Modelling the Impact of Hard Coal Mining Reduction on the Structure Energy Mix and Economy in an Inter-Industry Approach—A Case Study of Poland

Abstract

1. Introduction

2. Materials and Methods

2.1. Input-Output Method

- –

- Part I—the intermediate consumption matrix (ICM) (blue color), also called the transaction matrix, which includes mutual transactions between sectors. The rows present the flow of intermediate demand, i.e., purchases of products (services) intended for further processing. The columns, in turn, are interpreted as the structure of impersonal costs of individual sectors.

- –

- Part II—the final demand matrix (FDM) (pink colour), which consists of consumption in the household sector, in the sector of non-profit institutions serving households, and in the government and local government sector; gross fixed capital formation; changes in inventories and valuables; and exports.

- –

- Part III—the gross value added matrix (GVAM) (gold colour), which consists of employment-related costs; other taxes less subsidies on production; depreciation; net operating surplus/mixed income; and gross operating surplus/gross mixed income.

- —product/product supplier/branch of the economy from which the product originates,

- —product recipient/branch of the economy to which the product is delivered,

- —total output of branch ,

- —intermediate consumption of products from branch by branch , (intermediate demand),

- —final consumption of products from branch , (final demand).

- —the vector (n × 1) output in all sectors from to ;

- —the unit matrix;

- —the matrix (n × n) product intensity ratios ();

- —the vector (n ×1) final consumption in all branches.

- –

- The first type of forecasts: known (or ) and unknown Y (or ΔY):

- –

- The second type of forecasts: known (or ) and unknown (or ):

- –

- The system is closed; i.e., for each branch, the means of production are products generated within this system;

- –

- The system is static; i.e., the inputs for production in a given period are products produced in the same period;

- –

- Production is non-substitutable; i.e., the products of a given branch cannot be replaced by the products of other branches.

