1. Introduction

Electricity markets occupy a critical position in modern economies, serving as essential infrastructure that underpins household welfare, industrial productivity, and national competitiveness. Unlike conventional commodities, electricity exhibits unique characteristics that make its pricing dynamics particularly complex: it is essentially non-storable, requires real-time balancing of supply and demand, and faces significant transmission constraints [

1]. These structural features, combined with regulatory frameworks that vary from fully regulated monopolies to competitive markets across U.S. states (see [

2]), create an environment where prices can exhibit substantial volatility and potentially deviate from fundamental values. For the purpose of this article, regulatory structures refer to the set of rules, institutions, and policies governing the electricity market, including how prices are set (e.g., cost-of-service regulation in traditional monopolies) and the degree of competition allowed (e.g., retail choice in deregulated markets).

The stability of electricity prices is paramount for economic planning and consumer welfare. Sharp price fluctuations can strain household budgets, complicate business operations, and ripple through the broader economy as electricity serves as a key intermediate input across all sectors. While short-term price volatility driven by weather patterns (see [

3]), fuel costs, and demand fluctuations is well-documented, the potential for speculative bubbles—periods where prices exhibit explosive growth beyond fundamental values—remains largely unexplored in electricity markets. This study aims to address this gap by answering the following key research questions: (1) Is there evidence of speculative price bubbles in U.S. state-level electricity markets? (2) Do these bubbles manifest uniformly across the nation, or are they localized, state-specific phenomena? (3) How do bubble dynamics differ across residential, commercial, and industrial consumer segments?

Despite extensive research on price bubbles in financial and commodity markets, systematic investigation of speculative dynamics in electricity prices has received surprisingly little attention. While recent studies have identified bubble behavior in energy commodities such as oil and natural gas, and limited work has examined electricity bubbles in European markets [

4,

5], a comprehensive analysis across U.S. state-level electricity markets, considering different consumer segments, has been notably absent. This study aims to fill this critical research gap by providing the first such disaggregated analysis. The significance of this state-level approach lies in its ability to uncover localized vulnerabilities and dynamic patterns that would be obscured by national-level aggregation, given the pronounced heterogeneity in market structures and regulatory environments across the U.S.

The U.S. electricity sector presents a unique laboratory for studying price dynamics due to its diversity. Average retail electricity prices range dramatically—from approximately 8 ¢/kWh in North Dakota to nearly 40 ¢/kWh in Hawaii—reflecting regional variations in fuel supply chains, regulatory structures, and market conditions [

6]. Moreover, systematic price differences exist across consumer segments, with commercial rates typically exceeding industrial rates, which in turn are surpassed by residential rates due to distribution costs. This heterogeneity suggests that bubble dynamics may manifest differently across regions and sectors, making disaggregated analysis essential.

This study addresses these critical gaps by conducting the first comprehensive investigation of speculative bubbles in U.S. state-level electricity prices across all major consumer segments. Utilizing monthly data spanning from January 2001 to December 2024, we employ the Generalized Supremum Augmented Dickey–Fuller (GSADF) test and its panel data counterpart, the Panel GSADF method. The objective is to utilize both methods to test whether the electricity price variable exhibits episodes of irrational explosive behavior in U.S. states during specific periods. The GSADF methodology, developed by [

7], was chosen over other methods like the standard SADF test or Log-Periodic Power Law (LPPL) models due to its superior ability to detect multiple bubbles and its robustness in finite samples [

8,

9]. Unlike the SADF test, which is more suited for identifying a single bubble, the GSADF test employs a flexible windowing approach that enhances its power to identify multiple periods of explosive behavior. LPPL models, while useful for characterizing bubble regimes, often require more specific assumptions about the bubble’s functional form, which may not always hold in complex electricity markets. The GSADF and panel GSADF methods are particularly well-suited for this analysis due to their ability to endogenously detect and date-stamp multiple boom-bust periods, offering superior discriminatory power compared to earlier approaches by recursively testing for explosive behavior across multiple subsamples. This capability is crucial for analyzing complex temporal patterns in electricity markets influenced by various stress events.

Our empirical analysis reveals widespread but heterogeneous evidence of bubble episodes across U.S. electricity markets. Specifically, we identify statistically significant explosive price behavior in commercial sector for Florida, Hawaii, Indiana, Maine, Maryland, Nevada, New Hampshire, Pennsylvania, Tennessee, and Virginia; in Industrial sector for Florida, Hawaii, Maryland, Pennsylvania, Tennessee, Virginia, and West Virginia, and in Residential sector for Florida, Hawaii, Maine, Massachusetts, Oregon, Texas, and West Virginia. These findings demonstrate that speculative dynamics in electricity prices are neither uniform nor rare, with certain states experiencing bubbles across multiple sectors while others show sector-specific vulnerabilities. The detected bubble episodes often coincide with known market stress events, though the specific patterns vary considerably by state and consumer segment, reflecting the complex interplay of local market structures, fuel dependencies, and regulatory frameworks.

The U.S. electricity sector undergoes rapid transformation—driven by renewable energy integration, electrification of transportation, data center expansion, and climate-related disruptions—understanding and mitigating speculative price dynamics becomes increasingly critical. Our results provide an empirical foundation for designing market mechanisms that enhance price stability while maintaining the flexibility needed for efficient resource allocation.

The remainder of this paper proceeds as follows:

Section 2 reviews the relevant literature on electricity market dynamics, bubble theory, and detection methodologies, situating our contribution within the broader research landscape.

Section 3 describes our comprehensive dataset of state-level electricity prices and details the GSADF testing procedure.

Section 4 presents our empirical findings, including the identification and dating of bubble episodes across states and sectors.

Section 5 discusses the implications of these results for market participants, regulators, and policymakers, while

Section 6 concludes with suggestions for future research and policy actions.

2. Literature Review

An economic or financial bubble refers to a period characterized by a rapid and unsustainable escalation of asset prices that deviates significantly from their underlying fundamental value, typically driven by speculative investment [

10]. In electricity markets, the fundamental value of electricity is conceptually tied to the short-run marginal cost of production, which includes fuel costs, variable operation and maintenance costs, and the cost of emissions, along with components for grid transmission and distribution. A speculative bubble, therefore, represents a period where retail or wholesale prices exhibit explosive growth that cannot be justified by these underlying cost fundamentals, often driven by market psychology, regulatory failures, or extreme supply–demand imbalances.

In electricity markets, the complexity of pricing dynamics—arising from regulatory structures, limited storage capacity, supply–demand imbalances, and external shocks—makes these markets particularly susceptible to price anomalies, including speculative bubbles. A critical review of existing literature reveals a growing body of studies addressing the formation, dynamics, and implications of such phenomena, while notable gaps persist in the scope and granularity of the research.

The concept of speculative bubbles has been extensively documented in financial and commodity markets, tracing back to classic episodes such as the ‘Tulip Mania’ (1634–1637). Numerous studies examine the presence of this kind of bubbles in different markets, such as housing, stock, and commodity markets (see [

11,

12]); however, their application to electricity markets, which are uniquely characterized by economic and physical constraints, remains limited. The literature on electricity predominantly focuses on stock markets and commodity bubbles; only a small subset explicitly examines price bubbles in electricity—a crucial sector with widespread economic implications.

For instance, ref. [

13] explored wholesale electricity price dynamics in California, disaggregating prices into production costs, competitive rents, and the exercise of market power. Their results emphasize how weak competition exacerbates price distortions. Similarly, Mount et al. (2006) [

14] modeled price regime shifts in the PJM electricity market, highlighting the critical role of market structure, reserve capacity, and demand management in transitional pricing regimes. These insights underline a foundational understanding of structural influences that may contribute to speculative price episodes.

Recent studies have employed advanced econometric and statistical models to identify and analyze bubble dynamics in electricity prices. For instance, ref. [

15] applied GARCH models to investigate volatility in the New York State electricity market, revealing regional transmission congestion as a key driver of high intra-day market volatility, often linked to short-term speculative pressures. Similarly, ref. [

16] demonstrated the presence of long-memory price processes in the Scandinavian electricity market, using regime-switching fractional integration models. These findings suggest that electricity prices are frequently shaped by both transient shocks and persistent structural drivers.

Speculative bubbles in electricity prices are not confined to spot markets; futures markets exhibit similar dynamics. Ref. [

17] analyzed European energy futures markets, finding short-term contracts more prone to bubble dynamics, particularly during bear market conditions, where price spillovers amplify volatility. Ref. [

18] utilized GSADF test to detect explosive price patterns in South African markets, identifying monopolistic structures and regulatory deficiencies as key drivers of bubbles in electricity prices. These analyses demonstrate the interplay between structural inefficiencies and external shocks in forming speculative dynamics across time scales and geographic regions.

The influence of global crises and external shocks on bubble formation in electricity markets has been a prominent theme in the recent literature. Studies like [

5] highlight the destabilizing effect of the COVID-19 pandemic on Italy’s electricity prices, identifying explicit short-term bubble periods using sequential GSADF tests. Concurrently, ref.[

4] conducted comparative analyses of developed markets like Germany and Romania, reporting heightened sensitivity of bubble formations to external shocks—including supply disruptions and geopolitical stress.

