the general government final consumption expenditures. | World Bank Data | Current USD |

| lnGDP | Natural logarithm of gross domestic product. | World Bank data | Current USD |

| lnCO2 | Natural logarithm of carbon dioxide emissions of those stemming from the burning of fossil fuels and the manufacture of cement. They include carbon dioxide produced during consumption of solid, liquid, and gas fuels. | CAIT | Kg per PPP USD of GDP |

| XC | Exchange rate of the local currency regarding barter terms of trade index, which is calculated as the percentage ratio of the export unit value indexes, measured relatively to the base year 2000. | World Bank Data | 100 Base Year 2000 |

| CC | Control of corruption that reflects perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interest. | WGI | −2.5 (weak) to +2.5 (strong) governance performance |

| DLNOIL | DXC | DLNGX | DLNGDP | DLNCO2 | DCC | |

|---|---|---|---|---|---|---|

| Mean | 0.038596 | 1.076843 | 0.085141 | 0.076770 | −0.023227 | −0.005167 |

| Median | 0.105913 | 1.068100 | 0.082515 | 0.097830 | −0.026903 | −0.005000 |

| Maximum | 0.355079 | 77.39100 | 1.874950 | 0.536820 | 0.395744 | 1.010000 |

| Minimum | −0.637438 | −104.9340 | −0.728380 | −0.559600 | −0.269901 | −0.350000 |

| Std. Dev. | 0.278769 | 24.59223 | 0.192448 | 0.155927 | 0.075259 | 0.136728 |

| Skewness | −1.044286 | −1.302253 | 3.003147 | −0.851938 | 0.720687 | 1.554956 |

| Kurtosis | 3.306819 | 7.098326 | 34.96020 | 4.682826 | 7.556270 | 15.21296 |

| Jarque–Bera | 44.56273 | 235.7973 | 10575.30 | 57.35097 | 228.3716 | 1588.279 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 9.262960 | 258.4423 | 20.43388 | 18.42476 | −5.574575 | −1.240000 |

| Sum Sq. Dev. | 18.57316 | 144541.9 | 8.851696 | 5.810831 | 1.353681 | 4.467993 |

| Observations | 240 | 240 | 240 | 240 | 240 | 240 |

| Variable | Unit Root Tests | ||

|---|---|---|---|

| At Level Trend and Intercept | |||

| CC | Null: Unit root (assumes common unit root process) | ||

| Test | Test Statistic | Probability value | |

| Levin, Lin & Chu t * | −1.77969 | 0.0376 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | 1.08484 | 0.8610 | |

| ADF-Fisher Chi-square | 26.5715 | 0.7378 | |

| PP-Fisher Chi-square | 57.7539 | 0.0035 | |

| XC | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | 6.56148 | 1.0000 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | 5.64590 | 1.0000 | |

| ADF-Fisher Chi-square | 2.97051 | 1.0000 | |

| PP-Fisher Chi-square | 6.73614 | 1.0000 | |

| lnCO2 | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | −2.02437 | 0.0215 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | 1.65796 | 0.9513 | |

| ADF-Fisher Chi-square | 26.9212 | 0.7215 | |

| PP-Fisher Chi-square | 14.7480 | 0.9961 | |

| lnGDP | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | 3.38887 | 0.9996 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | 5.91842 | 1.0000 | |

| ADF-Fisher Chi-square | 8.03248 | 1.0000 | |

| PP-Fisher Chi-square | 2.38539 | 1.0000 | |

| lnGX | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | 2.27095 | 0.9884 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | 4.65135 | 1.0000 | |

| ADF-Fisher Chi-square | 9.81231 | 0.9999 | |

| PP-Fisher Chi-square | 7.02463 | 1.0000 | |

| lnOil | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | 8.33001 | 1.0000 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | 8.13931 | 1.0000 | |

| ADF-Fisher Chi-square | 0.35135 | 1.0000 | |

| PP-Fisher Chi-square | 0.03192 | 1.0000 | |

| Variable | Unit Root Tests | ||

|---|---|---|---|

| First differentiation Trend and Intercept | |||

| dCC | Null: Unit root (assumes common unit root process) | ||

| Test | Test Statistic | Probability value | |

| Levin, Lin & Chu t * | 3.15011 | 0.0092 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | −1.76658 | 0.0386 | |

| ADF-Fisher Chi-square | 45.5085 | 0.0574 | |

| PP-Fisher Chi-square | 171.409 | 0.0000 | |

| dXC | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | −5.29316 | 0.0000 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | −2.57873 | 0.0050 | |

| ADF-Fisher Chi-square | 52.9798 | 0.0113 | |

| PP-Fisher Chi-square | 162.551 | 0.0000 | |

| lnCO2 | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | −5.19560 | 0.0000 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | −3.64945 | 0.0001 | |

| ADF-Fisher Chi-square | 69.3400 | 0.0001 | |

| PP-Fisher Chi-square | 148.671 | 0.0000 | |

| lnGDP | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | −5.03727 | 0.0000 | |