2.2. Calculating the Impact of Coal Mining on GDP Development

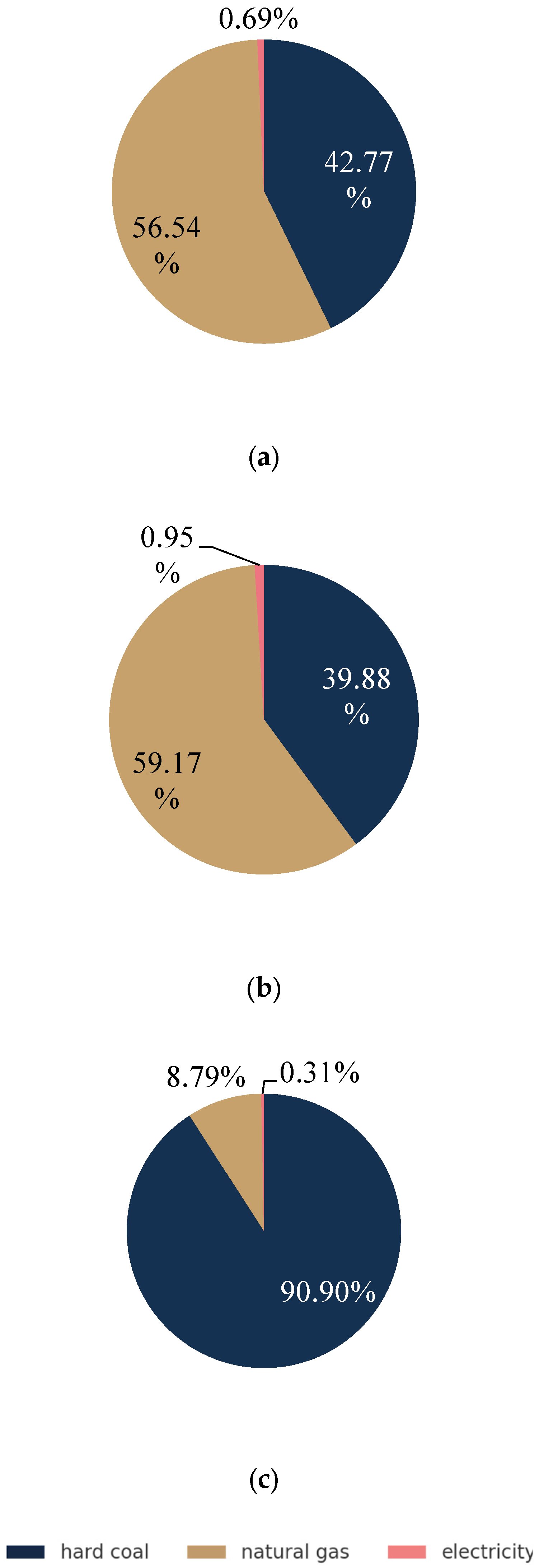

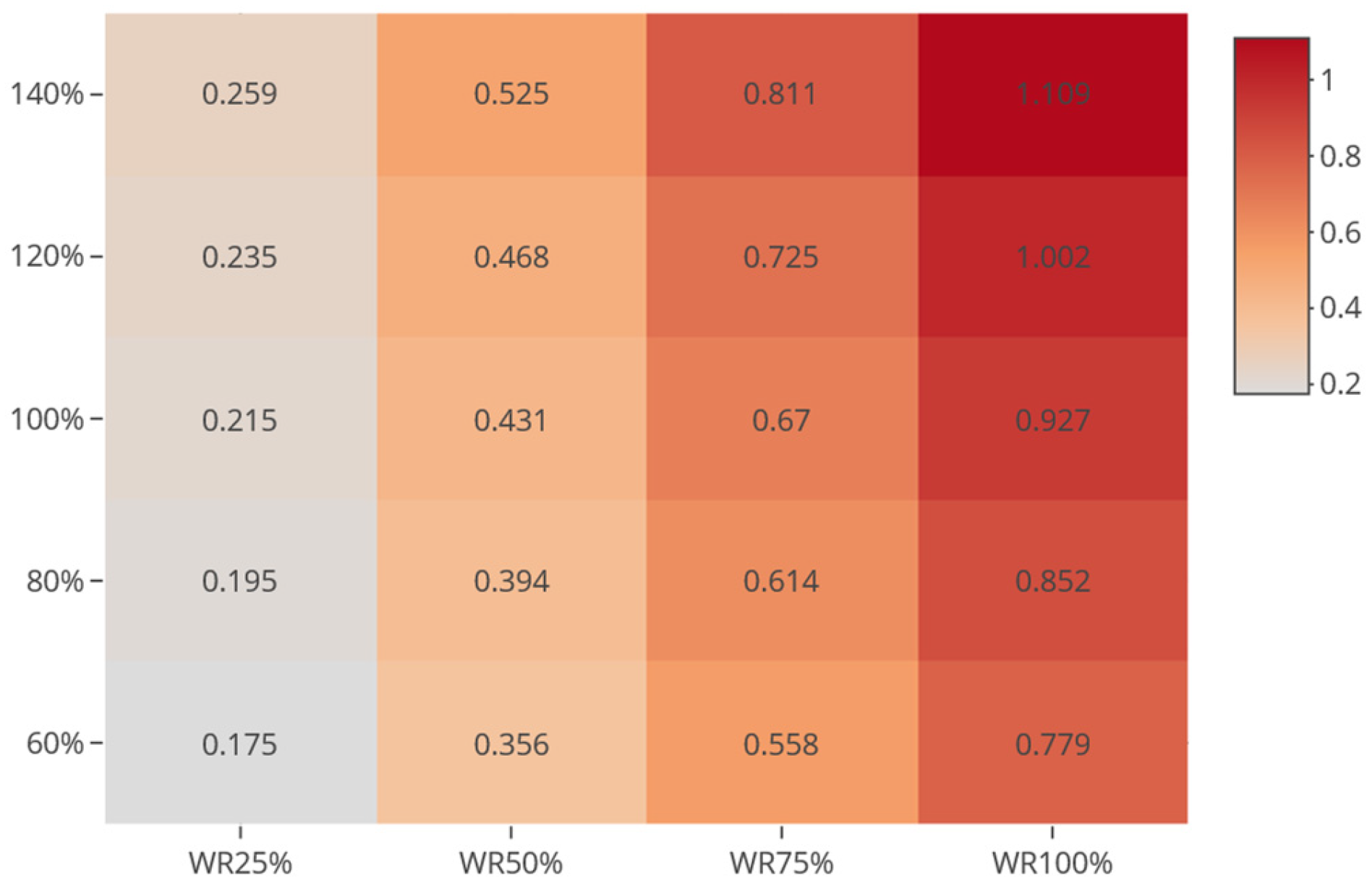

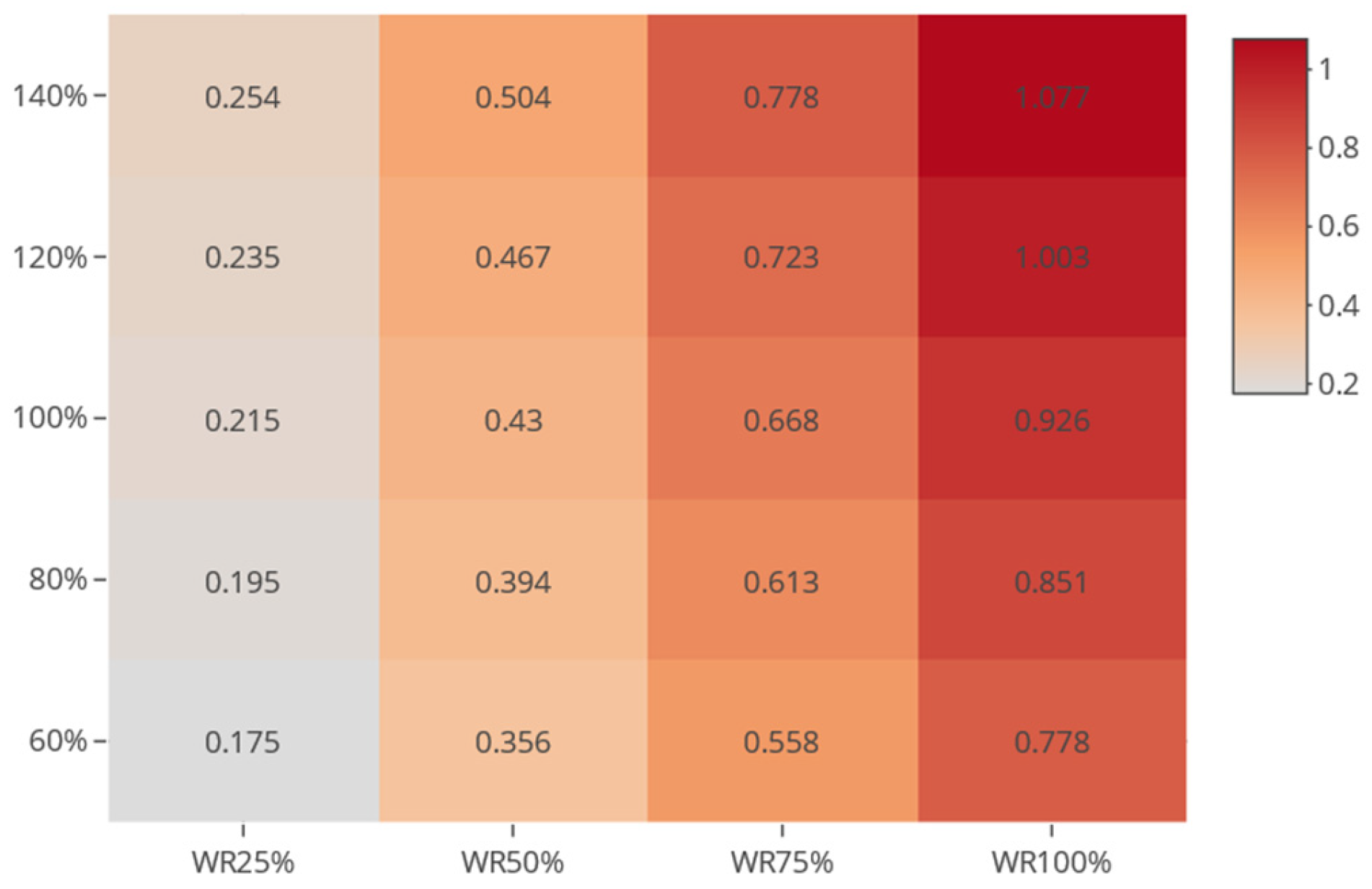

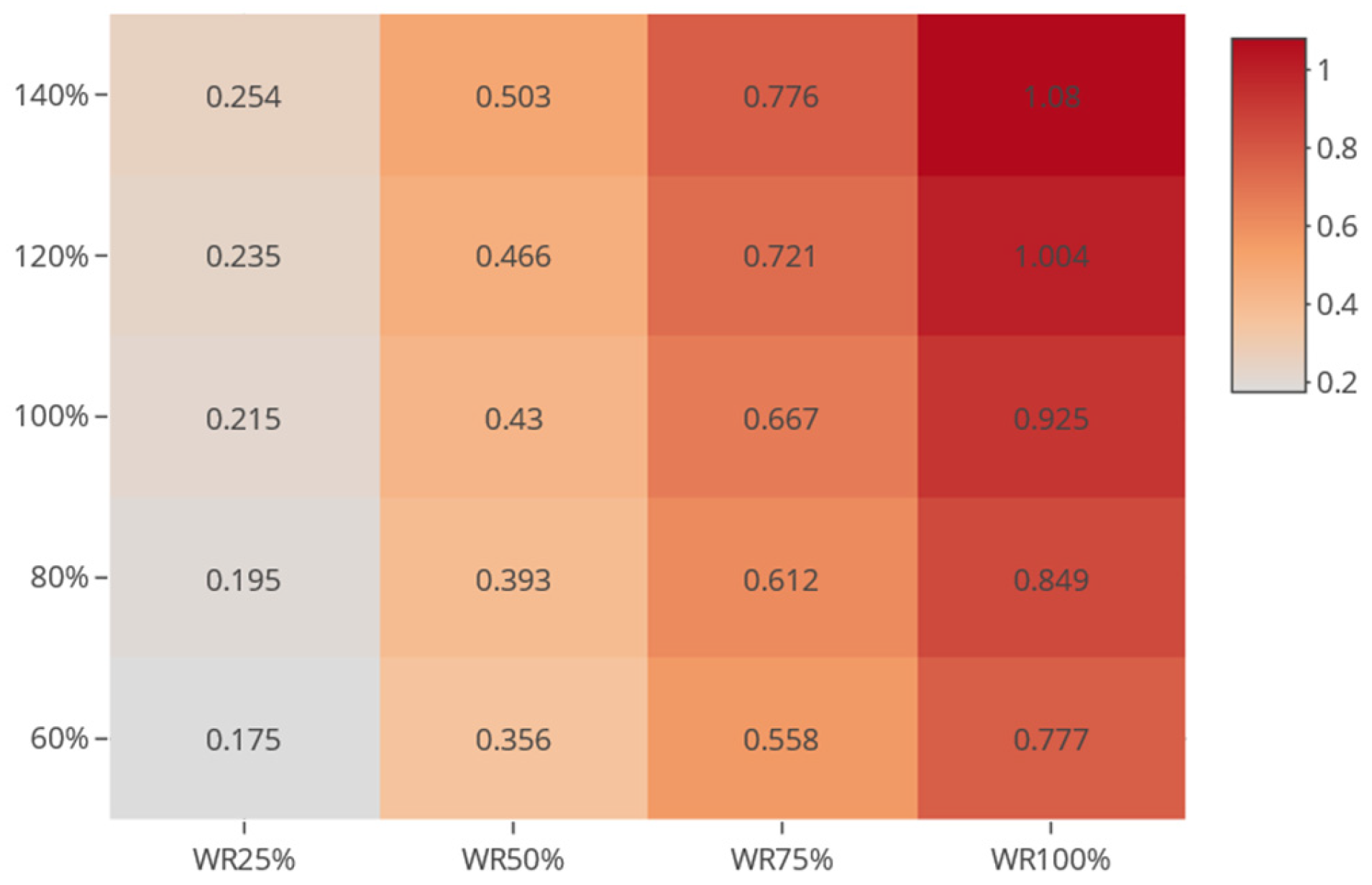

2.3. Reduction Variants of Domestic Hard Coal Supply and Substitution Scenarios

- –

- WR25%—reflecting the operation of the hard coal mining sector after a reduction of approximately 25% in domestic coal supply with a corresponding reduction in employment;