Global comparative assessments, such as those by [

19], underscore environmental and geopolitical factors like climatic risks, temperature increases, and renewable resource integration as significant influences. The study links rising geopolitical risks and climate-driven events with the formation of speculative episodes while identifying renewable energy as a stabilizing factor in price dynamics.

While the literature has made significant strides in identifying theoretical drivers and empirical manifestations of speculative bubbles in electricity prices, notable gaps remain. Existing studies often focus on aggregated or country-level analyses, neglecting regional and sectoral variations that may reveal important heterogeneities. The granularity and scope of the current literature remain limited, particularly when considering the diverse regulatory and market structures that characterize modern electricity systems. Furthermore, few studies examine the interactions between regulatory frameworks, renewable integration, and macroeconomic shocks within a unified framework, leaving critical questions about the complex interplay of these factors unanswered.

While much of the existing literature relies on frameworks predating 2020, recent regulatory adjustments at the state level necessitate updated context. For instance, ref. [

20] outline significant post-2020 policy reforms across the states, including adjustments to market competition mechanisms, the acceleration of grid modernization, and the introduction of schemes like Performance-Based Ratemaking (PBR). These contemporary policy shifts directly impact the marginal cost structure and the operational fluidity of the grid, thereby offering a crucial context for analyzing localized price anomalies and their timing. Incorporating this recent literature ensures our analysis of bubble formation is aligned with current U.S. market realities.

Disaggregated analyses based on end-user categories such as residential, commercial, and industrial segments are almost absent in the literature, though these segments likely exhibit distinct price dynamics due to differences in demand elasticity, regulatory treatment, and market access. Most studies employ low-frequency data measured annually or quarterly, which limits the precise detection of bubble formation and collapse periods that may occur over shorter timeframes. Additionally, research is often geographically restricted to single countries or regions, reducing the applicability of findings across diverse energy market structures, such as those found in the heterogeneous U.S. electricity sector where state-level regulatory frameworks and market designs vary substantially.

This research directly addresses these gaps by undertaking a state-level, consumption-type-specific analysis of retail electricity prices in the U.S., using disaggregated monthly data from 2005–2025. Leveraging high-frequency data provides a more robust basis for detecting the timing and persistence of speculative bubbles across regions and sectors. GSADF and panel GSADF tests provide a robust framework for detecting complex temporal patterns and price anomalies, allowing for analysis at a highly detailed level.

Furthermore, this study uniquely considers structural market conditions such as degree of competition and renewable integration alongside external shocks including geopolitical tensions and climate risks to disentangle their roles in bubble formation. The focus on spatial and sectoral heterogeneity offers policymakers and researchers deeper insight into regional vulnerabilities and the impact of policy interventions in managing price stability and market efficiency.

By bridging theoretical insights with empirical rigor, this study provides a comprehensive perspective on speculative bubbles in electricity markets, contributing valuable evidence to current policy debates around market design, transparency, and integration of energy and climate policies.

3. Data and Methodology

The primary objective of this study is to empirically test for the existence of speculative bubbles in monthly electricity prices across 51 sub-national units of the United States (USA)—comprising 50 states and Washington D.C.—spanning the period from January 2005 to December 2024. The data is obtained from the U.S. Energy Information Administration (EIA) and measured as cents/kWh. Electricity prices are often considered a reflection of supply–demand imbalances and non-market dynamics within energy markets; consequently, sudden and non-persistent price increases can signify the formation of speculative bubbles. For this analysis, electricity prices are categorized by consumption sectors: Commercial, Industrial, and Residential. Separate tests are conducted for each category, allowing for the disaggregation of price dynamics based on consumption type. This approach facilitates the analysis of price bubbles not only on a geographical basis but also according to end-use purpose.

3.1. U.S. State-Level Electricity Market Structure and Structural Conditions

To account for the heterogeneity in price-setting mechanisms—a key structural market condition—electricity markets in the U.S. states included in this study are classified into two broad categories: Traditionally Regulated and Restructured (Deregulated) Markets. This classification is critical because the presence of retail competition directly affects the volatility and underlying drivers of retail price behavior, which is essential context for our bubble detection methodology.

The primary distinction lies in the vertical integration of utilities and the existence of retail choice:

Traditionally Regulated Markets: In these states (e.g., Florida, Hawaii), a single vertically integrated utility holds the monopoly over generation, transmission, and distribution. Retail prices are determined via a cost-of-service model, with rates subject to rigorous approval by the State Public Utility Commission (PUC). Since price adjustments are driven by periodic regulatory rate cases rather than dynamic wholesale markets, these prices typically exhibit less high-frequency volatility but may be subject to larger, infrequent, step-function adjustments.

Restructured Markets: These markets have functionally separated power generation from transmission and distribution. This unbundling allows for retail choice, enabling customers to purchase electricity supply from competing suppliers whose prices are highly responsive to volatile wholesale market dynamics (often managed by a Regional Transmission Organization or Independent System Operator). This competitive structure inherently introduces a higher potential for short-term price excursions and speculative behavior.

The extent of restructuring frequently varies by customer segment (Residential, Commercial, Industrial), which validates the segmentation approach utilized in our empirical analysis.

Table 1 and

Table 2 summarize the structural and historical context for the states examined in this study.

The adoption of deregulation is a foundational regulatory event that fundamentally alters the mechanisms controlling price formation and volatility. Deregulation transforms the pricing environment from a uniform, regulated rate into a competitive menu of options, allowing consumers to seek lower rates or green energy alternatives, but also requiring them to navigate market complexity.

Table 2 provides the historical context of retail market opening in key restructured states.

The retail price of electricity in the United States is governed by a complex federal-state regulatory system, which dictates the rate setting mechanism and the structure of market supervision. While the Federal Energy Regulatory Commission (FERC) oversees wholesale and interstate transmission markets, State Public Utility Commissions (PUCs) or equivalent bodies maintain jurisdiction over local distribution and retail sales. This regulatory dichotomy means the mechanism for setting rates differs fundamentally between Traditionally Regulated and Restructured markets, directly influencing the frequency and magnitude with which fuel costs and market shocks translate into price anomalies.

Table 3 summarizes the primary legal and operational mechanisms governing the retail electricity rate component in the states examined in this study.

The legal regulations concerning electricity prices are essentially bifurcated according to the market structure of the individual state.

Regulated States (e.g., Florida, West Virginia): The legal mechanism relies on the cost-of-service model. The PUC acts as the primary market supervisor, ensuring that the vertically integrated utility’s rates are “just and reasonable.” The utility must justify all operating expenses and capital investments during a rate case, a formal regulatory proceeding. The supervision system is focused on auditing utility performance and expenses.

Restructured States (e.g., Pennsylvania, Texas): The regulatory framework is split. The distribution and transmission component of the bill remains under PUC regulation. However, the energy supply component is determined by market forces—competitive auctions, bilateral contracts, or spot prices—monitored by RTOs/ISOs and the state PUC. The supervision system is complex, prioritizing retail supplier conduct, transmission adequacy, and wholesale market integrity (e.g., preventing market manipulation).

This structural difference is foundational to our findings, explaining why price bubbles in regulated states often correlate with slow-moving regulatory cycles and fuel cost adjustments, while bubbles in restructured states are highly sensitive to high-frequency wholesale price spikes.

The formation of price bubbles must be analyzed in the context of the underlying physical infrastructure and fuel dependencies of the U.S. electricity sector. These physical structural conditions directly determine a state’s exposure to commodity price shocks and regional transmission congestion, both of which are critical factors driving the deviation of price from fundamental value.

According to the U.S. Energy Information Administration’s (EIA) Electric Power Monthly report (2024), the energy mix highlights critical systemic dependencies. The predominant fuel source for U.S. electricity generation is natural gas, which accounted for approximately 43.5 percent of the nation’s total generation in 2023. Conversely, coal contributed roughly 16.1 percent, and oil played only a marginal role at 0.5 percent. The dramatic growth in natural gas consumption in recent years, driven by its economic and lower-carbon advantages, has simultaneously introduced significant market risks, including historic price volatility, the necessity for expanded pipeline infrastructure, and limitations in storage capacity. These factors render many state grids inherently susceptible to supply-shock-induced price volatility when demand peaks.

The analysis of price anomalies must, therefore, be complemented by an assessment of the underlying energy infrastructure.

Table 4 synthesizes the market-relevant infrastructure components for the states in our study. This synthesis utilizes data compiled from the U.S. Energy Information Administration (EIA), FERC regulatory filings, and RTO/ISO operational reports.

Primary Generation Fuel Risk: This metric identifies the dominant marginal cost driver in the state’s electricity mix (e.g., Natural Gas for Texas, Petroleum for Hawaii). Volatility in the price of this fuel source is immediately or eventually transmitted to retail prices, serving as the most direct trigger for cost-driven price excursions.

Transmission Grid Structure: Classification by membership in an Organized Wholesale Market (RTO/ISO) or operation as an Isolated/Non-RTO entity is crucial. RTO/ISO participation introduces both regional integration—and thus exposure to larger market shocks—and the discipline of competitive wholesale pricing. Isolated grids, such as Hawaii’s, face extreme reliance on in-state generation and unique local market risks.