| Null: Unit root (assumes individual unit root process | |||

| Im, Pesaran and Shin W-stat | −2.31011 | 0.0104 | |

| ADF-Fisher Chi-square | 49.9843 | 0.0224 | |

| PP-Fisher Chi-square | 141.227 | 0.0000 | |

| dlnGX | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | 2.27095 | 0.9884 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | 4.65135 | 1.0000 | |

| ADF-Fisher Chi-square | 9.81231 | 0.9999 | |

| PP-Fisher Chi-square | 7.02463 | 1.0000 | |

| dlnOil | Null: Unit root (assumes common unit root process) | ||

| Levin, Lin & Chu t * | −6.78486 | 0.0000 | |

| Null: Unit root (assumes individual unit root process) | |||

| Im, Pesaran and Shin W-stat | −2.61354 | 0.0045 | |

| ADF-Fisher Chi-square | 51.4743 | 0.0160 | |

| PP-Fisher Chi-square | 155.651 | 0.0000 | |

| Null Hypothesis | Fisher Stat.* Trace Statistic | Probability | Fisher Stat.* Max-EigenStatistic | Probability |

|---|---|---|---|---|

| r ≤ 0 * | 0.000 | 1.0000 | 0.000 | 1.0000 |

| r ≤ 1 * | 0.000 | 1.0000 | 0.000 | 1.0000 |

| r ≤ 2 * | 196.6 | 0.0000 | 700.9 | 0.0000 |

| r ≤ 3 * | 473.8 | 0.0000 | 423.4 | 0.0000 |

| r ≤ 4 * | 563.4 | 0.0000 | 620.6 | 0.0000 |

| r ≤ 5 * | 4214. | 0.0000 | 4214. | 0.0000 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −78.48387 | NA | 1.05 × 10−7 | 0.960044 | 1.068129 * | 1.003883 |

| 1 | −16.45786 | 119.1181 | 7.83 × 10−8 * | 0.664294 * | 1.420887 | 0.971164 * |

| 2 | 2.607659 | 35.31454 | 9.50 × 10−8 | 0.856731 | 2.261832 | 1.426633 |

| 3 | 44.17649 | 74.16258 | 8.95 × 10−8 | 0.793449 | 2.847058 | 1.626383 |

| 4 | 78.67576 | 59.19761 * | 9.17 × 10−8 | 0.810503 | 3.512620 | 1.906468 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DlnOil | DXC | 2.979743 | 0.2254 |

| DlnGX | 0.471914 | 0.7898 | |

| DlnGDP | 2.353991 | 0.3082 | |

| DlnCO2 | 0.824290 | 0.6622 | |

| DCC | 1.864390 | 0.3937 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DXC | DlnOil | 0.302745 | 0.8595 |

| DlnGX | 1.644317 | 0.4395 | |

| DlnGDP | 0.622052 | 0.7327 | |

| DlnCO2 | 0.663451 | 0.0734 | |

| DCC | 1.740318 | 0.4189 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DlnGX | DlnOil | 2.945348 | 0.2293 |

| DXC | 2.350645 | 0.3087 | |

| DlnGDP | 3.043239 | 0.2184 | |

| DlnCO2 | 6.584637 | 0.0372 | |

| DCC | 2.240943 | 0.3261 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DlnGDP | DlnOil | 3.876749 | 0.1439 |

| DXC | 6.341761 | 0.0420 | |

| DlnGX | 0.381252 | 0.8264 | |

| DlnCO2 | 2.179596 | 0.3363 | |

| DCC | 4.132809 | 0.1266 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DlnCO2 | DlnOil | 1.672541 | 0.4333 |

| DXC | 2.334875 | 0.3112 | |

| DlnGX | 2.259353 | 0.3231 | |

| DlnGDP | 3.398898 | 0.1828 | |

| DCC | 2.119528 | 0.3465 |

| Dependent Variable | Independent Variable | Chi-Square | Probability |

|---|---|---|---|

| DCC | DlnOil | 3.976421 | 0.1369 |

| DXC | 4.828307 | 0.0894 | |

| DlnGX | 24.94431 | 0.0001 | |

| Dln GDP | 22.23291 | 0.0000 | |

| DlnCO2 | 7.301307 | 0.0260 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aker, H.A.; Akalpler, E. The Global Impact of Oil Revenue Dependency: Analysis of Key Indicators from Leading Energy-Producing Countries. Energies 2025, 18, 6057. https://doi.org/10.3390/en18226057

Aker HA, Akalpler E. The Global Impact of Oil Revenue Dependency: Analysis of Key Indicators from Leading Energy-Producing Countries. Energies. 2025; 18(22):6057. https://doi.org/10.3390/en18226057

Chicago/Turabian StyleAker, Huseyin Ali, and Ergin Akalpler. 2025. "The Global Impact of Oil Revenue Dependency: Analysis of Key Indicators from Leading Energy-Producing Countries" Energies 18, no. 22: 6057. https://doi.org/10.3390/en18226057

APA StyleAker, H. A., & Akalpler, E. (2025). The Global Impact of Oil Revenue Dependency: Analysis of Key Indicators from Leading Energy-Producing Countries. Energies, 18(22), 6057. https://doi.org/10.3390/en18226057