- –

- WR50%—reflecting a reduction of approximately 50% in domestic coal supply with a corresponding reduction in employment;

- –

- WR75%—reflecting a reduction of approximately 75% in domestic coal supply with a corresponding reduction in employment;

- –

- WR100%—reflecting the complete elimination of domestic hard coal production with a corresponding reduction in employment.

- —Reduction Variant;

- —imported natural gas price [thousand PLN];

- —imported hard coal price [thousand PLN];

- —imported electricity price [thousand PLN].

- —imported natural gas reference price [thousand PLN];

- —imported hard coal reference price [thousand PLN];

- —number of Reduction Variants;

- —number of Substitution Variants.

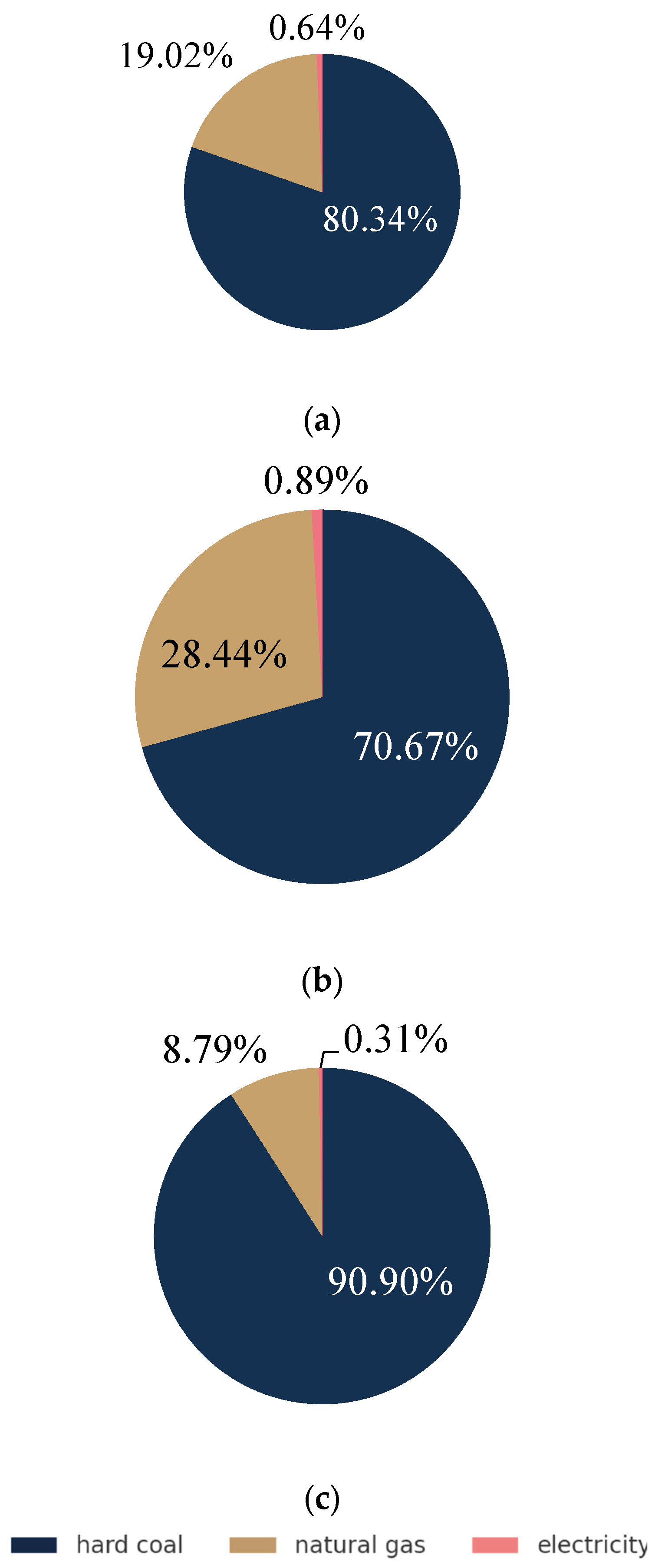

3. Results of Analyses

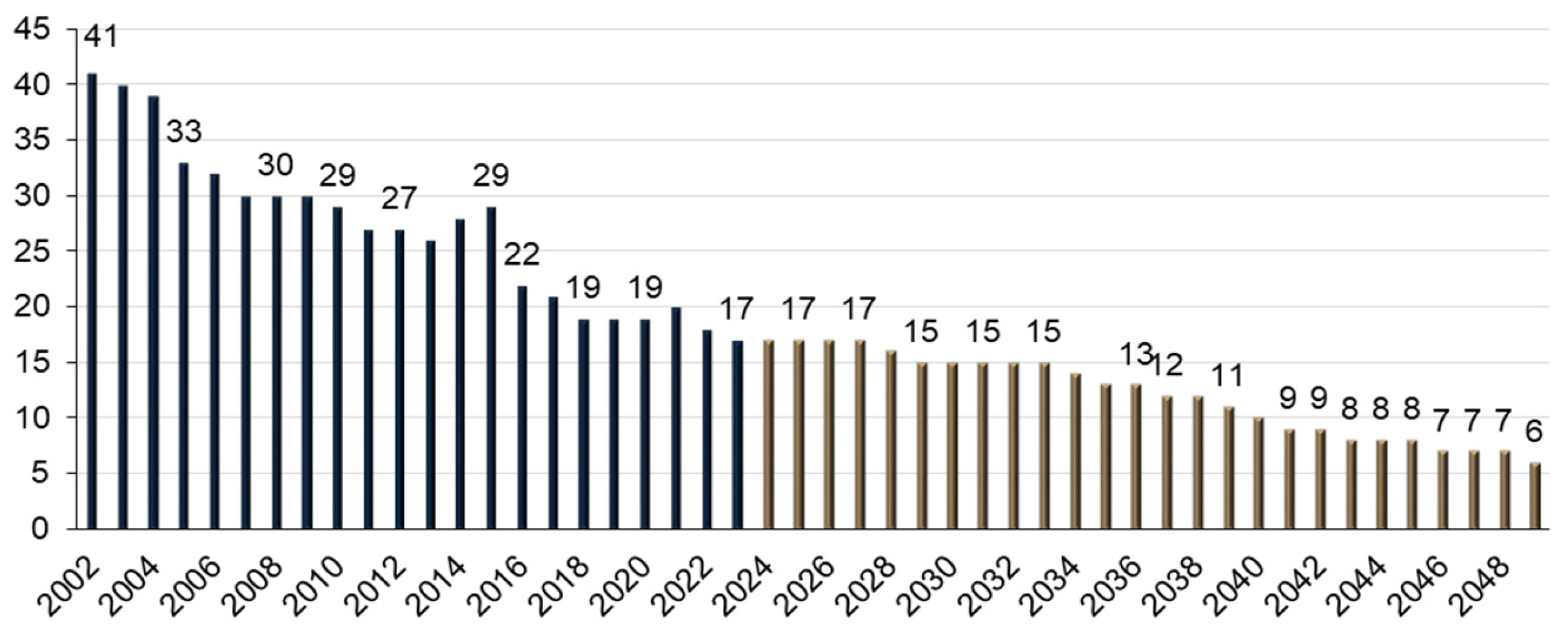

3.1. The Impact of Economic Sectors on the Country’s Economic Growth (GDP)

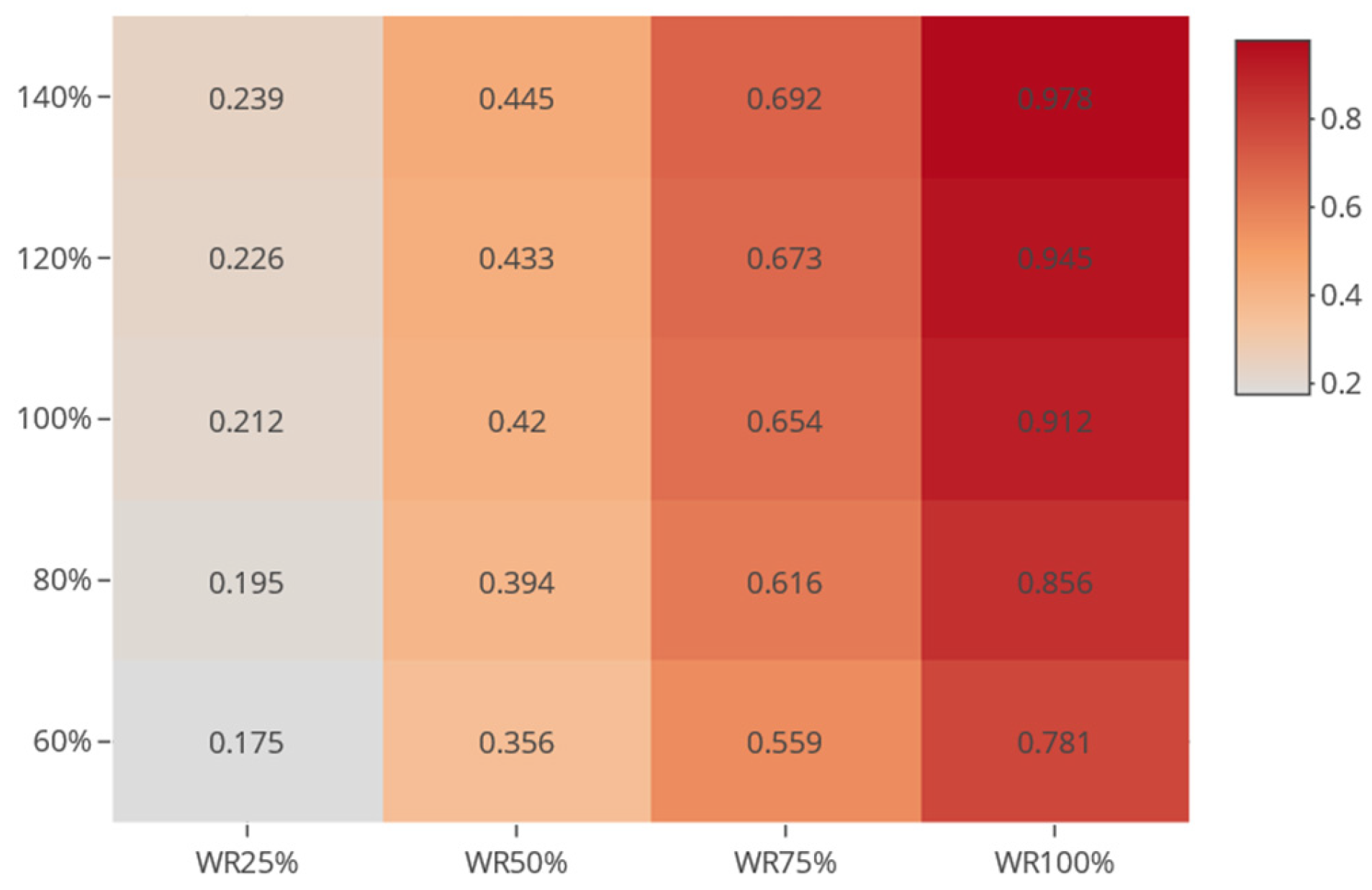

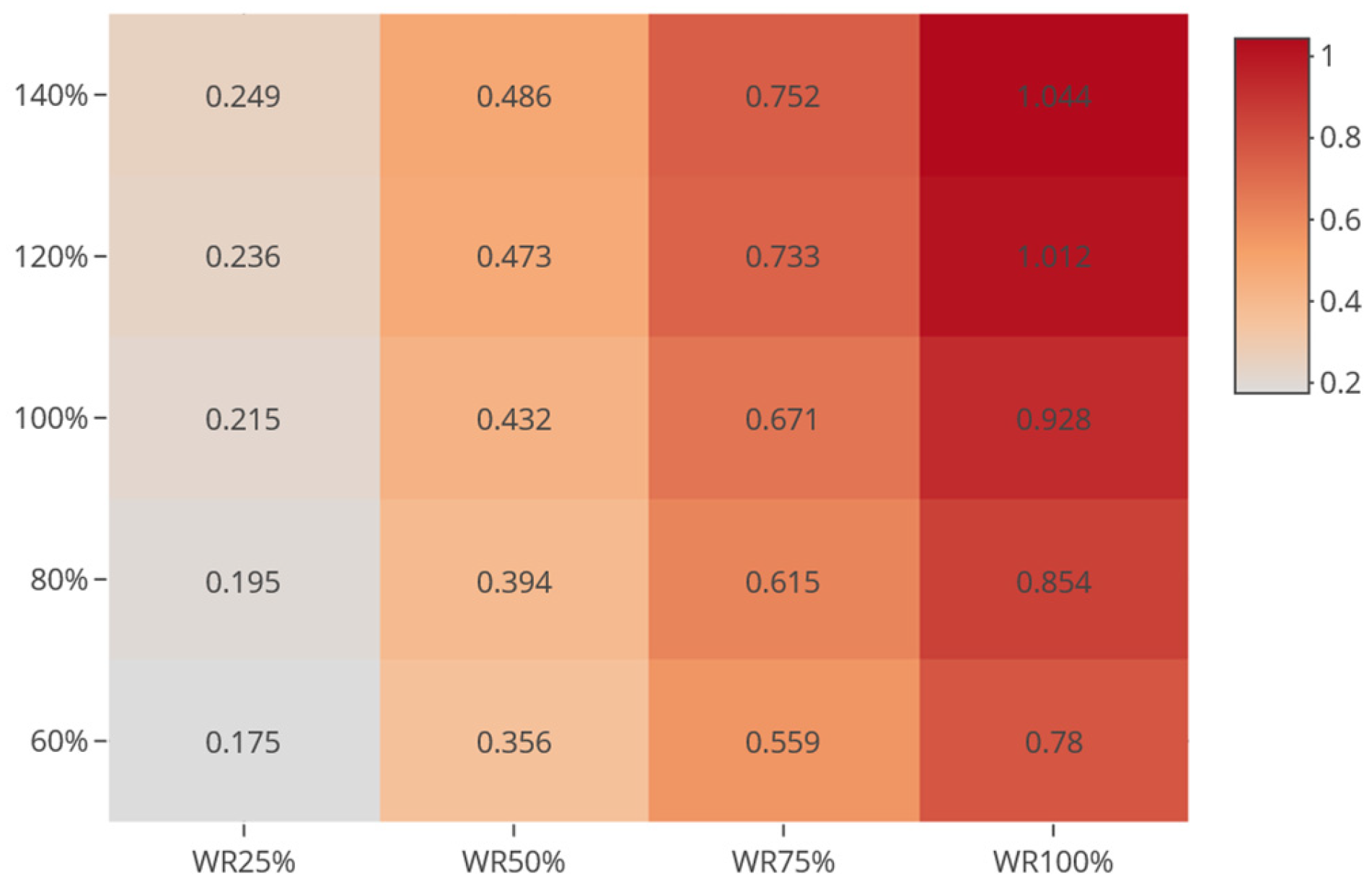

3.2. Results of Research Scenarios—Substitution Variant WS2

3.2.1. Natural Gas Price 40% Lower

3.2.2. Natural Gas Price 20% Lower

3.2.3. Natural Gas Price Equal to the Reference Price

3.2.4. Natural Gas Price 20% Higher

3.2.5. Natural Gas Price 40% Higher

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Social Agreement—Umowa Społeczna—Umowa Społeczna Dotycząca Transformacji Sektora Górnictwa Węgla Kamiennego Oraz Wybranych Procesów Transformacji Województwa Śląskiego. 2021. Available online: https://www.gov.pl/web/aktywa-panstwowe/umowa-spoleczna-dla-gornictwa-podpisana (accessed on 19 February 2025).