Grid Modernization Indicator: The deployment level of Smart Meters/Advanced Metering Infrastructure (AMI) acts as a proxy for the maturity and technological capability of the distribution infrastructure. States with high deployment are typically better positioned to integrate Distributed Energy Resources (DERs), implement advanced demand response, and potentially mitigate certain localized price spikes through granular system management.

The data in

Table 4 validates the unique vulnerabilities observed in the bubble analysis. For instance, Hawaii’s isolated grid and petroleum dependency fully explain its recurrence of sustained bubbles, while the high Natural Gas dependency of Texas within its isolated ERCOT RTO explains its exposure to extreme, weather-driven price spikes.

3.2. Generalized Sup Augmented Dickey–Fuller (GSADF) Test

This section explains the methodologies of the Sup Augmented Dickey–Fuller (SADF) and the advanced Generalized SADF (GSADF), and Backward SADF (BSADF) tests, introduced to the literature by [

21,

22], and [

7] respectively, which are used to detect speculative bubbles (explosive price behavior) in time series. Both SADF and GSADF test whether a time series follows a mildly explosive process rather than a unit root structure. The model considered for this purpose is the standard Augmented Dickey–Fuller (ADF) regression:

where

is the time series being analyzed (e.g., state-level electricity price),

is the coefficient that is used as an indicator of explosive behavior instead of a unit root (random walk).

is an independently and identically distributed (i.i.d.) error term, with

.

represent fractions of the total sample size, denoting the start and end points of a sub-sample period.

are the regression coefficients. The null hypothesis of the test is the presence of a unit root (i.e.,

) while the alternative hypothesis is the existence of explosive behavior (i.e.,

). A speculative bubble is recognized statistically when the calculated GSADF test statistic for a given period exceeds a pre-determined critical value, indicating that the price series is deviating from its normal random walk behavior in an explosive manner. The test statistic for the null hypothesis is:

When

ve

(representing the full sample), the standard ADF test statistic,

, is obtained. The limiting distribution of

is as follows:

Here,

is a Wiener process. The ADF test compares the

statistic with the right-tailed critical value derived from its limiting distribution. If the test statistic exceeds the respective critical value, the unit root hypothesis is rejected in favor of the alternative hypothesis of explosive behavior. The standard ADF test has low power in detecting explosive price movements, particularly when bubbles terminate with a crash, and may erroneously indicate stationarity in such cases [

23].

Ref. [

21] proposed a method of recursively estimating the ADF regression on data sub-samples to prevent sudden collapses from adversely affecting test results. In this method, sampling begins from a fixed starting point, and the test is repeated by adding one observation at each step. They suggested that this allows for a more robust detection of time-varying explosive behaviors. The SADF test statistic is defined as the supremum (largest value) of the sequence of

statistics [

21]:

In summary, the SADF statistic aims to detect explosive behaviors by selecting the highest value among the ADF test statistics obtained through an expanding window approach. Under the random walk null hypothesis, the limiting distribution of the SADF statistic is:

Similar to the standard ADF test, the SADF test detects explosive behavior if its test statistic exceeds the critical value. The SADF test provides more powerful and reliable results compared to some other alternative methods, especially if there is a single boom-bust period in the sample. This superiority has also been confirmed in simulation studies [

20].

Building on the SADF test, ref. [

8] introduced an advanced version, the GSADF test, to the literature. The GSADF conducts tests over a much larger number of sub-samples compared to the SADF by allowing flexibility in both the starting and ending points of the estimation window. This flexibility significantly enhances the test’s power to detect explosive behaviors. Furthermore, the GSADF test allows for the detection of multiple boom-bust periods within a time series. While the SADF test is primarily applicable for a single boom-bust period, the GSADF test can examine multiple periods. Thus, GSADF has been introduced as a more suitable tool for analyzing more complex and realistic market movements. The GSADF test statistic is:

The limiting distribution of the GSADF statistic under the null hypothesis, as defined by [

8], is:

where

is the window size used for each estimation. The unit root hypothesis is rejected in favor of explosive behavior when the test statistic exceeds the critical value. The critical threshold is determined through Monte Carlo simulations based on the sample size and desired significance level (90%). It represents the value beyond which it is statistically unlikely (less than a 10% chance) that the observed explosive behavior is a result of random chance under the null hypothesis of a unit root. Surpassing this threshold is taken as evidence of a bubble [

8]. The minimum window size r

0 is chosen to ensure sufficient observations for reliable estimation of the ADF regression. For this study, with monthly data from 2005 to 2025 (240 observations), a common choice for r

0 is approximately 0.01 + 1.8/√T, where T is the total number of observations.

If the unit root hypothesis is rejected for a time series, the SADF and GSADF tests can be used to determine the timing of explosive (bubble) periods in prices. Identifying periods when price–fundamental ratios are mildly explosive is important, as these periods are necessary for understanding the causes of certain existing global crises. The GSADF test is preferred in date-stamping strategies due to its greater power and consistency in capturing multiple boom-bust periods [

24].

Refs. [

7,

8] proposed the BSADF statistic to identify the start and end dates of explosive periods based on the GSADF test. The BSADF applies ADF tests on sub-samples that expand backward from the end of the sample. This allows for a more precise determination of when explosive behavior begins and ends. This date-stamping strategy supports the power and multiple boom-bust detection capabilities of the GSADF test, enabling analysis of the emergence and termination times of bubbles. It has been suggested that by charting the chronology of explosive periods in economic and financial analyses, the dynamics of crises or extreme price movements can be better understood [

24].

The start date of an explosive behavior period is the date of the observation where the BSADF statistic first exceeds its critical value. That is, the onset of an explosive period is determined as the first time the critical threshold is surpassed in the BSADF test.

The end date of the explosive behavior period is the date of the first observation where the BSADF statistic falls below its critical value.

Here, represents the 100(1 − α)% critical value of the SADF test corresponding to the chosen α significance level, based on the number of observations . Thus, the critical value of the test statistics is determined by the number of observations and the selected significance level.

3.3. Panel GSADF Test

The SADF and GSADF tests provide assessments on an individual unit basis. Ref. [

24], drawing upon the work of [

25], proposed the Panel GSADF sequential unit root test for panel data. That is, they proposed a new method adapting the GSADF test to heterogeneous panels. The panel ADF regression equation is as follows:

Here, an ADF regression is established for each cross-sectional unit to investigate the presence of a unit root across all units. The null hypothesis posits that the

coefficient is zero for all units (implying a unit root in all units), while the alternative hypothesis suggests that the

coefficient is positive for some units, indicating the presence of explosive behavior in those units. This method allows for heterogeneity among units—meaning each unit can have a different

coefficient—thereby offering a more flexible and realistic analysis. Furthermore, BSADF test statistics are calculated for each unit and then averaged across time periods to conform to the panel data structure. This facilitates the detection of different explosive periods that may occur simultaneously across multiple units. Consequently, this method provides a robust and comprehensive panel unit root test that accounts for unit-specific heterogeneities [

24].

The Panel BSADF test is defined as:

The Panel GSADF is then defined as the supremum of the Panel BSADF values:

The Panel GSADF test allows for monitoring explosive behaviors across varying windows over time. By accounting for inter-unit heterogeneity and cross-sectional dependence, it offers a powerful and consistent testing framework for detecting periods of exuberance (or explosive behavior) in panel data structures [

24]. Critical values for Panel GSADF tests are typically derived through Monte Carlo simulations tailored to the panel dimensions and specific characteristics of the data.

4. Empirical Findings

In the initial phase of this study, both the Generalized Supremum Augmented Dickey–Fuller (GSADF) and Panel GSADF tests were employed, utilizing state-level electricity prices for the United States, to investigate the presence of speculative bubbles in electricity prices. The GSADF test was applied individually to each state and consumption category to identify periods of bubble formation. Also, the Panel GSADF test, incorporating data from all states, was used to analyze the overall presence of bubbles across the panel. This methodological approach enables a comprehensive assessment of both transient speculative upswings in individual state electricity prices and the broader panel-wide trends. The findings of the panel GSADF test are presented in

Table 5 below.

The Panel GSADF test statistics in

Table 1 for all property types—commercial (−0.6024), industrial (−0.4375), and residential (−1.01)—are substantially negative and fall well below the positive critical values at the 90% levels. These findings indicate that the null hypothesis of no explosive episodes cannot be rejected for any of the examined sectors, thereby providing no statistical evidence for the presence of widespread, systemic speculative bubbles or explosive price dynamics across the U.S. as a whole during the sample period. However, the individual GSADF tests indicate the presence of price bubbles in certain states and for specific consumption categories. These findings are presented in

Table 6 and

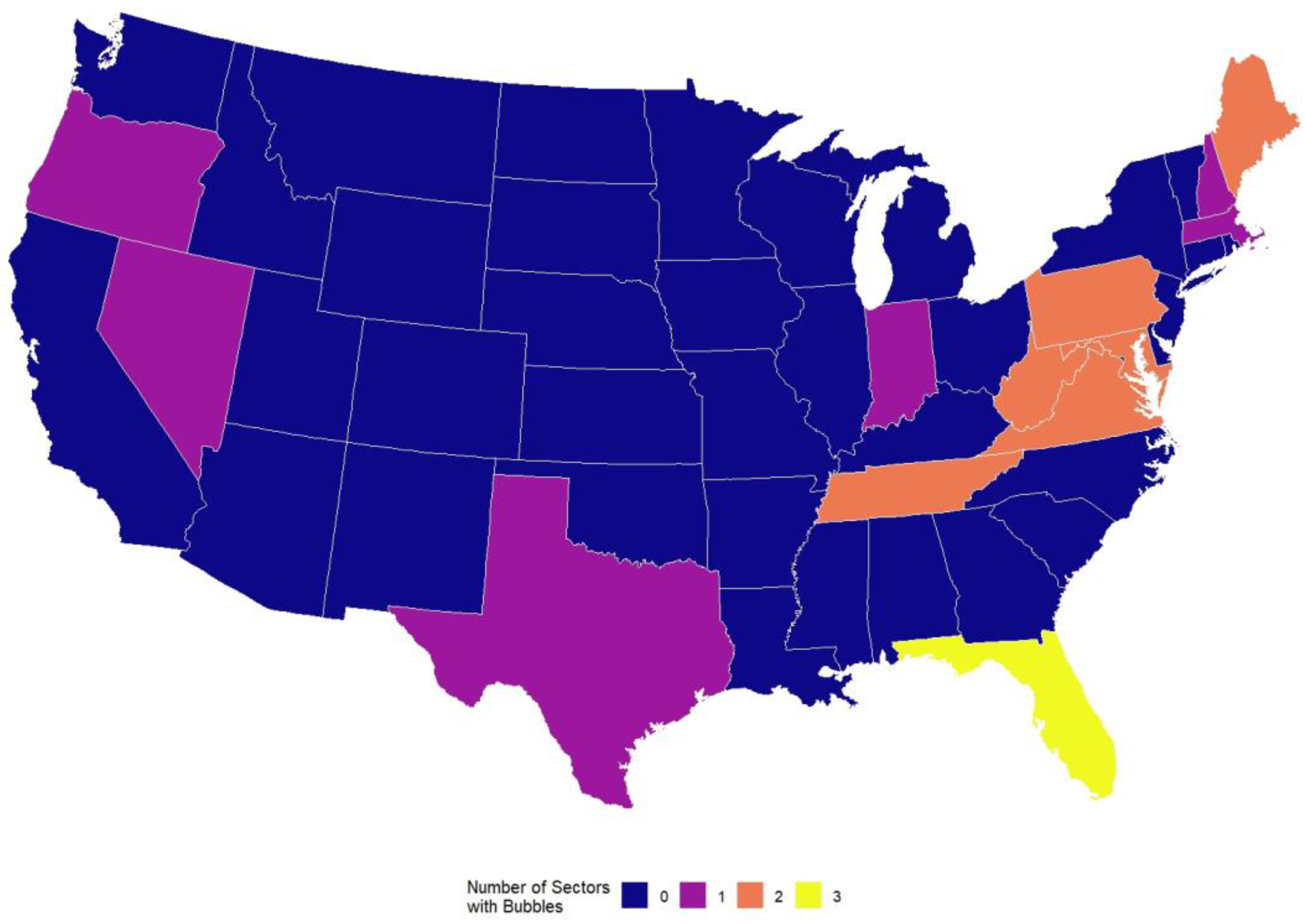

Figure 1 below.

The GSADF test results reveal significant heterogeneity in the presence of explosive behavior, with notable evidence of price bubbles concentrated in specific geographic regions and sectors. The most pronounced evidence of explosive price dynamics appears in Hawaii, where all three sectors exhibit statistically significant test statistics at the 1% level. This uniform pattern across sectors suggests systemic factors affecting the entire electricity market in Hawaii. This is likely attributable to the state’s isolated grid system, heavy reliance on imported fossil fuels (particularly oil for generation), and geographical constraints that limit interconnection with other grids [

26]. These factors make Hawaii’s electricity prices highly susceptible to global fuel price volatility and limit mitigation options. Similarly, Florida demonstrates significant explosive behavior for commercial and industrial sectors, with the residential sector, indicating comprehensive market instability. Florida’s vulnerability can be linked to its high dependence on natural gas for electricity generation, exposure to hurricane-related disruptions, and rapidly growing population and energy demand [

26].

Several states exhibit sector-specific explosive dynamics, revealing differential impacts across consumer categories. Pennsylvania shows significant results for both commercial and industrial sectors, while the residential sector remains below critical thresholds. Conversely, Massachusetts and Oregon display explosive behavior exclusively in their residential sectors, suggesting consumer-specific market pressures possibly related to retail market design or specific regulatory policies affecting residential rates. States such as Maryland, Indiana, and Virginia demonstrate significant explosive patterns primarily in their commercial and industrial sectors, indicating potential supply-side constraints or regulatory changes affecting business consumers disproportionately.

The geographic distribution of explosive behavior reveals interesting regional patterns (see

Figure 1). States with significant test statistics are dispersed across different regions, suggesting that local market conditions, regulatory frameworks, and energy infrastructure play crucial roles in price dynamics rather than broad regional trends. Notably, many states in the Midwest and Mountain regions show negative or insignificant test statistics across all sectors, indicating stable or even declining price trajectories. This stability contrasts sharply with coastal states and those with unique energy challenges (like Hawaii’s isolation or Florida’s weather exposure), where explosive price behavior is more prevalent. These findings have important implications for energy policy and market regulation, as they highlight the need for state-specific interventions to address explosive price dynamics in electricity markets.