- Pepłowska, M.; Olczak, P. Review of Research on the Impact of Changes Resulting from the Hard Coal Mining Sector in Poland on the GDP Value. Energies 2024, 17, 1477. [Google Scholar] [CrossRef]

- Fankhauser, S.; Jotzo, F. Economic growth and development with low-carbon energy. Wiley Interdiscip. Rev. Clim. Change 2018, 9, e495. [Google Scholar] [CrossRef]

- Wang, Q.; Li, X.; Li, R. The impact of political, financial, and economic risks on energy transition: The role of natural resource rents. Humanit. Soc. Sci. Commun. 2025, 12, 75. [Google Scholar] [CrossRef]

- Esposito, E.; Abramson, S. The European Coal Curse. J. Econ. Growth 2021, 26, 77–112. [Google Scholar] [CrossRef]

- Afkarina, K.; Wardana, S.; Damayanti, P. Coal mining sector contribution to environmental conditions and human development index in east kalimantan province. J. Environ. Sci. Sustain. Dev. 2019, 2, 192–207. [Google Scholar] [CrossRef]

- Pepłowska, M. The effect of coal mine closures on worker migration in Poland: An input-output analysis. Gospod. Surowcami Miner. 2024, 40, 147–159. [Google Scholar] [CrossRef]

- Hendryx, M.; Higginbotham, N.; Ewald, B.; Connor, L. Air quality in association with rural coal mining and combustion in new south wales australia. J. Rural. Health 2019, 35, 518–527. [Google Scholar] [CrossRef] [PubMed]

- Roman, J.; Ceran, B.; Wróblewski, R. Dobór mocy układu zgazowarka odpadów–silnik gazowy w hybrydowej instalacji OZE. Rynek Energii 2025, 179, 47–55. [Google Scholar]

- Polski, C.; Polski, T.; Roman, J.; Wróblewski, R.; Bartoszewicz, J.; Ceran, B. A novel concept to improve the flexibility of steam power plants using an electric feedwater heater. Appl. Therm. Eng. 2024, 236, 121661. [Google Scholar] [CrossRef]

- Kasińska, N.; Mielcarek, A.; Sierchuła, J.; Szczerbowski, R.; Ceran, B. Technical and Economic Comparative Analysis of Nuclear Power Plants: AP1000 and SMR. Energies 2025, 18, 4749. [Google Scholar] [CrossRef]

- García-Casals, X.; Ferroukhi, R.; Parajuli, B. Global Energy Transformation: A Roadmap to 2050; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Patrizio, P.; Pratama, Y.W.; Mac Dowell, N. Socially Equitable Energy System Transitions. Joule 2020, 4, 1609–1625. [Google Scholar] [CrossRef]

- Bohlmann, H.R.; Bohlmann, J.A.; Chitiga-Mabugu, M.; Inglesi-Lotz, R. Just Energy Transition of South Africa in a Post-COVID Era. Sustainability 2023, 15, 10854. [Google Scholar] [CrossRef]

- Pollin, R.; Callaci, B. The just transition needs a hard hat. New Left Rev. 2023, 139, 69–94. [Google Scholar]

- Klein, L.R. Wykłady z Ekonometrii; Państwowe Wydawnictwo Ekonomiczne: Warsaw, Poland, 1982. [Google Scholar]

- Plich, M. Budowa i Zastosowanie Wielosektorowych Modeli Ekonomiczno-Ekologicznych; Wydawnictwo Uniwersytetu Łódzkiego: Łódź, Poland, 2002. [Google Scholar]

- Lach, Ł. Tracing Key Sectors and Important Input-Output Coefficients: Methods and Applications Preface; Wydawnictwo CH Beck: Warsaw, Poland, 2020. [Google Scholar]

- Clark, D.L. Planning and the real origins of input-output analysis. J. Contemp. Asia 1984, 14, 408–429. [Google Scholar] [CrossRef]

- Schachter, G. Francois Quesnay: Interpreters and Critics Revisited. Am. J. Econ. Sociol. 1991, 50, 313–322. [Google Scholar] [CrossRef]

- Ormazabal, K. Quesnay and Leontief on Capital and Income; No. 1134-8984; Departamento de Economía Aplicada III (Econometría y Estadística), Universidad del País Vasco: Santsoena, Spain, 2002. [Google Scholar]

- Steenge, A.E.; Van Den Berg, R. Transcribing the Tableau conomique: Input-output analysis à la Quesnay. J. Hist. Econ. Thought 2007, 29, 331–358. [Google Scholar] [CrossRef]

- Akhabbar, A.; Lallement, J. Wassily Leontief and Léon Walras: The Production as a Circular Flow. MPRA Paper No. 30207. 2010. Available online: https://mpra.ub.uni-muenchen.de/30207/ (accessed on 9 September 2025).