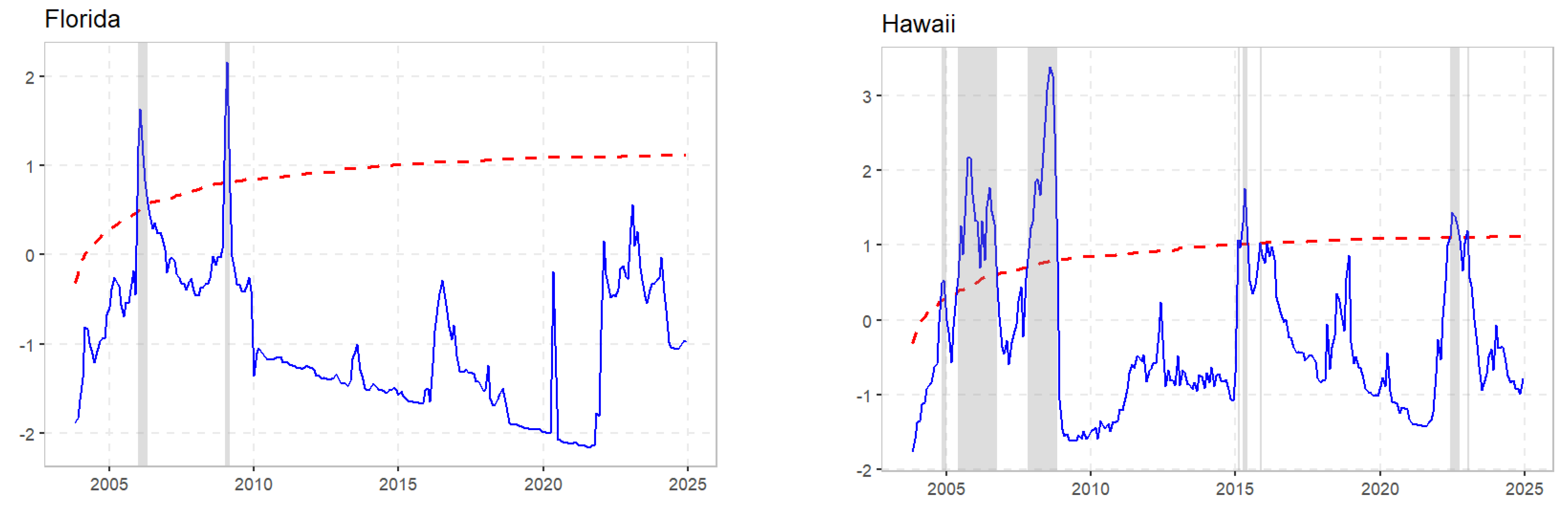

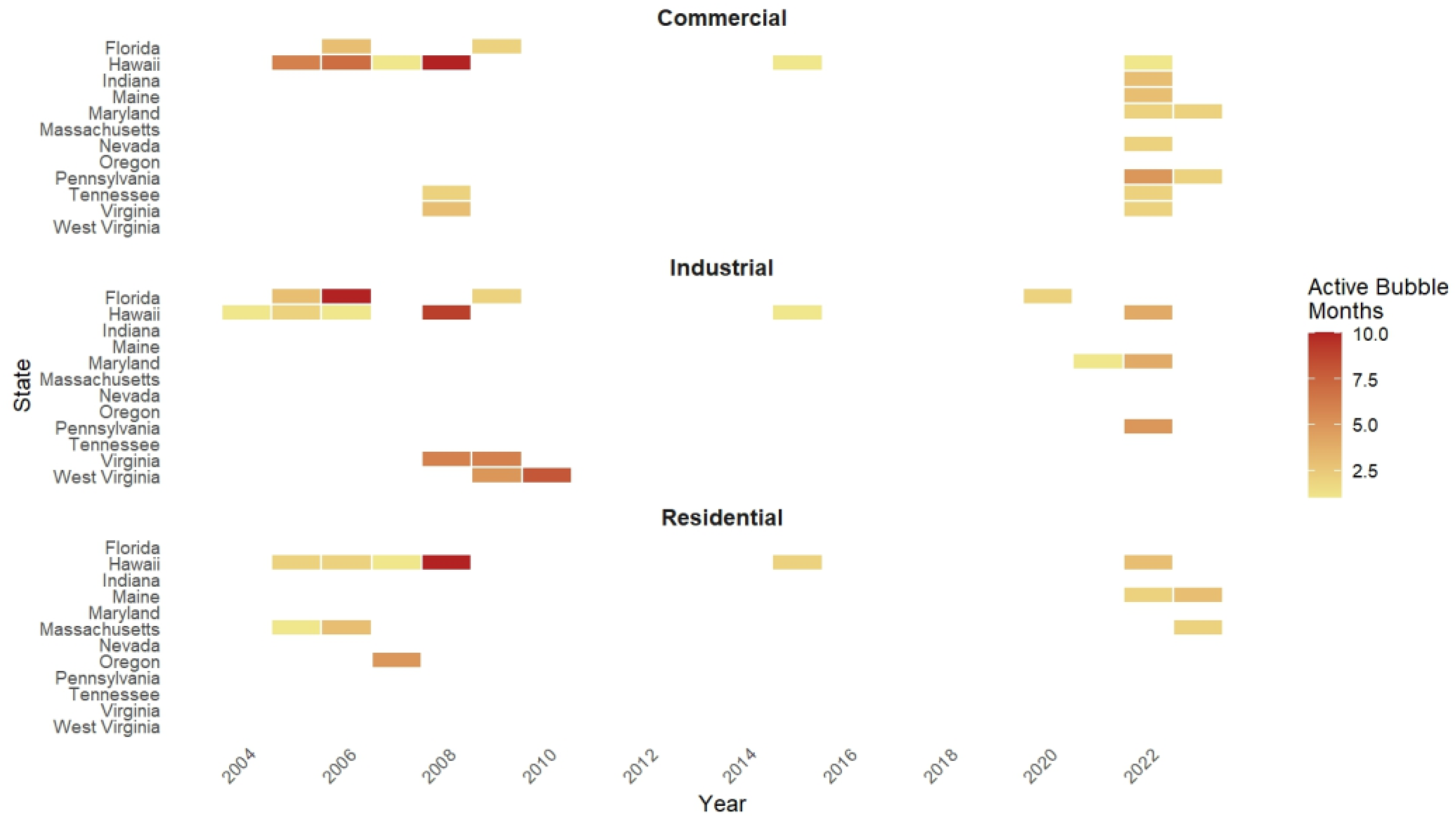

The bubble dates of electricity prices which are obtained using the BSADF test are presented in

Table 7 and

Figure 2.

Table 3 shows that the vast majority of these episodes were characterized by a “positive” signal, indicative of periods where prices significantly exceeded fundamental values before correcting. Hawaii exhibited the highest frequency of such positive bubbles, with six distinct occurrences between 2005 and 2022. These Hawaiian bubbles varied considerably in duration, from very brief one-month events (e.g., April 2006, May 2015, July 2022) to a protracted 11-month bubble spanning from December 2007 to November 2008. The frequent and sometimes prolonged bubbles in Hawaii’s commercial sector likely reflect its heavy dependence on imported oil for electricity generation, making it highly susceptible to global oil price shocks [

26].

In contrast, Florida experienced two shorter positive bubbles, one lasting three months in early 2006 and another for two months in early 2009. These may correlate with periods of natural gas price volatility or hurricane-related supply disruptions, given Florida’s energy profile. Several other states, including Maine, Maryland, Nevada, Pennsylvania, Tennessee, and Virginia, predominantly saw positive bubble activity clustered in 2022 and extending into early 2023. For instance, Pennsylvania experienced a notable five-month positive bubble from June to November 2022, followed by a shorter two-month event in early 2023. Maryland also had two positive bubbles in late 2022 and early 2023, lasting one and three months, respectively. Similarly, Tennessee and Virginia each had an earlier bubble in 2008 and a more recent one in 2022, all positive and lasting two to three months. The clustering in 2022–2023 aligns with global energy market disruptions following the pandemic and geopolitical events influencing fuel prices.

A unique observation is found in Indiana, which, after a brief one-month positive bubble in August 2022, was the only state to register a “negative” bubble, indicating a period of unusually suppressed prices, lasting two months from October to December 2022. This contrasts sharply with the general trend of positive price bubbles observed across the other states and within Indiana itself earlier in the same year. This negative bubble could be due to temporary local oversupply, specific industrial load changes, or regulatory interventions.

Overall, the findings suggest the majority of bubbles across all states are short-lived, with a notable concentration of one- and two-month durations, supporting the notion that commercial electricity markets generally self-correct rapidly following abnormal price movements. The emergence of multiple bubbles across diverse states in the years 2022 and 2023 indicates a period of widespread market disruption, contrasting with the more sporadic and state-specific bubbles observed in earlier years.

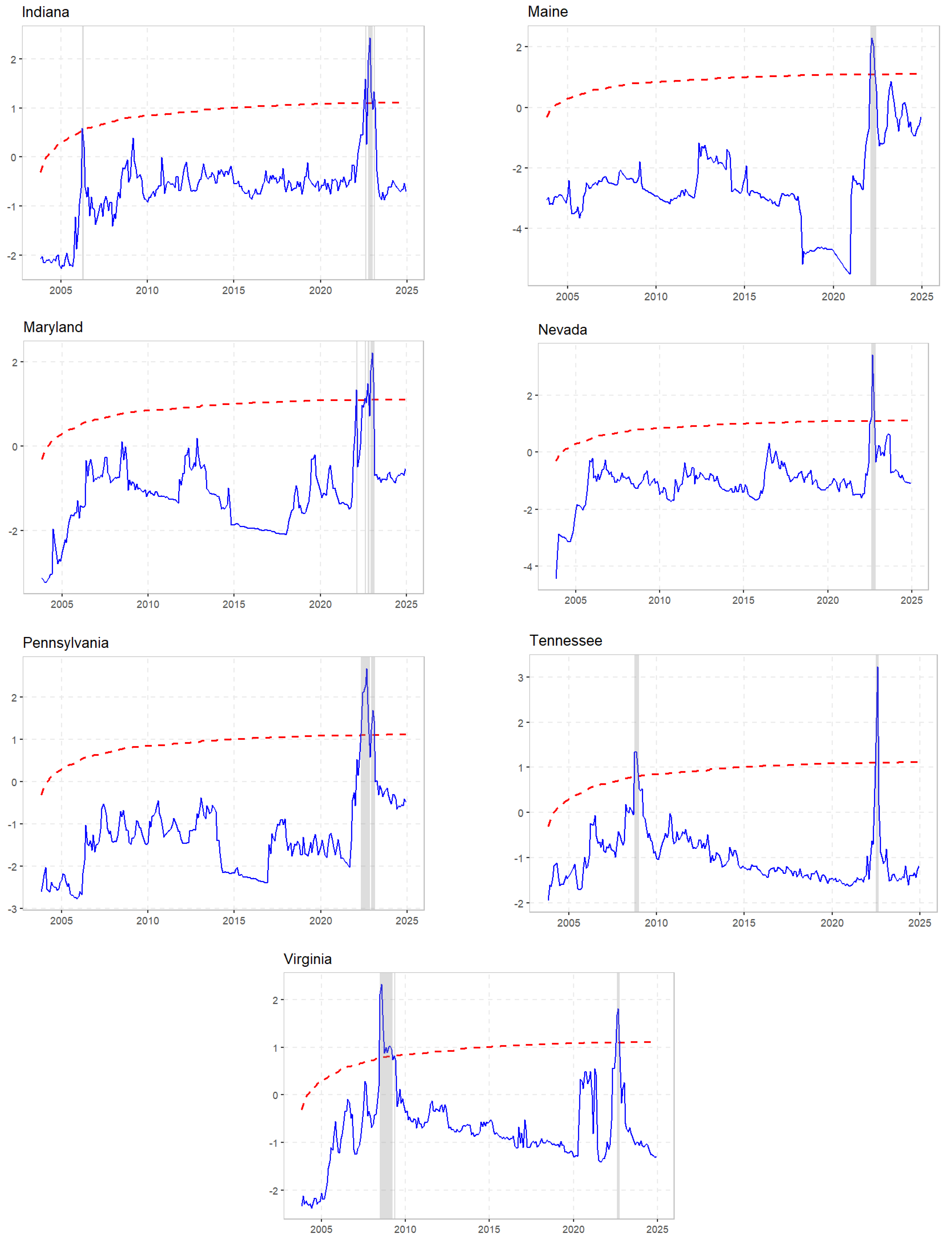

Next, we reveal the bubble dates in the Industrial Electricity Prices in

Table 8 and

Figure 3:

Table 4 delineates a consistent finding across all listed states—Florida, Hawaii, Maryland, Pennsylvania, Virginia, and West Virginia—in that all identified bubbles were characterized by a “positive” signal, indicating periods where prices significantly exceeded their fundamental values, and none of these bubbles were ongoing at the time of data collection.

Hawaii again exhibited the highest frequency of bubble episodes in industrial electricity prices, with six distinct positive bubbles identified between late 2004 and late 2022. These varied in duration, from very brief one-month events to a more substantial nine-month bubble in 2008, and a recent four-month bubble in late 2022. The repeated bubble occurrences in Hawaii’s industrial sector further underscore its vulnerability to fuel price shocks, directly impacting energy-intensive industries. Florida recorded four positive bubble events, including a notable 10-month bubble in 2006, potentially linked to sustained high natural gas prices or impacts from an active hurricane season affecting fuel supply and generation. West Virginia’s four bubbles were concentrated between 2009 and 2011, possibly reflecting shifts in coal markets (a key fuel for the state) or specific industrial demand patterns during that period.

Maryland experienced three positive bubbles, all relatively recent and short-lived (2021–2022), aligning with the broader energy market volatility seen post-pandemic. Pennsylvania also showed recent activity in 2022. Virginia stands out for experiencing the longest single bubble event in this sector; its sole identified positive bubble persisted for 12 months (2008–2009), coinciding with the global financial crisis which significantly impacted energy markets and industrial demand.

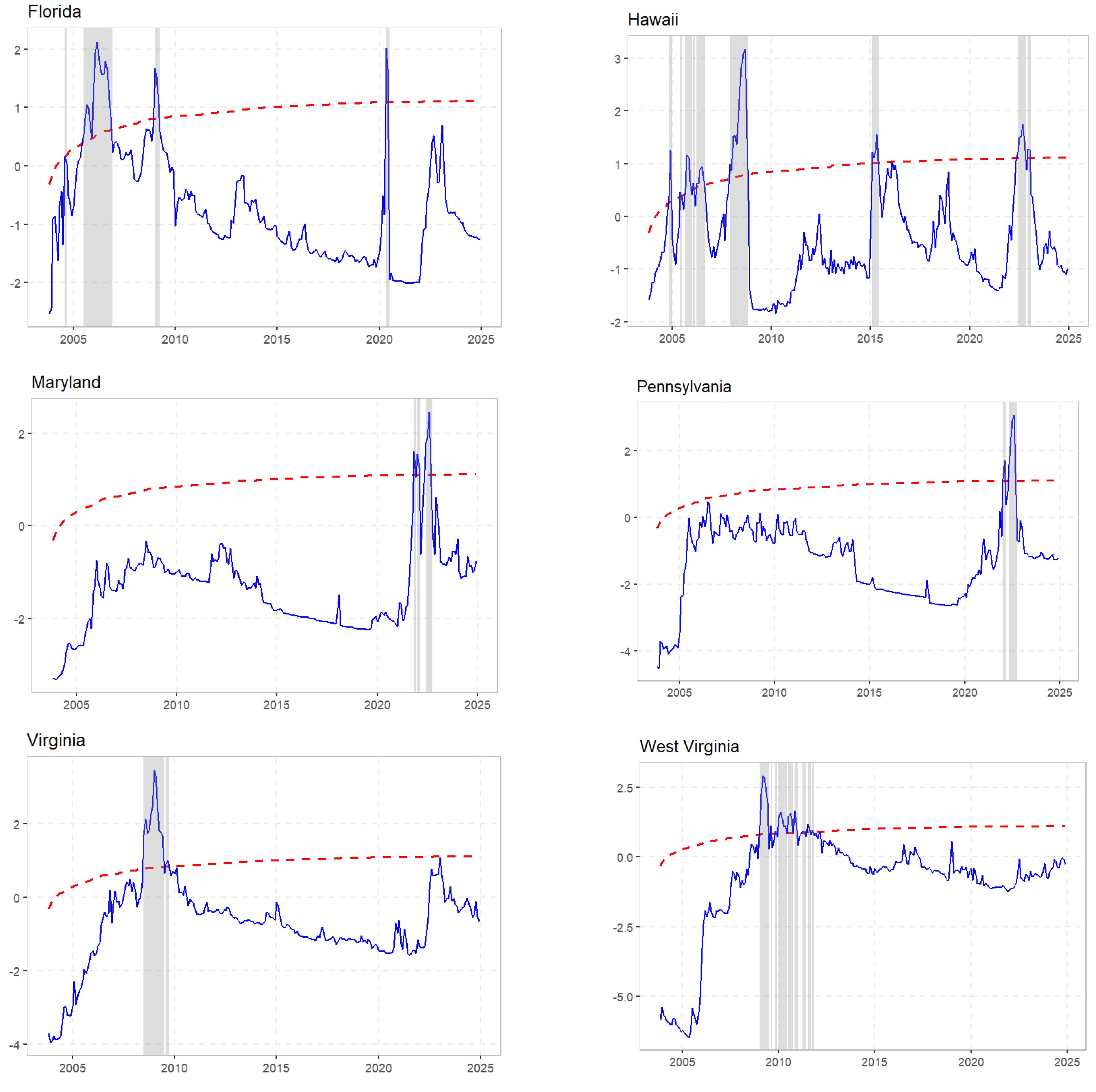

Finally, we present the bubble dates in residential electricity prices in

Table 9 and

Figure 4:

The results in

Table 9 show that Hawaii presented the highest frequency of such events in the residential sector as well, with five distinct positive bubbles identified. These occurrences included a notably protracted 11-month bubble from late 2007 to late 2008, reflecting how sustained fuel cost increases pass through to residential consumers in an isolated, import-dependent system.

In contrast, Maine and Massachusetts each experienced two positive bubble periods. Maine’s bubbles were relatively recent (2022 and 2023), possibly linked to wholesale market price spikes in New England affecting standard offer service rates, which are a common way residential customers receive electricity if not choosing a competitive supplier. Massachusetts saw an earlier four-month bubble (2005–2006) and a more contemporary two-month bubble in early 2023, similarly reflecting regional market conditions and fuel price volatility. Oregon registered only a single positive bubble in this dataset, which persisted for five months in 2007. This could be related to hydro conditions (a significant part of Oregon’s energy mix) or natural gas price movements during that specific period [

26].

The bubble period detections for this type of electricity consumption are as follows: The detection of residential bubble periods around 2020–2022 is strongly contextualized by U.S. Energy Information Administration data showing significant, localized consumption shocks and subsequent national price inflation. Regarding the 2020 period, per capita U.S. residential electricity use varied widely by state, creating highly differential demand pressures. Consumption rose significantly in the West, with states like Arizona (+10%), Nevada, and California (+9% each) experiencing increases due to record-warm summers, while it decreased in many Southern states like Arkansas and North Carolina where electric heating is prevalent. Crucially, this period of consumption volatility did not translate to explosive price movements; consistent with EIA reports indicating that U.S. residential electricity price movements were largely flat during 2020, our empirical methodology detected no positive speculative bubbles in any state for that year. Following this, bubble periods covering the 2021–2022 period are associated with a sharp increase in electricity residential prices [

27]. According to the EIA, U.S. residential electricity expenditures saw a substantial 4.3% increase in 2021, which represented the second-largest annual increase in nominal expenditures in the preceding decade. This national inflationary pressure, stemming from factors like higher fuel costs and supply chain constraints, generated the underlying momentum for the localized explosive price movements observed in various states [

28].

Comparing across states, Hawaii stands out for both the number of bubble episodes and the occurrence of the longest single bubble (11 months) in the residential sector. The other states showed more sporadic instances. The durations were generally short to moderate, with the extended Hawaiian bubble being an exception, emphasizing the unique challenges faced by islanded energy systems.

The detection of positive speculative bubbles across all consumer segments (Commercial, Industrial, and Residential), as summarized in

Table 3,

Table 4 and

Table 5, consistently demonstrates the sensitivity of U.S. state-level retail electricity prices to fundamental cost structures and exogenous market shocks. The timing and duration of these episodes align strongly with the primary factors influencing electricity pricing, as documented by the U.S. Energy Information Administration (EIA). These underlying factors include the cost to build, finance, maintain, and operate power generation facilities and the extensive transmission and distribution (T&D) grid, alongside financial returns for utilities. Critically, many bubbles were instigated by external pressures, primarily fuel price volatility—especially for natural gas and petroleum (relevant to states like Hawaii)—which increased generation costs during periods of high demand or supply disruption.

A substantial number of the identified bubble episodes coincided with the summer months. This pattern directly supports the EIA observation that electricity prices are typically highest during the summer due to heightened demand for heating and cooling, which necessitates the addition of more expensive generation sources to meet peak load. Recurrent and protracted summer bubbles, such as those noted in Hawaii and Florida, underscore the specific vulnerability of certain regions to these seasonal demand spikes and associated fuel supply constraints.

Furthermore, the characteristics of the bubbles—ranging from short, sharp spikes in competitive, restructured states (e.g., Pennsylvania, Maryland) to more sustained, protracted episodes in traditionally regulated or isolated markets (e.g., Hawaii, Virginia)—emphasize the central role of regulation. The findings confirm that market supervision and the mechanisms for setting electricity rates ultimately modulate the frequency and duration of explosive price behavior, reflecting whether price pressures are instantaneously passed through a competitive wholesale market or slowly incorporated through a cost-of-service rate case.

We can summarize these findings in the following spatial–temporal heatmap.

Figure 5 clearly highlights the spatial concentration (e.g., the recurring intensity in Hawaii) and the temporal clustering (e.g., the flare-ups around 2008 and 2022) of the price bubbles.