- Miernyk, W.H. The Elements of Input-Output Analysis; Web Book of Regional Science, Ed.; Regional Research Institute, West Virginia University: Morgantown, WV, USA, 2020. [Google Scholar]

- Kopeć, S.; Lach, Ł.; Spirydowicz, A. Wpływ rozbudowy infrastruktury fotowoltaicznej na rozwój gospodarczy w Polsce—Prognoza do 2040 r. Energetyka Rozproszona 2022, 7, 29–53. [Google Scholar] [CrossRef]

- Thlon, M. Wykorzystanie Modelu Leontiefa Jako Narzędzia Analizy Potencjału Rozwojowego Regionalnych Specjalizacji, Rzeszów. 2019. Available online: https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://min-pan.krakow.pl/dzialalnosc-naukowa/wp-content/uploads/sites/7/2024/06/Wplyw-gornictwa-weglowego-na-ksztaltowanie-sie-PKB-z-wykorzystaniem-przeplywow-miedzygaleziowych.pdf&ved=2ahUKEwiz2rLs-eaQAxXhafUHHZloBScQFnoECBoQAQ&usg=AOvVaw2RHcZc90lS4DpL-PXMexIV (accessed on 9 September 2025).

- Czechowski, T. Wstęp Matematyczny do Analizy Przepływów Międzygałęziowych; PWG: Warsaw, Poland, 1958. [Google Scholar]

- Kudrycka, I.; Górska, G. Wykorzystanie Przepływów Międzygałęziowych do Analizy Zmian w Strukturze Gospodarki Polski; Główny Urząd Statystyczny, Zakład Badań Statystyczno-Ekonomicznych Wykorzystanie: Warsaw, Poland, 1983. [Google Scholar]

- Tomaszewicz, Ł. Metody Analizy Input-Output Warszawa; Państwowe Wydawnictwo Ekonomiczne: Warsaw, Poland, 1994. [Google Scholar]

- Mućk, J. Przepływy Międzygałęziowe. Model Leontiefa; Szkoła Główna Handlowa w Warszawie: Warsaw, Poland, 2016. [Google Scholar]

- Kacprzak, D. Input-Output Model Based on Ordered Fuzzy Numbers. Theory and Applications of Ordered Fuzzy Numbers: A Tribute to Professor Witold Kosiński. 2017. Available online: http://www.springer.com/series/2941%0Ahttp://link.springer.com/10.1007/978-3-319-59614-3 (accessed on 26 November 2023).

- Lach, Ł.; Marcin, S.; Kusa, R.; Duda, J. Forecasting the economic impact of a vacuum tube high-speed transport system in Poland: An input-output approach. Manag. Econ. 2021, 22, 113–142. [Google Scholar] [CrossRef]

- GUS 2019—Główny Urząd Statystyczny. Bilans Przepływów Międzygałęziowych w Bieżących Cenach Bazowych w 2015 r; Główny Urząd Statystyczny: Warsaw, Poland, 2019. [Google Scholar]

- Kryzia, D. Analiza struktury wytwarzania energii elektrycznej z wykorzystaniem metod analizy portfelowej. Polityka Energetyczna—Energy Policy J. 2010, 13, 293–310. [Google Scholar]

- Kryzia, D.; Kaliski, M. Znaczenie technologii wytwarzania energii elektrycznej bazujących na gazie ziemnym dla przedsiębiorstwa energetycznego w kontekście dywersyfikacji jego struktury produkcyjnej. AGH Drill. Oil Gas 2012, 29, 241–251. [Google Scholar]

- Kryzia, D. Wybór Technologii Wytwarzania Energii Elektrycznej w Warunkach Ryzyka; Wydawnictwo Instytutu Gospodarki Surowcami Mineralnymi i Energią PAN: Kraków, Poland, 2015. [Google Scholar]

- Trzaskalik, T. Matematyka w Ekonomii; Prace Naukowe AE w Katowicach: Katowice, Poland, 2004. [Google Scholar]

| Direction of Use | Destination | Global Product | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Indirect Consumption | Final Consumption | |||||||||||||

| Sectors (Economic Branches) | Categories | |||||||||||||

| Products | 1 | 2 | … | n | Individual Consumption | Government Expenditure | Inwestments | Export | Zmiany Zapasów | |||||

| Place of origin | Secondary factors | Sectors (economic branches) | 1 | … | ||||||||||

| 2 | … | |||||||||||||

| … | … | … | … | … | … | … | … | … | … | … | ||||

| n | … | |||||||||||||

| Added value | Taxes | … | ||||||||||||

| Remuneration | … | |||||||||||||

| Profit | … | |||||||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pepłowska, M.; Tokarski, S.; Olczak, P. Modelling the Impact of Hard Coal Mining Reduction on the Structure Energy Mix and Economy in an Inter-Industry Approach—A Case Study of Poland. Energies 2025, 18, 6021. https://doi.org/10.3390/en18226021

Pepłowska M, Tokarski S, Olczak P. Modelling the Impact of Hard Coal Mining Reduction on the Structure Energy Mix and Economy in an Inter-Industry Approach—A Case Study of Poland. Energies. 2025; 18(22):6021. https://doi.org/10.3390/en18226021

Chicago/Turabian StylePepłowska, Monika, Stanisław Tokarski, and Piotr Olczak. 2025. "Modelling the Impact of Hard Coal Mining Reduction on the Structure Energy Mix and Economy in an Inter-Industry Approach—A Case Study of Poland" Energies 18, no. 22: 6021. https://doi.org/10.3390/en18226021

APA StylePepłowska, M., Tokarski, S., & Olczak, P. (2025). Modelling the Impact of Hard Coal Mining Reduction on the Structure Energy Mix and Economy in an Inter-Industry Approach—A Case Study of Poland. Energies, 18(22), 6021. https://doi.org/10.3390/en18226021