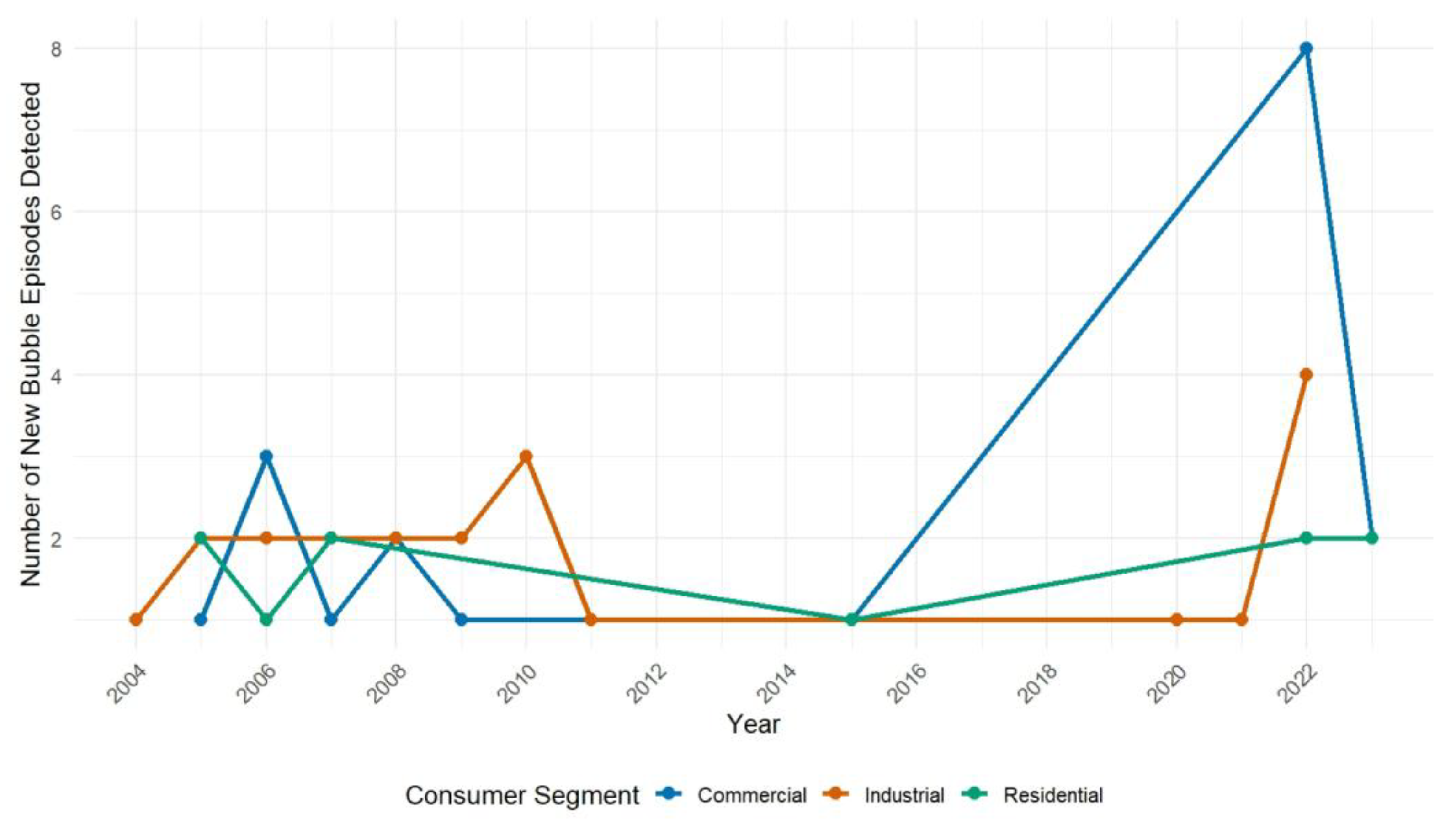

We, next illustrate temporal clustering of market instability across U.S. states in

Figure 6.

The figure effectively illustrates that U.S. electricity price bubbles are not isolated incidents but rather tend to emerge in waves during periods of significant economic or geopolitical stress. It powerfully visualizes the severe and widespread impact of the 2022 energy crisis, especially on business consumers, and provides a clear comparative timeline of market instability over the past two decades.

5. Discussion

The empirical investigation into speculative bubbles in U.S. state-level electricity markets has revealed significant heterogeneity in the nature and frequency of bubble episodes across consumer sectors—commercial, industrial, and residential. The localized presence of speculative price dynamics in specific states, as observed in the study, underscores the role of regional market structures (e.g., degree of competition, fuel mix), regulatory frameworks (e.g., rate-setting mechanisms, market oversight), and external shocks (e.g., fuel price volatility, extreme weather) as key drivers of price anomalies. This analysis highlights the critical need to identify and address state-specific factors contributing to price instability in electricity markets. The absence of a bubble at the national panel level, contrasted with its presence in specific states, is not contradictory. Instead, it suggests that the explosive price behavior is highly localized. The panel test, by averaging across all 51 units, dilutes the impact of these localized episodes, while the individual state-level tests effectively isolate them. This underscores that U.S. electricity market vulnerabilities are not systemic at a national scale but are concentrated in regions with specific structural weaknesses.

The fact that most bubbles were short-lived (e.g., 1–3 months) indicates the presence of effective market self-correction mechanisms in many states. These include supply responses (e.g., bringing peaker plants online), demand destruction (where high prices lead consumers to reduce usage), and, in some cases, regulatory interventions. However, the prolonged bubble episodes observed in Hawaii, such as the 11-month residential bubble in 2007–2008, signal a critical failure of these mechanisms. A comparative analysis reveals why self-correction is constrained in a market like Hawaii’s compared to mainland states.

First, market structure and competition play a pivotal role. States within interconnected grids and competitive wholesale markets, such as Pennsylvania and Maryland in the PJM Interconnection, benefit from robust self-correction. In these markets, a price spike in one area can be mitigated by importing cheaper power from other generators in the region. This competition incentivizes efficiency and pressures prices back toward marginal costs. In stark contrast, Hawaii operates as a set of isolated, islanded grids dominated by a vertically integrated monopoly. This structure lacks the competitive pressure to correct price deviations. Second, the availability of alternative energy sources is a key differentiator. During the 2007–2008 bubble, Hawaii was almost entirely dependent on imported oil for power generation. When global oil prices surged, the state had no immediate, cheaper alternative to pivot to, allowing the price shock to persist. Mainland states, with diverse fuel mixes including natural gas, coal, nuclear, and renewables, have more flexibility to absorb a price shock in a single fuel source. Third, regulatory systems influence the duration of price anomalies. In competitive markets, wholesale prices fluctuate in real-time, and while retail prices are stickier, persistent high costs can be contested. Hawaii’s regulated cost-of-service model, while designed to ensure utility revenue stability, can be slow to react. Fuel adjustment clauses allow the utility to pass on sustained high fuel costs directly to consumers over many months, institutionalizing the bubble rather than correcting it. Finally, demand elasticity is a factor. While residential electricity demand is generally inelastic, consumers in mainland states may have more options (e.g., switching to natural gas for heating) or be exposed to more dynamic pricing signals that encourage conservation during price spikes. In an isolated, high-cost environment like Hawaii’s, consumers have fewer alternatives, leading to lower demand responsiveness and allowing high prices to be sustained for longer.

Hawaii’s status as the state most prone to bubbles across all consumer sectors is a direct consequence of this confluence of factors: its geographical isolation and near-total dependence on imported petroleum for electricity generation [

26]. This structure leaves its electricity prices directly exposed to global oil price shocks, a primary trigger for the prolonged bubble episodes identified in our analysis. Key strategies to bolster resilience include:

Hawaii’s abundant solar, wind, and geothermal resources offer a direct path to energy independence. Accelerating the deployment of utility-scale and distributed solar PV, coupled with onshore and offshore wind, can systematically displace volatile fossil fuel generation. Geothermal energy, in particular, can provide firm, baseload renewable power, adding a crucial layer of stability.

Given the intermittent nature of solar and wind, large-scale battery energy storage systems (BESS) are essential for grid stability. BESS can absorb excess renewable generation during the day and discharge it during evening peak demand, smoothing supply, reducing the need for fossil-fuel peaker plants, and ultimately stabilizing prices. This directly counters the supply–demand imbalances that can fuel speculative price behavior.

Upgrading Hawaii’s grid infrastructure to a “smart grid” can improve operational efficiency and flexibility. Technologies like advanced metering and demand-response programs can empower consumers to reduce load during periods of grid stress, providing a non-supply-side mechanism to balance the grid and temper price spikes.

Florida’s vulnerability stems from its heavy reliance on natural gas for electricity generation and its exposure to extreme weather events like hurricanes, which can disrupt fuel supply chains and damage grid infrastructure. Strategies tailored to Florida’s context include:

The state’s significant dependence on natural gas makes it susceptible to fuel price volatility, a key driver of the bubbles observed in 2006, 2009, and the post-pandemic era. A concerted effort to diversify its generation portfolio by expanding utility-scale solar capacity—a resource abundant in the “Sunshine State”—is critical. This would create a natural hedge against natural gas price fluctuations.

The physical resilience of the grid is paramount. Strategies such as burying power lines in high-risk coastal areas, reinforcing transmission towers to withstand higher wind speeds, and deploying smart grid technologies that can automatically re-route power and isolate faults can significantly reduce the duration and severity of outages following hurricanes. By ensuring supply continuity, these measures prevent the kind of prolonged market disruptions that can lead to explosive price behavior.

Florida’s high energy demand, driven by population growth and air conditioning needs, puts immense pressure on the grid during heatwaves. Expanding demand-response programs that incentivize large commercial and industrial users to curtail consumption during peak hours can alleviate grid stress and mitigate the risk of price spikes.

While a direct quantitative forecast of how these resilience strategies would reduce bubble frequency is beyond the scope of this study’s methodology, existing research provides strong evidence of their price-stabilizing effects. For instance, studies by the National Renewable Energy Laboratory (NREL) have shown that the zero-marginal-cost nature of renewables exerts downward pressure on wholesale electricity prices. Moreover, research has demonstrated that energy storage can reduce price volatility by arbitraging between low- and high-price periods, effectively clipping the peaks that characterize bubble episodes [

29]. By insulating a state’s energy supply from external fuel price shocks and enhancing its ability to withstand physical disruptions, these strategies directly address the root causes of the explosive price dynamics identified in this paper. Future research could use simulation-based models to quantify the potential reduction in bubble probability and severity in high-risk states under various resilience investment scenarios.

Several states within the PJM Interconnection region, such as Pennsylvania, Maryland, and Virginia, exhibited sector-specific bubbles, predominantly in commercial and industrial segments. These bubbles occurred against the backdrop of complex regional energy markets characterized by diverse fuel mixes, including natural gas, coal, and nuclear energy. Notably, bubble episodes in the PJM region often coincided with high-demand periods and market stress, such as the 2008 financial crisis or the post-COVID recovery in 2022–2023. These results align with [

14] who highlighted the role of demand pressures and reserve scarcity in transitional pricing regimes, exacerbating volatility in wholesale electricity markets which can then filter through to retail prices, especially for larger consumers.

Interestingly, states such as Massachusetts and Oregon exhibited residential-sector-specific bubbles, suggesting consumer-facing vulnerabilities possibly linked to regulatory, seasonal fuel price impacts, or broader socio-economic disruptions. Such findings are reinforced by [

30], who identified external shocks such as local climate anomalies and shifts in energy demand patterns as contributors to residential market instability in other contexts.

The temporal clustering of bubbles during 2022–2023 highlights the impact of global disruptions. Geopolitical events, primarily the war in Ukraine, created unprecedented volatility in global fuel markets (especially natural gas), while post-pandemic economic recovery simultaneously drove up energy demand. Climate-related factors also play a role; extreme weather events, such as heatwaves or winter storms, strain grid infrastructure and can lead to sudden price spikes when demand outstrips available supply. The fact that most bubbles were short-lived (e.g., 1–3 months) indicates the presence of effective market self-correction mechanisms in many states. These include supply responses (e.g., bringing peaker plants online), demand destruction (where high prices lead consumers to reduce usage), and, in some cases, regulatory interventions. However, in markets like Hawaii’s, these mechanisms are weak. Its monopoly structure, physical isolation, and lack of fuel diversity severely limit the market’s ability to self-correct, leading to the observed prolonged bubble episodes. Similar patterns have been observed in European electricity markets, where geopolitical risks and climatic disruptions have influenced bubble formation [

4,

5]. Renewable energy integration in the European context has been linked to reduced price volatility, suggesting potential avenues for policy development in U.S. markets (e.g., expansion of renewable energy portfolios and investments in grid modernization).

Given these findings, this study underscores the need for regionally tailored policy interventions. Addressing systemic issues in vulnerable states like Hawaii may require investments in renewable energy integration, storage solutions, and grid resilience to mitigate reliance on volatile imported fuels. While integrating renewables is key to long-term stability, their intermittent nature can cause short-term volatility. This challenge must be addressed proactively through investments in energy storage, improved forecasting technology, and the development of more flexible grid management systems. This ensures that the transition to renewables enhances, rather than compromises, price stability. For states like Florida, diversification of the energy mix and enhanced demand-side management strategies could improve market stability. Moreover, the concentration of bubble activity within large interconnected regions, such as PJM, suggests the need for enhanced regulatory oversight to manage competitive dynamics and prevent speculative price behaviors [

31].

6. Conclusions

This study provides a nuanced, state-level exploration of speculative bubbles within the U.S. electricity market, employing both GSADF and Panel GSADF methodologies across commercial, industrial, and residential sectors. The findings reveal that speculative bubbles are localized phenomena rather than a nationwide trend. While no overarching bubbles were detected at the panel level, state-specific analyses uncovered notable episodes of price exuberance driven by regional factors. These insights highlight significant variability between states in terms of both frequency and intensity of bubble formations.

In response to our research questions, we found that: (1) Evidence of speculative bubbles is present and statistically significant, but not uniformly distributed. (2) Bubble episodes are highly localized phenomena, concentrated in states with specific structural vulnerabilities, rather than a national trend. (3) Bubble dynamics vary significantly by consumer segment, with commercial and industrial sectors in some deregulated states showing more sensitivity to wholesale market shocks, while residential bubbles appeared in both regulated and deregulated environments.

States like Hawaii and Florida exhibit pronounced vulnerabilities due to factors such as geographical isolation, reliance on volatile imported fuels, monopolistic market structures, and exposure to extreme weather.

The nature of bubble activity differs between regulated and deregulated markets. Deregulated states like Pennsylvania and Maryland saw bubbles in commercial and industrial sectors aligned with wholesale price volatility, while the regulated, isolated market of Hawaii experienced more frequent and prolonged bubbles across all sectors.

Most identified bubbles were short-lived (1–3 months), suggesting effective market correction mechanisms in many states. However, our analysis shows these mechanisms are severely constrained in markets like Hawaii’s by a lack of competition, limited energy alternatives, and rigid regulatory structures, leading to prolonged price instability. A significant clustering of bubbles also occurred in 2022–2023, linked to global energy market stress from geopolitical events and post-pandemic recovery.

The study carries important implications for policymakers, businesses, and consumers, particularly in shaping strategies to enhance energy market resilience and stability. For states such as Hawaii, prioritizing investments in energy storage and grid modernization can both strengthen supply resilience and reduce dependence on volatile imported fuels. Likewise, accelerating the integration of diverse renewable sources—solar, wind, and geothermal—paired with advanced storage systems can mitigate exposure to external shocks. In Florida, policy efforts should focus on diversifying the generation mix away from natural gas and reinforcing infrastructure to withstand extreme weather events, while improving demand-side management to stabilize prices. In competitive markets like PJM, enhancing regulatory oversight and refining market design are crucial to preventing speculative excesses and ensuring fair pricing, as recent volatility has demonstrated [

31]. Measures such as monitoring bidding strategies, implementing circuit breakers or price caps during periods of extreme volatility, and incentivizing demand-response programs that reward consumers for reducing consumption at peak times can act as natural stabilizers. The presence of speculative bubbles, even if short-lived, can result in significant price spikes that strain households and disrupt industrial operations, particularly in vulnerable states such as Hawaii and Florida. Although hedging strategies—such as futures and options contracts—can mitigate some of these risks [

32], the persistence of prolonged bubbles, as observed in Hawaii, signals deeper structural issues requiring long-term reforms. Addressing these challenges calls for fostering competition where appropriate, adopting flexible pricing mechanisms that reflect actual costs without amplifying volatility, and investing in forecasting technologies and adaptive grid management systems to ensure that the transition to renewable energy enhances, rather than undermines, price stability.

Looking ahead, several avenues for future research emerge from this study. First, incorporating higher-frequency data, such as daily or hourly price series, could capture short-term bubble dynamics that are missed by monthly aggregates, potentially revealing additional episodes particularly relevant for wholesale market analysis. Second, econometric modeling to identify specific triggers of bubble formation, such as regulatory changes, natural disasters, fuel price shocks, or shifts in energy supply and demand balances, would provide deeper insights into the causal mechanisms at play, enhancing understanding of market stress events. Third, exploring the impact of increasing renewable energy penetration on price stability is crucial. While renewables generally exert downward pressure on average wholesale prices, their intermittent nature and the evolving market designs to accommodate them could influence price volatility and the potential for bubble-like behavior [

33]; state-level analyses comparing different integration strategies would be particularly insightful.

It is important to acknowledge the limitations of this study. The reliance on monthly retail price data may not fully reflect the dynamics of wholesale markets, where price formation primarily occurs and where high-frequency volatility can be more pronounced. Additionally, while the GSADF test is effective in detecting bubbles and date-stamping episodes, it does not inherently provide information on the underlying causes of these episodes, limiting direct causal inference from the test itself. Future research should address these gaps by integrating wholesale price data, employing complementary econometric methodologies to better identify causal drivers of price volatility and bubble formation.

In conclusion, this study fills a critical gap in the literature by providing the first comprehensive state-level analysis of speculative bubbles in U.S. retail electricity markets across different consumer segments. The results emphasize the importance of flexible and region-specific regulatory frameworks and policy responses over uniform, national-level approaches. By tailoring measures to local market conditions and vulnerabilities, policymakers can enhance market efficiency, reduce speculative risks, and ensure price stability during the ongoing energy transition.